(PDF) Issues in financial accounting

VerifiedAdded on 2021/01/02

|11

|2516

|362

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ACCOUNTING

AND REPORTING

AND REPORTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

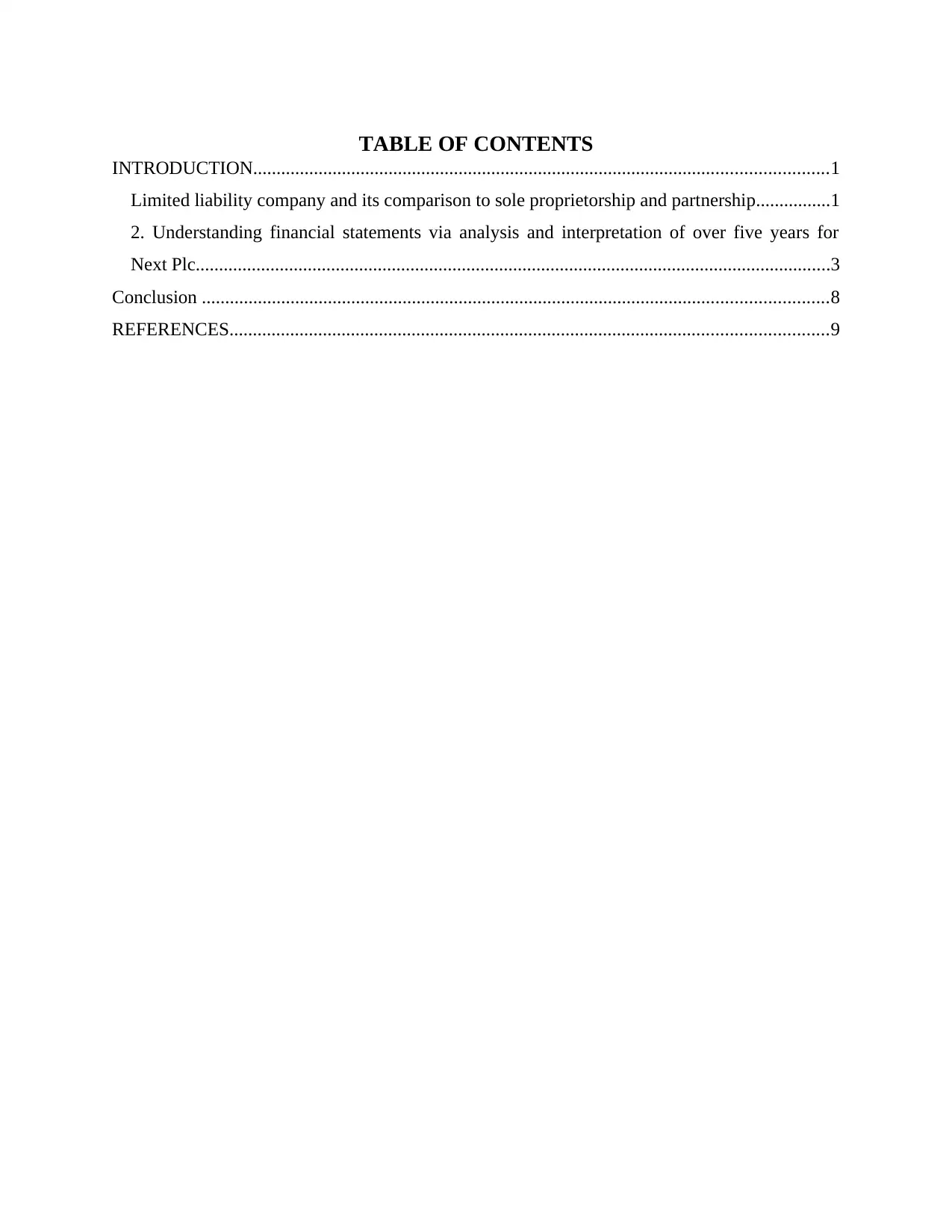

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Limited liability company and its comparison to sole proprietorship and partnership................1

2. Understanding financial statements via analysis and interpretation of over five years for

Next Plc........................................................................................................................................3

Conclusion ......................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

Limited liability company and its comparison to sole proprietorship and partnership................1

2. Understanding financial statements via analysis and interpretation of over five years for

Next Plc........................................................................................................................................3

Conclusion ......................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Financial accounting and reporting plays essential role in every business entity without

considering size of its company. The present report will give brief discussion about Limited

liability company which shows various set of propositions with differ through other form of

business which are drawing its merits and demerits as compared to other business forms like sole

proprietorship along with partnership. Further it will demonstrate understanding of financial

statements with Next Plc over past 5 years. It will state analysis with context of working capital,

liquidty, profitability and investor ratio as it will be establishing trend for individual ratio. Last

but not least, it would be commenting on future of Next Plc with context of UK clothing retail

sector.

Limited liability company and its comparison to sole proprietorship and partnership

Limited liability partnership is a type of partnership under which all the partners have

limited liability for financial obligation of business. Under this type of partnership, partners are

not responsible for their other partner's misconduct or carelessness. Under this partnership,

partners are septate entity of the business but there are certain situations in which partners are

liable for actions in partnership. This partnership provides rights to partners to manage business

directly. For doing business in limited liability partnership, partners have to register it with

company house and with registrar office. Under this, liability is in accordance with the

investment of partners in the organisation.(Everhart,2018.) As per partnership agreement,

partners part of income is used for taxation purpose which is accordance with their investment.

Merits of limited liability partnership

liability protection

Under general partnership, each partners are equally responsible for actions done by company.

But under limited liability partnership, partners are protected from liabilities of the company.

Under this liability, for debt's or others obligation of company partners individually not liable for

the operations of business.

Flexibility

Under these partners are fully provided flexibility in doing business operations. Partners have

full authority in this business about the amount of work is to be contributed by the members.

Partners are fully provided to take direct decisions regarding company's policies and procedures.

