Financial Ratio Analysis for a Company

VerifiedAdded on 2020/03/28

|13

|1521

|41

AI Summary

This assignment presents a case study analyzing the financial performance of a company using various ratio analysis techniques. It covers liquidity ratios (current ratio, quick ratio), profitability ratios (gross profit margin, net profit margin, return on equity), solvency ratios (debt-equity ratio, interest coverage ratio), efficiency ratios (inventory turnover ratio, debtor turnover ratio, creditor turnover ratio), and investment ratios (dividend yield ratio). The provided data for three years allows for a comparative analysis of the company's financial health and performance trends.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Financial analysis of company 1

Financial analysis implementation

Financial analysis implementation

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial analysis of company 2

Part-B

Executive summary

This report has shown key understanding on the financial analysis and using several

financial tools such as ratio analysis, capital structure analysis and capital budgeting analysis.

This report has shown how APN Outdoor Company has performed its business throughout the

time. However, APN Outdoor company has shown high amount of growth throughout the time.

Part-B

Executive summary

This report has shown key understanding on the financial analysis and using several

financial tools such as ratio analysis, capital structure analysis and capital budgeting analysis.

This report has shown how APN Outdoor Company has performed its business throughout the

time. However, APN Outdoor company has shown high amount of growth throughout the time.

Financial analysis of company 3

Table of Contents

Part-B...........................................................................................................................................................2

Executive summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Comparing Firm’s Capital Structure.........................................................................................................4

Analysis of Financial Ratios of APN Outdoor Company............................................................................7

Significant Changes in the Capital Structure in Past Three Years.............................................................7

Wealth Maximization in Past Three Years...............................................................................................8

Importance of Minimization of the Cost of Capital..................................................................................8

Recommendations for Lowering the Cost of Capital...............................................................................8

Conclusion...................................................................................................................................................9

References.................................................................................................................................................10

Table of Contents

Part-B...........................................................................................................................................................2

Executive summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Comparing Firm’s Capital Structure.........................................................................................................4

Analysis of Financial Ratios of APN Outdoor Company............................................................................7

Significant Changes in the Capital Structure in Past Three Years.............................................................7

Wealth Maximization in Past Three Years...............................................................................................8

Importance of Minimization of the Cost of Capital..................................................................................8

Recommendations for Lowering the Cost of Capital...............................................................................8

Conclusion...................................................................................................................................................9

References.................................................................................................................................................10

Financial analysis of company 4

Introduction

In this report, financial performance and capital structure of APN Outdoor Company. It

is an Australian company which has been providing media and advertisement services to clients.

This company has increased its overall profit since last three years and shown high value

creation on its investment. This report has shown the capital structure and ratio analysis of

company in determined approach.

Comparing Firm’s Capital Structure

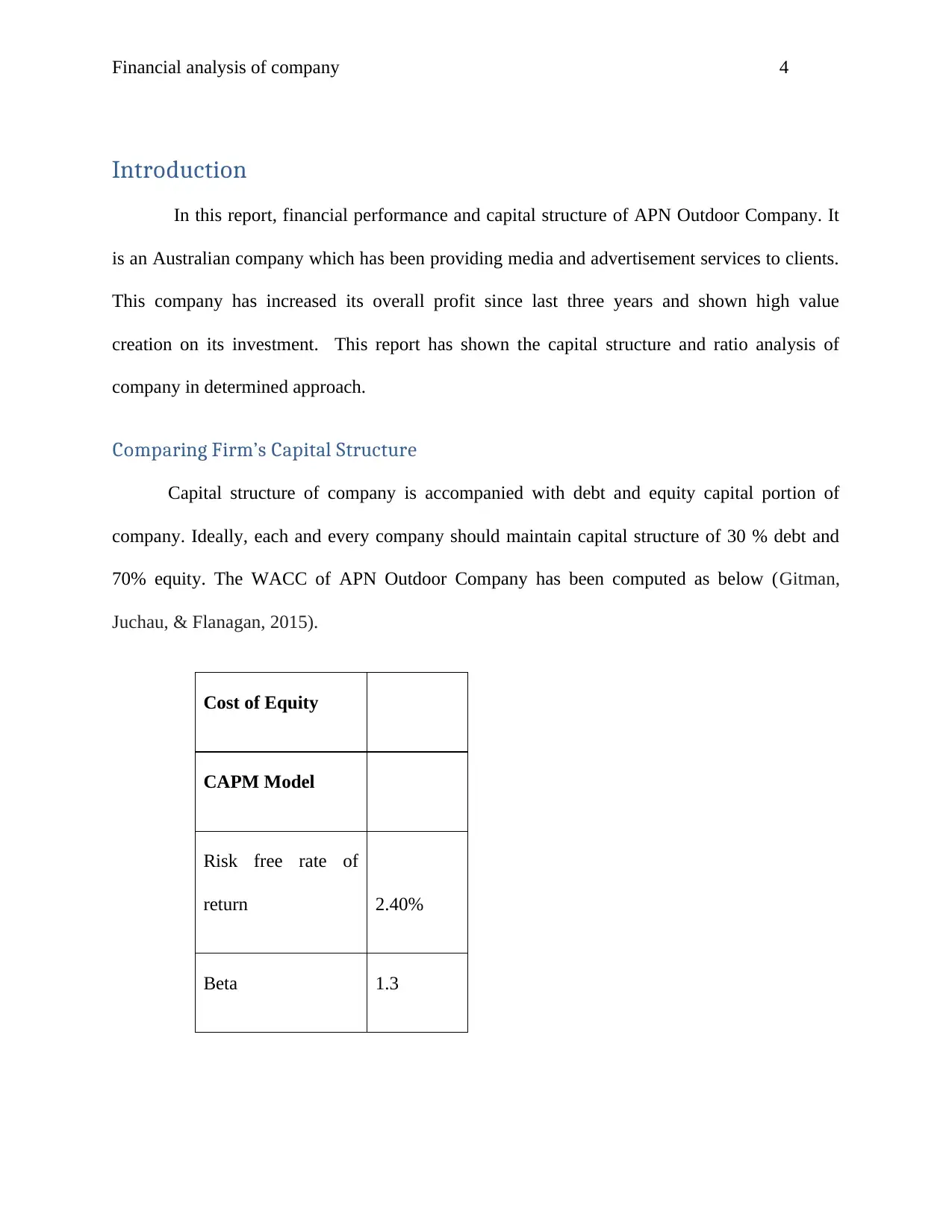

Capital structure of company is accompanied with debt and equity capital portion of

company. Ideally, each and every company should maintain capital structure of 30 % debt and

70% equity. The WACC of APN Outdoor Company has been computed as below (Gitman,

Juchau, & Flanagan, 2015).

