Financial Analysis: Harrison Plc Performance (2012-2016)

VerifiedAdded on 2020/06/06

|7

|1652

|62

Report

AI Summary

This report presents a detailed financial analysis of Harrison Plc from 2012 to 2016. It begins with an introduction emphasizing the importance of financial analysis for investment decisions and then proceeds to analyze the company's financial statements using various ratios. The analysis includes profitability ratios (gross profit, net profit, operating ratios, return on equity, return on assets, and return on capital employed), liquidity ratios (current ratio, liquid ratio, and net working capital ratio), and efficiency ratios (total assets turnover, inventory turnover, receivable turnover, and debt to equity). The report also includes a comparative analysis of Harrison's share price against competitors and the FTSE 100 index, assessing performance from 2012 to 2016. Finally, the report assesses the strength of premium investment in Harrison Plc based on the calculated ratios and share price performance, concluding that Harrison Plc presents a good investment opportunity. The report uses data, calculations, and comparisons to support its findings and conclusions, citing relevant sources. This analysis is crucial for making informed investment decisions.

Financial Coursework

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION..........................................................................................................................1

PART 1............................................................................................................................................1

Q1a: Analysis by using ratios.................................................................................................1

Q1.b: Comparative analysis of Harrison’s share price 2012 to 2016.....................................3

Q1.c: Assess the strength of premium investment................................................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION..........................................................................................................................1

PART 1............................................................................................................................................1

Q1a: Analysis by using ratios.................................................................................................1

Q1.b: Comparative analysis of Harrison’s share price 2012 to 2016.....................................3

Q1.c: Assess the strength of premium investment................................................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION

In every business organisation, it is essential to make proper analysis of financial position

of the company before making any investment decision. It is consider as one of the crucial

aspects for accountant to evaluate each and every financial statements by using certain tools and

techniques (Vogel, 2014). Under this project, financial statement of Harrison Plc is being

analysed for the period of 2012 to 2016 by using ratios. By this, effective decisions can be made

whether to making investment under the company is profitable for the investors.

PART 1

Q1a: Analysis by using ratios

For getting better outcomes for the investors in terms of profitability and effective

decision in coming time, it is necessary to analyse financial position of Harrison plc. The best

possible ways to determine the current status is by using various ratios. As, by the help of useful

ratios profitability, efficiency and liquidity position of the company can easily be identified

(Sheikhi, Ranjbar and Oraee, 2012). Some of them are discussed underneath:

