Financial Analysis Report

VerifiedAdded on 2019/09/30

|24

|4376

|232

Report

AI Summary

This report provides a comprehensive financial analysis of Ford Motor Company and Tesla, Inc. It begins by formulating a mini-case study of a hypothetical garment manufacturing company, Elliott Fashion Private Limited, to illustrate concepts like stock valuation, bond valuation, cost of capital, and capital budgeting. The core of the report focuses on a comparative analysis of Ford and Tesla. It calculates and interprets the betas of both companies, determining their systematic risk. Stock returns and risk are calculated, and a detailed comparison of their financial performance is presented using profitability ratios (net profit margin, gross profit margin, ROA, ROE), liquidity ratios (current ratio, quick ratio), and the debt-to-equity ratio. The analysis reveals that Ford exhibits stronger financial performance across most metrics compared to Tesla, despite Tesla having a higher gross profit margin. The report concludes that Ford presents a less risky and more financially sound investment option based on the data analyzed.

Running Head: Financial Analysis

FINANCIAL ANALYSIS

FINANCIAL ANALYSIS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 2

Table of Contents

1. Formulation of a mini case of a hypothetical company...............................................................3

2. Analysis of Ford Motor Company and Tesla, Inc.......................................................................8

a. Betas of Ford Motor Company and Tesla Inc..........................................................................8

b. Calculation of return of stock...................................................................................................8

c. Calculation of the risk of stocks...............................................................................................9

d. Comparison between Ford Motor Company and Tesla, Inc..................................................10

e. Calculation and Comparison between Ford Motor Company and Tesla, Inc........................10

Reference List................................................................................................................................16

Appendices....................................................................................................................................18

Appendix 1.................................................................................................................................18

Appendix 2.................................................................................................................................21

Table of Contents

1. Formulation of a mini case of a hypothetical company...............................................................3

2. Analysis of Ford Motor Company and Tesla, Inc.......................................................................8

a. Betas of Ford Motor Company and Tesla Inc..........................................................................8

b. Calculation of return of stock...................................................................................................8

c. Calculation of the risk of stocks...............................................................................................9

d. Comparison between Ford Motor Company and Tesla, Inc..................................................10

e. Calculation and Comparison between Ford Motor Company and Tesla, Inc........................10

Reference List................................................................................................................................16

Appendices....................................................................................................................................18

Appendix 1.................................................................................................................................18

Appendix 2.................................................................................................................................21

Financial Analysis 3

1. Formulation of a mini case of a hypothetical company

Elliott Fashion Private Limited is a garment manufacturing company which is located in

Australia. The company is highly capable of manufacturing high quality fashion garments by

using top-notch fabric and ultra-modern designs. The company uses to manufactured and retail

its products in the domestic market of Australia. It is famous for fast-fashion clothing items for

women, teenagers, men, and children. Within Australia, Elliott Fashion Private Limited sells its

products through ten retail outlets and two factory outlets that are solely operated by it. Besides

this, the company also retails its clothing items through supermarkets and retail chains. The

company is very much committed to deliver standard quality clothing items at an affordable

price without compromising with the quality and style of the products. It is aimed to expand its

garment business in and around the major cities of Australia and for long-term it is intended to

enter into some of the flourishing markets in Asia like India, Singapore, and China. The

company's stocks are valued at a satisfactorily due to its steady growth in terms of profit

generation and increasing goodwill.

The company has raised finance by issuing shares as well as bonds. For meeting annual

finance need, it uses to reinvest its profit it uses to retain every year after making required

payments to its shareholders and creditors. The stocks of Elliott Fashion are upwards moving

which ROA and EPS of the company stand stronger and upwards moving compared to some

same line companies. Current valuation of the company’s stocks makes potential investors to

invest in the company. The company has issued some bonds for raising external finance

and valued them by determining the faire value of those bonds. Cost of capital of Elliot is low

due to the presence of a number of market opportunities for the company, less inflation and less

business risks. Furthermore, the growth seeking investment policy, suitable capital structure

policy and well-maintained dividend policy of Elliot Fashion help it to make its cost of capital

less than some of its competitor companies. In future, the company has a plan to expand its

business by entering into new business venture and by opening a new business unit. In order to

do so, Elliot Fashion is expected to use capital budgeting techniques.

