Financial Accounting: Updated Financial Statements and Financial Analysis

VerifiedAdded on 2022/12/29

|18

|2495

|40

AI Summary

This document provides updated financial statements for Bialto Beach Limited and a financial analysis of Rapston Hotels. It includes information on liquidity ratios, such as the current ratio and quick ratio, as well as profitability ratios, such as gross profit margin and net profit margin.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

ASSESSMENT ...............................................................................................................................1

1. Updated Financial Statements Bialto Beach Limited .............................................................1

2. Financial Analysis of Rapston Hotels

REFERENCES..............................................................................................................................14

ASSESSMENT ...............................................................................................................................1

1. Updated Financial Statements Bialto Beach Limited .............................................................1

2. Financial Analysis of Rapston Hotels

REFERENCES..............................................................................................................................14

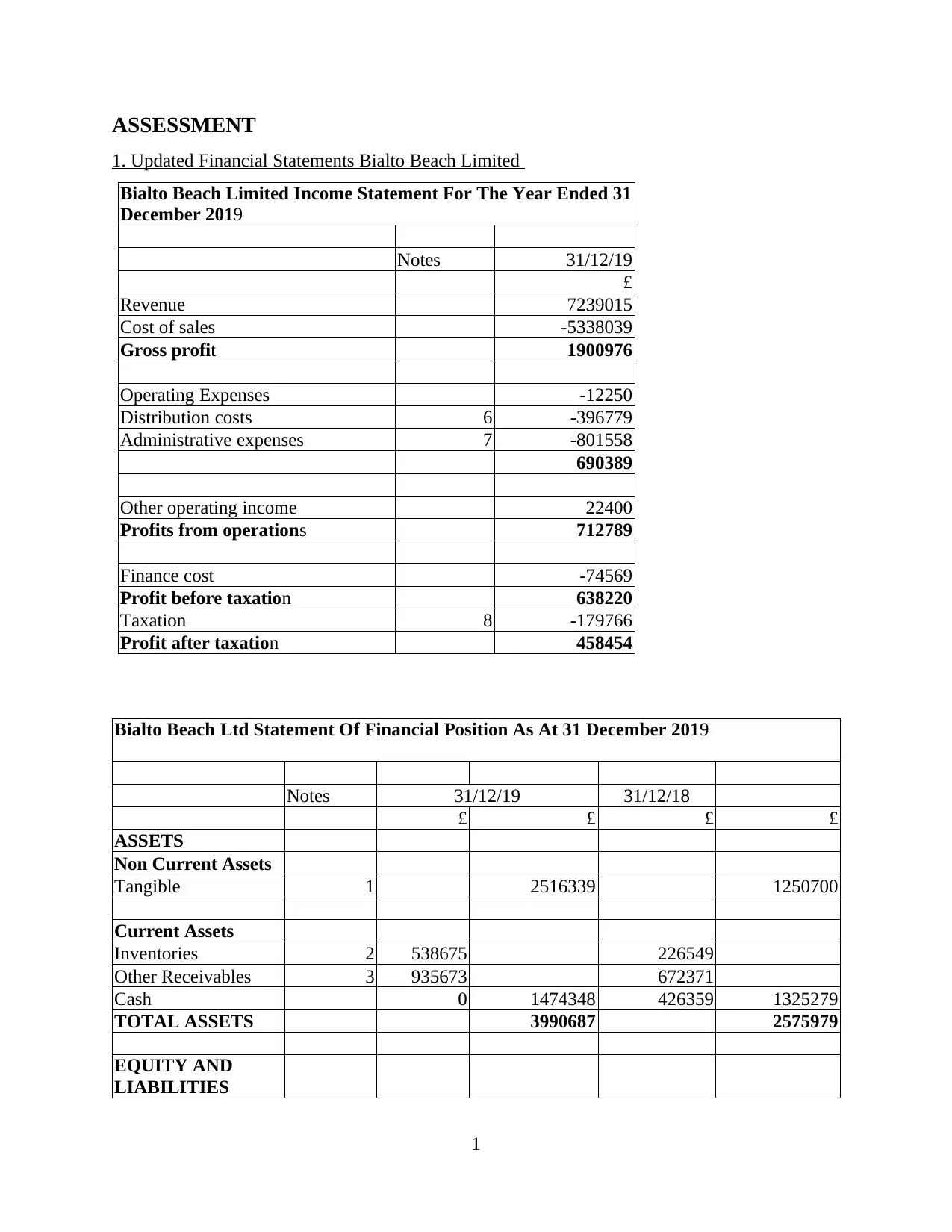

ASSESSMENT

1. Updated Financial Statements Bialto Beach Limited

Bialto Beach Limited Income Statement For The Year Ended 31

December 2019

Notes 31/12/19

£

Revenue 7239015

Cost of sales -5338039

Gross profit 1900976

Operating Expenses -12250

Distribution costs 6 -396779

Administrative expenses 7 -801558

690389

Other operating income 22400

Profits from operations 712789

Finance cost -74569

Profit before taxation 638220

Taxation 8 -179766

Profit after taxation 458454

Bialto Beach Ltd Statement Of Financial Position As At 31 December 2019

Notes 31/12/19 31/12/18

£ £ £ £

ASSETS

Non Current Assets

Tangible 1 2516339 1250700

Current Assets

Inventories 2 538675 226549

Other Receivables 3 935673 672371

Cash 0 1474348 426359 1325279

TOTAL ASSETS 3990687 2575979

EQUITY AND

LIABILITIES

1

1. Updated Financial Statements Bialto Beach Limited

Bialto Beach Limited Income Statement For The Year Ended 31

December 2019

Notes 31/12/19

£

Revenue 7239015

Cost of sales -5338039

Gross profit 1900976

Operating Expenses -12250

Distribution costs 6 -396779

Administrative expenses 7 -801558

690389

Other operating income 22400

Profits from operations 712789

Finance cost -74569

Profit before taxation 638220

Taxation 8 -179766

Profit after taxation 458454

Bialto Beach Ltd Statement Of Financial Position As At 31 December 2019

Notes 31/12/19 31/12/18

£ £ £ £

ASSETS

Non Current Assets

Tangible 1 2516339 1250700

Current Assets

Inventories 2 538675 226549

Other Receivables 3 935673 672371

Cash 0 1474348 426359 1325279

TOTAL ASSETS 3990687 2575979

EQUITY AND

LIABILITIES

1

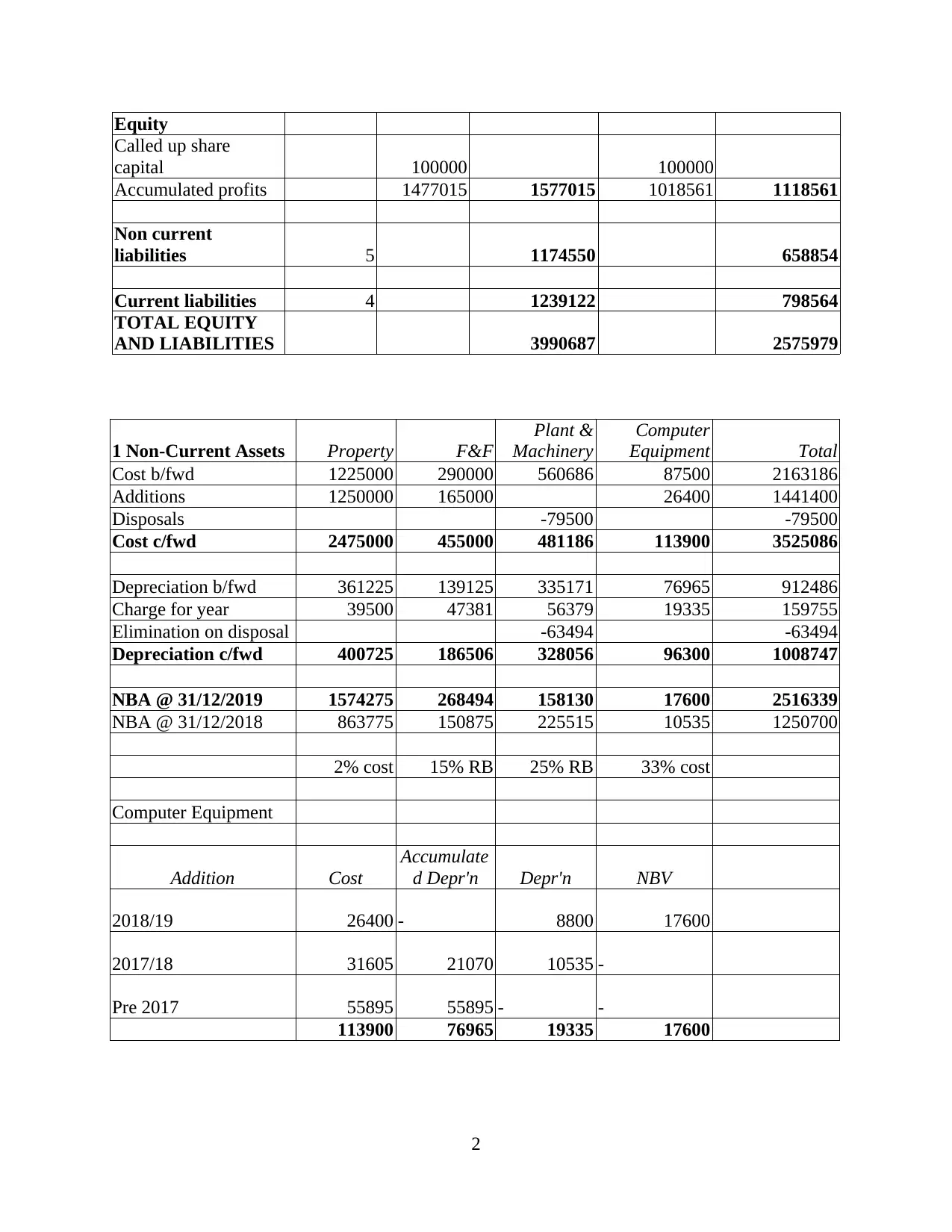

Equity

Called up share

capital 100000 100000

Accumulated profits 1477015 1577015 1018561 1118561

Non current

liabilities 5 1174550 658854

Current liabilities 4 1239122 798564

TOTAL EQUITY

AND LIABILITIES 3990687 2575979

1 Non-Current Assets Property F&F

