Financial Reporting: Concepts, Stakeholders, IFRS, and Bank Analysis

VerifiedAdded on 2020/07/22

|15

|4655

|27

Report

AI Summary

This report provides a comprehensive overview of financial reporting, beginning with fundamental concepts and their practical applications within businesses. It explores the evaluation of reporting design and the crucial role of stakeholders, detailing their advantages to an organization. The report emphasizes the value of financial reporting in achieving organizational objectives and highlights the importance of key financial statements, including the income statement, changes in equity, and financial position statement. Furthermore, it includes an interpretation of the financial statements of the Lloyd Banking Group from 2015-2016, a comparison of IFRS and IAS, and discusses the benefits of IFRS in financial reporting, including degrees of compliance. The report concludes with a summary of the key findings, providing a valuable resource for understanding financial reporting principles and practices.

Financial Reporting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Q1. Financial concept and its use ..........................................................................................1

Q2. Evaluation of reporting design........................................................................................2

Q3. Determination of stakeholders and its advantage in an organisation ............................3

Q4. Value of financial reporting for attaining organisational objectives...............................4

Q5. Crucial financial statements.............................................................................................5

a) Income statement................................................................................................................5

(b) Change in equity statements.............................................................................................5

(c) Financial position statement..............................................................................................6

Q6. Interpretation of two years financial statements of Lloyd banking group 2016-15........7

Q7. Comparison among IFRS and IAS................................................................................10

Q8. Advantage of IFRS........................................................................................................10

Q9. Determine degrees of compliance with relation of IFRS..............................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

Q1. Financial concept and its use ..........................................................................................1

Q2. Evaluation of reporting design........................................................................................2

Q3. Determination of stakeholders and its advantage in an organisation ............................3

Q4. Value of financial reporting for attaining organisational objectives...............................4

Q5. Crucial financial statements.............................................................................................5

a) Income statement................................................................................................................5

(b) Change in equity statements.............................................................................................5

(c) Financial position statement..............................................................................................6

Q6. Interpretation of two years financial statements of Lloyd banking group 2016-15........7

Q7. Comparison among IFRS and IAS................................................................................10

Q8. Advantage of IFRS........................................................................................................10

Q9. Determine degrees of compliance with relation of IFRS..............................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION

Financial reporting is a crucial aspect of corporate governance. It is essential for company

to attain its long term objectives by using information that is collected from daily operations. It is

a primary element that can help investors or other outside stakeholders to make valuable decision

on the basis of financial reports that are being prepared by company (Mackenzie and et. al.,

2012). It consists of disclosure of accounting data to management which is performed during the

time. They are mainly issued at quarterly and yearly basis.

This particular report provides necessary information about the purpose of financial

reporting and evaluation of framework. Role of stakeholders and their advantages to an

organisation are discussed in this report. Understanding of financial statements in order to

analyse the performance of Lloyd banking group Ltd as well as role of IFRS and benefits in

reporting are studied here.

Q1. Financial concept and its use

In any business organisation, whether related to service or manufacturing, there are

multiple departments which operate everyday in order to attain organisation’s objectives. The

functioning of all these departments is either dependent or independent, but at closing of the

year, they are connected together as basic threat for accounting and finance administration. The

accounting aspects of them are recorded and informed to different stakeholders. There are mainly

two types of reporting such as for stakeholder and management accounting for internal

department of an organisation (Rensburg and Botha, 2014). With the help of these two effective

part of accounting system. In case of listed company's frequency of financial report relies on

yearly performance of company. It consists of:

The financial statements: It consists of various records such as balance sheet, profit and

loss account and statement of stock holders equity.

The reporting of notes is required to make financial statements. Quarterly and annual reporting of listed company.

Objectives of financial reporting:

The purpose of reporting is to provide data regarding financial stability, performance and

all those changes essential for financial position of an organisation. It is use for making crucial

decision-making. It will serves mainly two primary objectives. Initially, it will be helpful for

1

Financial reporting is a crucial aspect of corporate governance. It is essential for company

to attain its long term objectives by using information that is collected from daily operations. It is

a primary element that can help investors or other outside stakeholders to make valuable decision

on the basis of financial reports that are being prepared by company (Mackenzie and et. al.,

2012). It consists of disclosure of accounting data to management which is performed during the

time. They are mainly issued at quarterly and yearly basis.

This particular report provides necessary information about the purpose of financial

reporting and evaluation of framework. Role of stakeholders and their advantages to an

organisation are discussed in this report. Understanding of financial statements in order to

analyse the performance of Lloyd banking group Ltd as well as role of IFRS and benefits in

reporting are studied here.

Q1. Financial concept and its use

In any business organisation, whether related to service or manufacturing, there are

multiple departments which operate everyday in order to attain organisation’s objectives. The

functioning of all these departments is either dependent or independent, but at closing of the

year, they are connected together as basic threat for accounting and finance administration. The

accounting aspects of them are recorded and informed to different stakeholders. There are mainly

two types of reporting such as for stakeholder and management accounting for internal

department of an organisation (Rensburg and Botha, 2014). With the help of these two effective

part of accounting system. In case of listed company's frequency of financial report relies on

yearly performance of company. It consists of:

The financial statements: It consists of various records such as balance sheet, profit and

loss account and statement of stock holders equity.

The reporting of notes is required to make financial statements. Quarterly and annual reporting of listed company.

Objectives of financial reporting:

The purpose of reporting is to provide data regarding financial stability, performance and

all those changes essential for financial position of an organisation. It is use for making crucial

decision-making. It will serves mainly two primary objectives. Initially, it will be helpful for

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management to get involve in effective decision-making that are primary concern with

objectives and overall planning of an organisation. The information disclosed in the report can be

helpful for managers to determine strengths and weaknesses of company as well as current

position in the market. Secondly, financial reporting is useful to get information about the

financial health and events of company that are presented in front of investors as well as other

concern parties (Flower, 2016).

It provides essential information to the owners of Lloyd banking group which is utilised

for the purpose of planning, setting benchmark and valuable decision-making.

Delivering information to external parties and public at a wide scale so that some specific

aspects can be analyse in effective manner.

