Financial Analysis and Reporting

VerifiedAdded on 2020/03/23

|10

|2185

|29

AI Summary

This assignment tasks you with analyzing a provided financial report of a New Zealand company. You need to explain various aspects including borrowings (mortgage and bank loan), asset revaluation reserve, issued and paid-up capital, and retained earnings. The analysis should reference relevant NZ FRS guidelines for clarity and accuracy.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL ACCOUNTING ASSIGNMENT

Financial Accounting Assignment

Student’s Name:

University Name:

Author Note

Financial Accounting Assignment

Student’s Name:

University Name:

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL ACCOUNTING ASSIGNMENT

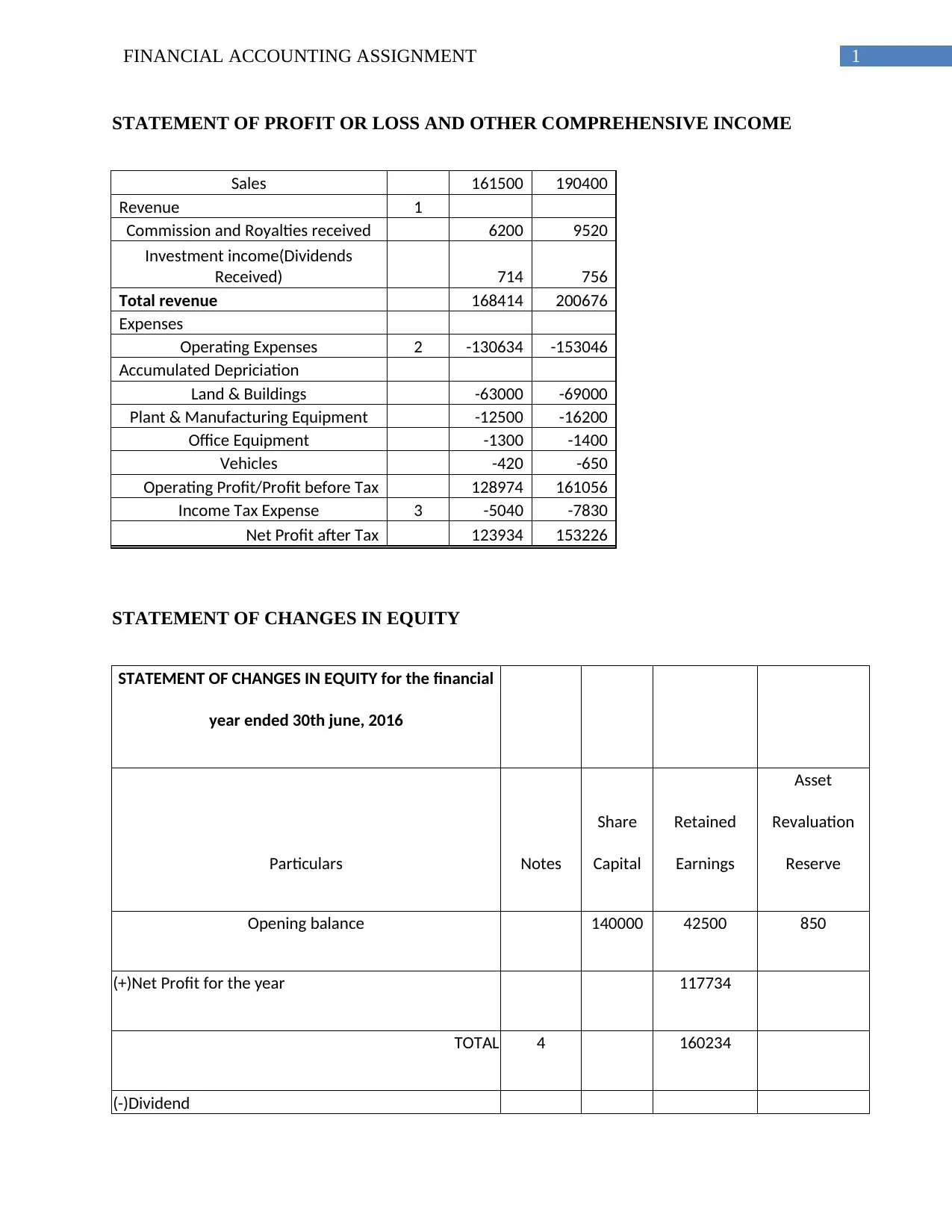

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

Sales 161500 190400

Revenue 1

Commission and Royalties received 6200 9520

Investment income(Dividends

Received) 714 756

Total revenue 168414 200676

Expenses

Operating Expenses 2 -130634 -153046

Accumulated Depriciation

Land & Buildings -63000 -69000

Plant & Manufacturing Equipment -12500 -16200

Office Equipment -1300 -1400

Vehicles -420 -650

Operating Profit/Profit before Tax 128974 161056

Income Tax Expense 3 -5040 -7830

Net Profit after Tax 123934 153226

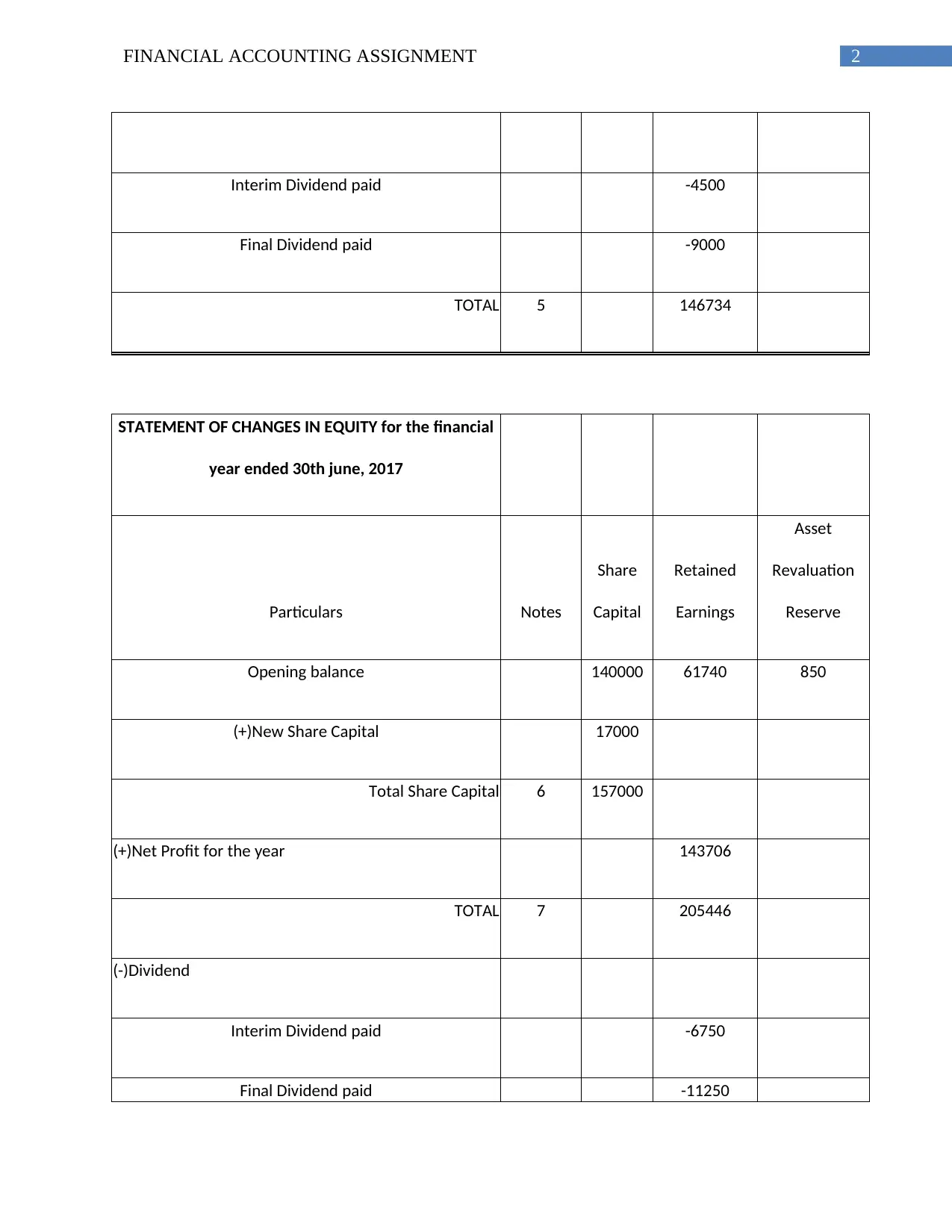

STATEMENT OF CHANGES IN EQUITY

STATEMENT OF CHANGES IN EQUITY for the financial

year ended 30th june, 2016

Particulars Notes

Share

Capital

Retained