1. Formulation of a mini case of a hypothetical company

Elliott Fashion Private Limited is a garment manufacturing company which is located in

Australia. The company is highly capable of manufacturing high quality fashion garments by

using top-notch fabric and ultra-modern designs. The company uses to manufactured and retail

its products in the domestic market of Australia. It is famous for fast-fashion clothing items for

women, teenagers, men, and children. Within Australia, Elliott Fashion Private Limited sells its

products through ten retail outlets and two factory outlets that are solely operated by it. Besides

this, the company also retails its clothing items through supermarkets and retail chains. The

company is very much committed to deliver standard quality clothing items at an affordable

price without compromising with the quality and style of the products. It is aimed to expand its

garment business in and around the major cities of Australia and for long-term it is intended to

enter into some of the flourishing markets in Asia like India, Singapore, and China. The

company's stocks are valued at a satisfactorily due to its steady growth in terms of profit

generation and increasing goodwill.

The company has raised finance by issuing shares as well as bonds. For meeting annual

finance need, it uses to reinvest its profit it uses to retain every year after making required

payments to its shareholders and creditors. The stocks of Elliott Fashion are upwards moving

which ROA and EPS of the company stand stronger and upwards moving compared to some

same line companies. Current valuation of the company’s stocks makes potential investors to

invest in the company. The company has issued some bonds for raising external finance

and valued them by determining the faire value of those bonds. Cost of capital of Elliot is low

due to the presence of a number of market opportunities for the company, less inflation and less

business risks. Furthermore, the growth seeking investment policy, suitable capital structure

policy and well-maintained dividend policy of Elliot Fashion help it to make its cost of capital

less than some of its competitor companies. In future, the company has a plan to expand its

business by entering into new business venture and by opening a new business unit. In order to

do so, Elliot Fashion is expected to use capital budgeting techniques.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 4

Questions and Answer on the following topics:

Stock Valuation

Question 1

What is the reason behind valuing stock?

Answer: In order to predict the future price of shares or potential market price of shares

stock valuation is done. It aimed to help the investors make their decision to make an investment

in a company through purchasing that company's shares.

Question 2

How stock valuation is done?

Answer: For calculating stock valuation current intrinsic value of a company’s stock is

multiplied by that company's projected EPS (earnings per share).

Question 3

What are the methods of stock valuation?

Answer: There are two types of stock valuation method such as absolute method and

relative method. The absolute method of stock valuation includes two types of valuation methods

such as the DDM (dividend discount model) and DCF (discounted cash flow model). On the

other side, relative stock valuation is done by calculating the major financial ratios of the same

line companies. Relative stock valuation stands as comparative analysis of companies on the

basis of their financial ratios like ROA (Return on Assets), EPS (earnings per share) and more

(corporatefinanceinstitute.com, 2019).

Bond valuation

Question 1

Questions and Answer on the following topics:

Stock Valuation

Question 1

What is the reason behind valuing stock?

Answer: In order to predict the future price of shares or potential market price of shares

stock valuation is done. It aimed to help the investors make their decision to make an investment

in a company through purchasing that company's shares.

Question 2

How stock valuation is done?

Answer: For calculating stock valuation current intrinsic value of a company’s stock is

multiplied by that company's projected EPS (earnings per share).

Question 3

What are the methods of stock valuation?

Answer: There are two types of stock valuation method such as absolute method and

relative method. The absolute method of stock valuation includes two types of valuation methods

such as the DDM (dividend discount model) and DCF (discounted cash flow model). On the

other side, relative stock valuation is done by calculating the major financial ratios of the same

line companies. Relative stock valuation stands as comparative analysis of companies on the

basis of their financial ratios like ROA (Return on Assets), EPS (earnings per share) and more

(corporatefinanceinstitute.com, 2019).

Bond valuation

Question 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 5

What is bond valuation?

Answer: Bond valuation refers to a technique by using which a specific bond’s

theoretical fair value is determined. Bond valuation uses to include the calculation of

present values of the future interest payment attached to a bond, and the value of a bond upon

maturity which is known as par value or face value of a bond.

Question 2

What is the reason behind bond valuation?

Answer: Bond valuation is done for determining the accurate PV (present value) of a

bind and for making an informed decision regarding investment.

Question 3

What are the steps of bond valuation?

Answer:

Step 1: Making an estimation of the expected cash flows.

Step 2: Determination of the appropriate rate of interest which is required to be used for

discounting the expected cash flows.

Step 3: Calculation of the PV (present value) of the expected cash flows (computed in

step -1) by using the interest rate calculated in step – 2 (efinancemanagement.com, 2019).

Cost of capital

Question 1

What stands as the cost of capital for an organisation?

