Financial Accounting Report: Depreciation Methods and IAS 16/AASB 116

VerifiedAdded on 2020/05/16

|15

|3452

|48

Report

AI Summary

This report delves into financial accounting, focusing on various depreciation methods. It begins with a brief overview and then proceeds to compute depreciation using four methods: Straight-line, Diminishing Value, Units of Production, and Sum of Years Digits. The report provides detailed calculations for each method. Furthermore, the report includes a management report that outlines the advantages and disadvantages of each depreciation method, offering recommendations for the most suitable approach. The report also addresses the requirements of IAS 16/AASB 116, highlighting the most consistent depreciation method for the computations made. The analysis provides valuable insights into depreciation techniques, aiding in understanding their application and impact on financial reporting.

Running head: FINANCIAL ACCOUNTING AND REPORTING

Financial Accounting and Reporting

Name of the Student

Name of the University

Authors Note

Course ID

Financial Accounting and Reporting

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING AND REPORTING

Table of Contents

Brief Overview:..........................................................................................................................2

Answer to Requirement A:.........................................................................................................2

Answer to Requirement B:.........................................................................................................4

Answer to requirement C:........................................................................................................11

Reference List:.........................................................................................................................13

Table of Contents

Brief Overview:..........................................................................................................................2

Answer to Requirement A:.........................................................................................................2

Answer to Requirement B:.........................................................................................................4

Answer to requirement C:........................................................................................................11

Reference List:.........................................................................................................................13

2FINANCIAL ACCOUNTING AND REPORTING

Brief Overview:

The current report is based on the determination of the depreciation under the four

methods namely the Straight-line method, Diminishing Value, Units of production

Depreciation and Sum of Years Digits Depreciation. The report will additionally provide the

advantages and disadvantage of each of the depreciation method with recommendations for

the most suitable method of depreciation. The report would further provide the requirements

of the IAS 16/AASB 116 and would highlight the most consistent method of depreciation

suitable for the computations made.

Answer to Requirement A:

Computations of Depreciations:

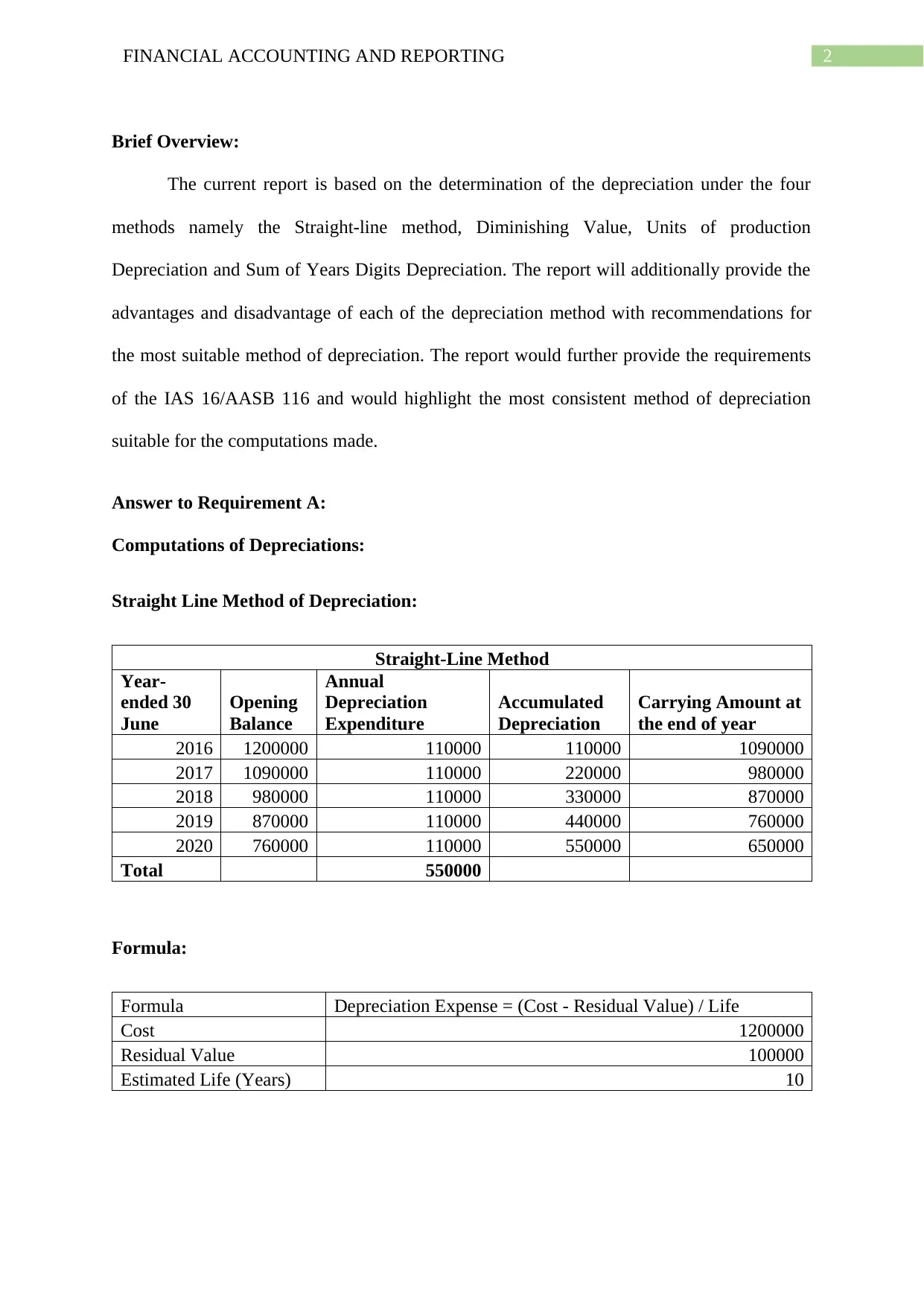

Straight Line Method of Depreciation:

