Comparative Financial Analysis of Apple Inc. and Samsung Ltd. Report

VerifiedAdded on 2020/10/05

|18

|3819

|425

Report

AI Summary

This report presents a detailed financial analysis of Apple Inc. and Samsung Ltd., comparing their financial strengths and weaknesses through ratio analysis. The introduction emphasizes the importance of financial analysis for organizational success and provides a brief overview of the two companies. The report then delves into profitability ratios, including gross profit margin and net profit margin, providing interpretations of the financial performance of both companies over a four-year period. Liquidity ratios, such as current and acid-test ratios, are examined to assess the companies' ability to meet short-term obligations. Solvency ratios, specifically the debt-equity ratio, are calculated to evaluate the companies' long-term financial stability. Finally, efficiency ratios, such as the inventory turnover ratio, are analyzed to assess how efficiently each company manages its inventory. The report provides a conclusion and recommendations based on the findings, offering insights into the financial health and performance of Apple and Samsung. This report is a valuable resource for students studying financial analysis and provides a comprehensive overview of the key financial aspects of two major industry players.

FINANCIAL

ANALYSIS

MANAGEMENT AND

ENTERPRISE

ANALYSIS

MANAGEMENT AND

ENTERPRISE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

1. Financial strength and weakness.............................................................................................3

2. Representing CSR section of both organizations of last two year and stating its findings...13

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

1. Financial strength and weakness.............................................................................................3

2. Representing CSR section of both organizations of last two year and stating its findings...13

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Financial analysis is very important aspect for every organization. The present case is

giving brief scenario two huge giants of industry such as Samsung and Apple in context of

profitability. The present report is giving brief discussion about critical awareness,

comprehension of business and its prospects related to future. Further it has identified organised

and critically analysed its financial information with well structured format. In the context of

same series various innovative ideas on basis of understanding has been explained by addressing

key problems and theories mentioned in corporate financial management. Further it has

displayed capability for evaluating business issues which are very complex for formulating

various concepts on basis of judgement. It has articulated financial strength and weakness of

both organizations Apple Inc and Samsung Ltd with ratio analysis. Last but not least, conclusion

and recommendations has been provided in independent manner according to analysis which is

informative along with critical appraisal.

1. Financial strength and weakness

In the present era, it is becoming very hard for choosing Samsung or Apple as

they both are equally flawed as brand which is ignored in unfair aspect. There are various

arguments, which are well made and acceptable in context of high performance phones of

Samsung and Apple.

As in 2018, Samsung had lost its flagship due to fundamental dullness and lack of

ephemeral compelling reasons. However, it had got high brand image which is obscuring

everything as it is known as world of Android which is everybody's first choice. Samsung

Electronics is committed for raising level of global community and it delivers groundbreaking

innovations, which are enhancing daily lives of people (Apple vs Samsung phones, 2018).

It is an inspiring world and shaping future with different transformative technologies and

ideas, which are providing power to people for discovering innovative experience such as

smartphones, digital appliances, LED solutions, wearable devices and memory. Apple

manufactures, design and markets mobile communication and various other and most important

is applications of third party digital content. It operates in context of selling and delivering

specific digital content and application via iTunes store.

Financial analysis is very important aspect for every organization. The present case is

giving brief scenario two huge giants of industry such as Samsung and Apple in context of

profitability. The present report is giving brief discussion about critical awareness,

comprehension of business and its prospects related to future. Further it has identified organised

and critically analysed its financial information with well structured format. In the context of

same series various innovative ideas on basis of understanding has been explained by addressing

key problems and theories mentioned in corporate financial management. Further it has

displayed capability for evaluating business issues which are very complex for formulating

various concepts on basis of judgement. It has articulated financial strength and weakness of

both organizations Apple Inc and Samsung Ltd with ratio analysis. Last but not least, conclusion

and recommendations has been provided in independent manner according to analysis which is

informative along with critical appraisal.

1. Financial strength and weakness

In the present era, it is becoming very hard for choosing Samsung or Apple as

they both are equally flawed as brand which is ignored in unfair aspect. There are various

arguments, which are well made and acceptable in context of high performance phones of

Samsung and Apple.

As in 2018, Samsung had lost its flagship due to fundamental dullness and lack of

ephemeral compelling reasons. However, it had got high brand image which is obscuring

everything as it is known as world of Android which is everybody's first choice. Samsung

Electronics is committed for raising level of global community and it delivers groundbreaking

innovations, which are enhancing daily lives of people (Apple vs Samsung phones, 2018).

It is an inspiring world and shaping future with different transformative technologies and

ideas, which are providing power to people for discovering innovative experience such as

smartphones, digital appliances, LED solutions, wearable devices and memory. Apple

manufactures, design and markets mobile communication and various other and most important

is applications of third party digital content. It operates in context of selling and delivering

specific digital content and application via iTunes store.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

