Zip Co Ltd (ASX: Z1P) Financial Accounting Statement Analysis

VerifiedAdded on 2023/06/18

|11

|2632

|219

Report

AI Summary

This report provides a comprehensive financial analysis of Zip Co Ltd, utilizing the company's annual reports from 2019 and 2020. It includes an overview of financial accounting principles, a detailed balance sheet analysis comparing the two years, and a financial statement analysis incorporating various financial ratios. The report interprets the trends and changes in the company's assets, liabilities, equity, and profitability. Key findings include assessments of the company's receivables, equity, cash flow, fixed assets, and borrowing. Recommendations are made to improve billing efficiency, manage debt, increase income, and control expenditure. The analysis covers profitability ratios, turnover ratios and liquidity ratios. The report concludes with overall recommendations for Zip Co Ltd to enhance its corporate efficiency, liquidity, and solvency, emphasizing the importance of improved accounting practices, financial statement analysis, and strategic growth initiatives.

Financial Accounting

Assessment 2

Assessment 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Overview.....................................................................................................................................3

Balance sheet analysis.................................................................................................................4

Part B...............................................................................................................................................6

Financial statement analysis........................................................................................................6

Overall recommendation.............................................................................................................8

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Overview.....................................................................................................................................3

Balance sheet analysis.................................................................................................................4

Part B...............................................................................................................................................6

Financial statement analysis........................................................................................................6

Overall recommendation.............................................................................................................8

REFERENCES..............................................................................................................................10

INTRODUCTION

Financial accounting is defined as the overall study of financial transactions related to a

business. It is the process of preparing financial statement like balance sheet, cash flow statement

and income data to analysis performance of the company. This present study is based on Zip Co

Ltd and presentation on strength of financial position of the company. This report will provide

purpose and outline the information required by the users. Further, it will analyse balance sheet

and financial statement with calculations. At last, this report will provide justification and

interpretation on ability of firm to achieve targets.

PART A

Overview

The financial accounting is prepared to evaluate the financial performance of the

company. It is maintained to prepare financial reports that gives overall information about

business stability to parties like creditors, investors, managers, tax authorities. It is helpful to

keep track on financial transactions with the company (Easton and et.al., 2018). It is prepared to

provide information to the users for rational decision-making.

Management team- It is designed to help managers for decision-making process within

the firm.

Employees-This is useful for employees to control budgets in the firm (Albanese and

et.al., 2021). It provides accurate data about company's assets and liabilities, profit and

loss.

Government authorities- This report will be used by tax authorities to determine how

much the company is liable to pay for taxes.

Creditors- Creditors will require the details whether to extend credit to the business or

not.

Investors- This report will assist Investors to determine about their investment decision,

whether the investment is profitable or not.

General public- This report is also maintained by public who have a specific interest in

the business activities.

Financial accounting is defined as the overall study of financial transactions related to a

business. It is the process of preparing financial statement like balance sheet, cash flow statement

and income data to analysis performance of the company. This present study is based on Zip Co

Ltd and presentation on strength of financial position of the company. This report will provide

purpose and outline the information required by the users. Further, it will analyse balance sheet

and financial statement with calculations. At last, this report will provide justification and

interpretation on ability of firm to achieve targets.

PART A

Overview

The financial accounting is prepared to evaluate the financial performance of the

company. It is maintained to prepare financial reports that gives overall information about

business stability to parties like creditors, investors, managers, tax authorities. It is helpful to

keep track on financial transactions with the company (Easton and et.al., 2018). It is prepared to

provide information to the users for rational decision-making.

Management team- It is designed to help managers for decision-making process within

the firm.

Employees-This is useful for employees to control budgets in the firm (Albanese and

et.al., 2021). It provides accurate data about company's assets and liabilities, profit and

loss.

Government authorities- This report will be used by tax authorities to determine how

much the company is liable to pay for taxes.

Creditors- Creditors will require the details whether to extend credit to the business or

not.

Investors- This report will assist Investors to determine about their investment decision,

whether the investment is profitable or not.

General public- This report is also maintained by public who have a specific interest in

the business activities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysts- Investment analysts require detailed financial information to analyse the

competitive performance of business in every sector.

Debtors- this report is important for debtors to collect information about the ability of the

company to survive and prosper.

