Comprehensive Financial Accounting Assignment: Consolidation Analysis

VerifiedAdded on 2020/05/16

|16

|2765

|140

Homework Assignment

AI Summary

This financial accounting assignment focuses on the consolidation of financial statements. The solution includes the preparation of acquisition analysis, journal entries for the acquisition of equity interest, and consolidated adjustments for PEACE Ltd and its controlled entity. It also involves the calculation of non-controlling interest (NCI) in the profit for the financial year ended, and the completion of a consolidation worksheet with all necessary journal entries. The assignment covers key aspects of consolidation, such as fair value adjustments, deferred tax liabilities, and the treatment of retained earnings, share capital, and revaluation reserves. Additionally, it addresses the impact of intercompany transactions and the allocation of profit to NCI, providing a comprehensive overview of the consolidation process. The document showcases the application of accounting principles to real-world scenarios, demonstrating the student's understanding of financial statement consolidation.

FINANCIAL ACCOUNTING

TABLE OF CONTENT

TABLE OF CONTENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

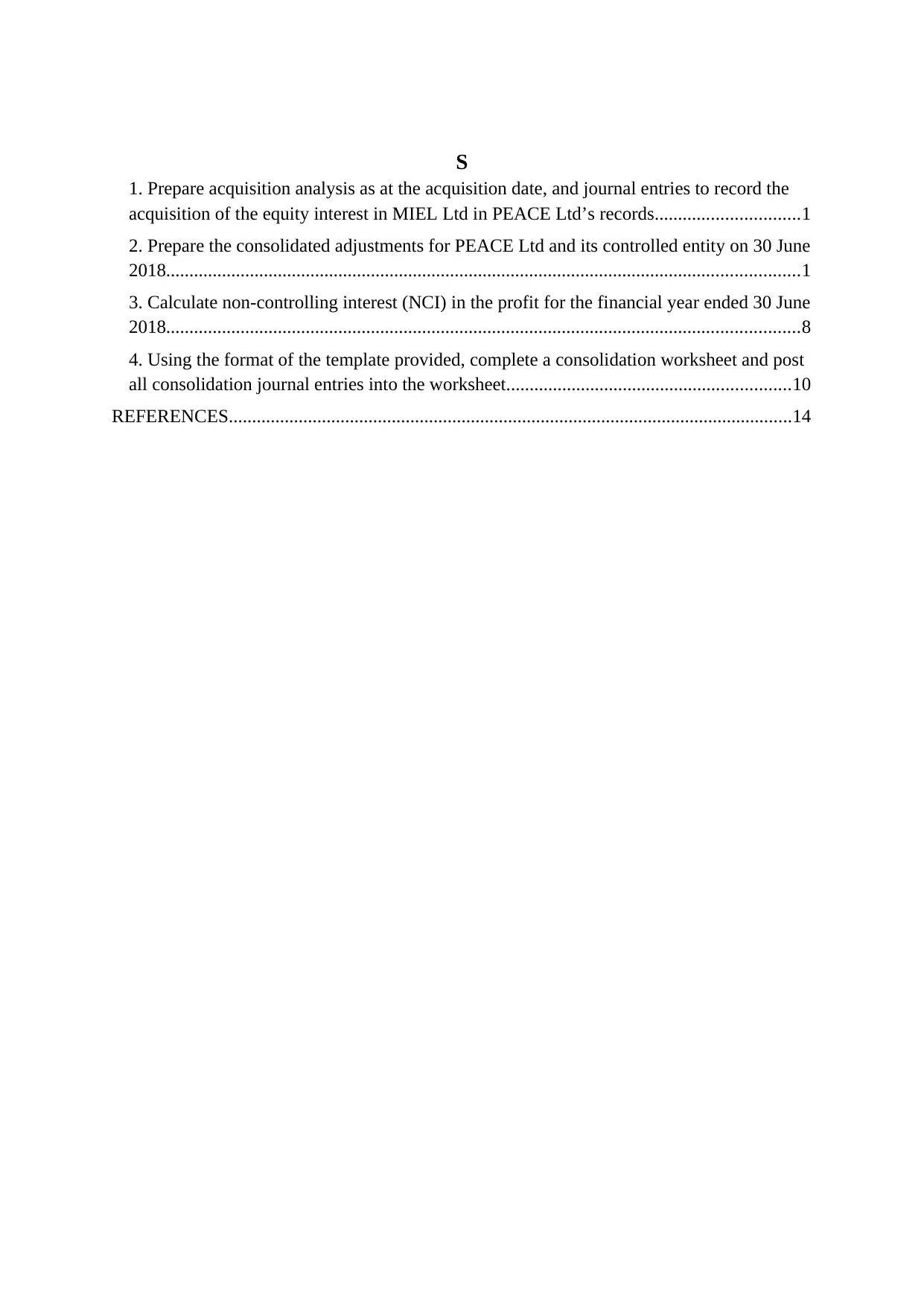

S

1. Prepare acquisition analysis as at the acquisition date, and journal entries to record the

acquisition of the equity interest in MIEL Ltd in PEACE Ltd’s records...............................1

2. Prepare the consolidated adjustments for PEACE Ltd and its controlled entity on 30 June

2018........................................................................................................................................1

3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June

2018........................................................................................................................................8

4. Using the format of the template provided, complete a consolidation worksheet and post

all consolidation journal entries into the worksheet.............................................................10

REFERENCES.........................................................................................................................14

1. Prepare acquisition analysis as at the acquisition date, and journal entries to record the

acquisition of the equity interest in MIEL Ltd in PEACE Ltd’s records...............................1

2. Prepare the consolidated adjustments for PEACE Ltd and its controlled entity on 30 June

2018........................................................................................................................................1

3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June

2018........................................................................................................................................8

4. Using the format of the template provided, complete a consolidation worksheet and post

all consolidation journal entries into the worksheet.............................................................10

REFERENCES.........................................................................................................................14

