Financial Analysis

VerifiedAdded on 2023/04/21

|22

|4552

|493

AI Summary

This report provides a financial analysis of two investment proposals for AYR Co. The analysis includes net present value, internal rate of return, and payback period calculations. Based on the findings, the Project Aspire is recommended due to its higher net present value and internal rate of return.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: FINANCIAL ANALYSIS 0

FINANCIAL ANALYSIS

FINANCIAL ANALYSIS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS 1

Abstract

AYR co is basically a company that is looking out for the proposals of investment of two

categories namely Aspire and Wolf. According to the information provided in the case study the

Directors of the AYR Co. are being advised on how to plan the capital expenditure. On the basis

of certain assumptions the Net Present Value, Internal Rate of Return and Payback period of the

projects were calculated. After comparing both the projects of the company the Project Aspire

has been recommended to the company due to the great amount of cash flows as compared to the

Project Wolf. However a number of other factors are also required to be considered in terms of

the financial and other market forces.

Abstract

AYR co is basically a company that is looking out for the proposals of investment of two

categories namely Aspire and Wolf. According to the information provided in the case study the

Directors of the AYR Co. are being advised on how to plan the capital expenditure. On the basis

of certain assumptions the Net Present Value, Internal Rate of Return and Payback period of the

projects were calculated. After comparing both the projects of the company the Project Aspire

has been recommended to the company due to the great amount of cash flows as compared to the

Project Wolf. However a number of other factors are also required to be considered in terms of

the financial and other market forces.

FINANCIAL ANALYSIS 2

Contents

Abstract.......................................................................................................................................................1

Phase 1: Capital Investment Appraisal........................................................................................................3

Methods and Techniques.........................................................................................................................3

Phase 2: Analysis and evaluation of the investment project option.............................................................4

Findings...................................................................................................................................................4

Net Present value.................................................................................................................................4

Internal Rate of Return........................................................................................................................6

Payback period....................................................................................................................................6

Interpretations and Recommendations.....................................................................................................8

Other factors............................................................................................................................................9

Financing and its sources...........................................................................................................................10

Description of Equity and Debt.............................................................................................................11

Cost of financing...................................................................................................................................12

Effects on WACC..................................................................................................................................13

Shareholders and Impact.......................................................................................................................13

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

Appendix...................................................................................................................................................18

Contents

Abstract.......................................................................................................................................................1

Phase 1: Capital Investment Appraisal........................................................................................................3

Methods and Techniques.........................................................................................................................3

Phase 2: Analysis and evaluation of the investment project option.............................................................4

Findings...................................................................................................................................................4

Net Present value.................................................................................................................................4

Internal Rate of Return........................................................................................................................6

Payback period....................................................................................................................................6

Interpretations and Recommendations.....................................................................................................8

Other factors............................................................................................................................................9

Financing and its sources...........................................................................................................................10

Description of Equity and Debt.............................................................................................................11

Cost of financing...................................................................................................................................12

Effects on WACC..................................................................................................................................13

Shareholders and Impact.......................................................................................................................13

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

Appendix...................................................................................................................................................18

FINANCIAL ANALYSIS 3

Phase 1: Capital Investment Appraisal

The capital investment appraisal is a segment of the planning which assist in evaluating the long

terms investments or the short term investment. There are various methods to calculate the

viability of the investments and such techniques are namely IRR, Net present Value, and

Profitability index. The current report will be restricted to these three methods an these

techniques are used to determine the future prospects that will be beneficial after the

implementation. In order to increase the market share the AYR Co shall focus on the ability of

the projects to generate enough cash flows (Caselli and Negri, 2018).

Methods and Techniques

As mentioned in the report the three methods of the appraisal and capital investments include the

net present value, the IRR and the payback period. The first two methods also consider the

concept of the time value of money (Burns and Walker, 2015).

Net Present value: it is the calculative description of the difference between the inflows and the

outflows of the cash. The net present value is calculated at the discounted rate. The decision on

the basis of the net present value can be considered on the basis of the high or low present value.

The higher the net present value, the desirability of the project increases accordingly (Rad,

Jamili, Tavakkoli-Moghaddam and Paknahad, 2016).

Formula:

NPV = Cashflow - Initial Investment

(1+i)^t

Phase 1: Capital Investment Appraisal

The capital investment appraisal is a segment of the planning which assist in evaluating the long

terms investments or the short term investment. There are various methods to calculate the

viability of the investments and such techniques are namely IRR, Net present Value, and

Profitability index. The current report will be restricted to these three methods an these

techniques are used to determine the future prospects that will be beneficial after the

implementation. In order to increase the market share the AYR Co shall focus on the ability of

the projects to generate enough cash flows (Caselli and Negri, 2018).

Methods and Techniques

As mentioned in the report the three methods of the appraisal and capital investments include the

net present value, the IRR and the payback period. The first two methods also consider the

concept of the time value of money (Burns and Walker, 2015).

Net Present value: it is the calculative description of the difference between the inflows and the

outflows of the cash. The net present value is calculated at the discounted rate. The decision on

the basis of the net present value can be considered on the basis of the high or low present value.

The higher the net present value, the desirability of the project increases accordingly (Rad,

Jamili, Tavakkoli-Moghaddam and Paknahad, 2016).

Formula:

NPV = Cashflow - Initial Investment

(1+i)^t

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS 4

Internal rate of return: IRR is the discounting rate that brings the NPV value equivalent to

zero. The decision on the basis of the IRR can be taken if the cost of capital is lower than the

IRR, otherwise the project is rejected (Gallo, 2016).

Formula:

IRR(Sum of cash flows including initial investment)

Payback period: The payback period can be referred to as the period in which the cost of

investment can be recovered. The investment proposals that have the shorter payback period

shall be selected (Abor, 2017).

Payback Period = A

+

B

C

Variable A: is the last period with a negative cumulative cash flow;

Variable B: is the absolute value of cumulative cash flow at the end of the period A

Variable C: is the total cash flow during the period after A

Phase 2: Analysis and evaluation of the investment project option

Findings

Net Present value

To analyze the discounted cash flows, NPV stands out as one of the common techniques used for

measuring the projects. In this way the future uncertainty of the cash flows is compensated. This

techniques allows the good comparison between the cash flows, hence the net present value is a

good factor to analyze the present position of the investment proposals. For two investment

proposals the project with higher NPV shall be selected. For the purpose of calculation the

Internal rate of return: IRR is the discounting rate that brings the NPV value equivalent to

zero. The decision on the basis of the IRR can be taken if the cost of capital is lower than the

IRR, otherwise the project is rejected (Gallo, 2016).

Formula:

IRR(Sum of cash flows including initial investment)

Payback period: The payback period can be referred to as the period in which the cost of

investment can be recovered. The investment proposals that have the shorter payback period

shall be selected (Abor, 2017).

Payback Period = A

+

B

C

Variable A: is the last period with a negative cumulative cash flow;

Variable B: is the absolute value of cumulative cash flow at the end of the period A

Variable C: is the total cash flow during the period after A

Phase 2: Analysis and evaluation of the investment project option

Findings

Net Present value

To analyze the discounted cash flows, NPV stands out as one of the common techniques used for

measuring the projects. In this way the future uncertainty of the cash flows is compensated. This

techniques allows the good comparison between the cash flows, hence the net present value is a

good factor to analyze the present position of the investment proposals. For two investment

proposals the project with higher NPV shall be selected. For the purpose of calculation the

FINANCIAL ANALYSIS 5

discounted rate of 10% is used to discount all the net cash flows to their present value. The same

can be observed with the help of the table (Leyman and Vanhoucke, 2016).