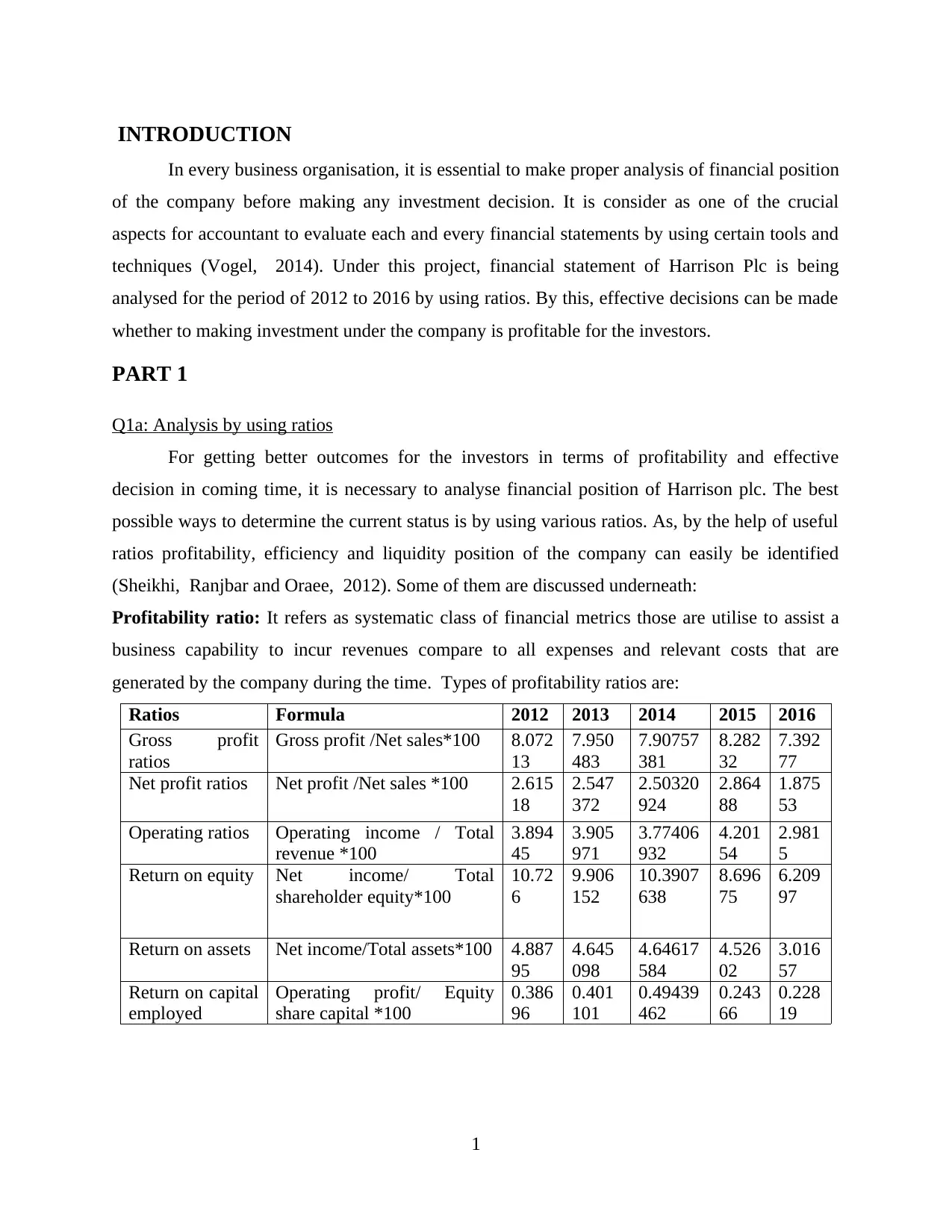

Profitability ratio: It refers as systematic class of financial metrics those are utilise to assist a

business capability to incur revenues compare to all expenses and relevant costs that are

generated by the company during the time. Types of profitability ratios are:

Ratios Formula 2012 2013 2014 2015 2016

Gross profit

ratios

Gross profit /Net sales*100 8.072

13

7.950

483

7.90757

381

8.282

32

7.392

77

Net profit ratios Net profit /Net sales *100 2.615

18

2.547

372

2.50320

924

2.864

88

1.875

53

Operating ratios Operating income / Total

revenue *100

3.894

45

3.905

971

3.77406

932

4.201

54

2.981

5

Return on equity Net income/ Total

shareholder equity*100

10.72

6

9.906

152

10.3907

638

8.696

75

6.209

97

Return on assets Net income/Total assets*100 4.887

95

4.645

098

4.64617

584

4.526

02

3.016

57

Return on capital

employed

Operating profit/ Equity

share capital *100

0.386

96

0.401

101

0.49439

462

0.243

66

0.228

19

1

In every business organisation, it is essential to make proper analysis of financial position

of the company before making any investment decision. It is consider as one of the crucial

aspects for accountant to evaluate each and every financial statements by using certain tools and

techniques (Vogel, 2014). Under this project, financial statement of Harrison Plc is being

analysed for the period of 2012 to 2016 by using ratios. By this, effective decisions can be made

whether to making investment under the company is profitable for the investors.