Answer: Cost of capital is comprised of the cost of equity and cost of debt both that are

used by a company for financing its business. Cost of capital of a company depends on the

What is bond valuation?

Answer: Bond valuation refers to a technique by using which a specific bond’s

theoretical fair value is determined. Bond valuation uses to include the calculation of

present values of the future interest payment attached to a bond, and the value of a bond upon

maturity which is known as par value or face value of a bond.

Question 2

What is the reason behind bond valuation?

Answer: Bond valuation is done for determining the accurate PV (present value) of a

bind and for making an informed decision regarding investment.

Question 3

What are the steps of bond valuation?

Answer:

Step 1: Making an estimation of the expected cash flows.

Step 2: Determination of the appropriate rate of interest which is required to be used for

discounting the expected cash flows.

Step 3: Calculation of the PV (present value) of the expected cash flows (computed in

step -1) by using the interest rate calculated in step – 2 (efinancemanagement.com, 2019).

Cost of capital

Question 1

What stands as the cost of capital for an organisation?

Answer: Cost of capital is comprised of the cost of equity and cost of debt both that are

used by a company for financing its business. Cost of capital of a company depends on the

Financial Analysis 6

financing type a company chooses for financing its business. It refers to an opportunity

cost attached with a particular investment. Cost of capital is a rate of return which could be

earned by an investor if he/she makes the same amount of investment in another investment

option that includes equal risk.

Question 2

Why the cost of capital matters?

Answer: Cost of capital is a vital component in the task of valuing a business. It is often

used as the discount rate for calculating the fair value of the cash flows an investment delivers. It

helps investors to gauge the risk of investing in a company’s shares and it is necessary to

calculate for making decisions on capital budgeting. It helps to frame an appropriate credit policy

and to evaluate investment options. Furthermore, cost of capital is also played a vital role in

designing an optimum capital structure for a company (businessjargons.com, 2019).

Capital Budgeting

Question 1

What is capital budgeting?

Answer: Capital budgeting refers to a process by applying which a company uses to

determine and evaluate the potential investments or large expenses required to incur for a

proposed investment. These investments and expenditures include large capital projects such as

investing in one or more long-term venture(s), constructing a new office building or plant or

installation of any heavy machineries for new plat or existing production plant and more. Capital

budgeting is also called investment appraisal by using which a company compares between two

or more investment options and then select one out of them which it found more profitable than

the other options.

Question 2

financing type a company chooses for financing its business. It refers to an opportunity

cost attached with a particular investment. Cost of capital is a rate of return which could be

earned by an investor if he/she makes the same amount of investment in another investment

option that includes equal risk.

Question 2

Why the cost of capital matters?

Answer: Cost of capital is a vital component in the task of valuing a business. It is often

used as the discount rate for calculating the fair value of the cash flows an investment delivers. It

helps investors to gauge the risk of investing in a company’s shares and it is necessary to

calculate for making decisions on capital budgeting. It helps to frame an appropriate credit policy

and to evaluate investment options. Furthermore, cost of capital is also played a vital role in

designing an optimum capital structure for a company (businessjargons.com, 2019).

Capital Budgeting

Question 1

What is capital budgeting?

Answer: Capital budgeting refers to a process by applying which a company uses to

determine and evaluate the potential investments or large expenses required to incur for a

proposed investment. These investments and expenditures include large capital projects such as

investing in one or more long-term venture(s), constructing a new office building or plant or

installation of any heavy machineries for new plat or existing production plant and more. Capital

budgeting is also called investment appraisal by using which a company compares between two

or more investment options and then select one out of them which it found more profitable than

the other options.

Question 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 7

What are the benefits of capital budgeting?

Answer: Capital budgeting decisions help a company to evaluate a proposed project by

considering the expected outcome (monetary in form) of the project. It also helps to evaluate

expenditure related decisions which are involved in the current outflow of funds, to understand

risk and efforts, let the company control its expenditure and abstain a company from under and

over-investment.

Question 3

What are some of the commonly applied capital budgeting techniques?

Answer: Capital budgeting methods are sub-divided into two segments such as

traditional method and modern or discounting method. Under the traditional method, capital

budgeting is done by calculating the payback period, accounting rate of return, and post-payback

period. On the other hand, modern or discounting method of capital budgeting includes

calculation of net present value (NPV), internal rate of return (IRR) and profitability index.

What are the benefits of capital budgeting?