Plant &

Machinery

Computer

Equipment Total

Cost b/fwd 1225000 290000 560686 87500 2163186

Additions 1250000 165000 26400 1441400

Disposals -79500 -79500

Cost c/fwd 2475000 455000 481186 113900 3525086

Depreciation b/fwd 361225 139125 335171 76965 912486

Charge for year 39500 47381 56379 19335 159755

Elimination on disposal -63494 -63494

Depreciation c/fwd 400725 186506 328056 96300 1008747

NBA @ 31/12/2019 1574275 268494 158130 17600 2516339

NBA @ 31/12/2018 863775 150875 225515 10535 1250700

2% cost 15% RB 25% RB 33% cost

Computer Equipment

Addition Cost

Accumulate

d Depr'n Depr'n NBV

2018/19 26400 - 8800 17600

2017/18 31605 21070 10535 -

Pre 2017 55895 55895 - -

113900 76965 19335 17600

2

Called up share

capital 100000 100000

Accumulated profits 1477015 1577015 1018561 1118561

Non current

liabilities 5 1174550 658854

Current liabilities 4 1239122 798564

TOTAL EQUITY

AND LIABILITIES 3990687 2575979

1 Non-Current Assets Property F&F

Plant &

Machinery

Computer

Equipment Total

Cost b/fwd 1225000 290000 560686 87500 2163186

Additions 1250000 165000 26400 1441400

Disposals -79500 -79500

Cost c/fwd 2475000 455000 481186 113900 3525086

Depreciation b/fwd 361225 139125 335171 76965 912486

Charge for year 39500 47381 56379 19335 159755

Elimination on disposal -63494 -63494

Depreciation c/fwd 400725 186506 328056 96300 1008747

NBA @ 31/12/2019 1574275 268494 158130 17600 2516339

NBA @ 31/12/2018 863775 150875 225515 10535 1250700

2% cost 15% RB 25% RB 33% cost

Computer Equipment

Addition Cost

Accumulate

d Depr'n Depr'n NBV

2018/19 26400 - 8800 17600

2017/18 31605 21070 10535 -

Pre 2017 55895 55895 - -

113900 76965 19335 17600

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

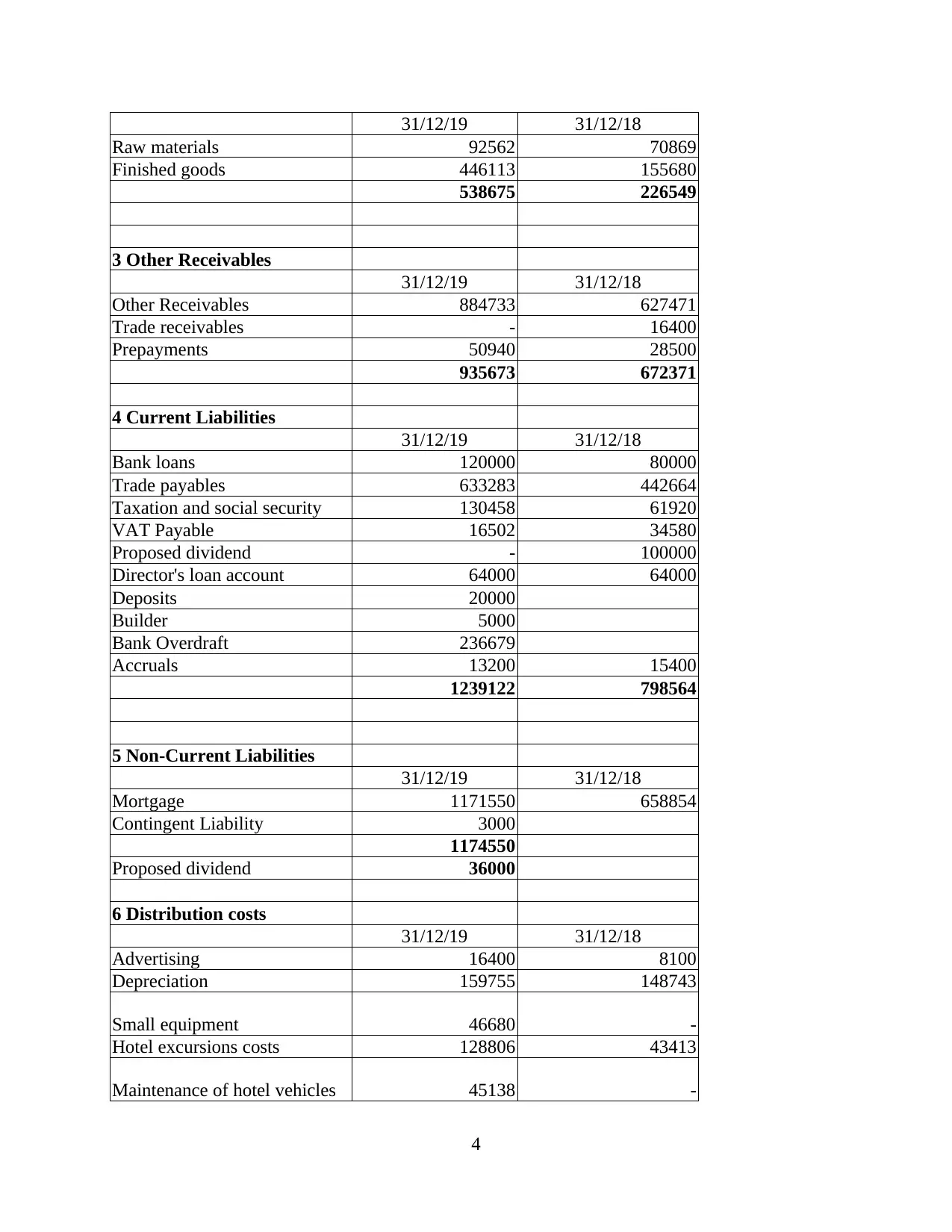

2 Inventories

3

3

31/12/19 31/12/18

Raw materials 92562 70869

Finished goods 446113 155680

538675 226549

3 Other Receivables

31/12/19 31/12/18

Other Receivables 884733 627471

Trade receivables - 16400

Prepayments 50940 28500

935673 672371

4 Current Liabilities

31/12/19 31/12/18

Bank loans 120000 80000

Trade payables 633283 442664

Taxation and social security 130458 61920

VAT Payable 16502 34580

Proposed dividend - 100000

Director's loan account 64000 64000

Deposits 20000

Builder 5000

Bank Overdraft 236679

Accruals 13200 15400

1239122 798564

5 Non-Current Liabilities

31/12/19 31/12/18

Mortgage 1171550 658854

Contingent Liability 3000

1174550

Proposed dividend 36000

6 Distribution costs

31/12/19 31/12/18

Advertising 16400 8100

Depreciation 159755 148743

Small equipment 46680 -

Hotel excursions costs 128806 43413

Maintenance of hotel vehicles 45138 -

4

Raw materials 92562 70869

Finished goods 446113 155680

538675 226549

3 Other Receivables

31/12/19 31/12/18

Other Receivables 884733 627471

Trade receivables - 16400

Prepayments 50940 28500

935673 672371

4 Current Liabilities

31/12/19 31/12/18

Bank loans 120000 80000

Trade payables 633283 442664

Taxation and social security 130458 61920

VAT Payable 16502 34580

Proposed dividend - 100000

Director's loan account 64000 64000

Deposits 20000

Builder 5000

Bank Overdraft 236679

Accruals 13200 15400

1239122 798564

5 Non-Current Liabilities

31/12/19 31/12/18

Mortgage 1171550 658854

Contingent Liability 3000

