PACCC6000 Financial Analysis: Accent Group Limited Report 2016-2018

VerifiedAdded on 2023/06/03

Financial Analysis

Accent Group Limited

Paraphrase This Document

Executive summary:

This report has been prepared to identify and highlight the financial strengths and weaknesses

of Accent Group Limited. The company is operating as the leading dealer of wide range of

sports footwear, apparel and other accessories in Australia. To analyse the financial

performance of the company various approaches have been used such as horizontal analysis,

vertical analysis and ratio analysis. The annual reports of Accent Group for the financial

years 2018, 2017 and 2016 have been thoroughly examined. The results of financial ratios

have revealed that the company has achieved profitability over the last three years. But it has

distributed maximum profits to its shareholders in 2018 among all the 3 years. However, at

the same time the liquidity position of the company in 2018 is not as strong as that was in the

previous two years. The capital structure of the company in all the three financial years is

adequate. However, in 2017, the portion of debt financing was relatively higher than that of

2016 and 2018.

Table of Contents

Executive summary:..............................................................................................................................1

Introduction:..........................................................................................................................................3

Profitability position:.............................................................................................................................3

Return on net sales ratio...................................................................................................................4

Ratio of return on total assets...........................................................................................................4

Asset turnover ratio...........................................................................................................................5

Return on equity ratio.......................................................................................................................5

Liquidity Position:..................................................................................................................................6

Current Ratio.....................................................................................................................................6

Quick Ratio........................................................................................................................................6

Inventory turnover ratio and day’s inventory ratio...........................................................................7

Gross Profit Ratio...............................................................................................................................7

Receivables turnover ratio.................................................................................................................7

Day’s sales in receivables...................................................................................................................7

Gearing Ratios:......................................................................................................................................8

Debt to asset ratio.............................................................................................................................8

Debt to equity ratio...........................................................................................................................8

Interest Coverage Ratio.....................................................................................................................8

Conclusion:............................................................................................................................................8

References:..........................................................................................................................................10

Appendix:............................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction:

Accent Group Limited is an Australian company listed on Australia’s Securities Exchange. It

had started its business operations in year 1981 and is headquartered at Waterloo, Australia.

The company is engaged in the retail, distribution as well as franchisee business of footwear,

Apparel and the various types of accessories across Australia as well as New Zealand. Accent

Group was initially known with the name of RCG Corporation Limited. The company is

operating as the regional leading distribution of lifestyle footwear and it currently owning

over 420 stores and 10 distribution brands across both the countries of its operations. The

brand portfolio of the company includes Athlete’s Foot, Hype DC, Platypus Shoes, Podium

Sports, Sketchers, Merrell, CAT, Vans, Dr. Martens, Saucony, Timberland, Sperry Top-

Sider, Palladium, and Stance (Bloomberg, 2018).

The present report is prepared to carry out the financial analysis of the Accent Group using

different techniques such as horizontal analysis (also known as trend analysis), vertical

analysis and ratio analysis. Under this report the financial performance of the company over

last three financial years i.e. 2016, 2017 and 2018 has been analysed using different financial

ratios. Financial performance of business is based on various aspects such as its profitability

position, liquidity position, solvency position and its efficiency in managing and using

different assets of the business (Higgins, 2003). These aspects have been taken into

consideration in order to assess the overall financial position of Accent Group.

For ratios calculation: Refer Appendix Table 3

Profitability position:

Profitability is the state when the firm has sufficient amount of earnings left after meeting all

the costs and expenses of the business. There are various rations which determine the

profitability position of the business. (Tracy, 2012). The use of the key profitability ratios

Paraphrase This Document

has been made in the present case to analyse the profitability position of business of Accent

Group Limited.

Return on net sales ratio

The return on net sales ratio is commonly known as Net Profit Margin Ratio. This ratio

measures the amount the earnings that are left in the business after making payment for the

expenses of the business in the given period of time. A firm with higher net profits is able to

offer higher returns to its owners and hence higher net profit is preferred in all types of

businesses. In the present case of Accent Group Limited, the net margin ratio was lowest in

2017 among all the three years under consideration. Though, the business of Accent Group

has experienced inclining trend in terms of sales revenue generation since 2016 to 2018.

However, the operating expenses in 2017 are relatively higher in 2017. The increased net

profit margin in 2018 as compared to 2018 reflects that company has earned better profits for

its owners in 2018.

Ratio of return on total assets

The ratio of return on total assets measures how effectively and efficiently the firm is

utilising its total assets in the business to generate returns for its owners. The ROA of Accent

Group is highest in 2018. It shows that the company has been able to utilise its total assets in

most efficient manner in 2018 when compared to 2016 and 2017. The increased operating

expenses and declining profit before interest have led to minimum ROA in 2017. Moreover,

increase in the level of fixed assets held in the business of Accent Group must have also

contributed to the lowest ROA in 2017 as the company could not have utilised its total assets

efficiently and therefore some of the assets must have remained idle in 2017. The excessive

investment in total assets has blocked the surplus funds of the business which could have

distributed among the owners of company if prudent investment in fixed assets was made

where minimum finance cost could be incurred to finance the assets (Accent Group Limited,

2018).

Asset turnover ratio

Asset turnover ratio is the type of efficiency ratio which is used to assess the efficiency of

firm in deploying the overall business in the business. Higher Asset turnover ratio is desirable

in any business as higher the asset turnover ratio, more is the efficiency of the firm in

utilising its assets to generate sales revenue (Tracy, 2012). Accent Group has highest ATR in

2017 despite of the fact that in this particular year company has achieved lowest ROA. This

shows that the company has earned highest sales revenue in 2017 by utilising its assets due

the reason that it has maintained fixed assets in highest proportion as compared to other years

i.e. 2018 and 2016. However, in order to invest more in assets in 2017, the company must

have had borrowed funds from the external market where cost of financing such assets had to

be paid which in turn must have reduced its level of profits. This has resulted in lower ROA

but higher ATR in 201. Moreover, the ratio of 1.15 shows that Accent Group must have

earned $ 1.50 sales by making investment of each dollar in assets (Accent Group Limited,

2018) (Refer Appendix Table 3).

