Financial Accounting Report: Wentnor Dairy and Woolworths

VerifiedAdded on 2021/05/31

|12

|1748

|49

Report

AI Summary

This comprehensive financial accounting report delves into various aspects of financial analysis. It begins with an examination of Cash Generating Units (CGUs) and impairment testing, using Wentnor Dairy Company Ltd as a case study. The report then provides a detailed ratio analysis of Woolworths, evaluating its financial performance based on balance sheet and income statement data from 2016 and 2017, offering recommendations for investors and discussing key financial ratios like current ratio, acid test ratio, and debt-equity ratio. The report further explores the translation of foreign currency transactions, referencing Qantas's annual report. Finally, it presents cash flow statements for Flash in the Pan Ltd, using both direct and indirect methods, with accompanying notes and references. This report provides a thorough understanding of financial accounting principles and their practical application.

1FINANCIAL ACCOUNTING

Financial accounting

Student Name

University Name

Financial accounting

Student Name

University Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2FINANCIAL ACCOUNTING

Table of Contents

Question 1........................................................................................................................................3

Part A...............................................................................................................................................3

Part B: Reasons for impairment testing...........................................................................................3

Part C: Factors to be considered in determining the CGU’s...........................................................4

Question 2........................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................7

Part C...............................................................................................................................................8

Question 3........................................................................................................................................8

Question 4........................................................................................................................................9

Part A: Cash flow statement (Direct Method) of Flash in the Pan Ltd............................................9

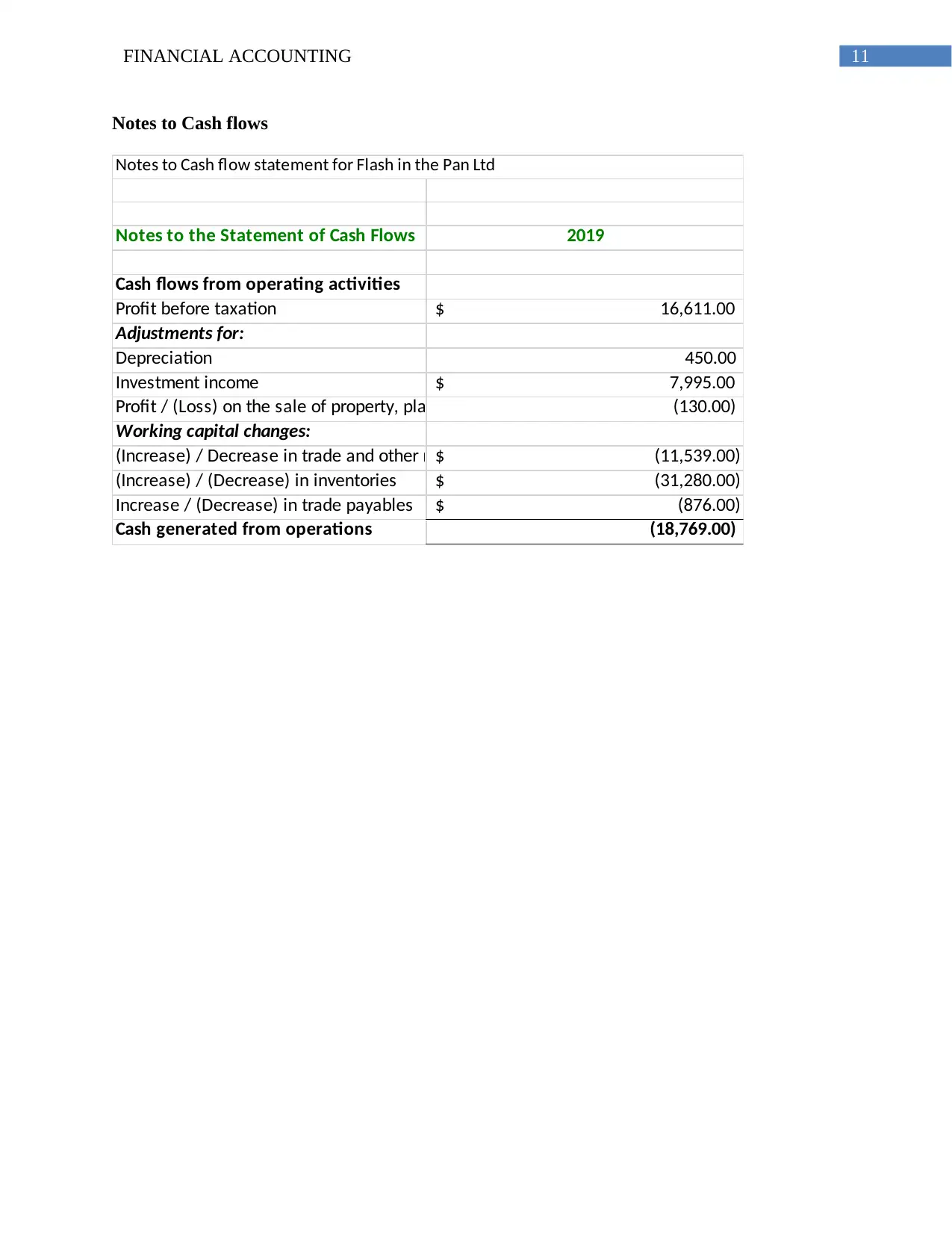

Notes to Cash flows.......................................................................................................................11

