Detailed Financial Analysis Report of Top Glove Corporation Berhad

VerifiedAdded on 2023/06/15

|12

|2646

|290

Report

AI Summary

This report presents a detailed financial analysis of Top Glove Corporation Berhad Group for the years 2019 and 2020, employing ratio analysis to assess the company's financial health. It covers various key financial ratios, including gross profit margin, operating profit margin, return on capital employed, trade receivable and payable settlement days, inventory turnover period, revenue to capital employed, current ratio, earnings per share, and price-earnings ratio. The analysis evaluates the company's profitability, liquidity, and efficiency, highlighting both positive trends and areas needing improvement. Additionally, the report discusses factors suppliers should consider before entering into contracts with Top Glove, such as operational efficiency, market share, and technological development capacity. The report also examines the advantages and limitations of ratio analysis and further evaluates appropriate methods for valuing a listed enterprise for sale, including net asset value, price-earnings multiples, and discounted cash flow method. Desklib provides students access to this assignment and many more solved papers.

Online Exam FINANCIAL

ANALYSIS

ANALYSIS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SECTION A

Question A1

a)

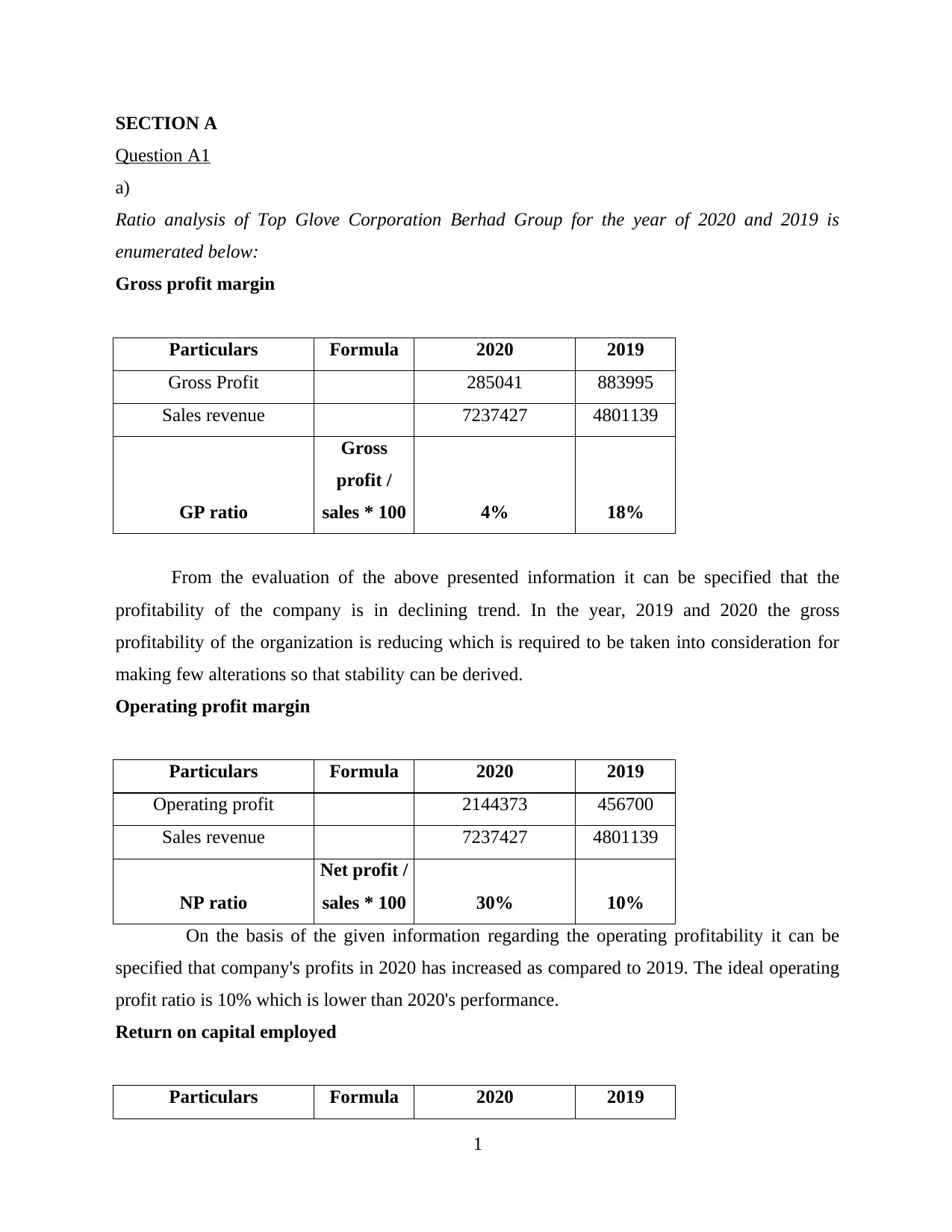

Ratio analysis of Top Glove Corporation Berhad Group for the year of 2020 and 2019 is

enumerated below:

Gross profit margin

Particulars Formula 2020 2019

Gross Profit 285041 883995

Sales revenue 7237427 4801139

GP ratio

Gross

profit /

sales * 100 4% 18%

From the evaluation of the above presented information it can be specified that the

profitability of the company is in declining trend. In the year, 2019 and 2020 the gross

profitability of the organization is reducing which is required to be taken into consideration for

making few alterations so that stability can be derived.

