Financial Accounting Assignment 1 Report - University - 2019

VerifiedAdded on 2023/01/17

|16

|2801

|92

Report

AI Summary

This financial accounting assignment presents a comprehensive annual report for a company, including a statement of profit or loss and other comprehensive income, a statement of financial position, and a statement of changes in equity. The report details various notes to accounts, covering significant accounting policies, prepaid expenses, current liabilities, provisions, contributed equity, general reserves, retained earnings, and other key financial aspects like extraordinary gains, non-operating income, and operating expenses. The report includes Directors' declarations, an annual directors' report, and an annual auditors' report. The report also addresses changes in estimates, dividends, government contracts, legal claims, and trade receivables, providing a holistic view of the company's financial performance and position. The assignment adheres to Australian Accounting Standards and the Corporation Act, 2001.

FINANCIAL

ACCOUNTING

ASSIGNMENT

ACCOUNTING

ASSIGNMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 25 April 2018.

[Type here]

By student name

Professor

University

Date: 25 April 2018.

[Type here]

2

Contents

Background..................................................................................................................................................3

Discussion and Analysis...............................................................................................................................3

Statement of Financial Position...............................................................................................................4

Statement of changes in equity...............................................................................................................5

Notes to accounts....................................................................................................................................6

Other required reports..........................................................................................................................11

Directors Declaration.........................................................................................................................11

Annual Directors report.....................................................................................................................12

Annual auditors report......................................................................................................................13

References.................................................................................................................................................14

[Type here]

Contents

Background..................................................................................................................................................3

Discussion and Analysis...............................................................................................................................3

Statement of Financial Position...............................................................................................................4

Statement of changes in equity...............................................................................................................5

Notes to accounts....................................................................................................................................6

Other required reports..........................................................................................................................11

Directors Declaration.........................................................................................................................11

Annual Directors report.....................................................................................................................12

Annual auditors report......................................................................................................................13

References.................................................................................................................................................14

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Background

A financial report or the annual report has been done for the company in hand for the year ending 30 th

June 2019. All the accounting adjustments has been done and the necessary financial statements have

been prepared and presented below in compliance with the Australian Accounting Standards (issued by

AASB) and the Corporation Act, 2001. Necessary disclosures and the notes on accounts have been

prepared and shown below. In addition to that, other required reports like that of Directors’ declaration,

Annual Directors Report and the Auditors Report has also been included in the assignment.

Discussion and Analysis

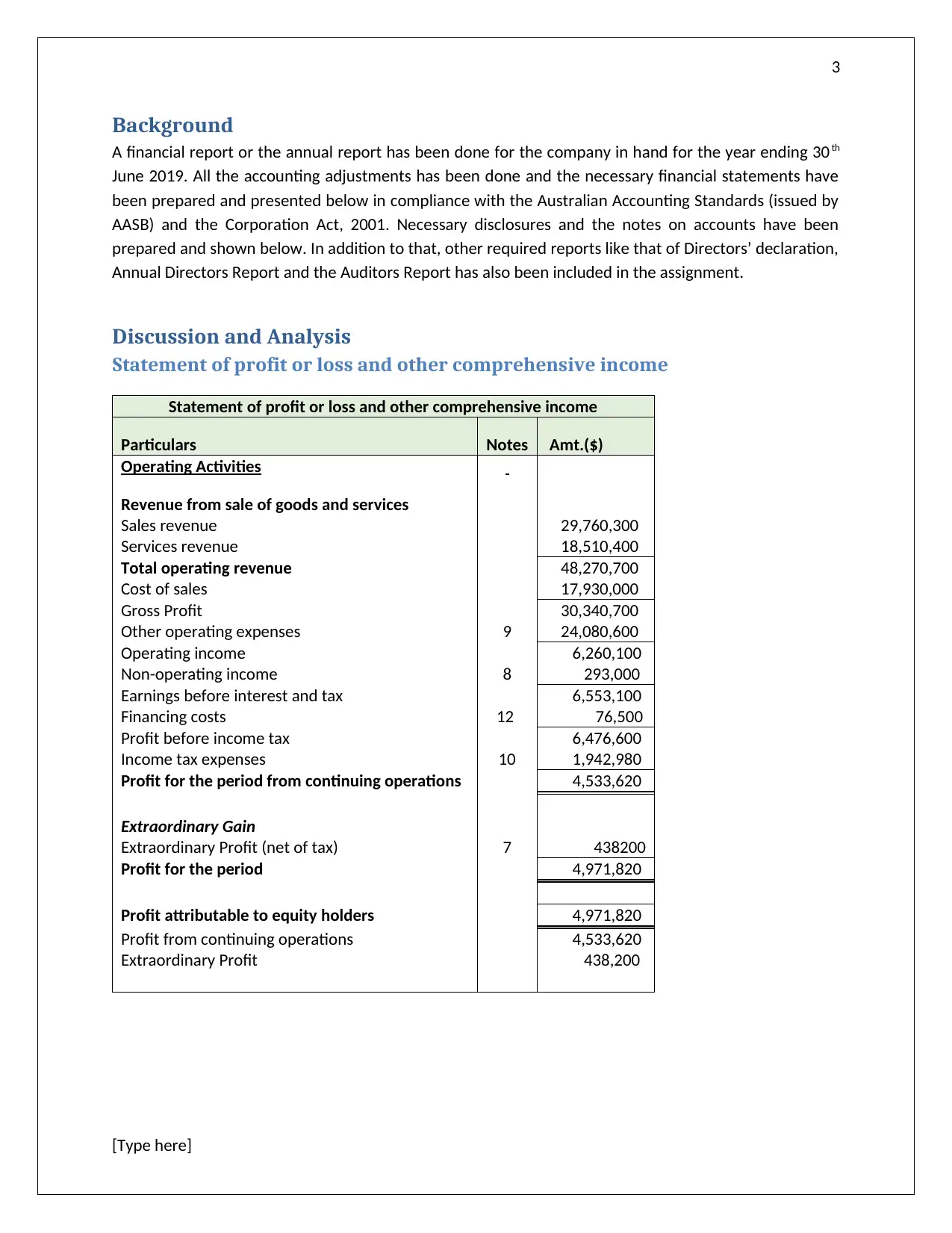

Statement of profit or loss and other comprehensive income

Statement of profit or loss and other comprehensive income

Particulars Notes Amt.($)

Operating Activities

Revenue from sale of goods and services

Sales revenue 29,760,300

Services revenue 18,510,400

Total operating revenue 48,270,700

Cost of sales 17,930,000

Gross Profit 30,340,700

Other operating expenses 9 24,080,600

Operating income 6,260,100

Non-operating income 8 293,000

Earnings before interest and tax 6,553,100

Financing costs 12 76,500

Profit before income tax 6,476,600

Income tax expenses 10 1,942,980

Profit for the period from continuing operations 4,533,620

Extraordinary Gain

Extraordinary Profit (net of tax) 7 438200

Profit for the period 4,971,820

Profit attributable to equity holders 4,971,820

Profit from continuing operations 4,533,620

Extraordinary Profit 438,200

[Type here]

Background

A financial report or the annual report has been done for the company in hand for the year ending 30 th

June 2019. All the accounting adjustments has been done and the necessary financial statements have

been prepared and presented below in compliance with the Australian Accounting Standards (issued by

AASB) and the Corporation Act, 2001. Necessary disclosures and the notes on accounts have been

prepared and shown below. In addition to that, other required reports like that of Directors’ declaration,

Annual Directors Report and the Auditors Report has also been included in the assignment.

