Comprehensive Financial Performance Report of Wesfarmers Ltd

VerifiedAdded on 2023/06/04

|17

|3679

|173

Report

AI Summary

This report provides a comprehensive financial analysis of Wesfarmers Limited for the years 2016 and 2017. It includes an overview of the company, its core activities, and competitive advantages. The analysis covers key performance ratios such as short-term solvency, long-term solvency, asset utilization, profitability, and market value ratios. The report also features a comparison of share price movements and a stock valuation using the Constant Dividend Growth Rate Model. Ultimately, the report aims to determine the financial soundness of Wesfarmers and provides recommendations based on the analysis, offering insights into the company's financial performance and position during the analyzed period; this assignment is available on Desklib, a platform offering a range of study tools for students.

RUNNING HEAD: BUSINESS FINANCE

Analysis of financial statements

Analysis of financial statements

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business finance 2

Contents

Introduction.................................................................................................................................................3

Company’s overview...................................................................................................................................3

Calculation and analysis of performance ratios...........................................................................................4

Short term solvency.................................................................................................................................4

Long term solvency.................................................................................................................................6

Asset utilization.......................................................................................................................................8

Profitability ratios....................................................................................................................................9

Market value ratios................................................................................................................................11

Graphs and comparison of share price movements....................................................................................12

Share valuation..........................................................................................................................................13

Recommendation and Conclusion.............................................................................................................14

References.................................................................................................................................................15

Contents

Introduction.................................................................................................................................................3

Company’s overview...................................................................................................................................3

Calculation and analysis of performance ratios...........................................................................................4

Short term solvency.................................................................................................................................4

Long term solvency.................................................................................................................................6

Asset utilization.......................................................................................................................................8

Profitability ratios....................................................................................................................................9

Market value ratios................................................................................................................................11

Graphs and comparison of share price movements....................................................................................12

Share valuation..........................................................................................................................................13

Recommendation and Conclusion.............................................................................................................14

References.................................................................................................................................................15

Business finance 3

Introduction

The report talks about the overall analysis of Wesfarmers Limited’s financial performance for

the past two years. The financial statements, share price trends and value of stock have been

analyzed in the whole report. Constant Dividend Growth Rate Model is applied to figure out the

value of company’s stock and then the same is compared to its current share price. It gives a

short overview about the organization selected, featuring its core activities, competitive

advantages and depicting the market in which it works. In the later part, performance ratios or

financial metrics are been computed which reflect the overall performance and position of

Wesfarmers in the past two years that are 2016 and 2017.

The report also presents graphical portrayal and comparison of past share prices with the market

index along with the assessment of organization's stock value. The purpose of the report is to

determine that whether the chosen company is monetary sound or not. In the last, a suggestion

and conclusion is given which summarizes the result of the analysis performed. It gives bits of

knowledge about the financial performance and position of Wesfarmers in 2016 and 2017.

Company’s overview

Wesfarmers Limited is an Australia based conglomerate company which deals in several types of

business consists of supermarkets, office supplies, coal products, fertilizers and many others. The

company was founded in 1914 and is listed on ASX with a symbol ASX: WES. It is considered

as the largest private employer across the country. Wesfarmers operates through segments named

as Coles, Home Improvement, Department stores including Kmart and Target, WIS and

WesCEF and others. The division Coles is a supermarket dealer having more than 770

Introduction

The report talks about the overall analysis of Wesfarmers Limited’s financial performance for

the past two years. The financial statements, share price trends and value of stock have been

analyzed in the whole report. Constant Dividend Growth Rate Model is applied to figure out the

value of company’s stock and then the same is compared to its current share price. It gives a

short overview about the organization selected, featuring its core activities, competitive

advantages and depicting the market in which it works. In the later part, performance ratios or

financial metrics are been computed which reflect the overall performance and position of

Wesfarmers in the past two years that are 2016 and 2017.

The report also presents graphical portrayal and comparison of past share prices with the market

index along with the assessment of organization's stock value. The purpose of the report is to

determine that whether the chosen company is monetary sound or not. In the last, a suggestion

and conclusion is given which summarizes the result of the analysis performed. It gives bits of

knowledge about the financial performance and position of Wesfarmers in 2016 and 2017.

Company’s overview

Wesfarmers Limited is an Australia based conglomerate company which deals in several types of

business consists of supermarkets, office supplies, coal products, fertilizers and many others. The

company was founded in 1914 and is listed on ASX with a symbol ASX: WES. It is considered

as the largest private employer across the country. Wesfarmers operates through segments named

as Coles, Home Improvement, Department stores including Kmart and Target, WIS and

WesCEF and others. The division Coles is a supermarket dealer having more than 770

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business finance 4

supermarkets; Home Improvement provided outdoor living products in Australia and New

Zealand. According to the annual report of 2017, the company has made revenue amounted to

$6.44 billion and profit worth $2.87 billion (Bloomberg. 2018).

The competitive advantage of Wesfarmers is its Kmart division which is delivering products at

reasonable prices and has maintained the style and quality of the services. Moreover, the

company is focused on keeping Coles highly competitive despite of the Woolworth’s billion

dollar investment in prices. In addition the sale of coal and competent float of Officeworks can

deliver more earnings to the company (SMH. 2017). According to the last year report of Deloitte,

Wesfarmers and Woolworths are the only two retailers that appeared in the list of top 250

retailers around the globe. Wesfarmers was ahead of Woolworth because of its constant growth

in Bunning brand and exit of WOW’s Home Improvement segment. The company has one a

major contribution to the retail industry of Australia (Deloitte. 2017). However, as per the report

of KPMG the retail sector of Australia is facing disruption due to the changes in customer

preferences and entrance of overseas businesses with a new approach of retailing. The future of

retail industry requires more multiplicity of delivery platforms to ensure that every requirement

is met. All such can easily impact the performance of Wesfarmers (KPMG. 2018).

Calculation and analysis of performance ratios

Short term solvency

Current ratio: It is one of the liquidity ratios which determine the probability of the

organization in satisfying its present liabilities by utilizing its current resources. The ideal

ratio is 2:1 which implies that the current assets should be twofold of liabilities in order to

meet all the obligations efficiently and effectively (Saleem and Rehman, 2011).

supermarkets; Home Improvement provided outdoor living products in Australia and New

Zealand. According to the annual report of 2017, the company has made revenue amounted to

$6.44 billion and profit worth $2.87 billion (Bloomberg. 2018).

The competitive advantage of Wesfarmers is its Kmart division which is delivering products at

reasonable prices and has maintained the style and quality of the services. Moreover, the

company is focused on keeping Coles highly competitive despite of the Woolworth’s billion

dollar investment in prices. In addition the sale of coal and competent float of Officeworks can

deliver more earnings to the company (SMH. 2017). According to the last year report of Deloitte,

Wesfarmers and Woolworths are the only two retailers that appeared in the list of top 250

retailers around the globe. Wesfarmers was ahead of Woolworth because of its constant growth

in Bunning brand and exit of WOW’s Home Improvement segment. The company has one a

major contribution to the retail industry of Australia (Deloitte. 2017). However, as per the report

of KPMG the retail sector of Australia is facing disruption due to the changes in customer

preferences and entrance of overseas businesses with a new approach of retailing. The future of

retail industry requires more multiplicity of delivery platforms to ensure that every requirement

is met. All such can easily impact the performance of Wesfarmers (KPMG. 2018).

