Financial Accounting 1 Report: Bookkeeping, Statements, and Analysis

VerifiedAdded on 2023/01/10

|21

|4289

|36

Report

AI Summary

This report delves into the core concepts of financial accounting, encompassing two key scenarios. The first scenario examines business transactions, differentiating between internal and external types, and exploring single and double-entry bookkeeping systems. It explains the significance of trial balances and provides practical examples of journal entries, ledger accounts, and trial balances. Furthermore, the report clarifies the distinctions between financial reports and statements, outlining fundamental accounting principles like the monetary unit assumption, going concern, and the matching principle. The second scenario shifts focus to bank reconciliation, detailing the process of aligning company records with bank statements, and explaining control accounts and suspense accounts. The report also includes illustrative examples, such as profit and loss accounts, and balance sheets, thereby offering a comprehensive understanding of financial accounting practices. Finally, it provides an analysis of income statements and balance sheets.

Financial Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

SCENARIO 1..................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................5

Question 3. Difference between financial report and statement................................................11

Question 4. Description of the fundamental principles of accounting......................................13

Question 5..................................................................................................................................14

SCENARIO 2................................................................................................................................16

Question 1. Description about bank reconciliation....................................................................16

Question 2. Description about control accounts........................................................................17

Question 4..................................................................................................................................17

Question 5..................................................................................................................................18

REFERENCES..............................................................................................................................20

2

INTRODUCTION...........................................................................................................................3

SCENARIO 1..................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................5

Question 3. Difference between financial report and statement................................................11

Question 4. Description of the fundamental principles of accounting......................................13

Question 5..................................................................................................................................14

SCENARIO 2................................................................................................................................16

Question 1. Description about bank reconciliation....................................................................16

Question 2. Description about control accounts........................................................................17

Question 4..................................................................................................................................17

Question 5..................................................................................................................................18

REFERENCES..............................................................................................................................20

2

INTRODUCTION

Financial accounting relates to practices or processes for readying financial statements

which a corporation uses to demonstrate its financial status and efficiency to outsiders like

creditors or lenders, investors, clients and suppliers. Simply put, this is specific accounting area

that involves different processes, like recording, efficiently summarizing as well as reporting the

outcomes of fiscal transactions from business processes over specific time-frame (Suryanto and

Ridwansyah, 2016).

This study is split into two parts, each of which has specific issues. In order to complete the

first portion, some queries need to be addressed, like the kinds of transactions involving single

entry system as well as double-entry system of book keeping, trial balance as well as its

significance. The second part in such section is focused on making journal entries with respect

to each transaction, the Ledgers and a Trial Balance. The distinction between the financial

statement vs the financial report, the basic principles of the accounting and statement of income

are also key part of this portion. Section 2 is focused on preparing bank reconciliation report,

journal entries, multiple control accounts, suspense account and many other dimensions.

SCENARIO 1

Question 1

Types of business transaction

Business transactions are financial events that have taken place within a commercial entity that

could be specific in financial terms. Business transactions have financial or direct effect on the

client. There are many types of business financial transactions, almost all of which are

categorized into inner versus external transactions. These are listed as follows:

Internal business transactions: The participation of outer parties isn't always allowed in such

an transaction. These transactions have a clear effect on financial performance of corporation,

since they do not require the transfer of interests with third parties. For instance:

internal transactions involve tracking depreciation on the fixed assets and also the loss of assets

due to fire or theft etc (Schroeder, Clark and Cathey, 2019).

External business transactions: Among these transactions, the company shall exchange

cash with third parties. These are simple transactions which are carried out by the

corporation on a regular basis. For instance: external transactions involve selling of

3

Financial accounting relates to practices or processes for readying financial statements

which a corporation uses to demonstrate its financial status and efficiency to outsiders like

creditors or lenders, investors, clients and suppliers. Simply put, this is specific accounting area

that involves different processes, like recording, efficiently summarizing as well as reporting the

outcomes of fiscal transactions from business processes over specific time-frame (Suryanto and

Ridwansyah, 2016).

This study is split into two parts, each of which has specific issues. In order to complete the

first portion, some queries need to be addressed, like the kinds of transactions involving single

entry system as well as double-entry system of book keeping, trial balance as well as its

significance. The second part in such section is focused on making journal entries with respect

to each transaction, the Ledgers and a Trial Balance. The distinction between the financial

statement vs the financial report, the basic principles of the accounting and statement of income

are also key part of this portion. Section 2 is focused on preparing bank reconciliation report,

journal entries, multiple control accounts, suspense account and many other dimensions.

SCENARIO 1

Question 1

Types of business transaction

Business transactions are financial events that have taken place within a commercial entity that

could be specific in financial terms. Business transactions have financial or direct effect on the

client. There are many types of business financial transactions, almost all of which are

categorized into inner versus external transactions. These are listed as follows:

Internal business transactions: The participation of outer parties isn't always allowed in such

an transaction. These transactions have a clear effect on financial performance of corporation,

since they do not require the transfer of interests with third parties. For instance:

internal transactions involve tracking depreciation on the fixed assets and also the loss of assets

due to fire or theft etc (Schroeder, Clark and Cathey, 2019).

External business transactions: Among these transactions, the company shall exchange

cash with third parties. These are simple transactions which are carried out by the

corporation on a regular basis. For instance: external transactions involve selling of

3

You're viewing a preview

Unlock full access by subscribing today!

products to consumers, acquisition of products from manufacturers, payments of utilities

or water charges, payment of wages to staff, etc.

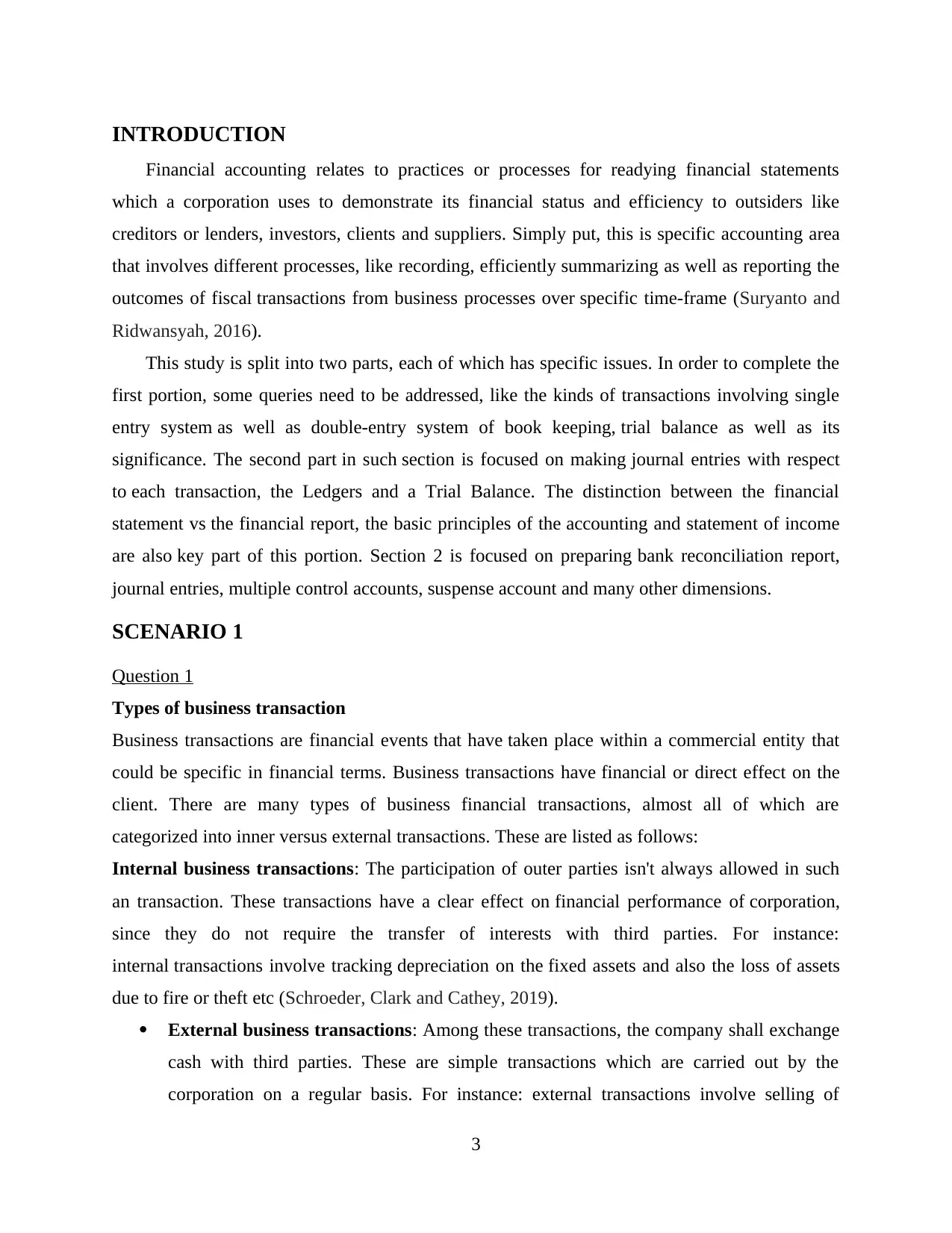

Single entry and double entry book keeping

Holding a single-entry book is referred to as a simple and cohesive form of accounting.

Under which as well as every financial transaction is reported at the same period as single entry

within journal. Single entry system of bookkeeping is a cash-based accounting methodology that

records all incoming and outgoing cash in journal.

Date Description Transaction value Balance

XX-XX-XXXX £ 0000.00 £ 0000.00

Double-entry bookkeeping system is yet another mechanism or procedure for recording

commercial transactions wherein, for every transaction, entry is noted in at minimum 2 accounts

that are credited or debited accounts. In double-entry method, the sum of capital reported as

debits will be equal to amount of capital reported as credits. Double-entry accounting method

works on basis of the accounting formula, for eg, Assets = Liabilities + Owner's capital

(Robson,, Young and Power, 2017). Framework of the Double Entry keeping records is seen as

follows:

Date Description L.F Debit Credit

XX-XX-XXXX £ 0000.00

£ 0000.00

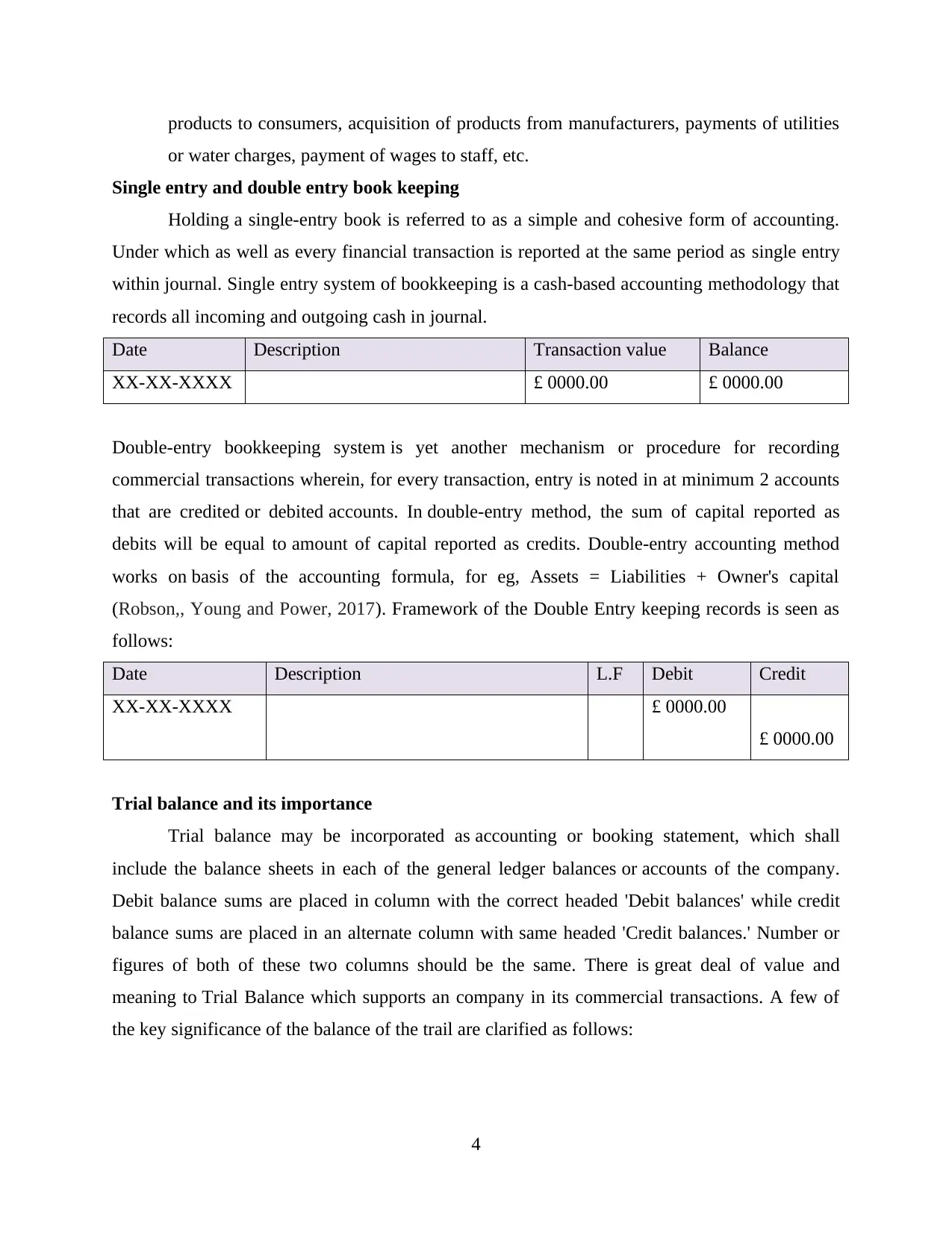

Trial balance and its importance

Trial balance may be incorporated as accounting or booking statement, which shall

include the balance sheets in each of the general ledger balances or accounts of the company.

Debit balance sums are placed in column with the correct headed 'Debit balances' while credit

balance sums are placed in an alternate column with same headed 'Credit balances.' Number or

figures of both of these two columns should be the same. There is great deal of value and

meaning to Trial Balance which supports an company in its commercial transactions. A few of

the key significance of the balance of the trail are clarified as follows:

4

or water charges, payment of wages to staff, etc.

Single entry and double entry book keeping

Holding a single-entry book is referred to as a simple and cohesive form of accounting.

Under which as well as every financial transaction is reported at the same period as single entry

within journal. Single entry system of bookkeeping is a cash-based accounting methodology that

records all incoming and outgoing cash in journal.

Date Description Transaction value Balance

XX-XX-XXXX £ 0000.00 £ 0000.00

Double-entry bookkeeping system is yet another mechanism or procedure for recording

commercial transactions wherein, for every transaction, entry is noted in at minimum 2 accounts

that are credited or debited accounts. In double-entry method, the sum of capital reported as

debits will be equal to amount of capital reported as credits. Double-entry accounting method

works on basis of the accounting formula, for eg, Assets = Liabilities + Owner's capital

(Robson,, Young and Power, 2017). Framework of the Double Entry keeping records is seen as

follows:

Date Description L.F Debit Credit

XX-XX-XXXX £ 0000.00

£ 0000.00

Trial balance and its importance

Trial balance may be incorporated as accounting or booking statement, which shall

include the balance sheets in each of the general ledger balances or accounts of the company.

Debit balance sums are placed in column with the correct headed 'Debit balances' while credit

balance sums are placed in an alternate column with same headed 'Credit balances.' Number or

figures of both of these two columns should be the same. There is great deal of value and

meaning to Trial Balance which supports an company in its commercial transactions. A few of

the key significance of the balance of the trail are clarified as follows:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

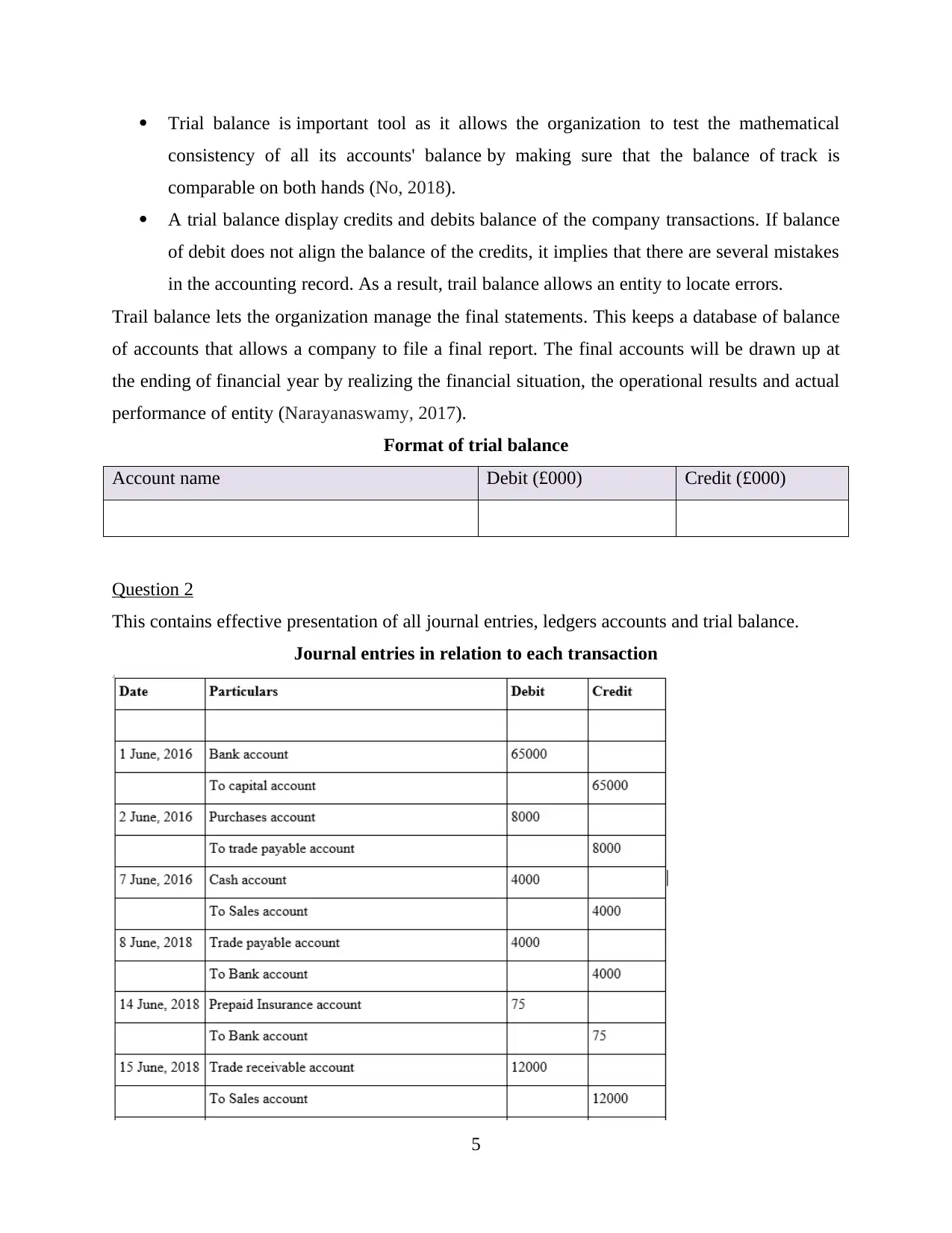

Trial balance is important tool as it allows the organization to test the mathematical

consistency of all its accounts' balance by making sure that the balance of track is

comparable on both hands (No, 2018).

A trial balance display credits and debits balance of the company transactions. If balance

of debit does not align the balance of the credits, it implies that there are several mistakes

in the accounting record. As a result, trail balance allows an entity to locate errors.

Trail balance lets the organization manage the final statements. This keeps a database of balance

of accounts that allows a company to file a final report. The final accounts will be drawn up at

the ending of financial year by realizing the financial situation, the operational results and actual

performance of entity (Narayanaswamy, 2017).

Format of trial balance

Account name Debit (£000) Credit (£000)

Question 2

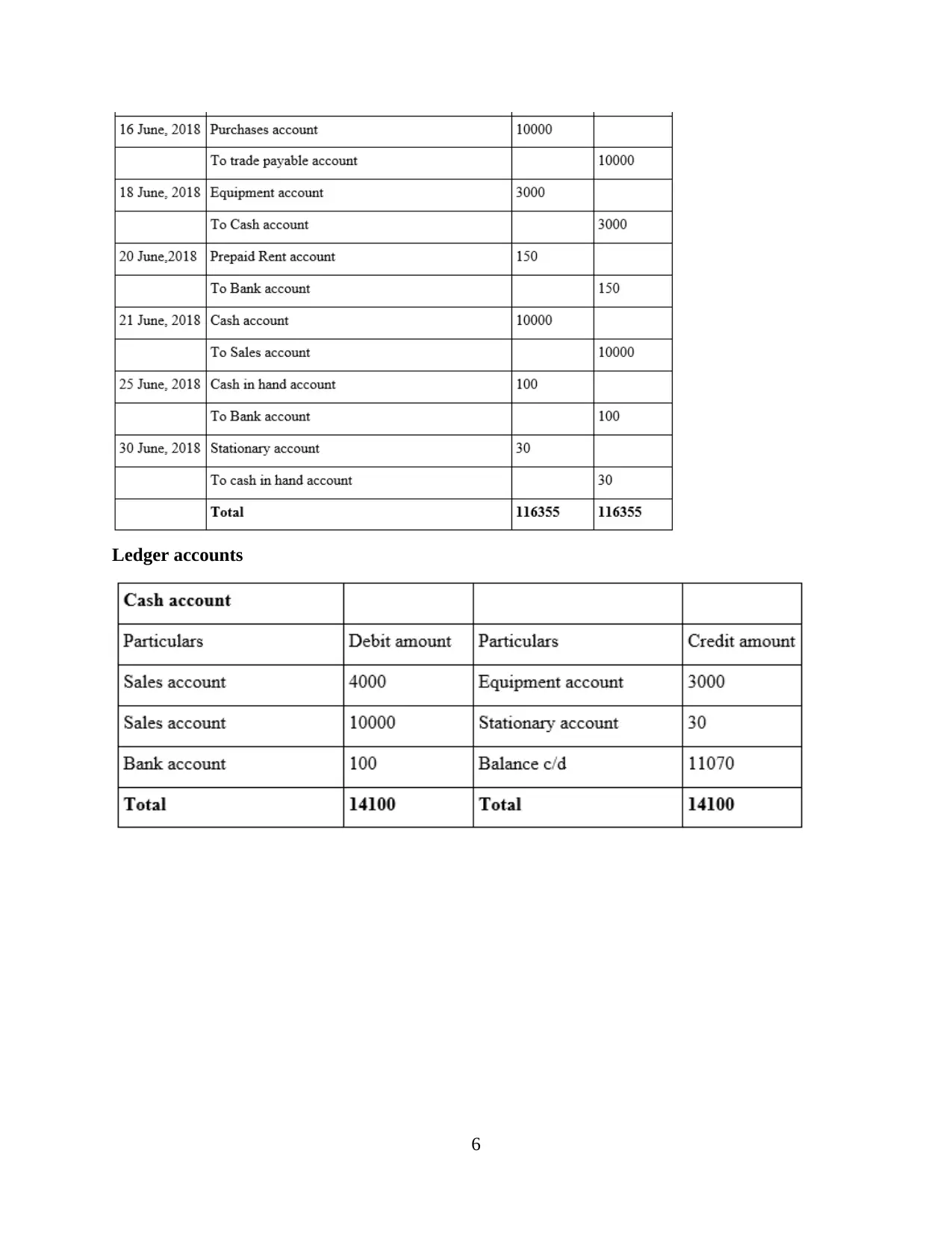

This contains effective presentation of all journal entries, ledgers accounts and trial balance.

