Financial Accounting and Reporting

VerifiedAdded on 2021/04/21

|10

|1367

|32

AI Summary

This assignment provides the financial statements, including the balance sheet statement, income statement, and cash flow statement, for Appliances Limited for the year ended 30 June 2018. The statements include details such as assets, liabilities, equity, revenue, expenses, net profit, and comprehensive income. Additionally, it includes a statement of change in equity, which shows the changes in share capital and retained earnings during the year. The assignment also references relevant accounting standards and provides a summary in English.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Accounting

News Letter

News Letter

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

NAME OF THE STUDENT

NAME OF THE UNIVERSITY

AUTHORS NOTE

COURSE ID

NAME OF THE UNIVERSITY

AUTHORS NOTE

COURSE ID

NEWS LETTER

AASB Standard Setting frameworks Finalised: 9th May

2018:

The Australian Accounting Standard Board has finalized the

standard setting framework on 9th May 2018. After developing

through the public consultation the Australian (Aasb.gov.au,

2018) Accounting Standard Board has finalized the framework

for setting standard for the non-profit companies as well as the

for-profit companies. The framework set by AASB lay down that

how the AASB makes the use of the IFRS standards in the form

of base for developing, issuing and maintaining the Accounting

standards of Australian. The standard setting framework helps in

identifying when the Australian accounting standard board

should take up the project of modifying the IFRS along with the

form and degree of such amendments.

New compilations for reporting periods commencing

from or after 1-1-18: 17th May:

AASB has released new

compilations for the

accounting period

commencing from 1-1-18

where AASB 15 is

mandatorily applicable to

the for-profit making

companies. The AASB 15

mandatory implementation

for non-profit companies

has been deferred by a year

to the accounting period

commencing from or after

1-1-19 (Aasb.gov.au,

2018). The AASB 111 and

AASB 118 following the

amendments on 1-1-18 is

applicable for additional one

year for non-profit

companies for the period

commencing from or after

Summary of development and news in the environment of financial reporting

Period 1st May to 31st July 2018:

AASB Standard Setting frameworks Finalised: 9th May

2018:

The Australian Accounting Standard Board has finalized the

standard setting framework on 9th May 2018. After developing

through the public consultation the Australian (Aasb.gov.au,

2018) Accounting Standard Board has finalized the framework

for setting standard for the non-profit companies as well as the

for-profit companies. The framework set by AASB lay down that

how the AASB makes the use of the IFRS standards in the form

of base for developing, issuing and maintaining the Accounting

standards of Australian. The standard setting framework helps in

identifying when the Australian accounting standard board

should take up the project of modifying the IFRS along with the

form and degree of such amendments.

New compilations for reporting periods commencing

from or after 1-1-18: 17th May:

AASB has released new

compilations for the

accounting period

commencing from 1-1-18

where AASB 15 is

mandatorily applicable to

the for-profit making

companies. The AASB 15

mandatory implementation

for non-profit companies

has been deferred by a year

to the accounting period

commencing from or after

1-1-19 (Aasb.gov.au,

2018). The AASB 111 and

AASB 118 following the

amendments on 1-1-18 is

applicable for additional one

year for non-profit

companies for the period

commencing from or after

Summary of development and news in the environment of financial reporting

Period 1st May to 31st July 2018:

1-1-18 but prior to 1-1-19 following which they are out of date

for the non-profit companies.

Amendment in AASB 16 Leases:

In the latest amendment, AASB 16 eliminates the

classifications of the leases as the operating or the financial

leases and treating effectively all the leases as the financial

leases. Leases that are of short term or less than 12 months

and leases that are of lower value assets namely the

personal computers are exempted from the requirements of

the lease accounting (Aasb.gov.au, 2018). There is also the

change in the accounting the lease life as well. Particularly,

companies are now required to identify the front loaded

pattern of the expenditure for majority of the leases even

though they pay the continuous yearly rentals.