Earnings

Asset

Revaluation

Reserve

Opening balance 140000 42500 850

(+)Net Profit for the year 117734

TOTAL 4 160234

(-)Dividend

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

Sales 161500 190400

Revenue 1

Commission and Royalties received 6200 9520

Investment income(Dividends

Received) 714 756

Total revenue 168414 200676

Expenses

Operating Expenses 2 -130634 -153046

Accumulated Depriciation

Land & Buildings -63000 -69000

Plant & Manufacturing Equipment -12500 -16200

Office Equipment -1300 -1400

Vehicles -420 -650

Operating Profit/Profit before Tax 128974 161056

Income Tax Expense 3 -5040 -7830

Net Profit after Tax 123934 153226

STATEMENT OF CHANGES IN EQUITY

STATEMENT OF CHANGES IN EQUITY for the financial

year ended 30th june, 2016

Particulars Notes

Share

Capital

Retained

Earnings

Asset

Revaluation

Reserve

Opening balance 140000 42500 850

(+)Net Profit for the year 117734

TOTAL 4 160234

(-)Dividend

2FINANCIAL ACCOUNTING ASSIGNMENT

Interim Dividend paid -4500

Final Dividend paid -9000

TOTAL 5 146734

STATEMENT OF CHANGES IN EQUITY for the financial

year ended 30th june, 2017

Particulars Notes

Share

Capital

Retained

Earnings

Asset

Revaluation

Reserve

Opening balance 140000 61740 850

(+)New Share Capital 17000

Total Share Capital 6 157000

(+)Net Profit for the year 143706

TOTAL 7 205446

(-)Dividend

Interim Dividend paid -6750

Final Dividend paid -11250

Interim Dividend paid -4500

Final Dividend paid -9000

TOTAL 5 146734