Tax advantage

1

Financial accounting and reporting plays essential role in every business entity without

considering size of its company. The present report will give brief discussion about Limited

liability company which shows various set of propositions with differ through other form of

business which are drawing its merits and demerits as compared to other business forms like sole

proprietorship along with partnership. Further it will demonstrate understanding of financial

statements with Next Plc over past 5 years. It will state analysis with context of working capital,

liquidty, profitability and investor ratio as it will be establishing trend for individual ratio. Last

but not least, it would be commenting on future of Next Plc with context of UK clothing retail

sector.

Limited liability company and its comparison to sole proprietorship and partnership

Limited liability partnership is a type of partnership under which all the partners have

limited liability for financial obligation of business. Under this type of partnership, partners are

not responsible for their other partner's misconduct or carelessness. Under this partnership,

partners are septate entity of the business but there are certain situations in which partners are

liable for actions in partnership. This partnership provides rights to partners to manage business

directly. For doing business in limited liability partnership, partners have to register it with

company house and with registrar office. Under this, liability is in accordance with the

investment of partners in the organisation.(Everhart,2018.) As per partnership agreement,

partners part of income is used for taxation purpose which is accordance with their investment.

Merits of limited liability partnership

liability protection

Under general partnership, each partners are equally responsible for actions done by company.

But under limited liability partnership, partners are protected from liabilities of the company.

Under this liability, for debt's or others obligation of company partners individually not liable for

the operations of business.

Flexibility

Under these partners are fully provided flexibility in doing business operations. Partners have

full authority in this business about the amount of work is to be contributed by the members.

Partners are fully provided to take direct decisions regarding company's policies and procedures.

Tax advantage

1

Under general partnership individual have to file their overall company's taxation procedure but

under limited liability all the partnership members are not responsible to pay tax. Under this

individual credits are provided according to their interest in the company which will prove

beneficial to them.

Demerits of limited liability partnership

public disclosure

Under limited liability partnership, partners have to disclose all their reports and accounts in

public. Financial accounts of the company is to be submitted to companies house and also

income of member is to be disclosed by the partners.

Rights of partners

Under this partnership structured is formed in such a way that individual partners have right to

take company's decision by which others may not feel comfortable to work which affect

company and business will not run positive direction.(Munro, 2017.)

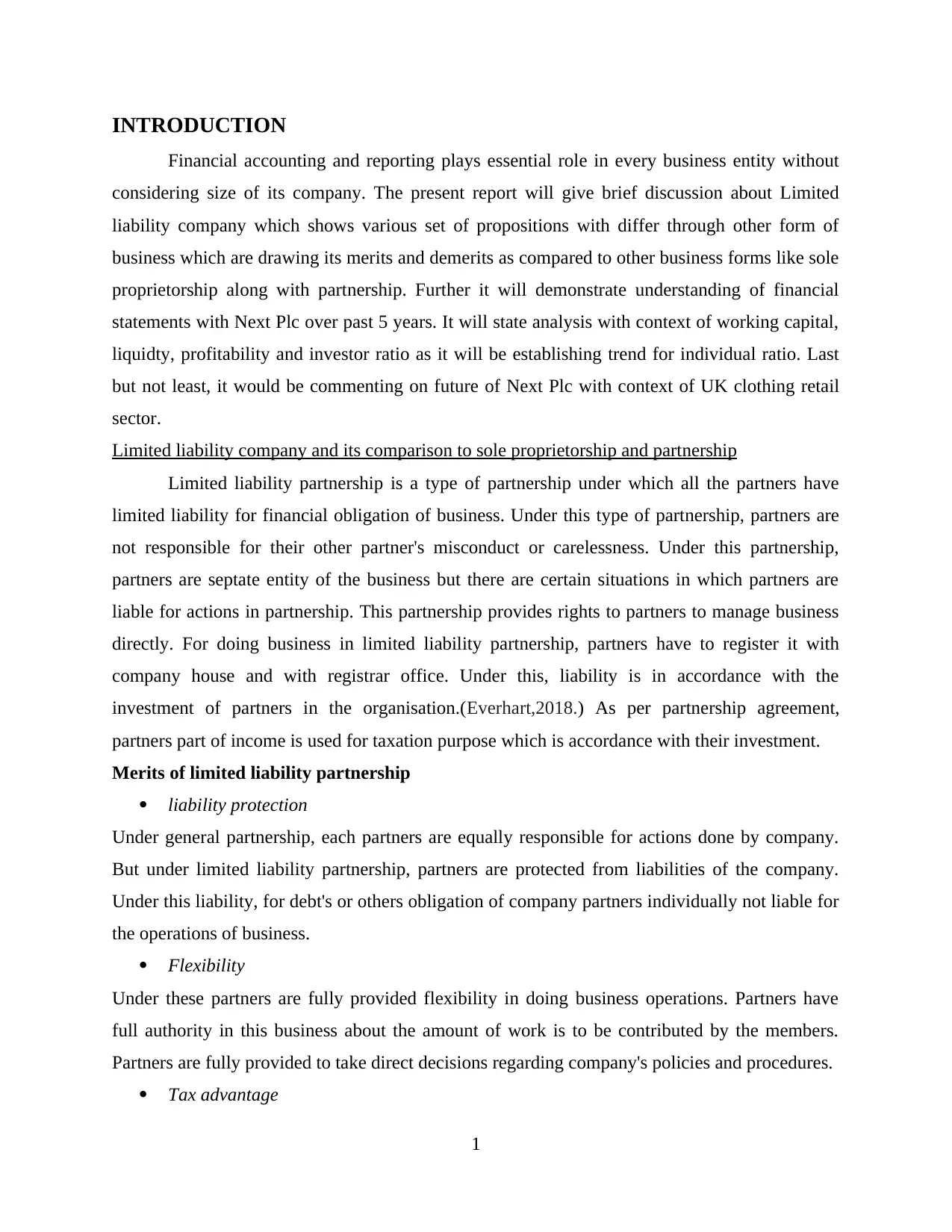

Comparison of sole proprietorship and partnership with limited liability partnership

Sole proprietorship partnership Limited liability

partnership

ownership Generally ownership

remains in the hands

of sole trader.

