Accounting Assignment Solution: Financial Statement and Reporting

VerifiedAdded on 2023/01/10

|19

|4553

|25

Homework Assignment

AI Summary

This accounting assignment solution provides a detailed analysis of various accounting concepts. It begins with an introduction to accounting, defining its purpose and scope. The main body of the assignment is divided into two scenarios. Scenario 1 covers different types of business transactions, single and double-entry bookkeeping, the trial balance, and its importance. It includes journal entries, ledger accounts, and a trial balance. Scenario 2 delves into the differences between financial statements and financial reports, the requirements for financial reporting, and the various users of financial reports. The solution also provides journal entries, ledger accounts, and a trial balance for the second scenario. The assignment concludes with a summary of the key takeaways and a list of references used.

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

SCENARIO 1..................................................................................................................................1

QUESTION 1..............................................................................................................................1

QUESTION 2..............................................................................................................................3

QUESTION 3..............................................................................................................................7

QUESTION 4..............................................................................................................................9

QUESTION 5..............................................................................................................................9

SCENARIO 2................................................................................................................................10

QUESTION 1............................................................................................................................10

QUESTION 2............................................................................................................................11

QUESTION 3............................................................................................................................12

QUESTION 4............................................................................................................................13

QUESTION 5............................................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

MAIN BODY..................................................................................................................................1

SCENARIO 1..................................................................................................................................1

QUESTION 1..............................................................................................................................1

QUESTION 2..............................................................................................................................3

QUESTION 3..............................................................................................................................7

QUESTION 4..............................................................................................................................9

QUESTION 5..............................................................................................................................9

SCENARIO 2................................................................................................................................10

QUESTION 1............................................................................................................................10

QUESTION 2............................................................................................................................11

QUESTION 3............................................................................................................................12

QUESTION 4............................................................................................................................13

QUESTION 5............................................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Accounting is a structured method for defining, documenting, evaluating, classifying,

checking, analysing, interpreting and sharing financial information(Barron, Chung and Yong,

2016). It discloses the revenue or loss over a period and the value of the property of the assets,

liabilities and equity of the business. Accounting is the practice of reporting business transactions

related to a company. The financial reporting process involves summarizing, evaluating and

monitoring these transfers to supervisory agencies, regulatory agencies and tax collectors. This

report cover the several topics such as record business transactions by using single and double

entry book keeping system, prepare final accounts by using appropriate accounting principles

and perform bank reconciliation. In addition, it covers the control and suspense account and why

it is required for drafting.

MAIN BODY

SCENARIO 1

QUESTION 1

Different types of business transactions:

There are numerous types of business transactions which are used to record in the books

of accounts and further classify the amount of the basis of it. Some of them are as follow:

Sales transactions are under which the goods are sold to the buyer in exchange of cash or

on credit basis. Selling proceeds are reported in the sales accounts a debit to cash or

receivable accounts and a credit to the selling account.

Purchases are the transfers which are needed by a company to purchase the goods or

services necessary to achieve the objectives of the organization (Edwards, Schwab and

Shevlin, 2015). Purchases of goods made in cash result in an inventory account debit and

a cash credit. If goods purchased on credit basis then credit the account, the debit would

still be put into the inventory account and the refund would be inserted into the accounts

payable.

Receivables are receipts that relate to the company being charged for the delivery of

goods to some other firm. The invoice transaction occurs in the vendor's journal as a cash

debit and a credit to the receivable.

1

Accounting is a structured method for defining, documenting, evaluating, classifying,

checking, analysing, interpreting and sharing financial information(Barron, Chung and Yong,

2016). It discloses the revenue or loss over a period and the value of the property of the assets,

liabilities and equity of the business. Accounting is the practice of reporting business transactions

related to a company. The financial reporting process involves summarizing, evaluating and

monitoring these transfers to supervisory agencies, regulatory agencies and tax collectors. This

report cover the several topics such as record business transactions by using single and double

entry book keeping system, prepare final accounts by using appropriate accounting principles

and perform bank reconciliation. In addition, it covers the control and suspense account and why

it is required for drafting.

MAIN BODY

SCENARIO 1

QUESTION 1

Different types of business transactions:

There are numerous types of business transactions which are used to record in the books

of accounts and further classify the amount of the basis of it. Some of them are as follow:

Sales transactions are under which the goods are sold to the buyer in exchange of cash or

on credit basis. Selling proceeds are reported in the sales accounts a debit to cash or

receivable accounts and a credit to the selling account.

Purchases are the transfers which are needed by a company to purchase the goods or

services necessary to achieve the objectives of the organization (Edwards, Schwab and

Shevlin, 2015). Purchases of goods made in cash result in an inventory account debit and

a cash credit. If goods purchased on credit basis then credit the account, the debit would

still be put into the inventory account and the refund would be inserted into the accounts

payable.

Receivables are receipts that relate to the company being charged for the delivery of

goods to some other firm. The invoice transaction occurs in the vendor's journal as a cash

debit and a credit to the receivable.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Payments are exchanges that attribute to a company that receives money for just a good

or service. Individuals are recorded in the company's accounting journal allowed to issue

the payment as a cash credit and a debit to the trade payables.

Define single entry book keeping:

It is an accounting system that used to keep every business transaction of a business.

There has been one entry for every money transfer and most of the entries register either inbound

or outbound funds. Exchanges are reported in the "cash book"—a report of columns that include

financial transactions such as the time, explanation and whether it is a cost or revenue.

Define double entry book keeping:

It is premised on the reality that each transaction seems to have two aspects and therefore

will have an impact on two accounting books (Chan, 2015). Each activity includes a debit entry

into one account and a credit entry into another account. It ensures that any transaction will be

reported in two accounts; one party will be debited since it collects value and the other party will

be credited since it has value.

Explain trial balance and its importance:

The trial balance is a workbook wherein the balances of all ledgers are combined into the

sums of the debit and credit side and balance the amount with each other (Jiang, Wang and Xie,

2015). The business used to prepare trial balance periodically, generally at the end of each

accounting period. Importances of trial balance are as follow:

Checking accuracy: This indicates that now the trial balance is being used to check the

exact sum deposited on the right side of the new account when transferring data from different

records such as buy records, selling books, cash books, etc. Trial Balance apart from account in

the general ledger, it is often helpful to determine the validity of specific purpose accounting

records.

Helps in preparing financial statements: The income statement, the balance sheet and

the cash flows must be prepared at the end of each financial reporting year. The balance of all the

accounts used to compile the financial reports is also accessible in the trial ledger, making it easy

to plan and interpret the financial information.

Rectifying errors: The total debit of both the trial balance shall be equivalent to the

combined credit of the trial balance. The whole checks the integer accuracy of the booklets. If

that's not the situation, the bookkeeper will find and correct the mistake. Accounting

2

or service. Individuals are recorded in the company's accounting journal allowed to issue

the payment as a cash credit and a debit to the trade payables.

