2108AFE Financial Accounting Practice Reflection Report, 2018

VerifiedAdded on 2023/06/07

|9

|2281

|130

Report

AI Summary

This practice-based reflection report delves into the student's learning experience in a financial accounting course, emphasizing the relevance of course material to the accounting profession. It covers the application of professional knowledge and skills in the workplace, identification of career pathways (CPA), professional roles (environmental accountant, financial controller), STOW analysis, future study options (CWA, CS, IFRS, CISA, CIMA, CIA), and legal/ethical responsibilities. The report highlights the importance of self-reflection, communication skills, and ethical conduct in accounting, concluding that the accounting profession is highly developed and requires continuous learning and adaptation to computerized processes. The student also reflects on their interest in environmental accounting and financial controlling roles.

Financial Accounting

Practice-Based Reflection Report

Name:

Student ID.:

Date of submission:

0 | P a eg

Practice-Based Reflection Report

Name:

Student ID.:

Date of submission:

0 | P a eg

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction.................................................................................................................................................2

Application of professional knowledge and skill in the workplace..............................................................2

Identification of career pathway related to the course program...................................................................3

Professional role in the firm and their responsibilities.................................................................................3

STOW analysis in relation to a particular career.........................................................................................4

Knowledge of future study and professional development option...............................................................4

Legal and ethical professional responsibilities and standard.......................................................................5

Conclusion...................................................................................................................................................6

References...................................................................................................................................................7

1 | P a eg

Introduction.................................................................................................................................................2

Application of professional knowledge and skill in the workplace..............................................................2

Identification of career pathway related to the course program...................................................................3

Professional role in the firm and their responsibilities.................................................................................3

STOW analysis in relation to a particular career.........................................................................................4

Knowledge of future study and professional development option...............................................................4

Legal and ethical professional responsibilities and standard.......................................................................5

Conclusion...................................................................................................................................................6

References...................................................................................................................................................7

1 | P a eg

Introduction

Self-reflection is one of the best ways to look inward the ability and skill of a person occupy.

Performing self-reflection allow me to strengthen my emotional intelligence then it also helps me

to be more confident. Generally speaking, this process of self-reflection is highly effective for

me to build my personality. This process helps to create the self-awareness as well as self-

regulation. Reflection is the crucial characteristics of the practice system that all the accountant

need to embody because in accountancy there are numerous measurement, then processing, and

also the financial information which require an effective learning technique. Reflection in

accounting help to determine the drawbacks and the flaw that might be visualised within the

accounting process (Komori, 2015). The primary purpose of the paper is to reflect on the

accounting profession and also on the career development related to the accountancy.

Application of professional knowledge and skill in the workplace

The manual accounting system always requires the accountant to understand the entire process in

a way which might be unnecessary with the help of a computerised accounting system. In this

process the effective communication skill along with the teamwork in necessary to perform the

accounting (Buchheit, Dalton, Harp, & Hollingsworth, 2015). Being the professional accountant

the most effective and the vital aspect is to maintain the team and also have an effective

interpersonal communication skill. In the process of accounting these skills are highly essential

to develop understanding and strength within the team members. The manual accounting process

is generally performed for the fresh accountant to understand the process and also to gather

effective knowledge on accounting.

It helps to analyse the financial statement and also help to learn the skill of maintaining

accounting book, forming a journal and the balance sheet. This is generally done to provide

knowledge for the accountant and help them to develop their skill and their capabilities regarding

the process. Both the process of accounting is highly effective for maintaining the accounts of a

firm. The benefits of using manual accounting are the error correction with double-entry

accounting (Güngörmüş, & Uyar, 2017). The limitation of manual or traditional accounting is the

frequent error in the data entry. Benefits of the computerised accounting process are the speed

than the access information for accounting (Bobek, Hageman, & Radtke, 2015). The limitation

of the computerised accounting process is the expense than the security and the performance for

2 | P a eg

Self-reflection is one of the best ways to look inward the ability and skill of a person occupy.

