Financial Analysis of Roast Ltd for Starbucks Acquisition Decision

VerifiedAdded on 2023/01/17

|15

|4649

|81

Report

AI Summary

This report presents a comprehensive financial analysis of Roast Ltd, focusing on its performance to aid Starbucks in its potential acquisition decision. The analysis begins with an overview of the UK coffee-house industry, followed by a detailed examination of Roast Ltd's financial statements, includin...

FINANCIAL DECISION

MAKING

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................3

MAIN BODY...................................................................................................................................3

Part 1. Industry review:...............................................................................................................3

Part 2. Business performance analysis:.......................................................................................3

2.1 Analysis of profit and loss account statement:......................................................................3

2.2 Statement of financial position:............................................................................................5

2.3 Statement of cash flows:.......................................................................................................8

Part 3. Investment appraisals:...................................................................................................11

3.1 a Management forecast: Management forecast:..................................................................11

3.1 b Investment appraisal technique:......................................................................................11

3.2 Source of finance:...............................................................................................................12

REFERENCES..............................................................................................................................14

EXECUTIVE SUMMARY.............................................................................................................3

MAIN BODY...................................................................................................................................3

Part 1. Industry review:...............................................................................................................3

Part 2. Business performance analysis:.......................................................................................3

2.1 Analysis of profit and loss account statement:......................................................................3

2.2 Statement of financial position:............................................................................................5

2.3 Statement of cash flows:.......................................................................................................8

Part 3. Investment appraisals:...................................................................................................11

3.1 a Management forecast: Management forecast:..................................................................11

3.1 b Investment appraisal technique:......................................................................................11

3.2 Source of finance:...............................................................................................................12

REFERENCES..............................................................................................................................14

EXECUTIVE SUMMARY

This study summarises the review of cafe industry with aim to effectively analyse

business performance of corporation Roast Ltd. The main aim of performance analysis of Roast

Ltd, is to recommend Starbucks UK in decision of acquisition of Roast Ltd. Here for

performance analysis, Roast Ltd's P&L, Balance sheet and cash flows are analysed critically.

Also several investment appraisal techniques are thoroughly evaluated to provide assistance in

decision-making process.

MAIN BODY

Part 1. Industry review:

UK coffee-house industry contains all unlicensed enterprise and licensed companies

which are engaged in selling of coffee, beverages, food items and soft drinks.

The entire UK coffee-shop market is of around £10.1bn and in UK there are around

25,483 shops and outlets.

The growth in coffee shop sector in the UK has risen 7.9 per cent per annum over two

decades, but turmoil created by Brexit's economic volatility tends to disrupt the industry.

Branded coffee shops achieved a strong growth of around 8.7 percent to around 8,149

stores during year 2018. Furthermore, during 2019, the resilience of UK market is a

major problem for the sector.

Coffee shops are ideally positioned to catalyze the increasing preference of customers for

experienced and digitally altered retail models – 45 percent of the industries surveyed

consider facebook and twitter as the best way of advertising.

During year-2018, coffee-shop industry appeared to be plagued by persistent confusion

with respect to UK's future dealings with EU. During the last Eighteen months political

stalemate has helped increase concern about workload shortages, increasing prices,

expenditure and eroding brand trust (Cafe Industry: UK. 2019).

Part 2. Business performance analysis:

2.1 Analysis of profit and loss account statement:

A corporation's financial statements includes balance sheet, income-statement and cash

flow. Here income-statement or P&L is most vital statement which shows company's

This study summarises the review of cafe industry with aim to effectively analyse

business performance of corporation Roast Ltd. The main aim of performance analysis of Roast

Ltd, is to recommend Starbucks UK in decision of acquisition of Roast Ltd. Here for

performance analysis, Roast Ltd's P&L, Balance sheet and cash flows are analysed critically.

Also several investment appraisal techniques are thoroughly evaluated to provide assistance in

decision-making process.

MAIN BODY

Part 1. Industry review:

UK coffee-house industry contains all unlicensed enterprise and licensed companies

which are engaged in selling of coffee, beverages, food items and soft drinks.

The entire UK coffee-shop market is of around £10.1bn and in UK there are around

25,483 shops and outlets.

The growth in coffee shop sector in the UK has risen 7.9 per cent per annum over two

decades, but turmoil created by Brexit's economic volatility tends to disrupt the industry.