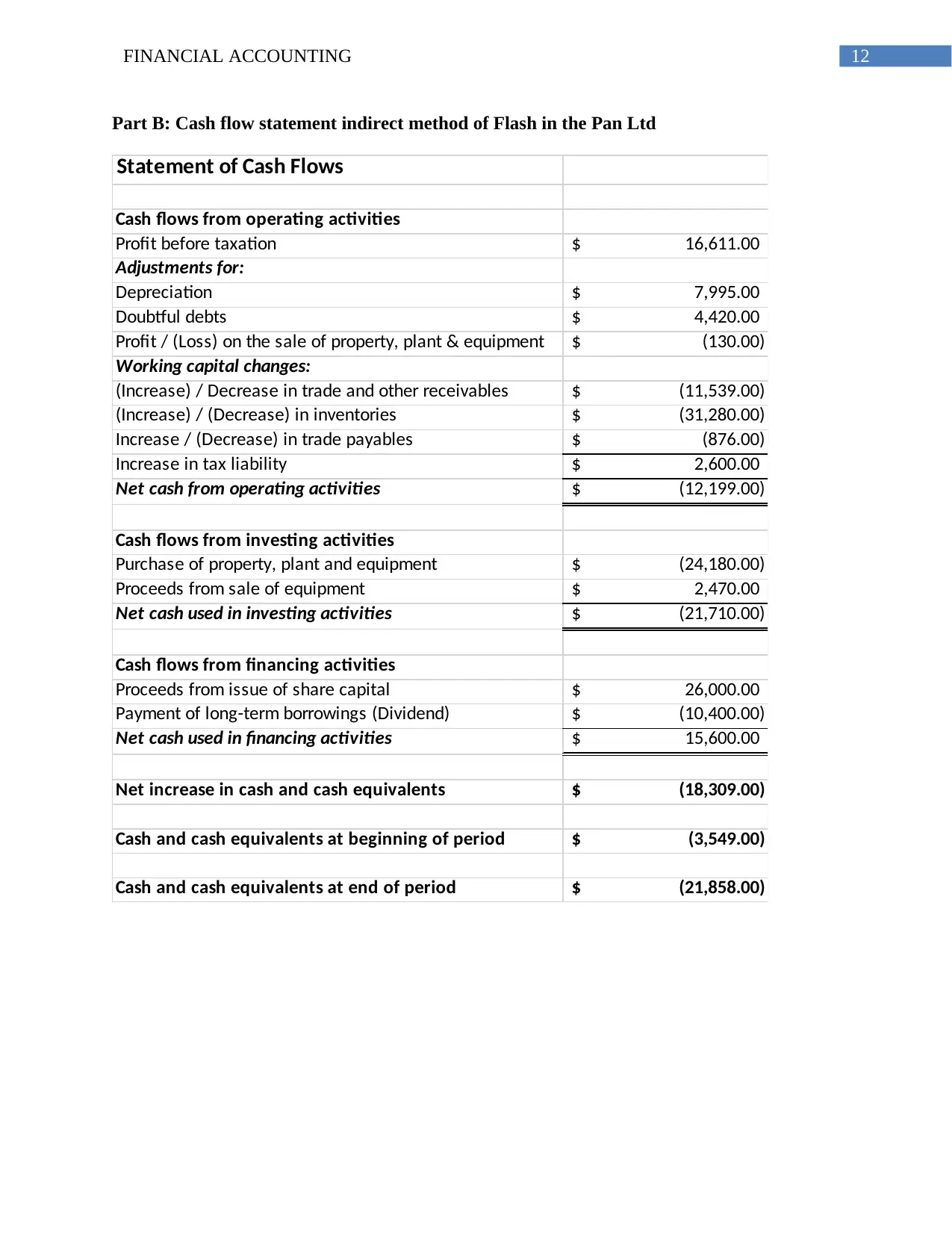

Part B: Cash flow statement indirect method of Flash in the Pan Ltd...........................................12

References......................................................................................................................................13

Table of Contents

Question 1........................................................................................................................................3

Part A...............................................................................................................................................3

Part B: Reasons for impairment testing...........................................................................................3

Part C: Factors to be considered in determining the CGU’s...........................................................4

Question 2........................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................7

Part C...............................................................................................................................................8

Question 3........................................................................................................................................8

Question 4........................................................................................................................................9

Part A: Cash flow statement (Direct Method) of Flash in the Pan Ltd............................................9

Notes to Cash flows.......................................................................................................................11

Part B: Cash flow statement indirect method of Flash in the Pan Ltd...........................................12

References......................................................................................................................................13

3FINANCIAL ACCOUNTING

Question 1

Part A

Cash Generating Unit or CGU can be defined as a smallest group of assets that helps the

organizations in generating cash flows (Hoyle, Schaefer and Doupnik 2015). This are

independent from cash flows generated from other assets. In the given case, the CFO of the firm

Wentnor Dairy Company Ltd is aiming to evaluate the reasons for impairment testing and factors

to be considered in determining the CGU’s.

Part B: Reasons for impairment testing

Impairment testing is done while comparing recoverable amount of an asset with the higher of

the asset’s value in use and fair value less costs of disposal. It also requires future cash flow

estimation in order to derive the asset and price of bearing the inherent risk factor in the asset

(Scott 2015).

In case of some assets, there are no separate cash flows generated independently from other

assets. (Williams 2014). For example, in case of Wentnor Dairy Company Ltd milk machines

could have been used to separate cream from milk and these are not used in generation of

independent cash flows. These machines could be sold separately, with a fair value less cost of

disposal. But, Wentnor Dairy Company Ltd use the machines rather than selling them and the

value in use is greater than the selling price. Due to this reason, impairment testing requires the

use of CGUs, rather than being based on single assets.

Question 1

Part A

Cash Generating Unit or CGU can be defined as a smallest group of assets that helps the

organizations in generating cash flows (Hoyle, Schaefer and Doupnik 2015). This are

independent from cash flows generated from other assets. In the given case, the CFO of the firm

Wentnor Dairy Company Ltd is aiming to evaluate the reasons for impairment testing and factors

to be considered in determining the CGU’s.

Part B: Reasons for impairment testing

Impairment testing is done while comparing recoverable amount of an asset with the higher of

the asset’s value in use and fair value less costs of disposal. It also requires future cash flow

estimation in order to derive the asset and price of bearing the inherent risk factor in the asset

(Scott 2015).

In case of some assets, there are no separate cash flows generated independently from other

assets. (Williams 2014). For example, in case of Wentnor Dairy Company Ltd milk machines

could have been used to separate cream from milk and these are not used in generation of

independent cash flows. These machines could be sold separately, with a fair value less cost of

disposal. But, Wentnor Dairy Company Ltd use the machines rather than selling them and the

value in use is greater than the selling price. Due to this reason, impairment testing requires the

use of CGUs, rather than being based on single assets.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4FINANCIAL ACCOUNTING

Part C: Factors to be considered in determining the CGU’s

As per AASB 136, there are several factors to be considered in case of determination of CGU’s

of The Wentnor Dairy Company Ltd. These are as follows:-

The process through which the organizations operational activities will be monitored

needs to be determined. It may be through product, factory or district. This have been

given in AASB 136.

The management of the firm should make decisions regarding whether to continue with

separate CGU’s or to sale a part of it (Hoyle, Schaefer and Doupnik 2015).

In case of Wentnor Dairy Company Ltd, the milk produced by the company can be used

in separate milk products and milk production section can also be used as separate CGU.

It depends upon the organization whether to choose it separately or together.

These are the factors to be considered by Wentnor Dairy Company Ltd in case of

determination of CGU’s.

