Financial Accounting: Superstore Ltd Financial Statement Analysis

VerifiedAdded on 2023/06/04

|14

|2006

|163

Homework Assignment

AI Summary

This financial accounting assignment provides a detailed analysis of Superstore Ltd's financial statements, addressing various scenarios including revisions to the useful life of manufacturing equipment, unrecorded repair invoices, fluctuations in share prices, and misclassified expenses. It also covers journal entries for Rippa Ltd, including share application, allotment, and forfeiture. Furthermore, the assignment includes a worksheet for current and deferred tax liabilities, calculations for revaluation gains or losses and deferred tax, and an analysis of impairment loss for Fizzy Drinks and Ice Creamery, including the allocation of impairment loss and relevant journal entries. Desklib offers this assignment as part of its extensive collection of solved papers and study resources for students.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCIAL ACCOUNTING

Table of Contents

Assessment 2...................................................................................................................................2

Answer to Question 1......................................................................................................................2

Requirement 1..............................................................................................................................2

Requirement 2..............................................................................................................................2

Requirement 3..............................................................................................................................3

Requirement 4..............................................................................................................................3

Answer to Question 2......................................................................................................................4

Requirement i...............................................................................................................................4

Requirement ii.............................................................................................................................5

Answer to Question 3......................................................................................................................6

Answer to Question 4......................................................................................................................8

Answer to Question 5....................................................................................................................10

Reference.......................................................................................................................................12

FINANCIAL ACCOUNTING

Table of Contents

Assessment 2...................................................................................................................................2

Answer to Question 1......................................................................................................................2

Requirement 1..............................................................................................................................2

Requirement 2..............................................................................................................................2

Requirement 3..............................................................................................................................3

Requirement 4..............................................................................................................................3

Answer to Question 2......................................................................................................................4

Requirement i...............................................................................................................................4

Requirement ii.............................................................................................................................5

Answer to Question 3......................................................................................................................6

Answer to Question 4......................................................................................................................8

Answer to Question 5....................................................................................................................10

Reference.......................................................................................................................................12

2

FINANCIAL ACCOUNTING

Assessment 2

Answer to Question 1

Requirement 1

The case which is given in the question shows that the management of Superstore ltd

wants to revise the useful life of a manufacturing equipment which was depreciated on a straight-

line basis. A change in the useful life of the asset is treated as a change in accounting estimate

and International Accounting Standard (IAS) 8, states that any change in accounting estimate is

to be treated with prospective effect which means the accounting estimate will be applicable in

for the current period and future periods but past records are not to be changed (Shalev, Zhang &

Zhang, 2013). Therefore, the director needs to revise the depreciation amount based on new

useful life of asset. The directors do not need to make changes in past records of 2016 and 2017

and only needs to change the depreciation amount which is shown in annual reports.\

Requirement 2

In this case, the management of the company has missed out to record an invoice of $

20,000 which is for repair of equipment. The management of the company needs to record the

same in the books of accounts for which appropriate adjustment entry is to be passed which is

shown below:

Retained Earnings A/c……………………………Dr 14,000

Deferred Tax Assets A/c…………………………Dr 6,000

To Account Payable A/c 20,000

(Being invoice relating to repair expenses recorded)

FINANCIAL ACCOUNTING

Assessment 2

Answer to Question 1

Requirement 1

The case which is given in the question shows that the management of Superstore ltd

wants to revise the useful life of a manufacturing equipment which was depreciated on a straight-

line basis. A change in the useful life of the asset is treated as a change in accounting estimate

and International Accounting Standard (IAS) 8, states that any change in accounting estimate is

to be treated with prospective effect which means the accounting estimate will be applicable in

for the current period and future periods but past records are not to be changed (Shalev, Zhang &

Zhang, 2013). Therefore, the director needs to revise the depreciation amount based on new

useful life of asset. The directors do not need to make changes in past records of 2016 and 2017

and only needs to change the depreciation amount which is shown in annual reports.\

Requirement 2

In this case, the management of the company has missed out to record an invoice of $

20,000 which is for repair of equipment. The management of the company needs to record the

same in the books of accounts for which appropriate adjustment entry is to be passed which is

shown below:

Retained Earnings A/c……………………………Dr 14,000

Deferred Tax Assets A/c…………………………Dr 6,000

To Account Payable A/c 20,000

(Being invoice relating to repair expenses recorded)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCIAL ACCOUNTING

Requirement 3

The case shows that there is a fall in the shares prices of ABC ltd in which Superstore ltd

has holdings. The shares price of ABC ltd which was shown in the books of accounts of

Superstore ltd as on 30th June is $ 6,00,000 which had declined to $ 2,50,000 in 10th July 2018.

The management needs to make appropriate changes in books of accounts by passing the

following journal entry:

Unrealized Holding Loss A/c……………………………Dr 3,50,000

To Shares in ABC ltd 3,50,000

(Being changes in shares prices of ABC Ltd recorded in Books of Superstore ltd)

Requirement 4

The case which is given in the question shows that the accountant of Superstore ltd has

recorded personal expenses of the accountant as advertisement expenses of the business which

needs to be adjusted. The management needs to reverse the advertisement entry and pass

necessary Journal entry in this respect. The Journal entries are shown below:

Cash A/c …………………………………………………Dr $ 32,000

To Advertisement A/c $ 32,000

(Being advertisement entry reversed)

Advertisement A/c ………………………………..……….Dr $ 32,000

To Max A/c $

32,000

FINANCIAL ACCOUNTING

Requirement 3

The case shows that there is a fall in the shares prices of ABC ltd in which Superstore ltd

has holdings. The shares price of ABC ltd which was shown in the books of accounts of

Superstore ltd as on 30th June is $ 6,00,000 which had declined to $ 2,50,000 in 10th July 2018.