Discussion and Analysis

Statement of profit or loss and other comprehensive income

Statement of profit or loss and other comprehensive income

Particulars Notes Amt.($)

Operating Activities

Revenue from sale of goods and services

Sales revenue 29,760,300

Services revenue 18,510,400

Total operating revenue 48,270,700

Cost of sales 17,930,000

Gross Profit 30,340,700

Other operating expenses 9 24,080,600

Operating income 6,260,100

Non-operating income 8 293,000

Earnings before interest and tax 6,553,100

Financing costs 12 76,500

Profit before income tax 6,476,600

Income tax expenses 10 1,942,980

Profit for the period from continuing operations 4,533,620

Extraordinary Gain

Extraordinary Profit (net of tax) 7 438200

Profit for the period 4,971,820

Profit attributable to equity holders 4,971,820

Profit from continuing operations 4,533,620

Extraordinary Profit 438,200

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

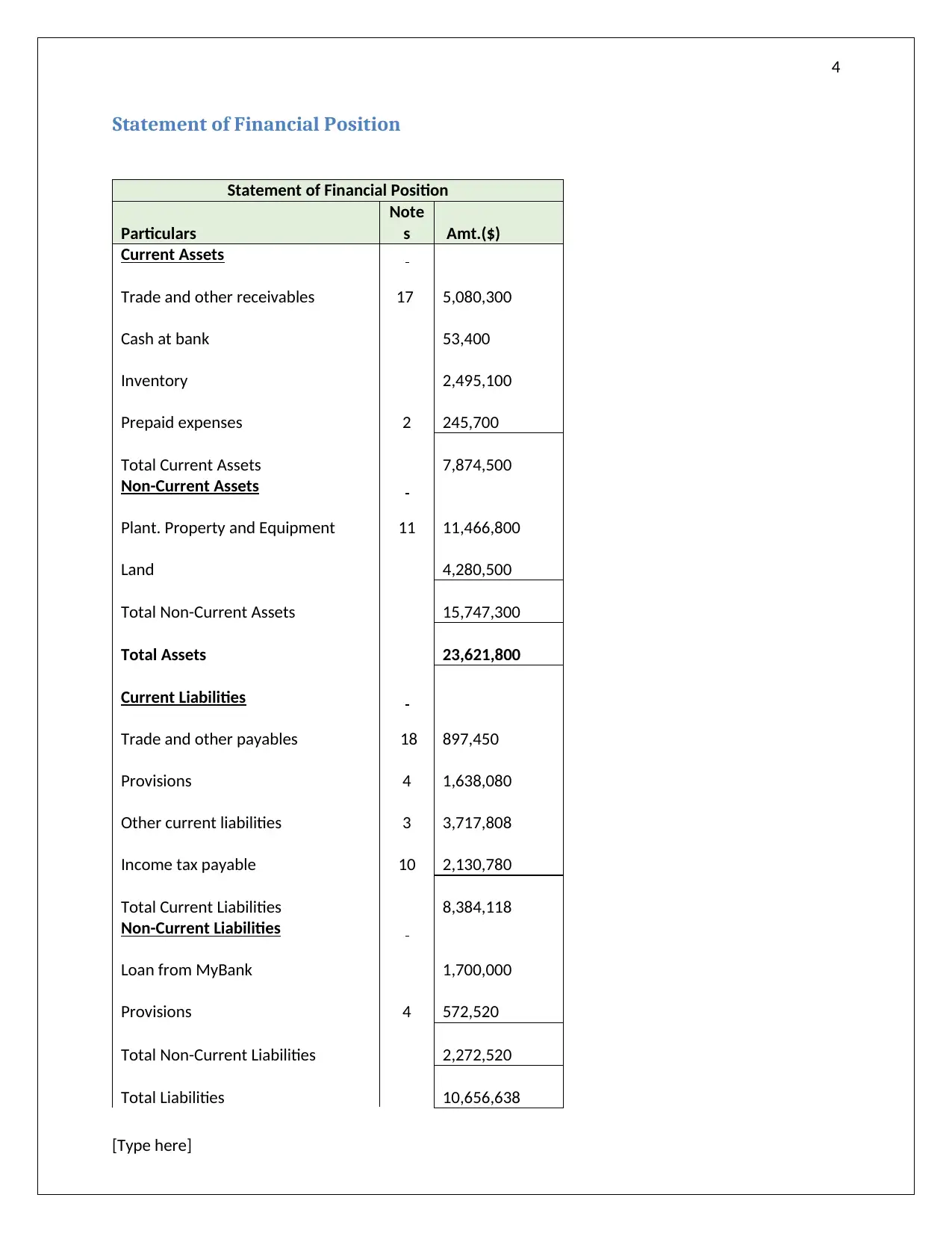

Statement of Financial Position

Statement of Financial Position

Particulars

Note

s Amt.($)

Current Assets

Trade and other receivables 17 5,080,300

Cash at bank 53,400

Inventory 2,495,100

Prepaid expenses 2 245,700

Total Current Assets 7,874,500

Non-Current Assets

Plant. Property and Equipment 11 11,466,800

Land 4,280,500

Total Non-Current Assets 15,747,300

Total Assets 23,621,800

Current Liabilities

Trade and other payables 18 897,450

Provisions 4 1,638,080

Other current liabilities 3 3,717,808

Income tax payable 10 2,130,780

Total Current Liabilities 8,384,118

Non-Current Liabilities

Loan from MyBank 1,700,000

Provisions 4 572,520

Total Non-Current Liabilities 2,272,520

Total Liabilities 10,656,638

[Type here]

Statement of Financial Position

Statement of Financial Position

Particulars

Note

s Amt.($)

Current Assets

Trade and other receivables 17 5,080,300

Cash at bank 53,400

Inventory 2,495,100

Prepaid expenses 2 245,700

Total Current Assets 7,874,500

Non-Current Assets

Plant. Property and Equipment 11 11,466,800

Land 4,280,500

Total Non-Current Assets 15,747,300

Total Assets 23,621,800

Current Liabilities

Trade and other payables 18 897,450

Provisions 4 1,638,080

Other current liabilities 3 3,717,808

Income tax payable 10 2,130,780

Total Current Liabilities 8,384,118

Non-Current Liabilities

Loan from MyBank 1,700,000

Provisions 4 572,520

Total Non-Current Liabilities 2,272,520

Total Liabilities 10,656,638

[Type here]