Question 2

Part A

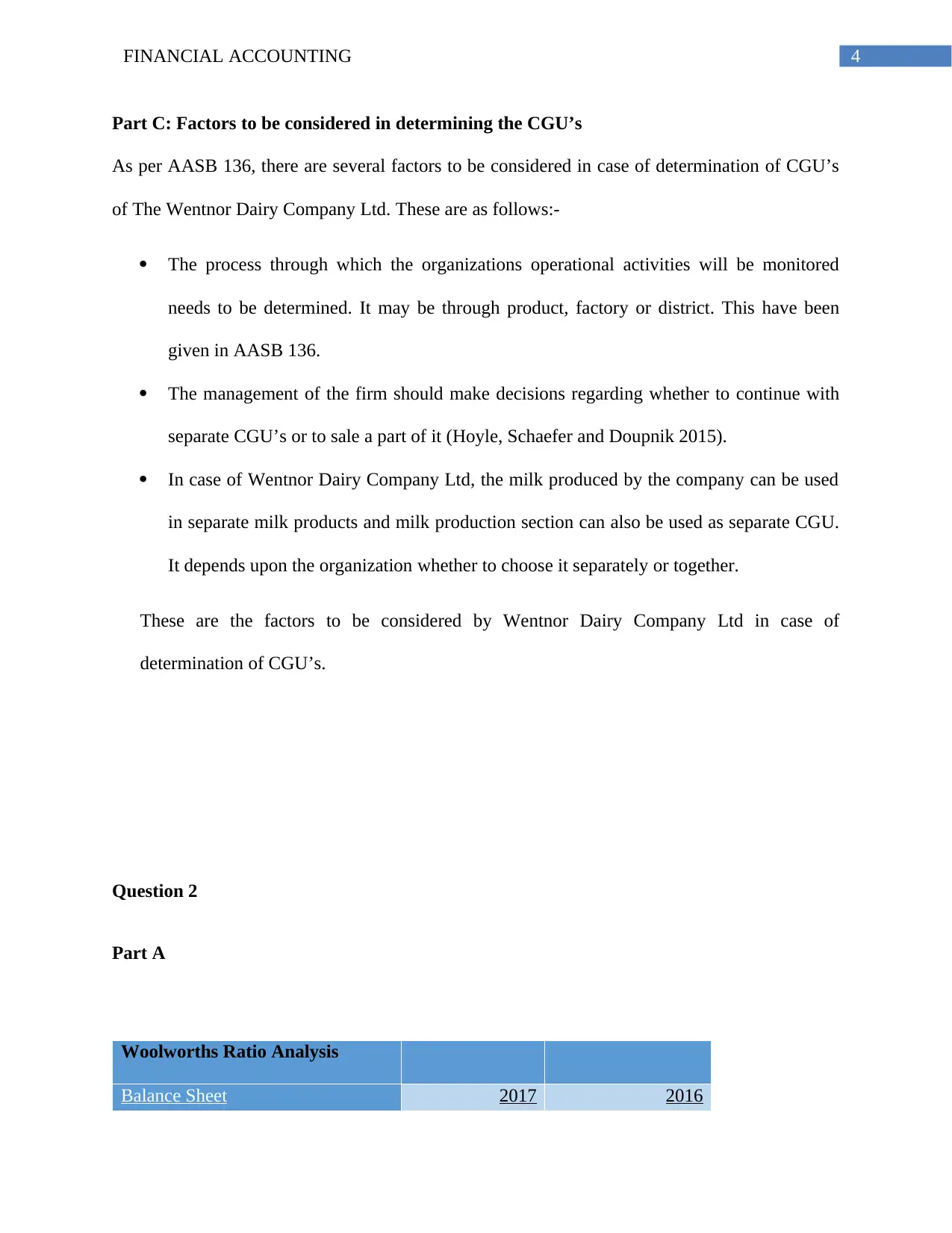

Woolworths Ratio Analysis

Balance Sheet 2017 2016

Part C: Factors to be considered in determining the CGU’s

As per AASB 136, there are several factors to be considered in case of determination of CGU’s

of The Wentnor Dairy Company Ltd. These are as follows:-

The process through which the organizations operational activities will be monitored

needs to be determined. It may be through product, factory or district. This have been

given in AASB 136.

The management of the firm should make decisions regarding whether to continue with

separate CGU’s or to sale a part of it (Hoyle, Schaefer and Doupnik 2015).

In case of Wentnor Dairy Company Ltd, the milk produced by the company can be used

in separate milk products and milk production section can also be used as separate CGU.

It depends upon the organization whether to choose it separately or together.

These are the factors to be considered by Wentnor Dairy Company Ltd in case of

determination of CGU’s.