The management needs to make appropriate changes in books of accounts by passing the

following journal entry:

Unrealized Holding Loss A/c……………………………Dr 3,50,000

To Shares in ABC ltd 3,50,000

(Being changes in shares prices of ABC Ltd recorded in Books of Superstore ltd)

Requirement 4

The case which is given in the question shows that the accountant of Superstore ltd has

recorded personal expenses of the accountant as advertisement expenses of the business which

needs to be adjusted. The management needs to reverse the advertisement entry and pass

necessary Journal entry in this respect. The Journal entries are shown below:

Cash A/c …………………………………………………Dr $ 32,000

To Advertisement A/c $ 32,000

(Being advertisement entry reversed)

Advertisement A/c ………………………………..……….Dr $ 32,000

To Max A/c $

32,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCIAL ACCOUNTING

(Being appropriate adjustment entry passed)

FINANCIAL ACCOUNTING

(Being appropriate adjustment entry passed)

5

FINANCIAL ACCOUNTING

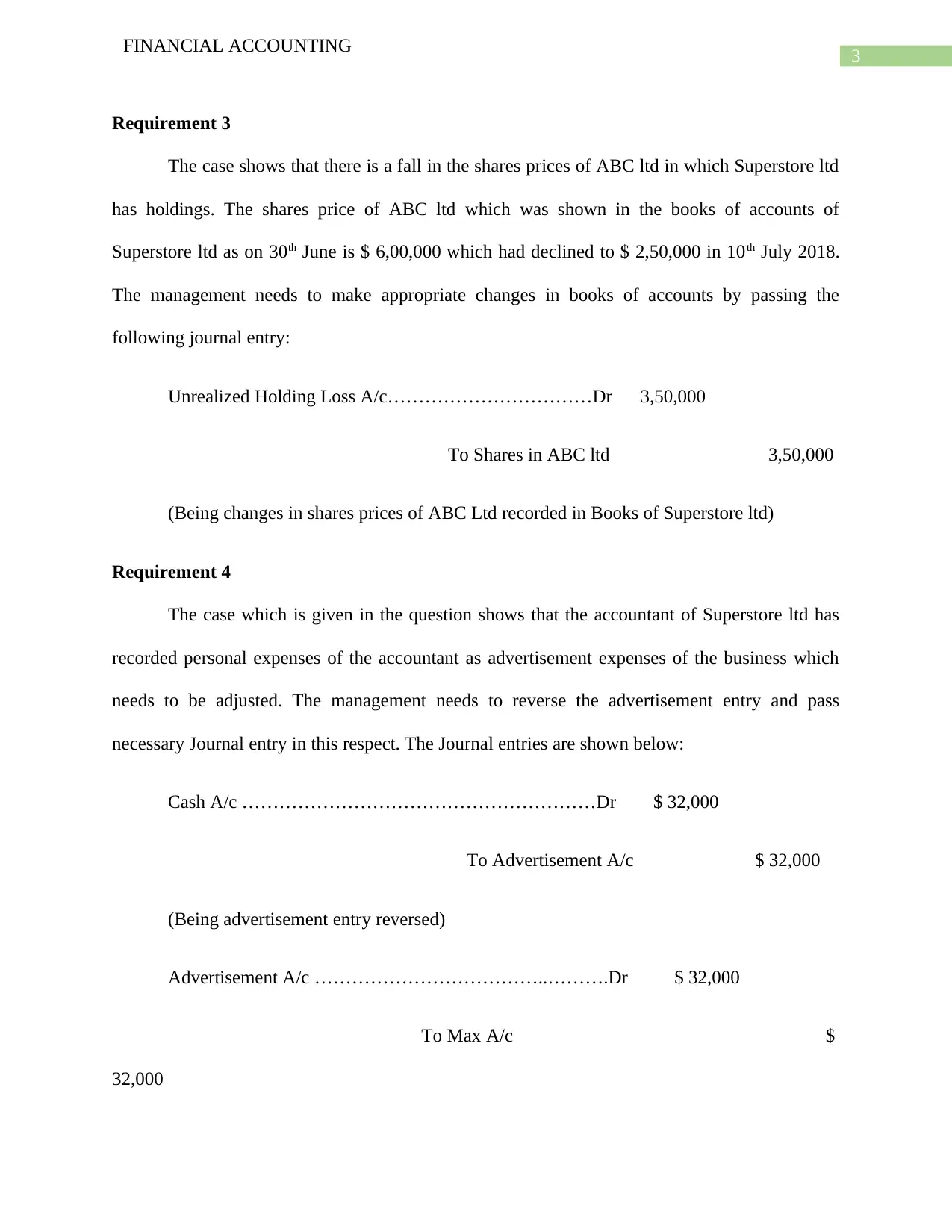

Answer to Question 2

Requirement i

Date L.F Debit Credit

31/07/2017 Bank A/c. 15,000,000

Share Application A/c. 15,000,000

10/08/2017 Share Application A/c. 15,000,000

Share Allotment A/c. 2,500,000

Share Capital A/c. 12,500,000

Share Allotment A/c. 5,000,000

Share Capital A/c. 5,000,000

12/08/2017 Underwritting Commission A/c. 12,000

Bank A/c. 12,000

10/09/2017 Bank A/c. 2,500,000

Share Allotment A/c. 2,500,000

1/02/2018 Share Call A/c. 2,500,000

Share Capital A/c. 2,500,000

28/02/2018 Bank A/c. 2,480,000

Calls-in-Arrear A/c. 20,000

Share Call A/c. 2,500,000

20/03/2018 Share Capital A/c. 160,000

Calls-in-Arrear A/c. 20,000

Share Forfeiture A/c. 140,000

Bank A/c. 128,000

Share Forfeiture A/c. 32,000

Share Capital A/c. 160,000

Re-issuance Cost of Shares A/c. 4,000

Bank A/c. 4,000

25/03/2018 Share Forfeiture A/c. 108,000

Share Re-Issuing Cost A/c. 4,000

Bank A/c. 104,000

In the books of Rippa Ltd.