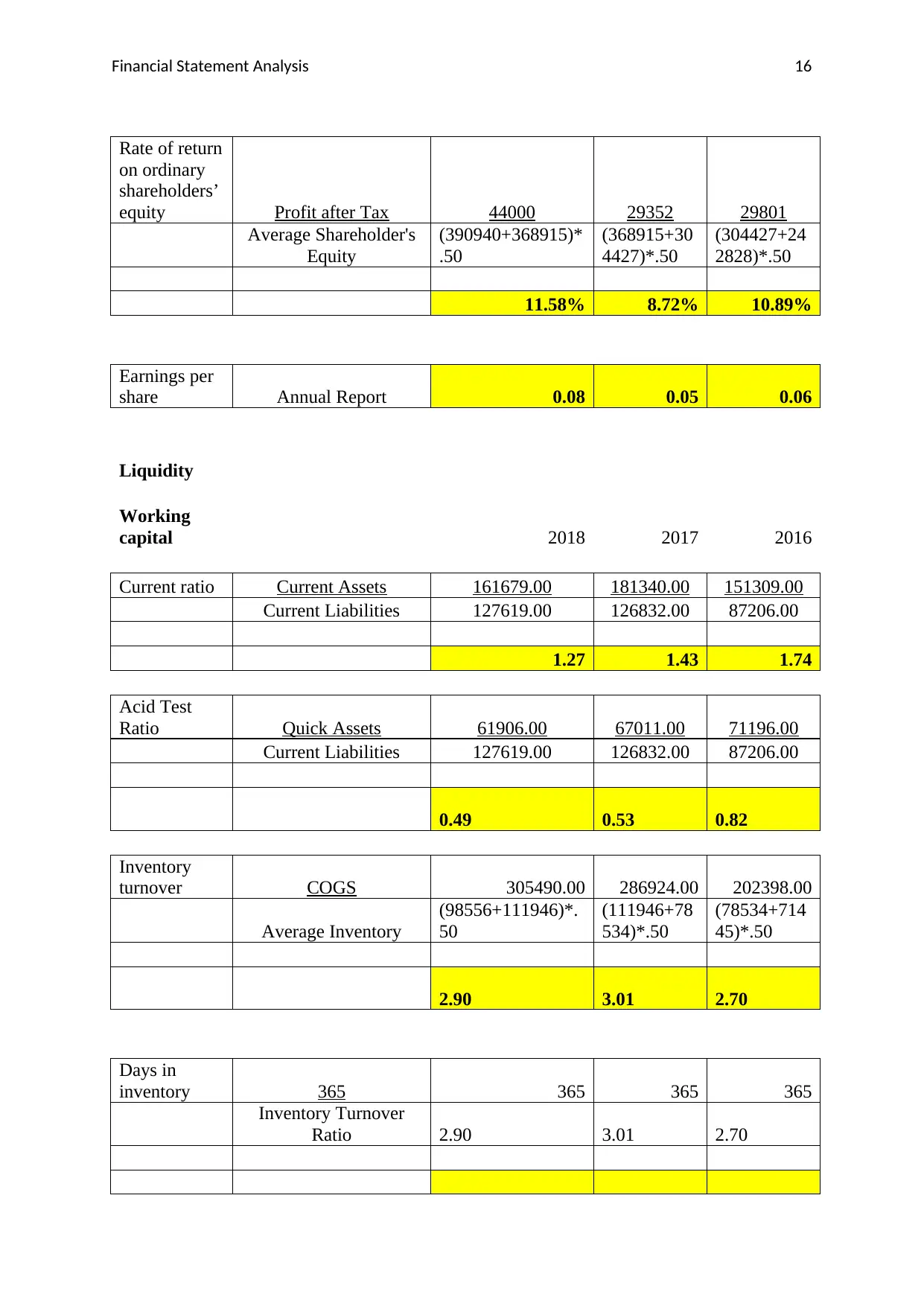

Return on equity ratio

The return on equity ratio measures the quantum of profits which have been passed to the

shareholders of the company (Nissim & Penman, 2001). Accent Group has generated

maximum returns for its shareholders in 2018 and this shows that it has effectively utilised

the funds provided by its shareholders in its business and through the effective utilisation, it

has distributed highest returns for its shareholders. Moreover, the earning per share of Accent

Group Limited is highest in 2018 which depicts that the company had strongest profitability

position in 2018. The reason of highest EPS in 2018 is that the company has earned highest

quantum of profits that are distributable among the shareholders is earned.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Liquidity Position:

The liquidity is the state which is achieved when the firm has sufficient amount of current

assets available with us to meet its current liabilities which falls due within next one year. To

determine the liquidity position of Accent Group Limited, use of various prominent ratios has

been made such as current ratio, quick ratio. If the company has implemented best working

capital management practices then it will certainly have the strong liquidity position in the

market.

Current Ratio

A company must have at-least maintained quantum of current assets which is equivalent to its

current liabilities. In the present case of Accent Group, the current ratio in all the 3 years is

higher than 1 which shows that the company has adequately invested in its current assets so

that it can meet its short term financial obligations as and when they become due without

requiring to dispose-off its fixed assets (Accent Group Limited, 2016). However, Accent

Group had experienced strongest liquidity position in 2016 and thereafter its liquidity state

had started weakening due to increase in the current liabilities like short term borrowings,

employees benefit expenses and deferred lease incentives. Moreover the total current assets

have been declined considerably in 2018 as compared to that of 2017 (Refer Appendix Table

1). In 2016, the company held lesser current financial obligations than that of 2017 and 2018.

However, in 2017, it has enhanced its investment in current assets to maintain its liquidity.

But, in 2018 the quantum of its current asset has reduced which had ultimately resulted in

weakened liquidity position.

Quick Ratio

The lowest quick ratio in 2018 as compared to that of 2017 and 2016 shows that although the

company has sufficient current assets to meet its short term financial obligations but the

balance of liquid asset which can easily and quickly be converted into cash is not sufficient

enough due to weaker cash conversion cycle (Higgins, 2012).

Paraphrase This Document

Inventory turnover ratio and day’s inventory ratio

The inventory turnover ratio of a firm shows the number of times the business inventory has

been converted into sales in the given period of time, generally a year (Foster, 2004). The

ITR of Accent Group has not varied significantly over the last three financial years. However,

the highest ITR was reported by the company in 2017 which shows that the inventory was

converted into sales more frequently in 2017 as compared to 2018 and 2016. Also, the

company has taken relatively lesser time to convert its inventory into sales in 2017 than 2018

and 2016. The highest ITR in 2016 reflects the inefficient working capital management

practices of the company.

Gross Profit Ratio

In 2018, highest quantum of revenue was generated out of sales. However, the cost of goods

sold which has been incurred in the lesser proportion of total sales as compared to 2017 and

2016.Due to this highest GP rate has been achieved in 2018.

Receivables turnover ratio

The receivables turnover ratio measures the frequency with which the receivables were

converted into cash. Higher receivable turnover ratio is generally preferred. In 2018, highest

RTR is achieved which shows that Accent Group has managed its accounts receivables in the

most efficient way in 2018.

Day’s sales in receivables

In terms of management of accounts receivable of the business, the company has performed

best in 2018 as it has taken least time to convert its trade receivables into cash sales as

compared to other two years. It clearly shows that Accent Group has strongest cash operating

cycle in 2018 due to which it quickly convert its credit sales into cash.