Performing self-reflection allow me to strengthen my emotional intelligence then it also helps me

to be more confident. Generally speaking, this process of self-reflection is highly effective for

me to build my personality. This process helps to create the self-awareness as well as self-

regulation. Reflection is the crucial characteristics of the practice system that all the accountant

need to embody because in accountancy there are numerous measurement, then processing, and

also the financial information which require an effective learning technique. Reflection in

accounting help to determine the drawbacks and the flaw that might be visualised within the

accounting process (Komori, 2015). The primary purpose of the paper is to reflect on the

accounting profession and also on the career development related to the accountancy.

Application of professional knowledge and skill in the workplace

The manual accounting system always requires the accountant to understand the entire process in

a way which might be unnecessary with the help of a computerised accounting system. In this

process the effective communication skill along with the teamwork in necessary to perform the

accounting (Buchheit, Dalton, Harp, & Hollingsworth, 2015). Being the professional accountant

the most effective and the vital aspect is to maintain the team and also have an effective

interpersonal communication skill. In the process of accounting these skills are highly essential

to develop understanding and strength within the team members. The manual accounting process

is generally performed for the fresh accountant to understand the process and also to gather

effective knowledge on accounting.

It helps to analyse the financial statement and also help to learn the skill of maintaining

accounting book, forming a journal and the balance sheet. This is generally done to provide

knowledge for the accountant and help them to develop their skill and their capabilities regarding

the process. Both the process of accounting is highly effective for maintaining the accounts of a

firm. The benefits of using manual accounting are the error correction with double-entry

accounting (Güngörmüş, & Uyar, 2017). The limitation of manual or traditional accounting is the

frequent error in the data entry. Benefits of the computerised accounting process are the speed

than the access information for accounting (Bobek, Hageman, & Radtke, 2015). The limitation

of the computerised accounting process is the expense than the security and the performance for

2 | P a eg

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accounting. Both the system are applicable within the workplace but the in the modern world

computerised accounting is considered to be the best for the firm.

Identification of career pathway related to the course program

Both the CPA and the CA is the credentials that one have to earn through study. Both of the

systems are equivalent for providing the financial service to the customers and it can be worked

in the public as well as private sector. In both the case the study of area involves the auditing,

financial reporting, managerial accounting and taxation (Anderson, Bian, & Çalıyurt, 2018). For

me, I would like to pursue CPA qualification as a student of CPA gets effective membership of

the AICPA and also they are able to learn regarding IFRS, GAAP and the GAAS. Accountants

have the wide range of option to perform their activity. My career aspiration at this point is to be

the CPA or to work independently and even can perform as the government accountant within

the country. There is another pathway also that could be easily developed if CA or CPA gets

failed. It can be seen that MBA is also an effective process in accounting to establish in the

market, then getting an education regarding auditing and taxation is also effective in the field of

accounting (Miranda, Leal, de Oliveira Medeiros, & Lemes, 2015). The management accounting

is also effective for working within the firm and providing best accounting results.

Professional role in the firm and their responsibilities

The different professional roles that could be visualised within the accounting firm rather than an

accountant or the auditors are an environmental accountant, then the financial controller, tax

agent, financial investigator, and the international accounting specialist. The environmental

accountant has the responsibility regarding the pollution licenses as well as the certification of

the clean technologies (Ismail, 2017). The responsibility of the financial controller is to ensure

that the accounting allocation has been performed in the appropriate manner. The responsibility

of the tax agent is the preparation of tax provision schedule and also recommend tax strategies

(Pendley, 2018). Financial investigator responsibility is to analyse the financial statement, bank

record, and the government database. The international accounting specialist responsibility is to

comply as well as sort the documents like work orders, then the vouchers and the business

transactions (Suddaby, Saxton, & Gunz, 2015). I have the special interest regarding the

environmental accounting and the financial controller. This is due to the fact that environmental

accounting deal with the pollution control level of the firm and financial controller maintain the

3 | P a eg

computerised accounting is considered to be the best for the firm.