Calculation and analysis of performance ratios

Short term solvency

Current ratio: It is one of the liquidity ratios which determine the probability of the

organization in satisfying its present liabilities by utilizing its current resources. The ideal

ratio is 2:1 which implies that the current assets should be twofold of liabilities in order to

meet all the obligations efficiently and effectively (Saleem and Rehman, 2011).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business finance 5

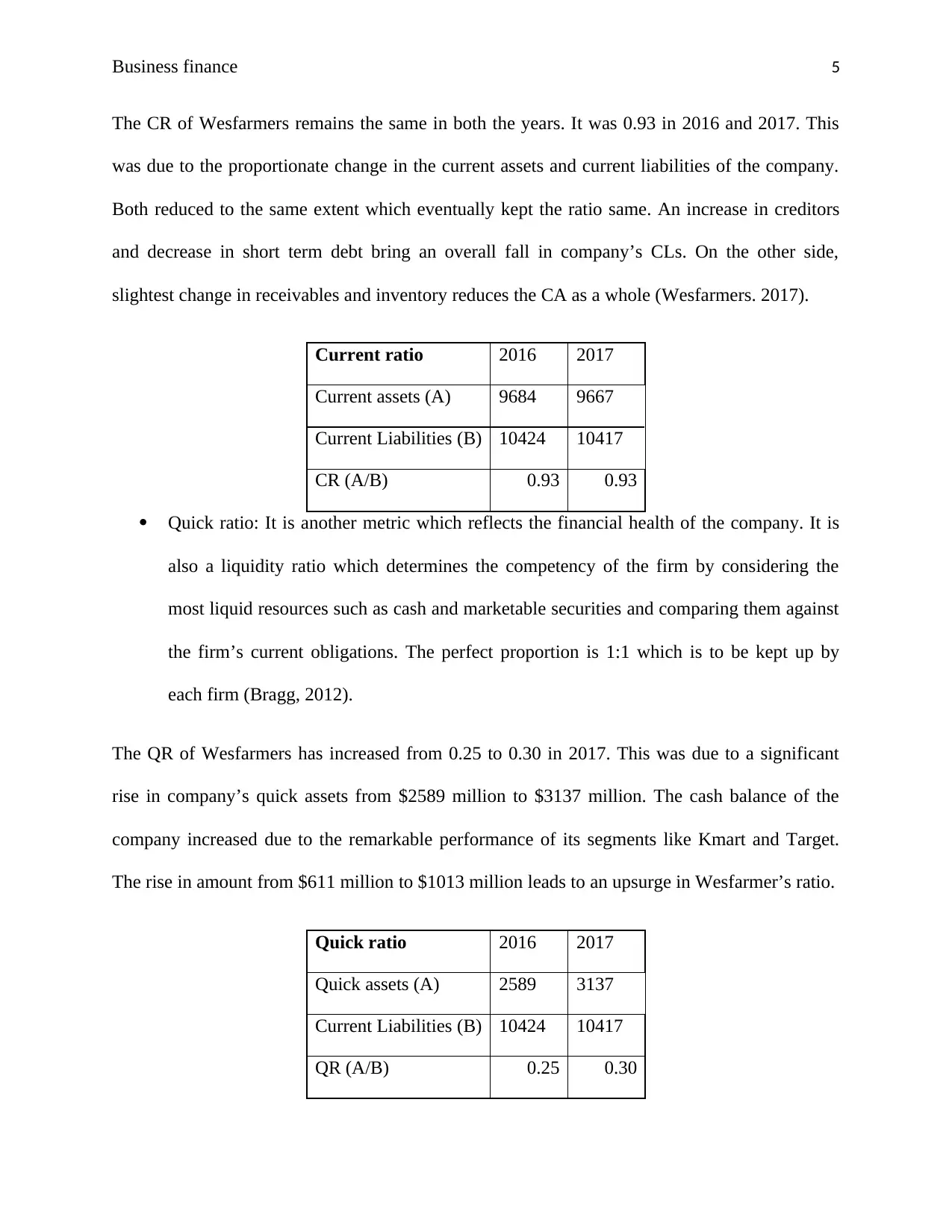

The CR of Wesfarmers remains the same in both the years. It was 0.93 in 2016 and 2017. This

was due to the proportionate change in the current assets and current liabilities of the company.

Both reduced to the same extent which eventually kept the ratio same. An increase in creditors

and decrease in short term debt bring an overall fall in company’s CLs. On the other side,

slightest change in receivables and inventory reduces the CA as a whole (Wesfarmers. 2017).

Current ratio 2016 2017

Current assets (A) 9684 9667

Current Liabilities (B) 10424 10417

CR (A/B) 0.93 0.93

Quick ratio: It is another metric which reflects the financial health of the company. It is

also a liquidity ratio which determines the competency of the firm by considering the

most liquid resources such as cash and marketable securities and comparing them against

the firm’s current obligations. The perfect proportion is 1:1 which is to be kept up by

each firm (Bragg, 2012).

The QR of Wesfarmers has increased from 0.25 to 0.30 in 2017. This was due to a significant

rise in company’s quick assets from $2589 million to $3137 million. The cash balance of the

company increased due to the remarkable performance of its segments like Kmart and Target.

The rise in amount from $611 million to $1013 million leads to an upsurge in Wesfarmer’s ratio.

Quick ratio 2016 2017

Quick assets (A) 2589 3137

Current Liabilities (B) 10424 10417

QR (A/B) 0.25 0.30

The CR of Wesfarmers remains the same in both the years. It was 0.93 in 2016 and 2017. This

was due to the proportionate change in the current assets and current liabilities of the company.

Both reduced to the same extent which eventually kept the ratio same. An increase in creditors

and decrease in short term debt bring an overall fall in company’s CLs. On the other side,

slightest change in receivables and inventory reduces the CA as a whole (Wesfarmers. 2017).

Current ratio 2016 2017

Current assets (A) 9684 9667

Current Liabilities (B) 10424 10417

CR (A/B) 0.93 0.93

Quick ratio: It is another metric which reflects the financial health of the company. It is

also a liquidity ratio which determines the competency of the firm by considering the

most liquid resources such as cash and marketable securities and comparing them against

the firm’s current obligations. The perfect proportion is 1:1 which is to be kept up by

each firm (Bragg, 2012).

The QR of Wesfarmers has increased from 0.25 to 0.30 in 2017. This was due to a significant

rise in company’s quick assets from $2589 million to $3137 million. The cash balance of the

company increased due to the remarkable performance of its segments like Kmart and Target.