Define single entry book keeping:

It is an accounting system that used to keep every business transaction of a business.

There has been one entry for every money transfer and most of the entries register either inbound

or outbound funds. Exchanges are reported in the "cash book"—a report of columns that include

financial transactions such as the time, explanation and whether it is a cost or revenue.

Define double entry book keeping:

It is premised on the reality that each transaction seems to have two aspects and therefore

will have an impact on two accounting books (Chan, 2015). Each activity includes a debit entry

into one account and a credit entry into another account. It ensures that any transaction will be

reported in two accounts; one party will be debited since it collects value and the other party will

be credited since it has value.

Explain trial balance and its importance:

The trial balance is a workbook wherein the balances of all ledgers are combined into the

sums of the debit and credit side and balance the amount with each other (Jiang, Wang and Xie,

2015). The business used to prepare trial balance periodically, generally at the end of each

accounting period. Importances of trial balance are as follow:

Checking accuracy: This indicates that now the trial balance is being used to check the

exact sum deposited on the right side of the new account when transferring data from different

records such as buy records, selling books, cash books, etc. Trial Balance apart from account in

the general ledger, it is often helpful to determine the validity of specific purpose accounting

records.

Helps in preparing financial statements: The income statement, the balance sheet and

the cash flows must be prepared at the end of each financial reporting year. The balance of all the

accounts used to compile the financial reports is also accessible in the trial ledger, making it easy

to plan and interpret the financial information.

Rectifying errors: The total debit of both the trial balance shall be equivalent to the

combined credit of the trial balance. The whole checks the integer accuracy of the booklets. If

that's not the situation, the bookkeeper will find and correct the mistake. Accounting

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

professionals consequently feel glad when the totals of the debit balance and the totals of the

credit balance are matched.

Help in adjustment: Adaptation accounts, such as prepaid costs, accrued obligations,

closing shares, etc., must be adjusted during the planning of the jury balance. This helps to make

adjustments that are only important in the current accounting year (Drexler, Fischer and Schoar,

2014). Businesses usually file the change reports at the close of the financial year. There really is

no limitation on the opening of alteration accounts as individuals occur.

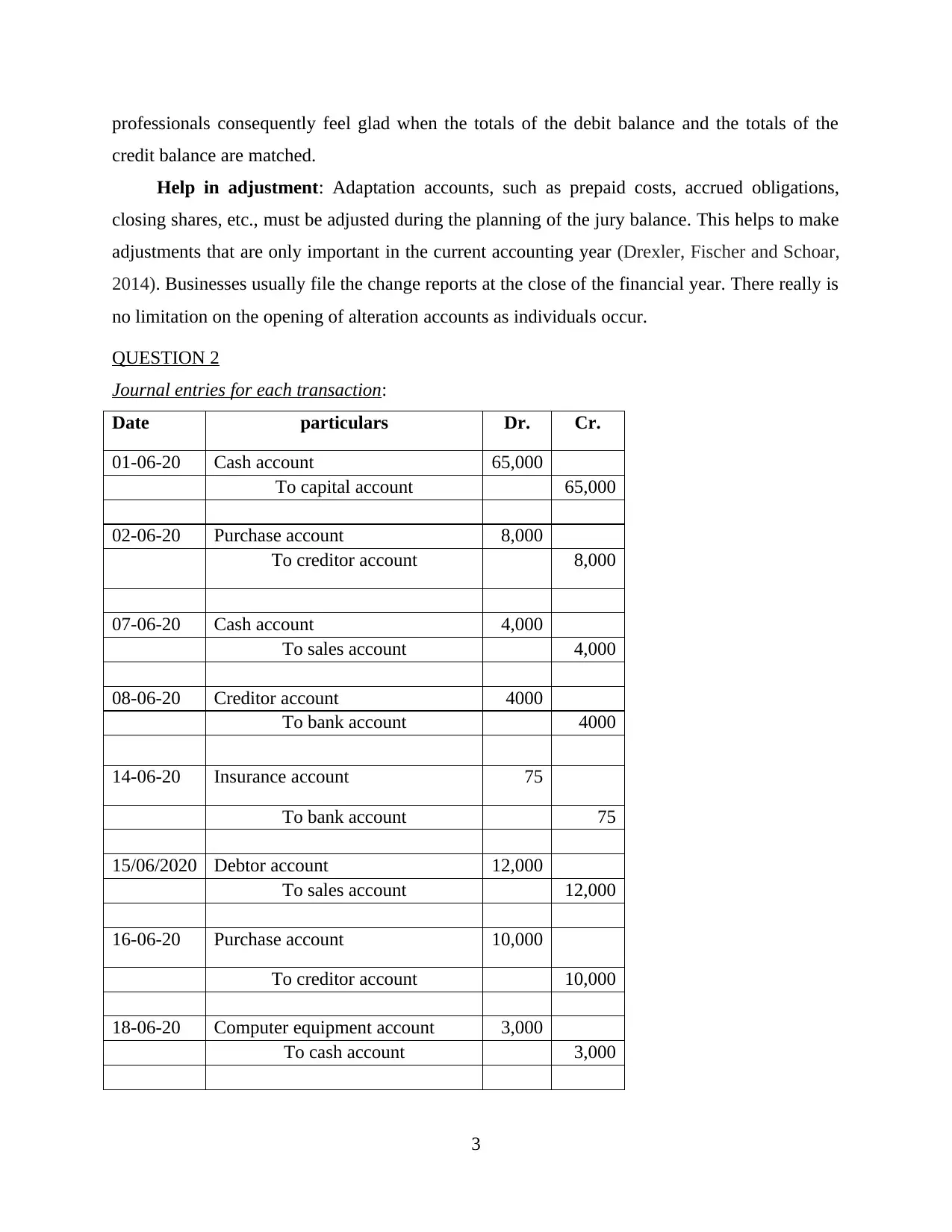

QUESTION 2

Journal entries for each transaction:

Date particulars Dr. Cr.

01-06-20 Cash account 65,000

To capital account 65,000

02-06-20 Purchase account 8,000

To creditor account 8,000

07-06-20 Cash account 4,000

To sales account 4,000

08-06-20 Creditor account 4000

To bank account 4000

14-06-20 Insurance account 75

To bank account 75

15/06/2020 Debtor account 12,000

To sales account 12,000

16-06-20 Purchase account 10,000

To creditor account 10,000

18-06-20 Computer equipment account 3,000

To cash account 3,000

3

credit balance are matched.

Help in adjustment: Adaptation accounts, such as prepaid costs, accrued obligations,

closing shares, etc., must be adjusted during the planning of the jury balance. This helps to make

adjustments that are only important in the current accounting year (Drexler, Fischer and Schoar,

2014). Businesses usually file the change reports at the close of the financial year. There really is

no limitation on the opening of alteration accounts as individuals occur.

