Financial Accounting Report: Pee Group Consolidated Statement

VerifiedAdded on 2023/01/05

|13

|3940

|29

Report

AI Summary

This financial accounting report presents a consolidated statement of financial position for the Pee Group, prepared as of December 31, 2019. The report includes the balance sheet, working notes for non-controlling interests, and goodwill calculations. The report then delves into the qualitative characteristics of financial information, specifically focusing on relevance, reliability, and comparability. It also includes an analysis of Patrick Financial Services' financial performance, comparing financial and non-financial information, highlighting the importance of considering both for decision-making. The report also analyses the internal business processes.

Financial Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1........................................................................................................................................3

a) Consolidated statement of financial position for the Pee group..............................................3

b) Relevance, reliability and comparability.................................................................................4

Question 2........................................................................................................................................7

a)..................................................................................................................................................7

b) Briefly discuss why professional ethics are important in accounting.....................................9

References......................................................................................................................................13

Question 1........................................................................................................................................3

a) Consolidated statement of financial position for the Pee group..............................................3

b) Relevance, reliability and comparability.................................................................................4

Question 2........................................................................................................................................7

a)..................................................................................................................................................7

b) Briefly discuss why professional ethics are important in accounting.....................................9

References......................................................................................................................................13

Question 1

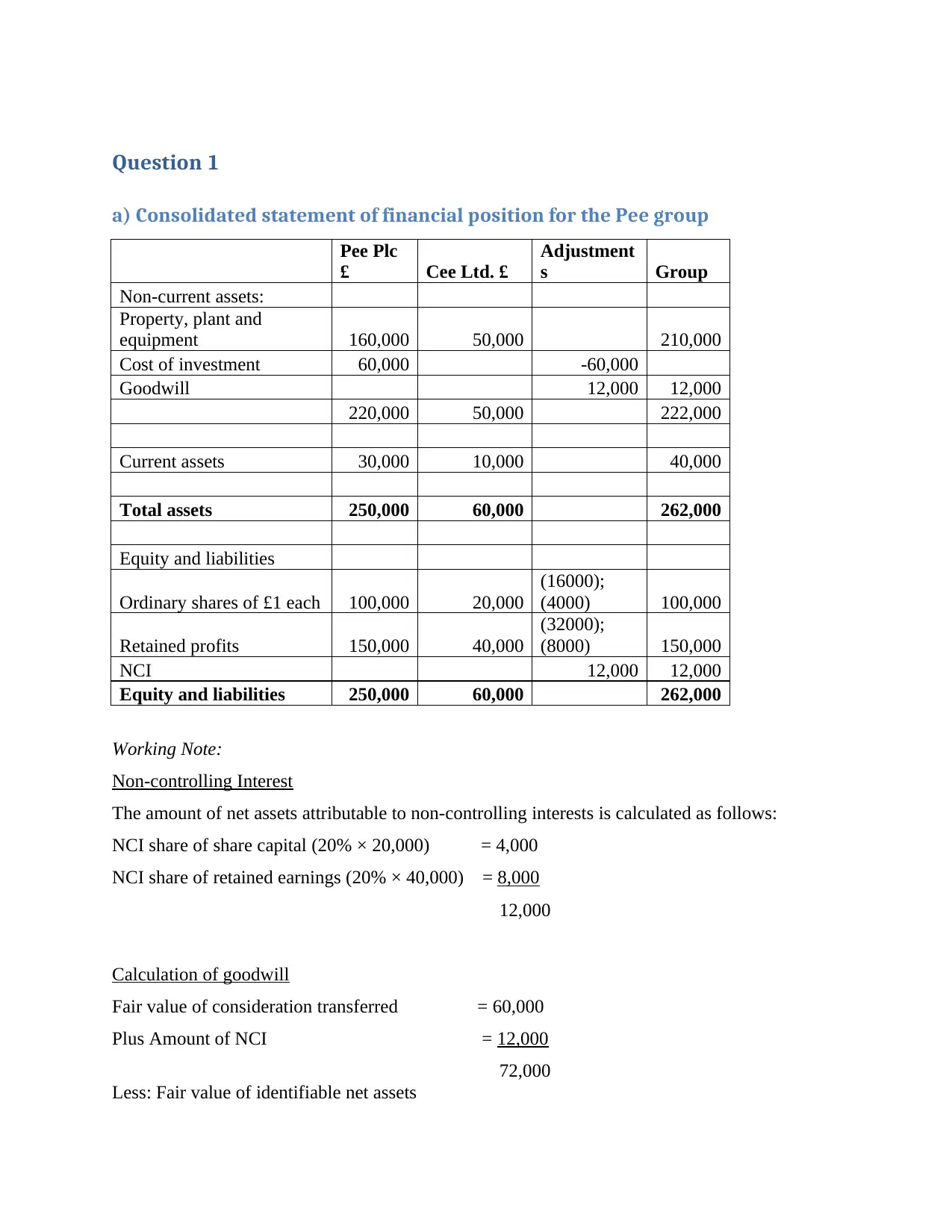

a) Consolidated statement of financial position for the Pee group

Pee Plc

£ Cee Ltd. £

Adjustment

s Group

Non-current assets:

Property, plant and

equipment 160,000 50,000 210,000

Cost of investment 60,000 -60,000

Goodwill 12,000 12,000

220,000 50,000 222,000

Current assets 30,000 10,000 40,000

Total assets 250,000 60,000 262,000

Equity and liabilities

Ordinary shares of £1 each 100,000 20,000

(16000);

(4000) 100,000

Retained profits 150,000 40,000

(32000);

(8000) 150,000

NCI 12,000 12,000

Equity and liabilities 250,000 60,000 262,000

Working Note:

Non-controlling Interest

The amount of net assets attributable to non-controlling interests is calculated as follows:

NCI share of share capital (20% × 20,000) = 4,000

NCI share of retained earnings (20% × 40,000) = 8,000

12,000

Calculation of goodwill

Fair value of consideration transferred = 60,000

Plus Amount of NCI = 12,000

72,000

Less: Fair value of identifiable net assets

a) Consolidated statement of financial position for the Pee group

Pee Plc

£ Cee Ltd. £

Adjustment

s Group

Non-current assets:

Property, plant and

equipment 160,000 50,000 210,000

Cost of investment 60,000 -60,000

Goodwill 12,000 12,000

220,000 50,000 222,000

Current assets 30,000 10,000 40,000

Total assets 250,000 60,000 262,000

Equity and liabilities

Ordinary shares of £1 each 100,000 20,000

(16000);

(4000) 100,000

Retained profits 150,000 40,000

(32000);

(8000) 150,000

NCI 12,000 12,000

Equity and liabilities 250,000 60,000 262,000

Working Note:

Non-controlling Interest

The amount of net assets attributable to non-controlling interests is calculated as follows:

NCI share of share capital (20% × 20,000) = 4,000

NCI share of retained earnings (20% × 40,000) = 8,000

12,000

Calculation of goodwill

Fair value of consideration transferred = 60,000

Plus Amount of NCI = 12,000

72,000

Less: Fair value of identifiable net assets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Share capital = 20,000

Retained earnings = 40,000

Goodwill on acquisition date 12,000

b) Relevance, reliability and comparability

Relevance:

Relevance is a general quality that is used as a selection criterion at all stages of the

financial reporting process. The data provided by the tax summaries should be relevant.

Furthermore, where decisions need to be made between relevant and reliable but not

fundamentally related alternatives, the option chosen should be the one that affects portfolio

adequacy data in general - on the whole, what is difficult and would be of great use to make

financial choices.

Relevant information has predictive value or confirmatory value. It has reasonable value

for the opportunity that does not encourage clients to evaluate or analyze past, present or future

activities and should not be a yardstick unparalleled measurement for prescient value. The data

has a positive value in that it does not induce messengers to corroborate or manipulate previous

assessments and assessments. Data can have both sensory and contemplative value. For example,

data on the current size and structure of buildings prompts customers to examine the element's

ability to misuse openings and respond to unfavorable conditions. Similar data helps confirm

past evaluations of the element structure and the outcome of actions.

The ability to use data in tax summaries to make assessments is augmented by the way it is

introduced. For example, the suppression estimate of the data provided by the presentation

statement of the financial statements will be updated if strange or rare items are revealed about

increases or mishaps and if data are provided that on customers finding additional or unfortunate

events, even unusual or inconsistent. after that. Similarly, an introduction that helps clients

understand the repetitive / non-repetitive nature of the various ups and downs further develops

the show’s approximate articulation estimate.