Cost of Equity

CAPM Model

Risk free rate of

return 2.40%

Beta 1.3

Introduction

In this report, financial performance and capital structure of APN Outdoor Company. It

is an Australian company which has been providing media and advertisement services to clients.

This company has increased its overall profit since last three years and shown high value

creation on its investment. This report has shown the capital structure and ratio analysis of

company in determined approach.

Comparing Firm’s Capital Structure

Capital structure of company is accompanied with debt and equity capital portion of

company. Ideally, each and every company should maintain capital structure of 30 % debt and

70% equity. The WACC of APN Outdoor Company has been computed as below (Gitman,

Juchau, & Flanagan, 2015).

Cost of Equity

CAPM Model

Risk free rate of

return 2.40%

Beta 1.3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial analysis of company 5

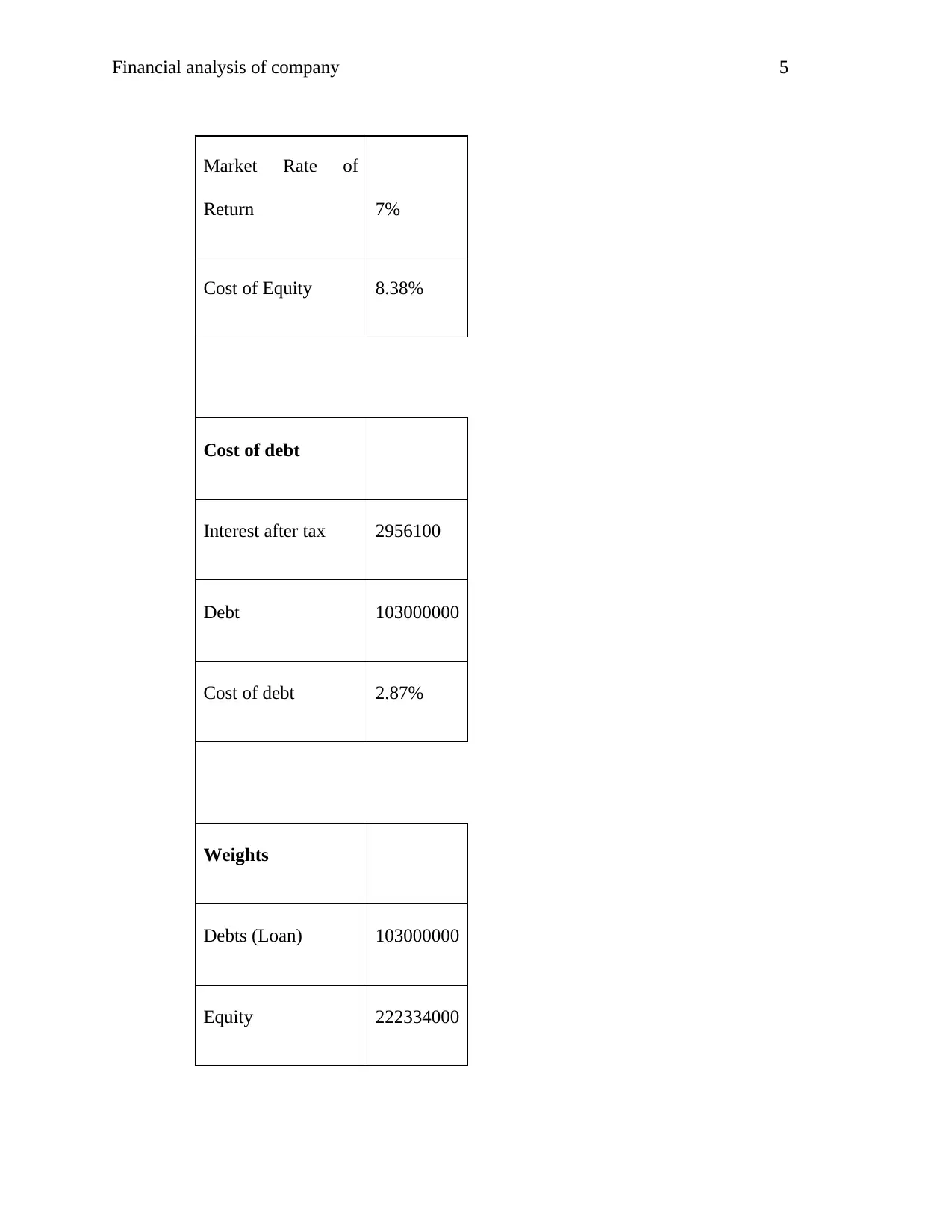

Market Rate of

Return 7%

Cost of Equity 8.38%

Cost of debt

Interest after tax 2956100

Debt 103000000

Cost of debt 2.87%

Weights

Debts (Loan) 103000000

Equity 222334000

Market Rate of

Return 7%

Cost of Equity 8.38%

Cost of debt

Interest after tax 2956100

Debt 103000000

Cost of debt 2.87%

Weights

Debts (Loan) 103000000

Equity 222334000

Financial analysis of company 6

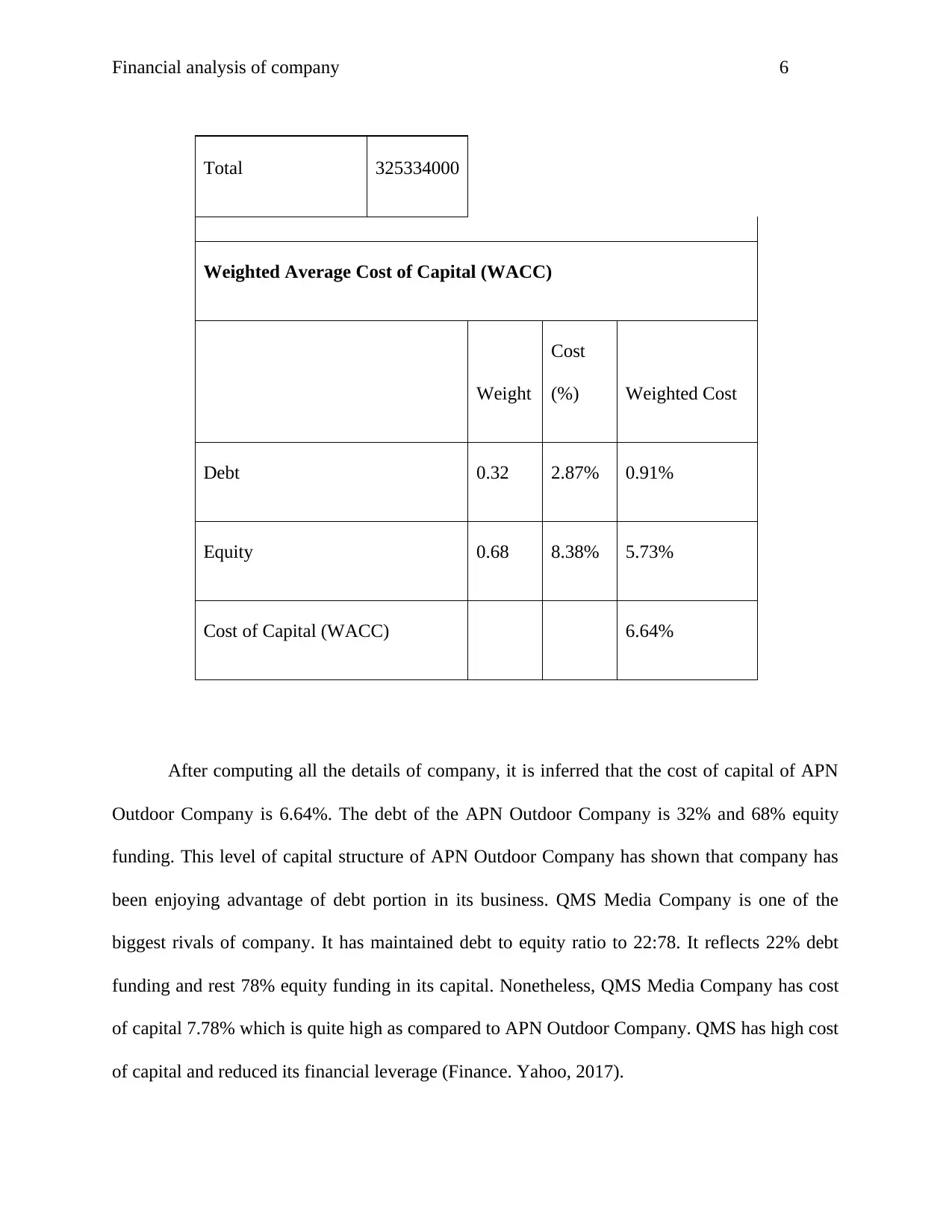

Total 325334000

Weighted Average Cost of Capital (WACC)

Weight

Cost

(%) Weighted Cost

Debt 0.32 2.87% 0.91%

Equity 0.68 8.38% 5.73%

Cost of Capital (WACC) 6.64%

