Corporate and Financial Accounting Analysis of Australian Firms

VerifiedAdded on 2023/06/05

|11

|3133

|94

Report

AI Summary

This report provides an analysis of corporate and financial accounting, examining the rationale behind financial reporting regulations and the role of the Australian Accounting Standards Board (AASB) in relation to International Financial Reporting Standards (IFRS). The report investigates the equity and debt positions of four pharmaceutical companies listed on the Australian Stock Exchange (ASX), including Actinogen Medical Limited, Adalta Limited, AFT Pharma Limited, and Antara Lifesciences Limited, comparing their financial performance over a four-year period. It delves into the components of equity, such as contributed equity, reserves, and accumulated losses, and analyzes debt structures, including gearing ratios. The report also discusses key accounting concepts and standards, offering insights into the financial health and performance of these companies. The report also details the financial health of these firms, examining their contributed equity, reserves, accumulated losses, and debt-to-equity ratios.

TABLE OF CONTENT

Executive Summary........................................................2

Part-(i).............................................................................3

Part(ii).............................................................................4

Part (iii) and (iv)..............................................................5

References:..................................................................11

Executive Summary........................................................2

Part-(i).............................................................................3

Part(ii).............................................................................4

Part (iii) and (iv)..............................................................5

References:..................................................................11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE AND FINANCIAL ACCOUNTING

Executive Summary

The intention behind preparation of report is to analyse whether regulation behind preparation shall be

continued or the same shall be dropped and management shall be allowed to disclose content in

annual report voluntarily. Further, the report explores the contribution made by AASB in the

implementation and setting up of AASB and the rationale for not making International Financial

Accounting Standard Compulsory for members.

In the latter half of the report a detailed analysis has been provided with regard to analysis of equity

segment of 4 listed entities in the Australian Exchange dealing in Pharmaceuticals. Further, the report

also provides an in depth analysis regarding the debt and equity position of the 4 companies by

comparing past 4 years.

Executive Summary

The intention behind preparation of report is to analyse whether regulation behind preparation shall be

continued or the same shall be dropped and management shall be allowed to disclose content in

annual report voluntarily. Further, the report explores the contribution made by AASB in the

implementation and setting up of AASB and the rationale for not making International Financial

Accounting Standard Compulsory for members.

In the latter half of the report a detailed analysis has been provided with regard to analysis of equity

segment of 4 listed entities in the Australian Exchange dealing in Pharmaceuticals. Further, the report

also provides an in depth analysis regarding the debt and equity position of the 4 companies by

comparing past 4 years.

Part-(i)

The question is very important from financial accounting of view as it is one of the fundamental aspect

of business on account of its strategic importance in understanding the true and transparent position

of the company. Any error of non-reporting can hide material facts and may lead to wrong

understanding of the financial position of the company. The said statement is used by multiple user

with multiple vested interest including shareholders, creditors, investors, government, buyers etc. The

report includes details of past, present and it set pace for the future course of actions (Accounting

Edu.org, n.d.) in a standardised manner which if unregulated can present a false and incorrect

information that can impact million of users.

The second point in favour of regulation and standardisation of financial statement of comparability of

companies in same sector through similar type of reporting which if unregulated shall lead to different

presentation and comparability of companies shall become difficult.

The third point that shall be considered is if the reporting is left at the discretion of the management,

the financial shall be cooked up and shall represent only those aspects of the company which it wants

its user to look and shall not represent true and fair view of the company.

Further, in the financial statement directors not only present the financial statement to the outside

people but also appoint an independent auditor to express opinion on the financial statement and

state whether the financial statement reflects a true and fair view and are free from any material

misstatements.

Though there are various points in favour to continue the regulation as the same prevents any scam

like Enron etc.

The question is very important from financial accounting of view as it is one of the fundamental aspect

of business on account of its strategic importance in understanding the true and transparent position

of the company. Any error of non-reporting can hide material facts and may lead to wrong

understanding of the financial position of the company. The said statement is used by multiple user

with multiple vested interest including shareholders, creditors, investors, government, buyers etc. The

report includes details of past, present and it set pace for the future course of actions (Accounting

Edu.org, n.d.) in a standardised manner which if unregulated can present a false and incorrect

information that can impact million of users.

The second point in favour of regulation and standardisation of financial statement of comparability of

companies in same sector through similar type of reporting which if unregulated shall lead to different

presentation and comparability of companies shall become difficult.

The third point that shall be considered is if the reporting is left at the discretion of the management,

the financial shall be cooked up and shall represent only those aspects of the company which it wants

its user to look and shall not represent true and fair view of the company.

Further, in the financial statement directors not only present the financial statement to the outside

people but also appoint an independent auditor to express opinion on the financial statement and

state whether the financial statement reflects a true and fair view and are free from any material

misstatements.

Though there are various points in favour to continue the regulation as the same prevents any scam

like Enron etc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Part(ii)

The Australian Accounting Standard Board is an agency which is controlled and monitored by the

government of Australia. The Board has a reporting obligation to the parliament of Australia. On the

other hand International Accounting Standard Board (IASB) is an independent organisation privately

managed and controlled and is located in London. The Australian board contributes to International

Accounting standard board under various ways including the following

(a) Funding for management of day- to day affairs of IASB;

(b) Cooperation with IASB on matter relating to preparation and presentation of financial statement;

(c) Sending replies to any draft questionnaire sent by IASB to its members for review;

(d) Raising any issue being faced by the AASB in the reporting standards;

(e) Aligning vision with IFRS;

(f) Adopting IFRS.

The flow cooperation has been detailed here-in-below:

(a) AASB identifies technical issue which require look through;

(b) Theissues are referred to IASB;

(c) The issue shall be added to agenda;

(d) The AASB shall do research and consider the issue;

(e) A consultation shall take place with stakeholders;

(f) Issuing of standard or other pronouncement;

(g) The report shall be submitted to IASB for comment;

(h) Implementation and compliance

The members have not been compelled to comply with IFRS on account of following reasons:-

(a) Adoption of IFRS is not a simple process;

(b) IFRS has its own limitations and implications;

(c) The matter involves various countries which has its own accounting system and

infrastructure;

(d) IFRS requires a lot of convergence from national standard.

(i)

The Australian Accounting Standard Board is an agency which is controlled and monitored by the

government of Australia. The Board has a reporting obligation to the parliament of Australia. On the

other hand International Accounting Standard Board (IASB) is an independent organisation privately

managed and controlled and is located in London. The Australian board contributes to International

Accounting standard board under various ways including the following

(a) Funding for management of day- to day affairs of IASB;

(b) Cooperation with IASB on matter relating to preparation and presentation of financial statement;

(c) Sending replies to any draft questionnaire sent by IASB to its members for review;

(d) Raising any issue being faced by the AASB in the reporting standards;

(e) Aligning vision with IFRS;

(f) Adopting IFRS.