1174550

Proposed dividend 36000

6 Distribution costs

31/12/19 31/12/18

Advertising 16400 8100

Depreciation 159755 148743

Small equipment 46680 -

Hotel excursions costs 128806 43413

Maintenance of hotel vehicles 45138 -

4

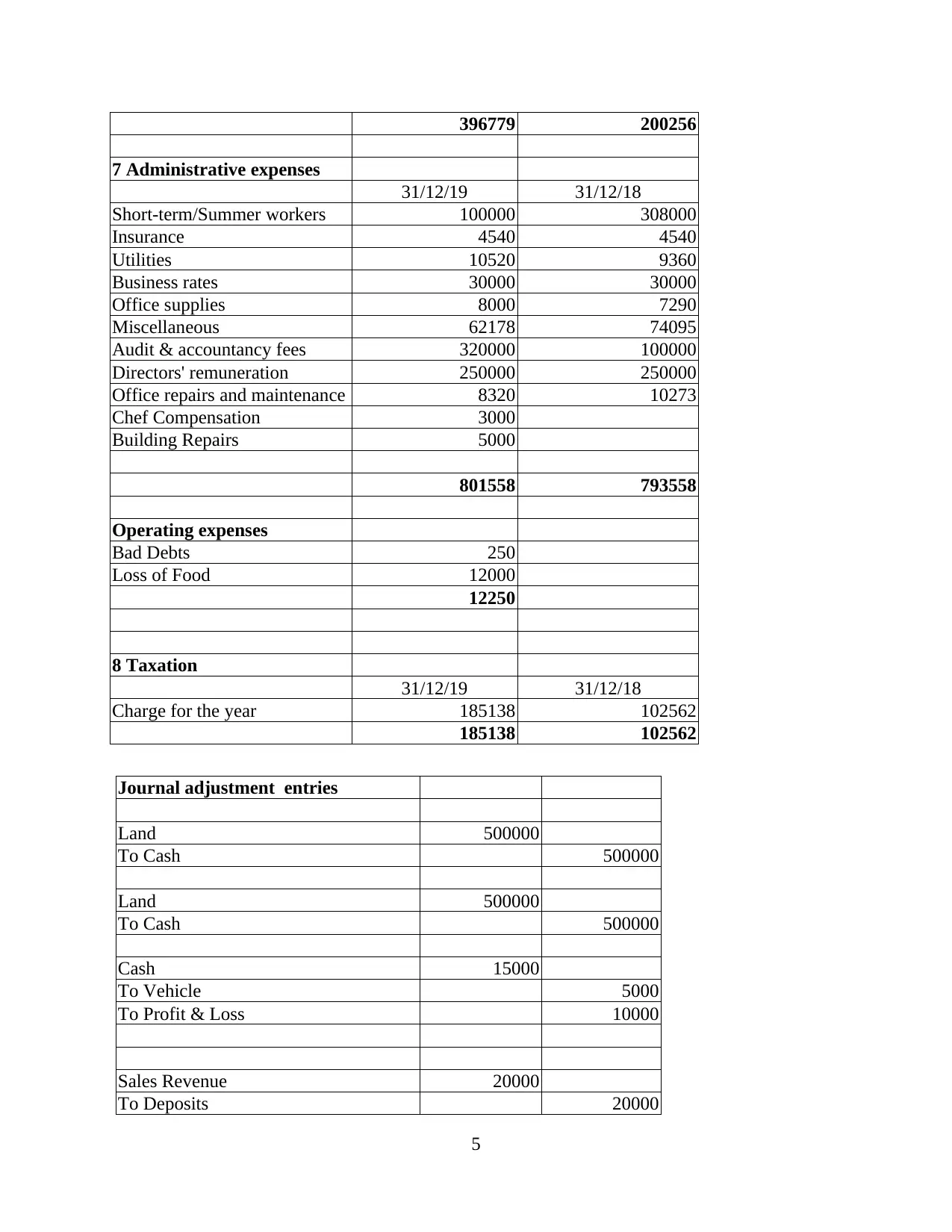

396779 200256

7 Administrative expenses

31/12/19 31/12/18

Short-term/Summer workers 100000 308000

Insurance 4540 4540

Utilities 10520 9360

Business rates 30000 30000

Office supplies 8000 7290

Miscellaneous 62178 74095

Audit & accountancy fees 320000 100000

Directors' remuneration 250000 250000

Office repairs and maintenance 8320 10273

Chef Compensation 3000

Building Repairs 5000

801558 793558

Operating expenses

Bad Debts 250

Loss of Food 12000

12250

8 Taxation

31/12/19 31/12/18

Charge for the year 185138 102562

185138 102562

Journal adjustment entries

Land 500000

To Cash 500000

Land 500000

To Cash 500000

Cash 15000

To Vehicle 5000

To Profit & Loss 10000

Sales Revenue 20000

To Deposits 20000

5

7 Administrative expenses

31/12/19 31/12/18

Short-term/Summer workers 100000 308000

Insurance 4540 4540

Utilities 10520 9360

Business rates 30000 30000

Office supplies 8000 7290

Miscellaneous 62178 74095

Audit & accountancy fees 320000 100000

Directors' remuneration 250000 250000

Office repairs and maintenance 8320 10273

Chef Compensation 3000

Building Repairs 5000

801558 793558

Operating expenses

Bad Debts 250

Loss of Food 12000

12250

8 Taxation

31/12/19 31/12/18

Charge for the year 185138 102562

185138 102562

Journal adjustment entries

Land 500000

To Cash 500000

Land 500000

To Cash 500000

Cash 15000

To Vehicle 5000

To Profit & Loss 10000

Sales Revenue 20000

To Deposits 20000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

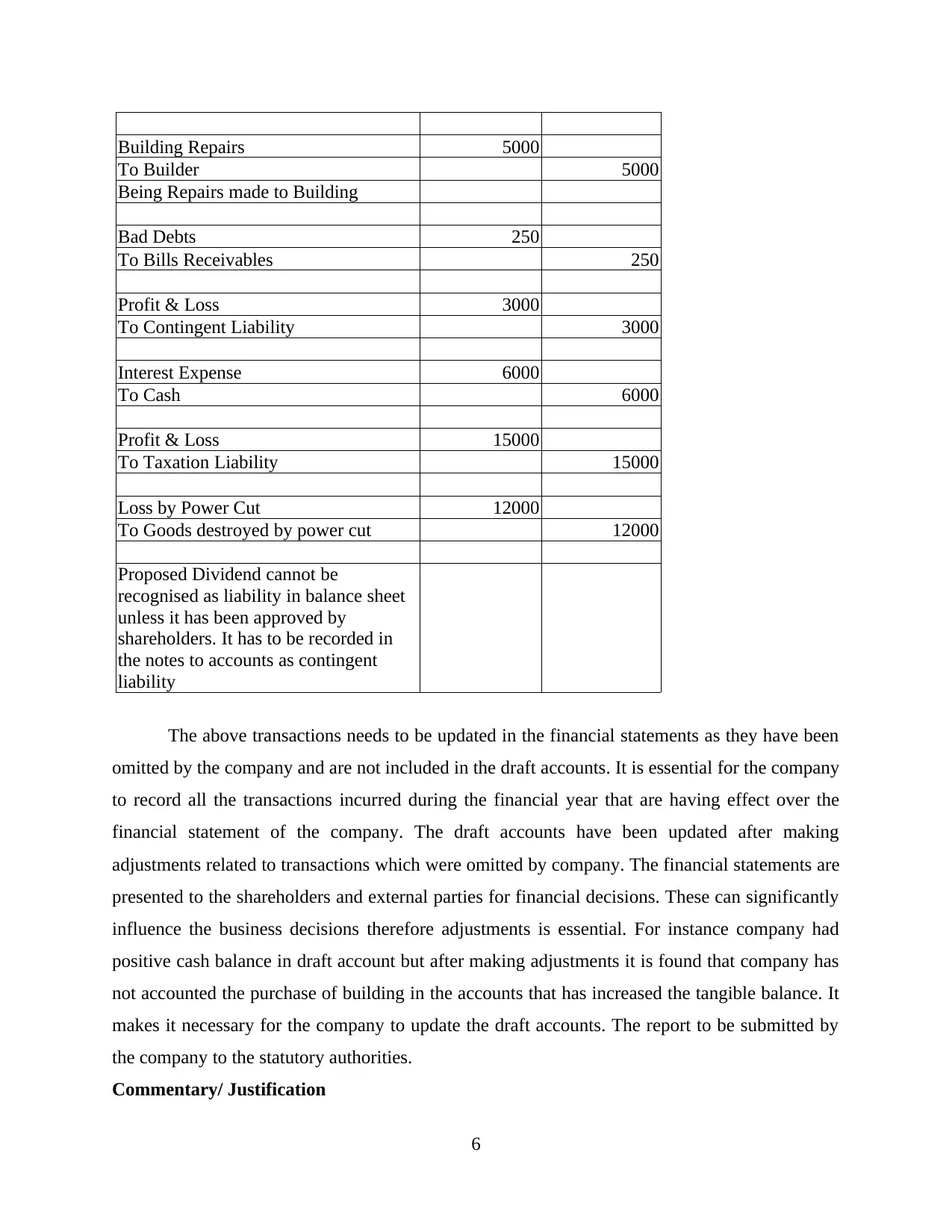

Building Repairs 5000

To Builder 5000

Being Repairs made to Building

Bad Debts 250

To Bills Receivables 250

Profit & Loss 3000

To Contingent Liability 3000

Interest Expense 6000

To Cash 6000

Profit & Loss 15000

To Taxation Liability 15000

Loss by Power Cut 12000

To Goods destroyed by power cut 12000

Proposed Dividend cannot be

recognised as liability in balance sheet

unless it has been approved by

shareholders. It has to be recorded in

the notes to accounts as contingent

liability

The above transactions needs to be updated in the financial statements as they have been

omitted by the company and are not included in the draft accounts. It is essential for the company

to record all the transactions incurred during the financial year that are having effect over the

financial statement of the company. The draft accounts have been updated after making

adjustments related to transactions which were omitted by company. The financial statements are

presented to the shareholders and external parties for financial decisions. These can significantly

influence the business decisions therefore adjustments is essential. For instance company had

positive cash balance in draft account but after making adjustments it is found that company has

not accounted the purchase of building in the accounts that has increased the tangible balance. It

makes it necessary for the company to update the draft accounts. The report to be submitted by

the company to the statutory authorities.

