(Sample) Financial Analysis Assignment

VerifiedAdded on 2021/06/17

|16

|2252

|20

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL ANALYSIS

Financial Analysis

Name of the Student:

Name of the University:

Authors Note:

Financial Analysis

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS

1

Table of Contents

1. Evaluating performance of the company and analysing its financial health, while

explaining the variations in the financial over time:..................................................................2

2. Analysing the financial ratio performance across companies, while identifying the weak

and strong areas of performance:...............................................................................................5

3. Stating the suggestions for improvement for each company:..............................................13

4. Stating whether it is a better company to buy shares from:.................................................14

5. Stating the company considered for investment:.................................................................14

6. Stating the company considered to lead:..............................................................................14

References:...............................................................................................................................15

1

Table of Contents

1. Evaluating performance of the company and analysing its financial health, while

explaining the variations in the financial over time:..................................................................2

2. Analysing the financial ratio performance across companies, while identifying the weak

and strong areas of performance:...............................................................................................5

3. Stating the suggestions for improvement for each company:..............................................13

4. Stating whether it is a better company to buy shares from:.................................................14

5. Stating the company considered for investment:.................................................................14

6. Stating the company considered to lead:..............................................................................14

References:...............................................................................................................................15

FINANCIAL ANALYSIS

2

1. Evaluating performance of the company and analysing its financial health, while

explaining the variations in the financial over time:

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

10

20

30

40

50

60

70

80

90

Gross Margin %

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-5

0

5

10

15

20

25

Net Margin %

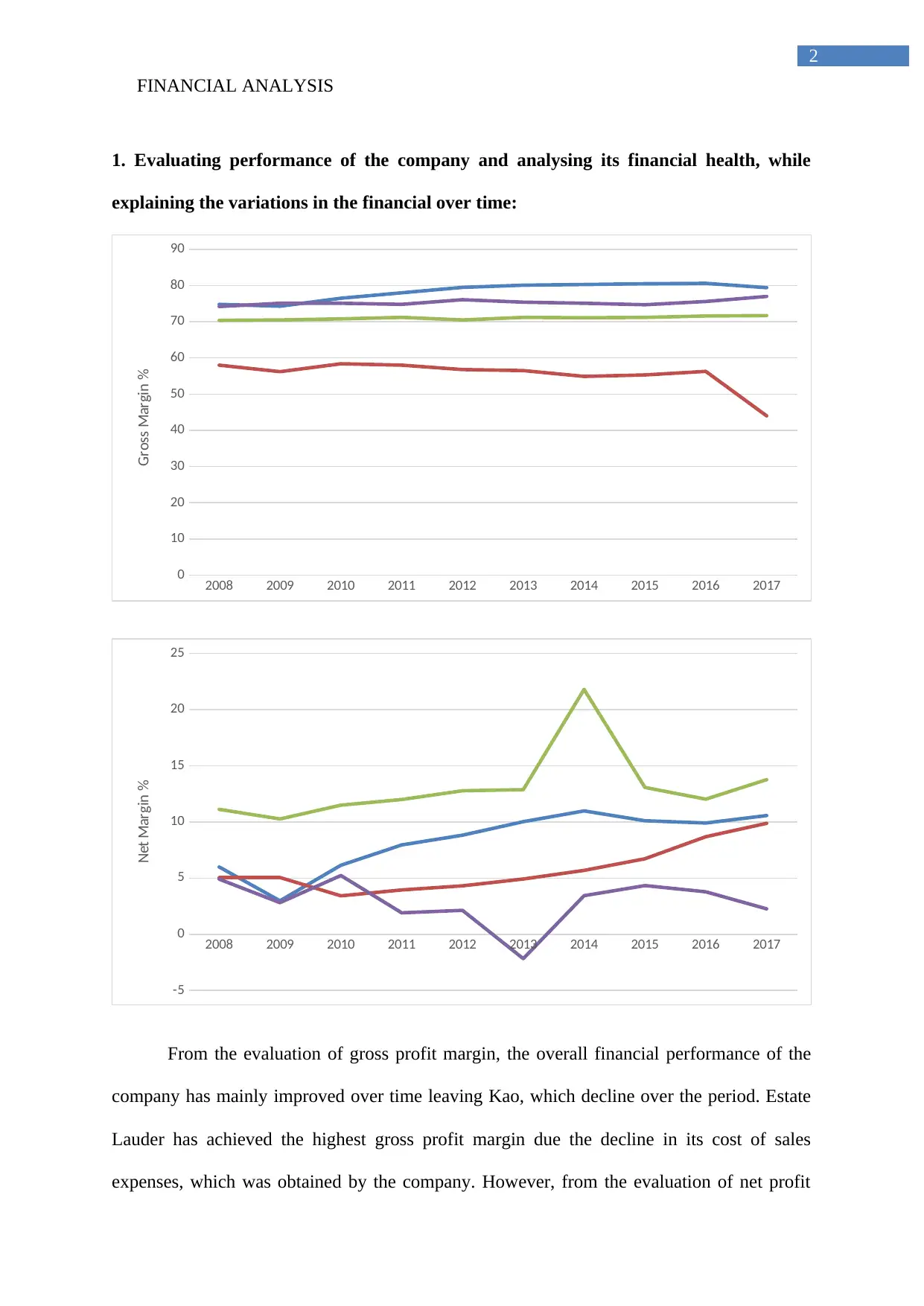

From the evaluation of gross profit margin, the overall financial performance of the

company has mainly improved over time leaving Kao, which decline over the period. Estate

Lauder has achieved the highest gross profit margin due the decline in its cost of sales

expenses, which was obtained by the company. However, from the evaluation of net profit

2

1. Evaluating performance of the company and analysing its financial health, while

explaining the variations in the financial over time:

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

10

20

30

40

50

60

70

80

90

Gross Margin %

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-5

0

5

10

15

20

25

Net Margin %

From the evaluation of gross profit margin, the overall financial performance of the

company has mainly improved over time leaving Kao, which decline over the period. Estate

Lauder has achieved the highest gross profit margin due the decline in its cost of sales

expenses, which was obtained by the company. However, from the evaluation of net profit

FINANCIAL ANALYSIS

3

margin the L’Oréal is considered to have the highest value in comparison to other companies.

The difference in gross and net profit madding indicates the administrative expenses incurred

by the company over the period. Hence, from the evaluation it could be stated that L’Oréal

administrative expenses has relatively declined over the period for generating high level of

profits. The profit and gross profit level maintained by all the four companies is due to the

innovative factors involved in their operations. The companies are aggressively innovating

new products to be in the market, which is helping them to become one of the largest

producers of cosmetic and packaged goods company. The effective market and distribution

system has allowed the companies to maximise the level of profits from their operations1.

