Financial Performance Analysis of Pandora A/S: A Detailed Report

VerifiedAdded on 2023/06/04

|31

|8895

|266

Report

AI Summary

This report offers a comprehensive financial and strategic analysis of Pandora A/S, a prominent jewelry designer and manufacturer. It begins with an executive summary that highlights key findings, including macroeconomic factors, industry analysis, competitive strategies, and accounting and financial evaluations. The analysis delves into the company's business and strategic aspects, examining macroeconomic influences, industry dynamics, and competitive positioning compared to Georg Jensen. The report also covers accounting analysis, identifying key balance sheet accounts and potential risks. A significant portion is dedicated to financial analysis, including ROE, Dupont analysis, and various financial ratios, alongside a cross-sectional comparison. The study identifies the company's competitive strengths, such as design and quality, and potential red flags, such as increasing costs and supply chain issues. The findings suggest that while Pandora A/S holds a strong position, external factors and internal challenges could impact future performance. The report concludes with recommendations based on the analysis.

Running head: FINANCIAL ANALYSIS

Financial Analysis

Name of Student:

Name of University:

Author’s Note:

Financial Analysis

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ANALYSIS

Executive Summary

The discourse of the report has stated about both financial and non-financial analysis of Pandora

A/S. Some of the main analysis includes macroeconomic factors affecting the company,

identification of the overall industry, competitive and corporate strategy, accounting analysis and

financial analysis. In addition to this, the study has also stated about cross-sectional analysis of

Pandora. The findings have revealed the company offers wide range of precious stones and high-

quality gold and silver jewellery and alternatives to such products is seen to be low in the market.

Moreover, Pandora A/S follows a competitive pricing strategy. The important nature of

competitive strengths of Pandora A/S are depicted in terms of designs and quality of jewellery as

agility of the value chain and an improved focus on the sustainability. The overall financial

comparison of both the companies has been able to state that Pandora A/S is significantly in a

better position in terms of current assets, current liabilities and stockholders’ equity compared to

its selected competitor Georg Jensen. However, the three potential red flag areas for the company

is identified with increasing nature of cost of goods sold, uncertainties associated with new

designs of jewellery and problems with fluctuations in the supply chain market. Based on the

cross-sectional findings it can be seen that fall in the ROE for both Pandora A/S and Georg

Jensen in the recent years may be a result of the macroeconomic changes which had significantly

affected the jewellery designers of Copenhagen.

Executive Summary

The discourse of the report has stated about both financial and non-financial analysis of Pandora

A/S. Some of the main analysis includes macroeconomic factors affecting the company,

identification of the overall industry, competitive and corporate strategy, accounting analysis and

financial analysis. In addition to this, the study has also stated about cross-sectional analysis of

Pandora. The findings have revealed the company offers wide range of precious stones and high-

quality gold and silver jewellery and alternatives to such products is seen to be low in the market.

Moreover, Pandora A/S follows a competitive pricing strategy. The important nature of

competitive strengths of Pandora A/S are depicted in terms of designs and quality of jewellery as

agility of the value chain and an improved focus on the sustainability. The overall financial

comparison of both the companies has been able to state that Pandora A/S is significantly in a

better position in terms of current assets, current liabilities and stockholders’ equity compared to

its selected competitor Georg Jensen. However, the three potential red flag areas for the company

is identified with increasing nature of cost of goods sold, uncertainties associated with new

designs of jewellery and problems with fluctuations in the supply chain market. Based on the

cross-sectional findings it can be seen that fall in the ROE for both Pandora A/S and Georg

Jensen in the recent years may be a result of the macroeconomic changes which had significantly

affected the jewellery designers of Copenhagen.

2FINANCIAL ANALYSIS

Table of Contents

Introduction.....................................................................................................................................................................4

1. Business and Strategic Analysis.................................................................................................................................4

Analysis of the economy............................................................................................................................................4

Macroeconomic Factors affecting Pandora...........................................................................................................4

Industry analysis........................................................................................................................................................5

Identification of the Industry.................................................................................................................................5

Identification of the Competitor Company...........................................................................................................5

Porters Five Force Analysis with Assessment......................................................................................................5

Industry’s Growth Potential..................................................................................................................................6

Company’s competitive and corporate strategy.........................................................................................................7

Company’s competitive strategy, risk factors and growth potential.....................................................................7

Company’s corporate strategy...............................................................................................................................8

2. Accounting Analysis...................................................................................................................................................8

Three Key Accounts in the balance sheet of both the company...........................................................................8

Evaluating the quality of disclosure......................................................................................................................9

Identifying 3 potential red flags for the company.................................................................................................9

3. Financial Analysis.....................................................................................................................................................10

ROE.....................................................................................................................................................................10

Dupont Analysis..................................................................................................................................................11

Financial Analysis...............................................................................................................................................11

Operating management Ratios............................................................................................................................11

Investment management Ratio............................................................................................................................15

Financial Leverage Ratios...................................................................................................................................17

Cross-sectional analysis...........................................................................................................................................18

Recommendations.........................................................................................................................................................19

Conclusion....................................................................................................................................................................20

References.....................................................................................................................................................................21

List of Appendix...........................................................................................................................................................23

Comprehensive Income............................................................................................................................................23

Financial Position.....................................................................................................................................................25

Dupont Method........................................................................................................................................................27

Cross Functional Analysis.......................................................................................................................................28

Financial Ratios........................................................................................................................................................29

Financial Figures......................................................................................................................................................30

Prospective Analysis................................................................................................................................................30

Table of Contents

Introduction.....................................................................................................................................................................4

1. Business and Strategic Analysis.................................................................................................................................4

Analysis of the economy............................................................................................................................................4

Macroeconomic Factors affecting Pandora...........................................................................................................4

Industry analysis........................................................................................................................................................5

Identification of the Industry.................................................................................................................................5

Identification of the Competitor Company...........................................................................................................5

Porters Five Force Analysis with Assessment......................................................................................................5

Industry’s Growth Potential..................................................................................................................................6

Company’s competitive and corporate strategy.........................................................................................................7

Company’s competitive strategy, risk factors and growth potential.....................................................................7