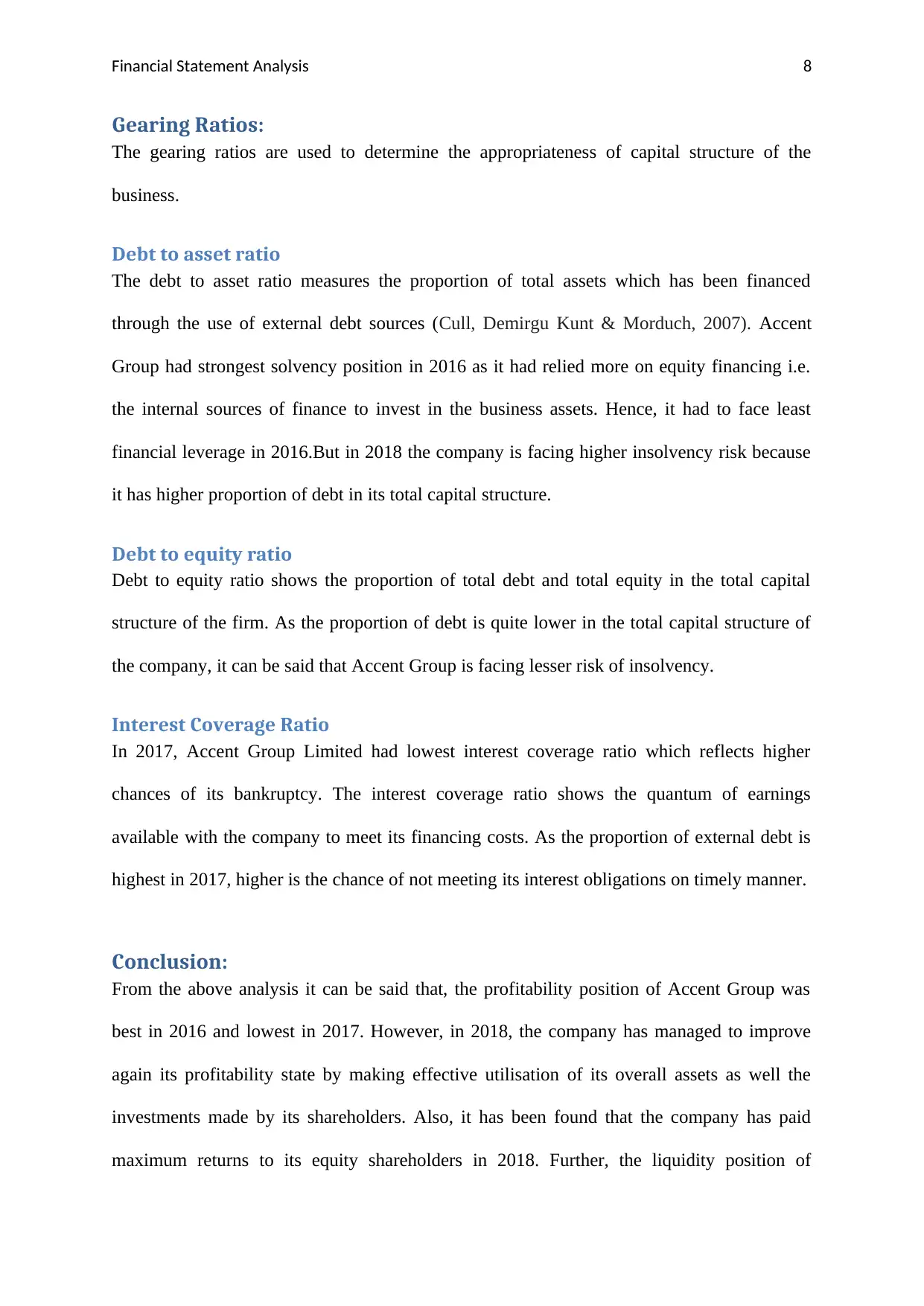

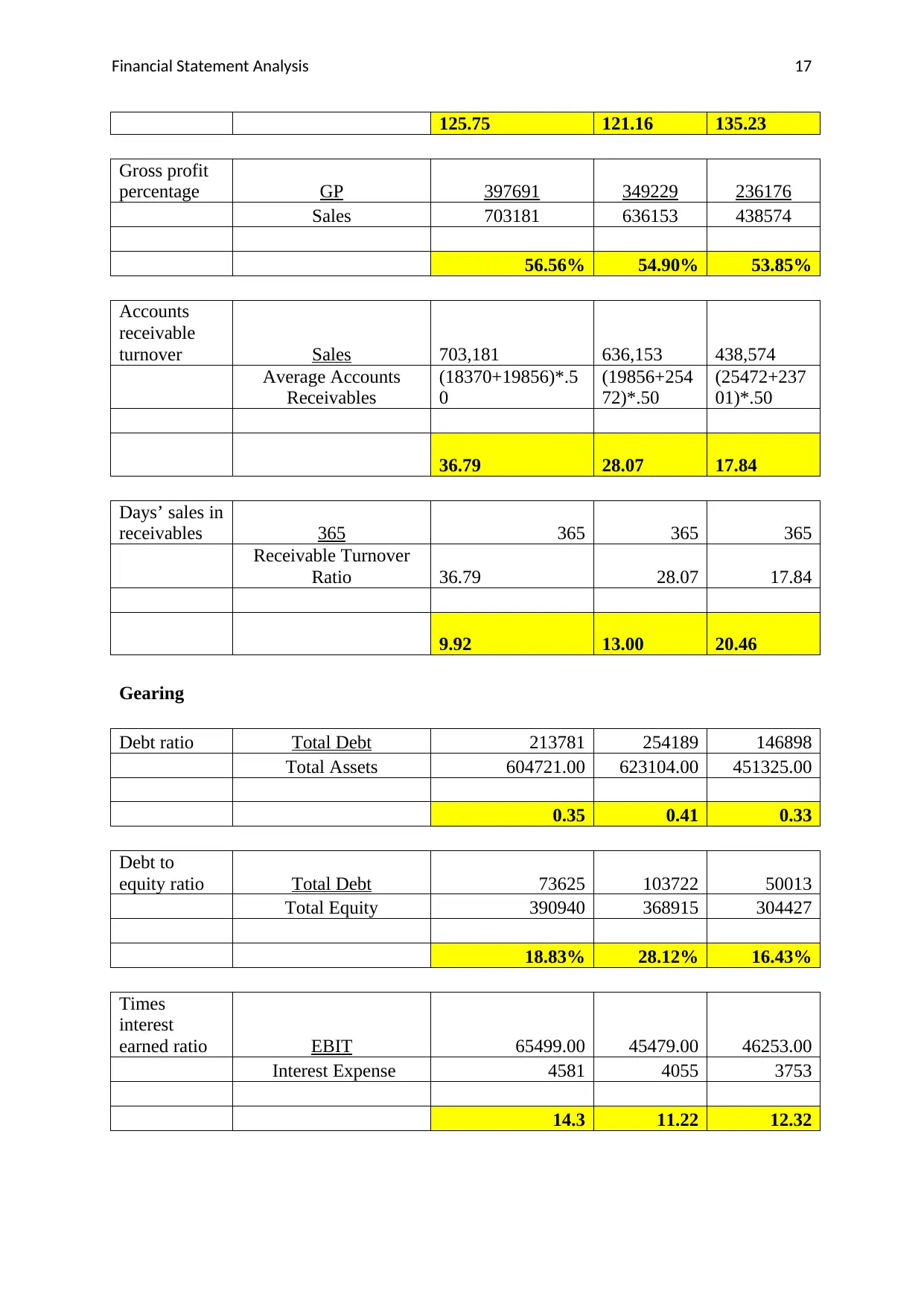

Gearing Ratios:

The gearing ratios are used to determine the appropriateness of capital structure of the

business.

Debt to asset ratio

The debt to asset ratio measures the proportion of total assets which has been financed

through the use of external debt sources (Cull, Demirgu Kunt & Morduch, 2007). Accent

Group had strongest solvency position in 2016 as it had relied more on equity financing i.e.

the internal sources of finance to invest in the business assets. Hence, it had to face least

financial leverage in 2016.But in 2018 the company is facing higher insolvency risk because

it has higher proportion of debt in its total capital structure.

Debt to equity ratio

Debt to equity ratio shows the proportion of total debt and total equity in the total capital

structure of the firm. As the proportion of debt is quite lower in the total capital structure of

the company, it can be said that Accent Group is facing lesser risk of insolvency.