QUESTION 2

Journal entries for each transaction:

Date particulars Dr. Cr.

01-06-20 Cash account 65,000

To capital account 65,000

02-06-20 Purchase account 8,000

To creditor account 8,000

07-06-20 Cash account 4,000

To sales account 4,000

08-06-20 Creditor account 4000

To bank account 4000

14-06-20 Insurance account 75

To bank account 75

15/06/2020 Debtor account 12,000

To sales account 12,000

16-06-20 Purchase account 10,000

To creditor account 10,000

18-06-20 Computer equipment account 3,000

To cash account 3,000

3

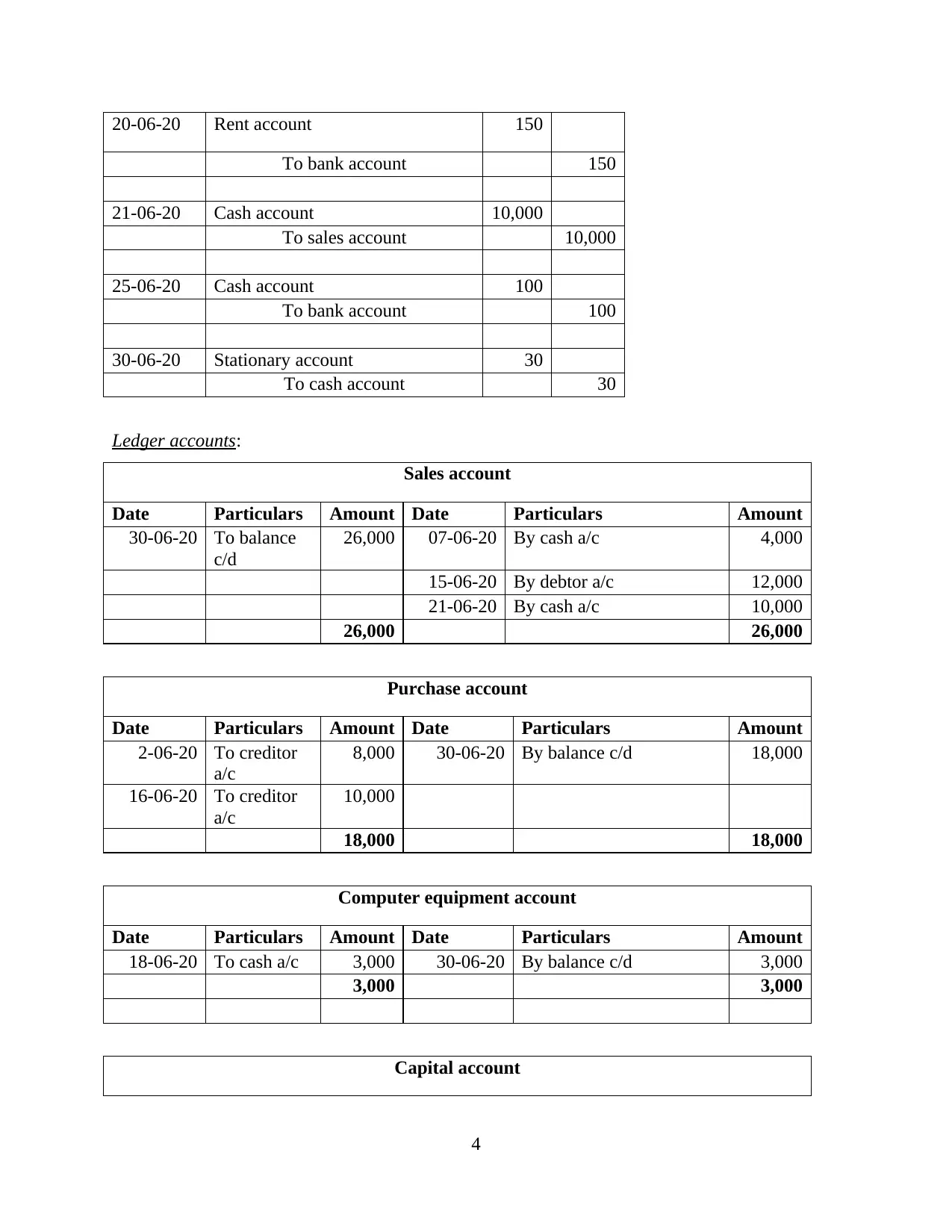

20-06-20 Rent account 150

To bank account 150

21-06-20 Cash account 10,000

To sales account 10,000

25-06-20 Cash account 100

To bank account 100

30-06-20 Stationary account 30

To cash account 30

Ledger accounts:

Sales account

Date Particulars Amount Date Particulars Amount

30-06-20 To balance

c/d

26,000 07-06-20 By cash a/c 4,000

15-06-20 By debtor a/c 12,000

21-06-20 By cash a/c 10,000

26,000 26,000

Purchase account

Date Particulars Amount Date Particulars Amount

2-06-20 To creditor

a/c

8,000 30-06-20 By balance c/d 18,000

16-06-20 To creditor

a/c

10,000

18,000 18,000

Computer equipment account

Date Particulars Amount Date Particulars Amount

18-06-20 To cash a/c 3,000 30-06-20 By balance c/d 3,000

3,000 3,000

Capital account

4

To bank account 150

21-06-20 Cash account 10,000

To sales account 10,000

25-06-20 Cash account 100

To bank account 100

30-06-20 Stationary account 30

To cash account 30

Ledger accounts:

Sales account

Date Particulars Amount Date Particulars Amount

30-06-20 To balance

c/d

26,000 07-06-20 By cash a/c 4,000

15-06-20 By debtor a/c 12,000

21-06-20 By cash a/c 10,000

26,000 26,000

Purchase account

Date Particulars Amount Date Particulars Amount

2-06-20 To creditor

a/c

8,000 30-06-20 By balance c/d 18,000

16-06-20 To creditor

a/c

10,000

18,000 18,000

Computer equipment account

Date Particulars Amount Date Particulars Amount

18-06-20 To cash a/c 3,000 30-06-20 By balance c/d 3,000

3,000 3,000

Capital account

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

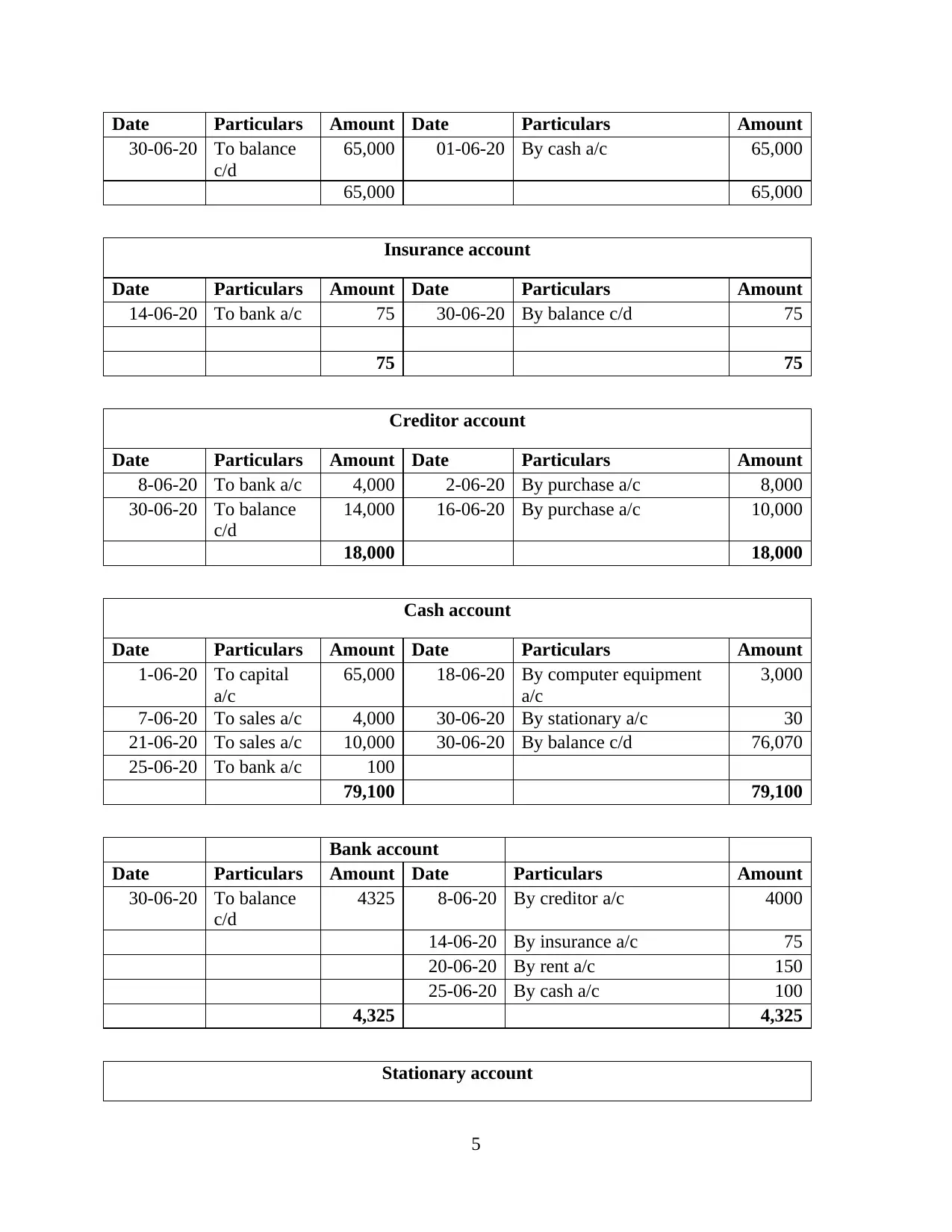

Date Particulars Amount Date Particulars Amount

30-06-20 To balance

c/d

65,000 01-06-20 By cash a/c 65,000

65,000 65,000

Insurance account

Date Particulars Amount Date Particulars Amount

14-06-20 To bank a/c 75 30-06-20 By balance c/d 75

75 75

Creditor account

Date Particulars Amount Date Particulars Amount

8-06-20 To bank a/c 4,000 2-06-20 By purchase a/c 8,000

30-06-20 To balance

c/d

14,000 16-06-20 By purchase a/c 10,000

18,000 18,000

Cash account

Date Particulars Amount Date Particulars Amount

1-06-20 To capital

a/c

65,000 18-06-20 By computer equipment

a/c

3,000

7-06-20 To sales a/c 4,000 30-06-20 By stationary a/c 30

21-06-20 To sales a/c 10,000 30-06-20 By balance c/d 76,070

25-06-20 To bank a/c 100

79,100 79,100

Bank account

Date Particulars Amount Date Particulars Amount

30-06-20 To balance

c/d

4325 8-06-20 By creditor a/c 4000

14-06-20 By insurance a/c 75

20-06-20 By rent a/c 150

25-06-20 By cash a/c 100

4,325 4,325

Stationary account

5

30-06-20 To balance

c/d

