Financial Statement Analysis and Performance of Airlines: 2013-2016

VerifiedAdded on 2020/07/22

|14

|3605

|102

Report

AI Summary

This report presents a financial analysis of three major airlines: Turkish Airlines, Lufthansa, and Emirates. The analysis focuses on evaluating their financial performance from 2013 to 2016, utilizing ratio analysis to assess profitability, liquidity, solvency, and efficiency. The report examines profitability ratios, including gross profit margin and net profit margin, highlighting trends and underlying factors such as network penetration, competitive pressures, and cost management. Liquidity ratios, such as current and quick ratios, are assessed to gauge the companies' ability to meet short-term obligations. Solvency ratios, particularly the debt-equity ratio, are analyzed to understand the companies' financial leverage and its impact on profitability. Efficiency ratios, including inventory turnover and total assets turnover, are examined to evaluate how effectively the companies utilize their assets. The report also includes an assessment of investment ratios, such as earnings per share, to provide insights into shareholder returns. Overall, the report provides a comprehensive financial overview, comparing the performance of these airlines and identifying key strengths and weaknesses.

Financial Analysis Management & Enterprise

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

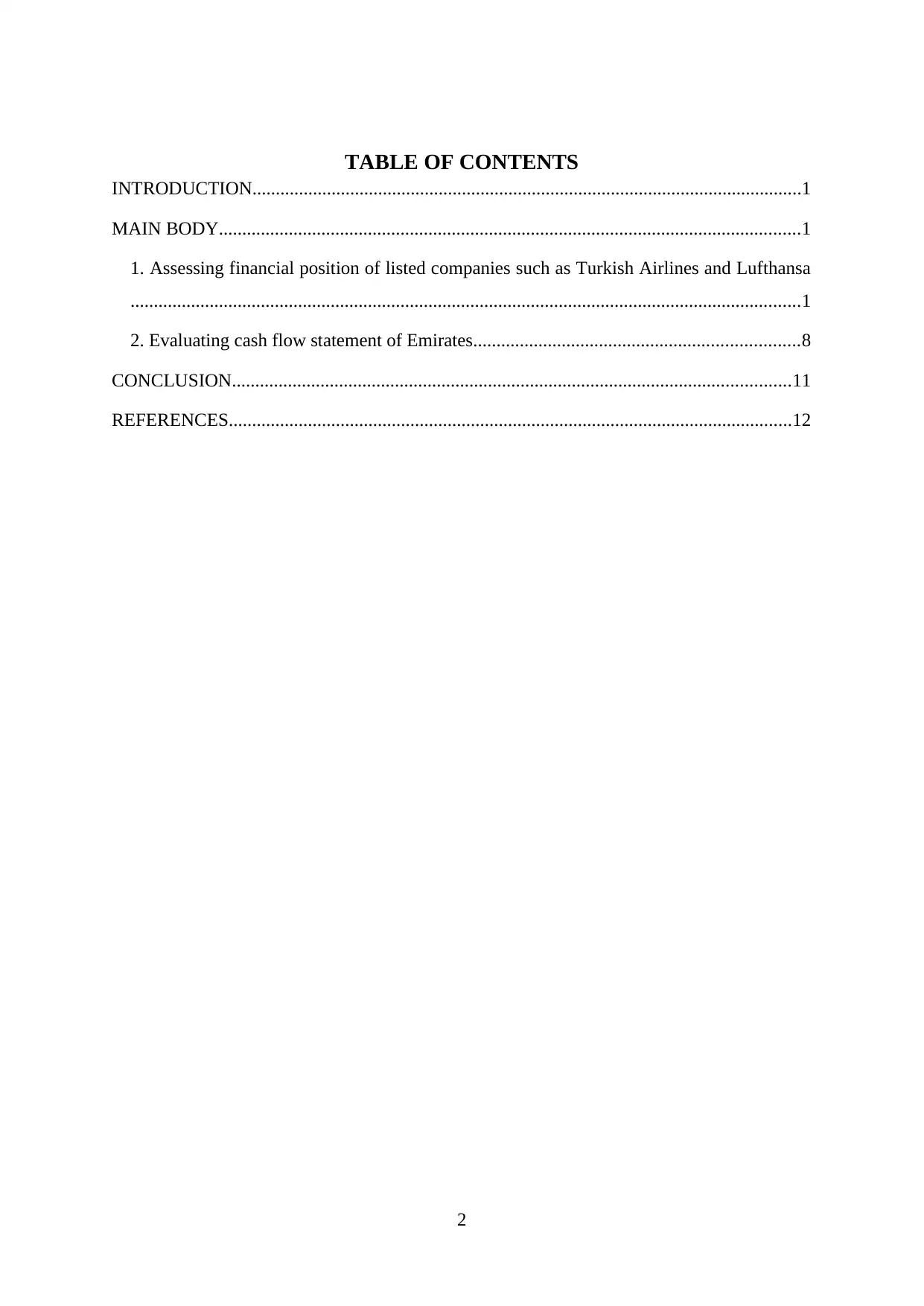

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................1

MAIN BODY.............................................................................................................................1

1. Assessing financial position of listed companies such as Turkish Airlines and Lufthansa

................................................................................................................................................1

2. Evaluating cash flow statement of Emirates......................................................................8

CONCLUSION........................................................................................................................11

REFERENCES.........................................................................................................................12

2

INTRODUCTION......................................................................................................................1

MAIN BODY.............................................................................................................................1

1. Assessing financial position of listed companies such as Turkish Airlines and Lufthansa

................................................................................................................................................1

2. Evaluating cash flow statement of Emirates......................................................................8

CONCLUSION........................................................................................................................11

REFERENCES.........................................................................................................................12

2

INTRODUCTION

In the current times, companies operating in airlines sector are facing stiff competitive

situation. All the units are placing high level of emphasis on providing customers with

quality services at lower prices. This in turn closely influences profit margin generated by the

organizations and overall success. Moreover, for gaining competitive edge over others

business unit needs to offer innovative and luxurious services to the passengers. Hence, for

this purpose effective management of funds highly needed. In this, study is carried out on

three airlines firms such as Turkish Airlines, Lufthansa and Emirates. As per the case, Head

of Equity Research seeks to identify the extent to which company or business units

performing better in monetary terms. Hence, report will present financial statement

evaluation of Turkish Airlines and Lufthansa, pertaining to four years period, via ratio

analysis.

MAIN BODY

1. Assessing financial position of listed companies such as Turkish Airlines and Lufthansa

Ratio analysis refers to the quantitative assessment or evaluation of information

contained in financial statements of business unit. Such technique is highly significant which

provides high level of assistance in analyzing financial performance from several

perspectives such as profitability, liquidity, solvency and efficiency. This technique gives

clear indication about company’s financial performance over the years and in against to the

competitors.

Comparison and critique of financial position of the companies such as TA and

Lufthansa

Ratio analysis of Turkish Airlines and Lufthansa from the period of 2013 to 2016 is as

follows:

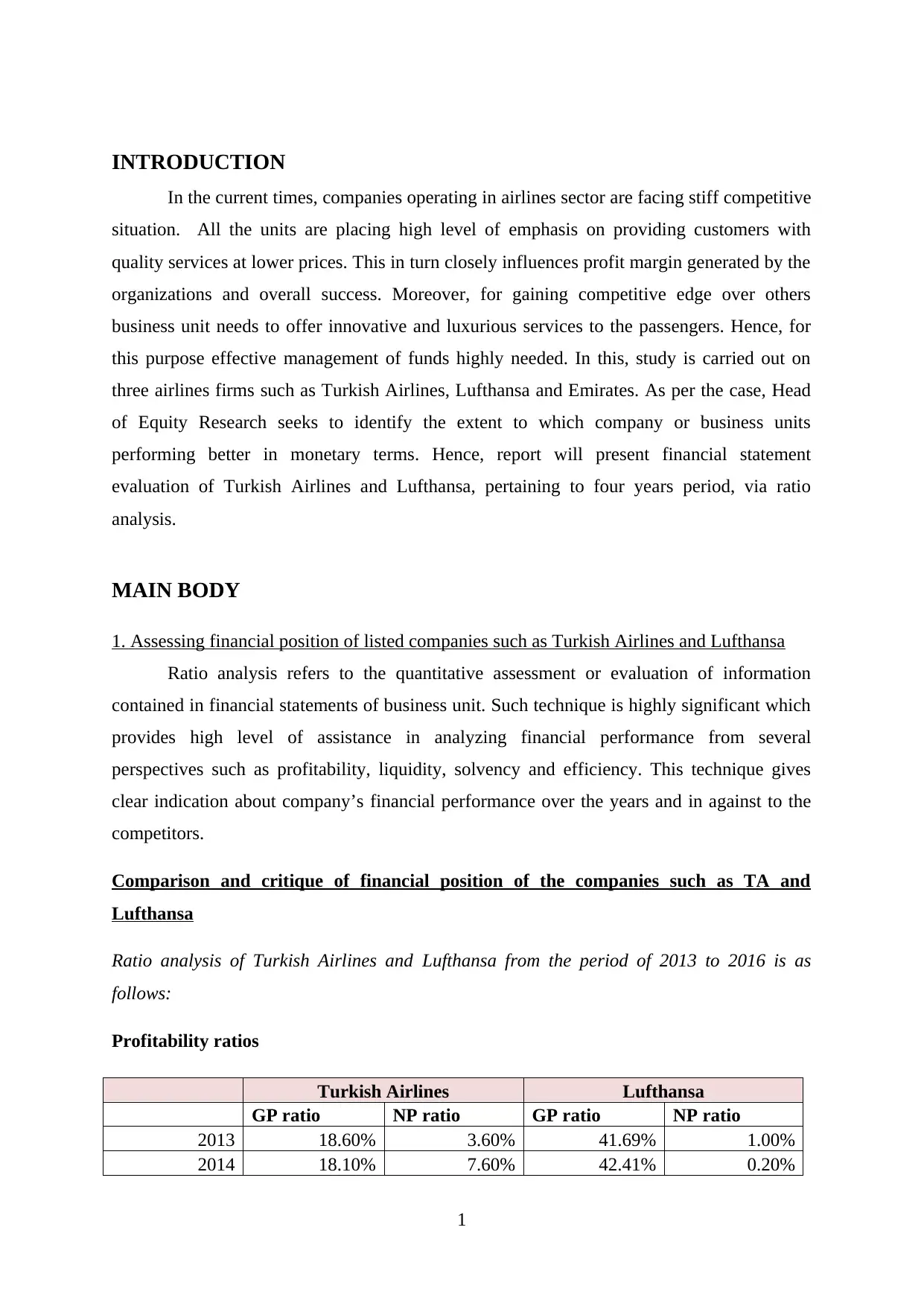

Profitability ratios

Turkish Airlines Lufthansa

GP ratio NP ratio GP ratio NP ratio

2013 18.60% 3.60% 41.69% 1.00%

2014 18.10% 7.60% 42.41% 0.20%

1

In the current times, companies operating in airlines sector are facing stiff competitive

situation. All the units are placing high level of emphasis on providing customers with

quality services at lower prices. This in turn closely influences profit margin generated by the

organizations and overall success. Moreover, for gaining competitive edge over others

business unit needs to offer innovative and luxurious services to the passengers. Hence, for

this purpose effective management of funds highly needed. In this, study is carried out on

three airlines firms such as Turkish Airlines, Lufthansa and Emirates. As per the case, Head

of Equity Research seeks to identify the extent to which company or business units

performing better in monetary terms. Hence, report will present financial statement

evaluation of Turkish Airlines and Lufthansa, pertaining to four years period, via ratio

analysis.

MAIN BODY

1. Assessing financial position of listed companies such as Turkish Airlines and Lufthansa

Ratio analysis refers to the quantitative assessment or evaluation of information

contained in financial statements of business unit. Such technique is highly significant which

provides high level of assistance in analyzing financial performance from several

perspectives such as profitability, liquidity, solvency and efficiency. This technique gives

clear indication about company’s financial performance over the years and in against to the

competitors.

Comparison and critique of financial position of the companies such as TA and

Lufthansa

Ratio analysis of Turkish Airlines and Lufthansa from the period of 2013 to 2016 is as

follows:

Profitability ratios

Turkish Airlines Lufthansa

GP ratio NP ratio GP ratio NP ratio

2013 18.60% 3.60% 41.69% 1.00%

2014 18.10% 7.60% 42.41% 0.20%

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2015 20.00% 10.20% 44.97% 5.30%

2016 11.60% -0.80% 45.96% 5.60%

Interpretation: GP margin of TA was 18.60% and 18.10% in the period of 2013 and

2014. On the other side, in 2015 and 2016, it was 20% & 11.60% respectively. From

assessment, it has found that sales revenue of TA was declined over the years due to its

network penetration of Asia Pacific is relatively weak. Along with this, due to the intense

competitive situation TA failed to maintain limited market share. Further, internal analysis

presents that initiative of business unit’s in CSR projects is limited (Swot analysis of Turkish

Airlines, 2018). TA provides customers or passengers with limited varieties pertaining to

beverages. Hence, due to the high cost of goods sold firm failed to generate high margin. On

the other side, as compared to TA, Lufthansa generated margin with the increasing rate. Over

the time period, GP margin of the company inclined from 41.69% & 45.96% respectively.

Thus, it can be depicted that TA exerted effectual control on the direct expenses of Lufthansa.

Profitability ratio analysis presents that, at the end of 2016, NP margin of TA was

increased over the years from 3.60% to 10.20% significantly. In 2016, NP ratio of the

company was negative such as -.80%. The reason behind the attainment of negative margin

was decrease in financial income from 532 million to 300 million. In addition to this,

financial expenditure of TA increased from 201 to 229 million. Hence, due to the increasing

level of indirect expenditure negative margin was assessed in the period of 2016. In contrast

to this, NP margin of Lufthansa was 5.3% and 5.6% significantly. Comparatively, such

increasing trend can be supported with the strength of Lufthansa such as multiple passenger

brand positioning and leading aviation services (Swot analysis of Lufthansa, 2018). In the

context of Lufthansa, it can be stated that firm made effectual control on indirect expenses in

the period of 2016.

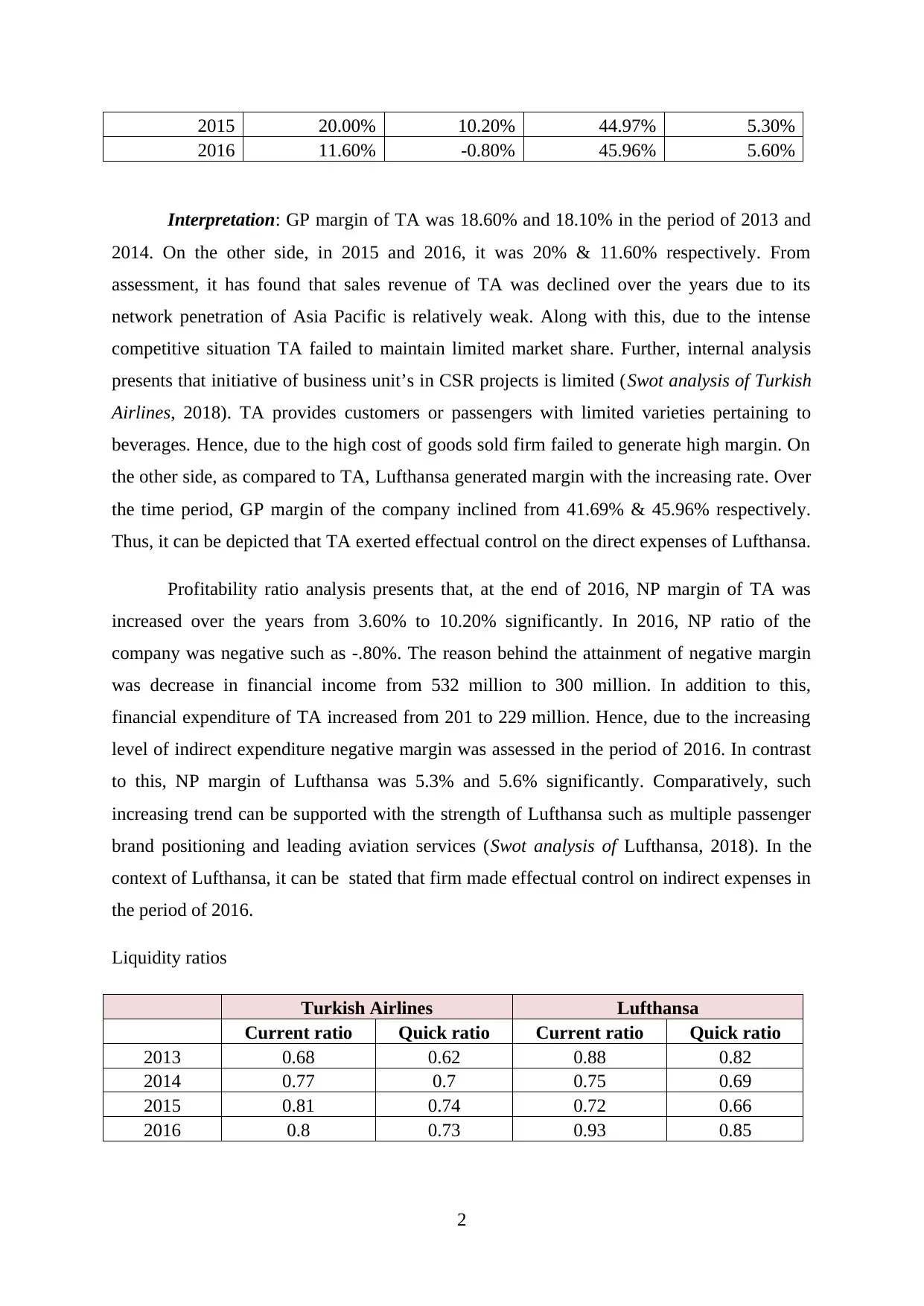

Liquidity ratios

Turkish Airlines Lufthansa

Current ratio Quick ratio Current ratio Quick ratio

2013 0.68 0.62 0.88 0.82

2014 0.77 0.7 0.75 0.69

2015 0.81 0.74 0.72 0.66

2016 0.8 0.73 0.93 0.85

2

2016 11.60% -0.80% 45.96% 5.60%

Interpretation: GP margin of TA was 18.60% and 18.10% in the period of 2013 and

2014. On the other side, in 2015 and 2016, it was 20% & 11.60% respectively. From

assessment, it has found that sales revenue of TA was declined over the years due to its