Commentary/ Justification

6

To Builder 5000

Being Repairs made to Building

Bad Debts 250

To Bills Receivables 250

Profit & Loss 3000

To Contingent Liability 3000

Interest Expense 6000

To Cash 6000

Profit & Loss 15000

To Taxation Liability 15000

Loss by Power Cut 12000

To Goods destroyed by power cut 12000

Proposed Dividend cannot be

recognised as liability in balance sheet

unless it has been approved by

shareholders. It has to be recorded in

the notes to accounts as contingent

liability

The above transactions needs to be updated in the financial statements as they have been

omitted by the company and are not included in the draft accounts. It is essential for the company

to record all the transactions incurred during the financial year that are having effect over the

financial statement of the company. The draft accounts have been updated after making

adjustments related to transactions which were omitted by company. The financial statements are

presented to the shareholders and external parties for financial decisions. These can significantly

influence the business decisions therefore adjustments is essential. For instance company had

positive cash balance in draft account but after making adjustments it is found that company has

not accounted the purchase of building in the accounts that has increased the tangible balance. It

makes it necessary for the company to update the draft accounts. The report to be submitted by

the company to the statutory authorities.

Commentary/ Justification

6

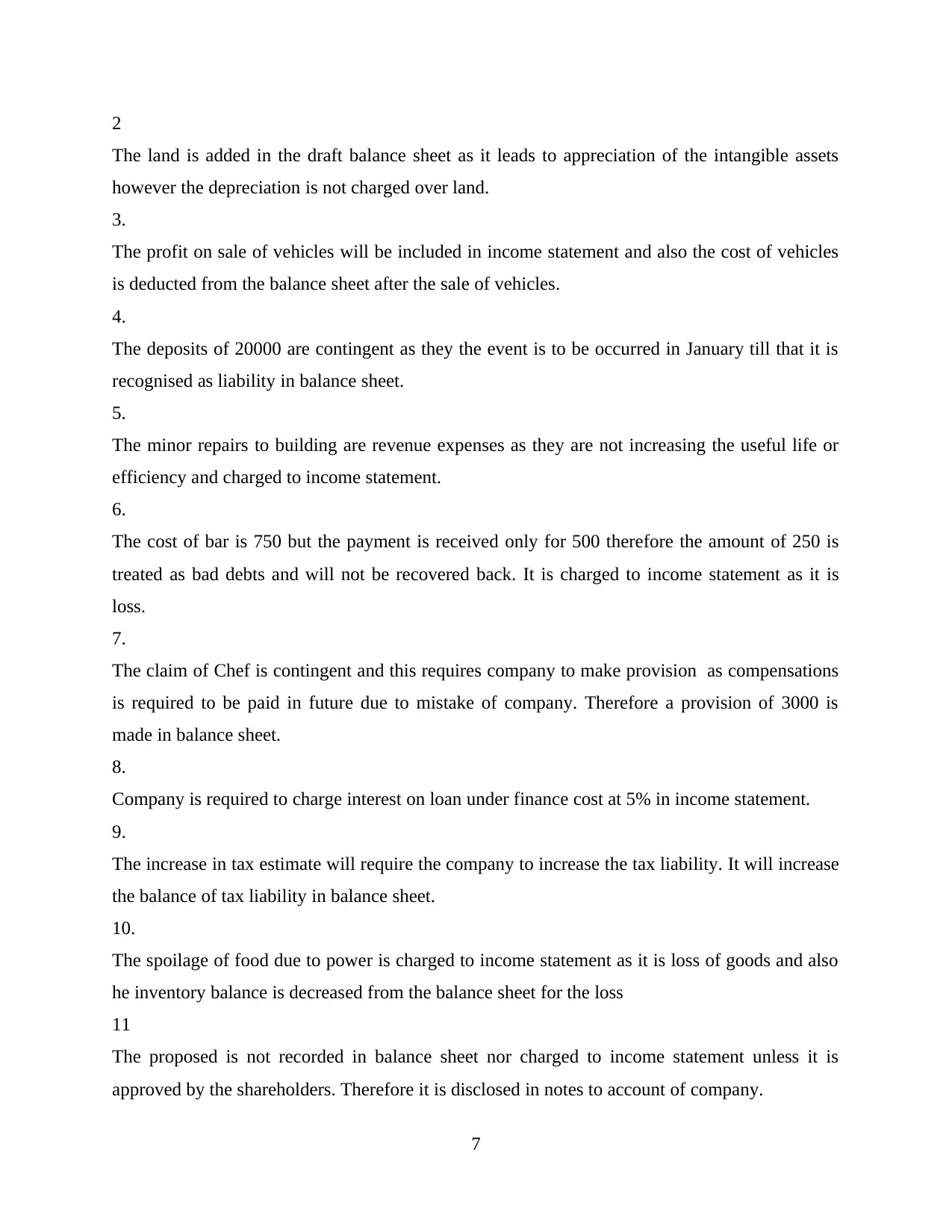

2

The land is added in the draft balance sheet as it leads to appreciation of the intangible assets

however the depreciation is not charged over land.

3.

The profit on sale of vehicles will be included in income statement and also the cost of vehicles

is deducted from the balance sheet after the sale of vehicles.

4.

The deposits of 20000 are contingent as they the event is to be occurred in January till that it is

recognised as liability in balance sheet.

5.

The minor repairs to building are revenue expenses as they are not increasing the useful life or

efficiency and charged to income statement.

6.

The cost of bar is 750 but the payment is received only for 500 therefore the amount of 250 is

treated as bad debts and will not be recovered back. It is charged to income statement as it is

loss.

7.

The claim of Chef is contingent and this requires company to make provision as compensations

is required to be paid in future due to mistake of company. Therefore a provision of 3000 is

made in balance sheet.

8.

Company is required to charge interest on loan under finance cost at 5% in income statement.

9.

The increase in tax estimate will require the company to increase the tax liability. It will increase

the balance of tax liability in balance sheet.

10.

The spoilage of food due to power is charged to income statement as it is loss of goods and also

he inventory balance is decreased from the balance sheet for the loss

11

The proposed is not recorded in balance sheet nor charged to income statement unless it is

approved by the shareholders. Therefore it is disclosed in notes to account of company.

7

The land is added in the draft balance sheet as it leads to appreciation of the intangible assets

however the depreciation is not charged over land.

3.

The profit on sale of vehicles will be included in income statement and also the cost of vehicles

is deducted from the balance sheet after the sale of vehicles.

4.

The deposits of 20000 are contingent as they the event is to be occurred in January till that it is

recognised as liability in balance sheet.

5.

The minor repairs to building are revenue expenses as they are not increasing the useful life or

efficiency and charged to income statement.

6.

The cost of bar is 750 but the payment is received only for 500 therefore the amount of 250 is

treated as bad debts and will not be recovered back. It is charged to income statement as it is

loss.

7.

The claim of Chef is contingent and this requires company to make provision as compensations

is required to be paid in future due to mistake of company. Therefore a provision of 3000 is

made in balance sheet.

8.

Company is required to charge interest on loan under finance cost at 5% in income statement.

9.

The increase in tax estimate will require the company to increase the tax liability. It will increase

the balance of tax liability in balance sheet.

10.

The spoilage of food due to power is charged to income statement as it is loss of goods and also

he inventory balance is decreased from the balance sheet for the loss

11

The proposed is not recorded in balance sheet nor charged to income statement unless it is

approved by the shareholders. Therefore it is disclosed in notes to account of company.