PART 1

Q1a: Analysis by using ratios

For getting better outcomes for the investors in terms of profitability and effective

decision in coming time, it is necessary to analyse financial position of Harrison plc. The best

possible ways to determine the current status is by using various ratios. As, by the help of useful

ratios profitability, efficiency and liquidity position of the company can easily be identified

(Sheikhi, Ranjbar and Oraee, 2012). Some of them are discussed underneath:

Profitability ratio: It refers as systematic class of financial metrics those are utilise to assist a

business capability to incur revenues compare to all expenses and relevant costs that are

generated by the company during the time. Types of profitability ratios are:

Ratios Formula 2012 2013 2014 2015 2016

Gross profit

ratios

Gross profit /Net sales*100 8.072

13

7.950

483

7.90757

381

8.282

32

7.392

77

Net profit ratios Net profit /Net sales *100 2.615

18

2.547

372

2.50320

924

2.864

88

1.875

53

Operating ratios Operating income / Total

revenue *100

3.894

45

3.905

971

3.77406

932

4.201

54

2.981

5

Return on equity Net income/ Total

shareholder equity*100

10.72

6

9.906

152

10.3907

638

8.696

75

6.209

97

Return on assets Net income/Total assets*100 4.887

95

4.645

098

4.64617

584

4.526

02

3.016

57

Return on capital

employed

Operating profit/ Equity

share capital *100

0.386

96

0.401

101

0.49439

462

0.243

66

0.228

19

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

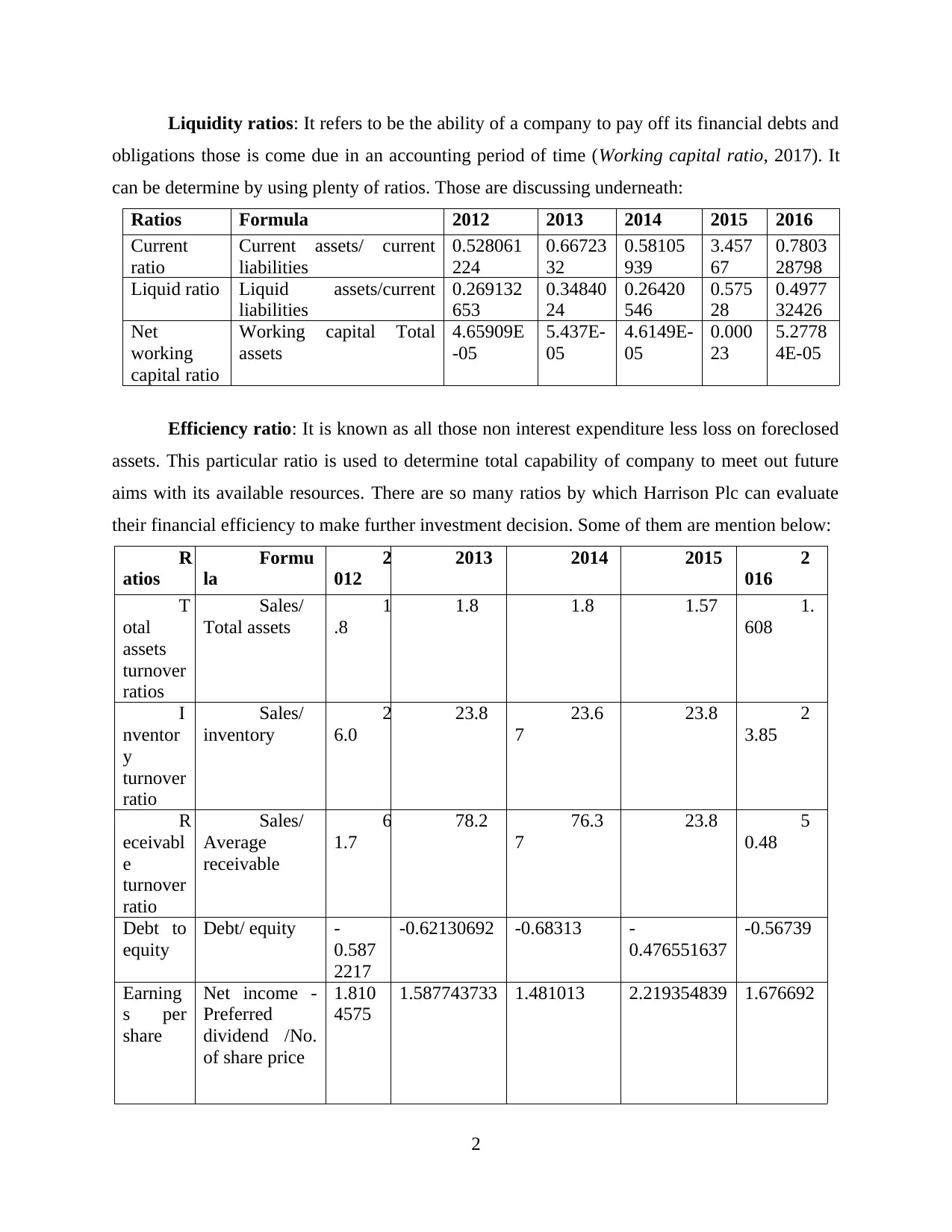

Liquidity ratios: It refers to be the ability of a company to pay off its financial debts and

obligations those is come due in an accounting period of time (Working capital ratio, 2017). It

can be determine by using plenty of ratios. Those are discussing underneath:

Ratios Formula 2012 2013 2014 2015 2016

Current

ratio

Current assets/ current

liabilities

0.528061

224

0.66723

32

0.58105

939

3.457

67

0.7803

28798

Liquid ratio Liquid assets/current

liabilities

0.269132

653

0.34840

24

0.26420

546

0.575

28

0.4977

32426

Net

working

