Financial Performance Analysis: Apple Inc. vs. Samsung Electronics

VerifiedAdded on 2020/10/22

|21

|3948

|433

Report

AI Summary

This report presents a comprehensive financial analysis of Apple Inc. and Samsung Electronics, two leading companies in the electronics manufacturing industry. The analysis begins with an introduction to financial analysis and its importance in evaluating a company's performance. The report then delves into a detailed comparison of the financial performance and position of both companies, including ratio analyses of profitability, solvency, and liquidity. Horizontal and vertical analyses are performed to evaluate trends and relative changes in financial metrics over the years. The profitability ratios are used to determine the profit-making ability of the companies, the solvency ratios are used to determine the long-term debt-paying ability, and the liquidity ratios are used to determine the capacity to pay short-term debts. The horizontal analysis compares historical data over multiple accounting years, while the vertical analysis evaluates relative changes in profitability and expenditures. The report also includes a critical analysis of CSR sections over the last couple of years. The findings provide insights into the strengths and weaknesses of both companies, offering a comparative view of their financial health.

Financial Analysis

Management & Enterprise

Management & Enterprise

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1(A).......................................................................................................................................1

1.1: Comparison of financial Performance and Financial position of given companies........1

Horizontal analyses of Samsung Electronics:........................................................................6

Vertical analyses of Samsung Electronics:............................................................................6

Horizontal analyses of Apple:..............................................................................................10

Vertical analyses of Apple: ................................................................................................10

TASK 2..........................................................................................................................................11

2.1: Critical analysis of CSR sections over the last couple of years....................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

APPENDIX....................................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1(A).......................................................................................................................................1

1.1: Comparison of financial Performance and Financial position of given companies........1

Horizontal analyses of Samsung Electronics:........................................................................6

Vertical analyses of Samsung Electronics:............................................................................6

Horizontal analyses of Apple:..............................................................................................10

Vertical analyses of Apple: ................................................................................................10

TASK 2..........................................................................................................................................11

2.1: Critical analysis of CSR sections over the last couple of years....................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

APPENDIX....................................................................................................................................16

INTRODUCTION

Financial analyses is the process of evaluating business statements of an organisation

which helps in ascertaining a true and fair position of a company. In this project report, financial

analyses of two companies are conducted which are Apple Inc. and Samsung electronics. Both

the companies are engaged in manufacturing electronics such as smartphones, tablets etc. Due to

the competitive environment between these two companies, various analyses are conducted.

Ratio analyses is performed to ascertain various profitability and liquidity of the companies.

Horizontal analyses is performed to determine most challenging year by considering a period as

the base year and vertical analyses is performed to evaluate most challenging and profitable year

by calculating percentages of various costs and incomes involved in the organisation.

In this project report, various financial analyses of above mentioned companies are

conducted in order to evaluate strengths and weaknesses of both the companies.

TASK 1(A)

1.1: Comparison of financial Performance and Financial position of given companies

Samsung company:

Samsung is a multinational company which deals mainly in electronics, textiles,

insurance etc. and has headquarters in Seoul. Founded in 1938. Samsung electronics is a

telecommunication company which has 220 subsidiaries which generates annual revenue of

around 220 trillion euros. Product range of Samsung includes printers, computers, smartphones,

televisions, refrigerators, tablets, air conditioners and many more. The mission of this company

is to produce innovative products which can improve standard of living of their consumers.

Samsung has the major market share in the field of smartphones along with which it is

considered as the world's largest manufacturer of television. The new vision statement of

Samsung electronics is “Inspire the world, create the future” which focuses on growing their

strengths such as new technology and innovative products (Chapman, 2011).

Ratio analysis of Samsung Electronics:

Ratio analyses is a tool which is used to analyse financial position of an organisation.

Here, ratio analyses of Samsung is conducted in order to identify their profitability, solvency and

liquidity so that a true and fair picture can be framed. Various ratios with their interpretations are

discussed below:

1

Financial analyses is the process of evaluating business statements of an organisation

which helps in ascertaining a true and fair position of a company. In this project report, financial

analyses of two companies are conducted which are Apple Inc. and Samsung electronics. Both

the companies are engaged in manufacturing electronics such as smartphones, tablets etc. Due to

the competitive environment between these two companies, various analyses are conducted.

Ratio analyses is performed to ascertain various profitability and liquidity of the companies.

Horizontal analyses is performed to determine most challenging year by considering a period as

the base year and vertical analyses is performed to evaluate most challenging and profitable year

by calculating percentages of various costs and incomes involved in the organisation.

In this project report, various financial analyses of above mentioned companies are

conducted in order to evaluate strengths and weaknesses of both the companies.

TASK 1(A)

1.1: Comparison of financial Performance and Financial position of given companies

Samsung company:

Samsung is a multinational company which deals mainly in electronics, textiles,

insurance etc. and has headquarters in Seoul. Founded in 1938. Samsung electronics is a

telecommunication company which has 220 subsidiaries which generates annual revenue of

around 220 trillion euros. Product range of Samsung includes printers, computers, smartphones,

televisions, refrigerators, tablets, air conditioners and many more. The mission of this company

is to produce innovative products which can improve standard of living of their consumers.

Samsung has the major market share in the field of smartphones along with which it is

considered as the world's largest manufacturer of television. The new vision statement of

Samsung electronics is “Inspire the world, create the future” which focuses on growing their

strengths such as new technology and innovative products (Chapman, 2011).

Ratio analysis of Samsung Electronics:

Ratio analyses is a tool which is used to analyse financial position of an organisation.

Here, ratio analyses of Samsung is conducted in order to identify their profitability, solvency and

liquidity so that a true and fair picture can be framed. Various ratios with their interpretations are