Under this ownership

provided as per the

agreement of

partnership.

Under this ownership

is provided as per the

partnership agreement.

liability Under this, liability is

in hands of sole trader

and is personally liable

for the debts of the

partnership.

Each partner is

personally liable for

the debt of the

partnership.

Under this, liability is

in accordance with the

investment of partners

in the organisation.

taxation Individual has to

provide part of income

in taxation purpose.

As per partnership

agreement part of

income from profit is

to be provided by

partners for taxation

In this, also as per

partnership agreement,

partners part of

income is used for

taxation purpose

2

under limited liability all the partnership members are not responsible to pay tax. Under this

individual credits are provided according to their interest in the company which will prove

beneficial to them.

Demerits of limited liability partnership

public disclosure

Under limited liability partnership, partners have to disclose all their reports and accounts in

public. Financial accounts of the company is to be submitted to companies house and also

income of member is to be disclosed by the partners.

Rights of partners

Under this partnership structured is formed in such a way that individual partners have right to

take company's decision by which others may not feel comfortable to work which affect

company and business will not run positive direction.(Munro, 2017.)

Comparison of sole proprietorship and partnership with limited liability partnership

Sole proprietorship partnership Limited liability

partnership

ownership Generally ownership

remains in the hands

of sole trader.

Under this ownership

provided as per the

agreement of

partnership.

Under this ownership

is provided as per the

partnership agreement.

liability Under this, liability is

in hands of sole trader

and is personally liable

for the debts of the

partnership.

Each partner is

personally liable for

the debt of the

partnership.

Under this, liability is

in accordance with the

investment of partners

in the organisation.

taxation Individual has to

provide part of income

in taxation purpose.

As per partnership

agreement part of

income from profit is

to be provided by

partners for taxation

In this, also as per

partnership agreement,

partners part of

income is used for

taxation purpose

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

purpose. which is accordance

with their investment.

accounts There is no obligation

for sole trader to

maintain records and

to file statutory

accounts and to submit

them in registrar of

companies.

There is no obligation

for sole trader to

maintain records and

to file statutory

accounts and to submit

them in registrar of

companies.(Levin and

Light, 2015.)

There is an obligation

for the partnership to

file accounts with

company house and

also to audit necessary

documents.

Registration Sole trader has to

notify within three

months of

commencement of

business to registrar of

company.

Partners has to notify

within three months of

commencement of

business to registrar of

company.

Under this registration

is to be done with

company house and

with registrar office.

2. Understanding financial statements via analysis and interpretation of over five years for Next

Plc.