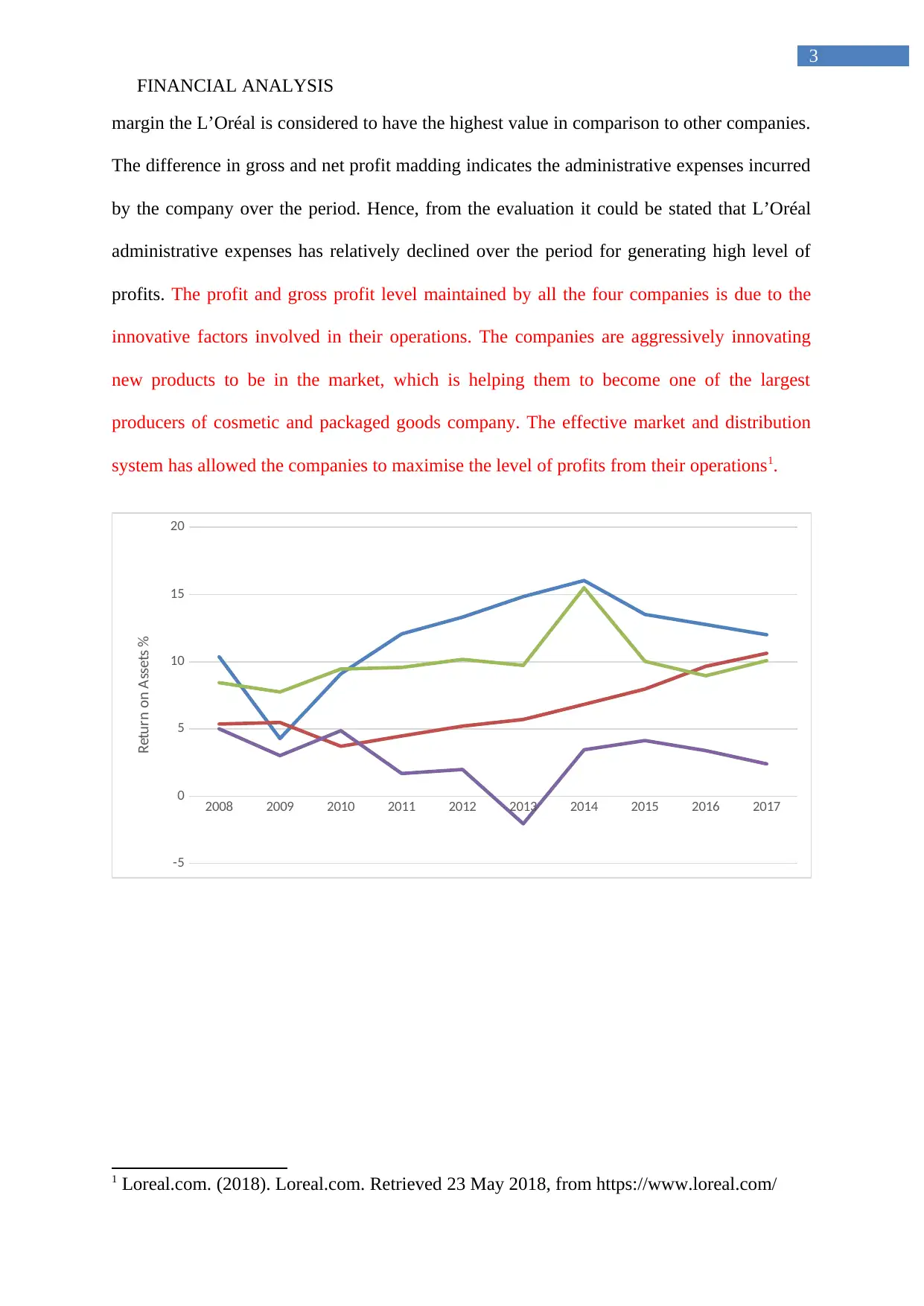

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-5

0

5

10

15

20

Return on Assets %

1 Loreal.com. (2018). Loreal.com. Retrieved 23 May 2018, from https://www.loreal.com/

3

margin the L’Oréal is considered to have the highest value in comparison to other companies.

The difference in gross and net profit madding indicates the administrative expenses incurred

by the company over the period. Hence, from the evaluation it could be stated that L’Oréal

administrative expenses has relatively declined over the period for generating high level of

profits. The profit and gross profit level maintained by all the four companies is due to the

innovative factors involved in their operations. The companies are aggressively innovating

new products to be in the market, which is helping them to become one of the largest

producers of cosmetic and packaged goods company. The effective market and distribution

system has allowed the companies to maximise the level of profits from their operations1.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-5

0

5

10

15

20

Return on Assets %

1 Loreal.com. (2018). Loreal.com. Retrieved 23 May 2018, from https://www.loreal.com/

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS

4

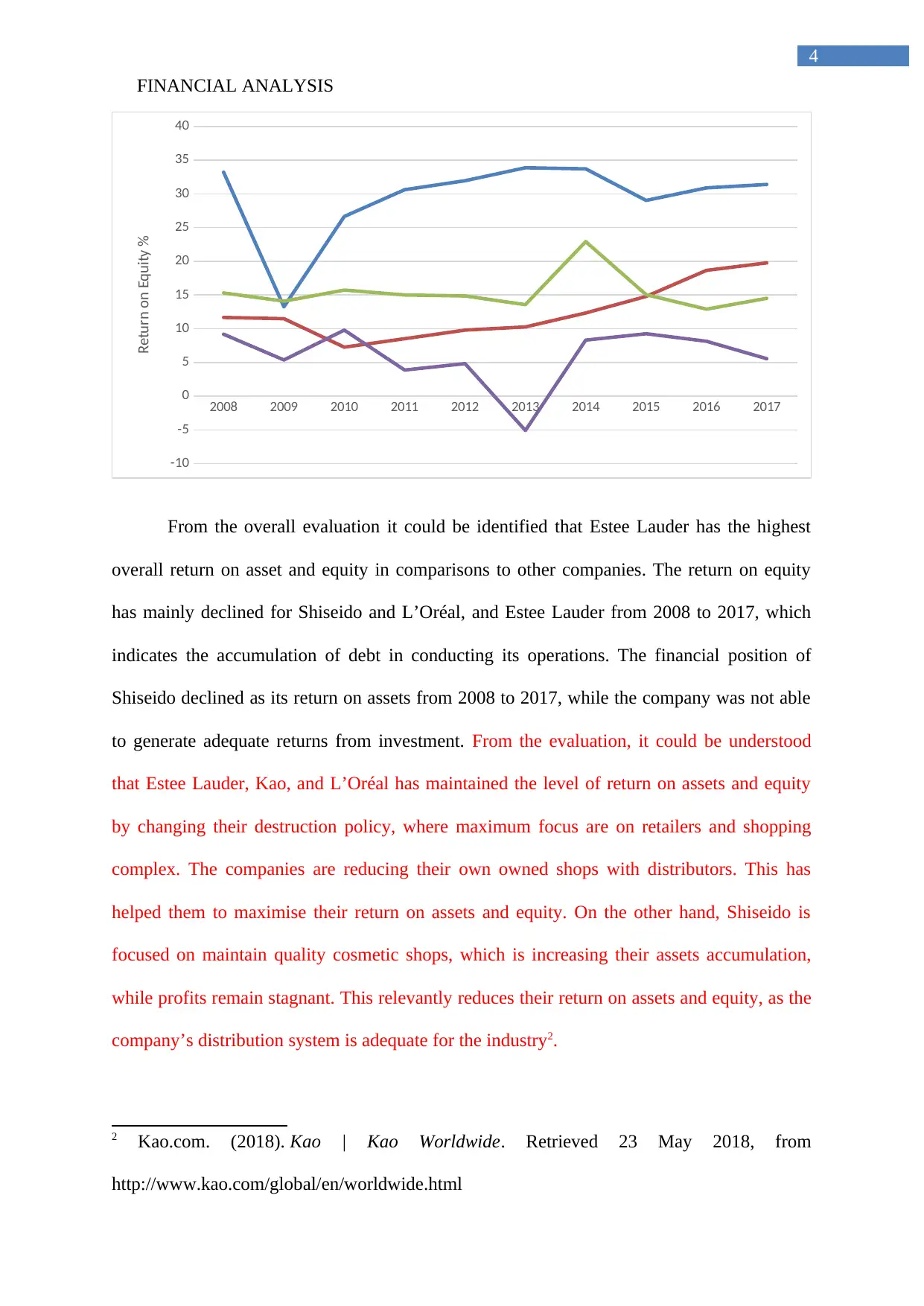

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-10

-5

0

5

10

15

20

25

30

35

40

Return on Equity %

From the overall evaluation it could be identified that Estee Lauder has the highest

overall return on asset and equity in comparisons to other companies. The return on equity

has mainly declined for Shiseido and L’Oréal, and Estee Lauder from 2008 to 2017, which

indicates the accumulation of debt in conducting its operations. The financial position of

Shiseido declined as its return on assets from 2008 to 2017, while the company was not able

to generate adequate returns from investment. From the evaluation, it could be understood

that Estee Lauder, Kao, and L’Oréal has maintained the level of return on assets and equity

by changing their destruction policy, where maximum focus are on retailers and shopping

complex. The companies are reducing their own owned shops with distributors. This has

helped them to maximise their return on assets and equity. On the other hand, Shiseido is

focused on maintain quality cosmetic shops, which is increasing their assets accumulation,

while profits remain stagnant. This relevantly reduces their return on assets and equity, as the

company’s distribution system is adequate for the industry2.

