Financial Analysis Report on Farsons and Heineken's Financials

VerifiedAdded on 2023/01/18

|26

|6837

|66

Report

AI Summary

This report presents a comprehensive financial analysis comparing Simonds Farsons Cisk plc. and Heineken, focusing on providing financial advice to a beer can manufacturer regarding potential suppliers. The analysis employs vertical, horizontal, and ratio analysis techniques to evaluate the financial performance and position of both companies from 2015 to 2018. The report examines income statements and balance sheets, assessing key metrics such as sales revenue, cost of revenue, inventory levels, and creditor amounts. Furthermore, it includes an evaluation of working capital and cash flow to offer informed recommendations. The findings indicate that while Farsons demonstrates stronger profitability, Heineken exhibits more robust growth and efficient creditor management. The report concludes with specific recommendations for the beer can manufacturer, considering factors like supplier payment policies and overall financial health to determine the most suitable business partner.

Financial Analysis Management &

Enterprise

Enterprise

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

Overview of the companies.........................................................................................................1

Evaluation of the financial performance and financial position of FARSONS and HEINIKEN....1

Vertical analysis of the financial statements...............................................................................1

Horizontal analysis of the financial statements...........................................................................3

Ratio analysis of the financial statements....................................................................................4

EVALUATION OF THE WORKING CAPITAL..........................................................................7

EVALUATION OF THE CASH FLOW........................................................................................8

CONCLUSION AND RECOMMENDATIONS............................................................................9

REFERENCES..............................................................................................................................10

APPENDIX....................................................................................................................................11

INTRODUCTION...........................................................................................................................1

Overview of the companies.........................................................................................................1

Evaluation of the financial performance and financial position of FARSONS and HEINIKEN....1

Vertical analysis of the financial statements...............................................................................1

Horizontal analysis of the financial statements...........................................................................3

Ratio analysis of the financial statements....................................................................................4

EVALUATION OF THE WORKING CAPITAL..........................................................................7

EVALUATION OF THE CASH FLOW........................................................................................8

CONCLUSION AND RECOMMENDATIONS............................................................................9

REFERENCES..............................................................................................................................10

APPENDIX....................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial analysis management is the procedure of analysing the financial performance and

position of an organisation in order to make reliable decisions (Blum and Dacorogna, 2014). This

management assists stakeholders in making calculated decisions so that they can earn reliable

returns of their investments (Bragg, 2012). The main aim of this report is to develop an

understanding about the ways by which financial information can be evaluated. In this report,

financial advice to a beer can manufacturer will be provided regarding to which company, this

organisation can supply their produce goods. The options which are available to this beer can

manufacturer are Farsons and Heineken. In this report, financial analysis against both these

companies are done using horizontal, vertical and ratio analysis. Along with working capital a

cash flow analysis is also done in this report to provide valid recommendations to the beer can

manufacturer.

Overview of the companies

Simonds Farsons Cisk plc. is a food and beverage company which is involved in

operations of brewing, manufacturing, sale and distribution of beers and other soft drinks. This is

a public limited company and its shares are listed at Malta stock exchange. This company was

established in 1928 and since then it is growing with a rapid pace, due to which it has a reliable

image in the market (Annual Report of Farsons, 2019).

Heineken is a beer manufacturing company which is dealing in operations such as brewing,

production, marketing and sales of the beer around the world. This company is engaged in huge

marketing activities due to sales revenue of this company is much higher than its competitors due

to which it is considered by the beer can manufacturer (Annual Report of Heineken, 2019).

Evaluation of the financial performance and financial position of FARSONS

and HEINIKEN

Vertical analysis of the financial statements

Vertical analysis is a technique of analysing the financial statements by considering one

element of financial statement as a base figure (usually sales revenue) and then comparing other

elements with it so that it can decided how other elements effect the sales of an organisation

(Christensen, Cottrell and Baker, 2013). In present case, this analysis is done on two companies’

1

Financial analysis management is the procedure of analysing the financial performance and

position of an organisation in order to make reliable decisions (Blum and Dacorogna, 2014). This

management assists stakeholders in making calculated decisions so that they can earn reliable

returns of their investments (Bragg, 2012). The main aim of this report is to develop an

understanding about the ways by which financial information can be evaluated. In this report,

financial advice to a beer can manufacturer will be provided regarding to which company, this

organisation can supply their produce goods. The options which are available to this beer can

manufacturer are Farsons and Heineken. In this report, financial analysis against both these

companies are done using horizontal, vertical and ratio analysis. Along with working capital a

cash flow analysis is also done in this report to provide valid recommendations to the beer can

manufacturer.

Overview of the companies

Simonds Farsons Cisk plc. is a food and beverage company which is involved in

operations of brewing, manufacturing, sale and distribution of beers and other soft drinks. This is

a public limited company and its shares are listed at Malta stock exchange. This company was

established in 1928 and since then it is growing with a rapid pace, due to which it has a reliable

image in the market (Annual Report of Farsons, 2019).

Heineken is a beer manufacturing company which is dealing in operations such as brewing,

production, marketing and sales of the beer around the world. This company is engaged in huge

marketing activities due to sales revenue of this company is much higher than its competitors due

to which it is considered by the beer can manufacturer (Annual Report of Heineken, 2019).

Evaluation of the financial performance and financial position of FARSONS

and HEINIKEN

Vertical analysis of the financial statements

Vertical analysis is a technique of analysing the financial statements by considering one

element of financial statement as a base figure (usually sales revenue) and then comparing other

elements with it so that it can decided how other elements effect the sales of an organisation

(Christensen, Cottrell and Baker, 2013). In present case, this analysis is done on two companies’

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

financial statements of four years (2015-2018) which is attached in appendix; commentary based

on that analysis is developed as below.

Vertical analysis of Simonds Farsons Cisk plc. (Income Statement)

Sales revenue is selected as the base for this analysis. It has been seen from the conducted

analysis that if the sales revenue of Farsons is 100% then the cost of revenue is 63% in 2015,

61.29% in 2016, 61.36% in 2017 and 61.05% in 2018. The aim of this vertical analysis is to

ascertain whether or not Farsons Plc. timely pay off their suppliers to advice beer can

manufacturer. The percentage of cost of sales is declining continuously in the case of this

company but it is also a benefit that the percentage of cost of revenue is considerably high that is

average of 62%. Cost of revenue includes the expenses which must be paid off to suppliers

against their supplied goods. This high percentage of supplier cost can be a benefit but also the

declining percentage can result into a limitation. Apart from sale revenue cost, other aspects of

the income statement are sound inclined as the end result of profit is average of 12% that is

continuously rising which says that the company is competent enough to pay their suppliers.

Vertical analysis of Simonds Farsons Cisk plc. (Balance Sheet)

In the case of balance sheet, total assets and liabilities are selected as a base from which

other elements of this financial statement will be compared. It has been seen from the analysis

that this company invests average of 8% against inventory from the total assets which means this

company invests huge amount on the raw material of beer cans that can be considered as an

opportunity for beer can manufacturer to offer them their proposal. To be more accurate, if the

total assets are 100% then the inventory percentage is 6.71% in 2015, 7.36% in 2016, 8.20% in

2017 and 8.64% in 2018. All other elements of balance sheet are effectively inclined against the

total assets and liabilities as the total of retained incomes and other incomes are averagely more

than 60% by which it can be said that this is a profit making company which enables them to pay

off their suppliers on time.