Project Aspire

Calculation of

Net present

Value

Years Cash

flows

Discounting

Factor @

10%

NPV

0 -2250000 1.00

-

2250000

1 623000 0.91 566930

2 665328 0.83 552222

3 664403 0.75 498302

4 699570 0.68 475708

5 1113063 0.62 690099

6 -193599 0.56 -108415

Net Present

Value 424846

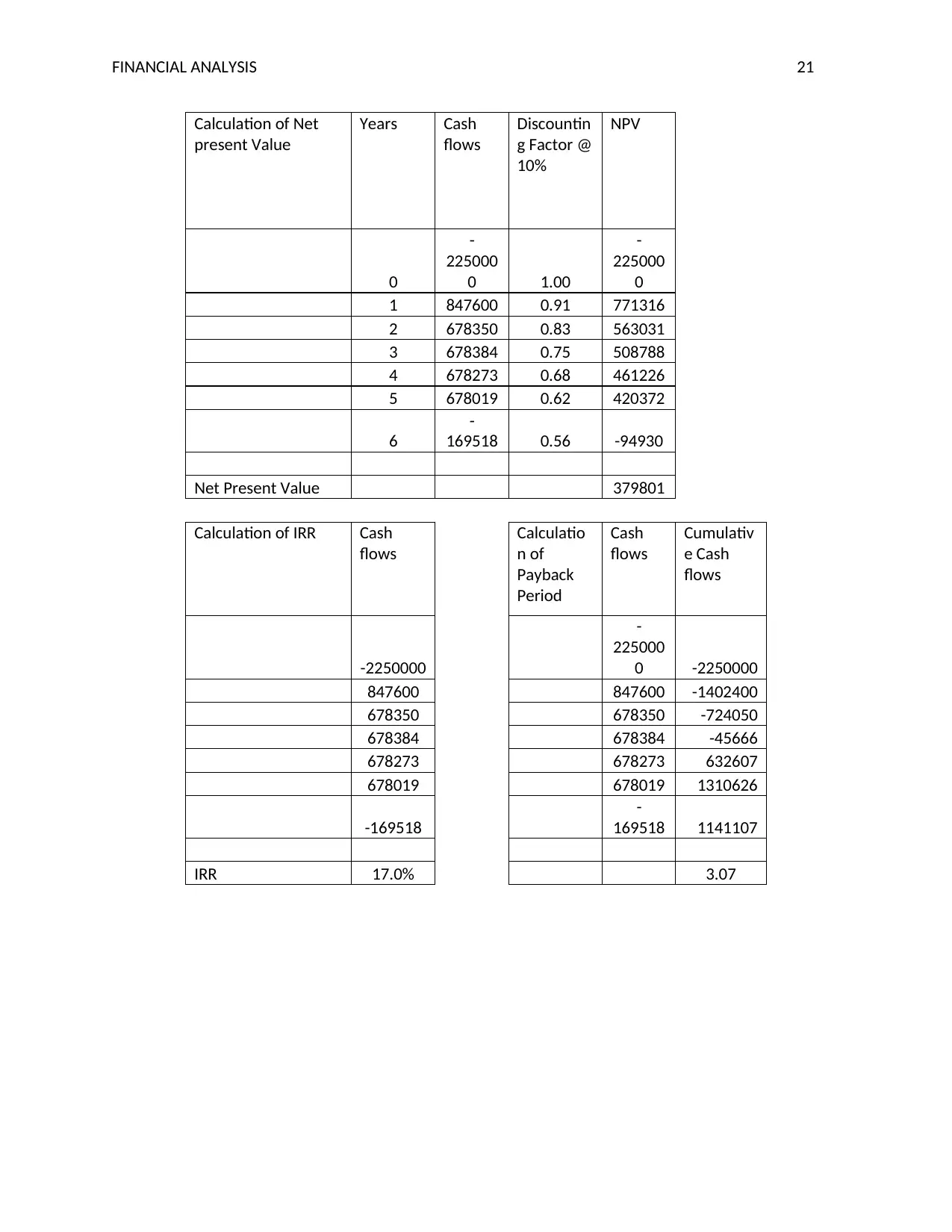

Project Wolf

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0

-

225000

0 1.00

-

225000

0

1 847600 0.91 771316

2 678350 0.83 563031

3 678384 0.75 508788

4 678273 0.68 461226

5 678019 0.62 420372

6

-

169518 0.56 -94930

Net Present Value 379801

discounted rate of 10% is used to discount all the net cash flows to their present value. The same

can be observed with the help of the table (Leyman and Vanhoucke, 2016).

Project Aspire

Calculation of

Net present

Value

Years Cash

flows

Discounting

Factor @

10%

NPV

0 -2250000 1.00

-

2250000

1 623000 0.91 566930

2 665328 0.83 552222

3 664403 0.75 498302

4 699570 0.68 475708

5 1113063 0.62 690099

6 -193599 0.56 -108415

Net Present

Value 424846

Project Wolf

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0

-

225000

0 1.00

-

225000

0

1 847600 0.91 771316

2 678350 0.83 563031

3 678384 0.75 508788

4 678273 0.68 461226

5 678019 0.62 420372

6

-

169518 0.56 -94930

Net Present Value 379801

FINANCIAL ANALYSIS 6

From the above analysis it can be found out that the net present value of the Project Aspire is

better than the net present value of the Project Wolf. But this single factor lone cannot help in

deciding whether the project shall be accepted or rejected or not. The other factors must also be

considered to determine which proposal shall be included.

