Financial Accounting Assignment: Superstore Ltd Solutions

VerifiedAdded on 2023/06/04

|13

|1208

|248

Homework Assignment

AI Summary

This document presents detailed solutions to a financial accounting assignment involving Superstore Ltd. It addresses various scenarios including changes in asset economic life, accounts payable, investment value declines, and error adjustments, referencing AASB 116 and AASB 110 standards. Journal entries for Rippa Limited's share issuance, allotment, and forfeiture are provided, along with explanations regarding shareholder returns. The document aims to provide comprehensive guidance and solutions for financial accounting problems. Desklib is your go-to resource for more solved assignments and past papers.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING

Table of Contents

Answer to Question 1:.....................................................................................................................2

Part i:............................................................................................................................................2

Part ii:...........................................................................................................................................4

Answer to Question 2:.....................................................................................................................5

Part i:............................................................................................................................................5

Part ii:...........................................................................................................................................6

Answer to Question 3:.....................................................................................................................7

Part i:............................................................................................................................................7

Part ii:...........................................................................................................................................8

Answer to Question 4:.....................................................................................................................9

Answer to Question 5:...................................................................................................................10

References:....................................................................................................................................12

Table of Contents

Answer to Question 1:.....................................................................................................................2

Part i:............................................................................................................................................2

Part ii:...........................................................................................................................................4

Answer to Question 2:.....................................................................................................................5

Part i:............................................................................................................................................5

Part ii:...........................................................................................................................................6

Answer to Question 3:.....................................................................................................................7

Part i:............................................................................................................................................7

Part ii:...........................................................................................................................................8

Answer to Question 4:.....................................................................................................................9

Answer to Question 5:...................................................................................................................10

References:....................................................................................................................................12

2FINANCIAL ACCOUNTING

Answer to Question 1:

Part i:

Situation 1:

In accordance with AASB 116, revising an asset’s economic life would automatically

result in a change in accounting estimate with no change needed in accounting policy. Hence, no

retrospection is required for restatement of accounts (Aasb.gov.au, 2018). Thus, the financial

statements of the prospective years only would be affected by such change. In this situation, it is

necessary to carry out the following calculations:

Book value on 1st July 2017 = ${800,000 – 2 x (800,000/10)} = $640,000

Depreciation expense to be incurred per year for the leftover six years = $640,000/6 = $106,667

Thus, when an accounting estimate change is obvious, disclosure in the form of notes to

accounts is required.

Situation 2:

The accounts payable would be used for recording the due amount of $20,000, which

would fall under the head of current liabilities in the balance sheet statement of Superstore

Limited on June 30, 2018. However, as this expense has been incurred in 2018, it is restricted by

accounting, matching and accrual accounting principles to disclose repairs cost as an expense in

the books of accounts of the organisation for the year 2017. Moreover, as this account n longer

exists after 2017, there is need of readjusting the retained earnings account depicting the

accumulated profits after dividend payments to the shareholders (Dagwell, Wines & Lambert,

2015).

Answer to Question 1:

Part i:

Situation 1:

In accordance with AASB 116, revising an asset’s economic life would automatically

result in a change in accounting estimate with no change needed in accounting policy. Hence, no

retrospection is required for restatement of accounts (Aasb.gov.au, 2018). Thus, the financial

statements of the prospective years only would be affected by such change. In this situation, it is

necessary to carry out the following calculations:

Book value on 1st July 2017 = ${800,000 – 2 x (800,000/10)} = $640,000

Depreciation expense to be incurred per year for the leftover six years = $640,000/6 = $106,667

Thus, when an accounting estimate change is obvious, disclosure in the form of notes to

accounts is required.

