Accounting Assignments Solutions

VerifiedAdded on 2020/06/04

|6

|878

|91

AI Summary

This accounting assignment provides solutions to various financial problems. It covers topics like calculating depreciation for different assets (cost, scrap value, useful life), accrued interest on a bank loan, outstanding wages for two days, and control accounts for accounts receivable and payable. The solutions are presented in a clear and organized manner with workings noted.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

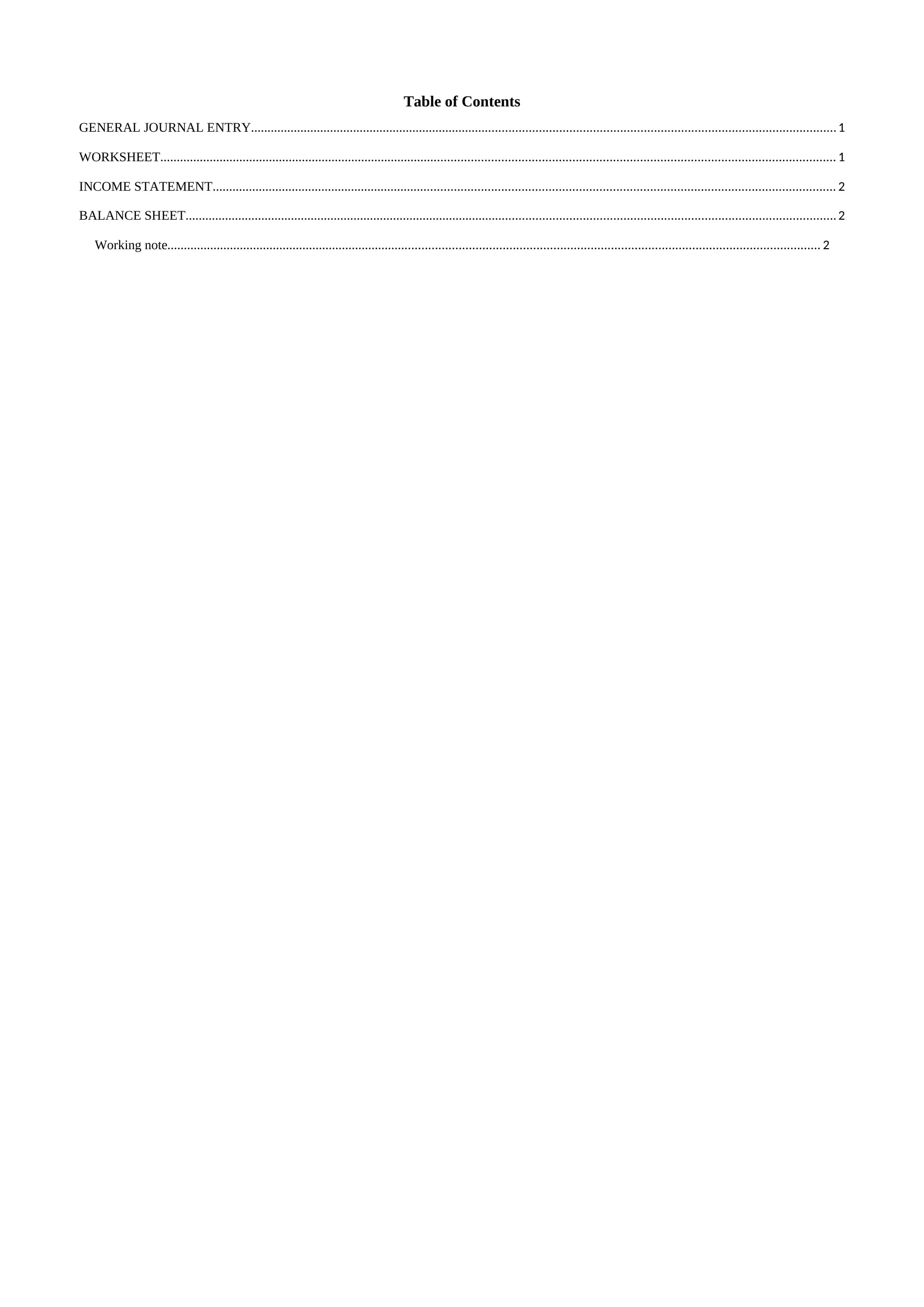

Table of Contents

GENERAL JOURNAL ENTRY............................................................................................................................................................................... 1