After computing all the details of company, it is inferred that the cost of capital of APN

Outdoor Company is 6.64%. The debt of the APN Outdoor Company is 32% and 68% equity

funding. This level of capital structure of APN Outdoor Company has shown that company has

been enjoying advantage of debt portion in its business. QMS Media Company is one of the

biggest rivals of company. It has maintained debt to equity ratio to 22:78. It reflects 22% debt

funding and rest 78% equity funding in its capital. Nonetheless, QMS Media Company has cost

of capital 7.78% which is quite high as compared to APN Outdoor Company. QMS has high cost

of capital and reduced its financial leverage (Finance. Yahoo, 2017).

Total 325334000

Weighted Average Cost of Capital (WACC)

Weight

Cost

(%) Weighted Cost

Debt 0.32 2.87% 0.91%

Equity 0.68 8.38% 5.73%

Cost of Capital (WACC) 6.64%

After computing all the details of company, it is inferred that the cost of capital of APN

Outdoor Company is 6.64%. The debt of the APN Outdoor Company is 32% and 68% equity

funding. This level of capital structure of APN Outdoor Company has shown that company has

been enjoying advantage of debt portion in its business. QMS Media Company is one of the

biggest rivals of company. It has maintained debt to equity ratio to 22:78. It reflects 22% debt

funding and rest 78% equity funding in its capital. Nonetheless, QMS Media Company has cost

of capital 7.78% which is quite high as compared to APN Outdoor Company. QMS has high cost

of capital and reduced its financial leverage (Finance. Yahoo, 2017).