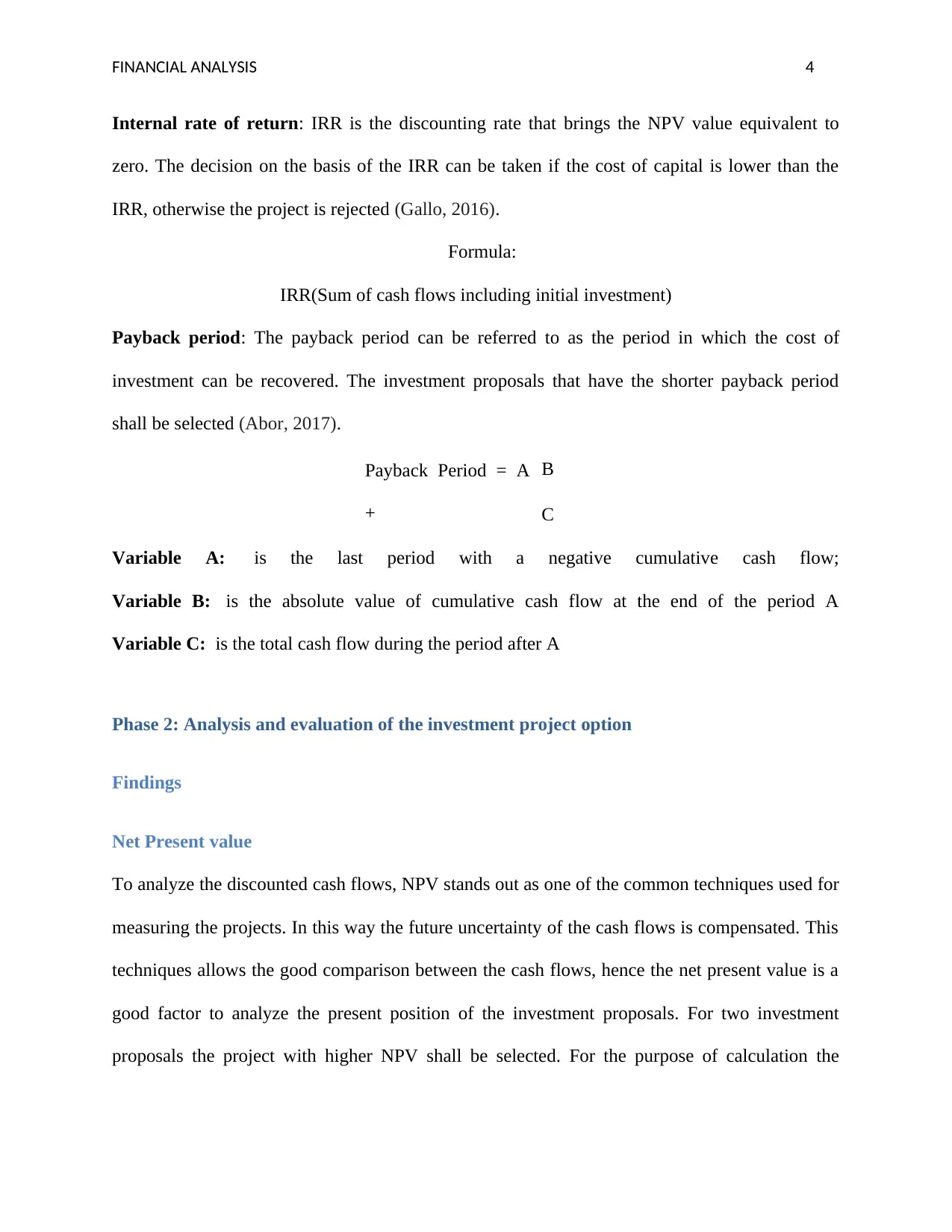

Internal Rate of Return

The internal rate of return is the accounting rate which is basically achieved when the project is

at breakeven. The investors invest in the project on the basis of the internal rate of return because

this rate reflects what amount in return the investor is going to get. The decision to choose the

investment is based upon IRR greater the cost of capital. The higher the IRR the more attractive

the project is. In order to calculate the IRR the following method can be used to present the IRR

(Bornholt, 2017).

Calculati

on of

IRR

Cash

flows

(Aspir

e)

Cash

flows

(Wolf)

-

22500

00

-

22500

00

62300

0

84760

0

66532

8

67835

0

66440

3

67838

4

69957

0

67827

3

11130

63

67801

9

- -

From the above analysis it can be found out that the net present value of the Project Aspire is

better than the net present value of the Project Wolf. But this single factor lone cannot help in

deciding whether the project shall be accepted or rejected or not. The other factors must also be

considered to determine which proposal shall be included.

Internal Rate of Return

The internal rate of return is the accounting rate which is basically achieved when the project is

at breakeven. The investors invest in the project on the basis of the internal rate of return because

this rate reflects what amount in return the investor is going to get. The decision to choose the

investment is based upon IRR greater the cost of capital. The higher the IRR the more attractive

the project is. In order to calculate the IRR the following method can be used to present the IRR

(Bornholt, 2017).

Calculati

on of

IRR

Cash

flows

(Aspir

e)

Cash

flows

(Wolf)

-

22500

00

-

22500

00

62300

0

84760

0

66532

8

67835

0

66440

3

67838

4

69957

0

67827

3

11130

63

67801

9

- -

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 7

19359

9

16951

8

IRR 16.8% 17.0%

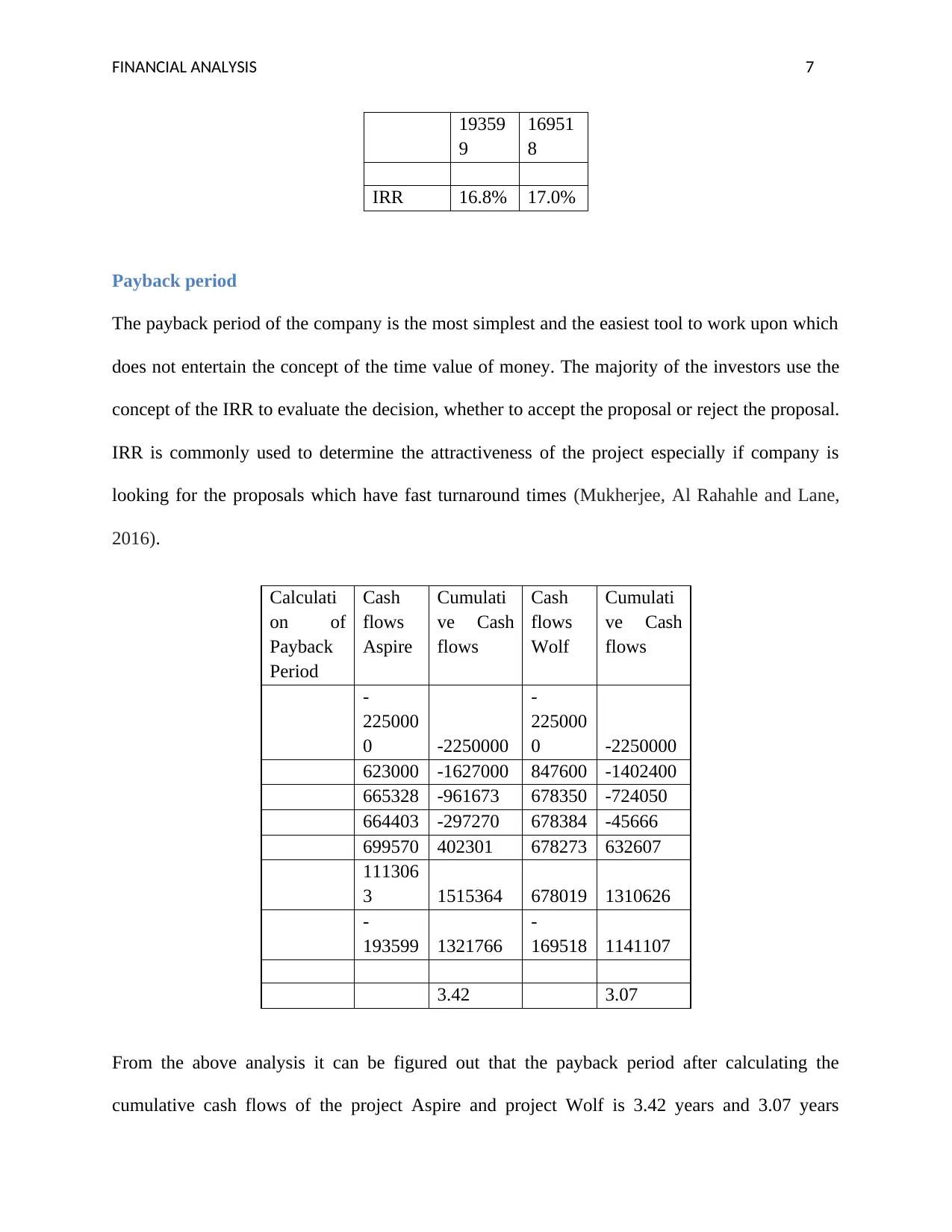

Payback period

The payback period of the company is the most simplest and the easiest tool to work upon which

does not entertain the concept of the time value of money. The majority of the investors use the

concept of the IRR to evaluate the decision, whether to accept the proposal or reject the proposal.

IRR is commonly used to determine the attractiveness of the project especially if company is

looking for the proposals which have fast turnaround times (Mukherjee, Al Rahahle and Lane,

2016).

Calculati

on of

Payback

Period

Cash

flows

Aspire

Cumulati

ve Cash

flows

Cash

flows

Wolf

Cumulati

ve Cash

flows

-

225000

0 -2250000

-

225000

0 -2250000

623000 -1627000 847600 -1402400

665328 -961673 678350 -724050

664403 -297270 678384 -45666

699570 402301 678273 632607

111306

3 1515364 678019 1310626

-

193599 1321766

-

169518 1141107

3.42 3.07

From the above analysis it can be figured out that the payback period after calculating the

cumulative cash flows of the project Aspire and project Wolf is 3.42 years and 3.07 years

19359

9

16951

8

IRR 16.8% 17.0%

Payback period

The payback period of the company is the most simplest and the easiest tool to work upon which

does not entertain the concept of the time value of money. The majority of the investors use the

concept of the IRR to evaluate the decision, whether to accept the proposal or reject the proposal.