WORKSHEET.......................................................................................................................................................................................................... 1

INCOME STATEMENT.......................................................................................................................................................................................... 2

BALANCE SHEET................................................................................................................................................................................................... 2

Working note................................................................................................................................................................................................... 2

GENERAL JOURNAL ENTRY............................................................................................................................................................................... 1

WORKSHEET.......................................................................................................................................................................................................... 1

INCOME STATEMENT.......................................................................................................................................................................................... 2

BALANCE SHEET................................................................................................................................................................................................... 2

Working note................................................................................................................................................................................................... 2

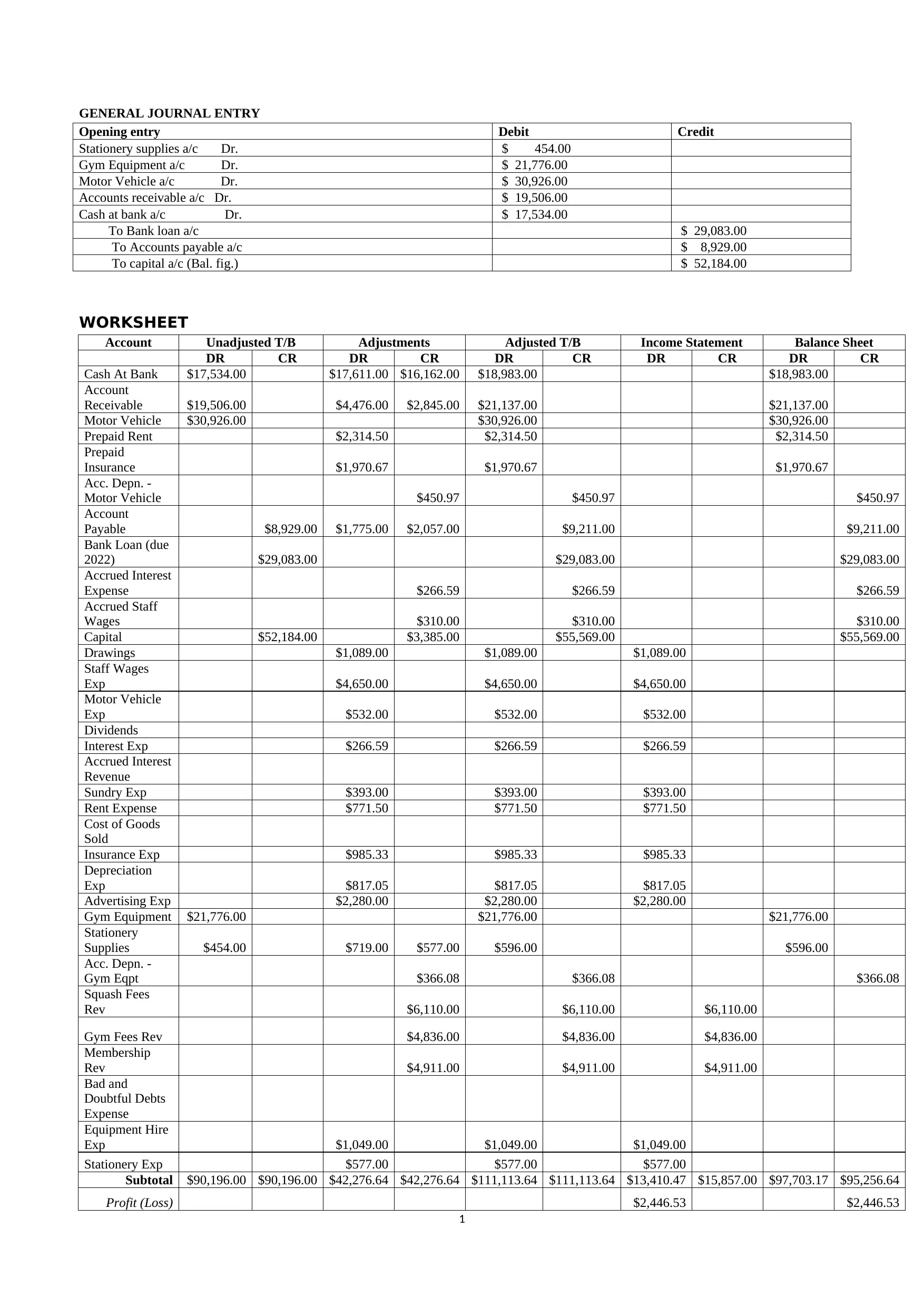

GENERAL JOURNAL ENTRY

Opening entry Debit Credit