STATEMENT OF CHANGES IN EQUITY for the financial

year ended 30th june, 2017

Particulars Notes

Share

Capital

Retained

Earnings

Asset

Revaluation

Reserve

Opening balance 140000 61740 850

(+)New Share Capital 17000

Total Share Capital 6 157000

(+)Net Profit for the year 143706

TOTAL 7 205446

(-)Dividend

Interim Dividend paid -6750

Final Dividend paid -11250

3FINANCIAL ACCOUNTING ASSIGNMENT

TOTAL 8 187446

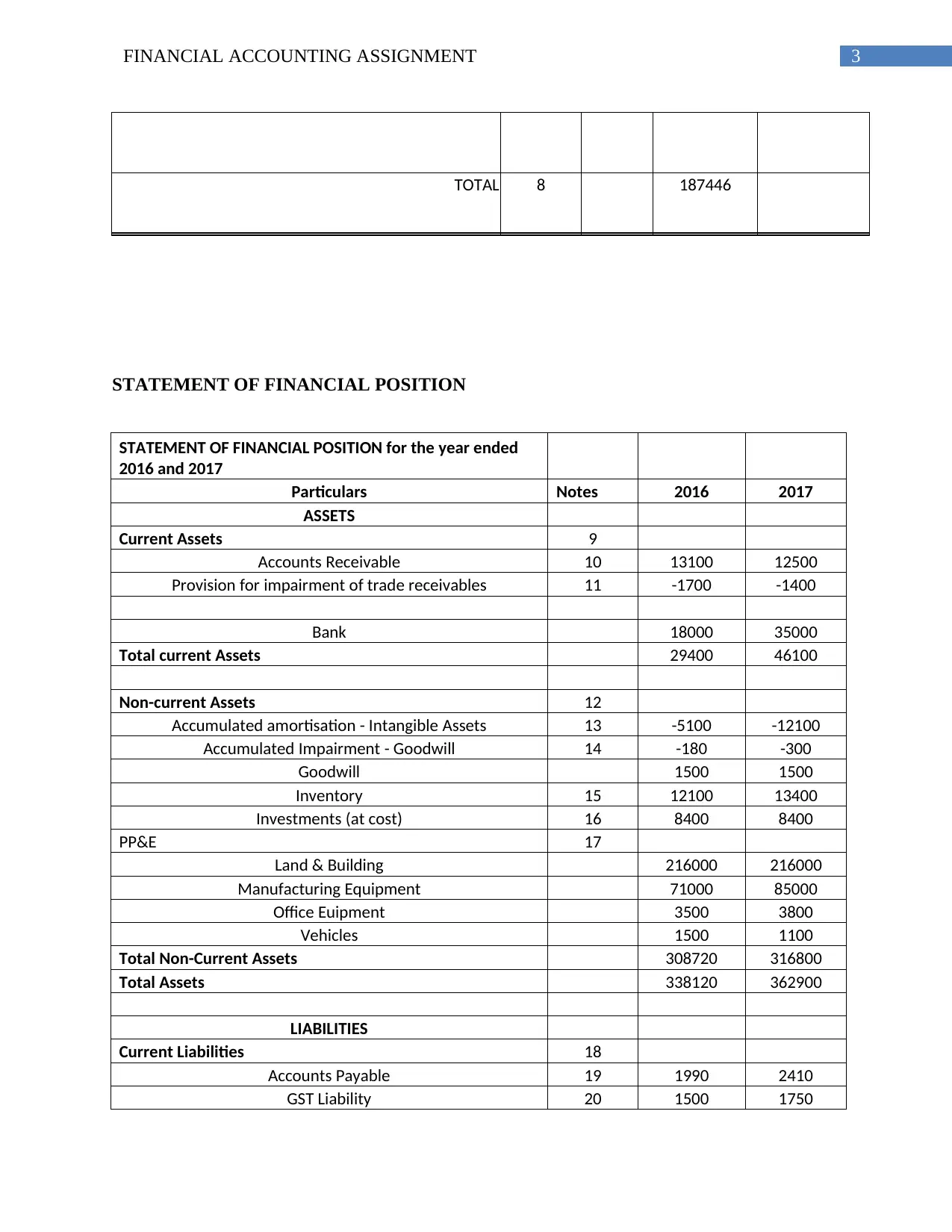

STATEMENT OF FINANCIAL POSITION

STATEMENT OF FINANCIAL POSITION for the year ended

2016 and 2017

Particulars Notes 2016 2017

ASSETS

Current Assets 9

Accounts Receivable 10 13100 12500

Provision for impairment of trade receivables 11 -1700 -1400

Bank 18000 35000

Total current Assets 29400 46100

Non-current Assets 12

Accumulated amortisation - Intangible Assets 13 -5100 -12100

Accumulated Impairment - Goodwill 14 -180 -300

Goodwill 1500 1500

Inventory 15 12100 13400

Investments (at cost) 16 8400 8400

PP&E 17

Land & Building 216000 216000

Manufacturing Equipment 71000 85000

Office Euipment 3500 3800

Vehicles 1500 1100

Total Non-Current Assets 308720 316800

Total Assets 338120 362900

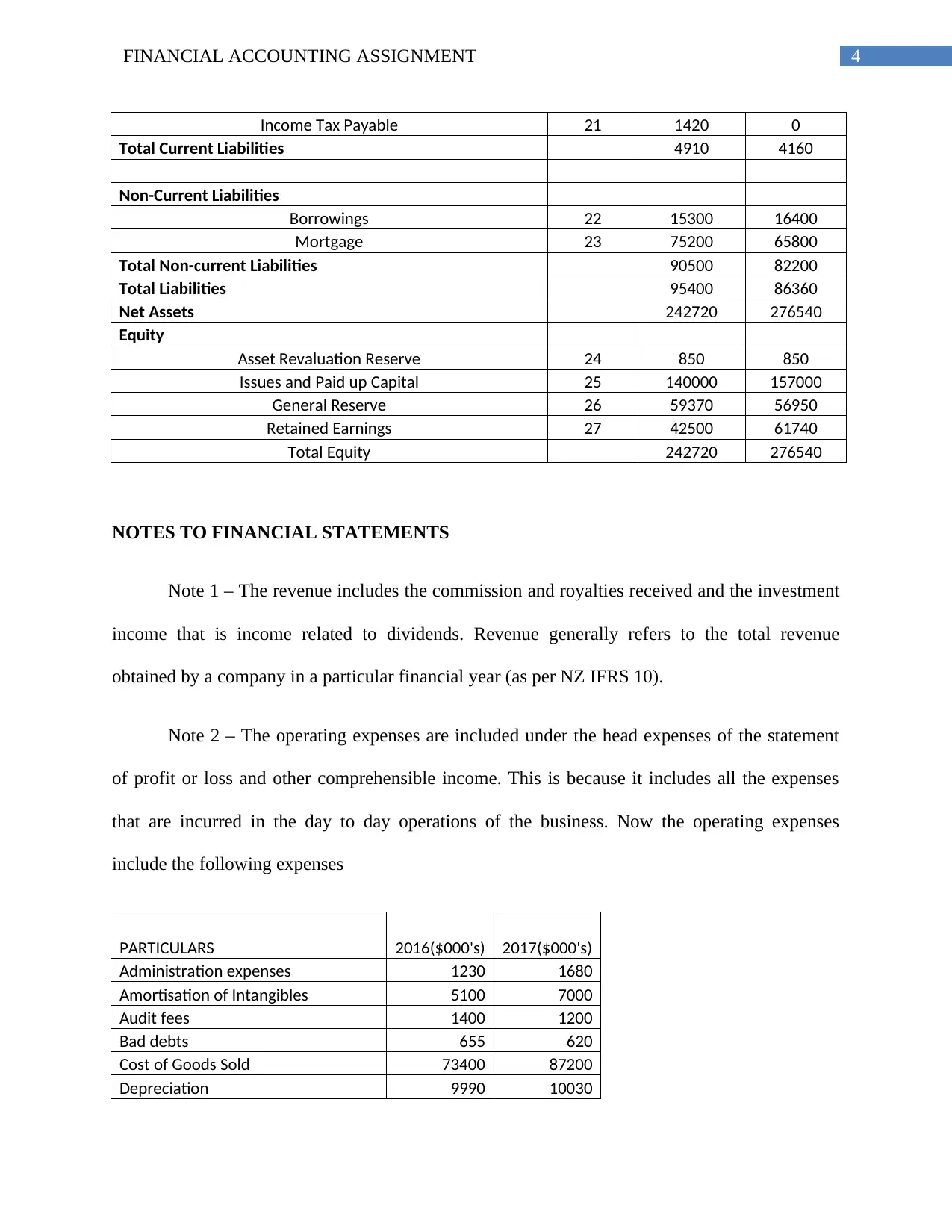

LIABILITIES

Current Liabilities 18

Accounts Payable 19 1990 2410

GST Liability 20 1500 1750

TOTAL 8 187446

STATEMENT OF FINANCIAL POSITION

STATEMENT OF FINANCIAL POSITION for the year ended

2016 and 2017

Particulars Notes 2016 2017

ASSETS

Current Assets 9