The rise in amount from $611 million to $1013 million leads to an upsurge in Wesfarmer’s ratio.

Quick ratio 2016 2017

Quick assets (A) 2589 3137

Current Liabilities (B) 10424 10417

QR (A/B) 0.25 0.30

Business finance 6

Long term solvency

Debt-Equity ratio: It is a financial metric utilized for estimating the long term solvency

position of the organization. It gauges the part of company's obligation against the value

of its equity. A high D/E proportion shows high financial risk and high dependency of the

firm on outside borrowings (Bragg, 2012).

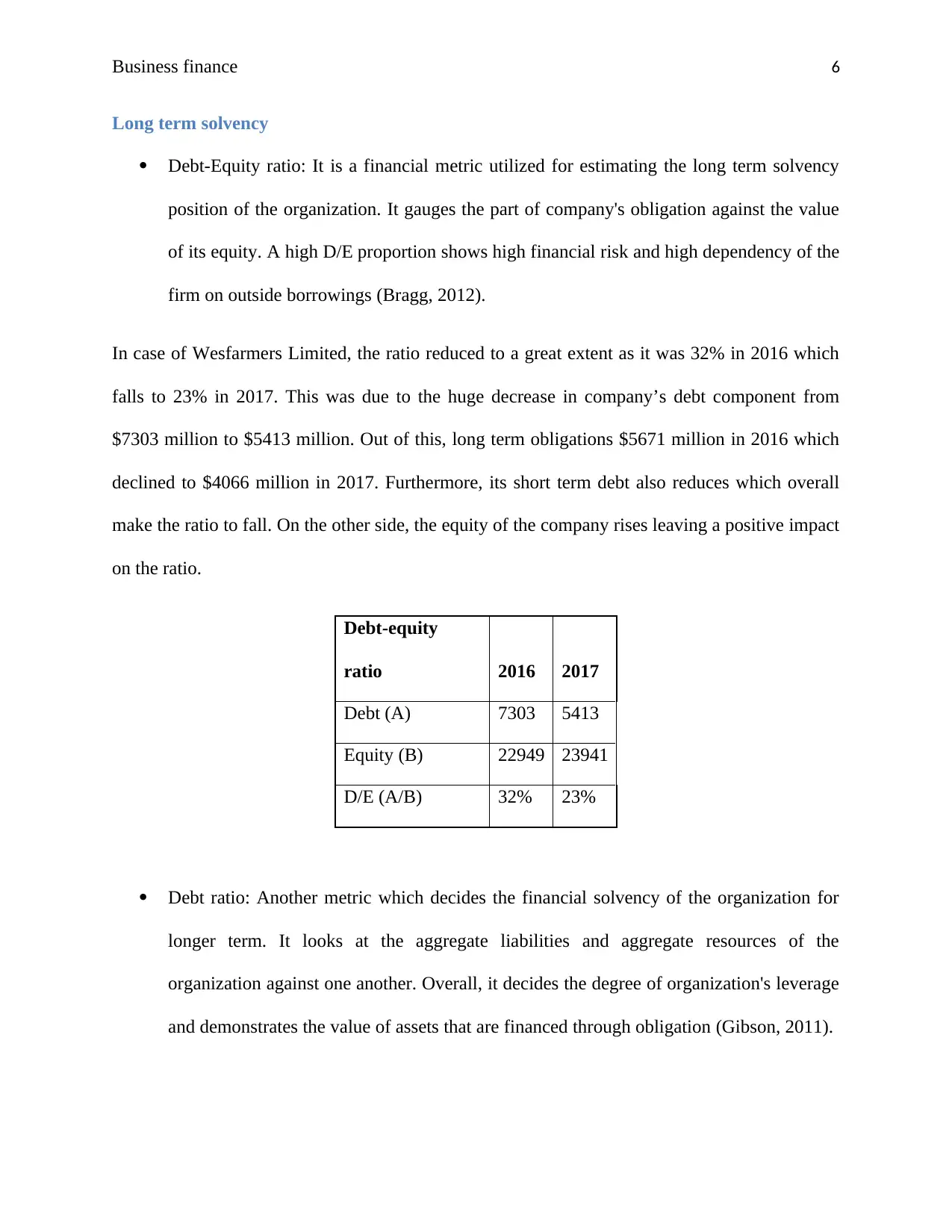

In case of Wesfarmers Limited, the ratio reduced to a great extent as it was 32% in 2016 which

falls to 23% in 2017. This was due to the huge decrease in company’s debt component from

$7303 million to $5413 million. Out of this, long term obligations $5671 million in 2016 which

declined to $4066 million in 2017. Furthermore, its short term debt also reduces which overall

make the ratio to fall. On the other side, the equity of the company rises leaving a positive impact

on the ratio.

Debt-equity

ratio 2016 2017

Debt (A) 7303 5413

Equity (B) 22949 23941

D/E (A/B) 32% 23%

Debt ratio: Another metric which decides the financial solvency of the organization for

longer term. It looks at the aggregate liabilities and aggregate resources of the

organization against one another. Overall, it decides the degree of organization's leverage

and demonstrates the value of assets that are financed through obligation (Gibson, 2011).

Long term solvency

Debt-Equity ratio: It is a financial metric utilized for estimating the long term solvency

position of the organization. It gauges the part of company's obligation against the value

of its equity. A high D/E proportion shows high financial risk and high dependency of the

firm on outside borrowings (Bragg, 2012).

In case of Wesfarmers Limited, the ratio reduced to a great extent as it was 32% in 2016 which

falls to 23% in 2017. This was due to the huge decrease in company’s debt component from

$7303 million to $5413 million. Out of this, long term obligations $5671 million in 2016 which

declined to $4066 million in 2017. Furthermore, its short term debt also reduces which overall

make the ratio to fall. On the other side, the equity of the company rises leaving a positive impact

on the ratio.

Debt-equity

ratio 2016 2017

Debt (A) 7303 5413

Equity (B) 22949 23941

D/E (A/B) 32% 23%

Debt ratio: Another metric which decides the financial solvency of the organization for

longer term. It looks at the aggregate liabilities and aggregate resources of the

organization against one another. Overall, it decides the degree of organization's leverage

and demonstrates the value of assets that are financed through obligation (Gibson, 2011).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business finance 7