Stationery supplies a/c Dr. $ 454.00

Gym Equipment a/c Dr. $ 21,776.00

Motor Vehicle a/c Dr. $ 30,926.00

Accounts receivable a/c Dr. $ 19,506.00

Cash at bank a/c Dr. $ 17,534.00

To Bank loan a/c $ 29,083.00

To Accounts payable a/c $ 8,929.00

To capital a/c (Bal. fig.) $ 52,184.00

WORKSHEET

Account Unadjusted T/B Adjustments Adjusted T/B Income Statement Balance Sheet

DR CR DR CR DR CR DR CR DR CR

Cash At Bank $17,534.00 $17,611.00 $16,162.00 $18,983.00 $18,983.00

Account

Receivable $19,506.00 $4,476.00 $2,845.00 $21,137.00 $21,137.00

Motor Vehicle $30,926.00 $30,926.00 $30,926.00

Prepaid Rent $2,314.50 $2,314.50 $2,314.50

Prepaid

Insurance $1,970.67 $1,970.67 $1,970.67

Acc. Depn. -

Motor Vehicle $450.97 $450.97 $450.97

Account

Payable $8,929.00 $1,775.00 $2,057.00 $9,211.00 $9,211.00

Bank Loan (due

2022) $29,083.00 $29,083.00 $29,083.00

Accrued Interest

Expense $266.59 $266.59 $266.59

Accrued Staff

Wages $310.00 $310.00 $310.00

Capital $52,184.00 $3,385.00 $55,569.00 $55,569.00

Drawings $1,089.00 $1,089.00 $1,089.00

Staff Wages

Exp $4,650.00 $4,650.00 $4,650.00

Motor Vehicle

Exp $532.00 $532.00 $532.00

Dividends

Interest Exp $266.59 $266.59 $266.59

Accrued Interest

Revenue

Sundry Exp $393.00 $393.00 $393.00

Rent Expense $771.50 $771.50 $771.50

Cost of Goods

Sold

Insurance Exp $985.33 $985.33 $985.33

Depreciation

Exp $817.05 $817.05 $817.05

Advertising Exp $2,280.00 $2,280.00 $2,280.00

Gym Equipment $21,776.00 $21,776.00 $21,776.00

Stationery

Supplies $454.00 $719.00 $577.00 $596.00 $596.00

Acc. Depn. -

Gym Eqpt $366.08 $366.08 $366.08

Squash Fees

Rev $6,110.00 $6,110.00 $6,110.00

Gym Fees Rev $4,836.00 $4,836.00 $4,836.00

Membership

Rev $4,911.00 $4,911.00 $4,911.00

Bad and

Doubtful Debts

Expense

Equipment Hire

Exp $1,049.00 $1,049.00 $1,049.00

Stationery Exp $577.00 $577.00 $577.00

Subtotal $90,196.00 $90,196.00 $42,276.64 $42,276.64 $111,113.64 $111,113.64 $13,410.47 $15,857.00 $97,703.17 $95,256.64

