Financial Accounting: Detailed Analysis of Financial Statements

VerifiedAdded on 2023/06/05

|13

|882

|208

Report

AI Summary

This financial accounting report covers several key areas including financial statement disclosures, accounting for share capital, accounting for income tax, revaluation of property, plant, and equipment, and impairment of assets. The report analyzes different scenarios related to financial statement disclosures, such as changes in asset useful life, unpaid repair expenses, investment value falls, and errors or fraud identification. It further discusses accounting for share capital, including share issuance and forfeiture. The report also delves into accounting for income tax, covering taxable and deductible temporary differences and deferred tax assets. Additionally, it addresses the revaluation of property, plant, and equipment and the impairment of assets, providing a comprehensive overview of these financial accounting topics. Desklib provides access to this and other solved assignments.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING

Table of Contents

Question 1: Financial statement disclosures....................................................................................2

Requirement i:.............................................................................................................................2

Requirement ii:............................................................................................................................4

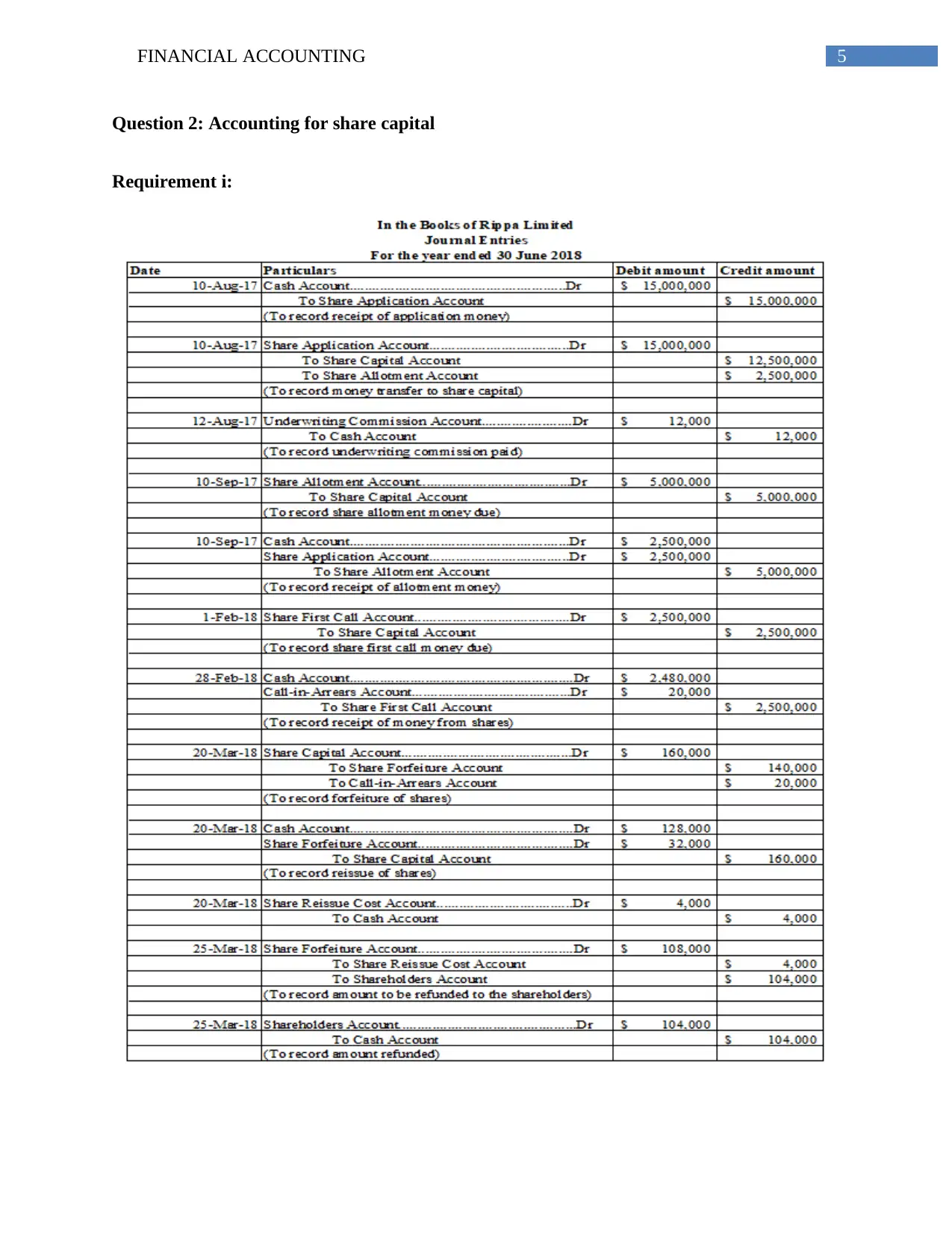

Question 2: Accounting for share capital........................................................................................5

Requirement i:.............................................................................................................................5

Requirement ii:............................................................................................................................6