network penetration of Asia Pacific is relatively weak. Along with this, due to the intense

competitive situation TA failed to maintain limited market share. Further, internal analysis

presents that initiative of business unit’s in CSR projects is limited (Swot analysis of Turkish

Airlines, 2018). TA provides customers or passengers with limited varieties pertaining to

beverages. Hence, due to the high cost of goods sold firm failed to generate high margin. On

the other side, as compared to TA, Lufthansa generated margin with the increasing rate. Over

the time period, GP margin of the company inclined from 41.69% & 45.96% respectively.

Thus, it can be depicted that TA exerted effectual control on the direct expenses of Lufthansa.

Profitability ratio analysis presents that, at the end of 2016, NP margin of TA was

increased over the years from 3.60% to 10.20% significantly. In 2016, NP ratio of the

company was negative such as -.80%. The reason behind the attainment of negative margin

was decrease in financial income from 532 million to 300 million. In addition to this,

financial expenditure of TA increased from 201 to 229 million. Hence, due to the increasing

level of indirect expenditure negative margin was assessed in the period of 2016. In contrast

to this, NP margin of Lufthansa was 5.3% and 5.6% significantly. Comparatively, such

increasing trend can be supported with the strength of Lufthansa such as multiple passenger

brand positioning and leading aviation services (Swot analysis of Lufthansa, 2018). In the

context of Lufthansa, it can be stated that firm made effectual control on indirect expenses in

the period of 2016.

Liquidity ratios

Turkish Airlines Lufthansa

Current ratio Quick ratio Current ratio Quick ratio

2013 0.68 0.62 0.88 0.82

2014 0.77 0.7 0.75 0.69

2015 0.81 0.74 0.72 0.66

2016 0.8 0.73 0.93 0.85

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: By analyzing balance sheet, liquidity position of both the companies

namely Turkish Airlines and Lufthansa has assessed. Current ratio of such both airline

companies fall within the range of .60 to .80. In 2016, current ratio of TA and Lufthansa

accounted for .80 and .73 (Annual report of Turkish Airlines (2016), n.d.). Hence, in against

to the ideal measure such as 2:1, liquidity position of TA and Lufthansa was not good. The

rationale behind such decreasing liquidity level is that high maintenance of current assets

over short term obligations impacts organizational profitability. Referring such belief lower

liquidity was maintained by TA and Lufthansa within the unit. However, company becomes

insolvent and faces difficulty in meeting requirements pertaining to daily operations. Hence,

considering outcome, it can be depicted that liquidity position of such airline firms was not

good during the last 4 years. Thus, for enhancing liquidity position focus needs to be made on

the maintenance of current assets such as debtors, stock, cash etc.

Tabular presentation shows inclining trend in the quick ratio of both TA and

Lufthansa. At the end of 2016, quick ratio of TA and Lufthansa was .73 & .85 respectively.

In accordance with the industry average and ideal ratio business unit should maintain 1

current asset except stock and prepaid expenses in against to 2 short term obligations. Hence,

present situation pertaining to four years period, from 2013 to 2016 shows that both the

companies had maintained enough assets that can easily be converted into cash for meeting

current liabilities.

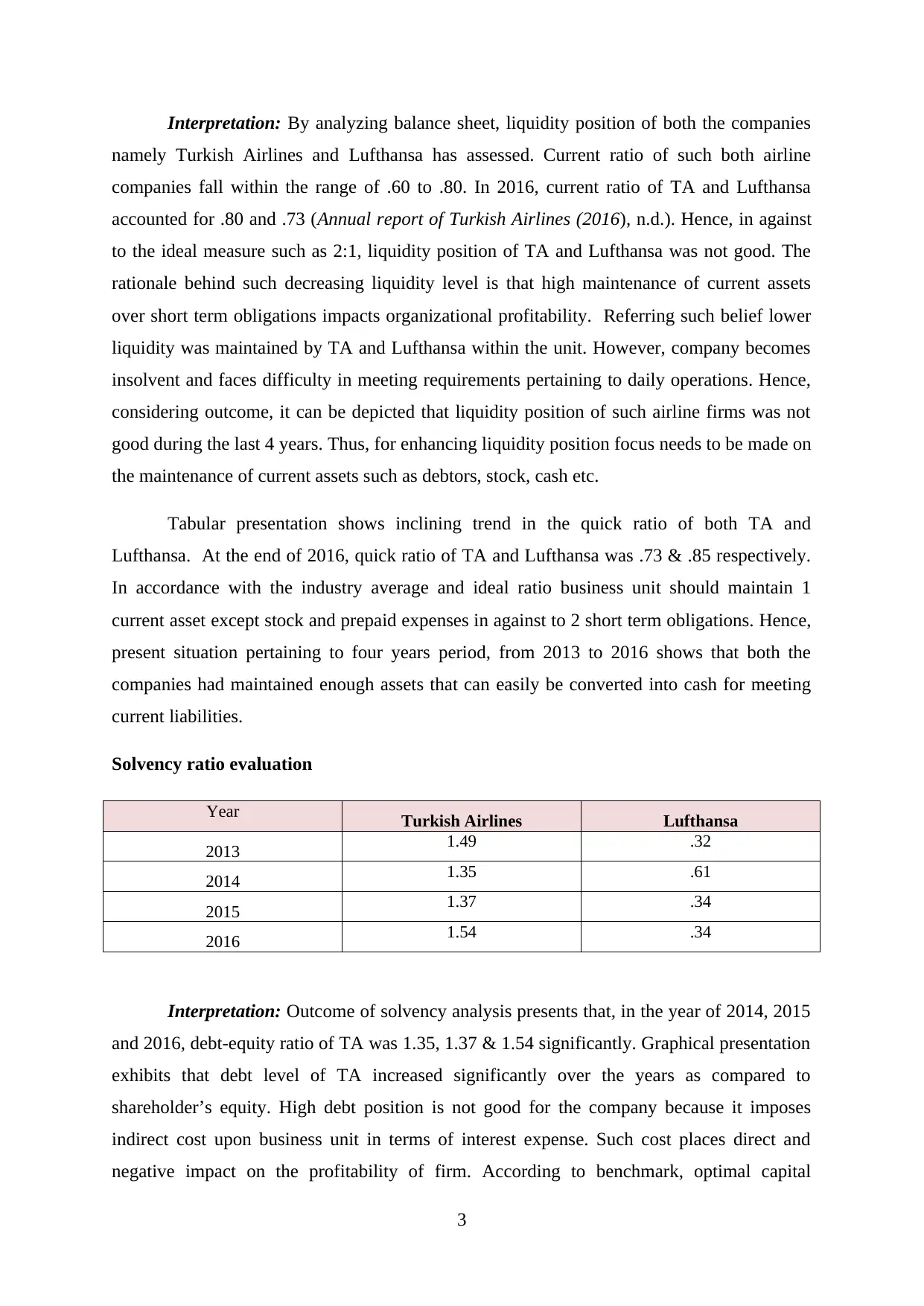

Solvency ratio evaluation

Year Turkish Airlines Lufthansa

2013 1.49 .32

2014 1.35 .61

2015 1.37 .34

2016 1.54 .34

Interpretation: Outcome of solvency analysis presents that, in the year of 2014, 2015

and 2016, debt-equity ratio of TA was 1.35, 1.37 & 1.54 significantly. Graphical presentation

exhibits that debt level of TA increased significantly over the years as compared to

shareholder’s equity. High debt position is not good for the company because it imposes

indirect cost upon business unit in terms of interest expense. Such cost places direct and

negative impact on the profitability of firm. According to benchmark, optimal capital

3

namely Turkish Airlines and Lufthansa has assessed. Current ratio of such both airline

companies fall within the range of .60 to .80. In 2016, current ratio of TA and Lufthansa

accounted for .80 and .73 (Annual report of Turkish Airlines (2016), n.d.). Hence, in against

to the ideal measure such as 2:1, liquidity position of TA and Lufthansa was not good. The

rationale behind such decreasing liquidity level is that high maintenance of current assets

over short term obligations impacts organizational profitability. Referring such belief lower

liquidity was maintained by TA and Lufthansa within the unit. However, company becomes

insolvent and faces difficulty in meeting requirements pertaining to daily operations. Hence,

considering outcome, it can be depicted that liquidity position of such airline firms was not

good during the last 4 years. Thus, for enhancing liquidity position focus needs to be made on

the maintenance of current assets such as debtors, stock, cash etc.