AASB 22 Interpretation: Transactions relating to

Foreign Currency and Advance Considerations:

The amendments explain that in ascertaining the rate of spot

exchange for use on initial recognition of the related assets,

expenditure or income on de-recognizing the non-financial assets

or liability related to advance considerations that transaction date

must be recognized (Aasb.gov.au, 2018). The transaction date

represents the date on which a company first identifies the non-

monetary assets or the non-financial liabilities originating from

the advance considerations. On noticing multiple payments or

receipts in advance, the company should then ascertain the

for the non-profit companies.

Amendment in AASB 16 Leases:

In the latest amendment, AASB 16 eliminates the

classifications of the leases as the operating or the financial

leases and treating effectively all the leases as the financial

leases. Leases that are of short term or less than 12 months

and leases that are of lower value assets namely the

personal computers are exempted from the requirements of

the lease accounting (Aasb.gov.au, 2018). There is also the

change in the accounting the lease life as well. Particularly,

companies are now required to identify the front loaded

pattern of the expenditure for majority of the leases even

though they pay the continuous yearly rentals.

AASB 22 Interpretation: Transactions relating to

Foreign Currency and Advance Considerations:

The amendments explain that in ascertaining the rate of spot

exchange for use on initial recognition of the related assets,

expenditure or income on de-recognizing the non-financial assets

or liability related to advance considerations that transaction date

must be recognized (Aasb.gov.au, 2018). The transaction date

represents the date on which a company first identifies the non-

monetary assets or the non-financial liabilities originating from

the advance considerations. On noticing multiple payments or

receipts in advance, the company should then ascertain the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

transaction date for each of receipts or payment for the advance considerations.

Answer to Question 2:

Answer to requirement I:

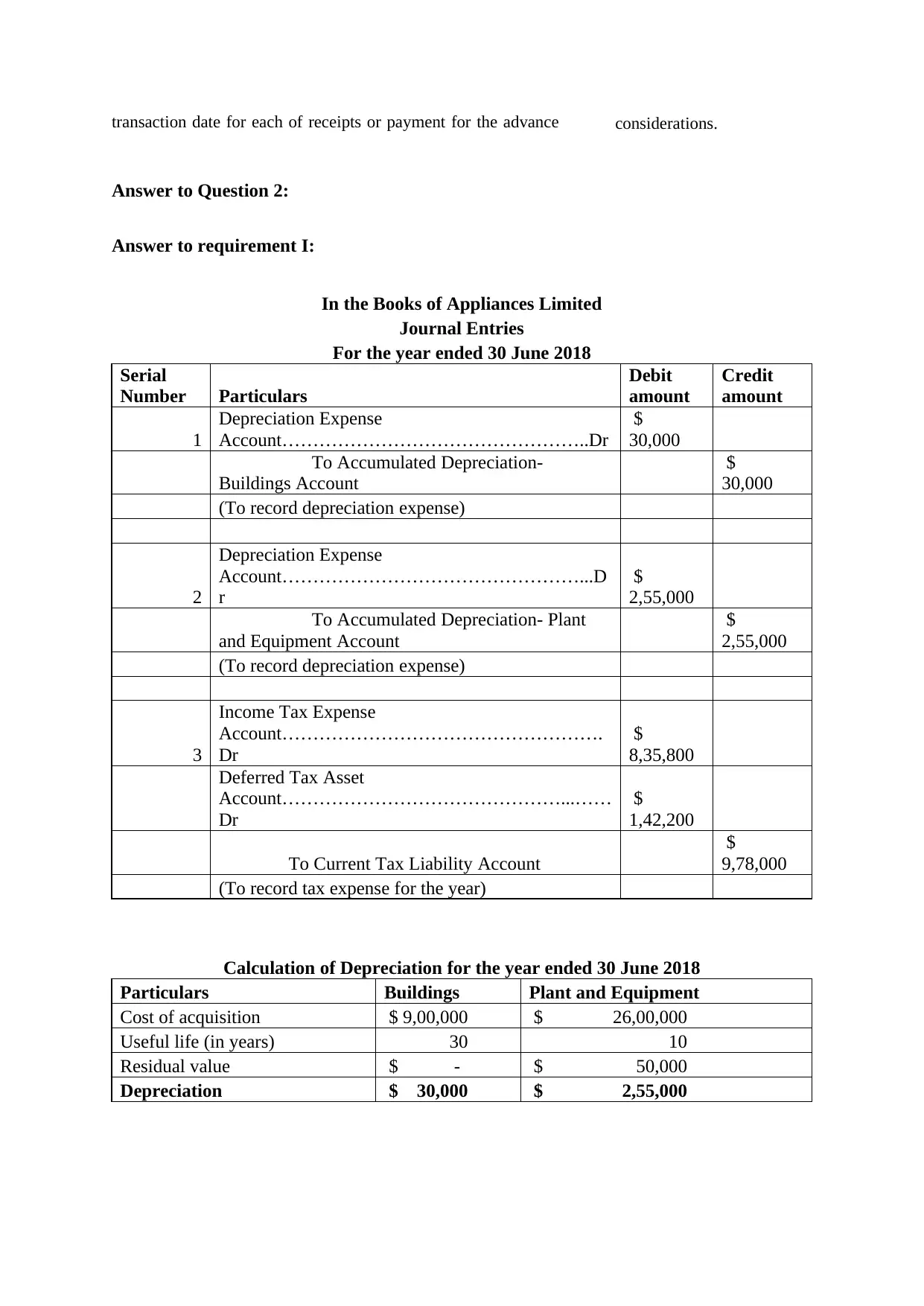

In the Books of Appliances Limited

Journal Entries

For the year ended 30 June 2018

Serial

Number Particulars

Debit

amount

Credit

amount

1

Depreciation Expense

Account…………………………………………..Dr

$

30,000

To Accumulated Depreciation-

Buildings Account

$

30,000

(To record depreciation expense)

2

Depreciation Expense

Account…………………………………………...D

r

$

2,55,000

To Accumulated Depreciation- Plant

and Equipment Account

$

2,55,000

(To record depreciation expense)

3

Income Tax Expense

Account…………………………………………….

Dr

$

8,35,800

Deferred Tax Asset

Account………………………………………...……

Dr

$

1,42,200

To Current Tax Liability Account

$

9,78,000

(To record tax expense for the year)

Calculation of Depreciation for the year ended 30 June 2018

Particulars Buildings Plant and Equipment

Cost of acquisition $ 9,00,000 $ 26,00,000

Useful life (in years) 30 10

Residual value $ - $ 50,000

Depreciation $ 30,000 $ 2,55,000

Answer to Question 2:

Answer to requirement I:

In the Books of Appliances Limited

Journal Entries

For the year ended 30 June 2018

Serial

Number Particulars

Debit

amount

Credit

amount

1

Depreciation Expense

Account…………………………………………..Dr

$

30,000

To Accumulated Depreciation-

Buildings Account

$

30,000

(To record depreciation expense)

2

Depreciation Expense

Account…………………………………………...D

r

$

2,55,000

To Accumulated Depreciation- Plant

and Equipment Account

$

2,55,000

(To record depreciation expense)

3

Income Tax Expense

Account…………………………………………….

Dr

$

8,35,800

Deferred Tax Asset

Account………………………………………...……

Dr

$

1,42,200

To Current Tax Liability Account

$

9,78,000

(To record tax expense for the year)

