Bank Reconciliation and Suspense Account

VerifiedAdded on 2020/10/22

|10

|2039

|199

AI Summary

This assignment discusses the process of bank reconciliation, including outstanding checks and NSF (Not Sufficient Funds) conditions. It also explains how to reconcile suspense and control accounts to determine accurate financial results. The document covers various examples and references from books and online resources.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Question 1 Producing final accounts of the Bamber Sharpe for the year ended 31 April 2018. 1

Question 2 Producing final accounts for Saunders Worsley Ltd for the year ended 30 August

2018........................................................................................................................................3

Question 3 Bank reconciliation statement and relevant terms...............................................6

Question 4 Discussing how control and suspense account are reconciled.............................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................1

Question 1 Producing final accounts of the Bamber Sharpe for the year ended 31 April 2018. 1

Question 2 Producing final accounts for Saunders Worsley Ltd for the year ended 30 August

2018........................................................................................................................................3

Question 3 Bank reconciliation statement and relevant terms...............................................6

Question 4 Discussing how control and suspense account are reconciled.............................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................7

INTRODUCTION

Financial accounting is the branch which deals with accounting records in effectual

manner. Present report deals with preparation of final accounts of Bamber Sharpe and Saunders

Worsley Ltd which are sole trader and organization respectively. Moreover, bank reconciliation

statement are prepared with terms related to it. Furthermore, control and suspense accounts are

discussed on how they are reconciled. Hence, financials are vital in assessing performance of

business in effectual manner.

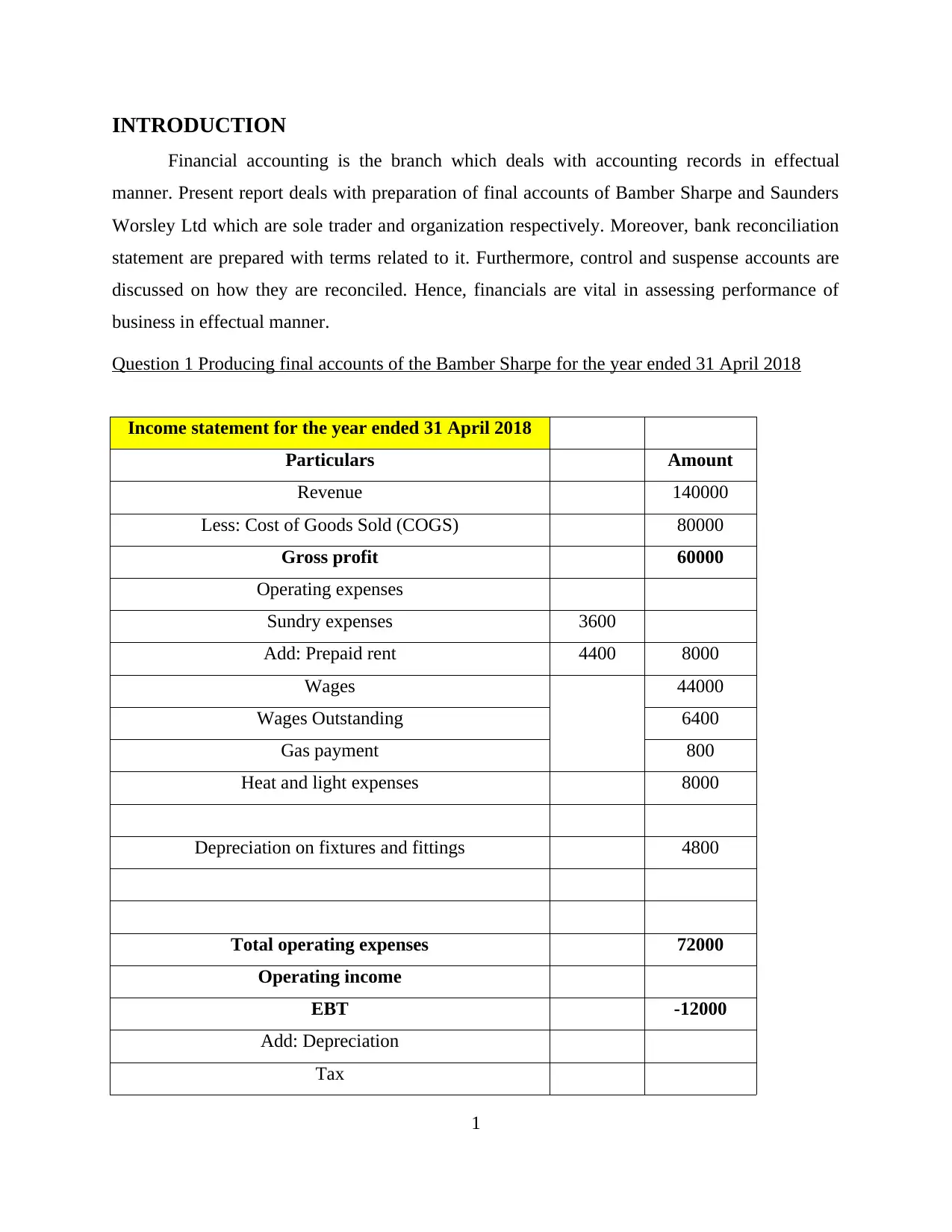

Question 1 Producing final accounts of the Bamber Sharpe for the year ended 31 April 2018