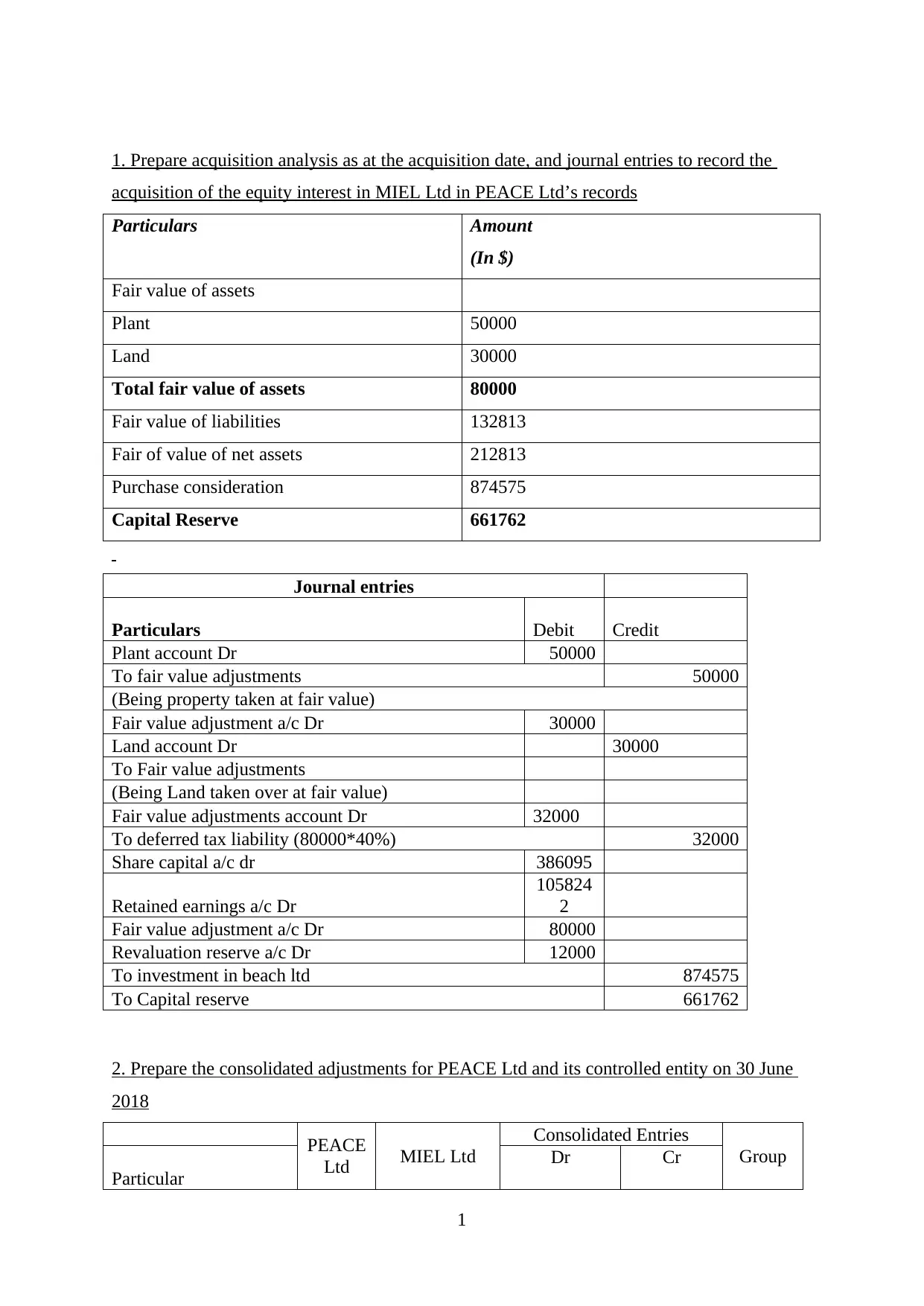

1. Prepare acquisition analysis as at the acquisition date, and journal entries to record the

acquisition of the equity interest in MIEL Ltd in PEACE Ltd’s records

Particulars Amount

(In $)

Fair value of assets

Plant 50000

Land 30000

Total fair value of assets 80000

Fair value of liabilities 132813

Fair of value of net assets 212813

Purchase consideration 874575

Capital Reserve 661762

Journal entries

Particulars Debit Credit

Plant account Dr 50000

To fair value adjustments 50000

(Being property taken at fair value)

Fair value adjustment a/c Dr 30000

Land account Dr 30000

To Fair value adjustments

(Being Land taken over at fair value)

Fair value adjustments account Dr 32000

To deferred tax liability (80000*40%) 32000

Share capital a/c dr 386095

Retained earnings a/c Dr

105824

2

Fair value adjustment a/c Dr 80000

Revaluation reserve a/c Dr 12000

To investment in beach ltd 874575

To Capital reserve 661762

2. Prepare the consolidated adjustments for PEACE Ltd and its controlled entity on 30 June

2018

PEACE

Ltd MIEL Ltd

Consolidated Entries

Group

Particular

Dr Cr

1

acquisition of the equity interest in MIEL Ltd in PEACE Ltd’s records

Particulars Amount

(In $)

Fair value of assets

Plant 50000

Land 30000

Total fair value of assets 80000

Fair value of liabilities 132813

Fair of value of net assets 212813

Purchase consideration 874575

Capital Reserve 661762

Journal entries

Particulars Debit Credit

Plant account Dr 50000

To fair value adjustments 50000

(Being property taken at fair value)

Fair value adjustment a/c Dr 30000

Land account Dr 30000

To Fair value adjustments

(Being Land taken over at fair value)

Fair value adjustments account Dr 32000

To deferred tax liability (80000*40%) 32000

Share capital a/c dr 386095

Retained earnings a/c Dr

105824

2

Fair value adjustment a/c Dr 80000

Revaluation reserve a/c Dr 12000

To investment in beach ltd 874575

To Capital reserve 661762

2. Prepare the consolidated adjustments for PEACE Ltd and its controlled entity on 30 June

2018

PEACE

Ltd MIEL Ltd

Consolidated Entries

Group

Particular

Dr Cr

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

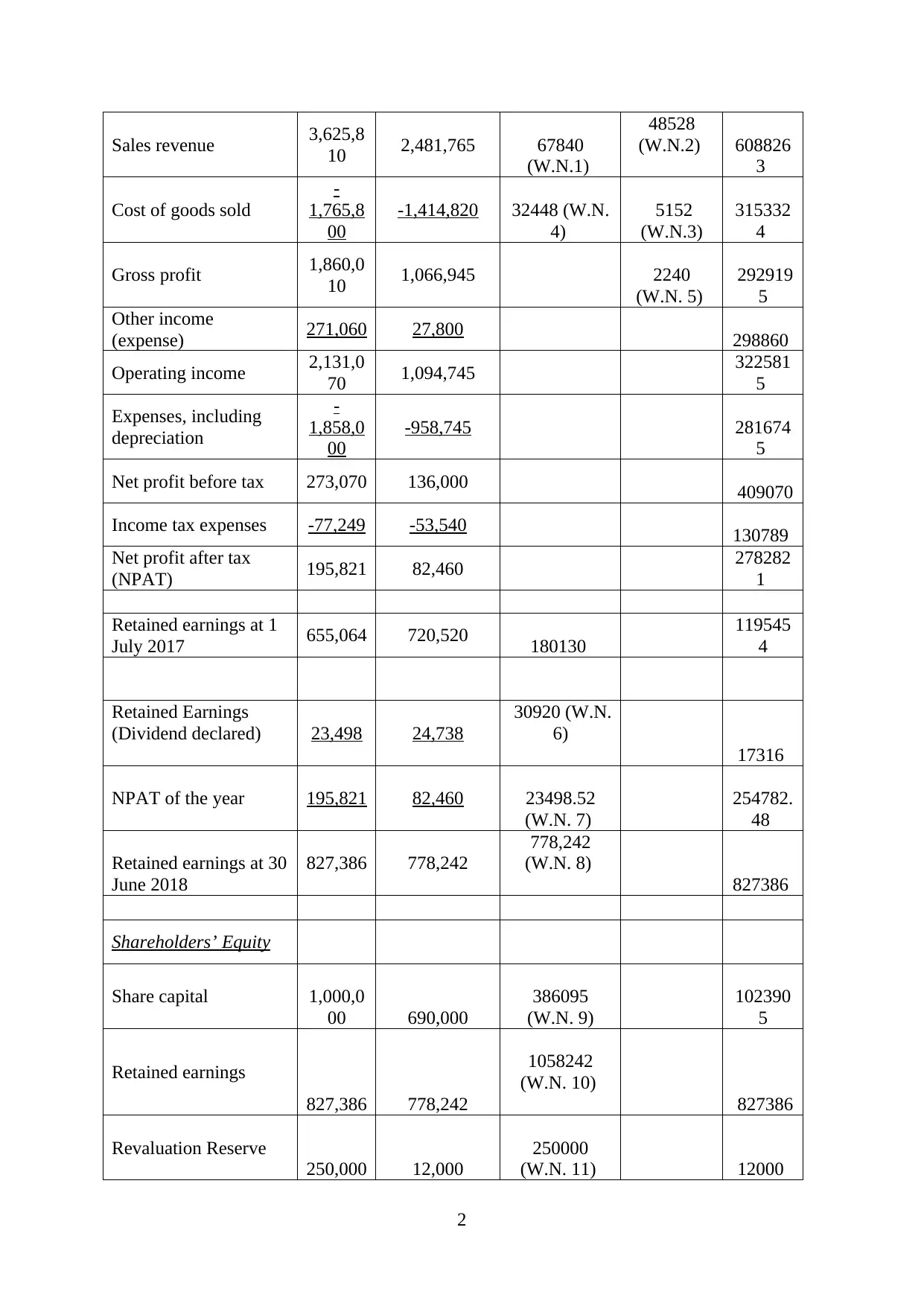

Sales revenue 3,625,8

10 2,481,765 67840

(W.N.1)

48528

(W.N.2) 608826

3

Cost of goods sold

-

1,765,8

00

-1,414,820 32448 (W.N.

4)

5152

(W.N.3)

315332

4

Gross profit 1,860,0

10 1,066,945 2240

(W.N. 5)

292919

5

Other income

(expense) 271,060 27,800 298860

Operating income 2,131,0

70 1,094,745 322581

5

Expenses, including

depreciation

-

1,858,0

00

-958,745 281674

5

Net profit before tax 273,070 136,000 409070

Income tax expenses -77,249 -53,540 130789

Net profit after tax

(NPAT) 195,821 82,460 278282

1

Retained earnings at 1

July 2017 655,064 720,520 180130

119545

4

Retained Earnings

(Dividend declared) 23,498 24,738

30920 (W.N.

6)

17316

NPAT of the year 195,821 82,460 23498.52

(W.N. 7)

254782.