The flow cooperation has been detailed here-in-below:

(a) AASB identifies technical issue which require look through;

(b) Theissues are referred to IASB;

(c) The issue shall be added to agenda;

(d) The AASB shall do research and consider the issue;

(e) A consultation shall take place with stakeholders;

(f) Issuing of standard or other pronouncement;

(g) The report shall be submitted to IASB for comment;

(h) Implementation and compliance

The members have not been compelled to comply with IFRS on account of following reasons:-

(a) Adoption of IFRS is not a simple process;

(b) IFRS has its own limitations and implications;

(c) The matter involves various countries which has its own accounting system and

infrastructure;

(d) IFRS requires a lot of convergence from national standard.

(i)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part (iii) and (iv)

The Chosen Companies for analysing under part B of the report belongs to pharmaceuticals and

Medical industry and are listed on Australian Stock Exchange. The name of the companies that have

been chosen for analysis has been detailed here-in-below:-

(a) Actinogen Medical Limited:

(b) Adalta Limited;

(c) AFT Pharma Limited;

(d) Antara Lifesciences Limited;

About the Company

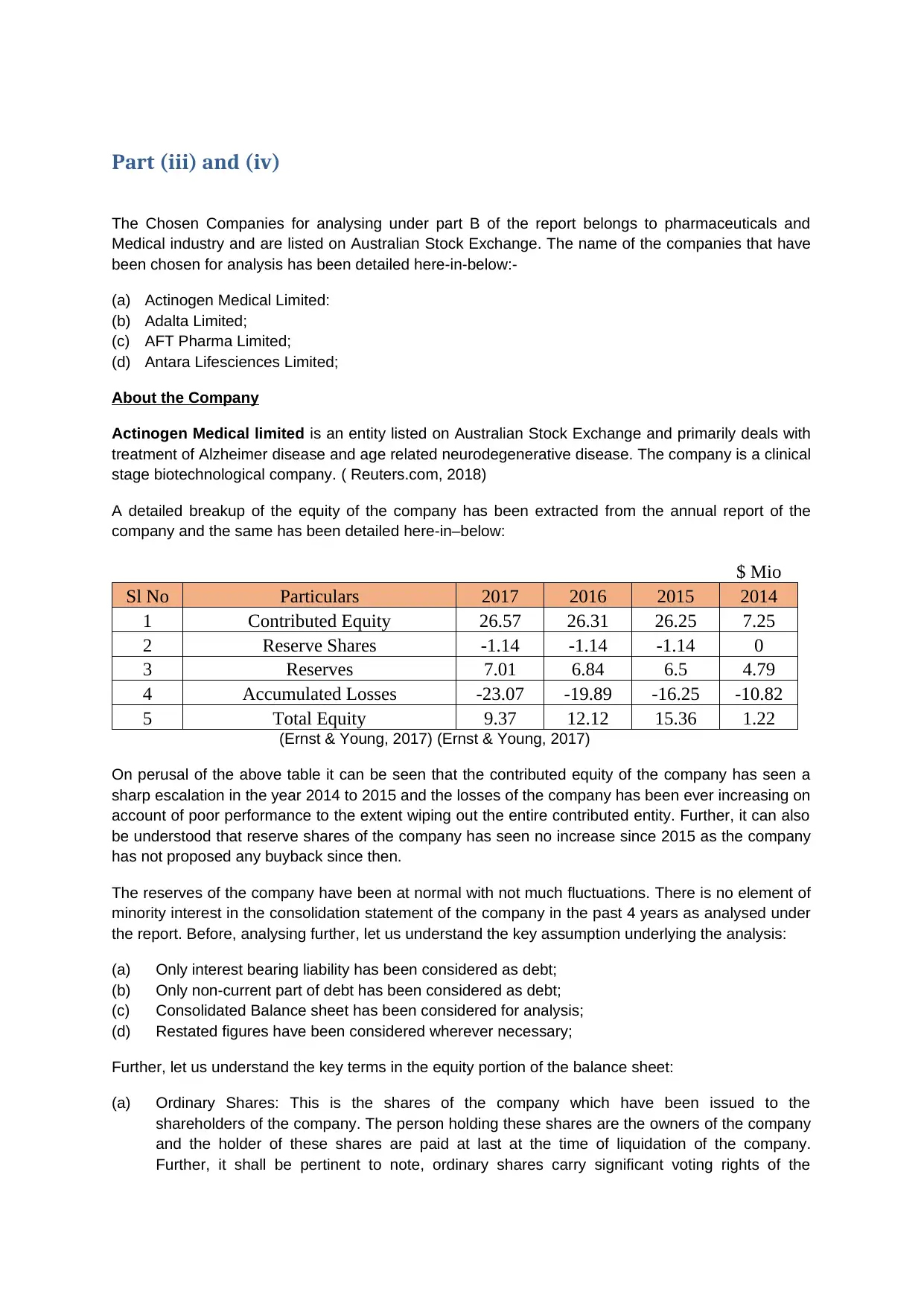

Actinogen Medical limited is an entity listed on Australian Stock Exchange and primarily deals with

treatment of Alzheimer disease and age related neurodegenerative disease. The company is a clinical

stage biotechnological company. ( Reuters.com, 2018)

A detailed breakup of the equity of the company has been extracted from the annual report of the

company and the same has been detailed here-in–below:

$ Mio

Sl No Particulars 2017 2016 2015 2014

1 Contributed Equity 26.57 26.31 26.25 7.25

2 Reserve Shares -1.14 -1.14 -1.14 0

3 Reserves 7.01 6.84 6.5 4.79

4 Accumulated Losses -23.07 -19.89 -16.25 -10.82

5 Total Equity 9.37 12.12 15.36 1.22

(Ernst & Young, 2017) (Ernst & Young, 2017)

On perusal of the above table it can be seen that the contributed equity of the company has seen a

sharp escalation in the year 2014 to 2015 and the losses of the company has been ever increasing on

account of poor performance to the extent wiping out the entire contributed entity. Further, it can also

be understood that reserve shares of the company has seen no increase since 2015 as the company

has not proposed any buyback since then.

The reserves of the company have been at normal with not much fluctuations. There is no element of

minority interest in the consolidation statement of the company in the past 4 years as analysed under

the report. Before, analysing further, let us understand the key assumption underlying the analysis:

(a) Only interest bearing liability has been considered as debt;

(b) Only non-current part of debt has been considered as debt;

(c) Consolidated Balance sheet has been considered for analysis;

(d) Restated figures have been considered wherever necessary;

Further, let us understand the key terms in the equity portion of the balance sheet:

(a) Ordinary Shares: This is the shares of the company which have been issued to the

shareholders of the company. The person holding these shares are the owners of the company

and the holder of these shares are paid at last at the time of liquidation of the company.