Balance sheet analysis

Assets 2020 2019 Changes in percentages

Cash and cash equivalents 32712 12611 159.39

Other receivables 6876 10920 -37.03

Term deposit 1507 1179 27.82

Customer receivables 1116618 647544 72.44

Investment 82930

Investment in associate 1184

Property, plant and equipment 3512 2547 37.89

Right- of- use assets 8160

Intangible assets 25093 5813 331.67

Goodwill 53441 4548 1075.04

Total Assets 1332033 685162 94.41

Liabilities

Trade and other payables 19533 19657 -0.63

Employee provisions 2753 1368 101.24

Deferred R&D tax incentives 392

Deferred contingent consideration 13979

Lease liability 8414

Borrowings 1081954 587445 84.18

Total Liabilities 1126633 608862 85.04

Net Assets 205400 76300 169.20

competitive performance of business in every sector.

Debtors- this report is important for debtors to collect information about the ability of the

company to survive and prosper.

Balance sheet analysis

Assets 2020 2019 Changes in percentages

Cash and cash equivalents 32712 12611 159.39

Other receivables 6876 10920 -37.03

Term deposit 1507 1179 27.82

Customer receivables 1116618 647544 72.44

Investment 82930

Investment in associate 1184

Property, plant and equipment 3512 2547 37.89

Right- of- use assets 8160

Intangible assets 25093 5813 331.67

Goodwill 53441 4548 1075.04

Total Assets 1332033 685162 94.41

Liabilities

Trade and other payables 19533 19657 -0.63

Employee provisions 2753 1368 101.24

Deferred R&D tax incentives 392

Deferred contingent consideration 13979

Lease liability 8414

Borrowings 1081954 587445 84.18

Total Liabilities 1126633 608862 85.04

Net Assets 205400 76300 169.20

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

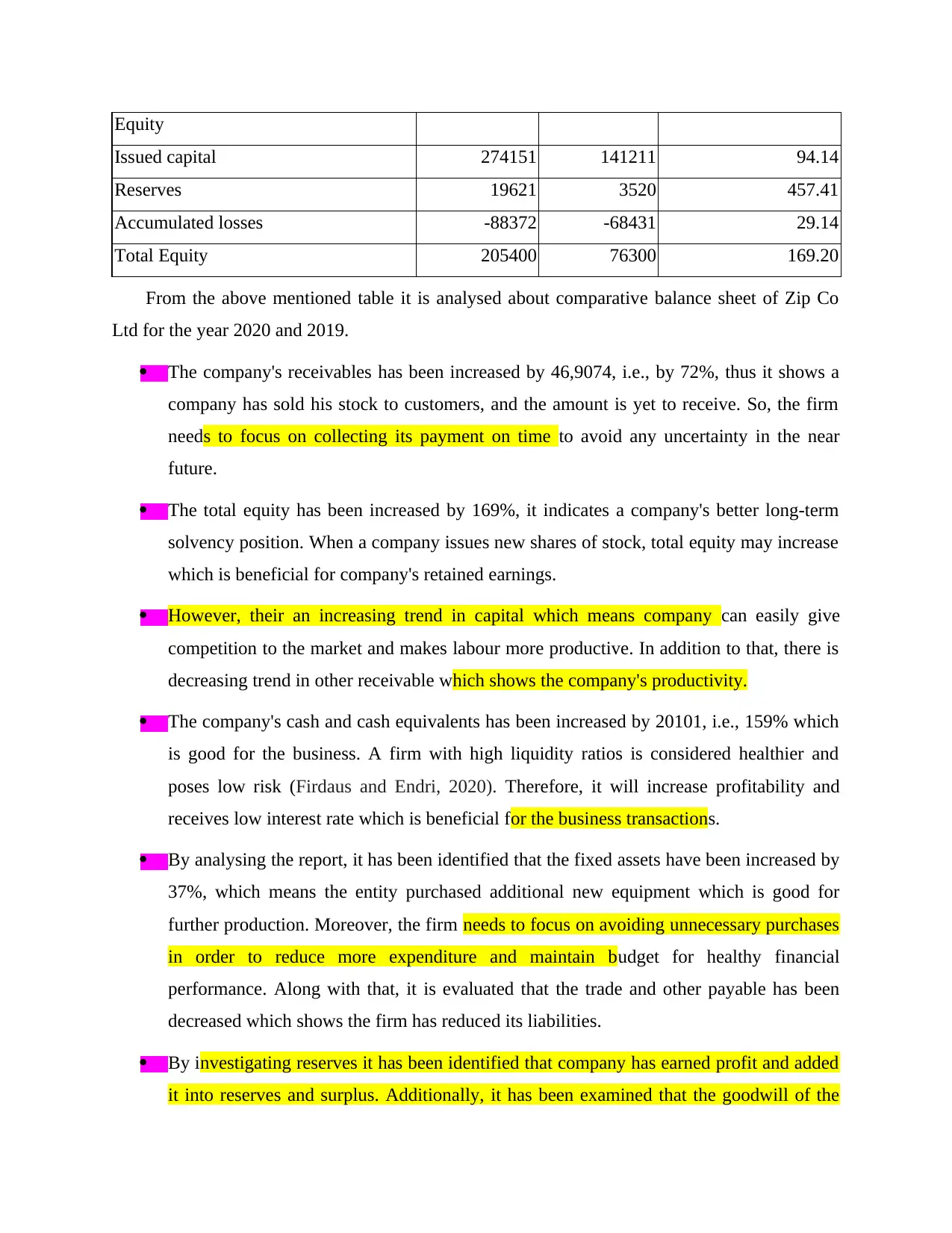

Equity

Issued capital 274151 141211 94.14

Reserves 19621 3520 457.41

Accumulated losses -88372 -68431 29.14

Total Equity 205400 76300 169.20

From the above mentioned table it is analysed about comparative balance sheet of Zip Co

Ltd for the year 2020 and 2019.

The company's receivables has been increased by 46,9074, i.e., by 72%, thus it shows a

company has sold his stock to customers, and the amount is yet to receive. So, the firm

needs to focus on collecting its payment on time to avoid any uncertainty in the near

future.

The total equity has been increased by 169%, it indicates a company's better long-term

solvency position. When a company issues new shares of stock, total equity may increase

which is beneficial for company's retained earnings.

However, their an increasing trend in capital which means company can easily give

competition to the market and makes labour more productive. In addition to that, there is

decreasing trend in other receivable which shows the company's productivity.

The company's cash and cash equivalents has been increased by 20101, i.e., 159% which

is good for the business. A firm with high liquidity ratios is considered healthier and

poses low risk (Firdaus and Endri, 2020). Therefore, it will increase profitability and

receives low interest rate which is beneficial for the business transactions.

By analysing the report, it has been identified that the fixed assets have been increased by

37%, which means the entity purchased additional new equipment which is good for

further production. Moreover, the firm needs to focus on avoiding unnecessary purchases

in order to reduce more expenditure and maintain budget for healthy financial