Tabular presentation shows inclining trend in the quick ratio of both TA and

Lufthansa. At the end of 2016, quick ratio of TA and Lufthansa was .73 & .85 respectively.

In accordance with the industry average and ideal ratio business unit should maintain 1

current asset except stock and prepaid expenses in against to 2 short term obligations. Hence,

present situation pertaining to four years period, from 2013 to 2016 shows that both the

companies had maintained enough assets that can easily be converted into cash for meeting

current liabilities.

Solvency ratio evaluation

Year Turkish Airlines Lufthansa

2013 1.49 .32

2014 1.35 .61

2015 1.37 .34

2016 1.54 .34

Interpretation: Outcome of solvency analysis presents that, in the year of 2014, 2015

and 2016, debt-equity ratio of TA was 1.35, 1.37 & 1.54 significantly. Graphical presentation

exhibits that debt level of TA increased significantly over the years as compared to

shareholder’s equity. High debt position is not good for the company because it imposes

indirect cost upon business unit in terms of interest expense. Such cost places direct and

negative impact on the profitability of firm. According to benchmark, optimal capital

3

structure contains the ratio of .5:1. When solvency or debt-equity ratio exceeds such limit

then it closely impact profit margin. On the contrary to this, in the year of 2014, debt-equity

ratio of Lufthansa was in line with the standard. However, in other years such as 2015 and

2016, solvency ratio of Lufthansa was constant such as .34 significantly. This in turn

positively contributes in the margin of firm. Moreover, in equities, firm offers dividend to the

shareholders when it generates enough funds or returns. Hence, in comparison to TA,

Lufthansa’s solvency of Lufthansa was good during the four concerned period.

Efficiency ratio

Turkish Airlines Lufthansa

Year

Inventory

turnover ratio

Total assets

turnover ratio

Inventory

turnover ratio

Total assets

turnover ratio

2013 50.02 0.83 27.36 0.97

2014 46.5 0.81 25.78 1.02

2015 38.98 0.6 24.15 1.01

2016 39.89 0.57 21.7 1.1

Ratio analysis result exhibits that inventory turnover ratio of TA decreased from

50.02 to 38.98 times. However, stock turnover ratio of the company inclined from 38.98 to

39.89 times at the end of 2016. Along with this, such ratio of Lufthansa decreased from 27.36

to 21.7 times. This shows that ability of both the companies in relation to converting stock

into cash declined over the time period. Moreover, now airline sector is facing high level of

competition and placing more emphasis on offering high discounts to the customers. Now,

customers switch to the airline company that provides them with attractive discounting or

promotional offers. However, in comparison to Lufthansa, TA’s stock turnover ratio was

good. Such increasing trend can be supported with the aspect that TA offers direct flights to

many destinations. Hence, stock management policies of TA were highly good over others

which in turn recognized as main reasons behind increasing margin in the period of 2013,

2014 & 2015.

Total assets turnover ratio of TA was .83 & .81 in the financial year 2013 and 2014.

On the contrary to this, in 2016, such ratio of the firm was decreased significantly and

accounted for .57 (Annual report of Turkish Airlines (2014), n.d.). Such trend presents that

over the time frame business unit generated less returns from total assets. It shows

inefficiency level of management team and employees in relation to developing strategies as

4

then it closely impact profit margin. On the contrary to this, in the year of 2014, debt-equity

ratio of Lufthansa was in line with the standard. However, in other years such as 2015 and

2016, solvency ratio of Lufthansa was constant such as .34 significantly. This in turn

positively contributes in the margin of firm. Moreover, in equities, firm offers dividend to the

shareholders when it generates enough funds or returns. Hence, in comparison to TA,

Lufthansa’s solvency of Lufthansa was good during the four concerned period.

Efficiency ratio

Turkish Airlines Lufthansa

Year

Inventory

turnover ratio

Total assets

turnover ratio

Inventory

turnover ratio

Total assets

turnover ratio

2013 50.02 0.83 27.36 0.97

2014 46.5 0.81 25.78 1.02

2015 38.98 0.6 24.15 1.01

2016 39.89 0.57 21.7 1.1

Ratio analysis result exhibits that inventory turnover ratio of TA decreased from

50.02 to 38.98 times. However, stock turnover ratio of the company inclined from 38.98 to

39.89 times at the end of 2016. Along with this, such ratio of Lufthansa decreased from 27.36

to 21.7 times. This shows that ability of both the companies in relation to converting stock

into cash declined over the time period. Moreover, now airline sector is facing high level of

competition and placing more emphasis on offering high discounts to the customers. Now,

customers switch to the airline company that provides them with attractive discounting or

promotional offers. However, in comparison to Lufthansa, TA’s stock turnover ratio was

good. Such increasing trend can be supported with the aspect that TA offers direct flights to

many destinations. Hence, stock management policies of TA were highly good over others

which in turn recognized as main reasons behind increasing margin in the period of 2013,

2014 & 2015.

Total assets turnover ratio of TA was .83 & .81 in the financial year 2013 and 2014.

On the contrary to this, in 2016, such ratio of the firm was decreased significantly and

accounted for .57 (Annual report of Turkish Airlines (2014), n.d.). Such trend presents that

over the time frame business unit generated less returns from total assets. It shows

inefficiency level of management team and employees in relation to developing strategies as

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

well as executing the same in productive activities. This ratio of Lufthansa was higher during

all the concerned four years, from 2013 to 2016, in against to the rival unit such TA. In 2013,

total assets turnover ratio of TA was .97:1 respectively, whereas from 2014 to 2016 outcome

of such tool implied for 1:1. It clearly reflects that Lufthansa made optimum use of total

assets over competitor.

Investment ratio assessment

Year Turkish Airlines Lufthansa

2013 .26 .68

2014 .61 .12

2015 .77 3.61

2016 -0.06 3.81

EPS measure provides information to both existing and potential shareholders about

profit margin allocated to each outstanding shareholder. EPS related to TA was higher only

into years such as 2014 and 2014, out of 4. In the accounting year, 2014 and 2015, EPS of

TA was .61 & .77 significantly. On the contrary to this, due to the negative net profit margin,

EPS of the company also moved in similar direction. This in turn affects investment decision

of shareholders. In addition to this, earnings on per share offer by Lufthansa are enhanced

over the time period. Hence, by allocating high profit Lufthansa provided shareholders with

enough returns.

Business Report

To

Head of Equity Research

Date: 21st March 2018

Subject: Financial Performance Assessment

Introduction: For analyzing the trend and growth perspective of companies operating in airlines

sector research has been carried out. Financial position gives clear indication about the extent to

which firm will grow in the near future. Hence, considering the importance of such assessment, ratio

analysis has performed to assess the financial position of TA and Lufthansa pertaining to the period of

four years.

5

all the concerned four years, from 2013 to 2016, in against to the rival unit such TA. In 2013,

total assets turnover ratio of TA was .97:1 respectively, whereas from 2014 to 2016 outcome

of such tool implied for 1:1. It clearly reflects that Lufthansa made optimum use of total

assets over competitor.

Investment ratio assessment

Year Turkish Airlines Lufthansa

2013 .26 .68

2014 .61 .12

2015 .77 3.61

2016 -0.06 3.81

EPS measure provides information to both existing and potential shareholders about

profit margin allocated to each outstanding shareholder. EPS related to TA was higher only

into years such as 2014 and 2014, out of 4. In the accounting year, 2014 and 2015, EPS of

TA was .61 & .77 significantly. On the contrary to this, due to the negative net profit margin,

EPS of the company also moved in similar direction. This in turn affects investment decision

of shareholders. In addition to this, earnings on per share offer by Lufthansa are enhanced

over the time period. Hence, by allocating high profit Lufthansa provided shareholders with

enough returns.