2 Kao.com. (2018). Kao | Kao Worldwide. Retrieved 23 May 2018, from

http://www.kao.com/global/en/worldwide.html

4

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-10

-5

0

5

10

15

20

25

30

35

40

Return on Equity %

From the overall evaluation it could be identified that Estee Lauder has the highest

overall return on asset and equity in comparisons to other companies. The return on equity

has mainly declined for Shiseido and L’Oréal, and Estee Lauder from 2008 to 2017, which

indicates the accumulation of debt in conducting its operations. The financial position of

Shiseido declined as its return on assets from 2008 to 2017, while the company was not able

to generate adequate returns from investment. From the evaluation, it could be understood

that Estee Lauder, Kao, and L’Oréal has maintained the level of return on assets and equity

by changing their destruction policy, where maximum focus are on retailers and shopping

complex. The companies are reducing their own owned shops with distributors. This has

helped them to maximise their return on assets and equity. On the other hand, Shiseido is

focused on maintain quality cosmetic shops, which is increasing their assets accumulation,

while profits remain stagnant. This relevantly reduces their return on assets and equity, as the

company’s distribution system is adequate for the industry2.

2 Kao.com. (2018). Kao | Kao Worldwide. Retrieved 23 May 2018, from

http://www.kao.com/global/en/worldwide.html

FINANCIAL ANALYSIS

5

2. Analysing the financial ratio performance across companies, while identifying the

weak and strong areas of performance:

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

10

20

30

40

50

60

70

Days Sales Outstanding

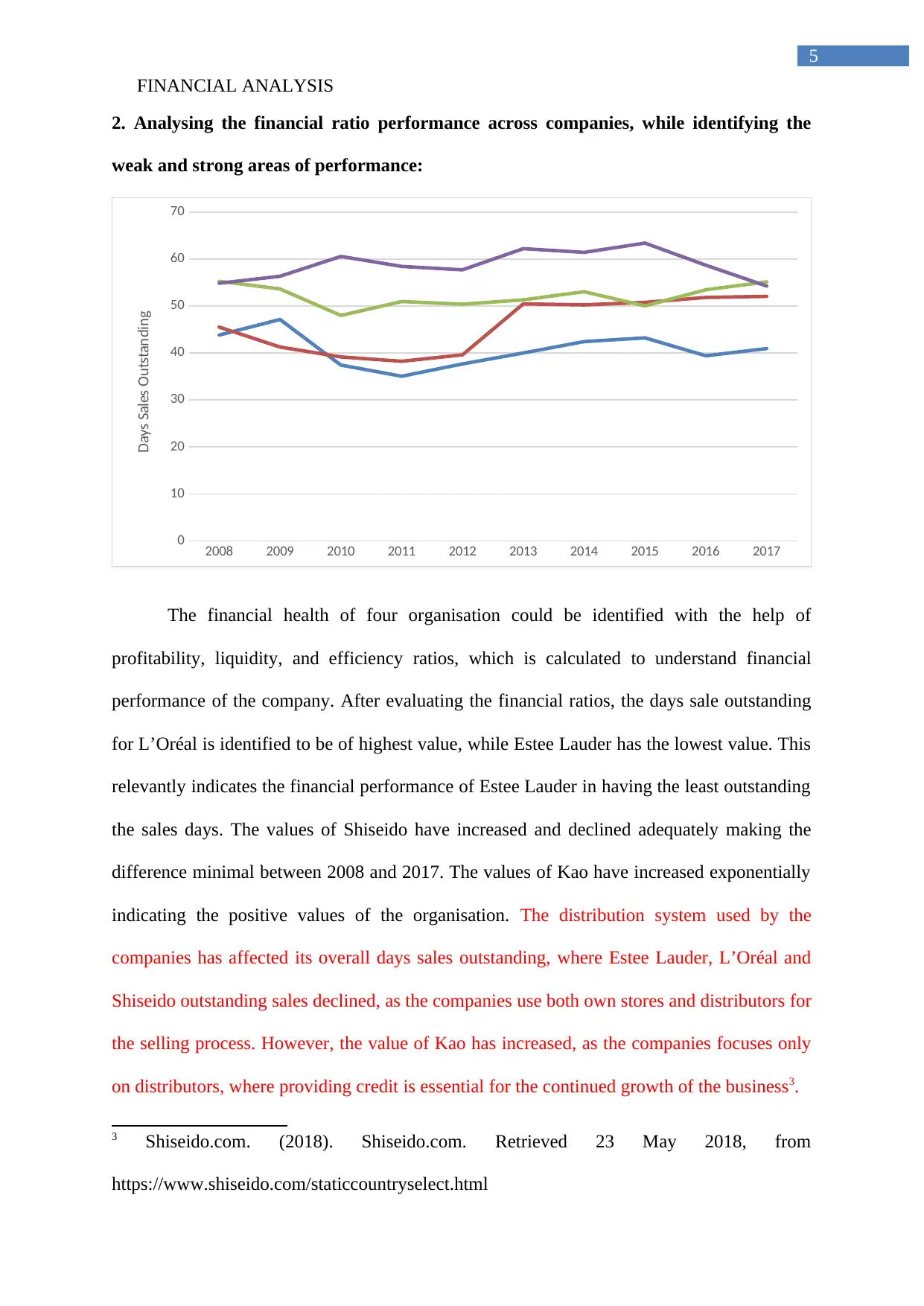

The financial health of four organisation could be identified with the help of

profitability, liquidity, and efficiency ratios, which is calculated to understand financial

performance of the company. After evaluating the financial ratios, the days sale outstanding

for L’Oréal is identified to be of highest value, while Estee Lauder has the lowest value. This

relevantly indicates the financial performance of Estee Lauder in having the least outstanding

the sales days. The values of Shiseido have increased and declined adequately making the

difference minimal between 2008 and 2017. The values of Kao have increased exponentially

indicating the positive values of the organisation. The distribution system used by the

companies has affected its overall days sales outstanding, where Estee Lauder, L’Oréal and

Shiseido outstanding sales declined, as the companies use both own stores and distributors for

the selling process. However, the value of Kao has increased, as the companies focuses only

on distributors, where providing credit is essential for the continued growth of the business3.

3 Shiseido.com. (2018). Shiseido.com. Retrieved 23 May 2018, from

https://www.shiseido.com/staticcountryselect.html

5

2. Analysing the financial ratio performance across companies, while identifying the

weak and strong areas of performance:

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

10

20

30

40

50

60

70

Days Sales Outstanding

The financial health of four organisation could be identified with the help of

profitability, liquidity, and efficiency ratios, which is calculated to understand financial

performance of the company. After evaluating the financial ratios, the days sale outstanding

for L’Oréal is identified to be of highest value, while Estee Lauder has the lowest value. This

relevantly indicates the financial performance of Estee Lauder in having the least outstanding

the sales days. The values of Shiseido have increased and declined adequately making the

difference minimal between 2008 and 2017. The values of Kao have increased exponentially

indicating the positive values of the organisation. The distribution system used by the

companies has affected its overall days sales outstanding, where Estee Lauder, L’Oréal and

Shiseido outstanding sales declined, as the companies use both own stores and distributors for

the selling process. However, the value of Kao has increased, as the companies focuses only

on distributors, where providing credit is essential for the continued growth of the business3.

