Financial Accounting Report: Whirl Limited and AASB Standards

VerifiedAdded on 2023/01/17

|11

|1370

|89

Report

AI Summary

This financial accounting report addresses two key questions related to financial reporting. The first section analyzes the regulatory environment, specifically focusing on changes and developments in Australian Accounting Standards (AASB) from December 2018 to March 2019, including amendments, new standards, and exposure drafts. It details the impact of these changes on companies, particularly regarding climate change and the introduction of new standards for various sectors. The second section presents an income statement and balance sheet for Whirl Limited, followed by a detailed analysis of required corrections to align with AASB 101. The corrections cover areas such as inventory valuation, prepaid insurance, repairs, dividends, and the classification of assets and liabilities. The report supports these corrections with references to specific paragraphs within AASB 101, emphasizing the importance of accurate financial statement presentation and compliance with accounting standards. A bibliography of relevant resources is also included.

FINANCIAL ACCOUTNING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING

Table of Contents

Answer to question 1:......................................................................................................................1

Answer to question 2:......................................................................................................................3

Corrections Required:..................................................................................................................5

Discussions in support of above corrections based on AASB 101:.............................................6

Bibliography:...................................................................................................................................7

Table of Contents

Answer to question 1:......................................................................................................................1

Answer to question 2:......................................................................................................................3

Corrections Required:..................................................................................................................5

Discussions in support of above corrections based on AASB 101:.............................................6

Bibliography:...................................................................................................................................7

2FINANCIAL ACCOUNTING

Answer to question 1:

AMENDMENTS IN THE AUSTRALIAN

ACCOUNTING STANDARDS, AASB

2019-X (Dated: 24.01.2019)

The proposed standards of AASB

2019-X brings significant changes in the

conceptual framework of financial reporting

(aasb.gov.au, 2019) and they have asked for

comments from various information users

on that proposed standards to improve its

efficiency and effectiveness. The new

accounting standard will be applicable for

the privet sector companies having public

accountability and it is voluntary for the not

for profit organisations (aasb.gov.au, 2019).

AASB PRACTICE STATEMENT 2

(Dated: 13.12.2018)

AASB have issued a bulletin on the

AASB practice statement 2. It requires

additional disclosure of information for the

Companies who have been affected by any

issues of the climate change. It issues a

guideline for the directors, accountants,

auditors and the financial statement

certifying authorities to disclose any climate

change related risks in the financial

statement (aasb.gov.au, 2019).

INTRODUCTION OF NEW

AUSTRALIAN ACCOUNTING

STANDARDS (Dated: 20.12.2018)

AASB have introduced two amended

accounting standards and clarified the

definition of business and ‘material’. The

newly amended AASB 2018-6 gives

clarification of business to specify whether a

transaction should be recorded as

combination of business of acquisition of

assets. The newly amended AASB 2018-7

CHANGES AND DEVELOPMENTS IN FINANCIAL REPORTING

FROM 1ST DECEMBER 2018 TO 31ST MARCH 2019

Answer to question 1:

AMENDMENTS IN THE AUSTRALIAN

ACCOUNTING STANDARDS, AASB

2019-X (Dated: 24.01.2019)

The proposed standards of AASB

2019-X brings significant changes in the

conceptual framework of financial reporting

(aasb.gov.au, 2019) and they have asked for

comments from various information users

on that proposed standards to improve its

efficiency and effectiveness. The new

accounting standard will be applicable for

the privet sector companies having public

accountability and it is voluntary for the not

for profit organisations (aasb.gov.au, 2019).

AASB PRACTICE STATEMENT 2

(Dated: 13.12.2018)

AASB have issued a bulletin on the

AASB practice statement 2. It requires

additional disclosure of information for the

Companies who have been affected by any

issues of the climate change. It issues a

guideline for the directors, accountants,

auditors and the financial statement

certifying authorities to disclose any climate

change related risks in the financial

statement (aasb.gov.au, 2019).