Straight-Line Method

Year-

ended 30

June

Opening

Balance

Annual

Depreciation

Expenditure

Accumulated

Depreciation

Carrying Amount at

the end of year

2016 1200000 110000 110000 1090000

2017 1090000 110000 220000 980000

2018 980000 110000 330000 870000

2019 870000 110000 440000 760000

2020 760000 110000 550000 650000

Total 550000

Formula:

Formula Depreciation Expense = (Cost - Residual Value) / Life

Cost 1200000

Residual Value 100000

Estimated Life (Years) 10

Brief Overview:

The current report is based on the determination of the depreciation under the four

methods namely the Straight-line method, Diminishing Value, Units of production

Depreciation and Sum of Years Digits Depreciation. The report will additionally provide the

advantages and disadvantage of each of the depreciation method with recommendations for

the most suitable method of depreciation. The report would further provide the requirements

of the IAS 16/AASB 116 and would highlight the most consistent method of depreciation

suitable for the computations made.

Answer to Requirement A:

Computations of Depreciations:

Straight Line Method of Depreciation:

Straight-Line Method

Year-

ended 30

June

Opening

Balance

Annual

Depreciation

Expenditure

Accumulated

Depreciation

Carrying Amount at

the end of year

2016 1200000 110000 110000 1090000

2017 1090000 110000 220000 980000

2018 980000 110000 330000 870000

2019 870000 110000 440000 760000

2020 760000 110000 550000 650000

Total 550000

Formula:

Formula Depreciation Expense = (Cost - Residual Value) / Life

Cost 1200000

Residual Value 100000

Estimated Life (Years) 10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING AND REPORTING

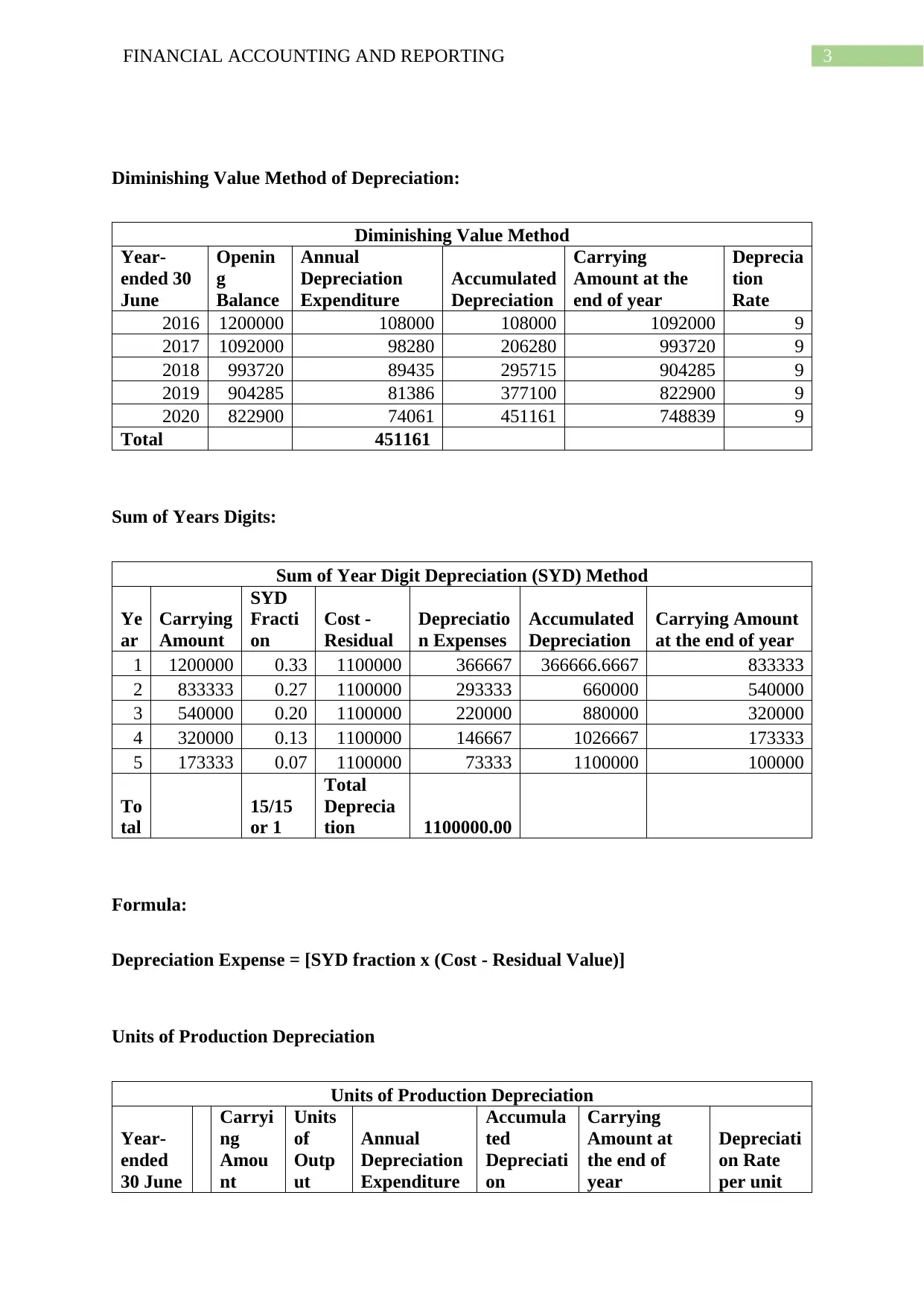

Diminishing Value Method of Depreciation:

Diminishing Value Method

Year-

ended 30

June

Openin

g

Balance

Annual

Depreciation

Expenditure

Accumulated

Depreciation

Carrying

Amount at the

end of year

Deprecia

tion

Rate

2016 1200000 108000 108000 1092000 9

2017 1092000 98280 206280 993720 9

2018 993720 89435 295715 904285 9

2019 904285 81386 377100 822900 9

2020 822900 74061 451161 748839 9

Total 451161

Sum of Years Digits:

Sum of Year Digit Depreciation (SYD) Method

Ye

ar

Carrying

Amount

SYD

Fracti

on

Cost -

Residual

Depreciatio

n Expenses

Accumulated

Depreciation

Carrying Amount

at the end of year

1 1200000 0.33 1100000 366667 366666.6667 833333

2 833333 0.27 1100000 293333 660000 540000

3 540000 0.20 1100000 220000 880000 320000

4 320000 0.13 1100000 146667 1026667 173333

5 173333 0.07 1100000 73333 1100000 100000

To

tal

15/15

or 1

Total

Deprecia

tion 1100000.00

Formula:

Depreciation Expense = [SYD fraction x (Cost - Residual Value)]

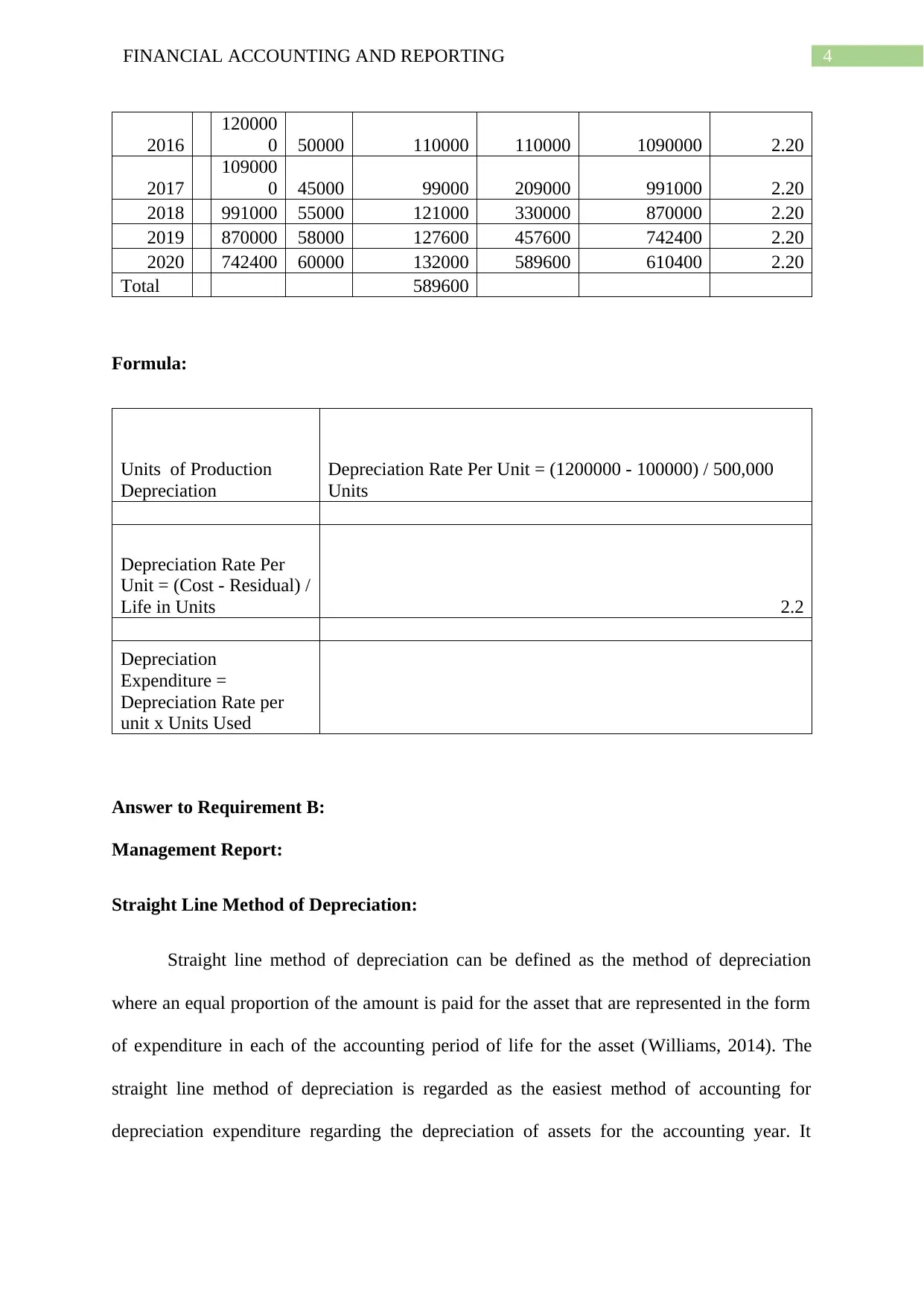

Units of Production Depreciation

Units of Production Depreciation

Year-

ended

30 June

Carryi

ng

Amou

nt

Units

of

Outp

ut

Annual

Depreciation

Expenditure

Accumula

ted

Depreciati

on

Carrying

Amount at

the end of

year

Depreciati

on Rate

per unit

Diminishing Value Method of Depreciation:

Diminishing Value Method

Year-

ended 30

June

Openin

g

Balance

Annual

Depreciation

Expenditure

Accumulated

Depreciation

Carrying

Amount at the

end of year

Deprecia

tion

Rate

2016 1200000 108000 108000 1092000 9

2017 1092000 98280 206280 993720 9

2018 993720 89435 295715 904285 9

2019 904285 81386 377100 822900 9

2020 822900 74061 451161 748839 9

Total 451161

Sum of Years Digits:

Sum of Year Digit Depreciation (SYD) Method

Ye

ar

Carrying

Amount

SYD

Fracti

on

Cost -

Residual

Depreciatio

n Expenses

Accumulated

Depreciation

Carrying Amount

at the end of year

1 1200000 0.33 1100000 366667 366666.6667 833333

2 833333 0.27 1100000 293333 660000 540000

3 540000 0.20 1100000 220000 880000 320000

4 320000 0.13 1100000 146667 1026667 173333

5 173333 0.07 1100000 73333 1100000 100000

To

tal

15/15

or 1

Total

Deprecia

tion 1100000.00

Formula:

Depreciation Expense = [SYD fraction x (Cost - Residual Value)]

Units of Production Depreciation

Units of Production Depreciation

Year-

ended

30 June

Carryi

ng

Amou

nt

Units

of

Outp

ut

Annual

Depreciation

Expenditure

Accumula

ted

Depreciati

on

Carrying

Amount at

the end of

year

Depreciati

on Rate

per unit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING AND REPORTING

2016

120000

0 50000 110000 110000 1090000 2.20

2017

109000

0 45000 99000 209000 991000 2.20

2018 991000 55000 121000 330000 870000 2.20

2019 870000 58000 127600 457600 742400 2.20

2020 742400 60000 132000 589600 610400 2.20

Total 589600

Formula:

Units of Production

Depreciation

Depreciation Rate Per Unit = (1200000 - 100000) / 500,000