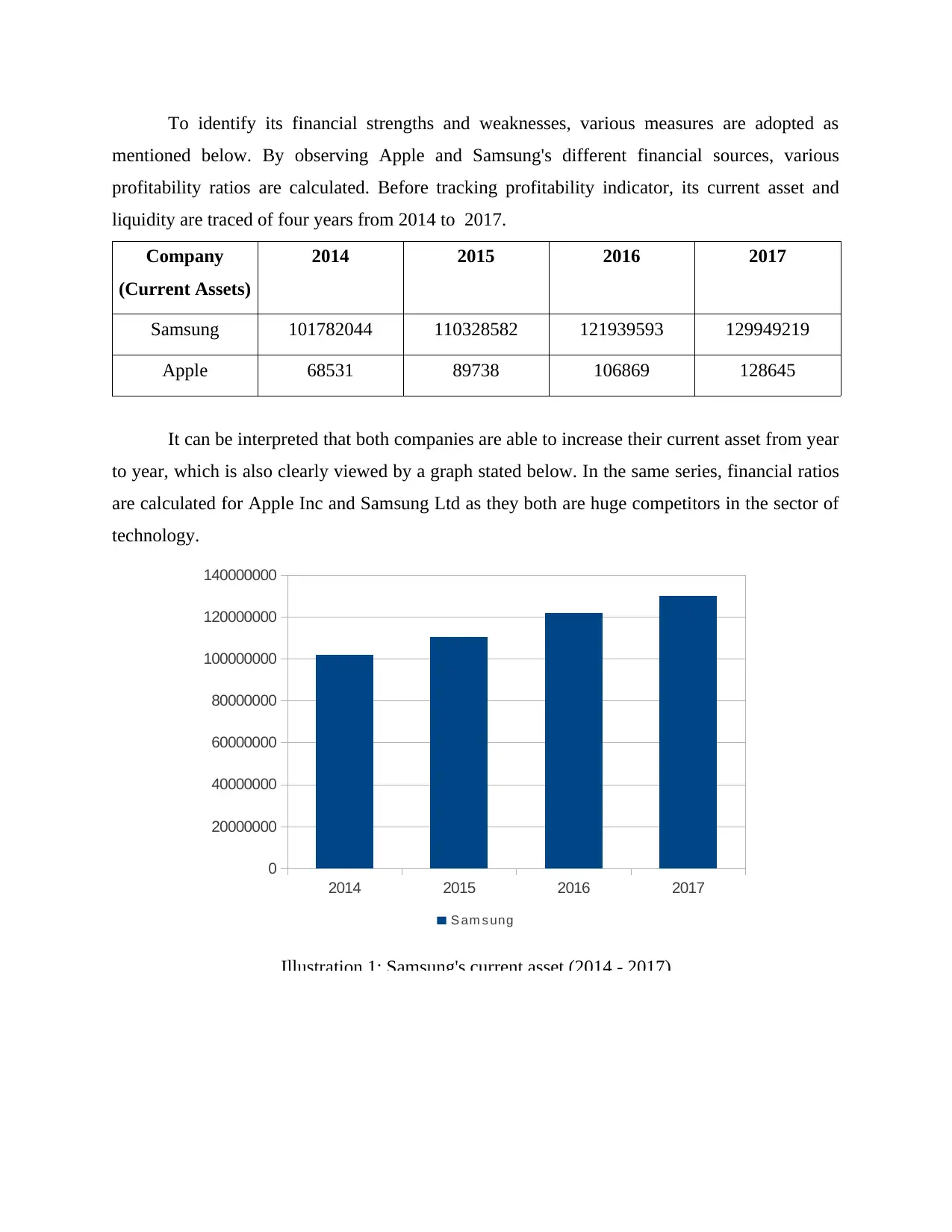

To identify its financial strengths and weaknesses, various measures are adopted as

mentioned below. By observing Apple and Samsung's different financial sources, various

profitability ratios are calculated. Before tracking profitability indicator, its current asset and

liquidity are traced of four years from 2014 to 2017.

Company

(Current Assets)

2014 2015 2016 2017

Samsung 101782044 110328582 121939593 129949219

Apple 68531 89738 106869 128645

It can be interpreted that both companies are able to increase their current asset from year

to year, which is also clearly viewed by a graph stated below. In the same series, financial ratios

are calculated for Apple Inc and Samsung Ltd as they both are huge competitors in the sector of

technology.

2014 2015 2016 2017

0

20000000

40000000

60000000

80000000

100000000

120000000

140000000

S am s ung

Illustration 1: Samsung's current asset (2014 - 2017)

mentioned below. By observing Apple and Samsung's different financial sources, various

profitability ratios are calculated. Before tracking profitability indicator, its current asset and

liquidity are traced of four years from 2014 to 2017.

Company

(Current Assets)

2014 2015 2016 2017

Samsung 101782044 110328582 121939593 129949219

Apple 68531 89738 106869 128645

It can be interpreted that both companies are able to increase their current asset from year

to year, which is also clearly viewed by a graph stated below. In the same series, financial ratios

are calculated for Apple Inc and Samsung Ltd as they both are huge competitors in the sector of

technology.

2014 2015 2016 2017

0

20000000

40000000

60000000

80000000

100000000

120000000

140000000

S am s ung

Illustration 1: Samsung's current asset (2014 - 2017)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

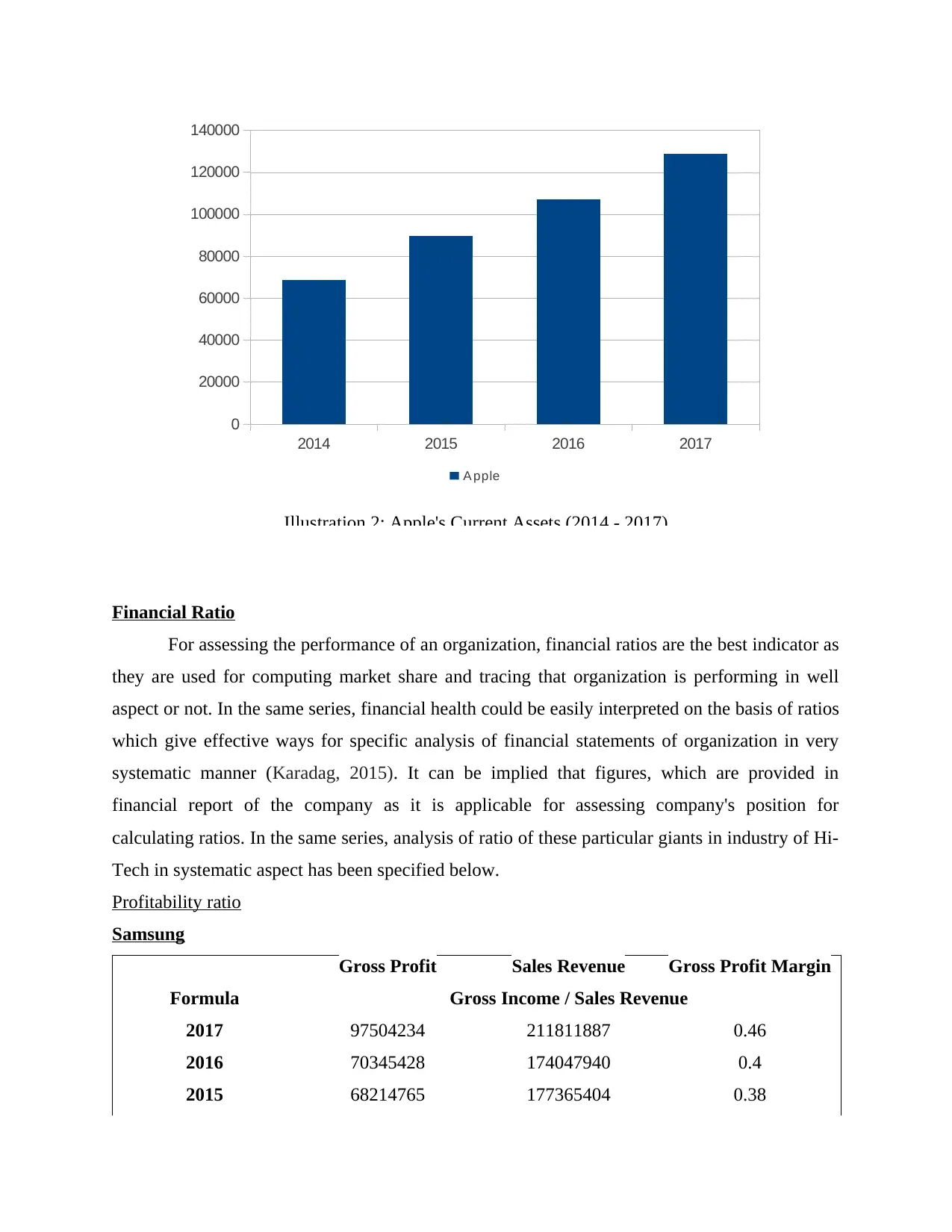

2014 2015 2016 2017

0

20000

40000

60000

80000

100000

120000

140000

A pple

Illustration 2: Apple's Current Assets (2014 - 2017)