performance. Along with that, it is evaluated that the trade and other payable has been

decreased which shows the firm has reduced its liabilities.

By investigating reserves it has been identified that company has earned profit and added

it into reserves and surplus. Additionally, it has been examined that the goodwill of the

Issued capital 274151 141211 94.14

Reserves 19621 3520 457.41

Accumulated losses -88372 -68431 29.14

Total Equity 205400 76300 169.20

From the above mentioned table it is analysed about comparative balance sheet of Zip Co

Ltd for the year 2020 and 2019.

The company's receivables has been increased by 46,9074, i.e., by 72%, thus it shows a

company has sold his stock to customers, and the amount is yet to receive. So, the firm

needs to focus on collecting its payment on time to avoid any uncertainty in the near

future.

The total equity has been increased by 169%, it indicates a company's better long-term

solvency position. When a company issues new shares of stock, total equity may increase

which is beneficial for company's retained earnings.

However, their an increasing trend in capital which means company can easily give

competition to the market and makes labour more productive. In addition to that, there is

decreasing trend in other receivable which shows the company's productivity.

The company's cash and cash equivalents has been increased by 20101, i.e., 159% which

is good for the business. A firm with high liquidity ratios is considered healthier and

poses low risk (Firdaus and Endri, 2020). Therefore, it will increase profitability and

receives low interest rate which is beneficial for the business transactions.

By analysing the report, it has been identified that the fixed assets have been increased by

37%, which means the entity purchased additional new equipment which is good for

further production. Moreover, the firm needs to focus on avoiding unnecessary purchases

in order to reduce more expenditure and maintain budget for healthy financial

performance. Along with that, it is evaluated that the trade and other payable has been

decreased which shows the firm has reduced its liabilities.

By investigating reserves it has been identified that company has earned profit and added

it into reserves and surplus. Additionally, it has been examined that the goodwill of the

firm has been increased in the year 2020, so, it can provide benefit in order to achieve

profit. By analysing the report it has been verified that company must control its

borrowing to avoid more liabilities otherwise the firm need to pay more interest on the

goods and services.

After analysing the above balance sheet interpretation, some justification is as below:

It is suggested to improve billing efficiency and customer relationship to manage

receivables in the company. Always send reminders to avoid late payment and make clear

payment terms upfront. It is advisable to organize financial affairs and save money for future

requirements. Along with that company must reduce its excess credit limits and debts to avoid

high interest rate (Sun, 2021). Trimming the unnecessary expenditure will increase your

borrowing power and limit down the burden. It is further recommended to increase income

effectively in order to increase business capacity. It is suggested to pay down debt quickly to

avoid burden in the future.