Units

Depreciation Rate Per

Unit = (Cost - Residual) /

Life in Units 2.2

Depreciation

Expenditure =

Depreciation Rate per

unit x Units Used

Answer to Requirement B:

Management Report:

Straight Line Method of Depreciation:

Straight line method of depreciation can be defined as the method of depreciation

where an equal proportion of the amount is paid for the asset that are represented in the form

of expenditure in each of the accounting period of life for the asset (Williams, 2014). The

straight line method of depreciation is regarded as the easiest method of accounting for

depreciation expenditure regarding the depreciation of assets for the accounting year. It

2016

120000

0 50000 110000 110000 1090000 2.20

2017

109000

0 45000 99000 209000 991000 2.20

2018 991000 55000 121000 330000 870000 2.20

2019 870000 58000 127600 457600 742400 2.20

2020 742400 60000 132000 589600 610400 2.20

Total 589600

Formula:

Units of Production

Depreciation

Depreciation Rate Per Unit = (1200000 - 100000) / 500,000

Units

Depreciation Rate Per

Unit = (Cost - Residual) /

Life in Units 2.2

Depreciation

Expenditure =

Depreciation Rate per

unit x Units Used

Answer to Requirement B:

Management Report:

Straight Line Method of Depreciation:

Straight line method of depreciation can be defined as the method of depreciation

where an equal proportion of the amount is paid for the asset that are represented in the form

of expenditure in each of the accounting period of life for the asset (Williams, 2014). The

straight line method of depreciation is regarded as the easiest method of accounting for

depreciation expenditure regarding the depreciation of assets for the accounting year. It

5FINANCIAL ACCOUNTING AND REPORTING

spreads out evenly all the cost that is associated with the purchase of the asset over the useful

life of the assets. The advantages and the disadvantages of the depreciation are as follows;

Advantages of Straight Line Method of Depreciation:

The straight-line method of depreciation has the following advantages;

a. Simplicity: The straight-line method of depreciation is regarded as the easiest method

of depreciation. The method of depreciation is easy to understand even though the

ordinary person with less knowledge of accounting can understand the depreciation

expenditure at the end of the year (Warren & Jones, 2018). The calculations that is

done under this method is ordinary and easy for any person to understand.

b. Assets can be entirely written off: Under the straight-line method of depreciation,

the assets can be easily written off up to the value of Zero. The depreciation is

computed based on the actual cost of the asset in respect of the specified rate

(Henderson et al., 2015). Therefore, the value of the asset under the straight line

method of depreciation can be entirely split over the useful life of the asset.

