Surya Trading Company: Cash Budget and Financial Analysis

VerifiedAdded on 2023/06/09

|8

|2259

|194

Project

AI Summary

This project provides a comprehensive analysis of financial concepts, focusing on cash budgets and profit analysis. It differentiates between cash and profit, explaining their individual importance and how they differ in accounting. The project also distinguishes between capital and revenue expenditure, expenses and drawings, gross profit and net profit, cash budget and cash flow statement, and accruals and prepayments. Furthermore, it defines key financial terms such as assets, liabilities, ordinary shares, preference shares, dividend, stock exchange, venture capital, budget, capital income, and company, providing a foundational understanding of these concepts. The project includes a cash budget for Surya Trading Company for the year ending 2022. Desklib offers students access to this project, along with a wealth of past papers and solved assignments, to aid in their studies.

Project

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

TASK 1.1.........................................................................................................................................3

Create a cash budget of Surya trading company for the year ending 31st December, 2022........3

TASK 2.1.........................................................................................................................................3

A. In your opinion, are cash and profit similar? Recommend any company proceedings that do

not include an instant flow of cash?............................................................................................3

Differentiation between:..............................................................................................................4

Explain the following terms.........................................................................................................6

REFERENCES................................................................................................................................8

TASK 1.1.........................................................................................................................................3

Create a cash budget of Surya trading company for the year ending 31st December, 2022........3

TASK 2.1.........................................................................................................................................3

A. In your opinion, are cash and profit similar? Recommend any company proceedings that do

not include an instant flow of cash?............................................................................................3

Differentiation between:..............................................................................................................4

Explain the following terms.........................................................................................................6

REFERENCES................................................................................................................................8