INTRODUCTION OF NEW

AUSTRALIAN ACCOUNTING

STANDARDS (Dated: 20.12.2018)

AASB have introduced two amended

accounting standards and clarified the

definition of business and ‘material’. The

newly amended AASB 2018-6 gives

clarification of business to specify whether a

transaction should be recorded as

combination of business of acquisition of

assets. The newly amended AASB 2018-7

CHANGES AND DEVELOPMENTS IN FINANCIAL REPORTING

FROM 1ST DECEMBER 2018 TO 31ST MARCH 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING

clarifies the definition of ‘material’ and

specifies its applications. It brings

amendments in AASB 101 Preparation of

financial statement.

NEW ACCOUNTING STANDARD ON

“RIGHT-OF-USE ASSETS OF NOT-

FOR-PROFIT ENTITIES”. (Dated:

24.12.2018)

The newly issued amended

accounting standard AASB 2018-8, gives

clarification and guidance recognition of

right to use of assts into lease or a right to

use. It also clarifies on the valuation aspect

of those leases or right to use. It brings two

key changes, temporary option to apply the

ROU assets on class by class basis and

government and general government sector

financial reporting to measure the ROU

assets at costs.

NEW COMPLIANCE FOR

REPORTING PERIOD (Dated:

30.01.2019)

AASB have made mandatory to

comply with the three accounting standards.

AASB 1 First time adoption of Australian

Accounting Standards. AASB 15 Revenue

from contract with customers and the AASB

1059 Service concession arrangements,

these three new accounting standards have

been made applicable for the reporting

period starting from 01.01.2019.

COLLECTIVE AND INDIVIDUAL

SERVICES AND EMERGENCY

RELIEF FOR PUBLIC SECTOR (Dated:

12.02.2019)

AASB have issued an Exposure

Draft (ED) 67 collective and individual

services and emergency relief, which aims at

accounting for collective and individual

services and also the emergency reliefs. It

proposes an amendments to the IPSAS 19. It

clarifies the definition of collective services

and emergency reliefs. The IPASB have

clarifies the definition of ‘material’ and

specifies its applications. It brings

amendments in AASB 101 Preparation of

financial statement.

NEW ACCOUNTING STANDARD ON

“RIGHT-OF-USE ASSETS OF NOT-

FOR-PROFIT ENTITIES”. (Dated:

24.12.2018)

The newly issued amended

accounting standard AASB 2018-8, gives

clarification and guidance recognition of

right to use of assts into lease or a right to

use. It also clarifies on the valuation aspect

of those leases or right to use. It brings two

key changes, temporary option to apply the

ROU assets on class by class basis and

government and general government sector

financial reporting to measure the ROU

assets at costs.

NEW COMPLIANCE FOR

REPORTING PERIOD (Dated:

30.01.2019)

AASB have made mandatory to

comply with the three accounting standards.

AASB 1 First time adoption of Australian

Accounting Standards. AASB 15 Revenue

from contract with customers and the AASB

1059 Service concession arrangements,

these three new accounting standards have

been made applicable for the reporting

period starting from 01.01.2019.

COLLECTIVE AND INDIVIDUAL

SERVICES AND EMERGENCY

RELIEF FOR PUBLIC SECTOR (Dated:

12.02.2019)

AASB have issued an Exposure

Draft (ED) 67 collective and individual

services and emergency relief, which aims at

accounting for collective and individual

services and also the emergency reliefs. It

proposes an amendments to the IPSAS 19. It

clarifies the definition of collective services

and emergency reliefs. The IPASB have

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING

asked for comments and views on it by 31st

May 2019.

asked for comments and views on it by 31st

May 2019.