Financial Ratio

For assessing the performance of an organization, financial ratios are the best indicator as

they are used for computing market share and tracing that organization is performing in well

aspect or not. In the same series, financial health could be easily interpreted on the basis of ratios

which give effective ways for specific analysis of financial statements of organization in very

systematic manner (Karadag, 2015). It can be implied that figures, which are provided in

financial report of the company as it is applicable for assessing company's position for

calculating ratios. In the same series, analysis of ratio of these particular giants in industry of Hi-

Tech in systematic aspect has been specified below.

Profitability ratio

Samsung

Gross Profit Sales Revenue Gross Profit Margin

Formula Gross Income / Sales Revenue

2017 97504234 211811887 0.46

2016 70345428 174047940 0.4

2015 68214765 177365404 0.38

0

20000

40000

60000

80000

100000

120000

140000

A pple

Illustration 2: Apple's Current Assets (2014 - 2017)

Financial Ratio

For assessing the performance of an organization, financial ratios are the best indicator as

they are used for computing market share and tracing that organization is performing in well

aspect or not. In the same series, financial health could be easily interpreted on the basis of ratios

which give effective ways for specific analysis of financial statements of organization in very

systematic manner (Karadag, 2015). It can be implied that figures, which are provided in

financial report of the company as it is applicable for assessing company's position for

calculating ratios. In the same series, analysis of ratio of these particular giants in industry of Hi-

Tech in systematic aspect has been specified below.

Profitability ratio

Samsung

Gross Profit Sales Revenue Gross Profit Margin

Formula Gross Income / Sales Revenue

2017 97504234 211811887 0.46

2016 70345428 174047940 0.4

2015 68214765 177365404 0.38

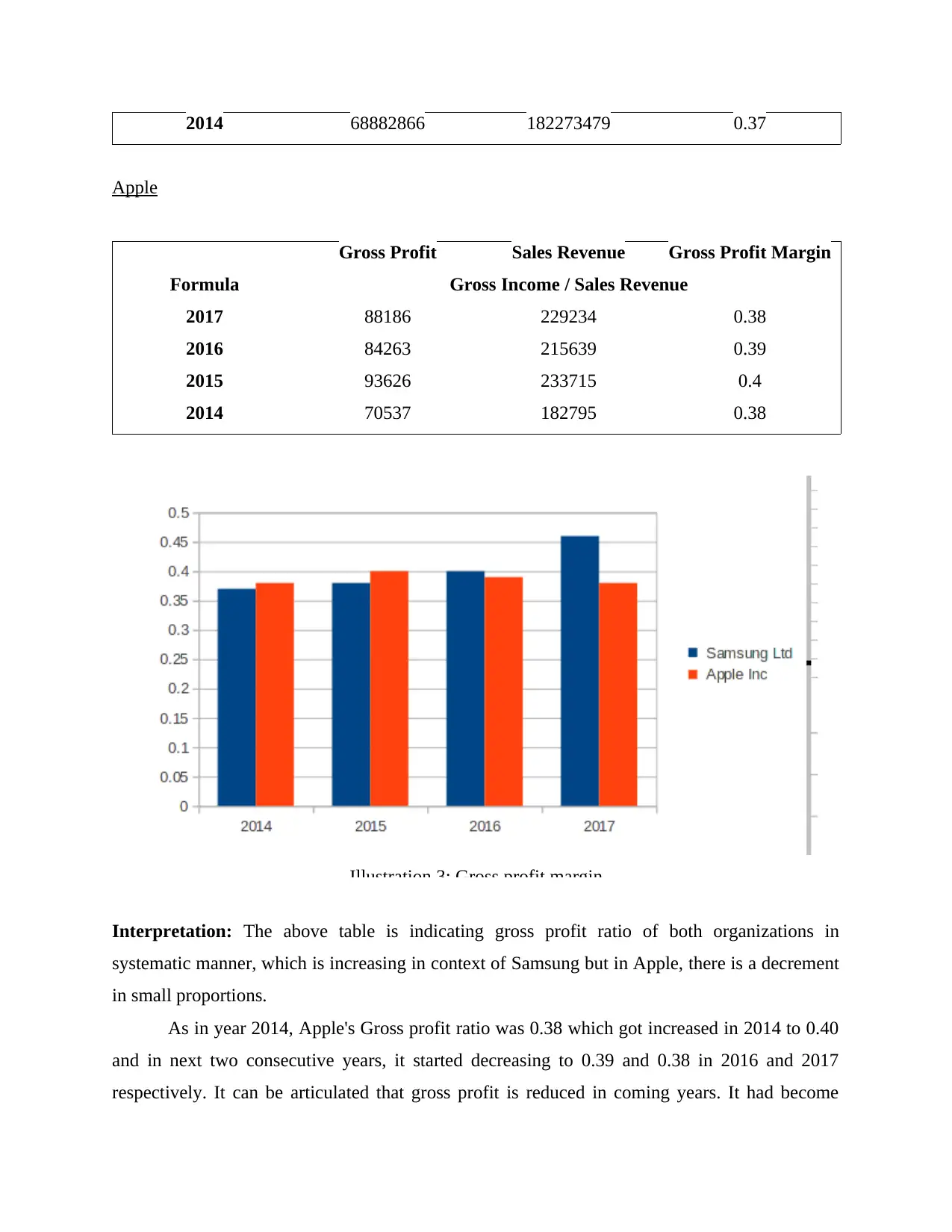

2014 68882866 182273479 0.37

Apple

Gross Profit Sales Revenue Gross Profit Margin

Formula Gross Income / Sales Revenue

2017 88186 229234 0.38

2016 84263 215639 0.39

2015 93626 233715 0.4

2014 70537 182795 0.38

Illustration 3: Gross profit margin

Interpretation: The above table is indicating gross profit ratio of both organizations in

systematic manner, which is increasing in context of Samsung but in Apple, there is a decrement

in small proportions.