Journal entries in relation to each transaction

5

consistency of all its accounts' balance by making sure that the balance of track is

comparable on both hands (No, 2018).

A trial balance display credits and debits balance of the company transactions. If balance

of debit does not align the balance of the credits, it implies that there are several mistakes

in the accounting record. As a result, trail balance allows an entity to locate errors.

Trail balance lets the organization manage the final statements. This keeps a database of balance

of accounts that allows a company to file a final report. The final accounts will be drawn up at

the ending of financial year by realizing the financial situation, the operational results and actual

performance of entity (Narayanaswamy, 2017).

Format of trial balance

Account name Debit (£000) Credit (£000)

Question 2

This contains effective presentation of all journal entries, ledgers accounts and trial balance.

Journal entries in relation to each transaction

5

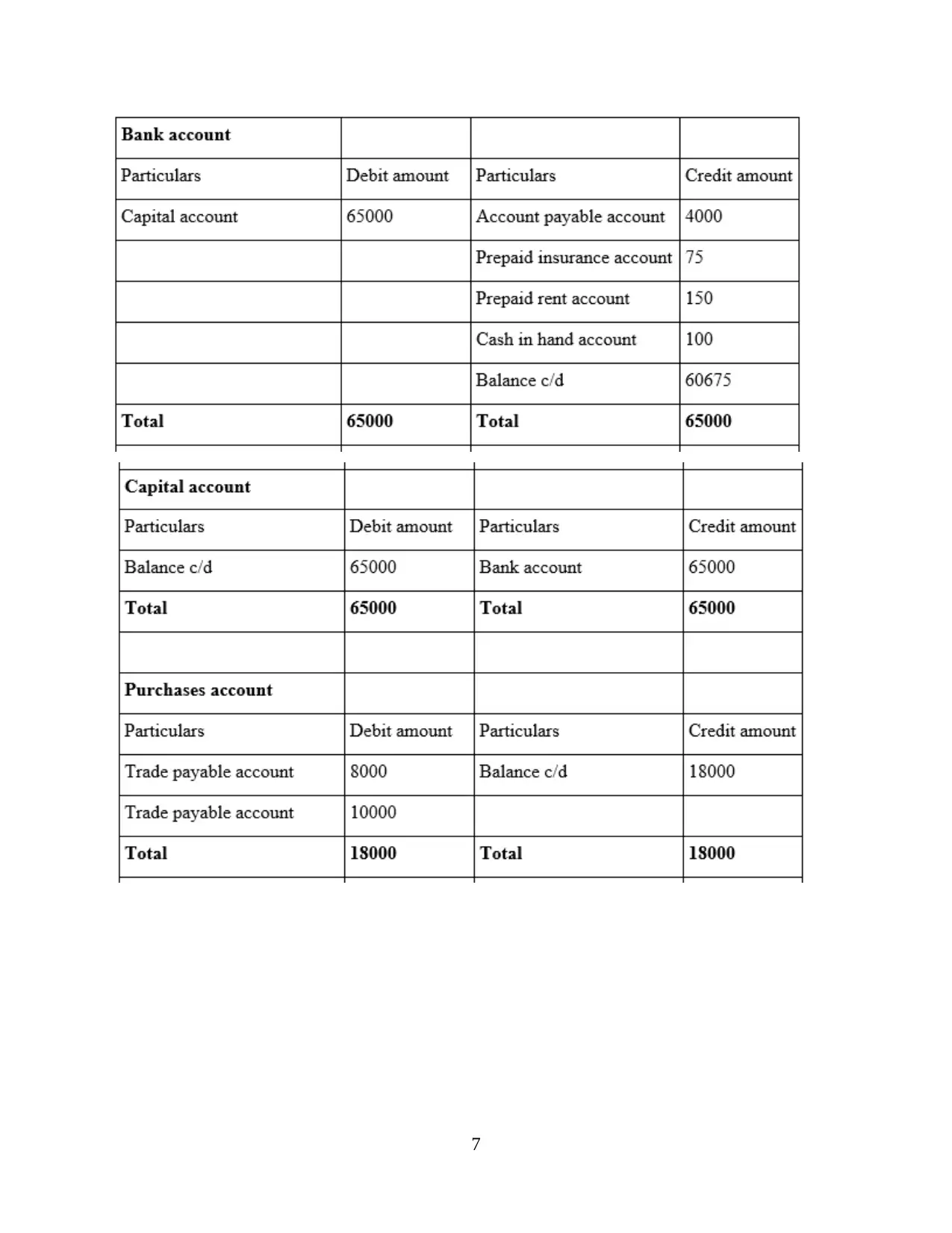

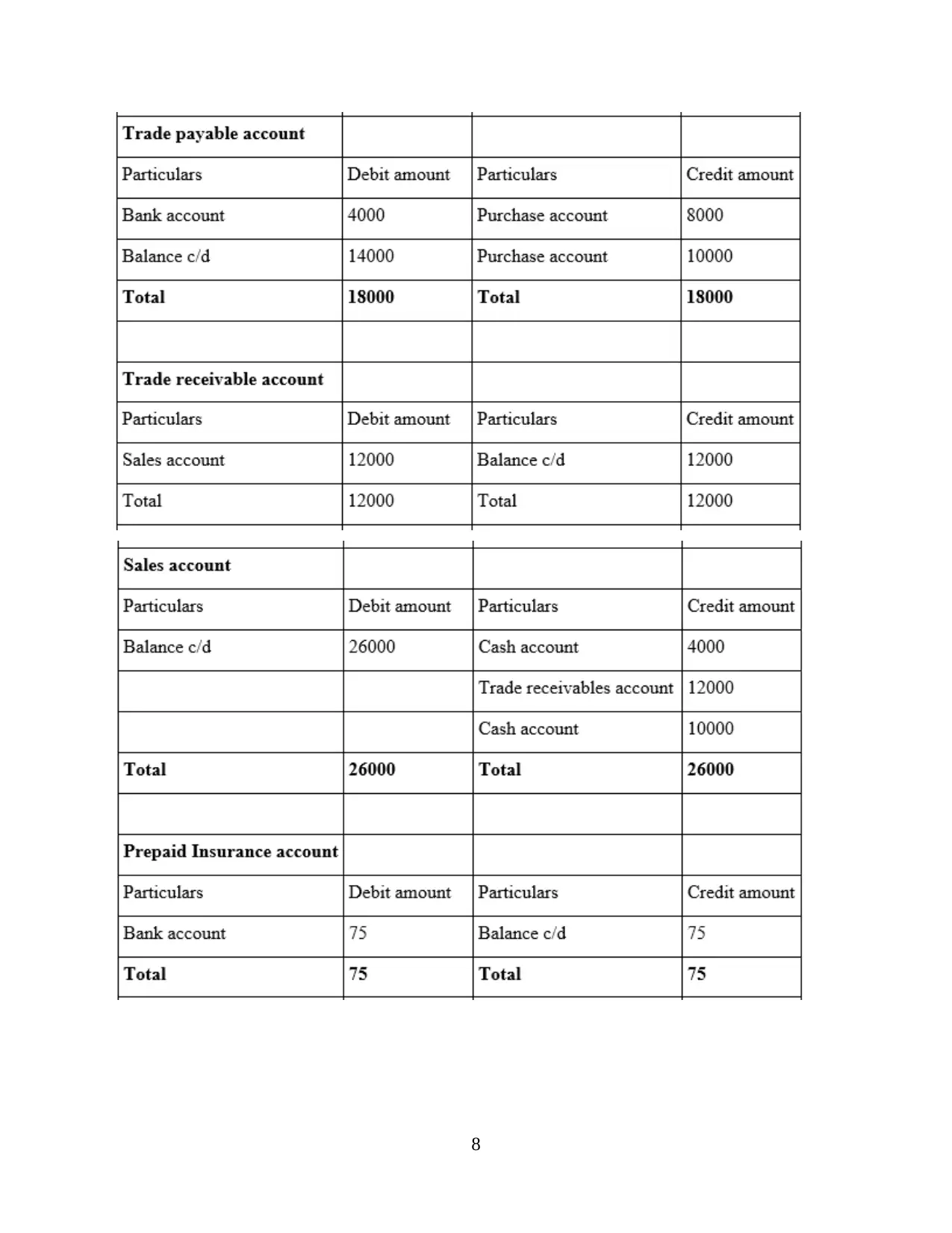

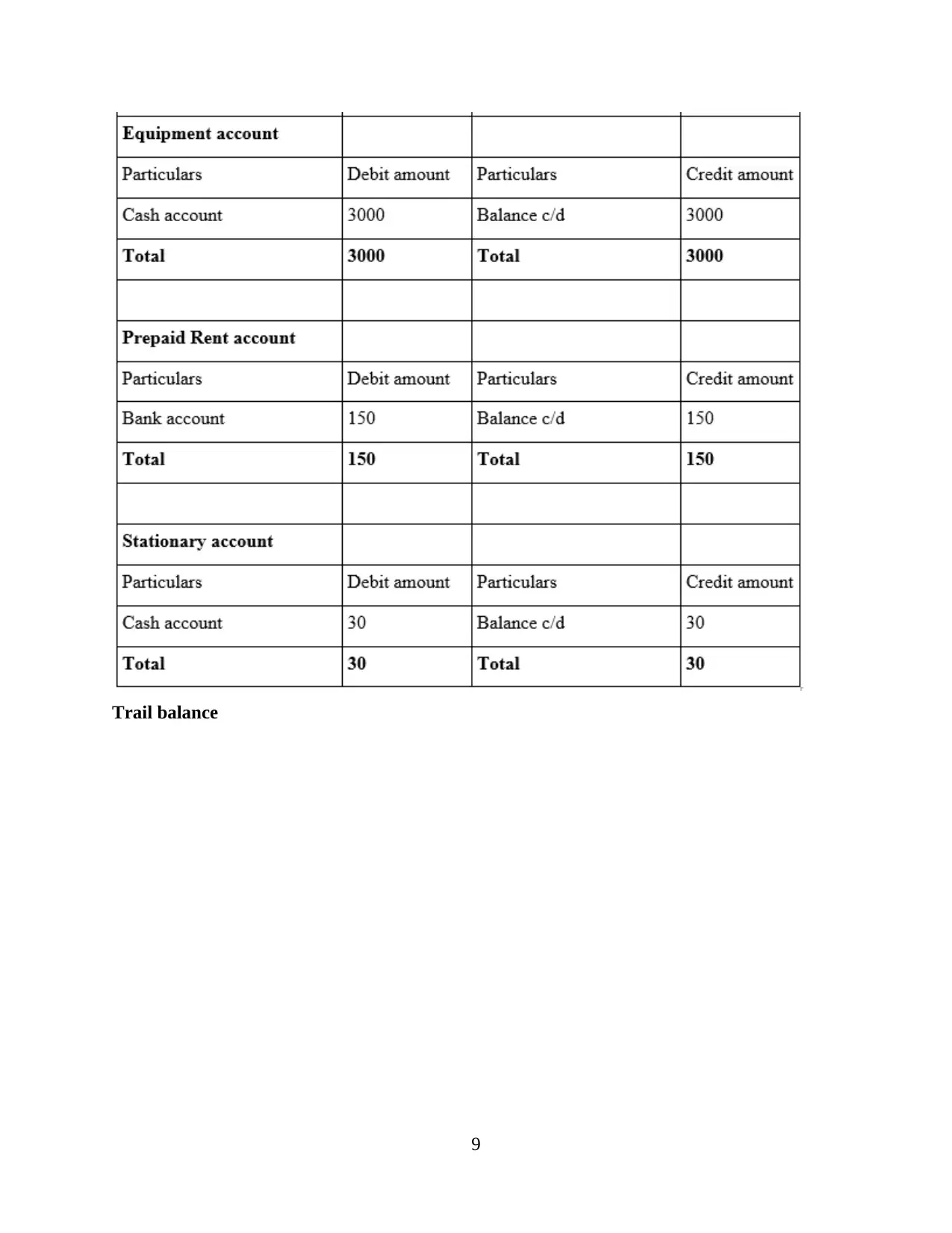

Ledger accounts

6

6

You're viewing a preview

Unlock full access by subscribing today!

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

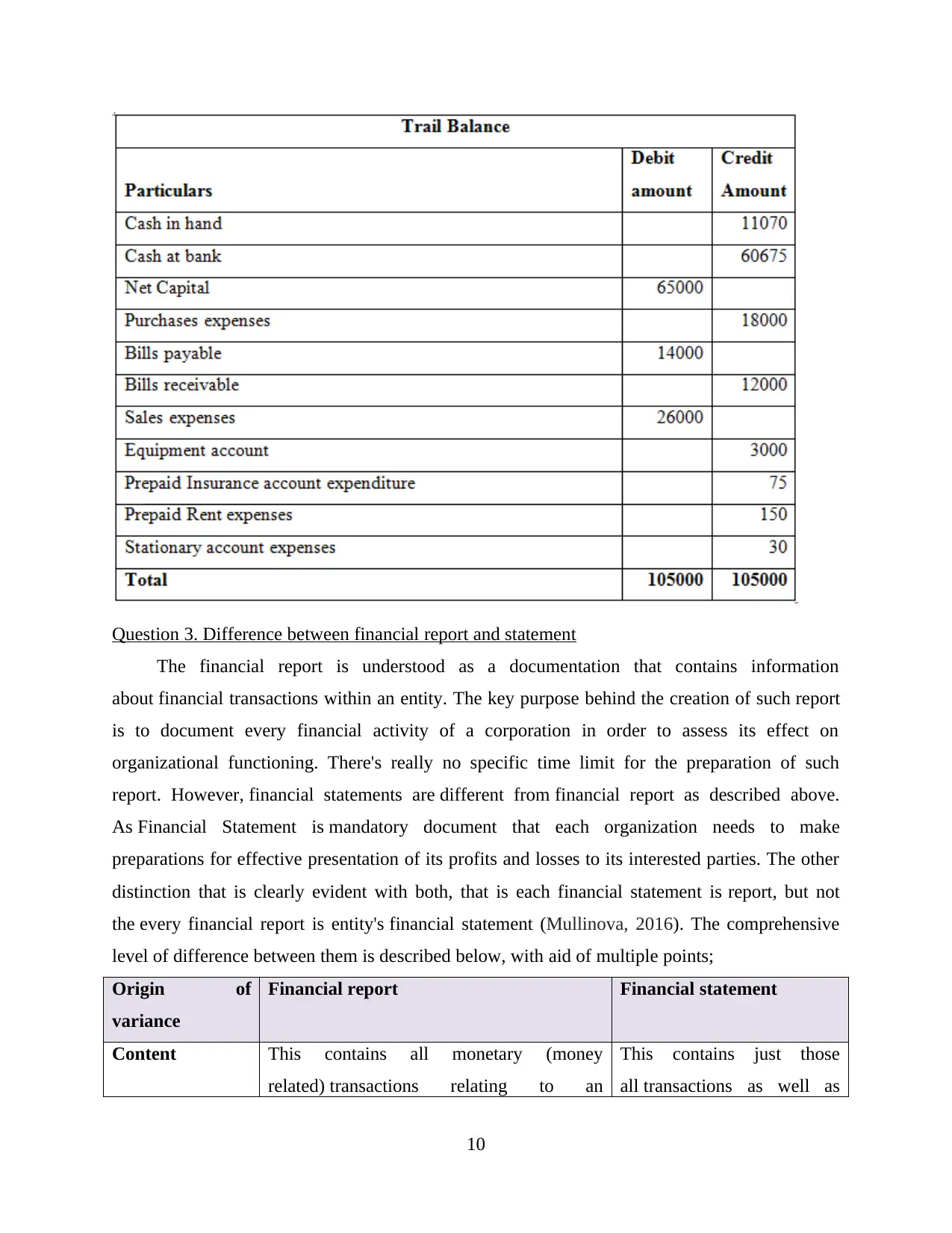

Trail balance

9

9

You're viewing a preview

Unlock full access by subscribing today!

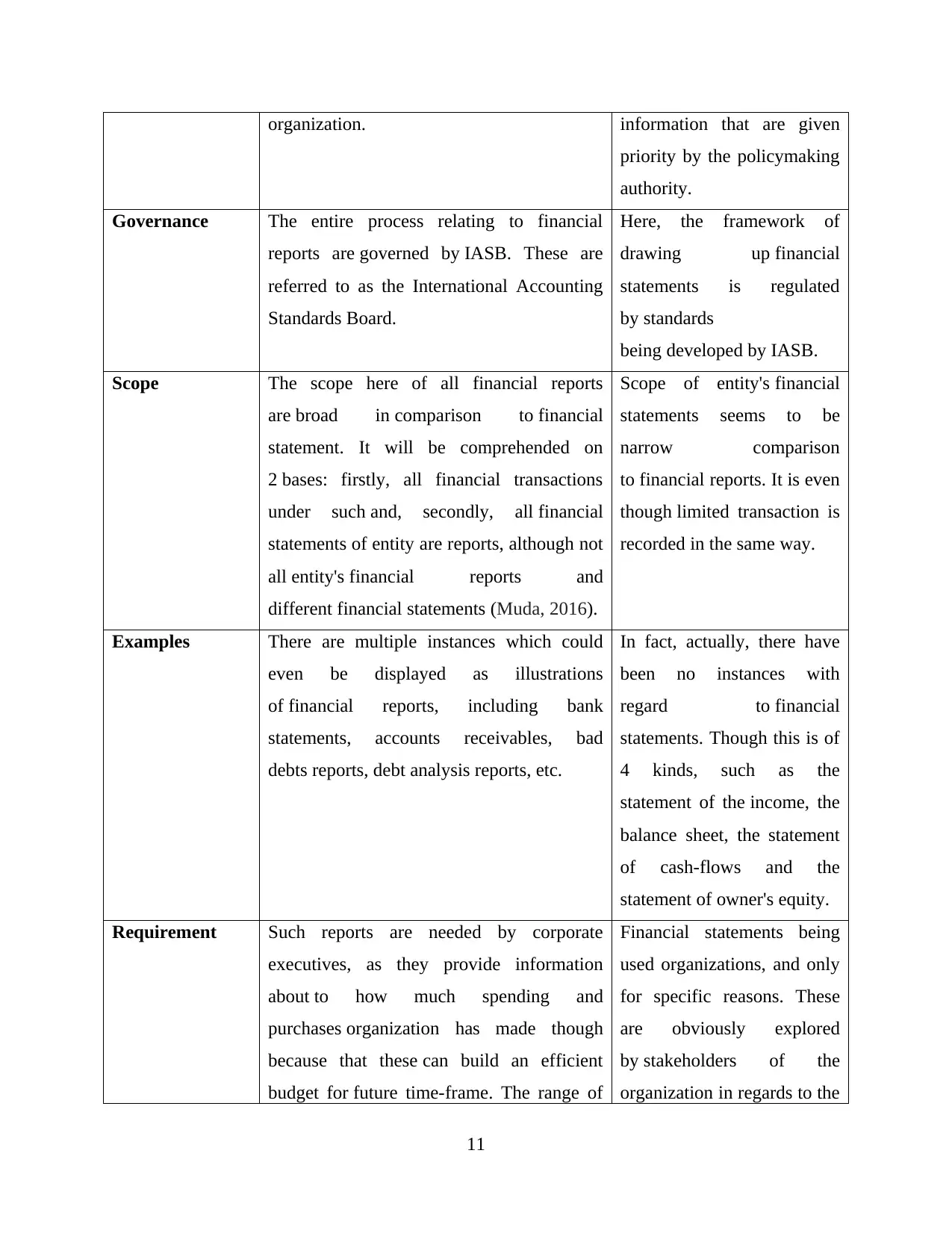

Question 3. Difference between financial report and statement

The financial report is understood as a documentation that contains information

about financial transactions within an entity. The key purpose behind the creation of such report

is to document every financial activity of a corporation in order to assess its effect on

organizational functioning. There's really no specific time limit for the preparation of such

report. However, financial statements are different from financial report as described above.

As Financial Statement is mandatory document that each organization needs to make

preparations for effective presentation of its profits and losses to its interested parties. The other

distinction that is clearly evident with both, that is each financial statement is report, but not

the every financial report is entity's financial statement (Mullinova, 2016). The comprehensive

level of difference between them is described below, with aid of multiple points;

Origin of

variance

Financial report Financial statement

Content This contains all monetary (money

related) transactions relating to an

This contains just those

all transactions as well as

10

The financial report is understood as a documentation that contains information

about financial transactions within an entity. The key purpose behind the creation of such report

is to document every financial activity of a corporation in order to assess its effect on

organizational functioning. There's really no specific time limit for the preparation of such

report. However, financial statements are different from financial report as described above.

As Financial Statement is mandatory document that each organization needs to make

preparations for effective presentation of its profits and losses to its interested parties. The other

distinction that is clearly evident with both, that is each financial statement is report, but not

the every financial report is entity's financial statement (Mullinova, 2016). The comprehensive

level of difference between them is described below, with aid of multiple points;

Origin of

variance

Financial report Financial statement

Content This contains all monetary (money

related) transactions relating to an

This contains just those

all transactions as well as

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organization. information that are given

priority by the policymaking

authority.