48

Retained earnings at 30

June 2018

827,386 778,242

778,242

(W.N. 8)

827386

Shareholders’ Equity

Share capital 1,000,0

00 690,000

386095

(W.N. 9)

102390

5

Retained earnings

827,386 778,242

1058242

(W.N. 10)

827386

Revaluation Reserve

250,000 12,000

250000

(W.N. 11) 12000

2

10 2,481,765 67840

(W.N.1)

48528

(W.N.2) 608826

3

Cost of goods sold

-

1,765,8

00

-1,414,820 32448 (W.N.

4)

5152

(W.N.3)

315332

4

Gross profit 1,860,0

10 1,066,945 2240

(W.N. 5)

292919

5

Other income

(expense) 271,060 27,800 298860

Operating income 2,131,0

70 1,094,745 322581

5

Expenses, including

depreciation

-

1,858,0

00

-958,745 281674

5

Net profit before tax 273,070 136,000 409070

Income tax expenses -77,249 -53,540 130789

Net profit after tax

(NPAT) 195,821 82,460 278282

1

Retained earnings at 1

July 2017 655,064 720,520 180130

119545

4

Retained Earnings

(Dividend declared) 23,498 24,738

30920 (W.N.

6)

17316

NPAT of the year 195,821 82,460 23498.52

(W.N. 7)

254782.

48

Retained earnings at 30

June 2018

827,386 778,242

778,242

(W.N. 8)

827386

Shareholders’ Equity

Share capital 1,000,0

00 690,000

386095

(W.N. 9)

102390

5

Retained earnings

827,386 778,242

1058242

(W.N. 10)

827386

Revaluation Reserve

250,000 12,000

250000

(W.N. 11) 12000

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

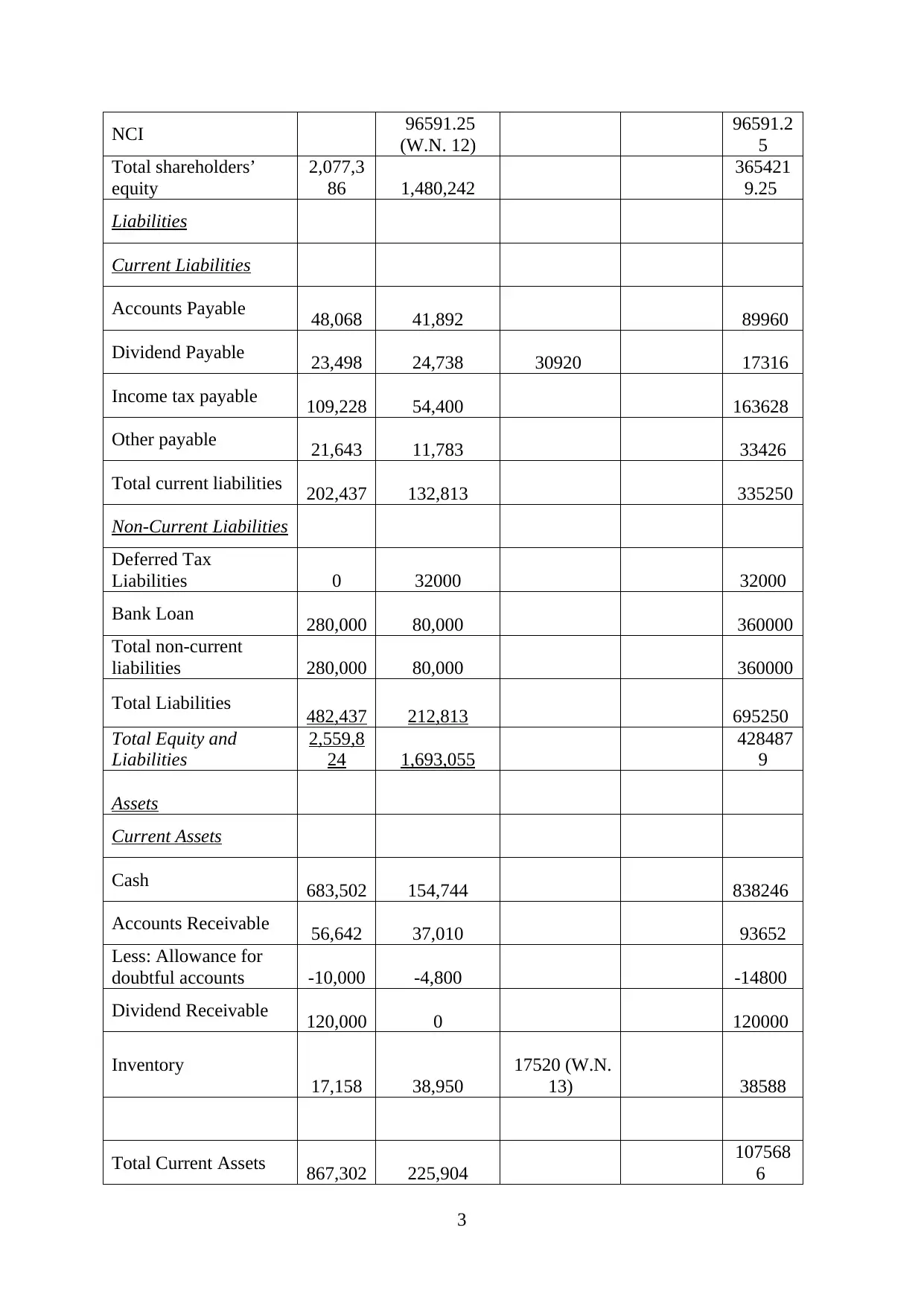

NCI 96591.25

(W.N. 12)

96591.2

5

Total shareholders’

equity

2,077,3

86 1,480,242

365421

9.25

Liabilities

Current Liabilities

Accounts Payable 48,068 41,892 89960

Dividend Payable 23,498 24,738 30920 17316

Income tax payable 109,228 54,400 163628

Other payable 21,643 11,783 33426

Total current liabilities 202,437 132,813 335250

Non-Current Liabilities

Deferred Tax

Liabilities 0 32000 32000

Bank Loan 280,000 80,000 360000

Total non-current

liabilities 280,000 80,000 360000

Total Liabilities 482,437 212,813 695250

Total Equity and

Liabilities

2,559,8

24 1,693,055

428487

9

Assets

Current Assets

Cash 683,502 154,744 838246

Accounts Receivable 56,642 37,010 93652

Less: Allowance for

doubtful accounts -10,000 -4,800 -14800

Dividend Receivable 120,000 0 120000

Inventory

17,158 38,950

17520 (W.N.

13) 38588

Total Current Assets 867,302 225,904

107568

6

3

(W.N. 12)

96591.2

5

Total shareholders’

equity

2,077,3

86 1,480,242

365421

9.25

Liabilities

Current Liabilities

Accounts Payable 48,068 41,892 89960

Dividend Payable 23,498 24,738 30920 17316

Income tax payable 109,228 54,400 163628

Other payable 21,643 11,783 33426

Total current liabilities 202,437 132,813 335250

Non-Current Liabilities

Deferred Tax

Liabilities 0 32000 32000

Bank Loan 280,000 80,000 360000

Total non-current

liabilities 280,000 80,000 360000

Total Liabilities 482,437 212,813 695250

Total Equity and

Liabilities

2,559,8

24 1,693,055

428487

9

Assets

Current Assets

Cash 683,502 154,744 838246

Accounts Receivable 56,642 37,010 93652

Less: Allowance for

doubtful accounts -10,000 -4,800 -14800

Dividend Receivable 120,000 0 120000

Inventory

17,158 38,950

17520 (W.N.