Profit (Loss) $2,446.53 $2,446.53

1

Opening entry Debit Credit

Stationery supplies a/c Dr. $ 454.00

Gym Equipment a/c Dr. $ 21,776.00

Motor Vehicle a/c Dr. $ 30,926.00

Accounts receivable a/c Dr. $ 19,506.00

Cash at bank a/c Dr. $ 17,534.00

To Bank loan a/c $ 29,083.00

To Accounts payable a/c $ 8,929.00

To capital a/c (Bal. fig.) $ 52,184.00

WORKSHEET

Account Unadjusted T/B Adjustments Adjusted T/B Income Statement Balance Sheet

DR CR DR CR DR CR DR CR DR CR

Cash At Bank $17,534.00 $17,611.00 $16,162.00 $18,983.00 $18,983.00

Account

Receivable $19,506.00 $4,476.00 $2,845.00 $21,137.00 $21,137.00

Motor Vehicle $30,926.00 $30,926.00 $30,926.00

Prepaid Rent $2,314.50 $2,314.50 $2,314.50

Prepaid

Insurance $1,970.67 $1,970.67 $1,970.67

Acc. Depn. -

Motor Vehicle $450.97 $450.97 $450.97

Account

Payable $8,929.00 $1,775.00 $2,057.00 $9,211.00 $9,211.00

Bank Loan (due

2022) $29,083.00 $29,083.00 $29,083.00

Accrued Interest

Expense $266.59 $266.59 $266.59

Accrued Staff

Wages $310.00 $310.00 $310.00

Capital $52,184.00 $3,385.00 $55,569.00 $55,569.00

Drawings $1,089.00 $1,089.00 $1,089.00

Staff Wages

Exp $4,650.00 $4,650.00 $4,650.00

Motor Vehicle

Exp $532.00 $532.00 $532.00

Dividends

Interest Exp $266.59 $266.59 $266.59

Accrued Interest

Revenue

Sundry Exp $393.00 $393.00 $393.00

Rent Expense $771.50 $771.50 $771.50

Cost of Goods

Sold

Insurance Exp $985.33 $985.33 $985.33

Depreciation

Exp $817.05 $817.05 $817.05

Advertising Exp $2,280.00 $2,280.00 $2,280.00

Gym Equipment $21,776.00 $21,776.00 $21,776.00

Stationery

Supplies $454.00 $719.00 $577.00 $596.00 $596.00

Acc. Depn. -

Gym Eqpt $366.08 $366.08 $366.08

Squash Fees

Rev $6,110.00 $6,110.00 $6,110.00

Gym Fees Rev $4,836.00 $4,836.00 $4,836.00

Membership

Rev $4,911.00 $4,911.00 $4,911.00

Bad and

Doubtful Debts

Expense

Equipment Hire

Exp $1,049.00 $1,049.00 $1,049.00

Stationery Exp $577.00 $577.00 $577.00

Subtotal $90,196.00 $90,196.00 $42,276.64 $42,276.64 $111,113.64 $111,113.64 $13,410.47 $15,857.00 $97,703.17 $95,256.64