Answer: Capital budgeting decisions help a company to evaluate a proposed project by

considering the expected outcome (monetary in form) of the project. It also helps to evaluate

expenditure related decisions which are involved in the current outflow of funds, to understand

risk and efforts, let the company control its expenditure and abstain a company from under and

over-investment.

Question 3

What are some of the commonly applied capital budgeting techniques?

Answer: Capital budgeting methods are sub-divided into two segments such as

traditional method and modern or discounting method. Under the traditional method, capital

budgeting is done by calculating the payback period, accounting rate of return, and post-payback

period. On the other hand, modern or discounting method of capital budgeting includes

calculation of net present value (NPV), internal rate of return (IRR) and profitability index.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 8

2. Analysis of Ford Motor Company and Tesla, Inc.

a. Betas of Ford Motor Company and Tesla Inc.

Betas (3 years monthly) of the above stated two companies are -

Ford Motor Company = 0.97 (finance.yahoo.com, 2019)

Tesla, Inc. = 0.03

Interpretation of Beta values

Beta stands as a measure of a company’s stock’s systematic risk or volatility compared to

the prevailing unsystematic risk in the entire market from where the company belongs. Beta

value is used to calculate the ERR (expected rate of return) of an asset under CAPM (capital

asset pricing model) and calculated the expected market return in relation to the asset.

The Beta value of Ford Motor Company, it is required to state that the stock of the

company does not swing more than the market over time and due to this, its Beta stands less than

1.0. It also represents that Ford’s stock(s) is less volatile in comparison to the market that means

investing in Ford is less risky than investing in other companies.

Similarly, the beta value of Tesla, Inc represents that the volatility of its stock is

extremely less in comparison to Ford’s stock as it stands at 0.03 and is very much more better

option for investors to invest in (finance.yahoo.com, 2019).

b. Calculation of return of stock

Formula to be used -

Here,

2. Analysis of Ford Motor Company and Tesla, Inc.

a. Betas of Ford Motor Company and Tesla Inc.

Betas (3 years monthly) of the above stated two companies are -

Ford Motor Company = 0.97 (finance.yahoo.com, 2019)

Tesla, Inc. = 0.03

Interpretation of Beta values

Beta stands as a measure of a company’s stock’s systematic risk or volatility compared to

the prevailing unsystematic risk in the entire market from where the company belongs. Beta

value is used to calculate the ERR (expected rate of return) of an asset under CAPM (capital

asset pricing model) and calculated the expected market return in relation to the asset.

The Beta value of Ford Motor Company, it is required to state that the stock of the

company does not swing more than the market over time and due to this, its Beta stands less than

1.0. It also represents that Ford’s stock(s) is less volatile in comparison to the market that means

investing in Ford is less risky than investing in other companies.

Similarly, the beta value of Tesla, Inc represents that the volatility of its stock is

extremely less in comparison to Ford’s stock as it stands at 0.03 and is very much more better

option for investors to invest in (finance.yahoo.com, 2019).

b. Calculation of return of stock

Formula to be used -

Here,

Financial Analysis 9

P0 = Initial price of stock

P1 = Ending price of stock

D = Dividend

For the calculated figure of stick return of Ford Motor Company, Refer to Appendix 1

For the calculated figure of stick return of Tesla, Inc., Refer to Appendix 2

c. Calculation of the risk of stocks

Assumptions: 20 shares to be purchased by investing USD500

For,

Ford Motor Company (for the last week of 2018)

Stock price dropped by USD 0.67

The loss or risk attached to stock due to the fall in stock price = (20*0.67) = USD13.4

Paid USD500 for purchasing 20 stocks (shares), i.e. the risk of stocks = USD (13.4/500) = 0.027

Tesla, Inc. (for the last week of 2018)

Stock price dropped by USD 28.13

The loss or risk attached to stock due to the fall in stock price = (20*28.13) = USD562.60

Paid USD500 for purchasing 20 stocks (shares), i.e. the risk of stocks = USD (562.60/500) =

1.12

P0 = Initial price of stock

P1 = Ending price of stock

D = Dividend

For the calculated figure of stick return of Ford Motor Company, Refer to Appendix 1

For the calculated figure of stick return of Tesla, Inc., Refer to Appendix 2

c. Calculation of the risk of stocks

Assumptions: 20 shares to be purchased by investing USD500

For,

Ford Motor Company (for the last week of 2018)

Stock price dropped by USD 0.67

The loss or risk attached to stock due to the fall in stock price = (20*0.67) = USD13.4