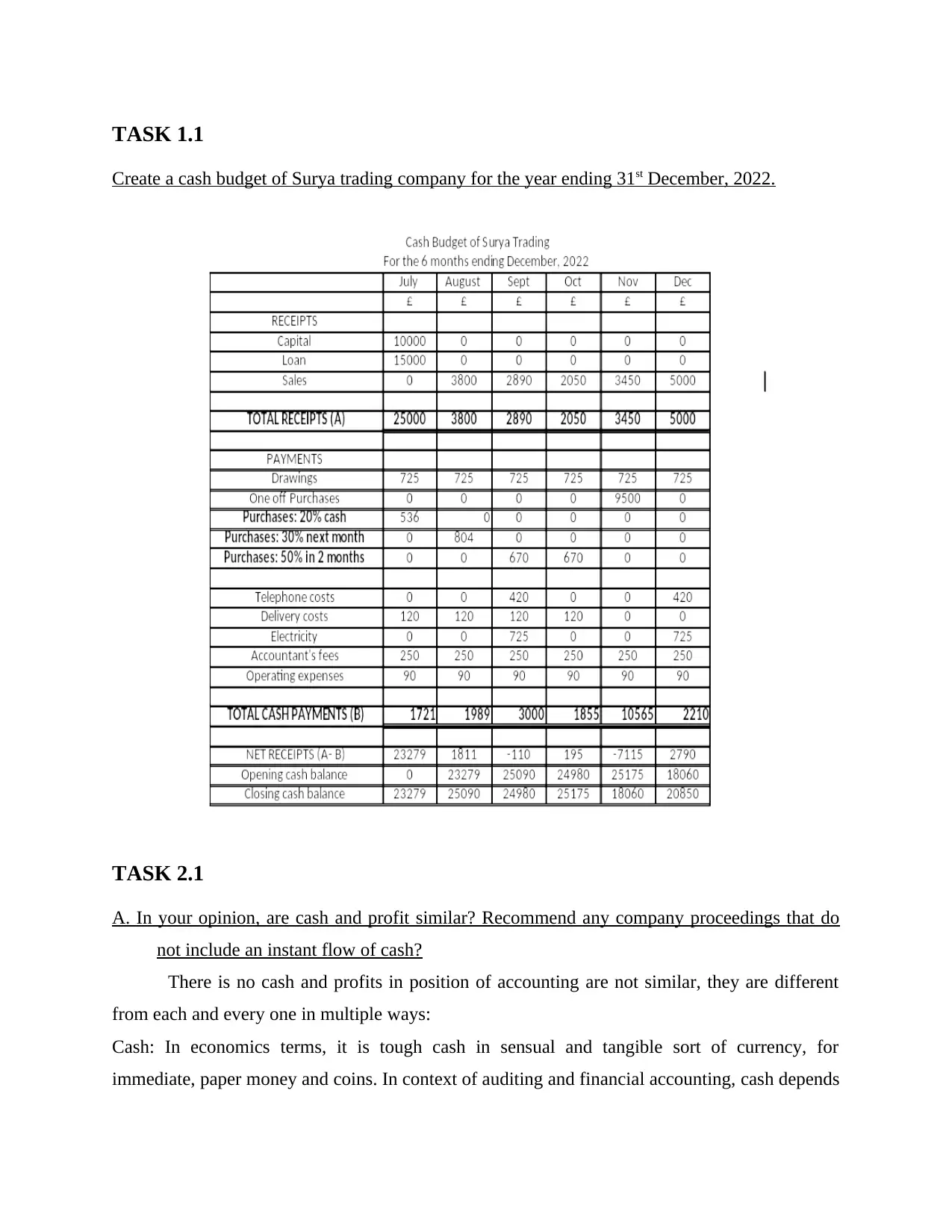

TASK 1.1

Create a cash budget of Surya trading company for the year ending 31st December, 2022.

TASK 2.1

A. In your opinion, are cash and profit similar? Recommend any company proceedings that do

not include an instant flow of cash?

There is no cash and profits in position of accounting are not similar, they are different

from each and every one in multiple ways:

Cash: In economics terms, it is tough cash in sensual and tangible sort of currency, for

immediate, paper money and coins. In context of auditing and financial accounting, cash depends

Create a cash budget of Surya trading company for the year ending 31st December, 2022.

TASK 2.1

A. In your opinion, are cash and profit similar? Recommend any company proceedings that do

not include an instant flow of cash?

There is no cash and profits in position of accounting are not similar, they are different

from each and every one in multiple ways:

Cash: In economics terms, it is tough cash in sensual and tangible sort of currency, for

immediate, paper money and coins. In context of auditing and financial accounting, cash depends

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

upon the classification of current assets involving currency or homogeneous currency that can be

merged immediately or in coming future. It can be negative and positive both movement of cash

showed that firm has high cash inflow in relation to its cash outflows. Adverse cash flow shows

that firm has highly cash outflows in relation to the inflow of cash. It classified into three main

parts named as operating, investing and financing cash flow (Aisaiti and et.al., 2019).

Profits: In terms of accounting, it is the interaction between the sales revenue received by an

enterprise from its outcomes and occurrence of cost on inputs. This is the firm profits analyses

which is proprietor's supporting interest in the procedure of income source for the production of

market. The allotment of profits among stakeholders and proprietors of company carry in a part

of payment due to dividend or reinvest in firm.

Difference between cash and profit:

1. Cash is the wealth that is easily available for use in the company whereas the profit is the

difference between revenue and expenses.

2. Companies cash denotes the liquidity to pay the financial debts and bills whereas profit shows

how effectively is organisation carrying out its operations.

3. Cash is necessary to run its businesses on daily basis whereas profit is the main tool of whole

business success.

4. Cash flow shows the inflow of cash or outflow of cash in to company whereas profit is the

money remains after deducting all expenses.

Differentiation between:

a) Capital Expenditure and revenue expenditure

Capital expenditure is the money which is spent by an entity in order to improve the

standard of the company by the acquisition of new assets. These are the expenses that take place

for the longer term and are financed and represented in the cash flow statements of the company.