Identification of career pathway related to the course program

Both the CPA and the CA is the credentials that one have to earn through study. Both of the

systems are equivalent for providing the financial service to the customers and it can be worked

in the public as well as private sector. In both the case the study of area involves the auditing,

financial reporting, managerial accounting and taxation (Anderson, Bian, & Çalıyurt, 2018). For

me, I would like to pursue CPA qualification as a student of CPA gets effective membership of

the AICPA and also they are able to learn regarding IFRS, GAAP and the GAAS. Accountants

have the wide range of option to perform their activity. My career aspiration at this point is to be

the CPA or to work independently and even can perform as the government accountant within

the country. There is another pathway also that could be easily developed if CA or CPA gets

failed. It can be seen that MBA is also an effective process in accounting to establish in the

market, then getting an education regarding auditing and taxation is also effective in the field of

accounting (Miranda, Leal, de Oliveira Medeiros, & Lemes, 2015). The management accounting

is also effective for working within the firm and providing best accounting results.

Professional role in the firm and their responsibilities

The different professional roles that could be visualised within the accounting firm rather than an

accountant or the auditors are an environmental accountant, then the financial controller, tax

agent, financial investigator, and the international accounting specialist. The environmental

accountant has the responsibility regarding the pollution licenses as well as the certification of

the clean technologies (Ismail, 2017). The responsibility of the financial controller is to ensure

that the accounting allocation has been performed in the appropriate manner. The responsibility

of the tax agent is the preparation of tax provision schedule and also recommend tax strategies

(Pendley, 2018). Financial investigator responsibility is to analyse the financial statement, bank

record, and the government database. The international accounting specialist responsibility is to

comply as well as sort the documents like work orders, then the vouchers and the business

transactions (Suddaby, Saxton, & Gunz, 2015). I have the special interest regarding the

environmental accounting and the financial controller. This is due to the fact that environmental

accounting deal with the pollution control level of the firm and financial controller maintain the

3 | P a eg

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

documentation in the accounting process. I think that these two are quite effective for the

business to maintain their activity and for that, I find this two role really interesting.