capital ratio

Working capital Total

assets

4.65909E

-05

5.437E-

05

4.6149E-

05

0.000

23

5.2778

4E-05

Efficiency ratio: It is known as all those non interest expenditure less loss on foreclosed

assets. This particular ratio is used to determine total capability of company to meet out future

aims with its available resources. There are so many ratios by which Harrison Plc can evaluate

their financial efficiency to make further investment decision. Some of them are mention below:

R

atios

Formu

la

2

012

2013 2014 2015 2

016

T

otal

assets

turnover

ratios

Sales/

Total assets

1

.8

1.8 1.8 1.57 1.

608

I

nventor

y

turnover

ratio

Sales/

inventory

2

6.0

23.8 23.6

7

23.8 2

3.85

R

eceivabl

e

turnover

ratio

Sales/

Average

receivable

6

1.7

78.2 76.3

7

23.8 5

0.48

Debt to

equity

Debt/ equity -

0.587

2217

-0.62130692 -0.68313 -

0.476551637

-0.56739

Earning

s per

share

Net income -

Preferred

dividend /No.

of share price

1.810

4575

1.587743733 1.481013 2.219354839 1.676692

2

obligations those is come due in an accounting period of time (Working capital ratio, 2017). It

can be determine by using plenty of ratios. Those are discussing underneath:

Ratios Formula 2012 2013 2014 2015 2016

Current

ratio

Current assets/ current

liabilities

0.528061

224

0.66723

32

0.58105

939

3.457

67

0.7803

28798

Liquid ratio Liquid assets/current

liabilities

0.269132

653

0.34840

24

0.26420

546

0.575

28

0.4977

32426

Net

working

capital ratio

Working capital Total

assets

4.65909E

-05

5.437E-

05

4.6149E-

05

0.000

23

5.2778

4E-05

Efficiency ratio: It is known as all those non interest expenditure less loss on foreclosed

assets. This particular ratio is used to determine total capability of company to meet out future

aims with its available resources. There are so many ratios by which Harrison Plc can evaluate

their financial efficiency to make further investment decision. Some of them are mention below:

R

atios

Formu

la

2

012

2013 2014 2015 2

016

T

otal

assets

turnover

ratios

Sales/

Total assets

1

.8

1.8 1.8 1.57 1.