Governance The entire process relating to financial

reports are governed by IASB. These are

referred to as the International Accounting

Standards Board.

Here, the framework of

drawing up financial

statements is regulated

by standards

being developed by IASB.

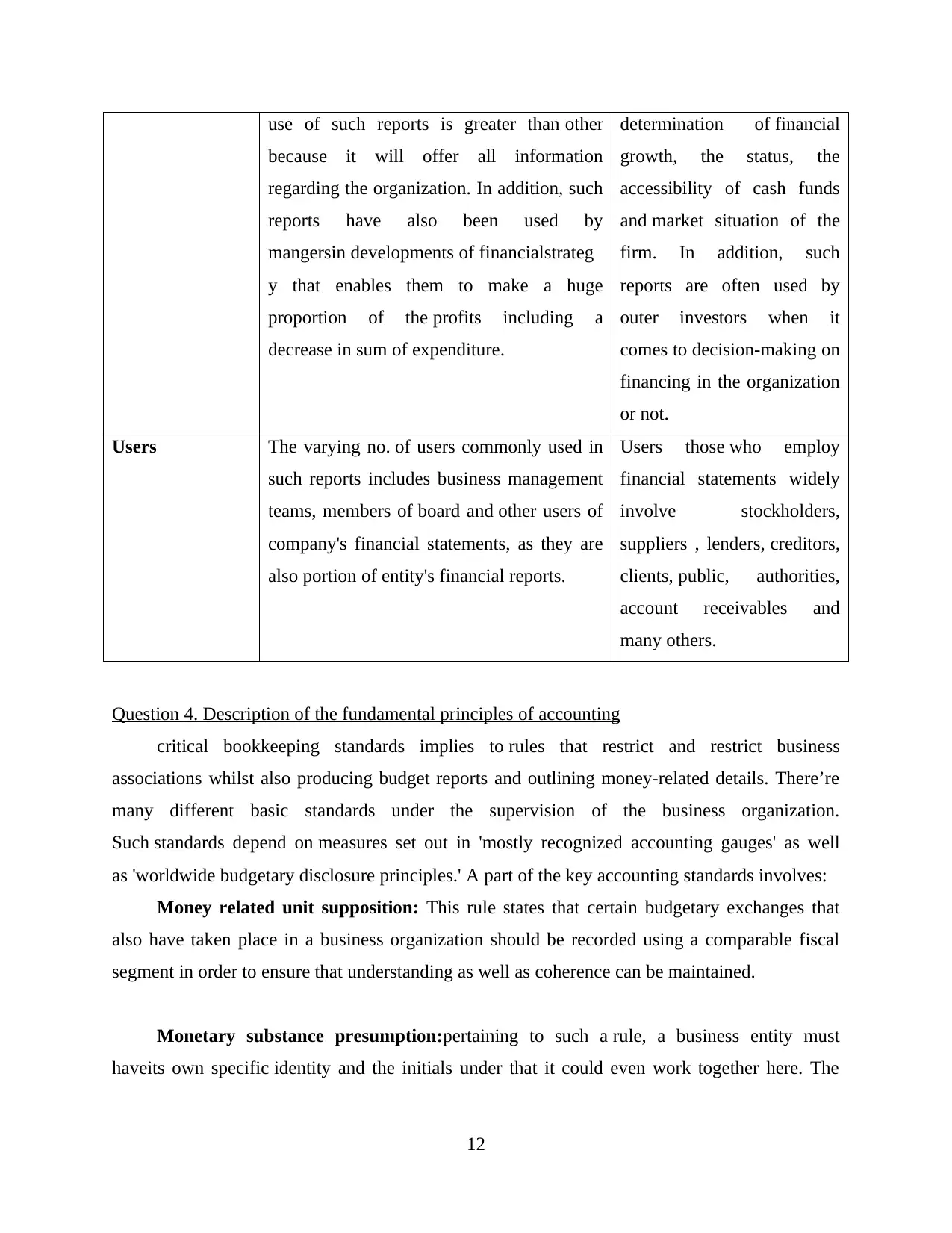

Scope The scope here of all financial reports

are broad in comparison to financial

statement. It will be comprehended on

2 bases: firstly, all financial transactions

under such and, secondly, all financial

statements of entity are reports, although not

all entity's financial reports and

different financial statements (Muda, 2016).

Scope of entity's financial

statements seems to be

narrow comparison

to financial reports. It is even

though limited transaction is

recorded in the same way.

Examples There are multiple instances which could

even be displayed as illustrations

of financial reports, including bank

statements, accounts receivables, bad

debts reports, debt analysis reports, etc.

In fact, actually, there have

been no instances with

regard to financial

statements. Though this is of

4 kinds, such as the

statement of the income, the

balance sheet, the statement

of cash-flows and the

statement of owner's equity.

Requirement Such reports are needed by corporate

executives, as they provide information

about to how much spending and

purchases organization has made though

because that these can build an efficient

budget for future time-frame. The range of

Financial statements being

used organizations, and only

for specific reasons. These

are obviously explored

by stakeholders of the

organization in regards to the

11

priority by the policymaking

authority.

Governance The entire process relating to financial

reports are governed by IASB. These are

referred to as the International Accounting

Standards Board.

Here, the framework of

drawing up financial

statements is regulated

by standards

being developed by IASB.

Scope The scope here of all financial reports

are broad in comparison to financial

statement. It will be comprehended on

2 bases: firstly, all financial transactions

under such and, secondly, all financial

statements of entity are reports, although not

all entity's financial reports and

different financial statements (Muda, 2016).

Scope of entity's financial

statements seems to be

narrow comparison

to financial reports. It is even

though limited transaction is

recorded in the same way.

Examples There are multiple instances which could

even be displayed as illustrations

of financial reports, including bank

statements, accounts receivables, bad

debts reports, debt analysis reports, etc.

In fact, actually, there have

been no instances with

regard to financial

statements. Though this is of

4 kinds, such as the

statement of the income, the

balance sheet, the statement

of cash-flows and the

statement of owner's equity.

Requirement Such reports are needed by corporate

executives, as they provide information

about to how much spending and

purchases organization has made though

because that these can build an efficient

budget for future time-frame. The range of

Financial statements being

used organizations, and only

for specific reasons. These

are obviously explored

by stakeholders of the

organization in regards to the

11

use of such reports is greater than other

because it will offer all information

regarding the organization. In addition, such

reports have also been used by

mangersin developments of financialstrateg

y that enables them to make a huge

proportion of the profits including a

decrease in sum of expenditure.

determination of financial

growth, the status, the

accessibility of cash funds

and market situation of the

firm. In addition, such

reports are often used by

outer investors when it

comes to decision-making on

financing in the organization

or not.

Users The varying no. of users commonly used in

such reports includes business management

teams, members of board and other users of

company's financial statements, as they are

also portion of entity's financial reports.

Users those who employ

financial statements widely

involve stockholders,

suppliers , lenders, creditors,

clients, public, authorities,

account receivables and

many others.

Question 4. Description of the fundamental principles of accounting

critical bookkeeping standards implies to rules that restrict and restrict business

associations whilst also producing budget reports and outlining money-related details. There’re

many different basic standards under the supervision of the business organization.

Such standards depend on measures set out in 'mostly recognized accounting gauges' as well

as 'worldwide budgetary disclosure principles.' A part of the key accounting standards involves:

Money related unit supposition: This rule states that certain budgetary exchanges that

also have taken place in a business organization should be recorded using a comparable fiscal

segment in order to ensure that understanding as well as coherence can be maintained.

Monetary substance presumption:pertaining to such a rule, a business entity must

haveits own specific identity and the initials under that it could even work together here. The

12

because it will offer all information

regarding the organization. In addition, such

reports have also been used by

mangersin developments of financialstrateg

y that enables them to make a huge

proportion of the profits including a

decrease in sum of expenditure.

determination of financial

growth, the status, the

accessibility of cash funds

and market situation of the

firm. In addition, such

reports are often used by

outer investors when it

comes to decision-making on

financing in the organization

or not.

Users The varying no. of users commonly used in

such reports includes business management

teams, members of board and other users of

company's financial statements, as they are

also portion of entity's financial reports.

Users those who employ

financial statements widely

involve stockholders,

suppliers , lenders, creditors,

clients, public, authorities,

account receivables and

many others.

Question 4. Description of the fundamental principles of accounting

critical bookkeeping standards implies to rules that restrict and restrict business

associations whilst also producing budget reports and outlining money-related details. There’re

many different basic standards under the supervision of the business organization.

Such standards depend on measures set out in 'mostly recognized accounting gauges' as well

as 'worldwide budgetary disclosure principles.' A part of the key accounting standards involves:

Money related unit supposition: This rule states that certain budgetary exchanges that

also have taken place in a business organization should be recorded using a comparable fiscal

segment in order to ensure that understanding as well as coherence can be maintained.

Monetary substance presumption:pertaining to such a rule, a business entity must

haveits own specific identity and the initials under that it could even work together here. The

12

You're viewing a preview

Unlock full access by subscribing today!

essential element of business association should not be exactly same as that of its owner (Lento,

2016).

Full Honesty Policy: This financial regulation is a policy of the entire company entity that

specifies that all financial transactions must be reported in the fiscal accounts of the group such

that a fair and rational decision may be taken on the organization's operation and status in

relation to revenue.

Going concern specification: As per this framework, a business group must in the certain

case continue to survive on the circumstance of the downfall of the shop owner. However if a

corporate group were decomposed, it's assumed there was in the meanwhile (Muda, 2016).

Materiality framework: This norm notes that sole money dependent trade should be

reported in the company content financial statements so these transactions must be documented

as they arise such that the organization collects or charges a financial interest.

Income identification standard: The organization should only recognize or report the

value when it is received not when the organization earns money.

Coordinating standard: Under this regulation that as a guideline refers to company

groups the sum of the tax returns' costs and credit aspects should be equal or organized. Costs

incurred by a company will be organized separately with the revenue generated by that

relationship (Mullinova, 2016).

Norm of Conservatism: It is among the most fundamental law for business group

and obviously, official business unions must be reasonable but for the most notably awful should

be formed. As suggested by this method, the predicted financial position in the agreement must

be reported regularly in the agreement once it is actually collected and the usual cash outflow

should be documented while the influx is unpredictable. This law deals with future-money

disasters in an organization.