Income statement for the year ended 31 April 2018

Particulars Amount

Revenue 140000

Less: Cost of Goods Sold (COGS) 80000

Gross profit 60000

Operating expenses

Sundry expenses 3600

Add: Prepaid rent 4400 8000

Wages 44000

Wages Outstanding 6400

Gas payment 800

Heat and light expenses 8000

Depreciation on fixtures and fittings 4800

Total operating expenses 72000

Operating income

EBT -12000

Add: Depreciation

Tax

1

Financial accounting is the branch which deals with accounting records in effectual

manner. Present report deals with preparation of final accounts of Bamber Sharpe and Saunders

Worsley Ltd which are sole trader and organization respectively. Moreover, bank reconciliation

statement are prepared with terms related to it. Furthermore, control and suspense accounts are

discussed on how they are reconciled. Hence, financials are vital in assessing performance of

business in effectual manner.

Question 1 Producing final accounts of the Bamber Sharpe for the year ended 31 April 2018

Income statement for the year ended 31 April 2018

Particulars Amount

Revenue 140000

Less: Cost of Goods Sold (COGS) 80000

Gross profit 60000

Operating expenses

Sundry expenses 3600

Add: Prepaid rent 4400 8000

Wages 44000

Wages Outstanding 6400

Gas payment 800

Heat and light expenses 8000

Depreciation on fixtures and fittings 4800

Total operating expenses 72000

Operating income

EBT -12000

Add: Depreciation

Tax

1

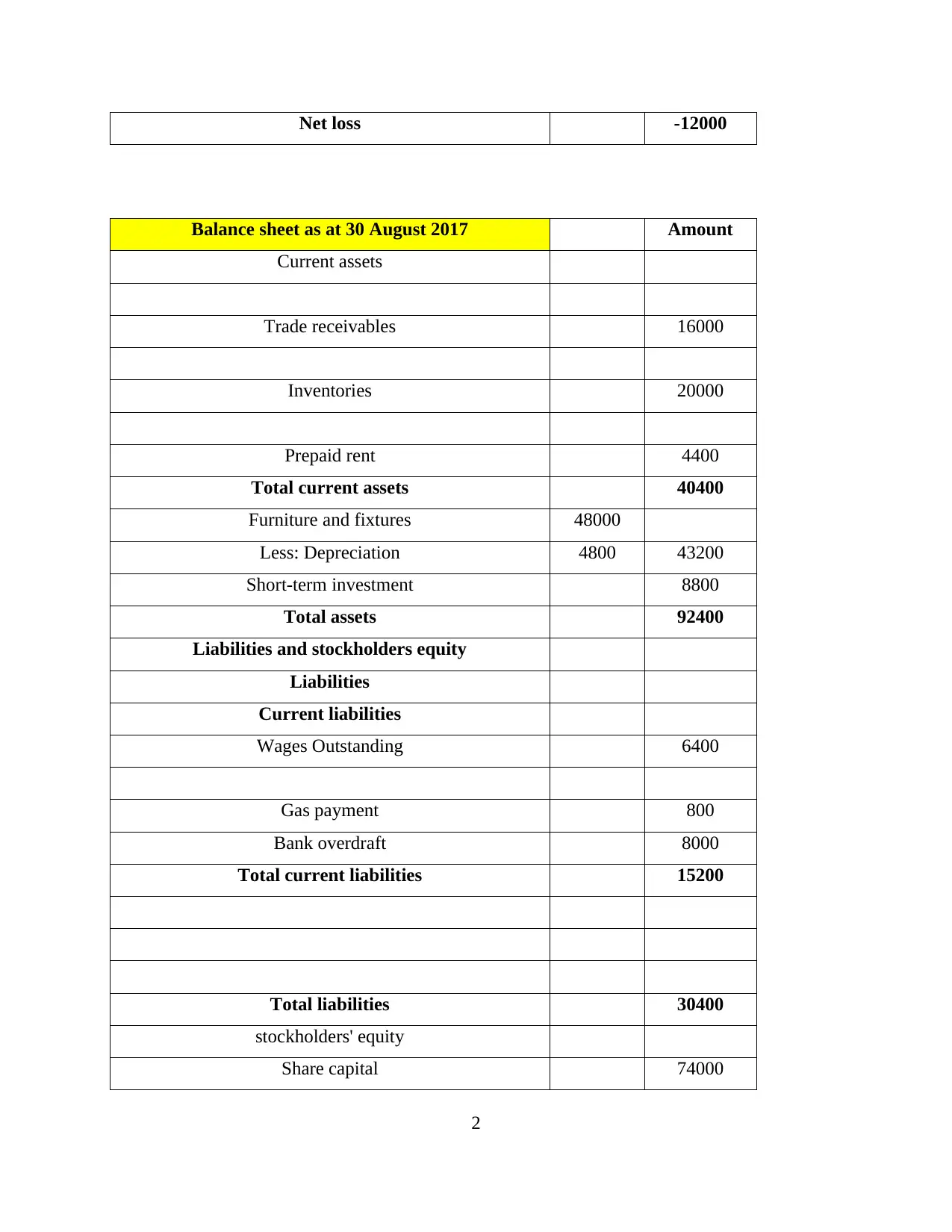

Net loss -12000

Balance sheet as at 30 August 2017 Amount

Current assets

Trade receivables 16000

Inventories 20000

Prepaid rent 4400

Total current assets 40400

Furniture and fixtures 48000

Less: Depreciation 4800 43200

Short-term investment 8800

Total assets 92400

Liabilities and stockholders equity

Liabilities

Current liabilities

Wages Outstanding 6400

Gas payment 800

Bank overdraft 8000

Total current liabilities 15200

Total liabilities 30400

stockholders' equity

Share capital 74000

2

Balance sheet as at 30 August 2017 Amount

Current assets

Trade receivables 16000

Inventories 20000

Prepaid rent 4400