Interest Coverage Ratio

In 2017, Accent Group Limited had lowest interest coverage ratio which reflects higher

chances of its bankruptcy. The interest coverage ratio shows the quantum of earnings

available with the company to meet its financing costs. As the proportion of external debt is

highest in 2017, higher is the chance of not meeting its interest obligations on timely manner.

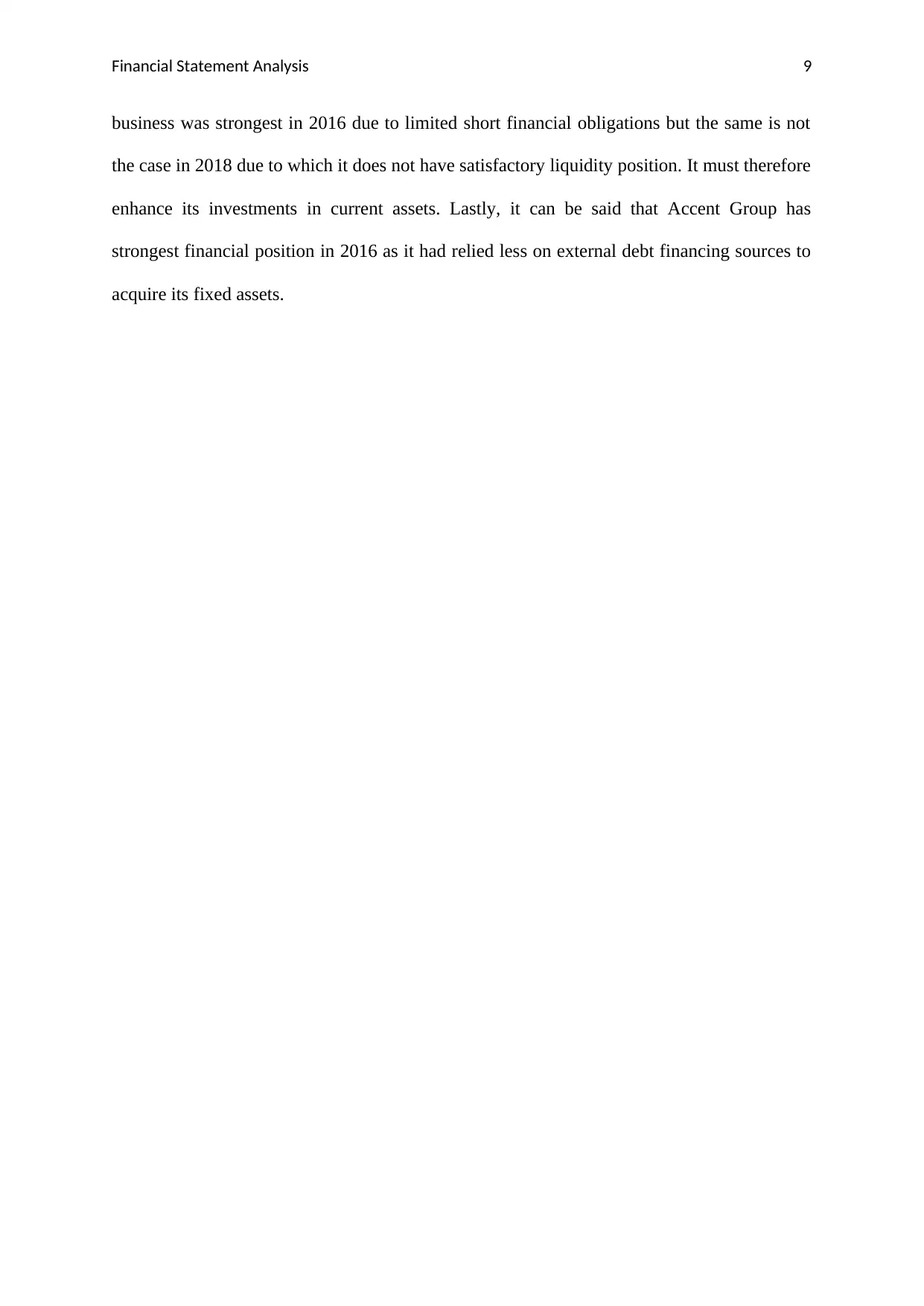

Conclusion:

From the above analysis it can be said that, the profitability position of Accent Group was

best in 2016 and lowest in 2017. However, in 2018, the company has managed to improve

again its profitability state by making effective utilisation of its overall assets as well the

investments made by its shareholders. Also, it has been found that the company has paid

maximum returns to its equity shareholders in 2018. Further, the liquidity position of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

business was strongest in 2016 due to limited short financial obligations but the same is not

the case in 2018 due to which it does not have satisfactory liquidity position. It must therefore

enhance its investments in current assets. Lastly, it can be said that Accent Group has

strongest financial position in 2016 as it had relied less on external debt financing sources to

acquire its fixed assets.

Paraphrase This Document

References:

Accent Group Limited. (2016). Annual Report: 2016. Retrieved from:

http://onlinereports.irmau.com/2016/RCG/index.html#27/z

Accent Group Limited. (2018). Annual Report: 2018. Retrieved from:

http://onlinereports.irmau.com/2018/AX1/26/#zoom=z

Bloomberg. (2018). Company Overview of Accent Group Limited. (2018). Retrieved from:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?

privcapId=10636950

Cull, R., Demirgu¨ ç‐Kunt, A. and Morduch, J. (2007). Financial performance and outreach:

A global analysis of leading microbanks. The Economic Journal, 117(517), pp.F107-

F133.

Foster, G. (2004). Financial Statement Analysis, 2/e. Pearson Education India.

Higgins, R.C. (2012). Analysis for financial management. McGraw-Hill/Irwin.

Nissim, D. and Penman, S.H. (2001). Ratio analysis and equity valuation: From research to

practice. Review of accounting studies, 6(1), pp.109-154.

Tracy, A. (2012). Ratio analysis fundamentals: how 17 financial ratios can allow you to

analyse any business on the planet. Ratio Analysis. Net.