3 Shiseido.com. (2018). Shiseido.com. Retrieved 23 May 2018, from

https://www.shiseido.com/staticcountryselect.html

FINANCIAL ANALYSIS

6

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

50

100

150

200

250

Days Inventory

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

50

100

150

200

250

Payables Period

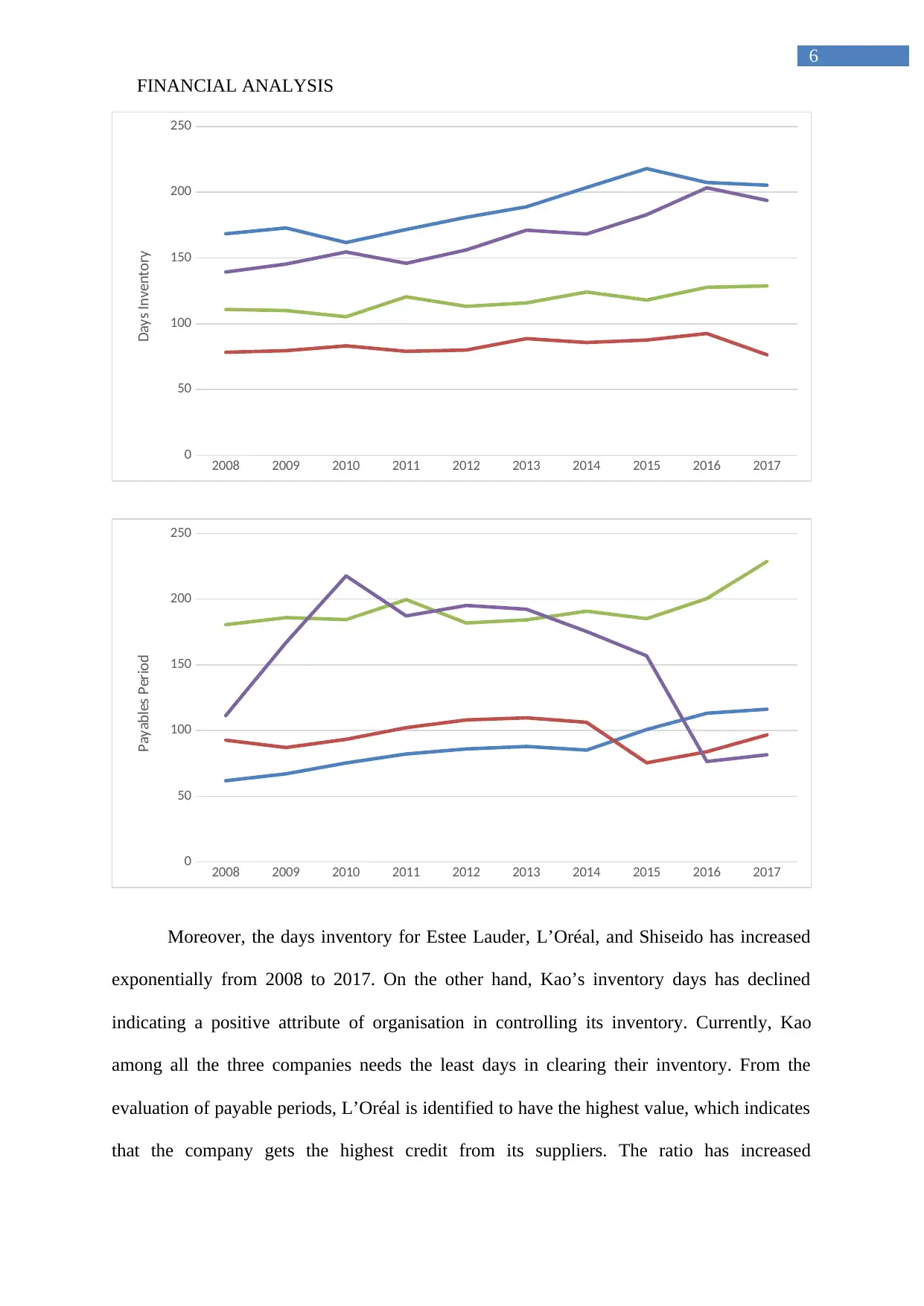

Moreover, the days inventory for Estee Lauder, L’Oréal, and Shiseido has increased

exponentially from 2008 to 2017. On the other hand, Kao’s inventory days has declined

indicating a positive attribute of organisation in controlling its inventory. Currently, Kao

among all the three companies needs the least days in clearing their inventory. From the

evaluation of payable periods, L’Oréal is identified to have the highest value, which indicates

that the company gets the highest credit from its suppliers. The ratio has increased

6

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

50

100

150

200

250

Days Inventory

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

50

100

150

200

250

Payables Period

Moreover, the days inventory for Estee Lauder, L’Oréal, and Shiseido has increased

exponentially from 2008 to 2017. On the other hand, Kao’s inventory days has declined

indicating a positive attribute of organisation in controlling its inventory. Currently, Kao

among all the three companies needs the least days in clearing their inventory. From the

evaluation of payable periods, L’Oréal is identified to have the highest value, which indicates

that the company gets the highest credit from its suppliers. The ratio has increased

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS

7

substantially from 2008 to 2017, while the value of Shiseido has declined indicting low trust

of supplies on the activities of the company. The payable period has substantially increased

for Estee Lauder and Kao, where the values has increased from 2008 to 2017. The changing

values of payables period and days inventory is due to the distribution system used by the

companies the high inventory and payable days is due to the distribution policy. The

companies such as Estee Lauder, L’Oréal, and Shiseido has used both instore distribution and

distributions, which increases the level of payables period and inventory stock 4. However,

Kao uses whole sales distribution system only, which has helped in reducing their inventory

blockage and payable period.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-100

-50

0

50

100

150

200

Cash Conversion Cycle

4 Esteelauder.com. (2018). Estée Lauder Official Site. Retrieved 23 May 2018, from

https://www.esteelauder.com/

7

substantially from 2008 to 2017, while the value of Shiseido has declined indicting low trust

of supplies on the activities of the company. The payable period has substantially increased

for Estee Lauder and Kao, where the values has increased from 2008 to 2017. The changing

values of payables period and days inventory is due to the distribution system used by the

companies the high inventory and payable days is due to the distribution policy. The

companies such as Estee Lauder, L’Oréal, and Shiseido has used both instore distribution and

distributions, which increases the level of payables period and inventory stock 4. However,

Kao uses whole sales distribution system only, which has helped in reducing their inventory

blockage and payable period.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-100