There are a number of different perspectives where it will be possible to see the cash

position and balance sheet position of content and the included viewpoint could have a

significant impact on assets and liabilities that are see and the movement of sums. Considering

the purpose of the tax reports, the generally more rational view depends on the assumption that

Retained earnings = 40,000

Goodwill on acquisition date 12,000

b) Relevance, reliability and comparability

Relevance:

Relevance is a general quality that is used as a selection criterion at all stages of the

financial reporting process. The data provided by the tax summaries should be relevant.

Furthermore, where decisions need to be made between relevant and reliable but not

fundamentally related alternatives, the option chosen should be the one that affects portfolio

adequacy data in general - on the whole, what is difficult and would be of great use to make

financial choices.

Relevant information has predictive value or confirmatory value. It has reasonable value

for the opportunity that does not encourage clients to evaluate or analyze past, present or future

activities and should not be a yardstick unparalleled measurement for prescient value. The data

has a positive value in that it does not induce messengers to corroborate or manipulate previous

assessments and assessments. Data can have both sensory and contemplative value. For example,

data on the current size and structure of buildings prompts customers to examine the element's

ability to misuse openings and respond to unfavorable conditions. Similar data helps confirm

past evaluations of the element structure and the outcome of actions.

The ability to use data in tax summaries to make assessments is augmented by the way it is

introduced. For example, the suppression estimate of the data provided by the presentation

statement of the financial statements will be updated if strange or rare items are revealed about

increases or mishaps and if data are provided that on customers finding additional or unfortunate

events, even unusual or inconsistent. after that. Similarly, an introduction that helps clients

understand the repetitive / non-repetitive nature of the various ups and downs further develops

the show’s approximate articulation estimate.

There are a number of different perspectives where it will be possible to see the cash

position and balance sheet position of content and the included viewpoint could have a

significant impact on assets and liabilities that are see and the movement of sums. Considering

the purpose of the tax reports, the generally more rational view depends on the assumption that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the element continues with an operating presence in the coming years. This concept is regularly

cited as a sign of business continuity.

Reliability:

Information may be relevant but this alone does not suffice for reliability as well. Reliable

data must be just as important to be valuable to dynamics. There are several components that

contribute to the dependency of money data.

The reliability principle is one of the important standards of accounting and is used to

ensure that accounting items and business documents extract the best data. more accessible

details. The inconsistent quality rule (or objectivity rule) underlies many accounting

requirements identified by GAAP or IFR guidelines. This rule is issued as a rule to ensure that all

organizations adhere to correct and accurate posting and accounting practices.

The accounting rule of the reliability principle concerns the financial information of a

business and states that the data entered in accounting records and items must be the most

accurate and most importantly accessible data. Overall, for money data to be valuable to

auditors, executives, and partners, it should be relevant. Relevant data includes everything that

can be considered valuable, important, relevant and reasonable for a dynamic, both internally and

remotely. The rationale behind the addiction guide is to ensure that all corporate accounting

documents and articles are valid and reasonable.

The reliability principle is to ensure that all trades, activities and businesses included in

balance sheets are reliable. Hard data on the opportunity is considered to be impossible to

analyze, validate and evaluate well with a target test. In addition, a customer should be able to

rely entirely on the data submitted to be an accurate and specific representation of what they are

going to be talking to.

Comparability:

Comparability of information refers to its ability to withstand extra precious time and

compared to the data associated with money coming from different sources. Clients are unable to

evaluate different parts of a position related to liquidity and cash performance due to the

possibility that they cannot analyze one-time budget data with other data or money data of a

material with data related to a other element of money.

cited as a sign of business continuity.

Reliability:

Information may be relevant but this alone does not suffice for reliability as well. Reliable

data must be just as important to be valuable to dynamics. There are several components that

contribute to the dependency of money data.

The reliability principle is one of the important standards of accounting and is used to

ensure that accounting items and business documents extract the best data. more accessible

details. The inconsistent quality rule (or objectivity rule) underlies many accounting

requirements identified by GAAP or IFR guidelines. This rule is issued as a rule to ensure that all

organizations adhere to correct and accurate posting and accounting practices.

The accounting rule of the reliability principle concerns the financial information of a

business and states that the data entered in accounting records and items must be the most

accurate and most importantly accessible data. Overall, for money data to be valuable to

auditors, executives, and partners, it should be relevant. Relevant data includes everything that

can be considered valuable, important, relevant and reasonable for a dynamic, both internally and

remotely. The rationale behind the addiction guide is to ensure that all corporate accounting

documents and articles are valid and reasonable.