Operating profit margin

Particulars Formula 2020 2019

Operating profit 2144373 456700

Sales revenue 7237427 4801139

NP ratio

Net profit /

sales * 100 30% 10%

On the basis of the given information regarding the operating profitability it can be

specified that company's profits in 2020 has increased as compared to 2019. The ideal operating

profit ratio is 10% which is lower than 2020's performance.

Return on capital employed

Particulars Formula 2020 2019

1

Question A1

a)

Ratio analysis of Top Glove Corporation Berhad Group for the year of 2020 and 2019 is

enumerated below:

Gross profit margin

Particulars Formula 2020 2019

Gross Profit 285041 883995

Sales revenue 7237427 4801139

GP ratio

Gross

profit /

sales * 100 4% 18%

From the evaluation of the above presented information it can be specified that the

profitability of the company is in declining trend. In the year, 2019 and 2020 the gross

profitability of the organization is reducing which is required to be taken into consideration for

making few alterations so that stability can be derived.

Operating profit margin

Particulars Formula 2020 2019

Operating profit 2144373 456700

Sales revenue 7237427 4801139

NP ratio

Net profit /

sales * 100 30% 10%

On the basis of the given information regarding the operating profitability it can be

specified that company's profits in 2020 has increased as compared to 2019. The ideal operating

profit ratio is 10% which is lower than 2020's performance.

Return on capital employed

Particulars Formula 2020 2019

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EBIT 2144373 456700

Capital employed

Total assets-

total current

liabilities 6573440 4096414

Return on capital

employed

EBIT/

Capital

employed 33% 11%

From the evaluation of given table, it can be specified that firm need to focus on this

ratio as presents that how effectively an organization uses capital to provide return. From the

evaluation it can be specified that company is facing upwind moving trend which can inclined

good Revelations with its investors. It is reflecting good financial health of the company.

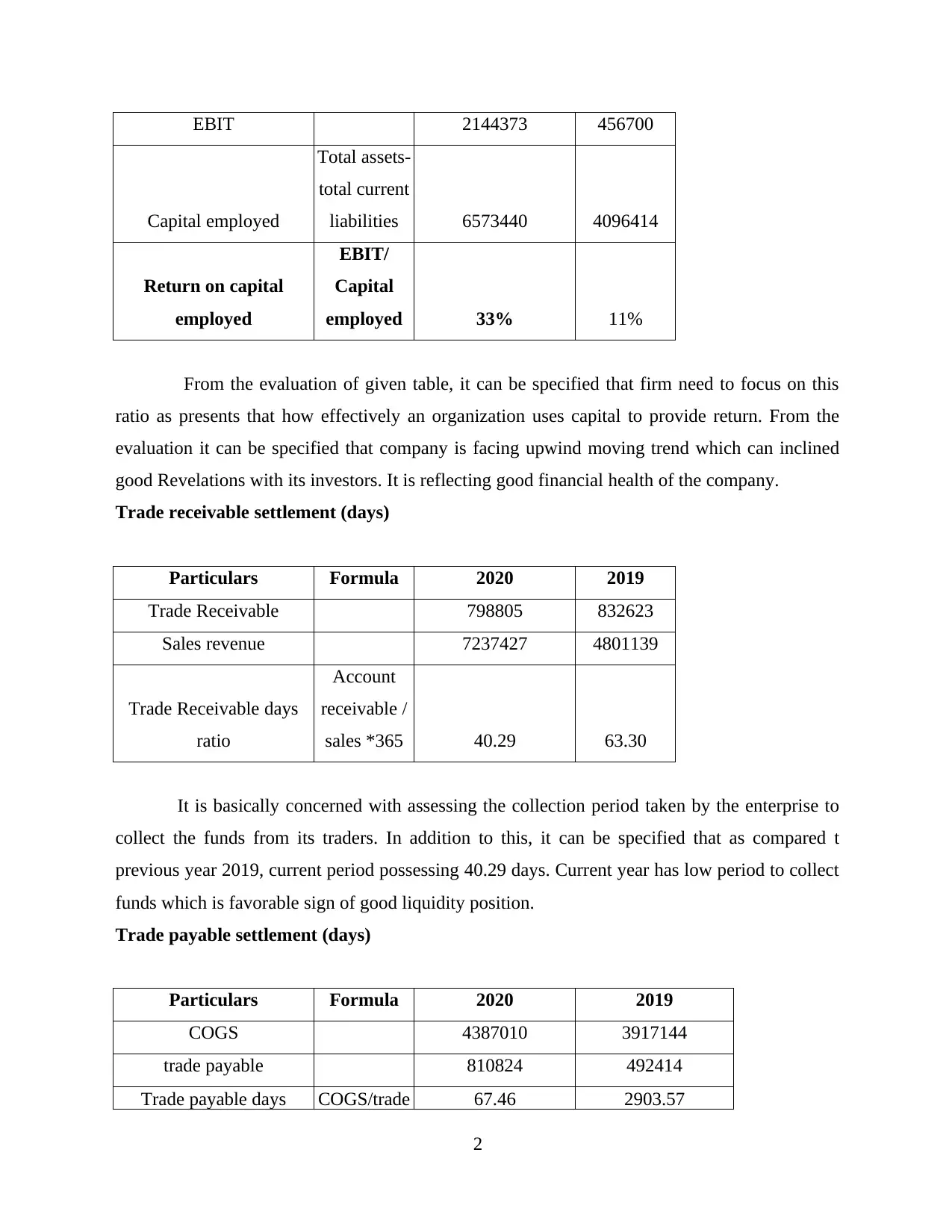

Trade receivable settlement (days)

Particulars Formula 2020 2019

Trade Receivable 798805 832623

Sales revenue 7237427 4801139

Trade Receivable days

ratio

Account

receivable /

sales *365 40.29 63.30

It is basically concerned with assessing the collection period taken by the enterprise to

collect the funds from its traders. In addition to this, it can be specified that as compared t

previous year 2019, current period possessing 40.29 days. Current year has low period to collect

funds which is favorable sign of good liquidity position.