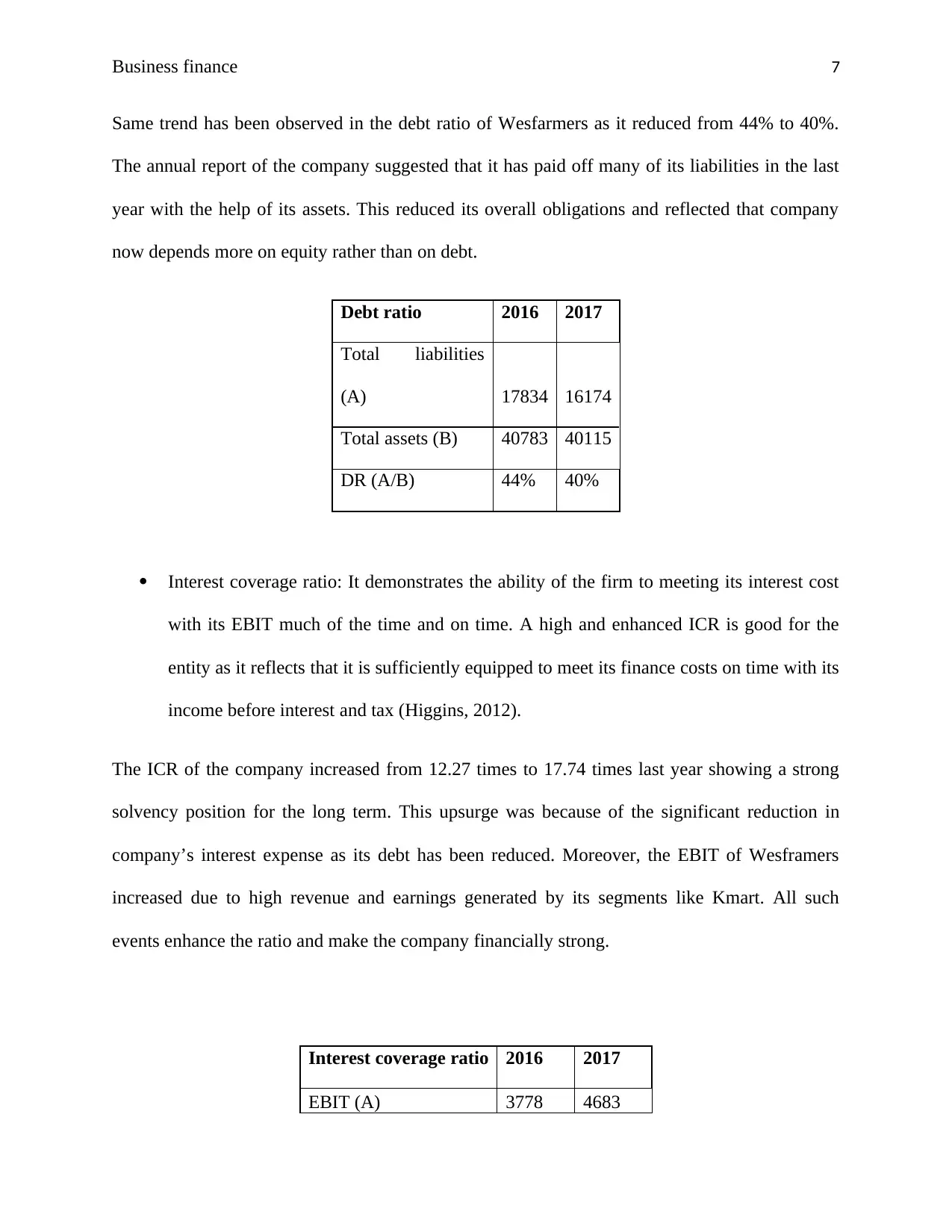

Same trend has been observed in the debt ratio of Wesfarmers as it reduced from 44% to 40%.

The annual report of the company suggested that it has paid off many of its liabilities in the last

year with the help of its assets. This reduced its overall obligations and reflected that company

now depends more on equity rather than on debt.

Debt ratio 2016 2017

Total liabilities

(A) 17834 16174

Total assets (B) 40783 40115

DR (A/B) 44% 40%

Interest coverage ratio: It demonstrates the ability of the firm to meeting its interest cost

with its EBIT much of the time and on time. A high and enhanced ICR is good for the

entity as it reflects that it is sufficiently equipped to meet its finance costs on time with its

income before interest and tax (Higgins, 2012).

The ICR of the company increased from 12.27 times to 17.74 times last year showing a strong

solvency position for the long term. This upsurge was because of the significant reduction in

company’s interest expense as its debt has been reduced. Moreover, the EBIT of Wesframers

increased due to high revenue and earnings generated by its segments like Kmart. All such

events enhance the ratio and make the company financially strong.

Interest coverage ratio 2016 2017

EBIT (A) 3778 4683

Same trend has been observed in the debt ratio of Wesfarmers as it reduced from 44% to 40%.

The annual report of the company suggested that it has paid off many of its liabilities in the last

year with the help of its assets. This reduced its overall obligations and reflected that company

now depends more on equity rather than on debt.

Debt ratio 2016 2017

Total liabilities

(A) 17834 16174

Total assets (B) 40783 40115

DR (A/B) 44% 40%

Interest coverage ratio: It demonstrates the ability of the firm to meeting its interest cost

with its EBIT much of the time and on time. A high and enhanced ICR is good for the

entity as it reflects that it is sufficiently equipped to meet its finance costs on time with its

income before interest and tax (Higgins, 2012).

The ICR of the company increased from 12.27 times to 17.74 times last year showing a strong

solvency position for the long term. This upsurge was because of the significant reduction in

company’s interest expense as its debt has been reduced. Moreover, the EBIT of Wesframers

increased due to high revenue and earnings generated by its segments like Kmart. All such

events enhance the ratio and make the company financially strong.

Interest coverage ratio 2016 2017

EBIT (A) 3778 4683

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business finance 8

Interest expense (B) 308 264

ICR (A/B) 12.27 17.74

Asset utilization

Inventory turnover ratio: It is a productivity ratio that shows how productively and

rapidly an organization can change over its inventories into money. It is computed by

isolating company's COGS with the estimation of average stock. A high ratio indicates

that company is efficient enough to convert its inventory into cash with an ease (Jenter

and Lewellen, 2015).