Financial analysis of company 7

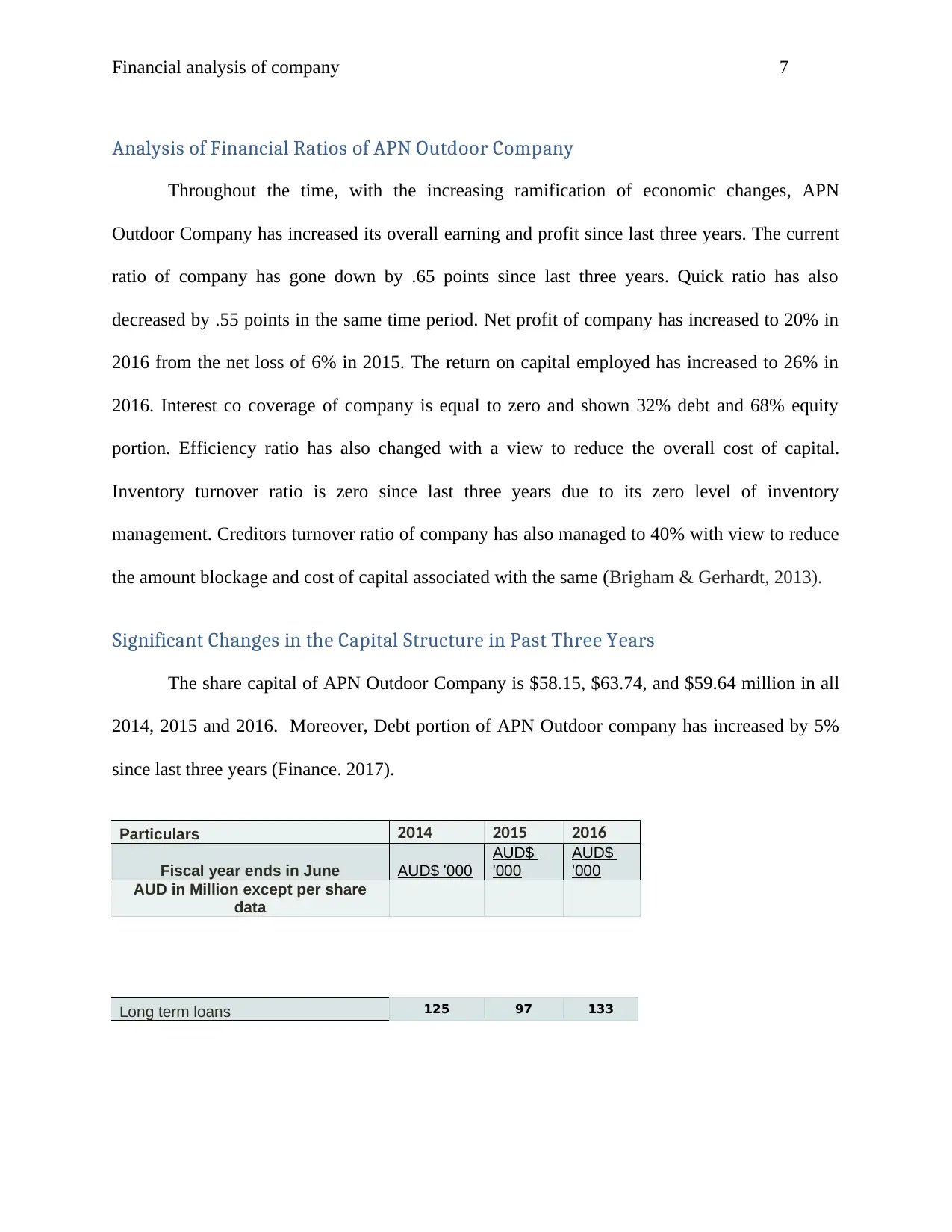

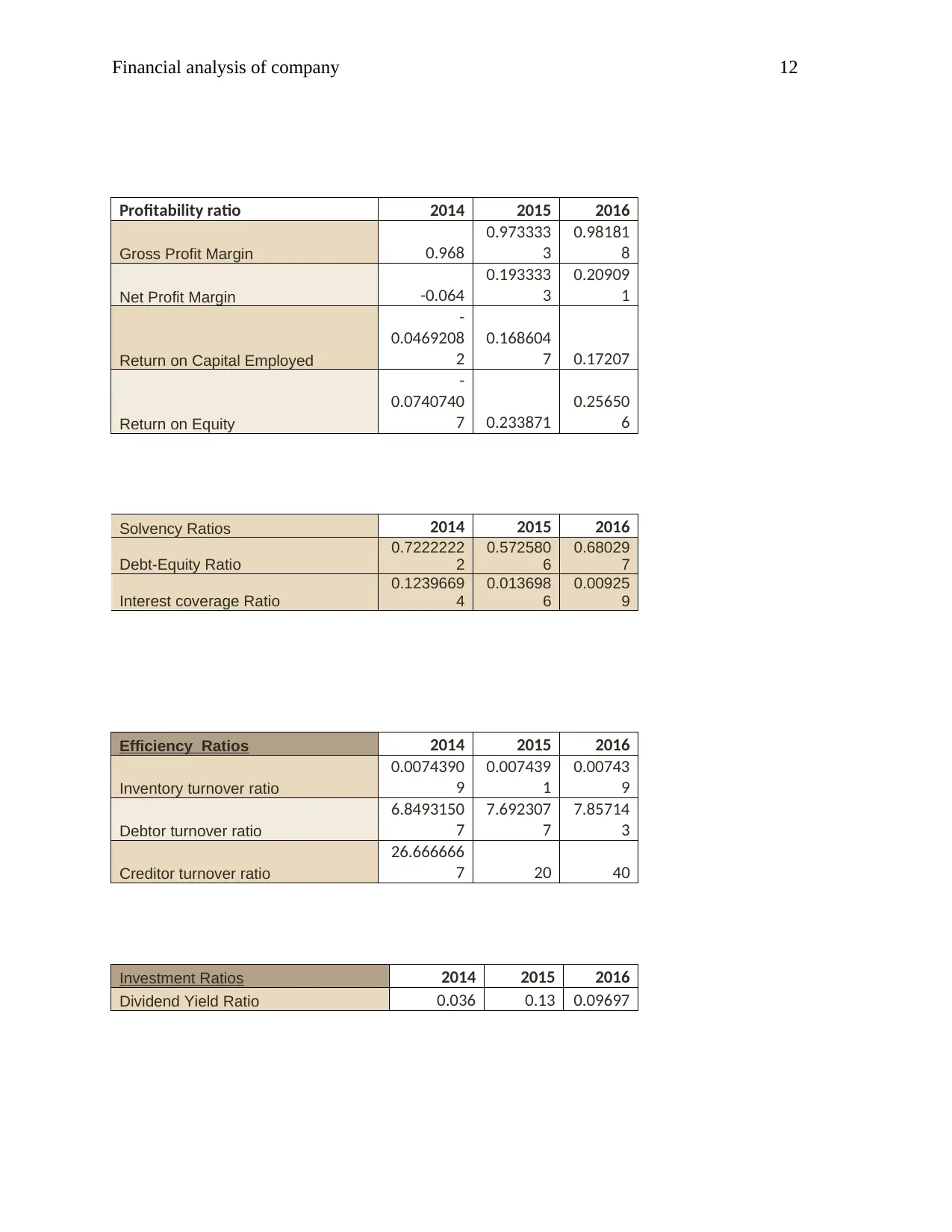

Analysis of Financial Ratios of APN Outdoor Company

Throughout the time, with the increasing ramification of economic changes, APN

Outdoor Company has increased its overall earning and profit since last three years. The current

ratio of company has gone down by .65 points since last three years. Quick ratio has also

decreased by .55 points in the same time period. Net profit of company has increased to 20% in

2016 from the net loss of 6% in 2015. The return on capital employed has increased to 26% in

2016. Interest co coverage of company is equal to zero and shown 32% debt and 68% equity