-50

0

50

100

150

200

Cash Conversion Cycle

4 Esteelauder.com. (2018). Estée Lauder Official Site. Retrieved 23 May 2018, from

https://www.esteelauder.com/

FINANCIAL ANALYSIS

8

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

2

4

6

8

10

12

Receivables Turnover

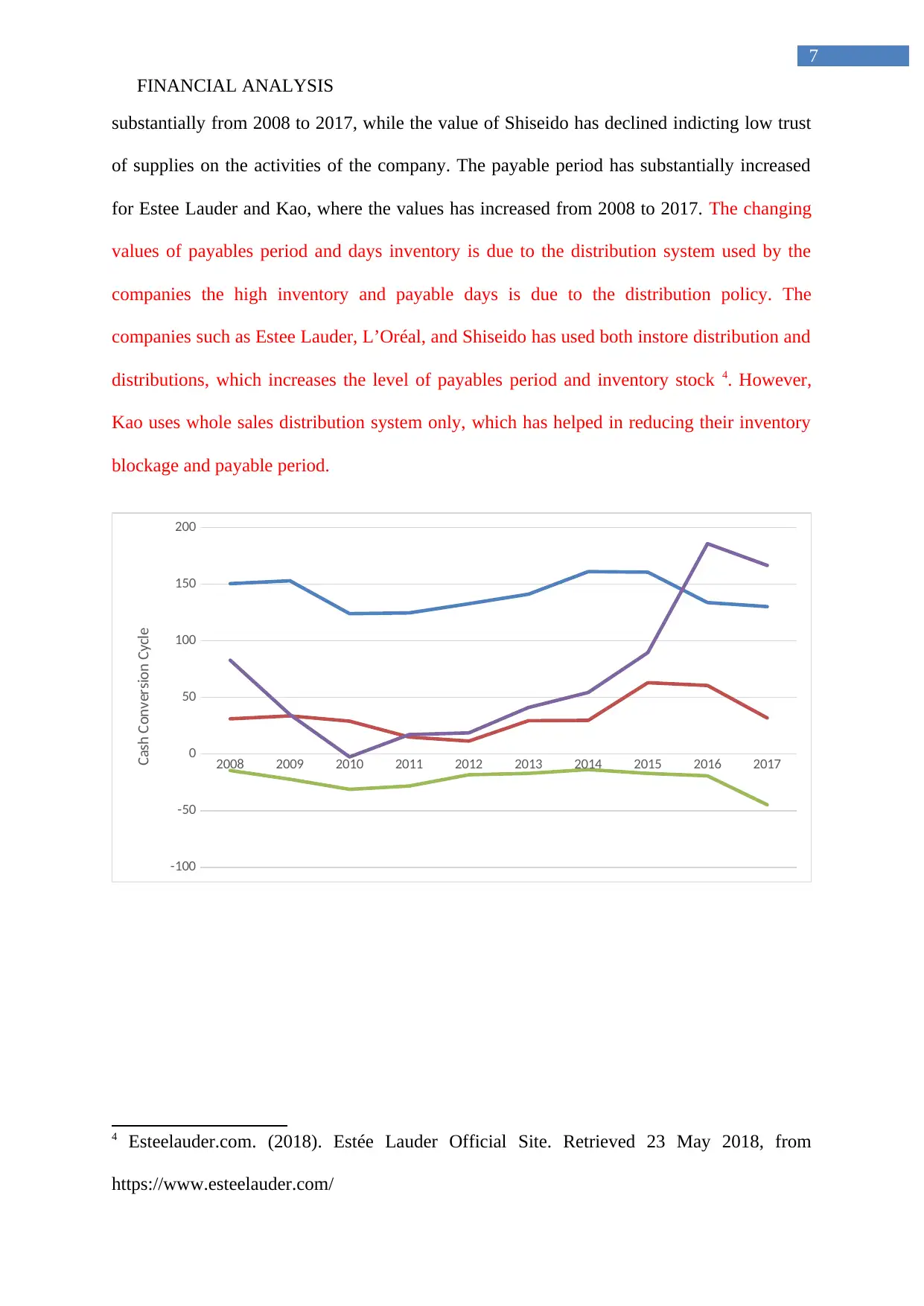

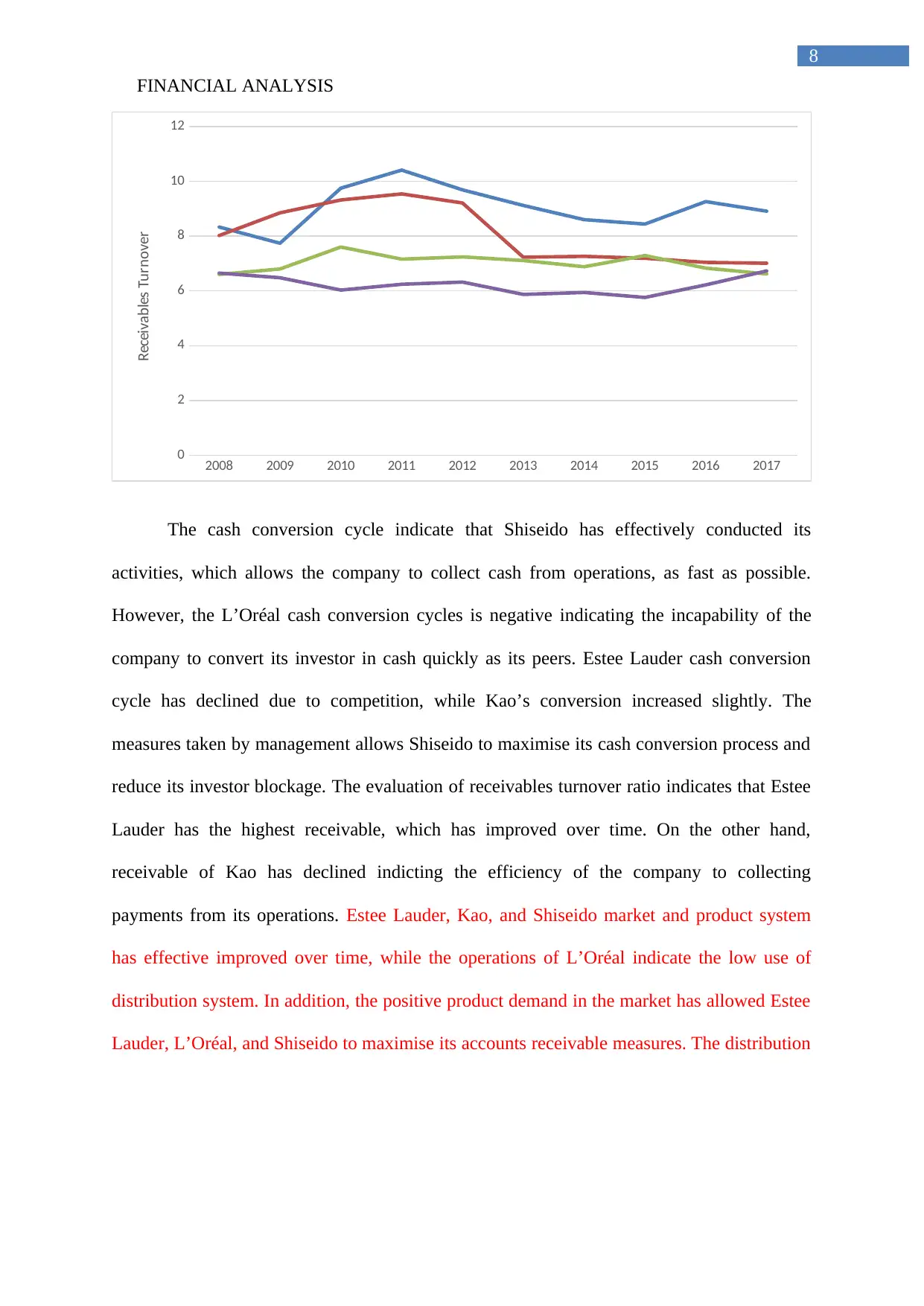

The cash conversion cycle indicate that Shiseido has effectively conducted its

activities, which allows the company to collect cash from operations, as fast as possible.

However, the L’Oréal cash conversion cycles is negative indicating the incapability of the

company to convert its investor in cash quickly as its peers. Estee Lauder cash conversion

cycle has declined due to competition, while Kao’s conversion increased slightly. The

measures taken by management allows Shiseido to maximise its cash conversion process and

reduce its investor blockage. The evaluation of receivables turnover ratio indicates that Estee

Lauder has the highest receivable, which has improved over time. On the other hand,

receivable of Kao has declined indicting the efficiency of the company to collecting

payments from its operations. Estee Lauder, Kao, and Shiseido market and product system

has effective improved over time, while the operations of L’Oréal indicate the low use of

distribution system. In addition, the positive product demand in the market has allowed Estee

Lauder, L’Oréal, and Shiseido to maximise its accounts receivable measures. The distribution

8

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

2

4

6

8

10

12

Receivables Turnover

The cash conversion cycle indicate that Shiseido has effectively conducted its

activities, which allows the company to collect cash from operations, as fast as possible.

However, the L’Oréal cash conversion cycles is negative indicating the incapability of the

company to convert its investor in cash quickly as its peers. Estee Lauder cash conversion

cycle has declined due to competition, while Kao’s conversion increased slightly. The

measures taken by management allows Shiseido to maximise its cash conversion process and

reduce its investor blockage. The evaluation of receivables turnover ratio indicates that Estee

Lauder has the highest receivable, which has improved over time. On the other hand,

receivable of Kao has declined indicting the efficiency of the company to collecting

payments from its operations. Estee Lauder, Kao, and Shiseido market and product system

has effective improved over time, while the operations of L’Oréal indicate the low use of

distribution system. In addition, the positive product demand in the market has allowed Estee

Lauder, L’Oréal, and Shiseido to maximise its accounts receivable measures. The distribution

FINANCIAL ANALYSIS

9

method used by Kao has mainly declined its receivable turnover ratio, as the company is

providing extra days payments to its buyers5.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

1

2

3

4

5

6

7

8

9

Fixed Assets Turnover

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Asset Turnover

5 Hutabarat, F. M., & Tarigan, D. (2015). Financial Performance Based on Profitability,

Liquidity, Solvency and Its Impact on the Stock Price of Companies Listed in Consumer

Goods Sector at Indonesia Stock Exchange from Year 2008-2014.