13) 38588

Total Current Assets 867,302 225,904

107568

6

3

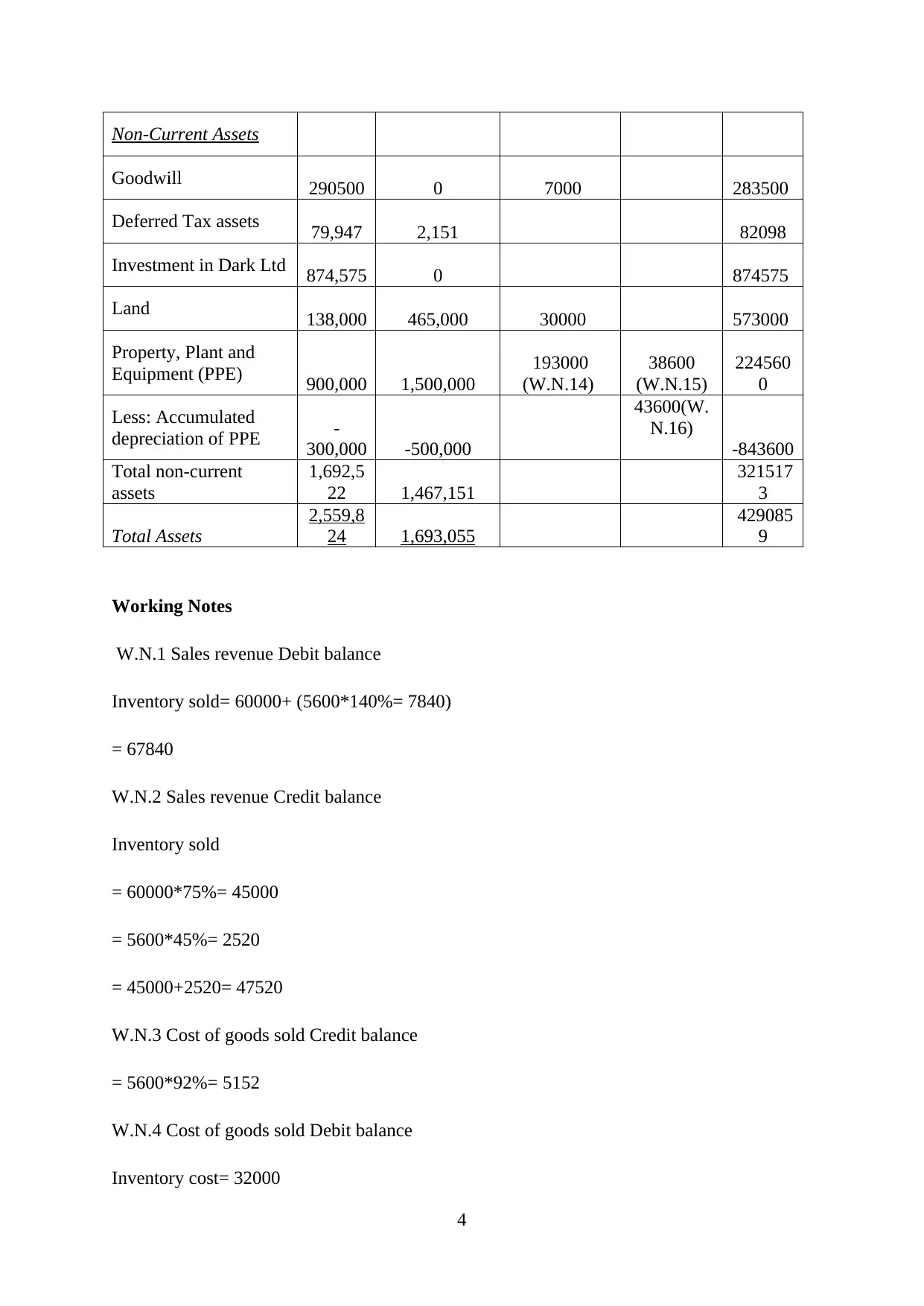

Non-Current Assets

Goodwill 290500 0 7000 283500

Deferred Tax assets 79,947 2,151 82098

Investment in Dark Ltd 874,575 0 874575

Land 138,000 465,000 30000 573000

Property, Plant and

Equipment (PPE) 900,000 1,500,000

193000

(W.N.14)

38600

(W.N.15)

224560

0

Less: Accumulated

depreciation of PPE -

300,000 -500,000

43600(W.

N.16)

-843600

Total non-current

assets

1,692,5

22 1,467,151

321517

3

Total Assets

2,559,8

24 1,693,055

429085

9

Working Notes

W.N.1 Sales revenue Debit balance

Inventory sold= 60000+ (5600*140%= 7840)

= 67840

W.N.2 Sales revenue Credit balance

Inventory sold

= 60000*75%= 45000

= 5600*45%= 2520

= 45000+2520= 47520

W.N.3 Cost of goods sold Credit balance

= 5600*92%= 5152

W.N.4 Cost of goods sold Debit balance

Inventory cost= 32000

4

Goodwill 290500 0 7000 283500

Deferred Tax assets 79,947 2,151 82098

Investment in Dark Ltd 874,575 0 874575

Land 138,000 465,000 30000 573000

Property, Plant and

Equipment (PPE) 900,000 1,500,000

193000

(W.N.14)

38600

(W.N.15)

224560

0

Less: Accumulated

depreciation of PPE -

300,000 -500,000

43600(W.

N.16)

-843600

Total non-current

assets

1,692,5

22 1,467,151

321517

3

Total Assets

2,559,8

24 1,693,055

429085

9

Working Notes

W.N.1 Sales revenue Debit balance

Inventory sold= 60000+ (5600*140%= 7840)

= 67840

W.N.2 Sales revenue Credit balance

Inventory sold

= 60000*75%= 45000

= 5600*45%= 2520

= 45000+2520= 47520

W.N.3 Cost of goods sold Credit balance

= 5600*92%= 5152

W.N.4 Cost of goods sold Debit balance

Inventory cost= 32000

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

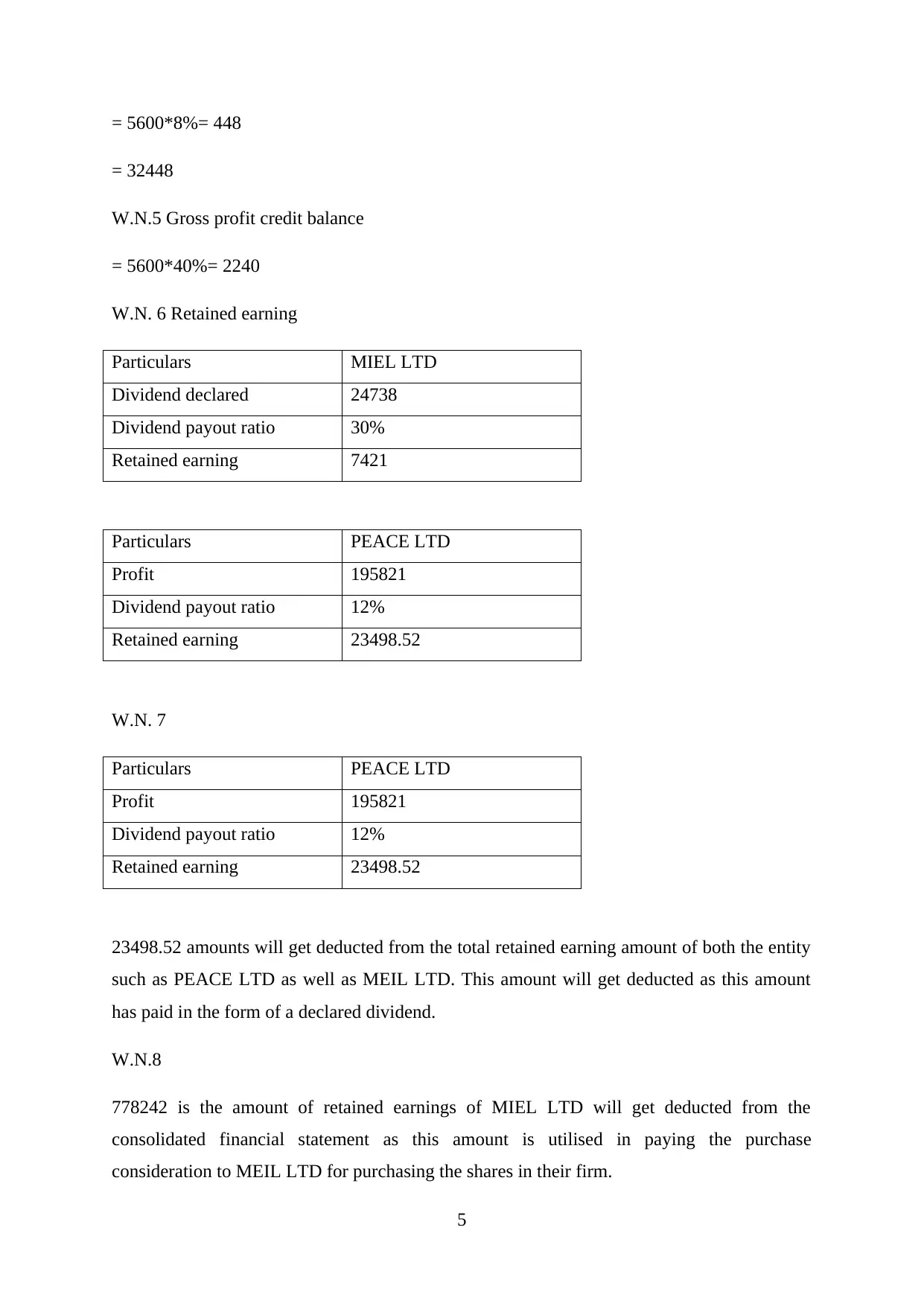

= 5600*8%= 448

= 32448

W.N.5 Gross profit credit balance

= 5600*40%= 2240

W.N. 6 Retained earning

Particulars MIEL LTD

Dividend declared 24738

Dividend payout ratio 30%

Retained earning 7421

Particulars PEACE LTD

Profit 195821

Dividend payout ratio 12%

Retained earning 23498.52

W.N. 7

Particulars PEACE LTD

Profit 195821

Dividend payout ratio 12%

Retained earning 23498.52

23498.52 amounts will get deducted from the total retained earning amount of both the entity

such as PEACE LTD as well as MEIL LTD. This amount will get deducted as this amount

has paid in the form of a declared dividend.