Trade payable settlement (days)

Particulars Formula 2020 2019

COGS 4387010 3917144

trade payable 810824 492414

Trade payable days COGS/trade 67.46 2903.57

2

Capital employed

Total assets-

total current

liabilities 6573440 4096414

Return on capital

employed

EBIT/

Capital

employed 33% 11%

From the evaluation of given table, it can be specified that firm need to focus on this

ratio as presents that how effectively an organization uses capital to provide return. From the

evaluation it can be specified that company is facing upwind moving trend which can inclined

good Revelations with its investors. It is reflecting good financial health of the company.

Trade receivable settlement (days)

Particulars Formula 2020 2019

Trade Receivable 798805 832623

Sales revenue 7237427 4801139

Trade Receivable days

ratio

Account

receivable /

sales *365 40.29 63.30

It is basically concerned with assessing the collection period taken by the enterprise to

collect the funds from its traders. In addition to this, it can be specified that as compared t

previous year 2019, current period possessing 40.29 days. Current year has low period to collect

funds which is favorable sign of good liquidity position.

Trade payable settlement (days)

Particulars Formula 2020 2019

COGS 4387010 3917144

trade payable 810824 492414

Trade payable days COGS/trade 67.46 2903.57

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

payable

*365

On the basis of the presented details regarding trade payable it can be identified that

obtained outcome for the two years are 2903.57 & 67.46 days. On the basis of this, it can be

articulated that as compared to previous, current year has good amount of credibility to pay off

its debt to suppliers. It is presenting higher effectiveness in meeting the short term obligation

which is positive indicator of growth.

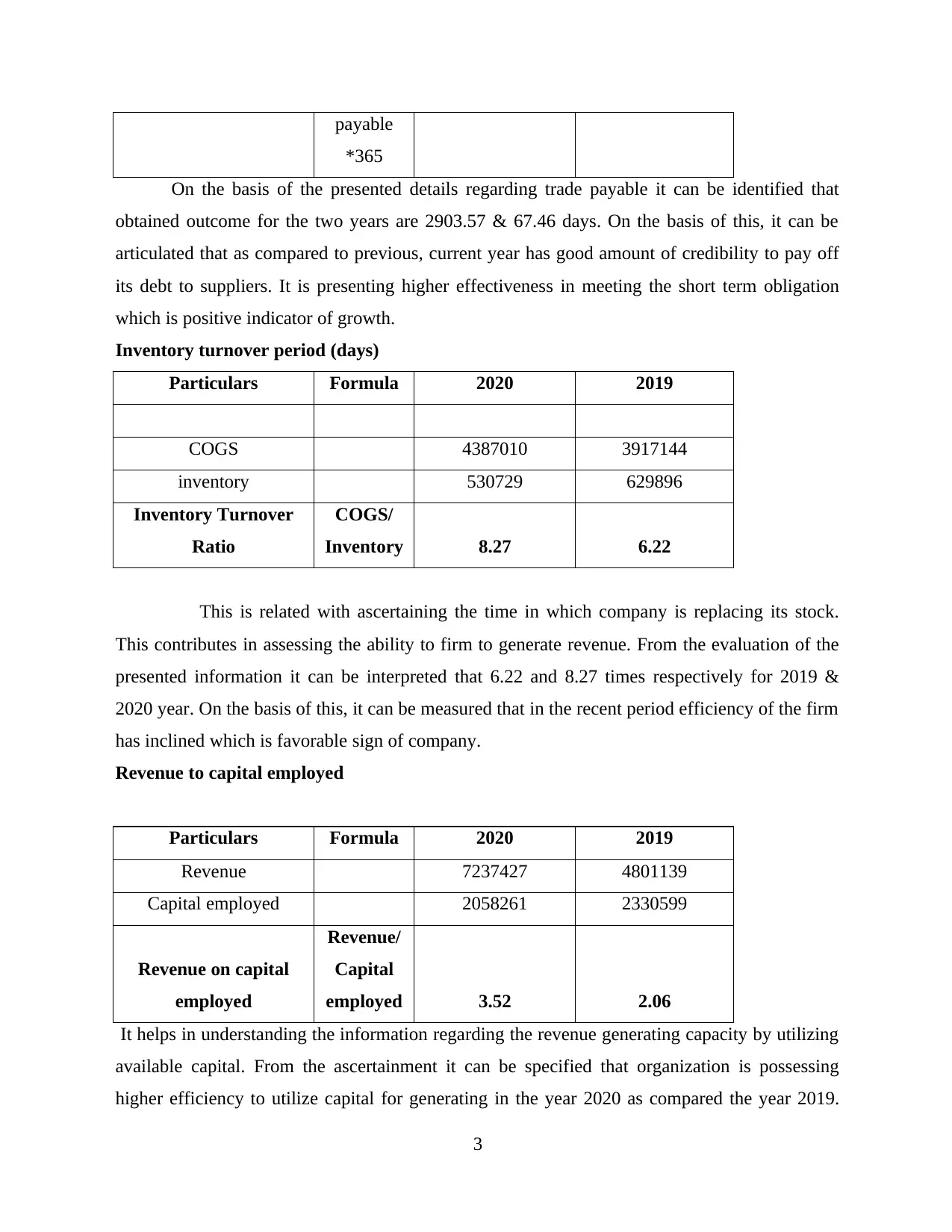

Inventory turnover period (days)

Particulars Formula 2020 2019

COGS 4387010 3917144

inventory 530729 629896

Inventory Turnover

Ratio

COGS/

Inventory 8.27 6.22

This is related with ascertaining the time in which company is replacing its stock.