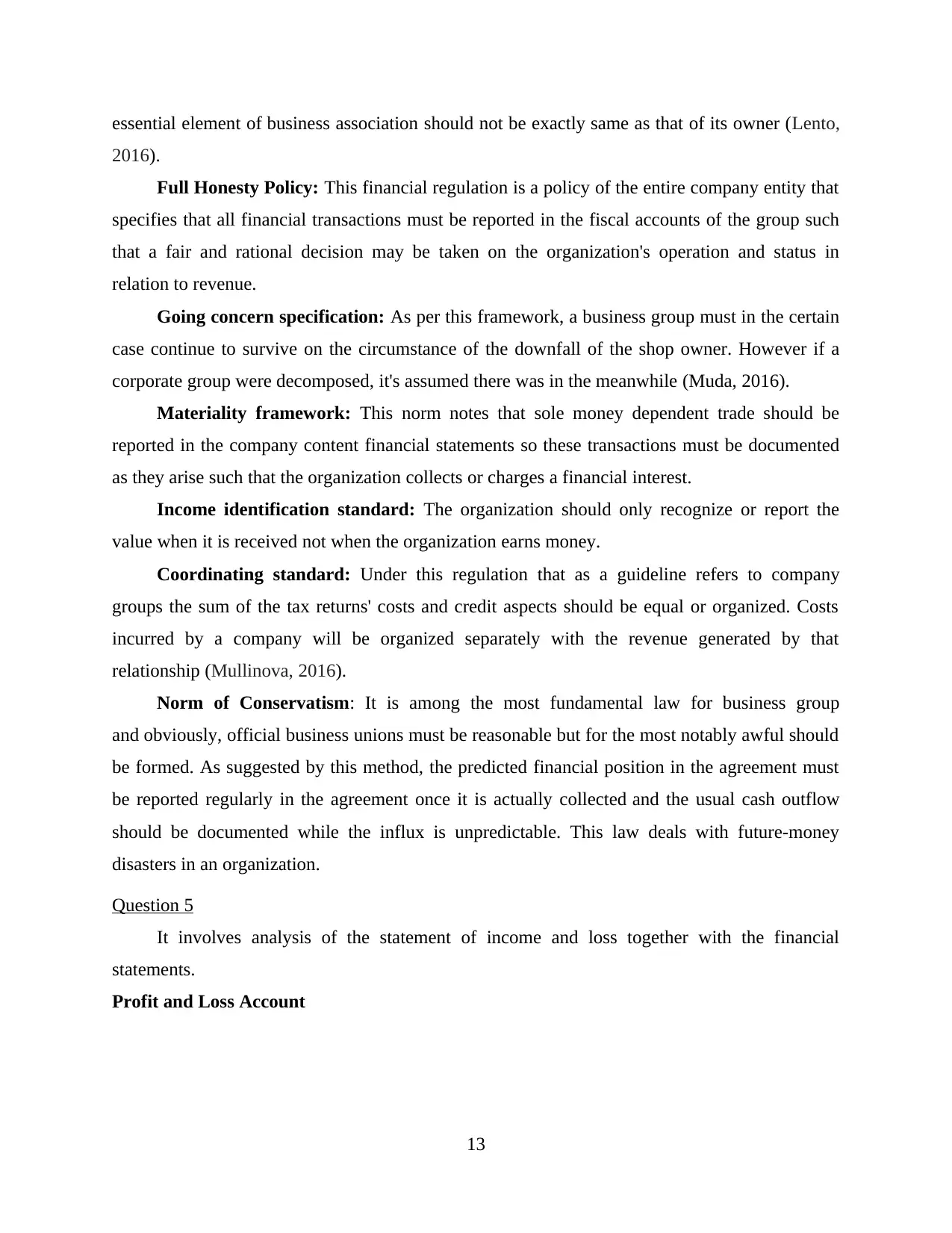

Question 5

It involves analysis of the statement of income and loss together with the financial

statements.

Profit and Loss Account

13

2016).

Full Honesty Policy: This financial regulation is a policy of the entire company entity that

specifies that all financial transactions must be reported in the fiscal accounts of the group such

that a fair and rational decision may be taken on the organization's operation and status in

relation to revenue.

Going concern specification: As per this framework, a business group must in the certain

case continue to survive on the circumstance of the downfall of the shop owner. However if a

corporate group were decomposed, it's assumed there was in the meanwhile (Muda, 2016).

Materiality framework: This norm notes that sole money dependent trade should be

reported in the company content financial statements so these transactions must be documented

as they arise such that the organization collects or charges a financial interest.

Income identification standard: The organization should only recognize or report the

value when it is received not when the organization earns money.

Coordinating standard: Under this regulation that as a guideline refers to company

groups the sum of the tax returns' costs and credit aspects should be equal or organized. Costs

incurred by a company will be organized separately with the revenue generated by that

relationship (Mullinova, 2016).

Norm of Conservatism: It is among the most fundamental law for business group

and obviously, official business unions must be reasonable but for the most notably awful should

be formed. As suggested by this method, the predicted financial position in the agreement must

be reported regularly in the agreement once it is actually collected and the usual cash outflow

should be documented while the influx is unpredictable. This law deals with future-money

disasters in an organization.

Question 5

It involves analysis of the statement of income and loss together with the financial

statements.

Profit and Loss Account

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

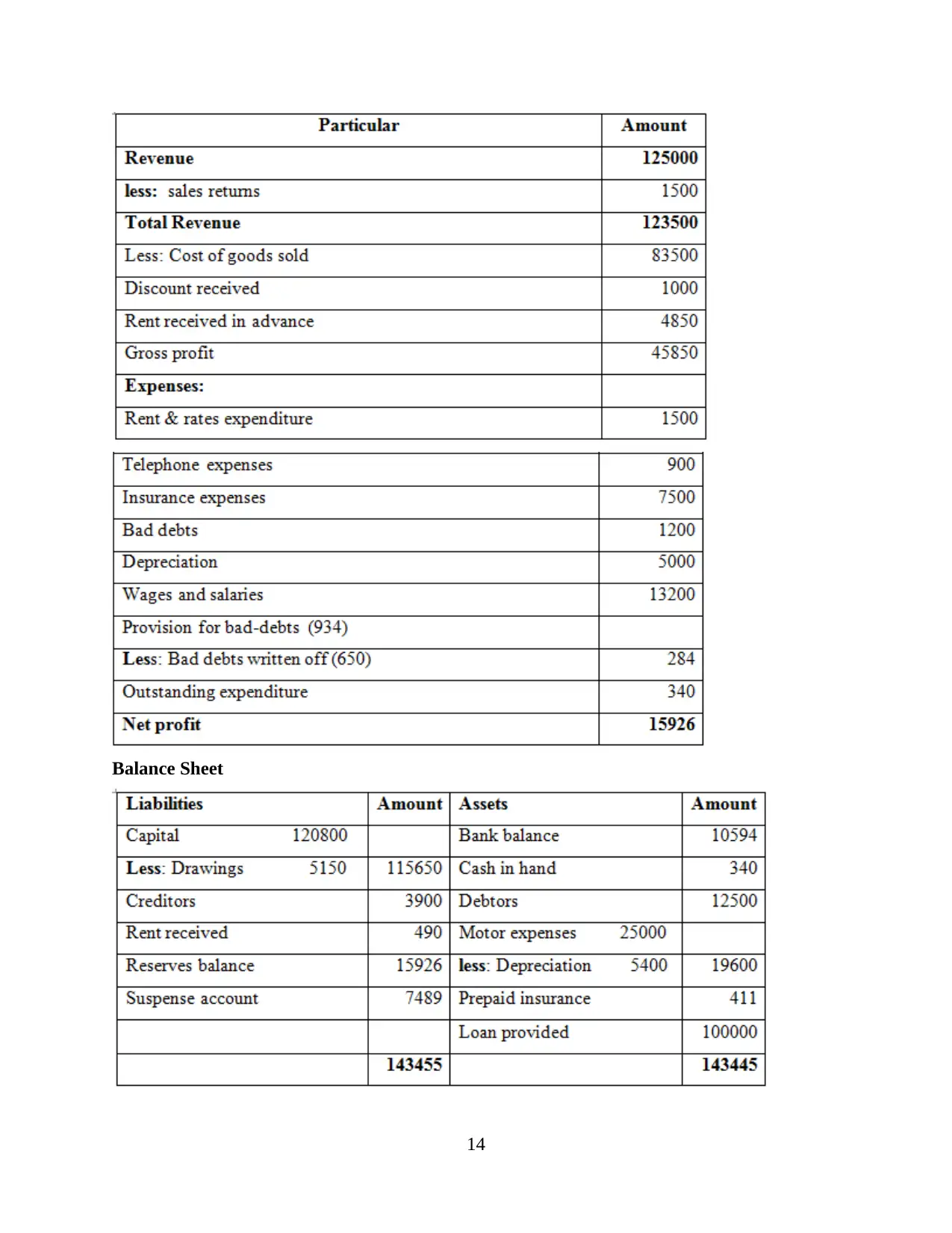

Balance Sheet

14

14

SCENARIO 2

Question 1. Description about bank reconciliation

Bank reconciliation is the process that offers the company with an ability to align its

financial documents with the amount of evidence obtained by a bank statement. That involves

matching the two accounts with an individual's cash account and financial balance issued by the

government of the same entity that represents both purchases.

This is critical when undertaking from an organization's side because it will help to assess the

discrepancy here between two accounts respectively. It provides the company anda chance to

identify the mistakes and make adjustments in all textbooks and calculate the number.

All the details contained in the financial statement is issued by the financial and involves

tracking any expenses and specifically impact an organization's bank account. There are several

explanations why the correlation between two accounts did not fit as well as the need to conduct

the reconcile bank experiment in addition to having the gap. The key and typical factors behind

the Bank reconciliation structure involve unpaid verification, NSF, and transition transaction. It

is because whenever the sum credited in the wallet is not reflected immediately in the general

ledger as it takes years and it's the explanation that the amount is variable within two books

(Narayanaswamy, 2017).

There are several other explanations why planning BRS, i.e. unpaid cheque, is important.

In this scenario, on obtaining the transaction in cheque, the candidate makes the credit entry

before dumping as well in the register. That is the explanation that because of the disparity all

books produce and ought to use the BRS approach to decide where mistake occurs and what has

to be stated in quantities for corrections. From the other side, the explanation for the difference in

sum is also NFS which stands for insufficient number. There have been some cases in which the

reimbursement is received in money order and the same is deposited in consideration but dis

honoured and the proportion is not deposited in payment if another person does not have enough

balance in consideration. In this scenario, the recipient party is making a bank statement entry,

but there is no down payment in the bank. That's the explanation why it is noticeable varying in

the sum of both books. The same goes for rectification with the help of BRS (No, 2018).

So planning BRS is relevant from the perspective of eliminating any difference in the

volume of both books together with ensuring the proper documents that do not reflect the

15

Question 1. Description about bank reconciliation

Bank reconciliation is the process that offers the company with an ability to align its

financial documents with the amount of evidence obtained by a bank statement. That involves

matching the two accounts with an individual's cash account and financial balance issued by the

government of the same entity that represents both purchases.

This is critical when undertaking from an organization's side because it will help to assess the

discrepancy here between two accounts respectively. It provides the company anda chance to

identify the mistakes and make adjustments in all textbooks and calculate the number.

All the details contained in the financial statement is issued by the financial and involves

tracking any expenses and specifically impact an organization's bank account. There are several

explanations why the correlation between two accounts did not fit as well as the need to conduct

the reconcile bank experiment in addition to having the gap. The key and typical factors behind

the Bank reconciliation structure involve unpaid verification, NSF, and transition transaction. It

is because whenever the sum credited in the wallet is not reflected immediately in the general

ledger as it takes years and it's the explanation that the amount is variable within two books

(Narayanaswamy, 2017).

There are several other explanations why planning BRS, i.e. unpaid cheque, is important.