Vertical analysis of Heineken (Income Statement)

In the case of Heineken company analysis, the cost of revenue is observed to be increasing.

From the vertical analysis of income statement, it has been seen that if the sales revenue is 100%

then cost of sales is 47.25% in 2015, 46.64% in 2016, 46.23% in 2017 and 48.71% in 2018.

From this observation, it is analysed that this company is increasing their cost against the

suppliers which is a benefit for beer can manufacturer but even after this increasing trend the

2

on that analysis is developed as below.

Vertical analysis of Simonds Farsons Cisk plc. (Income Statement)

Sales revenue is selected as the base for this analysis. It has been seen from the conducted

analysis that if the sales revenue of Farsons is 100% then the cost of revenue is 63% in 2015,

61.29% in 2016, 61.36% in 2017 and 61.05% in 2018. The aim of this vertical analysis is to

ascertain whether or not Farsons Plc. timely pay off their suppliers to advice beer can

manufacturer. The percentage of cost of sales is declining continuously in the case of this

company but it is also a benefit that the percentage of cost of revenue is considerably high that is

average of 62%. Cost of revenue includes the expenses which must be paid off to suppliers

against their supplied goods. This high percentage of supplier cost can be a benefit but also the

declining percentage can result into a limitation. Apart from sale revenue cost, other aspects of

the income statement are sound inclined as the end result of profit is average of 12% that is

continuously rising which says that the company is competent enough to pay their suppliers.

Vertical analysis of Simonds Farsons Cisk plc. (Balance Sheet)

In the case of balance sheet, total assets and liabilities are selected as a base from which

other elements of this financial statement will be compared. It has been seen from the analysis

that this company invests average of 8% against inventory from the total assets which means this

company invests huge amount on the raw material of beer cans that can be considered as an

opportunity for beer can manufacturer to offer them their proposal. To be more accurate, if the

total assets are 100% then the inventory percentage is 6.71% in 2015, 7.36% in 2016, 8.20% in

2017 and 8.64% in 2018. All other elements of balance sheet are effectively inclined against the

total assets and liabilities as the total of retained incomes and other incomes are averagely more

than 60% by which it can be said that this is a profit making company which enables them to pay

off their suppliers on time.

Vertical analysis of Heineken (Income Statement)

In the case of Heineken company analysis, the cost of revenue is observed to be increasing.

From the vertical analysis of income statement, it has been seen that if the sales revenue is 100%

then cost of sales is 47.25% in 2015, 46.64% in 2016, 46.23% in 2017 and 48.71% in 2018.

From this observation, it is analysed that this company is increasing their cost against the

suppliers which is a benefit for beer can manufacturer but even after this increasing trend the

2

percentage of Heineken expenses which they incur against their supplies is much lower than the

percentage of Simonds Farsons Cisk plc.

Vertical analysis of Heineken (Balance Sheet)

From the analysis of statement of financial position, it has been seen that Heineken has

average of 4% against their inventory level if compared to their total assets. This means, this

company believes in spending on fixed assets more than the current assets specially inventories.

In order to emphasis on the aim, it can be said that Heineken invests approximately half of their

total assets against inventory than of Simonds Farsons Cisk plc.

After analysing financial statements of both the companies, it has been evaluated that

Simonds Farsons Cisk plc. is much better than Heineken when compared in terms of the value

which they spend against procurement of supplies.

Horizontal analysis of the financial statements

Horizontal analysis of Simonds Farsons Cisk plc. (Income Statement)

Horizontal analysis is the technique evaluating financial statements in which a year is

taken as a base and then elements of the financial year of the base year are compared to other

years (El Kasmioui and Ceulemans, 2012). The main aim of this analysis is to ascertain the

growth and survival rate of the company so that relevant decisions can be taken. In the present

case of Simonds Farsons Cisk plc., year 2015 is taken as base year for 2016, 2016 is taken as

base year for 2017 and so on.

It has been observed from the analysis, that percentage of cost of revenue which is

increasing every year is increasing with a low difference which makes this company a slow

growing company. Also, as the beer can manufacturer is intending to be supplier of Simonds

Farsons Cisk plc., it is important to get it in notice to them growth rate of this company is low.

Horizontal analysis of Simonds Farsons Cisk plc. (Balance Sheet)

For the purpose of beer can manufacturer which intend to be a supplier of this company,

elements of balance sheet which can assist in valid recommendation are inventory and creditors

amount. From the analysis, it can be seen that recently inventory flow of this company has been

decreased which means this company is no more acquiring huge raw material which is a

restriction for the beer can manufacturer. Apart from the inventory level, creditors amount

(debts) are continuously increasing which means this company is unable to effectively pay off

their debts now. To be precise, debts has increased by 50% in 2016, 33% in 2017 and 150% in

3

percentage of Simonds Farsons Cisk plc.

Vertical analysis of Heineken (Balance Sheet)

From the analysis of statement of financial position, it has been seen that Heineken has

average of 4% against their inventory level if compared to their total assets. This means, this

company believes in spending on fixed assets more than the current assets specially inventories.

In order to emphasis on the aim, it can be said that Heineken invests approximately half of their

total assets against inventory than of Simonds Farsons Cisk plc.

After analysing financial statements of both the companies, it has been evaluated that

Simonds Farsons Cisk plc. is much better than Heineken when compared in terms of the value

which they spend against procurement of supplies.

Horizontal analysis of the financial statements

Horizontal analysis of Simonds Farsons Cisk plc. (Income Statement)

Horizontal analysis is the technique evaluating financial statements in which a year is

taken as a base and then elements of the financial year of the base year are compared to other

years (El Kasmioui and Ceulemans, 2012). The main aim of this analysis is to ascertain the

growth and survival rate of the company so that relevant decisions can be taken. In the present

case of Simonds Farsons Cisk plc., year 2015 is taken as base year for 2016, 2016 is taken as

base year for 2017 and so on.

It has been observed from the analysis, that percentage of cost of revenue which is

increasing every year is increasing with a low difference which makes this company a slow

growing company. Also, as the beer can manufacturer is intending to be supplier of Simonds

Farsons Cisk plc., it is important to get it in notice to them growth rate of this company is low.

Horizontal analysis of Simonds Farsons Cisk plc. (Balance Sheet)

For the purpose of beer can manufacturer which intend to be a supplier of this company,

elements of balance sheet which can assist in valid recommendation are inventory and creditors

amount. From the analysis, it can be seen that recently inventory flow of this company has been

decreased which means this company is no more acquiring huge raw material which is a

restriction for the beer can manufacturer. Apart from the inventory level, creditors amount

(debts) are continuously increasing which means this company is unable to effectively pay off

their debts now. To be precise, debts has increased by 50% in 2016, 33% in 2017 and 150% in

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2018. Even after this, the suppliers are concerned with the liquidity and debt level in which this

company is seemed to be effective.