This contributes in assessing the ability to firm to generate revenue. From the evaluation of the

presented information it can be interpreted that 6.22 and 8.27 times respectively for 2019 &

2020 year. On the basis of this, it can be measured that in the recent period efficiency of the firm

has inclined which is favorable sign of company.

Revenue to capital employed

Particulars Formula 2020 2019

Revenue 7237427 4801139

Capital employed 2058261 2330599

Revenue on capital

employed

Revenue/

Capital

employed 3.52 2.06

It helps in understanding the information regarding the revenue generating capacity by utilizing

available capital. From the ascertainment it can be specified that organization is possessing

higher efficiency to utilize capital for generating in the year 2020 as compared the year 2019.

3

*365

On the basis of the presented details regarding trade payable it can be identified that

obtained outcome for the two years are 2903.57 & 67.46 days. On the basis of this, it can be

articulated that as compared to previous, current year has good amount of credibility to pay off

its debt to suppliers. It is presenting higher effectiveness in meeting the short term obligation

which is positive indicator of growth.

Inventory turnover period (days)

Particulars Formula 2020 2019

COGS 4387010 3917144

inventory 530729 629896

Inventory Turnover

Ratio

COGS/

Inventory 8.27 6.22

This is related with ascertaining the time in which company is replacing its stock.

This contributes in assessing the ability to firm to generate revenue. From the evaluation of the

presented information it can be interpreted that 6.22 and 8.27 times respectively for 2019 &

2020 year. On the basis of this, it can be measured that in the recent period efficiency of the firm

has inclined which is favorable sign of company.

Revenue to capital employed

Particulars Formula 2020 2019

Revenue 7237427 4801139

Capital employed 2058261 2330599

Revenue on capital

employed

Revenue/

Capital

employed 3.52 2.06

It helps in understanding the information regarding the revenue generating capacity by utilizing

available capital. From the ascertainment it can be specified that organization is possessing

higher efficiency to utilize capital for generating in the year 2020 as compared the year 2019.

3

On the basis of this, it can be interpreted that company possessing high ability to generate

revenue e which is good for the organization.