discussed below:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

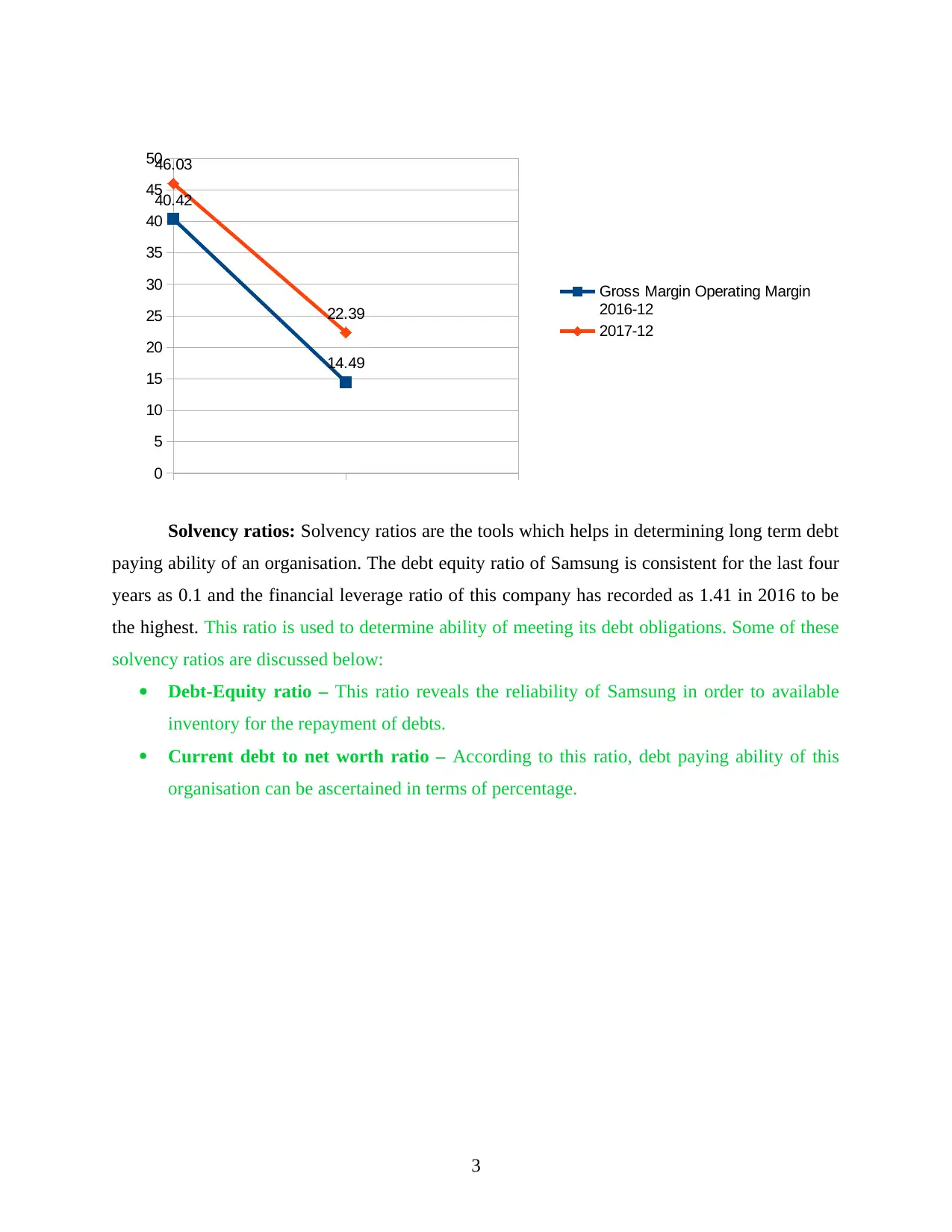

Profitability ratios: These ratios reflects profit making ability of an organisation. From

the below ratios, it can be said that Samsung's gross profit margin is way higher than operating

profit margin and net profit margin due to the cost which is involved in the activities of this

company such as research and developmental activities. Highest gross profit margin of this

company was 46% in the year 2017 and highest operating profit margin was 22.39% in the year

2017.

A higher profitability ratio reflects high revenue generating power of the company, These

ratios are used to analyse comparison between companies or comparison between past years.

There are various types of profitability ratios and some of them are discussed below:

Operating ratio – This ratio is used to determine earnings of an organisation in

percentage. Companies with high profit margin are considered to be highly capable of

paying fixed costs and other debt obligations. This helps in assessing strength of the

company.

Gross margin – This ratio is used here to compare gross profit of Samsung to sales

revenue of Samsung. This ratio reflects earning power by accounting all the cost involved

in the production of goods and services. Higher the gross profit, higher the efficiency of

Samsung.

Net profit margin – This ratio expresses comparison between operating activities of

Samsung and sales revenue of the Samsung. It helps in measuring the ability of company

to covert their sales into cash. Higher net profit margin means higher cash available in the

organisation. Managing this ratio considered as the most complex and complicated task

for an organisation.

2

the below ratios, it can be said that Samsung's gross profit margin is way higher than operating

profit margin and net profit margin due to the cost which is involved in the activities of this

company such as research and developmental activities. Highest gross profit margin of this

company was 46% in the year 2017 and highest operating profit margin was 22.39% in the year

2017.

A higher profitability ratio reflects high revenue generating power of the company, These

ratios are used to analyse comparison between companies or comparison between past years.

There are various types of profitability ratios and some of them are discussed below:

Operating ratio – This ratio is used to determine earnings of an organisation in

percentage. Companies with high profit margin are considered to be highly capable of

paying fixed costs and other debt obligations. This helps in assessing strength of the

company.

Gross margin – This ratio is used here to compare gross profit of Samsung to sales

revenue of Samsung. This ratio reflects earning power by accounting all the cost involved

in the production of goods and services. Higher the gross profit, higher the efficiency of

Samsung.

Net profit margin – This ratio expresses comparison between operating activities of

Samsung and sales revenue of the Samsung. It helps in measuring the ability of company

to covert their sales into cash. Higher net profit margin means higher cash available in the

organisation. Managing this ratio considered as the most complex and complicated task