Accounts Receivable 10 13100 12500

Provision for impairment of trade receivables 11 -1700 -1400

Bank 18000 35000

Total current Assets 29400 46100

Non-current Assets 12

Accumulated amortisation - Intangible Assets 13 -5100 -12100

Accumulated Impairment - Goodwill 14 -180 -300

Goodwill 1500 1500

Inventory 15 12100 13400

Investments (at cost) 16 8400 8400

PP&E 17

Land & Building 216000 216000

Manufacturing Equipment 71000 85000

Office Euipment 3500 3800

Vehicles 1500 1100

Total Non-Current Assets 308720 316800

Total Assets 338120 362900

LIABILITIES

Current Liabilities 18

Accounts Payable 19 1990 2410

GST Liability 20 1500 1750

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL ACCOUNTING ASSIGNMENT

Income Tax Payable 21 1420 0

Total Current Liabilities 4910 4160

Non-Current Liabilities

Borrowings 22 15300 16400

Mortgage 23 75200 65800

Total Non-current Liabilities 90500 82200

Total Liabilities 95400 86360

Net Assets 242720 276540

Equity

Asset Revaluation Reserve 24 850 850

Issues and Paid up Capital 25 140000 157000

General Reserve 26 59370 56950

Retained Earnings 27 42500 61740

Total Equity 242720 276540

NOTES TO FINANCIAL STATEMENTS

Note 1 – The revenue includes the commission and royalties received and the investment

income that is income related to dividends. Revenue generally refers to the total revenue

obtained by a company in a particular financial year (as per NZ IFRS 10).

Note 2 – The operating expenses are included under the head expenses of the statement