As in year 2014, Apple's Gross profit ratio was 0.38 which got increased in 2014 to 0.40

and in next two consecutive years, it started decreasing to 0.39 and 0.38 in 2016 and 2017

respectively. It can be articulated that gross profit is reduced in coming years. It had become

Apple

Gross Profit Sales Revenue Gross Profit Margin

Formula Gross Income / Sales Revenue

2017 88186 229234 0.38

2016 84263 215639 0.39

2015 93626 233715 0.4

2014 70537 182795 0.38

Illustration 3: Gross profit margin

Interpretation: The above table is indicating gross profit ratio of both organizations in

systematic manner, which is increasing in context of Samsung but in Apple, there is a decrement

in small proportions.

As in year 2014, Apple's Gross profit ratio was 0.38 which got increased in 2014 to 0.40

and in next two consecutive years, it started decreasing to 0.39 and 0.38 in 2016 and 2017

respectively. It can be articulated that gross profit is reduced in coming years. It had become

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

mandatory for controlling cost of expenditure related to operations in very efficient way which

will be giving impact to raise margin to great height (Apple Financials, 2018).

On its contrary, Samsung Ltd has better earning position due to growing growth profit

margin ratio as in 2014 it was 0.37 which got increased to 0.38 in 2015 and in 2016 and 2017, it

was 0.40 and 0.46 respectively. It is indicating that organization is able to get good quantum of

margin in efficient way and it will be providing gross profit in huge quantity. It can be easily

depicted from this analysis that Samsung Ltd has gained good position because of systematic

control over different expenditure and it will be giving fruitful outcomes (Lam, 2014).

Net Profit Margin

Illustration 4: Net profit margin (2014 - 2017)

Interpretation: The above graph is depicting net profit margin of both organizations by

seeking information from annual reports. It can be articulated that Samsung Ltd had 0.11 in 2014

which is decreasing to 0.09 but organization was able to recover to 0.11 and then 0.17 in 2016

and 2017 respectively, which is indicating that organization has initiated good control on its

expenses and it helped in generating net profit margin.

The financial position had increased from past few years which are enlightening earning

capacity of Samsung and good control. On its contrary, Apple Inc. is reflecting 0.21 in 2014

which had increased to 0.22 in 2015 but again it got decreased up to 0.21.

will be giving impact to raise margin to great height (Apple Financials, 2018).

On its contrary, Samsung Ltd has better earning position due to growing growth profit

margin ratio as in 2014 it was 0.37 which got increased to 0.38 in 2015 and in 2016 and 2017, it

was 0.40 and 0.46 respectively. It is indicating that organization is able to get good quantum of

margin in efficient way and it will be providing gross profit in huge quantity. It can be easily

depicted from this analysis that Samsung Ltd has gained good position because of systematic

control over different expenditure and it will be giving fruitful outcomes (Lam, 2014).

Net Profit Margin

Illustration 4: Net profit margin (2014 - 2017)

Interpretation: The above graph is depicting net profit margin of both organizations by

seeking information from annual reports. It can be articulated that Samsung Ltd had 0.11 in 2014

which is decreasing to 0.09 but organization was able to recover to 0.11 and then 0.17 in 2016

and 2017 respectively, which is indicating that organization has initiated good control on its

expenses and it helped in generating net profit margin.

The financial position had increased from past few years which are enlightening earning

capacity of Samsung and good control. On its contrary, Apple Inc. is reflecting 0.21 in 2014

which had increased to 0.22 in 2015 but again it got decreased up to 0.21.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Further, it can be interpreted that company's gross profit was low as compared to

Samsung but on basis of net profit margin, Apple Inc has increased its net profit from past year.

It can be depicted that better control has been performed over expenses, which are operational or

non-operational, which is leaning towards huge profit margin.

Liquidity ratio

Liquidity is referred as capability of organization for accomplishing its financial

obligations which are due. Its a computation which is applicable for measuring ability of

organization for repaying its short term debts. It is replicated as quickest aspect to know financial

stability of any organization. Under this category, liquid ratio is classified into three categories

such as current, acid and cash ratio. Among these three, current ratio is termed as very liberal

method (Lindeman and et. al., 2016).

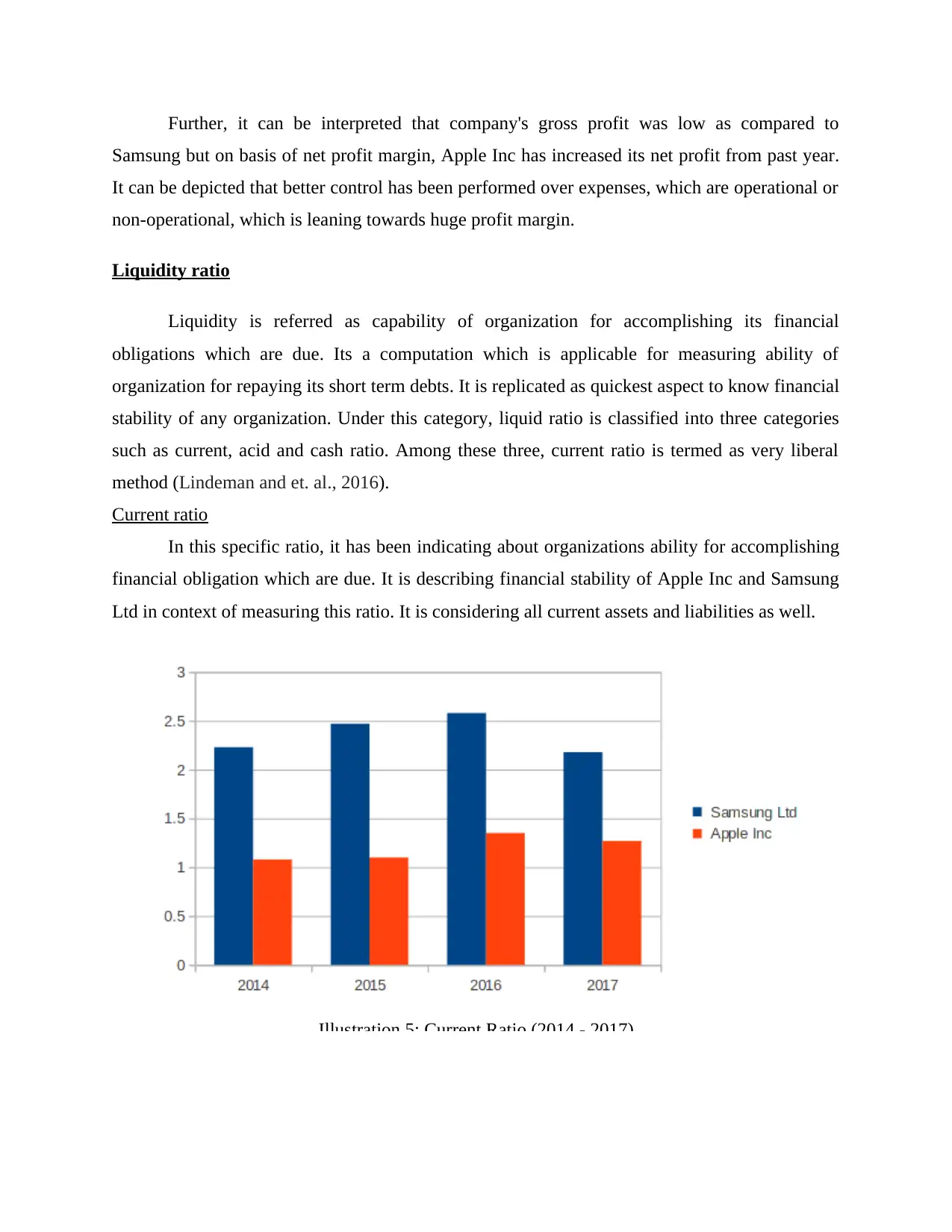

Current ratio

In this specific ratio, it has been indicating about organizations ability for accomplishing