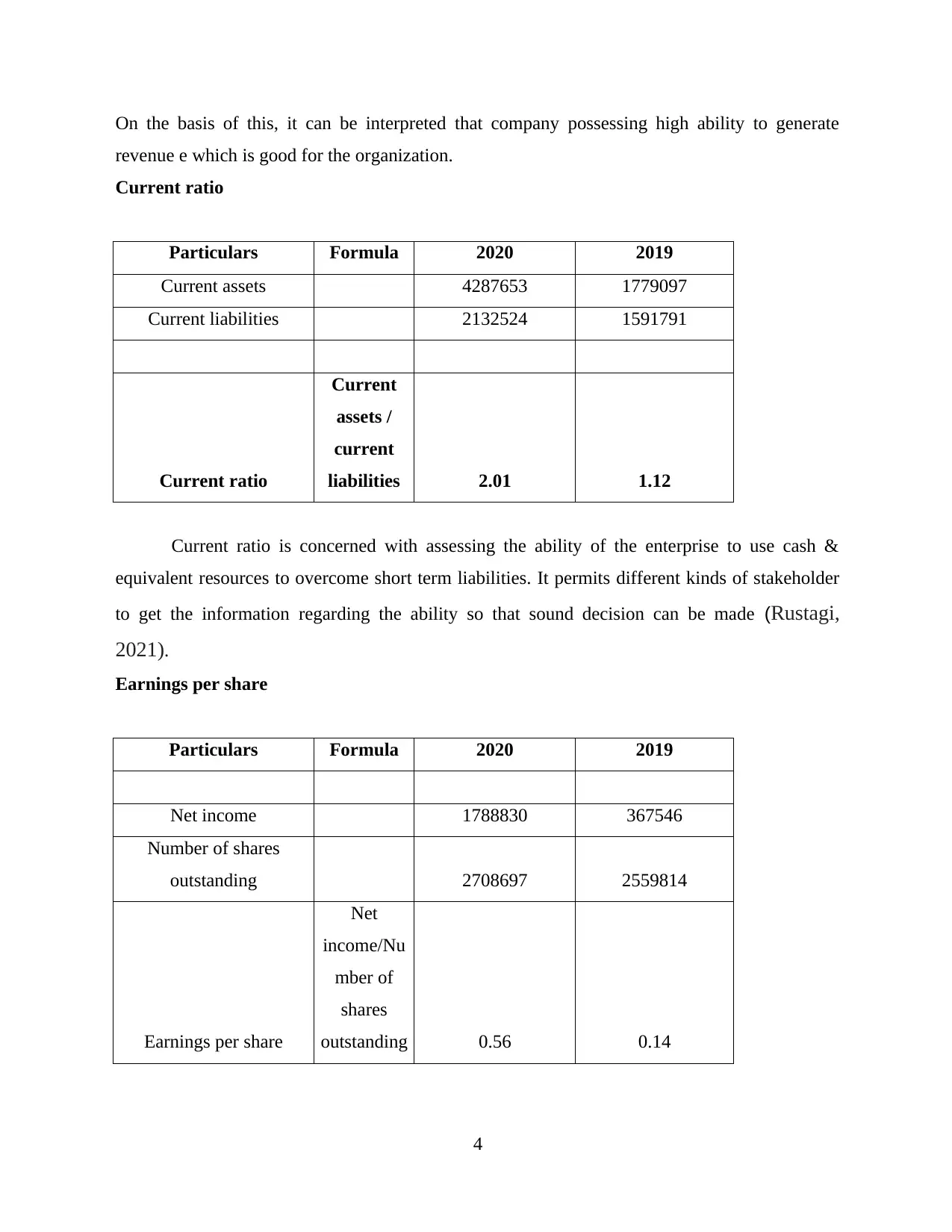

Current ratio

Particulars Formula 2020 2019

Current assets 4287653 1779097

Current liabilities 2132524 1591791

Current ratio

Current

assets /

current

liabilities 2.01 1.12

Current ratio is concerned with assessing the ability of the enterprise to use cash &

equivalent resources to overcome short term liabilities. It permits different kinds of stakeholder

to get the information regarding the ability so that sound decision can be made (Rustagi,

2021).

Earnings per share

Particulars Formula 2020 2019

Net income 1788830 367546

Number of shares

outstanding 2708697 2559814

Earnings per share

Net

income/Nu

mber of

shares

outstanding 0.56 0.14

4

revenue e which is good for the organization.

Current ratio

Particulars Formula 2020 2019

Current assets 4287653 1779097

Current liabilities 2132524 1591791

Current ratio

Current

assets /

current

liabilities 2.01 1.12

Current ratio is concerned with assessing the ability of the enterprise to use cash &

equivalent resources to overcome short term liabilities. It permits different kinds of stakeholder

to get the information regarding the ability so that sound decision can be made (Rustagi,

2021).

Earnings per share

Particulars Formula 2020 2019

Net income 1788830 367546

Number of shares

outstanding 2708697 2559814

Earnings per share

Net

income/Nu

mber of

shares

outstanding 0.56 0.14

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

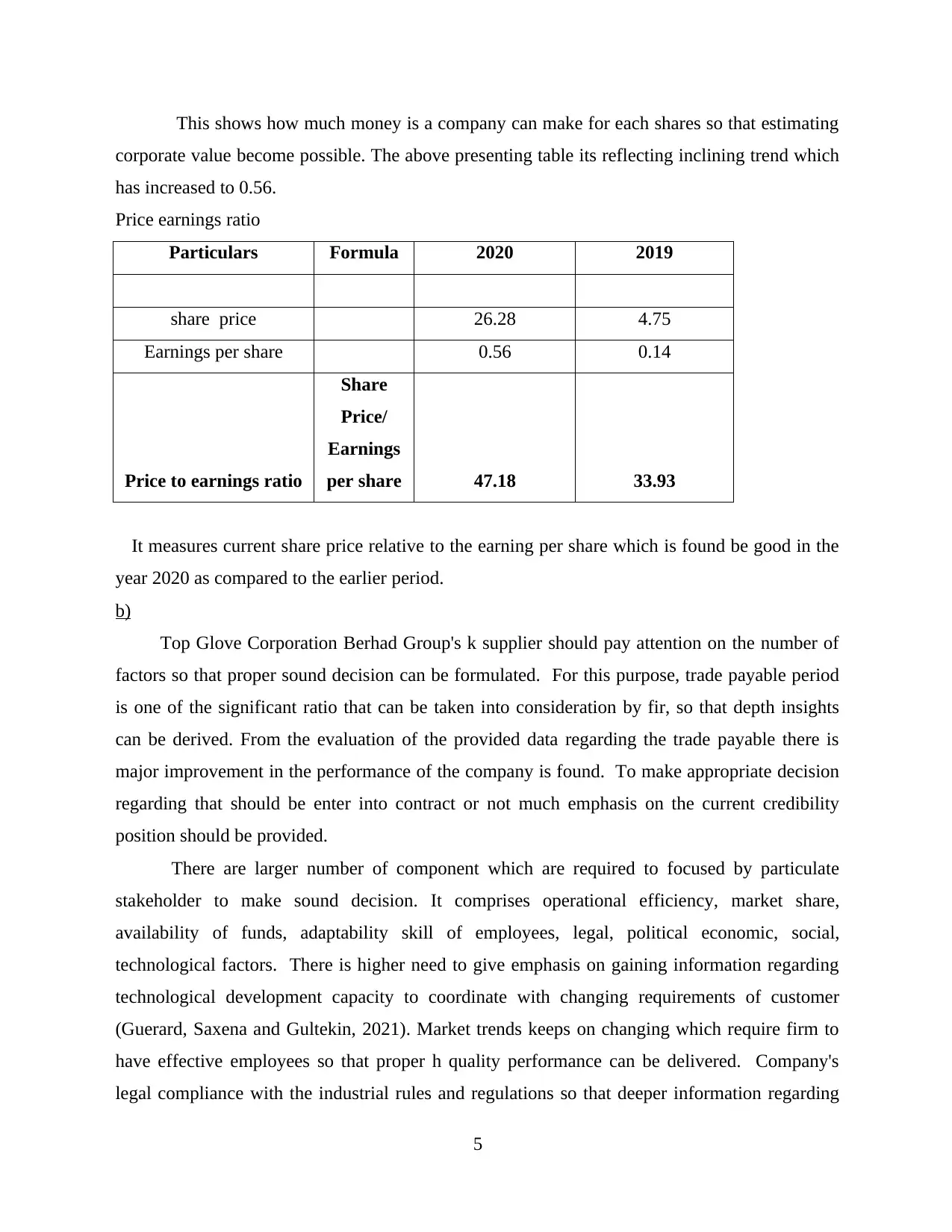

This shows how much money is a company can make for each shares so that estimating

corporate value become possible. The above presenting table its reflecting inclining trend which

has increased to 0.56.

