LB5212 Accounting: Comparative Financial Analysis of Telstra & Queste

VerifiedAdded on 2023/06/08

|27

|4185

|91

Report

AI Summary

This report presents a comprehensive financial analysis of Telstra Corporation, comparing its performance against Queste Communications from 2015 to 2018. It includes horizontal and vertical analysis of Telstra's income statement, balance sheet, and cash flow statement, highlighting trends in assets, liabilities, equity, sales, and profitability. Key financial ratios, such as liquidity, profitability, efficiency, and capital structure ratios, are calculated and compared for both companies to assess their financial health. The analysis reveals that while Telstra's profits have declined, its profitability and efficiency remain superior to Queste. Despite Queste's better liquidity position, Telstra's higher debt-to-equity ratio indicates greater financial risk. The report concludes with insights into the overall financial standing of both companies, suggesting that Telstra has outperformed Queste in key areas despite recent profit declines. Desklib provides access to similar reports and solved assignments for students.

RUNNING HEAD: ACCOUNTING AND FINANCE FOR MANAGER

System

[Pick the date]

Financial analysis

System

[Pick the date]

Financial analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance for manager 2

Executive Summary

The report prepared discusses the overall financial analysis of the Telstra Corporation and

compare its ratios to its competitor Queste Communications Limited. It is also a

telecommunication entity functioning in the same industry and is listed on Australian Securities

Exchange. The report explains the nature of assets, liabilities and net income of the Telstra in

respect to the accounting model as well as analyzes, compare and interpret its financial

performance and position with its competitor Queste.

First part of the report contains horizontal and vertical analysis of Telstra’s financial statements

for the years starting from 2015 to 2018. The analysis interprets the overall performance of

Telstra and shows the percentage change in each item of the statements. It can be observed that

the assets, equities and liabilities of the firm have shown an upward trend in the past four years.

In addition, there were some fluctuations in the sales and profit earned by the company during

the years. Furthermore, the analysis of cash flow statement reflected that there were negative

cash flows in some of the past years.

The second part of the report discusses the key ratio of Telstra including the calculation of

liquidity, profitability, efficiency and capital structure ratios. The same figures are been derived

for Queste Communications also and for the same time period of four years. After that the results

are compared and the performance has been measured. The findings of ratio analysis state that

the liquidity position of Queste is much better than Telstra while on the other side, the company

is not as much profitable as its competitor Telstra. A high debt to equity ratio indicates that

Telstra has high financial risk and relies more on borrowings and liabilities. In the last, all the

findings of the report are summarized in conclusion section which provide insights about the

Executive Summary

The report prepared discusses the overall financial analysis of the Telstra Corporation and

compare its ratios to its competitor Queste Communications Limited. It is also a

telecommunication entity functioning in the same industry and is listed on Australian Securities

Exchange. The report explains the nature of assets, liabilities and net income of the Telstra in

respect to the accounting model as well as analyzes, compare and interpret its financial

performance and position with its competitor Queste.

First part of the report contains horizontal and vertical analysis of Telstra’s financial statements

for the years starting from 2015 to 2018. The analysis interprets the overall performance of

Telstra and shows the percentage change in each item of the statements. It can be observed that

the assets, equities and liabilities of the firm have shown an upward trend in the past four years.

In addition, there were some fluctuations in the sales and profit earned by the company during

the years. Furthermore, the analysis of cash flow statement reflected that there were negative

cash flows in some of the past years.

The second part of the report discusses the key ratio of Telstra including the calculation of

liquidity, profitability, efficiency and capital structure ratios. The same figures are been derived

for Queste Communications also and for the same time period of four years. After that the results

are compared and the performance has been measured. The findings of ratio analysis state that

the liquidity position of Queste is much better than Telstra while on the other side, the company

is not as much profitable as its competitor Telstra. A high debt to equity ratio indicates that

Telstra has high financial risk and relies more on borrowings and liabilities. In the last, all the

findings of the report are summarized in conclusion section which provide insights about the

Accounting and finance for manager 3

overall position of Telstra and Queste. It suggests that though the profits of former company are

declining but it has performed better than its competitor (Queste) in relation to its profitability

and efficiency over the past years.

overall position of Telstra and Queste. It suggests that though the profits of former company are

declining but it has performed better than its competitor (Queste) in relation to its profitability

and efficiency over the past years.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and finance for manager 4

Contents

Introduction.................................................................................................................................................5

Income statement.........................................................................................................................................6

Balance sheet...............................................................................................................................................9

Cash flow statement..................................................................................................................................11

Ratio analysis............................................................................................................................................13

Liquidity ratios......................................................................................................................................13

Profitability ratios..................................................................................................................................14

Efficiency ratios....................................................................................................................................15

Capital structure ratios...........................................................................................................................17

Conclusion.................................................................................................................................................18

References.................................................................................................................................................20

Appendix 1.................................................................................................................................................21

Contents

Introduction.................................................................................................................................................5

Income statement.........................................................................................................................................6

Balance sheet...............................................................................................................................................9

Cash flow statement..................................................................................................................................11

Ratio analysis............................................................................................................................................13

Liquidity ratios......................................................................................................................................13

Profitability ratios..................................................................................................................................14

Efficiency ratios....................................................................................................................................15

Capital structure ratios...........................................................................................................................17

Conclusion.................................................................................................................................................18

References.................................................................................................................................................20

Appendix 1.................................................................................................................................................21

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance for manager 5

Introduction

Telstra Corporation Limited is an Australian based telecommunication company operating and

expanding its business all over the country. The core activities of the company include

establishment and distribution of communication services like mobile services, internet access

and many others. It provides 17.7 million retail mobile services, 3.6 million retail fixed

broadband services and 4.9 million retail fixed voice services. The main objective of Telstra is to

offer quality services to its customers and make efforts to connect more and more people across

the world. In order to achieve its goals, the firm produces easy technologies and content

solutions which are user friendly (Telstra. 2018).