7

2. Financial Analysis of Rapston Hotels

Liquidity ratios

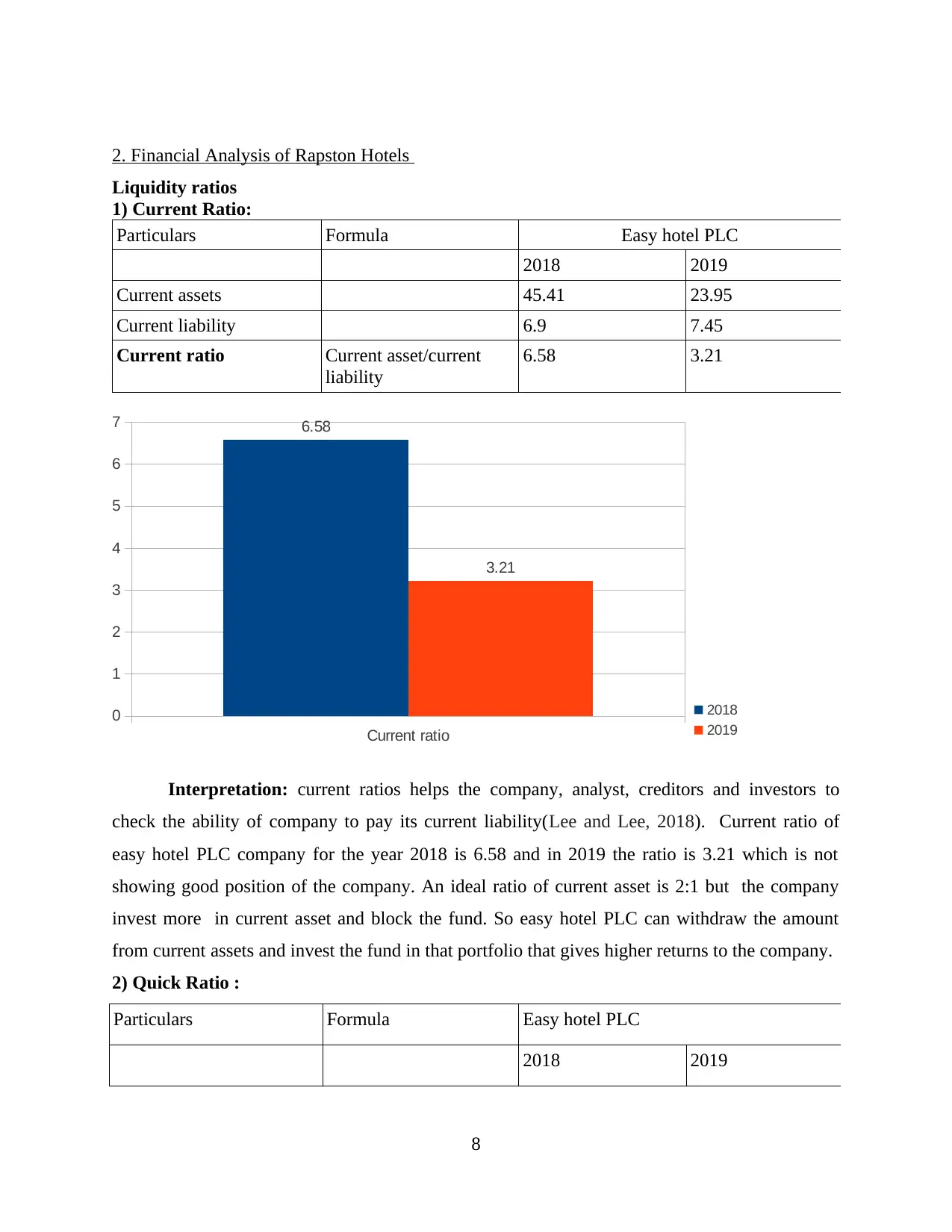

1) Current Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Current assets 45.41 23.95

Current liability 6.9 7.45

Current ratio Current asset/current

liability

6.58 3.21

Current ratio

0

1

2

3

4

5

6

7 6.58

3.21

2018

2019

Interpretation: current ratios helps the company, analyst, creditors and investors to

check the ability of company to pay its current liability(Lee and Lee, 2018). Current ratio of

easy hotel PLC company for the year 2018 is 6.58 and in 2019 the ratio is 3.21 which is not

showing good position of the company. An ideal ratio of current asset is 2:1 but the company

invest more in current asset and block the fund. So easy hotel PLC can withdraw the amount

from current assets and invest the fund in that portfolio that gives higher returns to the company.

2) Quick Ratio :

Particulars Formula Easy hotel PLC

2018 2019

8

Liquidity ratios

1) Current Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Current assets 45.41 23.95

Current liability 6.9 7.45

Current ratio Current asset/current

liability

6.58 3.21

Current ratio

0

1

2

3

4

5

6

7 6.58

3.21

2018

2019

Interpretation: current ratios helps the company, analyst, creditors and investors to

check the ability of company to pay its current liability(Lee and Lee, 2018). Current ratio of

easy hotel PLC company for the year 2018 is 6.58 and in 2019 the ratio is 3.21 which is not

showing good position of the company. An ideal ratio of current asset is 2:1 but the company

invest more in current asset and block the fund. So easy hotel PLC can withdraw the amount

from current assets and invest the fund in that portfolio that gives higher returns to the company.

2) Quick Ratio :

Particulars Formula Easy hotel PLC

2018 2019

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

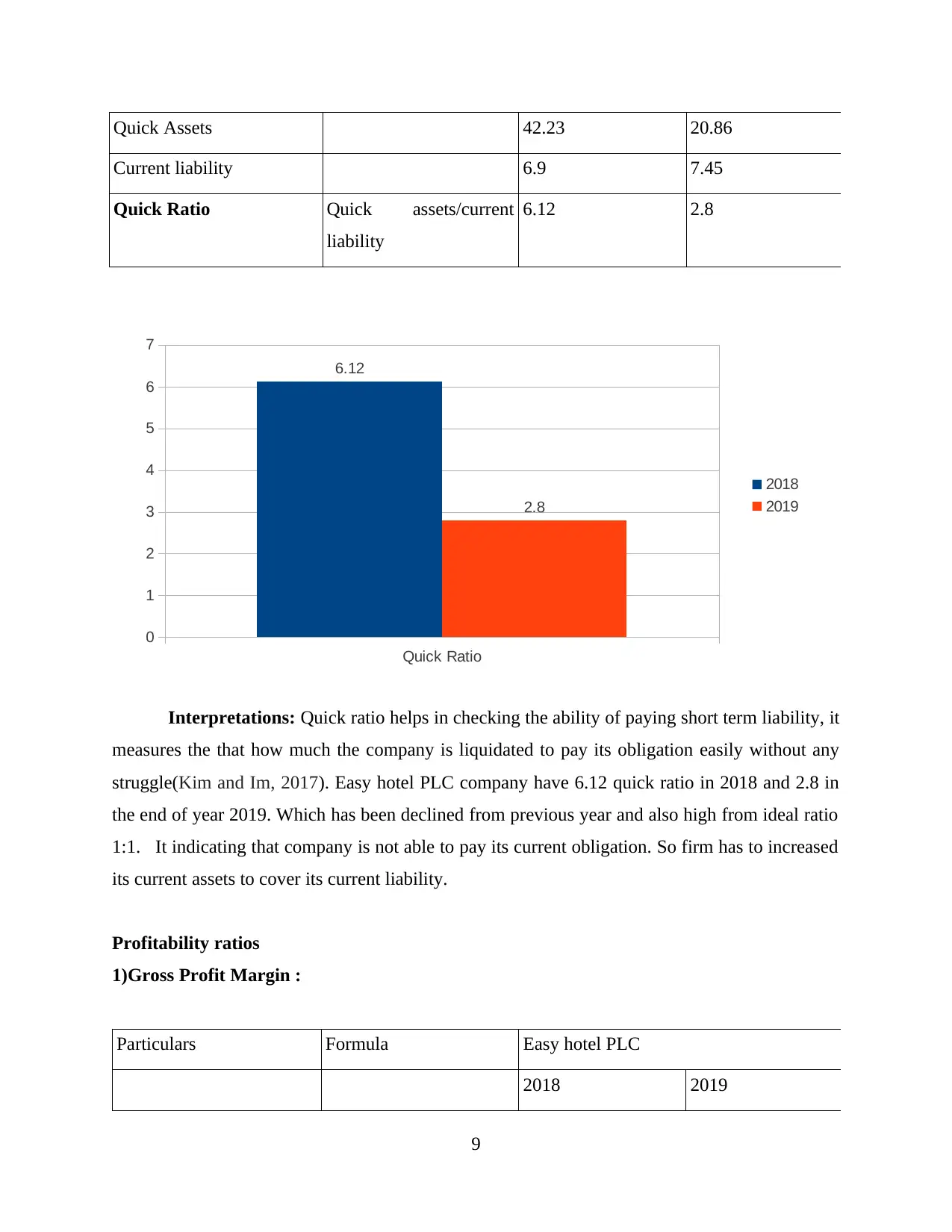

Quick Assets 42.23 20.86

Current liability 6.9 7.45

Quick Ratio Quick assets/current

liability

6.12 2.8

Quick Ratio

0

1

2

3

4

5

6

7

6.12

2.8

2018

2019

Interpretations: Quick ratio helps in checking the ability of paying short term liability, it

measures the that how much the company is liquidated to pay its obligation easily without any

struggle(Kim and Im, 2017). Easy hotel PLC company have 6.12 quick ratio in 2018 and 2.8 in

the end of year 2019. Which has been declined from previous year and also high from ideal ratio

1:1. It indicating that company is not able to pay its current obligation. So firm has to increased

its current assets to cover its current liability.

Profitability ratios

1)Gross Profit Margin :

Particulars Formula Easy hotel PLC

2018 2019

9

Current liability 6.9 7.45

Quick Ratio Quick assets/current

liability

6.12 2.8

Quick Ratio

0

1

2

3

4

5

6

7

6.12

2.8

2018

2019

Interpretations: Quick ratio helps in checking the ability of paying short term liability, it

measures the that how much the company is liquidated to pay its obligation easily without any

struggle(Kim and Im, 2017). Easy hotel PLC company have 6.12 quick ratio in 2018 and 2.8 in

the end of year 2019. Which has been declined from previous year and also high from ideal ratio

1:1. It indicating that company is not able to pay its current obligation. So firm has to increased

its current assets to cover its current liability.