Journal Entries

(Application money for 6,000,000 shares received @$2.50 per share))

(Amount, left in Share Forfeiture fund returned to defaulter shareholders)

(Share re-issuance cost duly paid)

(Forfeited shares re-issued @$3.20 per share)

(Receipts from partly paid 40,000 shares forfeited)

(Call money duly received for 4,960,000 shares and call money for balance 40,000

shares remain unpaid)

(Call money for 5,000,000 shares @$0.50 per share credited to Share Capital)

(Balance allotment money for 2,50,000 shares received @$1.00 per share)

(Underwritting commission paid)

(Allotment money for 5,000,000 shares @$1.00 per share credited to Share Capital)

(Application money for 5,000,000 shares transferred to Share Capital and balance fund

transferred to Allotment fund)

Particulars

FINANCIAL ACCOUNTING

Answer to Question 2

Requirement i

Date L.F Debit Credit

31/07/2017 Bank A/c. 15,000,000

Share Application A/c. 15,000,000

10/08/2017 Share Application A/c. 15,000,000

Share Allotment A/c. 2,500,000

Share Capital A/c. 12,500,000

Share Allotment A/c. 5,000,000

Share Capital A/c. 5,000,000

12/08/2017 Underwritting Commission A/c. 12,000

Bank A/c. 12,000

10/09/2017 Bank A/c. 2,500,000

Share Allotment A/c. 2,500,000

1/02/2018 Share Call A/c. 2,500,000

Share Capital A/c. 2,500,000

28/02/2018 Bank A/c. 2,480,000

Calls-in-Arrear A/c. 20,000

Share Call A/c. 2,500,000

20/03/2018 Share Capital A/c. 160,000

Calls-in-Arrear A/c. 20,000

Share Forfeiture A/c. 140,000

Bank A/c. 128,000

Share Forfeiture A/c. 32,000

Share Capital A/c. 160,000

Re-issuance Cost of Shares A/c. 4,000

Bank A/c. 4,000

25/03/2018 Share Forfeiture A/c. 108,000

Share Re-Issuing Cost A/c. 4,000

Bank A/c. 104,000

In the books of Rippa Ltd.

Journal Entries

(Application money for 6,000,000 shares received @$2.50 per share))

(Amount, left in Share Forfeiture fund returned to defaulter shareholders)

(Share re-issuance cost duly paid)

(Forfeited shares re-issued @$3.20 per share)

(Receipts from partly paid 40,000 shares forfeited)

(Call money duly received for 4,960,000 shares and call money for balance 40,000

shares remain unpaid)

(Call money for 5,000,000 shares @$0.50 per share credited to Share Capital)

(Balance allotment money for 2,50,000 shares received @$1.00 per share)

(Underwritting commission paid)

(Allotment money for 5,000,000 shares @$1.00 per share credited to Share Capital)

(Application money for 5,000,000 shares transferred to Share Capital and balance fund

transferred to Allotment fund)

Particulars

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCIAL ACCOUNTING

Requirement ii

As per the case which is provided, the management has forfeited the shares of

shareholders who have not paid the call moneys and paid up to allotment. One of the

shareholders whose share was forfeited claims to have received lesser amount of share money as

the shareholder had paid application and call money which was in total $ 3.50 per share. The

management has to incur cost of reissue of shares and cost which is related to forfeiture of share

(Libby, 2017). These costs have been transferred to the shareholders as it is the fault of the

shareholder that such costs have been incurred by the management in the first place. The original

costs of shares were $ 4 per share and the management had to sell the shares at $ 3.20 per shares

and therefore a loss is incurred. In addition to this, $ 4000 shares are incurred during the year.

FINANCIAL ACCOUNTING

Requirement ii

As per the case which is provided, the management has forfeited the shares of

shareholders who have not paid the call moneys and paid up to allotment. One of the

shareholders whose share was forfeited claims to have received lesser amount of share money as

the shareholder had paid application and call money which was in total $ 3.50 per share. The

management has to incur cost of reissue of shares and cost which is related to forfeiture of share

(Libby, 2017). These costs have been transferred to the shareholders as it is the fault of the

shareholder that such costs have been incurred by the management in the first place. The original

costs of shares were $ 4 per share and the management had to sell the shares at $ 3.20 per shares

and therefore a loss is incurred. In addition to this, $ 4000 shares are incurred during the year.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCIAL ACCOUNTING