608

I

nventor

y

turnover

ratio

Sales/

inventory

2

6.0

23.8 23.6

7

23.8 2

3.85

R

eceivabl

e

turnover

ratio

Sales/

Average

receivable

6

1.7

78.2 76.3

7

23.8 5

0.48

Debt to

equity

Debt/ equity -

0.587

2217

-0.62130692 -0.68313 -

0.476551637

-0.56739

Earning

s per

share

Net income -

Preferred

dividend /No.

of share price

1.810

4575

1.587743733 1.481013 2.219354839 1.676692

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

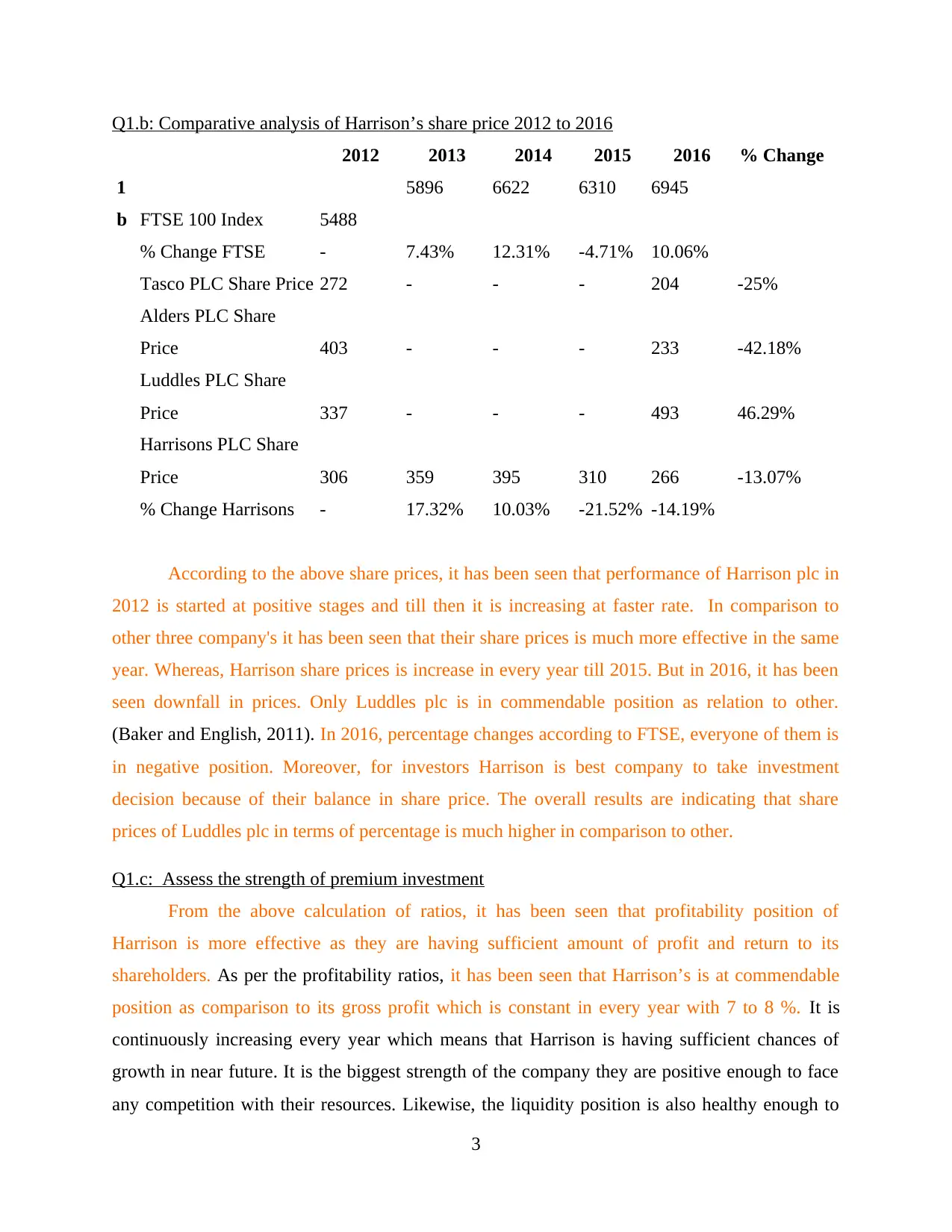

Q1.b: Comparative analysis of Harrison’s share price 2012 to 2016

2012 2013 2014 2015 2016 % Change

1

b FTSE 100 Index 5488

5896 6622 6310 6945

% Change FTSE - 7.43% 12.31% -4.71% 10.06%

Tasco PLC Share Price 272 - - - 204 -25%

Alders PLC Share

Price 403 - - - 233 -42.18%

Luddles PLC Share

Price 337 - - - 493 46.29%

Harrisons PLC Share

Price 306 359 395 310 266 -13.07%

% Change Harrisons - 17.32% 10.03% -21.52% -14.19%

According to the above share prices, it has been seen that performance of Harrison plc in

2012 is started at positive stages and till then it is increasing at faster rate. In comparison to

other three company's it has been seen that their share prices is much more effective in the same

year. Whereas, Harrison share prices is increase in every year till 2015. But in 2016, it has been

seen downfall in prices. Only Luddles plc is in commendable position as relation to other.

(Baker and English, 2011). In 2016, percentage changes according to FTSE, everyone of them is

in negative position. Moreover, for investors Harrison is best company to take investment

decision because of their balance in share price. The overall results are indicating that share

prices of Luddles plc in terms of percentage is much higher in comparison to other.