IRR is commonly used to determine the attractiveness of the project especially if company is

looking for the proposals which have fast turnaround times (Mukherjee, Al Rahahle and Lane,

2016).

Calculati

on of

Payback

Period

Cash

flows

Aspire

Cumulati

ve Cash

flows

Cash

flows

Wolf

Cumulati

ve Cash

flows

-

225000

0 -2250000

-

225000

0 -2250000

623000 -1627000 847600 -1402400

665328 -961673 678350 -724050

664403 -297270 678384 -45666

699570 402301 678273 632607

111306

3 1515364 678019 1310626

-

193599 1321766

-

169518 1141107

3.42 3.07

From the above analysis it can be figured out that the payback period after calculating the

cumulative cash flows of the project Aspire and project Wolf is 3.42 years and 3.07 years

FINANCIAL ANALYSIS 8

respectively. The Wolf project has more capacity than the Aspire project. This certainly doesn’t

mean that the Aspire project is bad and shall not be selected the Aspire project though is going to

recover the cost a little later yet it can be chosen on the basis of the net present value and internal

rate of return if combined in taking the overall decision (Robinson and Burnett, 2016).

respectively. The Wolf project has more capacity than the Aspire project. This certainly doesn’t

mean that the Aspire project is bad and shall not be selected the Aspire project though is going to

recover the cost a little later yet it can be chosen on the basis of the net present value and internal

rate of return if combined in taking the overall decision (Robinson and Burnett, 2016).

FINANCIAL ANALYSIS 9

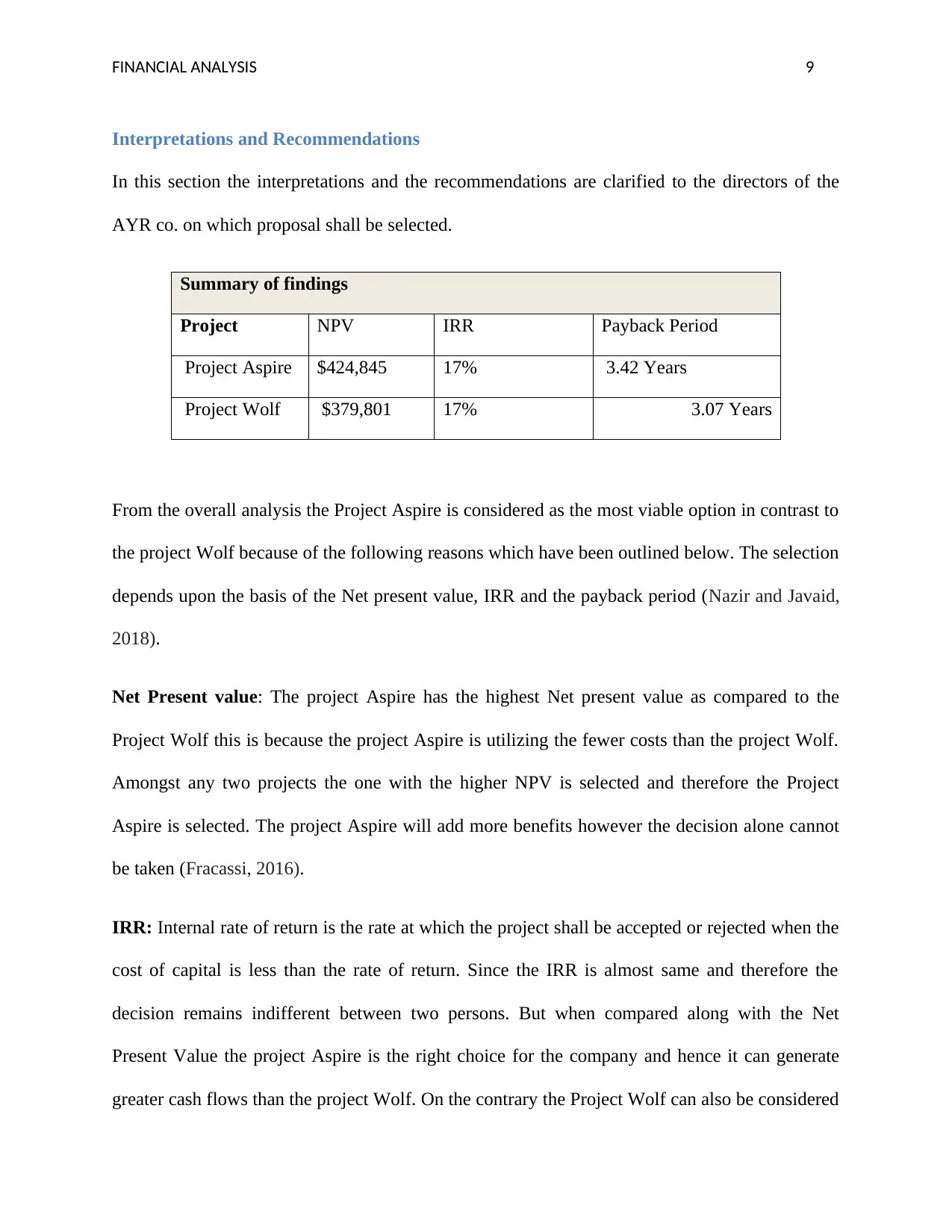

Interpretations and Recommendations

In this section the interpretations and the recommendations are clarified to the directors of the

AYR co. on which proposal shall be selected.

Summary of findings

Project NPV IRR Payback Period

Project Aspire $424,845 17% 3.42 Years

Project Wolf $379,801 17% 3.07 Years

From the overall analysis the Project Aspire is considered as the most viable option in contrast to

the project Wolf because of the following reasons which have been outlined below. The selection

depends upon the basis of the Net present value, IRR and the payback period (Nazir and Javaid,

2018).

Net Present value: The project Aspire has the highest Net present value as compared to the

Project Wolf this is because the project Aspire is utilizing the fewer costs than the project Wolf.

Amongst any two projects the one with the higher NPV is selected and therefore the Project

Aspire is selected. The project Aspire will add more benefits however the decision alone cannot

be taken (Fracassi, 2016).

IRR: Internal rate of return is the rate at which the project shall be accepted or rejected when the

cost of capital is less than the rate of return. Since the IRR is almost same and therefore the

decision remains indifferent between two persons. But when compared along with the Net

Present Value the project Aspire is the right choice for the company and hence it can generate

greater cash flows than the project Wolf. On the contrary the Project Wolf can also be considered

Interpretations and Recommendations

In this section the interpretations and the recommendations are clarified to the directors of the

AYR co. on which proposal shall be selected.

Summary of findings

Project NPV IRR Payback Period

Project Aspire $424,845 17% 3.42 Years

Project Wolf $379,801 17% 3.07 Years

From the overall analysis the Project Aspire is considered as the most viable option in contrast to

the project Wolf because of the following reasons which have been outlined below. The selection

depends upon the basis of the Net present value, IRR and the payback period (Nazir and Javaid,

2018).

Net Present value: The project Aspire has the highest Net present value as compared to the

Project Wolf this is because the project Aspire is utilizing the fewer costs than the project Wolf.

Amongst any two projects the one with the higher NPV is selected and therefore the Project

Aspire is selected. The project Aspire will add more benefits however the decision alone cannot

be taken (Fracassi, 2016).