portion. Efficiency ratio has also changed with a view to reduce the overall cost of capital.

Inventory turnover ratio is zero since last three years due to its zero level of inventory

management. Creditors turnover ratio of company has also managed to 40% with view to reduce

the amount blockage and cost of capital associated with the same (Brigham & Gerhardt, 2013).

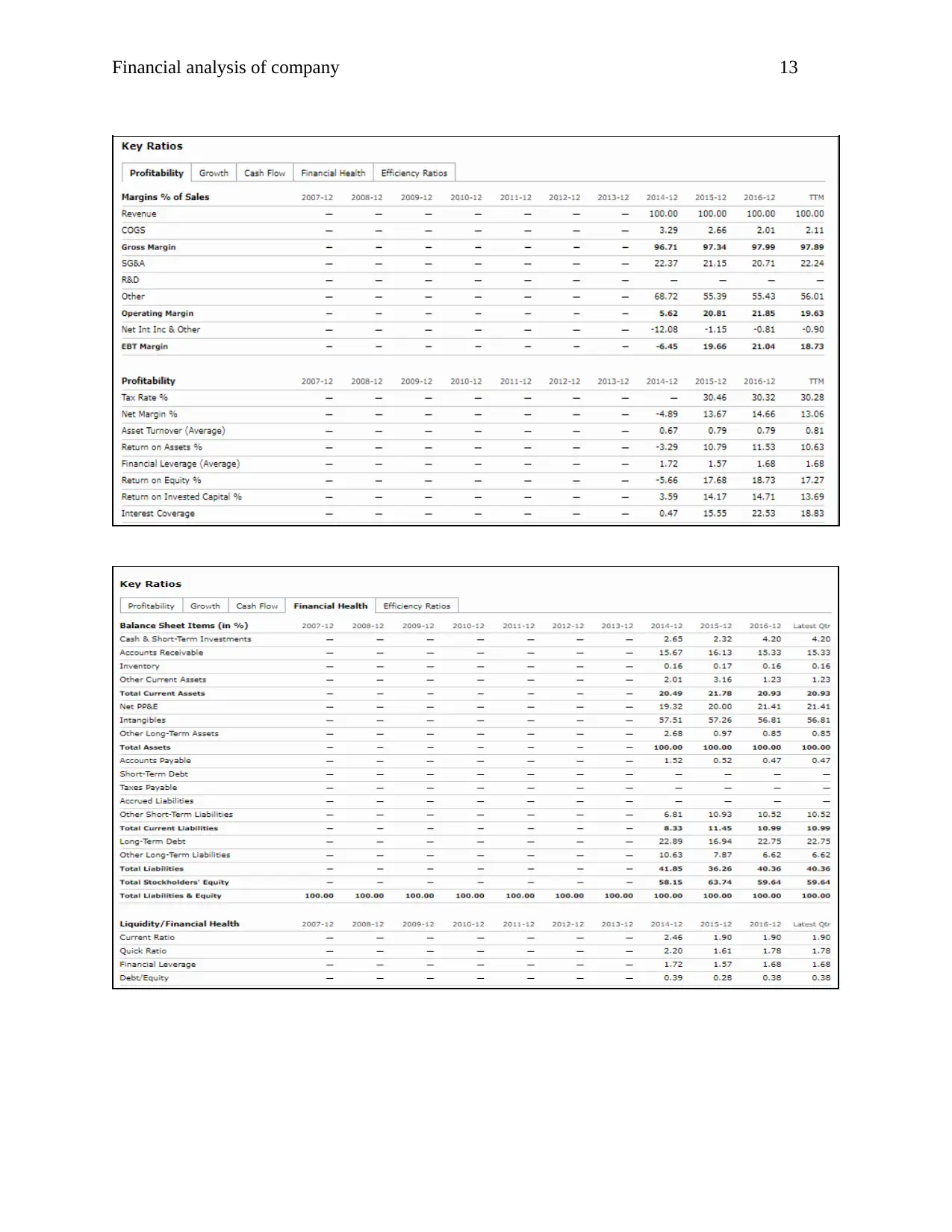

Significant Changes in the Capital Structure in Past Three Years

The share capital of APN Outdoor Company is $58.15, $63.74, and $59.64 million in all

2014, 2015 and 2016. Moreover, Debt portion of APN Outdoor company has increased by 5%

since last three years (Finance. 2017).