Company’s corporate strategy...............................................................................................................................8

2. Accounting Analysis...................................................................................................................................................8

Three Key Accounts in the balance sheet of both the company...........................................................................8

Evaluating the quality of disclosure......................................................................................................................9

Identifying 3 potential red flags for the company.................................................................................................9

3. Financial Analysis.....................................................................................................................................................10

ROE.....................................................................................................................................................................10

Dupont Analysis..................................................................................................................................................11

Financial Analysis...............................................................................................................................................11

Operating management Ratios............................................................................................................................11

Investment management Ratio............................................................................................................................15

Financial Leverage Ratios...................................................................................................................................17

Cross-sectional analysis...........................................................................................................................................18

Recommendations.........................................................................................................................................................19

Conclusion....................................................................................................................................................................20

References.....................................................................................................................................................................21

List of Appendix...........................................................................................................................................................23

Comprehensive Income............................................................................................................................................23

Financial Position.....................................................................................................................................................25

Dupont Method........................................................................................................................................................27

Cross Functional Analysis.......................................................................................................................................28

Financial Ratios........................................................................................................................................................29

Financial Figures......................................................................................................................................................30

Prospective Analysis................................................................................................................................................30

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ANALYSIS

Introduction

The given study aims to conduct both financial and non-financial analysis of Pandora A/S

which is a designer, manufacturer of the high-quality hand-finished and affordable contemporary

jewellery. The company was founded in 1982 and headquartered in Copenhagen, Denmark. The

company is further seen to employ more than 26,500 people worldwide having more than 13,200

retail outlets in Thailand. The company is publicly listed on the Nasdaq Copenhagen stock

exchange in Denmark. The total revenue in 2017 was estimated to be 22.8 billion.

The analysis of the competitive strategy has been done as per comparison with Georg

Jensen which is also a maker of jewellery established in 1904. The study has considered the

financial analysis of both the companies and computed the critical analysis based on the financial

position of Pandora A/S. The financial analysis is based on the calculation of the various ratios

which has been identified as per critical analysis of the annual reports (Ehrnsperger 2017).

1. Business and Strategic Analysis

Analysis of the economy

Macroeconomic Factors affecting Pandora

The understanding the economy for the chosen Danish Jewellery company is

predominantly identified with the various types of the factors by analysing the PEST factors.

There have been several types of the external factors which influence the operational

performance of he company. In addition to this, some of the different types of the other factors

are considered with the external factors which influence the performance and operations in the

company. As per the data provided in the annual report it needs to be identified that the Pandora

A/S will face several challenges pertaining to the macro environment performance other than the

competitive forces. In addition to this, it needs to be discerned that the industry may be profitable

with the strong growth projections made for a positive political scenario. Some of the main form

of the macro environment factors needs to be discerned as per the inclusion of inflation, rate of

savings, rate of interest, rate foreign exchange and the economic cycle which is beneficial in the

determination of the aggregate demand and investment in the economy (Jun et al. 2017).

Introduction

The given study aims to conduct both financial and non-financial analysis of Pandora A/S

which is a designer, manufacturer of the high-quality hand-finished and affordable contemporary

jewellery. The company was founded in 1982 and headquartered in Copenhagen, Denmark. The

company is further seen to employ more than 26,500 people worldwide having more than 13,200

retail outlets in Thailand. The company is publicly listed on the Nasdaq Copenhagen stock

exchange in Denmark. The total revenue in 2017 was estimated to be 22.8 billion.

The analysis of the competitive strategy has been done as per comparison with Georg

Jensen which is also a maker of jewellery established in 1904. The study has considered the

financial analysis of both the companies and computed the critical analysis based on the financial

position of Pandora A/S. The financial analysis is based on the calculation of the various ratios

which has been identified as per critical analysis of the annual reports (Ehrnsperger 2017).

1. Business and Strategic Analysis

Analysis of the economy

Macroeconomic Factors affecting Pandora

The understanding the economy for the chosen Danish Jewellery company is

predominantly identified with the various types of the factors by analysing the PEST factors.

There have been several types of the external factors which influence the operational

performance of he company. In addition to this, some of the different types of the other factors

are considered with the external factors which influence the performance and operations in the

company. As per the data provided in the annual report it needs to be identified that the Pandora

A/S will face several challenges pertaining to the macro environment performance other than the

competitive forces. In addition to this, it needs to be discerned that the industry may be profitable

with the strong growth projections made for a positive political scenario. Some of the main form

of the macro environment factors needs to be discerned as per the inclusion of inflation, rate of

savings, rate of interest, rate foreign exchange and the economic cycle which is beneficial in the

determination of the aggregate demand and investment in the economy (Jun et al. 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ANALYSIS

On the contrary, the micro environment factors are seen to be depicted in terms of the

consideration of the various types of the factors such as economic indicators in the jewellery

industry and consumer spending. Some of the other micro environment factors need to be

identified as per the growth rate, inflation and industry’s economic indicators.

Industry analysis

Identification of the Industry

The industry analysis of Pandora A/S is identified with the market factors which

influence the developmental initatives in the company. These factors are considered to influence

the competitors and market which involve the appropriate and supplier. The industry in which

Pandora A/S operates has been depicted with jewellery manufacturer and retailer. The total

market share of the company is seen as DKK 110.03m (Chandra 2017).

Identification of the Competitor Company

The analysis of the competitor company is identified with Georg Jensen which is dealing

with the same products. The overall EBIT margin of the company increased from 17 DKK

million in 2015 to 55 DKK million in 2016. The EBIT margin further increased to 74 DKK

million in 2017. It needs to be further identified that Pandora A/S and Georg Jensen needs to be

considered as the pioneers in the Danish jewellery business. However, in terms of market share it

is discerned that Pandora A/S is clearly in a better position in compared to Georg Jensen

(Fibre2fashion.com. 2018).

Porters Five Force Analysis with Assessment

The consideration of Porter’s five forces framework is inferred to be conducive in terms

of following points:

Threat of new entrants: As a jewellery manufacturer it is important for considering the new

procedures and the business strategies followed by Pandora A/S which has been mainly

considered with competitive pricing strategy. The threat of new entrant has been seen to be

moderate in nature.