Branded coffee shops achieved a strong growth of around 8.7 percent to around 8,149

stores during year 2018. Furthermore, during 2019, the resilience of UK market is a

major problem for the sector.

Coffee shops are ideally positioned to catalyze the increasing preference of customers for

experienced and digitally altered retail models – 45 percent of the industries surveyed

consider facebook and twitter as the best way of advertising.

During year-2018, coffee-shop industry appeared to be plagued by persistent confusion

with respect to UK's future dealings with EU. During the last Eighteen months political

stalemate has helped increase concern about workload shortages, increasing prices,

expenditure and eroding brand trust (Cafe Industry: UK. 2019).

Part 2. Business performance analysis:

2.1 Analysis of profit and loss account statement:

A corporation's financial statements includes balance sheet, income-statement and cash

flow. Here income-statement or P&L is most vital statement which shows company's

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

profitability scenario and current level. This statement involves all operating and non operating

expenses to derive actual net profit of company for specific time-period. Analysis of

corporation's income-statement help to assess the how efficient company's operations are to

generate net profits after considering all business expenses (Agarwal and Mazumder, 2013). This

analysis framework is used to evaluate entire cost systems and the efficiency of a business.

During a given period of time, it helps to assess the profitability level.

In this regard, Roast Ltd's income-statement review reveals that the company's revenue

have grown between the years of 2017 and 2018 from 2022,000 to 2534,000 pounds (25.32

percent growth), with production costs increasing between 2017 and 2018 from 1055,000 pounds

to 90 million pounds (32.23 percent growth). Operating revenues of the Corporation were 60,000

in year 2018. Operating costs, on the other hand, rose from £ 466,000 in 2017 to £ 477,000 in

2018. Operating profits of 127000 and 51000 in 2018 and 2017 were published by Roast Ltd.,

showing an upwards trend respectively. In 2018 and 2017, the corporation's net income amount

was 81000 and 36000, reflecting an improvement in total profitability.

Evaluation of distinct ratios will be beneficial in further efficient interpretation of the

corporation's P&L account. Ratio helps to understand the output of the corporation by evaluating

the key ties of various items throughout one or more periods of profits. Two equations for the

study of Roast Ltd's income statement are as follows:

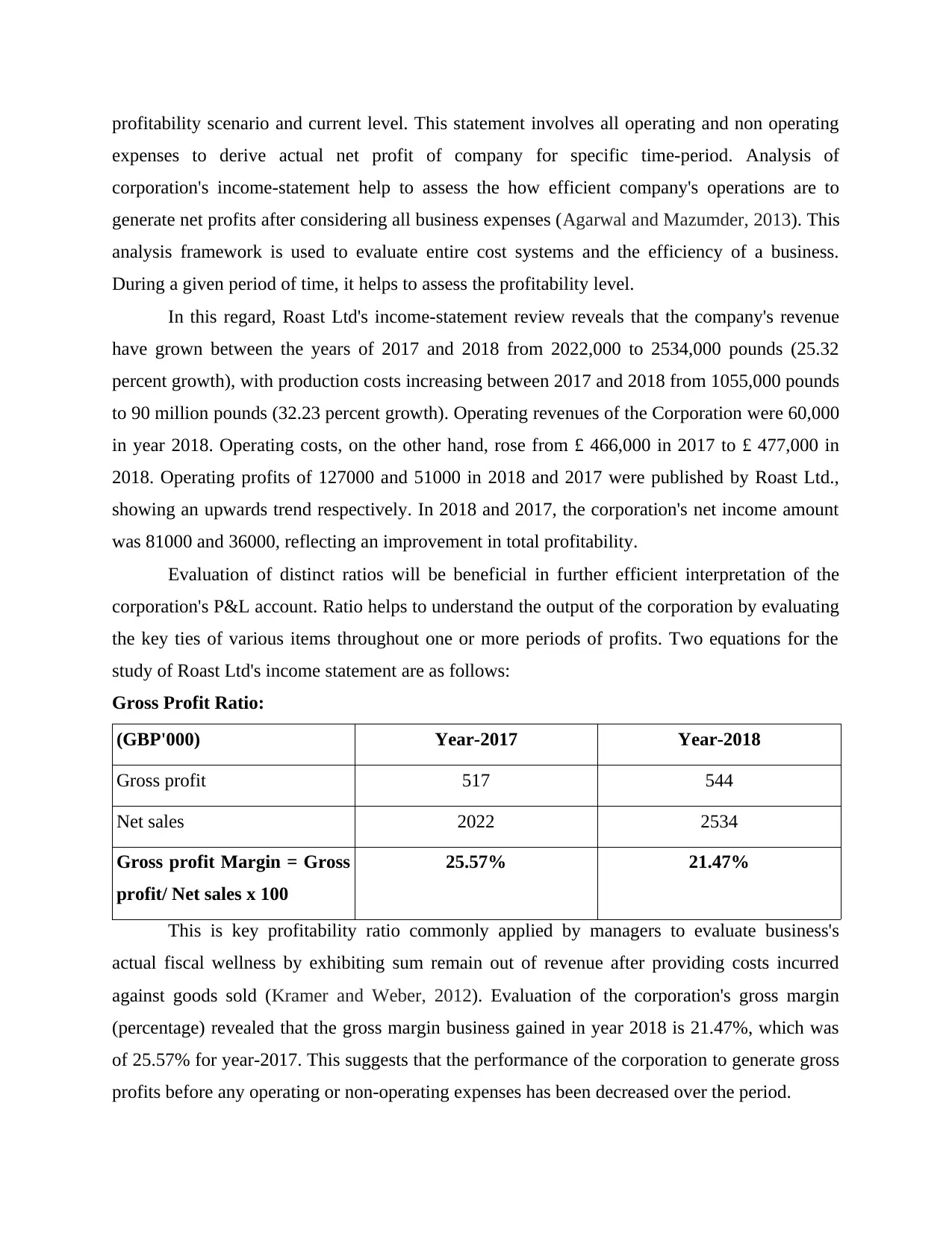

Gross Profit Ratio:

(GBP'000) Year-2017 Year-2018

Gross profit 517 544

Net sales 2022 2534

Gross profit Margin = Gross

profit/ Net sales x 100

25.57% 21.47%

This is key profitability ratio commonly applied by managers to evaluate business's

actual fiscal wellness by exhibiting sum remain out of revenue after providing costs incurred

against goods sold (Kramer and Weber, 2012). Evaluation of the corporation's gross margin

(percentage) revealed that the gross margin business gained in year 2018 is 21.47%, which was

of 25.57% for year-2017. This suggests that the performance of the corporation to generate gross

profits before any operating or non-operating expenses has been decreased over the period.

expenses to derive actual net profit of company for specific time-period. Analysis of

corporation's income-statement help to assess the how efficient company's operations are to

generate net profits after considering all business expenses (Agarwal and Mazumder, 2013). This

analysis framework is used to evaluate entire cost systems and the efficiency of a business.

During a given period of time, it helps to assess the profitability level.

In this regard, Roast Ltd's income-statement review reveals that the company's revenue

have grown between the years of 2017 and 2018 from 2022,000 to 2534,000 pounds (25.32

percent growth), with production costs increasing between 2017 and 2018 from 1055,000 pounds

to 90 million pounds (32.23 percent growth). Operating revenues of the Corporation were 60,000

in year 2018. Operating costs, on the other hand, rose from £ 466,000 in 2017 to £ 477,000 in

2018. Operating profits of 127000 and 51000 in 2018 and 2017 were published by Roast Ltd.,

showing an upwards trend respectively. In 2018 and 2017, the corporation's net income amount

was 81000 and 36000, reflecting an improvement in total profitability.

Evaluation of distinct ratios will be beneficial in further efficient interpretation of the

corporation's P&L account. Ratio helps to understand the output of the corporation by evaluating

the key ties of various items throughout one or more periods of profits. Two equations for the

study of Roast Ltd's income statement are as follows:

Gross Profit Ratio:

(GBP'000) Year-2017 Year-2018

Gross profit 517 544

Net sales 2022 2534

Gross profit Margin = Gross

profit/ Net sales x 100

25.57% 21.47%

This is key profitability ratio commonly applied by managers to evaluate business's

actual fiscal wellness by exhibiting sum remain out of revenue after providing costs incurred

against goods sold (Kramer and Weber, 2012). Evaluation of the corporation's gross margin

(percentage) revealed that the gross margin business gained in year 2018 is 21.47%, which was

of 25.57% for year-2017. This suggests that the performance of the corporation to generate gross

profits before any operating or non-operating expenses has been decreased over the period.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

