Capital Budgeting and Cash Flow Analysis

VerifiedAdded on 2021/04/17

|25

|5263

|67

AI Summary

This assignment provides a comprehensive example of capital budgeting and cash flow analysis. It includes a detailed calculation of net present value (NPV), internal rate of return (IRR), and payback period for a project with initial investment of £40 million and salvage value of £0. The cash flows are calculated over 5 years, with sales revenue, direct material, direct labor, fixed overhead apportioned, and variable overhead costs. The assignment also includes a detailed breakdown of the calculations, including cumulative cash flow and discounted cash flow, to facilitate understanding of the concepts.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL AND MANAGEMENT ACCOUNTING

Financial and Management Accounting

Name of the Student

Name of the University

Authors Note

Course ID

Financial and Management Accounting

Name of the Student

Name of the University

Authors Note

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL AND MANAGEMENT ACCOUNTING

Table of Contents

Answer to Case A:.....................................................................................................................2

Answer to requirement A:..........................................................................................................2

Answer to requirement B:..........................................................................................................4

Brief overview of organizations and business strategy:.............................................................4

Review of financial performance:..............................................................................................5

Profitability Ratio:......................................................................................................................5

Liquidity ratio:...........................................................................................................................7

Solvency Ratio:........................................................................................................................10

Efficiency Ratio:......................................................................................................................12

Answer to Case B1:..................................................................................................................15

Answer to A:............................................................................................................................15

Answer to B:............................................................................................................................15

Answer to C:............................................................................................................................15

Reference List:.........................................................................................................................17

Appendix:.................................................................................................................................20

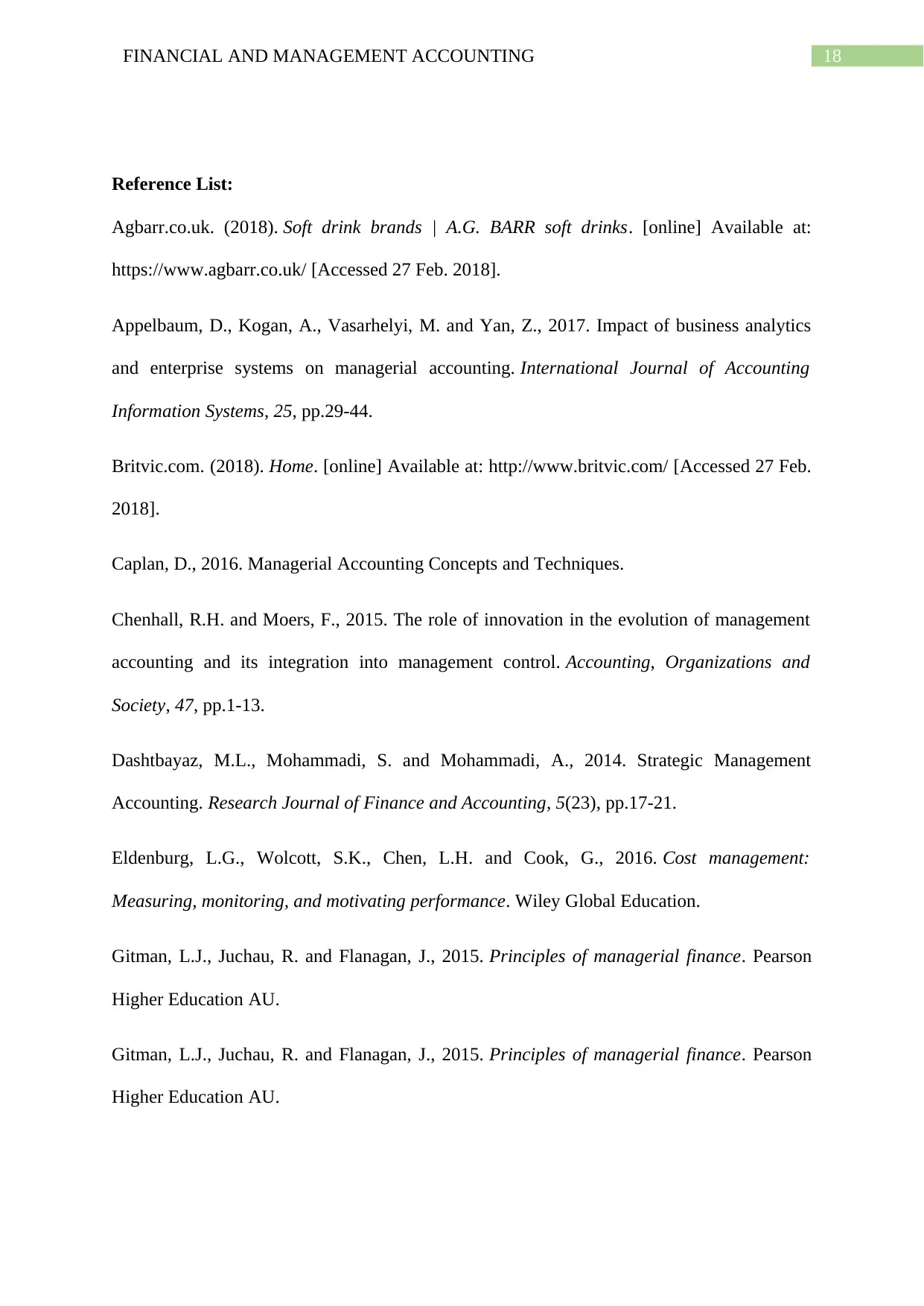

Appendix A:.............................................................................................................................20

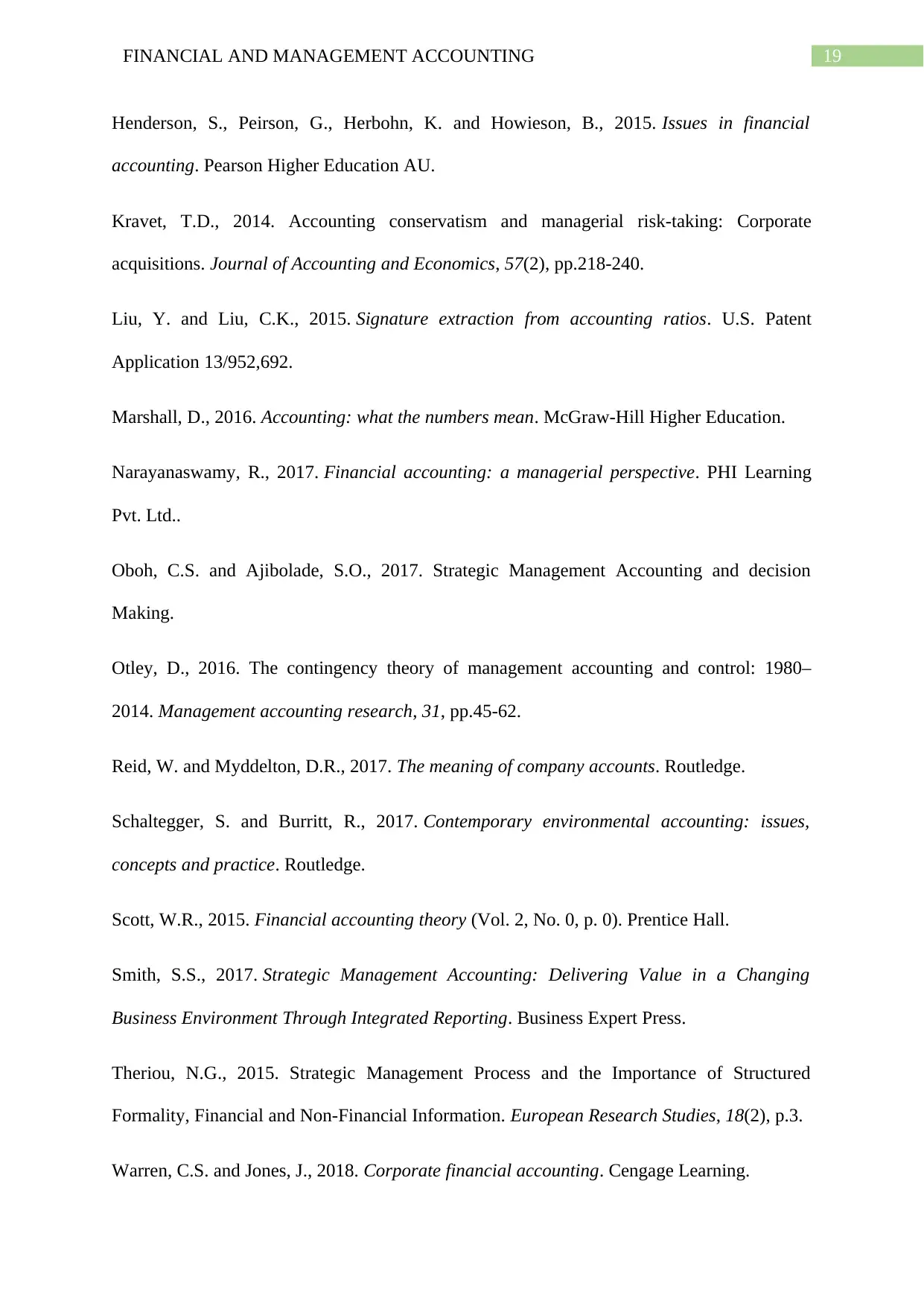

Appendix B:.............................................................................................................................20

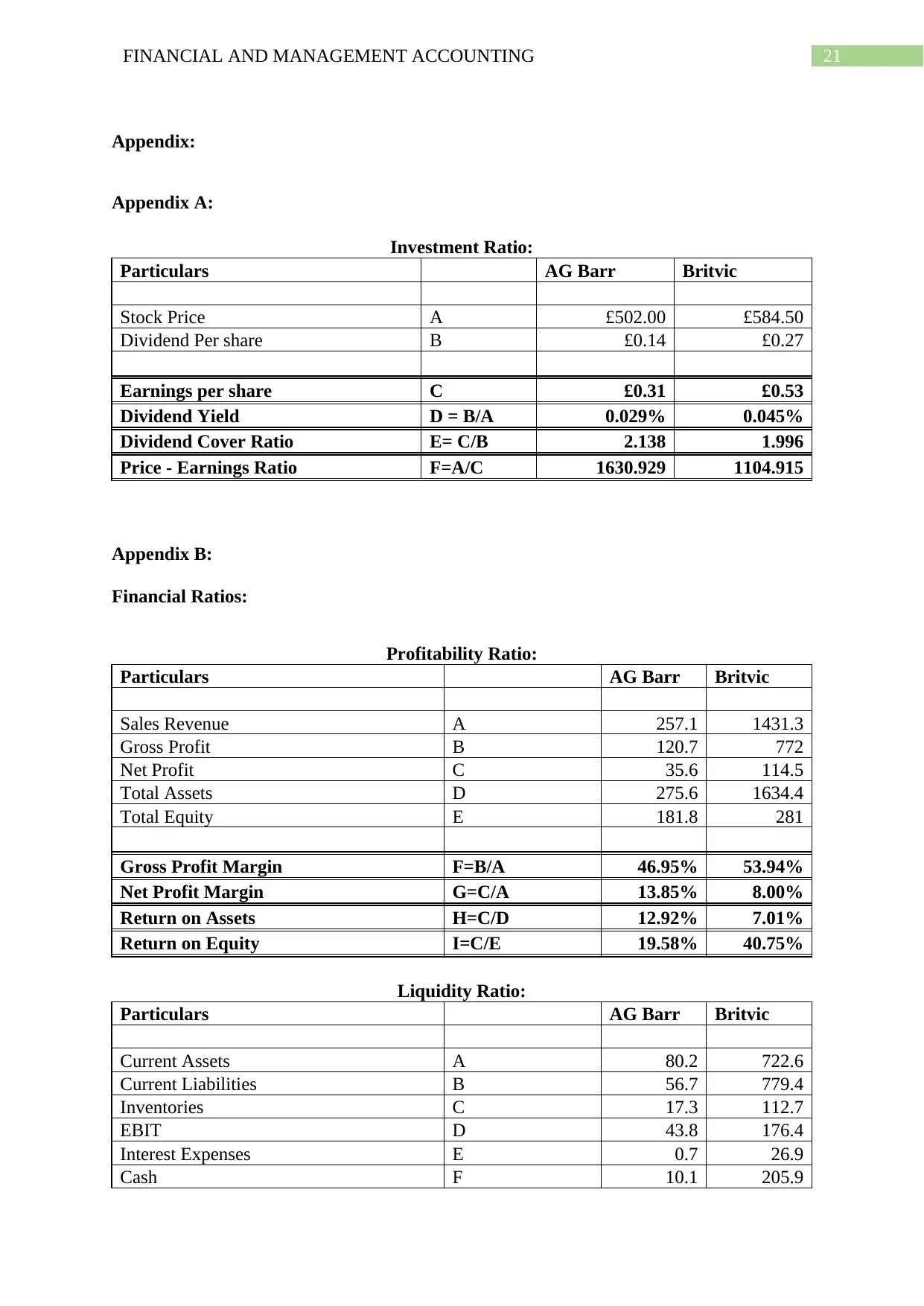

Appendix C:.............................................................................................................................21

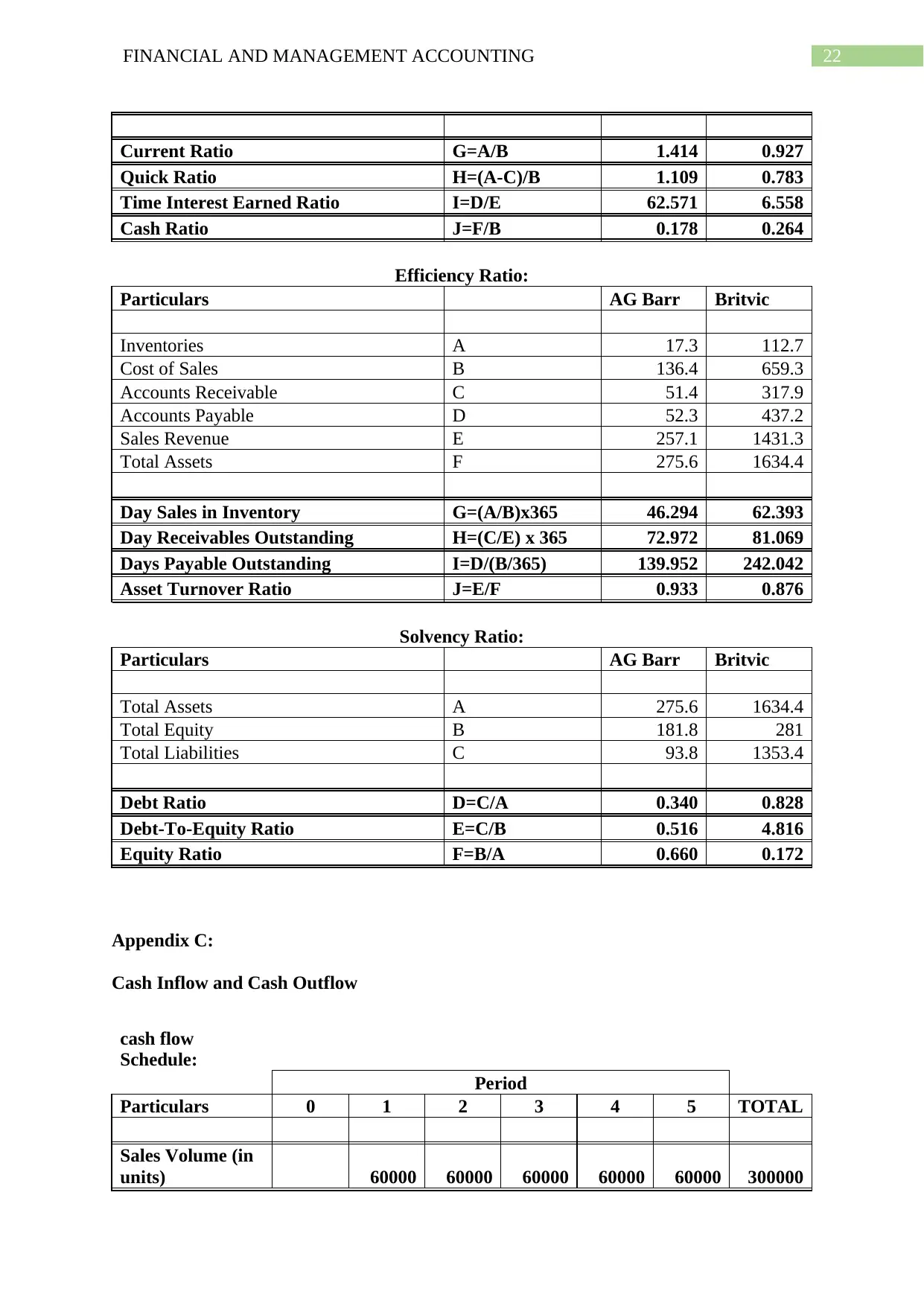

Appendix D:.............................................................................................................................22