Telstra is recognized as the leading communication company of Australia having four major

segments operating across the country. Initially, it was incorporated as a government entity

named as Australia Post but later on the company was fully privatized. It got listed on ASX and

is traded with a ticker symbol ASX: TLS. The CEO of the firm is focused on making Telstra

more consumers oriented by undertaking a change program. After getting privatized, the share

price of the company rose to $5 per share in December 2013 to $6 per share in the same month

of 2014 (Telstra. 2018).

As far as its financials are considered, it earned a net profit of $3.5 billion in 2018 and revenue

worth $29 billion during the same year. As of 2017, the company’s assets were reported at $42.8

billion along with the equity amounted to $15 billion. There were approximately 32000

employees working in the organizations in 2017 and 150 subsidiaries owned by Telstra. Overall,

the company is making efforts and is focused on experiencing growth and success in the coming

future (Telstra. 2018).

Introduction

Telstra Corporation Limited is an Australian based telecommunication company operating and

expanding its business all over the country. The core activities of the company include

establishment and distribution of communication services like mobile services, internet access

and many others. It provides 17.7 million retail mobile services, 3.6 million retail fixed

broadband services and 4.9 million retail fixed voice services. The main objective of Telstra is to

offer quality services to its customers and make efforts to connect more and more people across

the world. In order to achieve its goals, the firm produces easy technologies and content

solutions which are user friendly (Telstra. 2018).

Telstra is recognized as the leading communication company of Australia having four major

segments operating across the country. Initially, it was incorporated as a government entity

named as Australia Post but later on the company was fully privatized. It got listed on ASX and

is traded with a ticker symbol ASX: TLS. The CEO of the firm is focused on making Telstra

more consumers oriented by undertaking a change program. After getting privatized, the share

price of the company rose to $5 per share in December 2013 to $6 per share in the same month

of 2014 (Telstra. 2018).

As far as its financials are considered, it earned a net profit of $3.5 billion in 2018 and revenue

worth $29 billion during the same year. As of 2017, the company’s assets were reported at $42.8

billion along with the equity amounted to $15 billion. There were approximately 32000

employees working in the organizations in 2017 and 150 subsidiaries owned by Telstra. Overall,

the company is making efforts and is focused on experiencing growth and success in the coming

future (Telstra. 2018).

Accounting and finance for manager 6

Income statement

It is one of the financial statements prepared by the company at the end of the accounting period.

It reflects the operating performance of the entity by taking into account the figures such as total

revenue generated, net profit earned, operating profit made and many others. The analysis of

statement of performance provides insights to the investors about the profitability position of the

company. The amount of net profit shown is basically the excess of total revenues over total

expenses incurred during the year. However, if the difference turns out to be negative then it is

considered as net loss and the same reflects the decrease in owner’s equity. The term income is

defined as the earnings made from the increase in assets and decrease in liabilities. The following

section shows the overall analysis of Telstra’s income statement for the past four years (Agtarap-

San Juan, 2007).