c. Determination of the total depreciation charges: The over amount of the total

depreciation that is charged can be easily known by the managers by multiplying the

amount of depreciation with the total number of years under which the assets has been

used (Pratt, 2016).

d. Appropriate for small firms: Under the straight-line method of depreciation, the

determination of asset is appropriate for the small firms (Marshall, 2016). The small

firms makes the use of this method of depreciation since it is easy to understand and

implement given the size of the companies.

e. Appropriate for companies with large number of old and new machines: The

weakness under this method of depreciation is removed given the firm has both the

spreads out evenly all the cost that is associated with the purchase of the asset over the useful

life of the assets. The advantages and the disadvantages of the depreciation are as follows;

Advantages of Straight Line Method of Depreciation:

The straight-line method of depreciation has the following advantages;

a. Simplicity: The straight-line method of depreciation is regarded as the easiest method

of depreciation. The method of depreciation is easy to understand even though the

ordinary person with less knowledge of accounting can understand the depreciation

expenditure at the end of the year (Warren & Jones, 2018). The calculations that is

done under this method is ordinary and easy for any person to understand.

b. Assets can be entirely written off: Under the straight-line method of depreciation,

the assets can be easily written off up to the value of Zero. The depreciation is

computed based on the actual cost of the asset in respect of the specified rate

(Henderson et al., 2015). Therefore, the value of the asset under the straight line

method of depreciation can be entirely split over the useful life of the asset.

c. Determination of the total depreciation charges: The over amount of the total

depreciation that is charged can be easily known by the managers by multiplying the

amount of depreciation with the total number of years under which the assets has been

used (Pratt, 2016).

d. Appropriate for small firms: Under the straight-line method of depreciation, the

determination of asset is appropriate for the small firms (Marshall, 2016). The small

firms makes the use of this method of depreciation since it is easy to understand and

implement given the size of the companies.

e. Appropriate for companies with large number of old and new machines: The

weakness under this method of depreciation is removed given the firm has both the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ACCOUNTING AND REPORTING

old and the new machinery (Macve, 2015). A higher degree of maintenance charges

on the old machines and lesser in respect of the old machines helps in creating

balance for each other.

f. Beneficial for assets with lower value: The straight line method of depreciation is

regarded as the most suitable method of charging depreciation on the assets that are

having less value (Hoskin et al., 2015). These assets includes the furniture, fixture and

patents.

Disadvantages of Straight line method of Depreciation:

The straight line method of depreciation suffers from following disadvantages;

a. Unnecessary pressure during final years: Under the straight line method of

depreciation during the final years of the assets the life of the asset have to shoulder

higher amount of repairs and maintenance charges together with the amount of

deprecation. Whereas during the initial years it has suffer less amount of repair

charges.

b. No provision for replacement: The amount that is charged as depreciation under the

straight-line method of depreciation is reserved in the business and it is used in the

routine affairs (Warren, 2016). The organization has to worry for making funds in

order to replace the asset even though the depreciation has been charged each year.

c. Illogical method: The straight-line method of depreciation method of depreciation is

regarded as illogical method of depreciation. This is because the depreciation charged

on the original cost of the asset is considered as illogical when the asset balance is

falling every year.

d. Not suitable for assets with long life: The straight-line method of depreciation

cannot be regarded as the suitable method of charging depreciation for the assets that

old and the new machinery (Macve, 2015). A higher degree of maintenance charges

on the old machines and lesser in respect of the old machines helps in creating

balance for each other.

f. Beneficial for assets with lower value: The straight line method of depreciation is

regarded as the most suitable method of charging depreciation on the assets that are

having less value (Hoskin et al., 2015). These assets includes the furniture, fixture and

patents.

Disadvantages of Straight line method of Depreciation:

The straight line method of depreciation suffers from following disadvantages;

a. Unnecessary pressure during final years: Under the straight line method of

depreciation during the final years of the assets the life of the asset have to shoulder

higher amount of repairs and maintenance charges together with the amount of

deprecation. Whereas during the initial years it has suffer less amount of repair

charges.

b. No provision for replacement: The amount that is charged as depreciation under the

straight-line method of depreciation is reserved in the business and it is used in the

routine affairs (Warren, 2016). The organization has to worry for making funds in

order to replace the asset even though the depreciation has been charged each year.

c. Illogical method: The straight-line method of depreciation method of depreciation is

regarded as illogical method of depreciation. This is because the depreciation charged

on the original cost of the asset is considered as illogical when the asset balance is

falling every year.

d. Not suitable for assets with long life: The straight-line method of depreciation

cannot be regarded as the suitable method of charging depreciation for the assets that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING AND REPORTING

are having long life (Barth, 2015). There are certain assets such as land and building

and plant and machinery that are subjected to extension. Therefore, it is not

appropriate for assets with more value.

Diminishing Value Method: The diminishing method of depreciation, which is also known

as the reducing value method, consist of multiplying the carrying amount of the asset with the

rate of the depreciation, which can be claimed during the year (Gassen, 2014). The carrying

amount of the asset represents the value of the asset following any depreciation till the date

up to which the value of the asset can be claimed from the original cost.