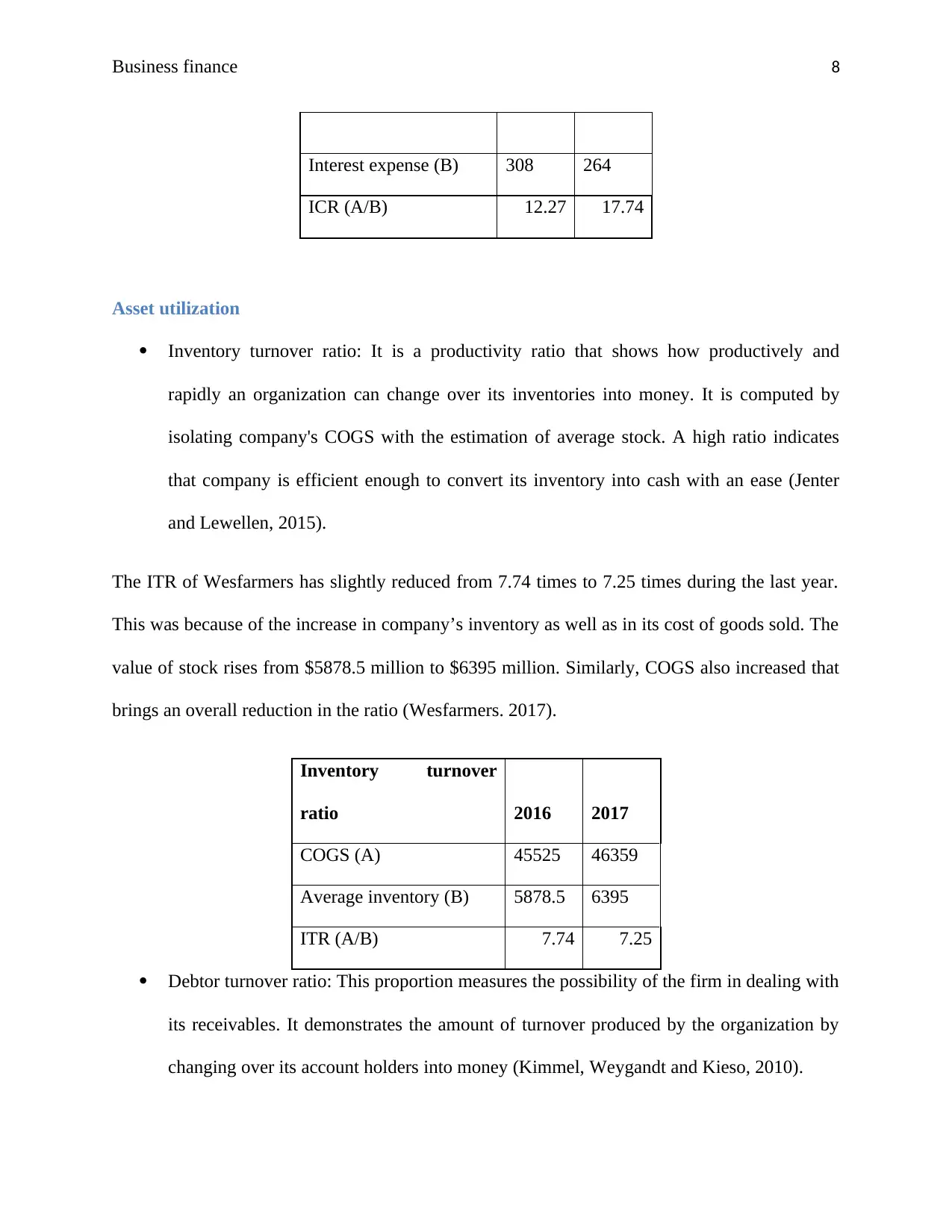

The ITR of Wesfarmers has slightly reduced from 7.74 times to 7.25 times during the last year.

This was because of the increase in company’s inventory as well as in its cost of goods sold. The

value of stock rises from $5878.5 million to $6395 million. Similarly, COGS also increased that

brings an overall reduction in the ratio (Wesfarmers. 2017).

Inventory turnover

ratio 2016 2017

COGS (A) 45525 46359

Average inventory (B) 5878.5 6395

ITR (A/B) 7.74 7.25

Debtor turnover ratio: This proportion measures the possibility of the firm in dealing with

its receivables. It demonstrates the amount of turnover produced by the organization by

changing over its account holders into money (Kimmel, Weygandt and Kieso, 2010).

Interest expense (B) 308 264

ICR (A/B) 12.27 17.74

Asset utilization

Inventory turnover ratio: It is a productivity ratio that shows how productively and

rapidly an organization can change over its inventories into money. It is computed by

isolating company's COGS with the estimation of average stock. A high ratio indicates

that company is efficient enough to convert its inventory into cash with an ease (Jenter

and Lewellen, 2015).

The ITR of Wesfarmers has slightly reduced from 7.74 times to 7.25 times during the last year.

This was because of the increase in company’s inventory as well as in its cost of goods sold. The

value of stock rises from $5878.5 million to $6395 million. Similarly, COGS also increased that

brings an overall reduction in the ratio (Wesfarmers. 2017).

Inventory turnover

ratio 2016 2017

COGS (A) 45525 46359

Average inventory (B) 5878.5 6395

ITR (A/B) 7.74 7.25

Debtor turnover ratio: This proportion measures the possibility of the firm in dealing with

its receivables. It demonstrates the amount of turnover produced by the organization by

changing over its account holders into money (Kimmel, Weygandt and Kieso, 2010).