Profitability ratios

1)Gross Profit Margin :

Particulars Formula Easy hotel PLC

2018 2019

9

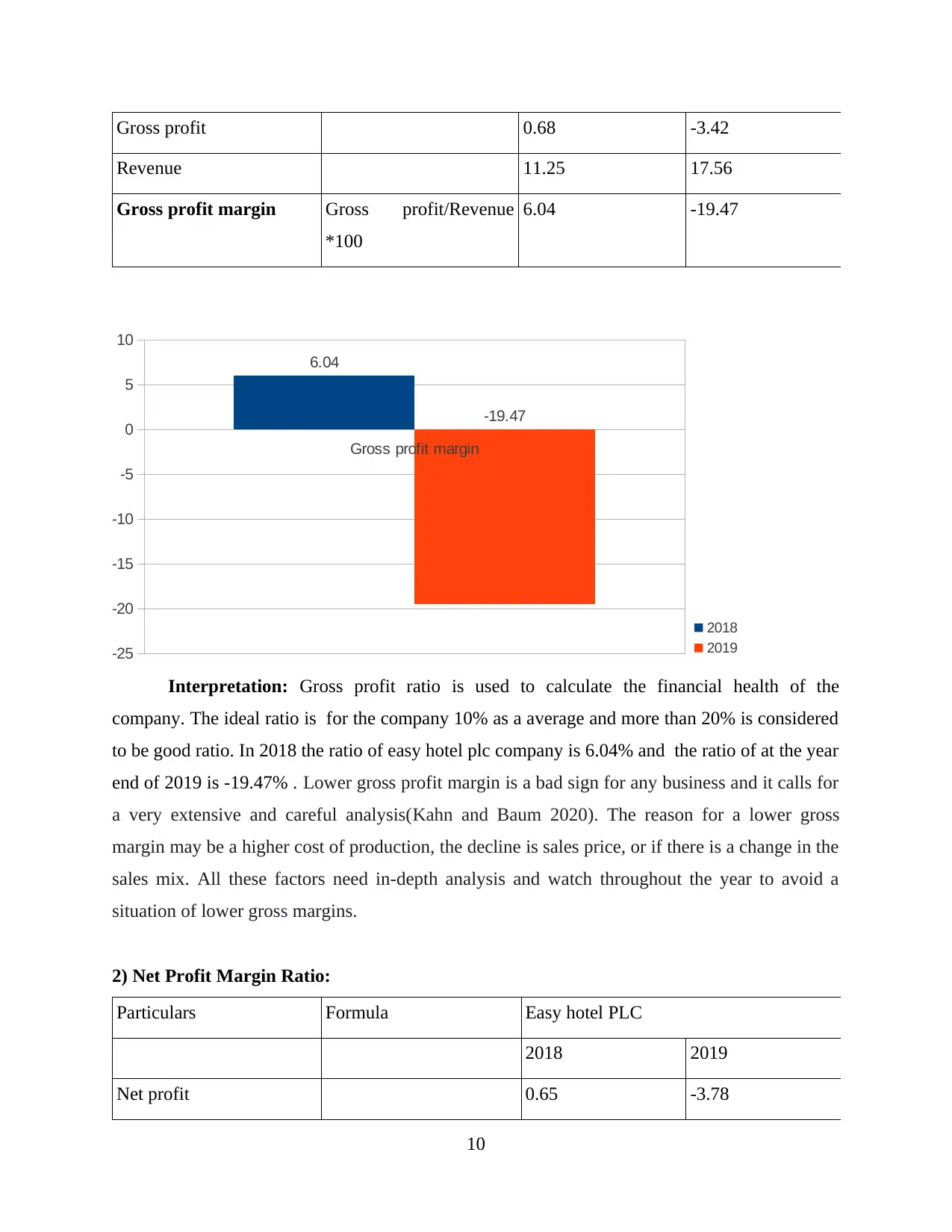

Gross profit 0.68 -3.42

Revenue 11.25 17.56

Gross profit margin Gross profit/Revenue

*100

6.04 -19.47

Gross profit margin

-25

-20

-15

-10

-5

0

5

10

6.04

-19.47

2018

2019

Interpretation: Gross profit ratio is used to calculate the financial health of the

company. The ideal ratio is for the company 10% as a average and more than 20% is considered

to be good ratio. In 2018 the ratio of easy hotel plc company is 6.04% and the ratio of at the year

end of 2019 is -19.47% . Lower gross profit margin is a bad sign for any business and it calls for

a very extensive and careful analysis(Kahn and Baum 2020). The reason for a lower gross

margin may be a higher cost of production, the decline is sales price, or if there is a change in the

sales mix. All these factors need in-depth analysis and watch throughout the year to avoid a

situation of lower gross margins.

2) Net Profit Margin Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Net profit 0.65 -3.78

10

Revenue 11.25 17.56

Gross profit margin Gross profit/Revenue

*100

6.04 -19.47

Gross profit margin

-25

-20

-15

-10

-5

0

5

10

6.04

-19.47

2018

2019

Interpretation: Gross profit ratio is used to calculate the financial health of the

company. The ideal ratio is for the company 10% as a average and more than 20% is considered

to be good ratio. In 2018 the ratio of easy hotel plc company is 6.04% and the ratio of at the year

end of 2019 is -19.47% . Lower gross profit margin is a bad sign for any business and it calls for

a very extensive and careful analysis(Kahn and Baum 2020). The reason for a lower gross

margin may be a higher cost of production, the decline is sales price, or if there is a change in the

sales mix. All these factors need in-depth analysis and watch throughout the year to avoid a

situation of lower gross margins.

2) Net Profit Margin Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Net profit 0.65 -3.78

10

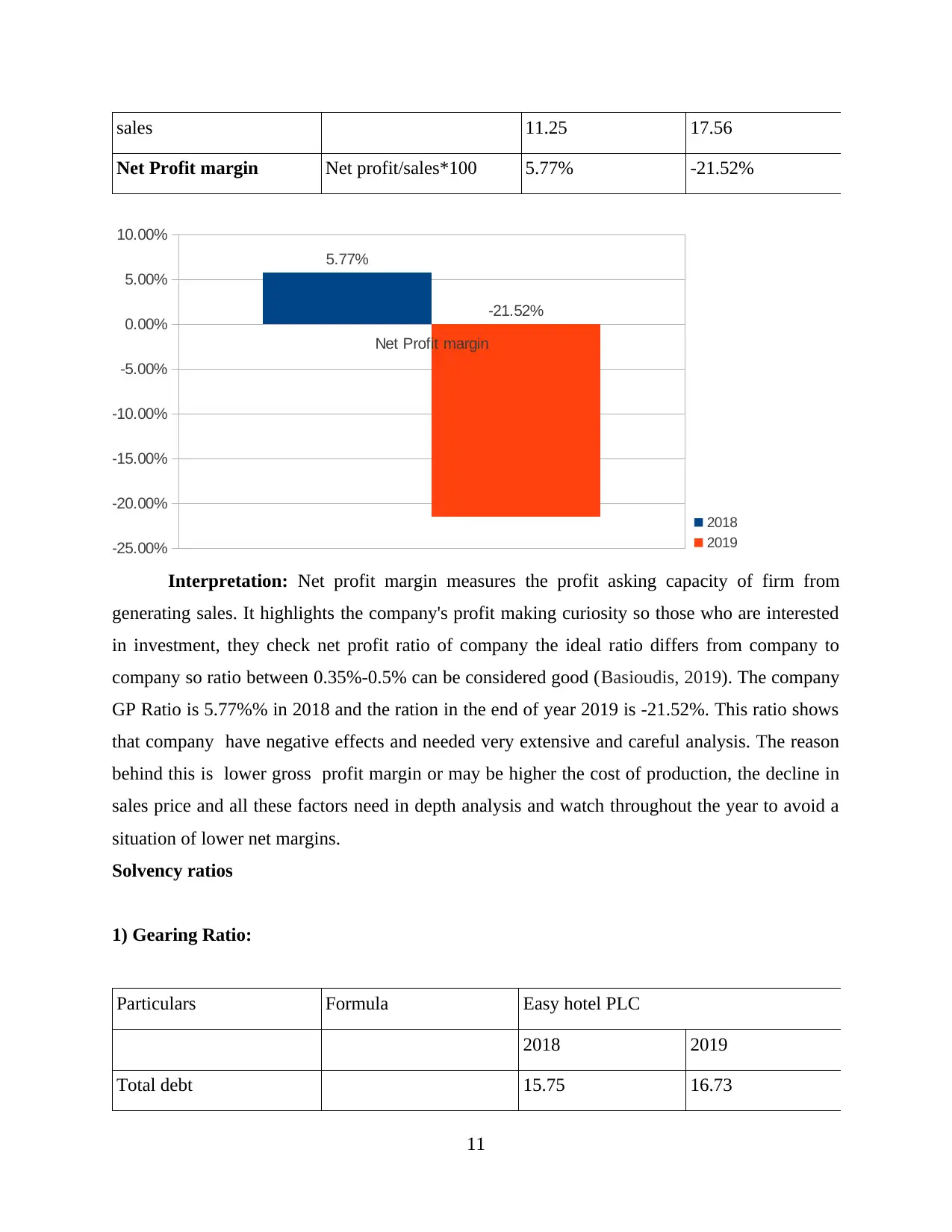

sales 11.25 17.56

Net Profit margin Net profit/sales*100 5.77% -21.52%

Net Profit margin

-25.00%

-20.00%

-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

5.77%

-21.52%

2018

2019

Interpretation: Net profit margin measures the profit asking capacity of firm from

generating sales. It highlights the company's profit making curiosity so those who are interested

in investment, they check net profit ratio of company the ideal ratio differs from company to

company so ratio between 0.35%-0.5% can be considered good (Basioudis, 2019). The company

GP Ratio is 5.77%% in 2018 and the ration in the end of year 2019 is -21.52%. This ratio shows

that company have negative effects and needed very extensive and careful analysis. The reason

behind this is lower gross profit margin or may be higher the cost of production, the decline in

sales price and all these factors need in depth analysis and watch throughout the year to avoid a

situation of lower net margins.