Situation 2:

The accounts payable would be used for recording the due amount of $20,000, which

would fall under the head of current liabilities in the balance sheet statement of Superstore

Limited on June 30, 2018. However, as this expense has been incurred in 2018, it is restricted by

accounting, matching and accrual accounting principles to disclose repairs cost as an expense in

the books of accounts of the organisation for the year 2017. Moreover, as this account n longer

exists after 2017, there is need of readjusting the retained earnings account depicting the

accumulated profits after dividend payments to the shareholders (Dagwell, Wines & Lambert,

2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING

Situation 3:

If an investment value declines after the completion of the accounting period, the event is

deemed to be non-adjusting. Therefore, as per AASB 110, the events are to be disclosed as

financial footnotes, if sufficient evidences are obtained that these events contain material

amounts (Aasb.gov.au, 2018). As per the provided situation, massive decline could be found in

the value of an investment to $250,000 from $600,000, which is matter of concern for the users

of the financial statements of Superstore Limited, particularly the investors and the shareholders.

Despite there is no need of asset valuation due to decline in market value, financial footnotes

need to be used for disclosure in the 2018 annual report of the organisation. On the other hand,

the effect would be inherent in the 2019 financial statements, in which investment is needed to

be written down to $250,000 resulting in loss for the organisation. Hence, in this case, income

statement account needs to be debited and the investment account needs to be credited and the

amount for both the accounts would be $350,000.

Situation 4:

It is necessary for an organisation to adjust events through adjustment of the likely

financial effects in the financial reports before issuance and finalisation (Hoskin, Fizzell &

Cherry, 2014). When there is detection of error or fraud at the time of reporting, the event is

needed to be adjusted. Hence, advertising cost and Max are the accounts needing adjustments.

Situation 3:

If an investment value declines after the completion of the accounting period, the event is

deemed to be non-adjusting. Therefore, as per AASB 110, the events are to be disclosed as

financial footnotes, if sufficient evidences are obtained that these events contain material

amounts (Aasb.gov.au, 2018). As per the provided situation, massive decline could be found in

the value of an investment to $250,000 from $600,000, which is matter of concern for the users

of the financial statements of Superstore Limited, particularly the investors and the shareholders.

Despite there is no need of asset valuation due to decline in market value, financial footnotes

need to be used for disclosure in the 2018 annual report of the organisation. On the other hand,

the effect would be inherent in the 2019 financial statements, in which investment is needed to

be written down to $250,000 resulting in loss for the organisation. Hence, in this case, income

statement account needs to be debited and the investment account needs to be credited and the

amount for both the accounts would be $350,000.

Situation 4:

It is necessary for an organisation to adjust events through adjustment of the likely

financial effects in the financial reports before issuance and finalisation (Hoskin, Fizzell &

Cherry, 2014). When there is detection of error or fraud at the time of reporting, the event is

needed to be adjusted. Hence, advertising cost and Max are the accounts needing adjustments.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING

Part ii:

Part ii:

5FINANCIAL ACCOUNTING

Answer to Question 2:

Part i:

Date Debit amount Credit amount

10/08/2017 15,000,000$

To Share Application Account 15,000,000$

10/08/2017 15,000,000$

To Share Capital Account 12,500,000$

To Share Allotment Account 2,500,000$

12/08/2017 Underwriting Commission Account........................Dr 12,000$

To Cash Account 12,000$

10/09/2017 5,000,000$

To Share Capital Account 5,000,000$

10/09/2017 2,500,000$

2,500,000$

To Share Allotment Account 5,000,000$

1/02/2018 2,500,000$

To Share Capital Account 2,500,000$

28/02/2018 2,480,000$

20,000$

To Share First Call Account 2,500,000$

20/03/2018 160,000$

To Share Forfeiture Account 140,000$

To Call-in-Arrears Account 20,000$

20/03/2018 128,000$

32,000$

To Share Capital Account 160,000$

20/03/2018 4,000$

To Cash Account 4,000$

25/03/2018 108,000$

To Share Reissue Cost Account 4,000$

To Shareholders Account 104,000$

25/03/2018 104,000$

To Cash Account 104,000$

In the Books of Rippa Limited

Journal Entries

For the year ended 30 June 2018

Particulars

Cash Account.........................................................Dr

(Application money recorded)

Share Application Account.....................................Dr

(Amount transferred to share capital)

(Underwriting commission payment recorded)