Particulars 2014 2015 2016

Fiscal year ends in June AUD$ '000

AUD$

'000

AUD$

'000

AUD in Million except per share

data

Long term loans 125 97 133

Analysis of Financial Ratios of APN Outdoor Company

Throughout the time, with the increasing ramification of economic changes, APN

Outdoor Company has increased its overall earning and profit since last three years. The current

ratio of company has gone down by .65 points since last three years. Quick ratio has also

decreased by .55 points in the same time period. Net profit of company has increased to 20% in

2016 from the net loss of 6% in 2015. The return on capital employed has increased to 26% in

2016. Interest co coverage of company is equal to zero and shown 32% debt and 68% equity

portion. Efficiency ratio has also changed with a view to reduce the overall cost of capital.

Inventory turnover ratio is zero since last three years due to its zero level of inventory

management. Creditors turnover ratio of company has also managed to 40% with view to reduce

the amount blockage and cost of capital associated with the same (Brigham & Gerhardt, 2013).

Significant Changes in the Capital Structure in Past Three Years

The share capital of APN Outdoor Company is $58.15, $63.74, and $59.64 million in all

2014, 2015 and 2016. Moreover, Debt portion of APN Outdoor company has increased by 5%

since last three years (Finance. 2017).

Particulars 2014 2015 2016

Fiscal year ends in June AUD$ '000

AUD$

'000

AUD$

'000

AUD in Million except per share

data

Long term loans 125 97 133

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial analysis of company 8

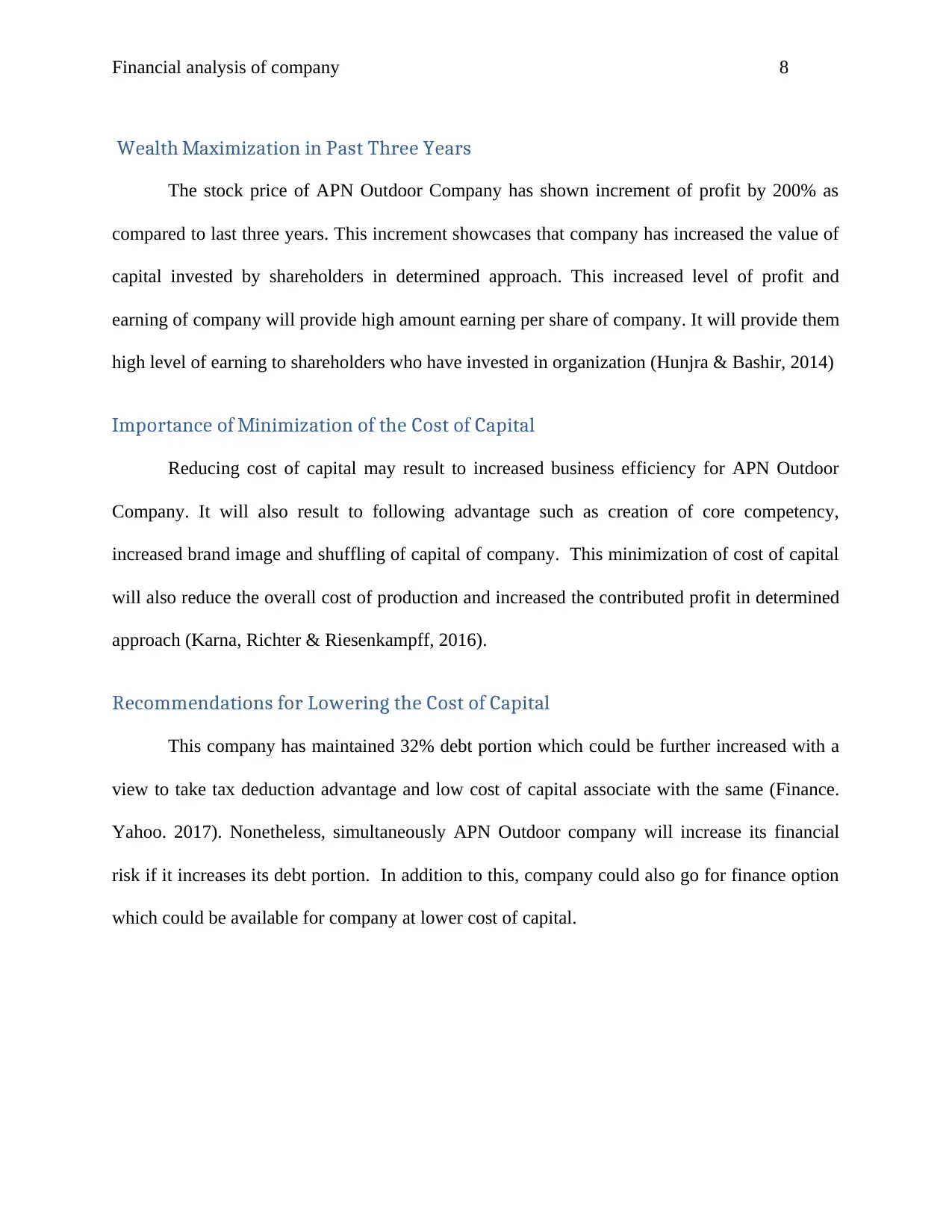

Wealth Maximization in Past Three Years

The stock price of APN Outdoor Company has shown increment of profit by 200% as

compared to last three years. This increment showcases that company has increased the value of

capital invested by shareholders in determined approach. This increased level of profit and

earning of company will provide high amount earning per share of company. It will provide them

high level of earning to shareholders who have invested in organization (Hunjra & Bashir, 2014)

Importance of Minimization of the Cost of Capital

Reducing cost of capital may result to increased business efficiency for APN Outdoor

Company. It will also result to following advantage such as creation of core competency,

increased brand image and shuffling of capital of company. This minimization of cost of capital

will also reduce the overall cost of production and increased the contributed profit in determined

approach (Karna, Richter & Riesenkampff, 2016).

Recommendations for Lowering the Cost of Capital

This company has maintained 32% debt portion which could be further increased with a

view to take tax deduction advantage and low cost of capital associate with the same (Finance.