of profit or loss and other comprehensible income. This is because it includes all the expenses

that are incurred in the day to day operations of the business. Now the operating expenses

include the following expenses

PARTICULARS 2016($000's) 2017($000's)

Administration expenses 1230 1680

Amortisation of Intangibles 5100 7000

Audit fees 1400 1200

Bad debts 655 620

Cost of Goods Sold 73400 87200

Depreciation 9990 10030

Income Tax Payable 21 1420 0

Total Current Liabilities 4910 4160

Non-Current Liabilities

Borrowings 22 15300 16400

Mortgage 23 75200 65800

Total Non-current Liabilities 90500 82200

Total Liabilities 95400 86360

Net Assets 242720 276540

Equity

Asset Revaluation Reserve 24 850 850

Issues and Paid up Capital 25 140000 157000

General Reserve 26 59370 56950

Retained Earnings 27 42500 61740

Total Equity 242720 276540

NOTES TO FINANCIAL STATEMENTS

Note 1 – The revenue includes the commission and royalties received and the investment

income that is income related to dividends. Revenue generally refers to the total revenue

obtained by a company in a particular financial year (as per NZ IFRS 10).

Note 2 – The operating expenses are included under the head expenses of the statement

of profit or loss and other comprehensible income. This is because it includes all the expenses

that are incurred in the day to day operations of the business. Now the operating expenses

include the following expenses

PARTICULARS 2016($000's) 2017($000's)