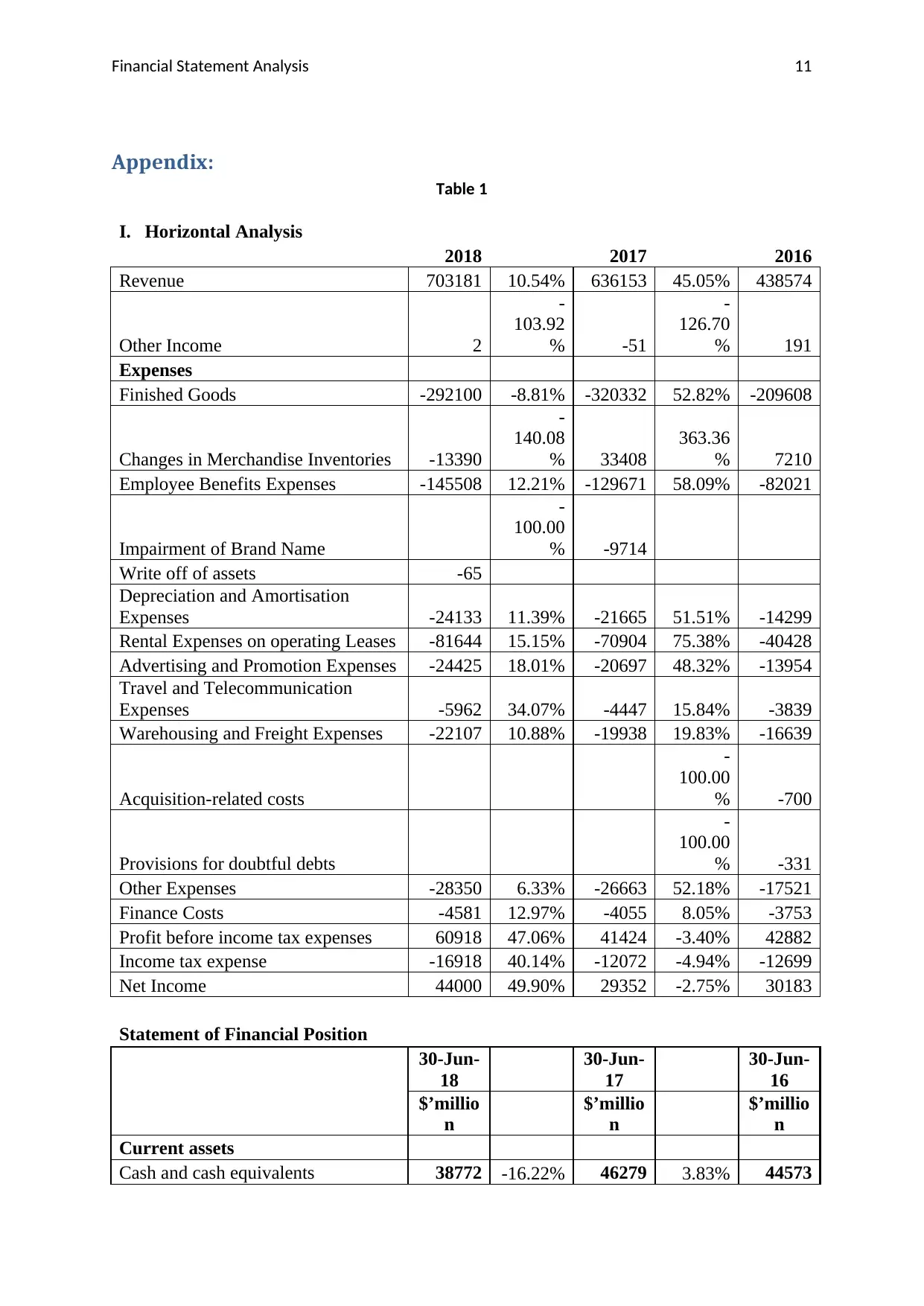

Appendix:

Table 1

I. Horizontal Analysis

2018 2017 2016

Revenue 703181 10.54% 636153 45.05% 438574

Other Income 2

-

103.92

% -51

-

126.70

% 191

Expenses

Finished Goods -292100 -8.81% -320332 52.82% -209608

Changes in Merchandise Inventories -13390

-

140.08

% 33408

363.36

% 7210

Employee Benefits Expenses -145508 12.21% -129671 58.09% -82021

Impairment of Brand Name

-

100.00

% -9714

Write off of assets -65

Depreciation and Amortisation

Expenses -24133 11.39% -21665 51.51% -14299

Rental Expenses on operating Leases -81644 15.15% -70904 75.38% -40428

Advertising and Promotion Expenses -24425 18.01% -20697 48.32% -13954

Travel and Telecommunication

Expenses -5962 34.07% -4447 15.84% -3839

Warehousing and Freight Expenses -22107 10.88% -19938 19.83% -16639

Acquisition-related costs

-

100.00

% -700

Provisions for doubtful debts

-

100.00

% -331

Other Expenses -28350 6.33% -26663 52.18% -17521

Finance Costs -4581 12.97% -4055 8.05% -3753

Profit before income tax expenses 60918 47.06% 41424 -3.40% 42882

Income tax expense -16918 40.14% -12072 -4.94% -12699

Net Income 44000 49.90% 29352 -2.75% 30183

Statement of Financial Position

30-Jun-

18

30-Jun-

17

30-Jun-

16

$’millio

n

$’millio

n

$’millio

n

Current assets

Cash and cash equivalents 38772 -16.22% 46279 3.83% 44573

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

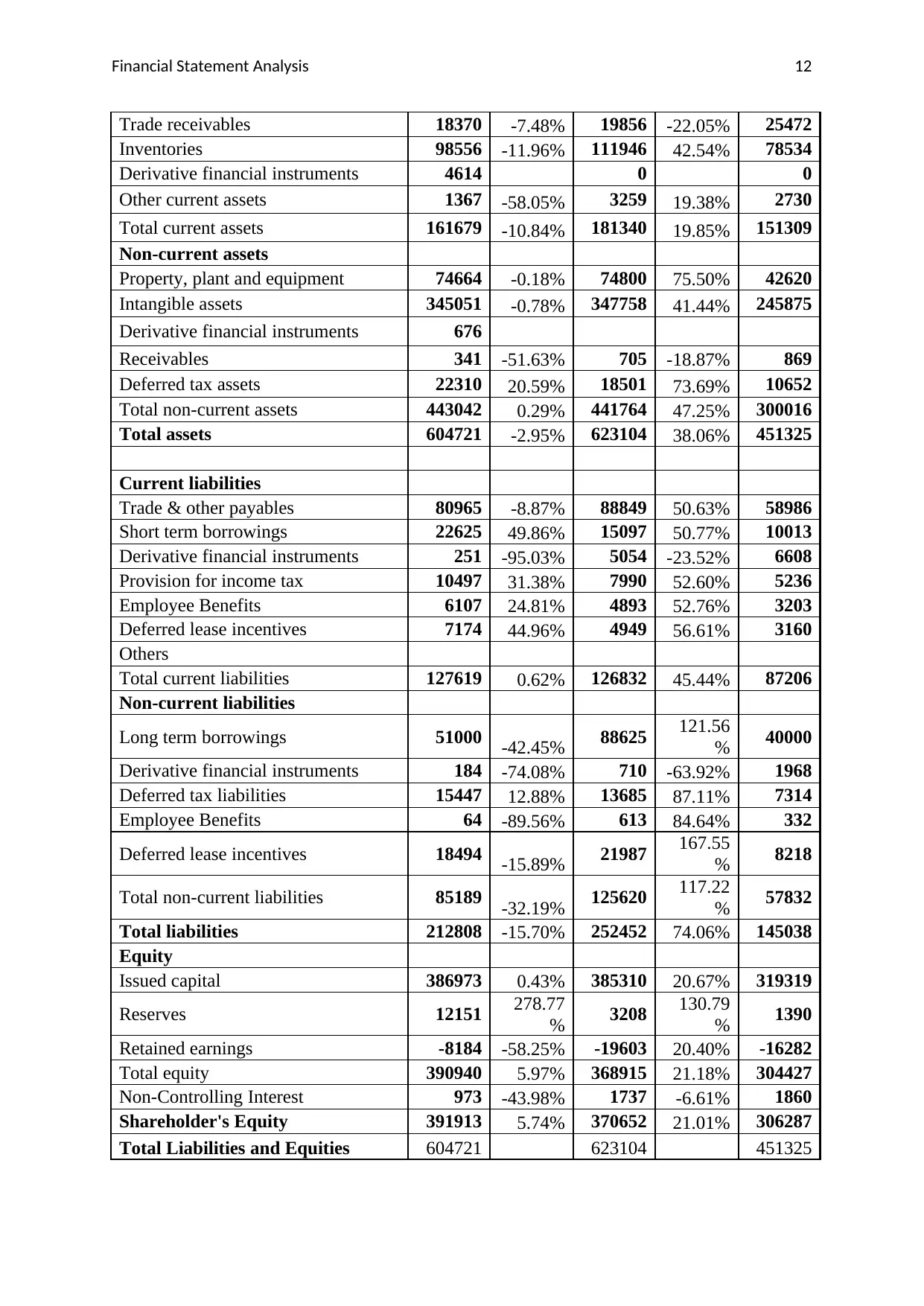

Trade receivables 18370 -7.48% 19856 -22.05% 25472

Inventories 98556 -11.96% 111946 42.54% 78534

Derivative financial instruments 4614 0 0

Other current assets 1367 -58.05% 3259 19.38% 2730

Total current assets 161679 -10.84% 181340 19.85% 151309

Non-current assets

Property, plant and equipment 74664 -0.18% 74800 75.50% 42620

Intangible assets 345051 -0.78% 347758 41.44% 245875

Derivative financial instruments 676

Receivables 341 -51.63% 705 -18.87% 869

Deferred tax assets 22310 20.59% 18501 73.69% 10652

Total non-current assets 443042 0.29% 441764 47.25% 300016

Total assets 604721 -2.95% 623104 38.06% 451325

Current liabilities

Trade & other payables 80965 -8.87% 88849 50.63% 58986

Short term borrowings 22625 49.86% 15097 50.77% 10013

Derivative financial instruments 251 -95.03% 5054 -23.52% 6608

Provision for income tax 10497 31.38% 7990 52.60% 5236

Employee Benefits 6107 24.81% 4893 52.76% 3203

Deferred lease incentives 7174 44.96% 4949 56.61% 3160

Others

Total current liabilities 127619 0.62% 126832 45.44% 87206

Non-current liabilities

Long term borrowings 51000 -42.45% 88625 121.56

% 40000

Derivative financial instruments 184 -74.08% 710 -63.92% 1968

Deferred tax liabilities 15447 12.88% 13685 87.11% 7314

Employee Benefits 64 -89.56% 613 84.64% 332

Deferred lease incentives 18494 -15.89% 21987 167.55

% 8218

Total non-current liabilities 85189 -32.19% 125620 117.22

% 57832

Total liabilities 212808 -15.70% 252452 74.06% 145038

Equity

Issued capital 386973 0.43% 385310 20.67% 319319

Reserves 12151 278.77

% 3208 130.79

% 1390

Retained earnings -8184 -58.25% -19603 20.40% -16282

Total equity 390940 5.97% 368915 21.18% 304427