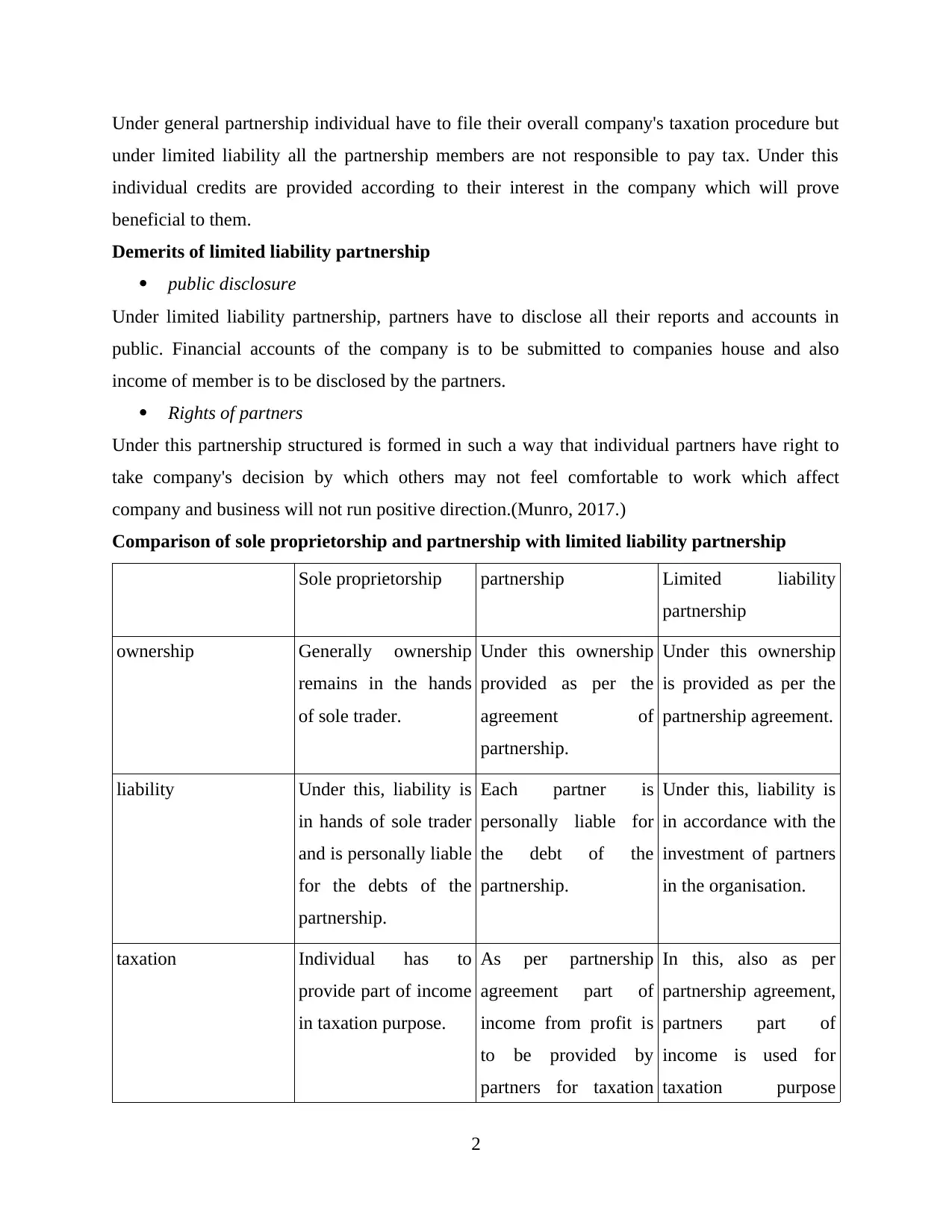

Profitability ratio

Particulars Formula 2014 2015 2016 2017 2018

Gross Profit margin 1235 1338 1446 1379 1356

Net profit margin 553 635 667 635 592

Total Sales revenue 3735 3994 4170 4090 4056

Gross Profit ratio

Gross profit / total sales

* 100 33% 34% 35% 34% 33%

Net Profit ratio

Net profit / total sales *

100 15% 16% 16% 16% 15%

3

with their investment.

accounts There is no obligation

for sole trader to

maintain records and

to file statutory

accounts and to submit

them in registrar of

companies.

There is no obligation

for sole trader to

maintain records and

to file statutory

accounts and to submit

them in registrar of

companies.(Levin and

Light, 2015.)

There is an obligation

for the partnership to

file accounts with

company house and

also to audit necessary

documents.

Registration Sole trader has to

notify within three

months of

commencement of

business to registrar of

company.

Partners has to notify

within three months of

commencement of

business to registrar of

company.

Under this registration

is to be done with

company house and

with registrar office.

2. Understanding financial statements via analysis and interpretation of over five years for Next

Plc.

Profitability ratio

Particulars Formula 2014 2015 2016 2017 2018

Gross Profit margin 1235 1338 1446 1379 1356

Net profit margin 553 635 667 635 592

Total Sales revenue 3735 3994 4170 4090 4056

Gross Profit ratio

Gross profit / total sales

* 100 33% 34% 35% 34% 33%

Net Profit ratio

Net profit / total sales *

100 15% 16% 16% 16% 15%

3

Interpretation: The above table is measuring profitability of Next Plc with context of

gross profit margin and net profit margin ratio. The organization's gross profit and net profit has

huge difference because of various expenses but it is making stable margin over 5 years. Gross

margin ratio compares the business's gross margin to its net sales. Indirectly, it is measuring

company's profitability for selling its inventory or merchandise. From year 2014 to 2017, its

gross profit is 33% as in these years its leading position of profitability was 35% which was

because of the highest gross profit margin along with net sales. The organization with huge gross

margin ratio signifies that it would have more money for repaying its operating expenses such as

utilities, salaries along with rent. This ratio is measuring margin by selling inventory as it is

specifying percentage sales which is applicable for funding other parts of business (Gross

margin Ratio, 2018).

In the similar aspect, organization's net profit has been extracted where its is indicated for

calculating percentage of margin of organisation which is generated through total revenue. The

total revenue is considered as money gained by Next Plc to give its services and goods, income

which is expressed in percentage format. Its trend is similar to gross margin ratio where its

position is similar to year 2014 and in 2015, 2016 and 2017 it was 16%. Thus, Next PLC is

generating gross profit and net profit of 33% and 16% respectively in year 2017. In nutshell, it is

4

gross profit margin and net profit margin ratio. The organization's gross profit and net profit has

huge difference because of various expenses but it is making stable margin over 5 years. Gross

margin ratio compares the business's gross margin to its net sales. Indirectly, it is measuring

company's profitability for selling its inventory or merchandise. From year 2014 to 2017, its

gross profit is 33% as in these years its leading position of profitability was 35% which was

because of the highest gross profit margin along with net sales. The organization with huge gross

margin ratio signifies that it would have more money for repaying its operating expenses such as

utilities, salaries along with rent. This ratio is measuring margin by selling inventory as it is

specifying percentage sales which is applicable for funding other parts of business (Gross

margin Ratio, 2018).

In the similar aspect, organization's net profit has been extracted where its is indicated for

calculating percentage of margin of organisation which is generated through total revenue. The

total revenue is considered as money gained by Next Plc to give its services and goods, income

which is expressed in percentage format. Its trend is similar to gross margin ratio where its

position is similar to year 2014 and in 2015, 2016 and 2017 it was 16%. Thus, Next PLC is

generating gross profit and net profit of 33% and 16% respectively in year 2017. In nutshell, it is

4

very important measure through income statement with analysing management and investors as

it always considers historical and peer margin for framing meaningful conclusion from similar

aspect.