W.N.8

778242 is the amount of retained earnings of MIEL LTD will get deducted from the

consolidated financial statement as this amount is utilised in paying the purchase

consideration to MEIL LTD for purchasing the shares in their firm.

5

= 32448

W.N.5 Gross profit credit balance

= 5600*40%= 2240

W.N. 6 Retained earning

Particulars MIEL LTD

Dividend declared 24738

Dividend payout ratio 30%

Retained earning 7421

Particulars PEACE LTD

Profit 195821

Dividend payout ratio 12%

Retained earning 23498.52

W.N. 7

Particulars PEACE LTD

Profit 195821

Dividend payout ratio 12%

Retained earning 23498.52

23498.52 amounts will get deducted from the total retained earning amount of both the entity

such as PEACE LTD as well as MEIL LTD. This amount will get deducted as this amount

has paid in the form of a declared dividend.

W.N.8

778242 is the amount of retained earnings of MIEL LTD will get deducted from the

consolidated financial statement as this amount is utilised in paying the purchase

consideration to MEIL LTD for purchasing the shares in their firm.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

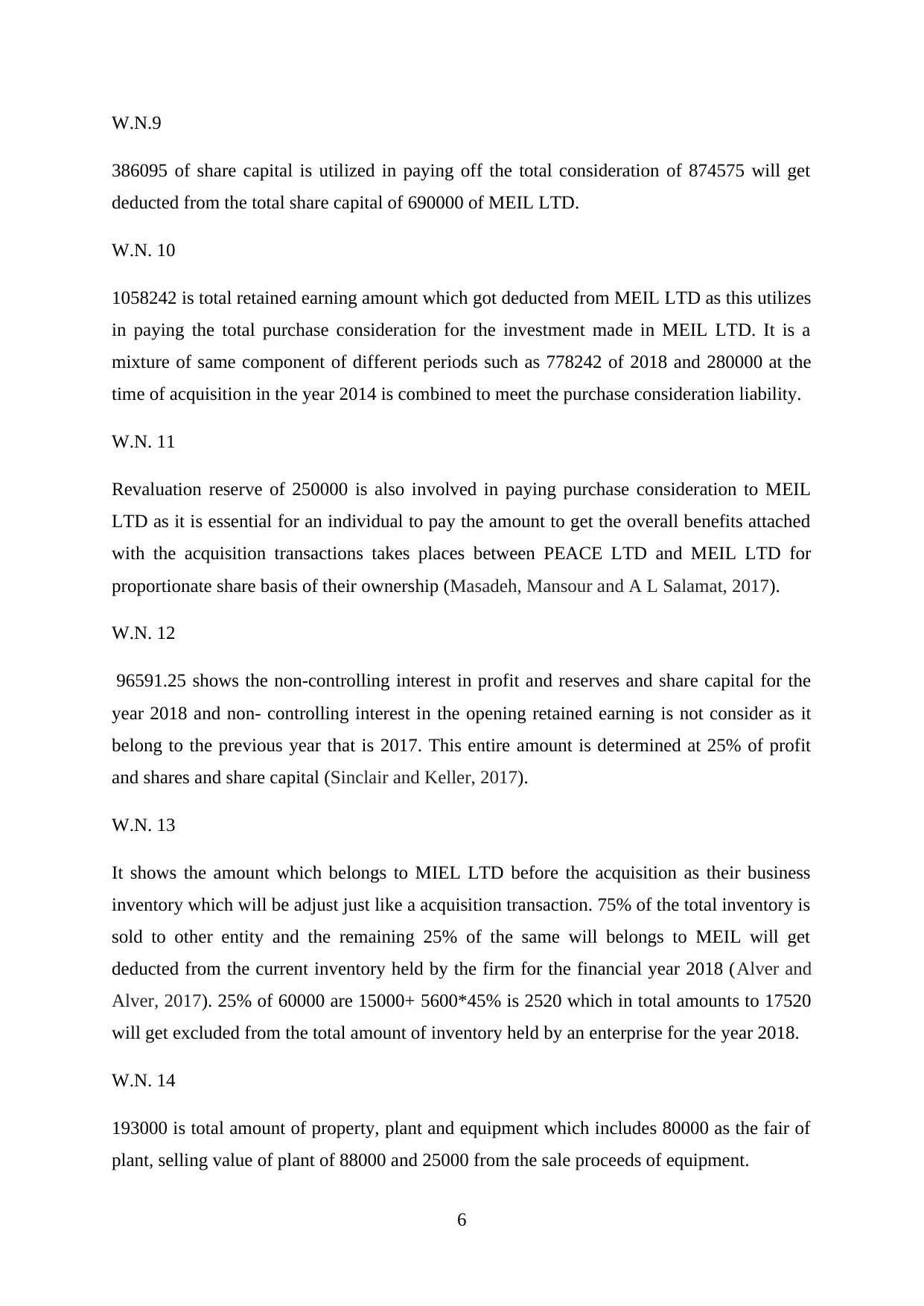

W.N.9

386095 of share capital is utilized in paying off the total consideration of 874575 will get

deducted from the total share capital of 690000 of MEIL LTD.

W.N. 10

1058242 is total retained earning amount which got deducted from MEIL LTD as this utilizes

in paying the total purchase consideration for the investment made in MEIL LTD. It is a

mixture of same component of different periods such as 778242 of 2018 and 280000 at the

time of acquisition in the year 2014 is combined to meet the purchase consideration liability.

W.N. 11

Revaluation reserve of 250000 is also involved in paying purchase consideration to MEIL

LTD as it is essential for an individual to pay the amount to get the overall benefits attached

with the acquisition transactions takes places between PEACE LTD and MEIL LTD for

proportionate share basis of their ownership (Masadeh, Mansour and A L Salamat, 2017).

W.N. 12

96591.25 shows the non-controlling interest in profit and reserves and share capital for the

year 2018 and non- controlling interest in the opening retained earning is not consider as it

belong to the previous year that is 2017. This entire amount is determined at 25% of profit

and shares and share capital (Sinclair and Keller, 2017).

W.N. 13

It shows the amount which belongs to MIEL LTD before the acquisition as their business

inventory which will be adjust just like a acquisition transaction. 75% of the total inventory is

sold to other entity and the remaining 25% of the same will belongs to MEIL will get

deducted from the current inventory held by the firm for the financial year 2018 (Alver and

Alver, 2017). 25% of 60000 are 15000+ 5600*45% is 2520 which in total amounts to 17520

will get excluded from the total amount of inventory held by an enterprise for the year 2018.

W.N. 14

193000 is total amount of property, plant and equipment which includes 80000 as the fair of

plant, selling value of plant of 88000 and 25000 from the sale proceeds of equipment.

6

386095 of share capital is utilized in paying off the total consideration of 874575 will get

deducted from the total share capital of 690000 of MEIL LTD.

W.N. 10

1058242 is total retained earning amount which got deducted from MEIL LTD as this utilizes

in paying the total purchase consideration for the investment made in MEIL LTD. It is a

mixture of same component of different periods such as 778242 of 2018 and 280000 at the

time of acquisition in the year 2014 is combined to meet the purchase consideration liability.

W.N. 11

Revaluation reserve of 250000 is also involved in paying purchase consideration to MEIL

LTD as it is essential for an individual to pay the amount to get the overall benefits attached

with the acquisition transactions takes places between PEACE LTD and MEIL LTD for

proportionate share basis of their ownership (Masadeh, Mansour and A L Salamat, 2017).

W.N. 12

96591.25 shows the non-controlling interest in profit and reserves and share capital for the

year 2018 and non- controlling interest in the opening retained earning is not consider as it

belong to the previous year that is 2017. This entire amount is determined at 25% of profit

and shares and share capital (Sinclair and Keller, 2017).