It will help company to provide necessary information about allocation of economic

resources of an organisation.

Data records about roles and responsibilities of managers in supporting ethical operation

are analyse by the department.

Q2. Evaluation of reporting design

The list of companies is growing at a faster rate. Business and other legal bodies are

following reporting systems of an organisation in order to make sustainable environment. An

applicable financial reporting framework is a set of rules are use as guidelines in preparation of

annual reports. This is use in typically important types of business organisation and where it is

located as per accounting laws. The nature of entity and objectives of financial statements is

prepare by using some rule and regulation (Klassen and Laplante, 2012). It is adopted by

management where appropriate charges with laws are apply in order to remove any unethical

practices in recording financial transactions. There are certain examples of using financial

reporting frameworks as these are based on GAAP principles and IFRS. Accountants are

following these particular rules to record transactions in the books of accounts. There are mainly

two types of reporting framework such as:

Conceptual: It deals with the fundamental reporting problems arises in an organisation.

Some of the issues are related with the objectives, users of financial statements as well as

characteristics that are helpful in making accounting information effective. It provides an idea

that leads to the formulation of a consistent set of standards and obligations. Basically, in

2

objectives and overall planning of an organisation. The information disclosed in the report can be

helpful for managers to determine strengths and weaknesses of company as well as current

position in the market. Secondly, financial reporting is useful to get information about the

financial health and events of company that are presented in front of investors as well as other

concern parties (Flower, 2016).

It provides essential information to the owners of Lloyd banking group which is utilised

for the purpose of planning, setting benchmark and valuable decision-making.

Delivering information to external parties and public at a wide scale so that some specific

aspects can be analyse in effective manner.

It will help company to provide necessary information about allocation of economic

resources of an organisation.

Data records about roles and responsibilities of managers in supporting ethical operation

are analyse by the department.

Q2. Evaluation of reporting design

The list of companies is growing at a faster rate. Business and other legal bodies are

following reporting systems of an organisation in order to make sustainable environment. An

applicable financial reporting framework is a set of rules are use as guidelines in preparation of

annual reports. This is use in typically important types of business organisation and where it is

located as per accounting laws. The nature of entity and objectives of financial statements is

prepare by using some rule and regulation (Klassen and Laplante, 2012). It is adopted by

management where appropriate charges with laws are apply in order to remove any unethical

practices in recording financial transactions. There are certain examples of using financial

reporting frameworks as these are based on GAAP principles and IFRS. Accountants are

following these particular rules to record transactions in the books of accounts. There are mainly

two types of reporting framework such as:

Conceptual: It deals with the fundamental reporting problems arises in an organisation.

Some of the issues are related with the objectives, users of financial statements as well as

characteristics that are helpful in making accounting information effective. It provides an idea

that leads to the formulation of a consistent set of standards and obligations. Basically, in

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

accounting, the rules are based on specific nature, functions and limitations that are practical in

accounting statements.

Regulatory: The presence of necessary format that provide direction, measure and

evaluation for the proper course of action and regulation. It is a form of uniform account that

are present in operators in order to keep regular entries in recording of financial transactions.

Characteristic:

It is necessary to determine certain types of information those are more effective for the

users in development of organisation proportion (Zeff, 2013).

The advantage of financial data is increases in case, it is more accurate and verifiable.

Those company which is using IFRS policies for recording of transaction in order to

increase status and profitability of an organisation this happens to be more crucial to

implement reporting system

Q3. Determination of stakeholders and its advantage in an organisation

A stakeholder is an individual or group of person those are interest in or making

investment in something and that can make huge impact to business with decision-making. It

provide negative impacts on the program and levelling demands, regulation and expectation that

are helpful to determine success of the project. In most common words, anyone those are having

stake in a business. Any individual or group that are connected with and has a unconditional

interest in an organisation. The profitability of business is affected with the decision made by

company in order to enhance productivity. The stakeholder is a person who make investment in a

business to earn profit and market share, whether the business is in good position or not. There

are certain examples of stakeholder such as customers, suppliers, communities and shareholder

or other outside financiers.

It is essential that every stakeholder of a company can have useful information regarding

capital that are invested under the projects (Shackelford, Slemrod and Sallee, 2011). All those

concern parties that are working for Lloyd banking group company is completely relies on

financial status and performance. In business, a stakeholder is mainly known as investors of a

company those are responsible for taking certain action in respect with the company. It is

responsibility of managers to provide proper information about their investment plan whether

they are in healthy position to cover their losses.

Benefits to the company's:

3

accounting statements.

Regulatory: The presence of necessary format that provide direction, measure and

evaluation for the proper course of action and regulation. It is a form of uniform account that

are present in operators in order to keep regular entries in recording of financial transactions.

Characteristic:

It is necessary to determine certain types of information those are more effective for the

users in development of organisation proportion (Zeff, 2013).

The advantage of financial data is increases in case, it is more accurate and verifiable.

Those company which is using IFRS policies for recording of transaction in order to

increase status and profitability of an organisation this happens to be more crucial to

implement reporting system

Q3. Determination of stakeholders and its advantage in an organisation

A stakeholder is an individual or group of person those are interest in or making

investment in something and that can make huge impact to business with decision-making. It

provide negative impacts on the program and levelling demands, regulation and expectation that

are helpful to determine success of the project. In most common words, anyone those are having

stake in a business. Any individual or group that are connected with and has a unconditional

interest in an organisation. The profitability of business is affected with the decision made by

company in order to enhance productivity. The stakeholder is a person who make investment in a

business to earn profit and market share, whether the business is in good position or not. There

are certain examples of stakeholder such as customers, suppliers, communities and shareholder

or other outside financiers.

It is essential that every stakeholder of a company can have useful information regarding

capital that are invested under the projects (Shackelford, Slemrod and Sallee, 2011). All those

concern parties that are working for Lloyd banking group company is completely relies on

financial status and performance. In business, a stakeholder is mainly known as investors of a

company those are responsible for taking certain action in respect with the company. It is

responsibility of managers to provide proper information about their investment plan whether

they are in healthy position to cover their losses.