Business Report

To

Head of Equity Research

Date: 21st March 2018

Subject: Financial Performance Assessment

Introduction: For analyzing the trend and growth perspective of companies operating in airlines

sector research has been carried out. Financial position gives clear indication about the extent to

which firm will grow in the near future. Hence, considering the importance of such assessment, ratio

analysis has performed to assess the financial position of TA and Lufthansa pertaining to the period of

four years.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

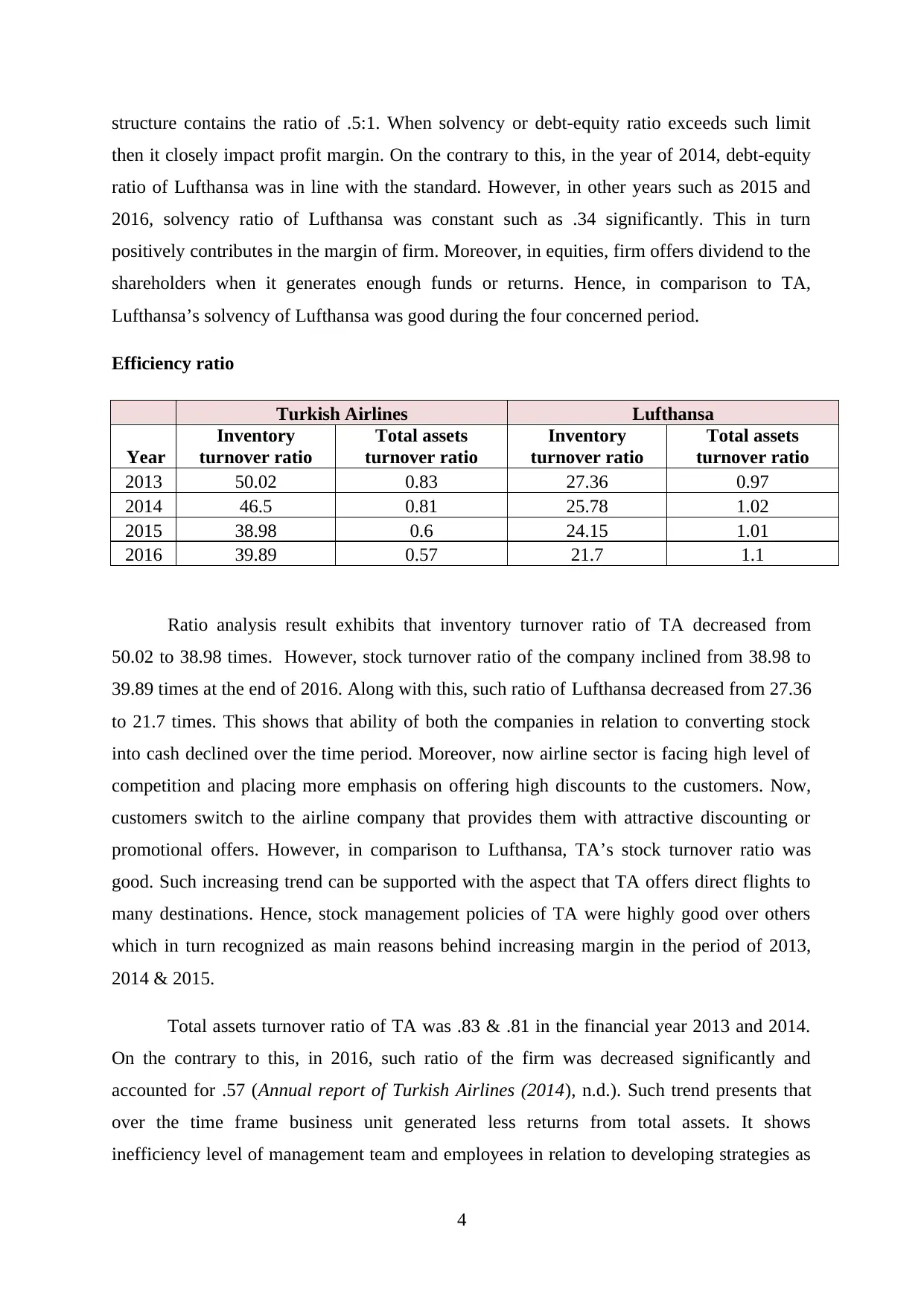

Main Body: This is to inform you that both the companies are recognized as a leading player in the

airlines sector. TA is known for the high quality flying experience offered by it to passengers. Further,

expansion strategies and promotional policies of TA are highly good. On the other side, luxurious in-

flight services, high brand strength, multi-passenger branding and coverage in Europe recognized as

the major strength of Lufthansa. Hence, by creating such strengths both the companies have built their

distinct identity in the airlines sector.

2013 2014 2015 2016

3.60%

7.60%

10.20%

-0.80%

1.00% 0.20%

5.30% 5.60%

NP Margin

Turkish Airlines Lufthansa

2013 2014 2015 2016

18.60% 18.10% 20.00%

11.60%

41.69% 42.41% 44.97% 45.96%

GP Margin

Turkish Airlines Lufthansa

In addition to this, financial evaluation presents that due to the rise in expenses, profitability of TA

falls significantly. In comparison to TA, Lufthansa control on expenses is highly good. In the year of

2016, both GP and NP margin of Lufthansa was good. However, both the companies need to take

specific actions such as employment of budgetary control tools etc for controlling expense level and

enhance profit margin.

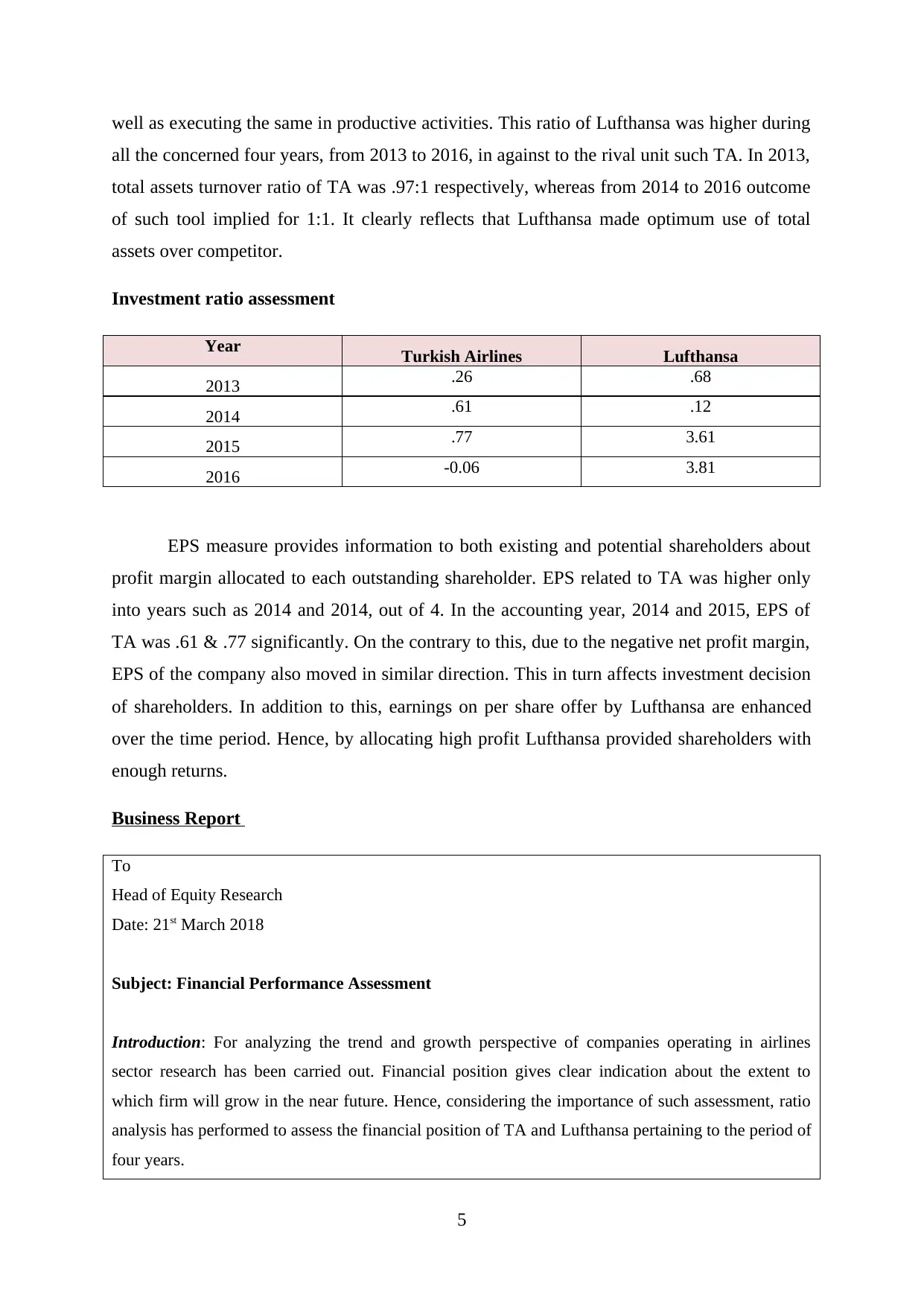

2013 2014 2015 2016

0.68

0.77 0.81 0.8

0.88

0.75 0.72

0.93

Current Ratio

Turkish Airlines Lufthansa

2013 2014 2015 2016

0.62

0.7 0.74 0.73

0.82

0.69 0.66

0.85

Quick Ratio

Turkish Airlines Lufthansa

6

airlines sector. TA is known for the high quality flying experience offered by it to passengers. Further,

expansion strategies and promotional policies of TA are highly good. On the other side, luxurious in-

flight services, high brand strength, multi-passenger branding and coverage in Europe recognized as

the major strength of Lufthansa. Hence, by creating such strengths both the companies have built their

distinct identity in the airlines sector.