Horizontal analysis of Heineken (Income Statement)

Cost of revenue is increasing with a huge rate in case of Heineken as in year 2016 it

increases by 0.01%, 4.40% in 2017 and 8.18% in 2018. These values can support the argument

that when it comes growth and survival Heineken is much more efficient than Simonds Farsons

Cisk plc. The manufacturer of beer can must consider these values as they reflect that Heineken

is continuously improving its supplier policies by which their suppliers get benefitted.

Horizontal analysis of Heineken (Balance Sheet)

In order to emphasising on the aim of assisting beer can manufacturer, suppliers are the

creditors for an organisation and according to the horizontal balance sheet analysis of Heineken,

it has been seen that creditors of this company are continuously decreasing which means this

company believes in quick payment to their suppliers. To provide an exact argument, the

creditors of this company has been decreased from past two years. Debts from creditors are

deceased by 15.36% in year 2017 and by 34.45% in 2018.

From the overall horizontal analysis, it has been observed that Heineken is growing with

rapid pace and is effective in paying their creditors which make it a better company then

Simonds Farsons Cisk plc., in which goods of beer can manufacturer can be supplied. But this

analysis, does not impact the potential of Farsons, as this company is an effective organisation of

being a client of beer can manufacturer.

Ratio analysis of the financial statements

Ratio analysis is a method of getting insights about the operational efficiency and liquidity

of the company (Eng, Lea and Cai, 2014). This assist in the procedure of decision making so that

a calculated decision regarding investment can be made by the stakeholders and potential clients.

Ratio analysis tool is even crucial in this situation as vertical analysis conducted above reflects

efficiency of Farsons Plc. and horizontal analysis shows effectiveness of both the companies

which are Farsons Plc and Heineken.

Ratio analysis in this case is done to observe liquidity, profitability and credibility of both

the companies; so that an informed decision can be made which can assist the potential supplier

of beer can manufacturer (Lee and et.al., 2018). Gross and net profit margin ratio are selected for

analysing profitability and current ratio is calculated for analysing the liquidity.

4

company is seemed to be effective.

Horizontal analysis of Heineken (Income Statement)

Cost of revenue is increasing with a huge rate in case of Heineken as in year 2016 it

increases by 0.01%, 4.40% in 2017 and 8.18% in 2018. These values can support the argument

that when it comes growth and survival Heineken is much more efficient than Simonds Farsons

Cisk plc. The manufacturer of beer can must consider these values as they reflect that Heineken

is continuously improving its supplier policies by which their suppliers get benefitted.

Horizontal analysis of Heineken (Balance Sheet)

In order to emphasising on the aim of assisting beer can manufacturer, suppliers are the

creditors for an organisation and according to the horizontal balance sheet analysis of Heineken,

it has been seen that creditors of this company are continuously decreasing which means this

company believes in quick payment to their suppliers. To provide an exact argument, the

creditors of this company has been decreased from past two years. Debts from creditors are

deceased by 15.36% in year 2017 and by 34.45% in 2018.

From the overall horizontal analysis, it has been observed that Heineken is growing with

rapid pace and is effective in paying their creditors which make it a better company then

Simonds Farsons Cisk plc., in which goods of beer can manufacturer can be supplied. But this

analysis, does not impact the potential of Farsons, as this company is an effective organisation of

being a client of beer can manufacturer.

Ratio analysis of the financial statements

Ratio analysis is a method of getting insights about the operational efficiency and liquidity

of the company (Eng, Lea and Cai, 2014). This assist in the procedure of decision making so that

a calculated decision regarding investment can be made by the stakeholders and potential clients.

Ratio analysis tool is even crucial in this situation as vertical analysis conducted above reflects

efficiency of Farsons Plc. and horizontal analysis shows effectiveness of both the companies

which are Farsons Plc and Heineken.

Ratio analysis in this case is done to observe liquidity, profitability and credibility of both

the companies; so that an informed decision can be made which can assist the potential supplier

of beer can manufacturer (Lee and et.al., 2018). Gross and net profit margin ratio are selected for

analysing profitability and current ratio is calculated for analysing the liquidity.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

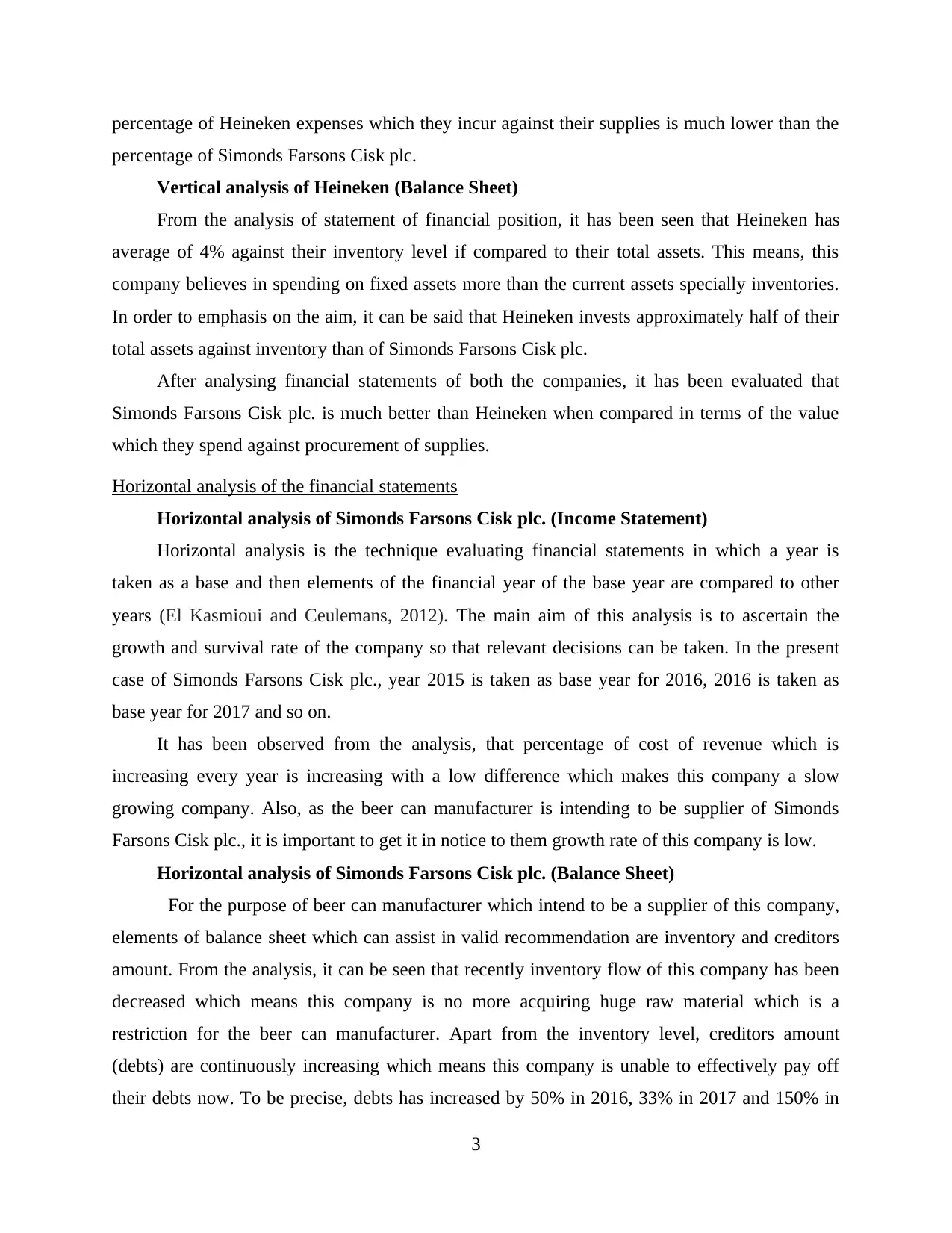

Net-profit Ratio

2015 2016 2017 2018

Net

Margin Farsons 10.11% 13.22% 13.77% 14.49%

Heineken 4.67% 3.75% 4.46% 4.28%

Net profit margin is the profitability ratio which reflects the profit earning ability of a

company (Najeeb, Bacha and Masih, 2015). In this case, net profit ratio of two companies are

calculated which are distinctly different but operates in same industry. The aim of calculating

this ratio is to assist the beer can manufacturer to decide which company is better to supply its

manufactured goods. Net profit margin of Farson company is 10.11% in 2015, 13.22% in 2016,