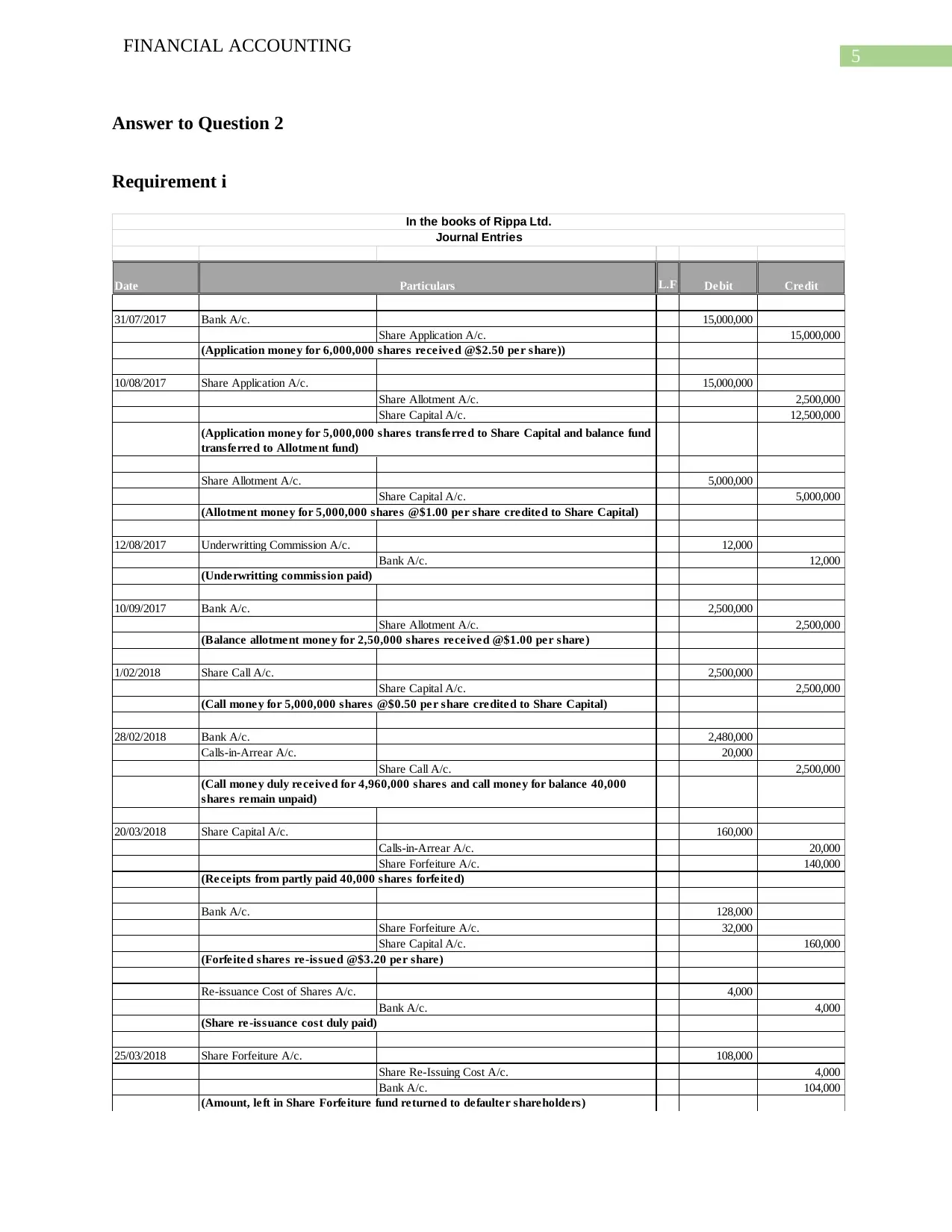

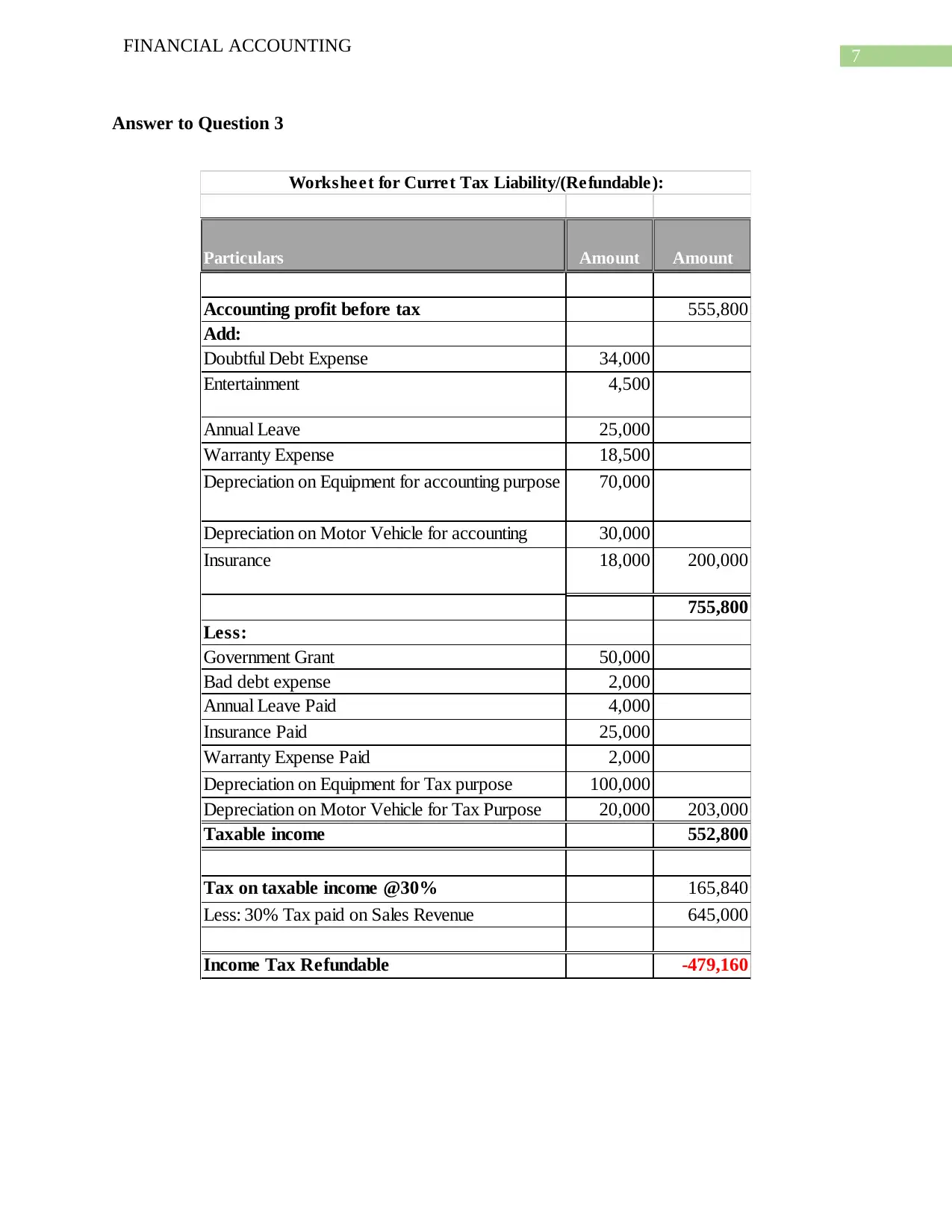

Answer to Question 3

Particulars Amount Amount

Accounting profit before tax 555,800

Add:

Doubtful Debt Expense 34,000

Entertainment 4,500

Annual Leave 25,000

Warranty Expense 18,500

Depreciation on Equipment for accounting purpose 70,000

Depreciation on Motor Vehicle for accounting

purpose

30,000

Insurance 18,000 200,000

755,800

Less:

Government Grant 50,000

Bad debt expense 2,000

Annual Leave Paid 4,000

Insurance Paid 25,000

Warranty Expense Paid 2,000

Depreciation on Equipment for Tax purpose 100,000

Depreciation on Motor Vehicle for Tax Purpose 20,000 203,000

Taxable income 552,800

Tax on taxable income @30% 165,840

Less: 30% Tax paid on Sales Revenue 645,000

Income Tax Refundable -479,160

Worksheet for Curret Tax Liability/(Refundable):

FINANCIAL ACCOUNTING

Answer to Question 3

Particulars Amount Amount

Accounting profit before tax 555,800

Add:

Doubtful Debt Expense 34,000

Entertainment 4,500

Annual Leave 25,000

Warranty Expense 18,500

Depreciation on Equipment for accounting purpose 70,000

Depreciation on Motor Vehicle for accounting

purpose

30,000

Insurance 18,000 200,000

755,800

Less:

Government Grant 50,000

Bad debt expense 2,000

Annual Leave Paid 4,000

Insurance Paid 25,000

Warranty Expense Paid 2,000

Depreciation on Equipment for Tax purpose 100,000

Depreciation on Motor Vehicle for Tax Purpose 20,000 203,000

Taxable income 552,800

Tax on taxable income @30% 165,840

Less: 30% Tax paid on Sales Revenue 645,000

Income Tax Refundable -479,160

Worksheet for Curret Tax Liability/(Refundable):