Advantages of Diminishing Value Method:

The advantages of Diminishing Value method are as follows;

a. Uniformity of Amount: Under the Diminishing Value method the amount that is

charged to the profit and loss account in respect of the depreciation and repairs which

would remain uniform for several years.

b. No Fresh calculations required: Any form of addition that is made in the fixed asset

requires no fresh computations unless any form of purchase that is made during the

middle of the year (Beaumont, 2015).

c. Easy to Use: The Diminishing Value method is regarded as easy to understand and

use.

Disadvantages:

There are also some disadvantages of the Diminishing Value method which are as follows;

a. Failure to consider Interest: Interest that is lost under the Diminishing Value

method to the capital investment made in the asset is not taken into the consideration

in this method.

are having long life (Barth, 2015). There are certain assets such as land and building

and plant and machinery that are subjected to extension. Therefore, it is not

appropriate for assets with more value.

Diminishing Value Method: The diminishing method of depreciation, which is also known

as the reducing value method, consist of multiplying the carrying amount of the asset with the

rate of the depreciation, which can be claimed during the year (Gassen, 2014). The carrying

amount of the asset represents the value of the asset following any depreciation till the date

up to which the value of the asset can be claimed from the original cost.

Advantages of Diminishing Value Method:

The advantages of Diminishing Value method are as follows;

a. Uniformity of Amount: Under the Diminishing Value method the amount that is

charged to the profit and loss account in respect of the depreciation and repairs which

would remain uniform for several years.

b. No Fresh calculations required: Any form of addition that is made in the fixed asset

requires no fresh computations unless any form of purchase that is made during the

middle of the year (Beaumont, 2015).

c. Easy to Use: The Diminishing Value method is regarded as easy to understand and

use.

Disadvantages:

There are also some disadvantages of the Diminishing Value method which are as follows;

a. Failure to consider Interest: Interest that is lost under the Diminishing Value

method to the capital investment made in the asset is not taken into the consideration

in this method.

8FINANCIAL ACCOUNTING AND REPORTING

b. Book value cannot be zero: Under the Diminishing Value method the book value of

the assets cannot be turned into the zero (Callen, 2015).

c. Low rate of depreciation: Under the Diminishing Value method the depreciation is

charged uniformly to the profit and loss account based on the yearly basis (Bettner et

al., 2015). However, in several circumstances this might not take place either because

of the lower rate of depreciation or because of the excessive amount of repair that is

charged in the later stages.

Units of Production method of depreciation: The units of production method of

depreciation can be defined as the method where the estimation of the total number of hours

of use for the assets or the total sum of units to be produced by it from the overall useful life

of the asset (Wahid, 2017). The units of production method of depreciation subtract the

estimated salvage value of the asset from the capitalized cost of the asset and the same is

divided by the total projected usage or the production made in respect of the net depreciable

cost.

Advantages of Units of Production:

The advantages of the Units of Production are as follows

a. This method of depreciation more closely reflects the original depreciation of the

assets at different levels of activity.

b. This method of depreciation matches more accurately the cost with the revenue.

c. The Units of production method of depreciation relates the depreciation to the activity

of the depreciable assets (Himick, 2015).

Disadvantages of the Units of production:

The disadvantages of the units of production methods are as follows;

b. Book value cannot be zero: Under the Diminishing Value method the book value of

the assets cannot be turned into the zero (Callen, 2015).

c. Low rate of depreciation: Under the Diminishing Value method the depreciation is

charged uniformly to the profit and loss account based on the yearly basis (Bettner et

al., 2015). However, in several circumstances this might not take place either because

of the lower rate of depreciation or because of the excessive amount of repair that is

charged in the later stages.

Units of Production method of depreciation: The units of production method of

depreciation can be defined as the method where the estimation of the total number of hours

of use for the assets or the total sum of units to be produced by it from the overall useful life

of the asset (Wahid, 2017). The units of production method of depreciation subtract the

estimated salvage value of the asset from the capitalized cost of the asset and the same is

divided by the total projected usage or the production made in respect of the net depreciable

cost.

Advantages of Units of Production:

The advantages of the Units of Production are as follows

a. This method of depreciation more closely reflects the original depreciation of the

assets at different levels of activity.

b. This method of depreciation matches more accurately the cost with the revenue.

c. The Units of production method of depreciation relates the depreciation to the activity

of the depreciable assets (Himick, 2015).

Disadvantages of the Units of production:

The disadvantages of the units of production methods are as follows;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ACCOUNTING AND REPORTING

a. Under this method if the depreciable assets has no activity, there would not be any

form of depreciation expenses irrespective of the fact that the machine is losing their

value. The units of production method of depreciation apparently makes the

accounting method unacceptable (Livdan & Nezlobin, 2017).

b. The calculations under this method is complex given that if they are performed on

manual basis

c. The units of production method of depreciation cannot be applied to all the

depreciable assets on equal basis. These includes the building or furniture where

depreciation is reliant on the passage of time.

Sum of years Digits Depreciation: The sum of year’s digit methodology of depreciation is

regarded as that method of depreciation, which is reliant on the assumption that the

productivity of the asset falls with the passing of time (Ionescu & Georgescu, 2014). Under

this method of depreciation, a fraction is calculated by dividing the remaining useful life of

the asset on the specific date by the sum of the year’s digits.

Advantages:

The advantages are as follows;

a. This method of depreciation is regarded as the better method of matching the costs

with the revenues since it takes more amount of depreciation during the yearly years

of the asset life (Demski, 2017).

b. This process of depreciation demonstrates more accurate differences in the usage of

the asset in respect of the different asset for one particular period of time to another

period.