for an organisation.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0

5

10

15

20

25

30

35

40

45

50

40.42

14.49

46.03

22.39

Gross Margin Operating Margin

2016-12

2017-12

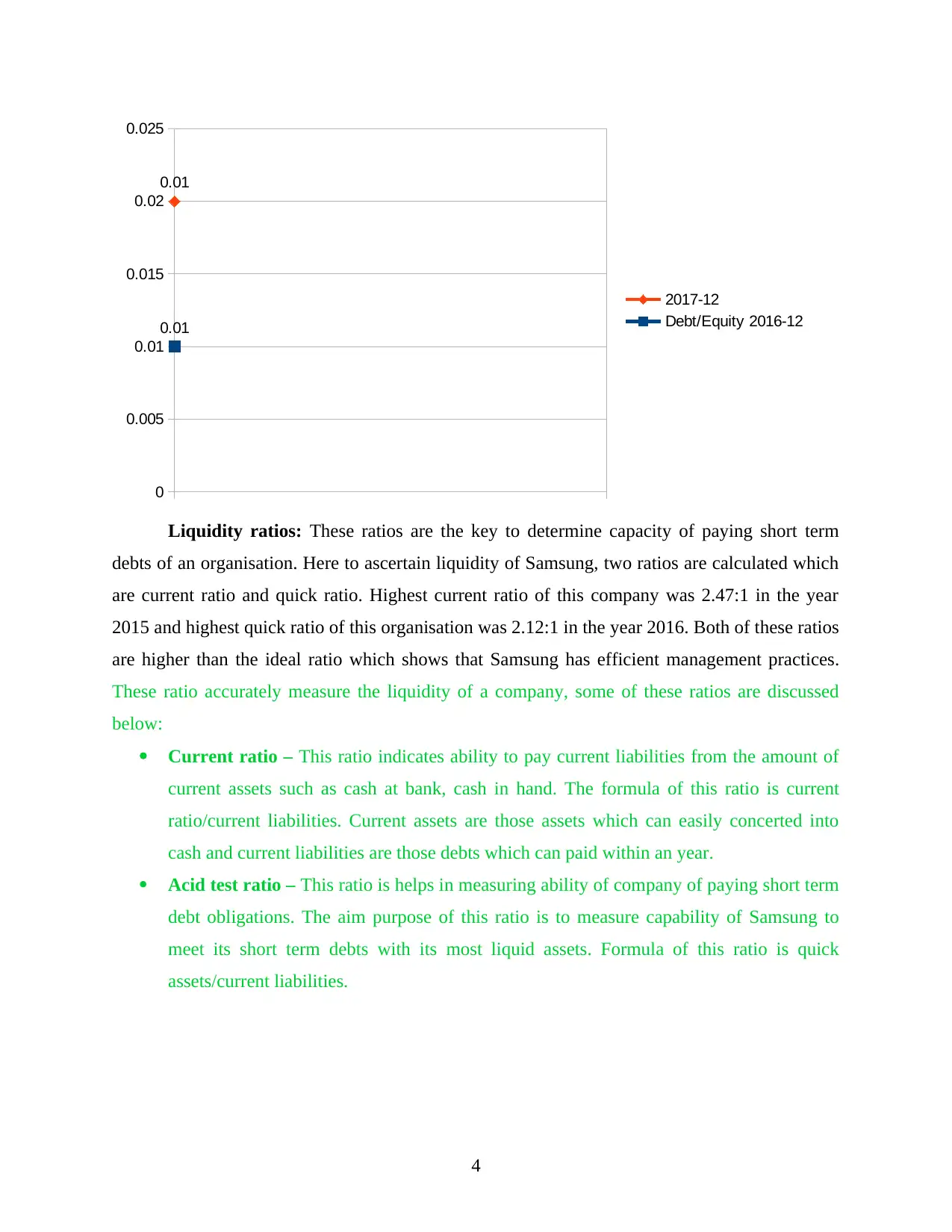

Solvency ratios: Solvency ratios are the tools which helps in determining long term debt

paying ability of an organisation. The debt equity ratio of Samsung is consistent for the last four

years as 0.1 and the financial leverage ratio of this company has recorded as 1.41 in 2016 to be

the highest. This ratio is used to determine ability of meeting its debt obligations. Some of these

solvency ratios are discussed below:

Debt-Equity ratio – This ratio reveals the reliability of Samsung in order to available

inventory for the repayment of debts.

Current debt to net worth ratio – According to this ratio, debt paying ability of this

organisation can be ascertained in terms of percentage.

3

5

10

15

20

25

30

35

40

45

50

40.42

14.49

46.03

22.39

Gross Margin Operating Margin

2016-12

2017-12

Solvency ratios: Solvency ratios are the tools which helps in determining long term debt

paying ability of an organisation. The debt equity ratio of Samsung is consistent for the last four

years as 0.1 and the financial leverage ratio of this company has recorded as 1.41 in 2016 to be

the highest. This ratio is used to determine ability of meeting its debt obligations. Some of these

solvency ratios are discussed below:

Debt-Equity ratio – This ratio reveals the reliability of Samsung in order to available

inventory for the repayment of debts.

Current debt to net worth ratio – According to this ratio, debt paying ability of this

organisation can be ascertained in terms of percentage.