13.77% in 2017 and 14.49% in 2018. These ratio values reflect that net profit of Farson Plc is

much higher than the net profits of Heineken in any year. It is important for an organisation to be

profitable in order to pay off their suppliers.

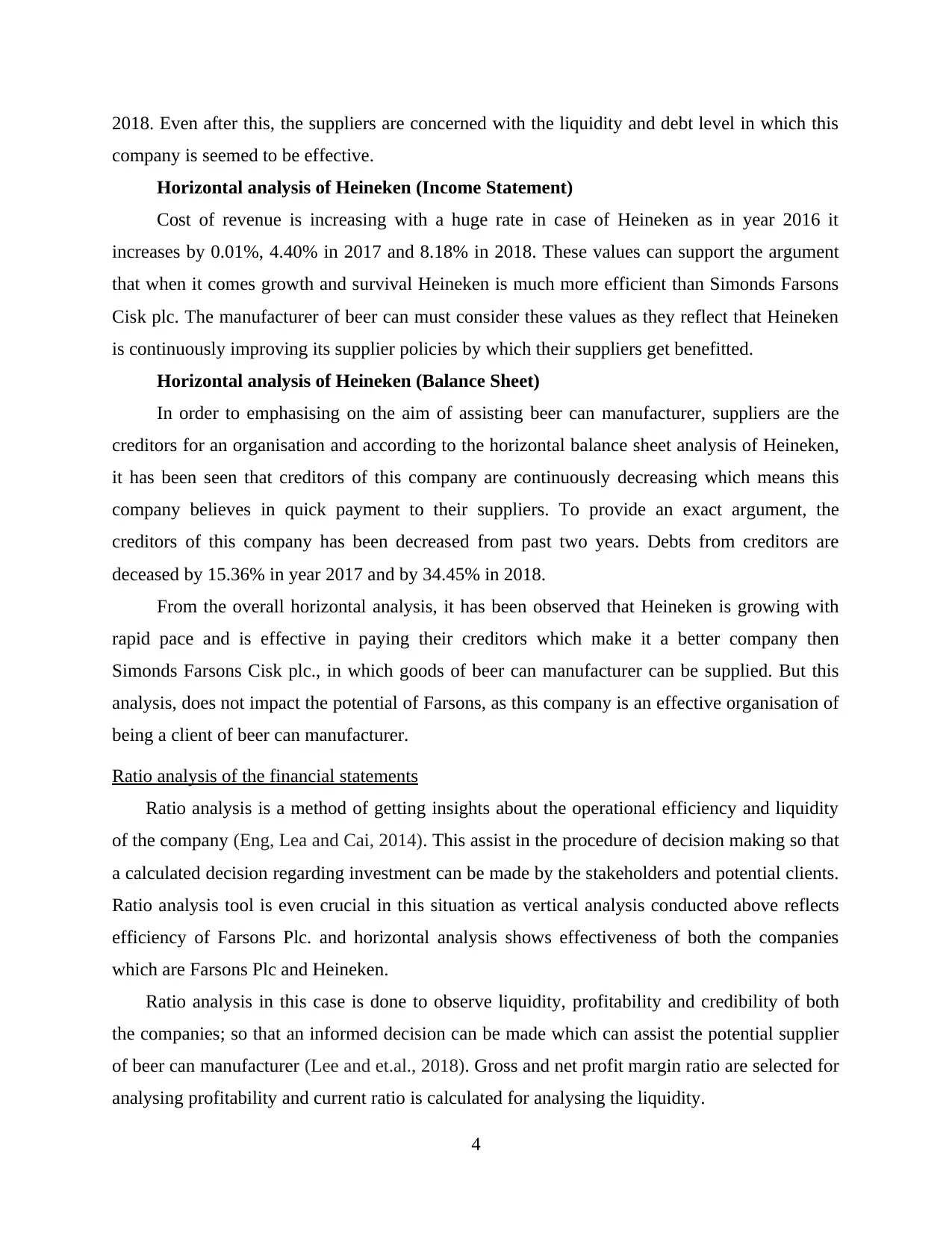

Gross Profit

2015 2016 2017 2018

Gross

Margin Farsons 37.97% 38.82% 38.64% 38.95%

Heineken 52.75% 53.39% 53.77% 51.29%

5

2015 2016 2017 2018

Net

Margin Farsons 10.11% 13.22% 13.77% 14.49%

Heineken 4.67% 3.75% 4.46% 4.28%

Net profit margin is the profitability ratio which reflects the profit earning ability of a

company (Najeeb, Bacha and Masih, 2015). In this case, net profit ratio of two companies are

calculated which are distinctly different but operates in same industry. The aim of calculating

this ratio is to assist the beer can manufacturer to decide which company is better to supply its

manufactured goods. Net profit margin of Farson company is 10.11% in 2015, 13.22% in 2016,

13.77% in 2017 and 14.49% in 2018. These ratio values reflect that net profit of Farson Plc is

much higher than the net profits of Heineken in any year. It is important for an organisation to be

profitable in order to pay off their suppliers.