Disadvantages:

a. Under this method if the depreciable assets has no activity, there would not be any

form of depreciation expenses irrespective of the fact that the machine is losing their

value. The units of production method of depreciation apparently makes the

accounting method unacceptable (Livdan & Nezlobin, 2017).

b. The calculations under this method is complex given that if they are performed on

manual basis

c. The units of production method of depreciation cannot be applied to all the

depreciable assets on equal basis. These includes the building or furniture where

depreciation is reliant on the passage of time.

Sum of years Digits Depreciation: The sum of year’s digit methodology of depreciation is

regarded as that method of depreciation, which is reliant on the assumption that the

productivity of the asset falls with the passing of time (Ionescu & Georgescu, 2014). Under

this method of depreciation, a fraction is calculated by dividing the remaining useful life of

the asset on the specific date by the sum of the year’s digits.

Advantages:

The advantages are as follows;

a. This method of depreciation is regarded as the better method of matching the costs

with the revenues since it takes more amount of depreciation during the yearly years

of the asset life (Demski, 2017).

b. This process of depreciation demonstrates more accurate differences in the usage of

the asset in respect of the different asset for one particular period of time to another

period.

Disadvantages:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ACCOUNTING AND REPORTING

a. The sum of years’ digit method of depreciation may be very confusing and difficult to

compute

b. The sum of year’s digits reports declining value of the depreciation expenditure.

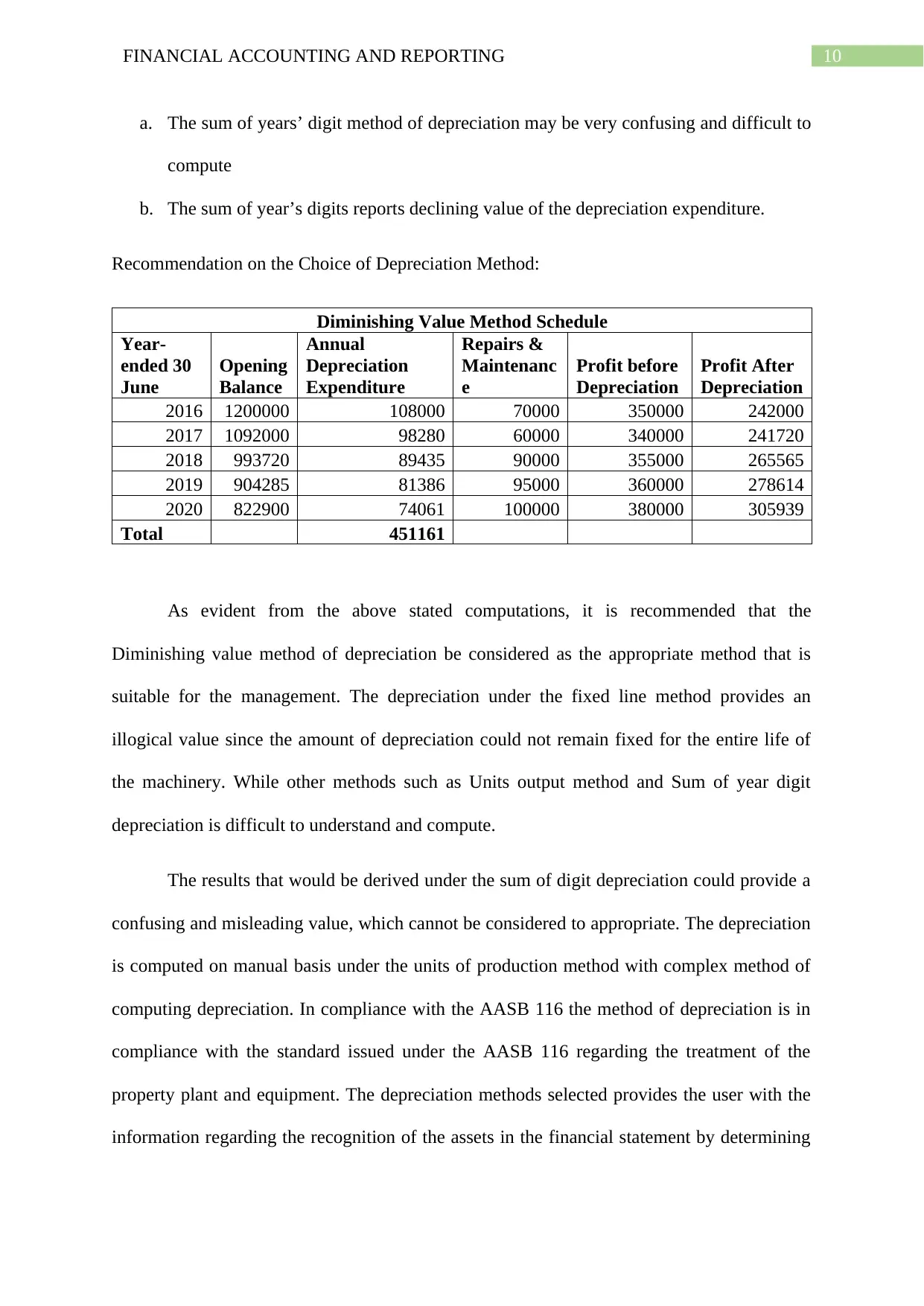

Recommendation on the Choice of Depreciation Method:

Diminishing Value Method Schedule

Year-

ended 30

June

Opening

Balance

Annual

Depreciation

Expenditure

Repairs &

Maintenanc

e

Profit before

Depreciation

Profit After

Depreciation

2016 1200000 108000 70000 350000 242000

2017 1092000 98280 60000 340000 241720

2018 993720 89435 90000 355000 265565

2019 904285 81386 95000 360000 278614

2020 822900 74061 100000 380000 305939

Total 451161

As evident from the above stated computations, it is recommended that the

Diminishing value method of depreciation be considered as the appropriate method that is

suitable for the management. The depreciation under the fixed line method provides an

illogical value since the amount of depreciation could not remain fixed for the entire life of

the machinery. While other methods such as Units output method and Sum of year digit

depreciation is difficult to understand and compute.