Further, it shall be pertinent to note, ordinary shares carry significant voting rights of the

The Chosen Companies for analysing under part B of the report belongs to pharmaceuticals and

Medical industry and are listed on Australian Stock Exchange. The name of the companies that have

been chosen for analysis has been detailed here-in-below:-

(a) Actinogen Medical Limited:

(b) Adalta Limited;

(c) AFT Pharma Limited;

(d) Antara Lifesciences Limited;

About the Company

Actinogen Medical limited is an entity listed on Australian Stock Exchange and primarily deals with

treatment of Alzheimer disease and age related neurodegenerative disease. The company is a clinical

stage biotechnological company. ( Reuters.com, 2018)

A detailed breakup of the equity of the company has been extracted from the annual report of the

company and the same has been detailed here-in–below:

$ Mio

Sl No Particulars 2017 2016 2015 2014

1 Contributed Equity 26.57 26.31 26.25 7.25

2 Reserve Shares -1.14 -1.14 -1.14 0

3 Reserves 7.01 6.84 6.5 4.79

4 Accumulated Losses -23.07 -19.89 -16.25 -10.82

5 Total Equity 9.37 12.12 15.36 1.22

(Ernst & Young, 2017) (Ernst & Young, 2017)

On perusal of the above table it can be seen that the contributed equity of the company has seen a

sharp escalation in the year 2014 to 2015 and the losses of the company has been ever increasing on

account of poor performance to the extent wiping out the entire contributed entity. Further, it can also

be understood that reserve shares of the company has seen no increase since 2015 as the company

has not proposed any buyback since then.

The reserves of the company have been at normal with not much fluctuations. There is no element of

minority interest in the consolidation statement of the company in the past 4 years as analysed under

the report. Before, analysing further, let us understand the key assumption underlying the analysis:

(a) Only interest bearing liability has been considered as debt;

(b) Only non-current part of debt has been considered as debt;

(c) Consolidated Balance sheet has been considered for analysis;

(d) Restated figures have been considered wherever necessary;

Further, let us understand the key terms in the equity portion of the balance sheet:

(a) Ordinary Shares: This is the shares of the company which have been issued to the

shareholders of the company. The person holding these shares are the owners of the company

and the holder of these shares are paid at last at the time of liquidation of the company.

Further, it shall be pertinent to note, ordinary shares carry significant voting rights of the

company but they are not entitled to fixed dividend. However, they are entitled to any left-over

profit post distribution of profits to other shareholders of the company;

(b) Preference shares; these shareholders are below equity shareholders and are entitled to a

fixed rate of dividend. These shares are also convertible to equity shares if the terms of issue

so specify or in case of non-payment;

(c) Options: These are potential shares which when become due becomes ordinary shares of the

company. They include employee stock option plan etc.

(d) Reserves: These are the amount set aside by the company to meet any future requirements.

There are various types of reserves that are formed by a company and includes the following:

(1) Foreign Currency translation Reserve: The same is created while merging the books of

account of subsidiary in the accounts of parent by using current, temporal or any other

method. The difference arising on account of foreign exchange and books maintained

under different currency is adjusted through this reserve;

(2) Available for Sale Investment Reserve: This reserve is created to mark investment mark

to market;

(3) Option Reserve are created with an intention to make appropriate apportionment to met

any liability to convert option right into equity;

(4) Cash flow hedging reserve is created by an entity to reduce the impact of change in

estimated cash flows of a financial asset or liability;

(e) Non- Controlling interest: Non-Controlling interest represent that portion of holding of the

company which is hold by small investor who do not exercise significant control over the

company but have their interest vested in such company;

(f) Treasury Shares: These represent that portion of ordinary shares of the company which has

been called back by the company with an intention to cancel the same and pay off the

shareholders on account of excess cash reserve pool lying with company;

(g) Retained earnings/ Accumulated losses: These portion represents the profits that have

accumulated in the company over the years of operation and it is an indicator of soundness of

the company. The higher the retained earning the better the return to ordinary shareholders.

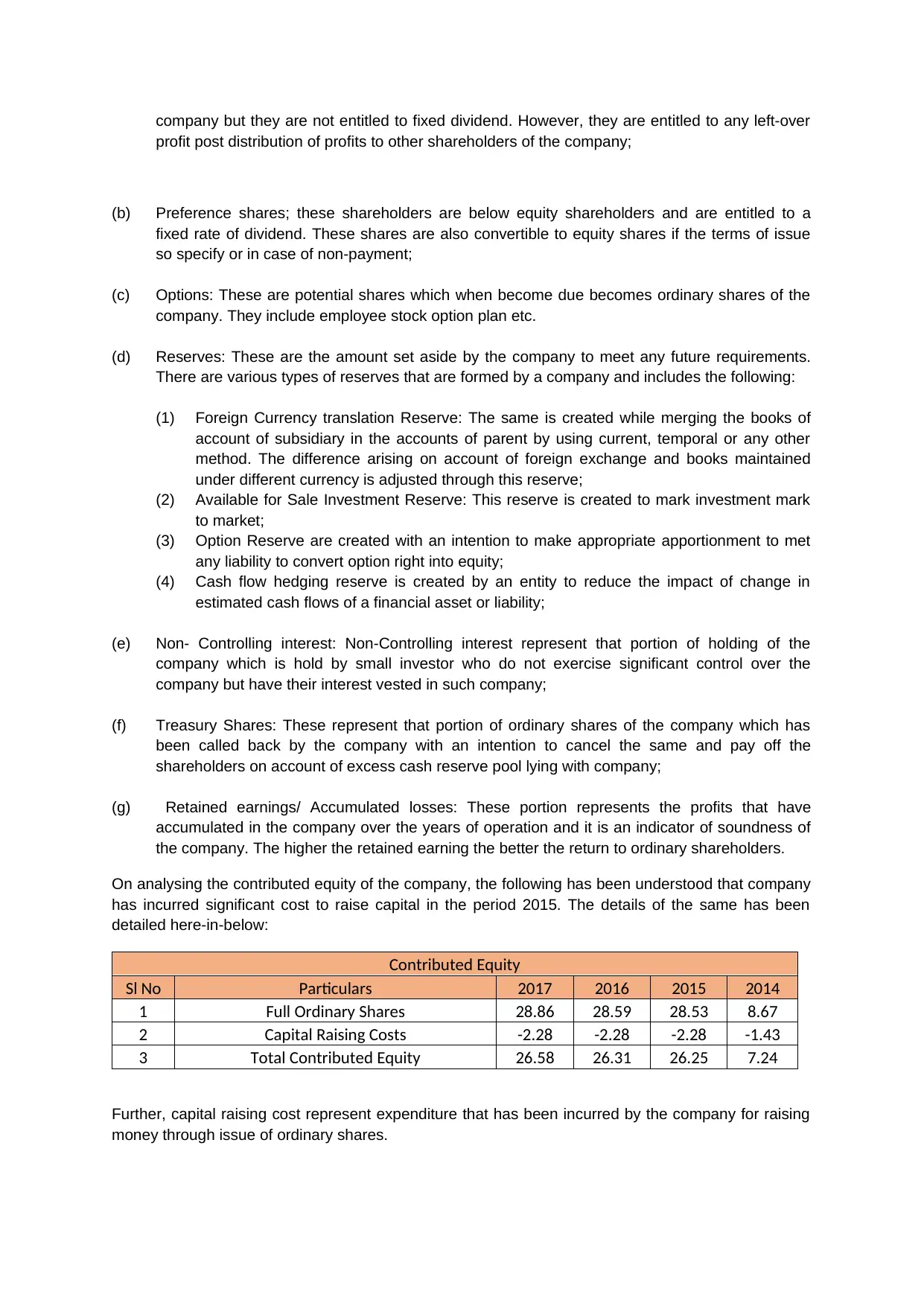

On analysing the contributed equity of the company, the following has been understood that company

has incurred significant cost to raise capital in the period 2015. The details of the same has been

detailed here-in-below:

Contributed Equity

Sl No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 28.86 28.59 28.53 8.67

2 Capital Raising Costs -2.28 -2.28 -2.28 -1.43

3 Total Contributed Equity 26.58 26.31 26.25 7.24

Further, capital raising cost represent expenditure that has been incurred by the company for raising

money through issue of ordinary shares.

profit post distribution of profits to other shareholders of the company;

(b) Preference shares; these shareholders are below equity shareholders and are entitled to a

fixed rate of dividend. These shares are also convertible to equity shares if the terms of issue

so specify or in case of non-payment;

(c) Options: These are potential shares which when become due becomes ordinary shares of the

company. They include employee stock option plan etc.

(d) Reserves: These are the amount set aside by the company to meet any future requirements.

There are various types of reserves that are formed by a company and includes the following:

(1) Foreign Currency translation Reserve: The same is created while merging the books of

account of subsidiary in the accounts of parent by using current, temporal or any other

method. The difference arising on account of foreign exchange and books maintained

under different currency is adjusted through this reserve;

(2) Available for Sale Investment Reserve: This reserve is created to mark investment mark

to market;

(3) Option Reserve are created with an intention to make appropriate apportionment to met

any liability to convert option right into equity;

(4) Cash flow hedging reserve is created by an entity to reduce the impact of change in

estimated cash flows of a financial asset or liability;

(e) Non- Controlling interest: Non-Controlling interest represent that portion of holding of the

company which is hold by small investor who do not exercise significant control over the

company but have their interest vested in such company;

(f) Treasury Shares: These represent that portion of ordinary shares of the company which has

been called back by the company with an intention to cancel the same and pay off the

shareholders on account of excess cash reserve pool lying with company;

(g) Retained earnings/ Accumulated losses: These portion represents the profits that have

accumulated in the company over the years of operation and it is an indicator of soundness of

the company. The higher the retained earning the better the return to ordinary shareholders.

On analysing the contributed equity of the company, the following has been understood that company

has incurred significant cost to raise capital in the period 2015. The details of the same has been

detailed here-in-below:

Contributed Equity

Sl No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 28.86 28.59 28.53 8.67

2 Capital Raising Costs -2.28 -2.28 -2.28 -1.43

3 Total Contributed Equity 26.58 26.31 26.25 7.24

Further, capital raising cost represent expenditure that has been incurred by the company for raising

money through issue of ordinary shares.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It can also be observed that company has been making losses for a long time and is ever increasing

as presented in the table above. Further, there is no non-controlling interest as displayed in annual

report Statement of Financial Position of the company for the past 4 years.

To further understand, let us analyse the reserve portion of the company. The same has been

detailed here-in-below:

Reserve

Sl.

No Particulars 2017 2016 2015 2014

1 Option Reserve 6.93 6.82 6.5 4.79

2 Available for Sale Investment Reserve 0.077 0.022

7.01 6.84 6.50 4.79

On perusal of the above, it can be seen that company has only two reserve i.e option and available for

sale investment reserve in terms of relevant standards under AASB. The information about these

reserves have already been detailed above.

Further, to conclude the analysis of the company debt to equity ratio and capital gearing ratio has

been computed. Further, cash and cash equivalent has not been reduced to compute net debt as the

company has no debt in its statement of financial position:

Gearing Ratio

Sl. No Particulars 2017 2016 2015 2014

1 Debt 0 0 0 0

2 Equity 9.37 12.12 15.36 1.22

3 Debt Equity Ratio 0 0 0 0

4 Gearing Ratio 0 0 0 0

On perusal of the above, it can be seen that company has no debt and thus analysis does not bear

any fruits in the said case.