2013 2014 2015 2016

3.60%

7.60%

10.20%

-0.80%

1.00% 0.20%

5.30% 5.60%

NP Margin

Turkish Airlines Lufthansa

2013 2014 2015 2016

18.60% 18.10% 20.00%

11.60%

41.69% 42.41% 44.97% 45.96%

GP Margin

Turkish Airlines Lufthansa

In addition to this, financial evaluation presents that due to the rise in expenses, profitability of TA

falls significantly. In comparison to TA, Lufthansa control on expenses is highly good. In the year of

2016, both GP and NP margin of Lufthansa was good. However, both the companies need to take

specific actions such as employment of budgetary control tools etc for controlling expense level and

enhance profit margin.

2013 2014 2015 2016

0.68

0.77 0.81 0.8

0.88

0.75 0.72

0.93

Current Ratio

Turkish Airlines Lufthansa

2013 2014 2015 2016

0.62

0.7 0.74 0.73

0.82

0.69 0.66

0.85

Quick Ratio

Turkish Airlines Lufthansa

6

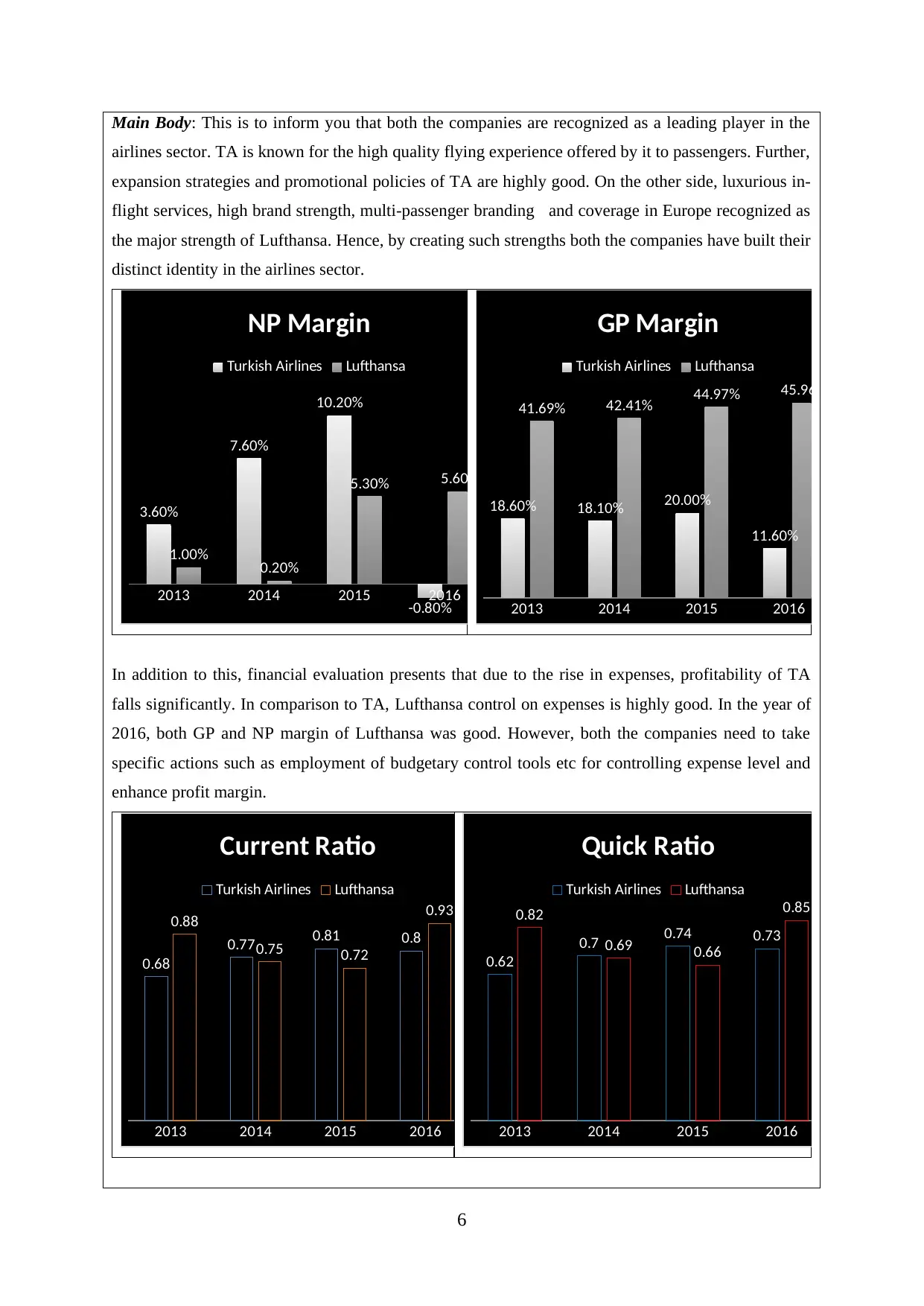

2013 2014 2015 2016

1.49

1.35 1.37

1.54

0.32

0.61

0.34 0.34

Solvency Position

Turkish Airlines Lufthansa

2013 2014 2015 2016

0.26

0.61 0.77

-0.06

0.68

0.12

3.61 3.81

EPS

Turkish Airlines Lufthansa

Referring graph, it is reported to the team that liquidity position of Lufthansa and TA was neither high

nor too lower. This is considered as good indicator because high liquidity places adverse impact on

the profitability aspect. On the other side, lower liquidity level imposes the risk of insolvency in front

of the company. Apart from this, solvency position of Lufthansa was good during the period of four

years from 2013 to 2016. This in turn reflects the ability of Lufthansa’s management team in relation

to the development of optimal capital structure and thereby makes control on expenses.

In addition to this, over the last four years, from 2013 to 2016, Lufthansa had made optimum use of

total assets while carry out business activities and functions. Hence, personnel of Lufthansa have

ability to carry out activities more effectually. Along with this, during the concerned years,

undertaken for investigation purpose, it has found that Lufthansa had offered more earnings to the

shareholders. Hence, in the upcoming time period TA would become able to attract more shareholders

while raising funds.

Conclusion: On the basis of financial evaluation, summary of this report is that monetary position and

7

1.49

1.35 1.37

1.54

0.32

0.61

0.34 0.34

Solvency Position

Turkish Airlines Lufthansa

2013 2014 2015 2016

0.26

0.61 0.77

-0.06

0.68

0.12

3.61 3.81

EPS

Turkish Airlines Lufthansa

Referring graph, it is reported to the team that liquidity position of Lufthansa and TA was neither high

nor too lower. This is considered as good indicator because high liquidity places adverse impact on

the profitability aspect. On the other side, lower liquidity level imposes the risk of insolvency in front

of the company. Apart from this, solvency position of Lufthansa was good during the period of four

years from 2013 to 2016. This in turn reflects the ability of Lufthansa’s management team in relation

to the development of optimal capital structure and thereby makes control on expenses.

In addition to this, over the last four years, from 2013 to 2016, Lufthansa had made optimum use of

total assets while carry out business activities and functions. Hence, personnel of Lufthansa have

ability to carry out activities more effectually. Along with this, during the concerned years,

undertaken for investigation purpose, it has found that Lufthansa had offered more earnings to the

shareholders. Hence, in the upcoming time period TA would become able to attract more shareholders

while raising funds.

Conclusion: On the basis of financial evaluation, summary of this report is that monetary position and

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

performance of Lufthansa was good from FY 2013 to 2016. Overall assessment exhibits that strategic

management has undertaken by Lufthansa for attaining success. Thus, considering overall assessment

investment in Lufthansa is advisable.

Thank You!!