Solvency ratios

1) Gearing Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Total debt 15.75 16.73

11

Net Profit margin Net profit/sales*100 5.77% -21.52%

Net Profit margin

-25.00%

-20.00%

-15.00%

-10.00%

-5.00%

0.00%

5.00%

10.00%

5.77%

-21.52%

2018

2019

Interpretation: Net profit margin measures the profit asking capacity of firm from

generating sales. It highlights the company's profit making curiosity so those who are interested

in investment, they check net profit ratio of company the ideal ratio differs from company to

company so ratio between 0.35%-0.5% can be considered good (Basioudis, 2019). The company

GP Ratio is 5.77%% in 2018 and the ration in the end of year 2019 is -21.52%. This ratio shows

that company have negative effects and needed very extensive and careful analysis. The reason

behind this is lower gross profit margin or may be higher the cost of production, the decline in

sales price and all these factors need in depth analysis and watch throughout the year to avoid a

situation of lower net margins.

Solvency ratios

1) Gearing Ratio:

Particulars Formula Easy hotel PLC

2018 2019

Total debt 15.75 16.73

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total equity 119.64 115.32

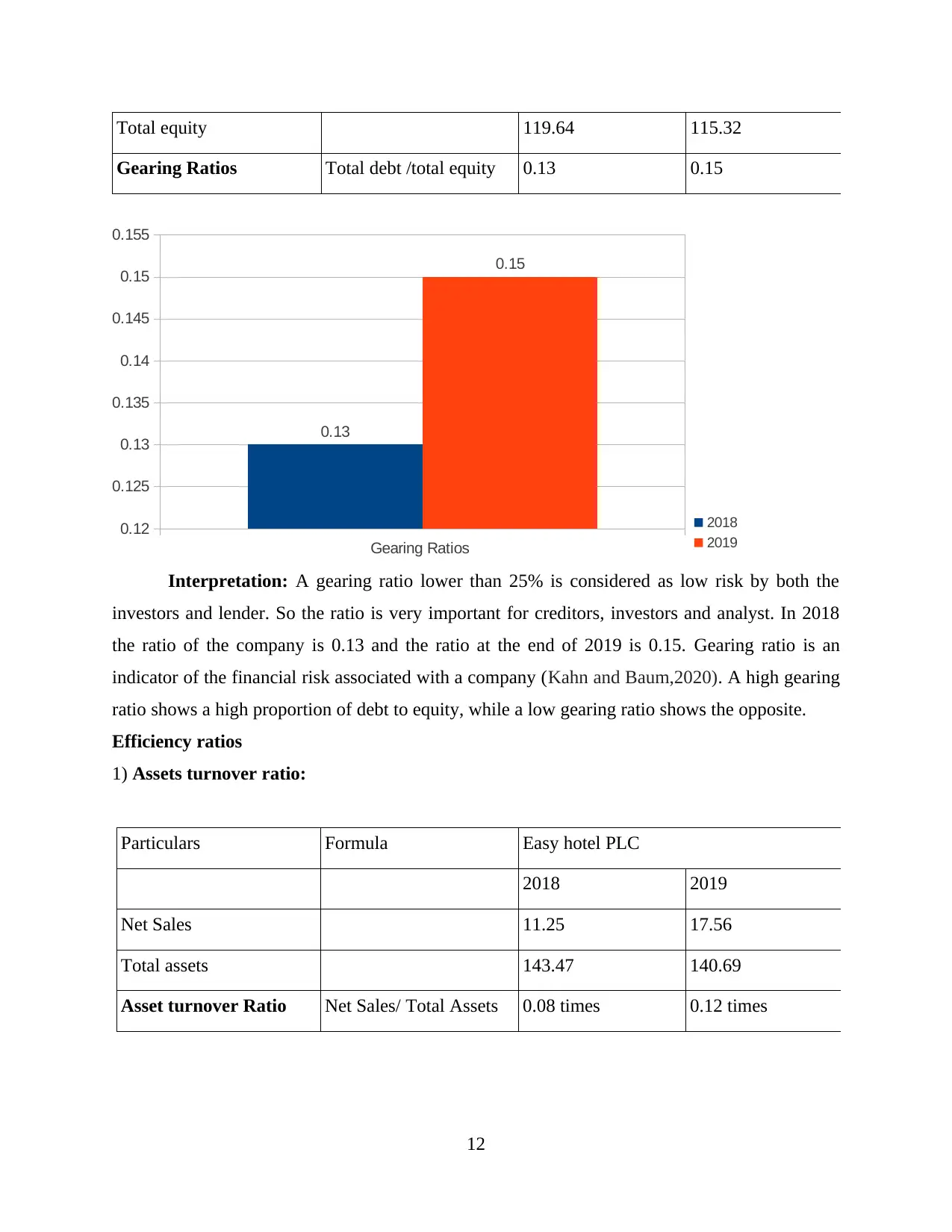

Gearing Ratios Total debt /total equity 0.13 0.15

Gearing Ratios

0.12

0.125

0.13

0.135

0.14

0.145

0.15

0.155

0.13

0.15

2018

2019

Interpretation: A gearing ratio lower than 25% is considered as low risk by both the

investors and lender. So the ratio is very important for creditors, investors and analyst. In 2018

the ratio of the company is 0.13 and the ratio at the end of 2019 is 0.15. Gearing ratio is an

indicator of the financial risk associated with a company (Kahn and Baum,2020). A high gearing

ratio shows a high proportion of debt to equity, while a low gearing ratio shows the opposite.

Efficiency ratios

1) Assets turnover ratio:

Particulars Formula Easy hotel PLC

2018 2019

Net Sales 11.25 17.56

Total assets 143.47 140.69

Asset turnover Ratio Net Sales/ Total Assets 0.08 times 0.12 times

12

Gearing Ratios Total debt /total equity 0.13 0.15

Gearing Ratios

0.12

0.125

0.13

0.135

0.14

0.145

0.15

0.155

0.13

0.15

2018

2019

Interpretation: A gearing ratio lower than 25% is considered as low risk by both the

investors and lender. So the ratio is very important for creditors, investors and analyst. In 2018

the ratio of the company is 0.13 and the ratio at the end of 2019 is 0.15. Gearing ratio is an

indicator of the financial risk associated with a company (Kahn and Baum,2020). A high gearing

ratio shows a high proportion of debt to equity, while a low gearing ratio shows the opposite.

Efficiency ratios

1) Assets turnover ratio:

Particulars Formula Easy hotel PLC

2018 2019

Net Sales 11.25 17.56

Total assets 143.47 140.69

Asset turnover Ratio Net Sales/ Total Assets 0.08 times 0.12 times

12

Asset turnover Ratio

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.08

0.12

2018

2019

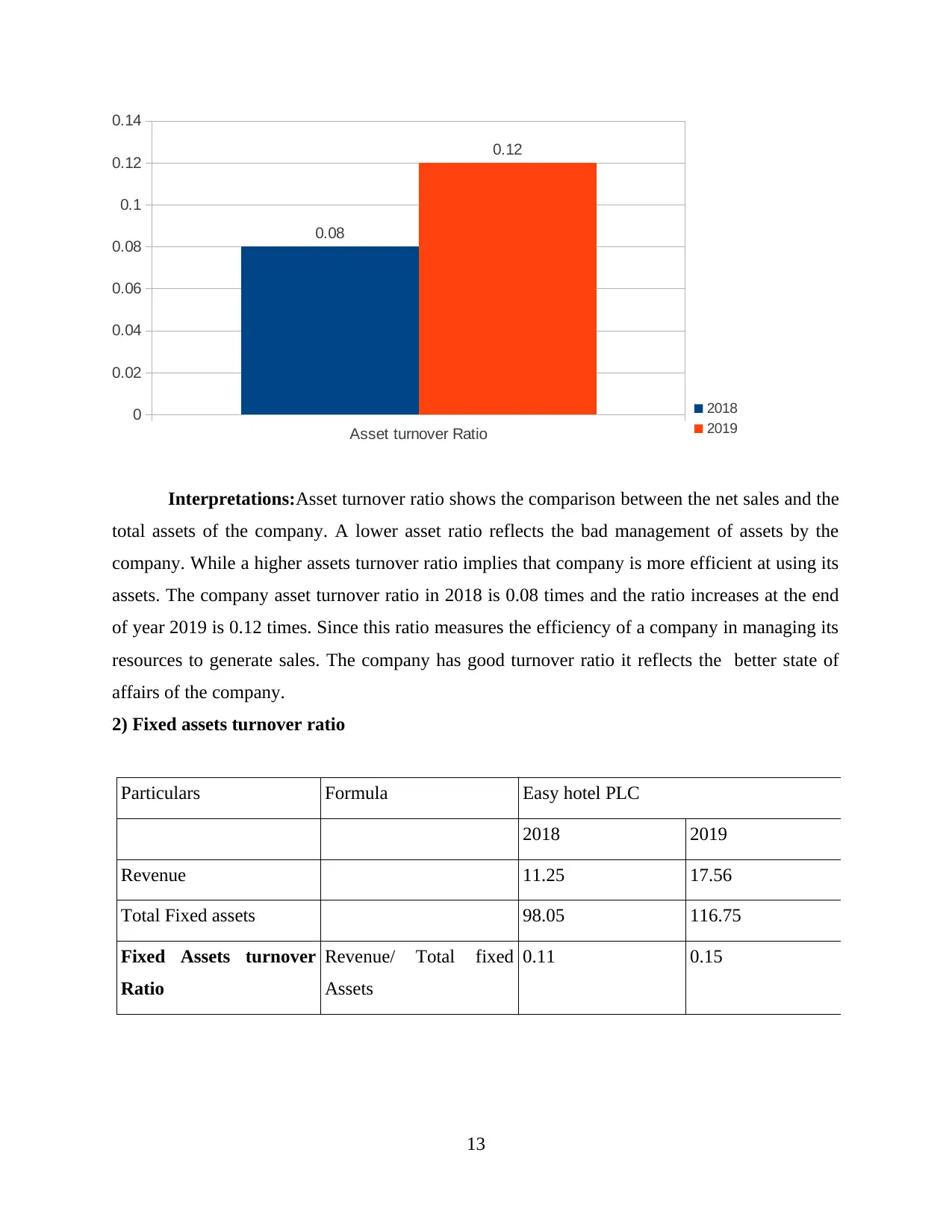

Interpretations:Asset turnover ratio shows the comparison between the net sales and the

total assets of the company. A lower asset ratio reflects the bad management of assets by the

company. While a higher assets turnover ratio implies that company is more efficient at using its

assets. The company asset turnover ratio in 2018 is 0.08 times and the ratio increases at the end

of year 2019 is 0.12 times. Since this ratio measures the efficiency of a company in managing its

resources to generate sales. The company has good turnover ratio it reflects the better state of

affairs of the company.