9

method used by Kao has mainly declined its receivable turnover ratio, as the company is

providing extra days payments to its buyers5.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

1

2

3

4

5

6

7

8

9

Fixed Assets Turnover

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Asset Turnover

5 Hutabarat, F. M., & Tarigan, D. (2015). Financial Performance Based on Profitability,

Liquidity, Solvency and Its Impact on the Stock Price of Companies Listed in Consumer

Goods Sector at Indonesia Stock Exchange from Year 2008-2014.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FINANCIAL ANALYSIS

10

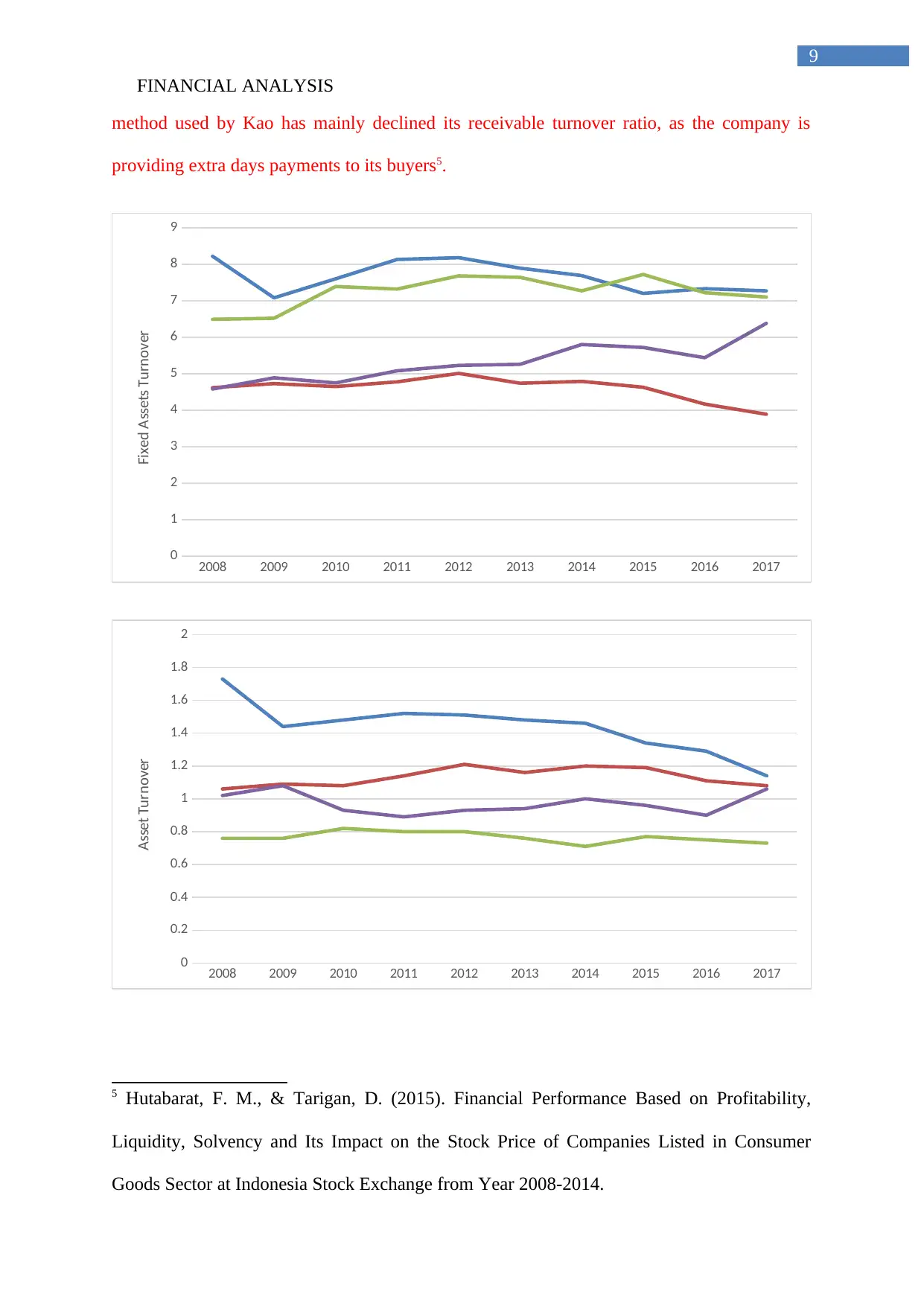

The fixed asset turnover and asset turnover indicates a positive attribute of Estee

Lauder, which has focused in accumulating high-end assets for its operations. In addition, the

overall improvement in Asset turnover to of Kai, L’Oréal and Shiseido is seen over the period

of 2008 to 2017, while Estee Lauder values has declined over time. On the other hand, the

fixed asset turnover ratio of Estee Lauder and Kao has mainly declined, while value of

L’Oréal and Shiseido increased from 2008 to 2017. The distribution and market condition of

companies has mainly helped in improving the level of profits from operations. However, the

fixed and total asset turnover ratio has affected by the distribution system and product used

by the companies6.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Debt/Equity

6 Greenbaum, S. I., Thakor, A. V., & Boot, A. (Eds.). (2015). Contemporary financial

intermediation. Academic press.

10

The fixed asset turnover and asset turnover indicates a positive attribute of Estee

Lauder, which has focused in accumulating high-end assets for its operations. In addition, the

overall improvement in Asset turnover to of Kai, L’Oréal and Shiseido is seen over the period

of 2008 to 2017, while Estee Lauder values has declined over time. On the other hand, the

fixed asset turnover ratio of Estee Lauder and Kao has mainly declined, while value of

L’Oréal and Shiseido increased from 2008 to 2017. The distribution and market condition of

companies has mainly helped in improving the level of profits from operations. However, the

fixed and total asset turnover ratio has affected by the distribution system and product used

by the companies6.

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Debt/Equity

6 Greenbaum, S. I., Thakor, A. V., & Boot, A. (Eds.). (2015). Contemporary financial

intermediation. Academic press.