On the contrary, the micro environment factors are seen to be depicted in terms of the

consideration of the various types of the factors such as economic indicators in the jewellery

industry and consumer spending. Some of the other micro environment factors need to be

identified as per the growth rate, inflation and industry’s economic indicators.

Industry analysis

Identification of the Industry

The industry analysis of Pandora A/S is identified with the market factors which

influence the developmental initatives in the company. These factors are considered to influence

the competitors and market which involve the appropriate and supplier. The industry in which

Pandora A/S operates has been depicted with jewellery manufacturer and retailer. The total

market share of the company is seen as DKK 110.03m (Chandra 2017).

Identification of the Competitor Company

The analysis of the competitor company is identified with Georg Jensen which is dealing

with the same products. The overall EBIT margin of the company increased from 17 DKK

million in 2015 to 55 DKK million in 2016. The EBIT margin further increased to 74 DKK

million in 2017. It needs to be further identified that Pandora A/S and Georg Jensen needs to be

considered as the pioneers in the Danish jewellery business. However, in terms of market share it

is discerned that Pandora A/S is clearly in a better position in compared to Georg Jensen

(Fibre2fashion.com. 2018).

Porters Five Force Analysis with Assessment

The consideration of Porter’s five forces framework is inferred to be conducive in terms

of following points:

Threat of new entrants: As a jewellery manufacturer it is important for considering the new

procedures and the business strategies followed by Pandora A/S which has been mainly

considered with competitive pricing strategy. The threat of new entrant has been seen to be

moderate in nature.

5FINANCIAL ANALYSIS

Bargaining power of the suppliers: The suppliers powerful in the consumer sector has been

seen to be based on the posing a negotiating power and charge higher price. This will

significantly impact on the bargaining position of the suppliers and profitability. Therefore,

suppliers have a high bargaining power (Fischer, A. and Pascucci 2017).

Bargaining power of the Buyers: It can prove to be difficult for Pandora A/S to earn profit in

the long-run. However, in the jewellery business in Copenhagen the consumers have a relatively

low bargaining power.

Threat of the substitutes: The company offers wide range of precious stones and high-quality

gold and silver jewellery and alternatives to such products is seen to be low in the market.

Competitor rivalry: The competitive rivalry in the operating industry for Pandora A/S is

depicted with other players such as Ole Lynggaard Copenhagen, Georg Jensen Silver, Marlene

Juhl Jørgensen Fine Jewellery, Zarah Voigt Boutique, Julie Sandlau Flagship Store, Ladyfingers,

Marianne Dulong, Jane Kønig Store and House of Amber. Henceforth, the competitive rivalry in

the industry is seen to be very high (Fleisher, C. S., & Bensoussan, B. E. 2015).

Industry’s Growth Potential

In the last few years, the Danish fashion industry went through several paradigms

associated with luxury retailers and changes in the high-street trend. The brands such as Ganni,

Saks Potts and Stine Goya are seen to be conquering the fashion business by combination of

fashionable trends and jewellery. At present the company has been able to get a prime spot in the

market which is seen to be associated to the various type of the services which are seen to be

based on international consumers and trendsetting influencers. The main mission of the company

has been seen to be associated to the various types of the functions which are depicted to be

considered with created a dedicated market for Danish and Scandinavian at the time of

Copenhagen Fashion Week (Giannakis and Papadopoulos 2016).

In the 11th edition, the jewellery room is seen to be supported with large number of

emerging talents ranging from Maria Black, Orit Elhanati and Pernille Lauridse. Moreover, the

potential of the jewellery pressroom is seen with the industry dedicated to the online space in

which the brands are organised in one single roof. The Jewellery Room is depicted to be

Bargaining power of the suppliers: The suppliers powerful in the consumer sector has been

seen to be based on the posing a negotiating power and charge higher price. This will

significantly impact on the bargaining position of the suppliers and profitability. Therefore,

suppliers have a high bargaining power (Fischer, A. and Pascucci 2017).

Bargaining power of the Buyers: It can prove to be difficult for Pandora A/S to earn profit in

the long-run. However, in the jewellery business in Copenhagen the consumers have a relatively

low bargaining power.

Threat of the substitutes: The company offers wide range of precious stones and high-quality

gold and silver jewellery and alternatives to such products is seen to be low in the market.

Competitor rivalry: The competitive rivalry in the operating industry for Pandora A/S is

depicted with other players such as Ole Lynggaard Copenhagen, Georg Jensen Silver, Marlene

Juhl Jørgensen Fine Jewellery, Zarah Voigt Boutique, Julie Sandlau Flagship Store, Ladyfingers,

Marianne Dulong, Jane Kønig Store and House of Amber. Henceforth, the competitive rivalry in

the industry is seen to be very high (Fleisher, C. S., & Bensoussan, B. E. 2015).

Industry’s Growth Potential

In the last few years, the Danish fashion industry went through several paradigms

associated with luxury retailers and changes in the high-street trend. The brands such as Ganni,

Saks Potts and Stine Goya are seen to be conquering the fashion business by combination of

fashionable trends and jewellery. At present the company has been able to get a prime spot in the

market which is seen to be associated to the various type of the services which are seen to be

based on international consumers and trendsetting influencers. The main mission of the company

has been seen to be associated to the various types of the functions which are depicted to be

considered with created a dedicated market for Danish and Scandinavian at the time of

Copenhagen Fashion Week (Giannakis and Papadopoulos 2016).

In the 11th edition, the jewellery room is seen to be supported with large number of

emerging talents ranging from Maria Black, Orit Elhanati and Pernille Lauridse. Moreover, the

potential of the jewellery pressroom is seen with the industry dedicated to the online space in

which the brands are organised in one single roof. The Jewellery Room is depicted to be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ANALYSIS

conducive with the various types of services which are associated with the changes brought to

Danish fashion. Moreover, the Danish Jewellery is often boosted with the changes among the

consumer behaviour which are seen with the increasing nature of daring designs and strong

storytelling. The brands such as Ole Lynggard’s masterful designs, Georg Jensen’s has created a

serval collaboration with the new artists which are depicted with the Nadia Shelbaya’s playful

pearl and gold creations. In addition to this, some of the other designer jewellery stores such as

Matchesfashion.com is also considered with assessment of the exact requirement of the clients

(Grant 2016).