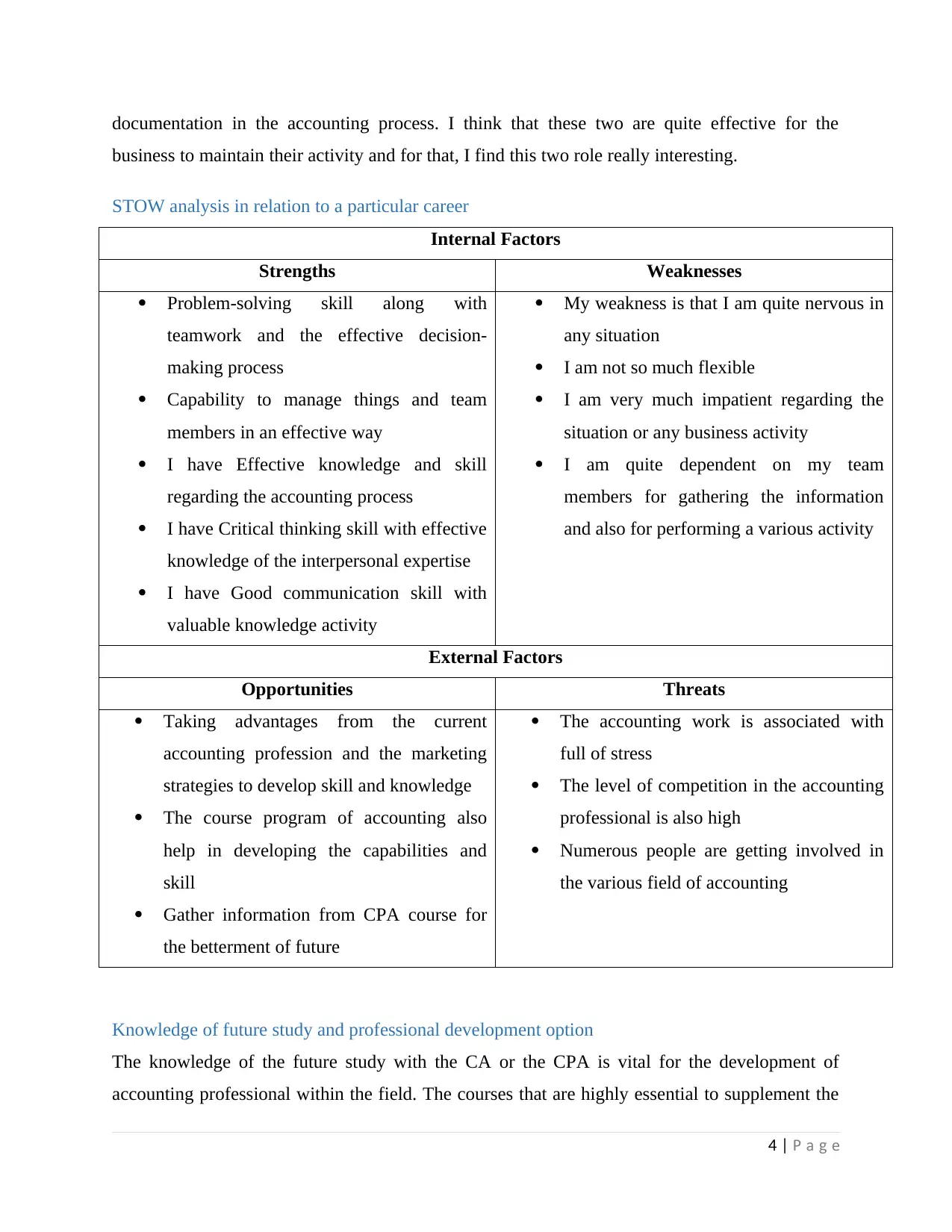

STOW analysis in relation to a particular career

Internal Factors

Strengths Weaknesses

Problem-solving skill along with

teamwork and the effective decision-

making process

Capability to manage things and team

members in an effective way

I have Effective knowledge and skill

regarding the accounting process

I have Critical thinking skill with effective

knowledge of the interpersonal expertise

I have Good communication skill with

valuable knowledge activity

My weakness is that I am quite nervous in

any situation

I am not so much flexible

I am very much impatient regarding the

situation or any business activity

I am quite dependent on my team

members for gathering the information

and also for performing a various activity

External Factors

Opportunities Threats

Taking advantages from the current

accounting profession and the marketing

strategies to develop skill and knowledge

The course program of accounting also

help in developing the capabilities and

skill

Gather information from CPA course for

the betterment of future

The accounting work is associated with

full of stress

The level of competition in the accounting

professional is also high

Numerous people are getting involved in

the various field of accounting

Knowledge of future study and professional development option

The knowledge of the future study with the CA or the CPA is vital for the development of

accounting professional within the field. The courses that are highly essential to supplement the

4 | P a eg

business to maintain their activity and for that, I find this two role really interesting.

STOW analysis in relation to a particular career

Internal Factors

Strengths Weaknesses

Problem-solving skill along with

teamwork and the effective decision-

making process

Capability to manage things and team

members in an effective way

I have Effective knowledge and skill

regarding the accounting process

I have Critical thinking skill with effective

knowledge of the interpersonal expertise

I have Good communication skill with

valuable knowledge activity

My weakness is that I am quite nervous in

any situation

I am not so much flexible

I am very much impatient regarding the

situation or any business activity

I am quite dependent on my team

members for gathering the information

and also for performing a various activity

External Factors

Opportunities Threats

Taking advantages from the current

accounting profession and the marketing

strategies to develop skill and knowledge

The course program of accounting also

help in developing the capabilities and

skill

Gather information from CPA course for

the betterment of future

The accounting work is associated with

full of stress

The level of competition in the accounting

professional is also high

Numerous people are getting involved in

the various field of accounting

Knowledge of future study and professional development option

The knowledge of the future study with the CA or the CPA is vital for the development of

accounting professional within the field. The courses that are highly essential to supplement the

4 | P a eg

CA degree within the field of accounting are the CWA or the CS then the IFRS along with the

CISA and CIMA and also CIA within the field (Almeida, & Fernando, 2017). This course

effectively allows the accountant to perform various actions for performing the accounting

within the field of accountancy. The IFRS is the certification course that is offered to the auditor

and the accountant to perform their activity within the field (Haynes, 2017). The future study

within the field of accounting is highly essential to follow the business process and the working

function for delivering highly essential accounting process for the field. The post-qualification

courses that are being offered by the ICAI is another option for the CA or the CPA student to

gain effective knowledge on the accounting process in the field. There are other courses also that

could be utilised effectively with the CA or the CPA are the LLB, then the MBA, government

service and also the financial risk management course.