Question 2

Part A

Woolworths Ratio Analysis

Balance Sheet 2017 2016

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5FINANCIAL ACCOUNTING

Cash $909 $948

Accounts Receivable 744 763

Inventories 4,080 4,558

Other assets 16 56

Total Current Assets 6,994 7,427

Total Assets $22,915 $23,502

=========== ===========

Current Liabilities $8,824 $8,993

Non current Liabilities 4,215 5,727

Common Equity 9,276 8,781

Total Liabilities & Equity $22,315 $23,501

=========== ===========

Income Statement 2001 2000

Sales $55,668 $53,473

Cost of Goods Sold 39,739 38,538

Gross Profit 15,929 14,935

Net Income $1,593 -$2,347

=========== ===========

Common Ratios 2017 2016

Current Ratio 0.793 0.826

Cash $909 $948

Accounts Receivable 744 763

Inventories 4,080 4,558

Other assets 16 56

Total Current Assets 6,994 7,427

Total Assets $22,915 $23,502

=========== ===========

Current Liabilities $8,824 $8,993

Non current Liabilities 4,215 5,727

Common Equity 9,276 8,781

Total Liabilities & Equity $22,315 $23,501

=========== ===========

Income Statement 2001 2000

Sales $55,668 $53,473

Cost of Goods Sold 39,739 38,538

Gross Profit 15,929 14,935

Net Income $1,593 -$2,347

=========== ===========

Common Ratios 2017 2016

Current Ratio 0.793 0.826

6FINANCIAL ACCOUNTING

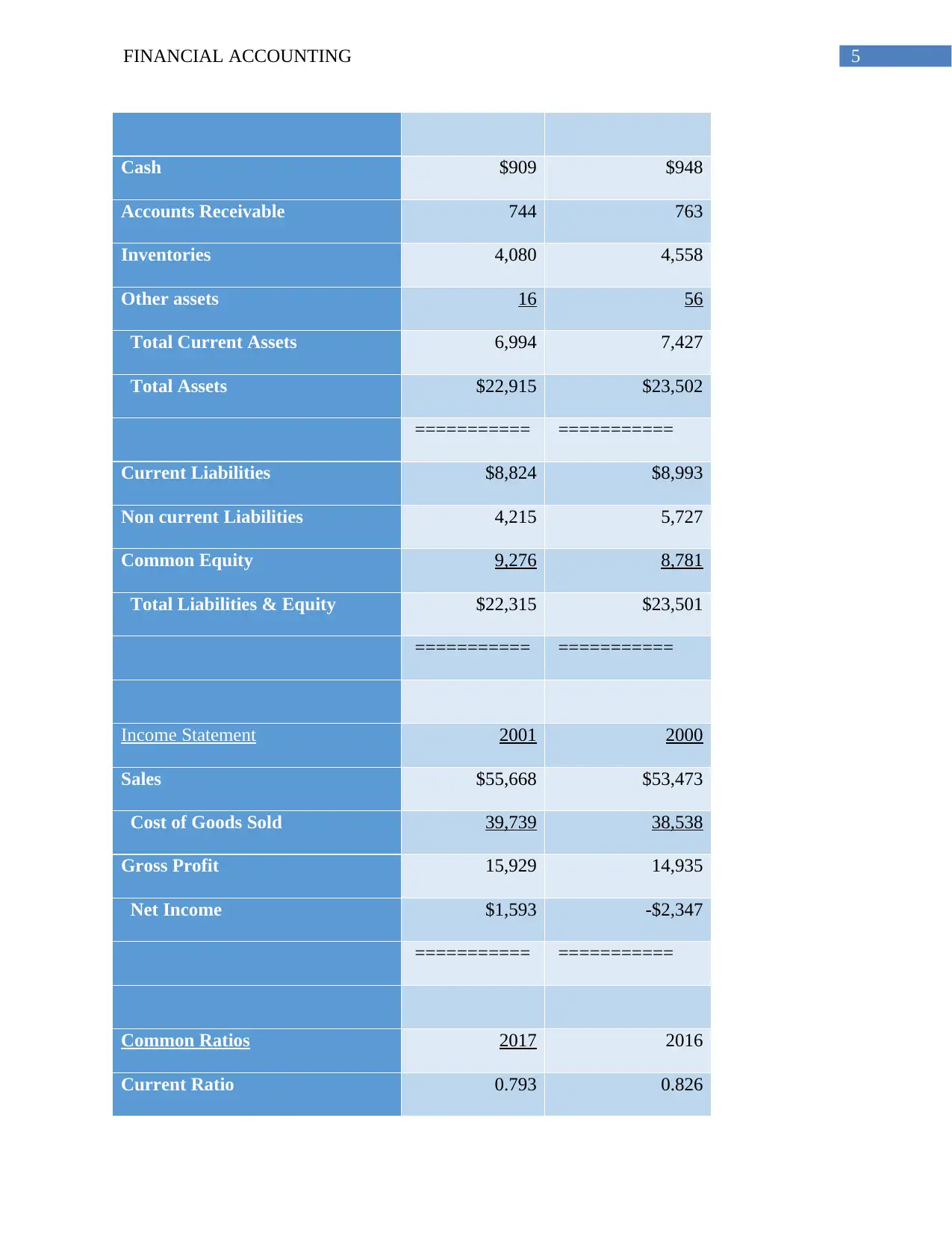

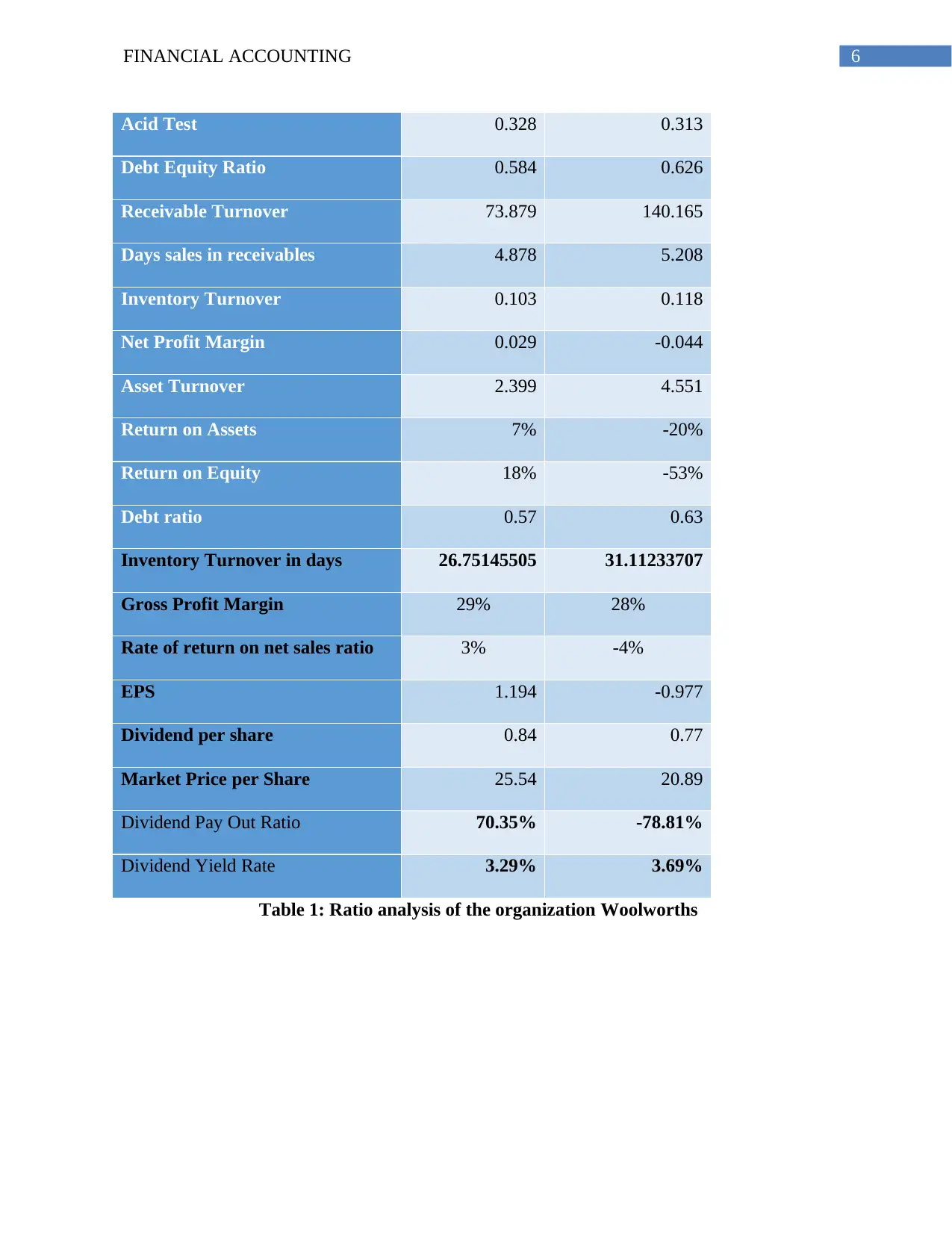

Acid Test 0.328 0.313

Debt Equity Ratio 0.584 0.626

Receivable Turnover 73.879 140.165

Days sales in receivables 4.878 5.208

Inventory Turnover 0.103 0.118

Net Profit Margin 0.029 -0.044

Asset Turnover 2.399 4.551

Return on Assets 7% -20%

Return on Equity 18% -53%

Debt ratio 0.57 0.63

Inventory Turnover in days 26.75145505 31.11233707

Gross Profit Margin 29% 28%

Rate of return on net sales ratio 3% -4%

EPS 1.194 -0.977

Dividend per share 0.84 0.77

Market Price per Share 25.54 20.89

Dividend Pay Out Ratio 70.35% -78.81%

Dividend Yield Rate 3.29% 3.69%

Table 1: Ratio analysis of the organization Woolworths

Acid Test 0.328 0.313

Debt Equity Ratio 0.584 0.626

Receivable Turnover 73.879 140.165