Company’s competitive and corporate strategy

Company’s competitive strategy, risk factors and growth potential

The competitive strengths of Pandora A/S are depicted in terms of designs and quality of

jewellery as agility of the value chain and an improved focus on the sustainability. The company

has maintained its brand as a leader of affordable player in the jewellery segment and often

referred as the largest producer of jewellery as per the pieces crafted. The main USP of the

company is identified in terms of quality and craftmanship. It is further depicted to innovate with

the designs which enhances the overall value chain. Moreover, the experience offered by

Pandora sets it apart from the other competitors. The company further involved in several types

of the risk awareness programs which are depicted to be aimed at increasing the awareness of the

risk management and appointment of the persons in each region where the operations exists. As

the company is involved with significant number of markets there is ample scope of growth

opportunity and earnings (Hill et al. 2014).

Georg Jensen has taken continued initiative to modernise the overall retail business and

making improvement to the digital shopping capabilities. This is seen to be based on

rationalising the network of physical shops. This has been further marked with an important step

for competing in an omni-channel approach which will prove to be more powerful and

competitively advantageous to the company. The business management done by the company

has been considered with the segregation of the risk as per commercial risk, logistics risk,

production facilities, IT breakdown, employees, brand and image. The company manages the

various types of the financial risk in terms of the monitoring the foreign exchange fluctuations.

conducive with the various types of services which are associated with the changes brought to

Danish fashion. Moreover, the Danish Jewellery is often boosted with the changes among the

consumer behaviour which are seen with the increasing nature of daring designs and strong

storytelling. The brands such as Ole Lynggard’s masterful designs, Georg Jensen’s has created a

serval collaboration with the new artists which are depicted with the Nadia Shelbaya’s playful

pearl and gold creations. In addition to this, some of the other designer jewellery stores such as

Matchesfashion.com is also considered with assessment of the exact requirement of the clients

(Grant 2016).

Company’s competitive and corporate strategy

Company’s competitive strategy, risk factors and growth potential

The competitive strengths of Pandora A/S are depicted in terms of designs and quality of

jewellery as agility of the value chain and an improved focus on the sustainability. The company

has maintained its brand as a leader of affordable player in the jewellery segment and often

referred as the largest producer of jewellery as per the pieces crafted. The main USP of the

company is identified in terms of quality and craftmanship. It is further depicted to innovate with

the designs which enhances the overall value chain. Moreover, the experience offered by

Pandora sets it apart from the other competitors. The company further involved in several types

of the risk awareness programs which are depicted to be aimed at increasing the awareness of the

risk management and appointment of the persons in each region where the operations exists. As

the company is involved with significant number of markets there is ample scope of growth

opportunity and earnings (Hill et al. 2014).

Georg Jensen has taken continued initiative to modernise the overall retail business and

making improvement to the digital shopping capabilities. This is seen to be based on

rationalising the network of physical shops. This has been further marked with an important step

for competing in an omni-channel approach which will prove to be more powerful and

competitively advantageous to the company. The business management done by the company

has been considered with the segregation of the risk as per commercial risk, logistics risk,

production facilities, IT breakdown, employees, brand and image. The company manages the

various types of the financial risk in terms of the monitoring the foreign exchange fluctuations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ANALYSIS

The management of the company expects a significant growth potential in the operating profit

segment (ATARERE et al. 2016).

Company’s corporate strategy

The strategic business strategies of Pandora A/S acts as the pillars for providing the right

direction to the consumers. Some of the main aspects of the corporate strategy are discerned as

per Innovate affordable jewellery, Agile manufacturing, Digitalised brand experience and

success in the omni-channel retail.

The business strategy adopted by Georg Jensen is considered with clear focus and

foundation on the performance improvements which will ensure continuous improvement for the

company. The business risk of the company is set in such a way that they are related to the brand

reputation, followed with a proactive communications strategy and which is consistent with the

communication efforts and public relations. The contribution of UN Global Compact signatory is

also seen to play a pivotal role in the formulation of the business strategy of the company (Prause

2014).

2. Accounting Analysis

Three Key Accounts in the balance sheet of both the company

The assessment of the main accounts for Pandora A/S in the balance sheet are identified

with current assets, current liabilities and stockholders’ equity. The current assets compose of the

accounts such as inventories, Derivative financial instruments, Trade receivables, Income tax

receivable, other receivable and cash. The total balance is depicted to increase from DKK 6356

m in 2016 to 6744 m in 2017. The accounts under the current liabilities are identified with

Derivative financial instruments, Trade payables, Income tax payable, loans and borrowings. The

total balance of the liabilities is identified to increase from DKK 8291 m in 2016 to DKK 10726

m in 2017. The accounts under equity is seen with Share capital, treasury shares, reserves,

dividend proposed and retained earnings. The total equity of the company increased from DKK

6794 m in 2016 to DKK 6514 m in 2017 (Euwema et al. 2014).

The management of the company expects a significant growth potential in the operating profit

segment (ATARERE et al. 2016).

Company’s corporate strategy

The strategic business strategies of Pandora A/S acts as the pillars for providing the right

direction to the consumers. Some of the main aspects of the corporate strategy are discerned as

per Innovate affordable jewellery, Agile manufacturing, Digitalised brand experience and

success in the omni-channel retail.

The business strategy adopted by Georg Jensen is considered with clear focus and

foundation on the performance improvements which will ensure continuous improvement for the

company. The business risk of the company is set in such a way that they are related to the brand

reputation, followed with a proactive communications strategy and which is consistent with the

communication efforts and public relations. The contribution of UN Global Compact signatory is

also seen to play a pivotal role in the formulation of the business strategy of the company (Prause

2014).