Legal and ethical professional responsibilities and standard

The situation is quite critical for the accounting profession and for that effective decision-making

process and working as a team is the most essential factor. Regarding the situation, I would like

to consult with the team members and also the executives within the business process to achieve

an effective and valuable result within the process. The situation clearly shows that the

alternatives for the material device along with the service is essential to develop the decision-

making process within the field. The code of ethics for the accounting profession is to maintain

the confidentiality in the document as well as provide the professional competence in the process

(Qiao, Chen, & Hung, 2018). It can be also seen that the accounting professional within need to

maintain their personal behaviour to maintain a healthy relationship with the clients within the

field. To solve this situation I would effectively gather more information regarding the situation

and try to critically analyse the process to understand the development and effective solution for

the situation. I would definitely hold the team meeting to discuss the situation and get the

suitable solution for the process.

5 | P a eg

CISA and CIMA and also CIA within the field (Almeida, & Fernando, 2017). This course

effectively allows the accountant to perform various actions for performing the accounting

within the field of accountancy. The IFRS is the certification course that is offered to the auditor

and the accountant to perform their activity within the field (Haynes, 2017). The future study

within the field of accounting is highly essential to follow the business process and the working

function for delivering highly essential accounting process for the field. The post-qualification

courses that are being offered by the ICAI is another option for the CA or the CPA student to

gain effective knowledge on the accounting process in the field. There are other courses also that

could be utilised effectively with the CA or the CPA are the LLB, then the MBA, government

service and also the financial risk management course.

Legal and ethical professional responsibilities and standard

The situation is quite critical for the accounting profession and for that effective decision-making

process and working as a team is the most essential factor. Regarding the situation, I would like

to consult with the team members and also the executives within the business process to achieve

an effective and valuable result within the process. The situation clearly shows that the

alternatives for the material device along with the service is essential to develop the decision-

making process within the field. The code of ethics for the accounting profession is to maintain

the confidentiality in the document as well as provide the professional competence in the process

(Qiao, Chen, & Hung, 2018). It can be also seen that the accounting professional within need to

maintain their personal behaviour to maintain a healthy relationship with the clients within the

field. To solve this situation I would effectively gather more information regarding the situation

and try to critically analyse the process to understand the development and effective solution for

the situation. I would definitely hold the team meeting to discuss the situation and get the

suitable solution for the process.

5 | P a eg

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

The paper eventually concludes the fact that the accounting process is highly developed within

the field to maintain their working function for the development of the process. The paper also

concludes the fact that in the accounting professional there is numerous course which could be

effectively achieved to get effective knowledge and skill in the process. It can be also seen that in

the recent years the development of computerised accounting process helps to analyse the

situation and the position within the market. The paper also evaluated the fact that accounting

professionals have the vital aspect within the firm for maintaining the financial activity.

6 | P a eg

The paper eventually concludes the fact that the accounting process is highly developed within

the field to maintain their working function for the development of the process. The paper also

concludes the fact that in the accounting professional there is numerous course which could be

effectively achieved to get effective knowledge and skill in the process. It can be also seen that in

the recent years the development of computerised accounting process helps to analyse the

situation and the position within the market. The paper also evaluated the fact that accounting

professionals have the vital aspect within the firm for maintaining the financial activity.

6 | P a eg

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Almeida, S., & Fernando, M. (2017). Making the cut: occupation-specific factors influencing

employers in their recruitment and selection of immigrant professionals in the

information technology and accounting occupations in regional Australia. The

International Journal of Human Resource Management, 28(6), 880-912.

Anderson, A., Bian, J., & Çalıyurt, K. T. (2018). Accounting professionals, 70, 238 Accounting

scandals, 70 Analysis of variance, 88–90. Regulations and Applications of Ethics in

Business Practice, 237, 323.

Bobek, D. D., Hageman, A. M., & Radtke, R. R. (2015). The effects of professional role,

decision context, and gender on the ethical decision making of public accounting

professionals. Behavioral Research in Accounting, 27(1), 55-78.