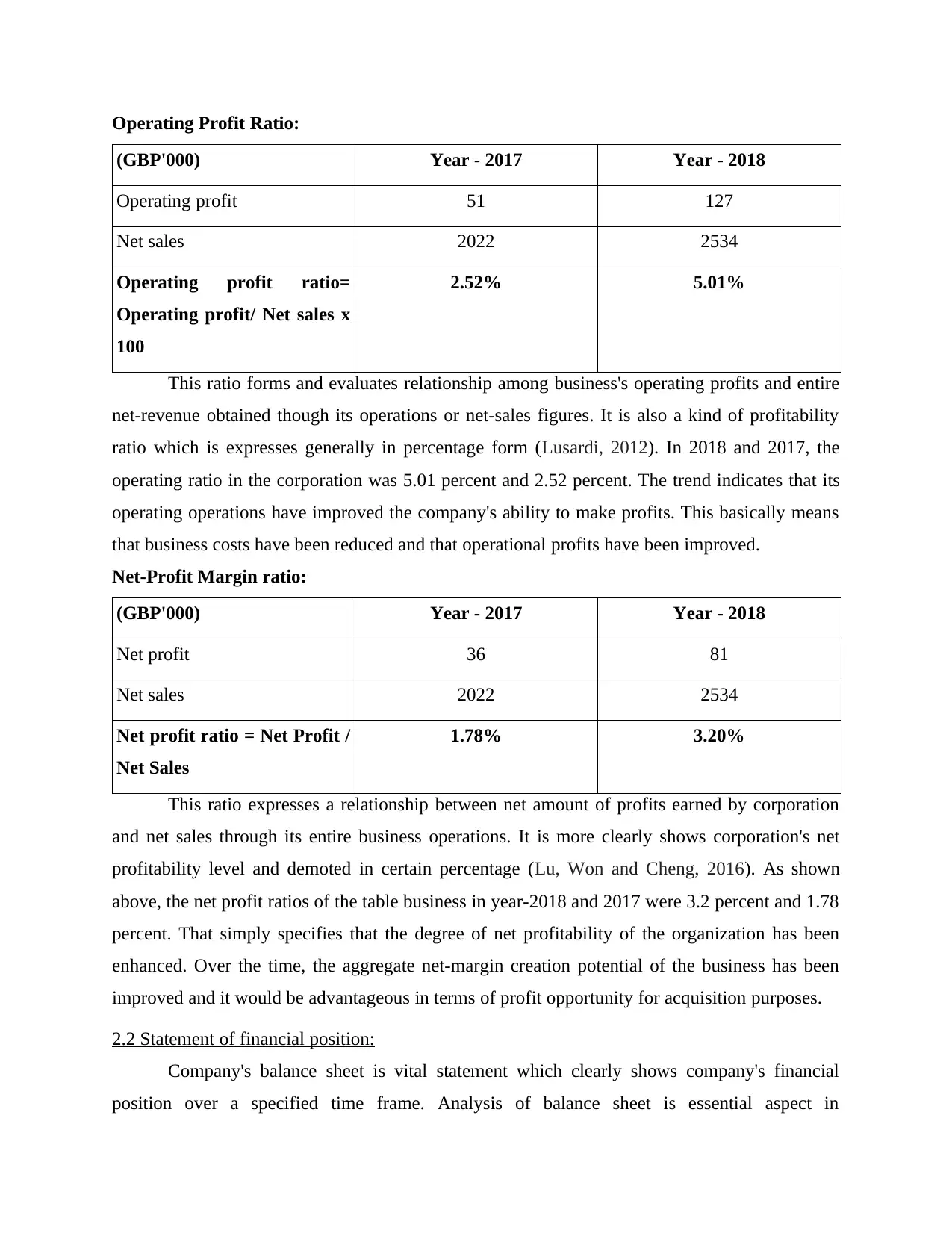

Operating Profit Ratio:

(GBP'000) Year - 2017 Year - 2018

Operating profit 51 127

Net sales 2022 2534

Operating profit ratio=

Operating profit/ Net sales x

100

2.52% 5.01%

This ratio forms and evaluates relationship among business's operating profits and entire

net-revenue obtained though its operations or net-sales figures. It is also a kind of profitability

ratio which is expresses generally in percentage form (Lusardi, 2012). In 2018 and 2017, the

operating ratio in the corporation was 5.01 percent and 2.52 percent. The trend indicates that its

operating operations have improved the company's ability to make profits. This basically means

that business costs have been reduced and that operational profits have been improved.