65,000 01-06-20 By cash a/c 65,000

65,000 65,000

Insurance account

Date Particulars Amount Date Particulars Amount

14-06-20 To bank a/c 75 30-06-20 By balance c/d 75

75 75

Creditor account

Date Particulars Amount Date Particulars Amount

8-06-20 To bank a/c 4,000 2-06-20 By purchase a/c 8,000

30-06-20 To balance

c/d

14,000 16-06-20 By purchase a/c 10,000

18,000 18,000

Cash account

Date Particulars Amount Date Particulars Amount

1-06-20 To capital

a/c

65,000 18-06-20 By computer equipment

a/c

3,000

7-06-20 To sales a/c 4,000 30-06-20 By stationary a/c 30

21-06-20 To sales a/c 10,000 30-06-20 By balance c/d 76,070

25-06-20 To bank a/c 100

79,100 79,100

Bank account

Date Particulars Amount Date Particulars Amount

30-06-20 To balance

c/d

4325 8-06-20 By creditor a/c 4000

14-06-20 By insurance a/c 75

20-06-20 By rent a/c 150

25-06-20 By cash a/c 100

4,325 4,325

Stationary account

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

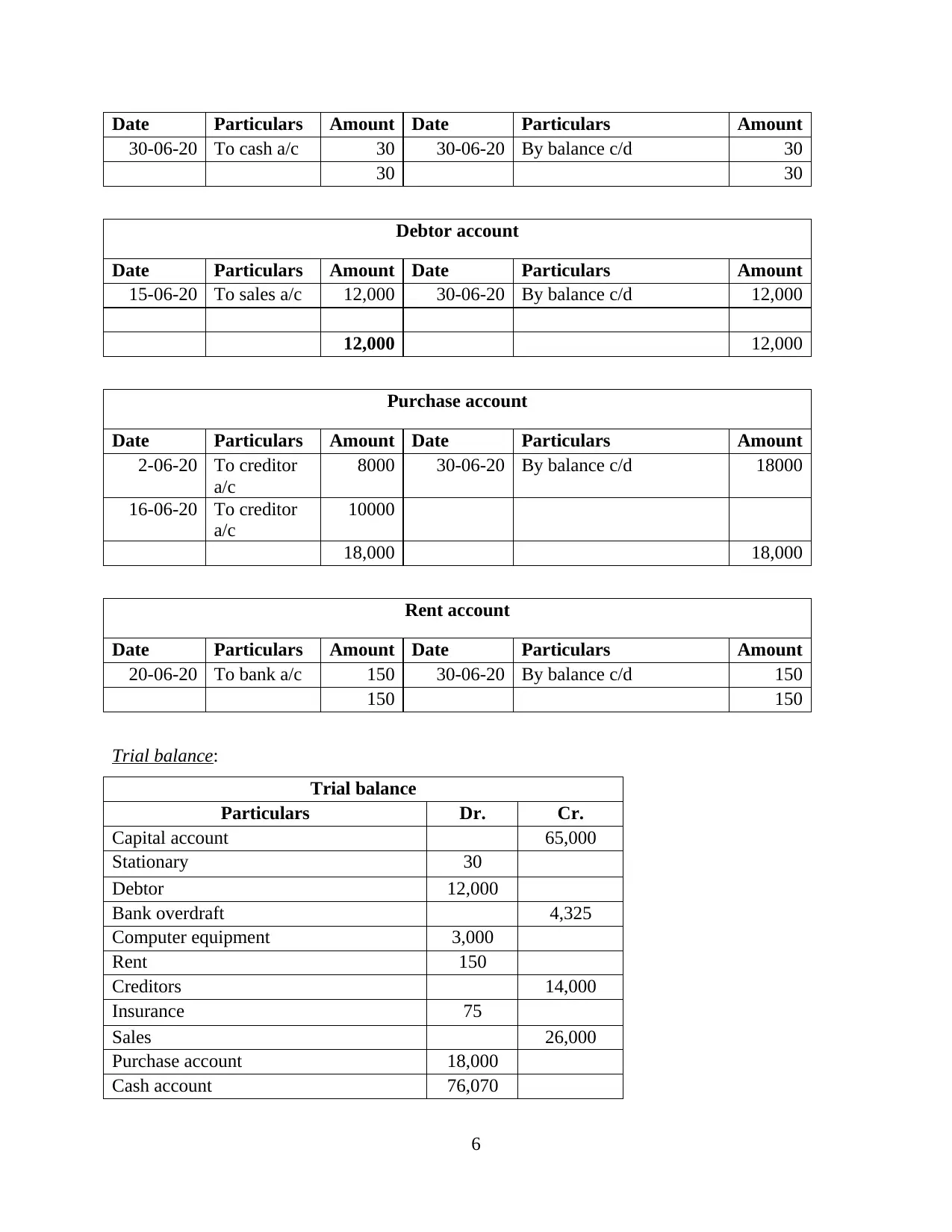

Date Particulars Amount Date Particulars Amount

30-06-20 To cash a/c 30 30-06-20 By balance c/d 30

30 30

Debtor account

Date Particulars Amount Date Particulars Amount

15-06-20 To sales a/c 12,000 30-06-20 By balance c/d 12,000

12,000 12,000

Purchase account

Date Particulars Amount Date Particulars Amount

2-06-20 To creditor

a/c

8000 30-06-20 By balance c/d 18000

16-06-20 To creditor

a/c

10000

18,000 18,000

Rent account

Date Particulars Amount Date Particulars Amount

20-06-20 To bank a/c 150 30-06-20 By balance c/d 150

150 150

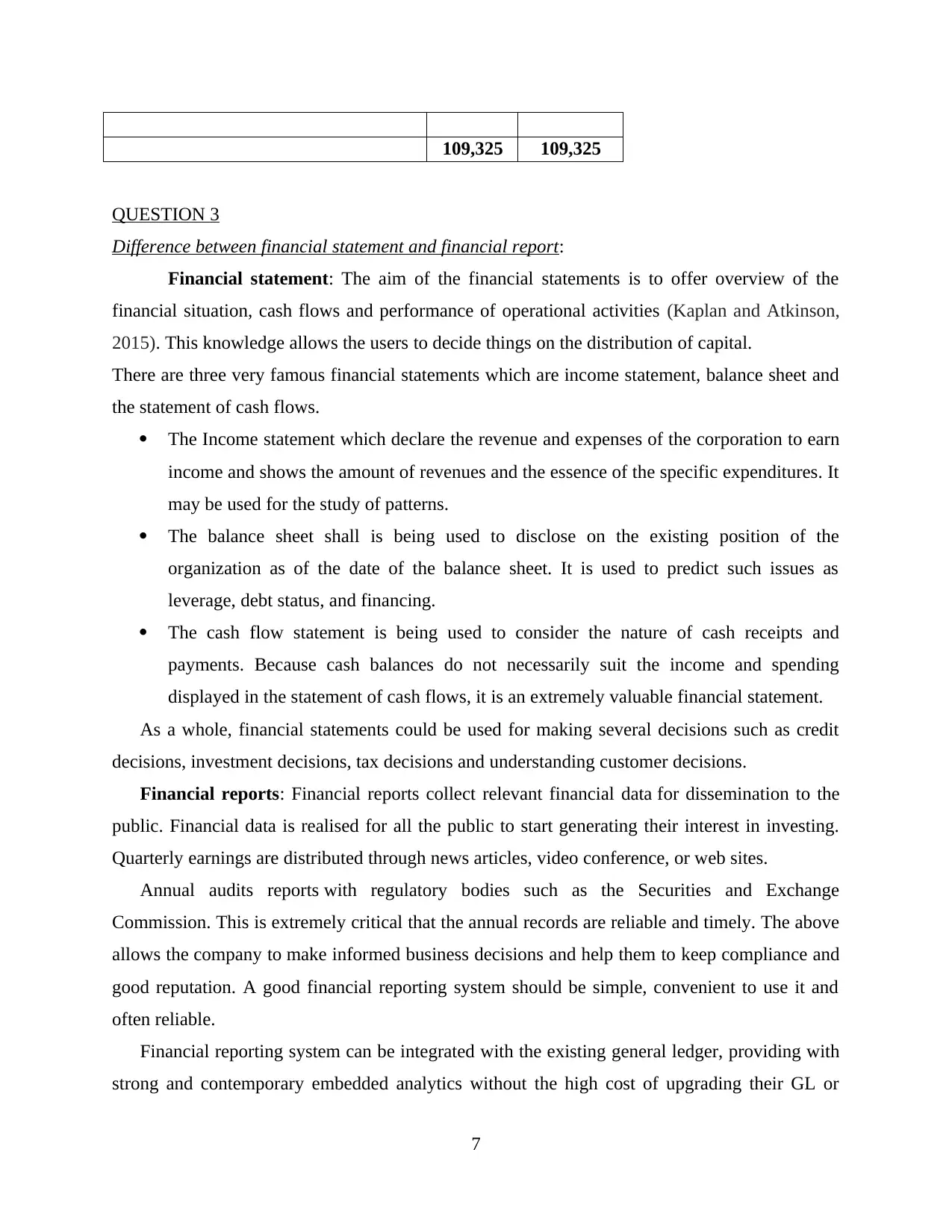

Trial balance:

Trial balance

Particulars Dr. Cr.