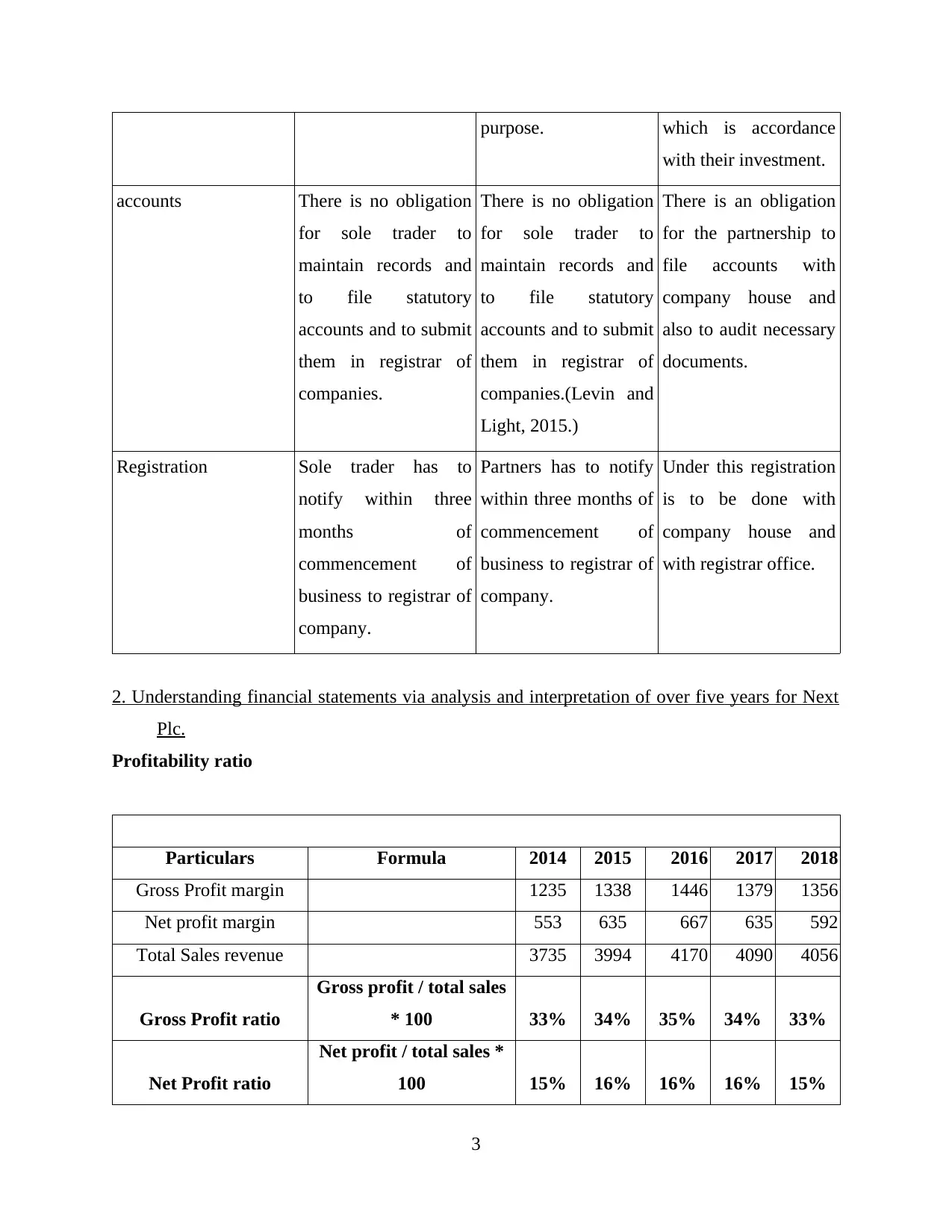

Liquidity and Working capital ratio:

Liquidity ratio analysis Formula 2014 2015 2016 2017 2018

Current assets 1468 1616 1642 1661 1798

Current liabilities 1024 1074 848 1169 1164

Inventory 386 417 487 451 490

Prepaid expenses 94 90 86 92 94

Quick assets 988 1109 1069 1118 1214

Current ratio/ Working

capital ratio

Current assets / current

liabilities 1.43 1.50 1.94 1.42 1.54

Quick ratio

Current assets - (stock +

prepaid expenses) 0.96 1.03 1.26 0.96 1.04

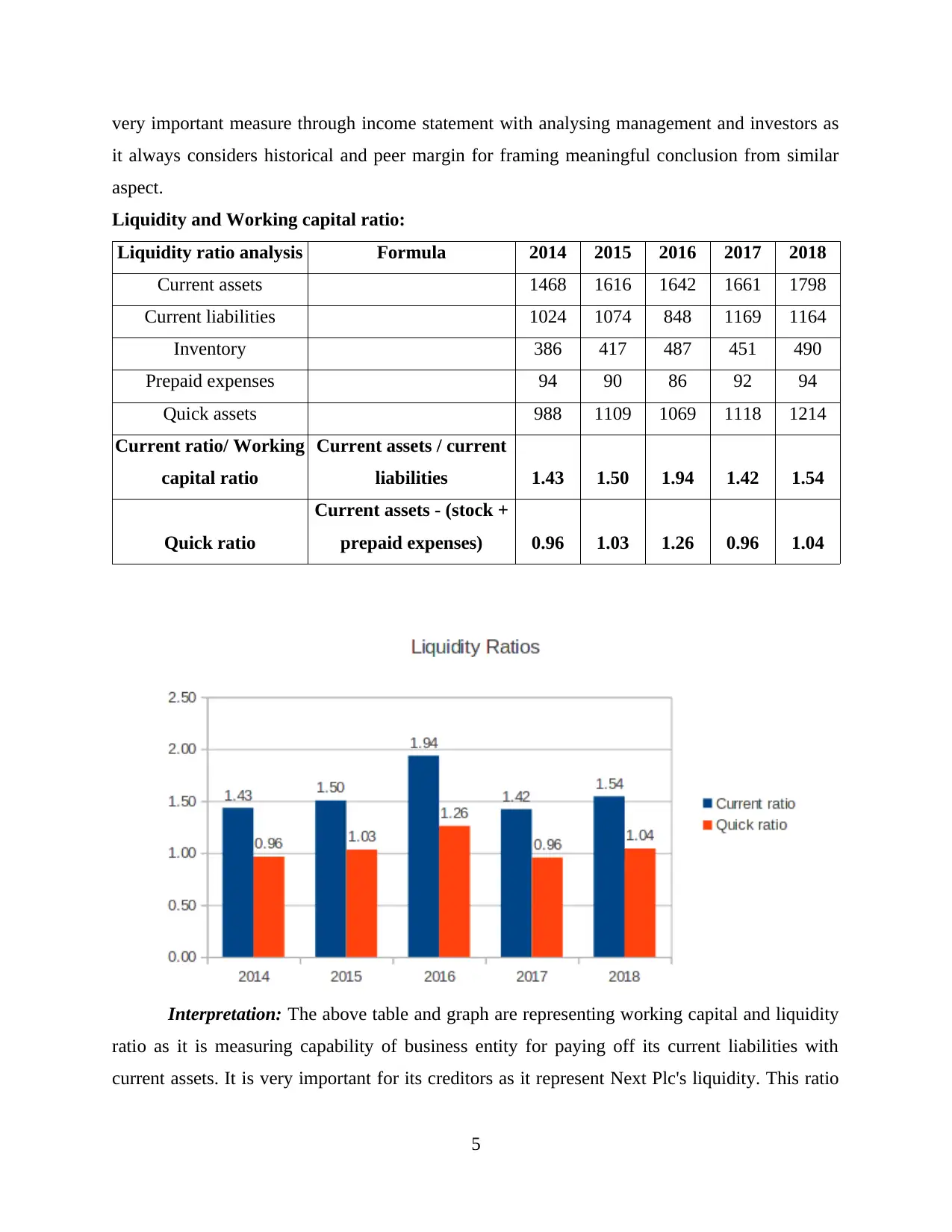

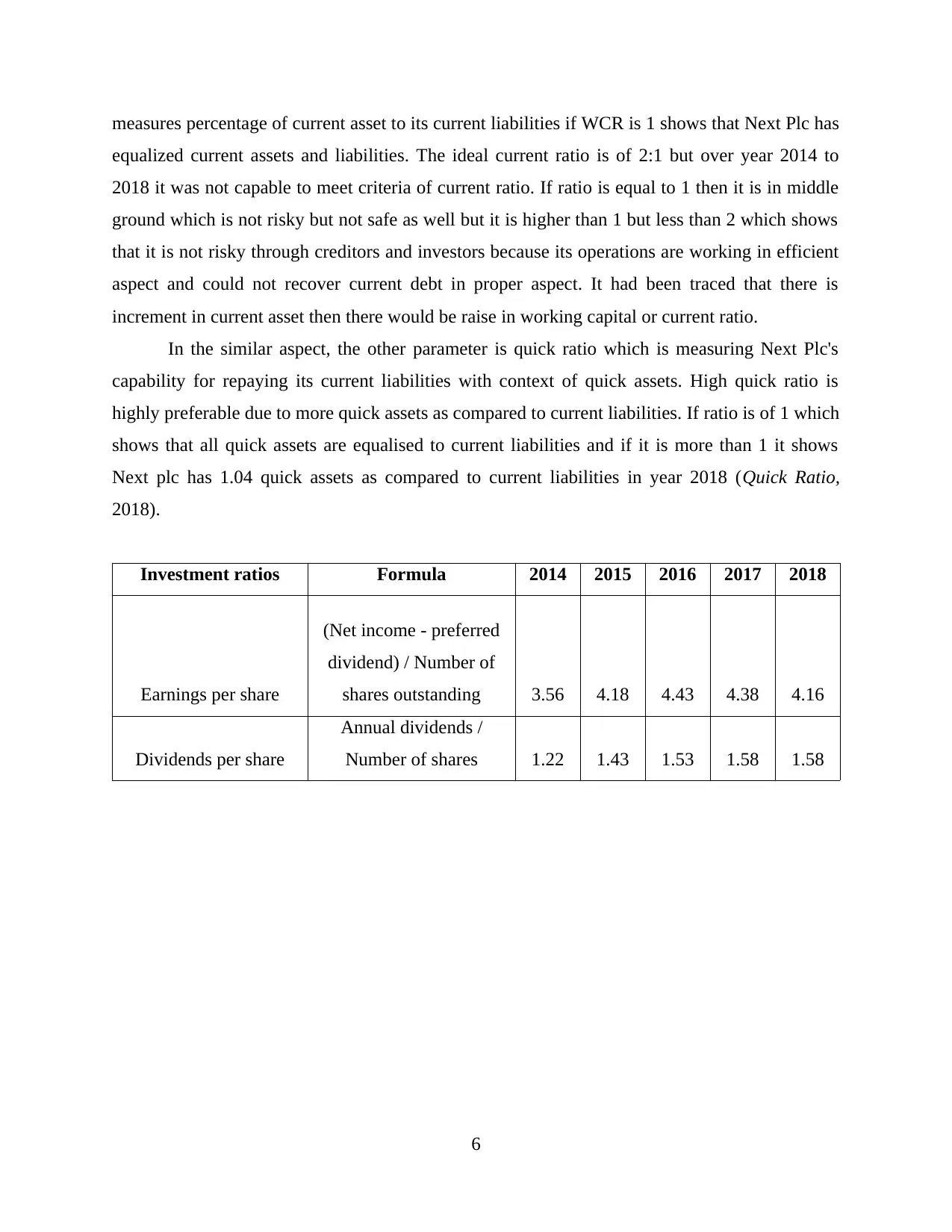

Interpretation: The above table and graph are representing working capital and liquidity

ratio as it is measuring capability of business entity for paying off its current liabilities with

current assets. It is very important for its creditors as it represent Next Plc's liquidity. This ratio

5

it always considers historical and peer margin for framing meaningful conclusion from similar

aspect.

Liquidity and Working capital ratio:

Liquidity ratio analysis Formula 2014 2015 2016 2017 2018

Current assets 1468 1616 1642 1661 1798

Current liabilities 1024 1074 848 1169 1164

Inventory 386 417 487 451 490

Prepaid expenses 94 90 86 92 94

Quick assets 988 1109 1069 1118 1214

Current ratio/ Working

capital ratio

Current assets / current

liabilities 1.43 1.50 1.94 1.42 1.54

Quick ratio

Current assets - (stock +

prepaid expenses) 0.96 1.03 1.26 0.96 1.04

Interpretation: The above table and graph are representing working capital and liquidity

ratio as it is measuring capability of business entity for paying off its current liabilities with

current assets. It is very important for its creditors as it represent Next Plc's liquidity. This ratio

5

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

measures percentage of current asset to its current liabilities if WCR is 1 shows that Next Plc has

equalized current assets and liabilities. The ideal current ratio is of 2:1 but over year 2014 to

2018 it was not capable to meet criteria of current ratio. If ratio is equal to 1 then it is in middle

ground which is not risky but not safe as well but it is higher than 1 but less than 2 which shows

that it is not risky through creditors and investors because its operations are working in efficient

aspect and could not recover current debt in proper aspect. It had been traced that there is

increment in current asset then there would be raise in working capital or current ratio.