Net-Profit Margin ratio:

(GBP'000) Year - 2017 Year - 2018

Net profit 36 81

Net sales 2022 2534

Net profit ratio = Net Profit /

Net Sales

1.78% 3.20%

This ratio expresses a relationship between net amount of profits earned by corporation

and net sales through its entire business operations. It is more clearly shows corporation's net

profitability level and demoted in certain percentage (Lu, Won and Cheng, 2016). As shown

above, the net profit ratios of the table business in year-2018 and 2017 were 3.2 percent and 1.78

percent. That simply specifies that the degree of net profitability of the organization has been

enhanced. Over the time, the aggregate net-margin creation potential of the business has been

improved and it would be advantageous in terms of profit opportunity for acquisition purposes.

2.2 Statement of financial position:

Company's balance sheet is vital statement which clearly shows company's financial

position over a specified time frame. Analysis of balance sheet is essential aspect in

(GBP'000) Year - 2017 Year - 2018

Operating profit 51 127

Net sales 2022 2534

Operating profit ratio=

Operating profit/ Net sales x

100

2.52% 5.01%

This ratio forms and evaluates relationship among business's operating profits and entire

net-revenue obtained though its operations or net-sales figures. It is also a kind of profitability

ratio which is expresses generally in percentage form (Lusardi, 2012). In 2018 and 2017, the

operating ratio in the corporation was 5.01 percent and 2.52 percent. The trend indicates that its

operating operations have improved the company's ability to make profits. This basically means

that business costs have been reduced and that operational profits have been improved.

Net-Profit Margin ratio:

(GBP'000) Year - 2017 Year - 2018

Net profit 36 81

Net sales 2022 2534

Net profit ratio = Net Profit /

Net Sales

1.78% 3.20%

This ratio expresses a relationship between net amount of profits earned by corporation

and net sales through its entire business operations. It is more clearly shows corporation's net

profitability level and demoted in certain percentage (Lu, Won and Cheng, 2016). As shown

above, the net profit ratios of the table business in year-2018 and 2017 were 3.2 percent and 1.78

percent. That simply specifies that the degree of net profitability of the organization has been

enhanced. Over the time, the aggregate net-margin creation potential of the business has been

improved and it would be advantageous in terms of profit opportunity for acquisition purposes.

2.2 Statement of financial position:

Company's balance sheet is vital statement which clearly shows company's financial

position over a specified time frame. Analysis of balance sheet is essential aspect in