Capital account 65,000

Stationary 30

Debtor 12,000

Bank overdraft 4,325

Computer equipment 3,000

Rent 150

Creditors 14,000

Insurance 75

Sales 26,000

Purchase account 18,000

Cash account 76,070

6

30-06-20 To cash a/c 30 30-06-20 By balance c/d 30

30 30

Debtor account

Date Particulars Amount Date Particulars Amount

15-06-20 To sales a/c 12,000 30-06-20 By balance c/d 12,000

12,000 12,000

Purchase account

Date Particulars Amount Date Particulars Amount

2-06-20 To creditor

a/c

8000 30-06-20 By balance c/d 18000

16-06-20 To creditor

a/c

10000

18,000 18,000

Rent account

Date Particulars Amount Date Particulars Amount

20-06-20 To bank a/c 150 30-06-20 By balance c/d 150

150 150

Trial balance:

Trial balance

Particulars Dr. Cr.

Capital account 65,000

Stationary 30

Debtor 12,000

Bank overdraft 4,325

Computer equipment 3,000

Rent 150

Creditors 14,000

Insurance 75

Sales 26,000

Purchase account 18,000

Cash account 76,070

6

109,325 109,325

QUESTION 3

Difference between financial statement and financial report:

Financial statement: The aim of the financial statements is to offer overview of the

financial situation, cash flows and performance of operational activities (Kaplan and Atkinson,

2015). This knowledge allows the users to decide things on the distribution of capital.

There are three very famous financial statements which are income statement, balance sheet and

the statement of cash flows.

The Income statement which declare the revenue and expenses of the corporation to earn

income and shows the amount of revenues and the essence of the specific expenditures. It

may be used for the study of patterns.

The balance sheet shall is being used to disclose on the existing position of the

organization as of the date of the balance sheet. It is used to predict such issues as

leverage, debt status, and financing.

The cash flow statement is being used to consider the nature of cash receipts and

payments. Because cash balances do not necessarily suit the income and spending

displayed in the statement of cash flows, it is an extremely valuable financial statement.

As a whole, financial statements could be used for making several decisions such as credit

decisions, investment decisions, tax decisions and understanding customer decisions.

Financial reports: Financial reports collect relevant financial data for dissemination to the

public. Financial data is realised for all the public to start generating their interest in investing.

Quarterly earnings are distributed through news articles, video conference, or web sites.

Annual audits reports with regulatory bodies such as the Securities and Exchange

Commission. This is extremely critical that the annual records are reliable and timely. The above

allows the company to make informed business decisions and help them to keep compliance and

good reputation. A good financial reporting system should be simple, convenient to use it and

often reliable.

Financial reporting system can be integrated with the existing general ledger, providing with

strong and contemporary embedded analytics without the high cost of upgrading their GL or

7

QUESTION 3

Difference between financial statement and financial report:

Financial statement: The aim of the financial statements is to offer overview of the

financial situation, cash flows and performance of operational activities (Kaplan and Atkinson,

2015). This knowledge allows the users to decide things on the distribution of capital.

There are three very famous financial statements which are income statement, balance sheet and

the statement of cash flows.

The Income statement which declare the revenue and expenses of the corporation to earn

income and shows the amount of revenues and the essence of the specific expenditures. It

may be used for the study of patterns.

The balance sheet shall is being used to disclose on the existing position of the

organization as of the date of the balance sheet. It is used to predict such issues as

leverage, debt status, and financing.

The cash flow statement is being used to consider the nature of cash receipts and

payments. Because cash balances do not necessarily suit the income and spending

displayed in the statement of cash flows, it is an extremely valuable financial statement.

As a whole, financial statements could be used for making several decisions such as credit

decisions, investment decisions, tax decisions and understanding customer decisions.

Financial reports: Financial reports collect relevant financial data for dissemination to the

public. Financial data is realised for all the public to start generating their interest in investing.

Quarterly earnings are distributed through news articles, video conference, or web sites.

Annual audits reports with regulatory bodies such as the Securities and Exchange

Commission. This is extremely critical that the annual records are reliable and timely. The above

allows the company to make informed business decisions and help them to keep compliance and

good reputation. A good financial reporting system should be simple, convenient to use it and

often reliable.

Financial reporting system can be integrated with the existing general ledger, providing with

strong and contemporary embedded analytics without the high cost of upgrading their GL or

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ERP. When the company has developed the right enduring relationship, owners see

the improvement in productivity (Kim and Zhang, 2016). The production, packaging and

distribution reports can be carried out with accuracy and control, even though data sources,

locations and exchange rates are consolidated. The technology to perform reports means that

reports are beautifully configured for the needs of either the committee or the SEC.

Requirement of financial reports and its users:

As per the GAAPs (Generally Accepted Accounting Principles) companies are

responsible for reporting on their cash flows, profit-making operations and overall monetary

policies. Under the GAAP, the following three main financial statements are required such

as Revenue statement, balance sheet and cash flow statement.

The declaration of earnings shall represent the profits received by the company over the

reporting period, along with the associated expenditures. It covers profits from operational and

non-operating operations, enabling creditors and borrowers to determine profitability. This is

often referred to as the statement of income and loss (P&L). Similarly, value of assets and

liabilities mentioned in the balance sheet and overall flow of cash represent in cash flow

statement. This information is used for the company’s stakeholders who have different interest in

the company’s financial performance. All are mentioned below:

Management: The management committee wants to consider the competitiveness,

liquidity and working capital of the enterprise monthly because it can make operating and

financial decisions more about product.

Competitors: Entities negotiating against a company may try to obtain access to their

financial records in order to identify their financial situation (Lara, Osma and Penalva, 2016).

Expertise that they acquire could change their strategic strategies.

Customers: While deciding which manufacturer to use for a big contract, the consumer

first wants to re-evaluate their financial statement to determine the financial capacity of the

manufacturer to stay in operation long enough to deliver the products or services required by the

contract.

Employees: A corporation may choose to start providing employees with its financial

statements, together with a thorough description of what the documents contain. This could be

used to boost the amount of employee participation in and understanding of the company.

8

the improvement in productivity (Kim and Zhang, 2016). The production, packaging and

distribution reports can be carried out with accuracy and control, even though data sources,

locations and exchange rates are consolidated. The technology to perform reports means that

reports are beautifully configured for the needs of either the committee or the SEC.

Requirement of financial reports and its users:

As per the GAAPs (Generally Accepted Accounting Principles) companies are

responsible for reporting on their cash flows, profit-making operations and overall monetary

policies. Under the GAAP, the following three main financial statements are required such

as Revenue statement, balance sheet and cash flow statement.

The declaration of earnings shall represent the profits received by the company over the

reporting period, along with the associated expenditures. It covers profits from operational and

non-operating operations, enabling creditors and borrowers to determine profitability. This is

often referred to as the statement of income and loss (P&L). Similarly, value of assets and

liabilities mentioned in the balance sheet and overall flow of cash represent in cash flow

statement. This information is used for the company’s stakeholders who have different interest in

the company’s financial performance. All are mentioned below:

Management: The management committee wants to consider the competitiveness,

liquidity and working capital of the enterprise monthly because it can make operating and

financial decisions more about product.