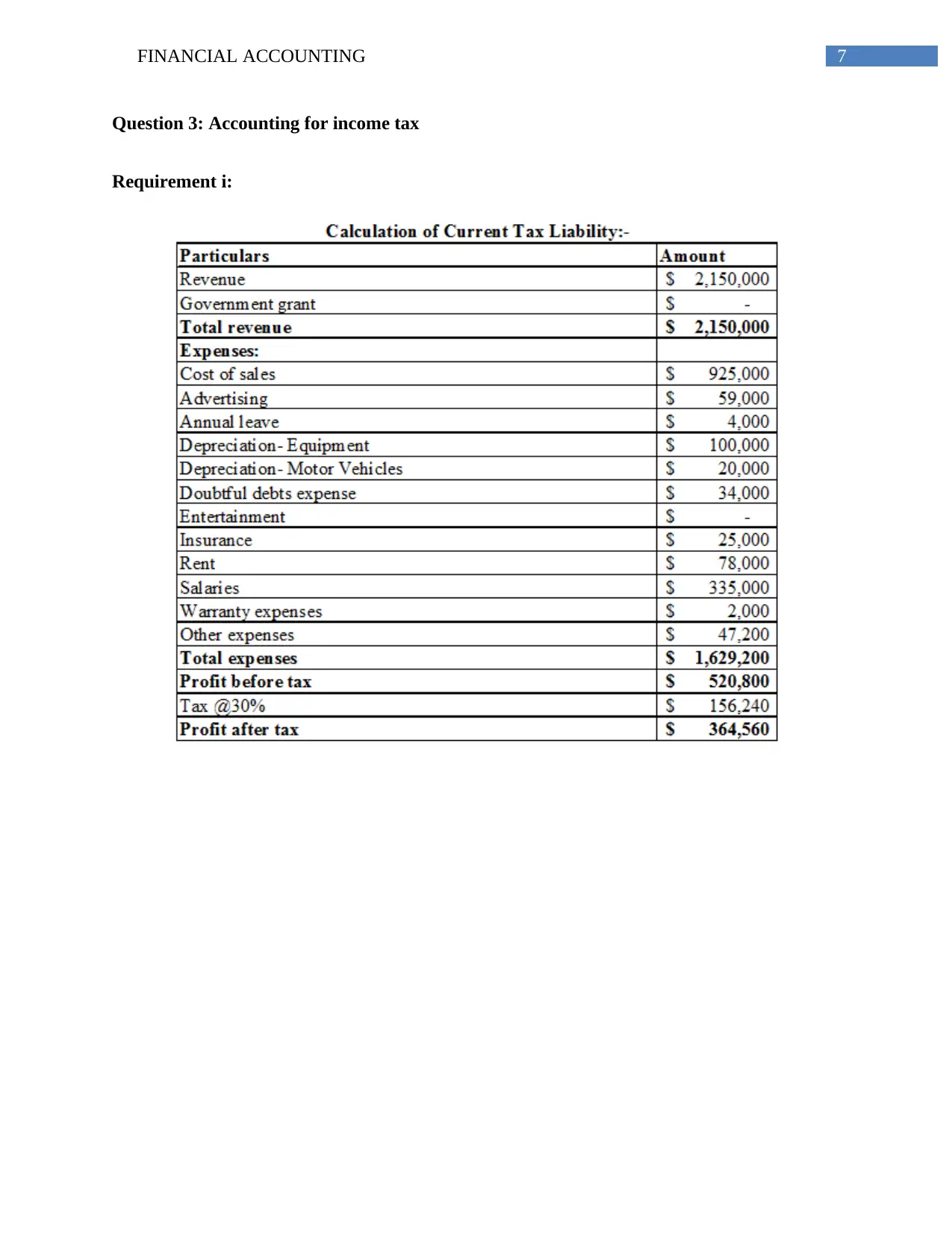

Question 3: Accounting for income tax...........................................................................................7

Requirement i:.............................................................................................................................7