In this scenario, on obtaining the transaction in cheque, the candidate makes the credit entry

before dumping as well in the register. That is the explanation that because of the disparity all

books produce and ought to use the BRS approach to decide where mistake occurs and what has

to be stated in quantities for corrections. From the other side, the explanation for the difference in

sum is also NFS which stands for insufficient number. There have been some cases in which the

reimbursement is received in money order and the same is deposited in consideration but dis

honoured and the proportion is not deposited in payment if another person does not have enough

balance in consideration. In this scenario, the recipient party is making a bank statement entry,

but there is no down payment in the bank. That's the explanation why it is noticeable varying in

the sum of both books. The same goes for rectification with the help of BRS (No, 2018).

So planning BRS is relevant from the perspective of eliminating any difference in the

volume of both books together with ensuring the proper documents that do not reflect the

15

You're viewing a preview

Unlock full access by subscribing today!

mistake in any way. It also allows an organization's management to make the right choices from

which they can most efficiently execute corporate tasks in the future.

Question 2. Description about control accounts

Control account is a database linked to money that is generated to be held for general

record. This report analyses the specific interventions of secondary documents and provide a

condensed view on accounts that include a large number of transactions. Money owed and

borrower obligations would be the most commonly known documents on which changes are

made across management systems. All of such documents are repositories with a large number of

transactions for the most part, so it is important to review them using a monitoring account while

attempting to analyse everything. In comparison to reporting in general accounts, the

equalizations of these documents are reported in an additional level report account according to

the money-related financial reporting method.

Such funds collectively play a significant role in an entity of financial accounting. Here are

the some aspects which aid in the same;

The key function of the financial reporting monitoring system is to hold the accounting

records away from the facts so that it would not be difficult to interpret the statistics in

the future.

Control account does have the function of having the appropriate balance number from

which successful financial reports can be produced from where the financial reporting

component can be attained.

The monitor aims to include condensed details as well as thorough information in the

subordinate accounts of where necessary to grasp all the data with little misunderstanding

and can be better utilized for internal audit and expense account creation purposes.

Question 3

Suspense account:

A suspense account is a record that is used intermittently or at any time to issue suspicious

sections and inconsistencies pending their unverified review and resolution. It could very well be

a source of financial exchanges recorded with invalid numbers. The indicated record may not

exist or may be deleted / confirmed.

16

which they can most efficiently execute corporate tasks in the future.

Question 2. Description about control accounts

Control account is a database linked to money that is generated to be held for general

record. This report analyses the specific interventions of secondary documents and provide a

condensed view on accounts that include a large number of transactions. Money owed and

borrower obligations would be the most commonly known documents on which changes are

made across management systems. All of such documents are repositories with a large number of

transactions for the most part, so it is important to review them using a monitoring account while

attempting to analyse everything. In comparison to reporting in general accounts, the

equalizations of these documents are reported in an additional level report account according to

the money-related financial reporting method.

Such funds collectively play a significant role in an entity of financial accounting. Here are

the some aspects which aid in the same;

The key function of the financial reporting monitoring system is to hold the accounting

records away from the facts so that it would not be difficult to interpret the statistics in

the future.

Control account does have the function of having the appropriate balance number from

which successful financial reports can be produced from where the financial reporting

component can be attained.

The monitor aims to include condensed details as well as thorough information in the

subordinate accounts of where necessary to grasp all the data with little misunderstanding

and can be better utilized for internal audit and expense account creation purposes.

Question 3

Suspense account:

A suspense account is a record that is used intermittently or at any time to issue suspicious

sections and inconsistencies pending their unverified review and resolution. It could very well be

a source of financial exchanges recorded with invalid numbers. The indicated record may not

exist or may be deleted / confirmed.

16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

A suspension account contains sections that contain vulnerabilities or errors. For example,

if a person in the store inadvertently registers a registration number incorrectly, the money is

kept in a leave account until the error is resolved. In another case, a customer can issue an

indemnity, however neglecting to determine which receipt he intends to pay with these funds.

Despite the mentioned vulnerabilities, dilution records are obtained once the disturbance is

resolved, at which point the funds are immediately reconciled with the deferred records assign

them correctly. At the time, the record should reach an alleged equivalent of zero dollars.

Although there are no authoritative records for the management of the discovery method, several

organizations try to achieve this goal usually month by month or quarterly.

Home loan Suspense Accounts

A home loan servicer can use the advance schedules to back up when a lender loses its mark on a

month-to-month credit repayment, where the strain registers capacity as a vessel insuring the

assets. Currently, a home loan manager can choose to distribute the fractional amount received in

several warehouses, including the principal amount due, the collections collected, the instalments

the cost of property and mortgage custodian protection programs.

From time to time, a borrower deliberately makes fractional instalments, separating the

regularly recorded portion into two pieces. In such cases, contract producers can use the voltage

tables to host the main input in half until the next input is switched off. After taking appropriate

actions to make a full contribution, the home loan manager then adds the consolidated equity to

the correct schedule.

Financier Suspense Accounts

Like corporate dilution records, treasurer accounts hold stores while exchanges are complete. For

example, if a financial specialist sells a collection of securities worth $ 500, but intends to

quickly put that amount into cash in another profit agreement, the deal's $ 500 would be

transferred to a tightening table so that it is likely to be assigned to the new purchase.

Reasons for drafting suspense accounts:

17

if a person in the store inadvertently registers a registration number incorrectly, the money is

kept in a leave account until the error is resolved. In another case, a customer can issue an

indemnity, however neglecting to determine which receipt he intends to pay with these funds.

Despite the mentioned vulnerabilities, dilution records are obtained once the disturbance is

resolved, at which point the funds are immediately reconciled with the deferred records assign

them correctly. At the time, the record should reach an alleged equivalent of zero dollars.

Although there are no authoritative records for the management of the discovery method, several

organizations try to achieve this goal usually month by month or quarterly.

Home loan Suspense Accounts

A home loan servicer can use the advance schedules to back up when a lender loses its mark on a

month-to-month credit repayment, where the strain registers capacity as a vessel insuring the

assets. Currently, a home loan manager can choose to distribute the fractional amount received in

several warehouses, including the principal amount due, the collections collected, the instalments

the cost of property and mortgage custodian protection programs.

From time to time, a borrower deliberately makes fractional instalments, separating the

regularly recorded portion into two pieces. In such cases, contract producers can use the voltage

tables to host the main input in half until the next input is switched off. After taking appropriate

actions to make a full contribution, the home loan manager then adds the consolidated equity to

the correct schedule.

Financier Suspense Accounts

Like corporate dilution records, treasurer accounts hold stores while exchanges are complete. For

example, if a financial specialist sells a collection of securities worth $ 500, but intends to

quickly put that amount into cash in another profit agreement, the deal's $ 500 would be

transferred to a tightening table so that it is likely to be assigned to the new purchase.

Reasons for drafting suspense accounts:

17

Suspense account is a temporary account which is maintained for transactions for which debit or

credit side is not found instantly. Later when proper debit or credit is found suspense account is

closed to that account.

The use of a suspense account permits time to explore the idea of an exchange while as yet

recording it on the organization's books. Run of the mill utilizes include:

Instalments got with invalid record data, muddled data concerning which receipt

instalments ought to be applied, or different issues that forestall their typical posting

In-travel exchanges where cash has been moved to a provider bank however not yet kept

into a record, or where cash is gotten before a strategy or agreement is composed

Booking of exchanges before a designation is made to the suitable expense or benefit

focuses

Sums subject to lawful question

Suspense accounts permit exchanges to be posted before there is adequate data accessible to

make a section to the right record or records. Without posting such exchanges, there might be

exchanges that are not recorded before the finish of an announcing period, bringing about

incorrect money related outcomes.

Notwithstanding, recall that things in a tension record speak to unallocated sums. Thus,

having a tension record introduced on the fiscal summaries with an equalization is for the most

part seen contrarily and can debilitate the announcement to outside financial specialists. In this

way, exertion ought to be made to clear anticipation accounts toward the finish of each monetary

period.

Suspense accounts are cleared by checking on every individual exchange in the record. The

target for checking on things is to move the exchange to the fitting record at the earliest

opportunity.

Exchanges will be increasingly hard to clear over the long haul, particularly if there is

negligible documentation with regards to why the exchange was at first positioned in the record.

Hence, the time of things ought to be followed and limited.

Suspense accounts are likewise viewed as a control hazard. As a prerequisite under

Sarbanes-Oxley (SOX), these records must be dissected by kind of item, maturing class, and

18

credit side is not found instantly. Later when proper debit or credit is found suspense account is

closed to that account.

The use of a suspense account permits time to explore the idea of an exchange while as yet

recording it on the organization's books. Run of the mill utilizes include:

Instalments got with invalid record data, muddled data concerning which receipt

instalments ought to be applied, or different issues that forestall their typical posting

In-travel exchanges where cash has been moved to a provider bank however not yet kept

into a record, or where cash is gotten before a strategy or agreement is composed

Booking of exchanges before a designation is made to the suitable expense or benefit

focuses

Sums subject to lawful question

Suspense accounts permit exchanges to be posted before there is adequate data accessible to

make a section to the right record or records. Without posting such exchanges, there might be

exchanges that are not recorded before the finish of an announcing period, bringing about

incorrect money related outcomes.

Notwithstanding, recall that things in a tension record speak to unallocated sums. Thus,

having a tension record introduced on the fiscal summaries with an equalization is for the most

part seen contrarily and can debilitate the announcement to outside financial specialists. In this

way, exertion ought to be made to clear anticipation accounts toward the finish of each monetary

period.

Suspense accounts are cleared by checking on every individual exchange in the record. The

target for checking on things is to move the exchange to the fitting record at the earliest

opportunity.

Exchanges will be increasingly hard to clear over the long haul, particularly if there is

negligible documentation with regards to why the exchange was at first positioned in the record.

Hence, the time of things ought to be followed and limited.

Suspense accounts are likewise viewed as a control hazard. As a prerequisite under

Sarbanes-Oxley (SOX), these records must be dissected by kind of item, maturing class, and

18

You're viewing a preview

Unlock full access by subscribing today!

business defence so as to comprehend what is still in the record. This data should be given to

reviewers intermittently too.

The reason for the suspense account preparation is to keep trades without random division.

Open a tension table when you need to use one. Close the table after moving the section to the

right eternal record.

For the diary measures of the dilution table, open an expectation account in your general

record. Apply whatever you are referring to. The arrangement of the portions of the debenture

records shall be a credit or commission. Also, enter a similar amount with opposite section in

another table.

When you get the data you need, change your account area in advance and make a step in

perpetual registration. This completes the compression table and displays the exchange on the

correct table.