financial obligation which are due. It is describing financial stability of Apple Inc and Samsung

Ltd in context of measuring this ratio. It is considering all current assets and liabilities as well.

Illustration 5: Current Ratio (2014 - 2017)

Samsung but on basis of net profit margin, Apple Inc has increased its net profit from past year.

It can be depicted that better control has been performed over expenses, which are operational or

non-operational, which is leaning towards huge profit margin.

Liquidity ratio

Liquidity is referred as capability of organization for accomplishing its financial

obligations which are due. Its a computation which is applicable for measuring ability of

organization for repaying its short term debts. It is replicated as quickest aspect to know financial

stability of any organization. Under this category, liquid ratio is classified into three categories

such as current, acid and cash ratio. Among these three, current ratio is termed as very liberal

method (Lindeman and et. al., 2016).

Current ratio

In this specific ratio, it has been indicating about organizations ability for accomplishing

financial obligation which are due. It is describing financial stability of Apple Inc and Samsung

Ltd in context of measuring this ratio. It is considering all current assets and liabilities as well.

Illustration 5: Current Ratio (2014 - 2017)

Interpretation: The above table is depicting financial position in context of current assets

and liabilities which is quick measure for tracing liquidity of organization. As per accounting,

idle current ratio should be 2 : 1 and in above scenario, Samsung is depicting current ratio in

various fluctuations but in 2017 it got decrease by huge number as it is meeting industry standard

but in 2014 it was 2.23 then 2.47 in 2015 (increased), 2.58 in 2016 (peak) and in 2017 it was

2.18 which is indicating that its current asset had decreased from previous year along with

optimum utilisation of resources. On its contrary aspect, Apple Inc's current ratio is increasing or

trying to improve but it not meeting standard and it can be indicated that Apple Inc is not having

great liquidity position in context current ratio.

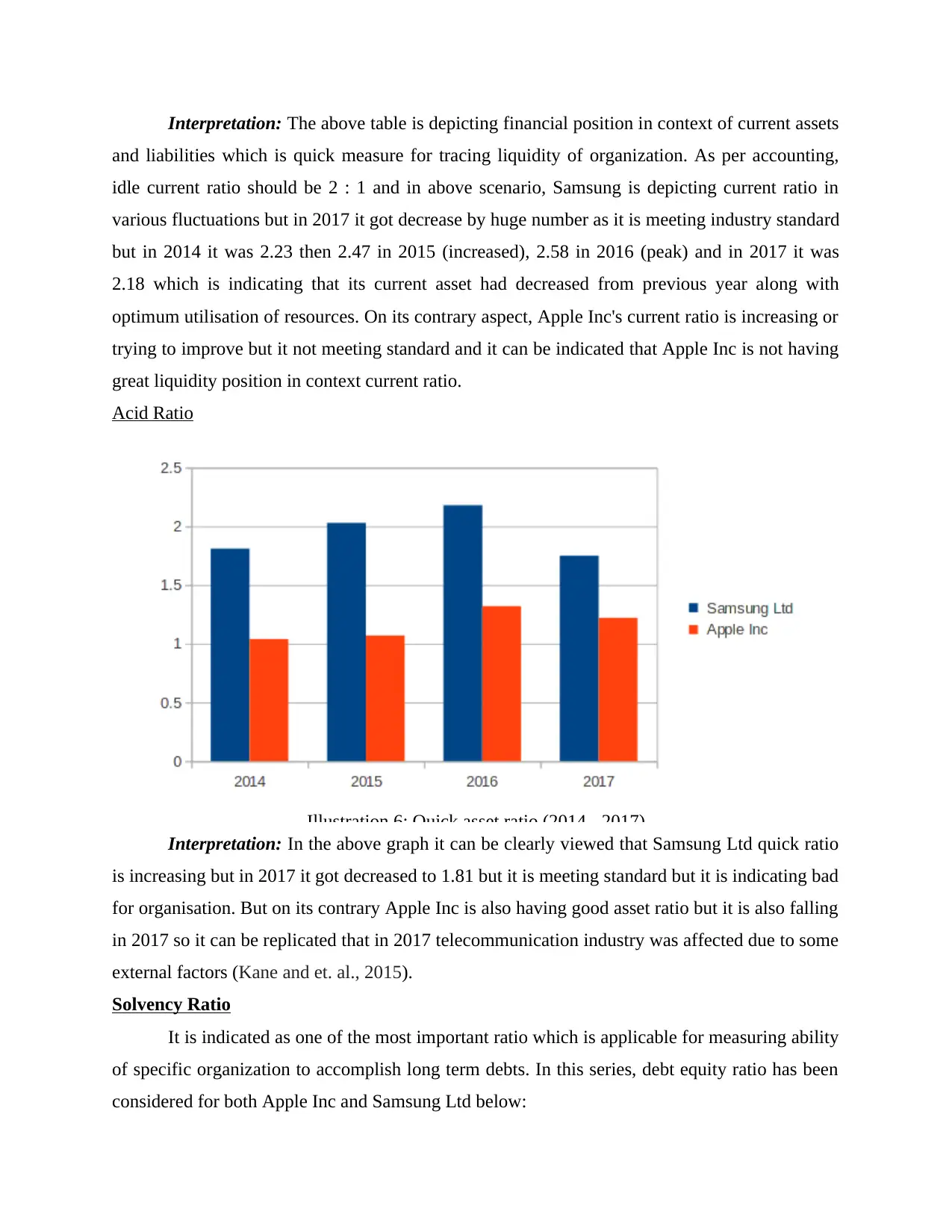

Acid Ratio

Illustration 6: Quick asset ratio (2014 - 2017)

Interpretation: In the above graph it can be clearly viewed that Samsung Ltd quick ratio

is increasing but in 2017 it got decreased to 1.81 but it is meeting standard but it is indicating bad

for organisation. But on its contrary Apple Inc is also having good asset ratio but it is also falling

in 2017 so it can be replicated that in 2017 telecommunication industry was affected due to some

external factors (Kane and et. al., 2015).