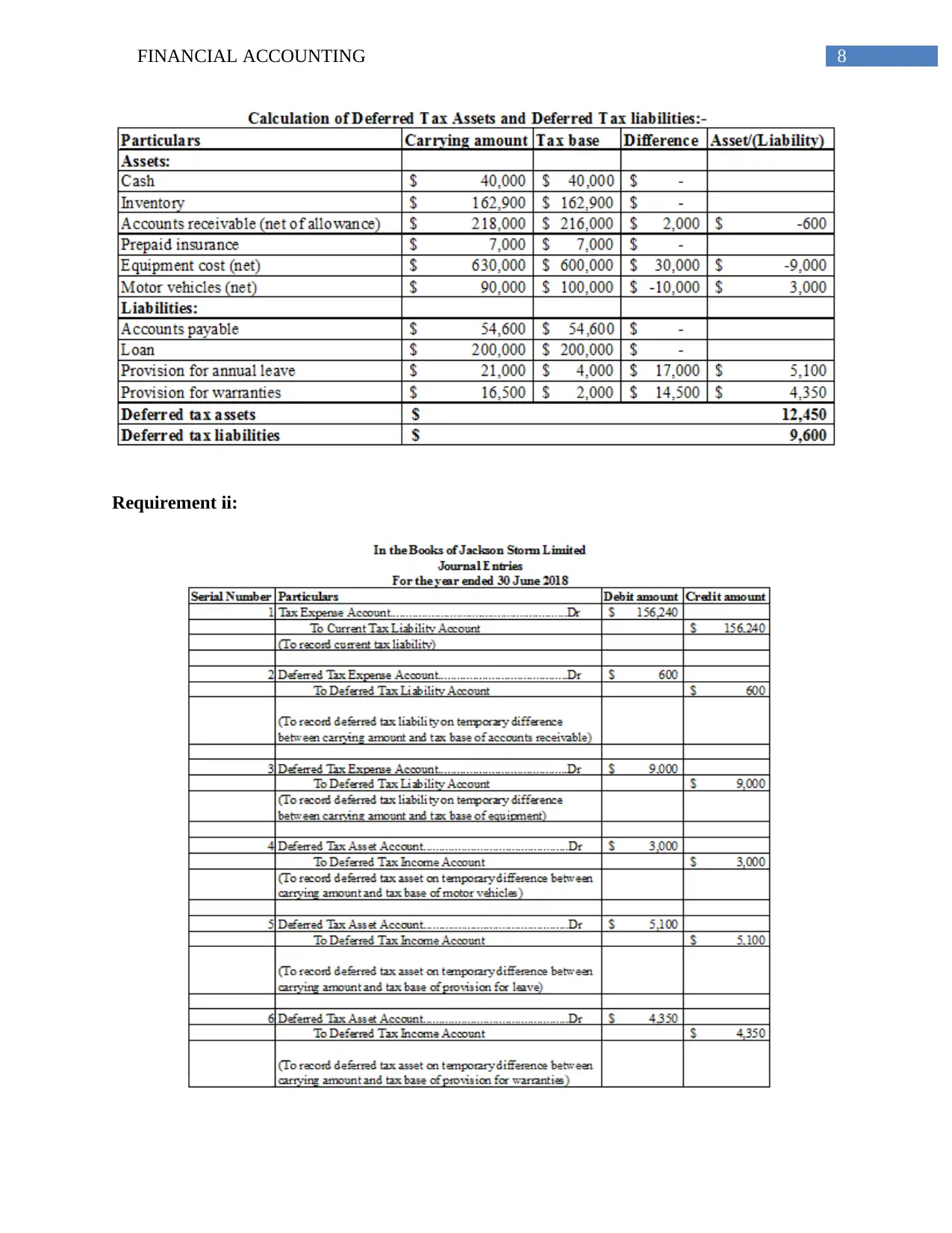

Requirement ii:............................................................................................................................8

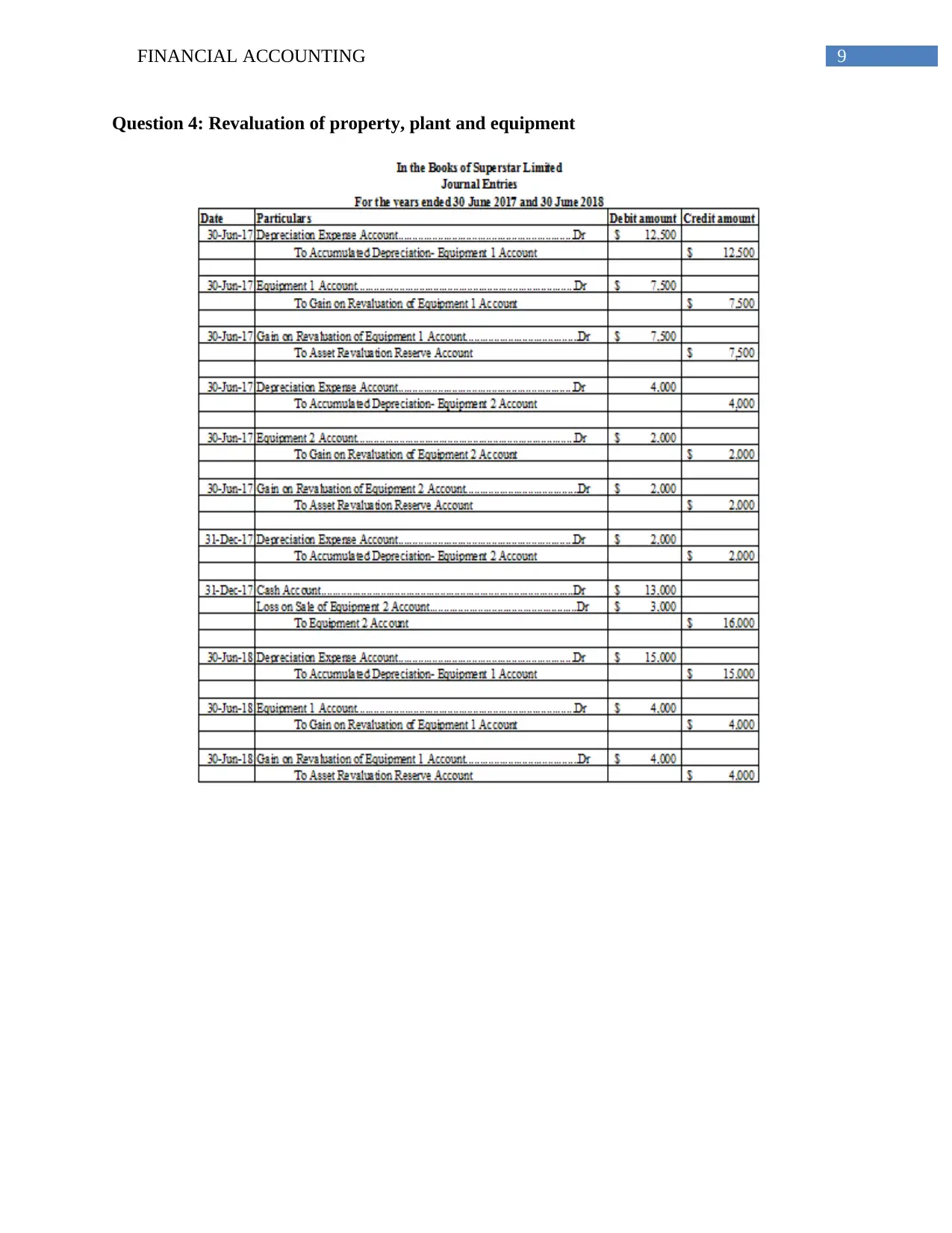

Question 4: Revaluation of property, plant and equipment.............................................................9