Competitors: Entities negotiating against a company may try to obtain access to their

financial records in order to identify their financial situation (Lara, Osma and Penalva, 2016).

Expertise that they acquire could change their strategic strategies.

Customers: While deciding which manufacturer to use for a big contract, the consumer

first wants to re-evaluate their financial statement to determine the financial capacity of the

manufacturer to stay in operation long enough to deliver the products or services required by the

contract.

Employees: A corporation may choose to start providing employees with its financial

statements, together with a thorough description of what the documents contain. This could be

used to boost the amount of employee participation in and understanding of the company.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Governments: A state from whose jurisdiction the corporation is based shall submit a

financial statement to decide if the company has paid the right amount of tax or not.

Creditors: They are likely to demand the presentation of financial statements because they

are the shareholders of the company and want to appreciate the success of their money.

QUESTION 4

Different fundamental principle of accounting:

There are several accounting principles which are adopted by the organization at the time

of recording their business transactions and prepare accounts. Those are discussed below:

Accrual principle: It is the principle which financial records should be documented in the

financial period because once they actually occur, rather than in the periods when cash flows are

aligned with them (Mussari, 2014). This would be the foundation of the income statement for

accounting. It is essential for the development of financial performance of the company what

actually happened during the accounting period, instead of being artificial means delayed or sped

up by the affiliated cash flows.

Conservatism Principle: It is also the principle which wil allow the report to

record obligations as soon as possible, but only record sales and profits if they are confident they

will exist. This idea appears to promote the reporting of expenses early rather than later. This

idea can be pushed too far, if a company insistently mischaracterizes the outcomes to be lower

than is actually the case.

Principle of full disclosure: This is the principle that company should include in or along

with the annual reports of the companies all information that could have an effect on the user's

understanding of such statements. The accounting rules have greatly enhanced this concept by

defining an overwhelming amount of interactive disclosures.

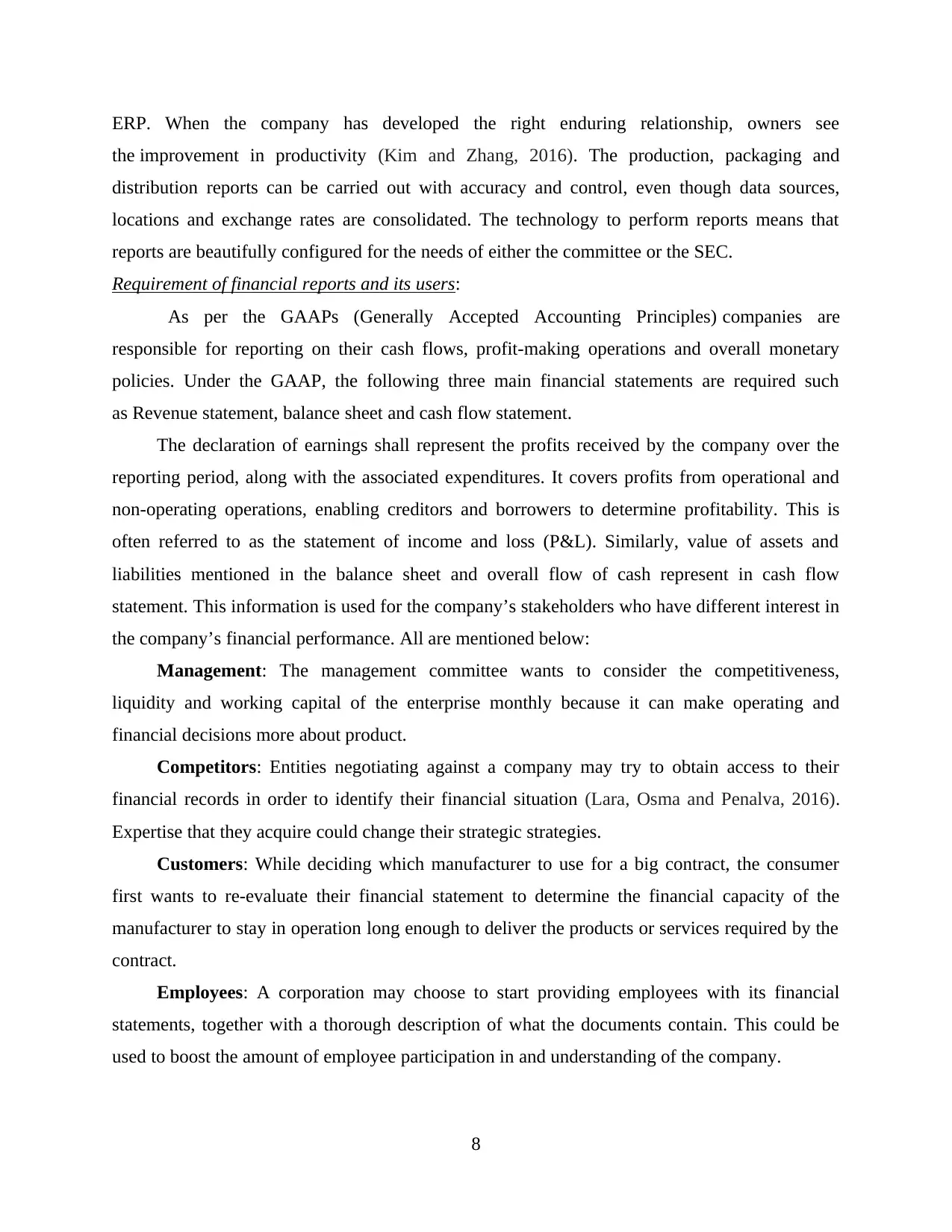

QUESTION 5

Profit and loss account for the year ended 31st December 2017:

Profit and loss account

Particulars Amount Particulars amount

Opening stock 9,500 Sales 125,000

Purchase 75000 Less: Return (1000) 124,000

Less: Return (1500) 73,500 Closing stock 1,000

Wages and salaries 13,200

Gross profit 28,800

9

financial statement to decide if the company has paid the right amount of tax or not.

Creditors: They are likely to demand the presentation of financial statements because they

are the shareholders of the company and want to appreciate the success of their money.

QUESTION 4

Different fundamental principle of accounting:

There are several accounting principles which are adopted by the organization at the time

of recording their business transactions and prepare accounts. Those are discussed below:

Accrual principle: It is the principle which financial records should be documented in the

financial period because once they actually occur, rather than in the periods when cash flows are

aligned with them (Mussari, 2014). This would be the foundation of the income statement for

accounting. It is essential for the development of financial performance of the company what

actually happened during the accounting period, instead of being artificial means delayed or sped

up by the affiliated cash flows.