Solvency Ratio

It is indicated as one of the most important ratio which is applicable for measuring ability

of specific organization to accomplish long term debts. In this series, debt equity ratio has been

considered for both Apple Inc and Samsung Ltd below:

and liabilities which is quick measure for tracing liquidity of organization. As per accounting,

idle current ratio should be 2 : 1 and in above scenario, Samsung is depicting current ratio in

various fluctuations but in 2017 it got decrease by huge number as it is meeting industry standard

but in 2014 it was 2.23 then 2.47 in 2015 (increased), 2.58 in 2016 (peak) and in 2017 it was

2.18 which is indicating that its current asset had decreased from previous year along with

optimum utilisation of resources. On its contrary aspect, Apple Inc's current ratio is increasing or

trying to improve but it not meeting standard and it can be indicated that Apple Inc is not having

great liquidity position in context current ratio.

Acid Ratio

Illustration 6: Quick asset ratio (2014 - 2017)

Interpretation: In the above graph it can be clearly viewed that Samsung Ltd quick ratio

is increasing but in 2017 it got decreased to 1.81 but it is meeting standard but it is indicating bad

for organisation. But on its contrary Apple Inc is also having good asset ratio but it is also falling

in 2017 so it can be replicated that in 2017 telecommunication industry was affected due to some

external factors (Kane and et. al., 2015).

Solvency Ratio

It is indicated as one of the most important ratio which is applicable for measuring ability

of specific organization to accomplish long term debts. In this series, debt equity ratio has been

considered for both Apple Inc and Samsung Ltd below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

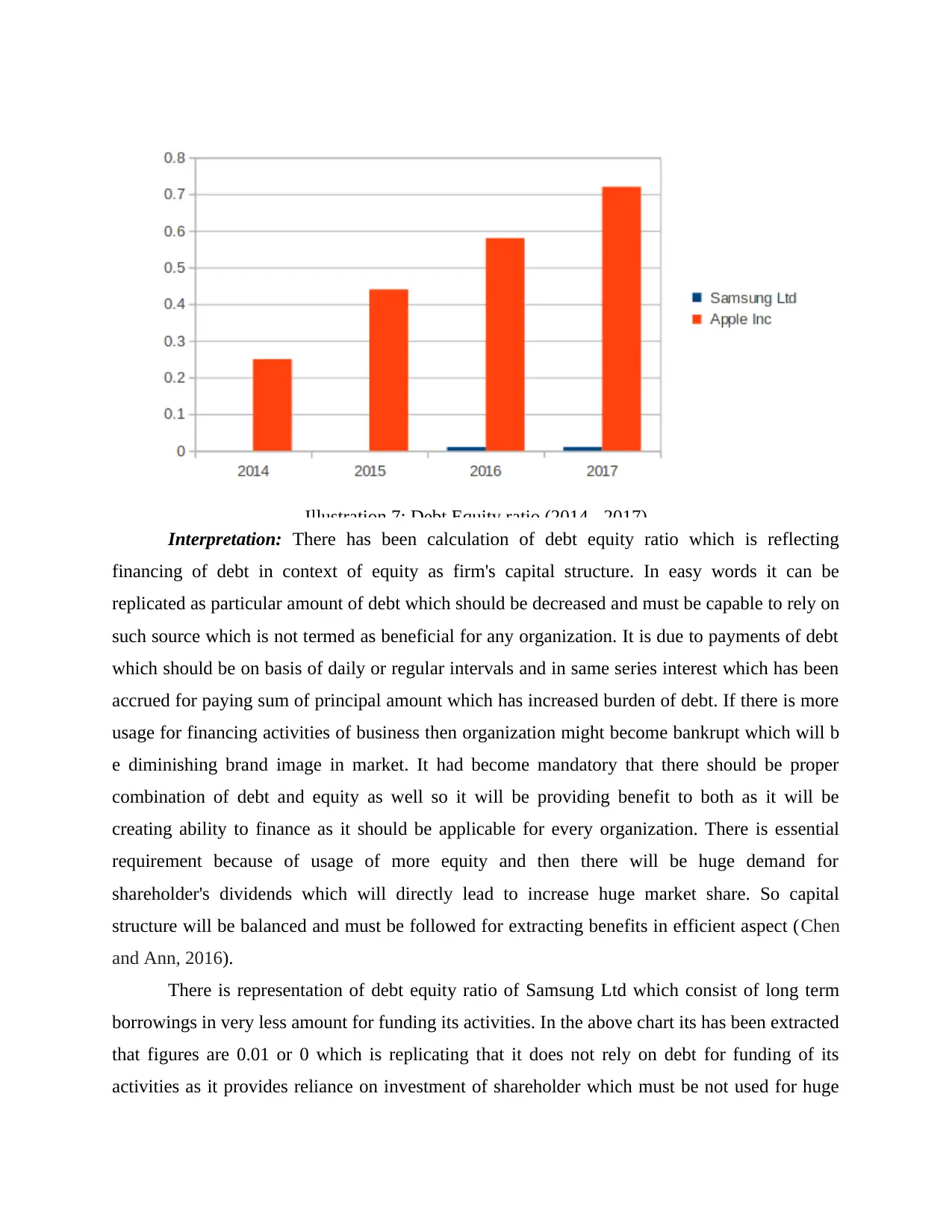

Illustration 7: Debt Equity ratio (2014 - 2017)

Interpretation: There has been calculation of debt equity ratio which is reflecting

financing of debt in context of equity as firm's capital structure. In easy words it can be

replicated as particular amount of debt which should be decreased and must be capable to rely on

such source which is not termed as beneficial for any organization. It is due to payments of debt

which should be on basis of daily or regular intervals and in same series interest which has been

accrued for paying sum of principal amount which has increased burden of debt. If there is more

usage for financing activities of business then organization might become bankrupt which will b

e diminishing brand image in market. It had become mandatory that there should be proper

combination of debt and equity as well so it will be providing benefit to both as it will be

creating ability to finance as it should be applicable for every organization. There is essential

requirement because of usage of more equity and then there will be huge demand for

shareholder's dividends which will directly lead to increase huge market share. So capital

structure will be balanced and must be followed for extracting benefits in efficient aspect (Chen

and Ann, 2016).