3

0

0.005

0.01

0.015

0.02

0.025

0.01

0.01

2017-12

Debt/Equity 2016-12

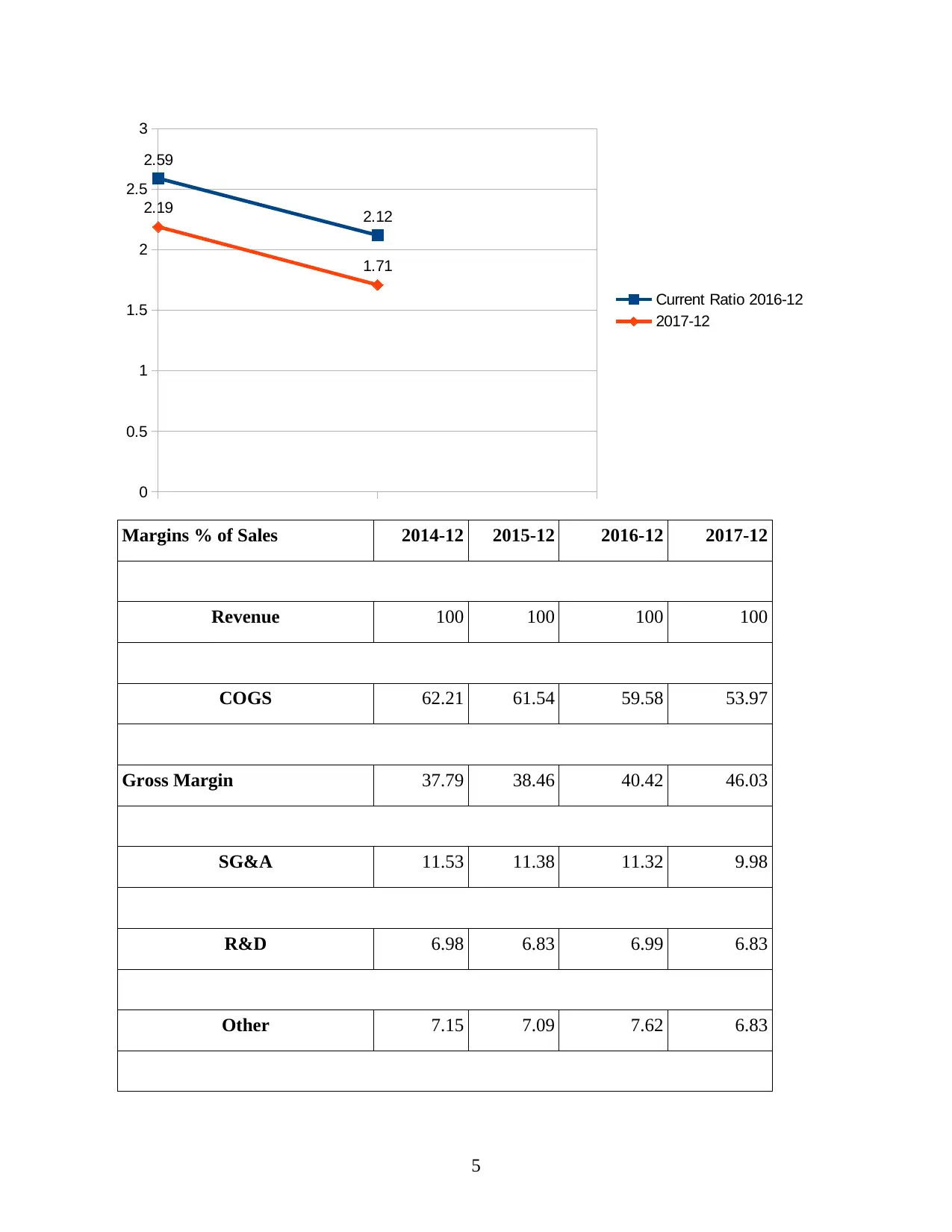

Liquidity ratios: These ratios are the key to determine capacity of paying short term

debts of an organisation. Here to ascertain liquidity of Samsung, two ratios are calculated which

are current ratio and quick ratio. Highest current ratio of this company was 2.47:1 in the year

2015 and highest quick ratio of this organisation was 2.12:1 in the year 2016. Both of these ratios

are higher than the ideal ratio which shows that Samsung has efficient management practices.

These ratio accurately measure the liquidity of a company, some of these ratios are discussed

below:

Current ratio – This ratio indicates ability to pay current liabilities from the amount of

current assets such as cash at bank, cash in hand. The formula of this ratio is current

ratio/current liabilities. Current assets are those assets which can easily concerted into

cash and current liabilities are those debts which can paid within an year.

Acid test ratio – This ratio is helps in measuring ability of company of paying short term

debt obligations. The aim purpose of this ratio is to measure capability of Samsung to

meet its short term debts with its most liquid assets. Formula of this ratio is quick

assets/current liabilities.

4

0.005

0.01

0.015

0.02

0.025

0.01

0.01

2017-12

Debt/Equity 2016-12

Liquidity ratios: These ratios are the key to determine capacity of paying short term

debts of an organisation. Here to ascertain liquidity of Samsung, two ratios are calculated which

are current ratio and quick ratio. Highest current ratio of this company was 2.47:1 in the year

2015 and highest quick ratio of this organisation was 2.12:1 in the year 2016. Both of these ratios

are higher than the ideal ratio which shows that Samsung has efficient management practices.

These ratio accurately measure the liquidity of a company, some of these ratios are discussed

below:

Current ratio – This ratio indicates ability to pay current liabilities from the amount of

current assets such as cash at bank, cash in hand. The formula of this ratio is current

ratio/current liabilities. Current assets are those assets which can easily concerted into

cash and current liabilities are those debts which can paid within an year.

Acid test ratio – This ratio is helps in measuring ability of company of paying short term

debt obligations. The aim purpose of this ratio is to measure capability of Samsung to

meet its short term debts with its most liquid assets. Formula of this ratio is quick

assets/current liabilities.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0