2015 2016 2017 2018

0

1000

2000

3000

4000

5000

6000

7000

Net income

Net income

Years

$million

Figure 1: Net income for 2015-2016

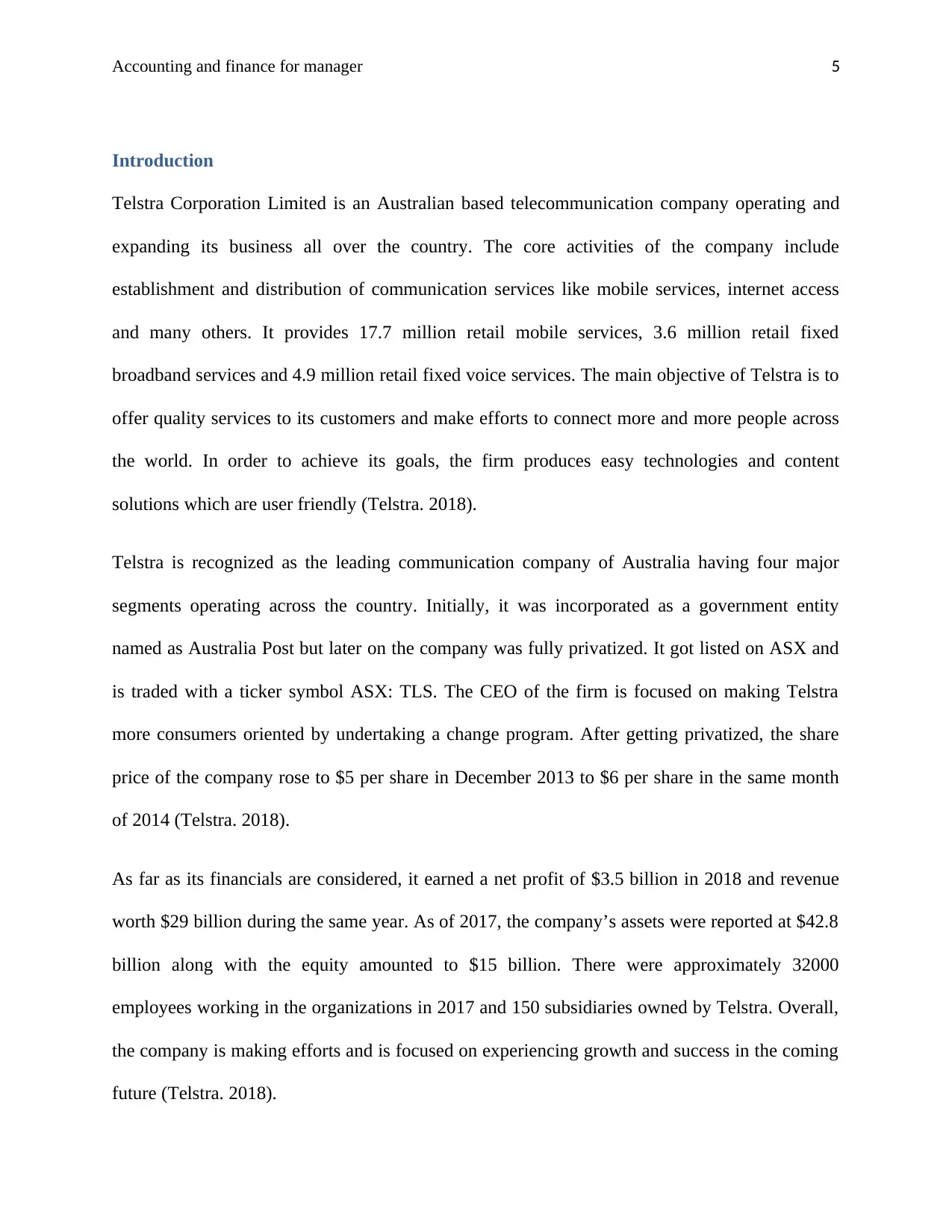

Referring to the appendix 1 as well as figure 1, it can be interpreted that the net profit or income

of Telstra has reduced after 2016. During the first two years, an increase of 36.61% was there in

Income statement

It is one of the financial statements prepared by the company at the end of the accounting period.

It reflects the operating performance of the entity by taking into account the figures such as total

revenue generated, net profit earned, operating profit made and many others. The analysis of

statement of performance provides insights to the investors about the profitability position of the

company. The amount of net profit shown is basically the excess of total revenues over total

expenses incurred during the year. However, if the difference turns out to be negative then it is

considered as net loss and the same reflects the decrease in owner’s equity. The term income is

defined as the earnings made from the increase in assets and decrease in liabilities. The following

section shows the overall analysis of Telstra’s income statement for the past four years (Agtarap-

San Juan, 2007).

2015 2016 2017 2018

0

1000

2000

3000

4000

5000

6000

7000

Net income

Net income

Years

$million

Figure 1: Net income for 2015-2016

Referring to the appendix 1 as well as figure 1, it can be interpreted that the net profit or income

of Telstra has reduced after 2016. During the first two years, an increase of 36.61% was there in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and finance for manager 7

the company’s net profit. However, the trend got reversed and the net income started declining

and continuously falls till 2018. In 2016, the profit was highest at $5780 million which fall to

$3563 million in the recent year. This reflected a deteriorating performance of the entity. In

contrast, Queste Communications has made losses in past years. In 2016, the company reported a

loss of $896,730 which increased to $2,248,319 in 2017 (Queste. 2017).