Total current assets 40400

Furniture and fixtures 48000

Less: Depreciation 4800 43200

Short-term investment 8800

Total assets 92400

Liabilities and stockholders equity

Liabilities

Current liabilities

Wages Outstanding 6400

Gas payment 800

Bank overdraft 8000

Total current liabilities 15200

Total liabilities 30400

stockholders' equity

Share capital 74000

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

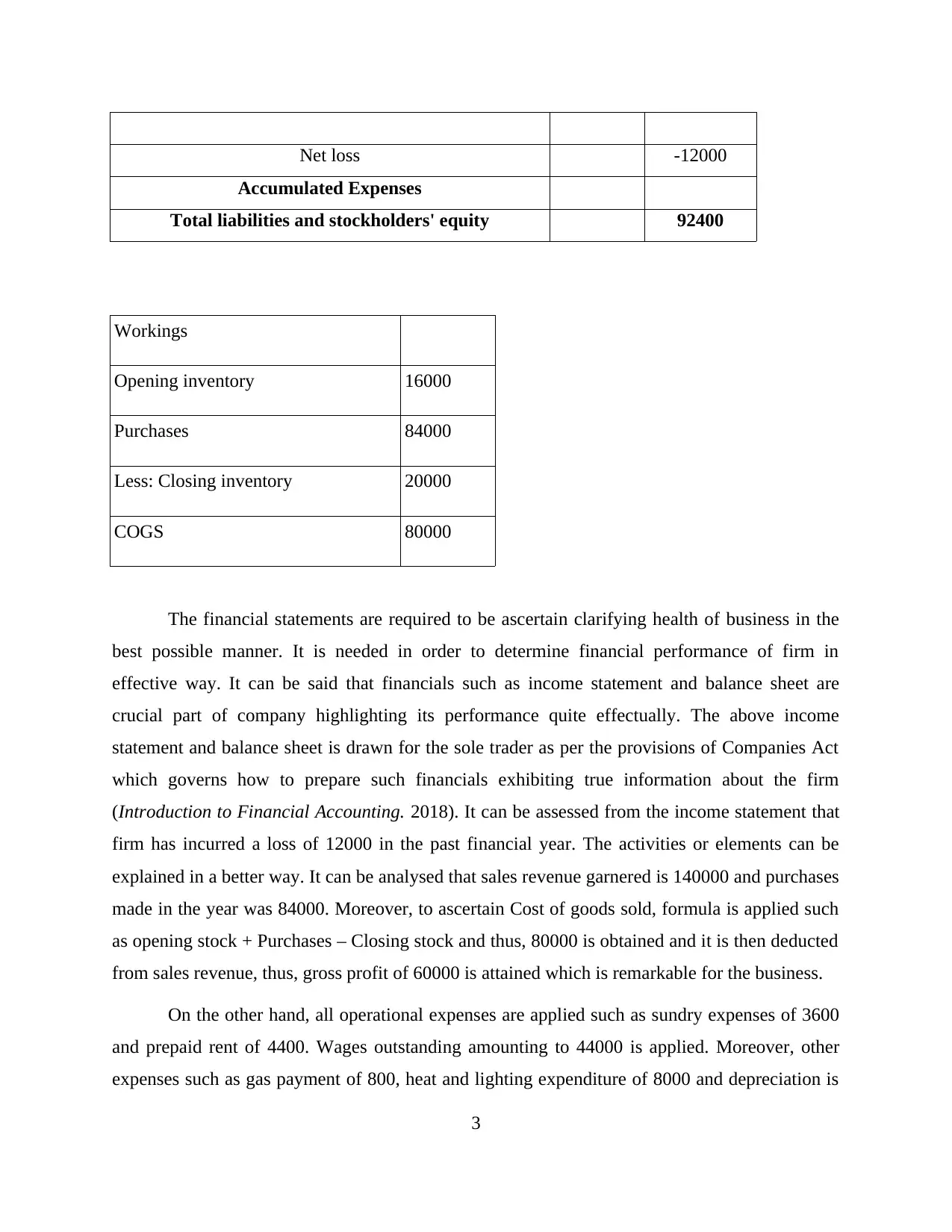

Net loss -12000

Accumulated Expenses

Total liabilities and stockholders' equity 92400

Workings

Opening inventory 16000

Purchases 84000

Less: Closing inventory 20000

COGS 80000

The financial statements are required to be ascertain clarifying health of business in the

best possible manner. It is needed in order to determine financial performance of firm in

effective way. It can be said that financials such as income statement and balance sheet are

crucial part of company highlighting its performance quite effectually. The above income

statement and balance sheet is drawn for the sole trader as per the provisions of Companies Act

which governs how to prepare such financials exhibiting true information about the firm

(Introduction to Financial Accounting. 2018). It can be assessed from the income statement that

firm has incurred a loss of 12000 in the past financial year. The activities or elements can be

explained in a better way. It can be analysed that sales revenue garnered is 140000 and purchases

made in the year was 84000. Moreover, to ascertain Cost of goods sold, formula is applied such

as opening stock + Purchases – Closing stock and thus, 80000 is obtained and it is then deducted

from sales revenue, thus, gross profit of 60000 is attained which is remarkable for the business.

On the other hand, all operational expenses are applied such as sundry expenses of 3600

and prepaid rent of 4400. Wages outstanding amounting to 44000 is applied. Moreover, other

expenses such as gas payment of 800, heat and lighting expenditure of 8000 and depreciation is

3

Accumulated Expenses

Total liabilities and stockholders' equity 92400