Part B

Financial statement analysis

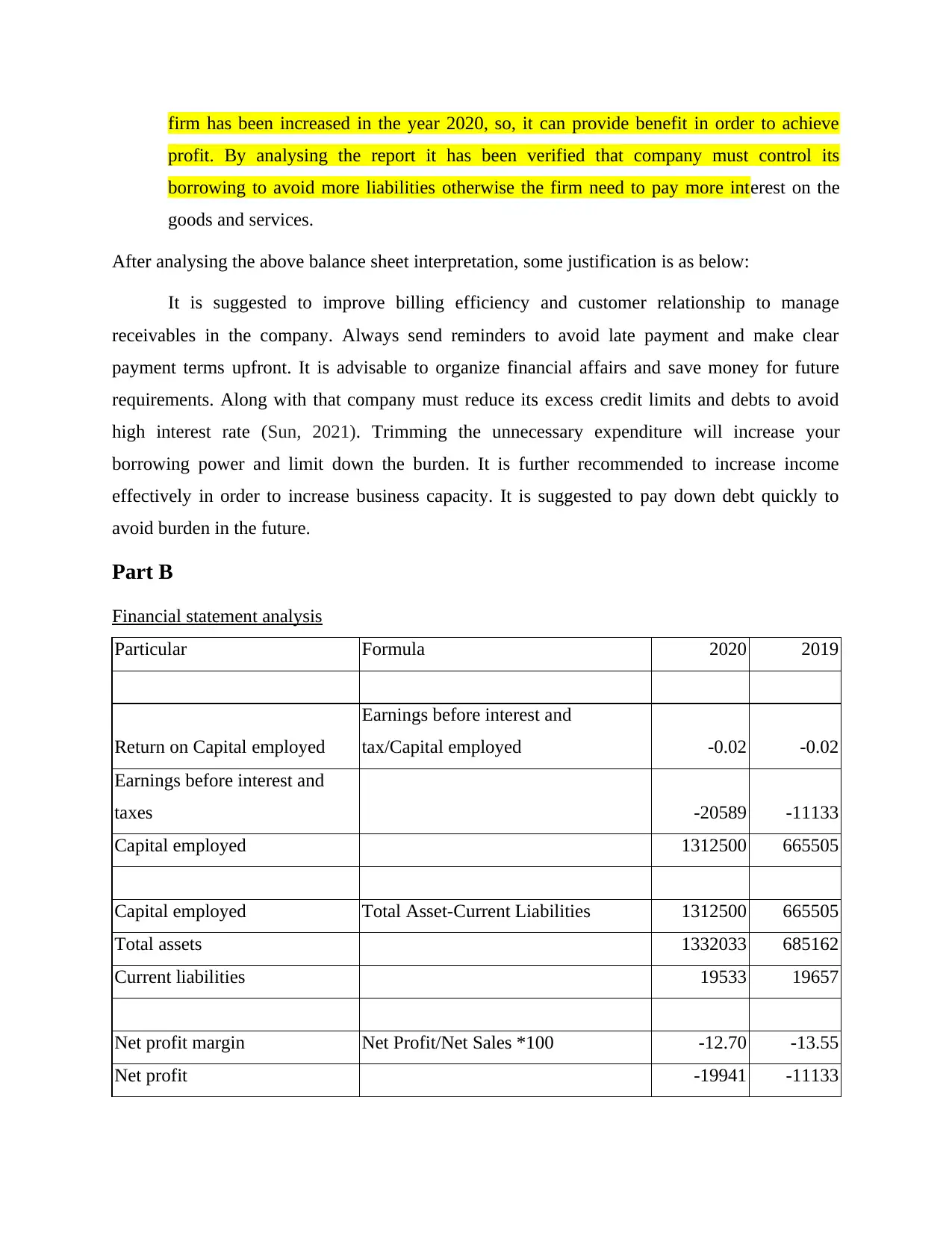

Particular Formula 2020 2019

Return on Capital employed

Earnings before interest and

tax/Capital employed -0.02 -0.02

Earnings before interest and

taxes -20589 -11133

Capital employed 1312500 665505

Capital employed Total Asset-Current Liabilities 1312500 665505

Total assets 1332033 685162

Current liabilities 19533 19657

Net profit margin Net Profit/Net Sales *100 -12.70 -13.55

Net profit -19941 -11133

profit. By analysing the report it has been verified that company must control its

borrowing to avoid more liabilities otherwise the firm need to pay more interest on the

goods and services.

After analysing the above balance sheet interpretation, some justification is as below:

It is suggested to improve billing efficiency and customer relationship to manage

receivables in the company. Always send reminders to avoid late payment and make clear

payment terms upfront. It is advisable to organize financial affairs and save money for future

requirements. Along with that company must reduce its excess credit limits and debts to avoid

high interest rate (Sun, 2021). Trimming the unnecessary expenditure will increase your

borrowing power and limit down the burden. It is further recommended to increase income

effectively in order to increase business capacity. It is suggested to pay down debt quickly to

avoid burden in the future.