Gross Profit

2015 2016 2017 2018

Gross

Margin Farsons 37.97% 38.82% 38.64% 38.95%

Heineken 52.75% 53.39% 53.77% 51.29%

5

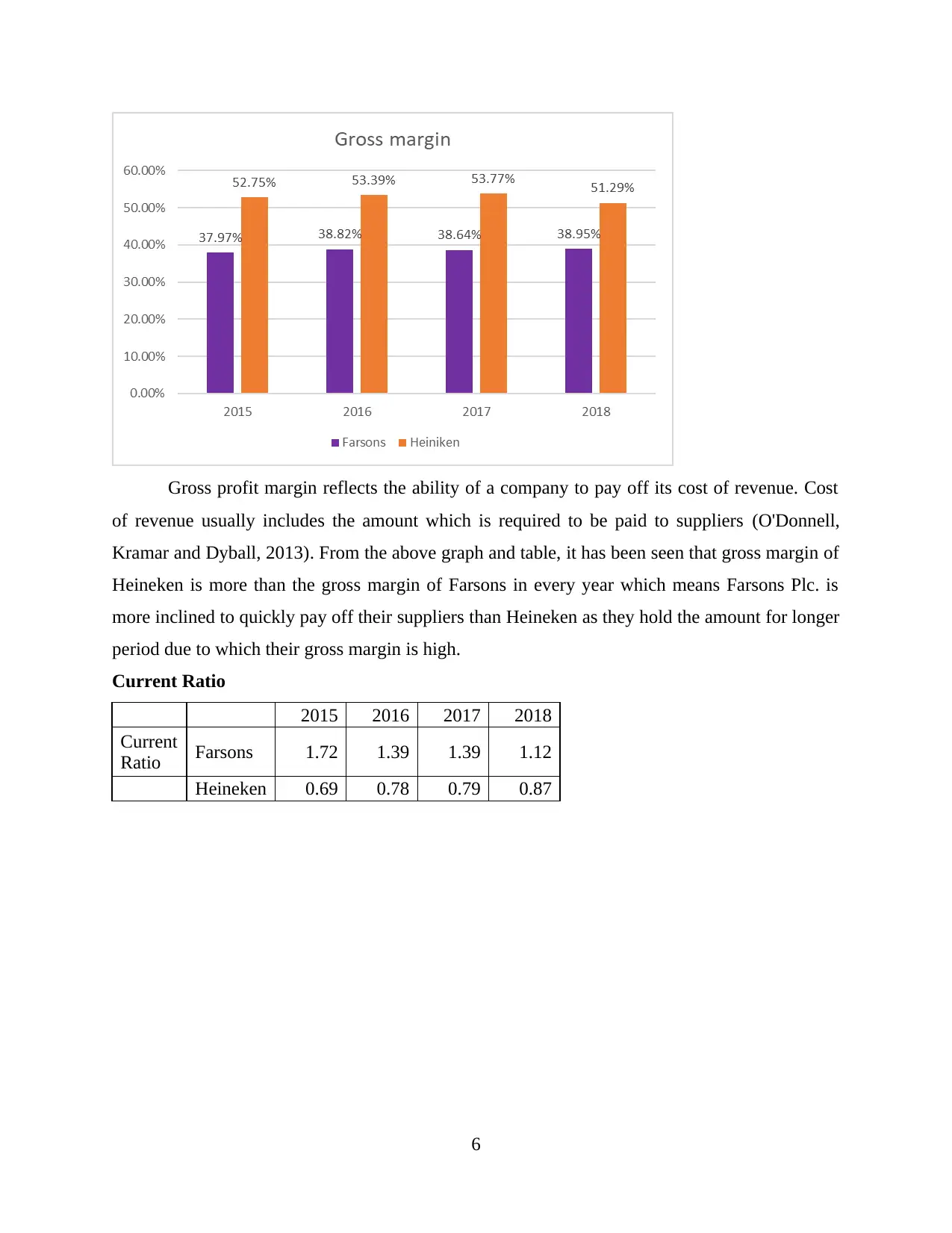

Gross profit margin reflects the ability of a company to pay off its cost of revenue. Cost

of revenue usually includes the amount which is required to be paid to suppliers (O'Donnell,

Kramar and Dyball, 2013). From the above graph and table, it has been seen that gross margin of

Heineken is more than the gross margin of Farsons in every year which means Farsons Plc. is

more inclined to quickly pay off their suppliers than Heineken as they hold the amount for longer

period due to which their gross margin is high.