Benefits to the company's:

3

As a active participants in Lloyd banking group operations they need to anticipate

external issues that are affecting growth of the company.

They are applicable for delivery proper solution to a problem and reduce risk those are

presented because of many reason.

Statement of equity can be helpful record to make necessary decision to overcome any

demand that are essential for the company.

It is crucial to analyse current position of an organisation with the help of proper

guidelines and rules (Eccles and et. al., 2012).

Stakeholder of the company is liable to take active participants in decision-making

process that are organise by the department.

The do have certain rights to evaluate valuable data whether firm have sufficient amount

of cash-flows to meet out short-term or long-term liabilities.

Q4. Value of financial reporting for attaining organisational objectives

Reporting is known as one of the crucial aspects for managers as well as accountant to

record and interpret various transactions that are during the time preparing financial statements.

It involves some effective statements such as profit and loss statements, balance sheet and cash-

flows statements. With the help of these financial statements, it will be easy to analyse current

position by comparing past and previous records. By this, it can be reliable for the company's to

make use of valuable changes that is based on current evaluation.

In the current time, it is vital for the company to prepare report for the purpose of

achieving individual as well as group goals. There are few consequence of increasing global

shareholding and trade. They are essential for dealing in various transaction. The rules to be

follow by accountants in order to maintain proper balance in accounting books which are base

for making reliable and accurate decision (Van Greuning, Scott and Terblanche, 2011). IAS is

a primary financial bodies that are set out as basic standard in order to incur better outcomes for

the company. It is necessary for every organisation department to follow proper rules and

accounting regulation according to the set standards. The main purpose of financial reporting is

to provide right direction to managers to perform its operation in the way of attaining maximum

profitability. The main components that are use in reporting purpose are mention underneath:

4

external issues that are affecting growth of the company.

They are applicable for delivery proper solution to a problem and reduce risk those are

presented because of many reason.

Statement of equity can be helpful record to make necessary decision to overcome any

demand that are essential for the company.

It is crucial to analyse current position of an organisation with the help of proper

guidelines and rules (Eccles and et. al., 2012).

Stakeholder of the company is liable to take active participants in decision-making

process that are organise by the department.

The do have certain rights to evaluate valuable data whether firm have sufficient amount

of cash-flows to meet out short-term or long-term liabilities.

Q4. Value of financial reporting for attaining organisational objectives

Reporting is known as one of the crucial aspects for managers as well as accountant to

record and interpret various transactions that are during the time preparing financial statements.

It involves some effective statements such as profit and loss statements, balance sheet and cash-

flows statements. With the help of these financial statements, it will be easy to analyse current

position by comparing past and previous records. By this, it can be reliable for the company's to

make use of valuable changes that is based on current evaluation.

In the current time, it is vital for the company to prepare report for the purpose of

achieving individual as well as group goals. There are few consequence of increasing global

shareholding and trade. They are essential for dealing in various transaction. The rules to be

follow by accountants in order to maintain proper balance in accounting books which are base

for making reliable and accurate decision (Van Greuning, Scott and Terblanche, 2011). IAS is

a primary financial bodies that are set out as basic standard in order to incur better outcomes for

the company. It is necessary for every organisation department to follow proper rules and

accounting regulation according to the set standards. The main purpose of financial reporting is

to provide right direction to managers to perform its operation in the way of attaining maximum

profitability. The main components that are use in reporting purpose are mention underneath:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Profit and loss statements: It is necessary for the company to known about the total

income and expenses those are incur during production process. It is collected from various

activities such as operational and non-operating activities.

Balance sheet: It is known as financial statement that consists detail information about assets

and liabilities of company's. In order to make critical decision regarding investment this happens

to be more effective statements (Nobes, 2014). With this, performance and growth of the

company can easily be identified.

Cash-flows statement: According to this, total data about company's cash-inflow ans

outflow done during the year from various activities can be identified. It will be vital to identify

exact information about actual cost levied at the time of production process.

Q5. Crucial financial statements

a) Income statement

Profit and loss statement of ROB Plc for

the year ending 31st December 2016

Particular Amount

Sales 285100

Less: COGS 191700

Gross profits 93400

Rental income 1600

Loss on sale of inventory 400

Loss on revaluation of investment property 3300

Operating expenses 43100

Profit from operation 44600

Preference dividend 1330

Bank interest 1030

PBT 42240

Tax expenses 12000

Profit after tax for equity shareholders

30240

(b) Change in equity statements

ROB Plc Share Retained

5

income and expenses those are incur during production process. It is collected from various

activities such as operational and non-operating activities.

Balance sheet: It is known as financial statement that consists detail information about assets

and liabilities of company's. In order to make critical decision regarding investment this happens

to be more effective statements (Nobes, 2014). With this, performance and growth of the

company can easily be identified.

Cash-flows statement: According to this, total data about company's cash-inflow ans

outflow done during the year from various activities can be identified. It will be vital to identify

exact information about actual cost levied at the time of production process.