2016 2017 2018

-40.00%

-20.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

Sales Revenue, Cost of Sales, and Gross

Margin Comparison

Revenue

Cost of revenue

Gross profit

Years

$million

Figure 2: Comparison of sales revenue, COGS and Gross margin

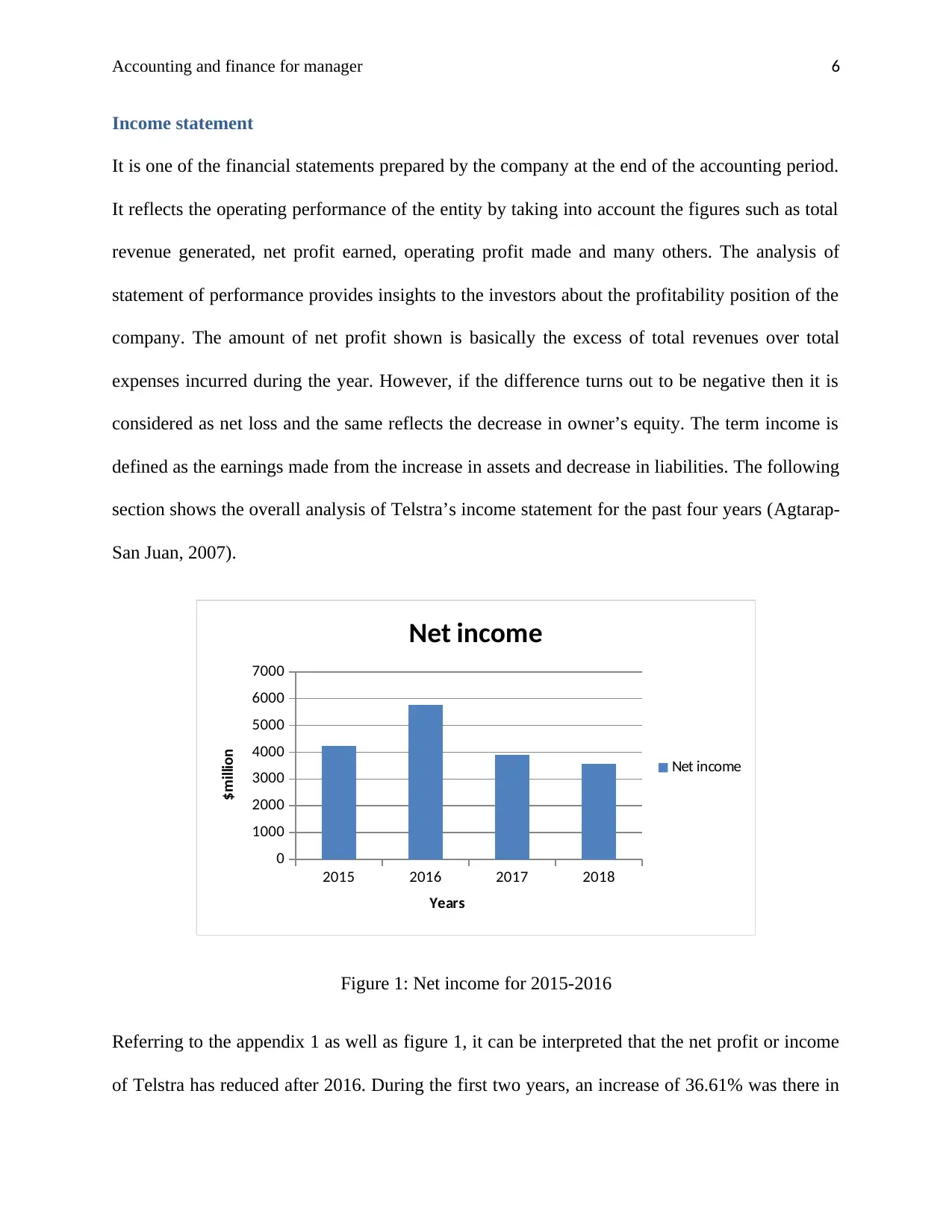

Generally, the company is considered to be profitable when its percentage increase in sales is

more than the percentage increase in its cost of revenue. Referring to Appendix 1.2 and above

figure, it is observed that the revenue has shown a % change from -0.04% to 0.26% in 2017.

However, the same decline by -0.69% in 2018. On the other side, the COGS have reported a

huge upsurge in 2017 that is from 5.49% to 59.51% and it further increased by 79.17% in 2018.

Due to such significant hike in company’s cost of revenue, the gross profit continuously reduces

in the past three years.

the company’s net profit. However, the trend got reversed and the net income started declining

and continuously falls till 2018. In 2016, the profit was highest at $5780 million which fall to

$3563 million in the recent year. This reflected a deteriorating performance of the entity. In

contrast, Queste Communications has made losses in past years. In 2016, the company reported a

loss of $896,730 which increased to $2,248,319 in 2017 (Queste. 2017).

2016 2017 2018

-40.00%

-20.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

Sales Revenue, Cost of Sales, and Gross

Margin Comparison

Revenue

Cost of revenue

Gross profit

Years

$million

Figure 2: Comparison of sales revenue, COGS and Gross margin

Generally, the company is considered to be profitable when its percentage increase in sales is

more than the percentage increase in its cost of revenue. Referring to Appendix 1.2 and above

figure, it is observed that the revenue has shown a % change from -0.04% to 0.26% in 2017.

However, the same decline by -0.69% in 2018. On the other side, the COGS have reported a

huge upsurge in 2017 that is from 5.49% to 59.51% and it further increased by 79.17% in 2018.

Due to such significant hike in company’s cost of revenue, the gross profit continuously reduces

in the past three years.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance for manager 8

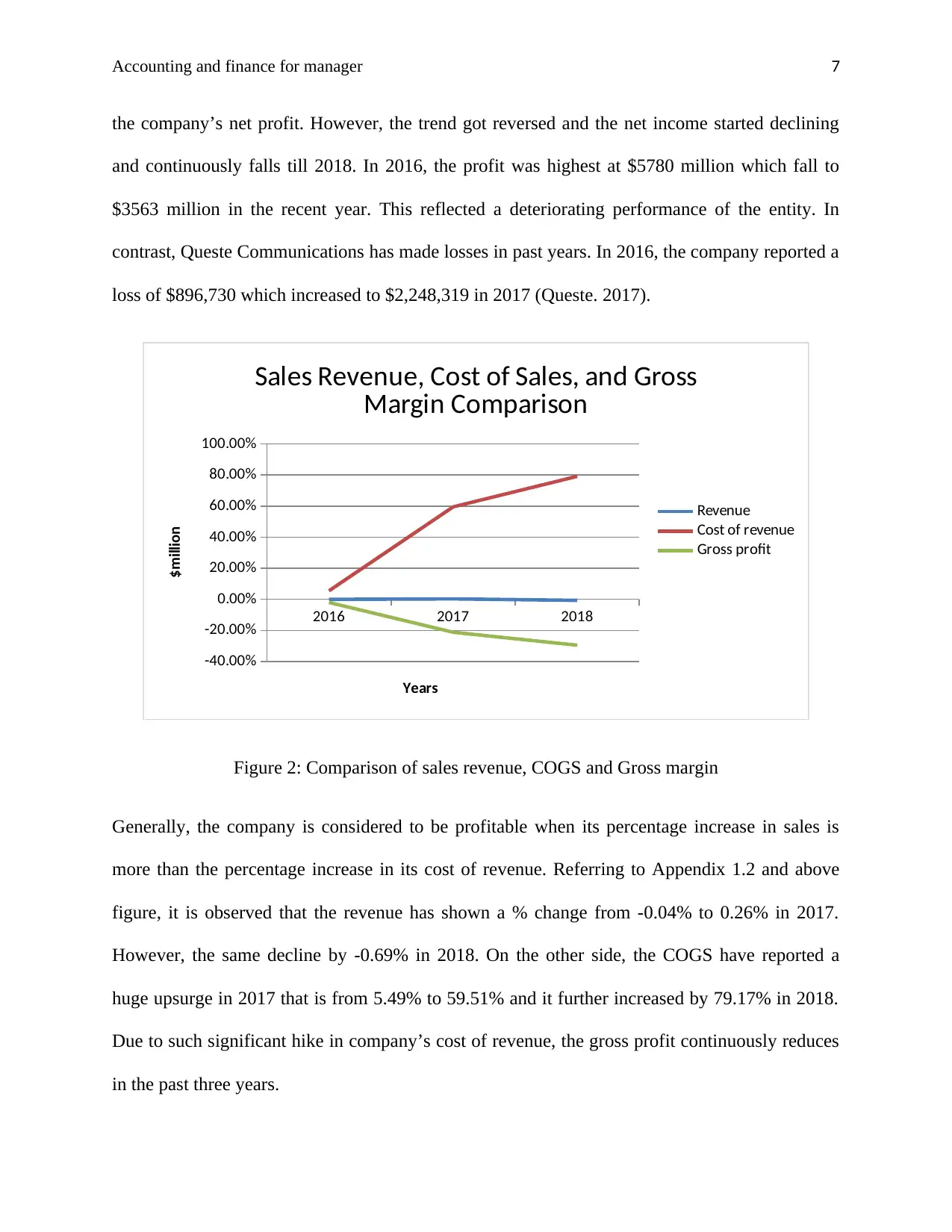

The below figure reflects the results from vertical analysis of the Telstra’s income statement. The

calculations done in Appendix 1.3 and the graph indicate that the gross profit reduced constantly

over the period of four years. In 2015, it was 73.42% of total sales which reduced to 52.04% in