The reliability principle is to ensure that all trades, activities and businesses included in

balance sheets are reliable. Hard data on the opportunity is considered to be impossible to

analyze, validate and evaluate well with a target test. In addition, a customer should be able to

rely entirely on the data submitted to be an accurate and specific representation of what they are

going to be talking to.

Comparability:

Comparability of information refers to its ability to withstand extra precious time and

compared to the data associated with money coming from different sources. Clients are unable to

evaluate different parts of a position related to liquidity and cash performance due to the

possibility that they cannot analyze one-time budget data with other data or money data of a

material with data related to a other element of money.

In order to have comparable information entities prepare their financial statements by

following a uniform pattern of presentation which is usually as instructed by the International or

Local Accounting Standards and after they adopt a particular style they remain consistent in its

application.

Information in an entity's financial statements gains in a comparable situation and

comparative material data over a period or other point in time to identify cash and budget

position performance patterns. Material data is also much more valuable on the off chance that it

can be compared and comparative data on different items to assess overall budget presentation

and financial position.

Information in financial statements therefore needs to be comparable—at least as far as is

possible. Also, to assist clients in conducting tests, such data should be organized and presented

in a way that allows users to view and evaluate the similarities and differences between the

nature and impact of the exchanges and the different roles that appear at long term and between

different detailed products. This can usually be achieved through a combination of consistency

and distribution of accounting techniques.

Making financial information useful

The demand for accounting information by investors, lenders, creditors, etc., makes the

fundamental qualitative characteristics attractive in accounting data. Relevant accounting data is

the possibility that it cannot provide supporting data about past duties and help anticipate future

actions or move to manage imaginary future activities. For example, an organization that comes

across a hard quarter and brings those better returns to banks is relevant to a dynamic circle of

lenders to expand or increase the group’s affordable credit.

Enhancing qualitative characteristics improve usefulness of financial information. In any

case, they do not compensate for the lack of meaning or a reliable introduction or the appearance

of rendering the data useless. They help establish two accounting decisions that are equally

relevant, valid and unsustainable for sole trading. Organizers of money data need to achieve

maximum improvement in thematic features. The development of personal qualities includes

appearance, evidence, ideology and comprehension.

following a uniform pattern of presentation which is usually as instructed by the International or

Local Accounting Standards and after they adopt a particular style they remain consistent in its

application.

Information in an entity's financial statements gains in a comparable situation and

comparative material data over a period or other point in time to identify cash and budget

position performance patterns. Material data is also much more valuable on the off chance that it

can be compared and comparative data on different items to assess overall budget presentation

and financial position.

Information in financial statements therefore needs to be comparable—at least as far as is

possible. Also, to assist clients in conducting tests, such data should be organized and presented

in a way that allows users to view and evaluate the similarities and differences between the

nature and impact of the exchanges and the different roles that appear at long term and between

different detailed products. This can usually be achieved through a combination of consistency

and distribution of accounting techniques.

Making financial information useful

The demand for accounting information by investors, lenders, creditors, etc., makes the

fundamental qualitative characteristics attractive in accounting data. Relevant accounting data is

the possibility that it cannot provide supporting data about past duties and help anticipate future

actions or move to manage imaginary future activities. For example, an organization that comes

across a hard quarter and brings those better returns to banks is relevant to a dynamic circle of

lenders to expand or increase the group’s affordable credit.

Enhancing qualitative characteristics improve usefulness of financial information. In any

case, they do not compensate for the lack of meaning or a reliable introduction or the appearance

of rendering the data useless. They help establish two accounting decisions that are equally

relevant, valid and unsustainable for sole trading. Organizers of money data need to achieve

maximum improvement in thematic features. The development of personal qualities includes

appearance, evidence, ideology and comprehension.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 2

a)

I. Patrick Financial Services turnover has been increased from 900 to 945 in current year. This

indicates good financial performance of the company and also shows that firm is growing. The

Net Profit of Patrick Financial Services also showed pick as compare to previous year; this is the

indication of better financial performance and better profitability. Average cash balances has also

been increased from 20 to 21; this indicates better liquidity of the firm but at the same time it

also reveals that company is inefficient to utilize its liquid funds into the growth of the business.

The average trade receivables of the company have been reduced from 22 days to 18 days.

This is the indication of better credit management by the firm. In previous year also, Patrick

Financial Services has maintained good credit management; as its average trade receivables are

greater than industries average which is 30 days.

II.