Days sales in receivables 4.878 5.208

Inventory Turnover 0.103 0.118

Net Profit Margin 0.029 -0.044

Asset Turnover 2.399 4.551

Return on Assets 7% -20%

Return on Equity 18% -53%

Debt ratio 0.57 0.63

Inventory Turnover in days 26.75145505 31.11233707

Gross Profit Margin 29% 28%

Rate of return on net sales ratio 3% -4%

EPS 1.194 -0.977

Dividend per share 0.84 0.77

Market Price per Share 25.54 20.89

Dividend Pay Out Ratio 70.35% -78.81%

Dividend Yield Rate 3.29% 3.69%

Table 1: Ratio analysis of the organization Woolworths

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7FINANCIAL ACCOUNTING

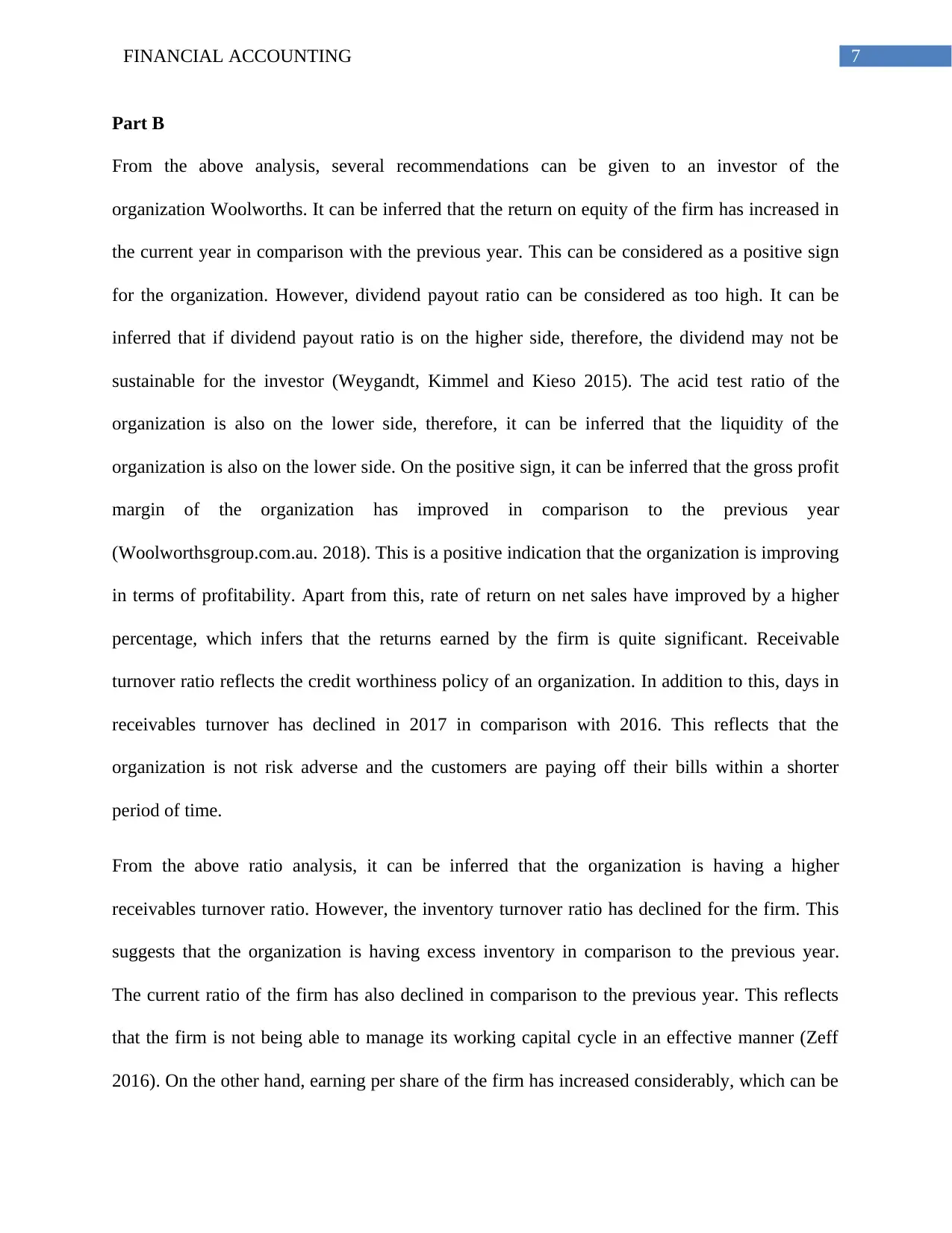

Part B

From the above analysis, several recommendations can be given to an investor of the

organization Woolworths. It can be inferred that the return on equity of the firm has increased in

the current year in comparison with the previous year. This can be considered as a positive sign

for the organization. However, dividend payout ratio can be considered as too high. It can be

inferred that if dividend payout ratio is on the higher side, therefore, the dividend may not be

sustainable for the investor (Weygandt, Kimmel and Kieso 2015). The acid test ratio of the

organization is also on the lower side, therefore, it can be inferred that the liquidity of the

organization is also on the lower side. On the positive sign, it can be inferred that the gross profit

margin of the organization has improved in comparison to the previous year

(Woolworthsgroup.com.au. 2018). This is a positive indication that the organization is improving

in terms of profitability. Apart from this, rate of return on net sales have improved by a higher

percentage, which infers that the returns earned by the firm is quite significant. Receivable

turnover ratio reflects the credit worthiness policy of an organization. In addition to this, days in

receivables turnover has declined in 2017 in comparison with 2016. This reflects that the

organization is not risk adverse and the customers are paying off their bills within a shorter

period of time.