Administration expenses 1230 1680

Amortisation of Intangibles 5100 7000

Audit fees 1400 1200

Bad debts 655 620

Cost of Goods Sold 73400 87200

Depreciation 9990 10030

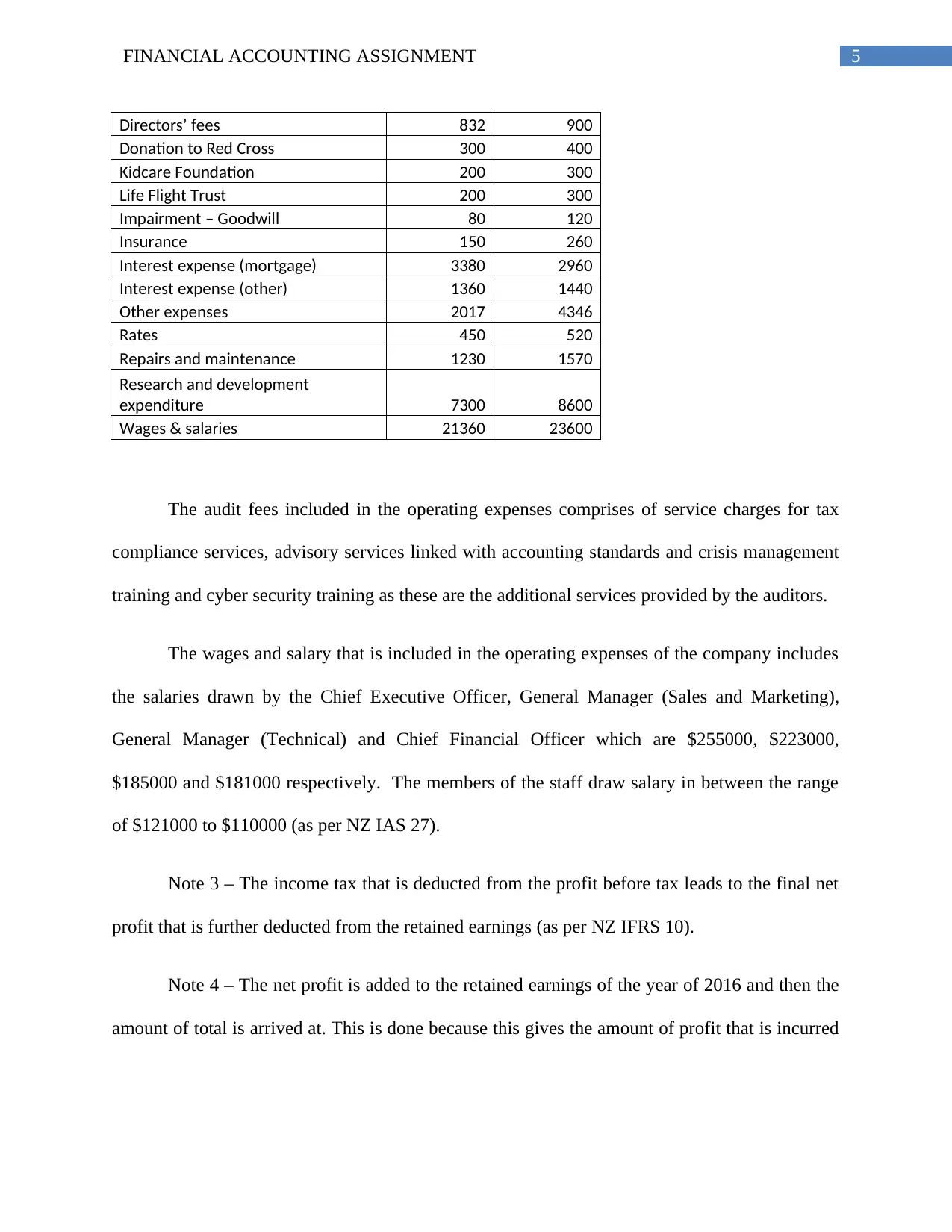

5FINANCIAL ACCOUNTING ASSIGNMENT

Directors’ fees 832 900

Donation to Red Cross 300 400

Kidcare Foundation 200 300

Life Flight Trust 200 300

Impairment – Goodwill 80 120

Insurance 150 260

Interest expense (mortgage) 3380 2960

Interest expense (other) 1360 1440

Other expenses 2017 4346

Rates 450 520

Repairs and maintenance 1230 1570

Research and development

expenditure 7300 8600

Wages & salaries 21360 23600

The audit fees included in the operating expenses comprises of service charges for tax

compliance services, advisory services linked with accounting standards and crisis management

training and cyber security training as these are the additional services provided by the auditors.

The wages and salary that is included in the operating expenses of the company includes

the salaries drawn by the Chief Executive Officer, General Manager (Sales and Marketing),

General Manager (Technical) and Chief Financial Officer which are $255000, $223000,

$185000 and $181000 respectively. The members of the staff draw salary in between the range

of $121000 to $110000 (as per NZ IAS 27).

Note 3 – The income tax that is deducted from the profit before tax leads to the final net

profit that is further deducted from the retained earnings (as per NZ IFRS 10).

Note 4 – The net profit is added to the retained earnings of the year of 2016 and then the

amount of total is arrived at. This is done because this gives the amount of profit that is incurred

Directors’ fees 832 900

Donation to Red Cross 300 400

Kidcare Foundation 200 300

Life Flight Trust 200 300

Impairment – Goodwill 80 120

Insurance 150 260

Interest expense (mortgage) 3380 2960

Interest expense (other) 1360 1440

Other expenses 2017 4346

Rates 450 520

Repairs and maintenance 1230 1570

Research and development

expenditure 7300 8600

Wages & salaries 21360 23600

The audit fees included in the operating expenses comprises of service charges for tax

compliance services, advisory services linked with accounting standards and crisis management

training and cyber security training as these are the additional services provided by the auditors.

The wages and salary that is included in the operating expenses of the company includes

the salaries drawn by the Chief Executive Officer, General Manager (Sales and Marketing),

General Manager (Technical) and Chief Financial Officer which are $255000, $223000,

$185000 and $181000 respectively. The members of the staff draw salary in between the range

of $121000 to $110000 (as per NZ IAS 27).

Note 3 – The income tax that is deducted from the profit before tax leads to the final net

profit that is further deducted from the retained earnings (as per NZ IFRS 10).

Note 4 – The net profit is added to the retained earnings of the year of 2016 and then the

amount of total is arrived at. This is done because this gives the amount of profit that is incurred

6FINANCIAL ACCOUNTING ASSIGNMENT

in a particular financial year including the dividend that has to be paid to different stakeholders

of business (as per NZ IFRS 10).

Note 5 – The interim dividend and final dividend paid is subtracted from the retained

earnings in order to get the final amount of revenue that is really incurred by a company in the

financial year (as per NZ IFRS 10).

Note 6 – In the statement of changes in equity the share capital in the year of 2017

increases by the amount of $17000. This is because in the year of 2017 new share capital was

issued by the company. This also indicates the fact that the company is doing enough profit and

its reputation among the investors is increasing which is why more shares are purchased by them.

Thus the new increased share capital becomes $157000.