Workings

Opening inventory 16000

Purchases 84000

Less: Closing inventory 20000

COGS 80000

The financial statements are required to be ascertain clarifying health of business in the

best possible manner. It is needed in order to determine financial performance of firm in

effective way. It can be said that financials such as income statement and balance sheet are

crucial part of company highlighting its performance quite effectually. The above income

statement and balance sheet is drawn for the sole trader as per the provisions of Companies Act

which governs how to prepare such financials exhibiting true information about the firm

(Introduction to Financial Accounting. 2018). It can be assessed from the income statement that

firm has incurred a loss of 12000 in the past financial year. The activities or elements can be

explained in a better way. It can be analysed that sales revenue garnered is 140000 and purchases

made in the year was 84000. Moreover, to ascertain Cost of goods sold, formula is applied such

as opening stock + Purchases – Closing stock and thus, 80000 is obtained and it is then deducted

from sales revenue, thus, gross profit of 60000 is attained which is remarkable for the business.

On the other hand, all operational expenses are applied such as sundry expenses of 3600

and prepaid rent of 4400. Wages outstanding amounting to 44000 is applied. Moreover, other

expenses such as gas payment of 800, heat and lighting expenditure of 8000 and depreciation is

3

allowed of 4800 and thus, total operational expenditures are 72000. Thus, by deducting gross

profit from operating expenses, net loss of 12000 is arrived which means that expenses are

increased leading to decreased profits. Balance sheet is also prepared which shows total

liabilities and stockholders' equity and total assets held in particular year. Both the figures are

matched (Macve, 2015). Thus, it is required to initiate reduction on the expenditures so that

profits can be attained in the best possible manner.

Question 2 Producing final accounts for Saunders Worsley Ltd for the year ended 30 August