Calculation of Depreciation for the year ended 30 June 2018

Particulars Buildings Plant and Equipment

Cost of acquisition $ 9,00,000 $ 26,00,000

Useful life (in years) 30 10

Residual value $ - $ 50,000

Depreciation $ 30,000 $ 2,55,000

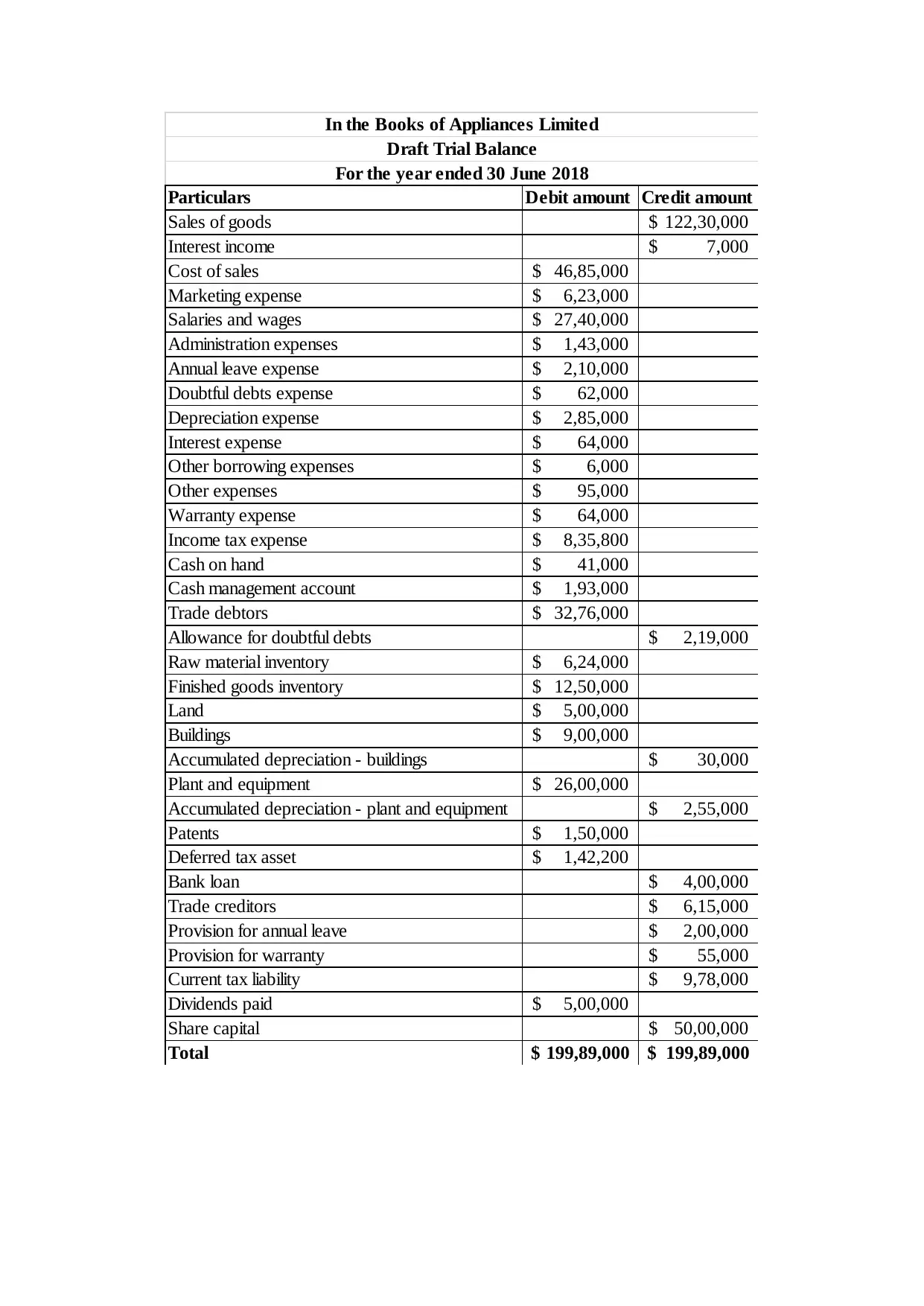

Particulars Debit amount Credit amount

Sales of goods 122,30,000$

Interest income 7,000$

Cost of sales 46,85,000$

Marketing expense 6,23,000$

Salaries and wages 27,40,000$

Administration expenses 1,43,000$

Annual leave expense 2,10,000$

Doubtful debts expense 62,000$

Depreciation expense 2,85,000$

Interest expense 64,000$

Other borrowing expenses 6,000$

Other expenses 95,000$

Warranty expense 64,000$

Income tax expense 8,35,800$

Cash on hand 41,000$

Cash management account 1,93,000$

Trade debtors 32,76,000$

Allowance for doubtful debts 2,19,000$

Raw material inventory 6,24,000$

Finished goods inventory 12,50,000$

Land 5,00,000$

Buildings 9,00,000$

Accumulated depreciation - buildings 30,000$

Plant and equipment 26,00,000$

Accumulated depreciation - plant and equipment 2,55,000$

Patents 1,50,000$

Deferred tax asset 1,42,200$

Bank loan 4,00,000$

Trade creditors 6,15,000$

Provision for annual leave 2,00,000$

Provision for warranty 55,000$

Current tax liability 9,78,000$

Dividends paid 5,00,000$

Share capital 50,00,000$

Total 199,89,000$ 199,89,000$

In the Books of Appliances Limited

Draft Trial Balance

For the year ended 30 June 2018

Sales of goods 122,30,000$