This type of expenses is non-recurring in nature. The yield of these expenses is not limited to a

year and is usually long term in nature. Meanwhile, revenue expenditure is the type of money

which is spent by businesses for meeting daily operations. These expense occurs for a short span

of time and bound for an accounting year and it is not financed. It can also be termed as

statement of income and is recurring in nature (Alber, 2020).

b) Expenses and Drawings

merged immediately or in coming future. It can be negative and positive both movement of cash

showed that firm has high cash inflow in relation to its cash outflows. Adverse cash flow shows

that firm has highly cash outflows in relation to the inflow of cash. It classified into three main

parts named as operating, investing and financing cash flow (Aisaiti and et.al., 2019).

Profits: In terms of accounting, it is the interaction between the sales revenue received by an

enterprise from its outcomes and occurrence of cost on inputs. This is the firm profits analyses

which is proprietor's supporting interest in the procedure of income source for the production of

market. The allotment of profits among stakeholders and proprietors of company carry in a part

of payment due to dividend or reinvest in firm.

Difference between cash and profit:

1. Cash is the wealth that is easily available for use in the company whereas the profit is the

difference between revenue and expenses.

2. Companies cash denotes the liquidity to pay the financial debts and bills whereas profit shows

how effectively is organisation carrying out its operations.

3. Cash is necessary to run its businesses on daily basis whereas profit is the main tool of whole

business success.

4. Cash flow shows the inflow of cash or outflow of cash in to company whereas profit is the

money remains after deducting all expenses.

Differentiation between:

a) Capital Expenditure and revenue expenditure

Capital expenditure is the money which is spent by an entity in order to improve the

standard of the company by the acquisition of new assets. These are the expenses that take place

for the longer term and are financed and represented in the cash flow statements of the company.

This type of expenses is non-recurring in nature. The yield of these expenses is not limited to a

year and is usually long term in nature. Meanwhile, revenue expenditure is the type of money

which is spent by businesses for meeting daily operations. These expense occurs for a short span

of time and bound for an accounting year and it is not financed. It can also be termed as

statement of income and is recurring in nature (Alber, 2020).

b) Expenses and Drawings

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Expense is related with costs that is needed for daily operations in the business and it can

be occurred in an enterprise in the form of rent, heat and light, insurance, wages etc. These

expenses are deducted from gross profit in the Profit and Loss account. Whereas, drawings can

be defined as an amount which can be withdrawn from the daily operations of business for

personal use of the owner. Moreover, it is very much different from the salary of an employee in

this owner of business can withdraw any amount they choose to withdraw. These withdrawals

are then debited from the capital of the owners in the balance sheet of the organisation (Bulut,

2022).

c) Gross profit and Net profit

Gross profit is the total sum of amount which a business earns in a particular financial

year. Cost of goods sold is termed as cost of purchasing materials, including expenses of labour,

etc. While taking total sales into consideration all the cash and credit sales are included. On the

other side of the coin, net profit is the total amount which is received from revenue after

excluding the cost of goods sold and other operating expenses. The expenses include operating

expenses, taxes, interest, and selling expenses. It is also referred as the bottom line because it is

recorded at the bottom of the income statement. It can be obtained after excluding all the

expenses incurred in that particular period (Donovan, 2021).

d) Cash Budget and Cash Flow Statement

Cash budget is a strategy wise plan which represents that how cash resources will be

required and used over a specific period. It shows the estimated inflow and outflow of cash. It is

easy to understand. It comprises the least amount of cash balance which a business can use to

meet its cash requirement. It is frequently prepared for a shorter time span, namely, daily,

weekly, monthly, half-yearly etc. While, on the other hand, cash Flow Statement is a complete

study presenting which shows that how cash resources will be obtained and deployed over a

particular time period. It is a primary external statement which consists of the sources of cash

and represents cash usage. It is prepared for a long period, generally yearly.

e) Accruals and Prepayments

Accrued Expense are those expenses which are linked with the current period have not

yet been charged and did not occur in the balance of expense. This expense is recognized in the

be occurred in an enterprise in the form of rent, heat and light, insurance, wages etc. These

expenses are deducted from gross profit in the Profit and Loss account. Whereas, drawings can

be defined as an amount which can be withdrawn from the daily operations of business for

personal use of the owner. Moreover, it is very much different from the salary of an employee in

this owner of business can withdraw any amount they choose to withdraw. These withdrawals

are then debited from the capital of the owners in the balance sheet of the organisation (Bulut,