Sincerely

Financial Analyst

2. Evaluating cash flow statement of Emirates

Cash flow statement

Statement of Cash Flow (SOCF) details out information about sources of cash in the

business and its use in the business for various purpose. It is different from the profitability

statement because it just incorporates the results of those transactions which affect cash. By

this way, it helps managers in assessing their cash management policies so as to have

sufficient working capital or liquid funds in the business so that it can meet short-term

liabilities timely. It is necessary for the firm to manage liquidity management so as to prevent

any sudden credit crunch. Emirates is a Global Airline that is serving 144 cities in 81

countries. It is operating world’s largest fleets of Boeing 777 and Airbus 380. It is one of the

fastest growing airline company whose main activity is the provision of commercial air and

transportation services is its main activity.

2012 2013 2014 2015 2016

Operating cash flow 8107 12814 12649 13265 14105

Revenues 62287 73113 82636 86728 83500

OCF/% of revenues 13.02% 17.53% 15.31% 15.29% 16.89%

2012 2013 2014 2015 2016

Cash flow from operating

activities 8107 12814 12649 13265 14105

Cash flow from investing

activities -10566 -15061 -4257 -6411 -2361

Cash flow from financing

activities -201 1240 -7107 -6264 -7975

Net cash -2660 -1007 1285 590 3769

8

management has undertaken by Lufthansa for attaining success. Thus, considering overall assessment

investment in Lufthansa is advisable.

Thank You!!

Sincerely

Financial Analyst

2. Evaluating cash flow statement of Emirates

Cash flow statement

Statement of Cash Flow (SOCF) details out information about sources of cash in the

business and its use in the business for various purpose. It is different from the profitability

statement because it just incorporates the results of those transactions which affect cash. By

this way, it helps managers in assessing their cash management policies so as to have

sufficient working capital or liquid funds in the business so that it can meet short-term

liabilities timely. It is necessary for the firm to manage liquidity management so as to prevent

any sudden credit crunch. Emirates is a Global Airline that is serving 144 cities in 81

countries. It is operating world’s largest fleets of Boeing 777 and Airbus 380. It is one of the

fastest growing airline company whose main activity is the provision of commercial air and

transportation services is its main activity.