Non-Controlling Interest 973 -43.98% 1737 -6.61% 1860

Shareholder's Equity 391913 5.74% 370652 21.01% 306287

Total Liabilities and Equities 604721 623104 451325

Paraphrase This Document

Table 2

Vertical Analysis

2018 2017 2016

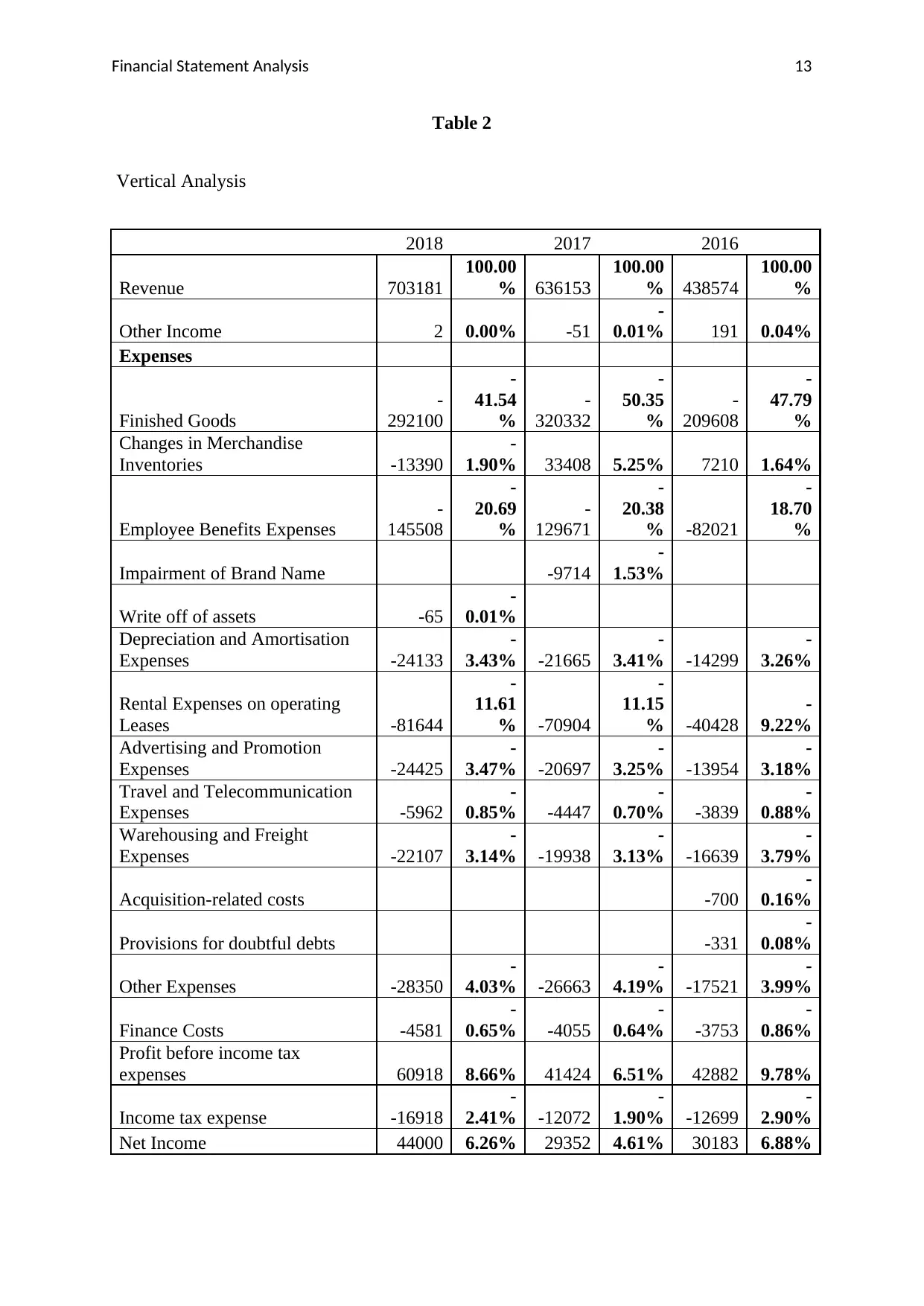

Revenue 703181

100.00

% 636153

100.00

% 438574

100.00

%

Other Income 2 0.00% -51

-

0.01% 191 0.04%

Expenses

Finished Goods

-

292100

-

41.54

%

-

320332

-

50.35

%

-

209608

-

47.79

%

Changes in Merchandise

Inventories -13390

-

1.90% 33408 5.25% 7210 1.64%

Employee Benefits Expenses

-

145508

-

20.69

%

-

129671

-

20.38

% -82021

-

18.70

%

Impairment of Brand Name -9714

-

1.53%

Write off of assets -65

-

0.01%

Depreciation and Amortisation

Expenses -24133

-

3.43% -21665

-

3.41% -14299

-

3.26%

Rental Expenses on operating

Leases -81644

-

11.61

% -70904

-

11.15

% -40428

-

9.22%

Advertising and Promotion

Expenses -24425

-

3.47% -20697

-

3.25% -13954

-

3.18%

Travel and Telecommunication

Expenses -5962

-

0.85% -4447

-

0.70% -3839

-

0.88%

Warehousing and Freight

Expenses -22107

-

3.14% -19938

-

3.13% -16639

-

3.79%

Acquisition-related costs -700

-

0.16%

Provisions for doubtful debts -331

-

0.08%

Other Expenses -28350

-

4.03% -26663

-

4.19% -17521

-

3.99%

Finance Costs -4581

-

0.65% -4055

-

0.64% -3753

-

0.86%

Profit before income tax

expenses 60918 8.66% 41424 6.51% 42882 9.78%

Income tax expense -16918

-

2.41% -12072

-

1.90% -12699

-

2.90%

Net Income 44000 6.26% 29352 4.61% 30183 6.88%

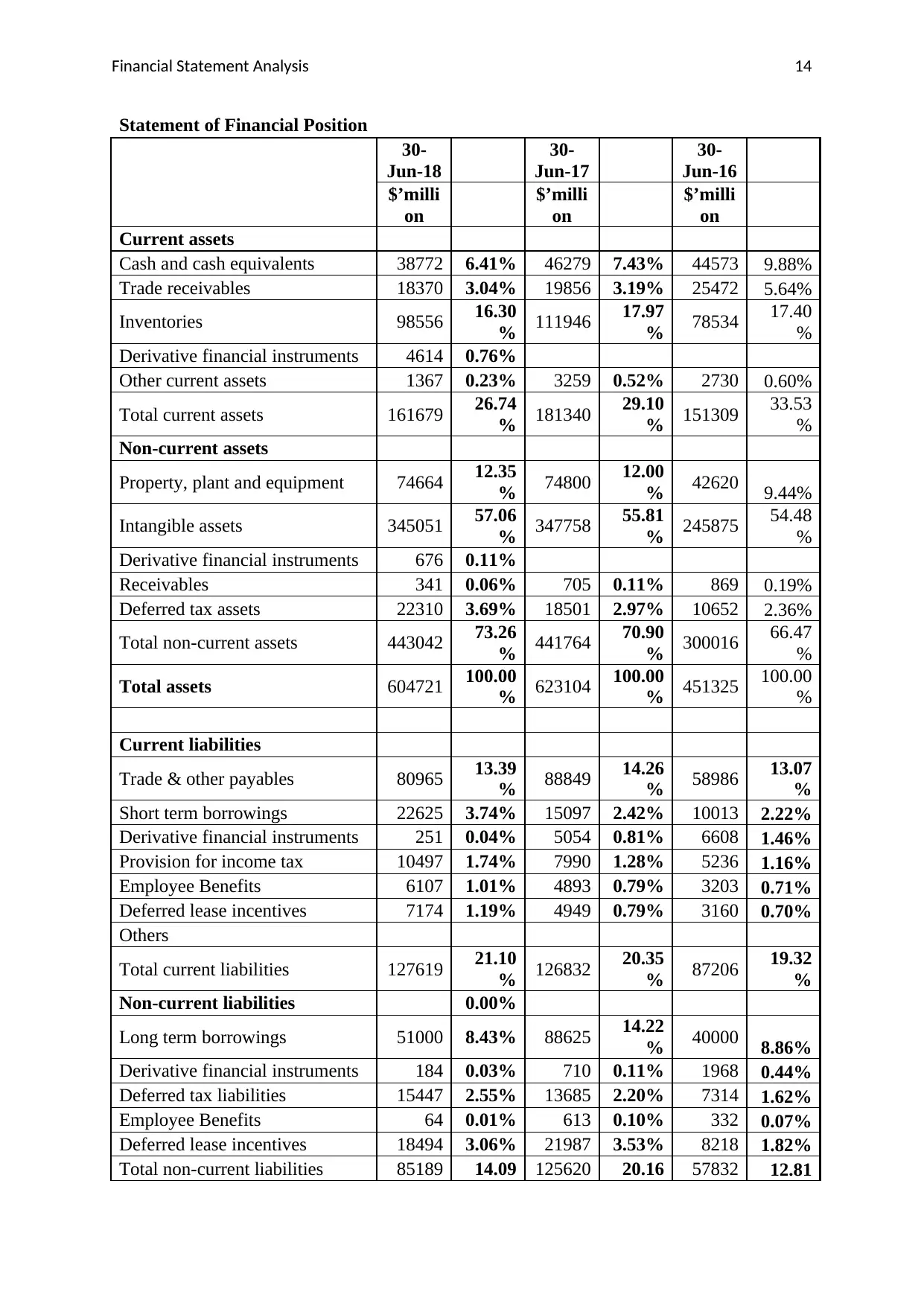

Statement of Financial Position

30-

Jun-18

30-

Jun-17

30-

Jun-16

$’milli

on

$’milli

on

$’milli

on

Current assets

Cash and cash equivalents 38772 6.41% 46279 7.43% 44573 9.88%

Trade receivables 18370 3.04% 19856 3.19% 25472 5.64%

Inventories 98556 16.30

% 111946 17.97

% 78534 17.40

%

Derivative financial instruments 4614 0.76%

Other current assets 1367 0.23% 3259 0.52% 2730 0.60%

Total current assets 161679 26.74

% 181340 29.10

% 151309 33.53

%

Non-current assets

Property, plant and equipment 74664 12.35

% 74800 12.00

% 42620 9.44%

Intangible assets 345051 57.06

% 347758 55.81

% 245875 54.48

%

Derivative financial instruments 676 0.11%

Receivables 341 0.06% 705 0.11% 869 0.19%

Deferred tax assets 22310 3.69% 18501 2.97% 10652 2.36%

Total non-current assets 443042 73.26

% 441764 70.90

% 300016 66.47

%

Total assets 604721 100.00

% 623104 100.00

% 451325 100.00

%

Current liabilities

Trade & other payables 80965 13.39

% 88849 14.26

% 58986 13.07

%

Short term borrowings 22625 3.74% 15097 2.42% 10013 2.22%

Derivative financial instruments 251 0.04% 5054 0.81% 6608 1.46%

Provision for income tax 10497 1.74% 7990 1.28% 5236 1.16%

Employee Benefits 6107 1.01% 4893 0.79% 3203 0.71%

Deferred lease incentives 7174 1.19% 4949 0.79% 3160 0.70%

Others

Total current liabilities 127619 21.10

% 126832 20.35

% 87206 19.32

%

Non-current liabilities 0.00%

Long term borrowings 51000 8.43% 88625 14.22