Table of Contents

Answer to Case A:.....................................................................................................................2

Answer to requirement A:..........................................................................................................2

Answer to requirement B:..........................................................................................................4

Brief overview of organizations and business strategy:.............................................................4

Review of financial performance:..............................................................................................5

Profitability Ratio:......................................................................................................................5

Liquidity ratio:...........................................................................................................................7

Solvency Ratio:........................................................................................................................10

Efficiency Ratio:......................................................................................................................12

Answer to Case B1:..................................................................................................................15

Answer to A:............................................................................................................................15

Answer to B:............................................................................................................................15

Answer to C:............................................................................................................................15

Reference List:.........................................................................................................................17

Appendix:.................................................................................................................................20

Appendix A:.............................................................................................................................20

Appendix B:.............................................................................................................................20

Appendix C:.............................................................................................................................21

Appendix D:.............................................................................................................................22

2FINANCIAL AND MANAGEMENT ACCOUNTING

3FINANCIAL AND MANAGEMENT ACCOUNTING

Answer to Case A:

Answer to requirement A:

The price earnings are one of the most widely used tools for making the selection of

stock. The price earnings are derived by dividing the current market price of the stock by its

earnings per share (Scott 2015). The price earnings represent the amount of money an

individual is ready to pay for each of the unit of worth earnings of the firm. As evident from

the computation, it is noticed that the price earnings of AG Barr Plc stood 1630.929 whereas

the Britvic on the other hand reported some price earnings of 1104.915 respectively.

Taking into the considerations the earnings per share of AG Barr Plc it is noted that

the earnings per share reported by the company stood 30.78p while the earnings per share of

Britvic Plc stood 52.9p. On the other hand, the full year dividend paid by AG Barr Plc stood

14.40p while the full year dividend per share of Britvic stood 26.5p per share. Overall, the

differences in the stock price between the AG Barr Plc and Britvic is higher amount of

current market price reported by Barr Plc over Britvic (Schaltegger and Burritt 2017).

An organization with higher amount of earnings per share ratio is capable of

producing significant amount of dividend for the investors or it may return the funds back

into the business for generating more amount of growth (Williams 2014). An assertion can be

bought forward by stating that the stock price of Barr plc is overprice since the price earnings

ratio reported by the company stood higher at 1630.929. The stock with higher price earnings

can be overprice and the dividend yield generated by Barr Plc is relatively lower as the

company reported the dividend yield of 0.029%. On the other hand, price earnings for Britvic

in comparison to Barr Plc stood relatively higher and it can be inferred that the dividend yield

for Britvic is comparatively higher than Barr Plc.

Answer to Case A:

Answer to requirement A:

The price earnings are one of the most widely used tools for making the selection of

stock. The price earnings are derived by dividing the current market price of the stock by its

earnings per share (Scott 2015). The price earnings represent the amount of money an

individual is ready to pay for each of the unit of worth earnings of the firm. As evident from

the computation, it is noticed that the price earnings of AG Barr Plc stood 1630.929 whereas

the Britvic on the other hand reported some price earnings of 1104.915 respectively.

Taking into the considerations the earnings per share of AG Barr Plc it is noted that

the earnings per share reported by the company stood 30.78p while the earnings per share of

Britvic Plc stood 52.9p. On the other hand, the full year dividend paid by AG Barr Plc stood

14.40p while the full year dividend per share of Britvic stood 26.5p per share. Overall, the

differences in the stock price between the AG Barr Plc and Britvic is higher amount of

current market price reported by Barr Plc over Britvic (Schaltegger and Burritt 2017).

An organization with higher amount of earnings per share ratio is capable of

producing significant amount of dividend for the investors or it may return the funds back

into the business for generating more amount of growth (Williams 2014). An assertion can be

bought forward by stating that the stock price of Barr plc is overprice since the price earnings

ratio reported by the company stood higher at 1630.929. The stock with higher price earnings

can be overprice and the dividend yield generated by Barr Plc is relatively lower as the

company reported the dividend yield of 0.029%. On the other hand, price earnings for Britvic

in comparison to Barr Plc stood relatively higher and it can be inferred that the dividend yield

for Britvic is comparatively higher than Barr Plc.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL AND MANAGEMENT ACCOUNTING

In either of the case, a higher amount of ratio reflects a worthwhile investment based

on the market price of the stock (Warren and Jones 2018). Similarly, in the event of Barr Plc

the higher amount of price earnings can be a reflector of producing higher dividend for its

investors however with lower earnings per share reported the dividend yield that has been

reported stood 0.029%. Making a long term investment in Britvic is more suitable than

making an investment in Barr Plc. This is because the dividend yield is higher for Britvic

since the company is worth for long term return to its shareholders than Barr Plc.

Dividend coverage ratio can be defined as the ratio that measures the earnings of the

organizations over the dividend paid to the shareholders (Henderson et al. 205). The dividend

coverage ratio derived for Barr Plc stood 2.13 while the Britvic dividend coverage stood 1.99.

For an individual shareholder they would be required to pay a higher amount for a respective

share to derive a dividend of 1.99. On the other hand, Barr plc stock price of 502 is viewed as

overpriced since the dividend coverage reported stood relatively higher of 2.13. An

organization with higher amount of dividend coverage ratio reflects a situation where the

company has little difficulty in paying off its preferred dividend requirements. Similarly, Barr

Plc has reported a higher dividend coverage ratio in comparison to Britvic. With higher

amount of dividend coverage, it is understood that Barr Plc might be facing little difficulty in

paying off its shareholders the preferred dividend requirements.

The dividend yield or in other words is the dividend price ratio of the share is the

dividend per share divided by the price for each share (Weygandt, Kimmel and Kieso 2015).

The dividend yield represents the organizations total amount of yearly dividend payments

divided by the present market capitalization based on the assumption that the number of share

is constant.

In either of the case, a higher amount of ratio reflects a worthwhile investment based

on the market price of the stock (Warren and Jones 2018). Similarly, in the event of Barr Plc

the higher amount of price earnings can be a reflector of producing higher dividend for its

investors however with lower earnings per share reported the dividend yield that has been

reported stood 0.029%. Making a long term investment in Britvic is more suitable than

making an investment in Barr Plc. This is because the dividend yield is higher for Britvic

since the company is worth for long term return to its shareholders than Barr Plc.

Dividend coverage ratio can be defined as the ratio that measures the earnings of the

organizations over the dividend paid to the shareholders (Henderson et al. 205). The dividend

coverage ratio derived for Barr Plc stood 2.13 while the Britvic dividend coverage stood 1.99.

For an individual shareholder they would be required to pay a higher amount for a respective

share to derive a dividend of 1.99. On the other hand, Barr plc stock price of 502 is viewed as

overpriced since the dividend coverage reported stood relatively higher of 2.13. An

organization with higher amount of dividend coverage ratio reflects a situation where the

company has little difficulty in paying off its preferred dividend requirements. Similarly, Barr

Plc has reported a higher dividend coverage ratio in comparison to Britvic. With higher

amount of dividend coverage, it is understood that Barr Plc might be facing little difficulty in

paying off its shareholders the preferred dividend requirements.

The dividend yield or in other words is the dividend price ratio of the share is the

dividend per share divided by the price for each share (Weygandt, Kimmel and Kieso 2015).

The dividend yield represents the organizations total amount of yearly dividend payments

divided by the present market capitalization based on the assumption that the number of share

is constant.

5FINANCIAL AND MANAGEMENT ACCOUNTING

The dividend yield reported by Barr Plc is relatively lower than Britvic representing a

lower return to the shareholder. This considers the sign of clear financial health and

confidence for the organization to pay out its dividends. Gauging into the dividend yield Barr

Plc and Britvic it is understood that Britvic total yearly dividend payments in respect of its

market capitalization is constant based on the total number of shares reported by it. The

overall assessment of both the firms provides that the differences in the price is largely

because of the overvalued stock price of Barr Plc in comparison to Britvic.

Note: The computation of the investment ratio has been provided in Appendix A.

Answer to requirement B:

Brief overview of organizations and business strategy:

Britvic plc. is the British Producer of soft drinks having its base on Hempstead. The

company is listed on the London stock exchange and it is one of the constituent of the FTSE

250 Index (Britvic.com 2018). A large part of its operations is concentrated in the United

Kingdom and Ireland the organizations overseas operations have expanded and exports its

products to more than 50 countries. On the other hand, AG Barr Plc is Scottish manufacturer

of soft drink having its base on Cumbernauld, North Lanarkshire (Agbarr.co.uk 2018). The

company manufactures the popular Scottish drink and it is listed on the London stock

exchange with the constituent of FTSE 250 Index.

The business strategy for Britvic is understanding the needs of consumer by

increasing the retail partners in order to increase the sale of soft drinks. Britvic undertakes the

international approach of sourcing the required raw materials to manufacture the soft drinks.

The business strategy for Barr Plc is based on placing focus on strongly differentiated brands.

The business strategy of Barr Plc is focussed on growing the driven partnerships and

leveraging its strength with team.

The dividend yield reported by Barr Plc is relatively lower than Britvic representing a

lower return to the shareholder. This considers the sign of clear financial health and

confidence for the organization to pay out its dividends. Gauging into the dividend yield Barr

Plc and Britvic it is understood that Britvic total yearly dividend payments in respect of its

market capitalization is constant based on the total number of shares reported by it. The

overall assessment of both the firms provides that the differences in the price is largely

because of the overvalued stock price of Barr Plc in comparison to Britvic.

Note: The computation of the investment ratio has been provided in Appendix A.

Answer to requirement B:

Brief overview of organizations and business strategy:

Britvic plc. is the British Producer of soft drinks having its base on Hempstead. The

company is listed on the London stock exchange and it is one of the constituent of the FTSE

250 Index (Britvic.com 2018). A large part of its operations is concentrated in the United

Kingdom and Ireland the organizations overseas operations have expanded and exports its

products to more than 50 countries. On the other hand, AG Barr Plc is Scottish manufacturer

of soft drink having its base on Cumbernauld, North Lanarkshire (Agbarr.co.uk 2018). The

company manufactures the popular Scottish drink and it is listed on the London stock

exchange with the constituent of FTSE 250 Index.

The business strategy for Britvic is understanding the needs of consumer by

increasing the retail partners in order to increase the sale of soft drinks. Britvic undertakes the

international approach of sourcing the required raw materials to manufacture the soft drinks.

The business strategy for Barr Plc is based on placing focus on strongly differentiated brands.

The business strategy of Barr Plc is focussed on growing the driven partnerships and

leveraging its strength with team.

6FINANCIAL AND MANAGEMENT ACCOUNTING

Review of financial performance:

Note: Refer to Appendix B for calculated financial Ratios:

Profitability Ratio:

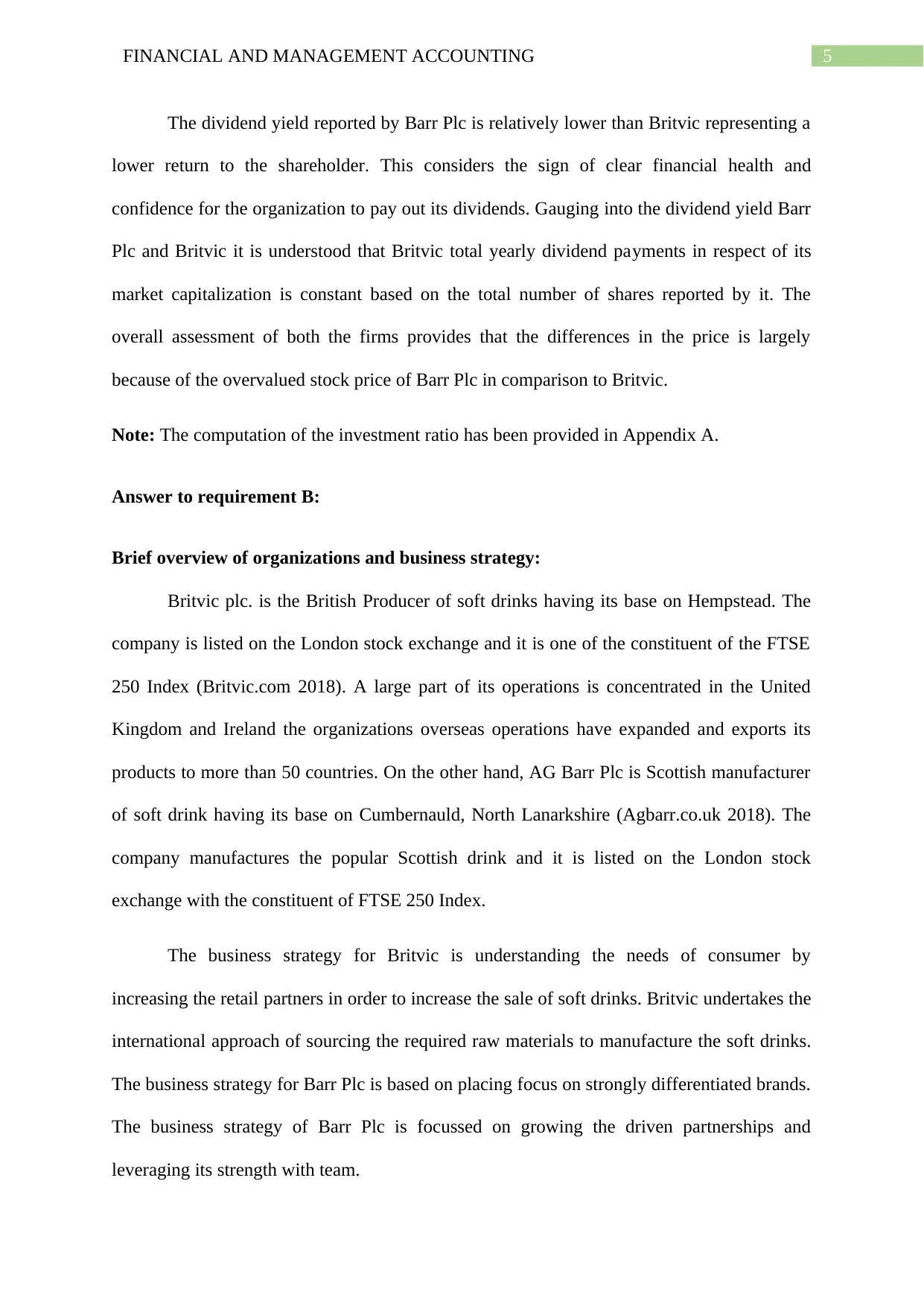

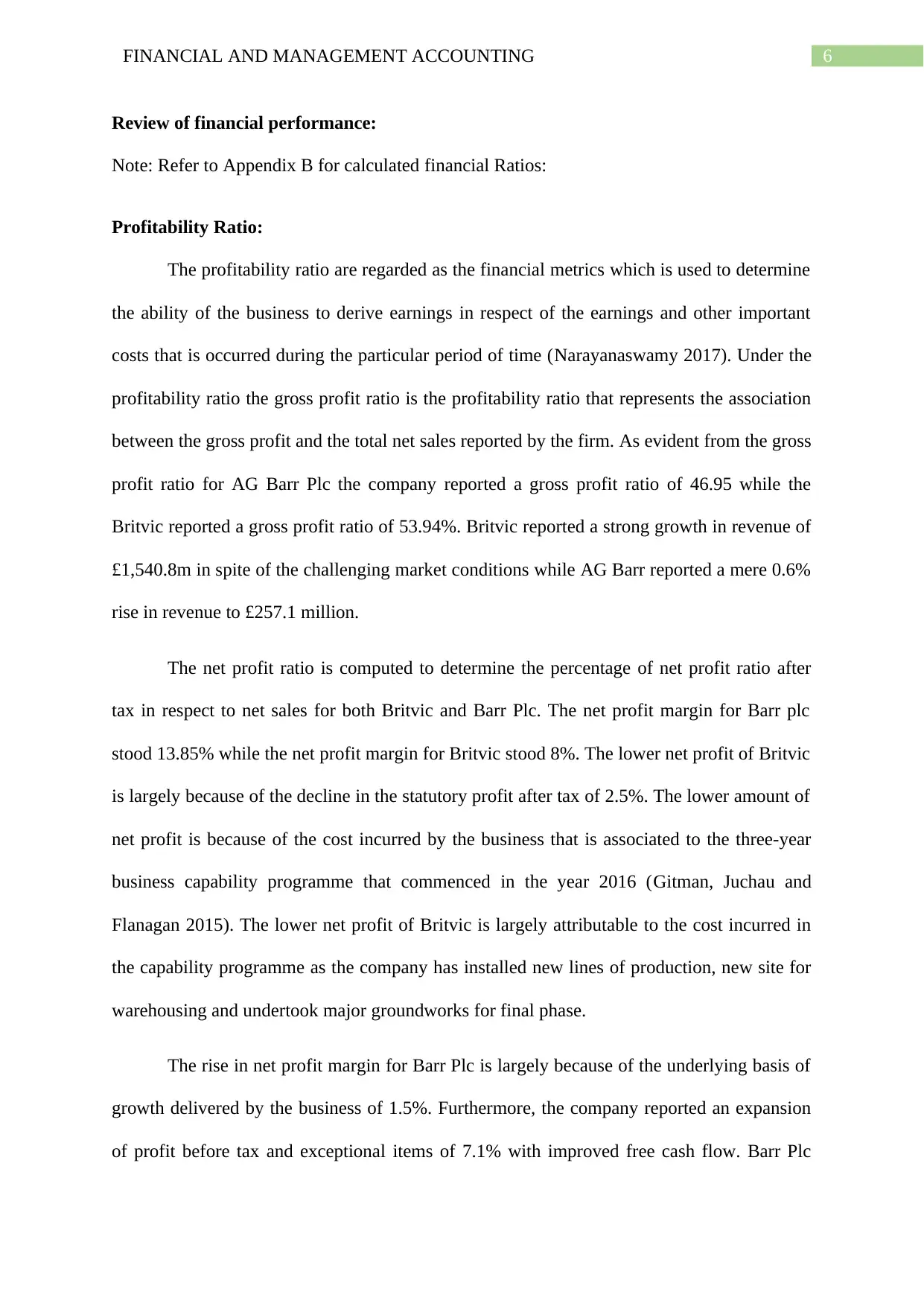

The profitability ratio are regarded as the financial metrics which is used to determine

the ability of the business to derive earnings in respect of the earnings and other important

costs that is occurred during the particular period of time (Narayanaswamy 2017). Under the

profitability ratio the gross profit ratio is the profitability ratio that represents the association

between the gross profit and the total net sales reported by the firm. As evident from the gross

profit ratio for AG Barr Plc the company reported a gross profit ratio of 46.95 while the

Britvic reported a gross profit ratio of 53.94%. Britvic reported a strong growth in revenue of

£1,540.8m in spite of the challenging market conditions while AG Barr reported a mere 0.6%

rise in revenue to £257.1 million.

The net profit ratio is computed to determine the percentage of net profit ratio after

tax in respect to net sales for both Britvic and Barr Plc. The net profit margin for Barr plc

stood 13.85% while the net profit margin for Britvic stood 8%. The lower net profit of Britvic

is largely because of the decline in the statutory profit after tax of 2.5%. The lower amount of

net profit is because of the cost incurred by the business that is associated to the three-year

business capability programme that commenced in the year 2016 (Gitman, Juchau and

Flanagan 2015). The lower net profit of Britvic is largely attributable to the cost incurred in

the capability programme as the company has installed new lines of production, new site for

warehousing and undertook major groundworks for final phase.

The rise in net profit margin for Barr Plc is largely because of the underlying basis of

growth delivered by the business of 1.5%. Furthermore, the company reported an expansion

of profit before tax and exceptional items of 7.1% with improved free cash flow. Barr Plc

Review of financial performance:

Note: Refer to Appendix B for calculated financial Ratios:

Profitability Ratio:

The profitability ratio are regarded as the financial metrics which is used to determine

the ability of the business to derive earnings in respect of the earnings and other important

costs that is occurred during the particular period of time (Narayanaswamy 2017). Under the

profitability ratio the gross profit ratio is the profitability ratio that represents the association

between the gross profit and the total net sales reported by the firm. As evident from the gross

profit ratio for AG Barr Plc the company reported a gross profit ratio of 46.95 while the

Britvic reported a gross profit ratio of 53.94%. Britvic reported a strong growth in revenue of

£1,540.8m in spite of the challenging market conditions while AG Barr reported a mere 0.6%

rise in revenue to £257.1 million.

The net profit ratio is computed to determine the percentage of net profit ratio after

tax in respect to net sales for both Britvic and Barr Plc. The net profit margin for Barr plc

stood 13.85% while the net profit margin for Britvic stood 8%. The lower net profit of Britvic

is largely because of the decline in the statutory profit after tax of 2.5%. The lower amount of

net profit is because of the cost incurred by the business that is associated to the three-year

business capability programme that commenced in the year 2016 (Gitman, Juchau and

Flanagan 2015). The lower net profit of Britvic is largely attributable to the cost incurred in

the capability programme as the company has installed new lines of production, new site for

warehousing and undertook major groundworks for final phase.

The rise in net profit margin for Barr Plc is largely because of the underlying basis of

growth delivered by the business of 1.5%. Furthermore, the company reported an expansion

of profit before tax and exceptional items of 7.1% with improved free cash flow. Barr Plc

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL AND MANAGEMENT ACCOUNTING

have successfully maintained the market share under the challenging market environment

with the company’s core carbonates business has delivered better performance (Marshall

2016). The international business has delivered double-digit revenue with the help of brand

development in its core markets.

The return on asset is computed for both Britvic and Barr Plc in order to measure the

efficiency of the organizations ability to generate the sales revenue from the total asset to

provide the management with an understanding of how well it is making use of the asset

(Caplan 2016). The return on assets for AG Barr Plc stood 12.92% whereas on the other hand

Britvic reported a return on assets of 7.01%. A higher return on assets of Barr Plc is largely

because of more than £12 million investment in the long term assets. Furthermore, the non-

current assets have increased slightly to £195.4 million after several years of sustained

investment in assets and infrastructure. The investment in asset have resulted Barr Plc in

maintaining a favourable position with the well-invested base of asset that are capable of

accommodating growth have increased by £1.7 million. However, the company has reported

an 8% return on assets but the company has reported 86% of revenue from their assets.

The return on equity represents the profitability ratio, which measures the ability of

the organization to produce profits from the shareholders’ investment in the company

(Appelbaum et al. 2017). The return on equity for Barr Plc stood 46.95% whereas for Britvic

the return on equity stood 40.75%. Britvic profit before taxation that are attributable to the

equity shareholders stood £138.8m while Barr Plc’s profit before taxation attributable to the

shareholder stood £35.6 million. With the increasing return on equity for Britvic, it can be

understood that the company is increasing ability of generating profit without requiring much

amount of capital.

have successfully maintained the market share under the challenging market environment

with the company’s core carbonates business has delivered better performance (Marshall

2016). The international business has delivered double-digit revenue with the help of brand

development in its core markets.

The return on asset is computed for both Britvic and Barr Plc in order to measure the

efficiency of the organizations ability to generate the sales revenue from the total asset to

provide the management with an understanding of how well it is making use of the asset

(Caplan 2016). The return on assets for AG Barr Plc stood 12.92% whereas on the other hand

Britvic reported a return on assets of 7.01%. A higher return on assets of Barr Plc is largely

because of more than £12 million investment in the long term assets. Furthermore, the non-

current assets have increased slightly to £195.4 million after several years of sustained

investment in assets and infrastructure. The investment in asset have resulted Barr Plc in

maintaining a favourable position with the well-invested base of asset that are capable of

accommodating growth have increased by £1.7 million. However, the company has reported

an 8% return on assets but the company has reported 86% of revenue from their assets.

The return on equity represents the profitability ratio, which measures the ability of

the organization to produce profits from the shareholders’ investment in the company

(Appelbaum et al. 2017). The return on equity for Barr Plc stood 46.95% whereas for Britvic

the return on equity stood 40.75%. Britvic profit before taxation that are attributable to the

equity shareholders stood £138.8m while Barr Plc’s profit before taxation attributable to the

shareholder stood £35.6 million. With the increasing return on equity for Britvic, it can be

understood that the company is increasing ability of generating profit without requiring much

amount of capital.

8FINANCIAL AND MANAGEMENT ACCOUNTING

Gross Profit Margin Net Profit Margin Return on Assets Return on Equity

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

46.95%

13.85% 12.92%

19.58%

53.94%

8.00% 7.01%

40.75%

Profi tability

AG Barr Britvic

Figure 1: Figure representing Profitability Ratio

(Source: As Created by Author)

Liquidity ratio:

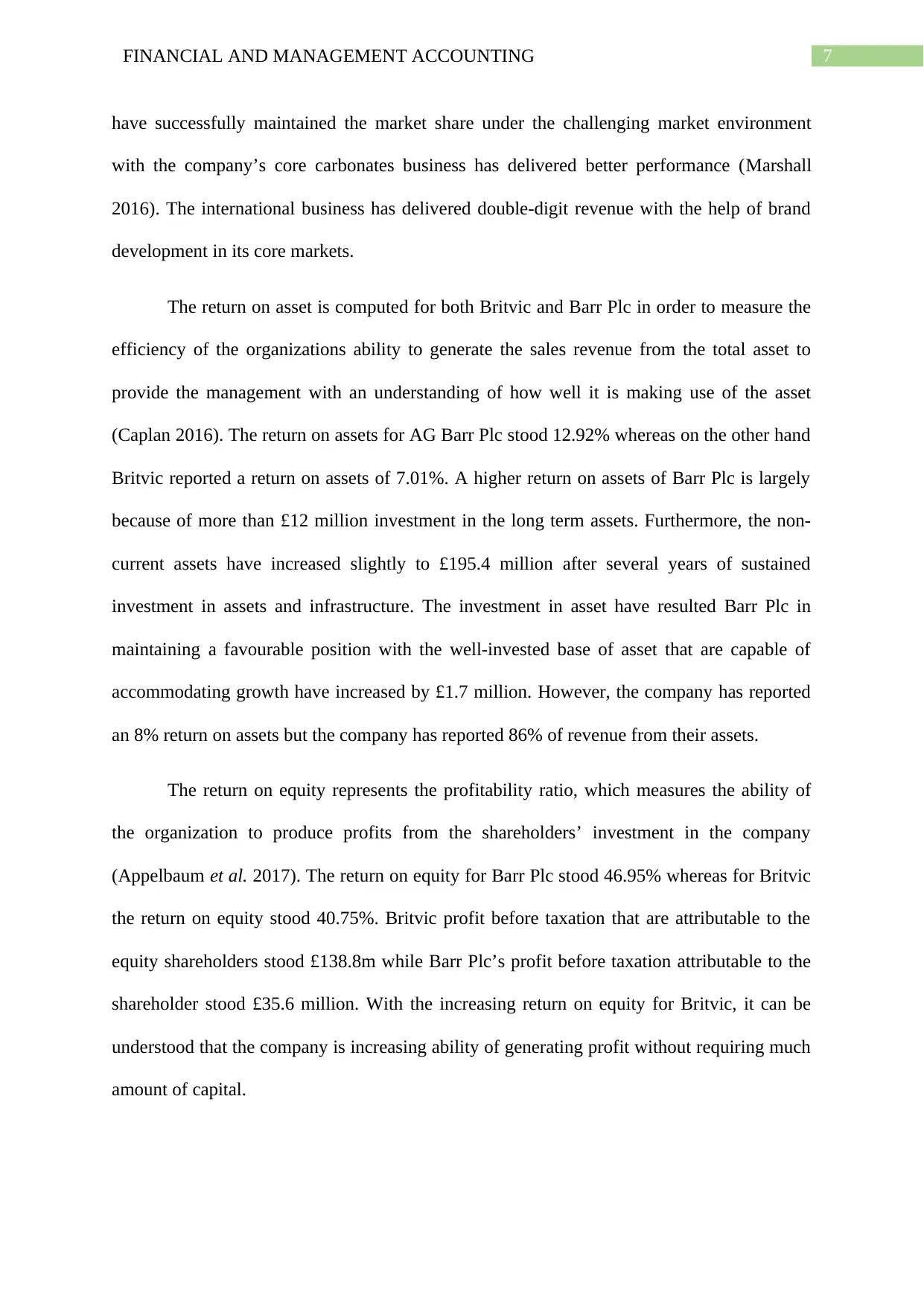

Liquidity ratio can be defined as the ratio that is used to gauge into the performance of

the organization in determining the ability of the organization to pay off its debts. The

liquidity ratio determines the ability of the organization to meet the both its current liabilities

and long-term liabilities become due (Kravet 2014). Under the liquidity ratio the current ratio

is largely used to provide an idea of the organizations to pay its liabilities from its assets. The

current ratio helps in determining the rough estimation of the organization health. The current

ratio for AG Barr Plc stood 1.414 whereas on the other hand the current ratio for Britvic

stood 0.927. The current ratio for AG Barr Plc indicates that liabilities that are due within the

span of a year are met by the company from its current assets. This represents that AG Barr

Plc has £1.50 of current assets for each of the £1 current liabilities and presumably, the

current assets is sufficient to meet its current liabilities that fall due within the span of one

year. On the other hand, Britvic reported a lower current ratio of 0.927 and it can be stated

that the firm may have trouble in meeting of its debt.