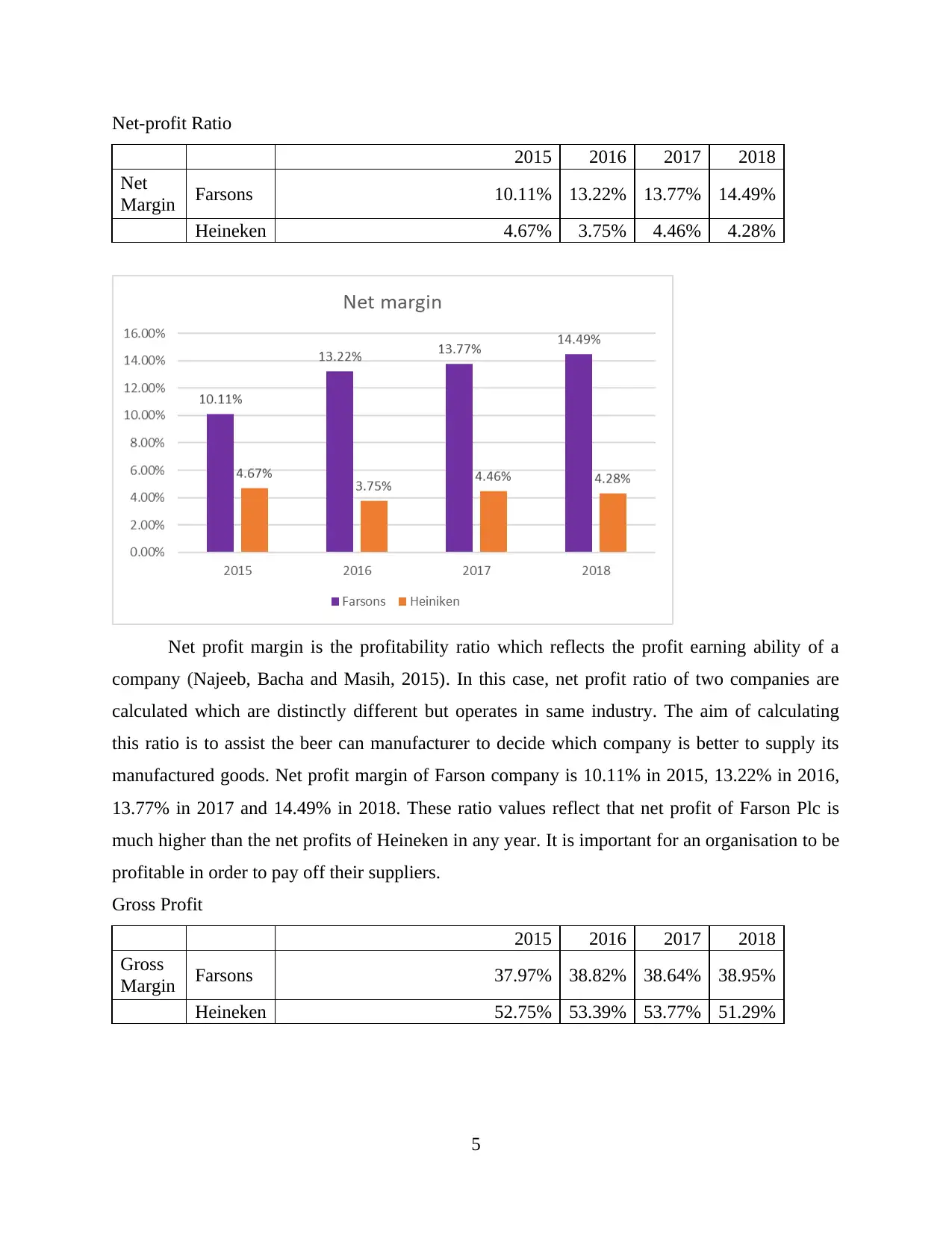

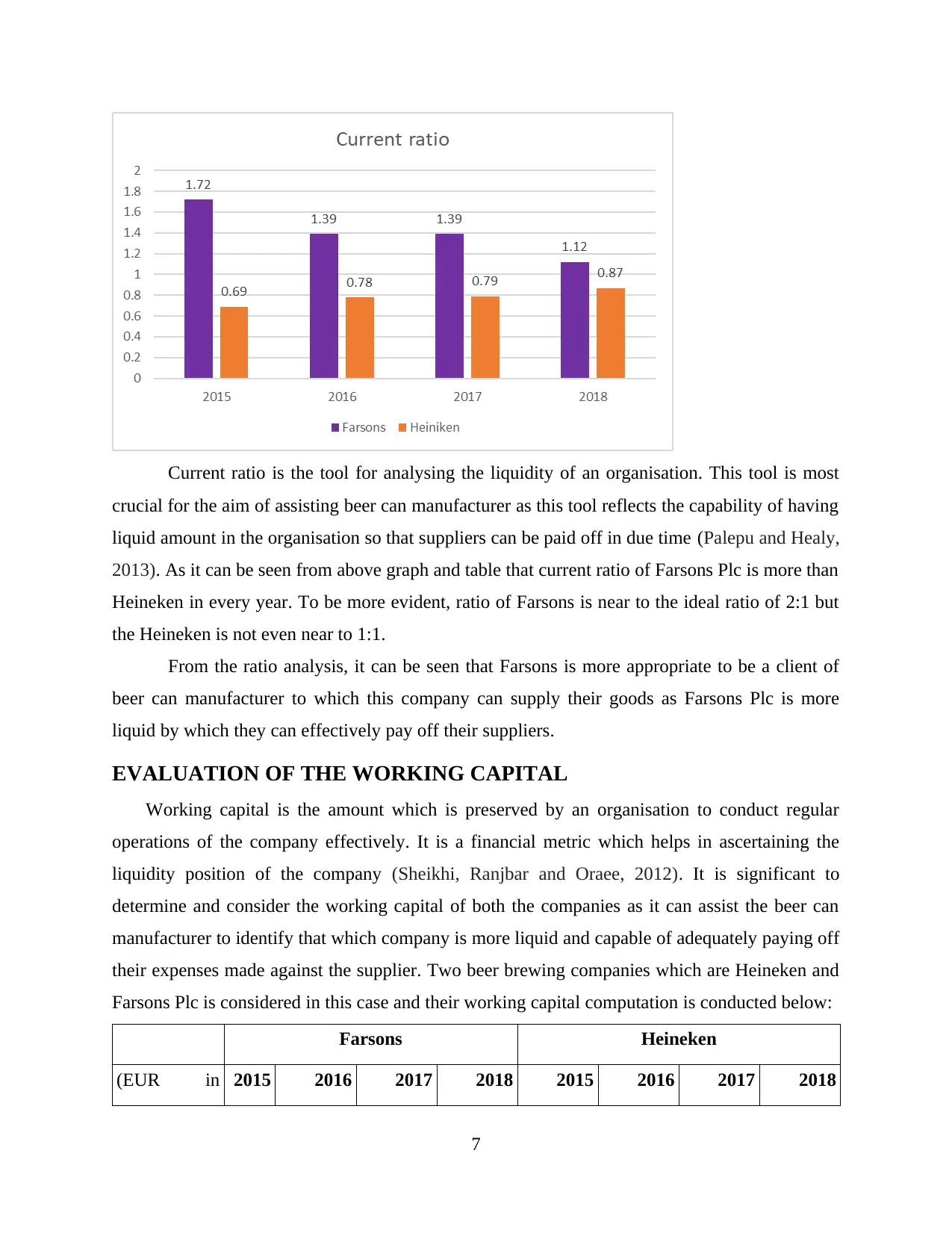

Current Ratio

2015 2016 2017 2018

Current

Ratio Farsons 1.72 1.39 1.39 1.12

Heineken 0.69 0.78 0.79 0.87

6

of revenue usually includes the amount which is required to be paid to suppliers (O'Donnell,

Kramar and Dyball, 2013). From the above graph and table, it has been seen that gross margin of

Heineken is more than the gross margin of Farsons in every year which means Farsons Plc. is

more inclined to quickly pay off their suppliers than Heineken as they hold the amount for longer

period due to which their gross margin is high.

Current Ratio

2015 2016 2017 2018

Current

Ratio Farsons 1.72 1.39 1.39 1.12

Heineken 0.69 0.78 0.79 0.87

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Current ratio is the tool for analysing the liquidity of an organisation. This tool is most

crucial for the aim of assisting beer can manufacturer as this tool reflects the capability of having

liquid amount in the organisation so that suppliers can be paid off in due time (Palepu and Healy,

2013). As it can be seen from above graph and table that current ratio of Farsons Plc is more than

Heineken in every year. To be more evident, ratio of Farsons is near to the ideal ratio of 2:1 but

the Heineken is not even near to 1:1.

From the ratio analysis, it can be seen that Farsons is more appropriate to be a client of

beer can manufacturer to which this company can supply their goods as Farsons Plc is more

liquid by which they can effectively pay off their suppliers.