5

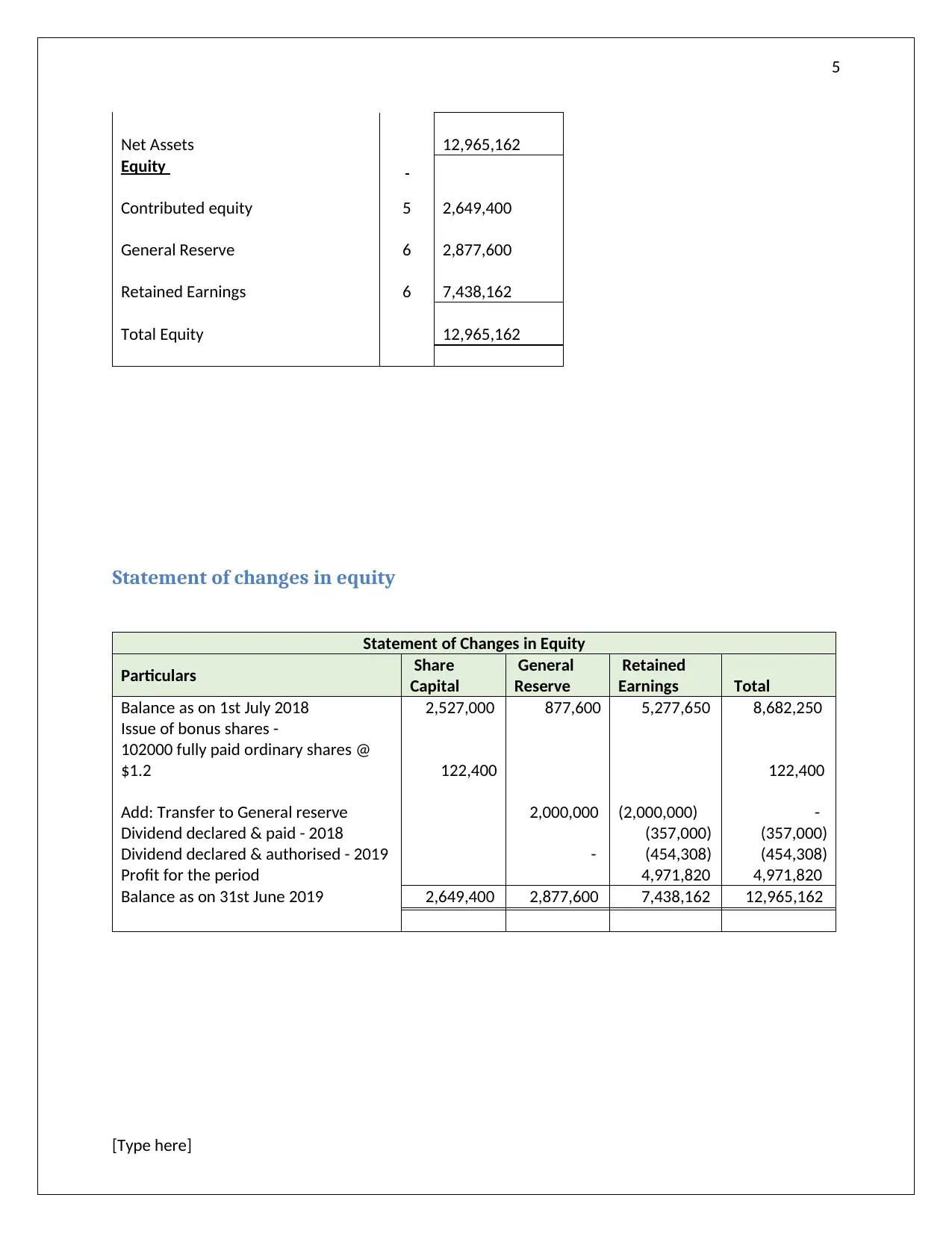

Net Assets 12,965,162

Equity

Contributed equity 5 2,649,400

General Reserve 6 2,877,600

Retained Earnings 6 7,438,162

Total Equity 12,965,162

Statement of changes in equity

Statement of Changes in Equity

Particulars Share

Capital

General

Reserve

Retained

Earnings Total

Balance as on 1st July 2018 2,527,000 877,600 5,277,650 8,682,250

Issue of bonus shares -

102000 fully paid ordinary shares @

$1.2 122,400 122,400

Add: Transfer to General reserve 2,000,000 (2,000,000) -

Dividend declared & paid - 2018 (357,000) (357,000)

Dividend declared & authorised - 2019 - (454,308) (454,308)

Profit for the period 4,971,820 4,971,820

Balance as on 31st June 2019 2,649,400 2,877,600 7,438,162 12,965,162

[Type here]

Net Assets 12,965,162

Equity

Contributed equity 5 2,649,400

General Reserve 6 2,877,600

Retained Earnings 6 7,438,162

Total Equity 12,965,162

Statement of changes in equity

Statement of Changes in Equity

Particulars Share

Capital

General

Reserve

Retained

Earnings Total

Balance as on 1st July 2018 2,527,000 877,600 5,277,650 8,682,250

Issue of bonus shares -

102000 fully paid ordinary shares @

$1.2 122,400 122,400

Add: Transfer to General reserve 2,000,000 (2,000,000) -

Dividend declared & paid - 2018 (357,000) (357,000)

Dividend declared & authorised - 2019 - (454,308) (454,308)