Business finance 9

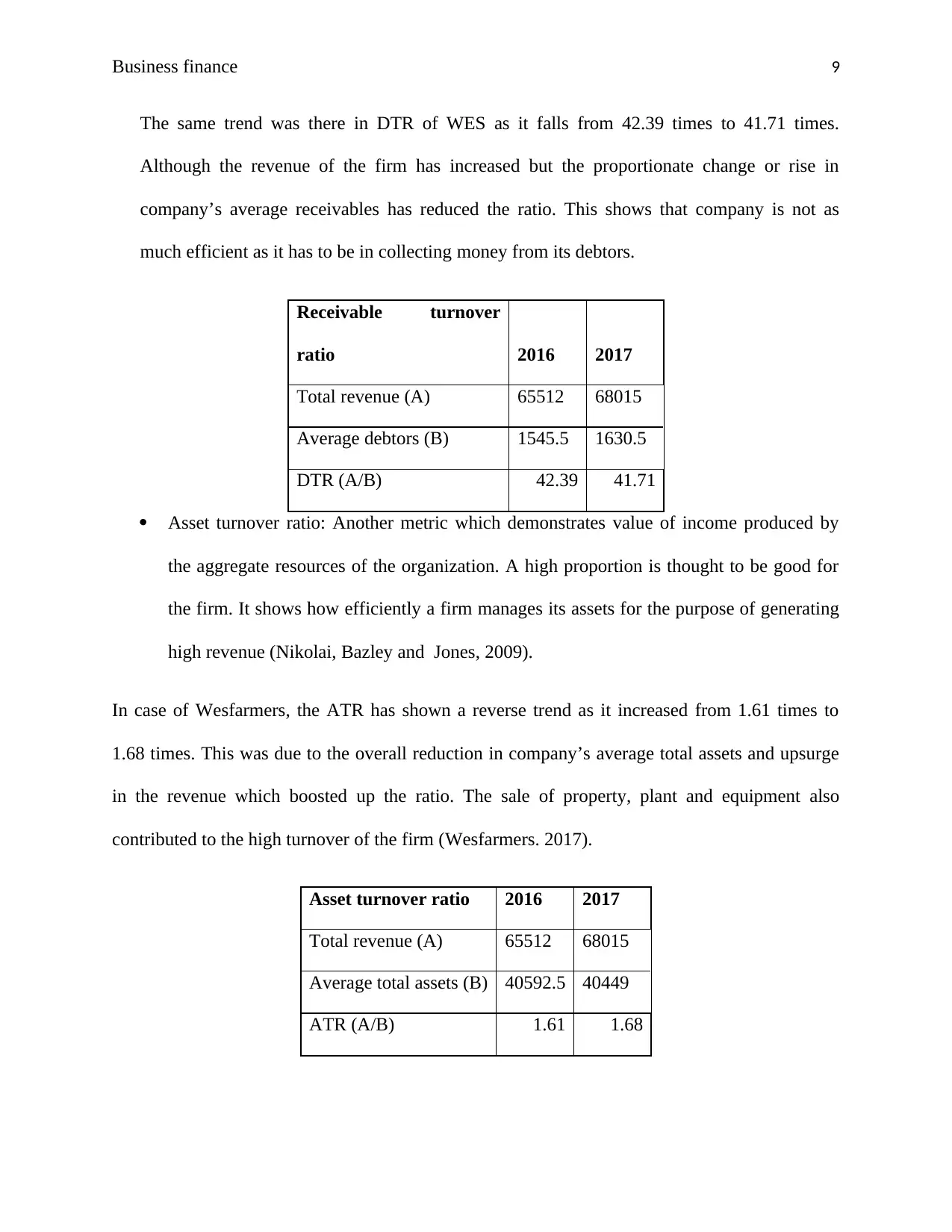

The same trend was there in DTR of WES as it falls from 42.39 times to 41.71 times.

Although the revenue of the firm has increased but the proportionate change or rise in

company’s average receivables has reduced the ratio. This shows that company is not as

much efficient as it has to be in collecting money from its debtors.

Receivable turnover

ratio 2016 2017

Total revenue (A) 65512 68015

Average debtors (B) 1545.5 1630.5

DTR (A/B) 42.39 41.71

Asset turnover ratio: Another metric which demonstrates value of income produced by

the aggregate resources of the organization. A high proportion is thought to be good for

the firm. It shows how efficiently a firm manages its assets for the purpose of generating

high revenue (Nikolai, Bazley and Jones, 2009).

In case of Wesfarmers, the ATR has shown a reverse trend as it increased from 1.61 times to

1.68 times. This was due to the overall reduction in company’s average total assets and upsurge

in the revenue which boosted up the ratio. The sale of property, plant and equipment also

contributed to the high turnover of the firm (Wesfarmers. 2017).

Asset turnover ratio 2016 2017

Total revenue (A) 65512 68015

Average total assets (B) 40592.5 40449

ATR (A/B) 1.61 1.68

The same trend was there in DTR of WES as it falls from 42.39 times to 41.71 times.

Although the revenue of the firm has increased but the proportionate change or rise in

company’s average receivables has reduced the ratio. This shows that company is not as

much efficient as it has to be in collecting money from its debtors.

Receivable turnover

ratio 2016 2017

Total revenue (A) 65512 68015

Average debtors (B) 1545.5 1630.5

DTR (A/B) 42.39 41.71

Asset turnover ratio: Another metric which demonstrates value of income produced by

the aggregate resources of the organization. A high proportion is thought to be good for

the firm. It shows how efficiently a firm manages its assets for the purpose of generating

high revenue (Nikolai, Bazley and Jones, 2009).

In case of Wesfarmers, the ATR has shown a reverse trend as it increased from 1.61 times to

1.68 times. This was due to the overall reduction in company’s average total assets and upsurge

in the revenue which boosted up the ratio. The sale of property, plant and equipment also

contributed to the high turnover of the firm (Wesfarmers. 2017).

Asset turnover ratio 2016 2017

Total revenue (A) 65512 68015

Average total assets (B) 40592.5 40449

ATR (A/B) 1.61 1.68

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business finance 10

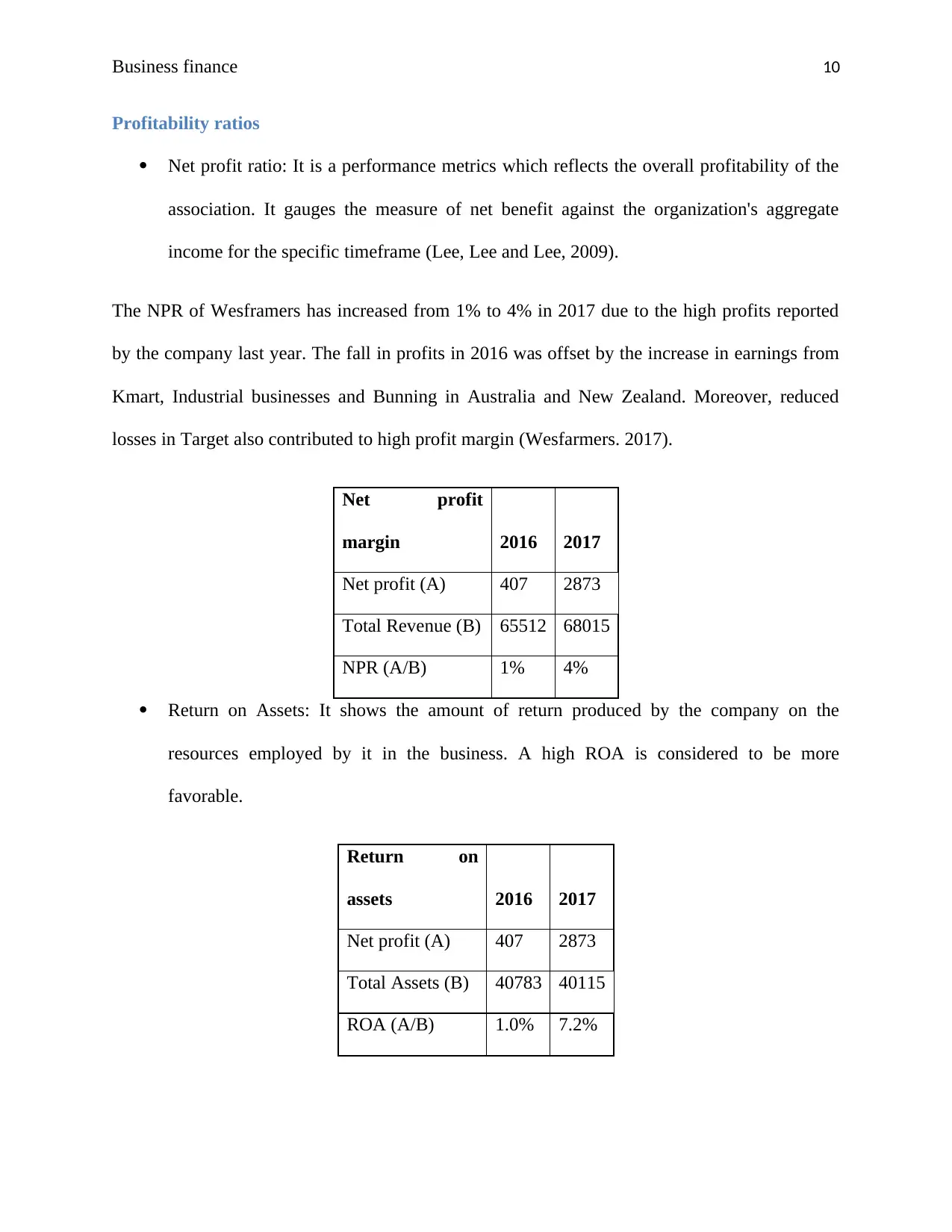

Profitability ratios

Net profit ratio: It is a performance metrics which reflects the overall profitability of the

association. It gauges the measure of net benefit against the organization's aggregate

income for the specific timeframe (Lee, Lee and Lee, 2009).