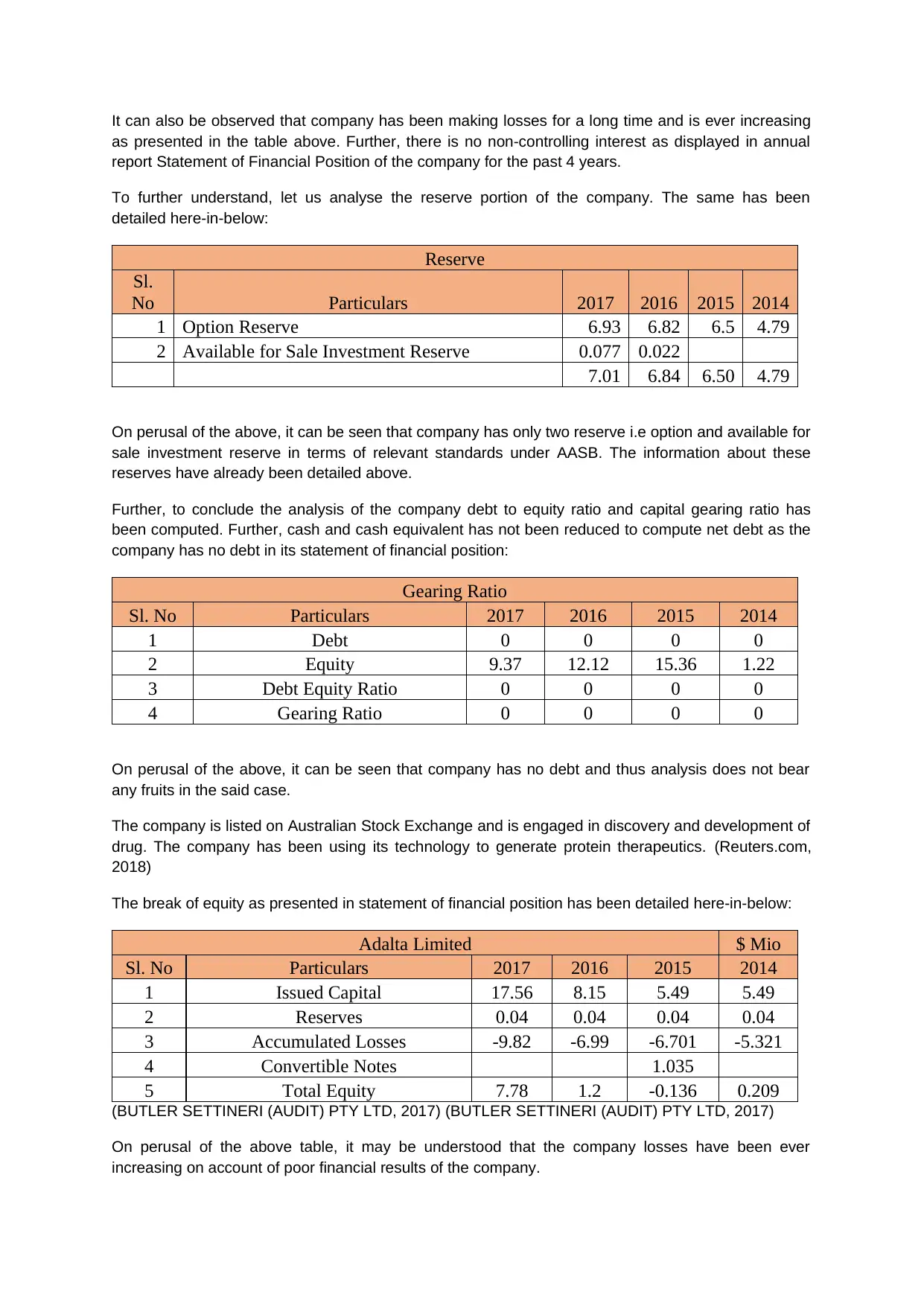

The company is listed on Australian Stock Exchange and is engaged in discovery and development of

drug. The company has been using its technology to generate protein therapeutics. (Reuters.com,

2018)

The break of equity as presented in statement of financial position has been detailed here-in-below:

Adalta Limited $ Mio

Sl. No Particulars 2017 2016 2015 2014

1 Issued Capital 17.56 8.15 5.49 5.49

2 Reserves 0.04 0.04 0.04 0.04

3 Accumulated Losses -9.82 -6.99 -6.701 -5.321

4 Convertible Notes 1.035

5 Total Equity 7.78 1.2 -0.136 0.209

(BUTLER SETTINERI (AUDIT) PTY LTD, 2017) (BUTLER SETTINERI (AUDIT) PTY LTD, 2017)

On perusal of the above table, it may be understood that the company losses have been ever

increasing on account of poor financial results of the company.

as presented in the table above. Further, there is no non-controlling interest as displayed in annual

report Statement of Financial Position of the company for the past 4 years.

To further understand, let us analyse the reserve portion of the company. The same has been

detailed here-in-below:

Reserve

Sl.

No Particulars 2017 2016 2015 2014

1 Option Reserve 6.93 6.82 6.5 4.79

2 Available for Sale Investment Reserve 0.077 0.022

7.01 6.84 6.50 4.79

On perusal of the above, it can be seen that company has only two reserve i.e option and available for

sale investment reserve in terms of relevant standards under AASB. The information about these

reserves have already been detailed above.

Further, to conclude the analysis of the company debt to equity ratio and capital gearing ratio has

been computed. Further, cash and cash equivalent has not been reduced to compute net debt as the

company has no debt in its statement of financial position:

Gearing Ratio

Sl. No Particulars 2017 2016 2015 2014

1 Debt 0 0 0 0

2 Equity 9.37 12.12 15.36 1.22

3 Debt Equity Ratio 0 0 0 0

4 Gearing Ratio 0 0 0 0

On perusal of the above, it can be seen that company has no debt and thus analysis does not bear

any fruits in the said case.

The company is listed on Australian Stock Exchange and is engaged in discovery and development of

drug. The company has been using its technology to generate protein therapeutics. (Reuters.com,

2018)

The break of equity as presented in statement of financial position has been detailed here-in-below:

Adalta Limited $ Mio

Sl. No Particulars 2017 2016 2015 2014

1 Issued Capital 17.56 8.15 5.49 5.49

2 Reserves 0.04 0.04 0.04 0.04

3 Accumulated Losses -9.82 -6.99 -6.701 -5.321

4 Convertible Notes 1.035

5 Total Equity 7.78 1.2 -0.136 0.209

(BUTLER SETTINERI (AUDIT) PTY LTD, 2017) (BUTLER SETTINERI (AUDIT) PTY LTD, 2017)

On perusal of the above table, it may be understood that the company losses have been ever

increasing on account of poor financial results of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The issued capital of the company has increased significantly twice in 4 years. The detailed breakup

of the same has been given here-in-below:

Contributed Equity

Sl

No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 17.56 2.49 2.49 2.49

2 Fully paid Series A Preference Shares 3 3 3

3 Fully paid convertible notes 2.66

4 Total Contributed Equity 17.56 8.15 5.49 5.49

On perusal of the above, it can be understood that the increase is on account of conversion of notes

and preference shares of the company. Further the company has issued fresh ordinary shares during

period 2017.

There is no minority interest as detailed above.

The breakup of reserve has been presented here-in-below:

Reserve

Sl. No Particulars 2017 2016 2015 2014

1 Share based payment reserve 0.04 0.04 0.04 0.04

Total 0.04 0.04 0.04 0.04

There has been no change in reserve.

Capital Gearing ratio

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 0 0 0 0

2 Equity 7.78 1.2 -0.136 0.209

3 Debt Equity Ratio 0 0 0 0

4 Gearing Ratio 0 0 0 0

On perusal of the above, it can be understood that the company has not debt accordingly the said

analysis does not bear any fruit.

of the same has been given here-in-below:

Contributed Equity

Sl

No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 17.56 2.49 2.49 2.49

2 Fully paid Series A Preference Shares 3 3 3

3 Fully paid convertible notes 2.66

4 Total Contributed Equity 17.56 8.15 5.49 5.49

On perusal of the above, it can be understood that the increase is on account of conversion of notes

and preference shares of the company. Further the company has issued fresh ordinary shares during

period 2017.

There is no minority interest as detailed above.

The breakup of reserve has been presented here-in-below:

Reserve

Sl. No Particulars 2017 2016 2015 2014

1 Share based payment reserve 0.04 0.04 0.04 0.04

Total 0.04 0.04 0.04 0.04

There has been no change in reserve.

Capital Gearing ratio

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 0 0 0 0

2 Equity 7.78 1.2 -0.136 0.209

3 Debt Equity Ratio 0 0 0 0

4 Gearing Ratio 0 0 0 0

On perusal of the above, it can be understood that the company has not debt accordingly the said

analysis does not bear any fruit.