Non-financial information is often referred to as sustainability data, allowing organizations to be

straightforward in providing and implementing these non-financial parts of management. Non-

monetary or sustainability data: the act of estimating, identifying and reporting authoritative

performance to internal and external partners towards a reasonable promotion goal Corporate

Social Responsibility (CSR): pursuing a duty with businesses to pursue morale and contribute to

the turnover of events by developing the personal satisfaction of the work team, their families,

the network and the company nearby everywhere Triple main responsibility: to cover budgetary,

ecological and social performance.

While non-financial information is currently intentional, it offers vital benefits to

companies in terms of partner engagement and reputation. This review provides some clarity on

the details about systems, standards and authentication types, as well as the data. For ideas on

how your association can make a profit with management data and performance management.

Within the private business there is a long history of reporting non-financial information,

with accountants, auditors and others providing comfort on the data being generated, with

improvements in the publication and use of non-monetary data, for example, medical services

with disclosure of information and regulatory capacity, accountants are being approached to

a)

I. Patrick Financial Services turnover has been increased from 900 to 945 in current year. This

indicates good financial performance of the company and also shows that firm is growing. The

Net Profit of Patrick Financial Services also showed pick as compare to previous year; this is the

indication of better financial performance and better profitability. Average cash balances has also

been increased from 20 to 21; this indicates better liquidity of the firm but at the same time it

also reveals that company is inefficient to utilize its liquid funds into the growth of the business.

The average trade receivables of the company have been reduced from 22 days to 18 days.

This is the indication of better credit management by the firm. In previous year also, Patrick

Financial Services has maintained good credit management; as its average trade receivables are

greater than industries average which is 30 days.

II.

Non-financial information is often referred to as sustainability data, allowing organizations to be

straightforward in providing and implementing these non-financial parts of management. Non-

monetary or sustainability data: the act of estimating, identifying and reporting authoritative

performance to internal and external partners towards a reasonable promotion goal Corporate

Social Responsibility (CSR): pursuing a duty with businesses to pursue morale and contribute to

the turnover of events by developing the personal satisfaction of the work team, their families,

the network and the company nearby everywhere Triple main responsibility: to cover budgetary,

ecological and social performance.

While non-financial information is currently intentional, it offers vital benefits to

companies in terms of partner engagement and reputation. This review provides some clarity on

the details about systems, standards and authentication types, as well as the data. For ideas on

how your association can make a profit with management data and performance management.

Within the private business there is a long history of reporting non-financial information,

with accountants, auditors and others providing comfort on the data being generated, with

improvements in the publication and use of non-monetary data, for example, medical services

with disclosure of information and regulatory capacity, accountants are being approached to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

verify non-monetary data. Similarly, the local plan will see an expansion of data analysis that the

area network considers important.

Non-financial information is normally used for strategy dynamics and data is provided to

assist with personal business resources. Similarly it is a key component of private liability for

personal business practices. Clients of unbalanced data include Parliament, government offices,

other public bodies, particular parties and individuals in society at large.

A common view is that non-financial information can be combined with monetary data to

provide understanding in authoritative administration and to clarify this approach. The provision

of projected data offers a more transparent business experience and is content with more

sophisticated dynamics. For example, there may be changes in buyer attitudes prior to the time of

the purchase options and thus of the resulting exchanges. In addition, the ability to collect and

use wider and more relevant data supports the ability to limit threats by anticipating changes in

the larger business environment and operating in the one way. That is, in the event of a more

widespread condemnation or climate change, at that point updating your articles or

administrations, and how they are introduced, is like commendable thinking.

After comparing Balanced Scorecard (Appendix 2) and Financial Information (Appendix

1); it is clear that both presents different results. For instance, according to Appendix 1; Patrick

Financial Services has performed well. But according to Appendix 2; company has only

improved its average job completion time, for remaining company has not shown good

performance. Appendix 1; reveals that turnover of the company is increased by Balanced

Scorecard clearly shows that number of customer is declined as compared to previous year. It

doesn’t mean Patrick Financial Services has disclosed fake report; as this is the result of increase

fee levels due to which company’s turnover shows increment despite decrease in number of

customers.

On the other hand; company’s market share has also decreased by 6% which is not a good

indicator for the future point of view. Hence, by comparing both the information it can be

concluded that financial information’s only reveals about figures; while non-financial

information gives internal information about the company and also explains the reason behind

any changes in financial information’s. Therefore, it is suggested that while taking decisions

considering both financial and non financial information’s are necessary.

area network considers important.