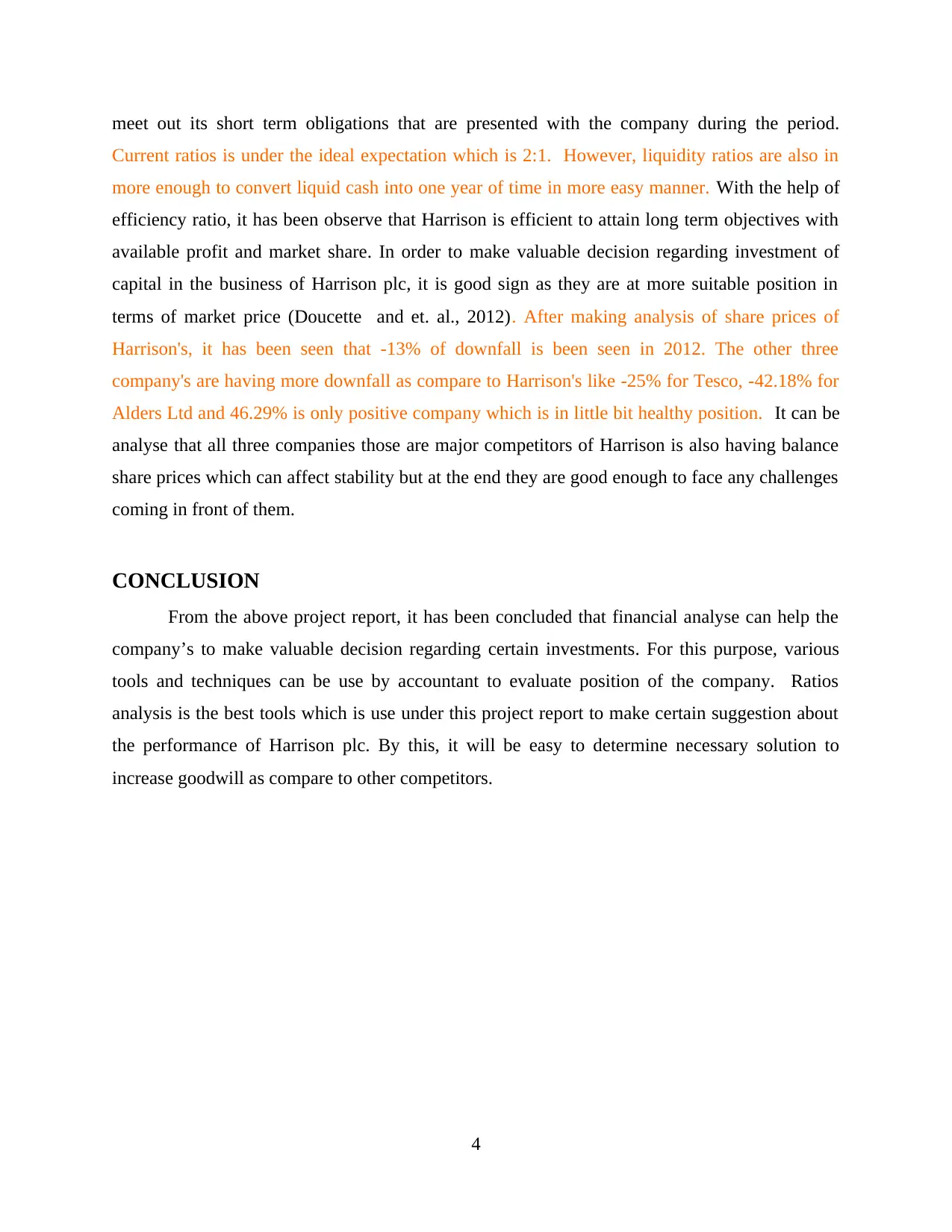

Q1.c: Assess the strength of premium investment

From the above calculation of ratios, it has been seen that profitability position of

Harrison is more effective as they are having sufficient amount of profit and return to its

shareholders. As per the profitability ratios, it has been seen that Harrison’s is at commendable

position as comparison to its gross profit which is constant in every year with 7 to 8 %. It is

continuously increasing every year which means that Harrison is having sufficient chances of

growth in near future. It is the biggest strength of the company they are positive enough to face

any competition with their resources. Likewise, the liquidity position is also healthy enough to

3

2012 2013 2014 2015 2016 % Change

1

b FTSE 100 Index 5488

5896 6622 6310 6945

% Change FTSE - 7.43% 12.31% -4.71% 10.06%

Tasco PLC Share Price 272 - - - 204 -25%

Alders PLC Share

Price 403 - - - 233 -42.18%

Luddles PLC Share

Price 337 - - - 493 46.29%

Harrisons PLC Share

Price 306 359 395 310 266 -13.07%

% Change Harrisons - 17.32% 10.03% -21.52% -14.19%

According to the above share prices, it has been seen that performance of Harrison plc in

2012 is started at positive stages and till then it is increasing at faster rate. In comparison to

other three company's it has been seen that their share prices is much more effective in the same

year. Whereas, Harrison share prices is increase in every year till 2015. But in 2016, it has been

seen downfall in prices. Only Luddles plc is in commendable position as relation to other.

(Baker and English, 2011). In 2016, percentage changes according to FTSE, everyone of them is

in negative position. Moreover, for investors Harrison is best company to take investment

decision because of their balance in share price. The overall results are indicating that share

prices of Luddles plc in terms of percentage is much higher in comparison to other.

Q1.c: Assess the strength of premium investment

From the above calculation of ratios, it has been seen that profitability position of

Harrison is more effective as they are having sufficient amount of profit and return to its

shareholders. As per the profitability ratios, it has been seen that Harrison’s is at commendable

position as comparison to its gross profit which is constant in every year with 7 to 8 %. It is

continuously increasing every year which means that Harrison is having sufficient chances of

growth in near future. It is the biggest strength of the company they are positive enough to face

any competition with their resources. Likewise, the liquidity position is also healthy enough to

3

meet out its short term obligations that are presented with the company during the period.