Part B

Financial statement analysis

Particular Formula 2020 2019

Return on Capital employed

Earnings before interest and

tax/Capital employed -0.02 -0.02

Earnings before interest and

taxes -20589 -11133

Capital employed 1312500 665505

Capital employed Total Asset-Current Liabilities 1312500 665505

Total assets 1332033 685162

Current liabilities 19533 19657

Net profit margin Net Profit/Net Sales *100 -12.70 -13.55

Net profit -19941 -11133

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

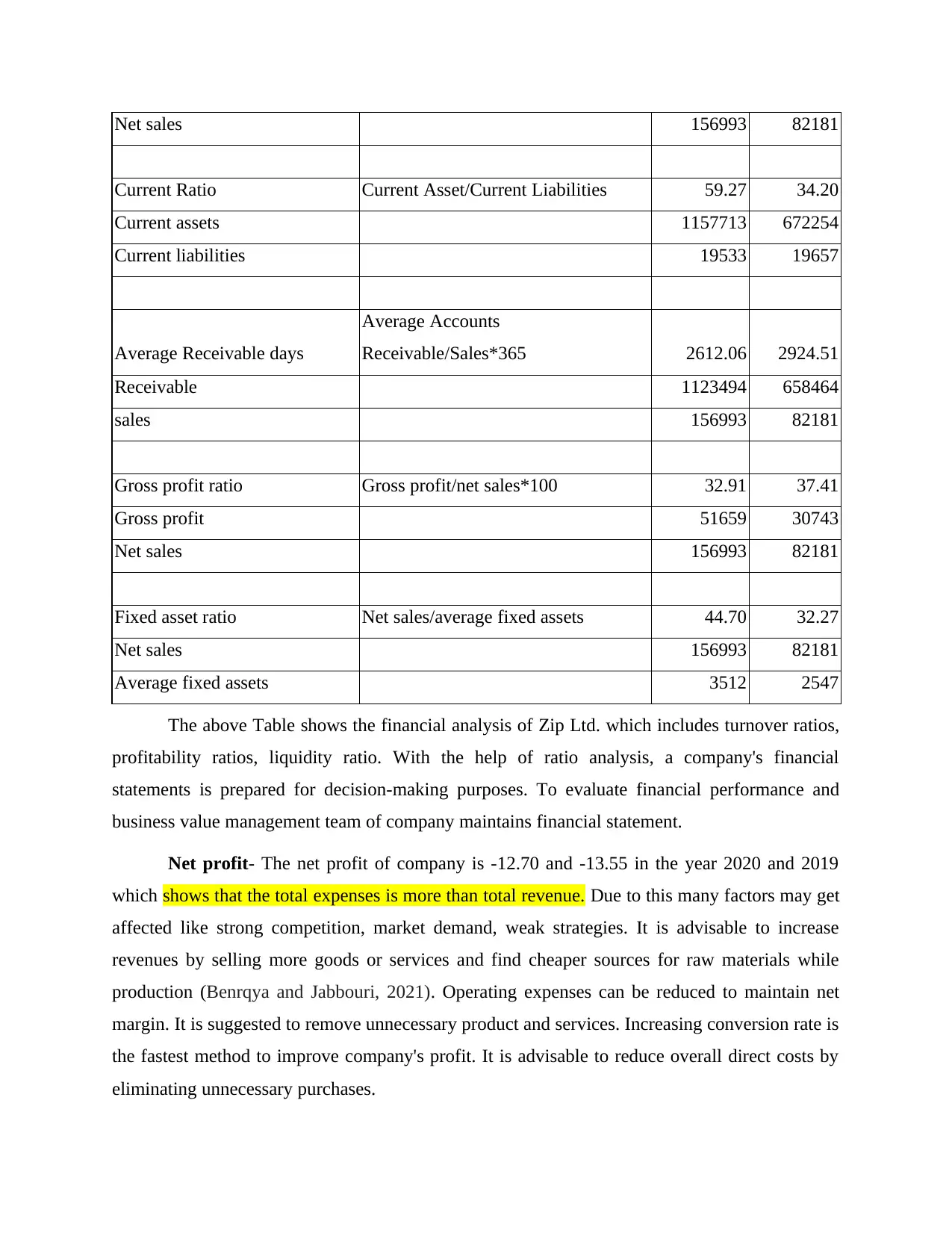

Net sales 156993 82181

Current Ratio Current Asset/Current Liabilities 59.27 34.20

Current assets 1157713 672254

Current liabilities 19533 19657

Average Receivable days

Average Accounts

Receivable/Sales*365 2612.06 2924.51

Receivable 1123494 658464

sales 156993 82181

Gross profit ratio Gross profit/net sales*100 32.91 37.41

Gross profit 51659 30743

Net sales 156993 82181

Fixed asset ratio Net sales/average fixed assets 44.70 32.27

Net sales 156993 82181

Average fixed assets 3512 2547

The above Table shows the financial analysis of Zip Ltd. which includes turnover ratios,