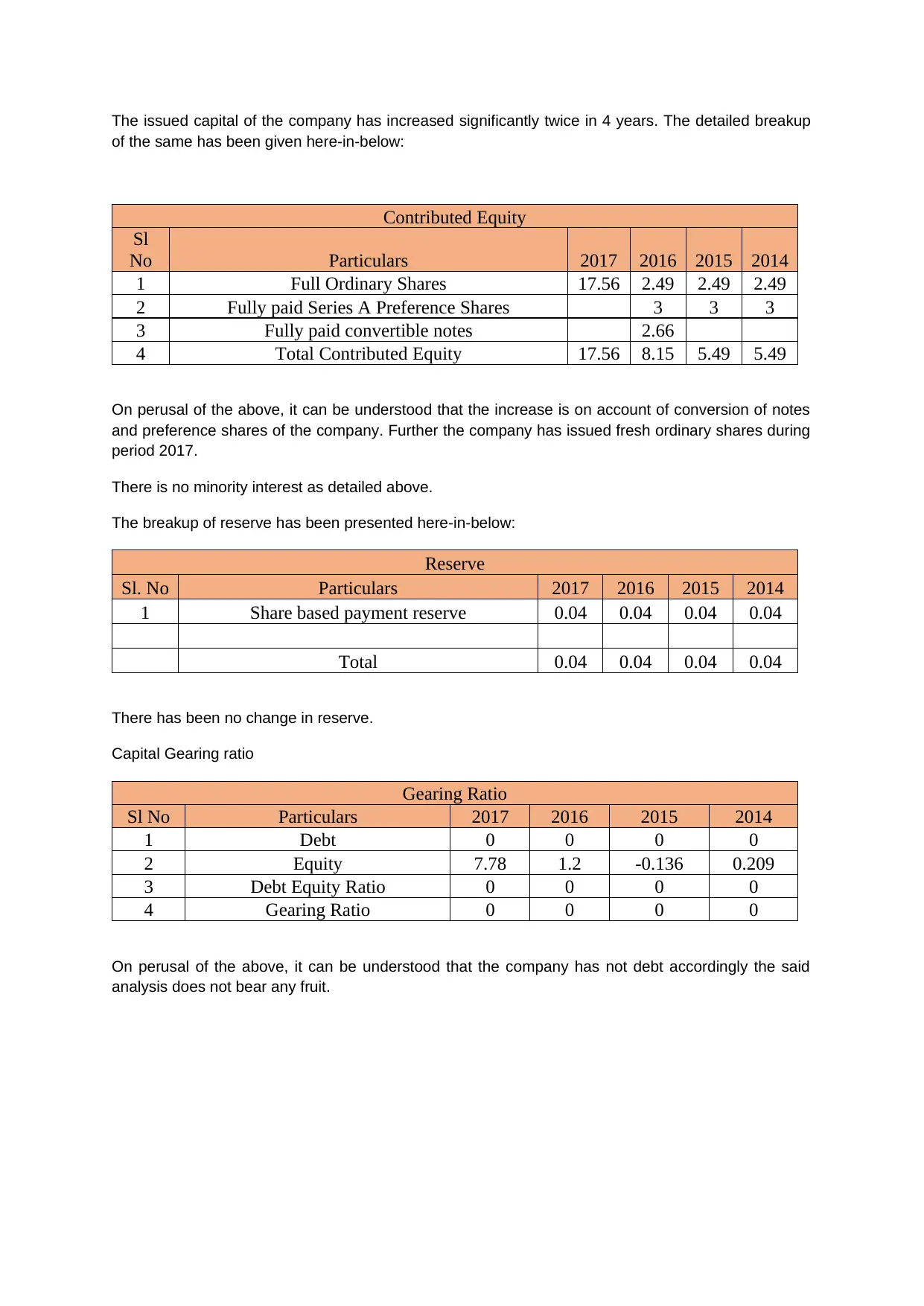

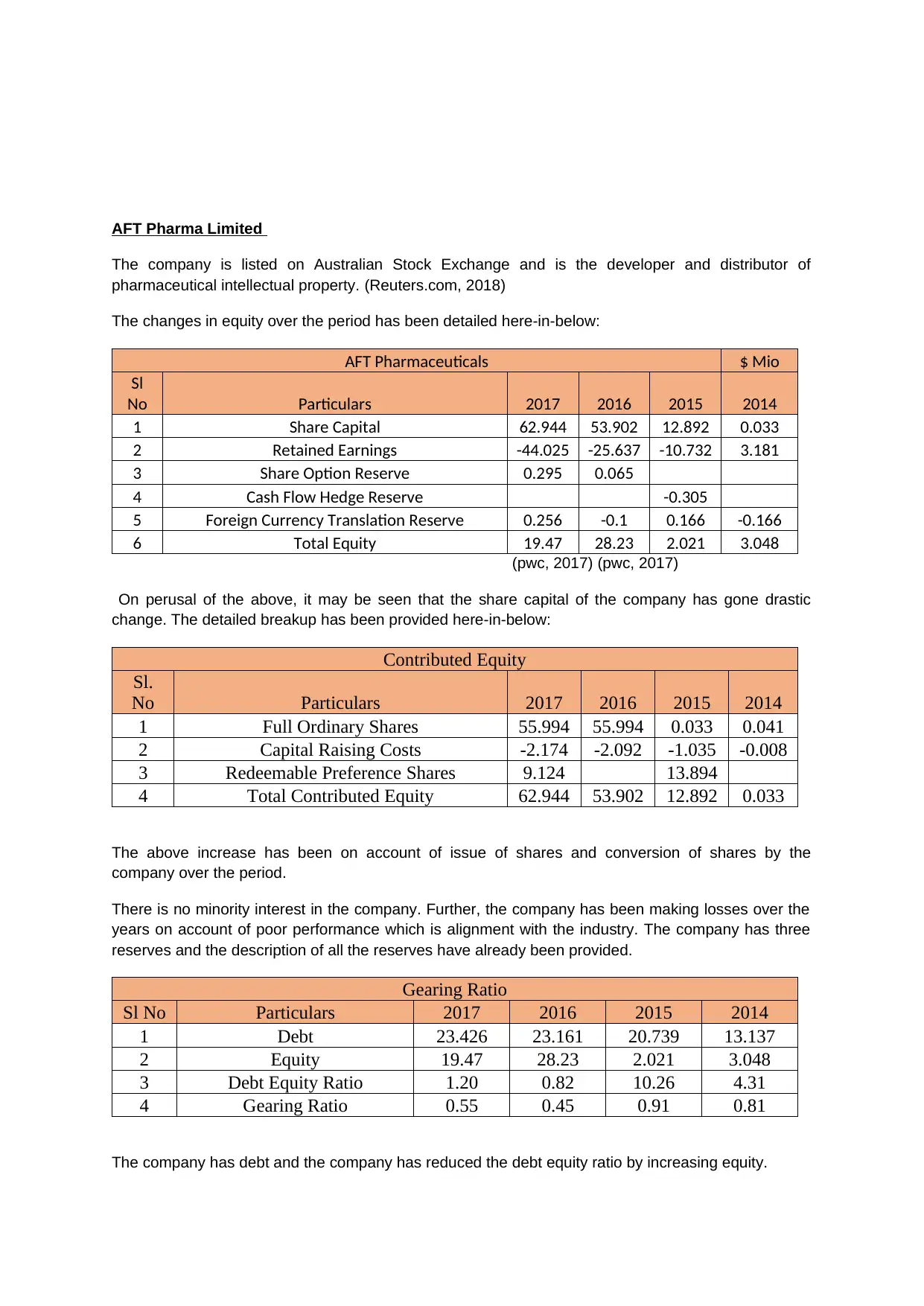

AFT Pharma Limited

The company is listed on Australian Stock Exchange and is the developer and distributor of

pharmaceutical intellectual property. (Reuters.com, 2018)