Current ratios is under the ideal expectation which is 2:1. However, liquidity ratios are also in

more enough to convert liquid cash into one year of time in more easy manner. With the help of

efficiency ratio, it has been observe that Harrison is efficient to attain long term objectives with

available profit and market share. In order to make valuable decision regarding investment of

capital in the business of Harrison plc, it is good sign as they are at more suitable position in

terms of market price (Doucette and et. al., 2012). After making analysis of share prices of

Harrison's, it has been seen that -13% of downfall is been seen in 2012. The other three

company's are having more downfall as compare to Harrison's like -25% for Tesco, -42.18% for

Alders Ltd and 46.29% is only positive company which is in little bit healthy position. It can be

analyse that all three companies those are major competitors of Harrison is also having balance

share prices which can affect stability but at the end they are good enough to face any challenges

coming in front of them.

CONCLUSION

From the above project report, it has been concluded that financial analyse can help the

company’s to make valuable decision regarding certain investments. For this purpose, various

tools and techniques can be use by accountant to evaluate position of the company. Ratios

analysis is the best tools which is use under this project report to make certain suggestion about

the performance of Harrison plc. By this, it will be easy to determine necessary solution to

increase goodwill as compare to other competitors.

4

Current ratios is under the ideal expectation which is 2:1. However, liquidity ratios are also in

more enough to convert liquid cash into one year of time in more easy manner. With the help of

efficiency ratio, it has been observe that Harrison is efficient to attain long term objectives with

available profit and market share. In order to make valuable decision regarding investment of

capital in the business of Harrison plc, it is good sign as they are at more suitable position in

terms of market price (Doucette and et. al., 2012). After making analysis of share prices of

Harrison's, it has been seen that -13% of downfall is been seen in 2012. The other three

company's are having more downfall as compare to Harrison's like -25% for Tesco, -42.18% for

Alders Ltd and 46.29% is only positive company which is in little bit healthy position. It can be

analyse that all three companies those are major competitors of Harrison is also having balance

share prices which can affect stability but at the end they are good enough to face any challenges

coming in front of them.

CONCLUSION

From the above project report, it has been concluded that financial analyse can help the

company’s to make valuable decision regarding certain investments. For this purpose, various

tools and techniques can be use by accountant to evaluate position of the company. Ratios

analysis is the best tools which is use under this project report to make certain suggestion about

the performance of Harrison plc. By this, it will be easy to determine necessary solution to

increase goodwill as compare to other competitors.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and journals:

Vogel, H. L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Sheikhi, A., Ranjbar, A. M. and Oraee, H., 2012. Financial analysis and optimal size and

operation for a multicarrier energy system. Energy and buildings. 48. pp.71-78.

Baker, H. K. and English, P., 2011. Capital budgeting valuation: Financial analysis for today's

investment projects (Vol. 13). John Wiley & Sons.

Doucette, W.R. and et. al., 2012. Three-year financial analysis of pharmacy services at an

independent community pharmacy. Journal of the American Pharmacists Association.

52(2). pp.181-187.

Online

Working capital ratio. 2017.[Online]. Available

through:<https://www.accountingtools.com/articles/2017/5/13/working-capital-ratio>.

5

Books and journals:

Vogel, H. L., 2014. Entertainment industry economics: A guide for financial analysis.

Cambridge University Press.

Sheikhi, A., Ranjbar, A. M. and Oraee, H., 2012. Financial analysis and optimal size and

operation for a multicarrier energy system. Energy and buildings. 48. pp.71-78.

Baker, H. K. and English, P., 2011. Capital budgeting valuation: Financial analysis for today's

investment projects (Vol. 13). John Wiley & Sons.

Doucette, W.R. and et. al., 2012. Three-year financial analysis of pharmacy services at an

independent community pharmacy. Journal of the American Pharmacists Association.

52(2). pp.181-187.

Online

Working capital ratio. 2017.[Online]. Available

through:<https://www.accountingtools.com/articles/2017/5/13/working-capital-ratio>.

5

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.