0.5

1

1.5

2

2.5

3

2.59

2.12

2.19

1.71

Current Ratio 2016-12

2017-12

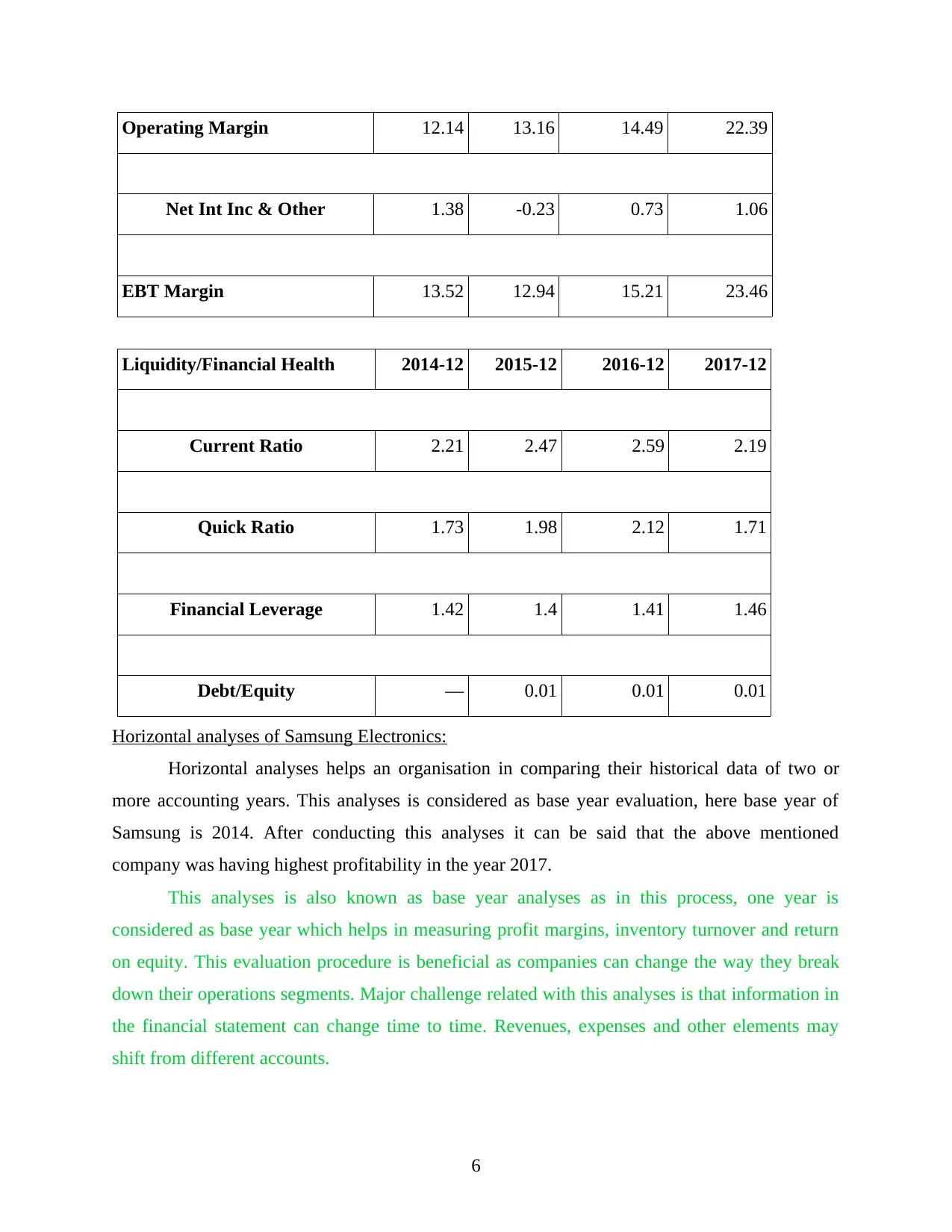

Margins % of Sales 2014-12 2015-12 2016-12 2017-12

Revenue 100 100 100 100

COGS 62.21 61.54 59.58 53.97

Gross Margin 37.79 38.46 40.42 46.03

SG&A 11.53 11.38 11.32 9.98

R&D 6.98 6.83 6.99 6.83

Other 7.15 7.09 7.62 6.83

5

0.5

1

1.5

2

2.5

3

2.59

2.12

2.19

1.71

Current Ratio 2016-12

2017-12

Margins % of Sales 2014-12 2015-12 2016-12 2017-12

Revenue 100 100 100 100

COGS 62.21 61.54 59.58 53.97

Gross Margin 37.79 38.46 40.42 46.03

SG&A 11.53 11.38 11.32 9.98

R&D 6.98 6.83 6.99 6.83

Other 7.15 7.09 7.62 6.83

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Operating Margin 12.14 13.16 14.49 22.39

Net Int Inc & Other 1.38 -0.23 0.73 1.06

EBT Margin 13.52 12.94 15.21 23.46

Liquidity/Financial Health 2014-12 2015-12 2016-12 2017-12

Current Ratio 2.21 2.47 2.59 2.19

Quick Ratio 1.73 1.98 2.12 1.71

Financial Leverage 1.42 1.4 1.41 1.46

Debt/Equity — 0.01 0.01 0.01

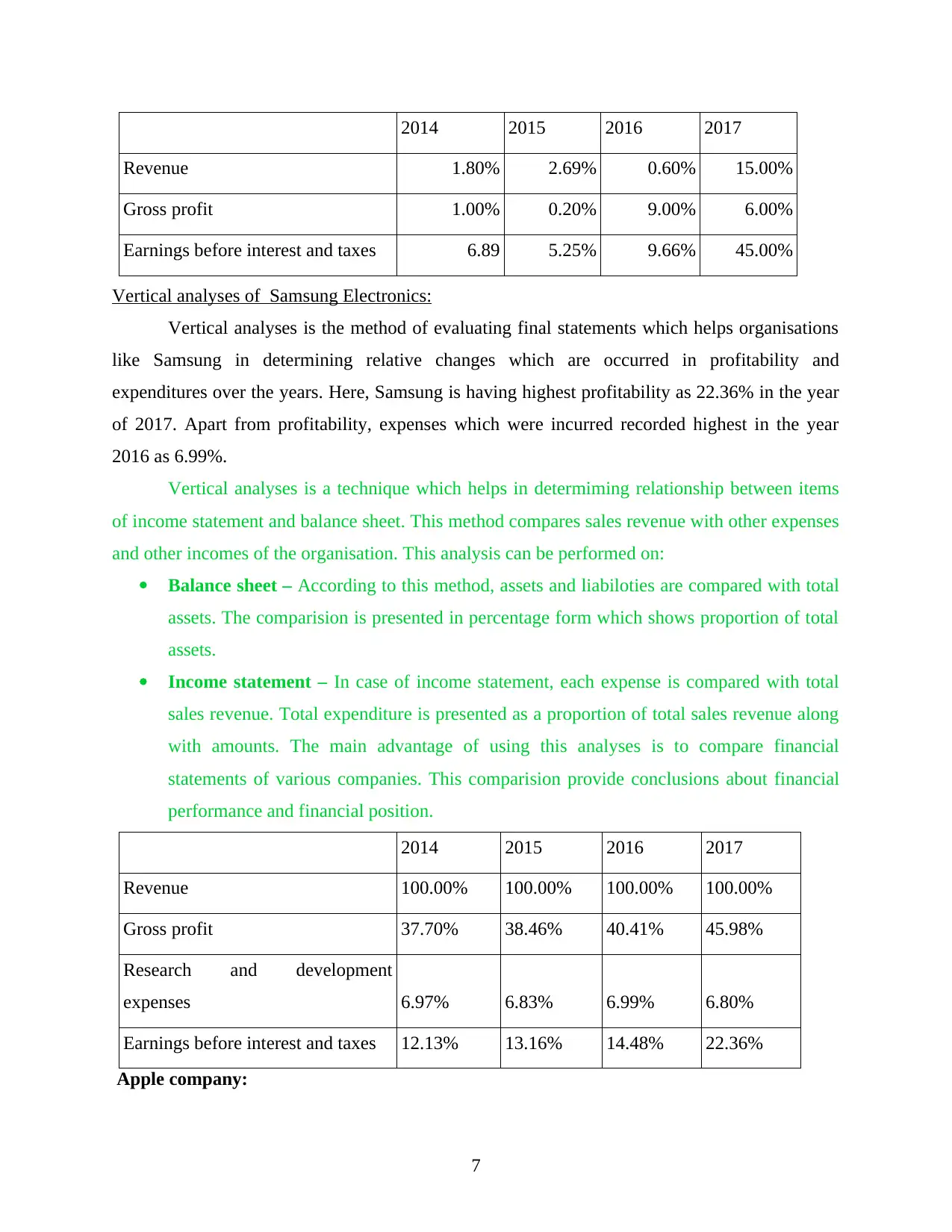

Horizontal analyses of Samsung Electronics:

Horizontal analyses helps an organisation in comparing their historical data of two or

more accounting years. This analyses is considered as base year evaluation, here base year of

Samsung is 2014. After conducting this analyses it can be said that the above mentioned

company was having highest profitability in the year 2017.

This analyses is also known as base year analyses as in this process, one year is

considered as base year which helps in measuring profit margins, inventory turnover and return

on equity. This evaluation procedure is beneficial as companies can change the way they break

down their operations segments. Major challenge related with this analyses is that information in

the financial statement can change time to time. Revenues, expenses and other elements may

shift from different accounts.

6

Net Int Inc & Other 1.38 -0.23 0.73 1.06

EBT Margin 13.52 12.94 15.21 23.46

Liquidity/Financial Health 2014-12 2015-12 2016-12 2017-12

Current Ratio 2.21 2.47 2.59 2.19

Quick Ratio 1.73 1.98 2.12 1.71

Financial Leverage 1.42 1.4 1.41 1.46

Debt/Equity — 0.01 0.01 0.01

Horizontal analyses of Samsung Electronics:

Horizontal analyses helps an organisation in comparing their historical data of two or

more accounting years. This analyses is considered as base year evaluation, here base year of

Samsung is 2014. After conducting this analyses it can be said that the above mentioned

company was having highest profitability in the year 2017.