2) Fixed assets turnover ratio

Particulars Formula Easy hotel PLC

2018 2019

Revenue 11.25 17.56

Total Fixed assets 98.05 116.75

Fixed Assets turnover

Ratio

Revenue/ Total fixed

Assets

0.11 0.15

13

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.08

0.12

2018

2019

Interpretations:Asset turnover ratio shows the comparison between the net sales and the

total assets of the company. A lower asset ratio reflects the bad management of assets by the

company. While a higher assets turnover ratio implies that company is more efficient at using its

assets. The company asset turnover ratio in 2018 is 0.08 times and the ratio increases at the end

of year 2019 is 0.12 times. Since this ratio measures the efficiency of a company in managing its

resources to generate sales. The company has good turnover ratio it reflects the better state of

affairs of the company.

2) Fixed assets turnover ratio

Particulars Formula Easy hotel PLC

2018 2019

Revenue 11.25 17.56

Total Fixed assets 98.05 116.75

Fixed Assets turnover

Ratio

Revenue/ Total fixed

Assets

0.11 0.15

13

Fixed Assets turnover Ratio

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.16

0.11

0.15

2018

2019

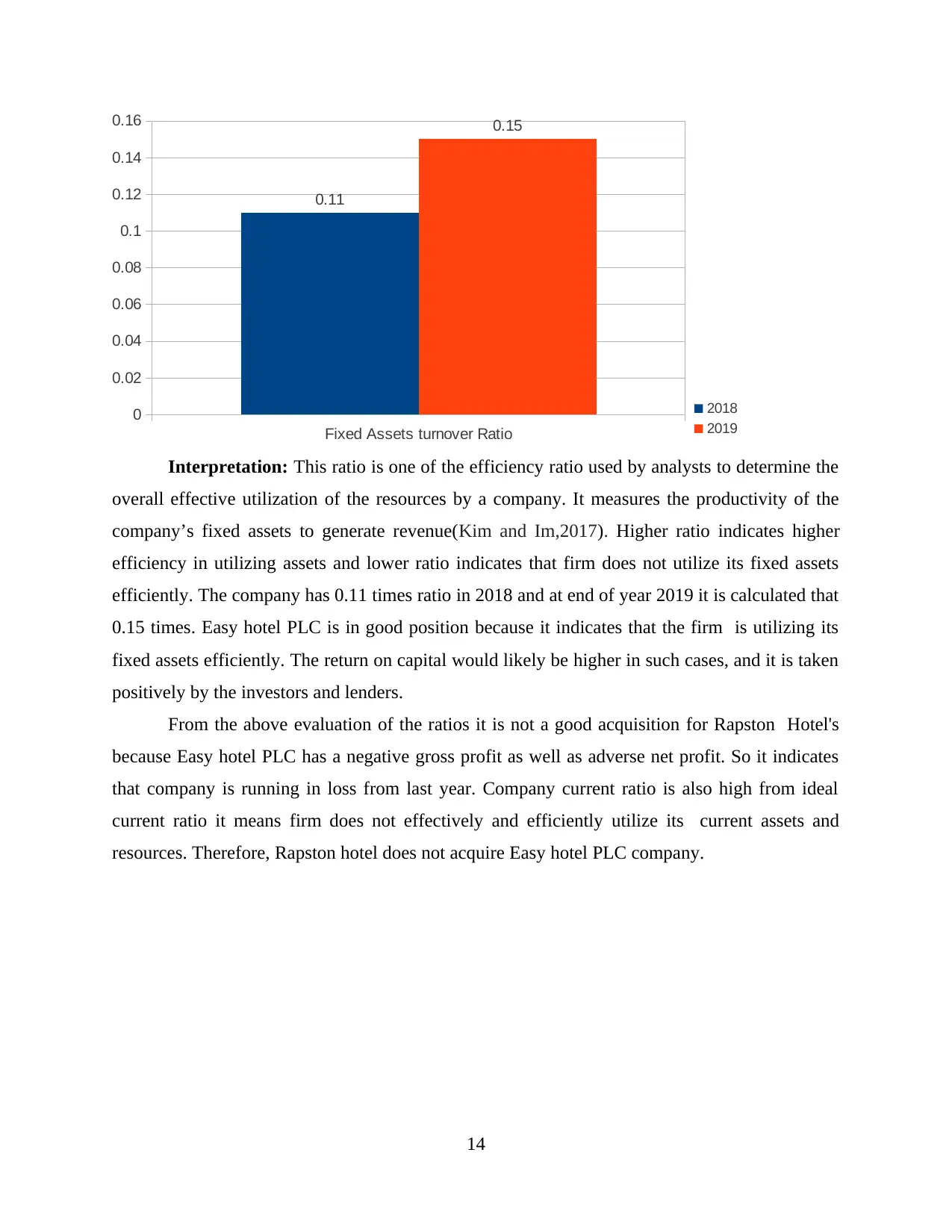

Interpretation: This ratio is one of the efficiency ratio used by analysts to determine the

overall effective utilization of the resources by a company. It measures the productivity of the

company’s fixed assets to generate revenue(Kim and Im,2017). Higher ratio indicates higher

efficiency in utilizing assets and lower ratio indicates that firm does not utilize its fixed assets

efficiently. The company has 0.11 times ratio in 2018 and at end of year 2019 it is calculated that

0.15 times. Easy hotel PLC is in good position because it indicates that the firm is utilizing its

fixed assets efficiently. The return on capital would likely be higher in such cases, and it is taken

positively by the investors and lenders.

From the above evaluation of the ratios it is not a good acquisition for Rapston Hotel's

because Easy hotel PLC has a negative gross profit as well as adverse net profit. So it indicates

that company is running in loss from last year. Company current ratio is also high from ideal

current ratio it means firm does not effectively and efficiently utilize its current assets and

resources. Therefore, Rapston hotel does not acquire Easy hotel PLC company.

14

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.16

0.11

0.15

2018

2019

Interpretation: This ratio is one of the efficiency ratio used by analysts to determine the

overall effective utilization of the resources by a company. It measures the productivity of the

company’s fixed assets to generate revenue(Kim and Im,2017). Higher ratio indicates higher

efficiency in utilizing assets and lower ratio indicates that firm does not utilize its fixed assets

efficiently. The company has 0.11 times ratio in 2018 and at end of year 2019 it is calculated that

0.15 times. Easy hotel PLC is in good position because it indicates that the firm is utilizing its

fixed assets efficiently. The return on capital would likely be higher in such cases, and it is taken

positively by the investors and lenders.

From the above evaluation of the ratios it is not a good acquisition for Rapston Hotel's

because Easy hotel PLC has a negative gross profit as well as adverse net profit. So it indicates

that company is running in loss from last year. Company current ratio is also high from ideal

current ratio it means firm does not effectively and efficiently utilize its current assets and

resources. Therefore, Rapston hotel does not acquire Easy hotel PLC company.

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

15

REFERENCES

Books and Journals

Lee, B. H. and Lee, S. H., 2018. A study on financial ratio and prediction of financial distress in

financial markets. The Journal of Distribution Science. 16(11). pp.21-27.

Kim, J. and Im, C., 2017. Study on corporate social responsibility (CSR): Focus on tax

avoidance and financial ratio analysis. Sustainability. 9(10). p.1710.

Basioudis, I. G., 2019. The Interpretation of Financial Statements. In Financial Accounting (pp.

274-308). Routledge.

Kahn, M. J. and Baum, N., 2020. Basic Accounting and Interpretation of Financial Statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

16

Books and Journals

Lee, B. H. and Lee, S. H., 2018. A study on financial ratio and prediction of financial distress in

financial markets. The Journal of Distribution Science. 16(11). pp.21-27.

Kim, J. and Im, C., 2017. Study on corporate social responsibility (CSR): Focus on tax

avoidance and financial ratio analysis. Sustainability. 9(10). p.1710.

Basioudis, I. G., 2019. The Interpretation of Financial Statements. In Financial Accounting (pp.

274-308). Routledge.

Kahn, M. J. and Baum, N., 2020. Basic Accounting and Interpretation of Financial Statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

16

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.