2. Accounting Analysis

Three Key Accounts in the balance sheet of both the company

The assessment of the main accounts for Pandora A/S in the balance sheet are identified

with current assets, current liabilities and stockholders’ equity. The current assets compose of the

accounts such as inventories, Derivative financial instruments, Trade receivables, Income tax

receivable, other receivable and cash. The total balance is depicted to increase from DKK 6356

m in 2016 to 6744 m in 2017. The accounts under the current liabilities are identified with

Derivative financial instruments, Trade payables, Income tax payable, loans and borrowings. The

total balance of the liabilities is identified to increase from DKK 8291 m in 2016 to DKK 10726

m in 2017. The accounts under equity is seen with Share capital, treasury shares, reserves,

dividend proposed and retained earnings. The total equity of the company increased from DKK

6794 m in 2016 to DKK 6514 m in 2017 (Euwema et al. 2014).

8FINANCIAL ANALYSIS

Similarly, the current assets for Georg Jensen is considered with items such as trade

receivables, receivables from the group enterprises, other receivables, deferred tax assets and

prepayments. The items under the current liabilities account needs to be seen with credit

institutions, trade payables, payables to the group enterprises, corporation tax and other payables.

The total balance of the current liabilities increased from DKK 3331m in 2016 to DKK 3847m in

2017. The total equity consists of the accounts such as share capital, share premium account,

Reserve for development costs and retained earnings. The total equity of Georg Jensen decreased

from DKK 4576 in 2016 to DKK 4154 m in 2017 (Renz 2016).

Evaluating the quality of disclosure

The preparation of the annual report of Pandora A/S has been prepared as per

International “Financial Reporting Standards (IFRS)” which has adopted the guidelines as

prescribed by EU and additional Danish disclosure requirements. The consolidation of the

financial statement is further seen to be based on the various types of the disclosures as stated

under Group’s and the Parent Company’s operations.

The preparation of the annual report of Georg Jensen is depicted to be in accordance with

the “International Standards on Auditing (ISAs)” along with the additional requirements which

are Applicable in Denmark. The company’s independent activities are seen to be considered as

per the “Inter-national Ethics Standards Board for Accountants’ Code of Ethics for

Professional Accountants (IESBA Code)” (Barr and McClellan 2018).

Identifying 3 potential red flags for the company

The three potential red flag areas of the company are seen in terms of commodity,

product development, Crafting and Supply Chain Major Market. The potential red flag

associated to the commodity is considered with the increase in the cost of goods for the range of

products offered by the company. In addition to this, the risk areas are also seen to be evident in

terms of the changes in the raw material cost especially gold and silver. Secondly, the red flag

area in the product development are considered as per the uncertainties pertaining to the new

jewellery designs do not adhere to the customer expectations or gain the desired traction in the

markets. Crafting and Supply Chain Major Market may get affected by large number of reasons

Similarly, the current assets for Georg Jensen is considered with items such as trade

receivables, receivables from the group enterprises, other receivables, deferred tax assets and

prepayments. The items under the current liabilities account needs to be seen with credit

institutions, trade payables, payables to the group enterprises, corporation tax and other payables.

The total balance of the current liabilities increased from DKK 3331m in 2016 to DKK 3847m in

2017. The total equity consists of the accounts such as share capital, share premium account,

Reserve for development costs and retained earnings. The total equity of Georg Jensen decreased

from DKK 4576 in 2016 to DKK 4154 m in 2017 (Renz 2016).

Evaluating the quality of disclosure

The preparation of the annual report of Pandora A/S has been prepared as per

International “Financial Reporting Standards (IFRS)” which has adopted the guidelines as

prescribed by EU and additional Danish disclosure requirements. The consolidation of the

financial statement is further seen to be based on the various types of the disclosures as stated

under Group’s and the Parent Company’s operations.

The preparation of the annual report of Georg Jensen is depicted to be in accordance with

the “International Standards on Auditing (ISAs)” along with the additional requirements which

are Applicable in Denmark. The company’s independent activities are seen to be considered as

per the “Inter-national Ethics Standards Board for Accountants’ Code of Ethics for

Professional Accountants (IESBA Code)” (Barr and McClellan 2018).

Identifying 3 potential red flags for the company

The three potential red flag areas of the company are seen in terms of commodity,

product development, Crafting and Supply Chain Major Market. The potential red flag

associated to the commodity is considered with the increase in the cost of goods for the range of

products offered by the company. In addition to this, the risk areas are also seen to be evident in

terms of the changes in the raw material cost especially gold and silver. Secondly, the red flag

area in the product development are considered as per the uncertainties pertaining to the new

jewellery designs do not adhere to the customer expectations or gain the desired traction in the

markets. Crafting and Supply Chain Major Market may get affected by large number of reasons

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ANALYSIS

which are seen to be based on the factors impacting on the stability of the supply chain.

However, these are not seen to be limited to the loss of suppliers, disasters pertaining to the

physical IT infrastructure at the crafting facilities and the distribution centres. There is a potential

risk of interruption in the sourcing, manufacturing and/or delivery activities (Balazs et al. 2016).

The potential red flag areas for Georg Jensen are concerned with business aspects,

financial and external risk concerns. The concerns related to the business risk are based on the

commercial red flag areas which are evident among the consumption of the luxury goods. Some

of the other concerns are also related to logistics risk and production facilities. The red flag areas

of the financial concerns are seen to be based on increased exposure to the foreign exchange

flections. These concerns are also depicted as per the changes variations in the commodity prices

of gold, silver, steel, brass, precious stones. The third red flag area of external risk is considered

with the different types of the issues such as the macroeconomic factors. At times it may not be

possible for the company to predict the sales which allows for flexible planning and discern the

appropriate impact of the cyclical economic trends (Karadag 2015).