W.N. 13

It shows the amount which belongs to MIEL LTD before the acquisition as their business

inventory which will be adjust just like a acquisition transaction. 75% of the total inventory is

sold to other entity and the remaining 25% of the same will belongs to MEIL will get

deducted from the current inventory held by the firm for the financial year 2018 (Alver and

Alver, 2017). 25% of 60000 are 15000+ 5600*45% is 2520 which in total amounts to 17520

will get excluded from the total amount of inventory held by an enterprise for the year 2018.

W.N. 14

193000 is total amount of property, plant and equipment which includes 80000 as the fair of

plant, selling value of plant of 88000 and 25000 from the sale proceeds of equipment.

6

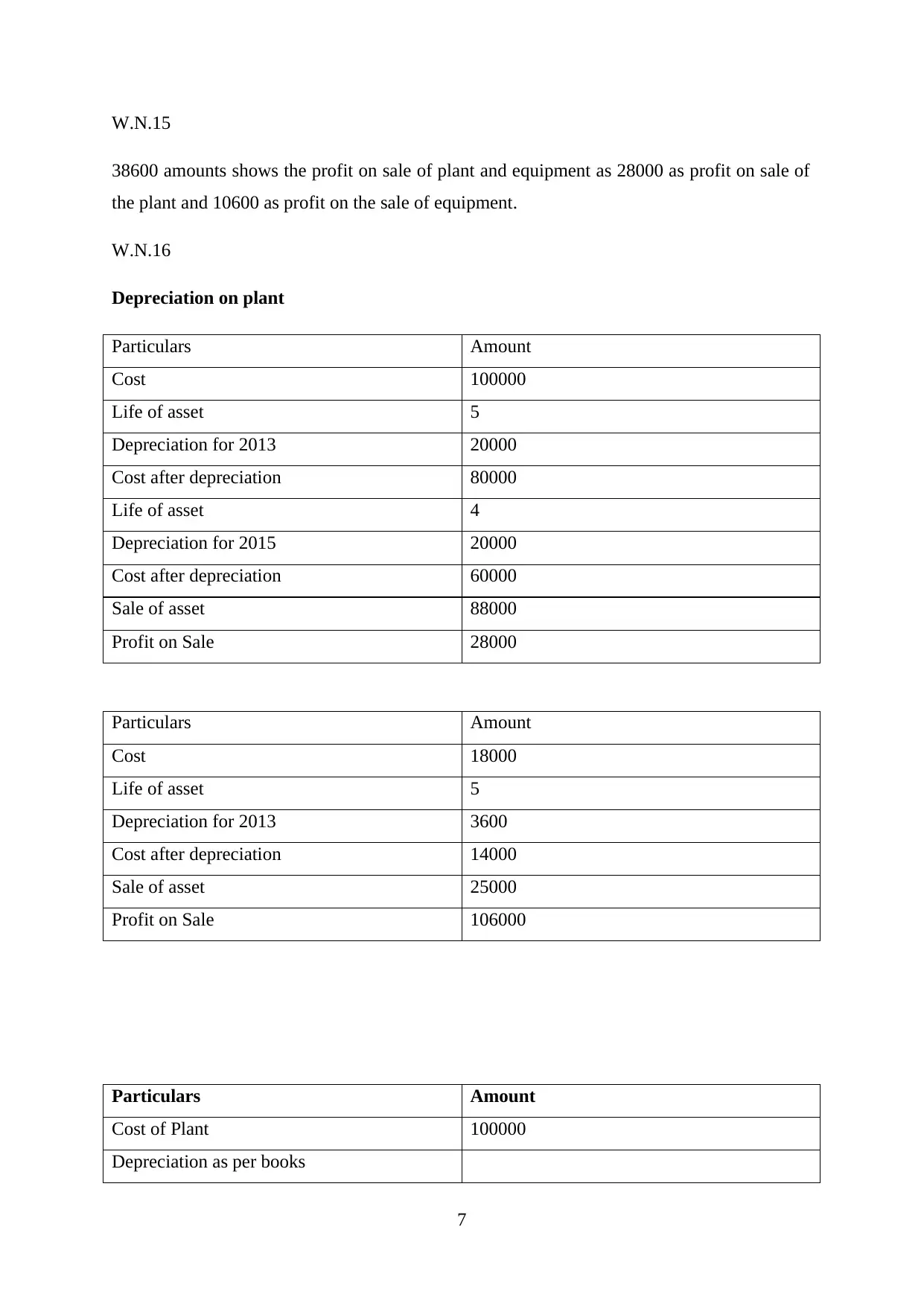

W.N.15

38600 amounts shows the profit on sale of plant and equipment as 28000 as profit on sale of

the plant and 10600 as profit on the sale of equipment.

W.N.16

Depreciation on plant

Particulars Amount

Cost 100000

Life of asset 5

Depreciation for 2013 20000

Cost after depreciation 80000

Life of asset 4

Depreciation for 2015 20000

Cost after depreciation 60000

Sale of asset 88000

Profit on Sale 28000

Particulars Amount

Cost 18000

Life of asset 5

Depreciation for 2013 3600

Cost after depreciation 14000

Sale of asset 25000

Profit on Sale 106000

Particulars Amount

Cost of Plant 100000

Depreciation as per books

7

38600 amounts shows the profit on sale of plant and equipment as 28000 as profit on sale of

the plant and 10600 as profit on the sale of equipment.