Q5. Crucial financial statements

a) Income statement

Profit and loss statement of ROB Plc for

the year ending 31st December 2016

Particular Amount

Sales 285100

Less: COGS 191700

Gross profits 93400

Rental income 1600

Loss on sale of inventory 400

Loss on revaluation of investment property 3300

Operating expenses 43100

Profit from operation 44600

Preference dividend 1330

Bank interest 1030

PBT 42240

Tax expenses 12000

Profit after tax for equity shareholders

30240

(b) Change in equity statements

ROB Plc Share Retained

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

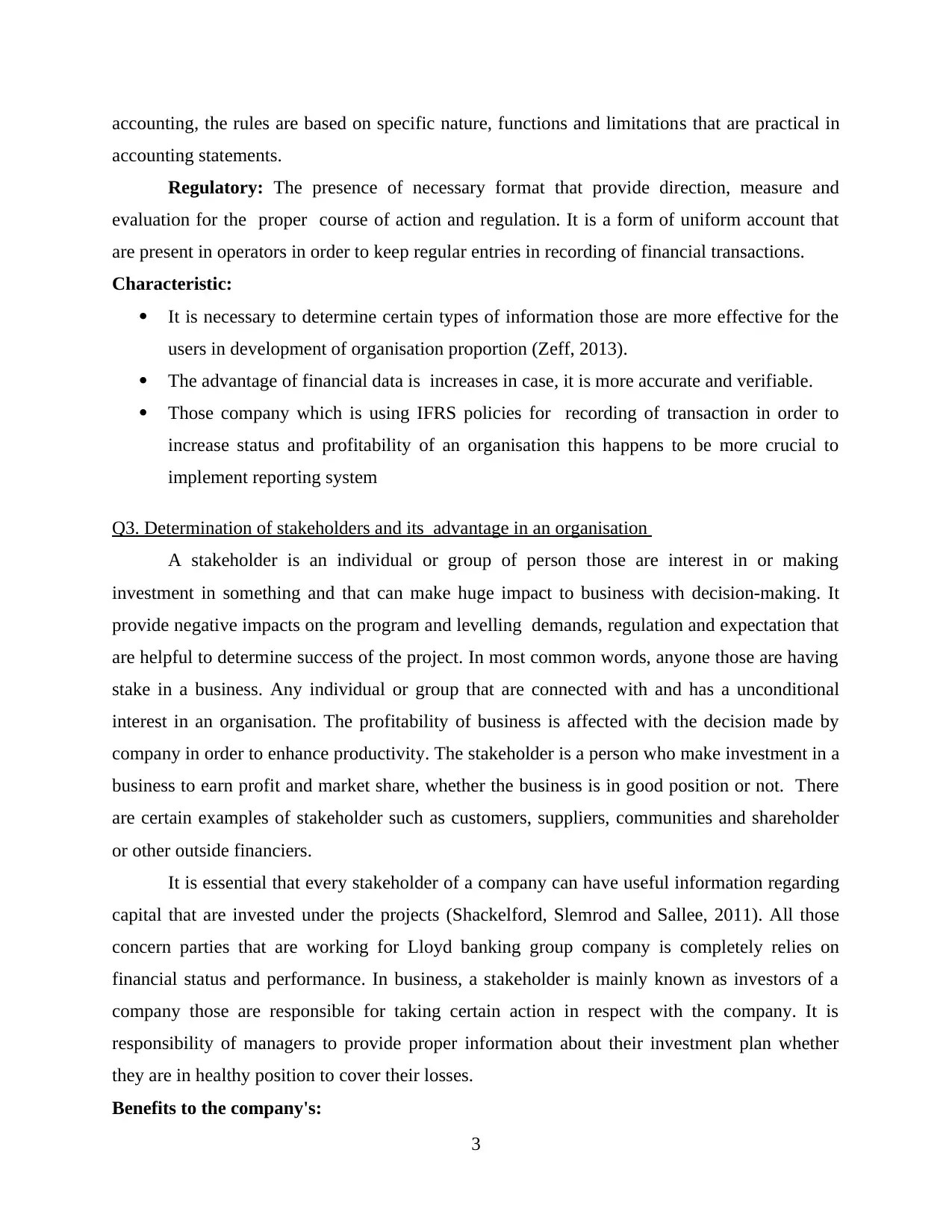

Statement of changes in equity for the

year ended 31st December 2016 Capital Earnings

Balance at 1 January 2016 26700 23300

Changes in accounting policy - -

Correction of prior period error - -

Restated balance 26700 23300

Changes in equity for the year 2016

Issue of share capital - -

Profit for the year - 30240

Revaluation gain - -

Dividends - -5340

Balance at 31 December 2016 26700 48200

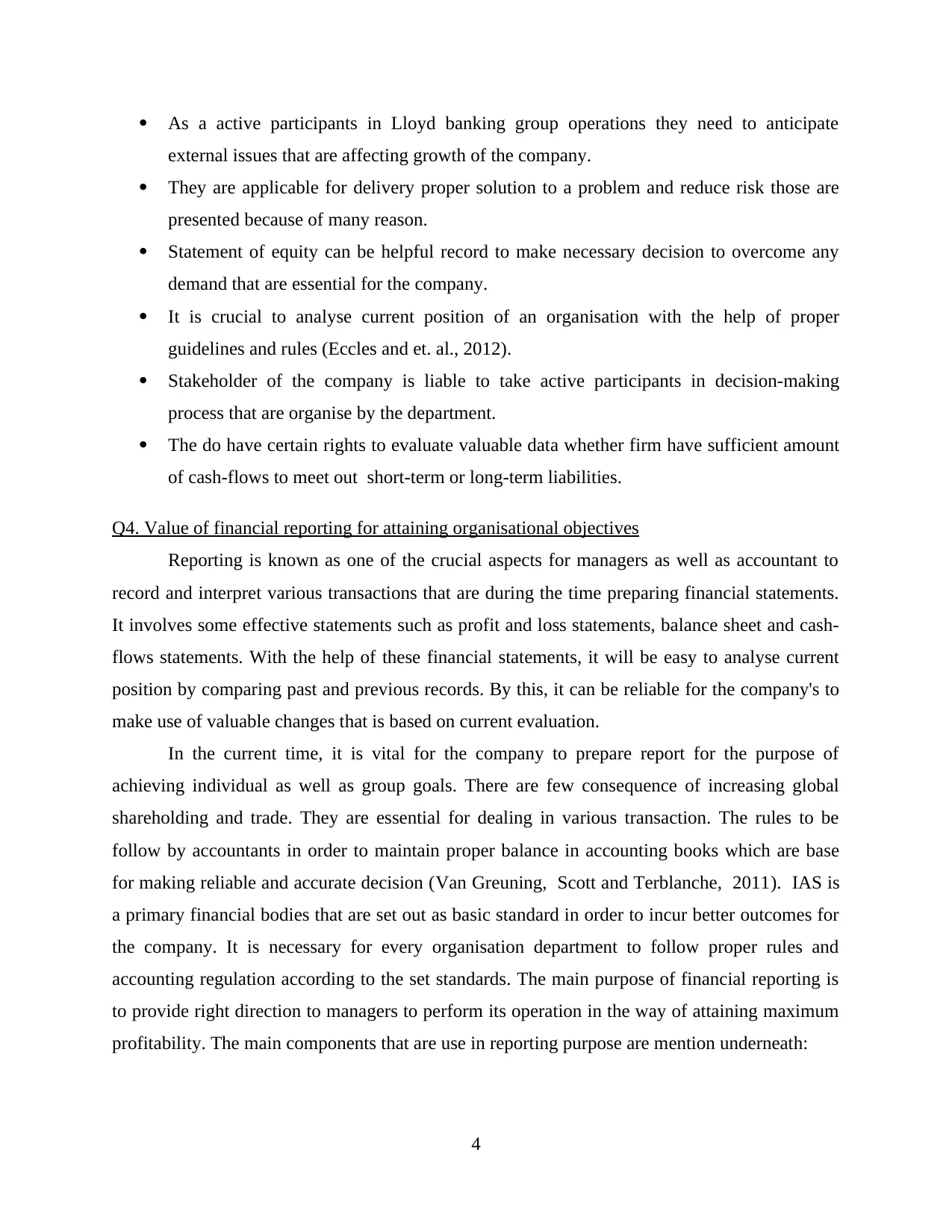

(c) Financial position statement

Statement of Financial Position of ROB