Profit (Loss) $2,446.53 $2,446.53

1

Total $97,703.17 $97,703.17

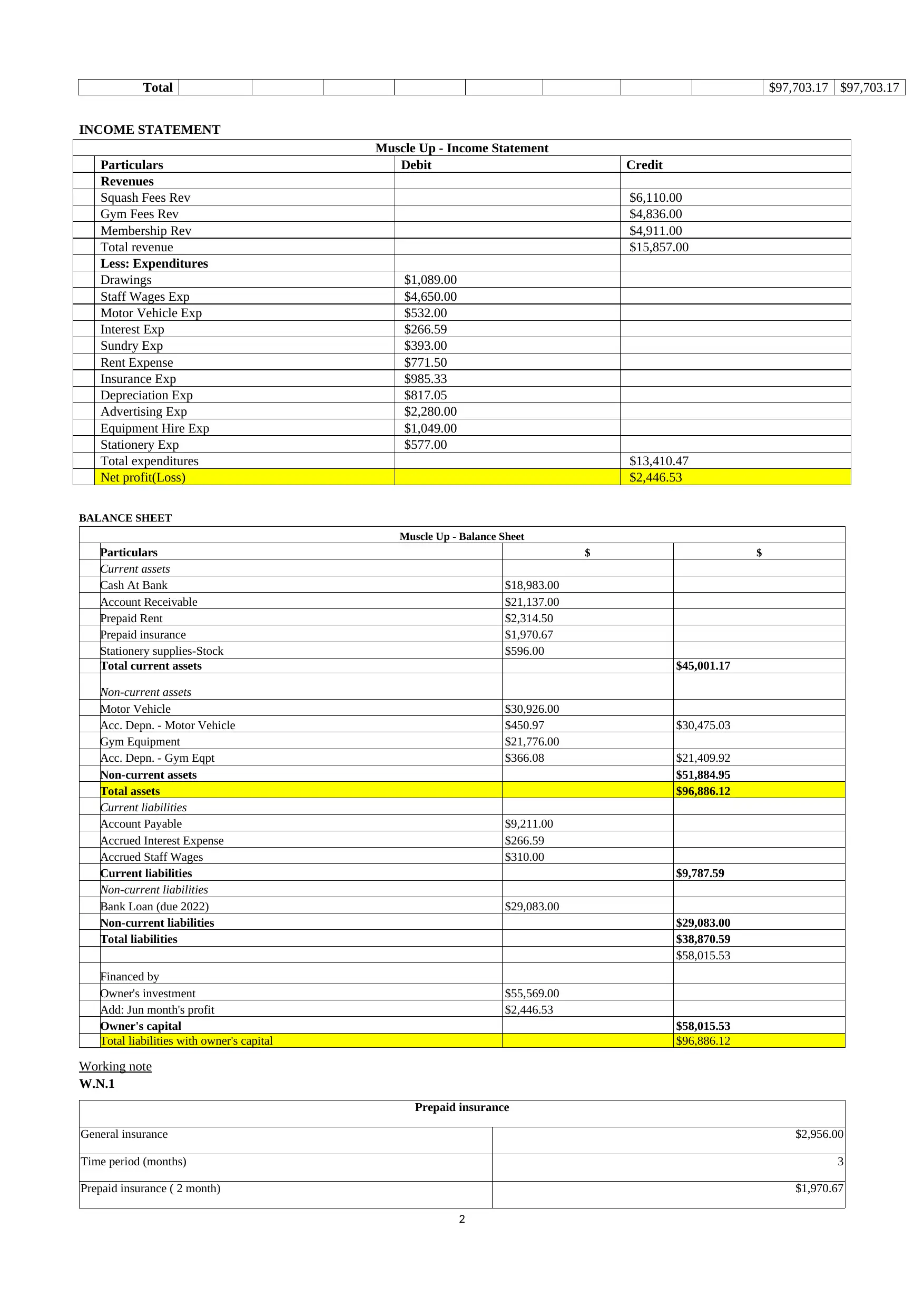

INCOME STATEMENT

Muscle Up - Income Statement

Particulars Debit Credit

Revenues

Squash Fees Rev $6,110.00

Gym Fees Rev $4,836.00

Membership Rev $4,911.00

Total revenue $15,857.00

Less: Expenditures

Drawings $1,089.00

Staff Wages Exp $4,650.00

Motor Vehicle Exp $532.00

Interest Exp $266.59

Sundry Exp $393.00

Rent Expense $771.50

Insurance Exp $985.33

Depreciation Exp $817.05

Advertising Exp $2,280.00

Equipment Hire Exp $1,049.00

Stationery Exp $577.00

Total expenditures $13,410.47

Net profit(Loss) $2,446.53

BALANCE SHEET

Muscle Up - Balance Sheet

Particulars $ $

Current assets

Cash At Bank $18,983.00

Account Receivable $21,137.00

Prepaid Rent $2,314.50

Prepaid insurance $1,970.67

Stationery supplies-Stock $596.00

Total current assets $45,001.17

Non-current assets

Motor Vehicle $30,926.00

Acc. Depn. - Motor Vehicle $450.97 $30,475.03

Gym Equipment $21,776.00

Acc. Depn. - Gym Eqpt $366.08 $21,409.92

Non-current assets $51,884.95

Total assets $96,886.12

Current liabilities

Account Payable $9,211.00

Accrued Interest Expense $266.59

Accrued Staff Wages $310.00

Current liabilities $9,787.59

Non-current liabilities

Bank Loan (due 2022) $29,083.00

Non-current liabilities $29,083.00

Total liabilities $38,870.59

$58,015.53

Financed by

Owner's investment $55,569.00

Add: Jun month's profit $2,446.53

Owner's capital $58,015.53

Total liabilities with owner's capital $96,886.12

Working note

W.N.1

Prepaid insurance

General insurance $2,956.00

Time period (months) 3