5FINANCIAL ACCOUNTING

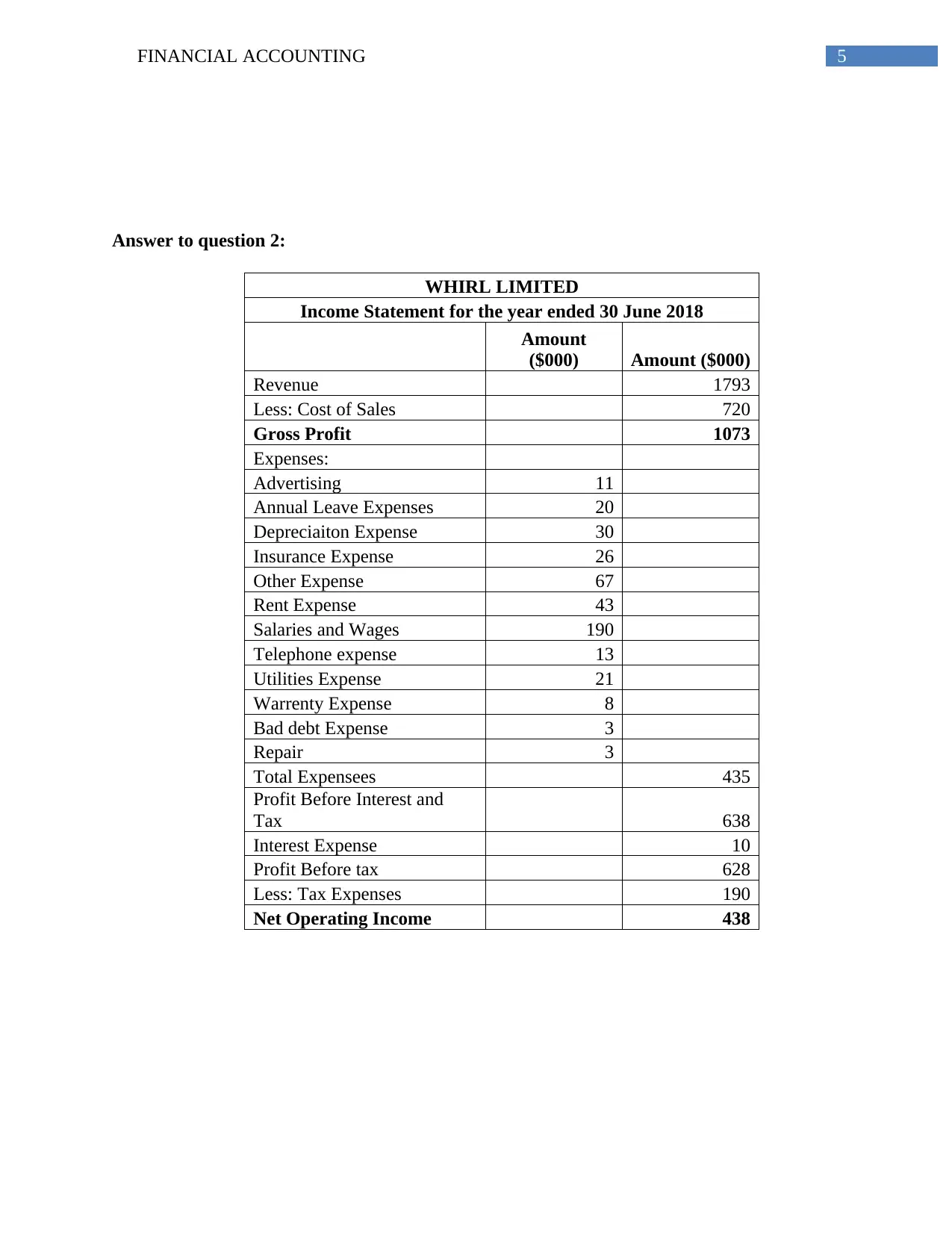

Answer to question 2:

WHIRL LIMITED

Income Statement for the year ended 30 June 2018

Amount

($000) Amount ($000)

Revenue 1793

Less: Cost of Sales 720

Gross Profit 1073

Expenses:

Advertising 11

Annual Leave Expenses 20

Depreciaiton Expense 30

Insurance Expense 26

Other Expense 67

Rent Expense 43

Salaries and Wages 190

Telephone expense 13

Utilities Expense 21

Warrenty Expense 8

Bad debt Expense 3

Repair 3

Total Expensees 435

Profit Before Interest and

Tax 638

Interest Expense 10

Profit Before tax 628

Less: Tax Expenses 190

Net Operating Income 438

Answer to question 2:

WHIRL LIMITED

Income Statement for the year ended 30 June 2018

Amount

($000) Amount ($000)

Revenue 1793

Less: Cost of Sales 720

Gross Profit 1073

Expenses:

Advertising 11

Annual Leave Expenses 20

Depreciaiton Expense 30

Insurance Expense 26

Other Expense 67

Rent Expense 43

Salaries and Wages 190

Telephone expense 13

Utilities Expense 21

Warrenty Expense 8

Bad debt Expense 3

Repair 3

Total Expensees 435

Profit Before Interest and

Tax 638

Interest Expense 10

Profit Before tax 628

Less: Tax Expenses 190

Net Operating Income 438

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ACCOUNTING

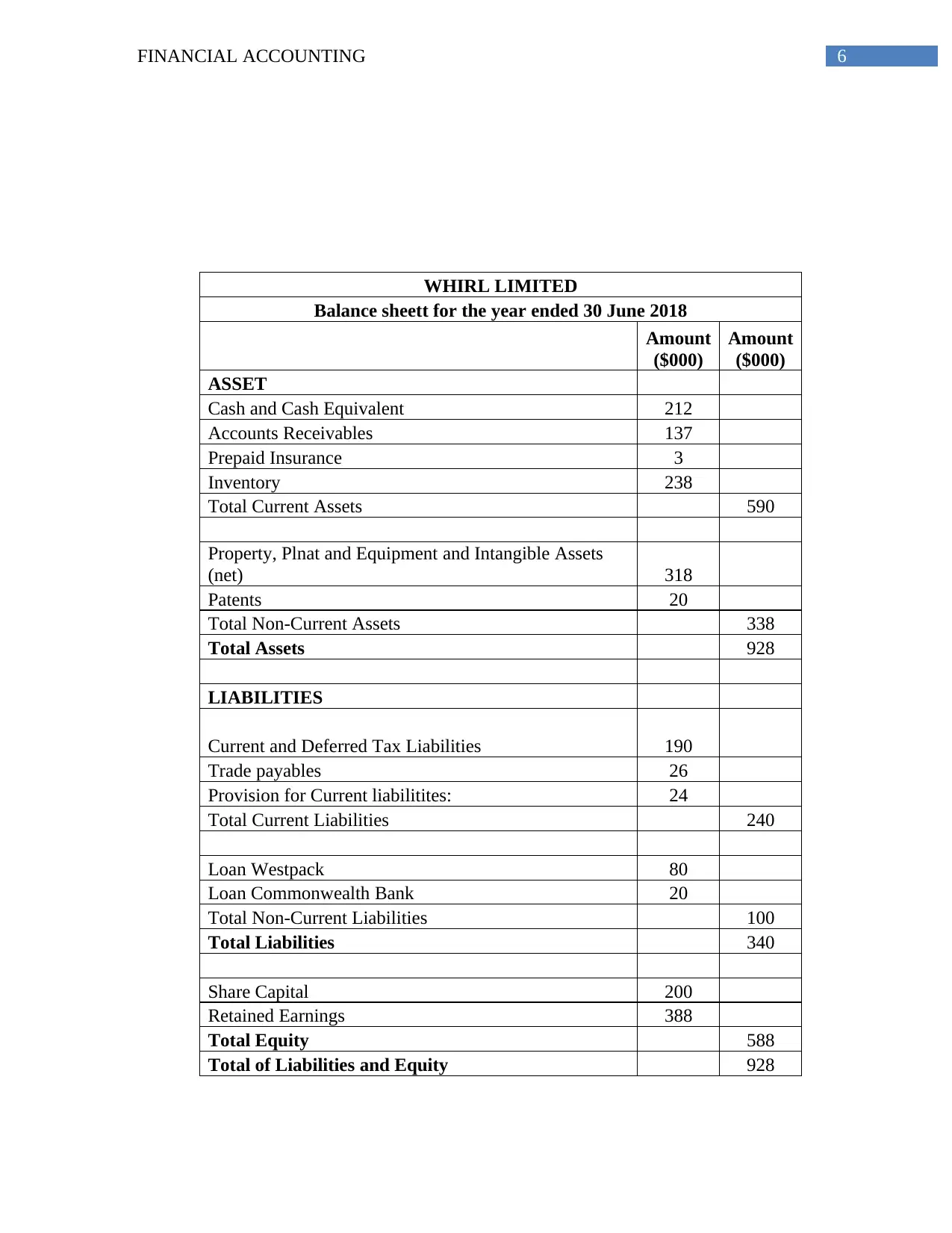

WHIRL LIMITED

Balance sheett for the year ended 30 June 2018

Amount

($000)

Amount

($000)

ASSET

Cash and Cash Equivalent 212

Accounts Receivables 137

Prepaid Insurance 3

Inventory 238

Total Current Assets 590

Property, Plnat and Equipment and Intangible Assets

(net) 318

Patents 20

Total Non-Current Assets 338

Total Assets 928

LIABILITIES

Current and Deferred Tax Liabilities 190

Trade payables 26

Provision for Current liabilitites: 24

Total Current Liabilities 240

Loan Westpack 80

Loan Commonwealth Bank 20

Total Non-Current Liabilities 100

Total Liabilities 340

Share Capital 200

Retained Earnings 388

Total Equity 588

Total of Liabilities and Equity 928

WHIRL LIMITED

Balance sheett for the year ended 30 June 2018

Amount

($000)

Amount

($000)