2012 2013 2014 2015 2016

Operating cash flow 8107 12814 12649 13265 14105

Revenues 62287 73113 82636 86728 83500

OCF/% of revenues 13.02% 17.53% 15.31% 15.29% 16.89%

2012 2013 2014 2015 2016

Cash flow from operating

activities 8107 12814 12649 13265 14105

Cash flow from investing

activities -10566 -15061 -4257 -6411 -2361

Cash flow from financing

activities -201 1240 -7107 -6264 -7975

Net cash -2660 -1007 1285 590 3769

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

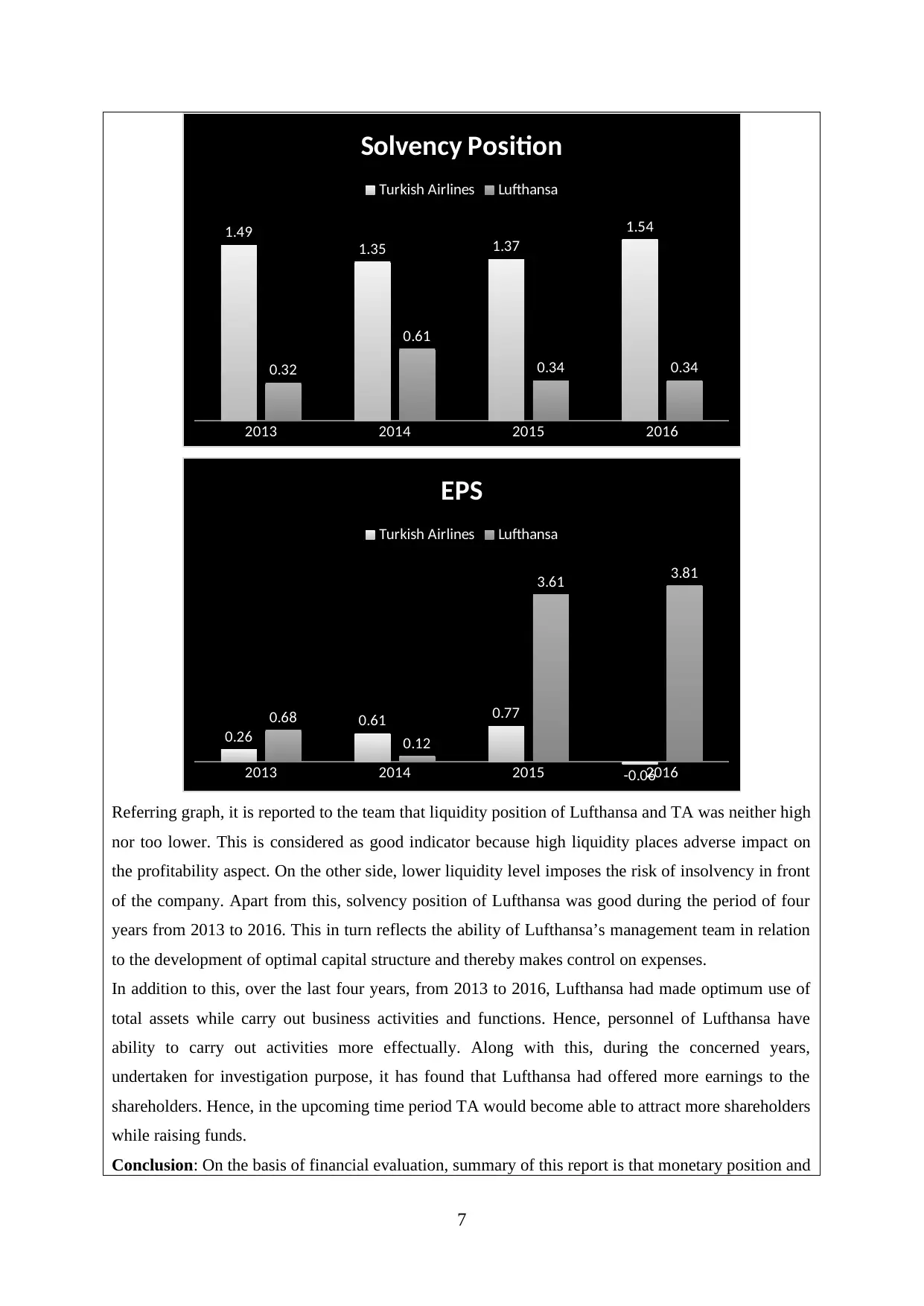

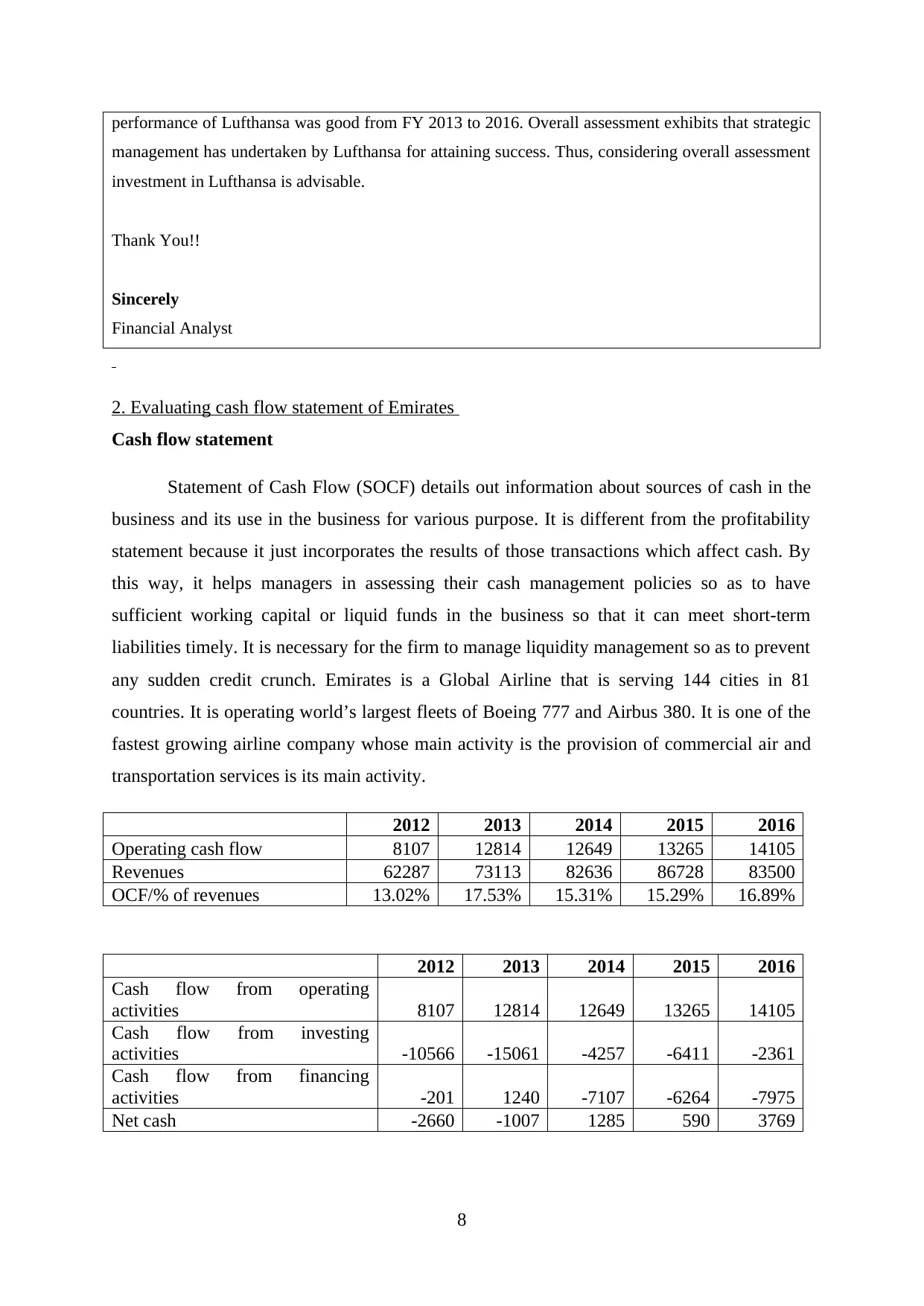

From the SOCF, it can be seen that except only in financial year 2014, cash flow from

operational activities shows a rising trend continuously. Similarly, the % of operating cash

flows over the total revenues depicts growing trend with an only exception of financial year

2014 when it dropped to 15.31% (Emirates Group Annual Report, 2013).

2012 2013 2014 2015 2016

-20000

-15000

-10000

-5000

0

5000

10000

15000

20000

8107

12814 12649 13265 14105

-10566

-15061

-4257 -6411

-2361

-201

1240

-7107 -6264 -7975

Changes in cash flow position

Cash fllow from operting activities Cash flow from investing activities

Cash flow from financing activities

In FY 2013-14, Emirates FCF (Free Cash Flow) had fallen from AED 703m to AED

355m. It is mainly driven by the large investment in the PPE (Property, Plant and

Equipment). Moreover, payment worth AED 328m for the acquisition of subsidiary firm was

the main reason behind declined cash balance in the business. In this year, firm had added

PPE amounted to AED 21,037m and incurred huge expenditures while assets valued to AED

7079m had been acquired under finance lease with net cash outflow of AED 13,958m on PPE

(Emirates Group Annual Report, 2014).

However, on the contrary side, company was exposed to the volatile foreign exchange

rate risk on their cash flows and financial position as well. More importantly, company had

struggled due to fluctuating exchange rates between UAE Dirham and other currencies in

where Emirates generates revenues and engaged in borrowing activities. The firm is also

subjected with the changing interest rate of borrowings (Emirates Group Annual Report

2014).

Later, in FY 2015, it rose from AED 12.6bn to AED 13.3bn which reported higher

inflow of cash from the operating activities. It is mainly because of growth in its profitability

by 5%. Company had made considerable growth in cash from operating activities and helped

business managing sufficient balance to serve financial obligations and partly fund

9

operational activities shows a rising trend continuously. Similarly, the % of operating cash

flows over the total revenues depicts growing trend with an only exception of financial year

2014 when it dropped to 15.31% (Emirates Group Annual Report, 2013).

2012 2013 2014 2015 2016

-20000

-15000

-10000

-5000

0

5000

10000

15000

20000

8107

12814 12649 13265 14105

-10566

-15061

-4257 -6411

-2361

-201

1240

-7107 -6264 -7975

Changes in cash flow position

Cash fllow from operting activities Cash flow from investing activities

Cash flow from financing activities

In FY 2013-14, Emirates FCF (Free Cash Flow) had fallen from AED 703m to AED

355m. It is mainly driven by the large investment in the PPE (Property, Plant and

Equipment). Moreover, payment worth AED 328m for the acquisition of subsidiary firm was

the main reason behind declined cash balance in the business. In this year, firm had added

PPE amounted to AED 21,037m and incurred huge expenditures while assets valued to AED

7079m had been acquired under finance lease with net cash outflow of AED 13,958m on PPE

(Emirates Group Annual Report, 2014).

However, on the contrary side, company was exposed to the volatile foreign exchange

rate risk on their cash flows and financial position as well. More importantly, company had

struggled due to fluctuating exchange rates between UAE Dirham and other currencies in

where Emirates generates revenues and engaged in borrowing activities. The firm is also

subjected with the changing interest rate of borrowings (Emirates Group Annual Report

2014).

Later, in FY 2015, it rose from AED 12.6bn to AED 13.3bn which reported higher

inflow of cash from the operating activities. It is mainly because of growth in its profitability

by 5%. Company had made considerable growth in cash from operating activities and helped

business managing sufficient balance to serve financial obligations and partly fund

9

investment that are required for its growth strategies. In this year, OCF as % on revenues

shows a marginal decline from 15.31% to 15.29%. Cash assets reported growth of AED

324m against preceding year was a clear indicator of more cash surplus availability. Cash

assets to revenue as well as operating income ratio shows slightly decline from 20% to 19%

below the target of 25% +-5% (Emirates Group Annual Report., 2015). Considering the

additional cash at dnata, the results depicts good health. Lower profitability margin on the

runway closure and relatively less growth of international travelling business were the two

key components that had affected operating cash margin adversely. In this year, disposal of

its Mercator business and inflow from other investment activities contributed towards hit a

record of FCF.

In 2016, Group operating activities reported 6% year on year growth in its cash inflow

mainly driven by the increased amount of profitability through daily activities. Although

revenue decreased still high amount of cash from daily trading functions helps increasing

operating cash margin to 16.6% (Emirates Group Annual Report, 2016). It had used it to

manage its debt and investment and in June, 2016, it decided to utilize its internal cash source

to dispose-off two bullet bonds valued AED 408m and AED 3.7 bn (SGD 150m and USD

1.0bn) respectively. Both the bonds were issued in 2006 and 2011 for meeting out the

working capital requirement of Emirates. Besides this, increased number of acquisition and

investment throughout the year declined FCF to AED 893m.

To:

Equity Research Head

Date: 21st March 2018

Subject: Evaluation of cash flow

On the basis of the evaluation, it is discovered that Emirate cash flow statement

depicts that firm continuously focuses on gaining more cash from its operational activities so

as to meet their daily requirements. It is mainly because of growth in the revenues due to

rising demand and greater return. However, on the other side, in 2013, investing activities

shows a sudden increase in cash outflow because of huge investment in fixed assets and

payment for acquisition. Again in 2015, as company had disposed off its Mercator business

brought cash inflow however, investment for expansion has reduced its net cash in spite of

increase in net cash from operating activities. Lastly, in 2016, high profit raised operating

10

shows a marginal decline from 15.31% to 15.29%. Cash assets reported growth of AED

324m against preceding year was a clear indicator of more cash surplus availability. Cash

assets to revenue as well as operating income ratio shows slightly decline from 20% to 19%

below the target of 25% +-5% (Emirates Group Annual Report., 2015). Considering the

additional cash at dnata, the results depicts good health. Lower profitability margin on the

runway closure and relatively less growth of international travelling business were the two

key components that had affected operating cash margin adversely. In this year, disposal of

its Mercator business and inflow from other investment activities contributed towards hit a

record of FCF.

In 2016, Group operating activities reported 6% year on year growth in its cash inflow

mainly driven by the increased amount of profitability through daily activities. Although

revenue decreased still high amount of cash from daily trading functions helps increasing

operating cash margin to 16.6% (Emirates Group Annual Report, 2016). It had used it to

manage its debt and investment and in June, 2016, it decided to utilize its internal cash source

to dispose-off two bullet bonds valued AED 408m and AED 3.7 bn (SGD 150m and USD

1.0bn) respectively. Both the bonds were issued in 2006 and 2011 for meeting out the

working capital requirement of Emirates. Besides this, increased number of acquisition and

investment throughout the year declined FCF to AED 893m.

To:

Equity Research Head

Date: 21st March 2018

Subject: Evaluation of cash flow

On the basis of the evaluation, it is discovered that Emirate cash flow statement

depicts that firm continuously focuses on gaining more cash from its operational activities so

as to meet their daily requirements. It is mainly because of growth in the revenues due to

rising demand and greater return. However, on the other side, in 2013, investing activities

shows a sudden increase in cash outflow because of huge investment in fixed assets and

payment for acquisition. Again in 2015, as company had disposed off its Mercator business

brought cash inflow however, investment for expansion has reduced its net cash in spite of

increase in net cash from operating activities. Lastly, in 2016, high profit raised operating

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.