2018. This reduction was due to the increase in company’s administrative cost and other

operating expenses, comprising of 31.26% and 18.47% of total sales respectively. The

percentage further increased in case of operating expenditure.

The net income of Telstra was highest in 2016 at 22.37% and after that it falls to 15.02% and

13.88% in 2017 and 2018 respectively. The major contributing factor for the fall in entity’s profit

was the continuous increase in its cost of revenue over the past years. In 2018, the COGS is

47.96% of total sales and the same was once reported at 26.58% of the revenue. Overall the

profitability of Telstra has reduced during the years.

2015 2016 2017 2018

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

Sales Revenue, Cost of Sales, and Gross Margin

Comparison

Cost of revenue

Gross profit

Sales, General and administrative

Other operating expenses

Net income

Years

% of sales revenue

Figure 3: Factors as percentage of sales

The below figure reflects the results from vertical analysis of the Telstra’s income statement. The

calculations done in Appendix 1.3 and the graph indicate that the gross profit reduced constantly

over the period of four years. In 2015, it was 73.42% of total sales which reduced to 52.04% in

2018. This reduction was due to the increase in company’s administrative cost and other

operating expenses, comprising of 31.26% and 18.47% of total sales respectively. The

percentage further increased in case of operating expenditure.

The net income of Telstra was highest in 2016 at 22.37% and after that it falls to 15.02% and

13.88% in 2017 and 2018 respectively. The major contributing factor for the fall in entity’s profit

was the continuous increase in its cost of revenue over the past years. In 2018, the COGS is

47.96% of total sales and the same was once reported at 26.58% of the revenue. Overall the

profitability of Telstra has reduced during the years.

2015 2016 2017 2018

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

Sales Revenue, Cost of Sales, and Gross Margin

Comparison

Cost of revenue

Gross profit

Sales, General and administrative

Other operating expenses

Net income

Years

% of sales revenue

Figure 3: Factors as percentage of sales

Accounting and finance for manager 9

Balance sheet

It is also known as statement of financial position which provides the snapshot of company’s all

assets, liabilities and equities. It reflects the financial situation and condition of the entity in a

summarized form. The balance sheet is also prepared at the end of a specific financial year and

the balances of all the assets and liabilities are reported in the statement at that date. On a whole,

it clearly showcases the company’s position in all the aspects including solvency, liquidity and

profitability (Makoujy, 2010). Generally, investors look up to such statements to gather the

information about the amount of assets owned by the firm and the extent of liabilities owed by it.

The following section provides the horizontal and vertical analysis of Telstra’s balance sheet for

the past four years.