8

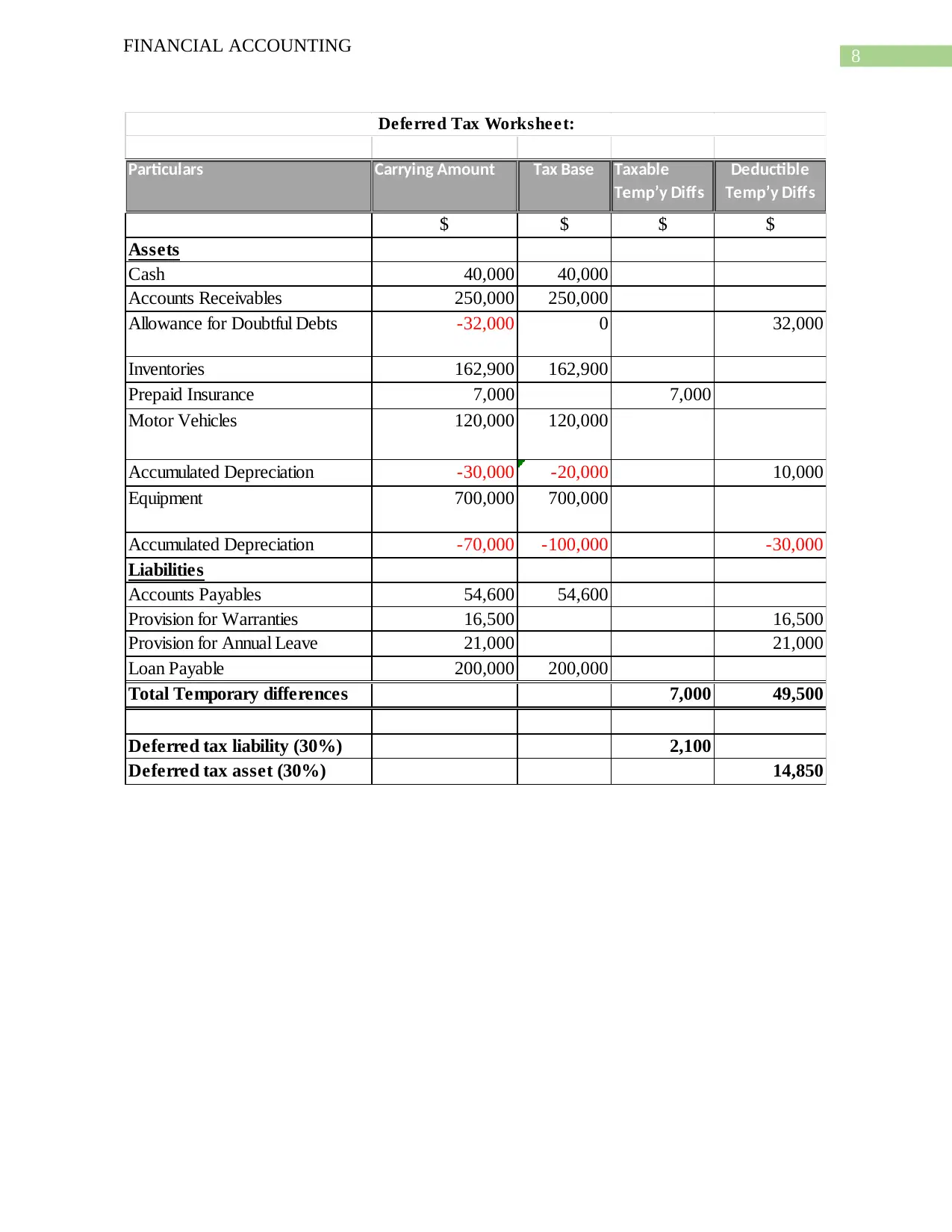

FINANCIAL ACCOUNTING

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash 40,000 40,000

Accounts Receivables 250,000 250,000

Allowance for Doubtful Debts -32,000 0 32,000

Inventories 162,900 162,900

Prepaid Insurance 7,000 7,000

Motor Vehicles 120,000 120,000

Accumulated Depreciation -30,000 -20,000 10,000

Equipment 700,000 700,000

Accumulated Depreciation -70,000 -100,000 -30,000

Liabilities

Accounts Payables 54,600 54,600

Provision for Warranties 16,500 16,500

Provision for Annual Leave 21,000 21,000

Loan Payable 200,000 200,000

Total Temporary differences 7,000 49,500

Deferred tax liability (30%) 2,100

Deferred tax asset (30%) 14,850

Deferred Tax Worksheet:

FINANCIAL ACCOUNTING

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash 40,000 40,000

Accounts Receivables 250,000 250,000

Allowance for Doubtful Debts -32,000 0 32,000

Inventories 162,900 162,900

Prepaid Insurance 7,000 7,000

Motor Vehicles 120,000 120,000

Accumulated Depreciation -30,000 -20,000 10,000

Equipment 700,000 700,000

Accumulated Depreciation -70,000 -100,000 -30,000

Liabilities

Accounts Payables 54,600 54,600

Provision for Warranties 16,500 16,500

Provision for Annual Leave 21,000 21,000

Loan Payable 200,000 200,000

Total Temporary differences 7,000 49,500

Deferred tax liability (30%) 2,100

Deferred tax asset (30%) 14,850

Deferred Tax Worksheet:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCIAL ACCOUNTING

Dr. Cr.

Date Particulars Amount Amount

30/06/2018 Income Tax Expense A/c. 165,840

Tax Receivables A/c. 479,160

Tax paid in advance A/c 645,000

(Income tax expenses adjusterd with advance tax

paid and income tax refundable recorded)

Deferred Tax Assets A/c. 14,850

Deferred Tax Liability A/c. 2,100

Income Tax Expense A/c. 12,750

(Deferred tax assets and deferred tax liabilities

recorded)

Profit & loss A/c. 163,740

Income Tax Expense A/c. 163,740

(Income tax expense transferred to P/L A/c.)