Plc. as on 31st December 2016

Particular Amount

ASSETS

Non-current assets (A)

Plant and equipment 22400

land and property 80000

Investment property 18000

Total (A) 120400

Current assets (B)

Cash and cash equivalents Nil

Bank -530

Trade receivables 18000

Inventories 12930

Total (B) 30400

TOTAL ASSETS (A+B) 150800

6

year ended 31st December 2016 Capital Earnings

Balance at 1 January 2016 26700 23300

Changes in accounting policy - -

Correction of prior period error - -

Restated balance 26700 23300

Changes in equity for the year 2016

Issue of share capital - -

Profit for the year - 30240

Revaluation gain - -

Dividends - -5340

Balance at 31 December 2016 26700 48200

(c) Financial position statement

Statement of Financial Position of ROB

Plc. as on 31st December 2016

Particular Amount

ASSETS

Non-current assets (A)

Plant and equipment 22400

land and property 80000

Investment property 18000

Total (A) 120400

Current assets (B)

Cash and cash equivalents Nil

Bank -530

Trade receivables 18000

Inventories 12930

Total (B) 30400

TOTAL ASSETS (A+B) 150800

6

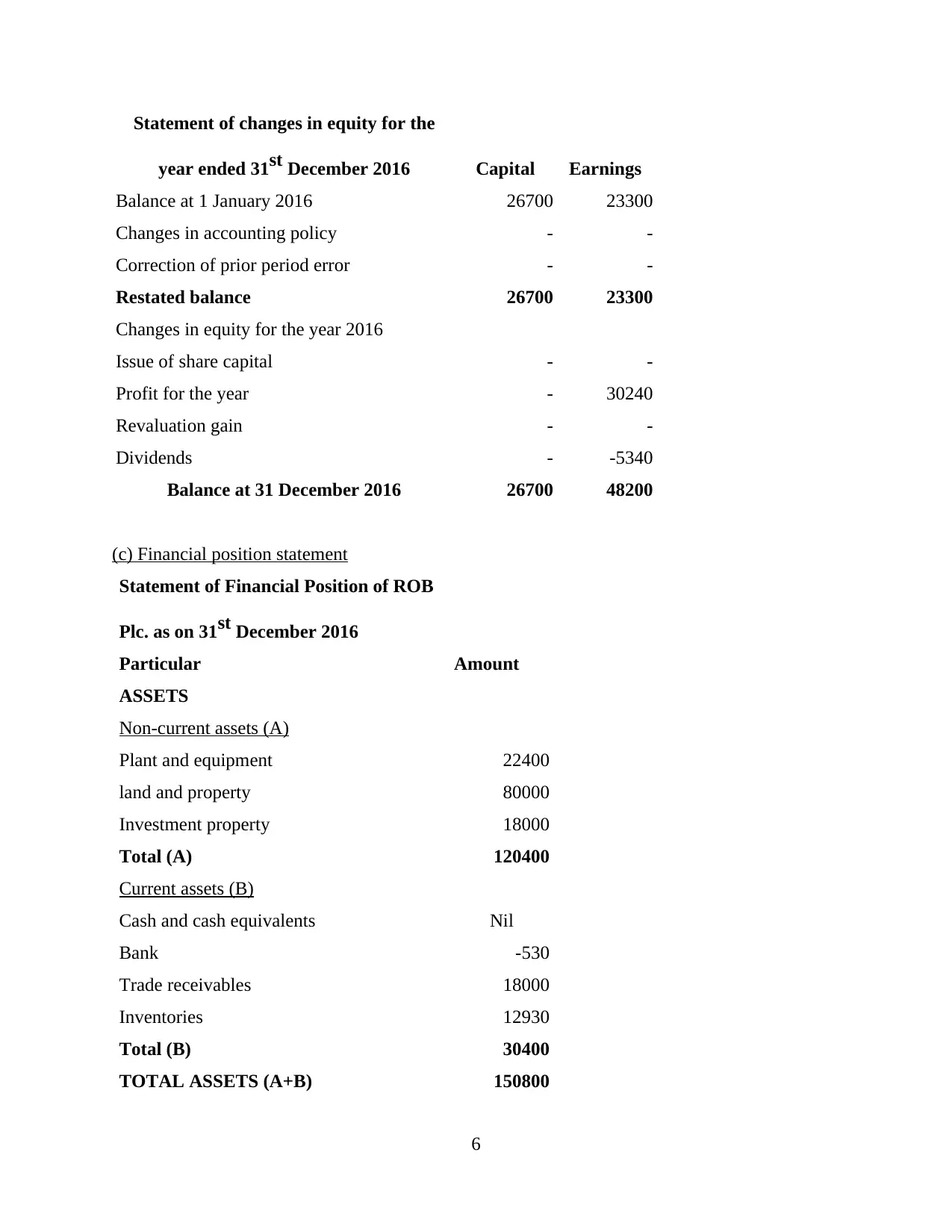

EQUITY AND LIABILITIES (C)