IRR: Internal rate of return is the rate at which the project shall be accepted or rejected when the

cost of capital is less than the rate of return. Since the IRR is almost same and therefore the

decision remains indifferent between two persons. But when compared along with the Net

Present Value the project Aspire is the right choice for the company and hence it can generate

greater cash flows than the project Wolf. On the contrary the Project Wolf can also be considered

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS 10

just on the basis of the IRR and this can also add more value to the AYR Co. hence, overall

conclusion will fall in favor of the Project Aspire only (Ehrhardt and Brigham, 2016).

Payback Period: Lastly in terms of the payback period the Project Wolf is ahead of Project

Aspire as the number of days the investment can recover the cost of investment in 3.07 years

whereas in case of the Aspire project the payback period is 3.42 years. Under this situation the

project Wolf is recommended to the AYR Co. as it will recover the cost of investment in the

faster manner. The project Wolf might be a fruitful one but the Project Aspire is the most

desirable choice in terms of the overall selection of the proposal (Pham and Alenikov, 2018).

Other factors

Strategic options

The strategy plays an important factor determining the selection of the proposal and the

acceptance. This usually occurs when the product breaks the sales of another product. If such

case arises for the Project Aspire it is recommended to the directors of the company to entertain

the Wolf project more as it appeal to the different categories and while the Aspire project is used

to fulfill the expectations of the existing customers. In such a case the desirability of the project

will increase and will be favorable for the company. Such strategies will define the right choice

that fits the resources of the company.

Personnel

Personnel also play a vital role in selection of the proposal and the situations differ accordingly.

In case of the AYR Co. has experts and the skilled people or they have the capacity to enjoy the

wider options in the market. The non-financial factors shall also be considered (Harris, 2018).

just on the basis of the IRR and this can also add more value to the AYR Co. hence, overall

conclusion will fall in favor of the Project Aspire only (Ehrhardt and Brigham, 2016).

Payback Period: Lastly in terms of the payback period the Project Wolf is ahead of Project

Aspire as the number of days the investment can recover the cost of investment in 3.07 years

whereas in case of the Aspire project the payback period is 3.42 years. Under this situation the

project Wolf is recommended to the AYR Co. as it will recover the cost of investment in the

faster manner. The project Wolf might be a fruitful one but the Project Aspire is the most

desirable choice in terms of the overall selection of the proposal (Pham and Alenikov, 2018).

Other factors

Strategic options

The strategy plays an important factor determining the selection of the proposal and the

acceptance. This usually occurs when the product breaks the sales of another product. If such

case arises for the Project Aspire it is recommended to the directors of the company to entertain

the Wolf project more as it appeal to the different categories and while the Aspire project is used

to fulfill the expectations of the existing customers. In such a case the desirability of the project

will increase and will be favorable for the company. Such strategies will define the right choice

that fits the resources of the company.

Personnel

Personnel also play a vital role in selection of the proposal and the situations differ accordingly.

In case of the AYR Co. has experts and the skilled people or they have the capacity to enjoy the

wider options in the market. The non-financial factors shall also be considered (Harris, 2018).

FINANCIAL ANALYSIS 11

Culture and system

The culture and system of the company can interfere the performance of the company in many

ways. This may also leads to the either the enhancement in the performance or the declining in

the performance of the company. If undertaking the Aspire project by the company can lead to

the interference of the culture and the values possessed by the companies on the basis of say the

method of the communication than the company can make the changes accordingly and decide.

It is the duty of the management to take all the possible alternatives before making any capital

investment decision. Therefore it is advised to the management of the AYR Co that it shall

analyze the effects of the investment proposal before spending the funds.

Economy and politics

The economic and the political factors are also critical from the point of view of the

management. The interest rates and the taxes can affect the performance the company that may

also give rise to inflation (Michiels and Molly, 2017).

Environmental concerns

The ethical practices and the environmental concerns are the major reasons that are to be

analyzed because it can possibly effect the financial option the company is going to adopt. This

suggests that the management shall supervise the changes happening in the external as well as

the internal environment (Frank and Shen, 2016).

Financing and its sources

In this particular phase of the report the methods of the financing are being discussed by the

AYR Co. The methods are classified into the Equity financing and debt financing. Under the

Culture and system

The culture and system of the company can interfere the performance of the company in many

ways. This may also leads to the either the enhancement in the performance or the declining in

the performance of the company. If undertaking the Aspire project by the company can lead to

the interference of the culture and the values possessed by the companies on the basis of say the

method of the communication than the company can make the changes accordingly and decide.

It is the duty of the management to take all the possible alternatives before making any capital

investment decision. Therefore it is advised to the management of the AYR Co that it shall

analyze the effects of the investment proposal before spending the funds.

Economy and politics

The economic and the political factors are also critical from the point of view of the

management. The interest rates and the taxes can affect the performance the company that may

also give rise to inflation (Michiels and Molly, 2017).

Environmental concerns

The ethical practices and the environmental concerns are the major reasons that are to be

analyzed because it can possibly effect the financial option the company is going to adopt. This

suggests that the management shall supervise the changes happening in the external as well as

the internal environment (Frank and Shen, 2016).

Financing and its sources

In this particular phase of the report the methods of the financing are being discussed by the

AYR Co. The methods are classified into the Equity financing and debt financing. Under the

FINANCIAL ANALYSIS 12

equity financing the new shares are issued to the general public whereas in debt financing the

money is borrowed from the third party (Chod, 2017).