Gross Profit Margin Net Profit Margin Return on Assets Return on Equity

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

46.95%

13.85% 12.92%

19.58%

53.94%

8.00% 7.01%

40.75%

Profi tability

AG Barr Britvic

Figure 1: Figure representing Profitability Ratio

(Source: As Created by Author)

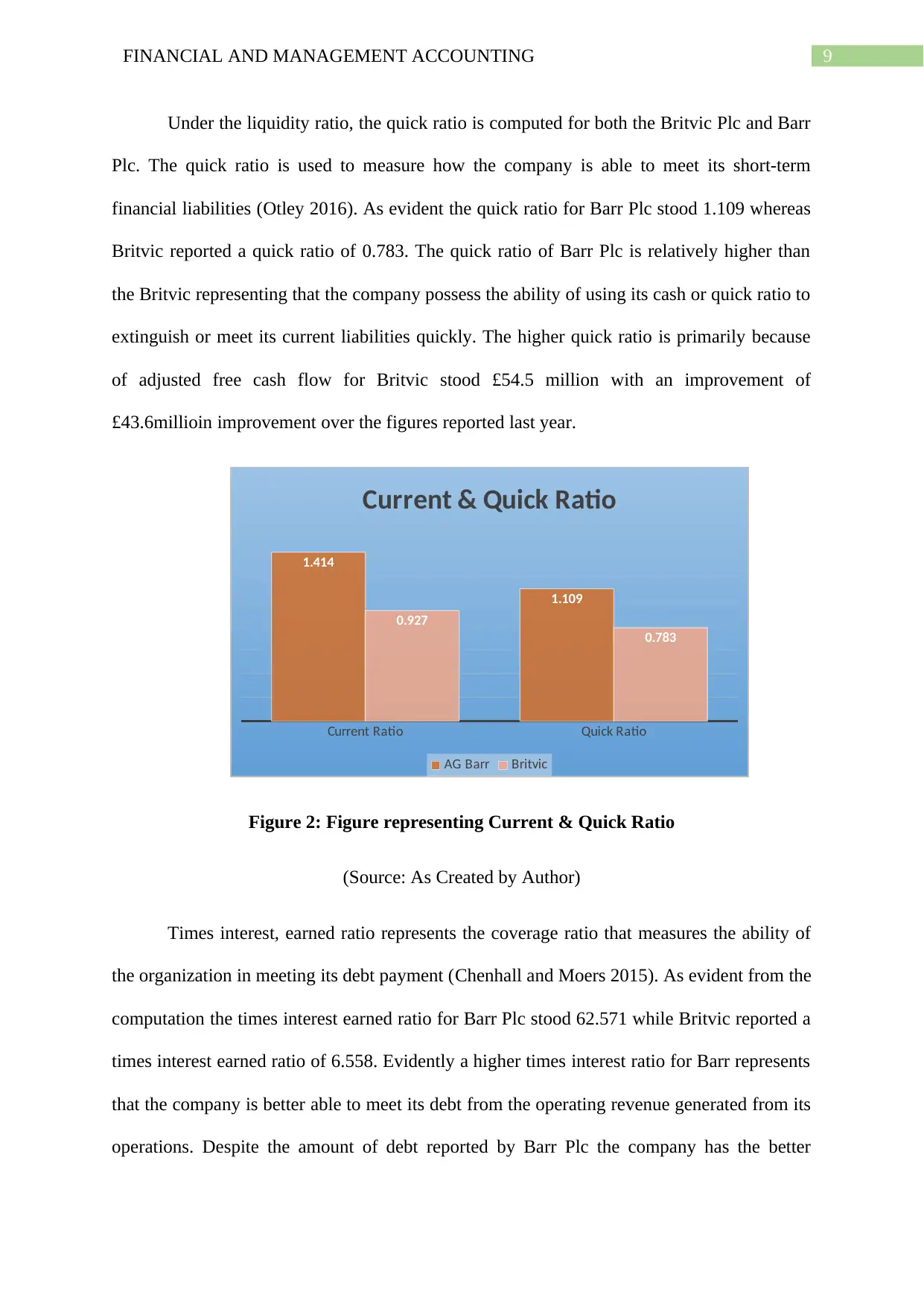

Liquidity ratio:

Liquidity ratio can be defined as the ratio that is used to gauge into the performance of

the organization in determining the ability of the organization to pay off its debts. The

liquidity ratio determines the ability of the organization to meet the both its current liabilities

and long-term liabilities become due (Kravet 2014). Under the liquidity ratio the current ratio

is largely used to provide an idea of the organizations to pay its liabilities from its assets. The

current ratio helps in determining the rough estimation of the organization health. The current

ratio for AG Barr Plc stood 1.414 whereas on the other hand the current ratio for Britvic

stood 0.927. The current ratio for AG Barr Plc indicates that liabilities that are due within the

span of a year are met by the company from its current assets. This represents that AG Barr

Plc has £1.50 of current assets for each of the £1 current liabilities and presumably, the

current assets is sufficient to meet its current liabilities that fall due within the span of one

year. On the other hand, Britvic reported a lower current ratio of 0.927 and it can be stated

that the firm may have trouble in meeting of its debt.

9FINANCIAL AND MANAGEMENT ACCOUNTING

Under the liquidity ratio, the quick ratio is computed for both the Britvic Plc and Barr

Plc. The quick ratio is used to measure how the company is able to meet its short-term

financial liabilities (Otley 2016). As evident the quick ratio for Barr Plc stood 1.109 whereas

Britvic reported a quick ratio of 0.783. The quick ratio of Barr Plc is relatively higher than

the Britvic representing that the company possess the ability of using its cash or quick ratio to

extinguish or meet its current liabilities quickly. The higher quick ratio is primarily because

of adjusted free cash flow for Britvic stood £54.5 million with an improvement of

£43.6millioin improvement over the figures reported last year.

Current Ratio Quick Ratio

1.414

1.109

0.927

0.783

Current & Quick Ratio

AG Barr Britvic

Figure 2: Figure representing Current & Quick Ratio

(Source: As Created by Author)

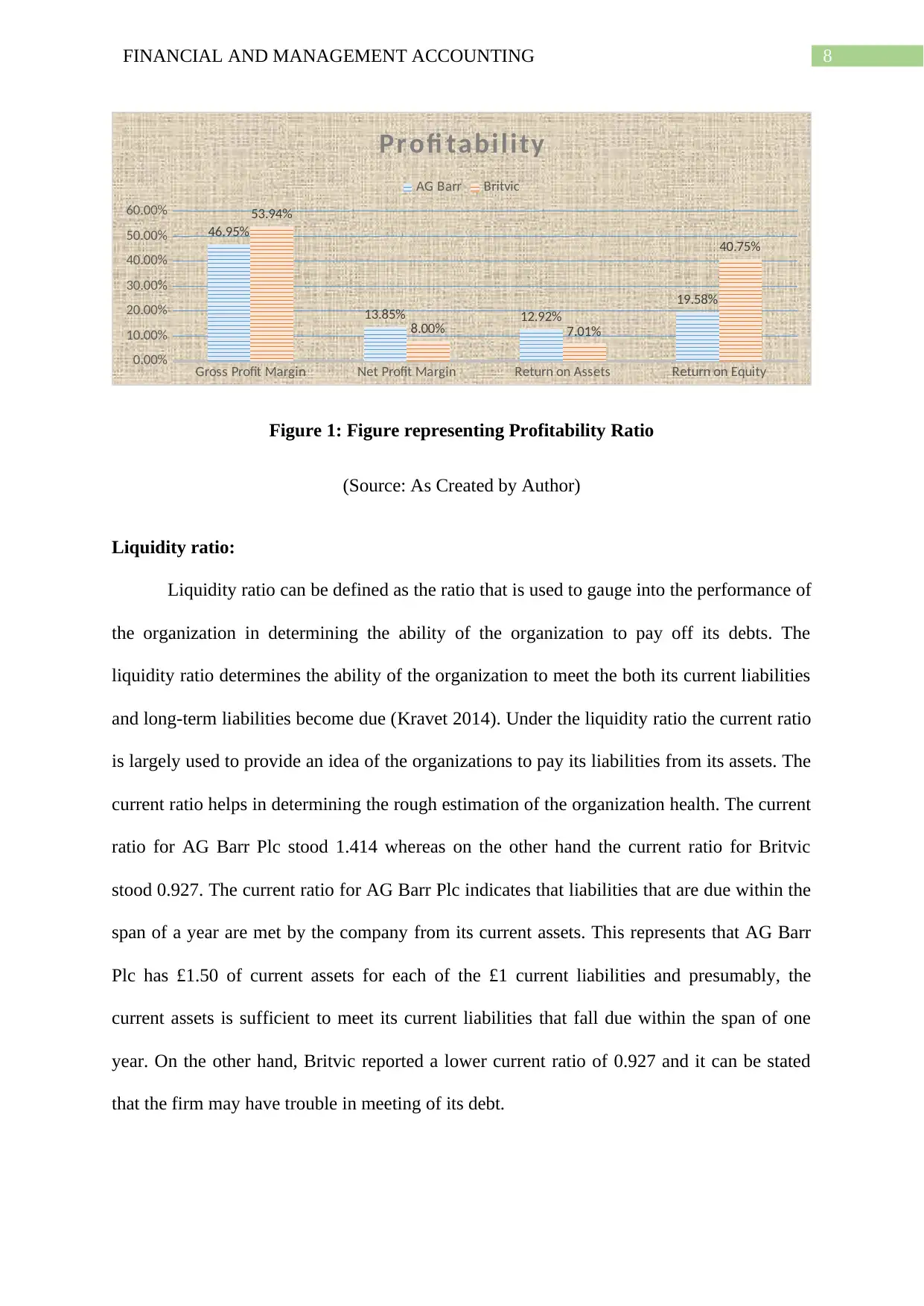

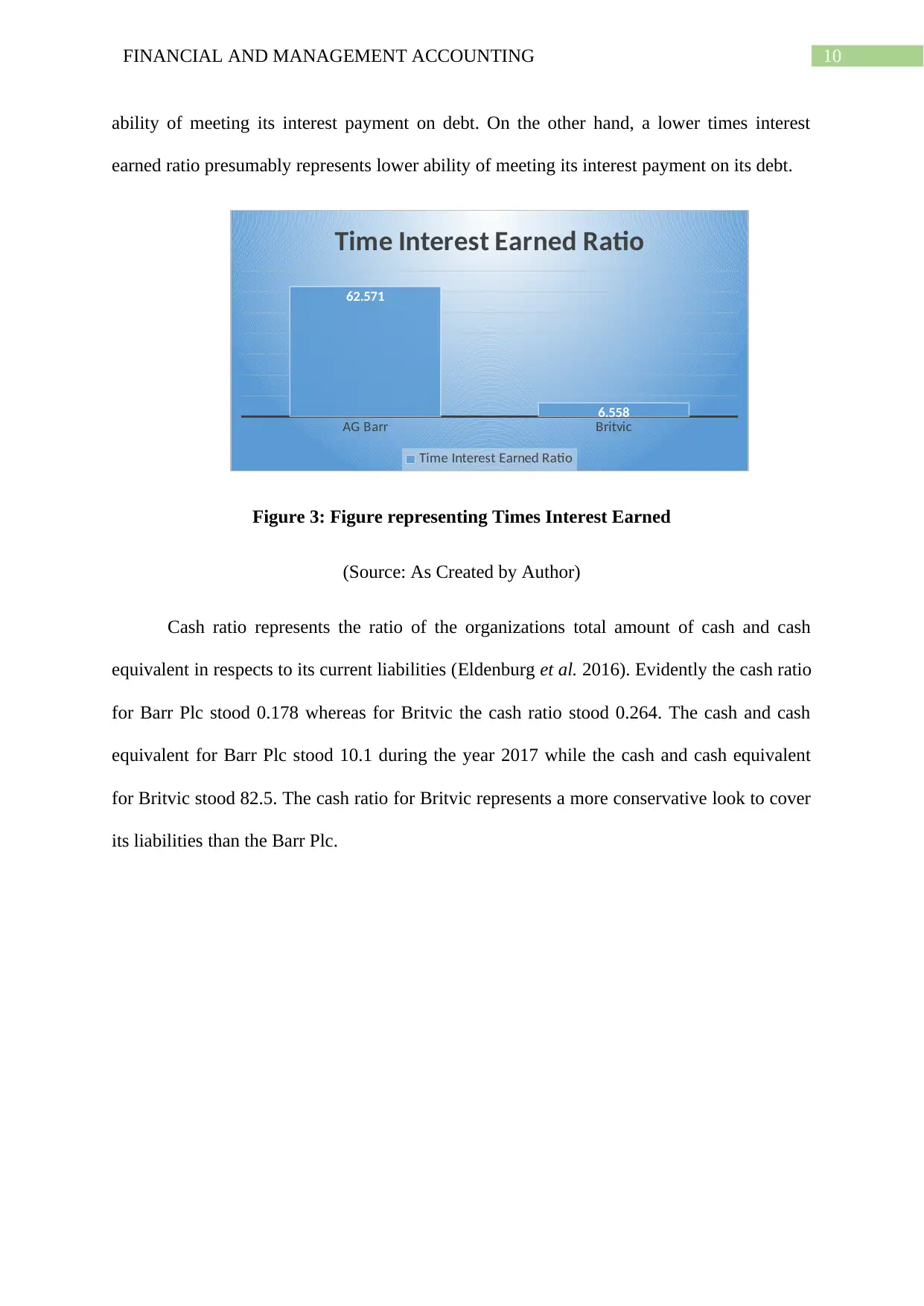

Times interest, earned ratio represents the coverage ratio that measures the ability of

the organization in meeting its debt payment (Chenhall and Moers 2015). As evident from the

computation the times interest earned ratio for Barr Plc stood 62.571 while Britvic reported a

times interest earned ratio of 6.558. Evidently a higher times interest ratio for Barr represents

that the company is better able to meet its debt from the operating revenue generated from its

operations. Despite the amount of debt reported by Barr Plc the company has the better

Under the liquidity ratio, the quick ratio is computed for both the Britvic Plc and Barr

Plc. The quick ratio is used to measure how the company is able to meet its short-term

financial liabilities (Otley 2016). As evident the quick ratio for Barr Plc stood 1.109 whereas

Britvic reported a quick ratio of 0.783. The quick ratio of Barr Plc is relatively higher than

the Britvic representing that the company possess the ability of using its cash or quick ratio to

extinguish or meet its current liabilities quickly. The higher quick ratio is primarily because

of adjusted free cash flow for Britvic stood £54.5 million with an improvement of

£43.6millioin improvement over the figures reported last year.