Retained earnings 48200

10% redeemable preference shares 13300

Ordinary shares 26700

Revaluation reserve 28000

Total equity (C) 116200

Non-current liabilities (D)

Long term borrowings Nil

Current liabilities (E)

Short-term borrowings Nil

Trade and other payables 15700

Deferred taxation 6900

Provision for tax 12000

Total current liabilities (C+D) 34600

TATAL EQUITY AND LIABILITIES 150800

Working note:

Particular Amount

Calculation of Depreciation:

On Land and property:

Plant and equipment 48000-

22400*12.5% 3200

Property 4000

Total 7200

Charged to operating expenses 3600

Charged to cost of sales 3600

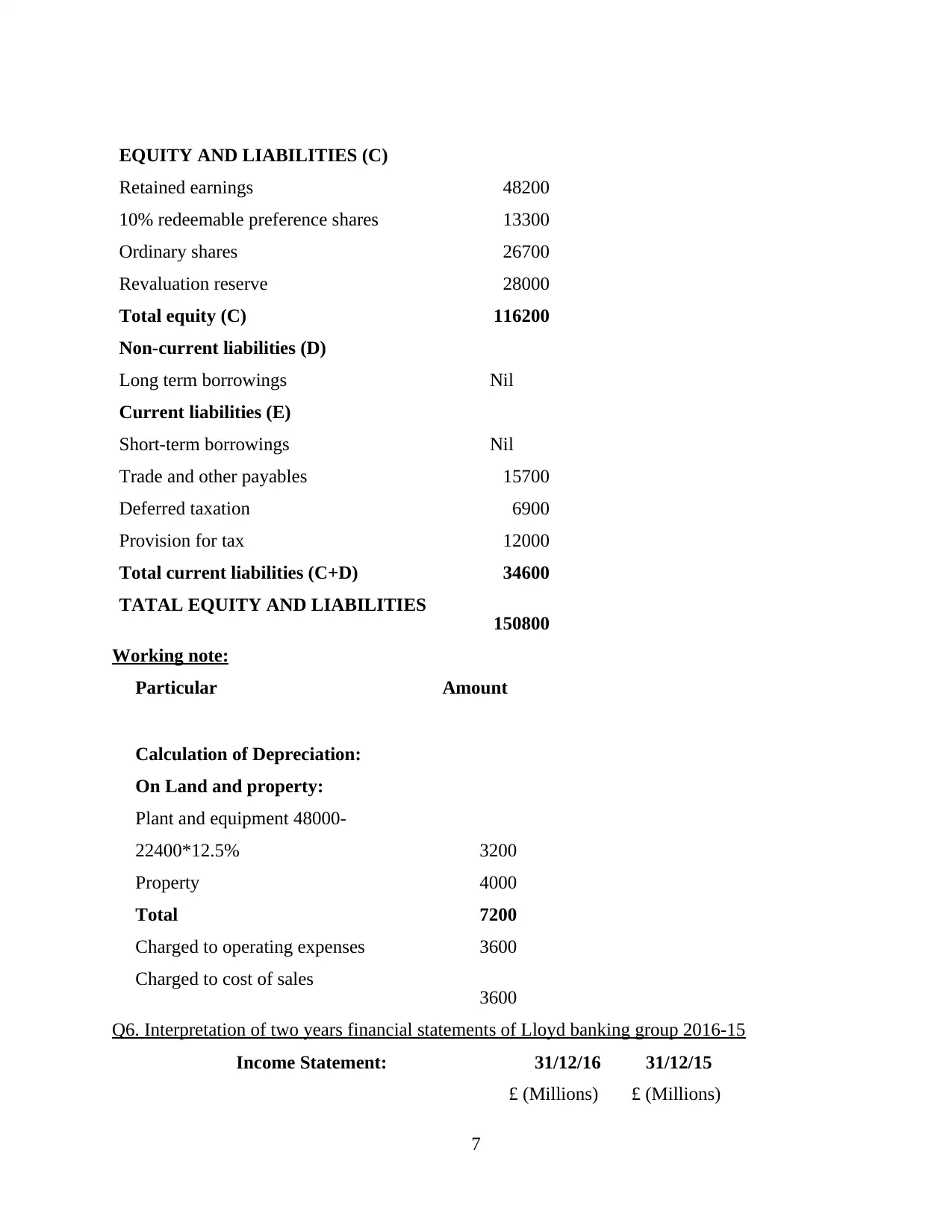

Q6. Interpretation of two years financial statements of Lloyd banking group 2016-15

Income Statement: 31/12/16 31/12/15

£ (Millions) £ (Millions)

7

Retained earnings 48200

10% redeemable preference shares 13300

Ordinary shares 26700

Revaluation reserve 28000

Total equity (C) 116200

Non-current liabilities (D)

Long term borrowings Nil

Current liabilities (E)

Short-term borrowings Nil

Trade and other payables 15700

Deferred taxation 6900

Provision for tax 12000

Total current liabilities (C+D) 34600

TATAL EQUITY AND LIABILITIES 150800

Working note:

Particular Amount

Calculation of Depreciation:

On Land and property:

Plant and equipment 48000-

22400*12.5% 3200

Property 4000

Total 7200

Charged to operating expenses 3600

Charged to cost of sales 3600

Q6. Interpretation of two years financial statements of Lloyd banking group 2016-15