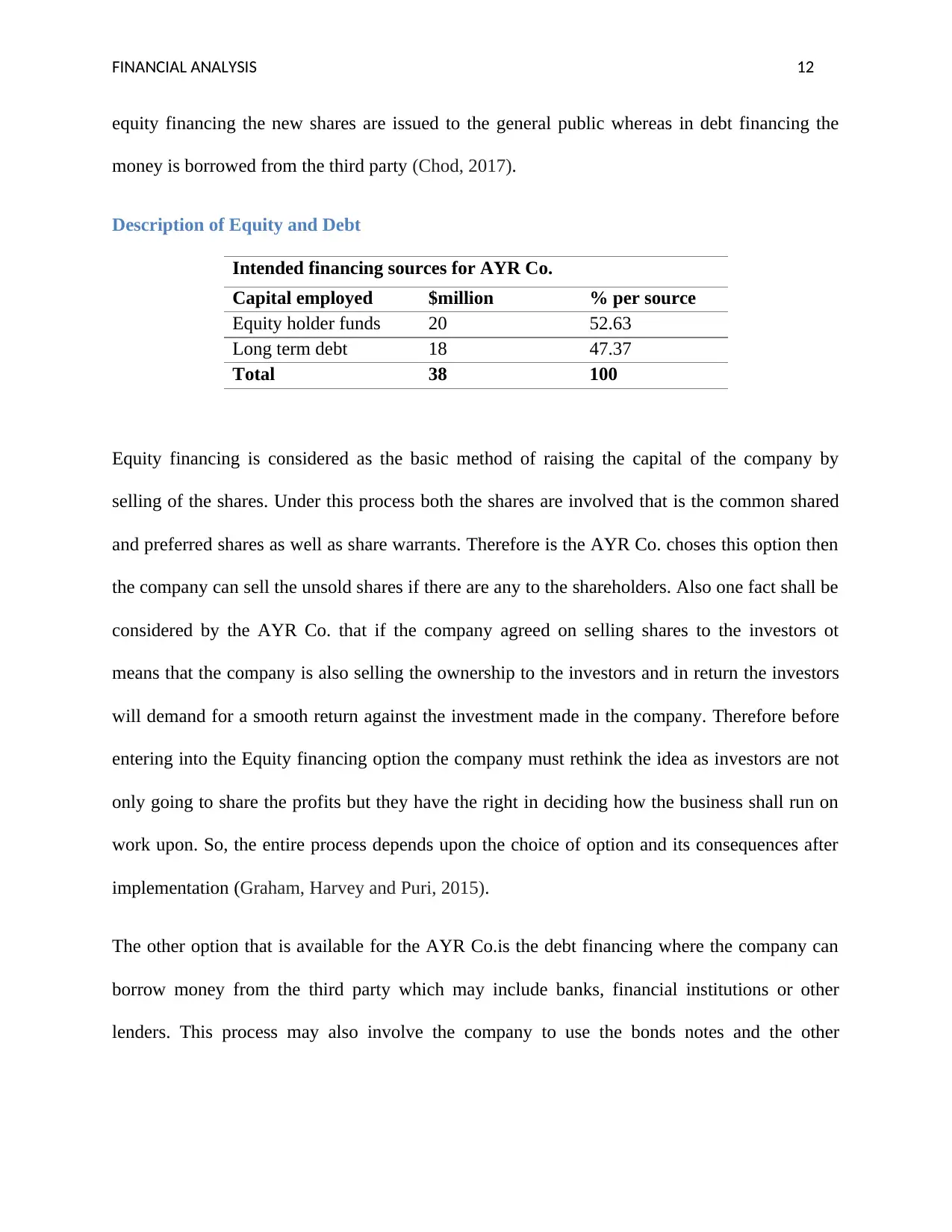

Description of Equity and Debt

Intended financing sources for AYR Co.

Capital employed $million % per source

Equity holder funds 20 52.63

Long term debt 18 47.37

Total 38 100

Equity financing is considered as the basic method of raising the capital of the company by

selling of the shares. Under this process both the shares are involved that is the common shared

and preferred shares as well as share warrants. Therefore is the AYR Co. choses this option then

the company can sell the unsold shares if there are any to the shareholders. Also one fact shall be

considered by the AYR Co. that if the company agreed on selling shares to the investors ot

means that the company is also selling the ownership to the investors and in return the investors

will demand for a smooth return against the investment made in the company. Therefore before

entering into the Equity financing option the company must rethink the idea as investors are not

only going to share the profits but they have the right in deciding how the business shall run on

work upon. So, the entire process depends upon the choice of option and its consequences after

implementation (Graham, Harvey and Puri, 2015).

The other option that is available for the AYR Co.is the debt financing where the company can

borrow money from the third party which may include banks, financial institutions or other

lenders. This process may also involve the company to use the bonds notes and the other

equity financing the new shares are issued to the general public whereas in debt financing the

money is borrowed from the third party (Chod, 2017).

Description of Equity and Debt

Intended financing sources for AYR Co.

Capital employed $million % per source

Equity holder funds 20 52.63

Long term debt 18 47.37

Total 38 100

Equity financing is considered as the basic method of raising the capital of the company by

selling of the shares. Under this process both the shares are involved that is the common shared

and preferred shares as well as share warrants. Therefore is the AYR Co. choses this option then

the company can sell the unsold shares if there are any to the shareholders. Also one fact shall be

considered by the AYR Co. that if the company agreed on selling shares to the investors ot

means that the company is also selling the ownership to the investors and in return the investors

will demand for a smooth return against the investment made in the company. Therefore before

entering into the Equity financing option the company must rethink the idea as investors are not

only going to share the profits but they have the right in deciding how the business shall run on

work upon. So, the entire process depends upon the choice of option and its consequences after

implementation (Graham, Harvey and Puri, 2015).

The other option that is available for the AYR Co.is the debt financing where the company can

borrow money from the third party which may include banks, financial institutions or other

lenders. This process may also involve the company to use the bonds notes and the other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 13

agreements with the lenders. Here the company needs to pay a fixed income in the form of the

interest cost from whom the money is borrowed (Foley and Manova, 2015).

On the basis of the analysis it is recommended that the company shall sell their shares rather than

paying the fixed income in the form of the interest cost which will only increase the liabilities on

account of the AYR Co. and this can also lead to the increase in the financial leverage (Serfling,

2016).

Cost of financing

The equity financing is more expensive and complex than the debt financing which gives the

benefit of the deduction of the interest payments as tax deduction (Öztekin, 2015).

In equity financing the cost of the equity is also associated with the higher risk. The investors on

one hand expect a smooth return from the company’s side whereas the management on the other

hand expects the investors to invest high amount of funds in the company. So this is the two way

concept. For instance if the company is bankrupt the investors had to lose all the money. Also

this situation can create loss for the company as well when the money is borrowed from the debt

lenders as if the company goes bankrupt the first hand will be of the debt holders. Further if

analyzed only a fixed income needs to be paid by the company for which the tax advantage is

also available hence the company shall opt for the debt financing rather than the equity financing

(Drover, et al 2017).

Effects on WACC

AYR Co. shall in detail decide the procedure of how well the company can finance the money

with the available options after taking into consideration the past as well as the current

agreements with the lenders. Here the company needs to pay a fixed income in the form of the

interest cost from whom the money is borrowed (Foley and Manova, 2015).

On the basis of the analysis it is recommended that the company shall sell their shares rather than

paying the fixed income in the form of the interest cost which will only increase the liabilities on

account of the AYR Co. and this can also lead to the increase in the financial leverage (Serfling,

2016).

Cost of financing

The equity financing is more expensive and complex than the debt financing which gives the

benefit of the deduction of the interest payments as tax deduction (Öztekin, 2015).

In equity financing the cost of the equity is also associated with the higher risk. The investors on

one hand expect a smooth return from the company’s side whereas the management on the other

hand expects the investors to invest high amount of funds in the company. So this is the two way

concept. For instance if the company is bankrupt the investors had to lose all the money. Also

this situation can create loss for the company as well when the money is borrowed from the debt

lenders as if the company goes bankrupt the first hand will be of the debt holders. Further if

analyzed only a fixed income needs to be paid by the company for which the tax advantage is

also available hence the company shall opt for the debt financing rather than the equity financing

(Drover, et al 2017).

Effects on WACC

AYR Co. shall in detail decide the procedure of how well the company can finance the money

with the available options after taking into consideration the past as well as the current

FINANCIAL ANALYSIS 14

performance of the company. However, whatever choice the company makes it has a direct

effect on the weighted average cost of capital of the company.

The scenario will be such that if the company wants to choose the equity financing the company

may face an increase in the cost of the capital due to increase in share whereas of the debt

financing is the option of the company there may be a reduction in the cost of capital due to the

increased size of the cheapest source. Not only this, AYR Co. shall also analyze the rate of

interest that will directly affect the annual cash flows generated (Klasa, Ortiz-Molina, Serfling

and Srinivasan, 2018).

Shareholders and Impact

There are two major sources of financing, namely the debt and the equity. In general these two

options affect the ownership and the profitability of the business which in fact affects the

shareholders and the investors of the company as well. In case if the equity financing the

shareholders which have the shares at present are diluted if they haven’t purchased any new

shares, whereas in case of the debt financing the liability increase on part of the management as

the fixed amount is kept aside in case of the interest income to be paid to the debenture holders.

Though the process may not have the direct impact on the shareholders yet it touches the overall

concept of the liability (Miller and Skinner, 2015).

Conclusion

From the overall analysis the investment proposal that shall be selected is the Aspire one in

contrast to the Wolf project. The following reasons were mentioned above and discussed in

detail however the Aspire showcased its best ability to fit within the requirements of the AYR

Co. The project has the real ability to pay back the proposal within the time period given.

performance of the company. However, whatever choice the company makes it has a direct

effect on the weighted average cost of capital of the company.

The scenario will be such that if the company wants to choose the equity financing the company

may face an increase in the cost of the capital due to increase in share whereas of the debt

financing is the option of the company there may be a reduction in the cost of capital due to the

increased size of the cheapest source. Not only this, AYR Co. shall also analyze the rate of

interest that will directly affect the annual cash flows generated (Klasa, Ortiz-Molina, Serfling

and Srinivasan, 2018).