Current Ratio Quick Ratio

1.414

1.109

0.927

0.783

Current & Quick Ratio

AG Barr Britvic

Figure 2: Figure representing Current & Quick Ratio

(Source: As Created by Author)

Times interest, earned ratio represents the coverage ratio that measures the ability of

the organization in meeting its debt payment (Chenhall and Moers 2015). As evident from the

computation the times interest earned ratio for Barr Plc stood 62.571 while Britvic reported a

times interest earned ratio of 6.558. Evidently a higher times interest ratio for Barr represents

that the company is better able to meet its debt from the operating revenue generated from its

operations. Despite the amount of debt reported by Barr Plc the company has the better

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10FINANCIAL AND MANAGEMENT ACCOUNTING

ability of meeting its interest payment on debt. On the other hand, a lower times interest

earned ratio presumably represents lower ability of meeting its interest payment on its debt.

AG Barr Britvic

62.571

6.558

Time Interest Earned Ratio

Time Interest Earned Ratio

Figure 3: Figure representing Times Interest Earned

(Source: As Created by Author)

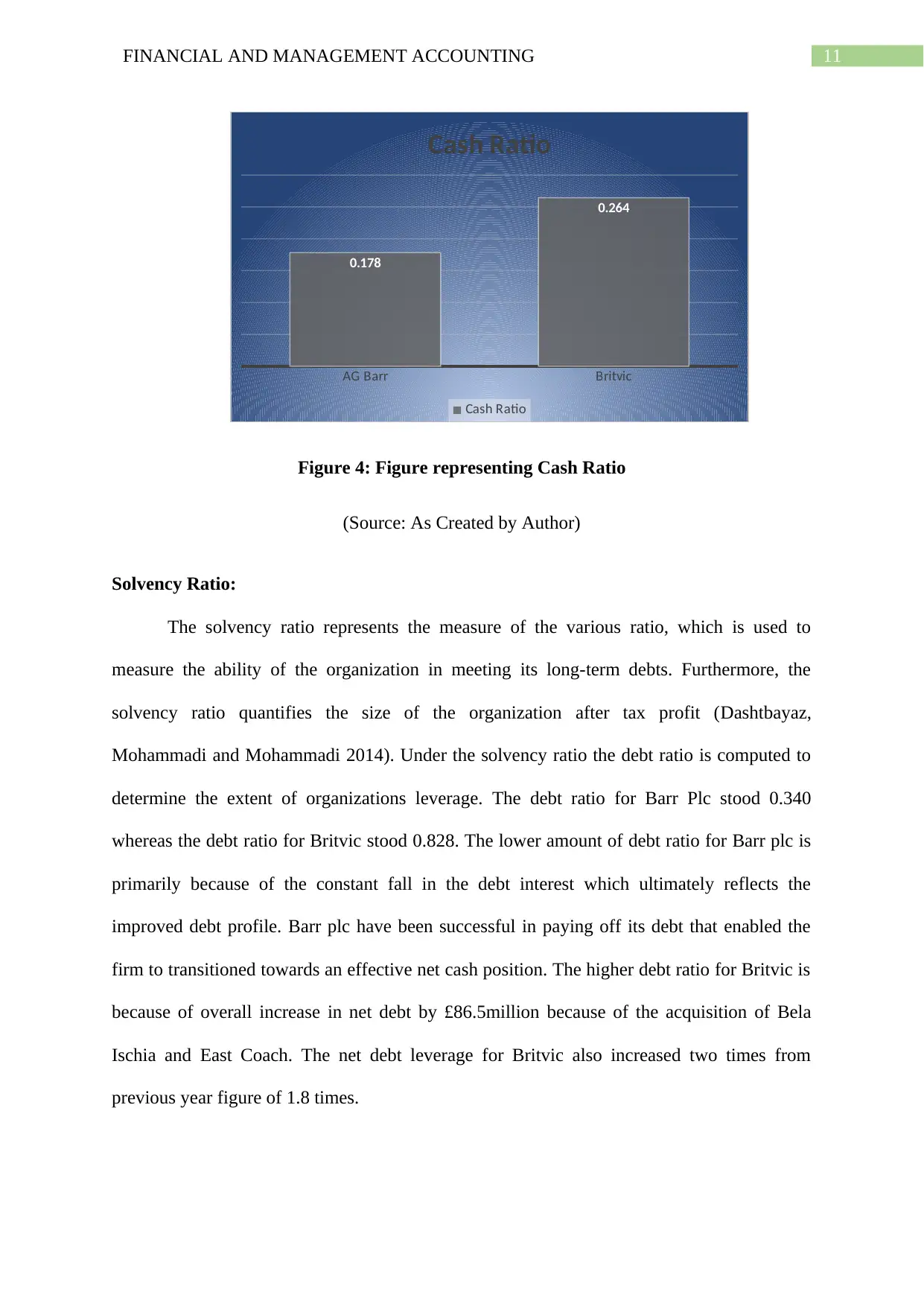

Cash ratio represents the ratio of the organizations total amount of cash and cash

equivalent in respects to its current liabilities (Eldenburg et al. 2016). Evidently the cash ratio

for Barr Plc stood 0.178 whereas for Britvic the cash ratio stood 0.264. The cash and cash

equivalent for Barr Plc stood 10.1 during the year 2017 while the cash and cash equivalent

for Britvic stood 82.5. The cash ratio for Britvic represents a more conservative look to cover

its liabilities than the Barr Plc.

ability of meeting its interest payment on debt. On the other hand, a lower times interest

earned ratio presumably represents lower ability of meeting its interest payment on its debt.

AG Barr Britvic

62.571

6.558

Time Interest Earned Ratio

Time Interest Earned Ratio

Figure 3: Figure representing Times Interest Earned

(Source: As Created by Author)

Cash ratio represents the ratio of the organizations total amount of cash and cash

equivalent in respects to its current liabilities (Eldenburg et al. 2016). Evidently the cash ratio

for Barr Plc stood 0.178 whereas for Britvic the cash ratio stood 0.264. The cash and cash

equivalent for Barr Plc stood 10.1 during the year 2017 while the cash and cash equivalent

for Britvic stood 82.5. The cash ratio for Britvic represents a more conservative look to cover

its liabilities than the Barr Plc.

11FINANCIAL AND MANAGEMENT ACCOUNTING

AG Barr Britvic

0.178

0.264

Cash Ratio

Cash Ratio

Figure 4: Figure representing Cash Ratio

(Source: As Created by Author)

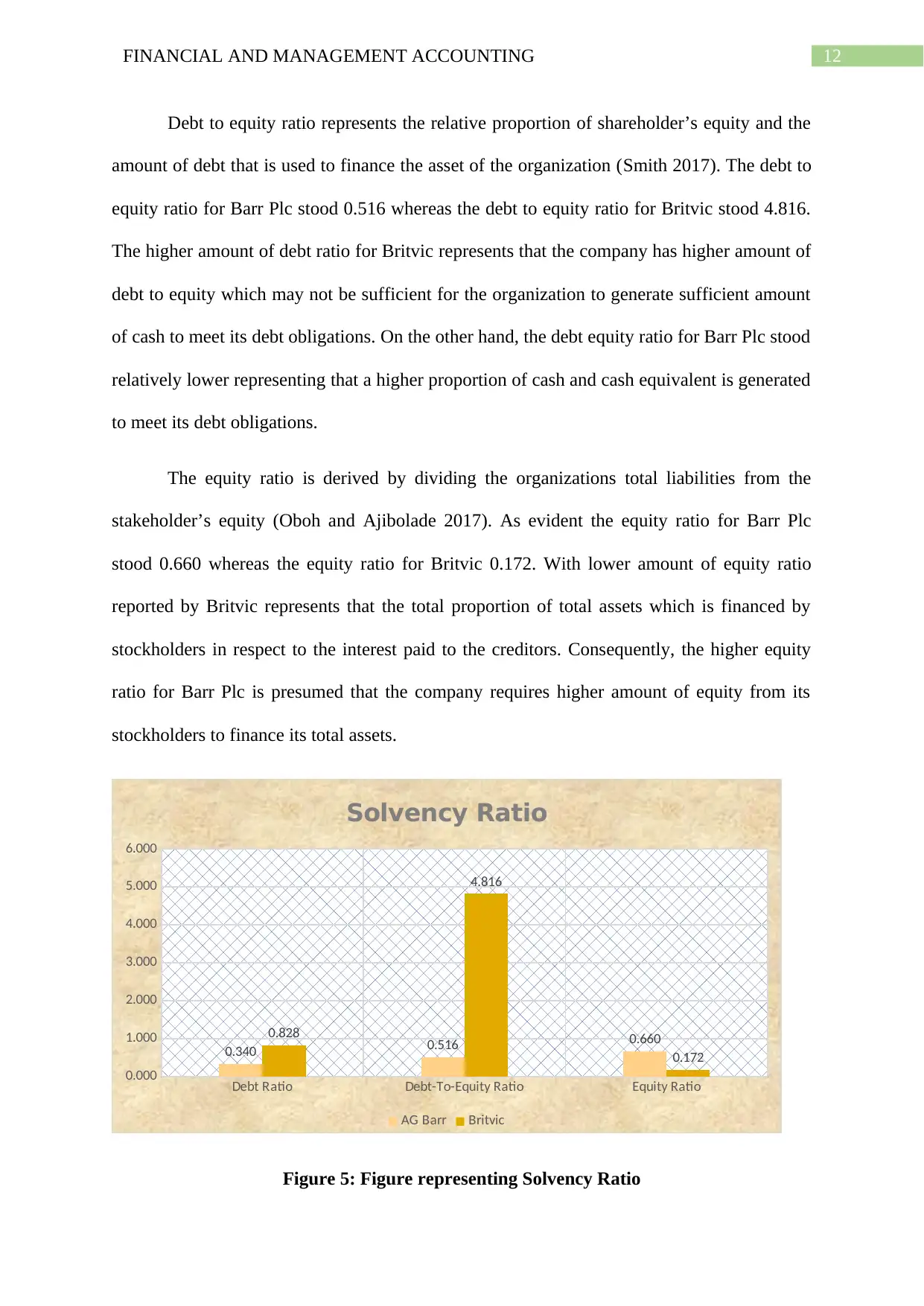

Solvency Ratio:

The solvency ratio represents the measure of the various ratio, which is used to

measure the ability of the organization in meeting its long-term debts. Furthermore, the

solvency ratio quantifies the size of the organization after tax profit (Dashtbayaz,

Mohammadi and Mohammadi 2014). Under the solvency ratio the debt ratio is computed to

determine the extent of organizations leverage. The debt ratio for Barr Plc stood 0.340

whereas the debt ratio for Britvic stood 0.828. The lower amount of debt ratio for Barr plc is

primarily because of the constant fall in the debt interest which ultimately reflects the

improved debt profile. Barr plc have been successful in paying off its debt that enabled the

firm to transitioned towards an effective net cash position. The higher debt ratio for Britvic is

because of overall increase in net debt by £86.5million because of the acquisition of Bela

Ischia and East Coach. The net debt leverage for Britvic also increased two times from

previous year figure of 1.8 times.

AG Barr Britvic

0.178

0.264

Cash Ratio

Cash Ratio

Figure 4: Figure representing Cash Ratio

(Source: As Created by Author)

Solvency Ratio:

The solvency ratio represents the measure of the various ratio, which is used to

measure the ability of the organization in meeting its long-term debts. Furthermore, the

solvency ratio quantifies the size of the organization after tax profit (Dashtbayaz,

Mohammadi and Mohammadi 2014). Under the solvency ratio the debt ratio is computed to

determine the extent of organizations leverage. The debt ratio for Barr Plc stood 0.340

whereas the debt ratio for Britvic stood 0.828. The lower amount of debt ratio for Barr plc is

primarily because of the constant fall in the debt interest which ultimately reflects the

improved debt profile. Barr plc have been successful in paying off its debt that enabled the

firm to transitioned towards an effective net cash position. The higher debt ratio for Britvic is

because of overall increase in net debt by £86.5million because of the acquisition of Bela

Ischia and East Coach. The net debt leverage for Britvic also increased two times from

previous year figure of 1.8 times.

12FINANCIAL AND MANAGEMENT ACCOUNTING

Debt to equity ratio represents the relative proportion of shareholder’s equity and the

amount of debt that is used to finance the asset of the organization (Smith 2017). The debt to

equity ratio for Barr Plc stood 0.516 whereas the debt to equity ratio for Britvic stood 4.816.

The higher amount of debt ratio for Britvic represents that the company has higher amount of

debt to equity which may not be sufficient for the organization to generate sufficient amount

of cash to meet its debt obligations. On the other hand, the debt equity ratio for Barr Plc stood

relatively lower representing that a higher proportion of cash and cash equivalent is generated

to meet its debt obligations.

The equity ratio is derived by dividing the organizations total liabilities from the

stakeholder’s equity (Oboh and Ajibolade 2017). As evident the equity ratio for Barr Plc

stood 0.660 whereas the equity ratio for Britvic 0.172. With lower amount of equity ratio

reported by Britvic represents that the total proportion of total assets which is financed by

stockholders in respect to the interest paid to the creditors. Consequently, the higher equity

ratio for Barr Plc is presumed that the company requires higher amount of equity from its

stockholders to finance its total assets.

Debt Ratio Debt-To-Equity Ratio Equity Ratio

0.000

1.000

2.000

3.000

4.000

5.000

6.000

0.340 0.516 0.6600.828

4.816

0.172

Solvency Ratio

AG Barr Britvic

Figure 5: Figure representing Solvency Ratio

Debt to equity ratio represents the relative proportion of shareholder’s equity and the

amount of debt that is used to finance the asset of the organization (Smith 2017). The debt to

equity ratio for Barr Plc stood 0.516 whereas the debt to equity ratio for Britvic stood 4.816.

The higher amount of debt ratio for Britvic represents that the company has higher amount of

debt to equity which may not be sufficient for the organization to generate sufficient amount

of cash to meet its debt obligations. On the other hand, the debt equity ratio for Barr Plc stood

relatively lower representing that a higher proportion of cash and cash equivalent is generated

to meet its debt obligations.