Income Statement: 31/12/16 31/12/15

£ (Millions) £ (Millions)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

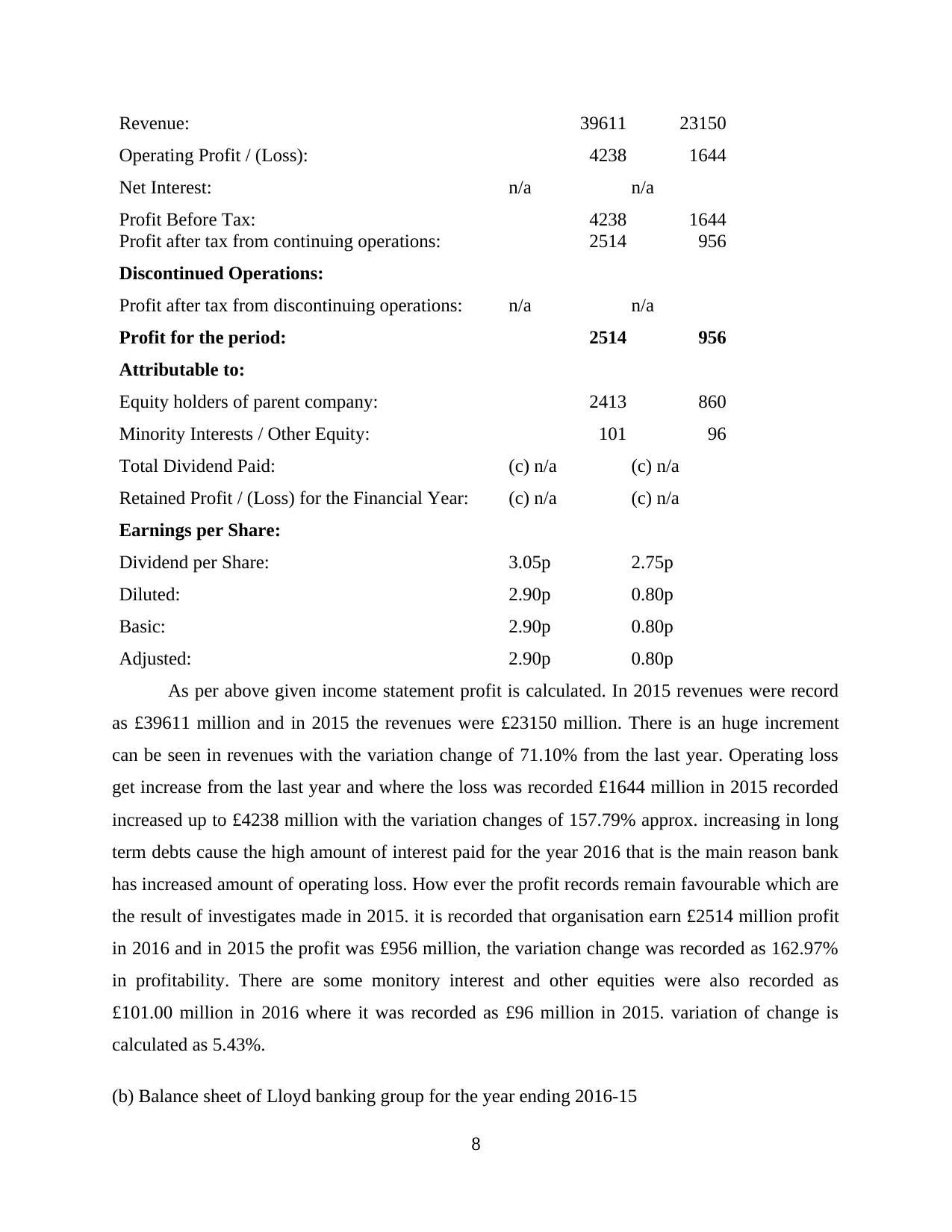

Revenue: 39611 23150

Operating Profit / (Loss): 4238 1644

Net Interest: n/a n/a

Profit Before Tax: 4238 1644

Profit after tax from continuing operations: 2514 956

Discontinued Operations:

Profit after tax from discontinuing operations: n/a n/a

Profit for the period: 2514 956

Attributable to:

Equity holders of parent company: 2413 860

Minority Interests / Other Equity: 101 96

Total Dividend Paid: (c) n/a (c) n/a

Retained Profit / (Loss) for the Financial Year: (c) n/a (c) n/a

Earnings per Share:

Dividend per Share: 3.05p 2.75p

Diluted: 2.90p 0.80p

Basic: 2.90p 0.80p

Adjusted: 2.90p 0.80p

As per above given income statement profit is calculated. In 2015 revenues were record

as £39611 million and in 2015 the revenues were £23150 million. There is an huge increment

can be seen in revenues with the variation change of 71.10% from the last year. Operating loss

get increase from the last year and where the loss was recorded £1644 million in 2015 recorded

increased up to £4238 million with the variation changes of 157.79% approx. increasing in long

term debts cause the high amount of interest paid for the year 2016 that is the main reason bank

has increased amount of operating loss. How ever the profit records remain favourable which are

the result of investigates made in 2015. it is recorded that organisation earn £2514 million profit

in 2016 and in 2015 the profit was £956 million, the variation change was recorded as 162.97%

in profitability. There are some monitory interest and other equities were also recorded as

£101.00 million in 2016 where it was recorded as £96 million in 2015. variation of change is

calculated as 5.43%.

(b) Balance sheet of Lloyd banking group for the year ending 2016-15

8

Operating Profit / (Loss): 4238 1644

Net Interest: n/a n/a

Profit Before Tax: 4238 1644

Profit after tax from continuing operations: 2514 956

Discontinued Operations:

Profit after tax from discontinuing operations: n/a n/a

Profit for the period: 2514 956

Attributable to:

Equity holders of parent company: 2413 860

Minority Interests / Other Equity: 101 96

Total Dividend Paid: (c) n/a (c) n/a

Retained Profit / (Loss) for the Financial Year: (c) n/a (c) n/a

Earnings per Share:

Dividend per Share: 3.05p 2.75p

Diluted: 2.90p 0.80p

Basic: 2.90p 0.80p

Adjusted: 2.90p 0.80p

As per above given income statement profit is calculated. In 2015 revenues were record

as £39611 million and in 2015 the revenues were £23150 million. There is an huge increment

can be seen in revenues with the variation change of 71.10% from the last year. Operating loss

get increase from the last year and where the loss was recorded £1644 million in 2015 recorded

increased up to £4238 million with the variation changes of 157.79% approx. increasing in long

term debts cause the high amount of interest paid for the year 2016 that is the main reason bank

has increased amount of operating loss. How ever the profit records remain favourable which are

the result of investigates made in 2015. it is recorded that organisation earn £2514 million profit

in 2016 and in 2015 the profit was £956 million, the variation change was recorded as 162.97%

in profitability. There are some monitory interest and other equities were also recorded as

£101.00 million in 2016 where it was recorded as £96 million in 2015. variation of change is

calculated as 5.43%.