The NPR of Wesframers has increased from 1% to 4% in 2017 due to the high profits reported

by the company last year. The fall in profits in 2016 was offset by the increase in earnings from

Kmart, Industrial businesses and Bunning in Australia and New Zealand. Moreover, reduced

losses in Target also contributed to high profit margin (Wesfarmers. 2017).

Net profit

margin 2016 2017

Net profit (A) 407 2873

Total Revenue (B) 65512 68015

NPR (A/B) 1% 4%

Return on Assets: It shows the amount of return produced by the company on the

resources employed by it in the business. A high ROA is considered to be more

favorable.

Return on

assets 2016 2017

Net profit (A) 407 2873

Total Assets (B) 40783 40115

ROA (A/B) 1.0% 7.2%

Profitability ratios

Net profit ratio: It is a performance metrics which reflects the overall profitability of the

association. It gauges the measure of net benefit against the organization's aggregate

income for the specific timeframe (Lee, Lee and Lee, 2009).

The NPR of Wesframers has increased from 1% to 4% in 2017 due to the high profits reported

by the company last year. The fall in profits in 2016 was offset by the increase in earnings from

Kmart, Industrial businesses and Bunning in Australia and New Zealand. Moreover, reduced

losses in Target also contributed to high profit margin (Wesfarmers. 2017).

Net profit

margin 2016 2017

Net profit (A) 407 2873

Total Revenue (B) 65512 68015

NPR (A/B) 1% 4%

Return on Assets: It shows the amount of return produced by the company on the

resources employed by it in the business. A high ROA is considered to be more

favorable.

Return on

assets 2016 2017

Net profit (A) 407 2873

Total Assets (B) 40783 40115

ROA (A/B) 1.0% 7.2%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business finance 11

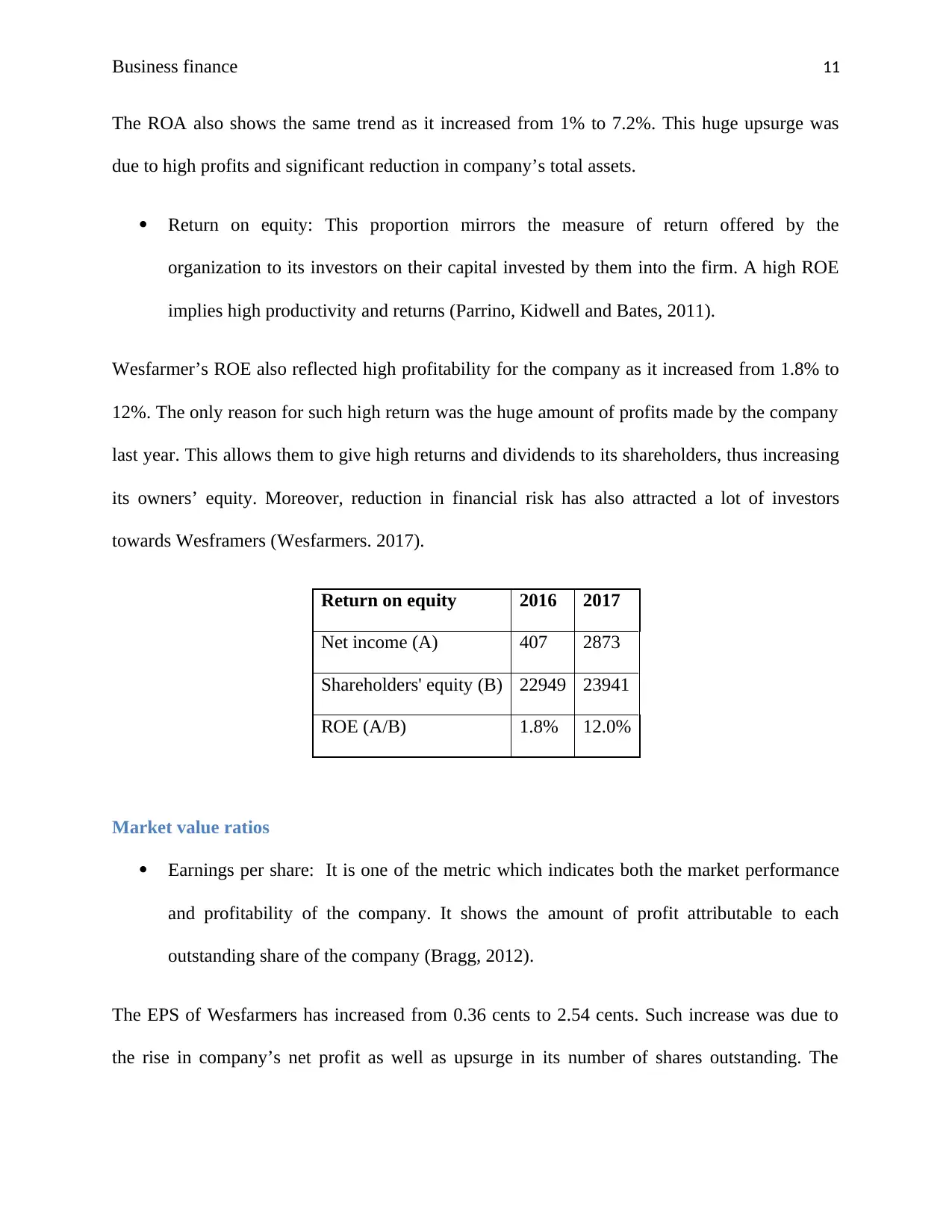

The ROA also shows the same trend as it increased from 1% to 7.2%. This huge upsurge was

due to high profits and significant reduction in company’s total assets.

Return on equity: This proportion mirrors the measure of return offered by the

organization to its investors on their capital invested by them into the firm. A high ROE

implies high productivity and returns (Parrino, Kidwell and Bates, 2011).

Wesfarmer’s ROE also reflected high profitability for the company as it increased from 1.8% to

12%. The only reason for such high return was the huge amount of profits made by the company

last year. This allows them to give high returns and dividends to its shareholders, thus increasing

its owners’ equity. Moreover, reduction in financial risk has also attracted a lot of investors

towards Wesframers (Wesfarmers. 2017).

Return on equity 2016 2017

Net income (A) 407 2873

Shareholders' equity (B) 22949 23941

ROE (A/B) 1.8% 12.0%

Market value ratios

Earnings per share: It is one of the metric which indicates both the market performance

and profitability of the company. It shows the amount of profit attributable to each

outstanding share of the company (Bragg, 2012).