(Share allotment amount due recorded)

Share Allotment Account........................................Dr

(Share first call amount recorded)

Cash Account...........................................................Dr

Cash Account..........................................................Dr

Share Application Account.....................................Dr

(Allotment money received and recorded)

(Money received from shares received)

Share Capital Account.............................................Dr

(Share forfeiture recorded)

Share First Call Account.........................................Dr

Shareholders Account...............................................Dr

(Money refund to shareholders recorded)

Share Reissue Cost Account....................................Dr

(Cost of share reissue recorded)

Share Forfeiture Account.........................................Dr

(Amount refunded to shareholders recorded)

Cash Account...........................................................Dr

Share Forfeiture Account.........................................Dr

(Shares reissued recorded)

Call-in-Arrears Account..........................................Dr

Answer to Question 2:

Part i:

Date Debit amount Credit amount

10/08/2017 15,000,000$

To Share Application Account 15,000,000$

10/08/2017 15,000,000$

To Share Capital Account 12,500,000$

To Share Allotment Account 2,500,000$

12/08/2017 Underwriting Commission Account........................Dr 12,000$

To Cash Account 12,000$

10/09/2017 5,000,000$

To Share Capital Account 5,000,000$

10/09/2017 2,500,000$

2,500,000$

To Share Allotment Account 5,000,000$

1/02/2018 2,500,000$

To Share Capital Account 2,500,000$

28/02/2018 2,480,000$

20,000$

To Share First Call Account 2,500,000$

20/03/2018 160,000$

To Share Forfeiture Account 140,000$

To Call-in-Arrears Account 20,000$

20/03/2018 128,000$

32,000$

To Share Capital Account 160,000$

20/03/2018 4,000$

To Cash Account 4,000$

25/03/2018 108,000$

To Share Reissue Cost Account 4,000$

To Shareholders Account 104,000$

25/03/2018 104,000$

To Cash Account 104,000$

In the Books of Rippa Limited

Journal Entries

For the year ended 30 June 2018

Particulars

Cash Account.........................................................Dr

(Application money recorded)

Share Application Account.....................................Dr

(Amount transferred to share capital)

(Underwriting commission payment recorded)

(Share allotment amount due recorded)

Share Allotment Account........................................Dr

(Share first call amount recorded)

Cash Account...........................................................Dr

Cash Account..........................................................Dr

Share Application Account.....................................Dr

(Allotment money received and recorded)

(Money received from shares received)

Share Capital Account.............................................Dr

(Share forfeiture recorded)

Share First Call Account.........................................Dr

Shareholders Account...............................................Dr

(Money refund to shareholders recorded)

Share Reissue Cost Account....................................Dr

(Cost of share reissue recorded)

Share Forfeiture Account.........................................Dr

(Amount refunded to shareholders recorded)

Cash Account...........................................................Dr

Share Forfeiture Account.........................................Dr

(Shares reissued recorded)

Call-in-Arrears Account..........................................Dr

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ACCOUNTING

Part ii:

The amount returned was not $3.50, according to the claim of one shareholder of the

organisation. This is due to share forfeiture, in which $4,000 is incurred as excess amount for

reissuing the shares. When reissue is completed, it is possible to receive $3.20, which would

result in loss of $0.80. Moreover, another loss amount of $0.10 would be faced because of

reissuance cost. Hence, the shareholders would suffer a total loss of $0.90. Therefore, the

shareholders would make $2.50 per share rather than $3.50 per share.