The changes in equity over the period has been detailed here-in-below:

AFT Pharmaceuticals $ Mio

Sl

No Particulars 2017 2016 2015 2014

1 Share Capital 62.944 53.902 12.892 0.033

2 Retained Earnings -44.025 -25.637 -10.732 3.181

3 Share Option Reserve 0.295 0.065

4 Cash Flow Hedge Reserve -0.305

5 Foreign Currency Translation Reserve 0.256 -0.1 0.166 -0.166

6 Total Equity 19.47 28.23 2.021 3.048

(pwc, 2017) (pwc, 2017)

On perusal of the above, it may be seen that the share capital of the company has gone drastic

change. The detailed breakup has been provided here-in-below:

Contributed Equity

Sl.

No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 55.994 55.994 0.033 0.041

2 Capital Raising Costs -2.174 -2.092 -1.035 -0.008

3 Redeemable Preference Shares 9.124 13.894

4 Total Contributed Equity 62.944 53.902 12.892 0.033

The above increase has been on account of issue of shares and conversion of shares by the

company over the period.

There is no minority interest in the company. Further, the company has been making losses over the

years on account of poor performance which is alignment with the industry. The company has three

reserves and the description of all the reserves have already been provided.

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 23.426 23.161 20.739 13.137

2 Equity 19.47 28.23 2.021 3.048

3 Debt Equity Ratio 1.20 0.82 10.26 4.31

4 Gearing Ratio 0.55 0.45 0.91 0.81

The company has debt and the company has reduced the debt equity ratio by increasing equity.

The company is listed on Australian Stock Exchange and is the developer and distributor of

pharmaceutical intellectual property. (Reuters.com, 2018)

The changes in equity over the period has been detailed here-in-below:

AFT Pharmaceuticals $ Mio

Sl

No Particulars 2017 2016 2015 2014

1 Share Capital 62.944 53.902 12.892 0.033

2 Retained Earnings -44.025 -25.637 -10.732 3.181

3 Share Option Reserve 0.295 0.065

4 Cash Flow Hedge Reserve -0.305

5 Foreign Currency Translation Reserve 0.256 -0.1 0.166 -0.166

6 Total Equity 19.47 28.23 2.021 3.048

(pwc, 2017) (pwc, 2017)

On perusal of the above, it may be seen that the share capital of the company has gone drastic

change. The detailed breakup has been provided here-in-below:

Contributed Equity

Sl.

No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 55.994 55.994 0.033 0.041

2 Capital Raising Costs -2.174 -2.092 -1.035 -0.008

3 Redeemable Preference Shares 9.124 13.894

4 Total Contributed Equity 62.944 53.902 12.892 0.033

The above increase has been on account of issue of shares and conversion of shares by the

company over the period.

There is no minority interest in the company. Further, the company has been making losses over the

years on account of poor performance which is alignment with the industry. The company has three

reserves and the description of all the reserves have already been provided.

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 23.426 23.161 20.739 13.137

2 Equity 19.47 28.23 2.021 3.048

3 Debt Equity Ratio 1.20 0.82 10.26 4.31

4 Gearing Ratio 0.55 0.45 0.91 0.81

The company has debt and the company has reduced the debt equity ratio by increasing equity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Antara Lifesciences Limited

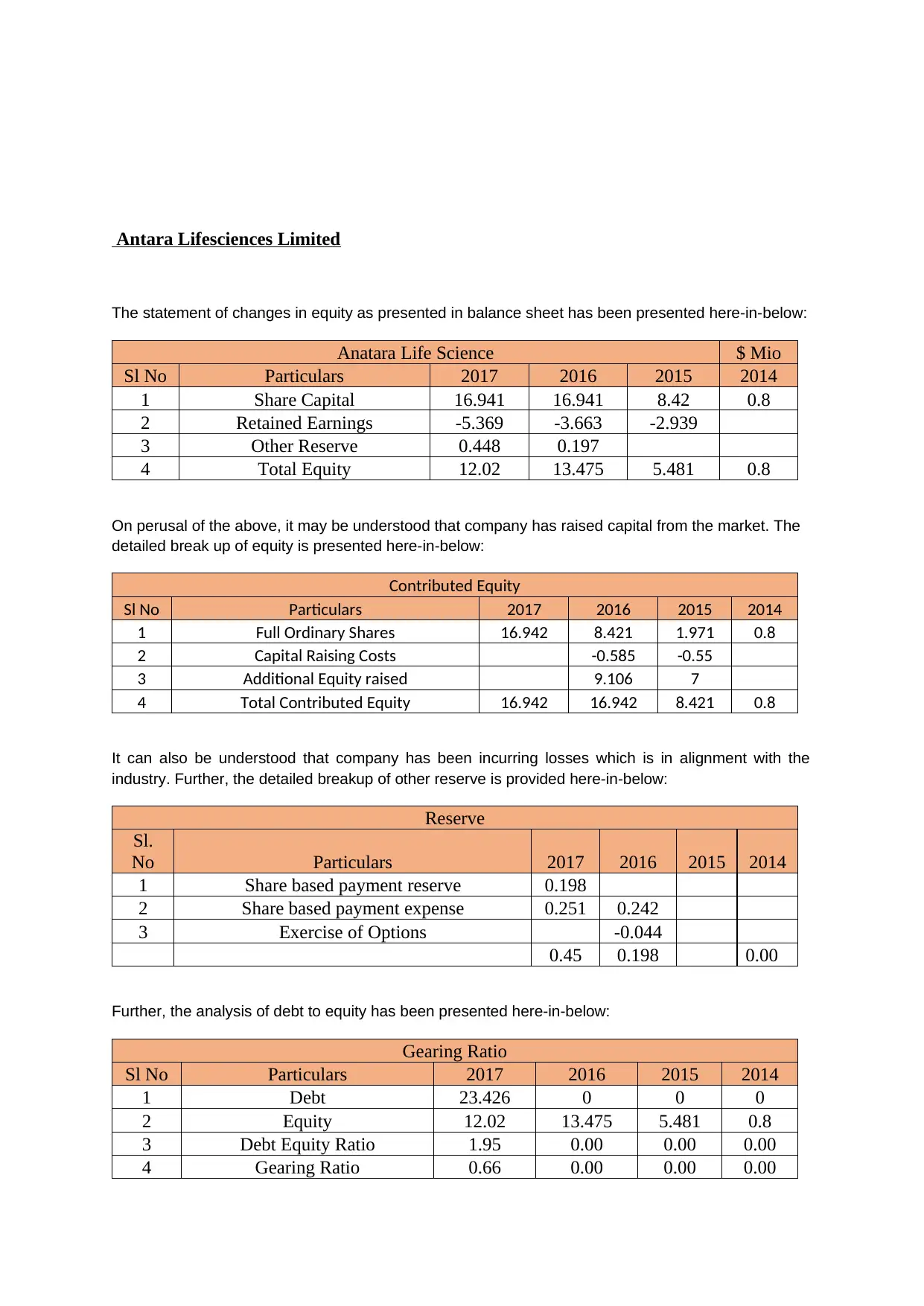

The statement of changes in equity as presented in balance sheet has been presented here-in-below:

Anatara Life Science $ Mio

Sl No Particulars 2017 2016 2015 2014

1 Share Capital 16.941 16.941 8.42 0.8

2 Retained Earnings -5.369 -3.663 -2.939

3 Other Reserve 0.448 0.197

4 Total Equity 12.02 13.475 5.481 0.8

On perusal of the above, it may be understood that company has raised capital from the market. The

detailed break up of equity is presented here-in-below:

Contributed Equity

Sl No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 16.942 8.421 1.971 0.8

2 Capital Raising Costs -0.585 -0.55

3 Additional Equity raised 9.106 7

4 Total Contributed Equity 16.942 16.942 8.421 0.8

It can also be understood that company has been incurring losses which is in alignment with the

industry. Further, the detailed breakup of other reserve is provided here-in-below:

Reserve

Sl.

No Particulars 2017 2016 2015 2014

1 Share based payment reserve 0.198

2 Share based payment expense 0.251 0.242

3 Exercise of Options -0.044

0.45 0.198 0.00

Further, the analysis of debt to equity has been presented here-in-below:

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 23.426 0 0 0

2 Equity 12.02 13.475 5.481 0.8

3 Debt Equity Ratio 1.95 0.00 0.00 0.00

4 Gearing Ratio 0.66 0.00 0.00 0.00

The statement of changes in equity as presented in balance sheet has been presented here-in-below:

Anatara Life Science $ Mio

Sl No Particulars 2017 2016 2015 2014

1 Share Capital 16.941 16.941 8.42 0.8

2 Retained Earnings -5.369 -3.663 -2.939

3 Other Reserve 0.448 0.197

4 Total Equity 12.02 13.475 5.481 0.8

On perusal of the above, it may be understood that company has raised capital from the market. The

detailed break up of equity is presented here-in-below:

Contributed Equity

Sl No Particulars 2017 2016 2015 2014

1 Full Ordinary Shares 16.942 8.421 1.971 0.8

2 Capital Raising Costs -0.585 -0.55

3 Additional Equity raised 9.106 7

4 Total Contributed Equity 16.942 16.942 8.421 0.8

It can also be understood that company has been incurring losses which is in alignment with the

industry. Further, the detailed breakup of other reserve is provided here-in-below:

Reserve

Sl.

No Particulars 2017 2016 2015 2014

1 Share based payment reserve 0.198

2 Share based payment expense 0.251 0.242

3 Exercise of Options -0.044

0.45 0.198 0.00

Further, the analysis of debt to equity has been presented here-in-below:

Gearing Ratio

Sl No Particulars 2017 2016 2015 2014

1 Debt 23.426 0 0 0

2 Equity 12.02 13.475 5.481 0.8

3 Debt Equity Ratio 1.95 0.00 0.00 0.00

4 Gearing Ratio 0.66 0.00 0.00 0.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

On perusal of the above, it can be understood that company has recently issued debt and there was

no debt over the past 3 years. The company has done the same on lack of availability of funds

through other modes.

References:

Accounting Edu.org, n.d. What is Financial Accounting?. [Online]

Available at: https://www.accountingedu.org/what-is-financial-accounting.html

[Accessed 21 September 2018].

BUTLER SETTINERI (AUDIT) PTY LTD, 2017. Financial Report 2017. [Online]

Available at: http://adalta.com.au/investors/annual-financial-reports/

[Accessed 28 September 2018].

Ernst & Young, 2017. Annual Financial statement. [Online]

Available at: https://actinogen.com.au/wp-content/uploads/2017/10/20171023-ASX-1729365-Annual-

Report-to-Shareholders.pdf

[Accessed 28 September 2018].

pwc, 2017. AFT Financial Statement. [Online]

Available at: investors.aftpharm.com/.../annual-reports/170524_2017_Financial_Statements.pd

[Accessed 28 September 2018].

Reuters.com, 2018. Actinogen Medical Ltd (ACW.AX). [Online]

Available at: https://in.reuters.com/finance/stocks/overview/ACW.AX

[Accessed 28 September 2018].

Reuters.com, 2018. Adalta Ltd (1AD.AX). [Online]

Available at: https://www.reuters.com/finance/stocks/companyProfile/1AD.AX

[Accessed 28 September 2018].

Reuters.com, 2018. AFT Pharmaceuticals Ltd (AFT.NZ). [Online]

Available at: https://in.reuters.com/finance/stocks/overview/AFT.NZ

[Accessed 28 September 2018].

no debt over the past 3 years. The company has done the same on lack of availability of funds

through other modes.

References:

Accounting Edu.org, n.d. What is Financial Accounting?. [Online]

Available at: https://www.accountingedu.org/what-is-financial-accounting.html

[Accessed 21 September 2018].

BUTLER SETTINERI (AUDIT) PTY LTD, 2017. Financial Report 2017. [Online]

Available at: http://adalta.com.au/investors/annual-financial-reports/

[Accessed 28 September 2018].

Ernst & Young, 2017. Annual Financial statement. [Online]

Available at: https://actinogen.com.au/wp-content/uploads/2017/10/20171023-ASX-1729365-Annual-

Report-to-Shareholders.pdf

[Accessed 28 September 2018].

pwc, 2017. AFT Financial Statement. [Online]

Available at: investors.aftpharm.com/.../annual-reports/170524_2017_Financial_Statements.pd

[Accessed 28 September 2018].

Reuters.com, 2018. Actinogen Medical Ltd (ACW.AX). [Online]

Available at: https://in.reuters.com/finance/stocks/overview/ACW.AX

[Accessed 28 September 2018].

Reuters.com, 2018. Adalta Ltd (1AD.AX). [Online]

Available at: https://www.reuters.com/finance/stocks/companyProfile/1AD.AX

[Accessed 28 September 2018].

Reuters.com, 2018. AFT Pharmaceuticals Ltd (AFT.NZ). [Online]

Available at: https://in.reuters.com/finance/stocks/overview/AFT.NZ

[Accessed 28 September 2018].

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.