2022).

c) Gross profit and Net profit

Gross profit is the total sum of amount which a business earns in a particular financial

year. Cost of goods sold is termed as cost of purchasing materials, including expenses of labour,

etc. While taking total sales into consideration all the cash and credit sales are included. On the

other side of the coin, net profit is the total amount which is received from revenue after

excluding the cost of goods sold and other operating expenses. The expenses include operating

expenses, taxes, interest, and selling expenses. It is also referred as the bottom line because it is

recorded at the bottom of the income statement. It can be obtained after excluding all the

expenses incurred in that particular period (Donovan, 2021).

d) Cash Budget and Cash Flow Statement

Cash budget is a strategy wise plan which represents that how cash resources will be

required and used over a specific period. It shows the estimated inflow and outflow of cash. It is

easy to understand. It comprises the least amount of cash balance which a business can use to

meet its cash requirement. It is frequently prepared for a shorter time span, namely, daily,

weekly, monthly, half-yearly etc. While, on the other hand, cash Flow Statement is a complete

study presenting which shows that how cash resources will be obtained and deployed over a

particular time period. It is a primary external statement which consists of the sources of cash

and represents cash usage. It is prepared for a long period, generally yearly.

e) Accruals and Prepayments

Accrued Expense are those expenses which are linked with the current period have not

yet been charged and did not occur in the balance of expense. This expense is recognized in the

profit and loss account and is shown in the balance sheet of the company on the liabilities side.

While paying up are that expenses which occurred during the current period but related to the

next accounting year. Meanwhile, these expenses are deducted from the expenses balance shown

in the Income statement. It is shown in the balance sheet as an asset of the Company (Ejiogu,

2018).

Explain the following terms.

a) Asset: It is used to quantify and measure, which shows economic value that of sole

trader, business firm, or nation owns or rule with the and expecting that it will provide a

for anticipated advantage. These are noted down in an organisation's balance sheet and

are required to produce to uplift a concerns worth or benefit the functioning of the firm. It

can generate cash flow, cut down expenses, or upgrade sales. Assets are ranked into five

categories wiz., tangible, intangible, financial, fixed and current assets (Emerson and

et.al., 2019).

b) Liabilities: It is that amount which a persons or company has to repay. These are charged

over time through the diversification of economic welfare which consists of funds,

commodities, or services. These are recorded on the credit side of the balance sheet. It

includes debt, creditors, security interest, deferred revenues, bonds, warranties, and

outstanding expenses. These are written down or recorded in an opposition to assets. It

also means a lawful or authoritative risk. It is non declining in nature. It is accountable

for outflows of cash from the organisation. Bank overdrafts, lease and short term loans

are some examples of liabilities.

a) Ordinary Shares: These shares are also known as common shares and are considered as

a stock which is sold on public exchange. Every shareholder has who purchases the stock

of a company has right to take participate in the shareholder meeting. Moreover, the

holders of these shares are not guaranteed a dividend just like holders of preference

shares. Shareholders of ordinary shares will receive dividend after payment of dividend

to preference shareholders.

b) Preference Shares: These are generally known as preferred stock. These are those shares

of an entity on which dividends are paid before paying dividend on ordinary shares. In

case of liquidation of a company, stakeholders of preference shares are entitled to receive

While paying up are that expenses which occurred during the current period but related to the

next accounting year. Meanwhile, these expenses are deducted from the expenses balance shown

in the Income statement. It is shown in the balance sheet as an asset of the Company (Ejiogu,

2018).