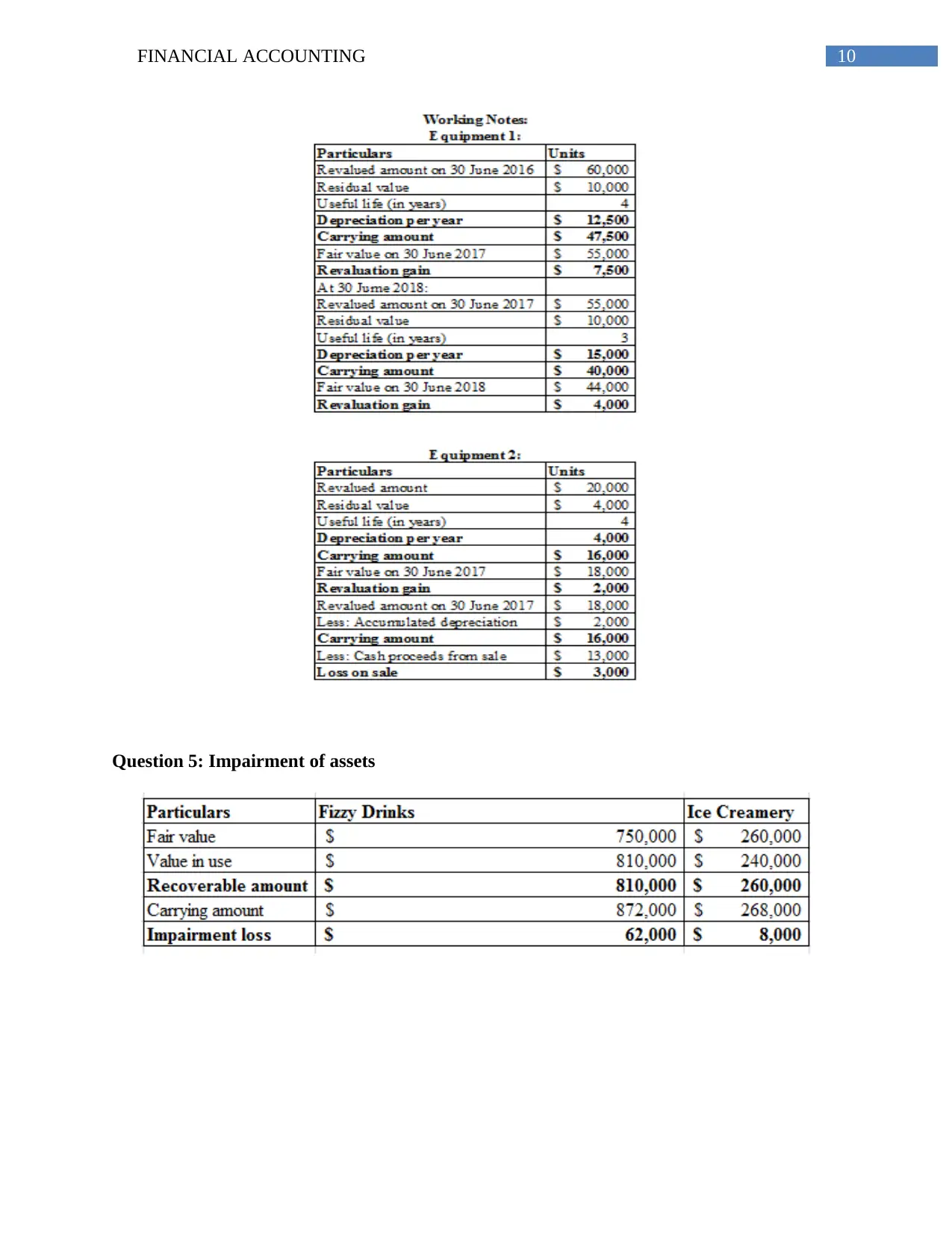

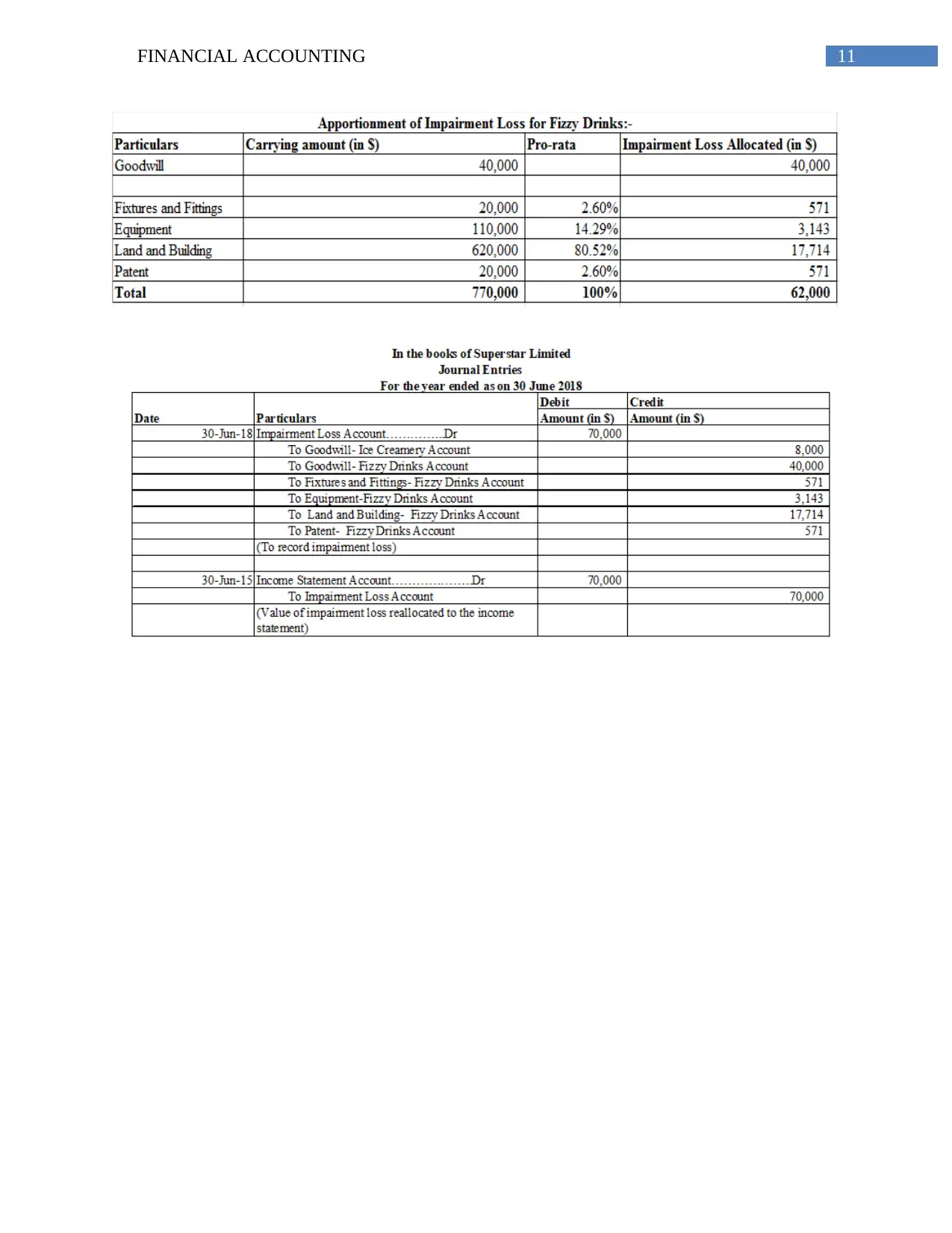

Question 5: Impairment of assets..................................................................................................10

References:....................................................................................................................................12

Table of Contents

Question 1: Financial statement disclosures....................................................................................2

Requirement i:.............................................................................................................................2

Requirement ii:............................................................................................................................4

Question 2: Accounting for share capital........................................................................................5

Requirement i:.............................................................................................................................5

Requirement ii:............................................................................................................................6

Question 3: Accounting for income tax...........................................................................................7

Requirement i:.............................................................................................................................7

Requirement ii:............................................................................................................................8

Question 4: Revaluation of property, plant and equipment.............................................................9

Question 5: Impairment of assets..................................................................................................10

References:....................................................................................................................................12

2FINANCIAL ACCOUNTING

Question 1: Financial statement disclosures

Requirement i:

Situation 1:

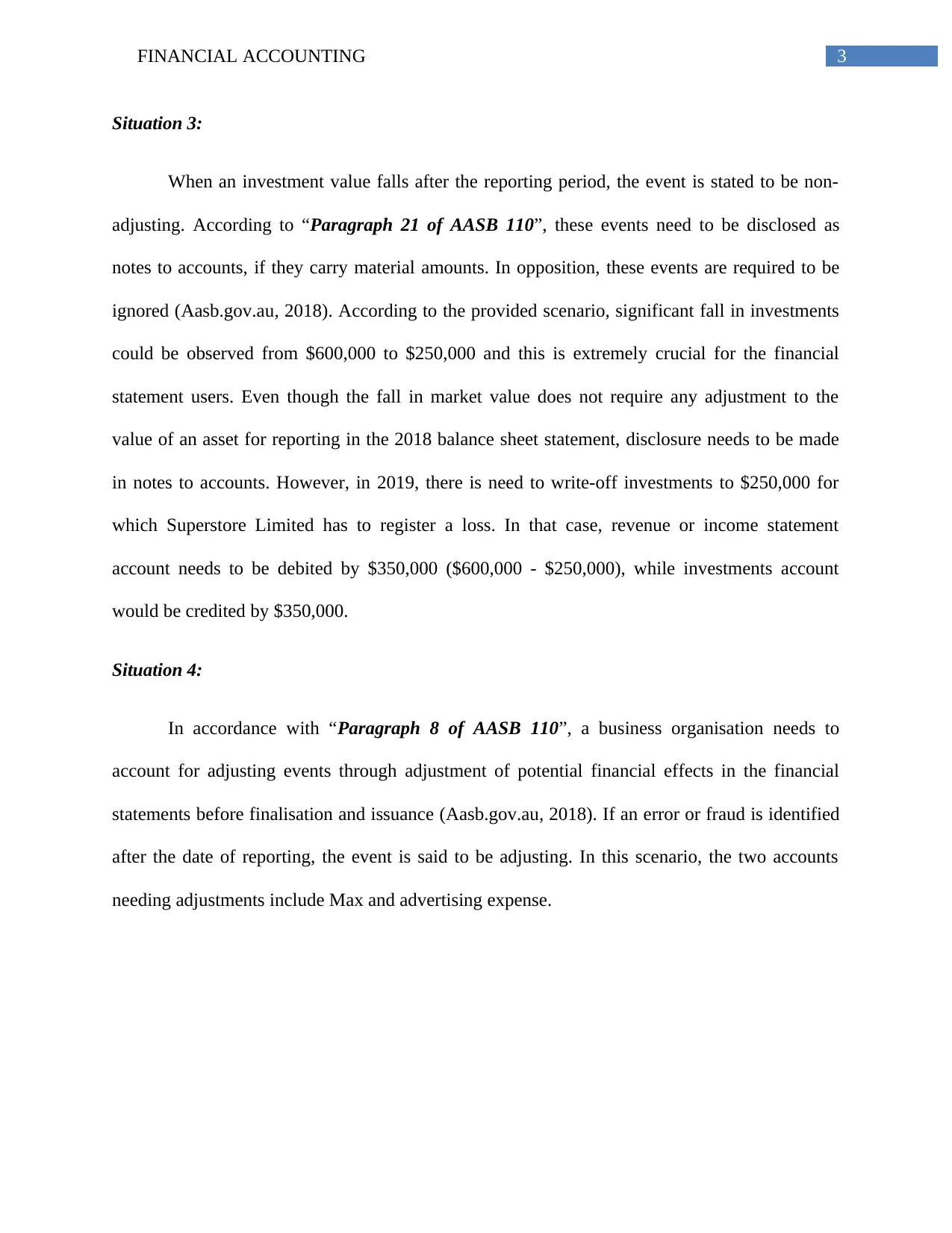

According to “Paragraph 51 of AASB 116”, any revision in an asset’s useful life is to be

considered as a change in accounting estimate, instead of accounting policy change

(Aasb.gov.au, 2018). Hence, this does not mandate the need for retrospective restatement of

accounts. The change would exert influence only on the financial statements of the prospective

periods.

Book value as at 1st July 2017 = ${800,000 – 2 x (800,000/10)} = $640,000

Depreciation charges per annum for the remaining six years = $640,000/6 = $106,667

Finally, a disclosure about the change in accounting estimate is to be made as financial

footnotes.

Situation 2:

The due amount of $200,000 would be shown in the form of accounts payable under the

section of current liabilities in the balance sheet statement as at 30th June 2018. Since the repairs

expense belong to the period ended 30th June 2017, it is not possible to show the same in the

form of expense in the income statement for the period ended 30th June 2018 in accordance with

accounting, accrual and matching principles. Due to the closure of repairs expense account in

2017, retained earnings account would be used for adjustment that denotes the accumulated

profits until date.

Question 1: Financial statement disclosures

Requirement i:

Situation 1:

According to “Paragraph 51 of AASB 116”, any revision in an asset’s useful life is to be

considered as a change in accounting estimate, instead of accounting policy change

(Aasb.gov.au, 2018). Hence, this does not mandate the need for retrospective restatement of

accounts. The change would exert influence only on the financial statements of the prospective

periods.

Book value as at 1st July 2017 = ${800,000 – 2 x (800,000/10)} = $640,000

Depreciation charges per annum for the remaining six years = $640,000/6 = $106,667

Finally, a disclosure about the change in accounting estimate is to be made as financial

footnotes.

Situation 2:

The due amount of $200,000 would be shown in the form of accounts payable under the

section of current liabilities in the balance sheet statement as at 30th June 2018. Since the repairs

expense belong to the period ended 30th June 2017, it is not possible to show the same in the

form of expense in the income statement for the period ended 30th June 2018 in accordance with

accounting, accrual and matching principles. Due to the closure of repairs expense account in

2017, retained earnings account would be used for adjustment that denotes the accumulated

profits until date.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING

Situation 3:

When an investment value falls after the reporting period, the event is stated to be non-

adjusting. According to “Paragraph 21 of AASB 110”, these events need to be disclosed as

notes to accounts, if they carry material amounts. In opposition, these events are required to be

ignored (Aasb.gov.au, 2018). According to the provided scenario, significant fall in investments

could be observed from $600,000 to $250,000 and this is extremely crucial for the financial

statement users. Even though the fall in market value does not require any adjustment to the

value of an asset for reporting in the 2018 balance sheet statement, disclosure needs to be made

in notes to accounts. However, in 2019, there is need to write-off investments to $250,000 for

which Superstore Limited has to register a loss. In that case, revenue or income statement

account needs to be debited by $350,000 ($600,000 - $250,000), while investments account

would be credited by $350,000.

Situation 4:

In accordance with “Paragraph 8 of AASB 110”, a business organisation needs to

account for adjusting events through adjustment of potential financial effects in the financial

statements before finalisation and issuance (Aasb.gov.au, 2018). If an error or fraud is identified

after the date of reporting, the event is said to be adjusting. In this scenario, the two accounts

needing adjustments include Max and advertising expense.