In the similar aspect, the other parameter is quick ratio which is measuring Next Plc's

capability for repaying its current liabilities with context of quick assets. High quick ratio is

highly preferable due to more quick assets as compared to current liabilities. If ratio is of 1 which

shows that all quick assets are equalised to current liabilities and if it is more than 1 it shows

Next plc has 1.04 quick assets as compared to current liabilities in year 2018 (Quick Ratio,

2018).

Investment ratios Formula 2014 2015 2016 2017 2018

Earnings per share

(Net income - preferred

dividend) / Number of

shares outstanding 3.56 4.18 4.43 4.38 4.16

Dividends per share

Annual dividends /

Number of shares 1.22 1.43 1.53 1.58 1.58

6

equalized current assets and liabilities. The ideal current ratio is of 2:1 but over year 2014 to

2018 it was not capable to meet criteria of current ratio. If ratio is equal to 1 then it is in middle

ground which is not risky but not safe as well but it is higher than 1 but less than 2 which shows

that it is not risky through creditors and investors because its operations are working in efficient

aspect and could not recover current debt in proper aspect. It had been traced that there is

increment in current asset then there would be raise in working capital or current ratio.

In the similar aspect, the other parameter is quick ratio which is measuring Next Plc's

capability for repaying its current liabilities with context of quick assets. High quick ratio is

highly preferable due to more quick assets as compared to current liabilities. If ratio is of 1 which

shows that all quick assets are equalised to current liabilities and if it is more than 1 it shows

Next plc has 1.04 quick assets as compared to current liabilities in year 2018 (Quick Ratio,

2018).

Investment ratios Formula 2014 2015 2016 2017 2018

Earnings per share

(Net income - preferred

dividend) / Number of

shares outstanding 3.56 4.18 4.43 4.38 4.16

Dividends per share

Annual dividends /

Number of shares 1.22 1.43 1.53 1.58 1.58

6

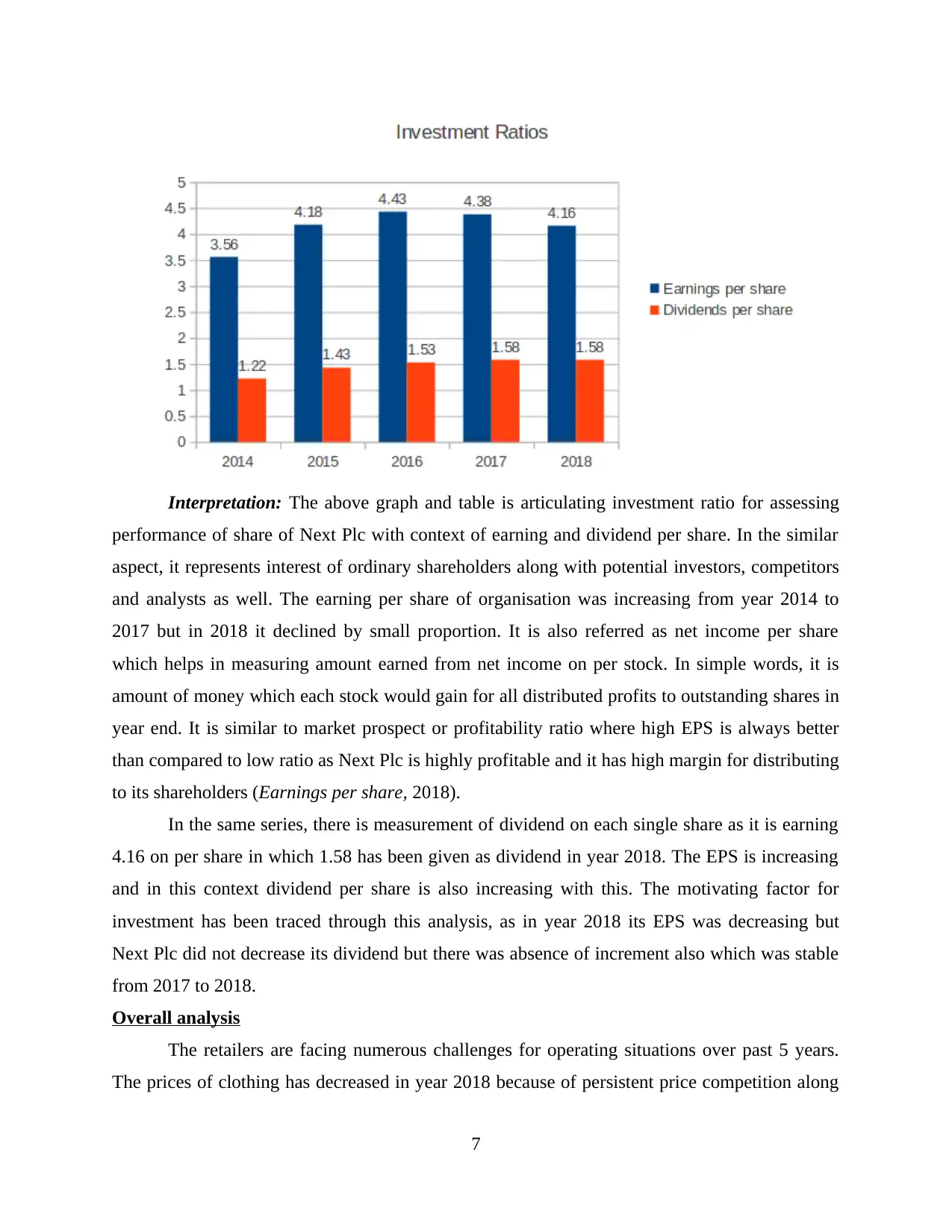

Interpretation: The above graph and table is articulating investment ratio for assessing

performance of share of Next Plc with context of earning and dividend per share. In the similar

aspect, it represents interest of ordinary shareholders along with potential investors, competitors

and analysts as well. The earning per share of organisation was increasing from year 2014 to

2017 but in 2018 it declined by small proportion. It is also referred as net income per share

which helps in measuring amount earned from net income on per stock. In simple words, it is

amount of money which each stock would gain for all distributed profits to outstanding shares in

year end. It is similar to market prospect or profitability ratio where high EPS is always better

than compared to low ratio as Next Plc is highly profitable and it has high margin for distributing

to its shareholders (Earnings per share, 2018).