2018

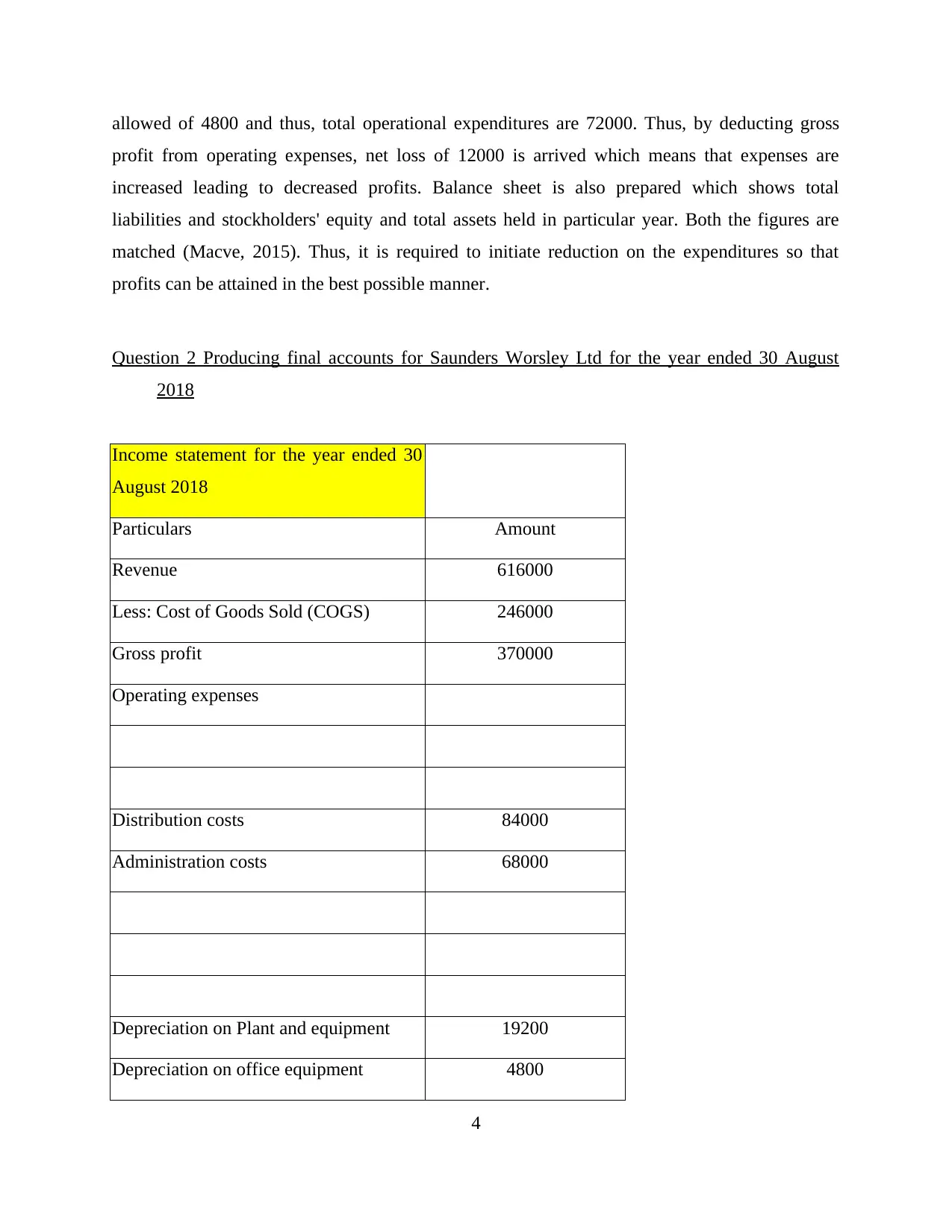

Income statement for the year ended 30

August 2018

Particulars Amount

Revenue 616000

Less: Cost of Goods Sold (COGS) 246000

Gross profit 370000

Operating expenses

Distribution costs 84000

Administration costs 68000

Depreciation on Plant and equipment 19200

Depreciation on office equipment 4800

4

profit from operating expenses, net loss of 12000 is arrived which means that expenses are

increased leading to decreased profits. Balance sheet is also prepared which shows total

liabilities and stockholders' equity and total assets held in particular year. Both the figures are

matched (Macve, 2015). Thus, it is required to initiate reduction on the expenditures so that

profits can be attained in the best possible manner.

Question 2 Producing final accounts for Saunders Worsley Ltd for the year ended 30 August