Buchheit, S., Dalton, D. W., Harp, N. L., & Hollingsworth, C. W. (2015). A contemporary

analysis of accounting professionals' work-life balance. Accounting Horizons, 30(1), 41-

62.

Güngörmüş, A. H., & Uyar, A. (2017). Investigation of internal and external factors causing the

unethical behavior of accounting professionals. In Sustainability and Management (pp.

71-82). Routledge.

Haynes, K. (2017). Accounting as gendering and gendered: A review of 25 years of critical

accounting research on gender. Critical Perspectives on Accounting, 43, 110-124.

Ismail, S. (2017). Ethical Judgment and Ethical Ideology of Accounting Professionals and

Accounting Students. Asian Journal of Accounting Perspectives, 99-113.

Komori, N. (2015). Beneath the globalization paradox: Towards the sustainability of cultural

diversity in accounting research. Critical Perspectives on Accounting, 26, 141-156.

Miranda, G. J., Leal, E. A., de Oliveira Medeiros, C. R., & Lemes, S. (2015). Social

representations of college applicants:(re) constructing the stereotype of accounting

professionals. Advances in Scientific and Applied Accounting, 8(1), 020-038.

7 | P a eg

Almeida, S., & Fernando, M. (2017). Making the cut: occupation-specific factors influencing

employers in their recruitment and selection of immigrant professionals in the

information technology and accounting occupations in regional Australia. The

International Journal of Human Resource Management, 28(6), 880-912.

Anderson, A., Bian, J., & Çalıyurt, K. T. (2018). Accounting professionals, 70, 238 Accounting

scandals, 70 Analysis of variance, 88–90. Regulations and Applications of Ethics in

Business Practice, 237, 323.

Bobek, D. D., Hageman, A. M., & Radtke, R. R. (2015). The effects of professional role,

decision context, and gender on the ethical decision making of public accounting

professionals. Behavioral Research in Accounting, 27(1), 55-78.

Buchheit, S., Dalton, D. W., Harp, N. L., & Hollingsworth, C. W. (2015). A contemporary

analysis of accounting professionals' work-life balance. Accounting Horizons, 30(1), 41-

62.

Güngörmüş, A. H., & Uyar, A. (2017). Investigation of internal and external factors causing the

unethical behavior of accounting professionals. In Sustainability and Management (pp.

71-82). Routledge.

Haynes, K. (2017). Accounting as gendering and gendered: A review of 25 years of critical

accounting research on gender. Critical Perspectives on Accounting, 43, 110-124.

Ismail, S. (2017). Ethical Judgment and Ethical Ideology of Accounting Professionals and

Accounting Students. Asian Journal of Accounting Perspectives, 99-113.

Komori, N. (2015). Beneath the globalization paradox: Towards the sustainability of cultural

diversity in accounting research. Critical Perspectives on Accounting, 26, 141-156.

Miranda, G. J., Leal, E. A., de Oliveira Medeiros, C. R., & Lemes, S. (2015). Social

representations of college applicants:(re) constructing the stereotype of accounting

professionals. Advances in Scientific and Applied Accounting, 8(1), 020-038.

7 | P a eg

Pendley, J. A. (2018). Finance and Accounting Professionals and Cybersecurity

Awareness. Journal of Corporate Accounting & Finance, 29(1), 53-58.

Qiao, Z., Chen, K. Y., & Hung, S. (2018). Professionals inside the boardroom: accounting

expertise of directors and dividend policy. Applied Economics, 1-12.

Suddaby, R., Saxton, G. D., & Gunz, S. (2015). Twittering change: The institutional work of

domain change in accounting expertise. Accounting, Organizations and Society, 45, 52-

68.

8 | P a eg

Awareness. Journal of Corporate Accounting & Finance, 29(1), 53-58.

Qiao, Z., Chen, K. Y., & Hung, S. (2018). Professionals inside the boardroom: accounting

expertise of directors and dividend policy. Applied Economics, 1-12.

Suddaby, R., Saxton, G. D., & Gunz, S. (2015). Twittering change: The institutional work of

domain change in accounting expertise. Accounting, Organizations and Society, 45, 52-

68.

8 | P a eg

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.