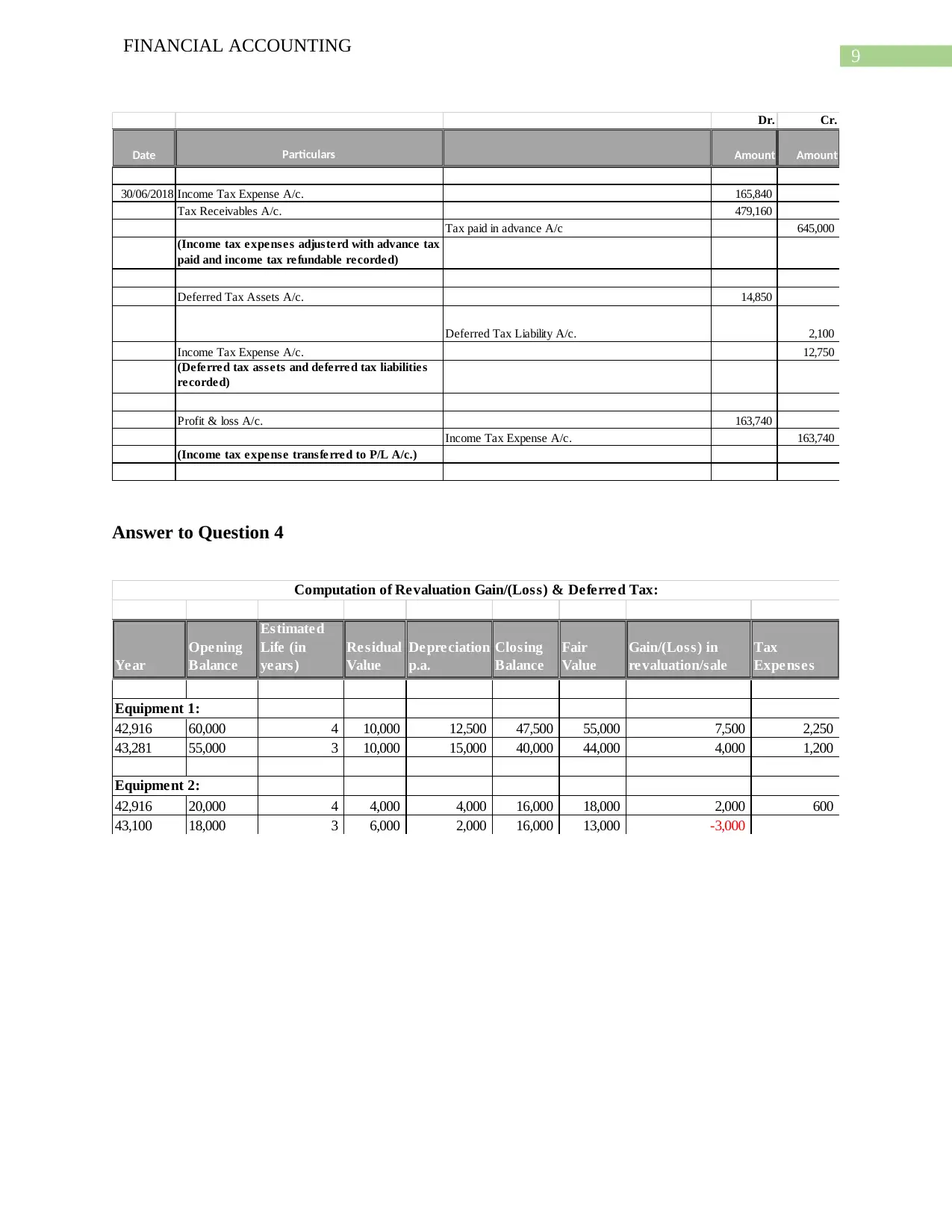

Answer to Question 4

Year

Opening

Balance

Estimated

Life (in

years)

Residual

Value

Depreciation

p.a.

Closing

Balance

Fair

Value

Gain/(Loss) in

revaluation/sale

Tax

Expenses

42,916 60,000 4 10,000 12,500 47,500 55,000 7,500 2,250

43,281 55,000 3 10,000 15,000 40,000 44,000 4,000 1,200

42,916 20,000 4 4,000 4,000 16,000 18,000 2,000 600

43,100 18,000 3 6,000 2,000 16,000 13,000 -3,000

Equipment 1:

Equipment 2:

Computation of Revaluation Gain/(Loss) & Deferred Tax:

FINANCIAL ACCOUNTING

Dr. Cr.

Date Particulars Amount Amount

30/06/2018 Income Tax Expense A/c. 165,840

Tax Receivables A/c. 479,160

Tax paid in advance A/c 645,000

(Income tax expenses adjusterd with advance tax

paid and income tax refundable recorded)

Deferred Tax Assets A/c. 14,850

Deferred Tax Liability A/c. 2,100

Income Tax Expense A/c. 12,750

(Deferred tax assets and deferred tax liabilities

recorded)

Profit & loss A/c. 163,740

Income Tax Expense A/c. 163,740

(Income tax expense transferred to P/L A/c.)

Answer to Question 4

Year

Opening

Balance

Estimated

Life (in

years)

Residual

Value

Depreciation

p.a.

Closing

Balance

Fair

Value

Gain/(Loss) in

revaluation/sale

Tax

Expenses

42,916 60,000 4 10,000 12,500 47,500 55,000 7,500 2,250

43,281 55,000 3 10,000 15,000 40,000 44,000 4,000 1,200

42,916 20,000 4 4,000 4,000 16,000 18,000 2,000 600

43,100 18,000 3 6,000 2,000 16,000 13,000 -3,000

Equipment 1:

Equipment 2:

Computation of Revaluation Gain/(Loss) & Deferred Tax:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCIAL ACCOUNTING