This analyses is also known as base year analyses as in this process, one year is

considered as base year which helps in measuring profit margins, inventory turnover and return

on equity. This evaluation procedure is beneficial as companies can change the way they break

down their operations segments. Major challenge related with this analyses is that information in

the financial statement can change time to time. Revenues, expenses and other elements may

shift from different accounts.

6

2014 2015 2016 2017

Revenue 1.80% 2.69% 0.60% 15.00%

Gross profit 1.00% 0.20% 9.00% 6.00%

Earnings before interest and taxes 6.89 5.25% 9.66% 45.00%

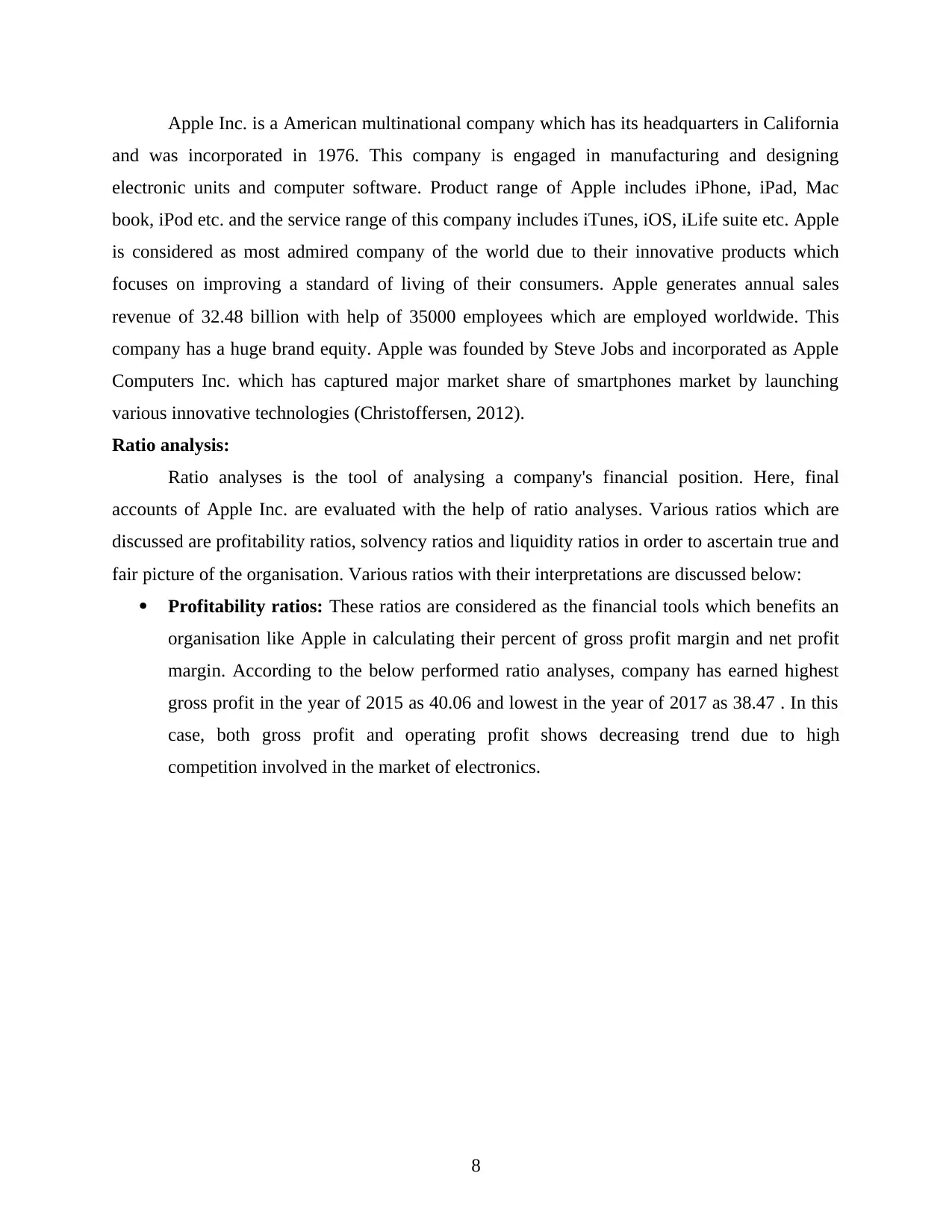

Vertical analyses of Samsung Electronics:

Vertical analyses is the method of evaluating final statements which helps organisations

like Samsung in determining relative changes which are occurred in profitability and

expenditures over the years. Here, Samsung is having highest profitability as 22.36% in the year

of 2017. Apart from profitability, expenses which were incurred recorded highest in the year

2016 as 6.99%.

Vertical analyses is a technique which helps in determiming relationship between items

of income statement and balance sheet. This method compares sales revenue with other expenses

and other incomes of the organisation. This analysis can be performed on:

Balance sheet – According to this method, assets and liabiloties are compared with total

assets. The comparision is presented in percentage form which shows proportion of total

assets.

Income statement – In case of income statement, each expense is compared with total

sales revenue. Total expenditure is presented as a proportion of total sales revenue along

with amounts. The main advantage of using this analyses is to compare financial

statements of various companies. This comparision provide conclusions about financial

performance and financial position.

2014 2015 2016 2017

Revenue 100.00% 100.00% 100.00% 100.00%

Gross profit 37.70% 38.46% 40.41% 45.98%

Research and development

expenses 6.97% 6.83% 6.99% 6.80%

Earnings before interest and taxes 12.13% 13.16% 14.48% 22.36%

Apple company:

7

Revenue 1.80% 2.69% 0.60% 15.00%

Gross profit 1.00% 0.20% 9.00% 6.00%

Earnings before interest and taxes 6.89 5.25% 9.66% 45.00%

Vertical analyses of Samsung Electronics:

Vertical analyses is the method of evaluating final statements which helps organisations

like Samsung in determining relative changes which are occurred in profitability and

expenditures over the years. Here, Samsung is having highest profitability as 22.36% in the year

of 2017. Apart from profitability, expenses which were incurred recorded highest in the year

2016 as 6.99%.

Vertical analyses is a technique which helps in determiming relationship between items

of income statement and balance sheet. This method compares sales revenue with other expenses

and other incomes of the organisation. This analysis can be performed on:

Balance sheet – According to this method, assets and liabiloties are compared with total

assets. The comparision is presented in percentage form which shows proportion of total

assets.

Income statement – In case of income statement, each expense is compared with total

sales revenue. Total expenditure is presented as a proportion of total sales revenue along

with amounts. The main advantage of using this analyses is to compare financial

statements of various companies. This comparision provide conclusions about financial

performance and financial position.