The results that would be derived under the sum of digit depreciation could provide a

confusing and misleading value, which cannot be considered to appropriate. The depreciation

is computed on manual basis under the units of production method with complex method of

computing depreciation. In compliance with the AASB 116 the method of depreciation is in

compliance with the standard issued under the AASB 116 regarding the treatment of the

property plant and equipment. The depreciation methods selected provides the user with the

information regarding the recognition of the assets in the financial statement by determining

a. The sum of years’ digit method of depreciation may be very confusing and difficult to

compute

b. The sum of year’s digits reports declining value of the depreciation expenditure.

Recommendation on the Choice of Depreciation Method:

Diminishing Value Method Schedule

Year-

ended 30

June

Opening

Balance

Annual

Depreciation

Expenditure

Repairs &

Maintenanc

e

Profit before

Depreciation

Profit After

Depreciation

2016 1200000 108000 70000 350000 242000

2017 1092000 98280 60000 340000 241720

2018 993720 89435 90000 355000 265565

2019 904285 81386 95000 360000 278614

2020 822900 74061 100000 380000 305939

Total 451161

As evident from the above stated computations, it is recommended that the

Diminishing value method of depreciation be considered as the appropriate method that is

suitable for the management. The depreciation under the fixed line method provides an

illogical value since the amount of depreciation could not remain fixed for the entire life of

the machinery. While other methods such as Units output method and Sum of year digit

depreciation is difficult to understand and compute.

The results that would be derived under the sum of digit depreciation could provide a

confusing and misleading value, which cannot be considered to appropriate. The depreciation

is computed on manual basis under the units of production method with complex method of

computing depreciation. In compliance with the AASB 116 the method of depreciation is in

compliance with the standard issued under the AASB 116 regarding the treatment of the

property plant and equipment. The depreciation methods selected provides the user with the

information regarding the recognition of the assets in the financial statement by determining

11FINANCIAL ACCOUNTING AND REPORTING

the carrying amount and depreciation that charged to the asset under the Diminishing value

method.

The diminishing method of depreciation is regarded as the appropriate method of

depreciation since under this method the amount that is charged to the profit and loss account

in respect of the depreciation and repairs would remain unvarying for several years.

Furthermore, even if the management consider any form of addition in the fixed asset it

would requires no fresh computations unless any form of purchase that is made during the

middle of the year. Hence bearing the suitability of the diminishing value method a

recommendation can be made by stating that the diminishing value method is regarded as the

most suitable method of depreciation.

Answer to requirement C:

For the business, owners that require certain form of equipment such as machinery to

conduct their business operations there are lot of factors that is required to take account of.

Beyond merely weighing the overall cost associated to purchase or merely leasing the piece

of equipment the management is also required to take account of the maintenance of

machinery, deductibility of tax, flexibility and more. On narrowing down the form of

equipment that is required by the business it is a better idea of considering leasing the

machinery. In certain state of affairs, the cost benefit one of one alternative might strongly

outweigh the other factors.

In the current circumstances, leasing could be regarded as the better option since the

equipment generally requires update and acquiring the updated technology of machine would

help in increasing the output for the management. Buying the equipment might lead the

management with additional burden, as they would be required to up their system based on

yearly basis to stay competitive. However leasing of equipment would enable the

the carrying amount and depreciation that charged to the asset under the Diminishing value

method.

The diminishing method of depreciation is regarded as the appropriate method of

depreciation since under this method the amount that is charged to the profit and loss account

in respect of the depreciation and repairs would remain unvarying for several years.

Furthermore, even if the management consider any form of addition in the fixed asset it

would requires no fresh computations unless any form of purchase that is made during the

middle of the year. Hence bearing the suitability of the diminishing value method a

recommendation can be made by stating that the diminishing value method is regarded as the

most suitable method of depreciation.

Answer to requirement C:

For the business, owners that require certain form of equipment such as machinery to

conduct their business operations there are lot of factors that is required to take account of.

Beyond merely weighing the overall cost associated to purchase or merely leasing the piece

of equipment the management is also required to take account of the maintenance of

machinery, deductibility of tax, flexibility and more. On narrowing down the form of

equipment that is required by the business it is a better idea of considering leasing the

machinery. In certain state of affairs, the cost benefit one of one alternative might strongly

outweigh the other factors.

In the current circumstances, leasing could be regarded as the better option since the

equipment generally requires update and acquiring the updated technology of machine would

help in increasing the output for the management. Buying the equipment might lead the

management with additional burden, as they would be required to up their system based on

yearly basis to stay competitive. However leasing of equipment would enable the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.