Shareholders and Impact

There are two major sources of financing, namely the debt and the equity. In general these two

options affect the ownership and the profitability of the business which in fact affects the

shareholders and the investors of the company as well. In case if the equity financing the

shareholders which have the shares at present are diluted if they haven’t purchased any new

shares, whereas in case of the debt financing the liability increase on part of the management as

the fixed amount is kept aside in case of the interest income to be paid to the debenture holders.

Though the process may not have the direct impact on the shareholders yet it touches the overall

concept of the liability (Miller and Skinner, 2015).

Conclusion

From the overall analysis the investment proposal that shall be selected is the Aspire one in

contrast to the Wolf project. The following reasons were mentioned above and discussed in

detail however the Aspire showcased its best ability to fit within the requirements of the AYR

Co. The project has the real ability to pay back the proposal within the time period given.

FINANCIAL ANALYSIS 15

Furthermore the internal rate of return is also more than the cost of capital as the Aspire has the

ability to generate the enough cash flows than the Wolf. Though the choice recommended to the

company is Aspire yet it is sensitive to certain number of factors such as culture, strategy,

environmental concerns and ethical concerns associated with it. Therefore on the final level the

AYR Co. shall choose the Aspire. The sources of the finances are also analyzed that affect the

cash flows such as the expected return, risks in the market and the ownership. The debt financing

is advised over the equity as the debt is the more cost effective option rather than the equity.

Furthermore the internal rate of return is also more than the cost of capital as the Aspire has the

ability to generate the enough cash flows than the Wolf. Though the choice recommended to the

company is Aspire yet it is sensitive to certain number of factors such as culture, strategy,

environmental concerns and ethical concerns associated with it. Therefore on the final level the

AYR Co. shall choose the Aspire. The sources of the finances are also analyzed that affect the

cash flows such as the expected return, risks in the market and the ownership. The debt financing

is advised over the equity as the debt is the more cost effective option rather than the equity.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS 16

References

Abor, J.Y., 2017. Evaluating Capital Investment Decisions: Capital Budgeting.

In Entrepreneurial Finance for MSMEs (pp. 293-320). Palgrave Macmillan, Cham.

Bornholt, G., 2017. What is an Investment Project's Implied Rate of Return?. Abacus, 53(4),

pp.513-526.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Caselli, S. and Negri, G., 2018. Private equity and venture capital in Europe: markets,

techniques, and deals. Academic Press.

Chod, J., 2017. Agency Cost of Debt: A Case for Supplier Financing. Foundations and Trends®

in Technology, Information and Operations Management, 10(3-4), pp.220-236.

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A. and Dushnitsky, G., 2017. A

review and road map of entrepreneurial equity financing research: venture capital, corporate

venture capital, angel investment, crowdfunding, and accelerators. Journal of

Management, 43(6), pp.1820-1853.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Foley, C.F. and Manova, K., 2015. International trade, multinational activity, and corporate

finance. economics, 7(1), pp.119-146.

References

Abor, J.Y., 2017. Evaluating Capital Investment Decisions: Capital Budgeting.

In Entrepreneurial Finance for MSMEs (pp. 293-320). Palgrave Macmillan, Cham.

Bornholt, G., 2017. What is an Investment Project's Implied Rate of Return?. Abacus, 53(4),

pp.513-526.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Caselli, S. and Negri, G., 2018. Private equity and venture capital in Europe: markets,

techniques, and deals. Academic Press.

Chod, J., 2017. Agency Cost of Debt: A Case for Supplier Financing. Foundations and Trends®

in Technology, Information and Operations Management, 10(3-4), pp.220-236.

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A. and Dushnitsky, G., 2017. A

review and road map of entrepreneurial equity financing research: venture capital, corporate

venture capital, angel investment, crowdfunding, and accelerators. Journal of

Management, 43(6), pp.1820-1853.

Ehrhardt, M.C. and Brigham, E.F., 2016. Corporate finance: A focused approach. Cengage

learning.

Foley, C.F. and Manova, K., 2015. International trade, multinational activity, and corporate

finance. economics, 7(1), pp.119-146.

FINANCIAL ANALYSIS 17

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

Frank, M.Z. and Shen, T., 2016. Investment and the weighted average cost of capital. Journal of

Financial Economics, 119(2), pp.300-315.

Gallo, A., 2016. A refresher on internal rate of return. Harvard Business Review Digital Articles,

pp.2-4.

Graham, J.R., Harvey, C.R. and Puri, M., 2015. Capital allocation and delegation of decision-

making authority within firms. Journal of Financial Economics, 115(3), pp.449-470.

Harris, J.C., 2018. Justice for Sale: The Cost of Private Financing of Prosecution, When Is It

Worth It. Geo. J. Legal Ethics, 31, p.635.

Klasa, S., Ortiz-Molina, H., Serfling, M. and Srinivasan, S., 2018. Protection of trade secrets and

capital structure decisions. Journal of Financial Economics, 128(2), pp.266-286.

Leyman, P. and Vanhoucke, M., 2016. Payment models and net present value optimization for

resource-constrained project scheduling. Computers & Industrial Engineering, 91, pp.139-153.

Michiels, A. and Molly, V., 2017. Financing decisions in family businesses: A review and

suggestions for developing the field. Family Business Review, 30(4), pp.369-399.

Miller, G.S. and Skinner, D.J., 2015. The evolving disclosure landscape: How changes in

technology, the media, and capital markets are affecting disclosure. Journal of Accounting

Research, 53(2), pp.221-239.

Fracassi, C., 2016. Corporate finance policies and social networks. Management Science, 63(8),

pp.2420-2438.

Frank, M.Z. and Shen, T., 2016. Investment and the weighted average cost of capital. Journal of

Financial Economics, 119(2), pp.300-315.

Gallo, A., 2016. A refresher on internal rate of return. Harvard Business Review Digital Articles,

pp.2-4.

Graham, J.R., Harvey, C.R. and Puri, M., 2015. Capital allocation and delegation of decision-

making authority within firms. Journal of Financial Economics, 115(3), pp.449-470.

Harris, J.C., 2018. Justice for Sale: The Cost of Private Financing of Prosecution, When Is It

Worth It. Geo. J. Legal Ethics, 31, p.635.

Klasa, S., Ortiz-Molina, H., Serfling, M. and Srinivasan, S., 2018. Protection of trade secrets and

capital structure decisions. Journal of Financial Economics, 128(2), pp.266-286.

Leyman, P. and Vanhoucke, M., 2016. Payment models and net present value optimization for

resource-constrained project scheduling. Computers & Industrial Engineering, 91, pp.139-153.

Michiels, A. and Molly, V., 2017. Financing decisions in family businesses: A review and

suggestions for developing the field. Family Business Review, 30(4), pp.369-399.

Miller, G.S. and Skinner, D.J., 2015. The evolving disclosure landscape: How changes in

technology, the media, and capital markets are affecting disclosure. Journal of Accounting

Research, 53(2), pp.221-239.

FINANCIAL ANALYSIS 18

Mukherjee, T., Al Rahahleh, N. and Lane, W., 2016. The capital budgeting process of healthcare

organizations: a review of surveys. Journal of Healthcare Management, 61(1), pp.58-76.

Nazir, M.S. and Javaid, A., 2018. Corporate Governance on Financing Policy: Mediating Role

of Cost of Capital. ToKnowPress.

Öztekin, Ö., 2015. Capital structure decisions around the world: which factors are reliably

important?. Journal of Financial and Quantitative Analysis, 50(3), pp.301-323.

Pham, T.N.B. and Alenikov, T., 2018. The importance of Weighted Average Cost of Capital in

investment decision-making for investors of corporations in the healthcare industry.

Rad, M.S., Jamili, A., Tavakkoli-Moghaddam, R. and Paknahad, M., 2016, January. Resource

Constraint Project Scheduling to meet Net Present Value and quality objectives of the program.