2014 2015 2016 2017

Revenue 100.00% 100.00% 100.00% 100.00%

Gross profit 37.70% 38.46% 40.41% 45.98%

Research and development

expenses 6.97% 6.83% 6.99% 6.80%

Earnings before interest and taxes 12.13% 13.16% 14.48% 22.36%

Apple company:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Apple Inc. is a American multinational company which has its headquarters in California

and was incorporated in 1976. This company is engaged in manufacturing and designing

electronic units and computer software. Product range of Apple includes iPhone, iPad, Mac

book, iPod etc. and the service range of this company includes iTunes, iOS, iLife suite etc. Apple

is considered as most admired company of the world due to their innovative products which

focuses on improving a standard of living of their consumers. Apple generates annual sales

revenue of 32.48 billion with help of 35000 employees which are employed worldwide. This

company has a huge brand equity. Apple was founded by Steve Jobs and incorporated as Apple

Computers Inc. which has captured major market share of smartphones market by launching

various innovative technologies (Christoffersen, 2012).

Ratio analysis:

Ratio analyses is the tool of analysing a company's financial position. Here, final

accounts of Apple Inc. are evaluated with the help of ratio analyses. Various ratios which are

discussed are profitability ratios, solvency ratios and liquidity ratios in order to ascertain true and

fair picture of the organisation. Various ratios with their interpretations are discussed below:

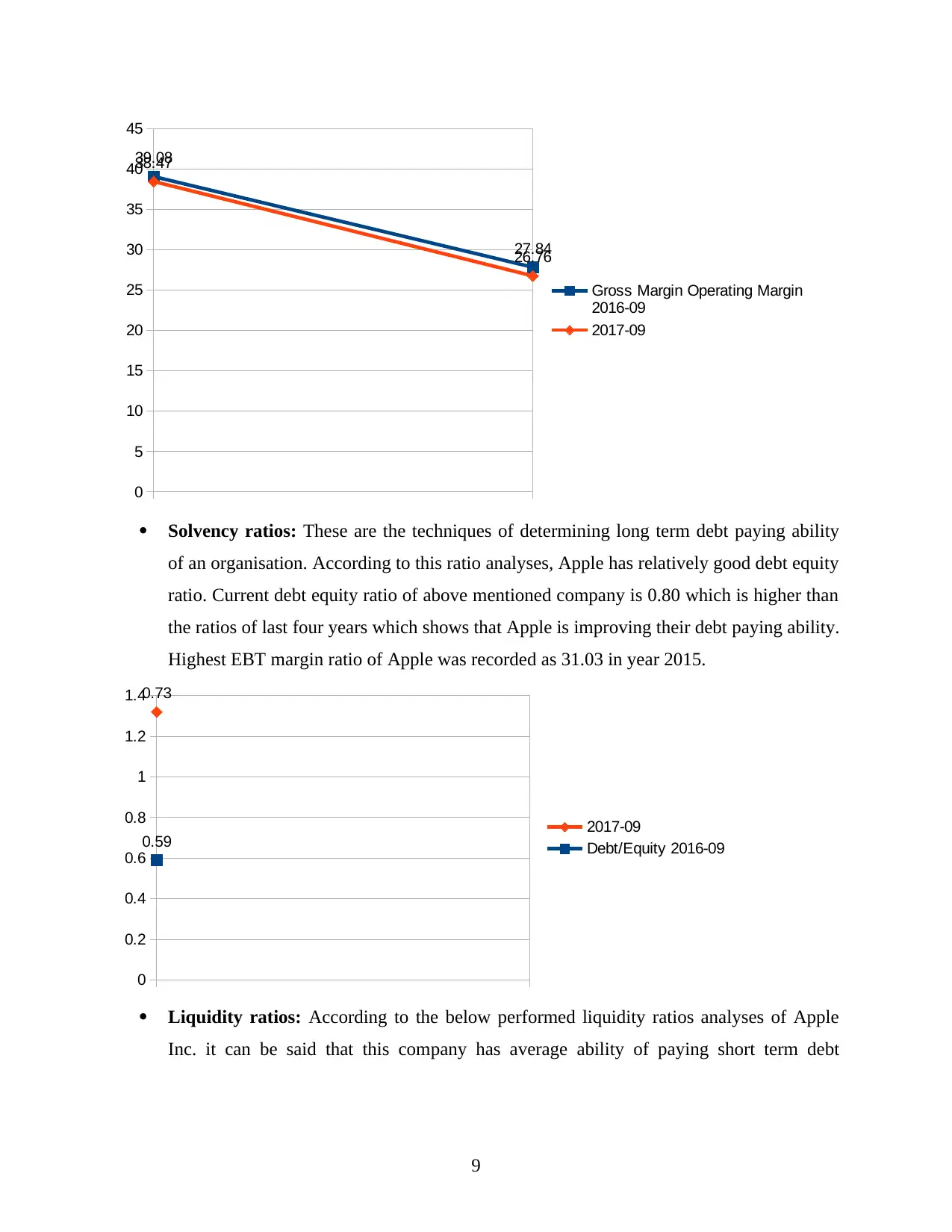

Profitability ratios: These ratios are considered as the financial tools which benefits an

organisation like Apple in calculating their percent of gross profit margin and net profit

margin. According to the below performed ratio analyses, company has earned highest

gross profit in the year of 2015 as 40.06 and lowest in the year of 2017 as 38.47 . In this

case, both gross profit and operating profit shows decreasing trend due to high

competition involved in the market of electronics.

8

and was incorporated in 1976. This company is engaged in manufacturing and designing

electronic units and computer software. Product range of Apple includes iPhone, iPad, Mac

book, iPod etc. and the service range of this company includes iTunes, iOS, iLife suite etc. Apple

is considered as most admired company of the world due to their innovative products which

focuses on improving a standard of living of their consumers. Apple generates annual sales

revenue of 32.48 billion with help of 35000 employees which are employed worldwide. This

company has a huge brand equity. Apple was founded by Steve Jobs and incorporated as Apple

Computers Inc. which has captured major market share of smartphones market by launching

various innovative technologies (Christoffersen, 2012).