2018

Income statement for the year ended 30

August 2018

Particulars Amount

Revenue 616000

Less: Cost of Goods Sold (COGS) 246000

Gross profit 370000

Operating expenses

Distribution costs 84000

Administration costs 68000

Depreciation on Plant and equipment 19200

Depreciation on office equipment 4800

4

Total operating expenses 176000

Operating income

EBT 194000

Tax 15000

Net profit 179000

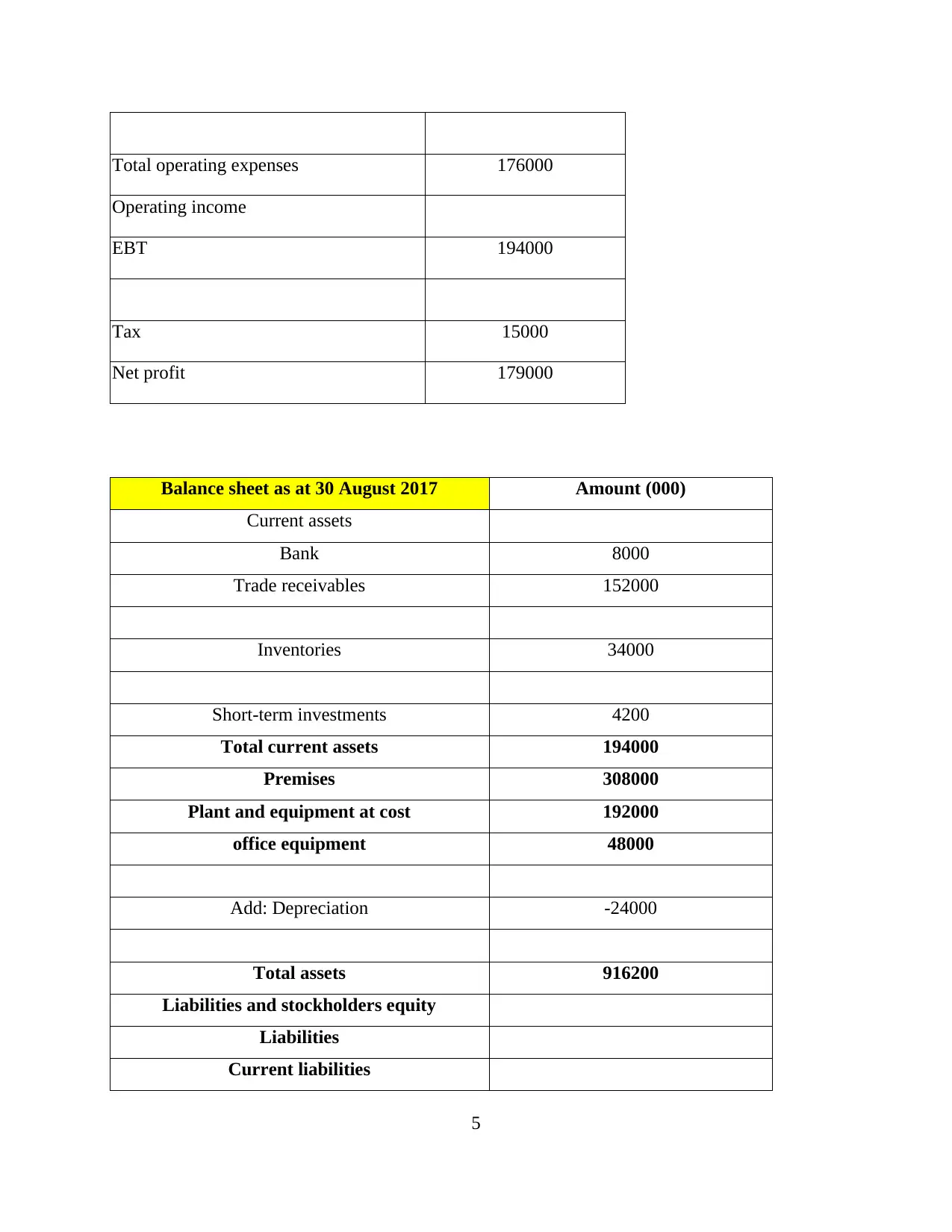

Balance sheet as at 30 August 2017 Amount (000)

Current assets

Bank 8000

Trade receivables 152000

Inventories 34000

Short-term investments 4200

Total current assets 194000

Premises 308000

Plant and equipment at cost 192000

office equipment 48000

Add: Depreciation -24000

Total assets 916200

Liabilities and stockholders equity

Liabilities

Current liabilities

5

Operating income

EBT 194000

Tax 15000

Net profit 179000

Balance sheet as at 30 August 2017 Amount (000)