(b) Balance sheet of Lloyd banking group for the year ending 2016-15

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

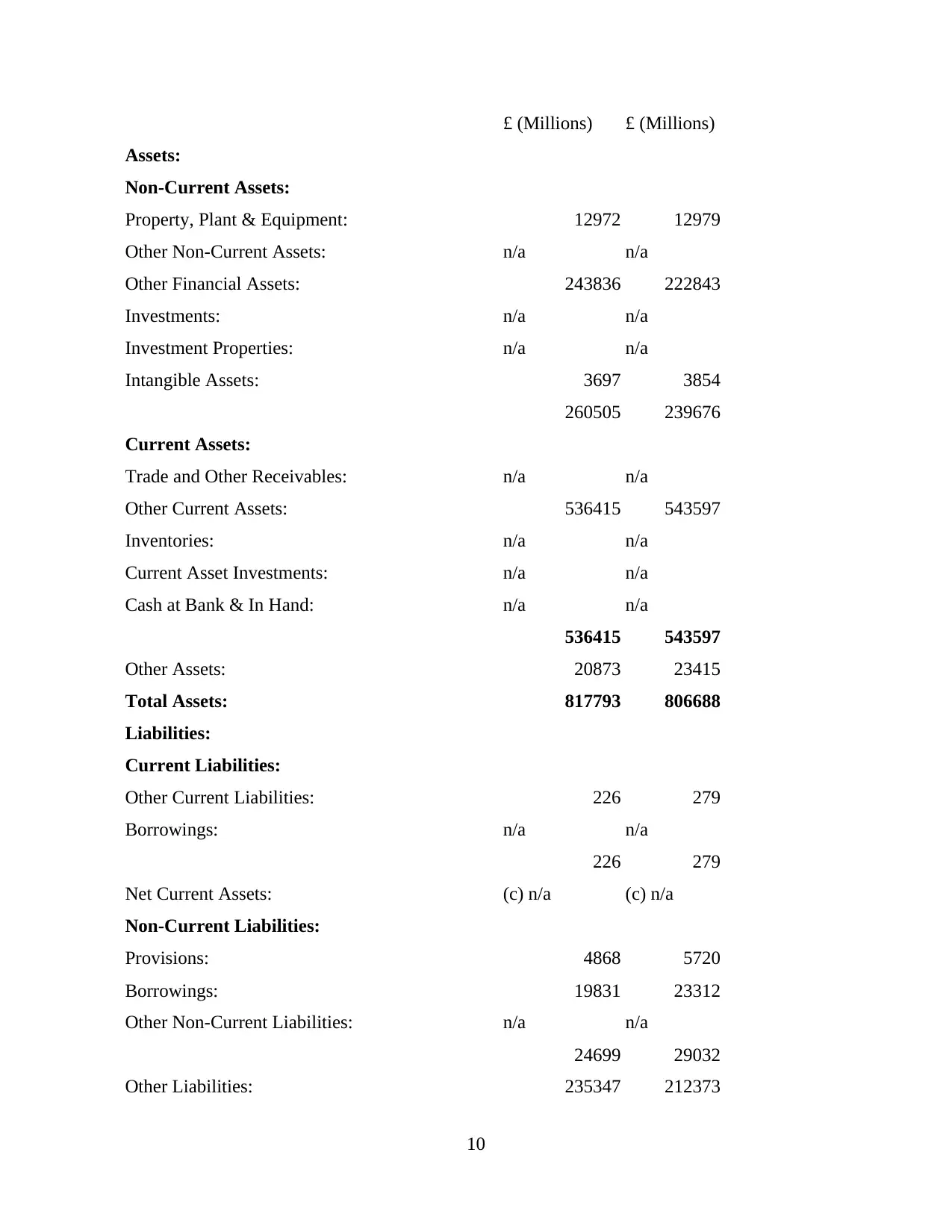

Balance Sheet: 31/12/16 31/12/15

9

9

£ (Millions) £ (Millions)

Assets:

Non-Current Assets:

Property, Plant & Equipment: 12972 12979

Other Non-Current Assets: n/a n/a

Other Financial Assets: 243836 222843

Investments: n/a n/a

Investment Properties: n/a n/a

Intangible Assets: 3697 3854

260505 239676

Current Assets:

Trade and Other Receivables: n/a n/a

Other Current Assets: 536415 543597

Inventories: n/a n/a

Current Asset Investments: n/a n/a

Cash at Bank & In Hand: n/a n/a

536415 543597

Other Assets: 20873 23415

Total Assets: 817793 806688

Liabilities:

Current Liabilities:

Other Current Liabilities: 226 279

Borrowings: n/a n/a

226 279

Net Current Assets: (c) n/a (c) n/a

Non-Current Liabilities:

Provisions: 4868 5720

Borrowings: 19831 23312

Other Non-Current Liabilities: n/a n/a

24699 29032

Other Liabilities: 235347 212373

10

Assets:

Non-Current Assets:

Property, Plant & Equipment: 12972 12979

Other Non-Current Assets: n/a n/a

Other Financial Assets: 243836 222843

Investments: n/a n/a

Investment Properties: n/a n/a

Intangible Assets: 3697 3854

260505 239676

Current Assets:

Trade and Other Receivables: n/a n/a

Other Current Assets: 536415 543597

Inventories: n/a n/a

Current Asset Investments: n/a n/a

Cash at Bank & In Hand: n/a n/a

536415 543597

Other Assets: 20873 23415

Total Assets: 817793 806688

Liabilities:

Current Liabilities:

Other Current Liabilities: 226 279

Borrowings: n/a n/a

226 279

Net Current Assets: (c) n/a (c) n/a

Non-Current Liabilities:

Provisions: 4868 5720

Borrowings: 19831 23312

Other Non-Current Liabilities: n/a n/a

24699 29032

Other Liabilities: 235347 212373

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.