Explain the following terms.

a) Asset: It is used to quantify and measure, which shows economic value that of sole

trader, business firm, or nation owns or rule with the and expecting that it will provide a

for anticipated advantage. These are noted down in an organisation's balance sheet and

are required to produce to uplift a concerns worth or benefit the functioning of the firm. It

can generate cash flow, cut down expenses, or upgrade sales. Assets are ranked into five

categories wiz., tangible, intangible, financial, fixed and current assets (Emerson and

et.al., 2019).

b) Liabilities: It is that amount which a persons or company has to repay. These are charged

over time through the diversification of economic welfare which consists of funds,

commodities, or services. These are recorded on the credit side of the balance sheet. It

includes debt, creditors, security interest, deferred revenues, bonds, warranties, and

outstanding expenses. These are written down or recorded in an opposition to assets. It

also means a lawful or authoritative risk. It is non declining in nature. It is accountable

for outflows of cash from the organisation. Bank overdrafts, lease and short term loans

are some examples of liabilities.

a) Ordinary Shares: These shares are also known as common shares and are considered as

a stock which is sold on public exchange. Every shareholder has who purchases the stock

of a company has right to take participate in the shareholder meeting. Moreover, the

holders of these shares are not guaranteed a dividend just like holders of preference

shares. Shareholders of ordinary shares will receive dividend after payment of dividend

to preference shareholders.

b) Preference Shares: These are generally known as preferred stock. These are those shares

of an entity on which dividends are paid before paying dividend on ordinary shares. In

case of liquidation of a company, stakeholders of preference shares are entitled to receive

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

dividends before shareholders of equity shares. In most cases preference shares have a

fixed dividend in comparison to ordinary shares. Their shareholders do not exercise

voting rights in shareholders meeting of the organisation (Fombang and Adjasi, 2018).

c) Dividend: It is diversification of profits of an organisation to its superior shareholders of

equity. When a business earns in excess, it becomes capable of paying a part of its profit

as dividend to stockholder of the company. It is generally distributed quarterly and can be

paid out in the form of cash. Shareholders of companies which regularly pay off its

dividend, are entitled to receive their part of profits till the date they hold their investment

in the company but before date of the declaration of ex-dividend.

d) Stock Exchange: It is an exchange where a stock trader can buy and sell securities. It is

also termed as securities exchange. It indulges shares of stocks, bonds and other financial

instruments. It also gives facilities for issuing and redemption of securities. Initial public

offering or IPO of stocks and bonds is furnished in primary market and afterwards trading

is done in the secondary market (Pan, 2019). There are many kinds of equities in which

an individual can invests like blue chips, penny stocks, hedging stocks, dividend stocks

and many more.

e) Venture Capital: It is a kind of personal equity of an individual or funds that is supplied

by investors for starting companies and mid cap or small cap businesses that are

estimated to have a potential to survive in the long term.

f) Budget: An evaluation of incomes to be earned and expenses to be incurred in a

particular future time period is referred to as budget.

g) Capital Income: An income which is derived from the capital or wealth instead of

production process of an organisation is referred to as capital income. It consists of stock

dividends and capital gains. It arises from passage of time of an asset not from utilisation

of an asset (Rugman, 2019).

h) Company: A legal entity which represents an association of people irrespective of fact

that they are natural, legal or combination of both.

fixed dividend in comparison to ordinary shares. Their shareholders do not exercise

voting rights in shareholders meeting of the organisation (Fombang and Adjasi, 2018).

c) Dividend: It is diversification of profits of an organisation to its superior shareholders of

equity. When a business earns in excess, it becomes capable of paying a part of its profit

as dividend to stockholder of the company. It is generally distributed quarterly and can be

paid out in the form of cash. Shareholders of companies which regularly pay off its

dividend, are entitled to receive their part of profits till the date they hold their investment

in the company but before date of the declaration of ex-dividend.

d) Stock Exchange: It is an exchange where a stock trader can buy and sell securities. It is

also termed as securities exchange. It indulges shares of stocks, bonds and other financial

instruments. It also gives facilities for issuing and redemption of securities. Initial public

offering or IPO of stocks and bonds is furnished in primary market and afterwards trading

is done in the secondary market (Pan, 2019). There are many kinds of equities in which

an individual can invests like blue chips, penny stocks, hedging stocks, dividend stocks

and many more.

e) Venture Capital: It is a kind of personal equity of an individual or funds that is supplied

by investors for starting companies and mid cap or small cap businesses that are

estimated to have a potential to survive in the long term.

f) Budget: An evaluation of incomes to be earned and expenses to be incurred in a

particular future time period is referred to as budget.

g) Capital Income: An income which is derived from the capital or wealth instead of

production process of an organisation is referred to as capital income. It consists of stock

dividends and capital gains. It arises from passage of time of an asset not from utilisation

of an asset (Rugman, 2019).

h) Company: A legal entity which represents an association of people irrespective of fact

that they are natural, legal or combination of both.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Aisaiti, G and et.al., 2019. An empirical analysis of rural farmers’ financing intention of

inclusive finance in China: The moderating role of digital finance and social enterprise

embeddedness. Industrial Management & Data Systems.