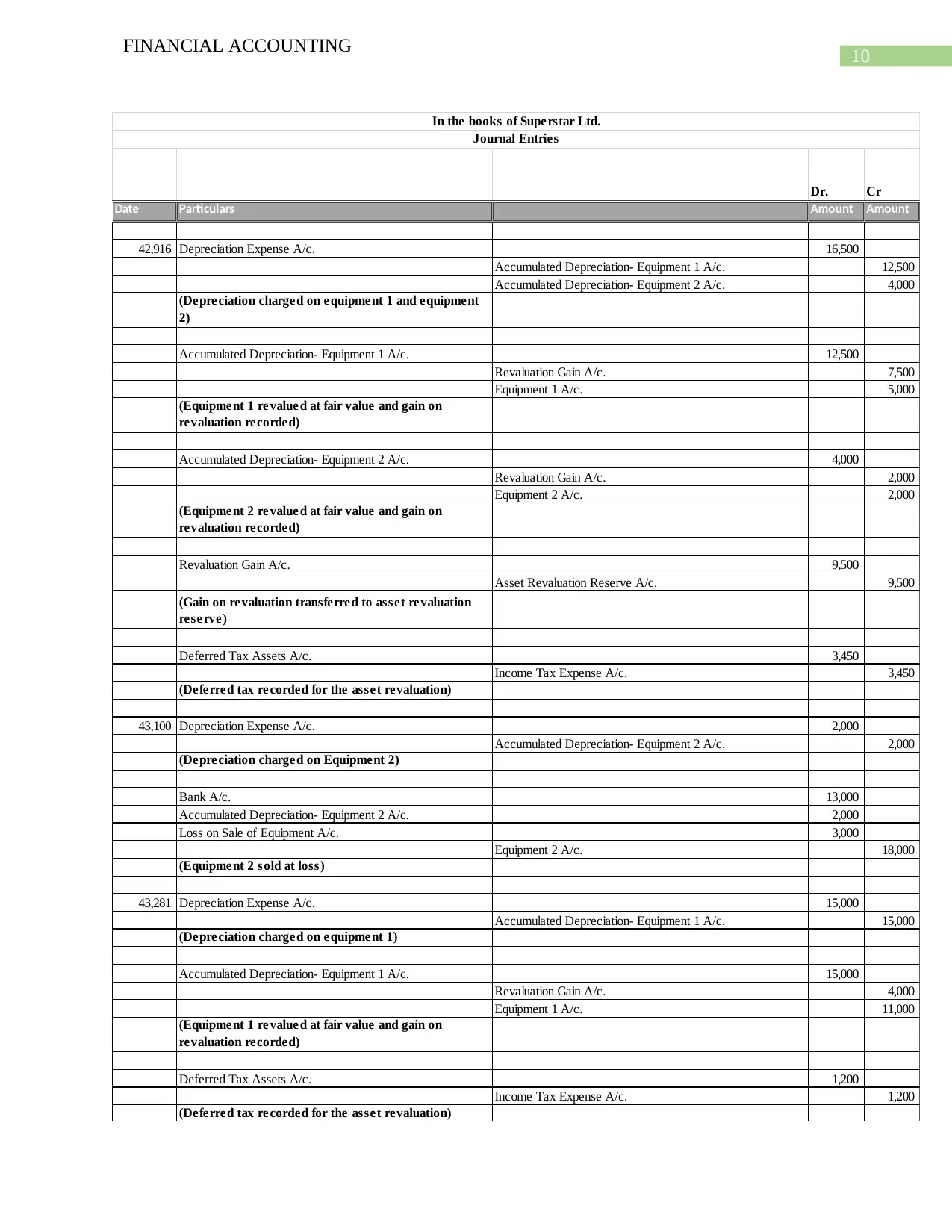

Dr. Cr

Date Particulars Amount Amount

42,916 Depreciation Expense A/c. 16,500

Accumulated Depreciation- Equipment 1 A/c. 12,500

Accumulated Depreciation- Equipment 2 A/c. 4,000

(Depre ciation charged on equipment 1 and equipment

2)

Accumulated Depreciation- Equipment 1 A/c. 12,500

Revaluation Gain A/c. 7,500

Equipment 1 A/c. 5,000

(Equipment 1 re valued at fair value and gain on

revaluation recorded)

Accumulated Depreciation- Equipment 2 A/c. 4,000

Revaluation Gain A/c. 2,000

Equipment 2 A/c. 2,000

(Equipment 2 re valued at fair value and gain on

revaluation recorded)

Revaluation Gain A/c. 9,500

Asset Revaluation Reserve A/c. 9,500

(Gain on revaluation transferred to asset revaluation

rese rve)

Deferred Tax Assets A/c. 3,450

Income Tax Expense A/c. 3,450

(Deferred tax re corded for the asset revaluation)

43,100 Depreciation Expense A/c. 2,000

Accumulated Depreciation- Equipment 2 A/c. 2,000

(Depre ciation charged on Equipment 2)

Bank A/c. 13,000

Accumulated Depreciation- Equipment 2 A/c. 2,000

Loss on Sale of Equipment A/c. 3,000

Equipment 2 A/c. 18,000

(Equipment 2 sold at loss)

43,281 Depreciation Expense A/c. 15,000

Accumulated Depreciation- Equipment 1 A/c. 15,000

(Depre ciation charged on equipment 1)

Accumulated Depreciation- Equipment 1 A/c. 15,000

Revaluation Gain A/c. 4,000

Equipment 1 A/c. 11,000

(Equipment 1 re valued at fair value and gain on

revaluation recorded)

Deferred Tax Assets A/c. 1,200

Income Tax Expense A/c. 1,200

(Deferred tax re corded for the asset revaluation)

Journal Entries

In the books of Superstar Ltd.

FINANCIAL ACCOUNTING

Dr. Cr

Date Particulars Amount Amount

42,916 Depreciation Expense A/c. 16,500

Accumulated Depreciation- Equipment 1 A/c. 12,500

Accumulated Depreciation- Equipment 2 A/c. 4,000

(Depre ciation charged on equipment 1 and equipment

2)

Accumulated Depreciation- Equipment 1 A/c. 12,500

Revaluation Gain A/c. 7,500

Equipment 1 A/c. 5,000

(Equipment 1 re valued at fair value and gain on

revaluation recorded)

Accumulated Depreciation- Equipment 2 A/c. 4,000

Revaluation Gain A/c. 2,000

Equipment 2 A/c. 2,000

(Equipment 2 re valued at fair value and gain on

revaluation recorded)

Revaluation Gain A/c. 9,500

Asset Revaluation Reserve A/c. 9,500

(Gain on revaluation transferred to asset revaluation

rese rve)

Deferred Tax Assets A/c. 3,450

Income Tax Expense A/c. 3,450

(Deferred tax re corded for the asset revaluation)

43,100 Depreciation Expense A/c. 2,000

Accumulated Depreciation- Equipment 2 A/c. 2,000

(Depre ciation charged on Equipment 2)

Bank A/c. 13,000

Accumulated Depreciation- Equipment 2 A/c. 2,000

Loss on Sale of Equipment A/c. 3,000

Equipment 2 A/c. 18,000

(Equipment 2 sold at loss)

43,281 Depreciation Expense A/c. 15,000

Accumulated Depreciation- Equipment 1 A/c. 15,000

(Depre ciation charged on equipment 1)

Accumulated Depreciation- Equipment 1 A/c. 15,000

Revaluation Gain A/c. 4,000

Equipment 1 A/c. 11,000

(Equipment 1 re valued at fair value and gain on

revaluation recorded)

Deferred Tax Assets A/c. 1,200

Income Tax Expense A/c. 1,200

(Deferred tax re corded for the asset revaluation)

Journal Entries

In the books of Superstar Ltd.