% 40000 8.86%

Derivative financial instruments 184 0.03% 710 0.11% 1968 0.44%

Deferred tax liabilities 15447 2.55% 13685 2.20% 7314 1.62%

Employee Benefits 64 0.01% 613 0.10% 332 0.07%

Deferred lease incentives 18494 3.06% 21987 3.53% 8218 1.82%

Total non-current liabilities 85189 14.09 125620 20.16 57832 12.81

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

% % %

Total liabilities 212808 35.19

% 252452 40.52

% 145038 32.14

%

Equity 0.00%

Issued capital 386973 63.99

% 385310 61.84

% 319319 70.75

%

Reserves 12151 2.01% 3208 0.51% 1390 0.31%

Retained earnings -8184 -

1.35% -19603 -

3.15% -16282 -

3.61%

Total equity 390940 64.65

% 368915 59.21

% 304427 67.45

%

Non-Controlling Interest 973 0.16% 1737 0.28% 1860 0.41%

Shareholder's Equity 391913 64.81

% 370652 59.48

% 306287 67.86

%

Total Liabilities and Equities 604721

100.00

% 623104

100.00

% 451325

100.00

%

Table 3

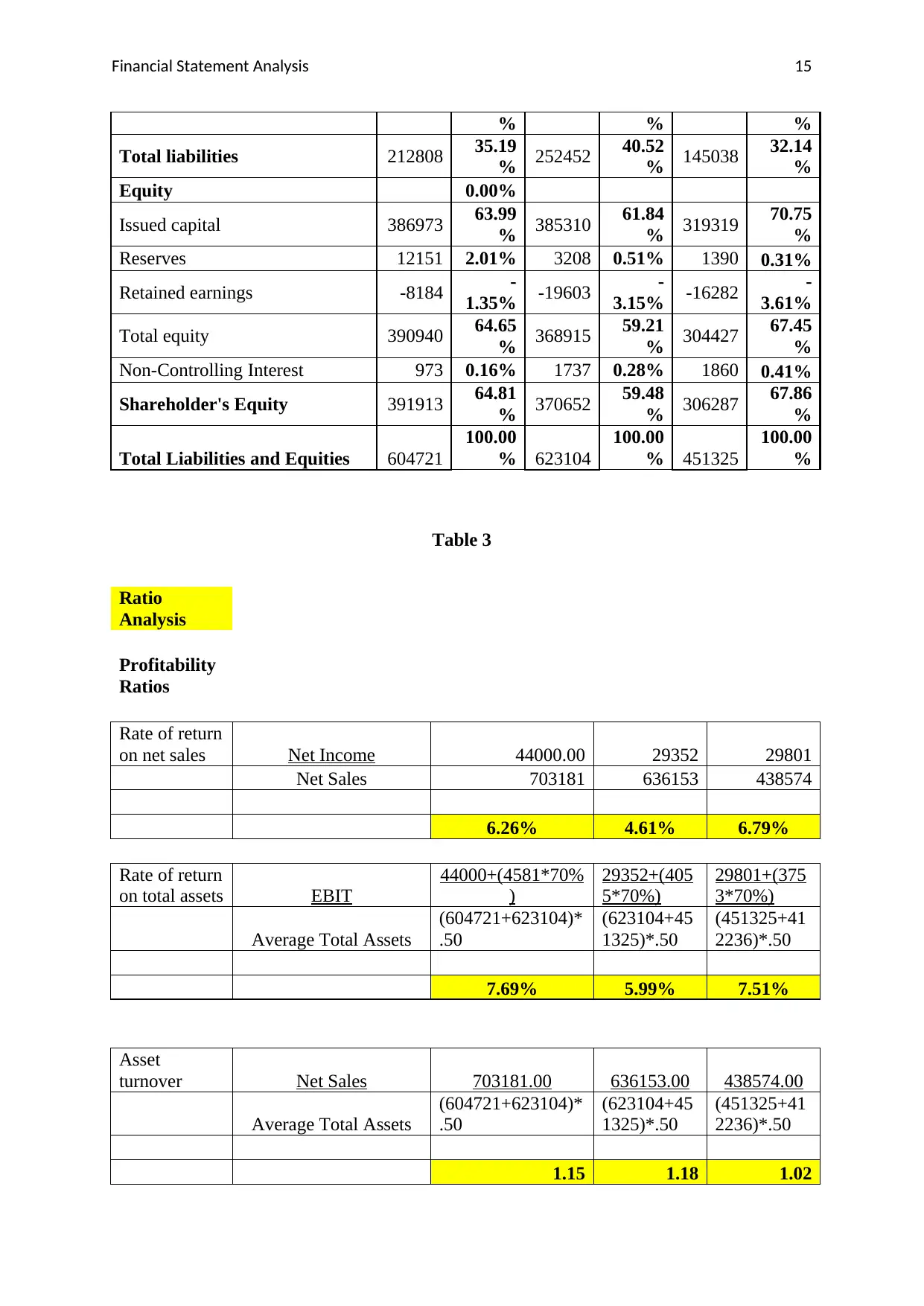

Ratio

Analysis

Profitability

Ratios

Rate of return

on net sales Net Income 44000.00 29352 29801

Net Sales 703181 636153 438574

6.26% 4.61% 6.79%

Rate of return

on total assets EBIT

44000+(4581*70%

)

29352+(405

5*70%)

29801+(375

3*70%)

Average Total Assets

(604721+623104)*

.50

(623104+45

1325)*.50

(451325+41

2236)*.50

7.69% 5.99% 7.51%

Asset

turnover Net Sales 703181.00 636153.00 438574.00

Average Total Assets

(604721+623104)*

.50

(623104+45

1325)*.50

(451325+41

2236)*.50

1.15 1.18 1.02

Paraphrase This Document

Rate of return

on ordinary

shareholders’

equity Profit after Tax 44000 29352 29801

Average Shareholder's

Equity

(390940+368915)*

.50

(368915+30

4427)*.50

(304427+24

2828)*.50

11.58% 8.72% 10.89%

Earnings per

share Annual Report 0.08 0.05 0.06

Liquidity

Working

capital 2018 2017 2016

Current ratio Current Assets 161679.00 181340.00 151309.00

Current Liabilities 127619.00 126832.00 87206.00

1.27 1.43 1.74

Acid Test

Ratio Quick Assets 61906.00 67011.00 71196.00

Current Liabilities 127619.00 126832.00 87206.00

0.49 0.53 0.82

Inventory

turnover COGS 305490.00 286924.00 202398.00

Average Inventory

(98556+111946)*.

50

(111946+78

534)*.50

(78534+714

45)*.50

2.90 3.01 2.70

Days in

inventory 365 365 365 365

Inventory Turnover

Ratio 2.90 3.01 2.70

125.75 121.16 135.23

Gross profit

percentage GP 397691 349229 236176

Sales 703181 636153 438574

56.56% 54.90% 53.85%

Accounts

receivable

turnover Sales 703,181 636,153 438,574

Average Accounts

Receivables

(18370+19856)*.5

0

(19856+254

72)*.50

(25472+237

01)*.50

36.79 28.07 17.84

Days’ sales in

receivables 365 365 365 365

Receivable Turnover

Ratio 36.79 28.07 17.84

9.92 13.00 20.46

Gearing

Debt ratio Total Debt 213781 254189 146898

Total Assets 604721.00 623104.00 451325.00

0.35 0.41 0.33

Debt to

equity ratio Total Debt 73625 103722 50013

Total Equity 390940 368915 304427

18.83% 28.12% 16.43%

Times

interest

earned ratio EBIT 65499.00 45479.00 46253.00

Interest Expense 4581 4055 3753

14.3 11.22 12.32

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.