Part ii:

The amount returned was not $3.50, according to the claim of one shareholder of the

organisation. This is due to share forfeiture, in which $4,000 is incurred as excess amount for

reissuing the shares. When reissue is completed, it is possible to receive $3.20, which would

result in loss of $0.80. Moreover, another loss amount of $0.10 would be faced because of

reissuance cost. Hence, the shareholders would suffer a total loss of $0.90. Therefore, the

shareholders would make $2.50 per share rather than $3.50 per share.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING

Answer to Question 3:

Part i:

Answer to Question 3:

Part i:

8FINANCIAL ACCOUNTING

Part ii:

Part ii:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ACCOUNTING

Answer to Question 4:

Answer to Question 4:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ACCOUNTING

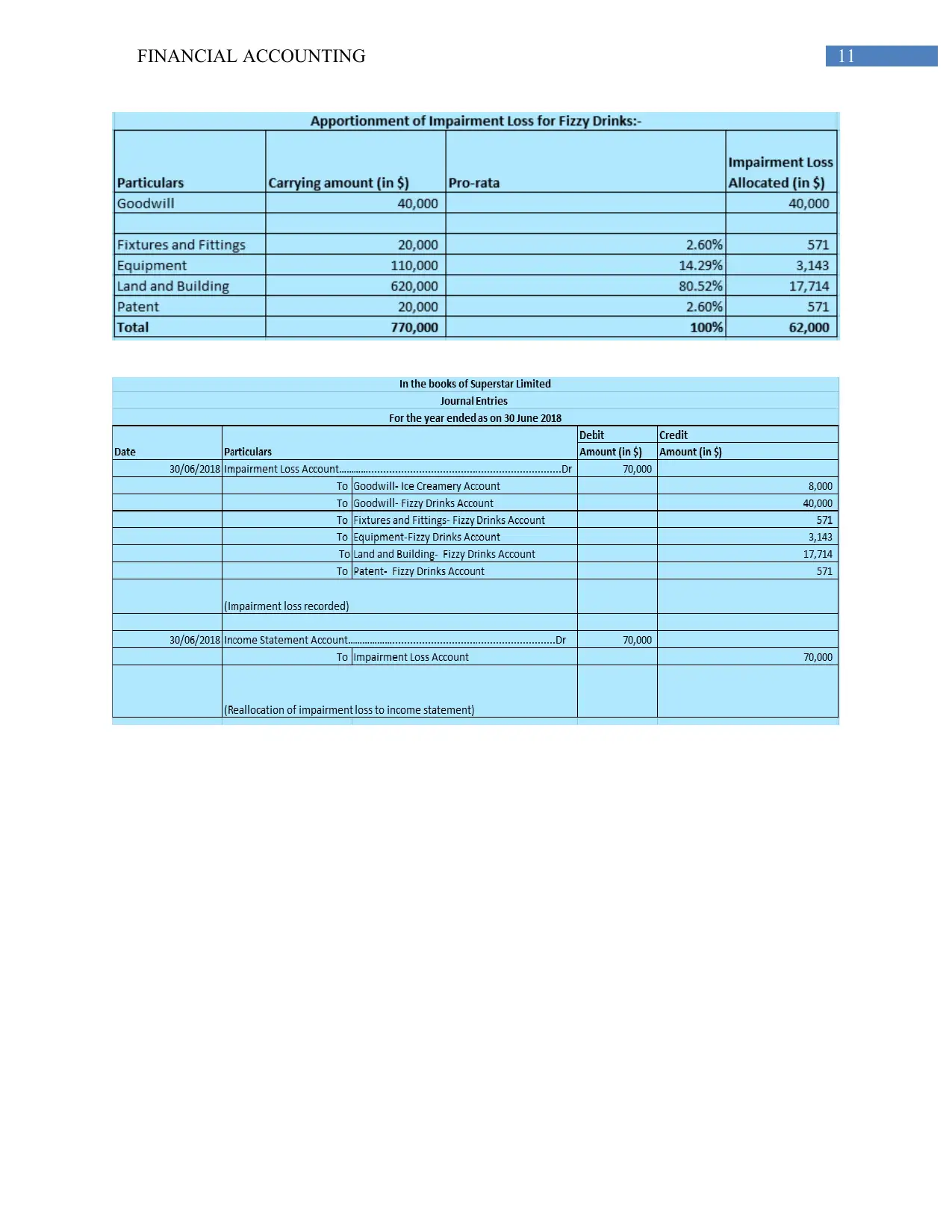

Answer to Question 5:

Answer to Question 5:

11FINANCIAL ACCOUNTING

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.