profitability ratios, liquidity ratio. With the help of ratio analysis, a company's financial

statements is prepared for decision-making purposes. To evaluate financial performance and

business value management team of company maintains financial statement.

Net profit- The net profit of company is -12.70 and -13.55 in the year 2020 and 2019

which shows that the total expenses is more than total revenue. Due to this many factors may get

affected like strong competition, market demand, weak strategies. It is advisable to increase

revenues by selling more goods or services and find cheaper sources for raw materials while

production (Benrqya and Jabbouri, 2021). Operating expenses can be reduced to maintain net

margin. It is suggested to remove unnecessary product and services. Increasing conversion rate is

the fastest method to improve company's profit. It is advisable to reduce overall direct costs by

eliminating unnecessary purchases.

Current Ratio Current Asset/Current Liabilities 59.27 34.20

Current assets 1157713 672254

Current liabilities 19533 19657

Average Receivable days

Average Accounts

Receivable/Sales*365 2612.06 2924.51

Receivable 1123494 658464

sales 156993 82181

Gross profit ratio Gross profit/net sales*100 32.91 37.41

Gross profit 51659 30743

Net sales 156993 82181

Fixed asset ratio Net sales/average fixed assets 44.70 32.27

Net sales 156993 82181

Average fixed assets 3512 2547

The above Table shows the financial analysis of Zip Ltd. which includes turnover ratios,

profitability ratios, liquidity ratio. With the help of ratio analysis, a company's financial

statements is prepared for decision-making purposes. To evaluate financial performance and

business value management team of company maintains financial statement.

Net profit- The net profit of company is -12.70 and -13.55 in the year 2020 and 2019

which shows that the total expenses is more than total revenue. Due to this many factors may get

affected like strong competition, market demand, weak strategies. It is advisable to increase

revenues by selling more goods or services and find cheaper sources for raw materials while

production (Benrqya and Jabbouri, 2021). Operating expenses can be reduced to maintain net

margin. It is suggested to remove unnecessary product and services. Increasing conversion rate is

the fastest method to improve company's profit. It is advisable to reduce overall direct costs by

eliminating unnecessary purchases.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Return on capital employed- By analysing balance sheet it has been noted that the

ROCE of a firm is -0.02 in both years it indicates the low net profit. Moreover, the first step to

improve any ratio is by reducing costs or increasing sales (Harjito and Wiratama, 2017). It is

advisable to reduce liabilities and work on capital employed. Company must work on

profitability and working capital to achieve success. It is suggested to evaluate the shareholders'

equity to accumulate other loss.

Fixed asset ratio- The ratio analysis indicates in the year 2020 company's fixed asset

ratio is 44.70 which is higher than 32.27. It is said that the higher the asset ratio, the better the

company is performing. It means company is efficiently using its assets and indicated that there

is proper utilization of assets. This evaluation is helpful to make critical decisions on investment

opportunities in the firm. It is advisable to analyse the company growth by calculating this ratio

eventually.

Gross profit ratio- The balance sheet analysis shows there is decreasing trends in

company in the year 2020 as compared to previous year. It is advisable to improve gross profit

margin by increasing prices of goods or services. It is also suggested reducing waste and

unnecessary expenses which includes direct costs will increase profit margin (Mettenheim,

2021). By reviewing all prices company can boost its profit margins. Management must work on

cash discounts from suppliers to ignore bad performance.

Current ratio- The study interpreted about current ratio for both years which shows

there is an increasing trends in year 2020 which is more than previous year. It is said the higher

the current ratio, the more capable a company is of paying its debt. The ratio analysis indicates

this company works on current ratio effectively. It is advisable to always work on current ratio

analysis to maintain stability in the market. Company must reduce the personal draw on the

business and improve cash payments.

Overall recommendation

From the above mentioned balance sheet and ratio analysis it is determined that Zip Ltd.

must adopt few important tips to improve performance.

ROCE of a firm is -0.02 in both years it indicates the low net profit. Moreover, the first step to

improve any ratio is by reducing costs or increasing sales (Harjito and Wiratama, 2017). It is

advisable to reduce liabilities and work on capital employed. Company must work on

profitability and working capital to achieve success. It is suggested to evaluate the shareholders'

equity to accumulate other loss.