FINANCIAL ANALYSIS

11

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

3.5

Financial Leverage

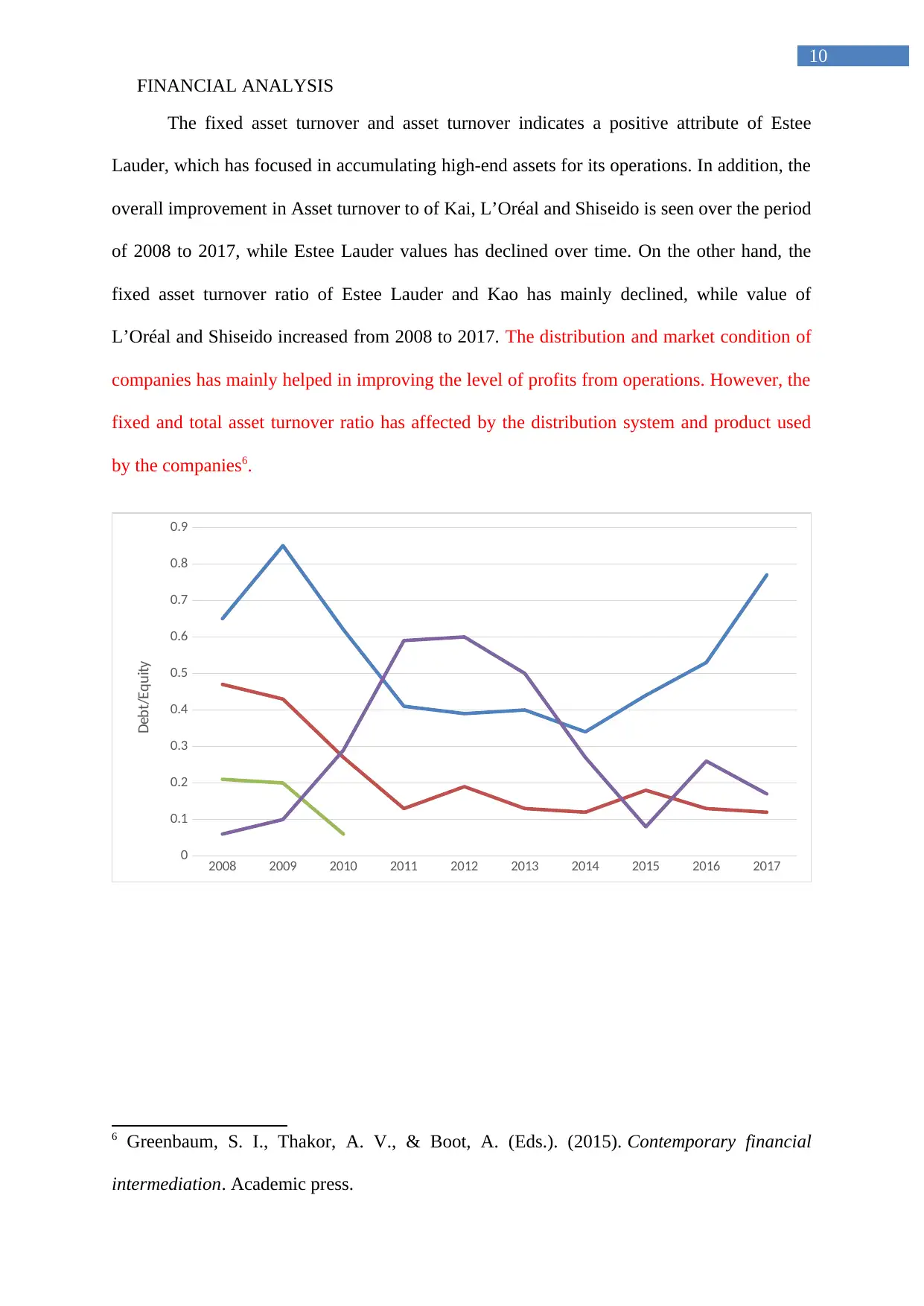

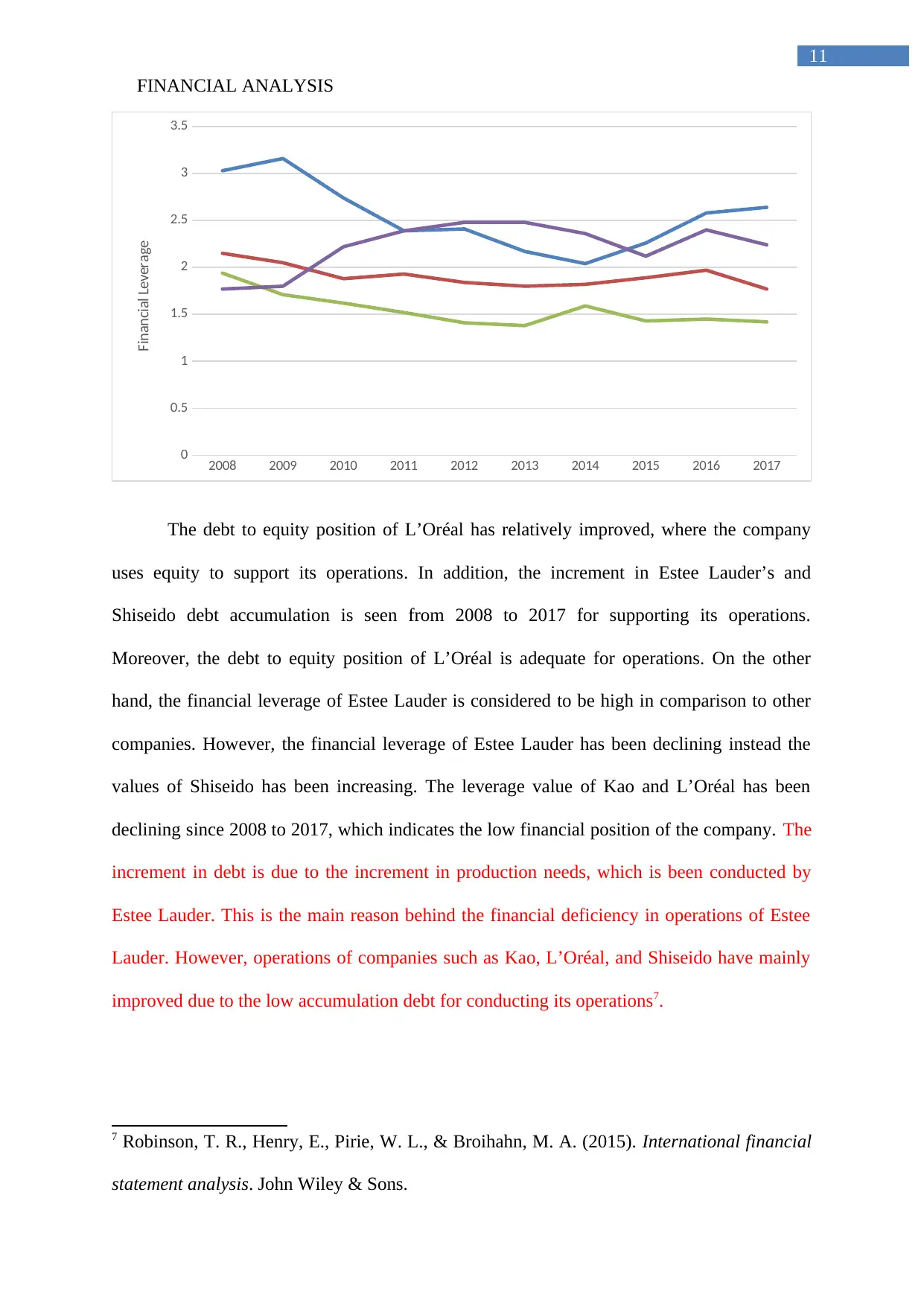

The debt to equity position of L’Oréal has relatively improved, where the company

uses equity to support its operations. In addition, the increment in Estee Lauder’s and

Shiseido debt accumulation is seen from 2008 to 2017 for supporting its operations.

Moreover, the debt to equity position of L’Oréal is adequate for operations. On the other

hand, the financial leverage of Estee Lauder is considered to be high in comparison to other

companies. However, the financial leverage of Estee Lauder has been declining instead the

values of Shiseido has been increasing. The leverage value of Kao and L’Oréal has been

declining since 2008 to 2017, which indicates the low financial position of the company. The

increment in debt is due to the increment in production needs, which is been conducted by

Estee Lauder. This is the main reason behind the financial deficiency in operations of Estee

Lauder. However, operations of companies such as Kao, L’Oréal, and Shiseido have mainly

improved due to the low accumulation debt for conducting its operations7.

7 Robinson, T. R., Henry, E., Pirie, W. L., & Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

11

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

3

3.5

Financial Leverage

The debt to equity position of L’Oréal has relatively improved, where the company

uses equity to support its operations. In addition, the increment in Estee Lauder’s and

Shiseido debt accumulation is seen from 2008 to 2017 for supporting its operations.

Moreover, the debt to equity position of L’Oréal is adequate for operations. On the other

hand, the financial leverage of Estee Lauder is considered to be high in comparison to other

companies. However, the financial leverage of Estee Lauder has been declining instead the

values of Shiseido has been increasing. The leverage value of Kao and L’Oréal has been

declining since 2008 to 2017, which indicates the low financial position of the company. The

increment in debt is due to the increment in production needs, which is been conducted by

Estee Lauder. This is the main reason behind the financial deficiency in operations of Estee

Lauder. However, operations of companies such as Kao, L’Oréal, and Shiseido have mainly

improved due to the low accumulation debt for conducting its operations7.