There is representation of debt equity ratio of Samsung Ltd which consist of long term

borrowings in very less amount for funding its activities. In the above chart its has been extracted

that figures are 0.01 or 0 which is replicating that it does not rely on debt for funding of its

activities as it provides reliance on investment of shareholder which must be not used for huge

Interpretation: There has been calculation of debt equity ratio which is reflecting

financing of debt in context of equity as firm's capital structure. In easy words it can be

replicated as particular amount of debt which should be decreased and must be capable to rely on

such source which is not termed as beneficial for any organization. It is due to payments of debt

which should be on basis of daily or regular intervals and in same series interest which has been

accrued for paying sum of principal amount which has increased burden of debt. If there is more

usage for financing activities of business then organization might become bankrupt which will b

e diminishing brand image in market. It had become mandatory that there should be proper

combination of debt and equity as well so it will be providing benefit to both as it will be

creating ability to finance as it should be applicable for every organization. There is essential

requirement because of usage of more equity and then there will be huge demand for

shareholder's dividends which will directly lead to increase huge market share. So capital

structure will be balanced and must be followed for extracting benefits in efficient aspect (Chen

and Ann, 2016).

There is representation of debt equity ratio of Samsung Ltd which consist of long term

borrowings in very less amount for funding its activities. In the above chart its has been extracted

that figures are 0.01 or 0 which is replicating that it does not rely on debt for funding of its

activities as it provides reliance on investment of shareholder which must be not used for huge

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

extent. In debt equity ratio, its ideal amount is 40% (0.40) debt and 60% (0.60) equity. For the

purpose of capital structure debt should be low as compared to equity. On its contrary, Apple had

increased its debt from year 2014 which is of 0.25 and it increased in 2015 to 0.44, 0.58 in 2016

and 0.72 in 2017. It has been replicated that Apple has to reduce burden of debt as it must be

under 0.4 according to idle ratio.

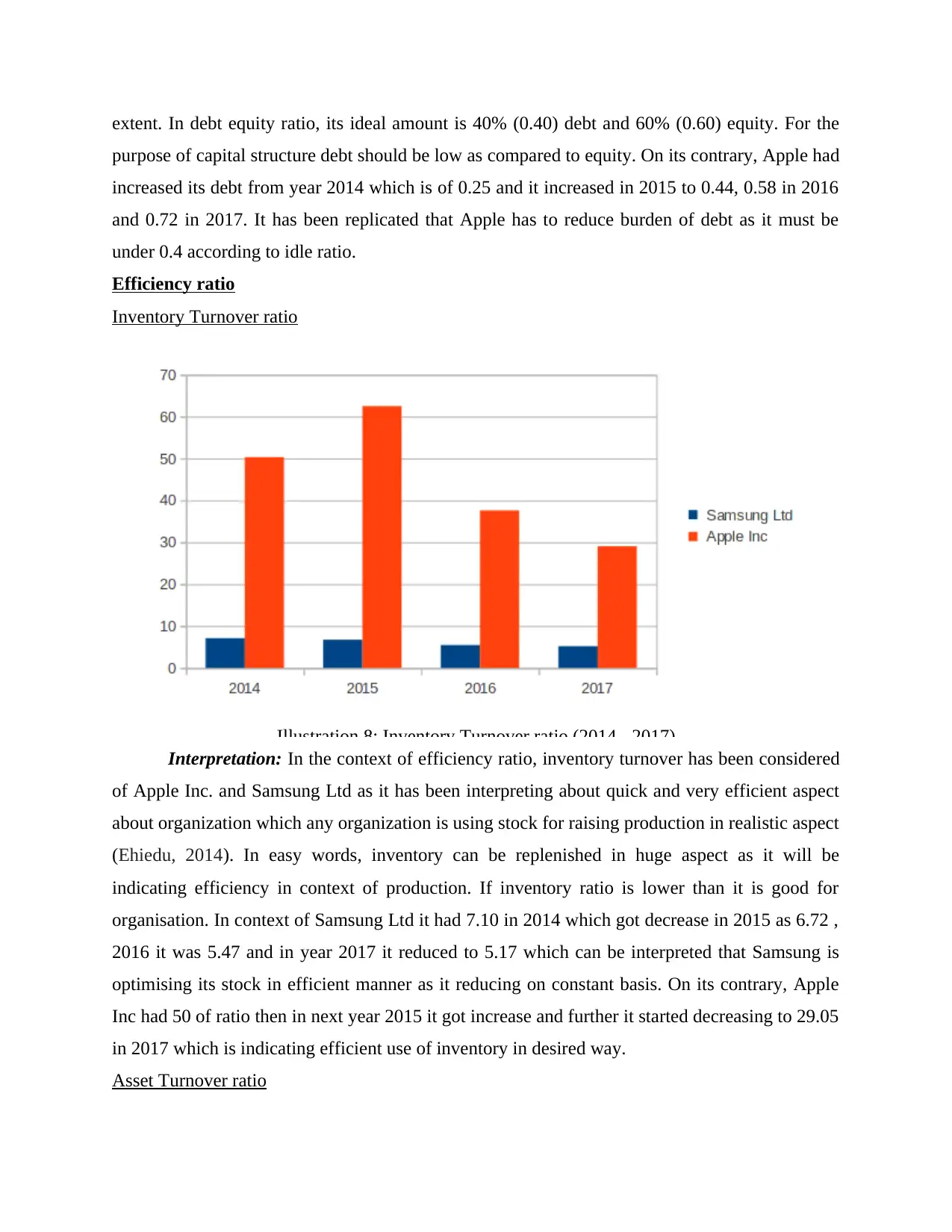

Efficiency ratio

Inventory Turnover ratio

Illustration 8: Inventory Turnover ratio (2014 - 2017)

Interpretation: In the context of efficiency ratio, inventory turnover has been considered

of Apple Inc. and Samsung Ltd as it has been interpreting about quick and very efficient aspect

about organization which any organization is using stock for raising production in realistic aspect

(Ehiedu, 2014). In easy words, inventory can be replenished in huge aspect as it will be

indicating efficiency in context of production. If inventory ratio is lower than it is good for

organisation. In context of Samsung Ltd it had 7.10 in 2014 which got decrease in 2015 as 6.72 ,

2016 it was 5.47 and in year 2017 it reduced to 5.17 which can be interpreted that Samsung is

optimising its stock in efficient manner as it reducing on constant basis. On its contrary, Apple

Inc had 50 of ratio then in next year 2015 it got increase and further it started decreasing to 29.05

in 2017 which is indicating efficient use of inventory in desired way.

Asset Turnover ratio

purpose of capital structure debt should be low as compared to equity. On its contrary, Apple had

increased its debt from year 2014 which is of 0.25 and it increased in 2015 to 0.44, 0.58 in 2016

and 0.72 in 2017. It has been replicated that Apple has to reduce burden of debt as it must be

under 0.4 according to idle ratio.