Prepaid insurance ( 2 month) $1,970.67

2

INCOME STATEMENT

Muscle Up - Income Statement

Particulars Debit Credit

Revenues

Squash Fees Rev $6,110.00

Gym Fees Rev $4,836.00

Membership Rev $4,911.00

Total revenue $15,857.00

Less: Expenditures

Drawings $1,089.00

Staff Wages Exp $4,650.00

Motor Vehicle Exp $532.00

Interest Exp $266.59

Sundry Exp $393.00

Rent Expense $771.50

Insurance Exp $985.33

Depreciation Exp $817.05

Advertising Exp $2,280.00

Equipment Hire Exp $1,049.00

Stationery Exp $577.00

Total expenditures $13,410.47

Net profit(Loss) $2,446.53

BALANCE SHEET

Muscle Up - Balance Sheet

Particulars $ $

Current assets

Cash At Bank $18,983.00

Account Receivable $21,137.00

Prepaid Rent $2,314.50

Prepaid insurance $1,970.67

Stationery supplies-Stock $596.00

Total current assets $45,001.17

Non-current assets

Motor Vehicle $30,926.00

Acc. Depn. - Motor Vehicle $450.97 $30,475.03

Gym Equipment $21,776.00

Acc. Depn. - Gym Eqpt $366.08 $21,409.92

Non-current assets $51,884.95

Total assets $96,886.12

Current liabilities

Account Payable $9,211.00

Accrued Interest Expense $266.59

Accrued Staff Wages $310.00

Current liabilities $9,787.59

Non-current liabilities

Bank Loan (due 2022) $29,083.00

Non-current liabilities $29,083.00

Total liabilities $38,870.59

$58,015.53

Financed by

Owner's investment $55,569.00

Add: Jun month's profit $2,446.53

Owner's capital $58,015.53

Total liabilities with owner's capital $96,886.12

Working note

W.N.1

Prepaid insurance

General insurance $2,956.00

Time period (months) 3

Prepaid insurance ( 2 month) $1,970.67

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