Paid USD500 for purchasing 20 stocks (shares), i.e. the risk of stocks = USD (13.4/500) = 0.027

Tesla, Inc. (for the last week of 2018)

Stock price dropped by USD 28.13

The loss or risk attached to stock due to the fall in stock price = (20*28.13) = USD562.60

Paid USD500 for purchasing 20 stocks (shares), i.e. the risk of stocks = USD (562.60/500) =

1.12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 10

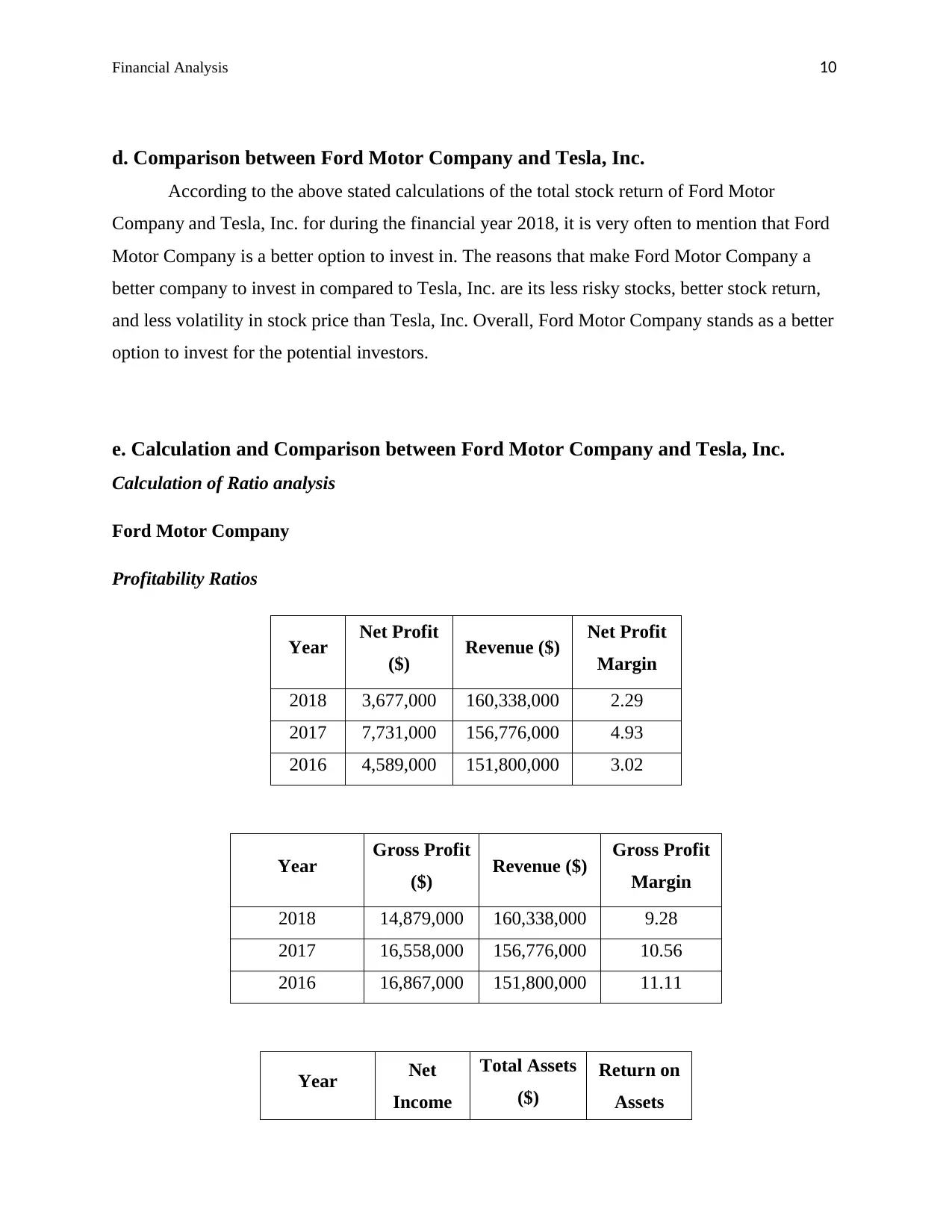

d. Comparison between Ford Motor Company and Tesla, Inc.