Fixed asset ratio- The ratio analysis indicates in the year 2020 company's fixed asset

ratio is 44.70 which is higher than 32.27. It is said that the higher the asset ratio, the better the

company is performing. It means company is efficiently using its assets and indicated that there

is proper utilization of assets. This evaluation is helpful to make critical decisions on investment

opportunities in the firm. It is advisable to analyse the company growth by calculating this ratio

eventually.

Gross profit ratio- The balance sheet analysis shows there is decreasing trends in

company in the year 2020 as compared to previous year. It is advisable to improve gross profit

margin by increasing prices of goods or services. It is also suggested reducing waste and

unnecessary expenses which includes direct costs will increase profit margin (Mettenheim,

2021). By reviewing all prices company can boost its profit margins. Management must work on

cash discounts from suppliers to ignore bad performance.

Current ratio- The study interpreted about current ratio for both years which shows

there is an increasing trends in year 2020 which is more than previous year. It is said the higher

the current ratio, the more capable a company is of paying its debt. The ratio analysis indicates

this company works on current ratio effectively. It is advisable to always work on current ratio

analysis to maintain stability in the market. Company must reduce the personal draw on the

business and improve cash payments.

Overall recommendation

From the above mentioned balance sheet and ratio analysis it is determined that Zip Ltd.

must adopt few important tips to improve performance.

It is recommended to focus on corporate efficiency, liquidity, solvency to achieve targets.

The most important recommendation for company is to improve accounting norms. The

management team must display financial items in a very specific way to determine data.

It is suggested to maintain shareholder's equity reports and profit and loss to evaluate the

condition of firm. It is also suggested company must use vertical, horizontal and ratio

analysis to compare financial statement with others.

To evaluate an organization financial standing company must work on cash inflows and

outflows. Investment analysts and managers must keep a detailed information about

accounting report to make allocation decision (dos Santos Maciel and Stephanie, 2021).

The company is advised to use performance tools to determine whether operating

strategies are working or not.

By comparing previous data with current data, management can detect errors and take

efficient steps to avoid uncertainty. It is recommended to control on budget and

overheads cost to improve financial condition.

Company must use safety ratio like debt equity ratio to evaluate the risk, this will further

improve debt management. It is advisable to create a picture of the organization current

performance related to market trends.

The firm must monitor various areas of company to achieve business efficiency. It is also

advisable to track overall financial statements on a regular basis to increase productivity.

The company needs to develop a growth strategy and good business strategy. In this case

study business growth leads to revenue loss because company has not taken any step to

cover market research. The company is suggested to take a brief note on solvency

position by preparing balance sheet. It is advisable to take areas of improvement like

confidence, knowledge and communication into consideration.

Return on capital employed is one of the best profitability ratio to consider deciding

about company's profit ratio (Eng, Tian and Robert Yu, 2018). The firm must adopt

diversification method to expand profit in the market. It is important to increase sales of

existing products on new markets. Thus, it will help to increase market growth and

economic stability.

The most important recommendation for company is to improve accounting norms. The

management team must display financial items in a very specific way to determine data.

It is suggested to maintain shareholder's equity reports and profit and loss to evaluate the

condition of firm. It is also suggested company must use vertical, horizontal and ratio

analysis to compare financial statement with others.

To evaluate an organization financial standing company must work on cash inflows and

outflows. Investment analysts and managers must keep a detailed information about

accounting report to make allocation decision (dos Santos Maciel and Stephanie, 2021).

The company is advised to use performance tools to determine whether operating

strategies are working or not.

By comparing previous data with current data, management can detect errors and take

efficient steps to avoid uncertainty. It is recommended to control on budget and

overheads cost to improve financial condition.

Company must use safety ratio like debt equity ratio to evaluate the risk, this will further

improve debt management. It is advisable to create a picture of the organization current

performance related to market trends.

The firm must monitor various areas of company to achieve business efficiency. It is also

advisable to track overall financial statements on a regular basis to increase productivity.

The company needs to develop a growth strategy and good business strategy. In this case

study business growth leads to revenue loss because company has not taken any step to

cover market research. The company is suggested to take a brief note on solvency

position by preparing balance sheet. It is advisable to take areas of improvement like

confidence, knowledge and communication into consideration.