Profit for the period 4,971,820 4,971,820

Balance as on 31st June 2019 2,649,400 2,877,600 7,438,162 12,965,162

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

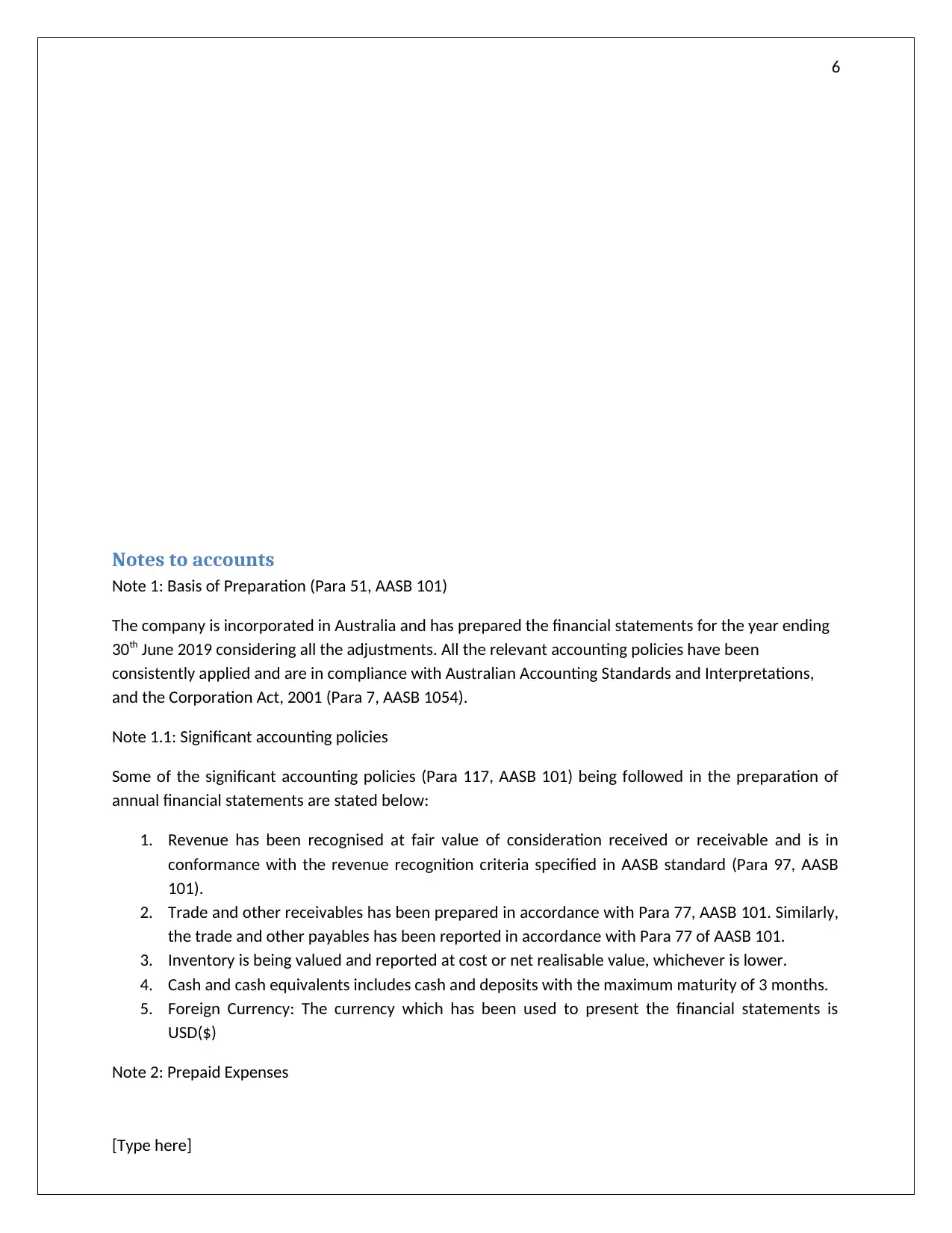

Notes to accounts

Note 1: Basis of Preparation (Para 51, AASB 101)

The company is incorporated in Australia and has prepared the financial statements for the year ending

30th June 2019 considering all the adjustments. All the relevant accounting policies have been

consistently applied and are in compliance with Australian Accounting Standards and Interpretations,

and the Corporation Act, 2001 (Para 7, AASB 1054).

Note 1.1: Significant accounting policies

Some of the significant accounting policies (Para 117, AASB 101) being followed in the preparation of

annual financial statements are stated below:

1. Revenue has been recognised at fair value of consideration received or receivable and is in

conformance with the revenue recognition criteria specified in AASB standard (Para 97, AASB

101).

2. Trade and other receivables has been prepared in accordance with Para 77, AASB 101. Similarly,

the trade and other payables has been reported in accordance with Para 77 of AASB 101.

3. Inventory is being valued and reported at cost or net realisable value, whichever is lower.

4. Cash and cash equivalents includes cash and deposits with the maximum maturity of 3 months.

5. Foreign Currency: The currency which has been used to present the financial statements is

USD($)

Note 2: Prepaid Expenses

[Type here]

Notes to accounts

Note 1: Basis of Preparation (Para 51, AASB 101)

The company is incorporated in Australia and has prepared the financial statements for the year ending

30th June 2019 considering all the adjustments. All the relevant accounting policies have been

consistently applied and are in compliance with Australian Accounting Standards and Interpretations,

and the Corporation Act, 2001 (Para 7, AASB 1054).

Note 1.1: Significant accounting policies

Some of the significant accounting policies (Para 117, AASB 101) being followed in the preparation of

annual financial statements are stated below:

1. Revenue has been recognised at fair value of consideration received or receivable and is in

conformance with the revenue recognition criteria specified in AASB standard (Para 97, AASB

101).

2. Trade and other receivables has been prepared in accordance with Para 77, AASB 101. Similarly,

the trade and other payables has been reported in accordance with Para 77 of AASB 101.

3. Inventory is being valued and reported at cost or net realisable value, whichever is lower.

4. Cash and cash equivalents includes cash and deposits with the maximum maturity of 3 months.

5. Foreign Currency: The currency which has been used to present the financial statements is

USD($)

Note 2: Prepaid Expenses

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

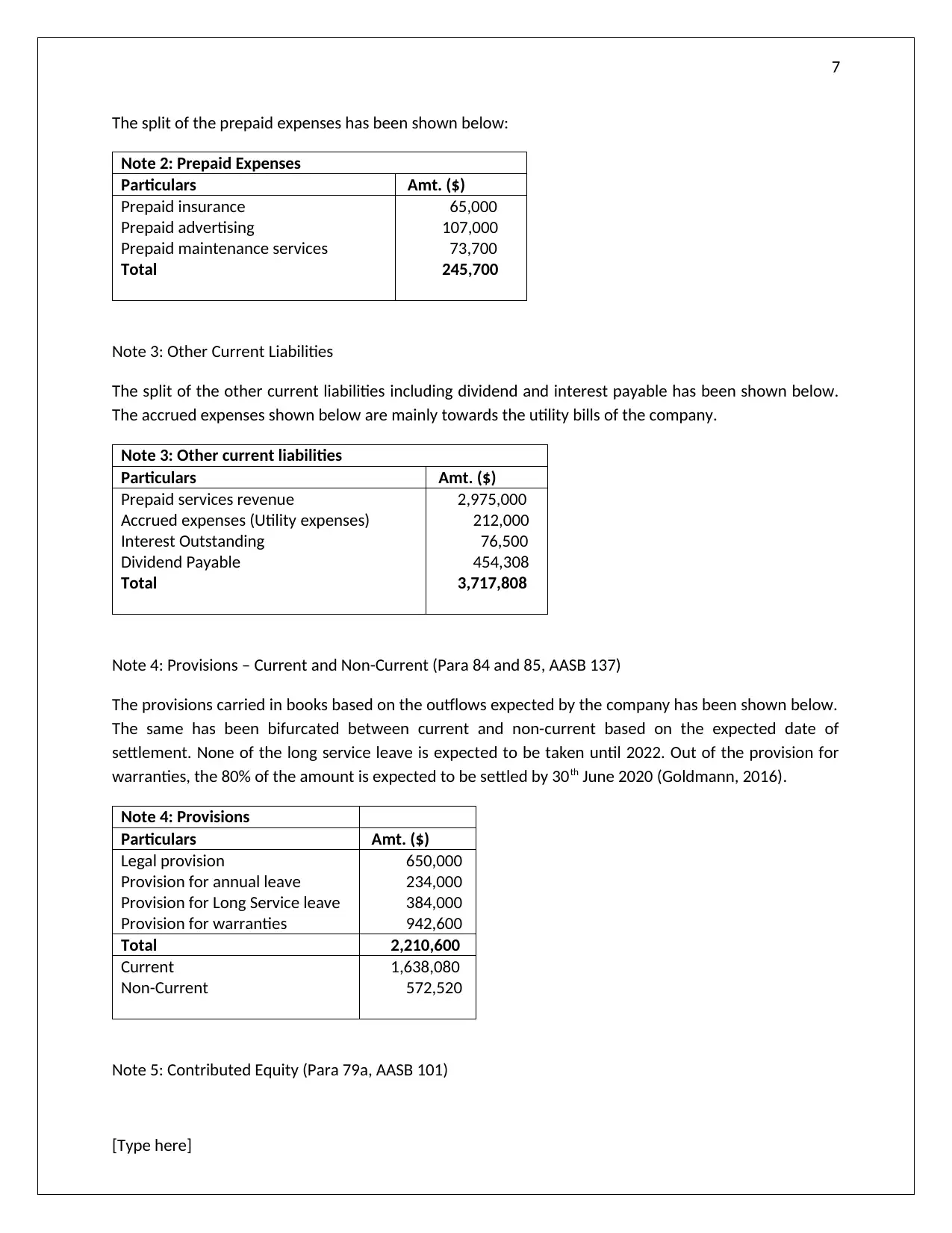

The split of the prepaid expenses has been shown below:

Note 2: Prepaid Expenses

Particulars Amt. ($)

Prepaid insurance 65,000

Prepaid advertising 107,000

Prepaid maintenance services 73,700

Total 245,700

Note 3: Other Current Liabilities

The split of the other current liabilities including dividend and interest payable has been shown below.