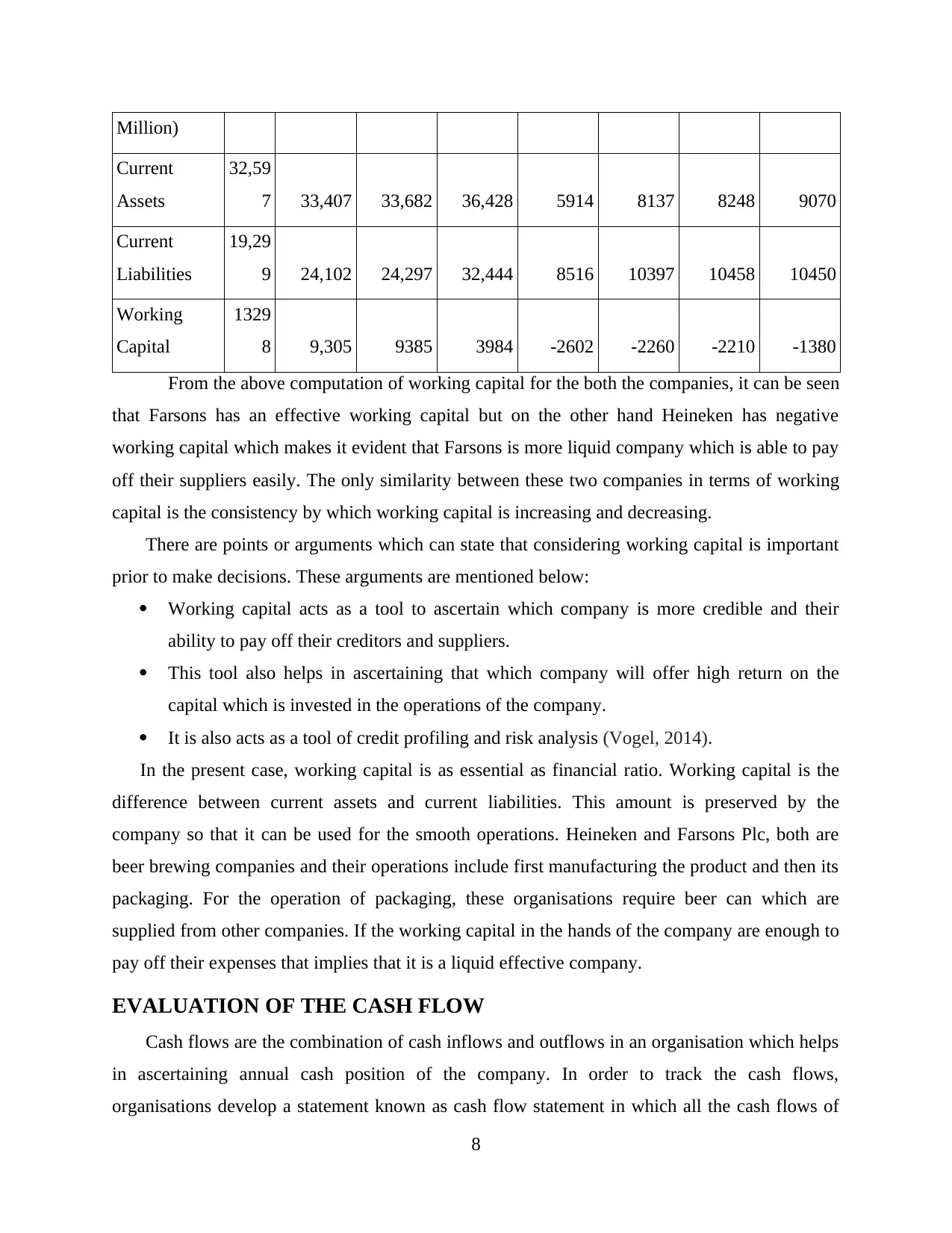

EVALUATION OF THE WORKING CAPITAL

Working capital is the amount which is preserved by an organisation to conduct regular

operations of the company effectively. It is a financial metric which helps in ascertaining the

liquidity position of the company (Sheikhi, Ranjbar and Oraee, 2012). It is significant to

determine and consider the working capital of both the companies as it can assist the beer can

manufacturer to identify that which company is more liquid and capable of adequately paying off

their expenses made against the supplier. Two beer brewing companies which are Heineken and

Farsons Plc is considered in this case and their working capital computation is conducted below:

Farsons Heineken

(EUR in 2015 2016 2017 2018 2015 2016 2017 2018

7

crucial for the aim of assisting beer can manufacturer as this tool reflects the capability of having

liquid amount in the organisation so that suppliers can be paid off in due time (Palepu and Healy,

2013). As it can be seen from above graph and table that current ratio of Farsons Plc is more than

Heineken in every year. To be more evident, ratio of Farsons is near to the ideal ratio of 2:1 but

the Heineken is not even near to 1:1.

From the ratio analysis, it can be seen that Farsons is more appropriate to be a client of

beer can manufacturer to which this company can supply their goods as Farsons Plc is more

liquid by which they can effectively pay off their suppliers.

EVALUATION OF THE WORKING CAPITAL

Working capital is the amount which is preserved by an organisation to conduct regular

operations of the company effectively. It is a financial metric which helps in ascertaining the

liquidity position of the company (Sheikhi, Ranjbar and Oraee, 2012). It is significant to

determine and consider the working capital of both the companies as it can assist the beer can

manufacturer to identify that which company is more liquid and capable of adequately paying off

their expenses made against the supplier. Two beer brewing companies which are Heineken and

Farsons Plc is considered in this case and their working capital computation is conducted below:

Farsons Heineken

(EUR in 2015 2016 2017 2018 2015 2016 2017 2018

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Million)

Current

Assets

32,59

7 33,407 33,682 36,428 5914 8137 8248 9070

Current

Liabilities

19,29

9 24,102 24,297 32,444 8516 10397 10458 10450

Working

Capital

1329

8 9,305 9385 3984 -2602 -2260 -2210 -1380

From the above computation of working capital for the both the companies, it can be seen

that Farsons has an effective working capital but on the other hand Heineken has negative

working capital which makes it evident that Farsons is more liquid company which is able to pay

off their suppliers easily. The only similarity between these two companies in terms of working

capital is the consistency by which working capital is increasing and decreasing.

There are points or arguments which can state that considering working capital is important

prior to make decisions. These arguments are mentioned below:

Working capital acts as a tool to ascertain which company is more credible and their

ability to pay off their creditors and suppliers.

This tool also helps in ascertaining that which company will offer high return on the

capital which is invested in the operations of the company.

It is also acts as a tool of credit profiling and risk analysis (Vogel, 2014).

In the present case, working capital is as essential as financial ratio. Working capital is the

difference between current assets and current liabilities. This amount is preserved by the

company so that it can be used for the smooth operations. Heineken and Farsons Plc, both are

beer brewing companies and their operations include first manufacturing the product and then its

packaging. For the operation of packaging, these organisations require beer can which are

supplied from other companies. If the working capital in the hands of the company are enough to

pay off their expenses that implies that it is a liquid effective company.