W.N.16

Depreciation on plant

Particulars Amount

Cost 100000

Life of asset 5

Depreciation for 2013 20000

Cost after depreciation 80000

Life of asset 4

Depreciation for 2015 20000

Cost after depreciation 60000

Sale of asset 88000

Profit on Sale 28000

Particulars Amount

Cost 18000

Life of asset 5

Depreciation for 2013 3600

Cost after depreciation 14000

Sale of asset 25000

Profit on Sale 106000

Particulars Amount

Cost of Plant 100000

Depreciation as per books

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

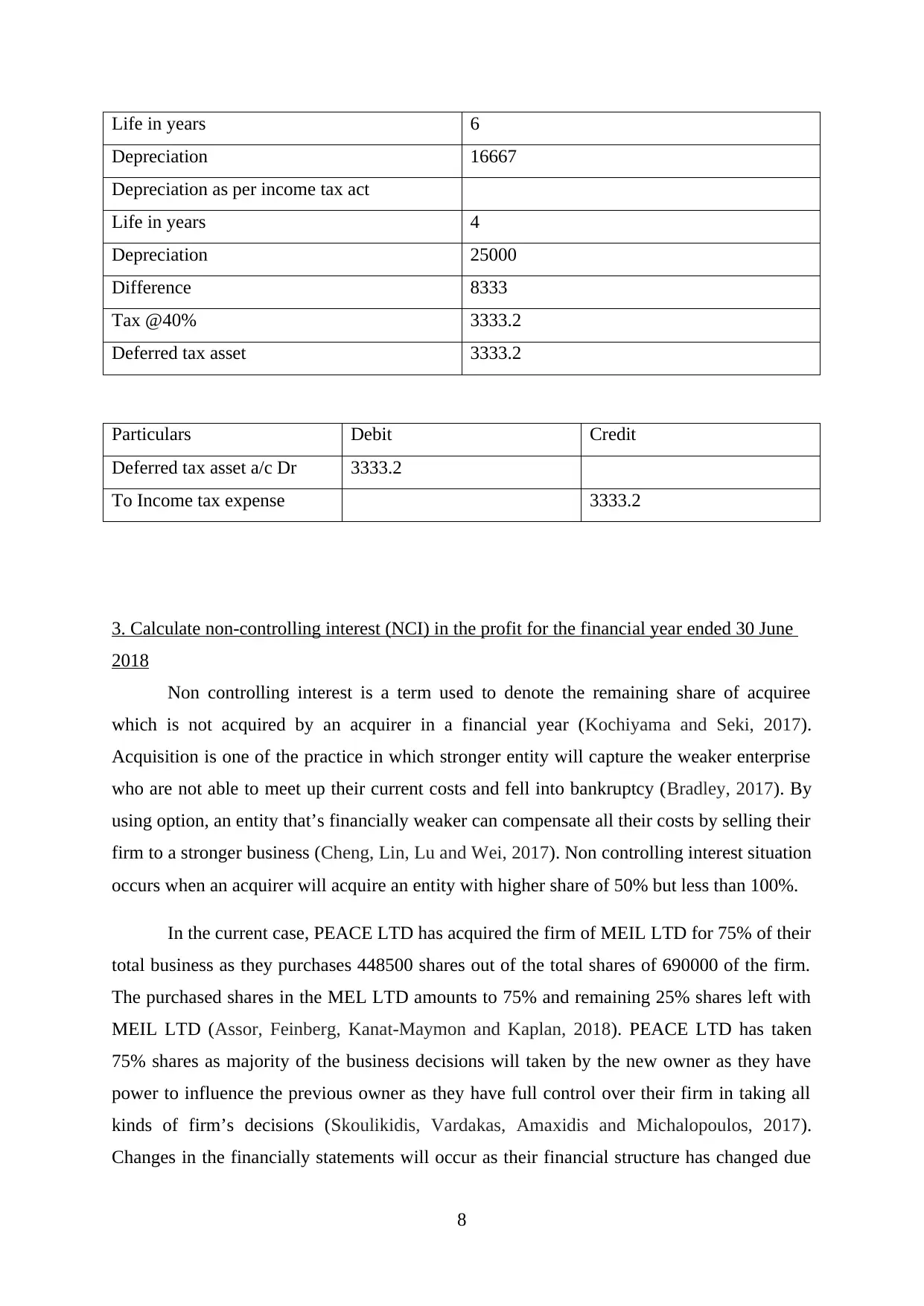

Life in years 6

Depreciation 16667

Depreciation as per income tax act

Life in years 4

Depreciation 25000

Difference 8333

Tax @40% 3333.2

Deferred tax asset 3333.2

Particulars Debit Credit

Deferred tax asset a/c Dr 3333.2

To Income tax expense 3333.2

3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June

2018

Non controlling interest is a term used to denote the remaining share of acquiree

which is not acquired by an acquirer in a financial year (Kochiyama and Seki, 2017).

Acquisition is one of the practice in which stronger entity will capture the weaker enterprise

who are not able to meet up their current costs and fell into bankruptcy (Bradley, 2017). By

using option, an entity that’s financially weaker can compensate all their costs by selling their

firm to a stronger business (Cheng, Lin, Lu and Wei, 2017). Non controlling interest situation

occurs when an acquirer will acquire an entity with higher share of 50% but less than 100%.

In the current case, PEACE LTD has acquired the firm of MEIL LTD for 75% of their

total business as they purchases 448500 shares out of the total shares of 690000 of the firm.

The purchased shares in the MEL LTD amounts to 75% and remaining 25% shares left with

MEIL LTD (Assor, Feinberg, Kanat-Maymon and Kaplan, 2018). PEACE LTD has taken

75% shares as majority of the business decisions will taken by the new owner as they have

power to influence the previous owner as they have full control over their firm in taking all

kinds of firm’s decisions (Skoulikidis, Vardakas, Amaxidis and Michalopoulos, 2017).

Changes in the financially statements will occur as their financial structure has changed due

8

Depreciation 16667

Depreciation as per income tax act

Life in years 4

Depreciation 25000

Difference 8333

Tax @40% 3333.2

Deferred tax asset 3333.2

Particulars Debit Credit

Deferred tax asset a/c Dr 3333.2

To Income tax expense 3333.2

3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June

2018

Non controlling interest is a term used to denote the remaining share of acquiree

which is not acquired by an acquirer in a financial year (Kochiyama and Seki, 2017).

Acquisition is one of the practice in which stronger entity will capture the weaker enterprise

who are not able to meet up their current costs and fell into bankruptcy (Bradley, 2017). By

using option, an entity that’s financially weaker can compensate all their costs by selling their

firm to a stronger business (Cheng, Lin, Lu and Wei, 2017). Non controlling interest situation

occurs when an acquirer will acquire an entity with higher share of 50% but less than 100%.

In the current case, PEACE LTD has acquired the firm of MEIL LTD for 75% of their

total business as they purchases 448500 shares out of the total shares of 690000 of the firm.

The purchased shares in the MEL LTD amounts to 75% and remaining 25% shares left with

MEIL LTD (Assor, Feinberg, Kanat-Maymon and Kaplan, 2018). PEACE LTD has taken

75% shares as majority of the business decisions will taken by the new owner as they have

power to influence the previous owner as they have full control over their firm in taking all

kinds of firm’s decisions (Skoulikidis, Vardakas, Amaxidis and Michalopoulos, 2017).

Changes in the financially statements will occur as their financial structure has changed due

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

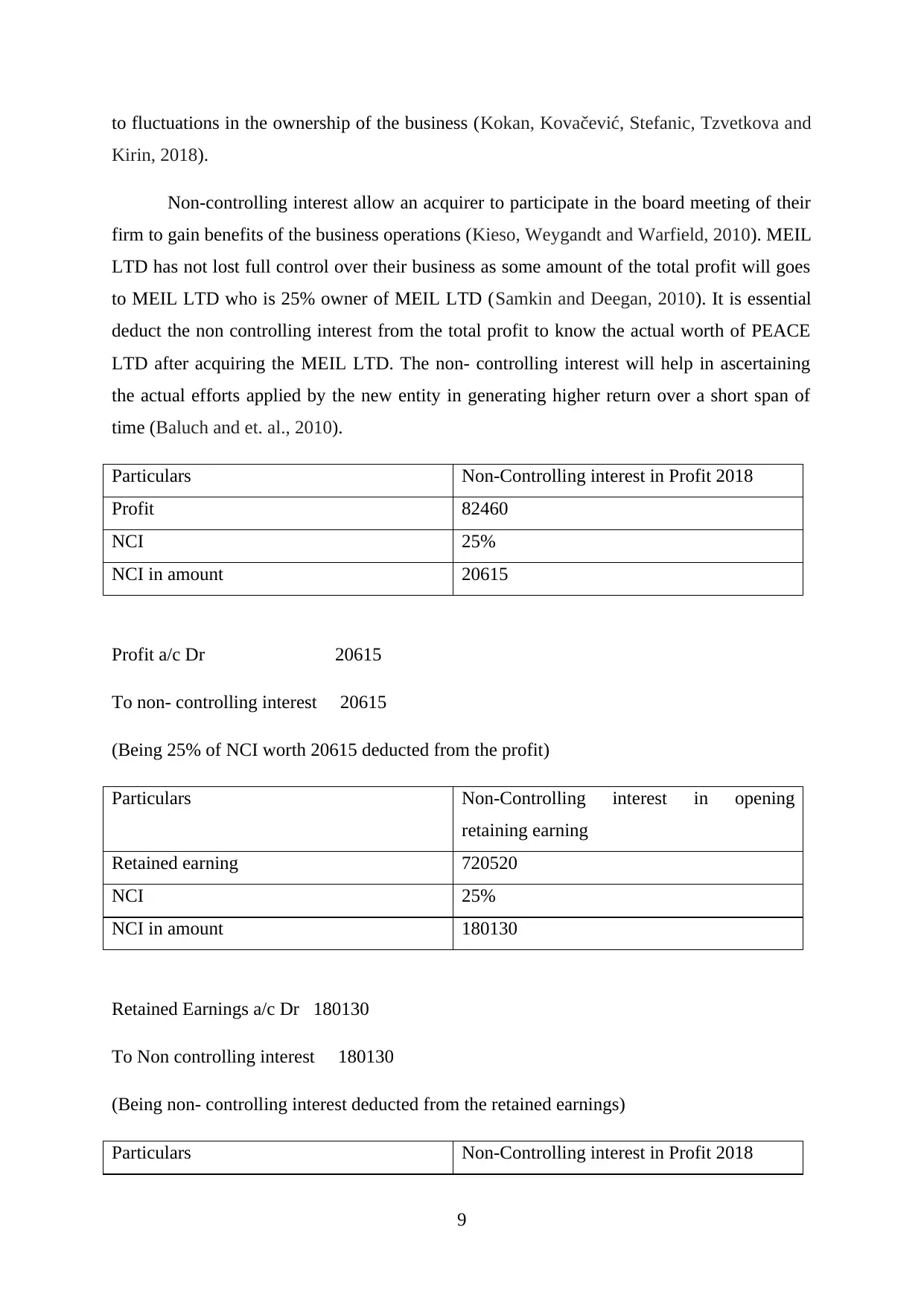

to fluctuations in the ownership of the business (Kokan, Kovačević, Stefanic, Tzvetkova and

Kirin, 2018).