Non-financial information is normally used for strategy dynamics and data is provided to

assist with personal business resources. Similarly it is a key component of private liability for

personal business practices. Clients of unbalanced data include Parliament, government offices,

other public bodies, particular parties and individuals in society at large.

A common view is that non-financial information can be combined with monetary data to

provide understanding in authoritative administration and to clarify this approach. The provision

of projected data offers a more transparent business experience and is content with more

sophisticated dynamics. For example, there may be changes in buyer attitudes prior to the time of

the purchase options and thus of the resulting exchanges. In addition, the ability to collect and

use wider and more relevant data supports the ability to limit threats by anticipating changes in

the larger business environment and operating in the one way. That is, in the event of a more

widespread condemnation or climate change, at that point updating your articles or

administrations, and how they are introduced, is like commendable thinking.

After comparing Balanced Scorecard (Appendix 2) and Financial Information (Appendix

1); it is clear that both presents different results. For instance, according to Appendix 1; Patrick

Financial Services has performed well. But according to Appendix 2; company has only

improved its average job completion time, for remaining company has not shown good

performance. Appendix 1; reveals that turnover of the company is increased by Balanced

Scorecard clearly shows that number of customer is declined as compared to previous year. It

doesn’t mean Patrick Financial Services has disclosed fake report; as this is the result of increase

fee levels due to which company’s turnover shows increment despite decrease in number of

customers.

On the other hand; company’s market share has also decreased by 6% which is not a good

indicator for the future point of view. Hence, by comparing both the information it can be

concluded that financial information’s only reveals about figures; while non-financial

information gives internal information about the company and also explains the reason behind

any changes in financial information’s. Therefore, it is suggested that while taking decisions

considering both financial and non financial information’s are necessary.

III.

Internal business processes shows that company has increased its error rates in jobs done

as compared to previous year, this shows bad performance by the firm; as error rates declines

better experience by customer. The average job completion time has been declined from 10

weeks to 7 weeks; this indicates increase in the productivity of the firm and hence, Patrick

Financial Services has performed well for this factor.

Customer Knowledge non-financial report shows that company’s number of customers

has been declined from 1500 to 1220 as compared to previous year. Company has increased

average fee level despite same inflation rate; because of this customer feels Patrick’s service

expensive and demand of firm’s services has declined. Decline in market share indicates that

growth of the Patrick Financial Services compared to industry is low.

Learn and Growth information shows that percentage of non core works which is high

margin work declined by 1% from previous year; due to this company has loose large proportion

of revenue. Employee retention rate has also declined by 20% which is not good indicator. This

indicates that employees have no more stakes in the company or they are getting better

opportunity and salary in the market.

The overall performance of the business is not good and clearly indicates that the impact of

current non-financial information would be seen on the growth, credibility and profitability of

the firm in next year. Company is internally weak and if this situation continuous then its hard

for the company to survive for long duration.

b) Briefly discuss why professional ethics are important in accounting

Ethics require accountants to follow the laws and guidelines that oversee their local areas and

work collections. Staying away from activities that could affect the call location is a reasonable

responsibility that colleagues and others should expect.

Trust and honesty play a vital role in accounting because they allow speculators to believe

the data they receive about the organizations they contribute to. Business executives rely on

legitimate accounting to manage their organizations without the knowledge of a one-sided

designation. Trust in accounting is the essential attraction of the call that allows for money-

related choice - creators make the right decisions.

Internal business processes shows that company has increased its error rates in jobs done

as compared to previous year, this shows bad performance by the firm; as error rates declines

better experience by customer. The average job completion time has been declined from 10

weeks to 7 weeks; this indicates increase in the productivity of the firm and hence, Patrick

Financial Services has performed well for this factor.

Customer Knowledge non-financial report shows that company’s number of customers

has been declined from 1500 to 1220 as compared to previous year. Company has increased

average fee level despite same inflation rate; because of this customer feels Patrick’s service

expensive and demand of firm’s services has declined. Decline in market share indicates that

growth of the Patrick Financial Services compared to industry is low.

Learn and Growth information shows that percentage of non core works which is high

margin work declined by 1% from previous year; due to this company has loose large proportion

of revenue. Employee retention rate has also declined by 20% which is not good indicator. This

indicates that employees have no more stakes in the company or they are getting better

opportunity and salary in the market.