Yahoo. 2017). Nonetheless, simultaneously APN Outdoor company will increase its financial

risk if it increases its debt portion. In addition to this, company could also go for finance option

which could be available for company at lower cost of capital.

Wealth Maximization in Past Three Years

The stock price of APN Outdoor Company has shown increment of profit by 200% as

compared to last three years. This increment showcases that company has increased the value of

capital invested by shareholders in determined approach. This increased level of profit and

earning of company will provide high amount earning per share of company. It will provide them

high level of earning to shareholders who have invested in organization (Hunjra & Bashir, 2014)

Importance of Minimization of the Cost of Capital

Reducing cost of capital may result to increased business efficiency for APN Outdoor

Company. It will also result to following advantage such as creation of core competency,

increased brand image and shuffling of capital of company. This minimization of cost of capital

will also reduce the overall cost of production and increased the contributed profit in determined

approach (Karna, Richter & Riesenkampff, 2016).

Recommendations for Lowering the Cost of Capital

This company has maintained 32% debt portion which could be further increased with a

view to take tax deduction advantage and low cost of capital associate with the same (Finance.

Yahoo. 2017). Nonetheless, simultaneously APN Outdoor company will increase its financial

risk if it increases its debt portion. In addition to this, company could also go for finance option

which could be available for company at lower cost of capital.

Financial analysis of company 9

Conclusion

In this report, it is observed that APN Outdoor company has high debt portion and

increased financial risk in its business functioning. However, this has resulted to tax advantage

and lowering down the overall cost of capital. Now in the end, it could be inferred that company

should maintain effective capital structure that could reduce the cost of capital and financial risk

at large.

Conclusion

In this report, it is observed that APN Outdoor company has high debt portion and

increased financial risk in its business functioning. However, this has resulted to tax advantage

and lowering down the overall cost of capital. Now in the end, it could be inferred that company

should maintain effective capital structure that could reduce the cost of capital and financial risk

at large.

Financial analysis of company 10

References

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage

Learning.

Finance. Yahoo. (2017). APN Outdoor Group Limited (APO.AX). Retrieved September 16, 2017 from,

https://finance.yahoo.com/quote/APO.AX/financials?p=APO.AX

Finance. Yahoo. (2017). QMS Media Limited (QMS.AX). Retrieved September 16, 2017 from,

https://finance.yahoo.com/quote/QMS.AX/balance-sheet?p=QMS.AX

Hunjra, A. I., & Bashir, A. (2014). Comparative Financial Performance Analysis of Conventional and

Islamic Banks in Pakistan. Bulletin of Business and Economics (BBE), 3(4), 196-206.

Karna, A., Richter, A., & Riesenkampff, E. (2016). Revisiting the role of the environment in the

capabilities–financial performance relationship: A meta‐analysis. Strategic Management

Journal, 37(6), 1154-1173.

References

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage

Learning.

Finance. Yahoo. (2017). APN Outdoor Group Limited (APO.AX). Retrieved September 16, 2017 from,

https://finance.yahoo.com/quote/APO.AX/financials?p=APO.AX

Finance. Yahoo. (2017). QMS Media Limited (QMS.AX). Retrieved September 16, 2017 from,

https://finance.yahoo.com/quote/QMS.AX/balance-sheet?p=QMS.AX

Hunjra, A. I., & Bashir, A. (2014). Comparative Financial Performance Analysis of Conventional and

Islamic Banks in Pakistan. Bulletin of Business and Economics (BBE), 3(4), 196-206.

Karna, A., Richter, A., & Riesenkampff, E. (2016). Revisiting the role of the environment in the

capabilities–financial performance relationship: A meta‐analysis. Strategic Management

Journal, 37(6), 1154-1173.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Financial analysis of company 11