In 2016 12th International Conference on Industrial Engineering (ICIE) (pp. 58-62). IEEE.

Robinson, C.J. and Burnett, J., 2016. Financial Management Practices: An Exploratory Study of

Capital Budgeting Techniques in the Caribbean Region. Available at SSRN 2857152.

Serfling, M., 2016. Firing costs and capital structure decisions. The Journal of Finance, 71(5),

pp.2239-2286.

Mukherjee, T., Al Rahahleh, N. and Lane, W., 2016. The capital budgeting process of healthcare

organizations: a review of surveys. Journal of Healthcare Management, 61(1), pp.58-76.

Nazir, M.S. and Javaid, A., 2018. Corporate Governance on Financing Policy: Mediating Role

of Cost of Capital. ToKnowPress.

Öztekin, Ö., 2015. Capital structure decisions around the world: which factors are reliably

important?. Journal of Financial and Quantitative Analysis, 50(3), pp.301-323.

Pham, T.N.B. and Alenikov, T., 2018. The importance of Weighted Average Cost of Capital in

investment decision-making for investors of corporations in the healthcare industry.

Rad, M.S., Jamili, A., Tavakkoli-Moghaddam, R. and Paknahad, M., 2016, January. Resource

Constraint Project Scheduling to meet Net Present Value and quality objectives of the program.

In 2016 12th International Conference on Industrial Engineering (ICIE) (pp. 58-62). IEEE.

Robinson, C.J. and Burnett, J., 2016. Financial Management Practices: An Exploratory Study of

Capital Budgeting Techniques in the Caribbean Region. Available at SSRN 2857152.

Serfling, M., 2016. Firing costs and capital structure decisions. The Journal of Finance, 71(5),

pp.2239-2286.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 19

Appendix

Project Aspire Years

0 1 2 3 4 5 6

Plant and

machinery 2250000

Scrap value 375000

Cash Inflows 650000 698750 751156 807493 868055

Variable costs -27000 -28823 -30768 -32845 -35062

Earnings before

interest and tax 623000 669928 720388 774648 1207993

Taxes @ 20% 0 124600 133986 144078 154930 241599

Capital Allowance 600000 390000 345000 300000 240000

Tax benefits 0 120000 78000 69000 60000 48000

Total cash flow 623000 665328 664403 699570 1113063

-

193599

Working note

Cash Inflows 650000 698750

751156.2

5

807492.968

8

868054.

9

Growth Rate 7.50% 7.50% 7.50% 7.50%

Variable costs

Variable costs -27000 -28823 -30768 -32845 -35062

6.75% 6.75% 6.75% 6.75%

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0 -2250000 1.00 -2250000

1 623000 0.91 566930

2 665328 0.83 552222

3 664403 0.75 498302

4 699570 0.68 475708

5 1113063 0.62 690099

6 -193599 0.56 -108415

Net Present Value 424846

Appendix

Project Aspire Years

0 1 2 3 4 5 6

Plant and

machinery 2250000

Scrap value 375000

Cash Inflows 650000 698750 751156 807493 868055

Variable costs -27000 -28823 -30768 -32845 -35062

Earnings before

interest and tax 623000 669928 720388 774648 1207993

Taxes @ 20% 0 124600 133986 144078 154930 241599

Capital Allowance 600000 390000 345000 300000 240000

Tax benefits 0 120000 78000 69000 60000 48000

Total cash flow 623000 665328 664403 699570 1113063

-

193599

Working note

Cash Inflows 650000 698750

751156.2

5

807492.968

8

868054.

9

Growth Rate 7.50% 7.50% 7.50% 7.50%

Variable costs

Variable costs -27000 -28823 -30768 -32845 -35062

6.75% 6.75% 6.75% 6.75%

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0 -2250000 1.00 -2250000

1 623000 0.91 566930

2 665328 0.83 552222

3 664403 0.75 498302

4 699570 0.68 475708

5 1113063 0.62 690099

6 -193599 0.56 -108415

Net Present Value 424846

FINANCIAL ANALYSIS 20

Calculation of IRR Cash

flows

Calculation

of Payback

Period

Cash

flows

Cumulative

Cash flows

-2250000 -2250000 -2250000

623000 623000 -1627000

665328 665328 -961673

664403 664403 -297270

699570 699570 402301

1113063 1113063 1515364

-193599 -193599 1321766

IRR 16.8% 3.42

Project Wolf Years

0 1 2 3 4 5 6

Plant and machinery 2250000

Scrap value 0

Cash Inflows 955000 955000 955000 955000 955000

Material costs -14400 -15480 -16641 -17889 -19231

Other Expenses 18000 16650 15401 14246 13178

Foregone Rental Income -75000 -75000 -75000 -75000 -75000

Earnings before interest

and tax 847600 847870 847958 847865 847592

Taxes @ 20% 0 169520 169574 169592 169573 169518

Total cashflow 847600 678350 678384 678273 678019 -169518

Working note

Other expense 18000 16650 15401 14246 13178

Declining Rate 7.50% 7.50% 7.50% 7.50%

Variable costs

Variable costs -14400 -15480 -16641 -17889 -19231

7.50% 7.50% 7.50% 7.50%

Calculation of IRR Cash

flows

Calculation

of Payback

Period

Cash

flows

Cumulative

Cash flows

-2250000 -2250000 -2250000

623000 623000 -1627000

665328 665328 -961673

664403 664403 -297270

699570 699570 402301

1113063 1113063 1515364

-193599 -193599 1321766

IRR 16.8% 3.42

Project Wolf Years

0 1 2 3 4 5 6

Plant and machinery 2250000

Scrap value 0

Cash Inflows 955000 955000 955000 955000 955000

Material costs -14400 -15480 -16641 -17889 -19231

Other Expenses 18000 16650 15401 14246 13178

Foregone Rental Income -75000 -75000 -75000 -75000 -75000

Earnings before interest

and tax 847600 847870 847958 847865 847592

Taxes @ 20% 0 169520 169574 169592 169573 169518

Total cashflow 847600 678350 678384 678273 678019 -169518

Working note

Other expense 18000 16650 15401 14246 13178

Declining Rate 7.50% 7.50% 7.50% 7.50%

Variable costs

Variable costs -14400 -15480 -16641 -17889 -19231

7.50% 7.50% 7.50% 7.50%

FINANCIAL ANALYSIS 21

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0

-

225000

0 1.00

-

225000

0

1 847600 0.91 771316

2 678350 0.83 563031

3 678384 0.75 508788

4 678273 0.68 461226

5 678019 0.62 420372

6

-

169518 0.56 -94930

Net Present Value 379801

Calculation of IRR Cash

flows

Calculatio

n of

Payback

Period

Cash

flows

Cumulativ

e Cash

flows

-2250000

-

225000

0 -2250000

847600 847600 -1402400

678350 678350 -724050

678384 678384 -45666

678273 678273 632607

678019 678019 1310626

-169518

-

169518 1141107

IRR 17.0% 3.07

Calculation of Net

present Value

Years Cash

flows

Discountin

g Factor @

10%

NPV

0

-

225000

0 1.00

-

225000

0

1 847600 0.91 771316

2 678350 0.83 563031

3 678384 0.75 508788

4 678273 0.68 461226

5 678019 0.62 420372

6

-

169518 0.56 -94930

Net Present Value 379801

Calculation of IRR Cash

flows

Calculatio

n of

Payback

Period

Cash

flows

Cumulativ

e Cash

flows

-2250000

-

225000

0 -2250000

847600 847600 -1402400

678350 678350 -724050

678384 678384 -45666

678273 678273 632607

678019 678019 1310626

-169518

-

169518 1141107

IRR 17.0% 3.07

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.