Current assets

Bank 8000

Trade receivables 152000

Inventories 34000

Short-term investments 4200

Total current assets 194000

Premises 308000

Plant and equipment at cost 192000

office equipment 48000

Add: Depreciation -24000

Total assets 916200

Liabilities and stockholders equity

Liabilities

Current liabilities

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

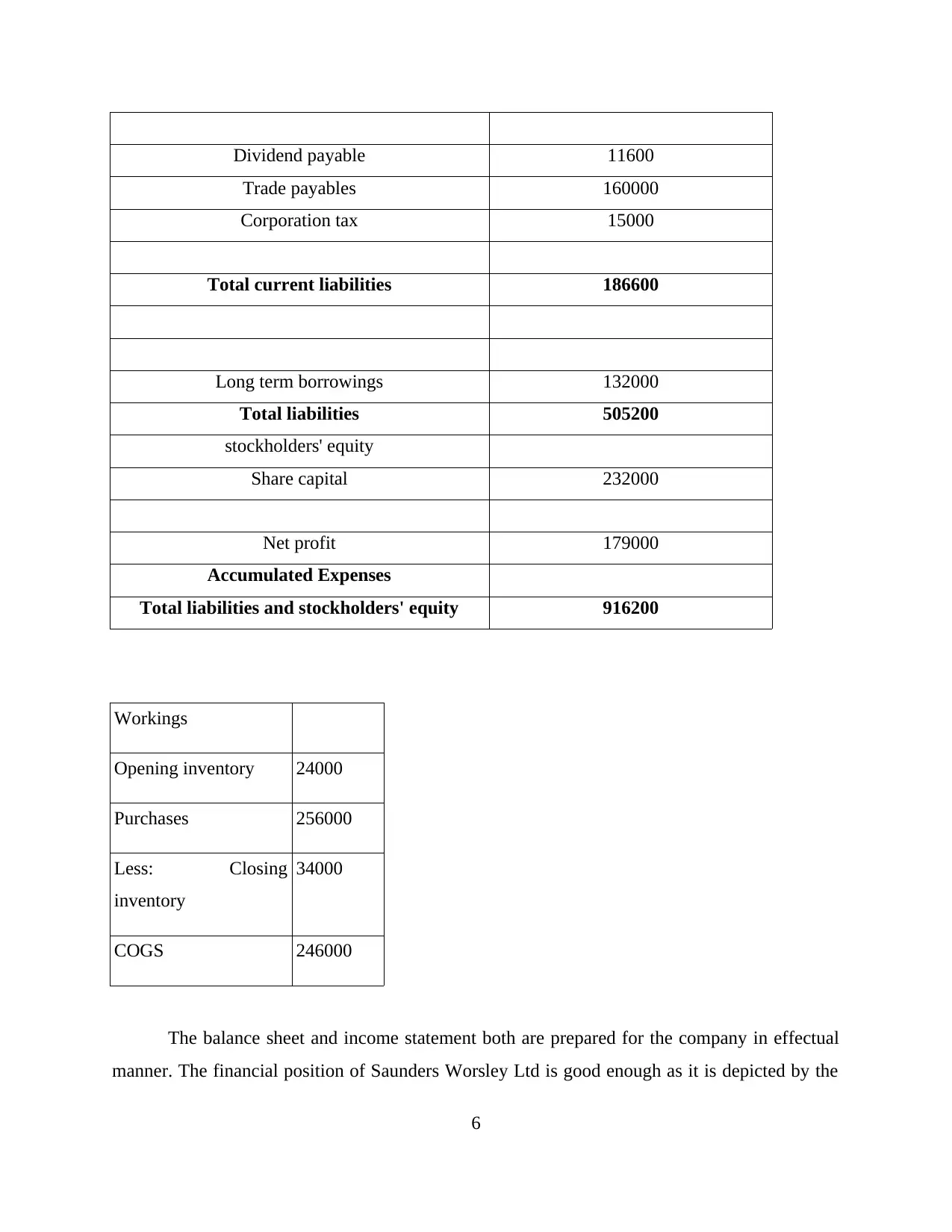

Dividend payable 11600

Trade payables 160000

Corporation tax 15000

Total current liabilities 186600

Long term borrowings 132000

Total liabilities 505200

stockholders' equity

Share capital 232000

Net profit 179000

Accumulated Expenses

Total liabilities and stockholders' equity 916200

Workings

Opening inventory 24000

Purchases 256000

Less: Closing

inventory

34000

COGS 246000

The balance sheet and income statement both are prepared for the company in effectual

manner. The financial position of Saunders Worsley Ltd is good enough as it is depicted by the

6

Trade payables 160000

Corporation tax 15000

Total current liabilities 186600

Long term borrowings 132000

Total liabilities 505200

stockholders' equity

Share capital 232000

Net profit 179000

Accumulated Expenses

Total liabilities and stockholders' equity 916200

Workings

Opening inventory 24000

Purchases 256000

Less: Closing

inventory

34000

COGS 246000

The balance sheet and income statement both are prepared for the company in effectual

manner. The financial position of Saunders Worsley Ltd is good enough as it is depicted by the

6

financial statement in the best possible manner. It can be analysed from the income statement

that firm has earned good net income amounting to 179000 in the past financial year which is

quite good as it is able to initiate control upon expenditures in effective way. This is evident from

the fact that sales made in the year were amounting to 616000. The COGS are arrived by using

the formula as purchases and closing and opening inventory were given. The formula is opening

stock + Purchases – Closing stock, thus, COGS is 246000.

From this, sales are deducted from COGS and gross profit of 370000 is being arrived

with much ease. After that operational expenditures are applied amounting to 176000. Thus, by

reducing gross profit from these expenses, operating income is arrived is 194000. From this,

corporation tax is deducted of 15000 and net income arrived is 179000. The balance sheet is

drawn clarifying fact that assets and liabilities are good enough of the company. Thus, it can be

said that overall financial position of Saunders Worsley Ltd is good and is earning profits quite

effectually.

Question 3 Bank reconciliation statement and relevant terms

Use of deposit in transit: It occurs when a deposit arrives too late in bank and to be

recorded that day. A deposit in transit is cash and checks that have been recorded by an entity,

which have not been yet recorded of the bank where the funds are deposited (Demerjian, 2017).

If it occurs at month end the deposit will not appear in bank statement issued by bank and

become reconcile in the bank reconciliation prepared by entity.

Out standing cheques: It is a cheque that is written by company, but not yet cleared by

bank account on which it is drawn. In the bank reconciliation process, total amount of

outstanding checks is subtracted from the end balance on the bank statement when calculating

the adjusted balance per bank.

Not sufficient funds: It is a condition where bank does not honour a check because the

account holder does not have sufficient fund.