The equity ratio is derived by dividing the organizations total liabilities from the

stakeholder’s equity (Oboh and Ajibolade 2017). As evident the equity ratio for Barr Plc

stood 0.660 whereas the equity ratio for Britvic 0.172. With lower amount of equity ratio

reported by Britvic represents that the total proportion of total assets which is financed by

stockholders in respect to the interest paid to the creditors. Consequently, the higher equity

ratio for Barr Plc is presumed that the company requires higher amount of equity from its

stockholders to finance its total assets.

Debt Ratio Debt-To-Equity Ratio Equity Ratio

0.000

1.000

2.000

3.000

4.000

5.000

6.000

0.340 0.516 0.6600.828

4.816

0.172

Solvency Ratio

AG Barr Britvic

Figure 5: Figure representing Solvency Ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13FINANCIAL AND MANAGEMENT ACCOUNTING

(Source: As Created by Author)

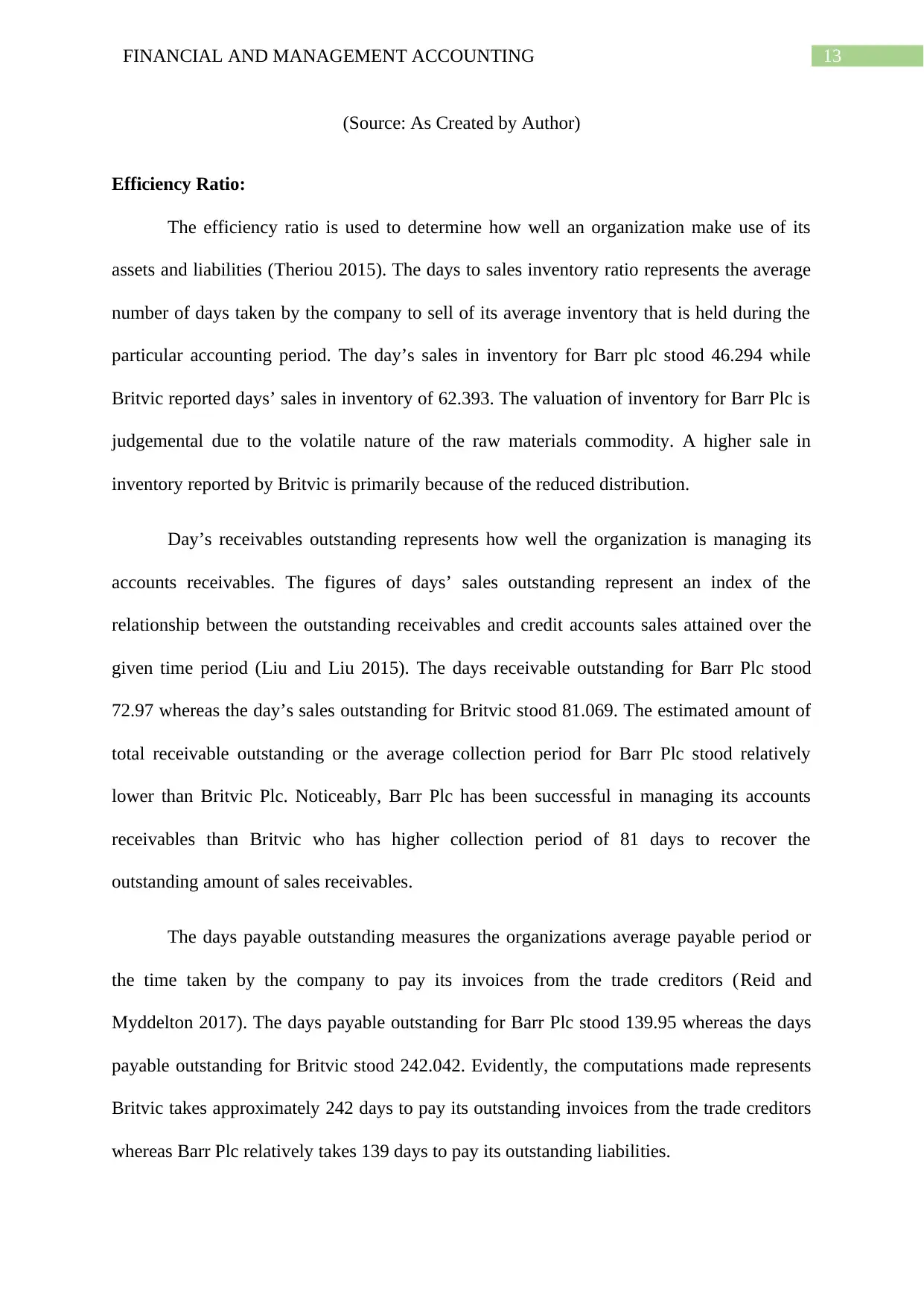

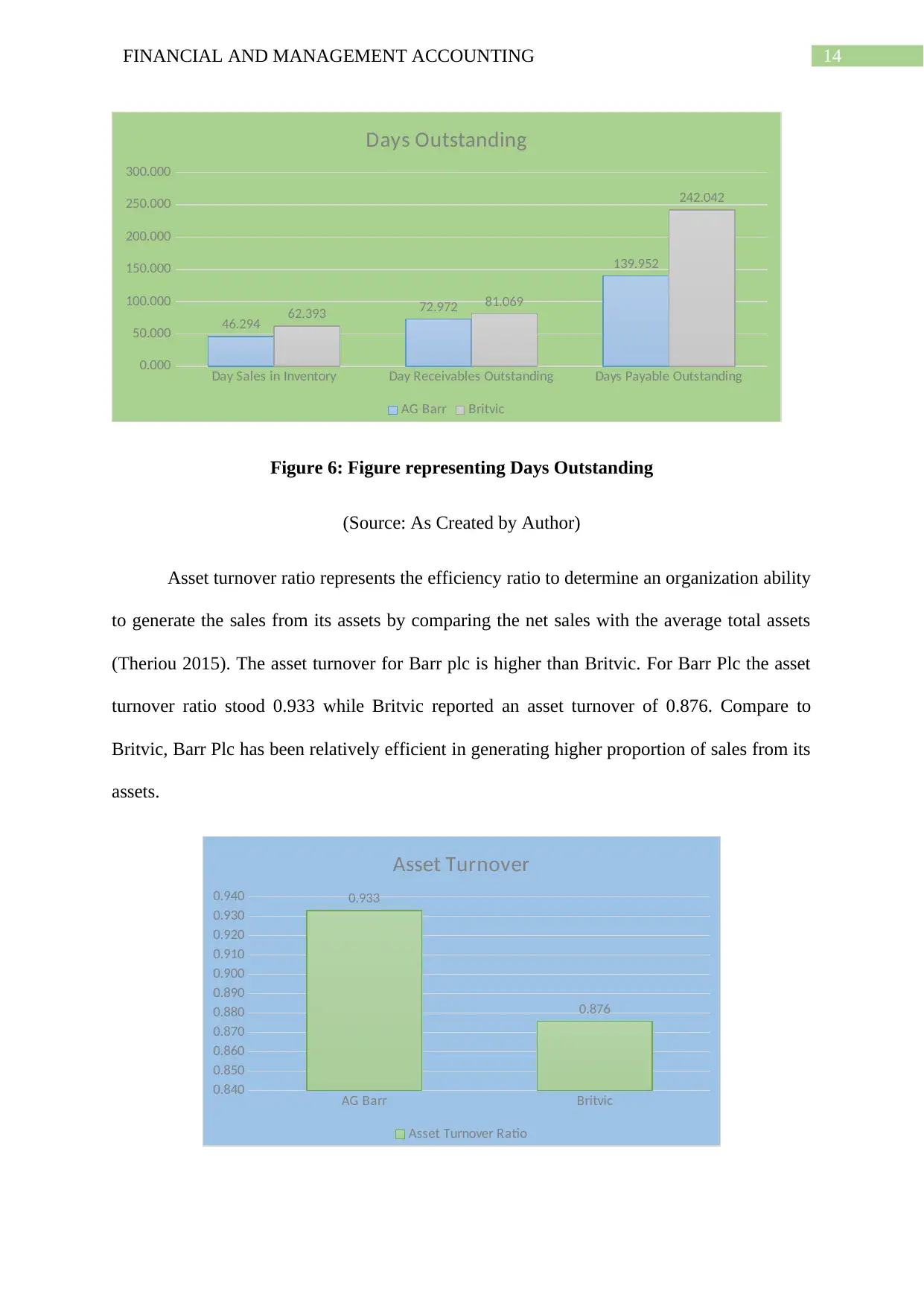

Efficiency Ratio:

The efficiency ratio is used to determine how well an organization make use of its

assets and liabilities (Theriou 2015). The days to sales inventory ratio represents the average

number of days taken by the company to sell of its average inventory that is held during the

particular accounting period. The day’s sales in inventory for Barr plc stood 46.294 while

Britvic reported days’ sales in inventory of 62.393. The valuation of inventory for Barr Plc is

judgemental due to the volatile nature of the raw materials commodity. A higher sale in

inventory reported by Britvic is primarily because of the reduced distribution.

Day’s receivables outstanding represents how well the organization is managing its

accounts receivables. The figures of days’ sales outstanding represent an index of the

relationship between the outstanding receivables and credit accounts sales attained over the

given time period (Liu and Liu 2015). The days receivable outstanding for Barr Plc stood

72.97 whereas the day’s sales outstanding for Britvic stood 81.069. The estimated amount of

total receivable outstanding or the average collection period for Barr Plc stood relatively

lower than Britvic Plc. Noticeably, Barr Plc has been successful in managing its accounts

receivables than Britvic who has higher collection period of 81 days to recover the

outstanding amount of sales receivables.

The days payable outstanding measures the organizations average payable period or

the time taken by the company to pay its invoices from the trade creditors (Reid and

Myddelton 2017). The days payable outstanding for Barr Plc stood 139.95 whereas the days

payable outstanding for Britvic stood 242.042. Evidently, the computations made represents

Britvic takes approximately 242 days to pay its outstanding invoices from the trade creditors

whereas Barr Plc relatively takes 139 days to pay its outstanding liabilities.

(Source: As Created by Author)

Efficiency Ratio:

The efficiency ratio is used to determine how well an organization make use of its

assets and liabilities (Theriou 2015). The days to sales inventory ratio represents the average

number of days taken by the company to sell of its average inventory that is held during the

particular accounting period. The day’s sales in inventory for Barr plc stood 46.294 while

Britvic reported days’ sales in inventory of 62.393. The valuation of inventory for Barr Plc is

judgemental due to the volatile nature of the raw materials commodity. A higher sale in

inventory reported by Britvic is primarily because of the reduced distribution.

Day’s receivables outstanding represents how well the organization is managing its

accounts receivables. The figures of days’ sales outstanding represent an index of the

relationship between the outstanding receivables and credit accounts sales attained over the

given time period (Liu and Liu 2015). The days receivable outstanding for Barr Plc stood

72.97 whereas the day’s sales outstanding for Britvic stood 81.069. The estimated amount of

total receivable outstanding or the average collection period for Barr Plc stood relatively

lower than Britvic Plc. Noticeably, Barr Plc has been successful in managing its accounts

receivables than Britvic who has higher collection period of 81 days to recover the

outstanding amount of sales receivables.

The days payable outstanding measures the organizations average payable period or

the time taken by the company to pay its invoices from the trade creditors (Reid and

Myddelton 2017). The days payable outstanding for Barr Plc stood 139.95 whereas the days

payable outstanding for Britvic stood 242.042. Evidently, the computations made represents

Britvic takes approximately 242 days to pay its outstanding invoices from the trade creditors

whereas Barr Plc relatively takes 139 days to pay its outstanding liabilities.

14FINANCIAL AND MANAGEMENT ACCOUNTING

Day Sales in Inventory Day Receivables Outstanding Days Payable Outstanding

0.000

50.000

100.000

150.000

200.000

250.000

300.000

46.294

72.972

139.952

62.393 81.069

242.042

Days Outstanding

AG Barr Britvic

Figure 6: Figure representing Days Outstanding

(Source: As Created by Author)

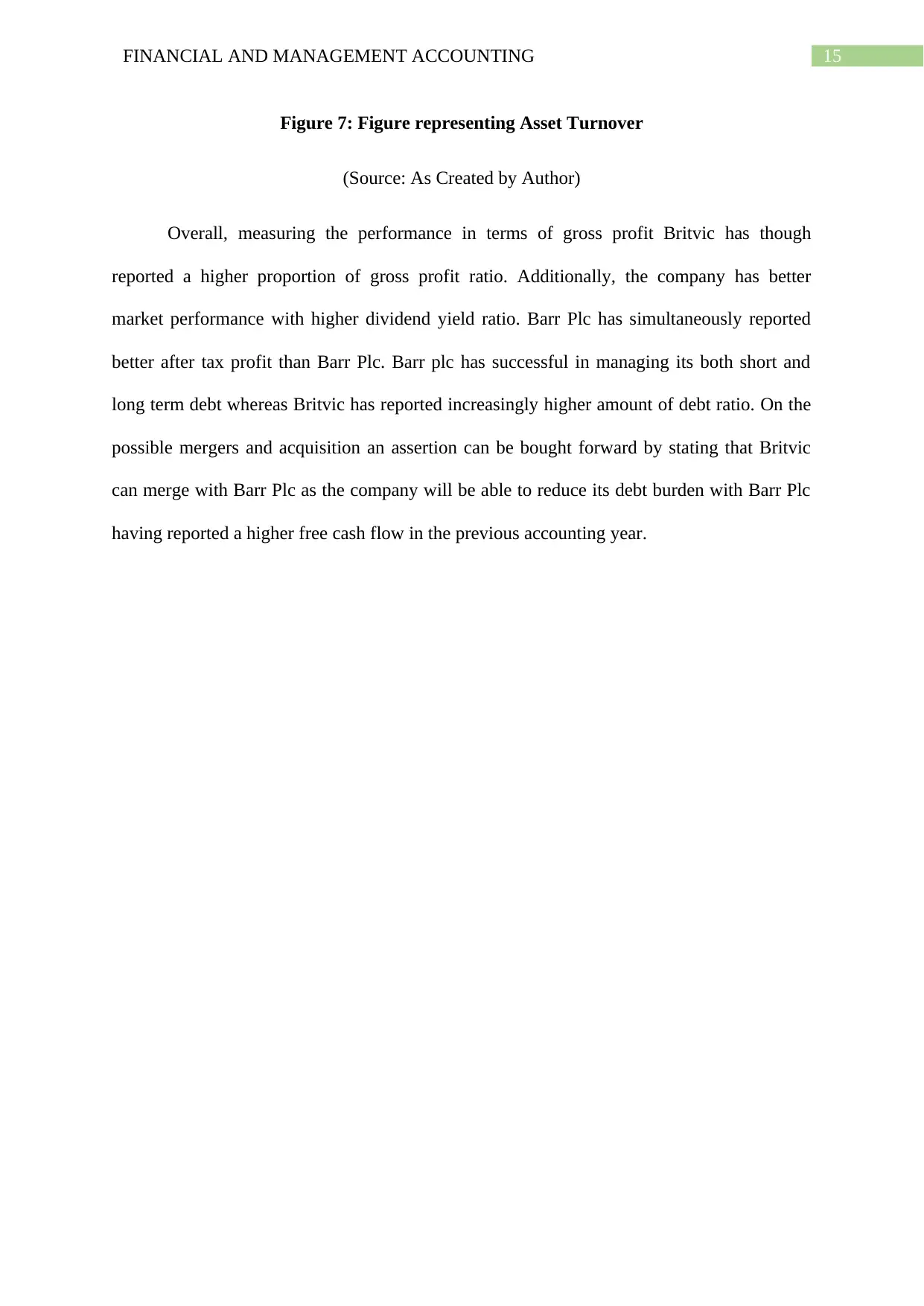

Asset turnover ratio represents the efficiency ratio to determine an organization ability

to generate the sales from its assets by comparing the net sales with the average total assets

(Theriou 2015). The asset turnover for Barr plc is higher than Britvic. For Barr Plc the asset

turnover ratio stood 0.933 while Britvic reported an asset turnover of 0.876. Compare to

Britvic, Barr Plc has been relatively efficient in generating higher proportion of sales from its

assets.