From the above ratio analysis, it can be inferred that the organization is having a higher

receivables turnover ratio. However, the inventory turnover ratio has declined for the firm. This

suggests that the organization is having excess inventory in comparison to the previous year.

The current ratio of the firm has also declined in comparison to the previous year. This reflects

that the firm is not being able to manage its working capital cycle in an effective manner (Zeff

2016). On the other hand, earning per share of the firm has increased considerably, which can be

Part B

From the above analysis, several recommendations can be given to an investor of the

organization Woolworths. It can be inferred that the return on equity of the firm has increased in

the current year in comparison with the previous year. This can be considered as a positive sign

for the organization. However, dividend payout ratio can be considered as too high. It can be

inferred that if dividend payout ratio is on the higher side, therefore, the dividend may not be

sustainable for the investor (Weygandt, Kimmel and Kieso 2015). The acid test ratio of the

organization is also on the lower side, therefore, it can be inferred that the liquidity of the

organization is also on the lower side. On the positive sign, it can be inferred that the gross profit

margin of the organization has improved in comparison to the previous year

(Woolworthsgroup.com.au. 2018). This is a positive indication that the organization is improving

in terms of profitability. Apart from this, rate of return on net sales have improved by a higher

percentage, which infers that the returns earned by the firm is quite significant. Receivable

turnover ratio reflects the credit worthiness policy of an organization. In addition to this, days in

receivables turnover has declined in 2017 in comparison with 2016. This reflects that the

organization is not risk adverse and the customers are paying off their bills within a shorter

period of time.

From the above ratio analysis, it can be inferred that the organization is having a higher

receivables turnover ratio. However, the inventory turnover ratio has declined for the firm. This

suggests that the organization is having excess inventory in comparison to the previous year.

The current ratio of the firm has also declined in comparison to the previous year. This reflects

that the firm is not being able to manage its working capital cycle in an effective manner (Zeff

2016). On the other hand, earning per share of the firm has increased considerably, which can be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8FINANCIAL ACCOUNTING

considered as a positive sign for any investor who is planning to invest in the organization. In

addition to this, it has been seen that the debt equity ratio of the firm is on the lower side. This

reflects the organization is managing its debts effectively. Net profit margin has also increased

and this can be considered as a positive sign for the firm. On the other hand, the asset turnover

ratio has declined, which further reflects that the firm is not utilizing its assets in its revenue in

an effective manner. The return on equity is on the higher side in comparison to the previous

year and this can be considered as a positive sign for an investor. Therefore, by considering all

the factors, it can be inferred that the firm Woolworths is good for investment due to its higher

return on equity, payout and efficiency ratios. However, it may not be considered as sustainable

for an investor in the long run due to its lower liquidity ratio and too higher dividend payout

ratios.

Part C

The ideal Current Ratio for businesses should be 2:1 and the Acid Test between1.5 to 1 (Scott

2015). However, in case of the organization Woolworths the current ratio for 2017 is 0.793 and

acid test ratio is 0.328. This reflects that the organization is not meeting the industry standards.

This is mainly because the organization is failing to manage its working capital cycle in an

effective manner, as they are not able to meet their debt obligations. This can be a cause of

concern for the firm.

Question 3

The given analysis reflects Note ii (p. 91) of the Qantas Annual Report 2017. This note reflects

foreign operations of the organization by translating foreign currency to domestic currency. The

considered as a positive sign for any investor who is planning to invest in the organization. In

addition to this, it has been seen that the debt equity ratio of the firm is on the lower side. This

reflects the organization is managing its debts effectively. Net profit margin has also increased

and this can be considered as a positive sign for the firm. On the other hand, the asset turnover

ratio has declined, which further reflects that the firm is not utilizing its assets in its revenue in

an effective manner. The return on equity is on the higher side in comparison to the previous

year and this can be considered as a positive sign for an investor. Therefore, by considering all

the factors, it can be inferred that the firm Woolworths is good for investment due to its higher

return on equity, payout and efficiency ratios. However, it may not be considered as sustainable

for an investor in the long run due to its lower liquidity ratio and too higher dividend payout

ratios.

Part C

The ideal Current Ratio for businesses should be 2:1 and the Acid Test between1.5 to 1 (Scott

2015). However, in case of the organization Woolworths the current ratio for 2017 is 0.793 and

acid test ratio is 0.328. This reflects that the organization is not meeting the industry standards.

This is mainly because the organization is failing to manage its working capital cycle in an

effective manner, as they are not able to meet their debt obligations. This can be a cause of

concern for the firm.

Question 3

The given analysis reflects Note ii (p. 91) of the Qantas Annual Report 2017. This note reflects

foreign operations of the organization by translating foreign currency to domestic currency. The

9FINANCIAL ACCOUNTING

transactions of assets and liabilities of foreign operations is on the higher side and therefore it is

mandatory for the firm to record its transactions in its annual report (Investor.qantas.com. 2018).

Due to this reason, they want to translate the amount in Australian Dollars along with the given

dates of transactions. The given difference in the amounts of the foreign currency in comparison

to domestic currency will be recorded in comprehensive income statement and any potential

revenues will be transferred to Foreign Currency Translation Reserve.