The overall performance of the business is not good and clearly indicates that the impact of

current non-financial information would be seen on the growth, credibility and profitability of

the firm in next year. Company is internally weak and if this situation continuous then its hard

for the company to survive for long duration.

b) Briefly discuss why professional ethics are important in accounting

Ethics require accountants to follow the laws and guidelines that oversee their local areas and

work collections. Staying away from activities that could affect the call location is a reasonable

responsibility that colleagues and others should expect.

Trust and honesty play a vital role in accounting because they allow speculators to believe

the data they receive about the organizations they contribute to. Business executives rely on

legitimate accounting to manage their organizations without the knowledge of a one-sided

designation. Trust in accounting is the essential attraction of the call that allows for money-

related choice - creators make the right decisions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

There are rules and regulations to normalize accounting data so that internal and external

data messages are read equally. With proper accounting rules, the rules govern how money-

related data is collected, tracked and reported. Following these standards is critical due to the fact

that the earning industry has built a protective dog for accounting experts and their work is

known as the Financial Accounting Standards Board.

As financial and regulatory accounting demonstrates, reliability in accounting evidence is

as essential to the financial performance of a member's instructions as to public attention. The

components of money relations and accounting artificers are normalized to ensure that everyone

can play according to similar principles. The rules required for budget reporting are clear and

uniform in all cases. In addition, accounting reports must be robust, relevant and reasonable for

both internal and external data customers.

It is essential to the extent that tax summaries are valid and correct that public bodies use

external public accountants to review their books to ensure that cash ratios are being met follow

strict accounting guidelines and accurate figures are accurate. Entrepreneurs regularly request

external reviews of their books to ensure that their accountants remain fair and are able to

provide that report to samplers and tenants. Review is a test that organizations regularly use to

prove that books are a true example of an organization’s financial strength.

Five fundamental principles of professional ethics for accountants

Integrity

The principle of integrity imposes all accountants to be clear and truthful in dealing between

experts and business. Integrity also implies fair dealing and truthfulness.

The achievements associated with behaving with integrity apply to both professional

integrity and personal integrity. Of course, professional integrity can be seen as a subset of

personal integrity. However, there is a fundamental difference: individual trust covers everything

we do, while potential social needs are usually limited by cognitive and business exercises.

Society's way of life influences the way people work within it. It is much easier to work

with respect when it is surrounded by a structure that encourages such behavior. A set of

accepted rules is often a key part of that framework when properly designed and used.

Objectivity

data messages are read equally. With proper accounting rules, the rules govern how money-

related data is collected, tracked and reported. Following these standards is critical due to the fact

that the earning industry has built a protective dog for accounting experts and their work is

known as the Financial Accounting Standards Board.

As financial and regulatory accounting demonstrates, reliability in accounting evidence is

as essential to the financial performance of a member's instructions as to public attention. The

components of money relations and accounting artificers are normalized to ensure that everyone

can play according to similar principles. The rules required for budget reporting are clear and

uniform in all cases. In addition, accounting reports must be robust, relevant and reasonable for

both internal and external data customers.

It is essential to the extent that tax summaries are valid and correct that public bodies use

external public accountants to review their books to ensure that cash ratios are being met follow

strict accounting guidelines and accurate figures are accurate. Entrepreneurs regularly request

external reviews of their books to ensure that their accountants remain fair and are able to

provide that report to samplers and tenants. Review is a test that organizations regularly use to

prove that books are a true example of an organization’s financial strength.

Five fundamental principles of professional ethics for accountants

Integrity

The principle of integrity imposes all accountants to be clear and truthful in dealing between

experts and business. Integrity also implies fair dealing and truthfulness.

The achievements associated with behaving with integrity apply to both professional

integrity and personal integrity. Of course, professional integrity can be seen as a subset of

personal integrity. However, there is a fundamental difference: individual trust covers everything

we do, while potential social needs are usually limited by cognitive and business exercises.

Society's way of life influences the way people work within it. It is much easier to work

with respect when it is surrounded by a structure that encourages such behavior. A set of

accepted rules is often a key part of that framework when properly designed and used.

Objectivity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

An experienced accountant agrees with the objectivity rule, which requires an accountant not to

negotiate a competent or business judgment based on bias, negligent circumstances, or excessive

influence of others. The objectivity guideline assures all experienced accountants not to negotiate

their expert or physical judgment as a result of foresight, negligent circumstances, or

unnecessary influence on others.

An experienced accountant can deal with situations that may interfere with efficiency. It is

impossible to identify and confirm that position. Links that extend or unduly influence the expert

accountant's expert judgment should be kept at a strategic pace.