The accrued expenses shown below are mainly towards the utility bills of the company.

Note 3: Other current liabilities

Particulars Amt. ($)

Prepaid services revenue 2,975,000

Accrued expenses (Utility expenses) 212,000

Interest Outstanding 76,500

Dividend Payable 454,308

Total 3,717,808

Note 4: Provisions – Current and Non-Current (Para 84 and 85, AASB 137)

The provisions carried in books based on the outflows expected by the company has been shown below.

The same has been bifurcated between current and non-current based on the expected date of

settlement. None of the long service leave is expected to be taken until 2022. Out of the provision for

warranties, the 80% of the amount is expected to be settled by 30th June 2020 (Goldmann, 2016).

Note 4: Provisions

Particulars Amt. ($)

Legal provision 650,000

Provision for annual leave 234,000

Provision for Long Service leave 384,000

Provision for warranties 942,600

Total 2,210,600

Current 1,638,080

Non-Current 572,520

Note 5: Contributed Equity (Para 79a, AASB 101)

[Type here]

The split of the prepaid expenses has been shown below:

Note 2: Prepaid Expenses

Particulars Amt. ($)

Prepaid insurance 65,000

Prepaid advertising 107,000

Prepaid maintenance services 73,700

Total 245,700

Note 3: Other Current Liabilities

The split of the other current liabilities including dividend and interest payable has been shown below.

The accrued expenses shown below are mainly towards the utility bills of the company.

Note 3: Other current liabilities

Particulars Amt. ($)

Prepaid services revenue 2,975,000

Accrued expenses (Utility expenses) 212,000

Interest Outstanding 76,500

Dividend Payable 454,308

Total 3,717,808

Note 4: Provisions – Current and Non-Current (Para 84 and 85, AASB 137)

The provisions carried in books based on the outflows expected by the company has been shown below.

The same has been bifurcated between current and non-current based on the expected date of

settlement. None of the long service leave is expected to be taken until 2022. Out of the provision for

warranties, the 80% of the amount is expected to be settled by 30th June 2020 (Goldmann, 2016).

Note 4: Provisions

Particulars Amt. ($)

Legal provision 650,000

Provision for annual leave 234,000

Provision for Long Service leave 384,000

Provision for warranties 942,600

Total 2,210,600

Current 1,638,080

Non-Current 572,520

Note 5: Contributed Equity (Para 79a, AASB 101)

[Type here]

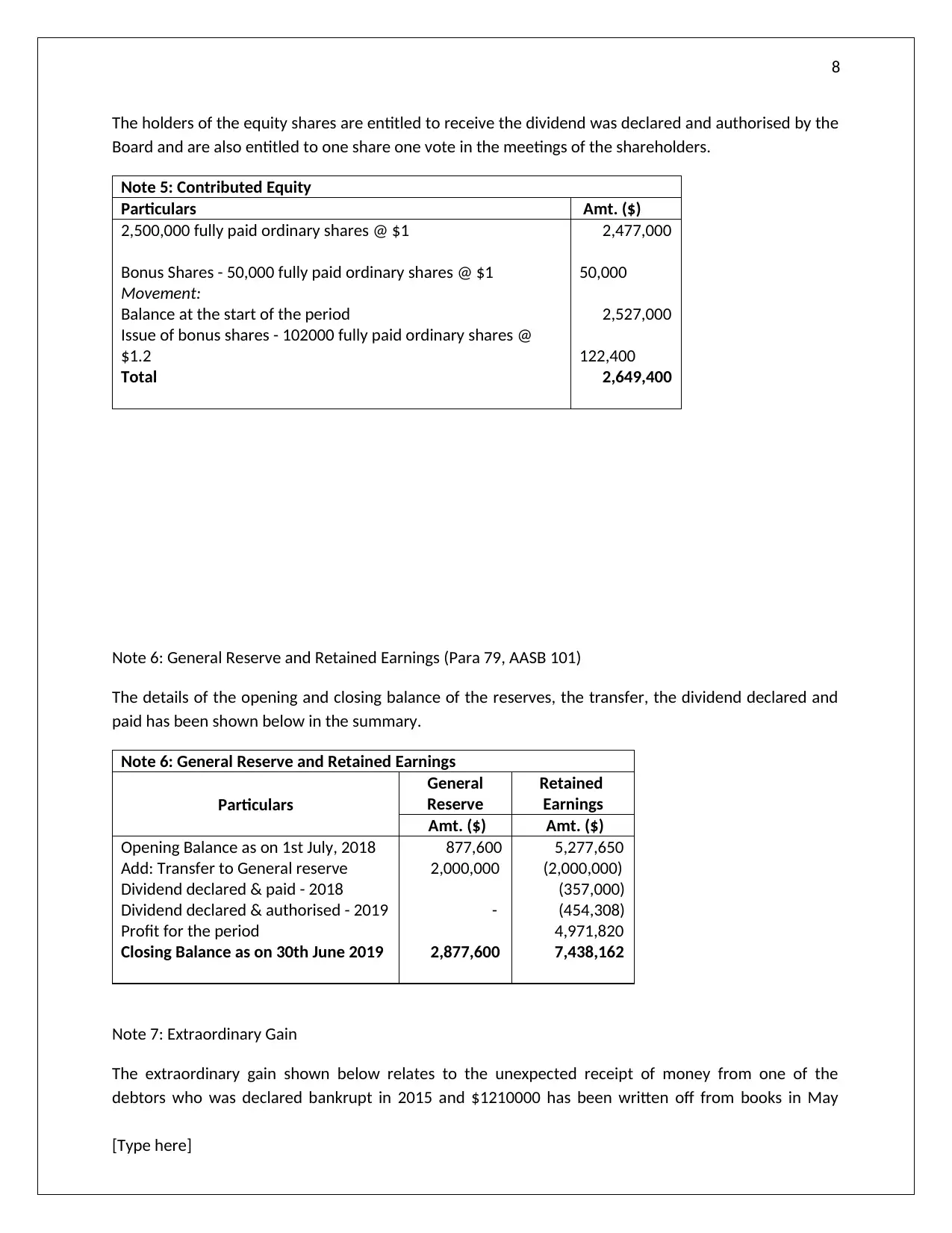

8

The holders of the equity shares are entitled to receive the dividend was declared and authorised by the

Board and are also entitled to one share one vote in the meetings of the shareholders.