AG Barr Britvic

0.840

0.850

0.860

0.870

0.880

0.890

0.900

0.910

0.920

0.930

0.940 0.933

0.876

Asset Turnover

Asset Turnover Ratio

Day Sales in Inventory Day Receivables Outstanding Days Payable Outstanding

0.000

50.000

100.000

150.000

200.000

250.000

300.000

46.294

72.972

139.952

62.393 81.069

242.042

Days Outstanding

AG Barr Britvic

Figure 6: Figure representing Days Outstanding

(Source: As Created by Author)

Asset turnover ratio represents the efficiency ratio to determine an organization ability

to generate the sales from its assets by comparing the net sales with the average total assets

(Theriou 2015). The asset turnover for Barr plc is higher than Britvic. For Barr Plc the asset

turnover ratio stood 0.933 while Britvic reported an asset turnover of 0.876. Compare to

Britvic, Barr Plc has been relatively efficient in generating higher proportion of sales from its

assets.

AG Barr Britvic

0.840

0.850

0.860

0.870

0.880

0.890

0.900

0.910

0.920

0.930

0.940 0.933

0.876

Asset Turnover

Asset Turnover Ratio

15FINANCIAL AND MANAGEMENT ACCOUNTING

Figure 7: Figure representing Asset Turnover

(Source: As Created by Author)

Overall, measuring the performance in terms of gross profit Britvic has though

reported a higher proportion of gross profit ratio. Additionally, the company has better

market performance with higher dividend yield ratio. Barr Plc has simultaneously reported

better after tax profit than Barr Plc. Barr plc has successful in managing its both short and

long term debt whereas Britvic has reported increasingly higher amount of debt ratio. On the

possible mergers and acquisition an assertion can be bought forward by stating that Britvic

can merge with Barr Plc as the company will be able to reduce its debt burden with Barr Plc

having reported a higher free cash flow in the previous accounting year.

Figure 7: Figure representing Asset Turnover

(Source: As Created by Author)

Overall, measuring the performance in terms of gross profit Britvic has though

reported a higher proportion of gross profit ratio. Additionally, the company has better

market performance with higher dividend yield ratio. Barr Plc has simultaneously reported

better after tax profit than Barr Plc. Barr plc has successful in managing its both short and

long term debt whereas Britvic has reported increasingly higher amount of debt ratio. On the

possible mergers and acquisition an assertion can be bought forward by stating that Britvic

can merge with Barr Plc as the company will be able to reduce its debt burden with Barr Plc

having reported a higher free cash flow in the previous accounting year.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16FINANCIAL AND MANAGEMENT ACCOUNTING

Answer to Case B1:

Answer to A:

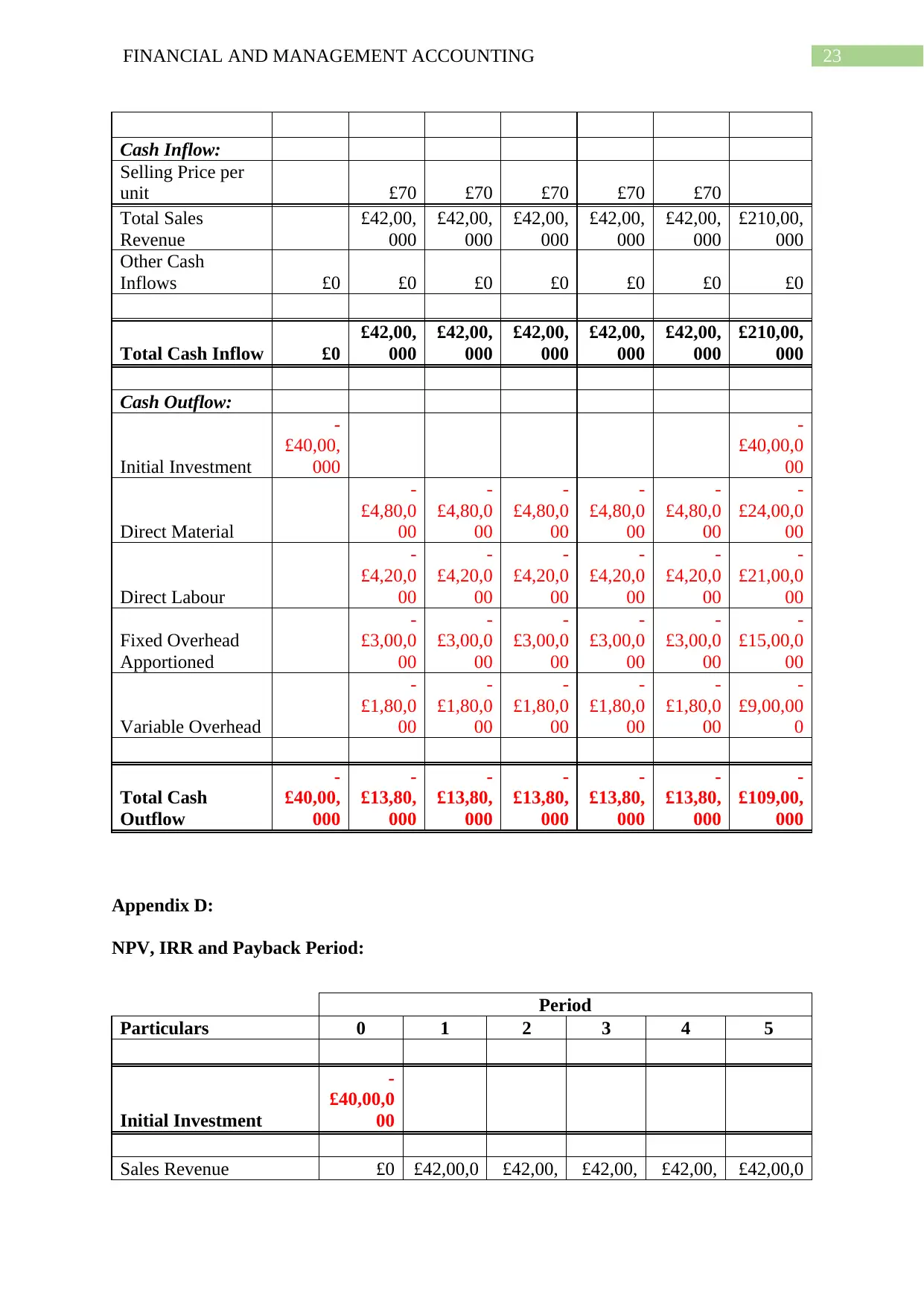

The relevant cash outflow, inflow for making possible investment is computed, and

the same is illustrated in appendix C.

Answer to B:

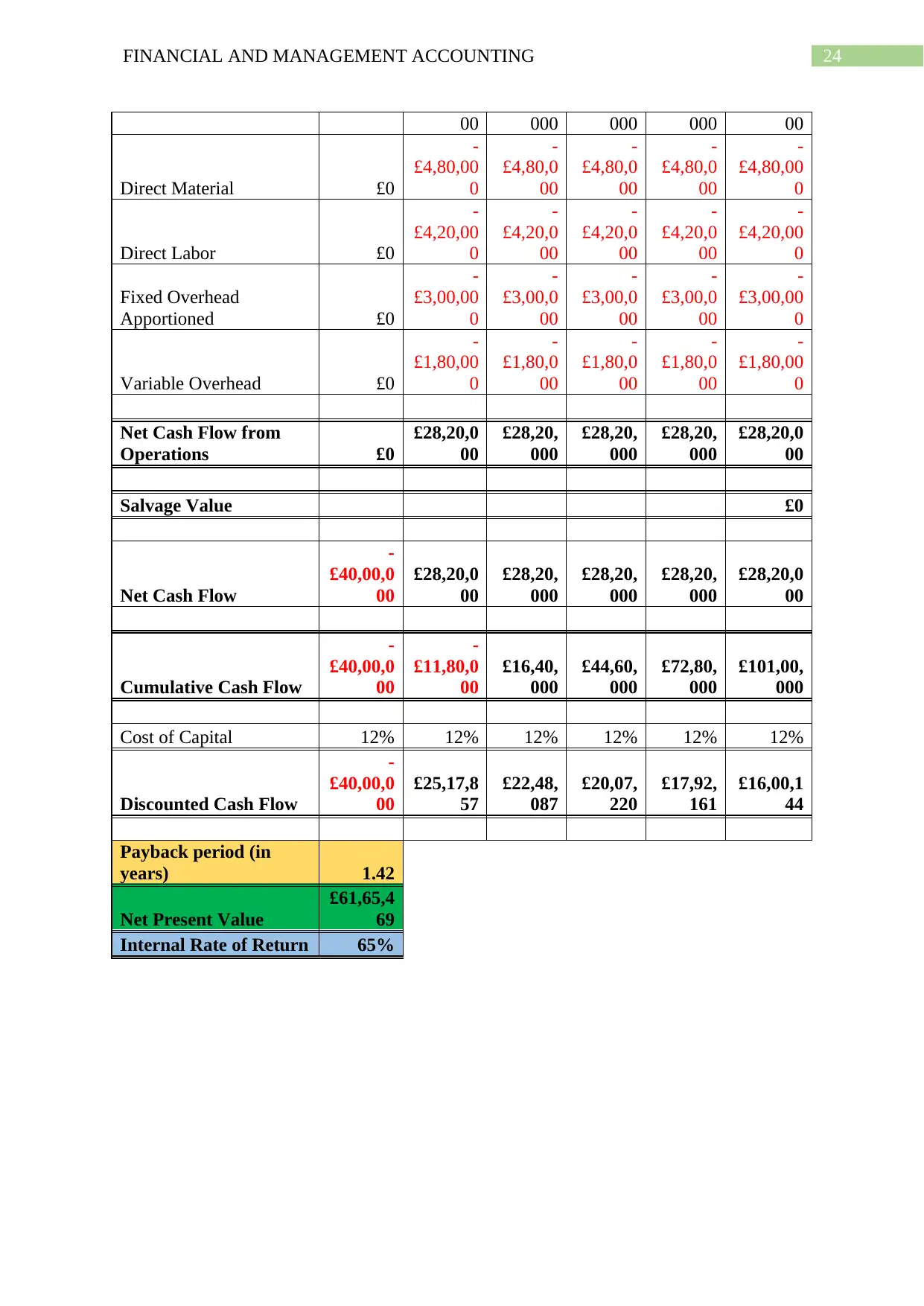

The computation of payback period, net present value and internal rate of return for

possible investment in plant 2 is stated in appendix D.

Answer to C:

On undertaking, the decision regarding making an investment in plant 2 it is feasible

for the directors of Graham to make an investment. Taking into the considerations the sales

volume of 60,000 units over the period of five years it can be stated that a stable amount of

cash inflow can be derived for each year of the five-year period. The selling price per unit is

stated to be around £70 per unit. On the other hand, the initial investment for the directors of

Graham stood £40,00,000 with direct material being £4,80,000. The direct labour and the

direct labour approximately standing £420,000 and £300,000 respectively. The variable

overhead for the project stood £180,000 and the total amount of cash outflow being £109,

90,000 over the period of the five year.

The net cash flow from the operations for each of the five-year period stood £28,

20,000. The cost of capital for the project stood 12%. In the process of capital budgeting

payback period can be defined as the period of time that is needed to recoup the funds

expanded in the investment in order to reach the break-even point. As evident from the

current investment scheme the payback period in years stood 1.42 for investment scheme.

Therefore, on making an initial investment of £40,00,000 on the new plant the company

Answer to Case B1:

Answer to A:

The relevant cash outflow, inflow for making possible investment is computed, and

the same is illustrated in appendix C.

Answer to B:

The computation of payback period, net present value and internal rate of return for

possible investment in plant 2 is stated in appendix D.

Answer to C:

On undertaking, the decision regarding making an investment in plant 2 it is feasible

for the directors of Graham to make an investment. Taking into the considerations the sales

volume of 60,000 units over the period of five years it can be stated that a stable amount of

cash inflow can be derived for each year of the five-year period. The selling price per unit is

stated to be around £70 per unit. On the other hand, the initial investment for the directors of

Graham stood £40,00,000 with direct material being £4,80,000. The direct labour and the

direct labour approximately standing £420,000 and £300,000 respectively. The variable

overhead for the project stood £180,000 and the total amount of cash outflow being £109,

90,000 over the period of the five year.

The net cash flow from the operations for each of the five-year period stood £28,

20,000. The cost of capital for the project stood 12%. In the process of capital budgeting

payback period can be defined as the period of time that is needed to recoup the funds

expanded in the investment in order to reach the break-even point. As evident from the

current investment scheme the payback period in years stood 1.42 for investment scheme.

Therefore, on making an initial investment of £40,00,000 on the new plant the company

17FINANCIAL AND MANAGEMENT ACCOUNTING

would be able to get the return from the amount invested in project within the span of 1.5

years.

The net present value or in other words the net present worth represents the measure

of profit computed following the subtraction of present values of cash outflows that also

included the initial cost of the present value of cash inflow over the period of time. As

evident from the computations carried out in respect to the new investment project of

investing in machine, the net present value of the machine stood £61,65,469. The net present

value computed for the new project is derived by subtracting the present value of the cash

outflow of the project along with the initial amount of £40,00,000.

The internal rate of return can be defined as the metric that is used in the

determination of the profitability relating to the probable investments in the project (Liu and

Liu 2015). Internal rate of return represents the discount rate to determine the net present

value of the cash flow from the particular project. The internal rate of return on investment

represents the annualized effective compound rate of return of the project. As evident, the

internal rate of return for the new plant stood 65%.

On the basis of the evaluation performed an assertion can be bought forward by

stating that making an investment in the new project or in other words making an investment

in new plant would be feasible. This is because the payback period in years for the new plant

is 1.42 years. similarly, the net present value of the plant stood £61,65,469 with the internal

rate of return for the project standing 65%. As the advice to the management in important

assertion can be bought, forward by stating that making an investment in the new project

would be provide directors with better amount of cash inflow and relatively lower cash

outflow.

would be able to get the return from the amount invested in project within the span of 1.5

years.