Efficiency ratio

Inventory Turnover ratio

Illustration 8: Inventory Turnover ratio (2014 - 2017)

Interpretation: In the context of efficiency ratio, inventory turnover has been considered

of Apple Inc. and Samsung Ltd as it has been interpreting about quick and very efficient aspect

about organization which any organization is using stock for raising production in realistic aspect

(Ehiedu, 2014). In easy words, inventory can be replenished in huge aspect as it will be

indicating efficiency in context of production. If inventory ratio is lower than it is good for

organisation. In context of Samsung Ltd it had 7.10 in 2014 which got decrease in 2015 as 6.72 ,

2016 it was 5.47 and in year 2017 it reduced to 5.17 which can be interpreted that Samsung is

optimising its stock in efficient manner as it reducing on constant basis. On its contrary, Apple

Inc had 50 of ratio then in next year 2015 it got increase and further it started decreasing to 29.05

in 2017 which is indicating efficient use of inventory in desired way.

Asset Turnover ratio

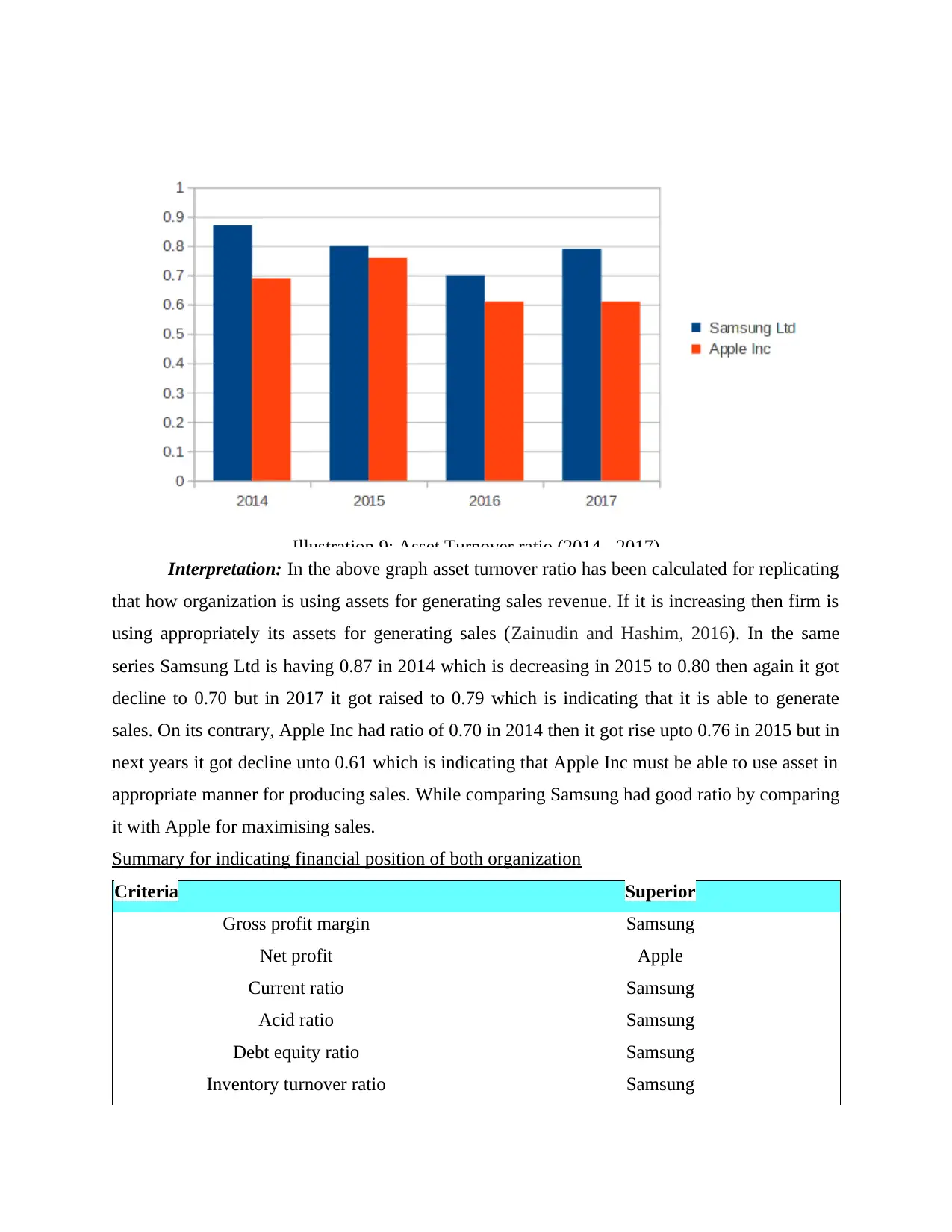

Illustration 9: Asset Turnover ratio (2014 - 2017)

Interpretation: In the above graph asset turnover ratio has been calculated for replicating

that how organization is using assets for generating sales revenue. If it is increasing then firm is

using appropriately its assets for generating sales (Zainudin and Hashim, 2016). In the same

series Samsung Ltd is having 0.87 in 2014 which is decreasing in 2015 to 0.80 then again it got

decline to 0.70 but in 2017 it got raised to 0.79 which is indicating that it is able to generate

sales. On its contrary, Apple Inc had ratio of 0.70 in 2014 then it got rise upto 0.76 in 2015 but in

next years it got decline unto 0.61 which is indicating that Apple Inc must be able to use asset in

appropriate manner for producing sales. While comparing Samsung had good ratio by comparing

it with Apple for maximising sales.

Summary for indicating financial position of both organization

Criteria Superior

Gross profit margin Samsung

Net profit Apple

Current ratio Samsung

Acid ratio Samsung

Debt equity ratio Samsung

Inventory turnover ratio Samsung

Interpretation: In the above graph asset turnover ratio has been calculated for replicating

that how organization is using assets for generating sales revenue. If it is increasing then firm is

using appropriately its assets for generating sales (Zainudin and Hashim, 2016). In the same

series Samsung Ltd is having 0.87 in 2014 which is decreasing in 2015 to 0.80 then again it got

decline to 0.70 but in 2017 it got raised to 0.79 which is indicating that it is able to generate

sales. On its contrary, Apple Inc had ratio of 0.70 in 2014 then it got rise upto 0.76 in 2015 but in

next years it got decline unto 0.61 which is indicating that Apple Inc must be able to use asset in

appropriate manner for producing sales. While comparing Samsung had good ratio by comparing

it with Apple for maximising sales.

Summary for indicating financial position of both organization

Criteria Superior

Gross profit margin Samsung

Net profit Apple

Current ratio Samsung

Acid ratio Samsung

Debt equity ratio Samsung

Inventory turnover ratio Samsung

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.