2015 2016 2017 2018

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

Total Assets, liabilities, and equities comparison

TOTAL ASSETS

TOTAL LIABILITIES

Total stockholders' equity

Years

$million

Figure 4: Comparison of total assets, total liabilities and equity

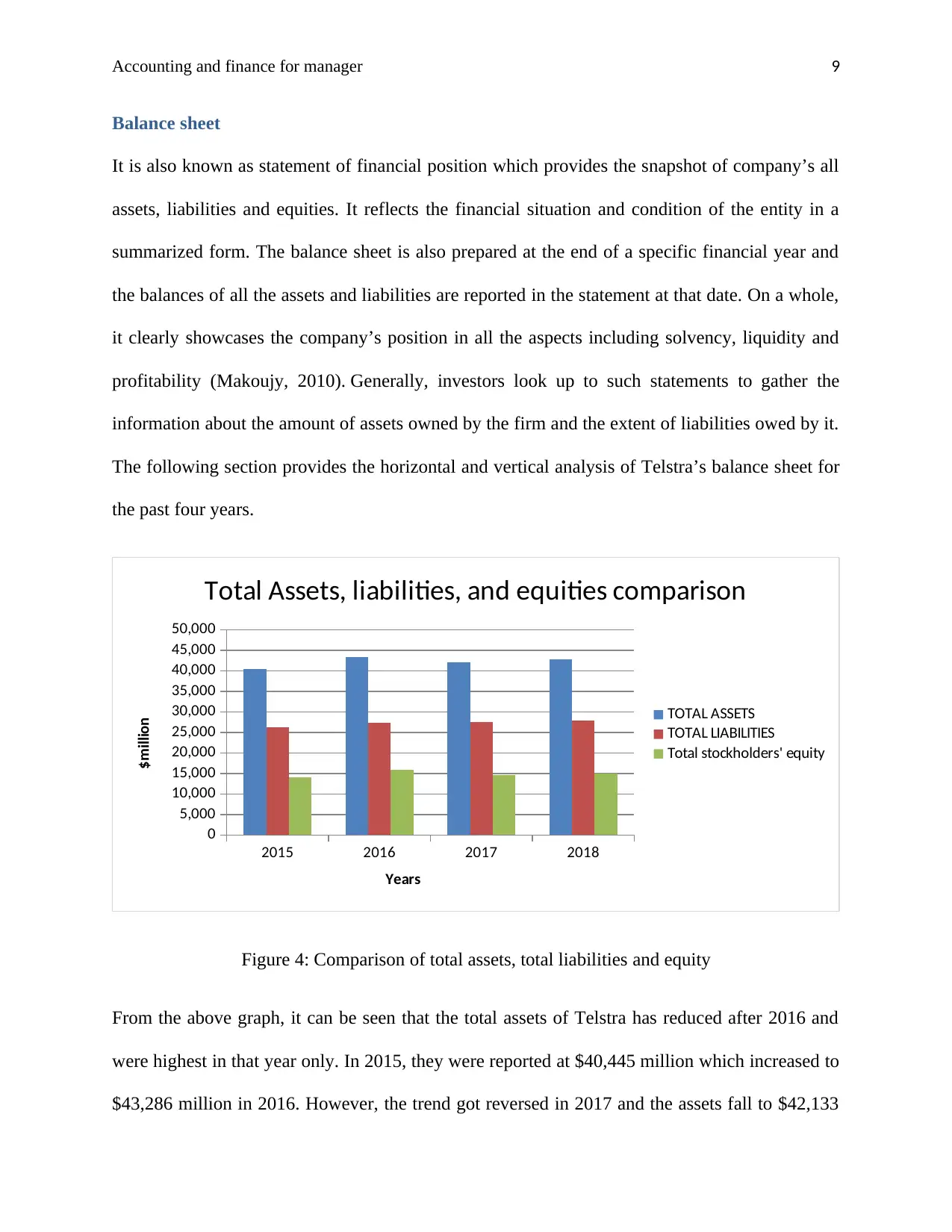

From the above graph, it can be seen that the total assets of Telstra has reduced after 2016 and

were highest in that year only. In 2015, they were reported at $40,445 million which increased to

$43,286 million in 2016. However, the trend got reversed in 2017 and the assets fall to $42,133

Balance sheet

It is also known as statement of financial position which provides the snapshot of company’s all

assets, liabilities and equities. It reflects the financial situation and condition of the entity in a

summarized form. The balance sheet is also prepared at the end of a specific financial year and

the balances of all the assets and liabilities are reported in the statement at that date. On a whole,

it clearly showcases the company’s position in all the aspects including solvency, liquidity and

profitability (Makoujy, 2010). Generally, investors look up to such statements to gather the

information about the amount of assets owned by the firm and the extent of liabilities owed by it.

The following section provides the horizontal and vertical analysis of Telstra’s balance sheet for

the past four years.

2015 2016 2017 2018

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

Total Assets, liabilities, and equities comparison

TOTAL ASSETS

TOTAL LIABILITIES

Total stockholders' equity

Years

$million

Figure 4: Comparison of total assets, total liabilities and equity

From the above graph, it can be seen that the total assets of Telstra has reduced after 2016 and

were highest in that year only. In 2015, they were reported at $40,445 million which increased to

$43,286 million in 2016. However, the trend got reversed in 2017 and the assets fall to $42,133

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and finance for manager 10

million. On the other side, liabilities had constantly increased over the years. They were at

$26,342 million in 2015 which increased to $27,843 million. Along with this, the stockholder’s

equity also rises in 2018 at $15,027 million from $14,541 million (Appendix 1.4). On the other

hand, the total assets of Queste were much higher than that of Telstra. Though, they have

reduced during the past years. In 2016, Queste has assets worth $8,038,176 million which

reduced to $5,677,929 million in 2017. However, the reverse trend was there in company’s total

liabilities as they rise from $375,795 million to $539,149 million in 2017. The amount of equity

had shown a significant decline in the years (Queste. 2017).