ASSET

Cash and Cash Equivalent 212

Accounts Receivables 137

Prepaid Insurance 3

Inventory 238

Total Current Assets 590

Property, Plnat and Equipment and Intangible Assets

(net) 318

Patents 20

Total Non-Current Assets 338

Total Assets 928

LIABILITIES

Current and Deferred Tax Liabilities 190

Trade payables 26

Provision for Current liabilitites: 24

Total Current Liabilities 240

Loan Westpack 80

Loan Commonwealth Bank 20

Total Non-Current Liabilities 100

Total Liabilities 340

Share Capital 200

Retained Earnings 388

Total Equity 588

Total of Liabilities and Equity 928

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING

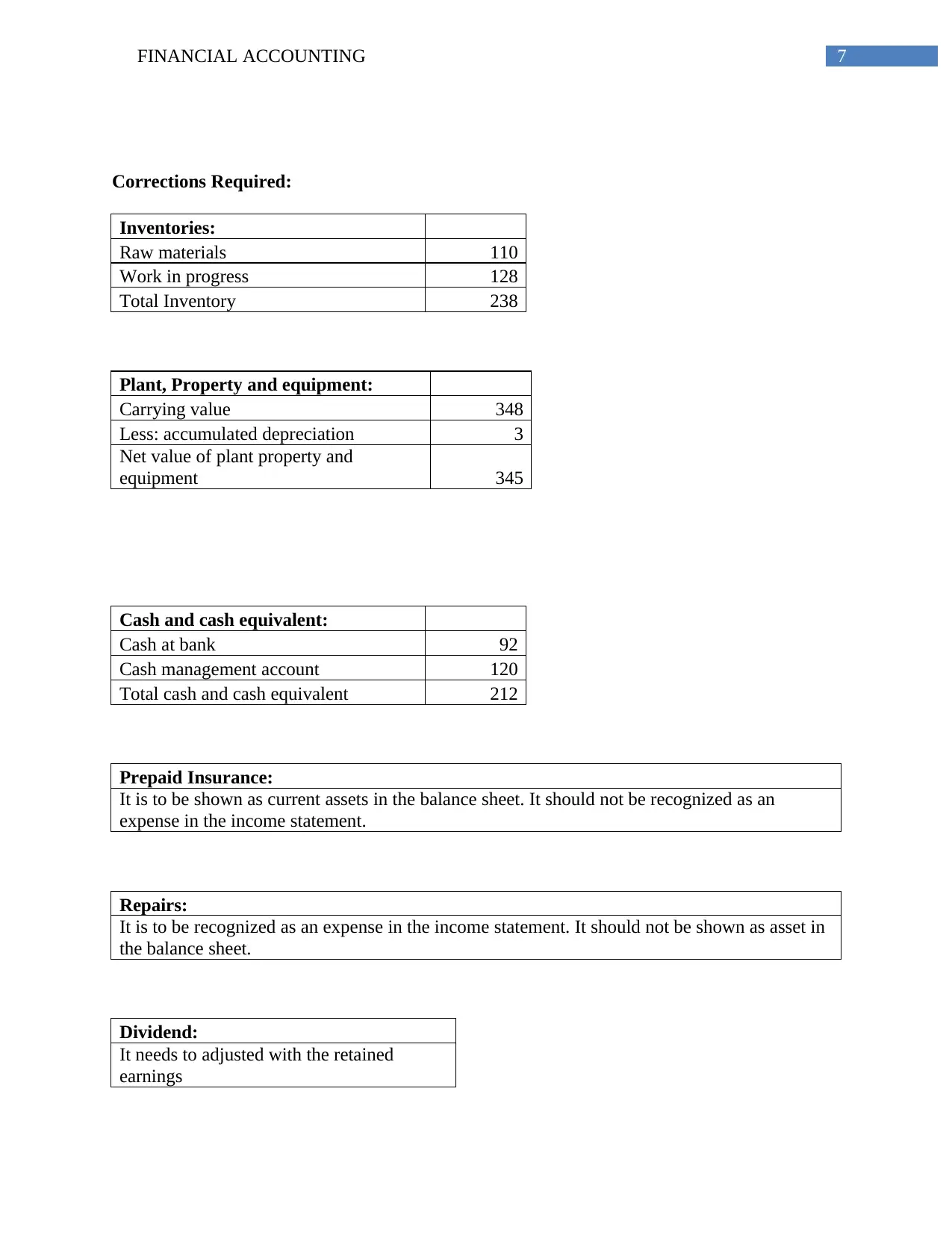

Corrections Required:

Inventories:

Raw materials 110

Work in progress 128

Total Inventory 238

Plant, Property and equipment:

Carrying value 348

Less: accumulated depreciation 3

Net value of plant property and

equipment 345

Cash and cash equivalent:

Cash at bank 92

Cash management account 120

Total cash and cash equivalent 212

Prepaid Insurance:

It is to be shown as current assets in the balance sheet. It should not be recognized as an

expense in the income statement.

Repairs:

It is to be recognized as an expense in the income statement. It should not be shown as asset in

the balance sheet.

Dividend:

It needs to adjusted with the retained

earnings

Corrections Required:

Inventories:

Raw materials 110

Work in progress 128

Total Inventory 238

Plant, Property and equipment:

Carrying value 348

Less: accumulated depreciation 3

Net value of plant property and

equipment 345

Cash and cash equivalent:

Cash at bank 92

Cash management account 120

Total cash and cash equivalent 212

Prepaid Insurance:

It is to be shown as current assets in the balance sheet. It should not be recognized as an

expense in the income statement.

Repairs:

It is to be recognized as an expense in the income statement. It should not be shown as asset in

the balance sheet.