Note 7 – Again the net profit is added in the same way as in the year of 2016 for the same

reason and the total amount is arrived at (as per NZ IFRS 10).

Note 8 – In the similar kind of way the dividends are subtracted in order to arrive at the

amount of total revenue earned for this particular financial year.

Note 9 – In the balance sheet of the company the total current asset of the company is

recorded, that is the assets that are used by the firm in the daily operations of business.

Note 10 - In note 10 the accounts receivable is recorded. It is generally a current asset .

Note 11 – In note 11 the provision for impairment of trade receivables is recorded as a

current asset, as this is a provision that offsets the accounts receivables in the financial

statements. A particular debtor owes the company a certain sum of money (as per NZ IFRS 10).

in a particular financial year including the dividend that has to be paid to different stakeholders

of business (as per NZ IFRS 10).

Note 5 – The interim dividend and final dividend paid is subtracted from the retained

earnings in order to get the final amount of revenue that is really incurred by a company in the

financial year (as per NZ IFRS 10).

Note 6 – In the statement of changes in equity the share capital in the year of 2017

increases by the amount of $17000. This is because in the year of 2017 new share capital was

issued by the company. This also indicates the fact that the company is doing enough profit and

its reputation among the investors is increasing which is why more shares are purchased by them.

Thus the new increased share capital becomes $157000.

Note 7 – Again the net profit is added in the same way as in the year of 2016 for the same

reason and the total amount is arrived at (as per NZ IFRS 10).

Note 8 – In the similar kind of way the dividends are subtracted in order to arrive at the

amount of total revenue earned for this particular financial year.

Note 9 – In the balance sheet of the company the total current asset of the company is

recorded, that is the assets that are used by the firm in the daily operations of business.

Note 10 - In note 10 the accounts receivable is recorded. It is generally a current asset .

Note 11 – In note 11 the provision for impairment of trade receivables is recorded as a

current asset, as this is a provision that offsets the accounts receivables in the financial

statements. A particular debtor owes the company a certain sum of money (as per NZ IFRS 10).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING ASSIGNMENT

Note 12 – In note 12 the non-current assets are recorded. These assets are non-current in

nature that is they are not used in the course of day to day operations of business.

Note 13 - The accumulated amortization is recorded under the head of non-current assets

and it is always a negative figure, hence subtracted (as per NZ SIC – 32).

Note 14 – The same goes for accumulated impairment – goodwill and it is also a negative

figure hence subtracted (as per NZ SIC – 32).

Note 15 – The inventory or stock in hand has been recorded under non-current assets.

The inventory is evaluated either on the base of lower cost or on the basis of net realizable value.

At the end of the financial year of 2017, finished goods became 30% and raw material became

25% and the remainder became work in progress (as per NZ SIC – 32).

Note 16 – The investment at cost is recorded under non-current assets and essentially

represents the cost incurred while making investments. At the date of balance the investment at

cost of the company was valued at an amount of $8820000. This was done in accordance with

the IFRS 9 standards (as per NZ SIC – 32).

Note 17 – The PP and E represents the property and equipment. In regarding to this it was

decided by the directors that land and building with a developed historic cost should be subjected

to revaluation as at 30th June, 2017. The Land and Building was revalued separately at $1550000.

Note 18 - The current liabilities are incurred or generated in the day to day course of a

business thus is current in nature (as per NZ IFRS 10).

Note 19 – The accounts payable is also recorded under the head of current liabilities. This

is because it represents the due amount that is yet to be paid by the company.

Note 12 – In note 12 the non-current assets are recorded. These assets are non-current in

nature that is they are not used in the course of day to day operations of business.

Note 13 - The accumulated amortization is recorded under the head of non-current assets

and it is always a negative figure, hence subtracted (as per NZ SIC – 32).

Note 14 – The same goes for accumulated impairment – goodwill and it is also a negative

figure hence subtracted (as per NZ SIC – 32).

Note 15 – The inventory or stock in hand has been recorded under non-current assets.

The inventory is evaluated either on the base of lower cost or on the basis of net realizable value.

At the end of the financial year of 2017, finished goods became 30% and raw material became

25% and the remainder became work in progress (as per NZ SIC – 32).

Note 16 – The investment at cost is recorded under non-current assets and essentially

represents the cost incurred while making investments. At the date of balance the investment at

cost of the company was valued at an amount of $8820000. This was done in accordance with

the IFRS 9 standards (as per NZ SIC – 32).

Note 17 – The PP and E represents the property and equipment. In regarding to this it was

decided by the directors that land and building with a developed historic cost should be subjected

to revaluation as at 30th June, 2017. The Land and Building was revalued separately at $1550000.

Note 18 - The current liabilities are incurred or generated in the day to day course of a

business thus is current in nature (as per NZ IFRS 10).

Note 19 – The accounts payable is also recorded under the head of current liabilities. This

is because it represents the due amount that is yet to be paid by the company.

8FINANCIAL ACCOUNTING ASSIGNMENT

Note 20 – The GST Liability refers to the liability that is kept aside by the company for

the purpose of paying the goods and services tax (as per NZ FRS - 43).