Note 5: Contributed Equity

Particulars Amt. ($)

2,500,000 fully paid ordinary shares @ $1 2,477,000

Bonus Shares - 50,000 fully paid ordinary shares @ $1 50,000

Movement:

Balance at the start of the period 2,527,000

Issue of bonus shares - 102000 fully paid ordinary shares @

$1.2 122,400

Total 2,649,400

Note 6: General Reserve and Retained Earnings (Para 79, AASB 101)

The details of the opening and closing balance of the reserves, the transfer, the dividend declared and

paid has been shown below in the summary.

Note 6: General Reserve and Retained Earnings

Particulars

General

Reserve

Retained

Earnings

Amt. ($) Amt. ($)

Opening Balance as on 1st July, 2018 877,600 5,277,650

Add: Transfer to General reserve 2,000,000 (2,000,000)

Dividend declared & paid - 2018 (357,000)

Dividend declared & authorised - 2019 - (454,308)

Profit for the period 4,971,820

Closing Balance as on 30th June 2019 2,877,600 7,438,162

Note 7: Extraordinary Gain

The extraordinary gain shown below relates to the unexpected receipt of money from one of the

debtors who was declared bankrupt in 2015 and $1210000 has been written off from books in May

[Type here]

The holders of the equity shares are entitled to receive the dividend was declared and authorised by the

Board and are also entitled to one share one vote in the meetings of the shareholders.

Note 5: Contributed Equity

Particulars Amt. ($)

2,500,000 fully paid ordinary shares @ $1 2,477,000

Bonus Shares - 50,000 fully paid ordinary shares @ $1 50,000

Movement:

Balance at the start of the period 2,527,000

Issue of bonus shares - 102000 fully paid ordinary shares @

$1.2 122,400

Total 2,649,400

Note 6: General Reserve and Retained Earnings (Para 79, AASB 101)

The details of the opening and closing balance of the reserves, the transfer, the dividend declared and

paid has been shown below in the summary.

Note 6: General Reserve and Retained Earnings

Particulars

General

Reserve

Retained

Earnings

Amt. ($) Amt. ($)

Opening Balance as on 1st July, 2018 877,600 5,277,650

Add: Transfer to General reserve 2,000,000 (2,000,000)

Dividend declared & paid - 2018 (357,000)

Dividend declared & authorised - 2019 - (454,308)

Profit for the period 4,971,820

Closing Balance as on 30th June 2019 2,877,600 7,438,162

Note 7: Extraordinary Gain

The extraordinary gain shown below relates to the unexpected receipt of money from one of the

debtors who was declared bankrupt in 2015 and $1210000 has been written off from books in May

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

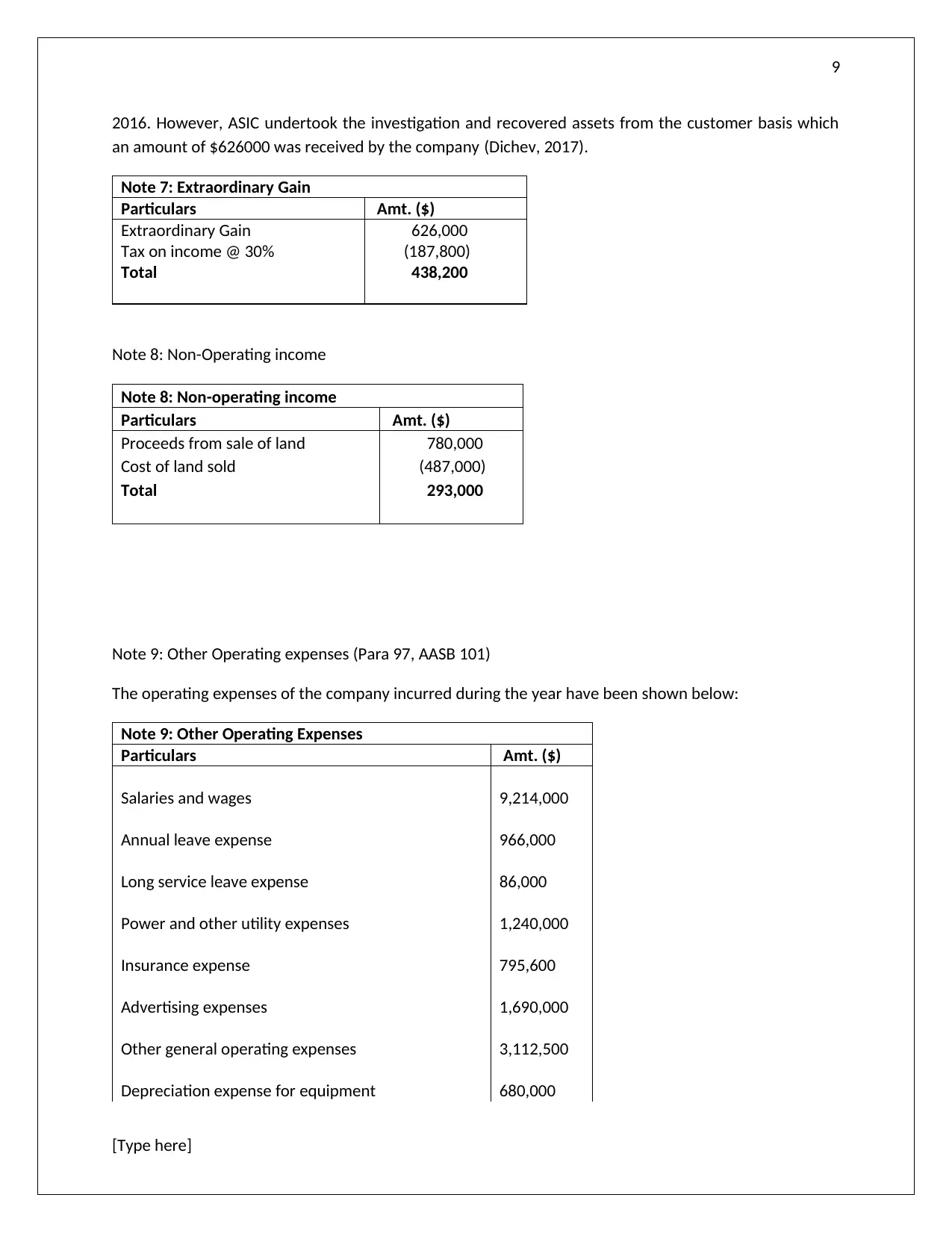

2016. However, ASIC undertook the investigation and recovered assets from the customer basis which

an amount of $626000 was received by the company (Dichev, 2017).

Note 7: Extraordinary Gain

Particulars Amt. ($)

Extraordinary Gain 626,000

Tax on income @ 30% (187,800)

Total 438,200

Note 8: Non-Operating income

Note 8: Non-operating income

Particulars Amt. ($)

Proceeds from sale of land 780,000

Cost of land sold (487,000)

Total 293,000

Note 9: Other Operating expenses (Para 97, AASB 101)

The operating expenses of the company incurred during the year have been shown below:

Note 9: Other Operating Expenses

Particulars Amt. ($)

Salaries and wages 9,214,000

Annual leave expense 966,000

Long service leave expense 86,000

Power and other utility expenses 1,240,000

Insurance expense 795,600

Advertising expenses 1,690,000

Other general operating expenses 3,112,500

Depreciation expense for equipment 680,000

[Type here]

2016. However, ASIC undertook the investigation and recovered assets from the customer basis which

an amount of $626000 was received by the company (Dichev, 2017).