Ratio analysis:

Ratio analyses is the tool of analysing a company's financial position. Here, final

accounts of Apple Inc. are evaluated with the help of ratio analyses. Various ratios which are

discussed are profitability ratios, solvency ratios and liquidity ratios in order to ascertain true and

fair picture of the organisation. Various ratios with their interpretations are discussed below:

Profitability ratios: These ratios are considered as the financial tools which benefits an

organisation like Apple in calculating their percent of gross profit margin and net profit

margin. According to the below performed ratio analyses, company has earned highest

gross profit in the year of 2015 as 40.06 and lowest in the year of 2017 as 38.47 . In this

case, both gross profit and operating profit shows decreasing trend due to high

competition involved in the market of electronics.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0

5

10

15

20

25

30

35

40

45

39.08

27.84

38.47

26.76

Gross Margin Operating Margin

2016-09

2017-09

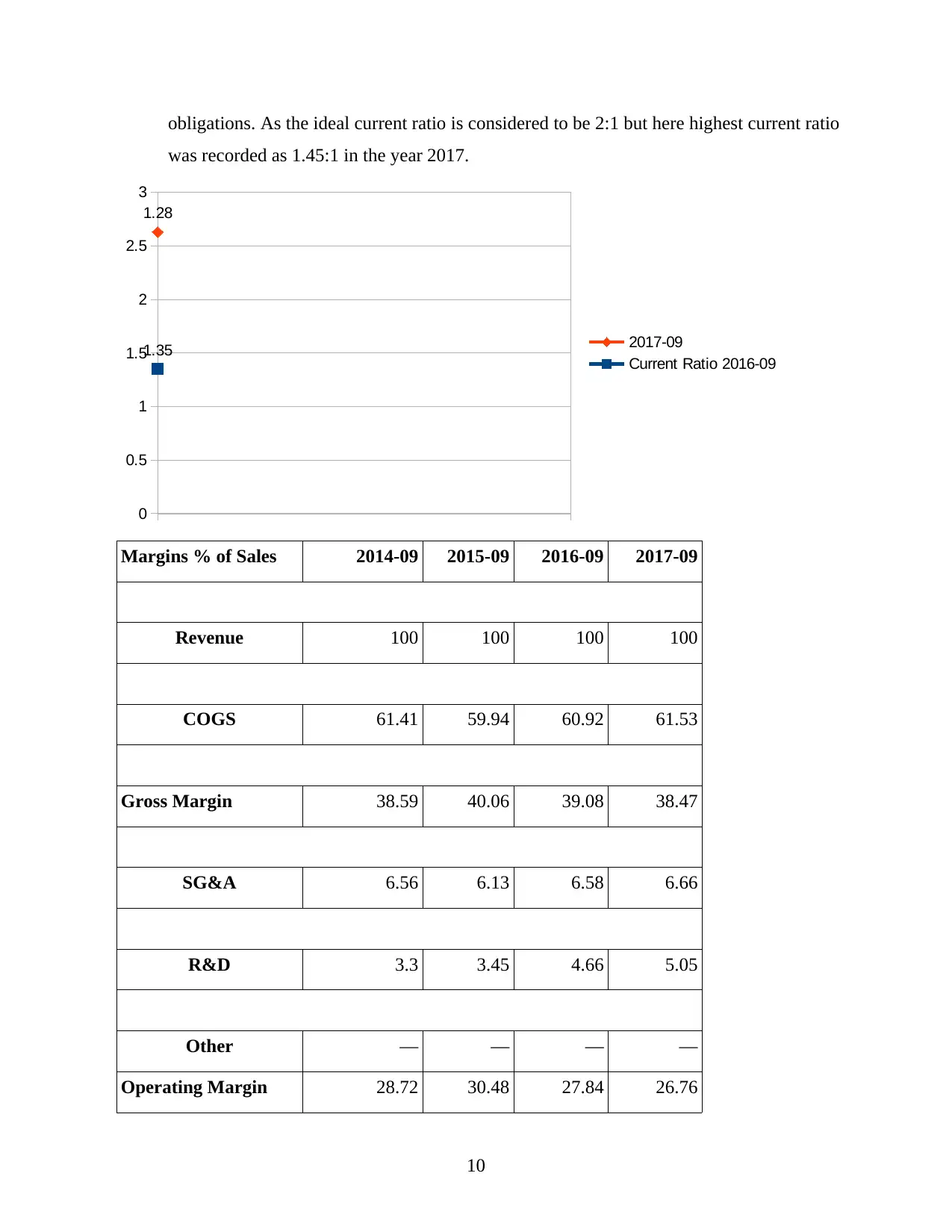

Solvency ratios: These are the techniques of determining long term debt paying ability

of an organisation. According to this ratio analyses, Apple has relatively good debt equity

ratio. Current debt equity ratio of above mentioned company is 0.80 which is higher than

the ratios of last four years which shows that Apple is improving their debt paying ability.

Highest EBT margin ratio of Apple was recorded as 31.03 in year 2015.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

0.59

0.73

2017-09

Debt/Equity 2016-09

Liquidity ratios: According to the below performed liquidity ratios analyses of Apple

Inc. it can be said that this company has average ability of paying short term debt

9

5

10

15

20

25

30

35

40

45

39.08

27.84

38.47

26.76

Gross Margin Operating Margin

2016-09

2017-09

Solvency ratios: These are the techniques of determining long term debt paying ability

of an organisation. According to this ratio analyses, Apple has relatively good debt equity

ratio. Current debt equity ratio of above mentioned company is 0.80 which is higher than

the ratios of last four years which shows that Apple is improving their debt paying ability.

Highest EBT margin ratio of Apple was recorded as 31.03 in year 2015.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

0.59

0.73

2017-09

Debt/Equity 2016-09

Liquidity ratios: According to the below performed liquidity ratios analyses of Apple

Inc. it can be said that this company has average ability of paying short term debt

9

obligations. As the ideal current ratio is considered to be 2:1 but here highest current ratio

was recorded as 1.45:1 in the year 2017.

0

0.5

1

1.5

2

2.5

3

1.35

1.28

2017-09

Current Ratio 2016-09

Margins % of Sales 2014-09 2015-09 2016-09 2017-09

Revenue 100 100 100 100

COGS 61.41 59.94 60.92 61.53

Gross Margin 38.59 40.06 39.08 38.47

SG&A 6.56 6.13 6.58 6.66

R&D 3.3 3.45 4.66 5.05

Other — — — —

Operating Margin 28.72 30.48 27.84 26.76

10

was recorded as 1.45:1 in the year 2017.

0

0.5

1

1.5

2

2.5

3

1.35

1.28

2017-09

Current Ratio 2016-09

Margins % of Sales 2014-09 2015-09 2016-09 2017-09

Revenue 100 100 100 100

COGS 61.41 59.94 60.92 61.53

Gross Margin 38.59 40.06 39.08 38.47

SG&A 6.56 6.13 6.58 6.66

R&D 3.3 3.45 4.66 5.05

Other — — — —

Operating Margin 28.72 30.48 27.84 26.76

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.