11

FINANCIAL ACCOUNTING

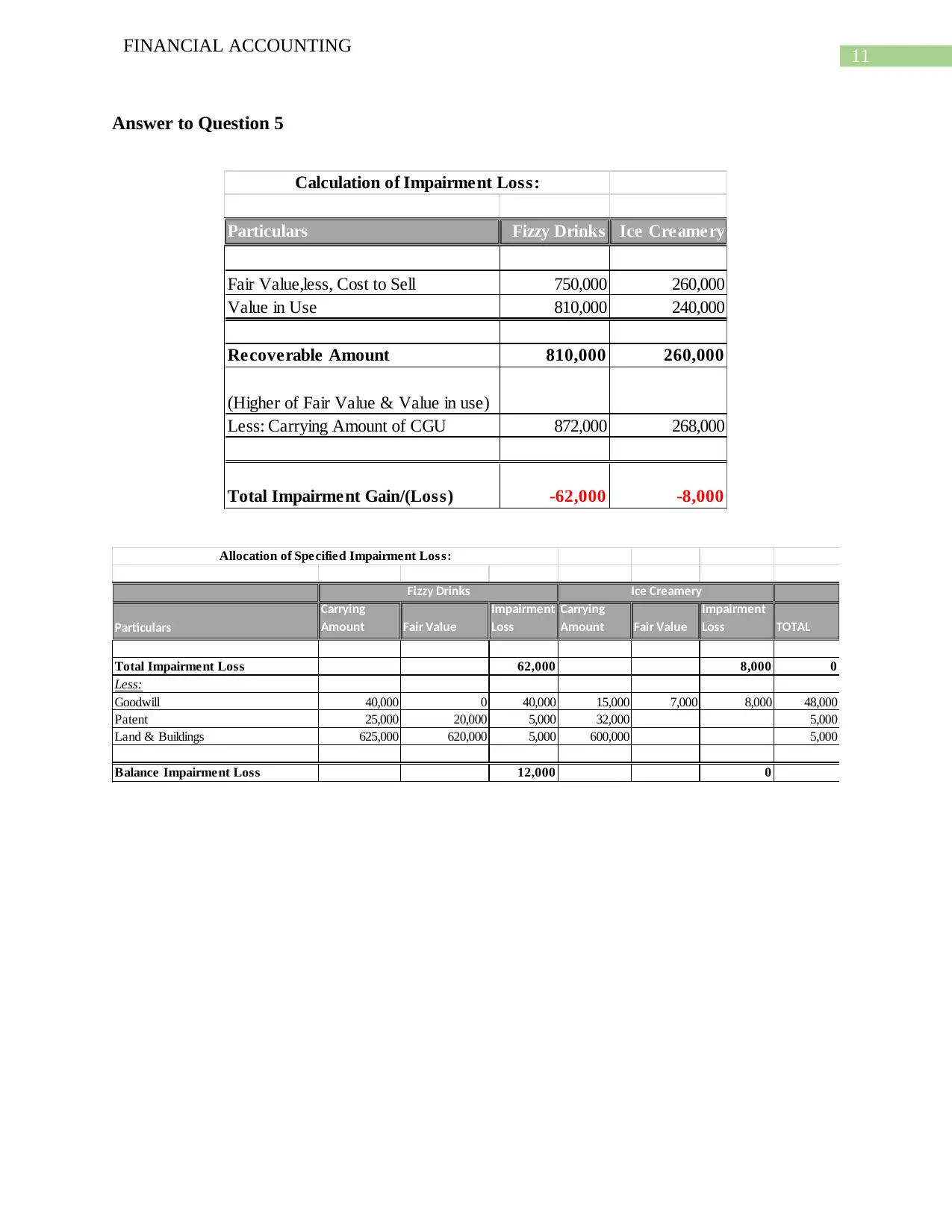

Answer to Question 5

Particulars Fizzy Drinks Ice Creamery

Fair Value,less, Cost to Sell 750,000 260,000

Value in Use 810,000 240,000

Recoverable Amount 810,000 260,000

(Higher of Fair Value & Value in use)

Less: Carrying Amount of CGU 872,000 268,000

Total Impairment Gain/(Loss) -62,000 -8,000

Calculation of Impairment Loss:

Particulars

Carrying

Amount Fair Value

Impairment

Loss

Carrying

Amount Fair Value

Impairment

Loss TOTAL

Total Impairment Loss 62,000 8,000 0

Less:

Goodwill 40,000 0 40,000 15,000 7,000 8,000 48,000

Patent 25,000 20,000 5,000 32,000 5,000

Land & Buildings 625,000 620,000 5,000 600,000 5,000

Balance Impairment Loss 12,000 0

Allocation of Specified Impairment Loss:

Fizzy Drinks Ice Creamery

FINANCIAL ACCOUNTING

Answer to Question 5

Particulars Fizzy Drinks Ice Creamery

Fair Value,less, Cost to Sell 750,000 260,000

Value in Use 810,000 240,000

Recoverable Amount 810,000 260,000

(Higher of Fair Value & Value in use)

Less: Carrying Amount of CGU 872,000 268,000

Total Impairment Gain/(Loss) -62,000 -8,000

Calculation of Impairment Loss:

Particulars

Carrying

Amount Fair Value

Impairment

Loss

Carrying

Amount Fair Value

Impairment

Loss TOTAL

Total Impairment Loss 62,000 8,000 0

Less:

Goodwill 40,000 0 40,000 15,000 7,000 8,000 48,000

Patent 25,000 20,000 5,000 32,000 5,000

Land & Buildings 625,000 620,000 5,000 600,000 5,000

Balance Impairment Loss 12,000 0

Allocation of Specified Impairment Loss:

Fizzy Drinks Ice Creamery

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.