Interest income 7,000$

Cost of sales 46,85,000$

Marketing expense 6,23,000$

Salaries and wages 27,40,000$

Administration expenses 1,43,000$

Annual leave expense 2,10,000$

Doubtful debts expense 62,000$

Depreciation expense 2,85,000$

Interest expense 64,000$

Other borrowing expenses 6,000$

Other expenses 95,000$

Warranty expense 64,000$

Income tax expense 8,35,800$

Cash on hand 41,000$

Cash management account 1,93,000$

Trade debtors 32,76,000$

Allowance for doubtful debts 2,19,000$

Raw material inventory 6,24,000$

Finished goods inventory 12,50,000$

Land 5,00,000$

Buildings 9,00,000$

Accumulated depreciation - buildings 30,000$

Plant and equipment 26,00,000$

Accumulated depreciation - plant and equipment 2,55,000$

Patents 1,50,000$

Deferred tax asset 1,42,200$

Bank loan 4,00,000$

Trade creditors 6,15,000$

Provision for annual leave 2,00,000$

Provision for warranty 55,000$

Current tax liability 9,78,000$

Dividends paid 5,00,000$

Share capital 50,00,000$

Total 199,89,000$ 199,89,000$

In the Books of Appliances Limited

Draft Trial Balance

For the year ended 30 June 2018

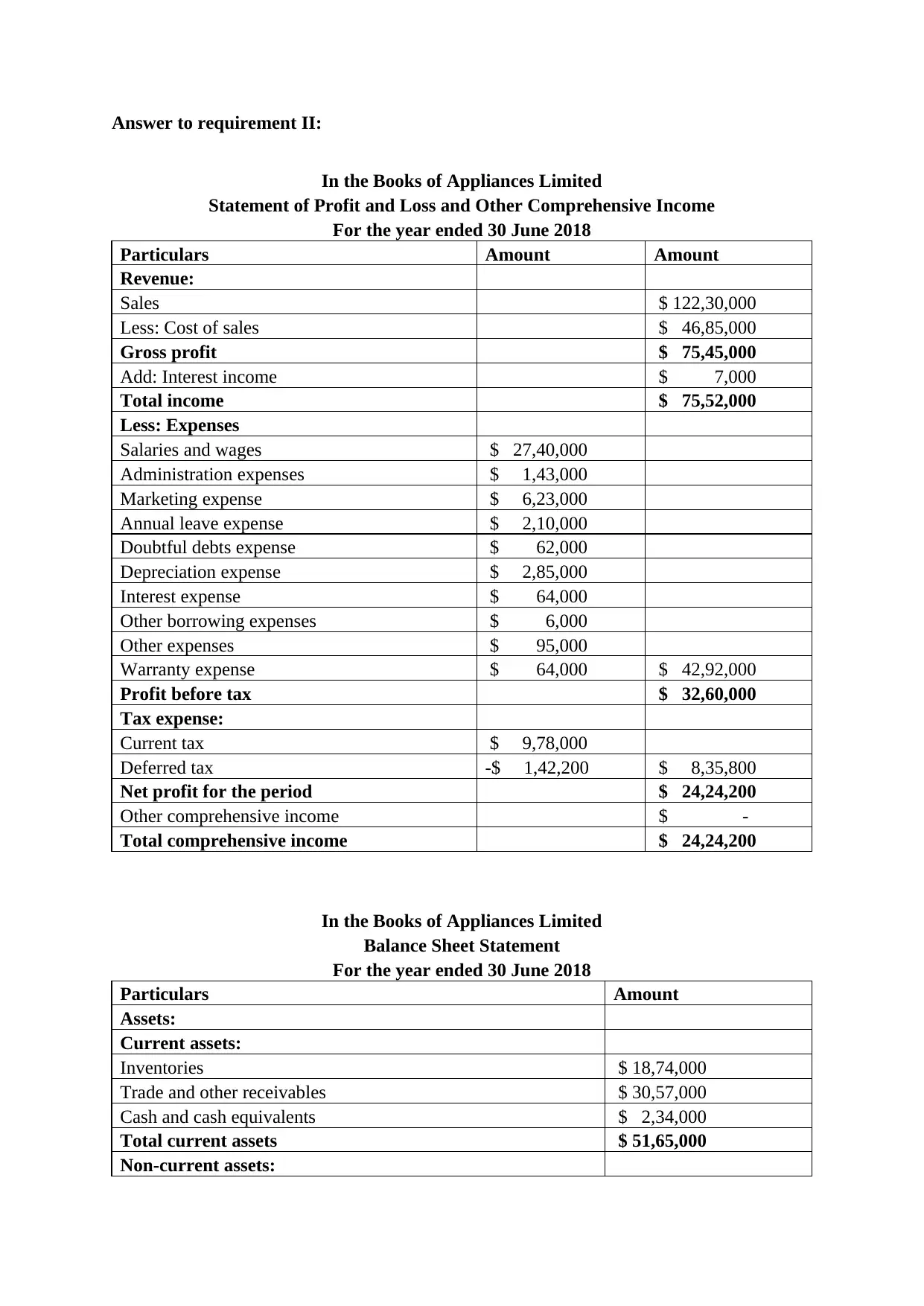

Answer to requirement II:

In the Books of Appliances Limited

Statement of Profit and Loss and Other Comprehensive Income

For the year ended 30 June 2018

Particulars Amount Amount

Revenue:

Sales $ 122,30,000

Less: Cost of sales $ 46,85,000

Gross profit $ 75,45,000

Add: Interest income $ 7,000

Total income $ 75,52,000

Less: Expenses