Note 7: Extraordinary Gain

Particulars Amt. ($)

Extraordinary Gain 626,000

Tax on income @ 30% (187,800)

Total 438,200

Note 8: Non-Operating income

Note 8: Non-operating income

Particulars Amt. ($)

Proceeds from sale of land 780,000

Cost of land sold (487,000)

Total 293,000

Note 9: Other Operating expenses (Para 97, AASB 101)

The operating expenses of the company incurred during the year have been shown below:

Note 9: Other Operating Expenses

Particulars Amt. ($)

Salaries and wages 9,214,000

Annual leave expense 966,000

Long service leave expense 86,000

Power and other utility expenses 1,240,000

Insurance expense 795,600

Advertising expenses 1,690,000

Other general operating expenses 3,112,500

Depreciation expense for equipment 680,000

[Type here]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

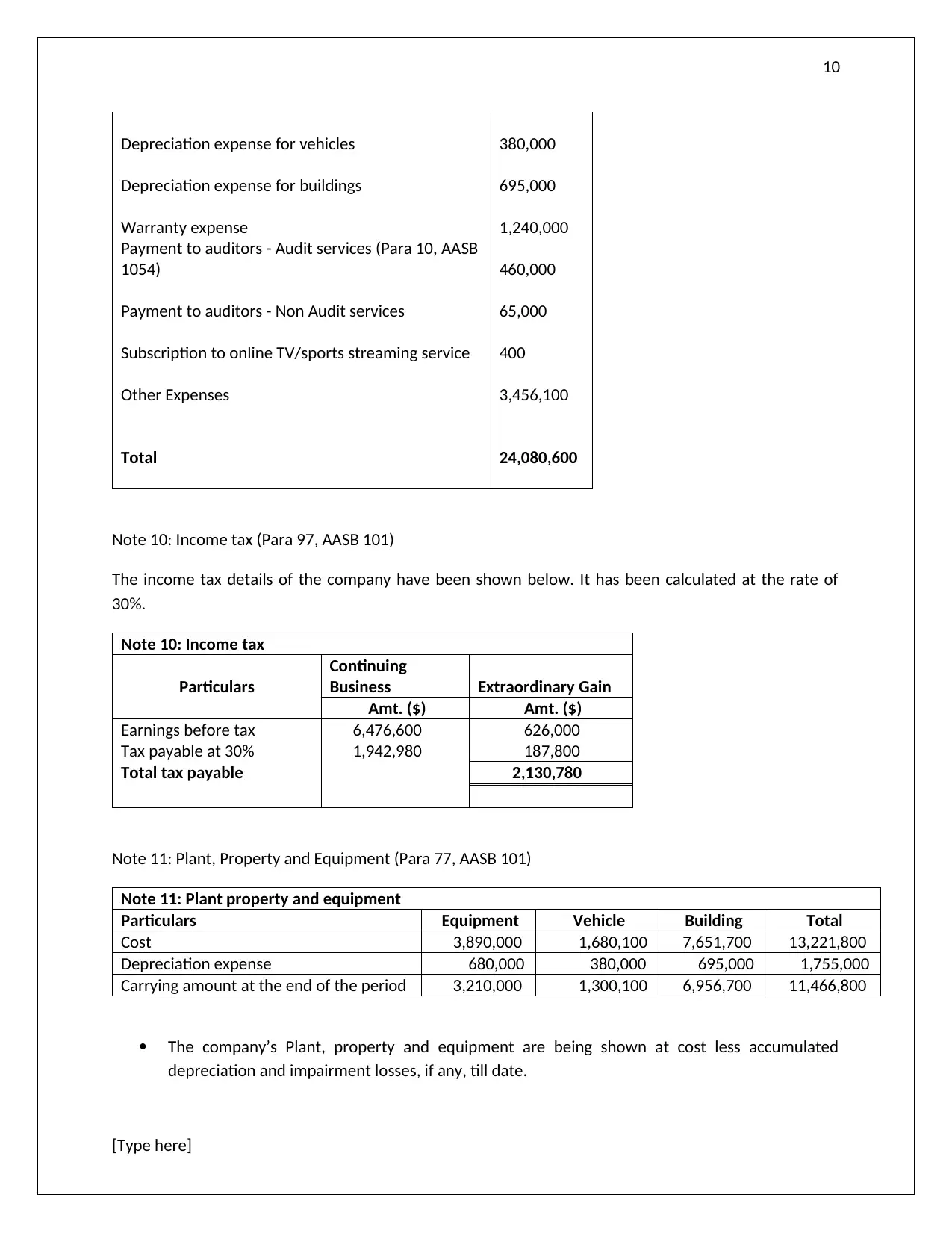

10

Depreciation expense for vehicles 380,000

Depreciation expense for buildings 695,000

Warranty expense 1,240,000

Payment to auditors - Audit services (Para 10, AASB

1054) 460,000

Payment to auditors - Non Audit services 65,000

Subscription to online TV/sports streaming service 400

Other Expenses 3,456,100

Total 24,080,600

Note 10: Income tax (Para 97, AASB 101)

The income tax details of the company have been shown below. It has been calculated at the rate of

30%.

Note 10: Income tax

Particulars

Continuing

Business Extraordinary Gain

Amt. ($) Amt. ($)

Earnings before tax 6,476,600 626,000

Tax payable at 30% 1,942,980 187,800

Total tax payable 2,130,780

Note 11: Plant, Property and Equipment (Para 77, AASB 101)

Note 11: Plant property and equipment

Particulars Equipment Vehicle Building Total

Cost 3,890,000 1,680,100 7,651,700 13,221,800

Depreciation expense 680,000 380,000 695,000 1,755,000

Carrying amount at the end of the period 3,210,000 1,300,100 6,956,700 11,466,800

The company’s Plant, property and equipment are being shown at cost less accumulated

depreciation and impairment losses, if any, till date.

[Type here]

Depreciation expense for vehicles 380,000

Depreciation expense for buildings 695,000

Warranty expense 1,240,000

Payment to auditors - Audit services (Para 10, AASB

1054) 460,000

Payment to auditors - Non Audit services 65,000

Subscription to online TV/sports streaming service 400

Other Expenses 3,456,100

Total 24,080,600

Note 10: Income tax (Para 97, AASB 101)

The income tax details of the company have been shown below. It has been calculated at the rate of

30%.

Note 10: Income tax

Particulars

Continuing

Business Extraordinary Gain

Amt. ($) Amt. ($)

Earnings before tax 6,476,600 626,000

Tax payable at 30% 1,942,980 187,800

Total tax payable 2,130,780

Note 11: Plant, Property and Equipment (Para 77, AASB 101)

Note 11: Plant property and equipment

Particulars Equipment Vehicle Building Total

Cost 3,890,000 1,680,100 7,651,700 13,221,800

Depreciation expense 680,000 380,000 695,000 1,755,000

Carrying amount at the end of the period 3,210,000 1,300,100 6,956,700 11,466,800

The company’s Plant, property and equipment are being shown at cost less accumulated

depreciation and impairment losses, if any, till date.