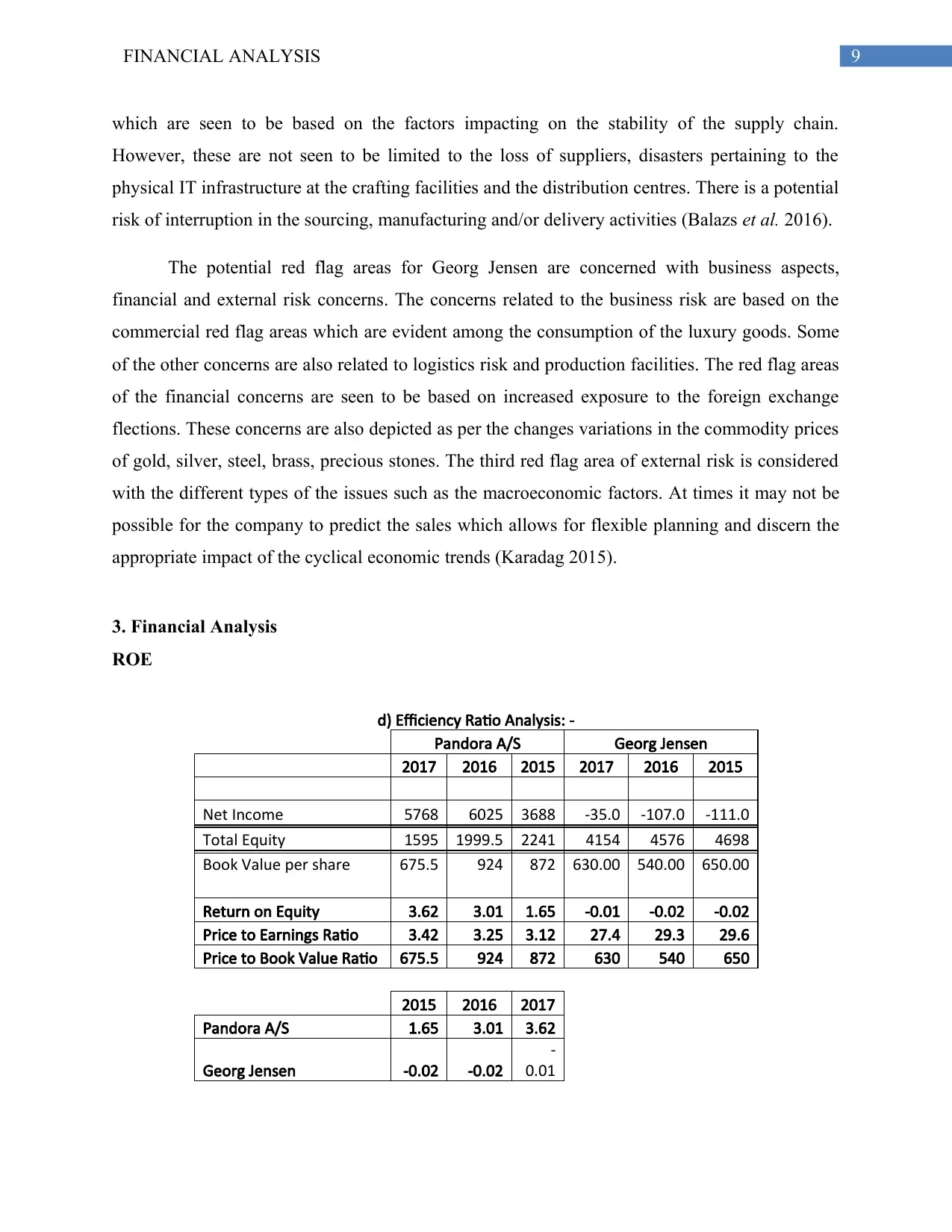

3. Financial Analysis

ROE

d) Efficiency Ratio Analysis: -

Pandora A/S Georg Jensen

2017 2016 2015 2017 2016 2015

Net Income 5768 6025 3688 -35.0 -107.0 -111.0

Total Equity 1595 1999.5 2241 4154 4576 4698

Book Value per share 675.5 924 872 630.00 540.00 650.00

Return on Equity 3.62 3.01 1.65 -0.01 -0.02 -0.02

Price to Earnings Ratio 3.42 3.25 3.12 27.4 29.3 29.6

Price to Book Value Ratio 675.5 924 872 630 540 650

2015 2016 2017

Pandora A/S 1.65 3.01 3.62

Georg Jensen -0.02 -0.02

-

0.01

which are seen to be based on the factors impacting on the stability of the supply chain.

However, these are not seen to be limited to the loss of suppliers, disasters pertaining to the

physical IT infrastructure at the crafting facilities and the distribution centres. There is a potential

risk of interruption in the sourcing, manufacturing and/or delivery activities (Balazs et al. 2016).

The potential red flag areas for Georg Jensen are concerned with business aspects,

financial and external risk concerns. The concerns related to the business risk are based on the

commercial red flag areas which are evident among the consumption of the luxury goods. Some

of the other concerns are also related to logistics risk and production facilities. The red flag areas

of the financial concerns are seen to be based on increased exposure to the foreign exchange

flections. These concerns are also depicted as per the changes variations in the commodity prices

of gold, silver, steel, brass, precious stones. The third red flag area of external risk is considered

with the different types of the issues such as the macroeconomic factors. At times it may not be

possible for the company to predict the sales which allows for flexible planning and discern the

appropriate impact of the cyclical economic trends (Karadag 2015).