The net present value or in other words the net present worth represents the measure

of profit computed following the subtraction of present values of cash outflows that also

included the initial cost of the present value of cash inflow over the period of time. As

evident from the computations carried out in respect to the new investment project of

investing in machine, the net present value of the machine stood £61,65,469. The net present

value computed for the new project is derived by subtracting the present value of the cash

outflow of the project along with the initial amount of £40,00,000.

The internal rate of return can be defined as the metric that is used in the

determination of the profitability relating to the probable investments in the project (Liu and

Liu 2015). Internal rate of return represents the discount rate to determine the net present

value of the cash flow from the particular project. The internal rate of return on investment

represents the annualized effective compound rate of return of the project. As evident, the

internal rate of return for the new plant stood 65%.

On the basis of the evaluation performed an assertion can be bought forward by

stating that making an investment in the new project or in other words making an investment

in new plant would be feasible. This is because the payback period in years for the new plant

is 1.42 years. similarly, the net present value of the plant stood £61,65,469 with the internal

rate of return for the project standing 65%. As the advice to the management in important

assertion can be bought, forward by stating that making an investment in the new project

would be provide directors with better amount of cash inflow and relatively lower cash

outflow.

18FINANCIAL AND MANAGEMENT ACCOUNTING

Reference List:

Agbarr.co.uk. (2018). Soft drink brands | A.G. BARR soft drinks. [online] Available at:

https://www.agbarr.co.uk/ [Accessed 27 Feb. 2018].

Appelbaum, D., Kogan, A., Vasarhelyi, M. and Yan, Z., 2017. Impact of business analytics

and enterprise systems on managerial accounting. International Journal of Accounting

Information Systems, 25, pp.29-44.

Britvic.com. (2018). Home. [online] Available at: http://www.britvic.com/ [Accessed 27 Feb.

2018].

Caplan, D., 2016. Managerial Accounting Concepts and Techniques.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Dashtbayaz, M.L., Mohammadi, S. and Mohammadi, A., 2014. Strategic Management

Accounting. Research Journal of Finance and Accounting, 5(23), pp.17-21.

Eldenburg, L.G., Wolcott, S.K., Chen, L.H. and Cook, G., 2016. Cost management:

Measuring, monitoring, and motivating performance. Wiley Global Education.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Reference List:

Agbarr.co.uk. (2018). Soft drink brands | A.G. BARR soft drinks. [online] Available at:

https://www.agbarr.co.uk/ [Accessed 27 Feb. 2018].

Appelbaum, D., Kogan, A., Vasarhelyi, M. and Yan, Z., 2017. Impact of business analytics

and enterprise systems on managerial accounting. International Journal of Accounting

Information Systems, 25, pp.29-44.

Britvic.com. (2018). Home. [online] Available at: http://www.britvic.com/ [Accessed 27 Feb.

2018].

Caplan, D., 2016. Managerial Accounting Concepts and Techniques.

Chenhall, R.H. and Moers, F., 2015. The role of innovation in the evolution of management

accounting and its integration into management control. Accounting, Organizations and

Society, 47, pp.1-13.

Dashtbayaz, M.L., Mohammadi, S. and Mohammadi, A., 2014. Strategic Management

Accounting. Research Journal of Finance and Accounting, 5(23), pp.17-21.

Eldenburg, L.G., Wolcott, S.K., Chen, L.H. and Cook, G., 2016. Cost management:

Measuring, monitoring, and motivating performance. Wiley Global Education.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19FINANCIAL AND MANAGEMENT ACCOUNTING

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Kravet, T.D., 2014. Accounting conservatism and managerial risk-taking: Corporate

acquisitions. Journal of Accounting and Economics, 57(2), pp.218-240.

Liu, Y. and Liu, C.K., 2015. Signature extraction from accounting ratios. U.S. Patent

Application 13/952,692.

Marshall, D., 2016. Accounting: what the numbers mean. McGraw-Hill Higher Education.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning

Pvt. Ltd..

Oboh, C.S. and Ajibolade, S.O., 2017. Strategic Management Accounting and decision

Making.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Reid, W. and Myddelton, D.R., 2017. The meaning of company accounts. Routledge.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Smith, S.S., 2017. Strategic Management Accounting: Delivering Value in a Changing

Business Environment Through Integrated Reporting. Business Expert Press.

Theriou, N.G., 2015. Strategic Management Process and the Importance of Structured

Formality, Financial and Non-Financial Information. European Research Studies, 18(2), p.3.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Kravet, T.D., 2014. Accounting conservatism and managerial risk-taking: Corporate

acquisitions. Journal of Accounting and Economics, 57(2), pp.218-240.

Liu, Y. and Liu, C.K., 2015. Signature extraction from accounting ratios. U.S. Patent

Application 13/952,692.

Marshall, D., 2016. Accounting: what the numbers mean. McGraw-Hill Higher Education.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning

Pvt. Ltd..

Oboh, C.S. and Ajibolade, S.O., 2017. Strategic Management Accounting and decision

Making.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Reid, W. and Myddelton, D.R., 2017. The meaning of company accounts. Routledge.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Smith, S.S., 2017. Strategic Management Accounting: Delivering Value in a Changing

Business Environment Through Integrated Reporting. Business Expert Press.

Theriou, N.G., 2015. Strategic Management Process and the Importance of Structured

Formality, Financial and Non-Financial Information. European Research Studies, 18(2), p.3.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

20FINANCIAL AND MANAGEMENT ACCOUNTING

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education.

21FINANCIAL AND MANAGEMENT ACCOUNTING

Appendix:

Appendix A:

Investment Ratio:

Particulars AG Barr Britvic

Stock Price A £502.00 £584.50

Dividend Per share B £0.14 £0.27

Earnings per share C £0.31 £0.53

Dividend Yield D = B/A 0.029% 0.045%

Dividend Cover Ratio E= C/B 2.138 1.996

Price - Earnings Ratio F=A/C 1630.929 1104.915

Appendix B:

Financial Ratios:

Profitability Ratio:

Particulars AG Barr Britvic

Sales Revenue A 257.1 1431.3

Gross Profit B 120.7 772

Net Profit C 35.6 114.5

Total Assets D 275.6 1634.4

Total Equity E 181.8 281

Gross Profit Margin F=B/A 46.95% 53.94%

Net Profit Margin G=C/A 13.85% 8.00%

Return on Assets H=C/D 12.92% 7.01%

Return on Equity I=C/E 19.58% 40.75%

Liquidity Ratio:

Particulars AG Barr Britvic

Current Assets A 80.2 722.6

Current Liabilities B 56.7 779.4

Inventories C 17.3 112.7

EBIT D 43.8 176.4

Interest Expenses E 0.7 26.9

Cash F 10.1 205.9

Appendix:

Appendix A:

Investment Ratio:

Particulars AG Barr Britvic

Stock Price A £502.00 £584.50

Dividend Per share B £0.14 £0.27

Earnings per share C £0.31 £0.53

Dividend Yield D = B/A 0.029% 0.045%

Dividend Cover Ratio E= C/B 2.138 1.996

Price - Earnings Ratio F=A/C 1630.929 1104.915

Appendix B:

Financial Ratios:

Profitability Ratio:

Particulars AG Barr Britvic

Sales Revenue A 257.1 1431.3

Gross Profit B 120.7 772

Net Profit C 35.6 114.5

Total Assets D 275.6 1634.4

Total Equity E 181.8 281

Gross Profit Margin F=B/A 46.95% 53.94%

Net Profit Margin G=C/A 13.85% 8.00%

Return on Assets H=C/D 12.92% 7.01%

Return on Equity I=C/E 19.58% 40.75%

Liquidity Ratio:

Particulars AG Barr Britvic

Current Assets A 80.2 722.6

Current Liabilities B 56.7 779.4

Inventories C 17.3 112.7

EBIT D 43.8 176.4

Interest Expenses E 0.7 26.9

Cash F 10.1 205.9

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22FINANCIAL AND MANAGEMENT ACCOUNTING

Current Ratio G=A/B 1.414 0.927

Quick Ratio H=(A-C)/B 1.109 0.783

Time Interest Earned Ratio I=D/E 62.571 6.558

Cash Ratio J=F/B 0.178 0.264

Efficiency Ratio:

Particulars AG Barr Britvic

Inventories A 17.3 112.7

Cost of Sales B 136.4 659.3

Accounts Receivable C 51.4 317.9

Accounts Payable D 52.3 437.2

Sales Revenue E 257.1 1431.3

Total Assets F 275.6 1634.4

Day Sales in Inventory G=(A/B)x365 46.294 62.393

Day Receivables Outstanding H=(C/E) x 365 72.972 81.069

Days Payable Outstanding I=D/(B/365) 139.952 242.042

Asset Turnover Ratio J=E/F 0.933 0.876

Solvency Ratio:

Particulars AG Barr Britvic

Total Assets A 275.6 1634.4

Total Equity B 181.8 281

Total Liabilities C 93.8 1353.4

Debt Ratio D=C/A 0.340 0.828

Debt-To-Equity Ratio E=C/B 0.516 4.816

Equity Ratio F=B/A 0.660 0.172

Appendix C:

Cash Inflow and Cash Outflow

cash flow

Schedule:

Period

Particulars 0 1 2 3 4 5 TOTAL

Sales Volume (in

units) 60000 60000 60000 60000 60000 300000

Current Ratio G=A/B 1.414 0.927

Quick Ratio H=(A-C)/B 1.109 0.783

Time Interest Earned Ratio I=D/E 62.571 6.558

Cash Ratio J=F/B 0.178 0.264

Efficiency Ratio:

Particulars AG Barr Britvic

Inventories A 17.3 112.7

Cost of Sales B 136.4 659.3

Accounts Receivable C 51.4 317.9

Accounts Payable D 52.3 437.2

Sales Revenue E 257.1 1431.3

Total Assets F 275.6 1634.4

Day Sales in Inventory G=(A/B)x365 46.294 62.393

Day Receivables Outstanding H=(C/E) x 365 72.972 81.069

Days Payable Outstanding I=D/(B/365) 139.952 242.042

Asset Turnover Ratio J=E/F 0.933 0.876

Solvency Ratio:

Particulars AG Barr Britvic

Total Assets A 275.6 1634.4

Total Equity B 181.8 281

Total Liabilities C 93.8 1353.4

Debt Ratio D=C/A 0.340 0.828

Debt-To-Equity Ratio E=C/B 0.516 4.816

Equity Ratio F=B/A 0.660 0.172

Appendix C:

Cash Inflow and Cash Outflow

cash flow

Schedule:

Period

Particulars 0 1 2 3 4 5 TOTAL

Sales Volume (in

units) 60000 60000 60000 60000 60000 300000

23FINANCIAL AND MANAGEMENT ACCOUNTING

Cash Inflow:

Selling Price per

unit £70 £70 £70 £70 £70

Total Sales

Revenue

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£210,00,

000

Other Cash

Inflows £0 £0 £0 £0 £0 £0 £0

Total Cash Inflow £0

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£210,00,

000

Cash Outflow:

Initial Investment

-

£40,00,

000

-

£40,00,0

00

Direct Material

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£24,00,0

00

Direct Labour

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£21,00,0

00

Fixed Overhead

Apportioned

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£15,00,0

00

Variable Overhead

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£9,00,00

0

Total Cash

Outflow

-

£40,00,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£109,00,

000

Appendix D:

NPV, IRR and Payback Period:

Period

Particulars 0 1 2 3 4 5

Initial Investment

-

£40,00,0

00

Sales Revenue £0 £42,00,0 £42,00, £42,00, £42,00, £42,00,0

Cash Inflow:

Selling Price per

unit £70 £70 £70 £70 £70

Total Sales

Revenue

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£210,00,

000

Other Cash

Inflows £0 £0 £0 £0 £0 £0 £0

Total Cash Inflow £0

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£42,00,

000

£210,00,

000

Cash Outflow:

Initial Investment

-

£40,00,

000

-

£40,00,0

00

Direct Material

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£24,00,0

00

Direct Labour

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£21,00,0

00

Fixed Overhead

Apportioned

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£15,00,0

00

Variable Overhead

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£9,00,00

0

Total Cash

Outflow

-

£40,00,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£13,80,

000

-

£109,00,

000

Appendix D:

NPV, IRR and Payback Period:

Period

Particulars 0 1 2 3 4 5

Initial Investment

-

£40,00,0

00

Sales Revenue £0 £42,00,0 £42,00, £42,00, £42,00, £42,00,0

24FINANCIAL AND MANAGEMENT ACCOUNTING

00 000 000 000 00

Direct Material £0

-

£4,80,00

0

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,00

0

Direct Labor £0

-

£4,20,00

0

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,00

0

Fixed Overhead

Apportioned £0

-

£3,00,00

0

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,00

0

Variable Overhead £0

-

£1,80,00

0

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,00

0

Net Cash Flow from

Operations £0

£28,20,0

00

£28,20,

000

£28,20,

000

£28,20,

000

£28,20,0

00

Salvage Value £0

Net Cash Flow

-

£40,00,0

00

£28,20,0

00

£28,20,

000

£28,20,

000

£28,20,

000

£28,20,0

00

Cumulative Cash Flow

-

£40,00,0

00

-

£11,80,0

00

£16,40,

000

£44,60,

000

£72,80,

000

£101,00,

000

Cost of Capital 12% 12% 12% 12% 12% 12%

Discounted Cash Flow

-

£40,00,0

00

£25,17,8

57

£22,48,

087

£20,07,

220

£17,92,

161

£16,00,1

44

Payback period (in

years) 1.42

Net Present Value

£61,65,4

69

Internal Rate of Return 65%

00 000 000 000 00

Direct Material £0

-

£4,80,00

0

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,0

00

-

£4,80,00

0

Direct Labor £0

-

£4,20,00

0

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,0

00

-

£4,20,00

0

Fixed Overhead

Apportioned £0

-

£3,00,00

0

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,0

00

-

£3,00,00

0

Variable Overhead £0

-

£1,80,00

0

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,0

00

-

£1,80,00

0

Net Cash Flow from

Operations £0

£28,20,0

00

£28,20,

000

£28,20,

000

£28,20,

000

£28,20,0

00

Salvage Value £0

Net Cash Flow

-

£40,00,0

00

£28,20,0

00

£28,20,

000

£28,20,

000

£28,20,

000

£28,20,0

00

Cumulative Cash Flow

-

£40,00,0

00

-

£11,80,0

00

£16,40,

000

£44,60,

000

£72,80,

000

£101,00,

000

Cost of Capital 12% 12% 12% 12% 12% 12%

Discounted Cash Flow

-

£40,00,0

00

£25,17,8

57

£22,48,

087

£20,07,

220

£17,92,

161

£16,00,1

44

Payback period (in

years) 1.42

Net Present Value

£61,65,4

69

Internal Rate of Return 65%

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.