Professional Competence and Due Care

An experienced accountant should find a way to ensure that those working under the influence of

the experienced accountant have appropriate preparation and guidance in a familiar territory.

Maintaining competent knowledge and experience at the level necessary to ensure that a

customer or business obtains expert lines in line with current developments in and from,

emanations and procedures and works consistently and in accordance with specific instructions

know the stuff.

Maintaining the capability of process specialists requires an awareness and understanding

of relevant specialist skills and business advancement. Proceeding with competent development

creates and maintains the skills that allow an experienced accountant to achieve skills in expert

settings.

Confidentiality

In the case of classification of data obtained as a result of expert and business connections as a

result, do not disclose such data to outsiders without a valid and explicit position, unless there is

a legal or expert right or obligation to obtain it -out, or use the data for the small path of the

experienced accountant or outsiders.

Professional Behavior

Accept individual responsibility to show and manage by adopting the best expectations of a lucid

approach, following important laws and guidelines, and accept the ethical commitment to act

negotiate a competent or business judgment based on bias, negligent circumstances, or excessive

influence of others. The objectivity guideline assures all experienced accountants not to negotiate

their expert or physical judgment as a result of foresight, negligent circumstances, or

unnecessary influence on others.

An experienced accountant can deal with situations that may interfere with efficiency. It is

impossible to identify and confirm that position. Links that extend or unduly influence the expert

accountant's expert judgment should be kept at a strategic pace.

Professional Competence and Due Care

An experienced accountant should find a way to ensure that those working under the influence of

the experienced accountant have appropriate preparation and guidance in a familiar territory.

Maintaining competent knowledge and experience at the level necessary to ensure that a

customer or business obtains expert lines in line with current developments in and from,

emanations and procedures and works consistently and in accordance with specific instructions

know the stuff.

Maintaining the capability of process specialists requires an awareness and understanding

of relevant specialist skills and business advancement. Proceeding with competent development

creates and maintains the skills that allow an experienced accountant to achieve skills in expert

settings.

Confidentiality

In the case of classification of data obtained as a result of expert and business connections as a

result, do not disclose such data to outsiders without a valid and explicit position, unless there is

a legal or expert right or obligation to obtain it -out, or use the data for the small path of the

experienced accountant or outsiders.

Professional Behavior

Accept individual responsibility to show and manage by adopting the best expectations of a lucid

approach, following important laws and guidelines, and accept the ethical commitment to act

expertly in the public interest while maintaining a strategic distance from any direct executive

governance.

The data is read in the same way. With proper accounting rules, the rules govern how

money-related data is collected, tracked and interpreted. It is imperative that these standards are

followed to the extent that the money industry has raised a protective dog for accounting experts

and their work known as the Financial Accounting Standards Board.

As with financial and regulatory accounting, bookkeeping is as essential to financial

business as the founding principles of the public interest. The sections of the money reporting

and accounting articles are standardized to ensure everyone plays to similar standards. The rules

required for financial statements are clear and uniform in all cases. Additionally, accounting

reports must be reliable, relevant and reasonable to internal and external data clients.

It is essential to the extent that balance sheet summaries are valid and accurate that public

entities use outside public accountants to review their books to ensure that - Money-related

reports follow correct accounting rules and exact figures are accurate. Business owners regularly

request external audits of their books to ensure that accountants remain truthful and have the

ability to report that report to financial experts and tenants. Review is a study that is usually used

by organizations to prove that books actually reflect the financial well-being of the organization.

governance.

The data is read in the same way. With proper accounting rules, the rules govern how

money-related data is collected, tracked and interpreted. It is imperative that these standards are

followed to the extent that the money industry has raised a protective dog for accounting experts

and their work known as the Financial Accounting Standards Board.

As with financial and regulatory accounting, bookkeeping is as essential to financial

business as the founding principles of the public interest. The sections of the money reporting

and accounting articles are standardized to ensure everyone plays to similar standards. The rules

required for financial statements are clear and uniform in all cases. Additionally, accounting

reports must be reliable, relevant and reasonable to internal and external data clients.

It is essential to the extent that balance sheet summaries are valid and accurate that public

entities use outside public accountants to review their books to ensure that - Money-related

reports follow correct accounting rules and exact figures are accurate. Business owners regularly

request external audits of their books to ensure that accountants remain truthful and have the

ability to report that report to financial experts and tenants. Review is a study that is usually used

by organizations to prove that books actually reflect the financial well-being of the organization.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.