In the same series, there is measurement of dividend on each single share as it is earning

4.16 on per share in which 1.58 has been given as dividend in year 2018. The EPS is increasing

and in this context dividend per share is also increasing with this. The motivating factor for

investment has been traced through this analysis, as in year 2018 its EPS was decreasing but

Next Plc did not decrease its dividend but there was absence of increment also which was stable

from 2017 to 2018.

Overall analysis

The retailers are facing numerous challenges for operating situations over past 5 years.

The prices of clothing has decreased in year 2018 because of persistent price competition along

7

performance of share of Next Plc with context of earning and dividend per share. In the similar

aspect, it represents interest of ordinary shareholders along with potential investors, competitors

and analysts as well. The earning per share of organisation was increasing from year 2014 to

2017 but in 2018 it declined by small proportion. It is also referred as net income per share

which helps in measuring amount earned from net income on per stock. In simple words, it is

amount of money which each stock would gain for all distributed profits to outstanding shares in

year end. It is similar to market prospect or profitability ratio where high EPS is always better

than compared to low ratio as Next Plc is highly profitable and it has high margin for distributing

to its shareholders (Earnings per share, 2018).

In the same series, there is measurement of dividend on each single share as it is earning

4.16 on per share in which 1.58 has been given as dividend in year 2018. The EPS is increasing

and in this context dividend per share is also increasing with this. The motivating factor for

investment has been traced through this analysis, as in year 2018 its EPS was decreasing but

Next Plc did not decrease its dividend but there was absence of increment also which was stable

from 2017 to 2018.

Overall analysis

The retailers are facing numerous challenges for operating situations over past 5 years.

The prices of clothing has decreased in year 2018 because of persistent price competition along

7

with widespread discounting. It has directly constrained growth of revenue and retailers has work

hard for retaining and drawing away consumers through rivalry department stores, online-only

retailers and supermarkets. This evolution and persistent increase in online shopping with prompt

retailers for investing substantially with online offerings and capabilities of delivery is beneficial

and delivery options could create substantial share of operators of industry. While analysing

financial statements of Next Plc it had been stated that this industry is facing various threats but

then too it is making profitability which has minor impact from past year. Its current ratio is not

appropriate but quick ratio is highly preferable which is positive point in the similar aspect, its

investment ratio is constant from year 2014 to 2017, but decreased in 2018 but it does not impact

its dividends (Annual report of Next plc, 2017).

Conclusion

From the above report it is explained about limited liability meaning and its merits and

demerits. After that in this report a comparison is done between limited liability with sole

proprietorship and with partnership. Further, in this report it is explained about Understanding

financial statements via analysis and interpretation of over five years for Next Plc. Overall

analysis is also provided in this report.

8

hard for retaining and drawing away consumers through rivalry department stores, online-only

retailers and supermarkets. This evolution and persistent increase in online shopping with prompt

retailers for investing substantially with online offerings and capabilities of delivery is beneficial

and delivery options could create substantial share of operators of industry. While analysing

financial statements of Next Plc it had been stated that this industry is facing various threats but

then too it is making profitability which has minor impact from past year. Its current ratio is not

appropriate but quick ratio is highly preferable which is positive point in the similar aspect, its

investment ratio is constant from year 2014 to 2017, but decreased in 2018 but it does not impact

its dividends (Annual report of Next plc, 2017).

Conclusion

From the above report it is explained about limited liability meaning and its merits and

demerits. After that in this report a comparison is done between limited liability with sole

proprietorship and with partnership. Further, in this report it is explained about Understanding

financial statements via analysis and interpretation of over five years for Next Plc. Overall

analysis is also provided in this report.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Everhart, J.R., 2018. Unlimited Tax Liability: A Common Misnomer of Limited Liability

Company Taxation in the United States. Small Business Institute Journal. 14(1). pp.44-51.

Levin, J.S. and Light, R.S. eds., 2015. Structuring venture capital, private equity and

entrepreneurial transactions. Wolters Kluwer Law & Business.

Munro, B., 2017. Limited Liability Partnerships and Fiduciary Duties.

ONLINE

Annual report of Next plc. 2017. [Online]. Available through

<https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2017/Copy%20of

%20WEBSITE%20FINAL%20PDF.pdf>.

Quick Ratio. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/quick-ratio>.

Gross margin Ratio. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/gross-margin-ratio>.

Earnings per share. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/earnings-per-share>.

9

Books and Journals

Everhart, J.R., 2018. Unlimited Tax Liability: A Common Misnomer of Limited Liability

Company Taxation in the United States. Small Business Institute Journal. 14(1). pp.44-51.

Levin, J.S. and Light, R.S. eds., 2015. Structuring venture capital, private equity and

entrepreneurial transactions. Wolters Kluwer Law & Business.

Munro, B., 2017. Limited Liability Partnerships and Fiduciary Duties.

ONLINE

Annual report of Next plc. 2017. [Online]. Available through

<https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2017/Copy%20of

%20WEBSITE%20FINAL%20PDF.pdf>.

Quick Ratio. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/quick-ratio>.

Gross margin Ratio. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/gross-margin-ratio>.

Earnings per share. 2018. [Online]. Available through

<https://www.myaccountingcourse.com/financial-ratios/earnings-per-share>.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.