Non-controlling interest allow an acquirer to participate in the board meeting of their

firm to gain benefits of the business operations (Kieso, Weygandt and Warfield, 2010). MEIL

LTD has not lost full control over their business as some amount of the total profit will goes

to MEIL LTD who is 25% owner of MEIL LTD (Samkin and Deegan, 2010). It is essential

deduct the non controlling interest from the total profit to know the actual worth of PEACE

LTD after acquiring the MEIL LTD. The non- controlling interest will help in ascertaining

the actual efforts applied by the new entity in generating higher return over a short span of

time (Baluch and et. al., 2010).

Particulars Non-Controlling interest in Profit 2018

Profit 82460

NCI 25%

NCI in amount 20615

Profit a/c Dr 20615

To non- controlling interest 20615

(Being 25% of NCI worth 20615 deducted from the profit)

Particulars Non-Controlling interest in opening

retaining earning

Retained earning 720520

NCI 25%

NCI in amount 180130

Retained Earnings a/c Dr 180130

To Non controlling interest 180130

(Being non- controlling interest deducted from the retained earnings)

Particulars Non-Controlling interest in Profit 2018

9

Kirin, 2018).

Non-controlling interest allow an acquirer to participate in the board meeting of their

firm to gain benefits of the business operations (Kieso, Weygandt and Warfield, 2010). MEIL

LTD has not lost full control over their business as some amount of the total profit will goes

to MEIL LTD who is 25% owner of MEIL LTD (Samkin and Deegan, 2010). It is essential

deduct the non controlling interest from the total profit to know the actual worth of PEACE

LTD after acquiring the MEIL LTD. The non- controlling interest will help in ascertaining

the actual efforts applied by the new entity in generating higher return over a short span of

time (Baluch and et. al., 2010).

Particulars Non-Controlling interest in Profit 2018

Profit 82460

NCI 25%

NCI in amount 20615

Profit a/c Dr 20615

To non- controlling interest 20615

(Being 25% of NCI worth 20615 deducted from the profit)

Particulars Non-Controlling interest in opening

retaining earning

Retained earning 720520

NCI 25%

NCI in amount 180130

Retained Earnings a/c Dr 180130

To Non controlling interest 180130

(Being non- controlling interest deducted from the retained earnings)

Particulars Non-Controlling interest in Profit 2018

9

Reserves and share capital 303905

NCI 25%

NCI in amount 75976.25

Reserves and share capital a/c Dr 75796.25

To Non controlling interest 75796.25

(Being reserves and share capital of Peace LTD decreases by 75976.25)

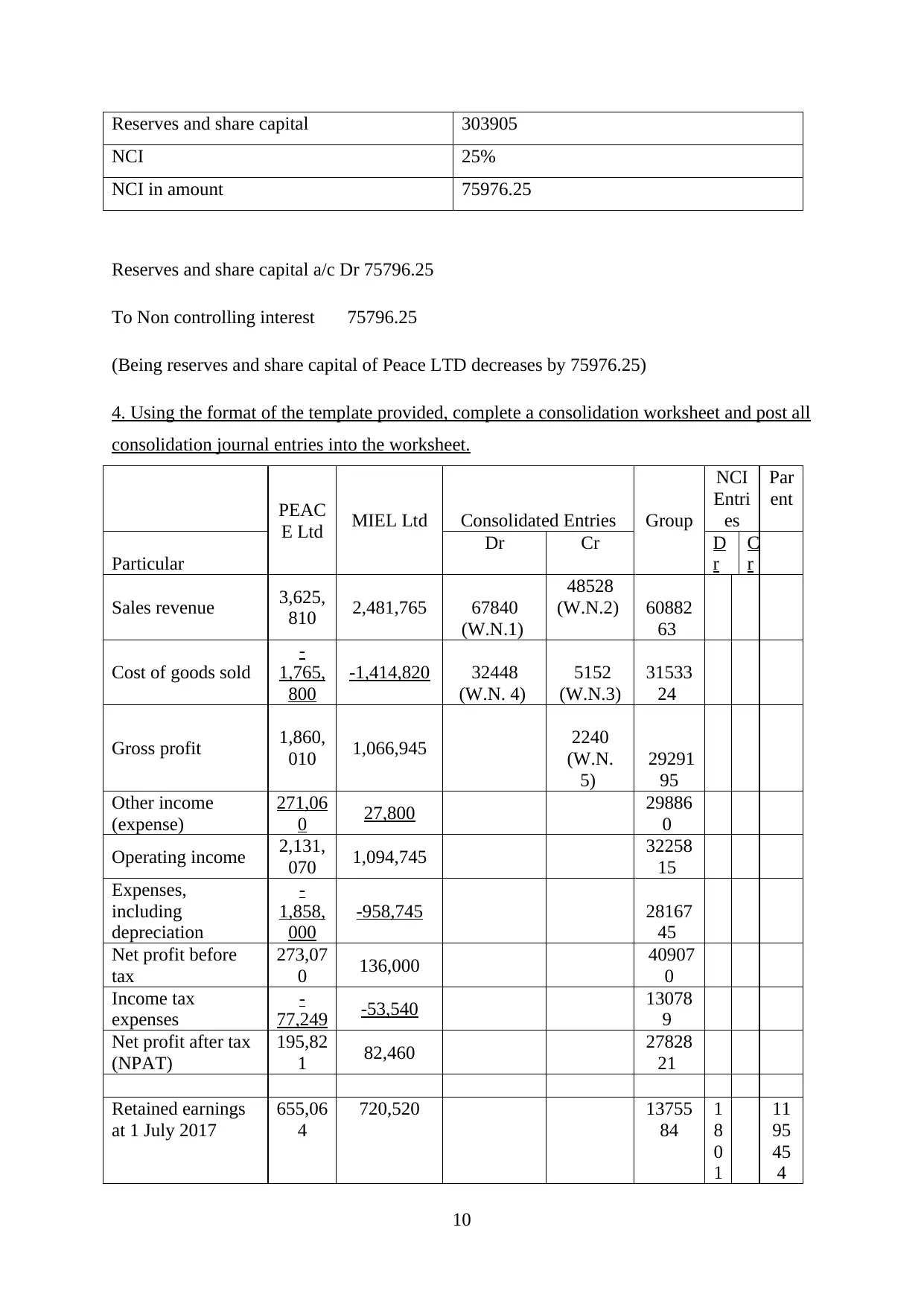

4. Using the format of the template provided, complete a consolidation worksheet and post all

consolidation journal entries into the worksheet.

PEAC

E Ltd MIEL Ltd Consolidated Entries Group

NCI

Entri

es

Par

ent

Particular

Dr Cr D

r

C

r

Sales revenue 3,625,

810 2,481,765 67840

(W.N.1)

48528

(W.N.2) 60882

63

Cost of goods sold

-

1,765,

800

-1,414,820 32448

(W.N. 4)

5152

(W.N.3)

31533

24

Gross profit 1,860,

010 1,066,945 2240

(W.N.

5)

29291

95

Other income

(expense)

271,06

0 27,800 29886

0

Operating income 2,131,

070 1,094,745 32258

15

Expenses,

including

depreciation

-

1,858,

000

-958,745 28167

45

Net profit before

tax

273,07

0 136,000 40907

0

Income tax

expenses

-

77,249 -53,540 13078

9

Net profit after tax

(NPAT)

195,82

1 82,460 27828

21

Retained earnings

at 1 July 2017

655,06

4

720,520 13755

84

1

8

0

1

11

95

45

4

10

NCI 25%

NCI in amount 75976.25

Reserves and share capital a/c Dr 75796.25

To Non controlling interest 75796.25

(Being reserves and share capital of Peace LTD decreases by 75976.25)

4. Using the format of the template provided, complete a consolidation worksheet and post all

consolidation journal entries into the worksheet.

PEAC

E Ltd MIEL Ltd Consolidated Entries Group

NCI

Entri

es

Par

ent

Particular

Dr Cr D

r

C

r

Sales revenue 3,625,

810 2,481,765 67840

(W.N.1)

48528

(W.N.2) 60882

63

Cost of goods sold

-

1,765,

800

-1,414,820 32448

(W.N. 4)

5152

(W.N.3)

31533

24

Gross profit 1,860,

010 1,066,945 2240

(W.N.

5)

29291

95

Other income

(expense)

271,06

0 27,800 29886

0

Operating income 2,131,

070 1,094,745 32258

15

Expenses,

including

depreciation

-

1,858,

000

-958,745 28167

45

Net profit before

tax

273,07

0 136,000 40907

0

Income tax

expenses

-

77,249 -53,540 13078

9

Net profit after tax

(NPAT)

195,82

1 82,460 27828

21

Retained earnings

at 1 July 2017

655,06

4

720,520 13755

84

1

8

0

1

11

95

45

4

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.