2015 2016 2017 2018

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

Selected Factors as % of Total Assets

Current assets Non-current assets current liabilities TOTAL LIABILITIES

Years

% of Total Assets

Figure 5: Selected factors as % of total assets

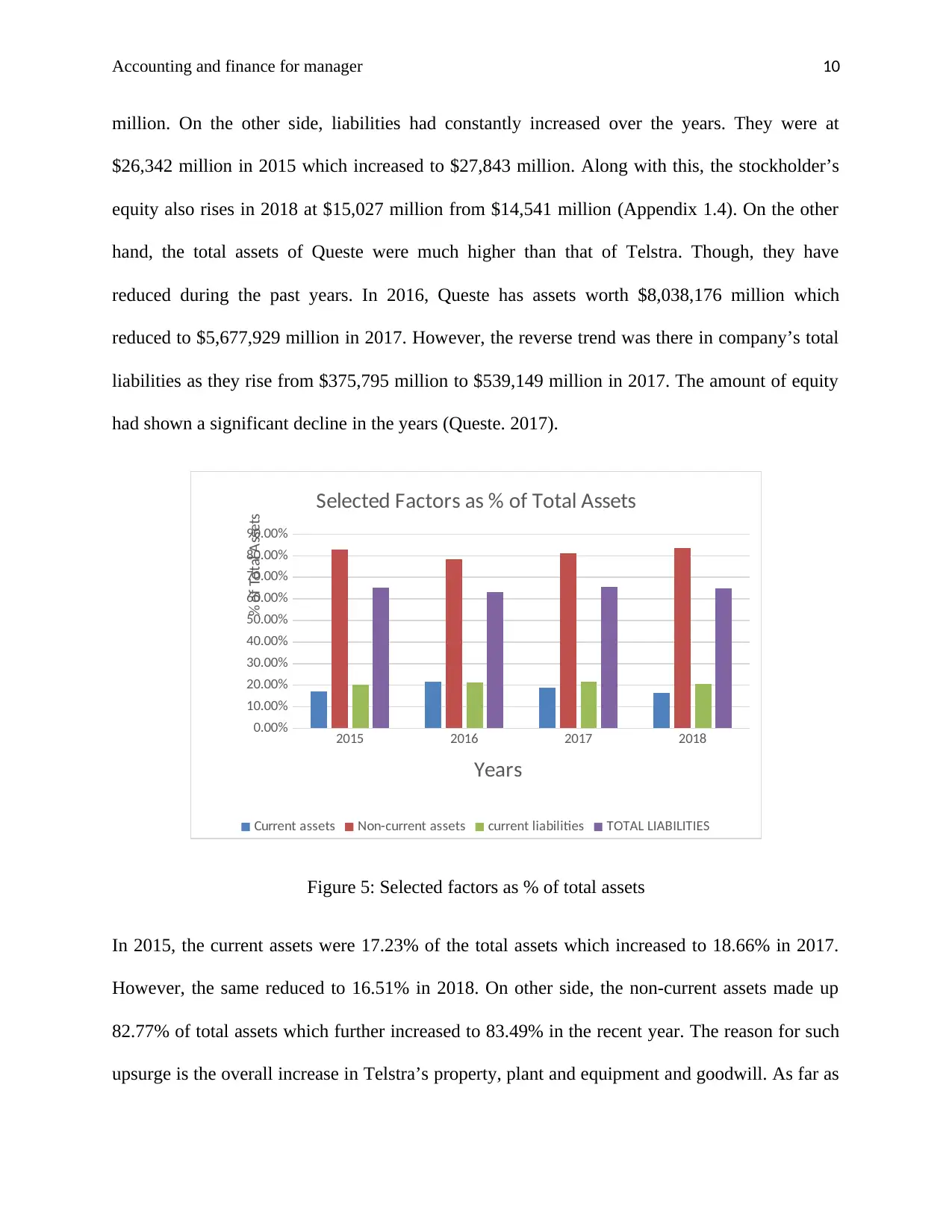

In 2015, the current assets were 17.23% of the total assets which increased to 18.66% in 2017.

However, the same reduced to 16.51% in 2018. On other side, the non-current assets made up

82.77% of total assets which further increased to 83.49% in the recent year. The reason for such

upsurge is the overall increase in Telstra’s property, plant and equipment and goodwill. As far as

million. On the other side, liabilities had constantly increased over the years. They were at

$26,342 million in 2015 which increased to $27,843 million. Along with this, the stockholder’s

equity also rises in 2018 at $15,027 million from $14,541 million (Appendix 1.4). On the other

hand, the total assets of Queste were much higher than that of Telstra. Though, they have

reduced during the past years. In 2016, Queste has assets worth $8,038,176 million which

reduced to $5,677,929 million in 2017. However, the reverse trend was there in company’s total

liabilities as they rise from $375,795 million to $539,149 million in 2017. The amount of equity

had shown a significant decline in the years (Queste. 2017).

2015 2016 2017 2018

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

Selected Factors as % of Total Assets

Current assets Non-current assets current liabilities TOTAL LIABILITIES

Years

% of Total Assets

Figure 5: Selected factors as % of total assets

In 2015, the current assets were 17.23% of the total assets which increased to 18.66% in 2017.

However, the same reduced to 16.51% in 2018. On other side, the non-current assets made up

82.77% of total assets which further increased to 83.49% in the recent year. The reason for such

upsurge is the overall increase in Telstra’s property, plant and equipment and goodwill. As far as

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance for manager 11

total liabilities are concerned, they have shown a slightest reduction of 64.95% from 65.49% in

2018. The reasons for such increase were the rise in company’s current liabilities and its short

term borrowings (Appendix 1.5).