According to the above stated calculations of the total stock return of Ford Motor

Company and Tesla, Inc. for during the financial year 2018, it is very often to mention that Ford

Motor Company is a better option to invest in. The reasons that make Ford Motor Company a

better company to invest in compared to Tesla, Inc. are its less risky stocks, better stock return,

and less volatility in stock price than Tesla, Inc. Overall, Ford Motor Company stands as a better

option to invest for the potential investors.

e. Calculation and Comparison between Ford Motor Company and Tesla, Inc.

Calculation of Ratio analysis

Ford Motor Company

Profitability Ratios

Year Net Profit

($) Revenue ($) Net Profit

Margin

2018 3,677,000 160,338,000 2.29

2017 7,731,000 156,776,000 4.93

2016 4,589,000 151,800,000 3.02

Year Gross Profit

($) Revenue ($) Gross Profit

Margin

2018 14,879,000 160,338,000 9.28

2017 16,558,000 156,776,000 10.56

2016 16,867,000 151,800,000 11.11

Year Net

Income

Total Assets

($)

Return on

Assets

d. Comparison between Ford Motor Company and Tesla, Inc.

According to the above stated calculations of the total stock return of Ford Motor

Company and Tesla, Inc. for during the financial year 2018, it is very often to mention that Ford

Motor Company is a better option to invest in. The reasons that make Ford Motor Company a

better company to invest in compared to Tesla, Inc. are its less risky stocks, better stock return,

and less volatility in stock price than Tesla, Inc. Overall, Ford Motor Company stands as a better

option to invest for the potential investors.

e. Calculation and Comparison between Ford Motor Company and Tesla, Inc.

Calculation of Ratio analysis

Ford Motor Company

Profitability Ratios

Year Net Profit

($) Revenue ($) Net Profit

Margin

2018 3,677,000 160,338,000 2.29

2017 7,731,000 156,776,000 4.93

2016 4,589,000 151,800,000 3.02

Year Gross Profit

($) Revenue ($) Gross Profit

Margin

2018 14,879,000 160,338,000 9.28

2017 16,558,000 156,776,000 10.56

2016 16,867,000 151,800,000 11.11

Year Net

Income

Total Assets

($)