Return on capital employed is one of the best profitability ratio to consider deciding

about company's profit ratio (Eng, Tian and Robert Yu, 2018). The firm must adopt

diversification method to expand profit in the market. It is important to increase sales of

existing products on new markets. Thus, it will help to increase market growth and

economic stability.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONCLUSION

The report shows an overview of Zip co Ltd and gives information about potential users

of the report. Along with that report outline the information required by the users to evaluate the

performance of business. This report is prepared to analyse the financial position of the company

and shows whether it is strong enough to support the future growth ambitions or not. Further, the

report evaluates the balance sheet analysis with the help of annual report. The case study

provides brief justification about position of company with the most relevant ratios. By using

annual reports, the study determines various ratio analysis to find out company's stability. At last,

the case study provides few recommendations to undertake future growth ambitions. At last, it is

also recommended investing time in proper optimization of conversion rate analysis. In this way,

company can evaluate the ideas and technique for the improvement of marketing operations.

The report shows an overview of Zip co Ltd and gives information about potential users

of the report. Along with that report outline the information required by the users to evaluate the

performance of business. This report is prepared to analyse the financial position of the company

and shows whether it is strong enough to support the future growth ambitions or not. Further, the

report evaluates the balance sheet analysis with the help of annual report. The case study

provides brief justification about position of company with the most relevant ratios. By using

annual reports, the study determines various ratio analysis to find out company's stability. At last,

the case study provides few recommendations to undertake future growth ambitions. At last, it is

also recommended investing time in proper optimization of conversion rate analysis. In this way,

company can evaluate the ideas and technique for the improvement of marketing operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Albanese, C., Crépey, S., Hoskinson, R. and Saadeddine, B. (2021). XVA analysis from the

balance sheet. Quantitative Finance. 21(1). 99-123.

Benrqya, Y. and Jabbouri, I. (2021). Performance evaluation of European grocery retailers: a

financial statement analysis. International Journal of Logistics Economics and

Globalisation. 9(1). 24-39.

dos Santos Maciel, F. and Stephanie, C. (2021). Law on Access to Information in the Federal

Government: A Balance Sheet of Its Eight Years of Effectiveness. Law J. Pub. Admin. 21.

Easton, P. D., McAnally, M. L., Sommers, G. A. and Zhang, X. J. (2018). Financial statement

analysis & valuation. Boston, MA: Cambridge Business Publishers.

Eng, L. L., Tian, X. and Robert Yu, T. (2018). Financial statement analysis: evidence from

Chinese firms. Review of Pacific Basin Financial Markets and Policies. 21(04). 1850027.

Firdaus, F. and Endri, E. (2020). Financial Statement Analysis: Evidence from Indonesian Bank

BUKU IV. International Journal of Innovative Science and Research Technology. 5(4).

455-461.

Harjito, D. A. and Wiratama, M. H. (2017). The Balance Sheet Network Analysis for Measuring

Systemic Risk of Islamic Commercial Banks in Indonesia. Journal of Islamic Finance. 6.

100-113.

Mettenheim, K. (2021). Political Economy of Financialization in the United States: A

Historical-institutional Balance-sheet Approach. Routledge.

Sun, L. (2021). Systemic risk and macro-financial contagion in China: financial balance sheet-

based network analysis. Journal of the Asia Pacific Economy. 1-34.

Online

Books and Journals

Albanese, C., Crépey, S., Hoskinson, R. and Saadeddine, B. (2021). XVA analysis from the

balance sheet. Quantitative Finance. 21(1). 99-123.

Benrqya, Y. and Jabbouri, I. (2021). Performance evaluation of European grocery retailers: a

financial statement analysis. International Journal of Logistics Economics and

Globalisation. 9(1). 24-39.

dos Santos Maciel, F. and Stephanie, C. (2021). Law on Access to Information in the Federal

Government: A Balance Sheet of Its Eight Years of Effectiveness. Law J. Pub. Admin. 21.

Easton, P. D., McAnally, M. L., Sommers, G. A. and Zhang, X. J. (2018). Financial statement

analysis & valuation. Boston, MA: Cambridge Business Publishers.

Eng, L. L., Tian, X. and Robert Yu, T. (2018). Financial statement analysis: evidence from

Chinese firms. Review of Pacific Basin Financial Markets and Policies. 21(04). 1850027.

Firdaus, F. and Endri, E. (2020). Financial Statement Analysis: Evidence from Indonesian Bank

BUKU IV. International Journal of Innovative Science and Research Technology. 5(4).

455-461.

Harjito, D. A. and Wiratama, M. H. (2017). The Balance Sheet Network Analysis for Measuring

Systemic Risk of Islamic Commercial Banks in Indonesia. Journal of Islamic Finance. 6.

100-113.

Mettenheim, K. (2021). Political Economy of Financialization in the United States: A

Historical-institutional Balance-sheet Approach. Routledge.

Sun, L. (2021). Systemic risk and macro-financial contagion in China: financial balance sheet-

based network analysis. Journal of the Asia Pacific Economy. 1-34.

Online

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.