7 Robinson, T. R., Henry, E., Pirie, W. L., & Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

FINANCIAL ANALYSIS

12

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

Quick Ratio

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

Current Ratio

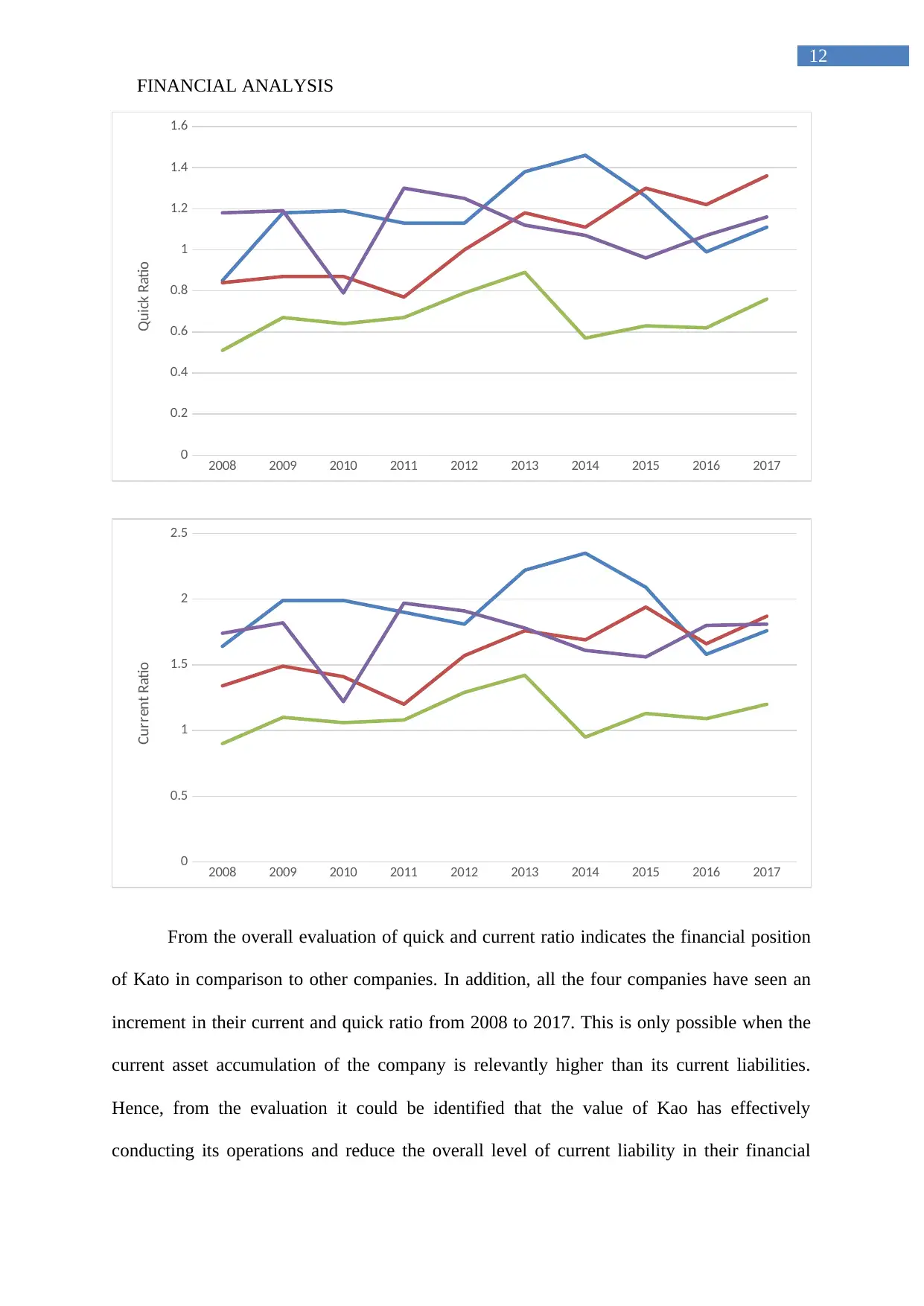

From the overall evaluation of quick and current ratio indicates the financial position

of Kato in comparison to other companies. In addition, all the four companies have seen an

increment in their current and quick ratio from 2008 to 2017. This is only possible when the

current asset accumulation of the company is relevantly higher than its current liabilities.

Hence, from the evaluation it could be identified that the value of Kao has effectively

conducting its operations and reduce the overall level of current liability in their financial

12

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

Quick Ratio

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

0.5

1

1.5

2

2.5

Current Ratio

From the overall evaluation of quick and current ratio indicates the financial position

of Kato in comparison to other companies. In addition, all the four companies have seen an

increment in their current and quick ratio from 2008 to 2017. This is only possible when the

current asset accumulation of the company is relevantly higher than its current liabilities.

Hence, from the evaluation it could be identified that the value of Kao has effectively

conducting its operations and reduce the overall level of current liability in their financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS

13

report to increase their capability for supporting their short term obligations. The demand for

the products, market and distribution system has mainly allowed Estee lauder, Kao, and

Shiseido to maintain adequate level of current asset for supporting its financial obligations.

However, the low market penetration and product demand has increased current liabilities of

L’Oréal8.

3. Stating the suggestions for improvement for each company:

From the overall evaluation it could be identified that improved in the operations of

Shiseido needs to be conducting, as the financial performance of the company from 2008 to

2017 has declined substantially. In addition, the debt and solvency position of Estee Lauder

needs to be improved, as the company accumulates high end debt to support its activities.

4. Stating whether it is a better company to buy shares from:

From the perspective of investment Estee Lauder and L’Oréal is considered to be the

best investment option for the investors, who could generate high level of returns from

investment. From the evaluation it could be identified that the company has mainly improved

the level of profit over time and strengthened their financial condition9.

5. Stating the company considered for investment:

However, from further evaluation of the pay-out ratios investments in L’Oréal is

considered to provide the highest rate of return from investment to their investors. The rising

8 Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

9 DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

13

report to increase their capability for supporting their short term obligations. The demand for

the products, market and distribution system has mainly allowed Estee lauder, Kao, and

Shiseido to maintain adequate level of current asset for supporting its financial obligations.

However, the low market penetration and product demand has increased current liabilities of

L’Oréal8.

3. Stating the suggestions for improvement for each company:

From the overall evaluation it could be identified that improved in the operations of

Shiseido needs to be conducting, as the financial performance of the company from 2008 to

2017 has declined substantially. In addition, the debt and solvency position of Estee Lauder

needs to be improved, as the company accumulates high end debt to support its activities.

4. Stating whether it is a better company to buy shares from:

From the perspective of investment Estee Lauder and L’Oréal is considered to be the

best investment option for the investors, who could generate high level of returns from

investment. From the evaluation it could be identified that the company has mainly improved

the level of profit over time and strengthened their financial condition9.

5. Stating the company considered for investment:

However, from further evaluation of the pay-out ratios investments in L’Oréal is

considered to provide the highest rate of return from investment to their investors. The rising

8 Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

9 DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

FINANCIAL ANALYSIS

14

profits and stable financial position of L’Oréal mainly portrays an adequate investment

opportunity for the investors, which could help in improving their profit level.

6. Stating the company considered to lead:

In addition, the evaluation of ratios indicates that Estee Lauder has the highest level of

financial performance and can be considered, as the market leader. The high profitability and

strengthened financial position of Estee Lauder mainly makes the company the industry

leader, where performance of other companies needs to be compared10.

References:

Esteelauder.com. (2018). Estée Lauder Official Site. Retrieved 23 May 2018, from

https://www.esteelauder.com/

Hutabarat, F. M., & Tarigan, D. (2015). Financial Performance Based on Profitability,

Liquidity, Solvency and Its Impact on the Stock Price of Companies Listed in Consumer

Goods Sector at Indonesia Stock Exchange from Year 2008-2014.

Greenbaum, S. I., Thakor, A. V., & Boot, A. (Eds.). (2015). Contemporary financial

intermediation. Academic press.

Robinson, T. R., Henry, E., Pirie, W. L., & Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

10 Warren, C. S., & Jones, J. (2018). Corporate financial accounting. Cengage Learning.

14

profits and stable financial position of L’Oréal mainly portrays an adequate investment

opportunity for the investors, which could help in improving their profit level.

6. Stating the company considered to lead:

In addition, the evaluation of ratios indicates that Estee Lauder has the highest level of

financial performance and can be considered, as the market leader. The high profitability and

strengthened financial position of Estee Lauder mainly makes the company the industry

leader, where performance of other companies needs to be compared10.

References:

Esteelauder.com. (2018). Estée Lauder Official Site. Retrieved 23 May 2018, from

https://www.esteelauder.com/

Hutabarat, F. M., & Tarigan, D. (2015). Financial Performance Based on Profitability,

Liquidity, Solvency and Its Impact on the Stock Price of Companies Listed in Consumer

Goods Sector at Indonesia Stock Exchange from Year 2008-2014.

Greenbaum, S. I., Thakor, A. V., & Boot, A. (Eds.). (2015). Contemporary financial

intermediation. Academic press.

Robinson, T. R., Henry, E., Pirie, W. L., & Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

10 Warren, C. S., & Jones, J. (2018). Corporate financial accounting. Cengage Learning.

FINANCIAL ANALYSIS

15

Warren, C. S., & Jones, J. (2018). Corporate financial accounting. Cengage Learning.

Shiseido.com. (2018). Shiseido.com. Retrieved 23 May 2018, from

https://www.shiseido.com/staticcountryselect.html

Kao.com. (2018). Kao | Kao Worldwide. Retrieved 23 May 2018, from

http://www.kao.com/global/en/worldwide.html

Loreal.com. (2018). Loreal.com. Retrieved 23 May 2018, from https://www.loreal.com/

15

Warren, C. S., & Jones, J. (2018). Corporate financial accounting. Cengage Learning.

Shiseido.com. (2018). Shiseido.com. Retrieved 23 May 2018, from

https://www.shiseido.com/staticcountryselect.html

Kao.com. (2018). Kao | Kao Worldwide. Retrieved 23 May 2018, from

http://www.kao.com/global/en/worldwide.html

Loreal.com. (2018). Loreal.com. Retrieved 23 May 2018, from https://www.loreal.com/

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.