Note 21 – The Income Tax payable or the income tax expenses come down to $11260000

which is payable by the company and therefore is recorded under current liabilities (as per NZ

FRS - 43)

Note 22 - There are two borrowings done by the company. Firstly the company has

arranged for a mortgage loan on the basis of land and buildings. Secondly a bank loan has been

obtained by the company from the Westpac Bank. The company also can avail the facility of

bank overdraft of $100000 (as per NZ FRS - 43).

Note 23 – the mortgage is included in the borrowings as mentioned above.

Note 24 – The asset revaluation reserve is the reserve that is kept aside for the purpose of

reserving the revalued amounts of assets. It is also included in the statement of equity (as per NZ

FRS - 43).

Note 25 – The issued and paid up capital is the total amount of share capital that is

required to distribute among the shareholders. It was decided by the company that a final

dividend of 25 cents per share would be paid (as per NZ FRS - 43).

Note 26 – The retained earnings in the provided in the trial appears twice. Once in the

Equity section ofthe balance sheet and another time in the statement of equity (as per NZ FRS -

43).

Note 20 – The GST Liability refers to the liability that is kept aside by the company for

the purpose of paying the goods and services tax (as per NZ FRS - 43).

Note 21 – The Income Tax payable or the income tax expenses come down to $11260000

which is payable by the company and therefore is recorded under current liabilities (as per NZ

FRS - 43)

Note 22 - There are two borrowings done by the company. Firstly the company has

arranged for a mortgage loan on the basis of land and buildings. Secondly a bank loan has been

obtained by the company from the Westpac Bank. The company also can avail the facility of

bank overdraft of $100000 (as per NZ FRS - 43).

Note 23 – the mortgage is included in the borrowings as mentioned above.

Note 24 – The asset revaluation reserve is the reserve that is kept aside for the purpose of

reserving the revalued amounts of assets. It is also included in the statement of equity (as per NZ

FRS - 43).

Note 25 – The issued and paid up capital is the total amount of share capital that is

required to distribute among the shareholders. It was decided by the company that a final

dividend of 25 cents per share would be paid (as per NZ FRS - 43).

Note 26 – The retained earnings in the provided in the trial appears twice. Once in the

Equity section ofthe balance sheet and another time in the statement of equity (as per NZ FRS -

43).

9FINANCIAL ACCOUNTING ASSIGNMENT

References

Biondi, Y. (2014). Harmonising European public sector accounting standards (EPSAS): issues

and perspectives for Europe’s economy and society. Accounting, Economics and Law,

4(3), 165-178.

Brown, P., Preiato, J., & Tarca, A. (2014). Measuring country differences in enforcement of

accounting standards: An audit and enforcement proxy. Journal of Business Finance &

Accounting, 41(1-2), 1-52.

Cordery, C. J., & Simpkins, K. (2016). Financial reporting standards for the public sector: New

Zealand's 21st-century experience. Public Money & Management, 36(3), 209-218.

De Silva, T. A., Stratford, M., & Clark, M. (2014). Intellectual capital reporting: a longitudinal

study of New Zealand companies. Journal of Intellectual Capital, 15(1), 157-172.

Ellwood, S., & Newberry, S. (2016). New development: The conceptual underpinnings of

international public sector accounting. Public Money & Management, 36(3), 231-234.

Habib, A. (2015). The new Chinese accounting standards and audit report lag. International

Journal of Auditing, 19(1), 1-14.

Jones, R., & Caruana, J. (2014). A perspective on the proposal for European public sector

accounting standards, in the context of accruals in UK government accounting.

Accounting, Economics and Law, 4(3), 265-282.

References

Biondi, Y. (2014). Harmonising European public sector accounting standards (EPSAS): issues

and perspectives for Europe’s economy and society. Accounting, Economics and Law,

4(3), 165-178.

Brown, P., Preiato, J., & Tarca, A. (2014). Measuring country differences in enforcement of

accounting standards: An audit and enforcement proxy. Journal of Business Finance &

Accounting, 41(1-2), 1-52.

Cordery, C. J., & Simpkins, K. (2016). Financial reporting standards for the public sector: New

Zealand's 21st-century experience. Public Money & Management, 36(3), 209-218.

De Silva, T. A., Stratford, M., & Clark, M. (2014). Intellectual capital reporting: a longitudinal

study of New Zealand companies. Journal of Intellectual Capital, 15(1), 157-172.

Ellwood, S., & Newberry, S. (2016). New development: The conceptual underpinnings of

international public sector accounting. Public Money & Management, 36(3), 231-234.

Habib, A. (2015). The new Chinese accounting standards and audit report lag. International

Journal of Auditing, 19(1), 1-14.

Jones, R., & Caruana, J. (2014). A perspective on the proposal for European public sector

accounting standards, in the context of accruals in UK government accounting.

Accounting, Economics and Law, 4(3), 265-282.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.

![[FULL ACCESS] Financial Statement Analysis](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Ffs%2F1dd5829f62eb4bbb90d421cba7439003.jpg&w=256&q=75)