Conservatism Principle: It is also the principle which wil allow the report to

record obligations as soon as possible, but only record sales and profits if they are confident they

will exist. This idea appears to promote the reporting of expenses early rather than later. This

idea can be pushed too far, if a company insistently mischaracterizes the outcomes to be lower

than is actually the case.

Principle of full disclosure: This is the principle that company should include in or along

with the annual reports of the companies all information that could have an effect on the user's

understanding of such statements. The accounting rules have greatly enhanced this concept by

defining an overwhelming amount of interactive disclosures.

QUESTION 5

Profit and loss account for the year ended 31st December 2017:

Profit and loss account

Particulars Amount Particulars amount

Opening stock 9,500 Sales 125,000

Purchase 75000 Less: Return (1000) 124,000

Less: Return (1500) 73,500 Closing stock 1,000

Wages and salaries 13,200

Gross profit 28,800

9

125,000 125,000

Rent and rates 1500 Gross profit 28,800

Add: Out. Rates 340 1,160 Interest received 1,000

Postage 900 Rent received - 4850

Insurance - 7500 Less: Advance rent -

490

4,360

Less: Prepaid insurance -

411

7,089

Bad debt write off 650

Net profit 24,361

34,160 34,160

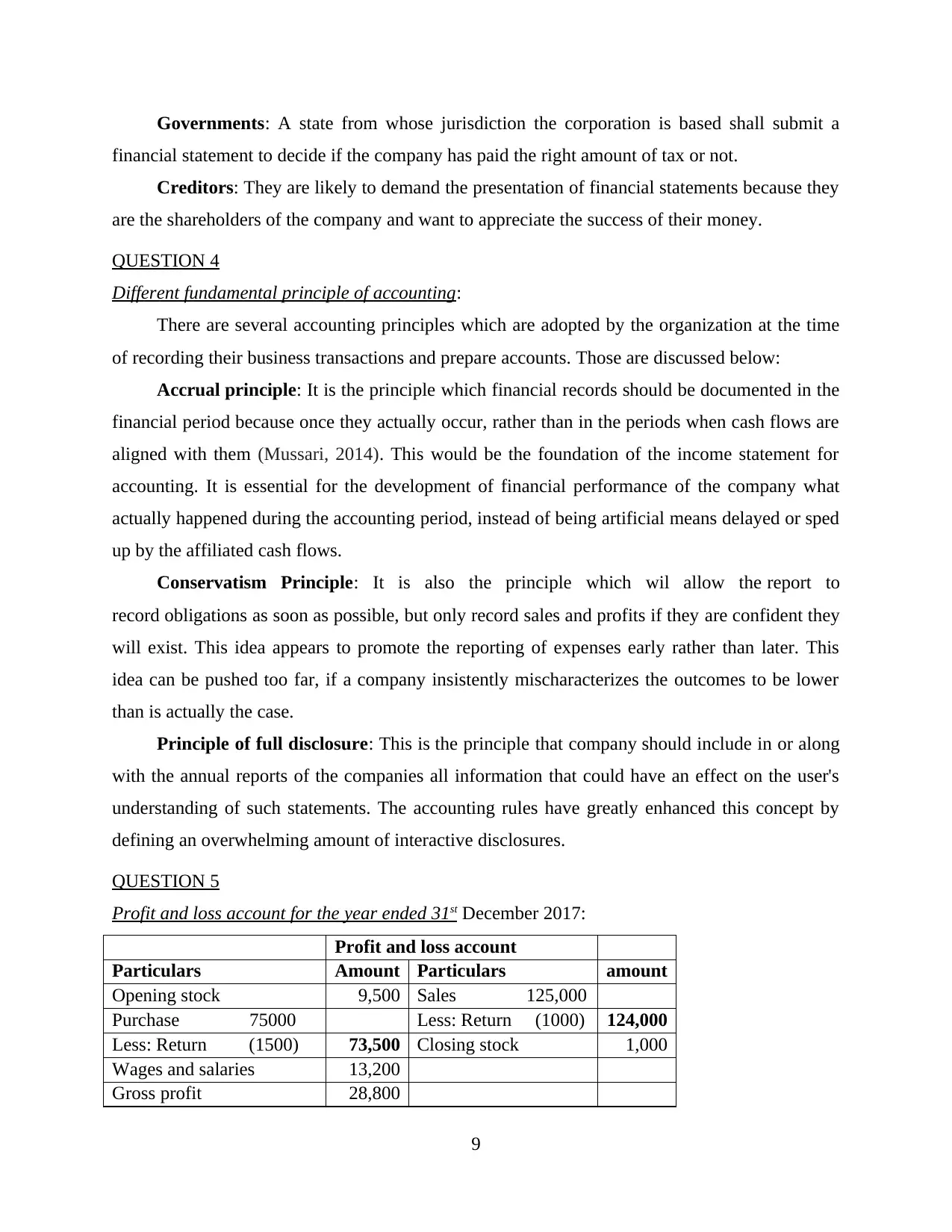

Balance sheet:

Balance sheet

Liabilities amount Assets Amount

Capital – 120,800 Bank 10,594

Less: Drawings

5,150

Cash 340

Add: Net profit -

24361

140,011 Prepaid insurance 411

Provision for bad

debts

934 Advance rent 490

Debtor - 12500

Creditor 3,900 Less: Bad debt write off -

934

11,850

Outstanding rates 340 Motor van at WDV - 19600

Less: Dep - 5000 14,600

Loan 100,000

Closing stock 1,000

145,185 145,185

SCENARIO 2

QUESTION 1

Meaning of bank reconciliation:

It is a declaration that individuals are prepared to identify, explain and recognize any

variations in between balance as per the bank statement and balance as per the accounting

records. All exchanges between the issuer and the bank are decided to enter independently in

their documents by both party leaders. Such documents can be unhappy for a number of reasons

10

Rent and rates 1500 Gross profit 28,800

Add: Out. Rates 340 1,160 Interest received 1,000

Postage 900 Rent received - 4850

Insurance - 7500 Less: Advance rent -

490

4,360

Less: Prepaid insurance -

411

7,089

Bad debt write off 650

Net profit 24,361

34,160 34,160

Balance sheet:

Balance sheet

Liabilities amount Assets Amount

Capital – 120,800 Bank 10,594

Less: Drawings

5,150

Cash 340

Add: Net profit -

24361

140,011 Prepaid insurance 411

Provision for bad

debts

934 Advance rent 490

Debtor - 12500

Creditor 3,900 Less: Bad debt write off -

934

11,850

Outstanding rates 340 Motor van at WDV - 19600

Less: Dep - 5000 14,600

Loan 100,000

Closing stock 1,000

145,185 145,185

SCENARIO 2

QUESTION 1

Meaning of bank reconciliation:

It is a declaration that individuals are prepared to identify, explain and recognize any

variations in between balance as per the bank statement and balance as per the accounting

records. All exchanges between the issuer and the bank are decided to enter independently in

their documents by both party leaders. Such documents can be unhappy for a number of reasons

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.