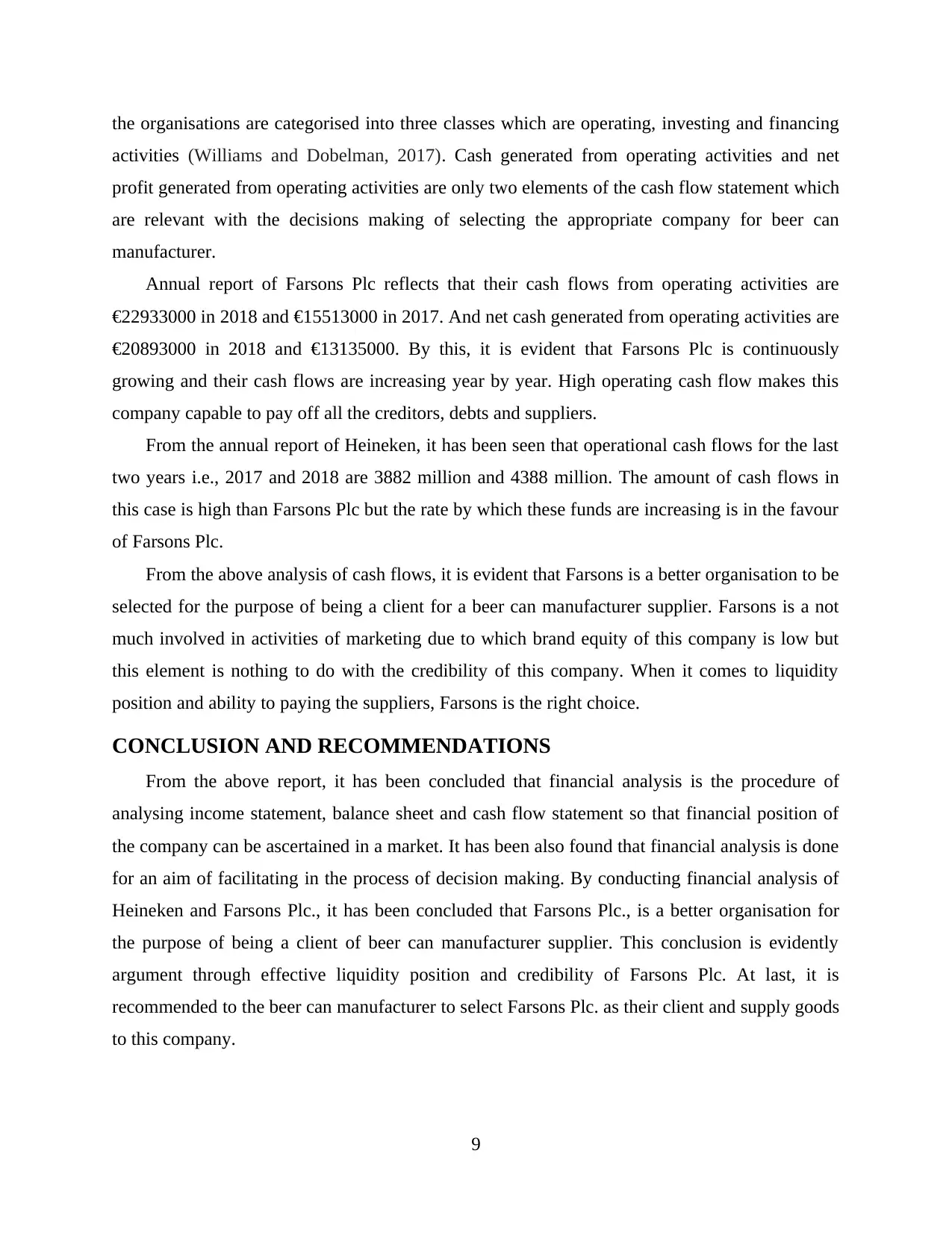

EVALUATION OF THE CASH FLOW

Cash flows are the combination of cash inflows and outflows in an organisation which helps

in ascertaining annual cash position of the company. In order to track the cash flows,

organisations develop a statement known as cash flow statement in which all the cash flows of

8

Current

Assets

32,59

7 33,407 33,682 36,428 5914 8137 8248 9070

Current

Liabilities

19,29

9 24,102 24,297 32,444 8516 10397 10458 10450

Working

Capital

1329

8 9,305 9385 3984 -2602 -2260 -2210 -1380

From the above computation of working capital for the both the companies, it can be seen

that Farsons has an effective working capital but on the other hand Heineken has negative

working capital which makes it evident that Farsons is more liquid company which is able to pay

off their suppliers easily. The only similarity between these two companies in terms of working

capital is the consistency by which working capital is increasing and decreasing.

There are points or arguments which can state that considering working capital is important

prior to make decisions. These arguments are mentioned below:

Working capital acts as a tool to ascertain which company is more credible and their

ability to pay off their creditors and suppliers.

This tool also helps in ascertaining that which company will offer high return on the

capital which is invested in the operations of the company.

It is also acts as a tool of credit profiling and risk analysis (Vogel, 2014).

In the present case, working capital is as essential as financial ratio. Working capital is the

difference between current assets and current liabilities. This amount is preserved by the

company so that it can be used for the smooth operations. Heineken and Farsons Plc, both are

beer brewing companies and their operations include first manufacturing the product and then its

packaging. For the operation of packaging, these organisations require beer can which are

supplied from other companies. If the working capital in the hands of the company are enough to

pay off their expenses that implies that it is a liquid effective company.

EVALUATION OF THE CASH FLOW

Cash flows are the combination of cash inflows and outflows in an organisation which helps

in ascertaining annual cash position of the company. In order to track the cash flows,

organisations develop a statement known as cash flow statement in which all the cash flows of

8

the organisations are categorised into three classes which are operating, investing and financing

activities (Williams and Dobelman, 2017). Cash generated from operating activities and net

profit generated from operating activities are only two elements of the cash flow statement which

are relevant with the decisions making of selecting the appropriate company for beer can

manufacturer.

Annual report of Farsons Plc reflects that their cash flows from operating activities are

€22933000 in 2018 and €15513000 in 2017. And net cash generated from operating activities are

€20893000 in 2018 and €13135000. By this, it is evident that Farsons Plc is continuously

growing and their cash flows are increasing year by year. High operating cash flow makes this

company capable to pay off all the creditors, debts and suppliers.

From the annual report of Heineken, it has been seen that operational cash flows for the last

two years i.e., 2017 and 2018 are 3882 million and 4388 million. The amount of cash flows in

this case is high than Farsons Plc but the rate by which these funds are increasing is in the favour

of Farsons Plc.

From the above analysis of cash flows, it is evident that Farsons is a better organisation to be

selected for the purpose of being a client for a beer can manufacturer supplier. Farsons is a not

much involved in activities of marketing due to which brand equity of this company is low but

this element is nothing to do with the credibility of this company. When it comes to liquidity

position and ability to paying the suppliers, Farsons is the right choice.

CONCLUSION AND RECOMMENDATIONS

From the above report, it has been concluded that financial analysis is the procedure of

analysing income statement, balance sheet and cash flow statement so that financial position of

the company can be ascertained in a market. It has been also found that financial analysis is done

for an aim of facilitating in the process of decision making. By conducting financial analysis of

Heineken and Farsons Plc., it has been concluded that Farsons Plc., is a better organisation for

the purpose of being a client of beer can manufacturer supplier. This conclusion is evidently

argument through effective liquidity position and credibility of Farsons Plc. At last, it is

recommended to the beer can manufacturer to select Farsons Plc. as their client and supply goods

to this company.

9

activities (Williams and Dobelman, 2017). Cash generated from operating activities and net

profit generated from operating activities are only two elements of the cash flow statement which

are relevant with the decisions making of selecting the appropriate company for beer can

manufacturer.

Annual report of Farsons Plc reflects that their cash flows from operating activities are

€22933000 in 2018 and €15513000 in 2017. And net cash generated from operating activities are

€20893000 in 2018 and €13135000. By this, it is evident that Farsons Plc is continuously

growing and their cash flows are increasing year by year. High operating cash flow makes this

company capable to pay off all the creditors, debts and suppliers.

From the annual report of Heineken, it has been seen that operational cash flows for the last

two years i.e., 2017 and 2018 are 3882 million and 4388 million. The amount of cash flows in

this case is high than Farsons Plc but the rate by which these funds are increasing is in the favour

of Farsons Plc.

From the above analysis of cash flows, it is evident that Farsons is a better organisation to be

selected for the purpose of being a client for a beer can manufacturer supplier. Farsons is a not

much involved in activities of marketing due to which brand equity of this company is low but

this element is nothing to do with the credibility of this company. When it comes to liquidity

position and ability to paying the suppliers, Farsons is the right choice.

CONCLUSION AND RECOMMENDATIONS

From the above report, it has been concluded that financial analysis is the procedure of

analysing income statement, balance sheet and cash flow statement so that financial position of

the company can be ascertained in a market. It has been also found that financial analysis is done

for an aim of facilitating in the process of decision making. By conducting financial analysis of

Heineken and Farsons Plc., it has been concluded that Farsons Plc., is a better organisation for

the purpose of being a client of beer can manufacturer supplier. This conclusion is evidently

argument through effective liquidity position and credibility of Farsons Plc. At last, it is

recommended to the beer can manufacturer to select Farsons Plc. as their client and supply goods

to this company.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 26

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.