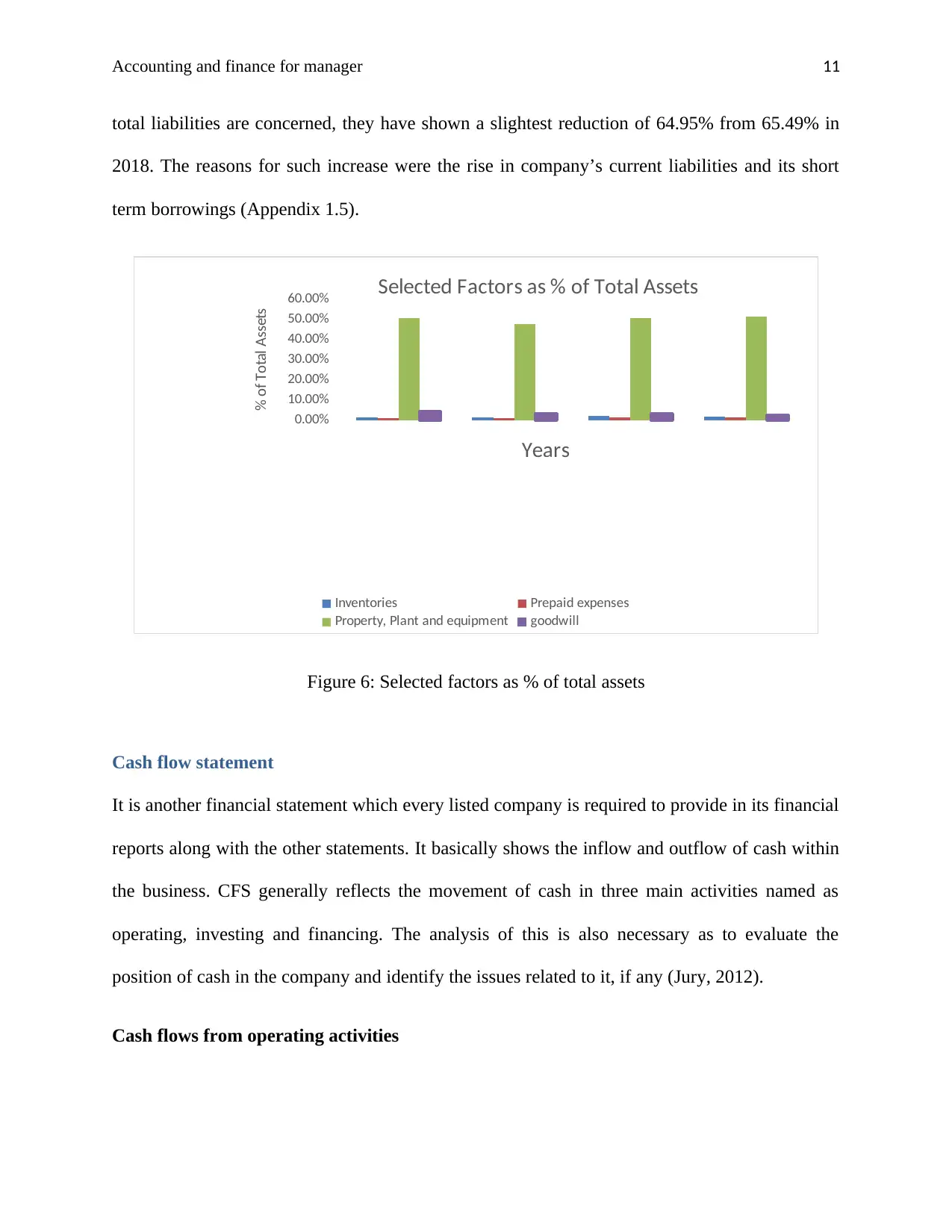

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00% Selected Factors as % of Total Assets

Inventories Prepaid expenses

Property, Plant and equipment goodwill

Years

% of Total Assets

Figure 6: Selected factors as % of total assets

Cash flow statement

It is another financial statement which every listed company is required to provide in its financial

reports along with the other statements. It basically shows the inflow and outflow of cash within

the business. CFS generally reflects the movement of cash in three main activities named as

operating, investing and financing. The analysis of this is also necessary as to evaluate the

position of cash in the company and identify the issues related to it, if any (Jury, 2012).

Cash flows from operating activities

total liabilities are concerned, they have shown a slightest reduction of 64.95% from 65.49% in

2018. The reasons for such increase were the rise in company’s current liabilities and its short

term borrowings (Appendix 1.5).

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00% Selected Factors as % of Total Assets

Inventories Prepaid expenses

Property, Plant and equipment goodwill

Years

% of Total Assets

Figure 6: Selected factors as % of total assets

Cash flow statement

It is another financial statement which every listed company is required to provide in its financial

reports along with the other statements. It basically shows the inflow and outflow of cash within

the business. CFS generally reflects the movement of cash in three main activities named as

operating, investing and financing. The analysis of this is also necessary as to evaluate the

position of cash in the company and identify the issues related to it, if any (Jury, 2012).

Cash flows from operating activities

Accounting and finance for manager 12

It can be observed that the cash generated from operating activities has increased from $7775

million to $8606 million in 2018. However, in the starting the same had shown a declining trend

which can be identified by the cash flow in 2015 and the same in 2017. It reduced from $8311

million to $7775 million. Overall, the figures remain positive in all the four years (Refer

appendix 1.6). In contrast, the operating cash flow of Queste was more than Telstra but the same

reduced to $46,220 million from $92,641 million in 2017 (Queste. 2017).

Cash flows from investing activities

Investing activities show the overall cash used in them. In 2015, it was $5692 million which

reduced to $3911 million in 2018. However, some fluctuations are noticed in between and they

were due to the investments made in PP&E and purchase of intangibles. On a whole, the cash

used in investing activities in year 2018 is comparatively less than amount used in 2017 and

2015 (Refer appendix 1.6). The overall net cash used in investing activities of Queste was $1783

million in 2017. The figure was lower than the cash utilized in Telstra’s activities.

Cash flows from financing activities

It also showed the negative cash flow but the amount was less in 2018 as compare to other

periods. In 2015, the net cash used was $6882 million which reduced to $5015 million in the

recent year. This was due to the repayments of company’s debt and the dividends to the

shareholders. Some cash was also used in other financing activities (Refer appendix 1.6).

Overall, the net cash flow from all the three activities turned out to be positive in the four years,

though declining. In 2015, it was $3209 million which increased to $3939 million in 2016.

However, the same reduced to $2454 million in FY2017 but again the trend got reversed and the

cash flow shows a hike at $3674 million in the current year. In a nutshell, Telstra has improved

It can be observed that the cash generated from operating activities has increased from $7775

million to $8606 million in 2018. However, in the starting the same had shown a declining trend

which can be identified by the cash flow in 2015 and the same in 2017. It reduced from $8311

million to $7775 million. Overall, the figures remain positive in all the four years (Refer

appendix 1.6). In contrast, the operating cash flow of Queste was more than Telstra but the same

reduced to $46,220 million from $92,641 million in 2017 (Queste. 2017).

Cash flows from investing activities

Investing activities show the overall cash used in them. In 2015, it was $5692 million which

reduced to $3911 million in 2018. However, some fluctuations are noticed in between and they

were due to the investments made in PP&E and purchase of intangibles. On a whole, the cash

used in investing activities in year 2018 is comparatively less than amount used in 2017 and

2015 (Refer appendix 1.6). The overall net cash used in investing activities of Queste was $1783

million in 2017. The figure was lower than the cash utilized in Telstra’s activities.

Cash flows from financing activities

It also showed the negative cash flow but the amount was less in 2018 as compare to other

periods. In 2015, the net cash used was $6882 million which reduced to $5015 million in the

recent year. This was due to the repayments of company’s debt and the dividends to the

shareholders. Some cash was also used in other financing activities (Refer appendix 1.6).

Overall, the net cash flow from all the three activities turned out to be positive in the four years,

though declining. In 2015, it was $3209 million which increased to $3939 million in 2016.

However, the same reduced to $2454 million in FY2017 but again the trend got reversed and the

cash flow shows a hike at $3674 million in the current year. In a nutshell, Telstra has improved

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.