Alber, N., 2020. Finance in the time of coronavirus during 100 days of isolation: The case of the

European stock markets. Available at SSRN 3631517.

Bulut, E., 2022. Blockchain-based entrepreneurial finance: success determinants of tourism

initial coin offerings. Current Issues in Tourism, 25(11), pp.1767-1781.

Donovan, J., 2021. Financial reporting and entrepreneurial finance: Evidence from equity

crowdfunding. Management Science, 67(11), pp.7214-7237.

Ejiogu, A.O. ed., 2018. Agricultural finance and opportunities for investment and expansion. IGI

Global.

Emerson, S., Kennedy, R., O'Shea, L. and O'Brien, J., 2019, May. Trends and applications of

machine learning in quantitative finance. In 8th international conference on economics

and finance research (ICEFR 2019).

Fombang, M.S. and Adjasi, C.K., 2018. Access to finance and firm innovation. Journal of

financial economic policy, 10(1), pp.73-94.

Pan, H., 2019, May. Intelligent Finance Global Monitoring and Observatory: A New Perspective

for Global Macro beyond Big Data. In 2019 IEEE International Conference on

Industrial Cyber Physical Systems (ICPS) (pp. 623-628). IEEE.Appiah‐Otoo, I. and

Song, N., 2020.

Rugman, A.M., 2019. From globalisation to regionalism: The foreign direct investment

dimension of international finance. In Shaping a new international financial system (pp.

203-219). Routledge.

Tran, D.V., Hoang, K. and Nguyen, C., 2021. How does economic policy uncertainty affect bank

business models?. Finance Research Letters, 39, p.101639.

Books and Journals

Aisaiti, G and et.al., 2019. An empirical analysis of rural farmers’ financing intention of

inclusive finance in China: The moderating role of digital finance and social enterprise

embeddedness. Industrial Management & Data Systems.

Alber, N., 2020. Finance in the time of coronavirus during 100 days of isolation: The case of the

European stock markets. Available at SSRN 3631517.

Bulut, E., 2022. Blockchain-based entrepreneurial finance: success determinants of tourism

initial coin offerings. Current Issues in Tourism, 25(11), pp.1767-1781.

Donovan, J., 2021. Financial reporting and entrepreneurial finance: Evidence from equity

crowdfunding. Management Science, 67(11), pp.7214-7237.

Ejiogu, A.O. ed., 2018. Agricultural finance and opportunities for investment and expansion. IGI

Global.

Emerson, S., Kennedy, R., O'Shea, L. and O'Brien, J., 2019, May. Trends and applications of

machine learning in quantitative finance. In 8th international conference on economics

and finance research (ICEFR 2019).

Fombang, M.S. and Adjasi, C.K., 2018. Access to finance and firm innovation. Journal of

financial economic policy, 10(1), pp.73-94.

Pan, H., 2019, May. Intelligent Finance Global Monitoring and Observatory: A New Perspective

for Global Macro beyond Big Data. In 2019 IEEE International Conference on

Industrial Cyber Physical Systems (ICPS) (pp. 623-628). IEEE.Appiah‐Otoo, I. and

Song, N., 2020.

Rugman, A.M., 2019. From globalisation to regionalism: The foreign direct investment

dimension of international finance. In Shaping a new international financial system (pp.

203-219). Routledge.

Tran, D.V., Hoang, K. and Nguyen, C., 2021. How does economic policy uncertainty affect bank

business models?. Finance Research Letters, 39, p.101639.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.