The EPS of Wesfarmers has increased from 0.36 cents to 2.54 cents. Such increase was due to

the rise in company’s net profit as well as upsurge in its number of shares outstanding. The

The ROA also shows the same trend as it increased from 1% to 7.2%. This huge upsurge was

due to high profits and significant reduction in company’s total assets.

Return on equity: This proportion mirrors the measure of return offered by the

organization to its investors on their capital invested by them into the firm. A high ROE

implies high productivity and returns (Parrino, Kidwell and Bates, 2011).

Wesfarmer’s ROE also reflected high profitability for the company as it increased from 1.8% to

12%. The only reason for such high return was the huge amount of profits made by the company

last year. This allows them to give high returns and dividends to its shareholders, thus increasing

its owners’ equity. Moreover, reduction in financial risk has also attracted a lot of investors

towards Wesframers (Wesfarmers. 2017).

Return on equity 2016 2017

Net income (A) 407 2873

Shareholders' equity (B) 22949 23941

ROE (A/B) 1.8% 12.0%

Market value ratios

Earnings per share: It is one of the metric which indicates both the market performance

and profitability of the company. It shows the amount of profit attributable to each

outstanding share of the company (Bragg, 2012).

The EPS of Wesfarmers has increased from 0.36 cents to 2.54 cents. Such increase was due to

the rise in company’s net profit as well as upsurge in its number of shares outstanding. The

Business finance 12

growth in EPS reflected that Wesfarmers is performing well and is making more money for its

shareholders.

Earnings per share 2016 2017

Net income (A) 407 2873

Number of shares

(B) 1123 1130

EPS (A/B) 0.36 2.54

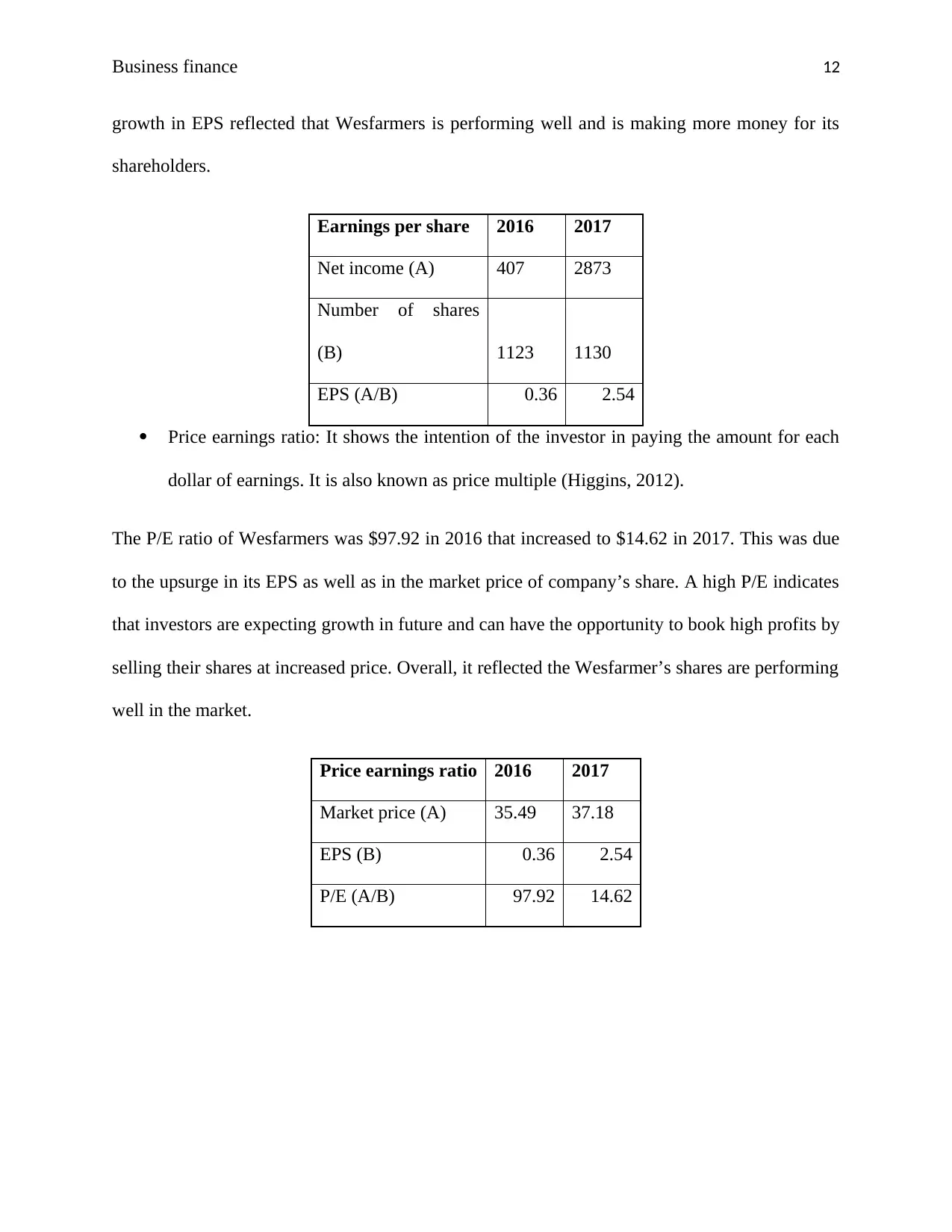

Price earnings ratio: It shows the intention of the investor in paying the amount for each

dollar of earnings. It is also known as price multiple (Higgins, 2012).

The P/E ratio of Wesfarmers was $97.92 in 2016 that increased to $14.62 in 2017. This was due

to the upsurge in its EPS as well as in the market price of company’s share. A high P/E indicates

that investors are expecting growth in future and can have the opportunity to book high profits by

selling their shares at increased price. Overall, it reflected the Wesfarmer’s shares are performing

well in the market.

Price earnings ratio 2016 2017

Market price (A) 35.49 37.18

EPS (B) 0.36 2.54

P/E (A/B) 97.92 14.62

growth in EPS reflected that Wesfarmers is performing well and is making more money for its

shareholders.

Earnings per share 2016 2017

Net income (A) 407 2873

Number of shares

(B) 1123 1130

EPS (A/B) 0.36 2.54

Price earnings ratio: It shows the intention of the investor in paying the amount for each

dollar of earnings. It is also known as price multiple (Higgins, 2012).

The P/E ratio of Wesfarmers was $97.92 in 2016 that increased to $14.62 in 2017. This was due

to the upsurge in its EPS as well as in the market price of company’s share. A high P/E indicates

that investors are expecting growth in future and can have the opportunity to book high profits by

selling their shares at increased price. Overall, it reflected the Wesfarmer’s shares are performing

well in the market.

Price earnings ratio 2016 2017

Market price (A) 35.49 37.18

EPS (B) 0.36 2.54

P/E (A/B) 97.92 14.62

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.