Salaries and wages $ 27,40,000

Administration expenses $ 1,43,000

Marketing expense $ 6,23,000

Annual leave expense $ 2,10,000

Doubtful debts expense $ 62,000

Depreciation expense $ 2,85,000

Interest expense $ 64,000

Other borrowing expenses $ 6,000

Other expenses $ 95,000

Warranty expense $ 64,000 $ 42,92,000

Profit before tax $ 32,60,000

Tax expense:

Current tax $ 9,78,000

Deferred tax -$ 1,42,200 $ 8,35,800

Net profit for the period $ 24,24,200

Other comprehensive income $ -

Total comprehensive income $ 24,24,200

In the Books of Appliances Limited

Balance Sheet Statement

For the year ended 30 June 2018

Particulars Amount

Assets:

Current assets:

Inventories $ 18,74,000

Trade and other receivables $ 30,57,000

Cash and cash equivalents $ 2,34,000

Total current assets $ 51,65,000

Non-current assets:

In the Books of Appliances Limited

Statement of Profit and Loss and Other Comprehensive Income

For the year ended 30 June 2018

Particulars Amount Amount

Revenue:

Sales $ 122,30,000

Less: Cost of sales $ 46,85,000

Gross profit $ 75,45,000

Add: Interest income $ 7,000

Total income $ 75,52,000

Less: Expenses

Salaries and wages $ 27,40,000

Administration expenses $ 1,43,000

Marketing expense $ 6,23,000

Annual leave expense $ 2,10,000

Doubtful debts expense $ 62,000

Depreciation expense $ 2,85,000

Interest expense $ 64,000

Other borrowing expenses $ 6,000

Other expenses $ 95,000

Warranty expense $ 64,000 $ 42,92,000

Profit before tax $ 32,60,000

Tax expense:

Current tax $ 9,78,000

Deferred tax -$ 1,42,200 $ 8,35,800

Net profit for the period $ 24,24,200

Other comprehensive income $ -

Total comprehensive income $ 24,24,200

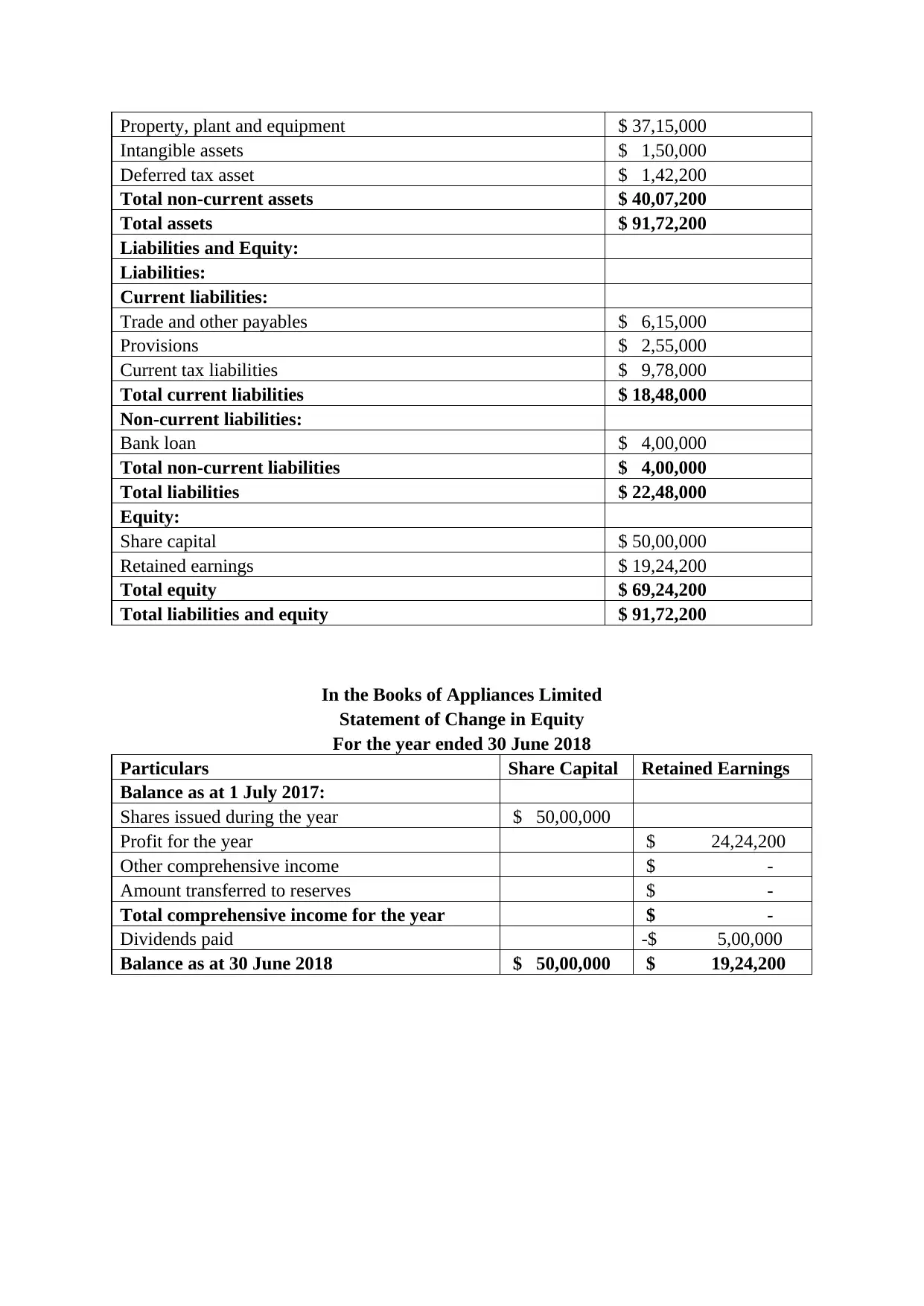

In the Books of Appliances Limited

Balance Sheet Statement

For the year ended 30 June 2018

Particulars Amount

Assets:

Current assets:

Inventories $ 18,74,000

Trade and other receivables $ 30,57,000

Cash and cash equivalents $ 2,34,000

Total current assets $ 51,65,000

Non-current assets:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Property, plant and equipment $ 37,15,000