Dividend:

It needs to adjusted with the retained

earnings

8FINANCIAL ACCOUNTING

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ACCOUNTING

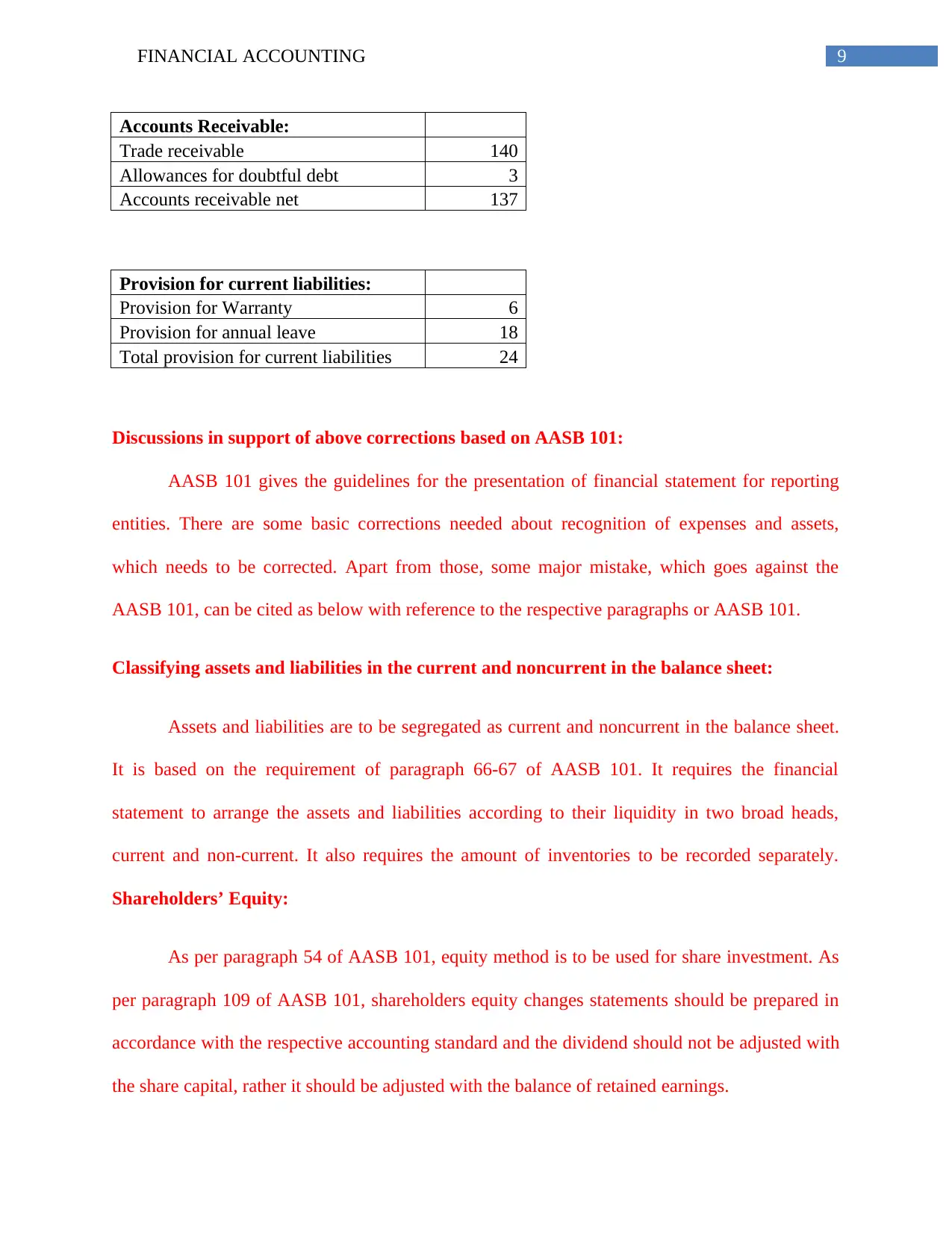

Accounts Receivable:

Trade receivable 140

Allowances for doubtful debt 3

Accounts receivable net 137

Provision for current liabilities:

Provision for Warranty 6

Provision for annual leave 18

Total provision for current liabilities 24

Discussions in support of above corrections based on AASB 101:

AASB 101 gives the guidelines for the presentation of financial statement for reporting

entities. There are some basic corrections needed about recognition of expenses and assets,

which needs to be corrected. Apart from those, some major mistake, which goes against the

AASB 101, can be cited as below with reference to the respective paragraphs or AASB 101.