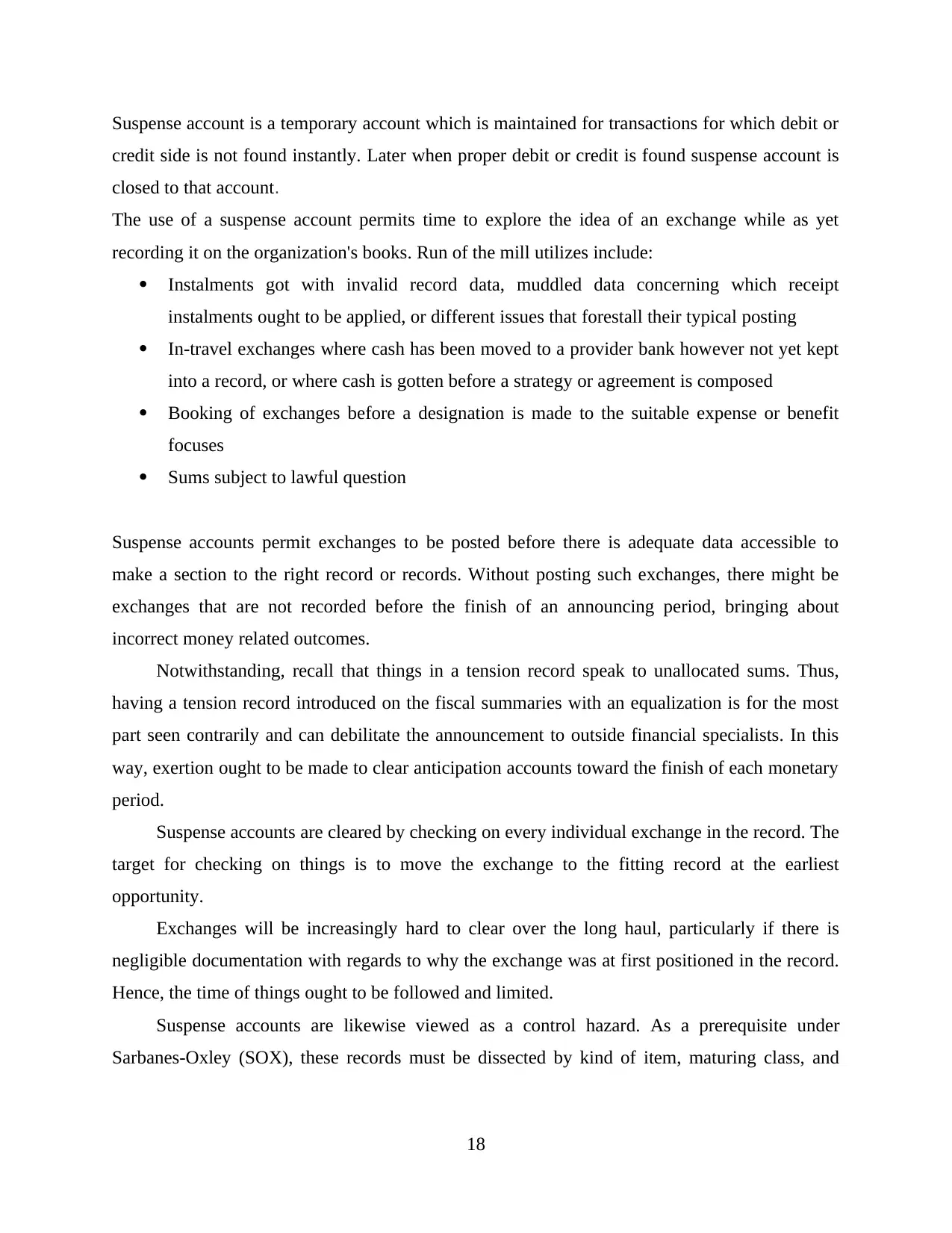

Question 4

Updated bank reconciliation and cash book as on 28th February 2010

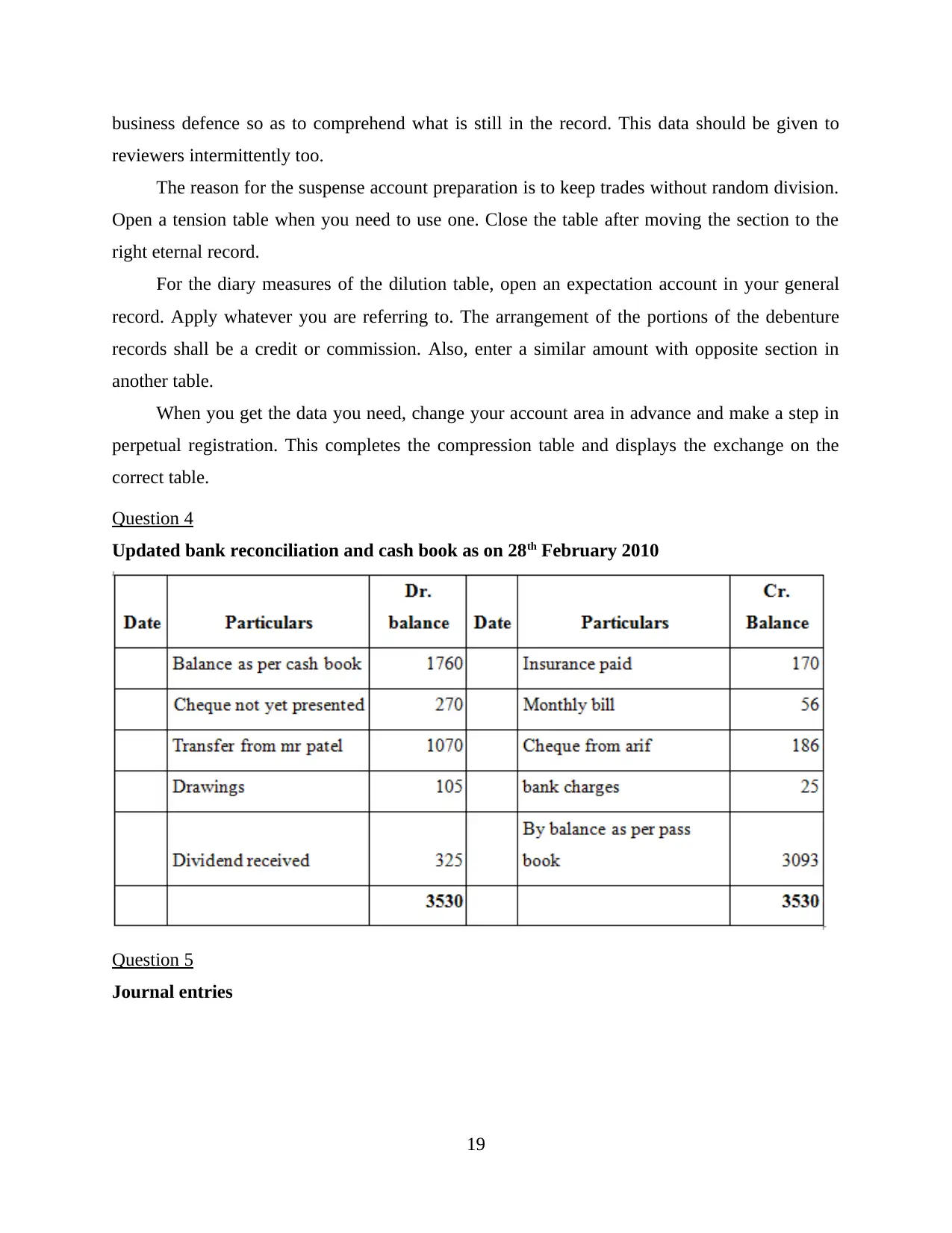

Question 5

Journal entries

19

reviewers intermittently too.

The reason for the suspense account preparation is to keep trades without random division.

Open a tension table when you need to use one. Close the table after moving the section to the

right eternal record.

For the diary measures of the dilution table, open an expectation account in your general

record. Apply whatever you are referring to. The arrangement of the portions of the debenture

records shall be a credit or commission. Also, enter a similar amount with opposite section in

another table.

When you get the data you need, change your account area in advance and make a step in

perpetual registration. This completes the compression table and displays the exchange on the

correct table.

Question 4

Updated bank reconciliation and cash book as on 28th February 2010

Question 5

Journal entries

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Suspense account

20

20

REFERENCES

Books and Journals

Al-Sulaiti, J., Ousama, A. A. and Hamammi, H., 2018.The compliance of disclosure with

AAOIFI financial accounting standards. Journal of Islamic Accounting and Business

Research.

Biddle, G. C., Ma, M. L. and Song, F. M., 2020.Accounting conservatism and bankruptcy

risk. Journal of Accounting, Auditing and Finance, Forthcoming.

Dutta, S. and Patatoukas, P. N., 2017.Identifying conditional conservatism in financial

accounting data: theory and evidence. The Accounting Review. 92(4).pp.191-216.

Garbowski, M. and et al., 2019.Financial accounting of E-business enterprises. Academy of

Accounting and Financial Studies Journal. 23. pp.1-5.

Kimmel, P. D., Weygandt, J. J. and Kieso, D. E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

Lento, C., 2016.Promoting active learning in introductory financial accounting through the

flipped classroom design. Journal of Applied Research in Higher Education.

Muda, I., 2016. The Skills and Understangding of Rural Enterprise Management of the

Preparation of Financial Statements Using Financial Accounting Standards (IFRS)

Finacial Statement on the Entities Without Public Accountability (ETAP) Framework on

the Implementation of Village Administration Law.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments: recognition

and assessment" for bank financial accounting. Modern European Researches, (1), pp.60-

64.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning Pvt.

Ltd.

No, A. S., 2018. Conceptual framework for financial reporting. Norwalk, CT: FASB.

Robson, K., Young, J. and Power, M., 2017. Themed section on financial accounting as social

and organizational practice: exploring the work of financial reporting. Accounting,

Organizations and Society. 56. pp.35-37.

Schroeder, R. G., Clark, M. W. and Cathey, J. M., 2019. Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Suryanto, T. and Ridwansyah, R., 2016. The Shariah financial accounting standards: How they

prevent fraud in Islamic Banking.

21

Books and Journals

Al-Sulaiti, J., Ousama, A. A. and Hamammi, H., 2018.The compliance of disclosure with

AAOIFI financial accounting standards. Journal of Islamic Accounting and Business

Research.

Biddle, G. C., Ma, M. L. and Song, F. M., 2020.Accounting conservatism and bankruptcy

risk. Journal of Accounting, Auditing and Finance, Forthcoming.

Dutta, S. and Patatoukas, P. N., 2017.Identifying conditional conservatism in financial

accounting data: theory and evidence. The Accounting Review. 92(4).pp.191-216.

Garbowski, M. and et al., 2019.Financial accounting of E-business enterprises. Academy of

Accounting and Financial Studies Journal. 23. pp.1-5.

Kimmel, P. D., Weygandt, J. J. and Kieso, D. E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

Lento, C., 2016.Promoting active learning in introductory financial accounting through the

flipped classroom design. Journal of Applied Research in Higher Education.

Muda, I., 2016. The Skills and Understangding of Rural Enterprise Management of the

Preparation of Financial Statements Using Financial Accounting Standards (IFRS)

Finacial Statement on the Entities Without Public Accountability (ETAP) Framework on

the Implementation of Village Administration Law.

Mullinova, S., 2016. Use of the principles of IFRS (IAS) 39" Financial instruments: recognition

and assessment" for bank financial accounting. Modern European Researches, (1), pp.60-

64.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning Pvt.

Ltd.

No, A. S., 2018. Conceptual framework for financial reporting. Norwalk, CT: FASB.

Robson, K., Young, J. and Power, M., 2017. Themed section on financial accounting as social

and organizational practice: exploring the work of financial reporting. Accounting,

Organizations and Society. 56. pp.35-37.

Schroeder, R. G., Clark, M. W. and Cathey, J. M., 2019. Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Suryanto, T. and Ridwansyah, R., 2016. The Shariah financial accounting standards: How they

prevent fraud in Islamic Banking.

21

You're viewing a preview

Unlock full access by subscribing today!

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.