Intangible assets $ 1,50,000

Deferred tax asset $ 1,42,200

Total non-current assets $ 40,07,200

Total assets $ 91,72,200

Liabilities and Equity:

Liabilities:

Current liabilities:

Trade and other payables $ 6,15,000

Provisions $ 2,55,000

Current tax liabilities $ 9,78,000

Total current liabilities $ 18,48,000

Non-current liabilities:

Bank loan $ 4,00,000

Total non-current liabilities $ 4,00,000

Total liabilities $ 22,48,000

Equity:

Share capital $ 50,00,000

Retained earnings $ 19,24,200

Total equity $ 69,24,200

Total liabilities and equity $ 91,72,200

In the Books of Appliances Limited

Statement of Change in Equity

For the year ended 30 June 2018

Particulars Share Capital Retained Earnings

Balance as at 1 July 2017:

Shares issued during the year $ 50,00,000

Profit for the year $ 24,24,200

Other comprehensive income $ -

Amount transferred to reserves $ -

Total comprehensive income for the year $ -

Dividends paid -$ 5,00,000

Balance as at 30 June 2018 $ 50,00,000 $ 19,24,200

Intangible assets $ 1,50,000

Deferred tax asset $ 1,42,200

Total non-current assets $ 40,07,200

Total assets $ 91,72,200

Liabilities and Equity:

Liabilities:

Current liabilities:

Trade and other payables $ 6,15,000

Provisions $ 2,55,000

Current tax liabilities $ 9,78,000

Total current liabilities $ 18,48,000

Non-current liabilities:

Bank loan $ 4,00,000

Total non-current liabilities $ 4,00,000

Total liabilities $ 22,48,000

Equity:

Share capital $ 50,00,000

Retained earnings $ 19,24,200

Total equity $ 69,24,200

Total liabilities and equity $ 91,72,200

In the Books of Appliances Limited

Statement of Change in Equity

For the year ended 30 June 2018

Particulars Share Capital Retained Earnings

Balance as at 1 July 2017:

Shares issued during the year $ 50,00,000

Profit for the year $ 24,24,200

Other comprehensive income $ -

Amount transferred to reserves $ -

Total comprehensive income for the year $ -

Dividends paid -$ 5,00,000

Balance as at 30 June 2018 $ 50,00,000 $ 19,24,200

References and Bibliographies:

Aasb.gov.au/. (2018). Retrieved from http://www.aasb.gov.au/News/Hot-Topic-update--

Applying-the-IASB-s-Revised-Conceptual-Framework-and-Solving-the-Reporting-Entity-

and-Special-Purpose-Financial-Statement-Problems?newsID=277156

Accounting standards. (2018). Retrieved from

http://www.aasb.gov.au/Pronouncements/Current-standards.aspx

Deegan, C. (2013). Financial accounting theory. McGraw-Hill Education Australia.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

Hoskin, R. E., Fizzell, M. R., & Cherry, D. C. (2014). Financial Accounting: a user

perspective. Wiley Global Education.

Mullinova, S. (2016). Use of the principles of IFRS (IAS) 39" Financial instruments:

recognition and assessment" for bank financial accounting. Modern European

Researches, (1), 60-64.

Aasb.gov.au/. (2018). Retrieved from http://www.aasb.gov.au/News/Hot-Topic-update--

Applying-the-IASB-s-Revised-Conceptual-Framework-and-Solving-the-Reporting-Entity-

and-Special-Purpose-Financial-Statement-Problems?newsID=277156

Accounting standards. (2018). Retrieved from

http://www.aasb.gov.au/Pronouncements/Current-standards.aspx

Deegan, C. (2013). Financial accounting theory. McGraw-Hill Education Australia.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

Hoskin, R. E., Fizzell, M. R., & Cherry, D. C. (2014). Financial Accounting: a user

perspective. Wiley Global Education.

Mullinova, S. (2016). Use of the principles of IFRS (IAS) 39" Financial instruments:

recognition and assessment" for bank financial accounting. Modern European

Researches, (1), 60-64.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.