Classifying assets and liabilities in the current and noncurrent in the balance sheet:

Assets and liabilities are to be segregated as current and noncurrent in the balance sheet.

It is based on the requirement of paragraph 66-67 of AASB 101. It requires the financial

statement to arrange the assets and liabilities according to their liquidity in two broad heads,

current and non-current. It also requires the amount of inventories to be recorded separately.

Shareholders’ Equity:

As per paragraph 54 of AASB 101, equity method is to be used for share investment. As

per paragraph 109 of AASB 101, shareholders equity changes statements should be prepared in

accordance with the respective accounting standard and the dividend should not be adjusted with

the share capital, rather it should be adjusted with the balance of retained earnings.

Accounts Receivable:

Trade receivable 140

Allowances for doubtful debt 3

Accounts receivable net 137

Provision for current liabilities:

Provision for Warranty 6

Provision for annual leave 18

Total provision for current liabilities 24

Discussions in support of above corrections based on AASB 101:

AASB 101 gives the guidelines for the presentation of financial statement for reporting

entities. There are some basic corrections needed about recognition of expenses and assets,

which needs to be corrected. Apart from those, some major mistake, which goes against the

AASB 101, can be cited as below with reference to the respective paragraphs or AASB 101.

Classifying assets and liabilities in the current and noncurrent in the balance sheet:

Assets and liabilities are to be segregated as current and noncurrent in the balance sheet.

It is based on the requirement of paragraph 66-67 of AASB 101. It requires the financial

statement to arrange the assets and liabilities according to their liquidity in two broad heads,

current and non-current. It also requires the amount of inventories to be recorded separately.

Shareholders’ Equity:

As per paragraph 54 of AASB 101, equity method is to be used for share investment. As

per paragraph 109 of AASB 101, shareholders equity changes statements should be prepared in

accordance with the respective accounting standard and the dividend should not be adjusted with

the share capital, rather it should be adjusted with the balance of retained earnings.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ACCOUNTING

Bibliography:

Aasb.gov.au.(2019). Presentation of Financial Statements. Retrieved 7 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Aasb.gov.au. (2019). Onerous Contracts – Cost of Fulfilling a Contract. Retrieved 7 April 2019,

from https://www.aasb.gov.au/admin/file/content105/c9/ACCED287_01-19.pdf

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Henderson, S., Peirson, G., Herbohn, K., &Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/Fatal-

flaw-review-draft---Proposed-Standard-AASB-2019-X-Amendments-to-Australian-

Accounting-Standards---References-to-the-Conceptual-Framework?newsID=310721

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/New-

Accounting-Standard--Right-of-Use-Assets-of-Not-for-Profit-Entities?newsID=310718

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/New-

Australian-Accounting-Standards?newsID=310717

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/How-

special-are-special-purpose-financial-statements---For-profit-User-and-Preparer-Survey-

Results?newsID=310714

Bibliography:

Aasb.gov.au.(2019). Presentation of Financial Statements. Retrieved 7 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Aasb.gov.au. (2019). Onerous Contracts – Cost of Fulfilling a Contract. Retrieved 7 April 2019,

from https://www.aasb.gov.au/admin/file/content105/c9/ACCED287_01-19.pdf

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Henderson, S., Peirson, G., Herbohn, K., &Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/Fatal-

flaw-review-draft---Proposed-Standard-AASB-2019-X-Amendments-to-Australian-

Accounting-Standards---References-to-the-Conceptual-Framework?newsID=310721

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/New-

Accounting-Standard--Right-of-Use-Assets-of-Not-for-Profit-Entities?newsID=310718

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/New-

Australian-Accounting-Standards?newsID=310717

News . (2019). Aasb.gov.au. Retrieved 7 April 2019, from https://www.aasb.gov.au/News/How-

special-are-special-purpose-financial-statements---For-profit-User-and-Preparer-Survey-

Results?newsID=310714

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.