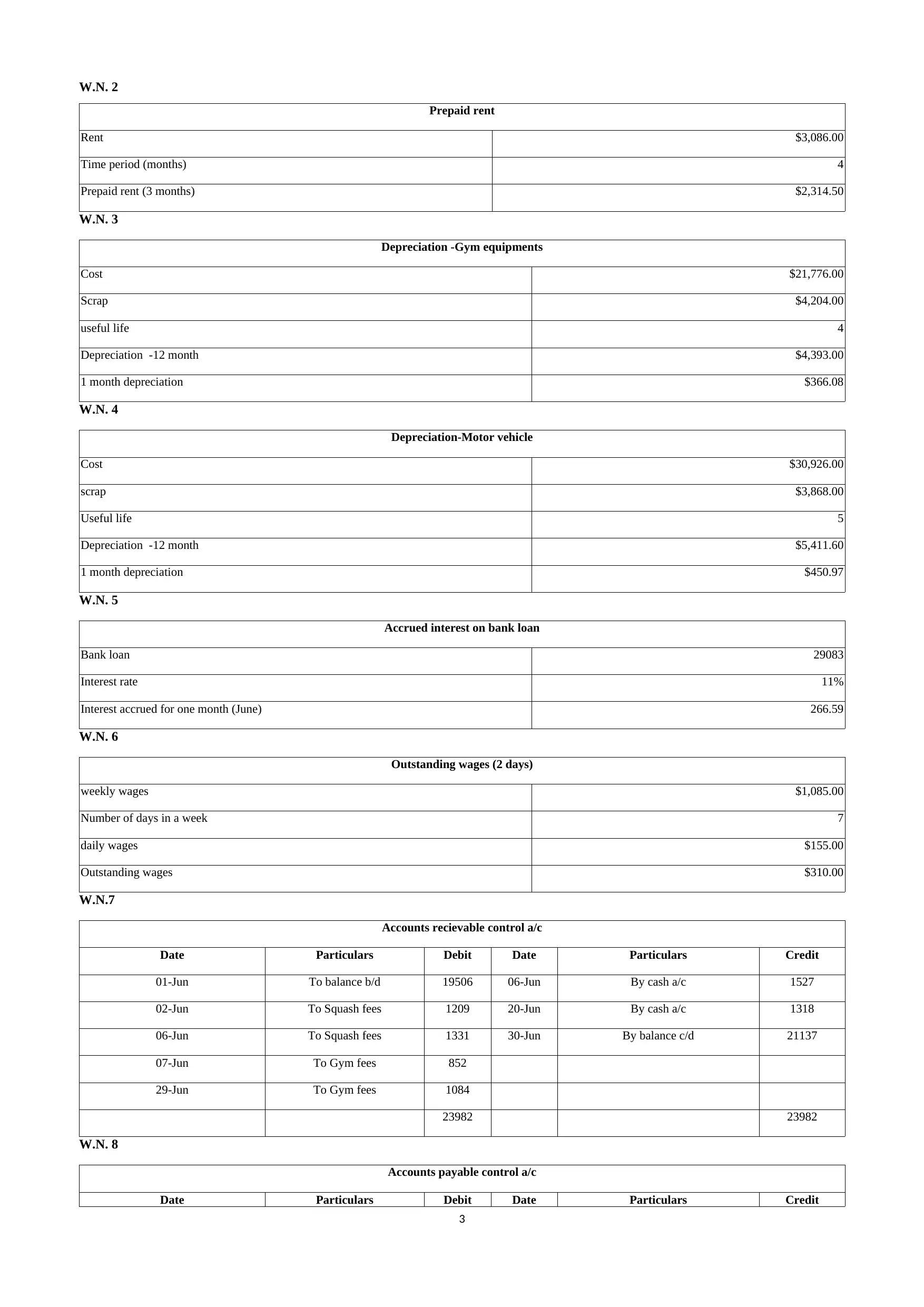

W.N. 2

Prepaid rent

Rent $3,086.00

Time period (months) 4

Prepaid rent (3 months) $2,314.50

W.N. 3

Depreciation -Gym equipments

Cost $21,776.00

Scrap $4,204.00

useful life 4

Depreciation -12 month $4,393.00

1 month depreciation $366.08

W.N. 4

Depreciation-Motor vehicle

Cost $30,926.00

scrap $3,868.00

Useful life 5

Depreciation -12 month $5,411.60

1 month depreciation $450.97

W.N. 5

Accrued interest on bank loan

Bank loan 29083

Interest rate 11%

Interest accrued for one month (June) 266.59

W.N. 6

Outstanding wages (2 days)

weekly wages $1,085.00

Number of days in a week 7

daily wages $155.00

Outstanding wages $310.00

W.N.7

Accounts recievable control a/c

Date Particulars Debit Date Particulars Credit

01-Jun To balance b/d 19506 06-Jun By cash a/c 1527

02-Jun To Squash fees 1209 20-Jun By cash a/c 1318

06-Jun To Squash fees 1331 30-Jun By balance c/d 21137

07-Jun To Gym fees 852

29-Jun To Gym fees 1084

23982 23982

W.N. 8

Accounts payable control a/c

Date Particulars Debit Date Particulars Credit

3

Prepaid rent

Rent $3,086.00

Time period (months) 4

Prepaid rent (3 months) $2,314.50

W.N. 3

Depreciation -Gym equipments

Cost $21,776.00

Scrap $4,204.00

useful life 4

Depreciation -12 month $4,393.00

1 month depreciation $366.08

W.N. 4

Depreciation-Motor vehicle

Cost $30,926.00

scrap $3,868.00

Useful life 5

Depreciation -12 month $5,411.60

1 month depreciation $450.97

W.N. 5

Accrued interest on bank loan

Bank loan 29083

Interest rate 11%

Interest accrued for one month (June) 266.59

W.N. 6

Outstanding wages (2 days)