Return on

Assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 11

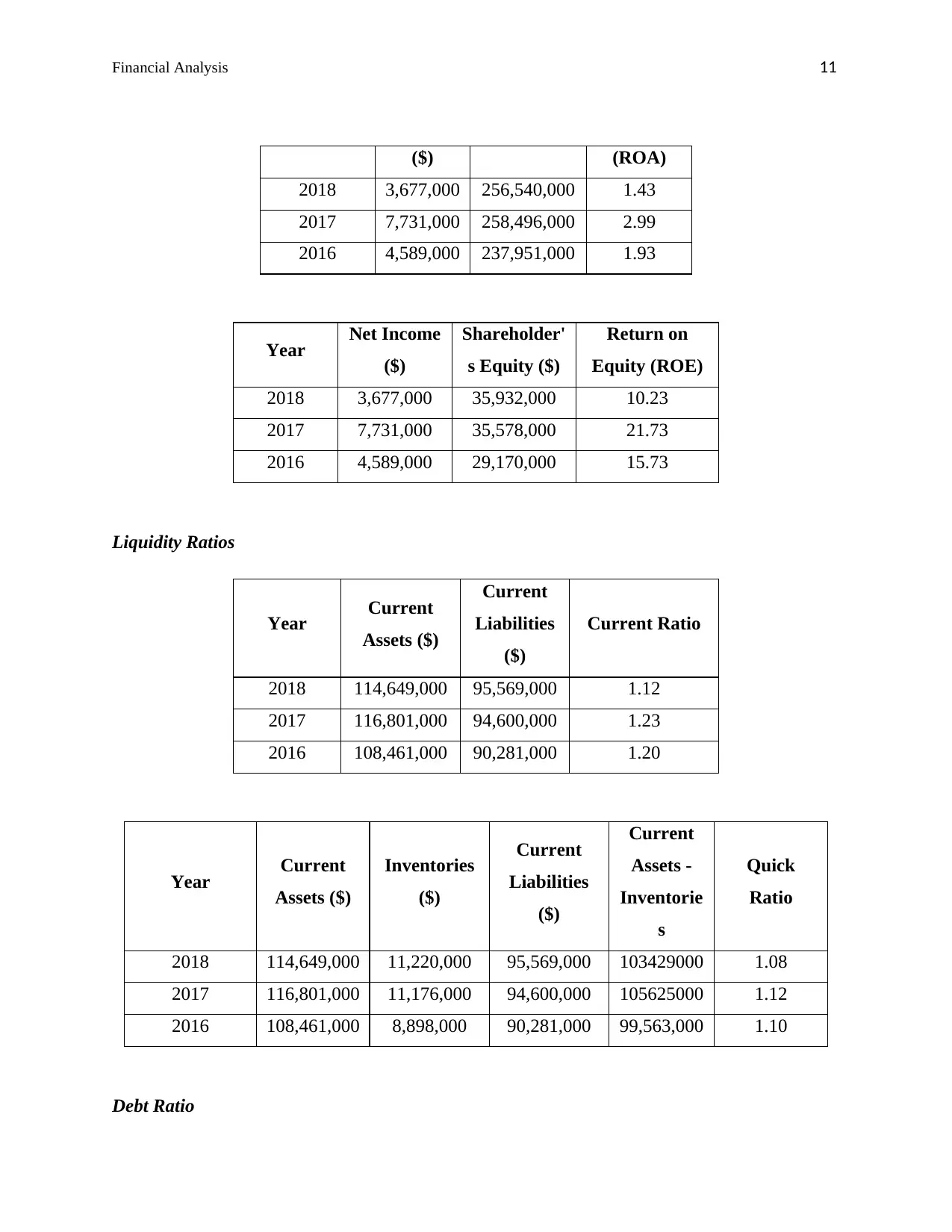

($) (ROA)

2018 3,677,000 256,540,000 1.43

2017 7,731,000 258,496,000 2.99

2016 4,589,000 237,951,000 1.93

Year Net Income

($)

Shareholder'

s Equity ($)

Return on

Equity (ROE)

2018 3,677,000 35,932,000 10.23

2017 7,731,000 35,578,000 21.73

2016 4,589,000 29,170,000 15.73

Liquidity Ratios

Year Current

Assets ($)

Current

Liabilities

($)

Current Ratio

2018 114,649,000 95,569,000 1.12

2017 116,801,000 94,600,000 1.23

2016 108,461,000 90,281,000 1.20

Year Current

Assets ($)

Inventories

($)

Current

Liabilities

($)

Current

Assets -

Inventorie

s

Quick

Ratio

2018 114,649,000 11,220,000 95,569,000 103429000 1.08

2017 116,801,000 11,176,000 94,600,000 105625000 1.12

2016 108,461,000 8,898,000 90,281,000 99,563,000 1.10

Debt Ratio

($) (ROA)

2018 3,677,000 256,540,000 1.43

2017 7,731,000 258,496,000 2.99

2016 4,589,000 237,951,000 1.93

Year Net Income

($)

Shareholder'

s Equity ($)

Return on

Equity (ROE)

2018 3,677,000 35,932,000 10.23

2017 7,731,000 35,578,000 21.73

2016 4,589,000 29,170,000 15.73

Liquidity Ratios

Year Current

Assets ($)

Current

Liabilities

($)

Current Ratio

2018 114,649,000 95,569,000 1.12

2017 116,801,000 94,600,000 1.23

2016 108,461,000 90,281,000 1.20

Year Current

Assets ($)

Inventories

($)

Current

Liabilities

($)

Current

Assets -

Inventorie

s

Quick

Ratio

2018 114,649,000 11,220,000 95,569,000 103429000 1.08

2017 116,801,000 11,176,000 94,600,000 105625000 1.12

2016 108,461,000 8,898,000 90,281,000 99,563,000 1.10

Debt Ratio

Financial Analysis 12

Year

Total

Liabilities

($)

Shareholder'

s Equity ($)

