Accounting Financial Analysis Report

VerifiedAdded on 2023/06/11

|6

|777

|363

AI Summary

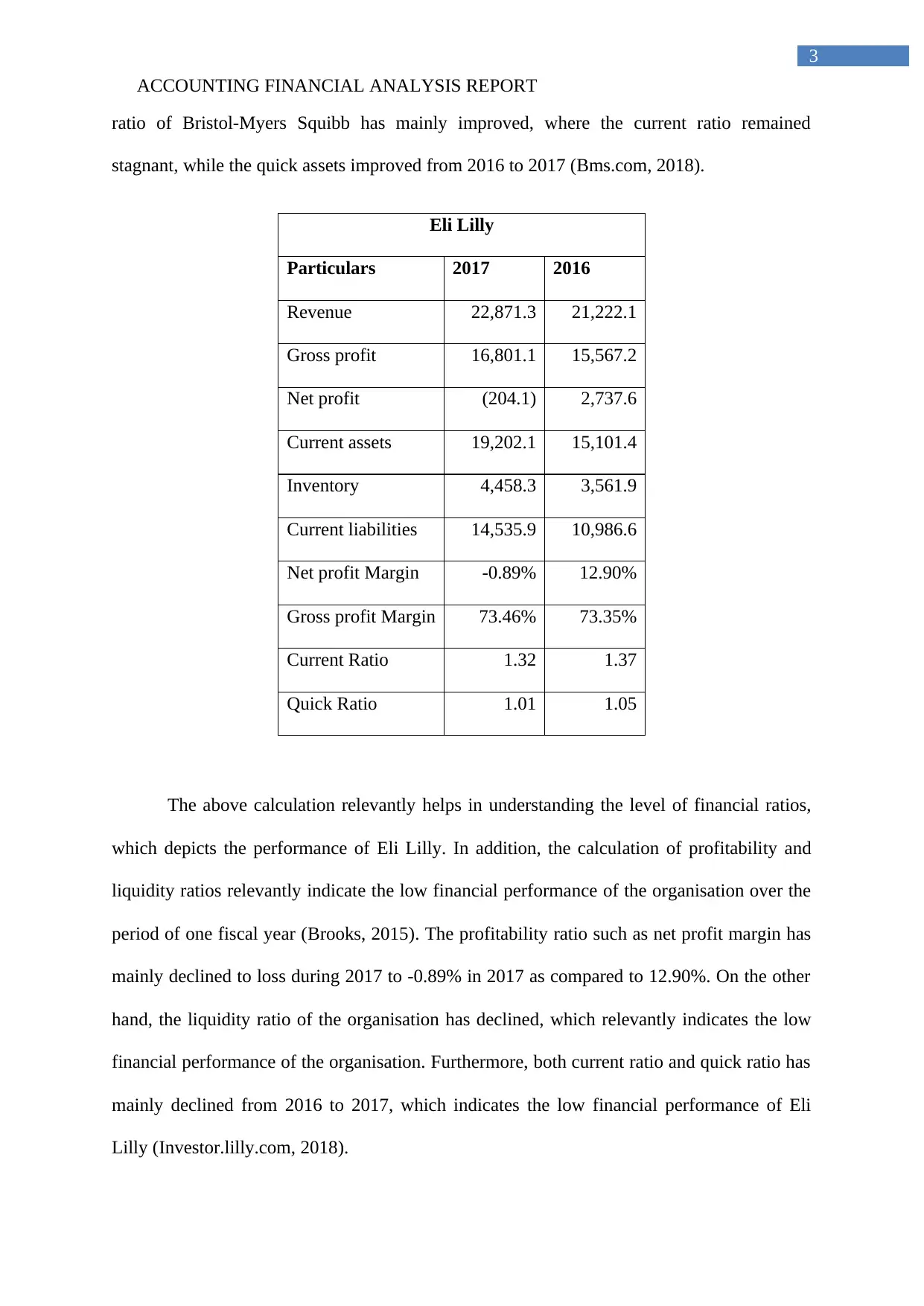

This report provides a financial analysis of Bristol Myers Squibb and Eli Lilly, including their revenue, gross profit, net profit, current assets, inventory, current liabilities, net profit margin, gross profit margin, current ratio, and quick ratio. The report recommends investing in Bristol Myers Squibb due to its higher financial performance compared to Eli Lilly.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)