[Type here]

11

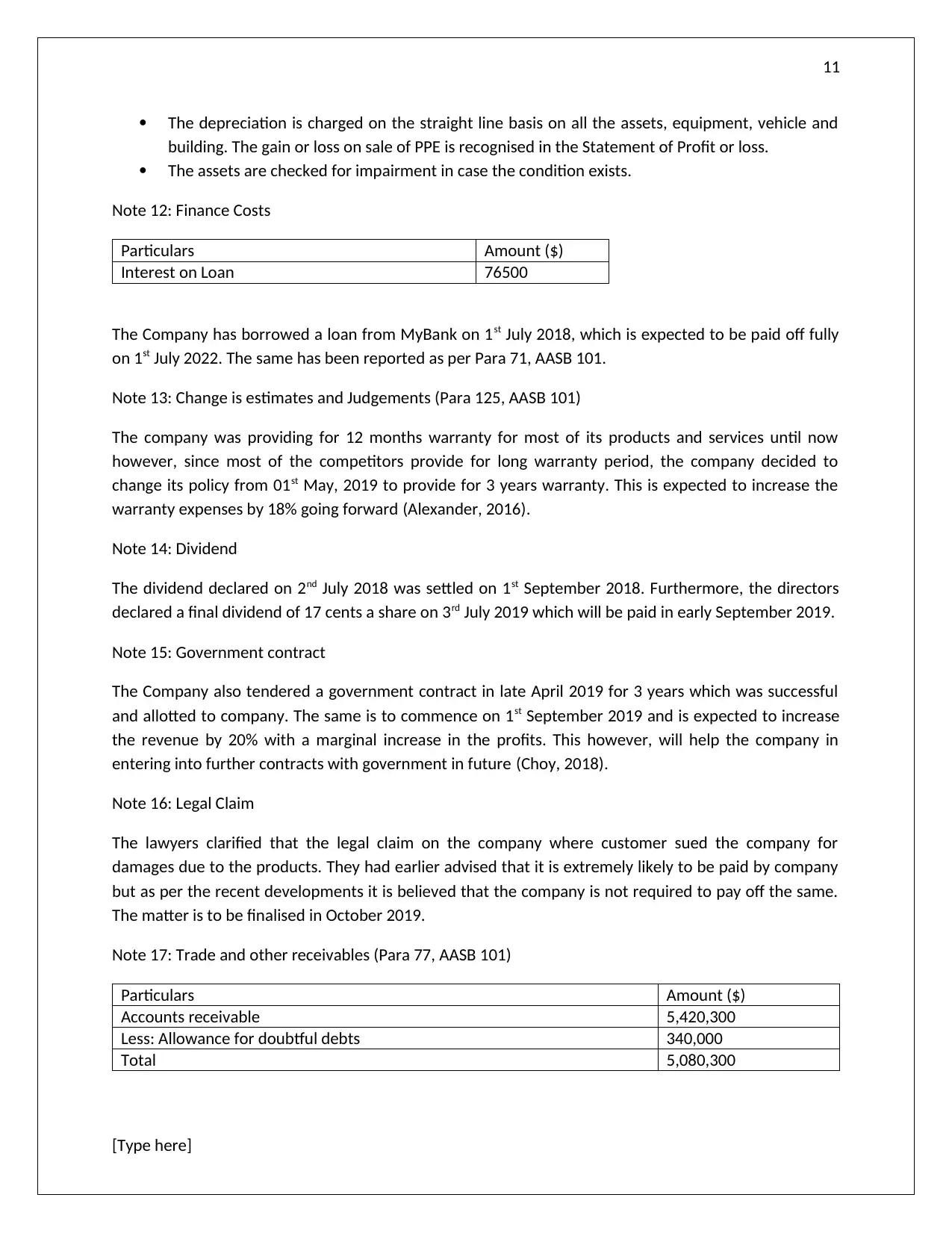

The depreciation is charged on the straight line basis on all the assets, equipment, vehicle and

building. The gain or loss on sale of PPE is recognised in the Statement of Profit or loss.

The assets are checked for impairment in case the condition exists.

Note 12: Finance Costs

Particulars Amount ($)

Interest on Loan 76500

The Company has borrowed a loan from MyBank on 1st July 2018, which is expected to be paid off fully

on 1st July 2022. The same has been reported as per Para 71, AASB 101.

Note 13: Change is estimates and Judgements (Para 125, AASB 101)

The company was providing for 12 months warranty for most of its products and services until now

however, since most of the competitors provide for long warranty period, the company decided to

change its policy from 01st May, 2019 to provide for 3 years warranty. This is expected to increase the

warranty expenses by 18% going forward (Alexander, 2016).

Note 14: Dividend

The dividend declared on 2nd July 2018 was settled on 1st September 2018. Furthermore, the directors

declared a final dividend of 17 cents a share on 3rd July 2019 which will be paid in early September 2019.

Note 15: Government contract

The Company also tendered a government contract in late April 2019 for 3 years which was successful

and allotted to company. The same is to commence on 1st September 2019 and is expected to increase

the revenue by 20% with a marginal increase in the profits. This however, will help the company in

entering into further contracts with government in future (Choy, 2018).

Note 16: Legal Claim

The lawyers clarified that the legal claim on the company where customer sued the company for

damages due to the products. They had earlier advised that it is extremely likely to be paid by company

but as per the recent developments it is believed that the company is not required to pay off the same.

The matter is to be finalised in October 2019.

Note 17: Trade and other receivables (Para 77, AASB 101)

Particulars Amount ($)

Accounts receivable 5,420,300

Less: Allowance for doubtful debts 340,000

Total 5,080,300

[Type here]

The depreciation is charged on the straight line basis on all the assets, equipment, vehicle and

building. The gain or loss on sale of PPE is recognised in the Statement of Profit or loss.

The assets are checked for impairment in case the condition exists.

Note 12: Finance Costs

Particulars Amount ($)

Interest on Loan 76500

The Company has borrowed a loan from MyBank on 1st July 2018, which is expected to be paid off fully

on 1st July 2022. The same has been reported as per Para 71, AASB 101.

Note 13: Change is estimates and Judgements (Para 125, AASB 101)

The company was providing for 12 months warranty for most of its products and services until now

however, since most of the competitors provide for long warranty period, the company decided to

change its policy from 01st May, 2019 to provide for 3 years warranty. This is expected to increase the

warranty expenses by 18% going forward (Alexander, 2016).

Note 14: Dividend

The dividend declared on 2nd July 2018 was settled on 1st September 2018. Furthermore, the directors

declared a final dividend of 17 cents a share on 3rd July 2019 which will be paid in early September 2019.

Note 15: Government contract

The Company also tendered a government contract in late April 2019 for 3 years which was successful

and allotted to company. The same is to commence on 1st September 2019 and is expected to increase

the revenue by 20% with a marginal increase in the profits. This however, will help the company in

entering into further contracts with government in future (Choy, 2018).

Note 16: Legal Claim

The lawyers clarified that the legal claim on the company where customer sued the company for

damages due to the products. They had earlier advised that it is extremely likely to be paid by company

but as per the recent developments it is believed that the company is not required to pay off the same.

The matter is to be finalised in October 2019.

Note 17: Trade and other receivables (Para 77, AASB 101)

Particulars Amount ($)

Accounts receivable 5,420,300

Less: Allowance for doubtful debts 340,000

Total 5,080,300

[Type here]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.