weekly wages $1,085.00

Number of days in a week 7

daily wages $155.00

Outstanding wages $310.00

W.N.7

Accounts recievable control a/c

Date Particulars Debit Date Particulars Credit

01-Jun To balance b/d 19506 06-Jun By cash a/c 1527

02-Jun To Squash fees 1209 20-Jun By cash a/c 1318

06-Jun To Squash fees 1331 30-Jun By balance c/d 21137

07-Jun To Gym fees 852

29-Jun To Gym fees 1084

23982 23982

W.N. 8

Accounts payable control a/c

Date Particulars Debit Date Particulars Credit

3

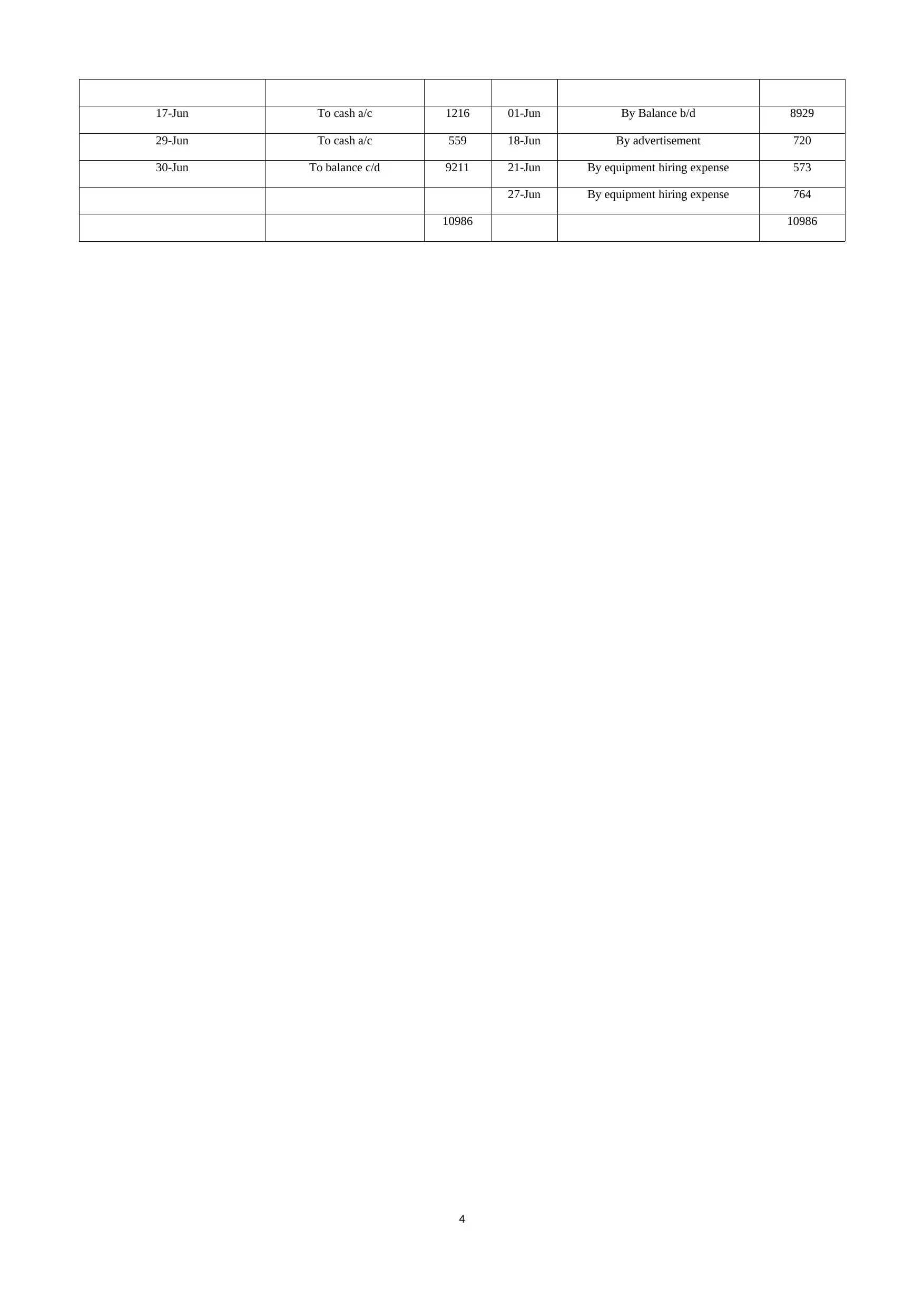

17-Jun To cash a/c 1216 01-Jun By Balance b/d 8929

29-Jun To cash a/c 559 18-Jun By advertisement 720

30-Jun To balance c/d 9211 21-Jun By equipment hiring expense 573

27-Jun By equipment hiring expense 764

10986 10986

4

29-Jun To cash a/c 559 18-Jun By advertisement 720

30-Jun To balance c/d 9211 21-Jun By equipment hiring expense 573

27-Jun By equipment hiring expense 764

10986 10986

4

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.