Question 4 Discussing how control and suspense account are reconciled

A suspense account is an account in the general ledger that temporarily stores any

transaction for which there is not having sufficient details to create an entry to correct account,

otherwise larger unreported transactions may not be recorded by the end of reporting period

which result in inaccurate financial results (Warren and Jones, 2018). Once, user clarifies the

7

that firm has earned good net income amounting to 179000 in the past financial year which is

quite good as it is able to initiate control upon expenditures in effective way. This is evident from

the fact that sales made in the year were amounting to 616000. The COGS are arrived by using

the formula as purchases and closing and opening inventory were given. The formula is opening

stock + Purchases – Closing stock, thus, COGS is 246000.

From this, sales are deducted from COGS and gross profit of 370000 is being arrived

with much ease. After that operational expenditures are applied amounting to 176000. Thus, by

reducing gross profit from these expenses, operating income is arrived is 194000. From this,

corporation tax is deducted of 15000 and net income arrived is 179000. The balance sheet is

drawn clarifying fact that assets and liabilities are good enough of the company. Thus, it can be

said that overall financial position of Saunders Worsley Ltd is good and is earning profits quite

effectually.

Question 3 Bank reconciliation statement and relevant terms

Use of deposit in transit: It occurs when a deposit arrives too late in bank and to be

recorded that day. A deposit in transit is cash and checks that have been recorded by an entity,

which have not been yet recorded of the bank where the funds are deposited (Demerjian, 2017).

If it occurs at month end the deposit will not appear in bank statement issued by bank and

become reconcile in the bank reconciliation prepared by entity.

Out standing cheques: It is a cheque that is written by company, but not yet cleared by

bank account on which it is drawn. In the bank reconciliation process, total amount of

outstanding checks is subtracted from the end balance on the bank statement when calculating

the adjusted balance per bank.

Not sufficient funds: It is a condition where bank does not honour a check because the

account holder does not have sufficient fund.

Question 4 Discussing how control and suspense account are reconciled

A suspense account is an account in the general ledger that temporarily stores any

transaction for which there is not having sufficient details to create an entry to correct account,

otherwise larger unreported transactions may not be recorded by the end of reporting period

which result in inaccurate financial results (Warren and Jones, 2018). Once, user clarifies the

7

purpose of this type of transaction it shifts the transaction out of suspense account into the

correct account. On the other side control account is a summary account in general ledger. It is

done to have correct balance for the financial statement. It is help to know the exact position of

bank like total transaction for the day, total sales on account for the day etc. It is mostly used in

large organization because their transaction value is quite high and the balance should be match

the total for the related subsidiary ledger.

This is necessary to reconcile suspense account and control account to know the exact

position of business and by using these both tools, individual can know the day to day

transaction and sales during a period and if the user does not have all the information related to

sales then he can use suspense account to transfer the amount and when the purpose of account is

clarified then it can shift the transaction out of suspense account into the correct account (Warren

and Jones, 2018).

For example: Customers send in a payment for $5000 but does not specify which open

invoices it intends to pay. Then staff temporarily parks $5000 in suspense account and in this

case the entry to place the funds in suspense account is cash account debit to $5000 and suspense

account credit to $5000 and when invoice is identified then reverse entry should be shown. And

for control account, example is accounts receivable general ledger account. Either summary or

detail posting are made to the accounts and the total of customer account balances must equal to

the total balance of control, they are used for cash, account payable, inventory and fixed asset

account.

CONCLUSION

Hereby it can be concluded that financials plays crucial role in the company determining

financial health in the best possible manner. Moreover, Bank reconciliation statement is also

useful in assessing discrepancies observed in passbook and accounting records of company.

8

correct account. On the other side control account is a summary account in general ledger. It is

done to have correct balance for the financial statement. It is help to know the exact position of

bank like total transaction for the day, total sales on account for the day etc. It is mostly used in

large organization because their transaction value is quite high and the balance should be match

the total for the related subsidiary ledger.

This is necessary to reconcile suspense account and control account to know the exact

position of business and by using these both tools, individual can know the day to day

transaction and sales during a period and if the user does not have all the information related to

sales then he can use suspense account to transfer the amount and when the purpose of account is

clarified then it can shift the transaction out of suspense account into the correct account (Warren

and Jones, 2018).

For example: Customers send in a payment for $5000 but does not specify which open

invoices it intends to pay. Then staff temporarily parks $5000 in suspense account and in this

case the entry to place the funds in suspense account is cash account debit to $5000 and suspense

account credit to $5000 and when invoice is identified then reverse entry should be shown. And

for control account, example is accounts receivable general ledger account. Either summary or

detail posting are made to the accounts and the total of customer account balances must equal to

the total balance of control, they are used for cash, account payable, inventory and fixed asset

account.

CONCLUSION

Hereby it can be concluded that financials plays crucial role in the company determining

financial health in the best possible manner. Moreover, Bank reconciliation statement is also

useful in assessing discrepancies observed in passbook and accounting records of company.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.