3. Financial Analysis

ROE

d) Efficiency Ratio Analysis: -

Pandora A/S Georg Jensen

2017 2016 2015 2017 2016 2015

Net Income 5768 6025 3688 -35.0 -107.0 -111.0

Total Equity 1595 1999.5 2241 4154 4576 4698

Book Value per share 675.5 924 872 630.00 540.00 650.00

Return on Equity 3.62 3.01 1.65 -0.01 -0.02 -0.02

Price to Earnings Ratio 3.42 3.25 3.12 27.4 29.3 29.6

Price to Book Value Ratio 675.5 924 872 630 540 650

2015 2016 2017

Pandora A/S 1.65 3.01 3.62

Georg Jensen -0.02 -0.02

-

0.01

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ANALYSIS

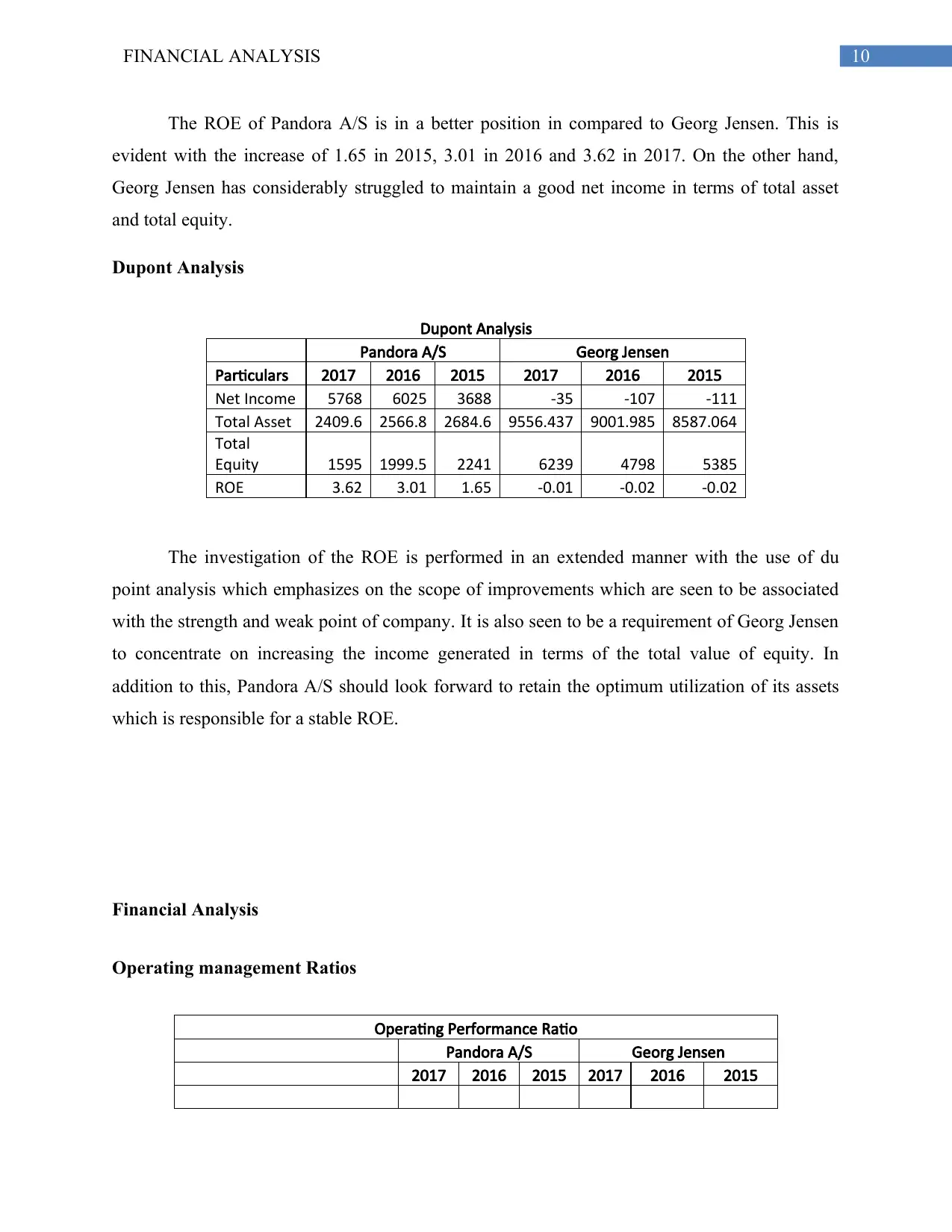

The ROE of Pandora A/S is in a better position in compared to Georg Jensen. This is

evident with the increase of 1.65 in 2015, 3.01 in 2016 and 3.62 in 2017. On the other hand,

Georg Jensen has considerably struggled to maintain a good net income in terms of total asset

and total equity.

Dupont Analysis

Dupont Analysis

Pandora A/S Georg Jensen

Particulars 2017 2016 2015 2017 2016 2015

Net Income 5768 6025 3688 -35 -107 -111

Total Asset 2409.6 2566.8 2684.6 9556.437 9001.985 8587.064

Total

Equity 1595 1999.5 2241 6239 4798 5385

ROE 3.62 3.01 1.65 -0.01 -0.02 -0.02

The investigation of the ROE is performed in an extended manner with the use of du

point analysis which emphasizes on the scope of improvements which are seen to be associated

with the strength and weak point of company. It is also seen to be a requirement of Georg Jensen

to concentrate on increasing the income generated in terms of the total value of equity. In

addition to this, Pandora A/S should look forward to retain the optimum utilization of its assets

which is responsible for a stable ROE.

Financial Analysis

Operating management Ratios

Operating Performance Ratio

Pandora A/S Georg Jensen

2017 2016 2015 2017 2016 2015

The ROE of Pandora A/S is in a better position in compared to Georg Jensen. This is

evident with the increase of 1.65 in 2015, 3.01 in 2016 and 3.62 in 2017. On the other hand,

Georg Jensen has considerably struggled to maintain a good net income in terms of total asset

and total equity.

Dupont Analysis

Dupont Analysis

Pandora A/S Georg Jensen

Particulars 2017 2016 2015 2017 2016 2015

Net Income 5768 6025 3688 -35 -107 -111

Total Asset 2409.6 2566.8 2684.6 9556.437 9001.985 8587.064

Total

Equity 1595 1999.5 2241 6239 4798 5385

ROE 3.62 3.01 1.65 -0.01 -0.02 -0.02

The investigation of the ROE is performed in an extended manner with the use of du

point analysis which emphasizes on the scope of improvements which are seen to be associated

with the strength and weak point of company. It is also seen to be a requirement of Georg Jensen

to concentrate on increasing the income generated in terms of the total value of equity. In

addition to this, Pandora A/S should look forward to retain the optimum utilization of its assets

which is responsible for a stable ROE.