Question 4

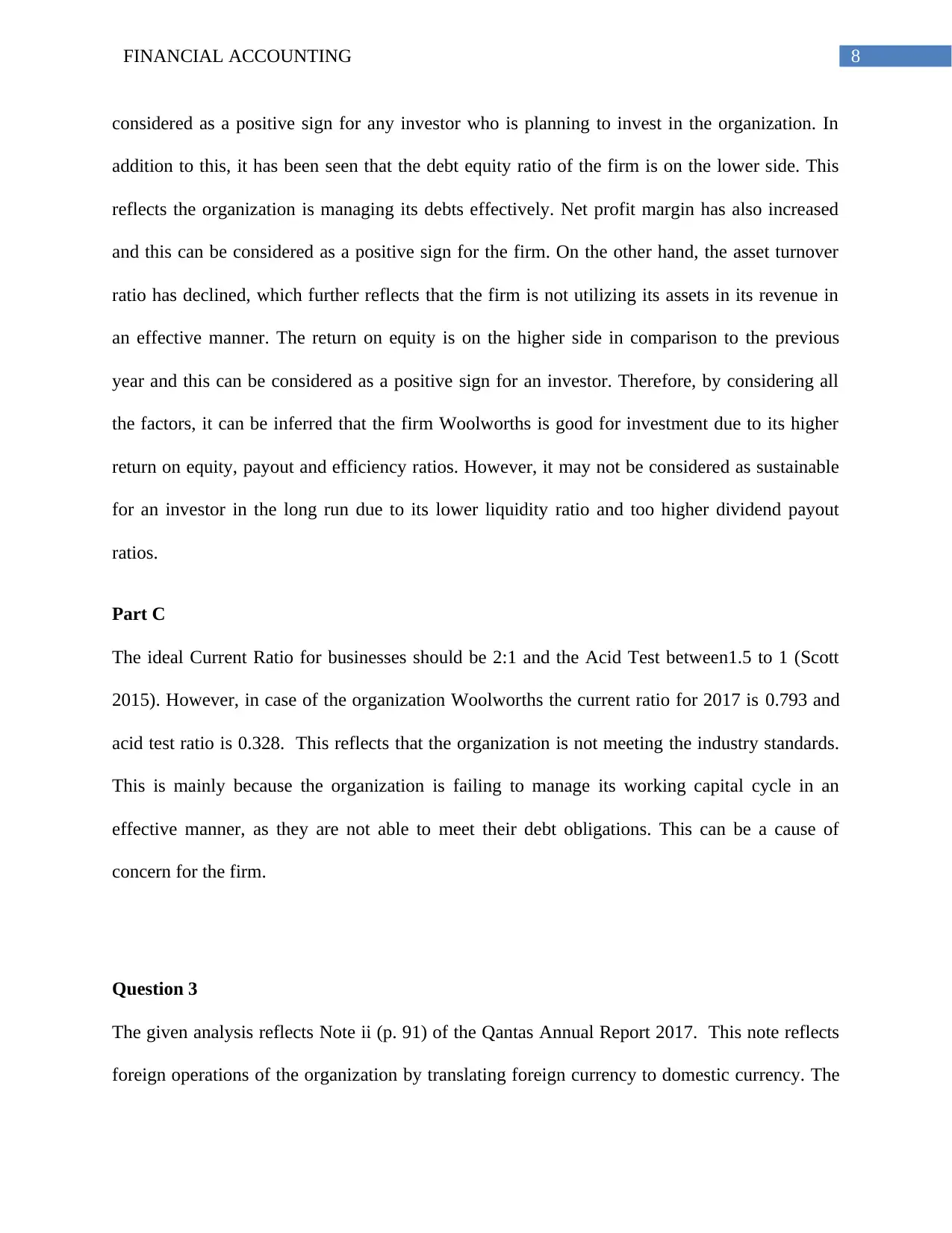

Part A: Cash flow statement (Direct Method) of Flash in the Pan Ltd

Date and starting cash

For the Year Ending

Cash at Beginning of Year -3549

transactions of assets and liabilities of foreign operations is on the higher side and therefore it is

mandatory for the firm to record its transactions in its annual report (Investor.qantas.com. 2018).

Due to this reason, they want to translate the amount in Australian Dollars along with the given

dates of transactions. The given difference in the amounts of the foreign currency in comparison

to domestic currency will be recorded in comprehensive income statement and any potential

revenues will be transferred to Foreign Currency Translation Reserve.