Debt to

Equity

2018 220,474,000 35,932,000 6.14

2017 222,792,000 35,578,000 6.26

2016 208,668,000 29,170,000 7.15

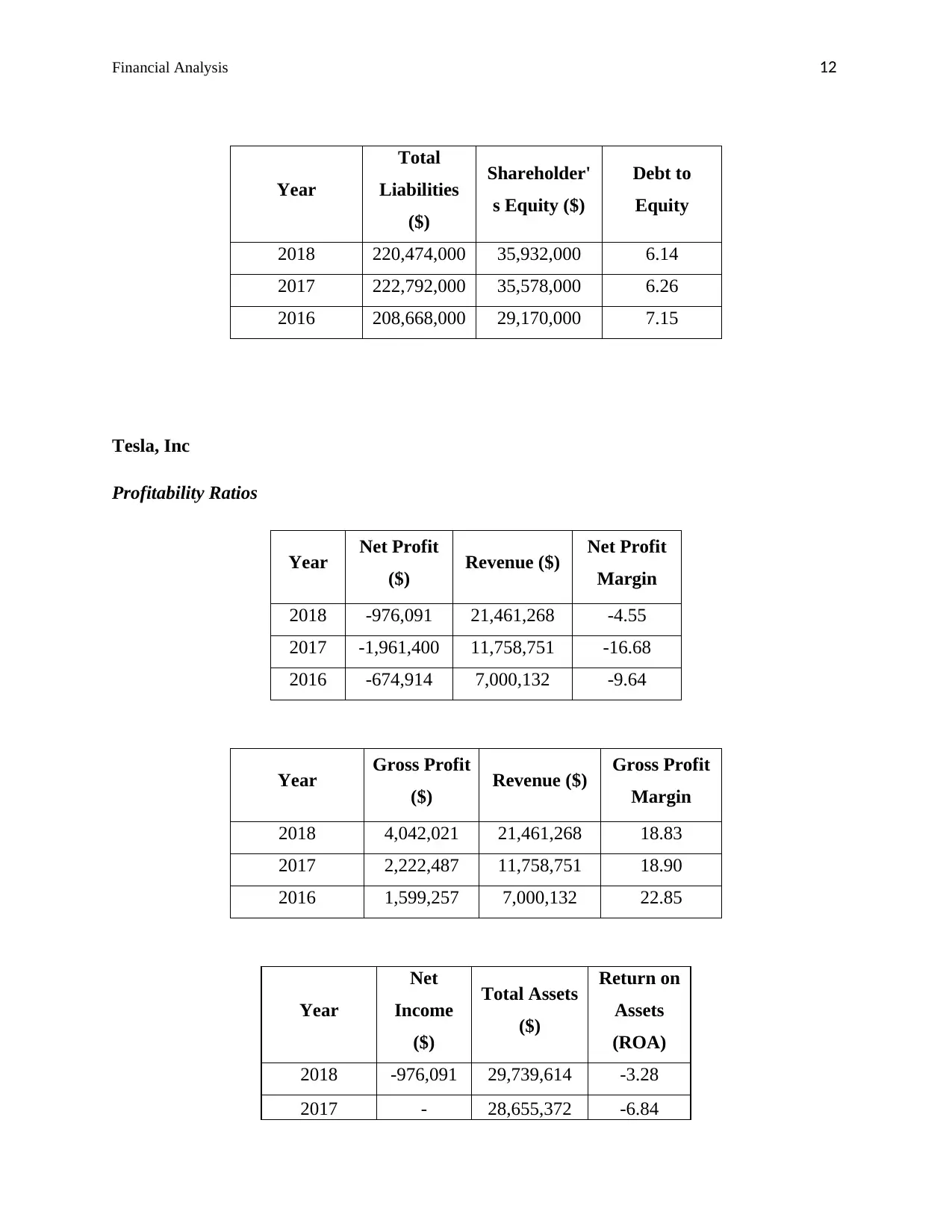

Tesla, Inc

Profitability Ratios

Year Net Profit

($) Revenue ($) Net Profit

Margin

2018 -976,091 21,461,268 -4.55

2017 -1,961,400 11,758,751 -16.68

2016 -674,914 7,000,132 -9.64

Year Gross Profit

($) Revenue ($) Gross Profit

Margin

2018 4,042,021 21,461,268 18.83

2017 2,222,487 11,758,751 18.90

2016 1,599,257 7,000,132 22.85

Year

Net

Income

($)

Total Assets

($)

Return on

Assets

(ROA)

2018 -976,091 29,739,614 -3.28

2017 - 28,655,372 -6.84

Year

Total

Liabilities

($)

Shareholder'

s Equity ($)

Debt to

Equity

2018 220,474,000 35,932,000 6.14

2017 222,792,000 35,578,000 6.26

2016 208,668,000 29,170,000 7.15

Tesla, Inc

Profitability Ratios

Year Net Profit

($) Revenue ($) Net Profit

Margin

2018 -976,091 21,461,268 -4.55

2017 -1,961,400 11,758,751 -16.68

2016 -674,914 7,000,132 -9.64

Year Gross Profit

($) Revenue ($) Gross Profit

Margin

2018 4,042,021 21,461,268 18.83

2017 2,222,487 11,758,751 18.90

2016 1,599,257 7,000,132 22.85

Year

Net

Income

($)

Total Assets

($)

Return on

Assets

(ROA)

2018 -976,091 29,739,614 -3.28

2017 - 28,655,372 -6.84

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.