Price earnings ratio

Particulars Formula 2020 2019

share price 26.28 4.75

Earnings per share 0.56 0.14

Price to earnings ratio

Share

Price/

Earnings

per share 47.18 33.93

It measures current share price relative to the earning per share which is found be good in the

year 2020 as compared to the earlier period.

b)

Top Glove Corporation Berhad Group's k supplier should pay attention on the number of

factors so that proper sound decision can be formulated. For this purpose, trade payable period

is one of the significant ratio that can be taken into consideration by fir, so that depth insights

can be derived. From the evaluation of the provided data regarding the trade payable there is

major improvement in the performance of the company is found. To make appropriate decision

regarding that should be enter into contract or not much emphasis on the current credibility

position should be provided.

There are larger number of component which are required to focused by particulate

stakeholder to make sound decision. It comprises operational efficiency, market share,

availability of funds, adaptability skill of employees, legal, political economic, social,

technological factors. There is higher need to give emphasis on gaining information regarding

technological development capacity to coordinate with changing requirements of customer

(Guerard, Saxena and Gultekin, 2021). Market trends keeps on changing which require firm to

have effective employees so that proper h quality performance can be delivered. Company's

legal compliance with the industrial rules and regulations so that deeper information regarding

5

corporate value become possible. The above presenting table its reflecting inclining trend which

has increased to 0.56.

Price earnings ratio

Particulars Formula 2020 2019

share price 26.28 4.75

Earnings per share 0.56 0.14

Price to earnings ratio

Share

Price/

Earnings

per share 47.18 33.93

It measures current share price relative to the earning per share which is found be good in the

year 2020 as compared to the earlier period.

b)

Top Glove Corporation Berhad Group's k supplier should pay attention on the number of

factors so that proper sound decision can be formulated. For this purpose, trade payable period

is one of the significant ratio that can be taken into consideration by fir, so that depth insights

can be derived. From the evaluation of the provided data regarding the trade payable there is

major improvement in the performance of the company is found. To make appropriate decision

regarding that should be enter into contract or not much emphasis on the current credibility

position should be provided.

There are larger number of component which are required to focused by particulate

stakeholder to make sound decision. It comprises operational efficiency, market share,

availability of funds, adaptability skill of employees, legal, political economic, social,

technological factors. There is higher need to give emphasis on gaining information regarding

technological development capacity to coordinate with changing requirements of customer

(Guerard, Saxena and Gultekin, 2021). Market trends keeps on changing which require firm to

have effective employees so that proper h quality performance can be delivered. Company's

legal compliance with the industrial rules and regulations so that deeper information regarding

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

performance of the company can be identified. The prevailing policies structure, etc are the few

other factors which are needed to be ascertained by supplier to assess liquidity and operational

efficiency so that higher profitability and stability decision can be made. On the basis of this

information can be specified that supplier can positively enter into contract so that sustainability

in the processing can be derived.

c)

Ratio analysis is concerned with possessing the information regarding the financial

position of the company in effective manner. There are several set who uses this technique to

analyses the performance of the organization. The main reason behind applying ratio analysis is

to give the information in understandable, accurate and easy manner (Hussain, Salia and Karim,

2018). To meet this objective both internal and external stakeholder pay attention on possessing

information from the ratio analysis.

There are several types of benefits which can be derived by applying ratio analysis it

includes forecasting and planning, budgeting, measuring operational efficiency,

communicating has crucial information, indication of liquidity position, m long term solvency

status, profitability of organization, etc.

On the other side, there are different kinds of limitations which are required to be taken

into practice by the organization for making appropriate decision (Khan and et.al., 2021). It

involves relying on historical information, in immateriality of financial statements, distinct

accounting policies, quantitative analysis, window dressing, different interpreting pattern, etc

form the given information it can be specified that these are the pros and cons which are

identified from the given statement. It can be mentioned that these are the crucial aspects which

are required to be highlighted by stakeholders for making strategic decision.

QUESTION B3

a. Five sources with advantages and disadvantages:

1. Share capital: It is the money that the company raises by issuing the shares in the market. The

amount of share capital may change with the fluctuations in the share market.

Advantages: Flexible as company can used this amount however they want, it is long-

term financing, collateral-free financing, it lowers the risk when the company become

bankrupt, etc.

6

other factors which are needed to be ascertained by supplier to assess liquidity and operational

efficiency so that higher profitability and stability decision can be made. On the basis of this

information can be specified that supplier can positively enter into contract so that sustainability

in the processing can be derived.

c)

Ratio analysis is concerned with possessing the information regarding the financial

position of the company in effective manner. There are several set who uses this technique to

analyses the performance of the organization. The main reason behind applying ratio analysis is

to give the information in understandable, accurate and easy manner (Hussain, Salia and Karim,

2018). To meet this objective both internal and external stakeholder pay attention on possessing

information from the ratio analysis.