Financial Analysis

Operating management Ratios

Operating Performance Ratio

Pandora A/S Georg Jensen

2017 2016 2015 2017 2016 2015

11FINANCIAL ANALYSIS

Net Sales 22781 20281 16737 1089 1091 1144

Total Fixed Assets 2324 1767 1237 0 54.00 47.00

Total no. of employees 20904 17770 13971 1287

1352.0

0 1440.00

Days Inventory Outstanding 8 8 6 0 1.12 1.45

Days Sales Outstanding 62 56 46 3 3 3

Days Payable Outstanding 5 4 4 3 3 3

Operating Expense 9182 7819 6379 39 15.00 76.00

Fixed Asset Turnover Ratio 37.24 31.80 26.98 Nil 18.07 15.00

Sales/Revenue Per Employee 1.09 1.14 1.20 0.85 0.81 0.79

Operating Cycle 75 68 56 5.75 7.06 7.23

Operating Ratio 40% 39% 38% 4% 1% 7%

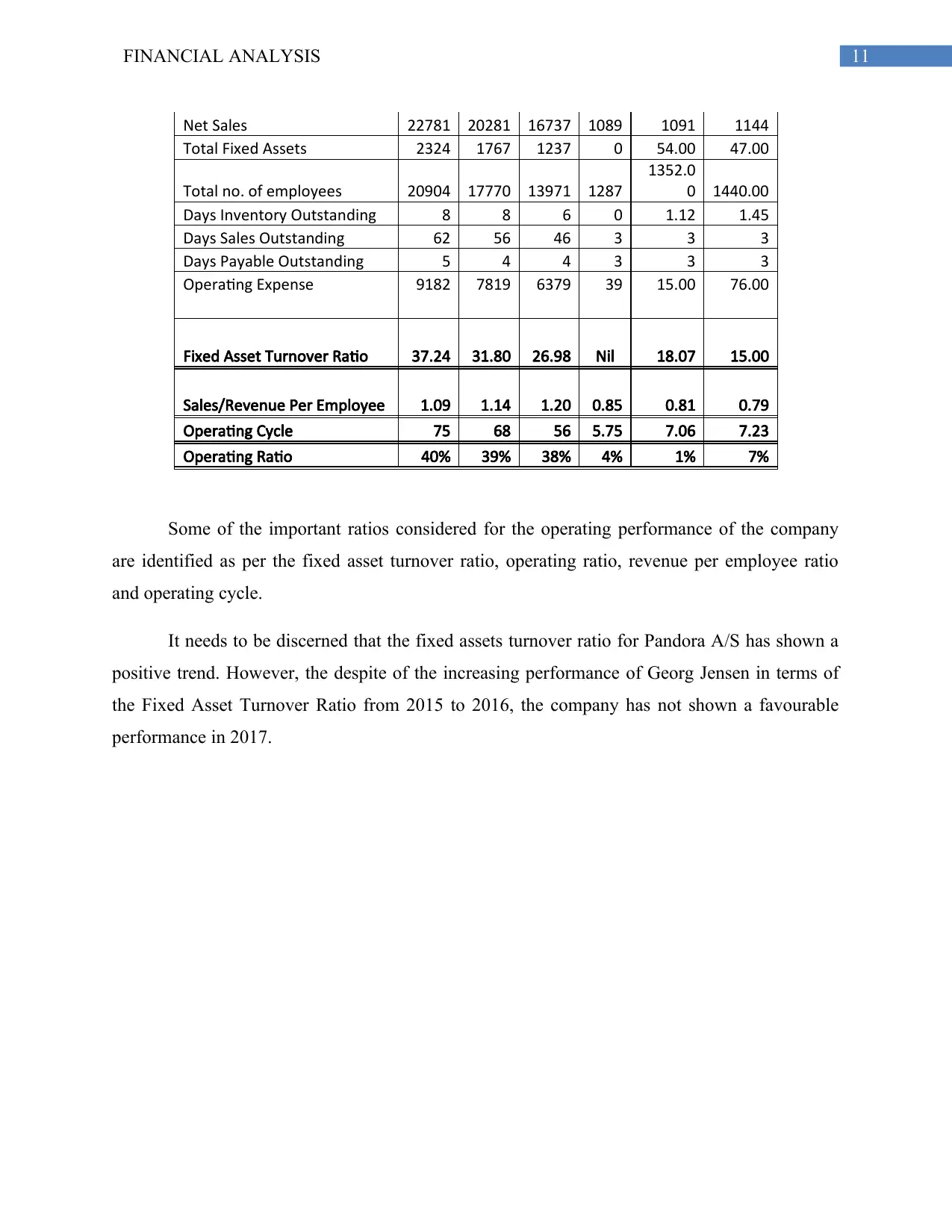

Some of the important ratios considered for the operating performance of the company

are identified as per the fixed asset turnover ratio, operating ratio, revenue per employee ratio

and operating cycle.

It needs to be discerned that the fixed assets turnover ratio for Pandora A/S has shown a

positive trend. However, the despite of the increasing performance of Georg Jensen in terms of

the Fixed Asset Turnover Ratio from 2015 to 2016, the company has not shown a favourable

performance in 2017.

Net Sales 22781 20281 16737 1089 1091 1144

Total Fixed Assets 2324 1767 1237 0 54.00 47.00

Total no. of employees 20904 17770 13971 1287

1352.0

0 1440.00

Days Inventory Outstanding 8 8 6 0 1.12 1.45

Days Sales Outstanding 62 56 46 3 3 3

Days Payable Outstanding 5 4 4 3 3 3

Operating Expense 9182 7819 6379 39 15.00 76.00

Fixed Asset Turnover Ratio 37.24 31.80 26.98 Nil 18.07 15.00

Sales/Revenue Per Employee 1.09 1.14 1.20 0.85 0.81 0.79

Operating Cycle 75 68 56 5.75 7.06 7.23

Operating Ratio 40% 39% 38% 4% 1% 7%

Some of the important ratios considered for the operating performance of the company

are identified as per the fixed asset turnover ratio, operating ratio, revenue per employee ratio

and operating cycle.

It needs to be discerned that the fixed assets turnover ratio for Pandora A/S has shown a

positive trend. However, the despite of the increasing performance of Georg Jensen in terms of

the Fixed Asset Turnover Ratio from 2015 to 2016, the company has not shown a favourable

performance in 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 31

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.