Question 4

Part A: Cash flow statement (Direct Method) of Flash in the Pan Ltd

Date and starting cash

For the Year Ending

Cash at Beginning of Year -3549

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10FINANCIAL ACCOUNTING

Cash Flow Statement

Cashflows from Operations

Cash receipts from customers

Cash collected from customers (debtors) $245,341

Cash paid for

Total Expenses (134,384.00)$

Payment made to suppliers (123,156.00)$

-$

Net Cash Flow from Operations (12,199.00)$

Investing Activities

Cash receipts from

Sale of property and equipment 2,470.00$

Matured Investments -$

Cash paid for

Purchase of property and equipment (24,180.00)$

Purchase of investments -$

Net Cash Flow from Investing Activities (21,710.00)$

Financing Activities

Cash receipts from

Issue of shares 26,000.00$

Cash paid for

Repayment of loans -$

Dividends (10,400.00)$

Net Cash Flow from Financing Activities 15,600.00$

Net Increase in Cash (18,309.00)$

Cash at End of Year (21,858.00)$

Cash Flow Statement

Cashflows from Operations

Cash receipts from customers

Cash collected from customers (debtors) $245,341

Cash paid for

Total Expenses (134,384.00)$

Payment made to suppliers (123,156.00)$

-$

Net Cash Flow from Operations (12,199.00)$

Investing Activities

Cash receipts from

Sale of property and equipment 2,470.00$

Matured Investments -$

Cash paid for

Purchase of property and equipment (24,180.00)$

Purchase of investments -$

Net Cash Flow from Investing Activities (21,710.00)$

Financing Activities

Cash receipts from

Issue of shares 26,000.00$

Cash paid for

Repayment of loans -$

Dividends (10,400.00)$

Net Cash Flow from Financing Activities 15,600.00$

Net Increase in Cash (18,309.00)$

Cash at End of Year (21,858.00)$

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11FINANCIAL ACCOUNTING

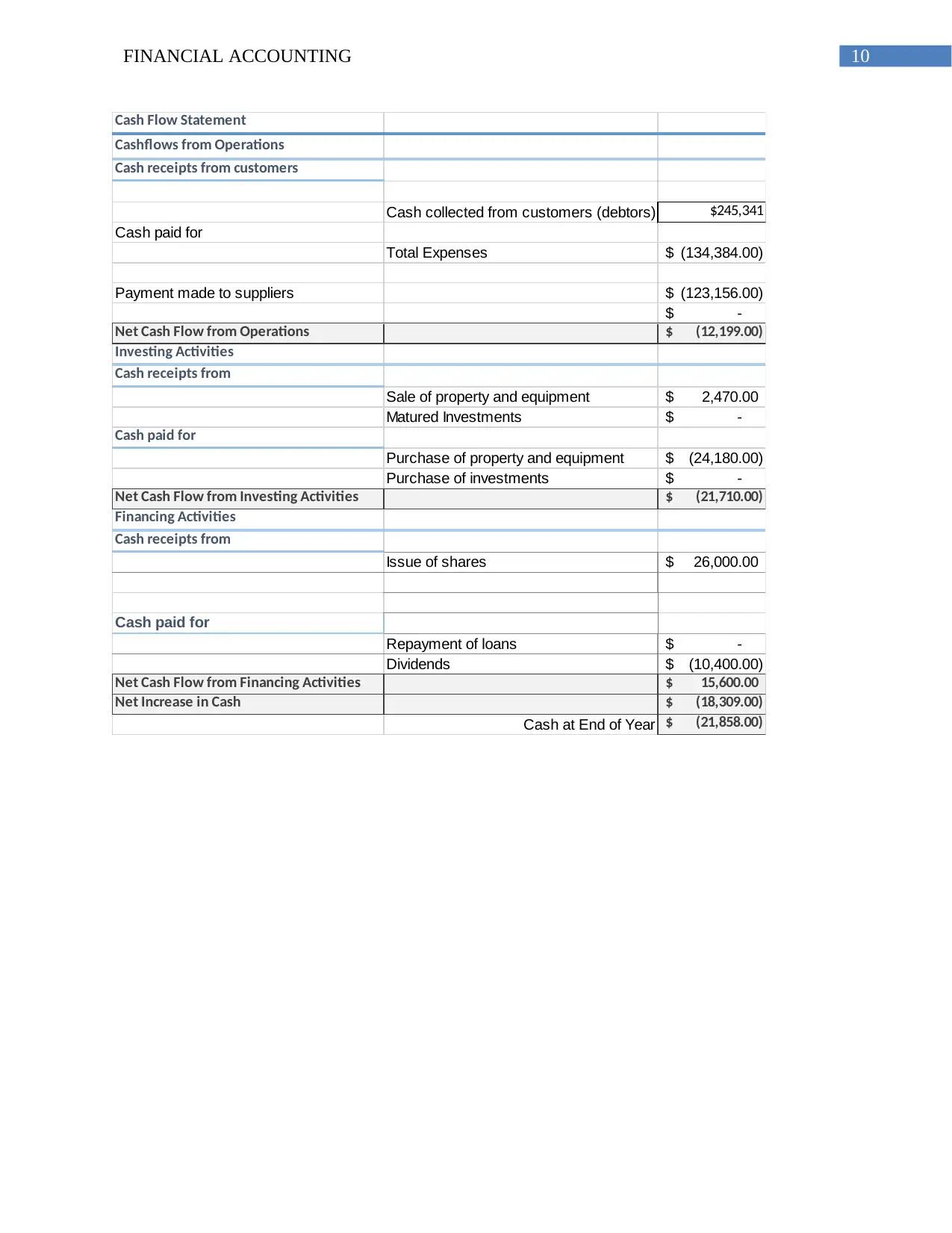

Notes to Cash flows

Notes to Cash flow statement for Flash in the Pan Ltd

Notes to the Statement of Cash Flows 2019

Cash flows from operating activities

Profit before taxation 16,611.00$

Adjustments for:

Depreciation 450.00

Investment income 7,995.00$

Profit / (Loss) on the sale of property, plant & equipment (130.00)

Working capital changes:

(Increase) / Decrease in trade and other receivables (11,539.00)$

(Increase) / (Decrease) in inventories (31,280.00)$

Increase / (Decrease) in trade payables (876.00)$

Cash generated from operations (18,769.00)

Notes to Cash flows

Notes to Cash flow statement for Flash in the Pan Ltd

Notes to the Statement of Cash Flows 2019

Cash flows from operating activities

Profit before taxation 16,611.00$

Adjustments for:

Depreciation 450.00

Investment income 7,995.00$

Profit / (Loss) on the sale of property, plant & equipment (130.00)

Working capital changes:

(Increase) / Decrease in trade and other receivables (11,539.00)$

(Increase) / (Decrease) in inventories (31,280.00)$

Increase / (Decrease) in trade payables (876.00)$

Cash generated from operations (18,769.00)

12FINANCIAL ACCOUNTING

Part B: Cash flow statement indirect method of Flash in the Pan Ltd

Statement of Cash Flows

© www.excel-skills.com

Cash flows from operating activities

Profit before taxation 16,611.00$

Adjustments for:

Depreciation 7,995.00$

Doubtful debts 4,420.00$

Profit / (Loss) on the sale of property, plant & equipment (130.00)$

Working capital changes:

(Increase) / Decrease in trade and other receivables (11,539.00)$

(Increase) / (Decrease) in inventories (31,280.00)$

Increase / (Decrease) in trade payables (876.00)$

Increase in tax liability 2,600.00$

Net cash from operating activities (12,199.00)$

Cash flows from investing activities

Purchase of property, plant and equipment (24,180.00)$

Proceeds from sale of equipment 2,470.00$

Net cash used in investing activities (21,710.00)$

Cash flows from financing activities

Proceeds from issue of share capital 26,000.00$

Payment of long-term borrowings (Dividend) (10,400.00)$

Net cash used in financing activities 15,600.00$

Net increase in cash and cash equivalents (18,309.00)$

Cash and cash equivalents at beginning of period (3,549.00)$

Cash and cash equivalents at end of period (21,858.00)$

Part B: Cash flow statement indirect method of Flash in the Pan Ltd

Statement of Cash Flows

© www.excel-skills.com

Cash flows from operating activities

Profit before taxation 16,611.00$

Adjustments for:

Depreciation 7,995.00$

Doubtful debts 4,420.00$

Profit / (Loss) on the sale of property, plant & equipment (130.00)$

Working capital changes:

(Increase) / Decrease in trade and other receivables (11,539.00)$

(Increase) / (Decrease) in inventories (31,280.00)$

Increase / (Decrease) in trade payables (876.00)$

Increase in tax liability 2,600.00$

Net cash from operating activities (12,199.00)$

Cash flows from investing activities

Purchase of property, plant and equipment (24,180.00)$

Proceeds from sale of equipment 2,470.00$

Net cash used in investing activities (21,710.00)$

Cash flows from financing activities

Proceeds from issue of share capital 26,000.00$

Payment of long-term borrowings (Dividend) (10,400.00)$

Net cash used in financing activities 15,600.00$

Net increase in cash and cash equivalents (18,309.00)$

Cash and cash equivalents at beginning of period (3,549.00)$

Cash and cash equivalents at end of period (21,858.00)$

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.