There are several types of benefits which can be derived by applying ratio analysis it

includes forecasting and planning, budgeting, measuring operational efficiency,

communicating has crucial information, indication of liquidity position, m long term solvency

status, profitability of organization, etc.

On the other side, there are different kinds of limitations which are required to be taken

into practice by the organization for making appropriate decision (Khan and et.al., 2021). It

involves relying on historical information, in immateriality of financial statements, distinct

accounting policies, quantitative analysis, window dressing, different interpreting pattern, etc

form the given information it can be specified that these are the pros and cons which are

identified from the given statement. It can be mentioned that these are the crucial aspects which

are required to be highlighted by stakeholders for making strategic decision.

QUESTION B3

a. Five sources with advantages and disadvantages:

1. Share capital: It is the money that the company raises by issuing the shares in the market. The

amount of share capital may change with the fluctuations in the share market.

Advantages: Flexible as company can used this amount however they want, it is long-

term financing, collateral-free financing, it lowers the risk when the company become

bankrupt, etc.

6

Disadvantages: The dividends are not certain on share capital, involves the high risk as it

depends on market fluctuations, high changes in price, limited control, etc.

2. Retained Earnings: This is the portion of the earnings of the company's total profit that are

saved and used for the future problems (Yemi and Seriki, 2018). It is also called surplus that

helps the company to reinvest into the business.

Advantages: It provides finance for facing the contingencies, available funds in order to

grow and develop business, these are free source of finance, etc. Disadvantages: There must be improper utilization of funds, over-capitalization may

happen, by retains it lowers the rate of dividend for shareholders.

3. Right issue: It means offering of the shares to all the equity and preference shareholders of

the company (Kusuma and Yasa, 2019). These shares are issued in order to raise the capital in

the organization.

Advantages: It is the fastest and economical method in order to increase the capital,

provides and opportunities for existing shareholders to increase stake at the reduced cost. Disadvantages: After having right issue the prices of share may decline, shareholding

percentage may get reduced, creates negative effect of the company in public, etc.

4. Secured Bond: It is a type of investment in the debt instrument which are secured by the

specific asset that is owned by the issuer. The bonds must be secured in order recover the

amount in failure of payments and interests.

Advantages: There is no risk for the payment of the principal amount, can avail the tax

benefits by the person, etc. Disadvantages: Investors receives less interest on the loans given, sometimes amount is

not recovered by the collateral security, etc.

5. Leases: It is the legal and binding contract which outlines the terms and conditions when one

party agrees to rent their property to the other party (Iskandar and Husniah, 2017). There must

be a written agreement which includes all the terms and conditions.

Advantages: Less starting cash investments is required, lowers the monthly payments,

provides the tax benefits, etc.

Disadvantages: There is no permission of the renovation, high risk is involved, loss in

salvage value of the property leased, etc.

7

depends on market fluctuations, high changes in price, limited control, etc.

2. Retained Earnings: This is the portion of the earnings of the company's total profit that are

saved and used for the future problems (Yemi and Seriki, 2018). It is also called surplus that

helps the company to reinvest into the business.

Advantages: It provides finance for facing the contingencies, available funds in order to

grow and develop business, these are free source of finance, etc. Disadvantages: There must be improper utilization of funds, over-capitalization may

happen, by retains it lowers the rate of dividend for shareholders.

3. Right issue: It means offering of the shares to all the equity and preference shareholders of

the company (Kusuma and Yasa, 2019). These shares are issued in order to raise the capital in

the organization.

Advantages: It is the fastest and economical method in order to increase the capital,

provides and opportunities for existing shareholders to increase stake at the reduced cost. Disadvantages: After having right issue the prices of share may decline, shareholding

percentage may get reduced, creates negative effect of the company in public, etc.

4. Secured Bond: It is a type of investment in the debt instrument which are secured by the

specific asset that is owned by the issuer. The bonds must be secured in order recover the

amount in failure of payments and interests.

Advantages: There is no risk for the payment of the principal amount, can avail the tax

benefits by the person, etc. Disadvantages: Investors receives less interest on the loans given, sometimes amount is

not recovered by the collateral security, etc.

5. Leases: It is the legal and binding contract which outlines the terms and conditions when one

party agrees to rent their property to the other party (Iskandar and Husniah, 2017). There must

be a written agreement which includes all the terms and conditions.

Advantages: Less starting cash investments is required, lowers the monthly payments,

provides the tax benefits, etc.

Disadvantages: There is no permission of the renovation, high risk is involved, loss in

salvage value of the property leased, etc.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b. Critically evaluating the appropriate method when valuing a listed enterprise for sale

Net asset value: Net asset value that is NAV of the entity is calculated by the value of the

firm’s assets minus the value of the liabilities of the firm. Securities and exchange commission

are also redeemed at their net asset value (Sumantyo and Savitri, 2019). This makes the

company to have accurate valuation of the assets in order to have good decision for company. It

is used by company to identify the potential investments benefits in mutual fund or indexes. But

this valuation did not reflect the benefits to the company for the future point of view.

Price earnings multiples: This method used to compare the earning per share that is

reported by the company to the price of the market of its common stock. These multiples are

used by the investors in order to judge that how the expensive a share of the company's stock. It

is calculated by dividing the market value of the per share by the company's earning on per

share. It si sometimes difficult to compare companies around the industries. It is one of the best

method to do the valuation of the stocks in the company.