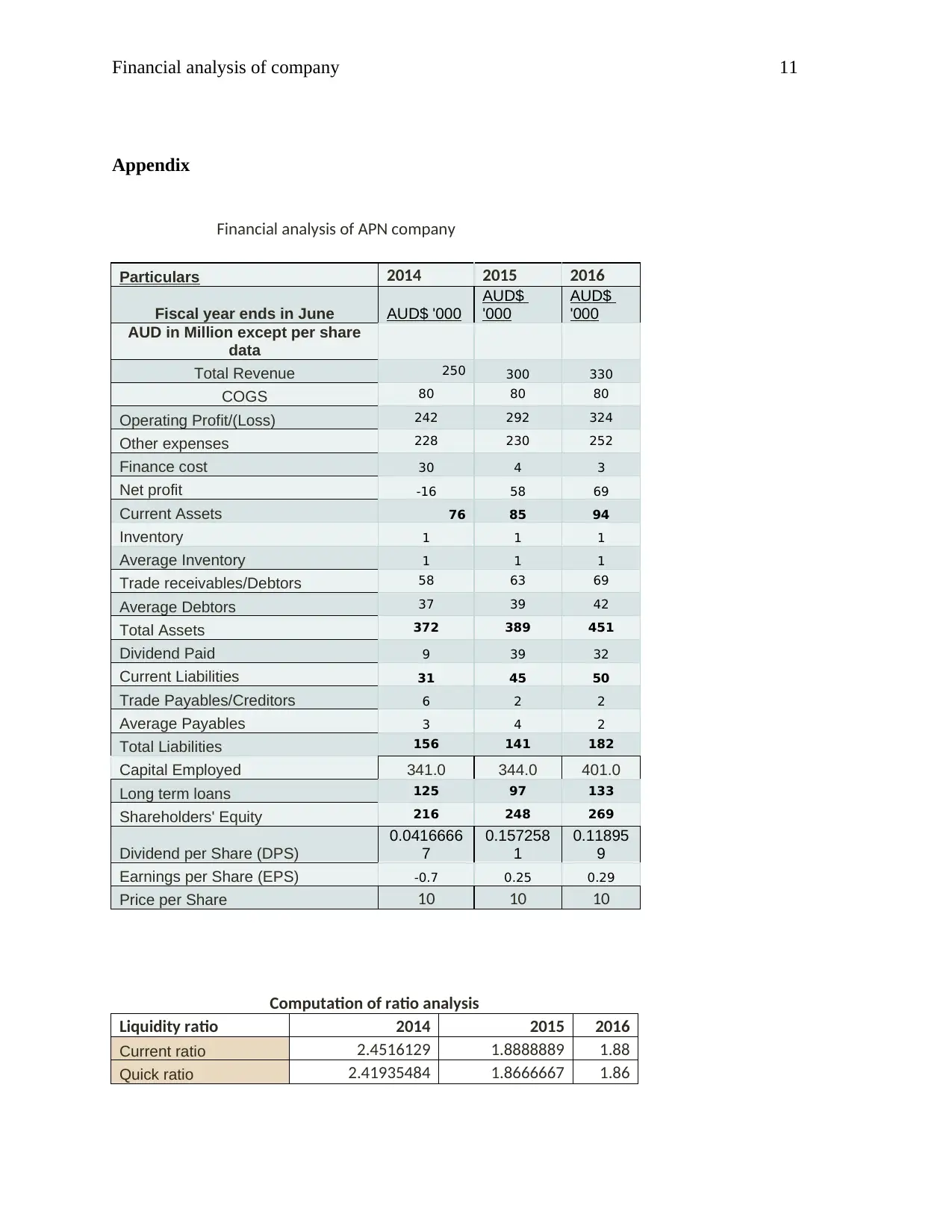

Appendix

Financial analysis of APN company

Particulars 2014 2015 2016

Fiscal year ends in June AUD$ '000

AUD$

'000

AUD$

'000

AUD in Million except per share

data

Total Revenue 250 300 330

COGS 80 80 80

Operating Profit/(Loss) 242 292 324

Other expenses 228 230 252

Finance cost 30 4 3

Net profit -16 58 69

Current Assets 76 85 94

Inventory 1 1 1

Average Inventory 1 1 1

Trade receivables/Debtors 58 63 69

Average Debtors 37 39 42

Total Assets 372 389 451

Dividend Paid 9 39 32

Current Liabilities 31 45 50

Trade Payables/Creditors 6 2 2

Average Payables 3 4 2

Total Liabilities 156 141 182

Capital Employed 341.0 344.0 401.0

Long term loans 125 97 133

Shareholders' Equity 216 248 269

Dividend per Share (DPS)

0.0416666

7

0.157258

1

0.11895

9

Earnings per Share (EPS) -0.7 0.25 0.29

Price per Share 10 10 10

Computation of ratio analysis

Liquidity ratio 2014 2015 2016

Current ratio 2.4516129 1.8888889 1.88

Quick ratio 2.41935484 1.8666667 1.86

Appendix

Financial analysis of APN company

Particulars 2014 2015 2016

Fiscal year ends in June AUD$ '000

AUD$

'000

AUD$

'000

AUD in Million except per share

data

Total Revenue 250 300 330

COGS 80 80 80

Operating Profit/(Loss) 242 292 324

Other expenses 228 230 252

Finance cost 30 4 3

Net profit -16 58 69

Current Assets 76 85 94

Inventory 1 1 1

Average Inventory 1 1 1

Trade receivables/Debtors 58 63 69

Average Debtors 37 39 42

Total Assets 372 389 451

Dividend Paid 9 39 32

Current Liabilities 31 45 50

Trade Payables/Creditors 6 2 2

Average Payables 3 4 2

Total Liabilities 156 141 182

Capital Employed 341.0 344.0 401.0

Long term loans 125 97 133

Shareholders' Equity 216 248 269

Dividend per Share (DPS)

0.0416666

7

0.157258

1

0.11895

9

Earnings per Share (EPS) -0.7 0.25 0.29

Price per Share 10 10 10

Computation of ratio analysis

Liquidity ratio 2014 2015 2016

Current ratio 2.4516129 1.8888889 1.88

Quick ratio 2.41935484 1.8666667 1.86

Financial analysis of company 12

Profitability ratio 2014 2015 2016

Gross Profit Margin 0.968

0.973333

3

0.98181

8

Net Profit Margin -0.064

0.193333

3

0.20909

1

Return on Capital Employed

-

0.0469208

2

0.168604

7 0.17207

Return on Equity

-

0.0740740

7 0.233871

0.25650

6

Solvency Ratios 2014 2015 2016

Debt-Equity Ratio

0.7222222

2

0.572580

6

0.68029

7

Interest coverage Ratio

0.1239669

4

0.013698

6

0.00925

9

Efficiency Ratios 2014 2015 2016

Inventory turnover ratio

0.0074390

9

0.007439

1

0.00743

9

Debtor turnover ratio

6.8493150

7

7.692307

7

7.85714

3

Creditor turnover ratio

26.666666

7 20 40

Investment Ratios 2014 2015 2016

Dividend Yield Ratio 0.036 0.13 0.09697

Profitability ratio 2014 2015 2016

Gross Profit Margin 0.968

0.973333

3

0.98181

8

Net Profit Margin -0.064

0.193333

3

0.20909

1

Return on Capital Employed

-

0.0469208

2

0.168604

7 0.17207

Return on Equity

-

0.0740740

7 0.233871

0.25650

6

Solvency Ratios 2014 2015 2016

Debt-Equity Ratio

0.7222222

2

0.572580

6

0.68029

7

Interest coverage Ratio

0.1239669

4

0.013698

6

0.00925

9

Efficiency Ratios 2014 2015 2016

Inventory turnover ratio

0.0074390

9

0.007439

1

0.00743

9

Debtor turnover ratio

6.8493150

7

7.692307

7

7.85714

3

Creditor turnover ratio

26.666666

7 20 40

Investment Ratios 2014 2015 2016

Dividend Yield Ratio 0.036 0.13 0.09697

Financial analysis of company 13

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.