Situation 3:

When an investment value falls after the reporting period, the event is stated to be non-

adjusting. According to “Paragraph 21 of AASB 110”, these events need to be disclosed as

notes to accounts, if they carry material amounts. In opposition, these events are required to be

ignored (Aasb.gov.au, 2018). According to the provided scenario, significant fall in investments

could be observed from $600,000 to $250,000 and this is extremely crucial for the financial

statement users. Even though the fall in market value does not require any adjustment to the

value of an asset for reporting in the 2018 balance sheet statement, disclosure needs to be made

in notes to accounts. However, in 2019, there is need to write-off investments to $250,000 for

which Superstore Limited has to register a loss. In that case, revenue or income statement

account needs to be debited by $350,000 ($600,000 - $250,000), while investments account

would be credited by $350,000.

Situation 4:

In accordance with “Paragraph 8 of AASB 110”, a business organisation needs to

account for adjusting events through adjustment of potential financial effects in the financial

statements before finalisation and issuance (Aasb.gov.au, 2018). If an error or fraud is identified

after the date of reporting, the event is said to be adjusting. In this scenario, the two accounts

needing adjustments include Max and advertising expense.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING

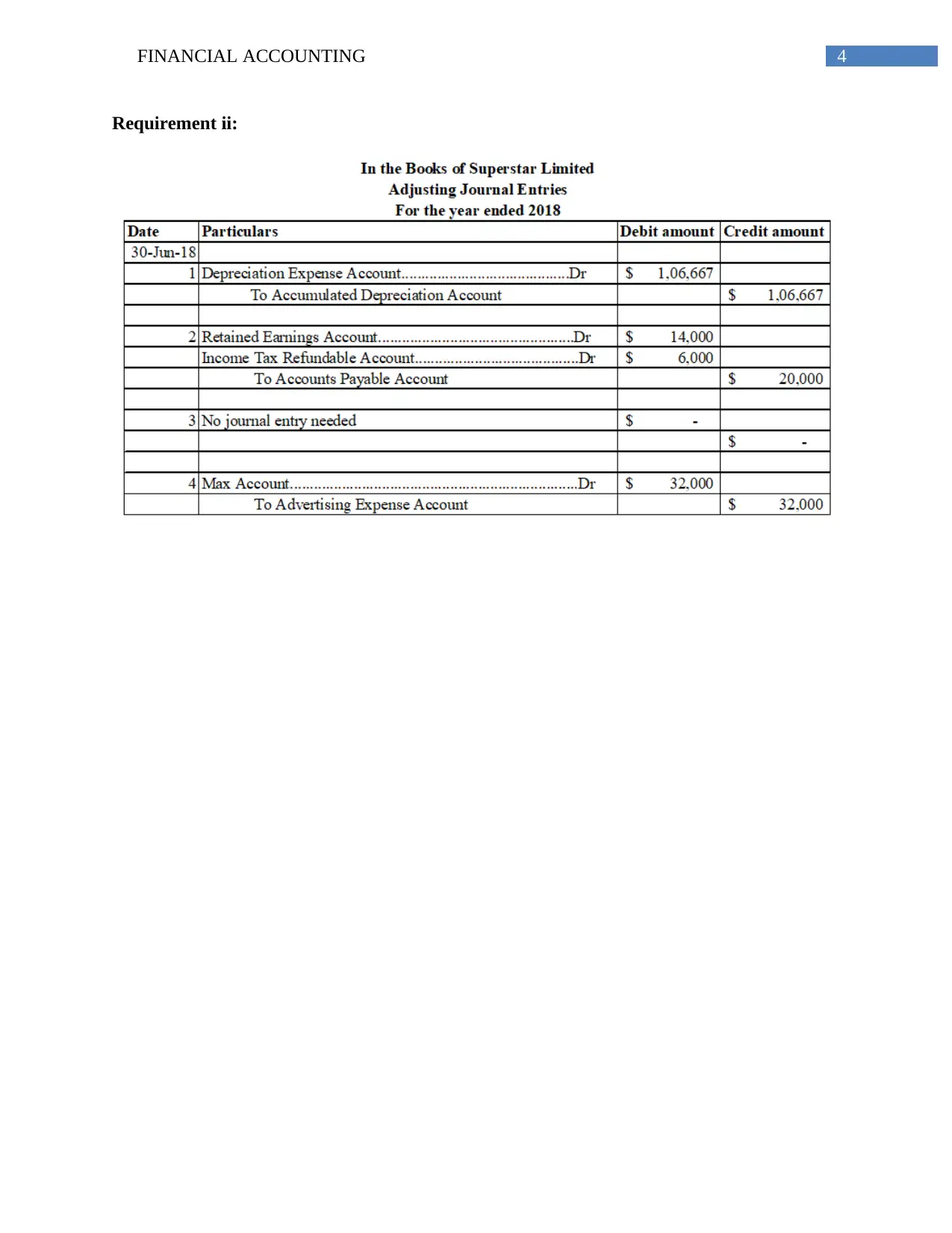

Requirement ii:

Requirement ii:

5FINANCIAL ACCOUNTING

Question 2: Accounting for share capital

Requirement i:

Question 2: Accounting for share capital

Requirement i:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ACCOUNTING

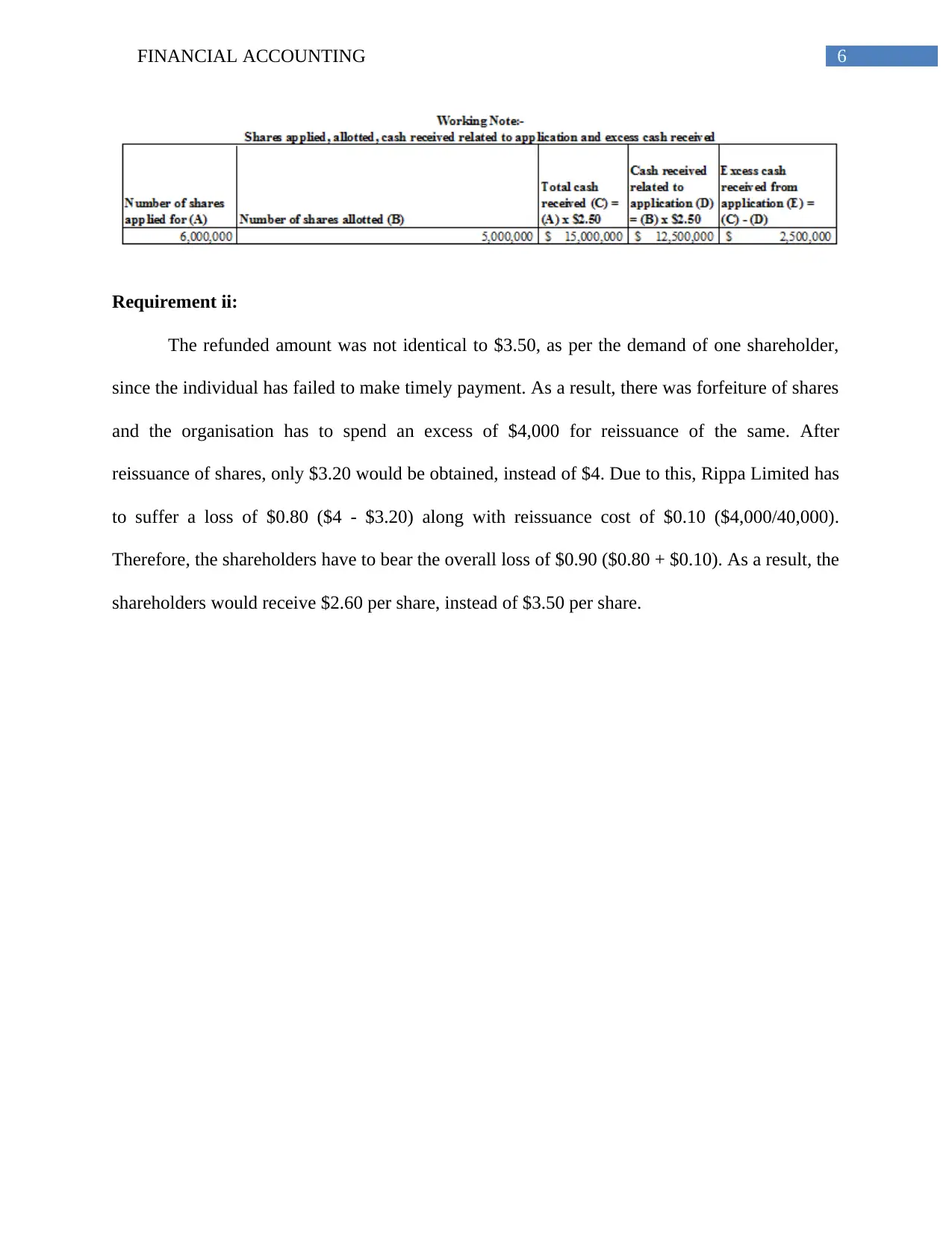

Requirement ii:

The refunded amount was not identical to $3.50, as per the demand of one shareholder,

since the individual has failed to make timely payment. As a result, there was forfeiture of shares

and the organisation has to spend an excess of $4,000 for reissuance of the same. After

reissuance of shares, only $3.20 would be obtained, instead of $4. Due to this, Rippa Limited has

to suffer a loss of $0.80 ($4 - $3.20) along with reissuance cost of $0.10 ($4,000/40,000).

Therefore, the shareholders have to bear the overall loss of $0.90 ($0.80 + $0.10). As a result, the

shareholders would receive $2.60 per share, instead of $3.50 per share.

Requirement ii:

The refunded amount was not identical to $3.50, as per the demand of one shareholder,

since the individual has failed to make timely payment. As a result, there was forfeiture of shares

and the organisation has to spend an excess of $4,000 for reissuance of the same. After

reissuance of shares, only $3.20 would be obtained, instead of $4. Due to this, Rippa Limited has

to suffer a loss of $0.80 ($4 - $3.20) along with reissuance cost of $0.10 ($4,000/40,000).

Therefore, the shareholders have to bear the overall loss of $0.90 ($0.80 + $0.10). As a result, the

shareholders would receive $2.60 per share, instead of $3.50 per share.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING

Question 3: Accounting for income tax

Requirement i:

Question 3: Accounting for income tax

Requirement i:

8FINANCIAL ACCOUNTING

Requirement ii:

Requirement ii:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ACCOUNTING

Question 4: Revaluation of property, plant and equipment

Question 4: Revaluation of property, plant and equipment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ACCOUNTING

Question 5: Impairment of assets

Question 5: Impairment of assets

11FINANCIAL ACCOUNTING

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.