Discounted cash flow method: Discounted cash flow is the method of valuation which si

used to estimate the value of the investment which is basically based on the future cash flows of

the company. The present value of the expected cash flow is taken out by using this method of

valuation (Li and et.al., 2017). If the current cost of the capital is lower than discounted cash

flow the organization has opportunity to have positive returns to the future. These methods have

limitation like that it believes on the estimations of the expected future cash flow, which may be

proved wrong by the company in the future.

The best and appropriate method that the company can have when valuing the

organization for sale is the Net asset value. This is the most appropriate because the calculated

by the value of the firm’s assets subtracting the value of the liabilities of the organization. By

this the listed enterprise can get the best value of their organization. By having this method, the

company can have the best investment opportunities in the future.

8

Net asset value: Net asset value that is NAV of the entity is calculated by the value of the

firm’s assets minus the value of the liabilities of the firm. Securities and exchange commission

are also redeemed at their net asset value (Sumantyo and Savitri, 2019). This makes the

company to have accurate valuation of the assets in order to have good decision for company. It

is used by company to identify the potential investments benefits in mutual fund or indexes. But

this valuation did not reflect the benefits to the company for the future point of view.

Price earnings multiples: This method used to compare the earning per share that is

reported by the company to the price of the market of its common stock. These multiples are

used by the investors in order to judge that how the expensive a share of the company's stock. It

is calculated by dividing the market value of the per share by the company's earning on per

share. It si sometimes difficult to compare companies around the industries. It is one of the best

method to do the valuation of the stocks in the company.

Discounted cash flow method: Discounted cash flow is the method of valuation which si

used to estimate the value of the investment which is basically based on the future cash flows of

the company. The present value of the expected cash flow is taken out by using this method of

valuation (Li and et.al., 2017). If the current cost of the capital is lower than discounted cash

flow the organization has opportunity to have positive returns to the future. These methods have

limitation like that it believes on the estimations of the expected future cash flow, which may be

proved wrong by the company in the future.

The best and appropriate method that the company can have when valuing the

organization for sale is the Net asset value. This is the most appropriate because the calculated

by the value of the firm’s assets subtracting the value of the liabilities of the organization. By

this the listed enterprise can get the best value of their organization. By having this method, the

company can have the best investment opportunities in the future.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Guerard, J. B., Saxena, A. and Gultekin, M., 2021. Financing Current Operations and Efficiency

Ratio Analysis. In Quantitative Corporate Finance (pp. 79-98). Springer, Cham.

Hussain, J., Salia, S. and Karim, A., 2018. Is knowledge that powerful? Financial literacy and

access to finance: An analysis of enterprises in the UK. Journal of Small Business and

Enterprise Development.

Iskandar, B. P. and Husniah, H., 2017. Optimal preventive maintenance for a two dimensional

lease contract. Computers & Industrial Engineering.113. pp.693-703.

Khan, A. and et.al., 2021. A survey of Islamic finance research–Influences and

influencers. Pacific-Basin Finance Journal. 69. p.101437.

Kusuma, P. S. A. J. and Yasa, G. W., 2019. Comparative analysis of company market reactions

on right issue for pay debt and investment. International Research Journal of

Management, IT and Social Sciences. 6(3). pp.29-36.

Li, R. and et.al., 2017. Pricing and lot-sizing policies for perishable products with advance-cash-

credit payments by a discounted cash-flow analysis. International Journal of

Production Economics. 193. pp.578-589.

pp.300-307.

Stewart, B., 2017. Sport funding and finance. Routledge.

Sumantyo, R. and Savitri, D. A., 2019. Macroeconomic variables towards net asset value of

sharia mutual funds in Indonesia and Malaysia. Jurnal Keuangan dan Perbankan. 23(2).

Yemi, A. E. and Seriki, A. I., 2018. Retained Earnings and Firms' Market Value: Nigeria

Experience. The Business & Management Review. 9(3). pp.482-496.

9

Books and Journals

Guerard, J. B., Saxena, A. and Gultekin, M., 2021. Financing Current Operations and Efficiency

Ratio Analysis. In Quantitative Corporate Finance (pp. 79-98). Springer, Cham.

Hussain, J., Salia, S. and Karim, A., 2018. Is knowledge that powerful? Financial literacy and

access to finance: An analysis of enterprises in the UK. Journal of Small Business and

Enterprise Development.

Iskandar, B. P. and Husniah, H., 2017. Optimal preventive maintenance for a two dimensional

lease contract. Computers & Industrial Engineering.113. pp.693-703.

Khan, A. and et.al., 2021. A survey of Islamic finance research–Influences and

influencers. Pacific-Basin Finance Journal. 69. p.101437.

Kusuma, P. S. A. J. and Yasa, G. W., 2019. Comparative analysis of company market reactions

on right issue for pay debt and investment. International Research Journal of

Management, IT and Social Sciences. 6(3). pp.29-36.

Li, R. and et.al., 2017. Pricing and lot-sizing policies for perishable products with advance-cash-

credit payments by a discounted cash-flow analysis. International Journal of

Production Economics. 193. pp.578-589.

pp.300-307.

Stewart, B., 2017. Sport funding and finance. Routledge.

Sumantyo, R. and Savitri, D. A., 2019. Macroeconomic variables towards net asset value of

sharia mutual funds in Indonesia and Malaysia. Jurnal Keuangan dan Perbankan. 23(2).

Yemi, A. E. and Seriki, A. I., 2018. Retained Earnings and Firms' Market Value: Nigeria

Experience. The Business & Management Review. 9(3). pp.482-496.

9

<https://ohiostate.pressbooks.pub/drivechange/chapter/chapter-1/>.

10

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.