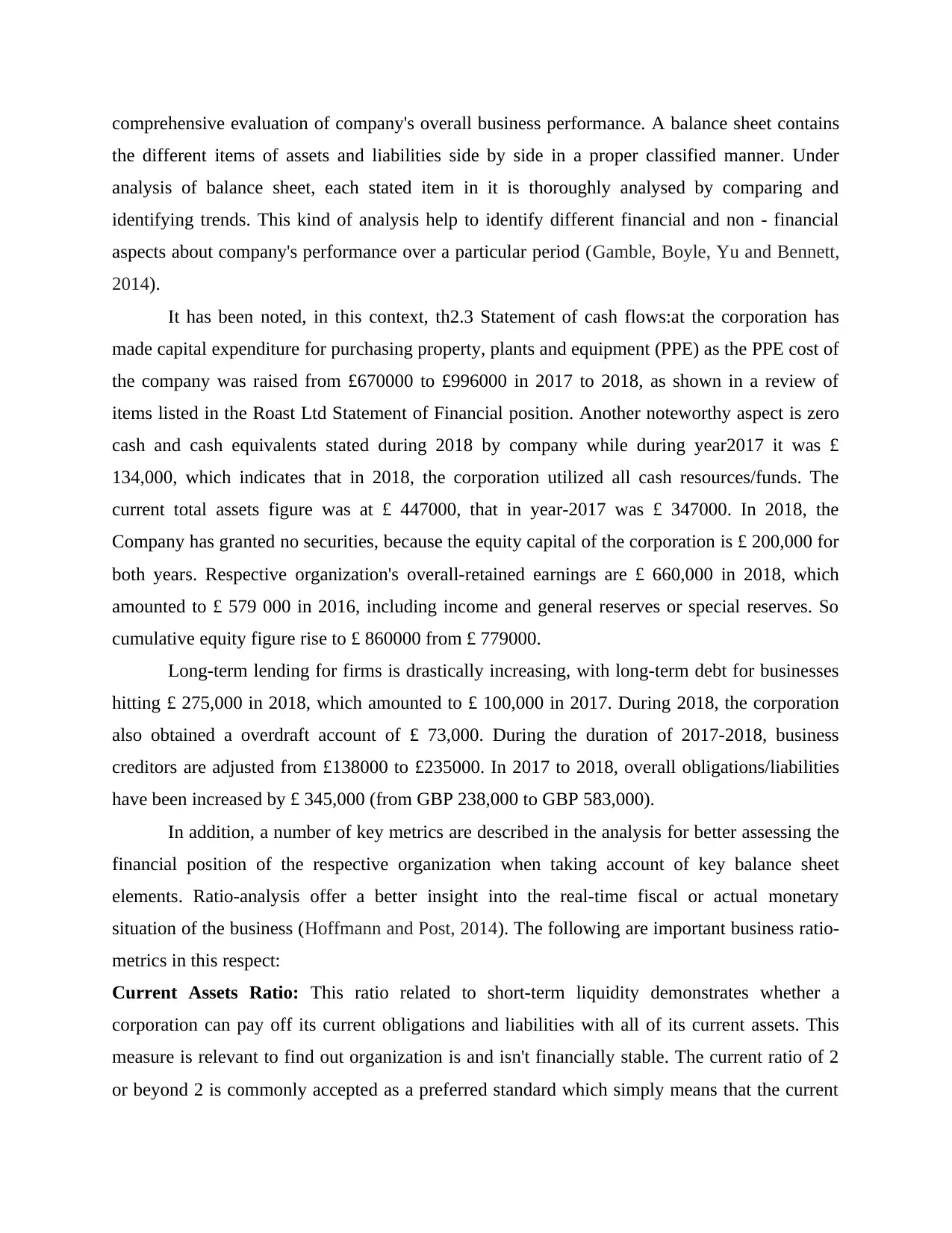

comprehensive evaluation of company's overall business performance. A balance sheet contains

the different items of assets and liabilities side by side in a proper classified manner. Under

analysis of balance sheet, each stated item in it is thoroughly analysed by comparing and

identifying trends. This kind of analysis help to identify different financial and non - financial

aspects about company's performance over a particular period (Gamble, Boyle, Yu and Bennett,

2014).

It has been noted, in this context, th2.3 Statement of cash flows:at the corporation has

made capital expenditure for purchasing property, plants and equipment (PPE) as the PPE cost of

the company was raised from £670000 to £996000 in 2017 to 2018, as shown in a review of

items listed in the Roast Ltd Statement of Financial position. Another noteworthy aspect is zero

cash and cash equivalents stated during 2018 by company while during year2017 it was £

134,000, which indicates that in 2018, the corporation utilized all cash resources/funds. The

current total assets figure was at £ 447000, that in year-2017 was £ 347000. In 2018, the

Company has granted no securities, because the equity capital of the corporation is £ 200,000 for

both years. Respective organization's overall-retained earnings are £ 660,000 in 2018, which

amounted to £ 579 000 in 2016, including income and general reserves or special reserves. So

cumulative equity figure rise to £ 860000 from £ 779000.

Long-term lending for firms is drastically increasing, with long-term debt for businesses

hitting £ 275,000 in 2018, which amounted to £ 100,000 in 2017. During 2018, the corporation

also obtained a overdraft account of £ 73,000. During the duration of 2017-2018, business

creditors are adjusted from £138000 to £235000. In 2017 to 2018, overall obligations/liabilities

have been increased by £ 345,000 (from GBP 238,000 to GBP 583,000).

In addition, a number of key metrics are described in the analysis for better assessing the

financial position of the respective organization when taking account of key balance sheet

elements. Ratio-analysis offer a better insight into the real-time fiscal or actual monetary

situation of the business (Hoffmann and Post, 2014). The following are important business ratio-

metrics in this respect:

Current Assets Ratio: This ratio related to short-term liquidity demonstrates whether a

corporation can pay off its current obligations and liabilities with all of its current assets. This

measure is relevant to find out organization is and isn't financially stable. The current ratio of 2

or beyond 2 is commonly accepted as a preferred standard which simply means that the current

the different items of assets and liabilities side by side in a proper classified manner. Under

analysis of balance sheet, each stated item in it is thoroughly analysed by comparing and

identifying trends. This kind of analysis help to identify different financial and non - financial

aspects about company's performance over a particular period (Gamble, Boyle, Yu and Bennett,

2014).

It has been noted, in this context, th2.3 Statement of cash flows:at the corporation has

made capital expenditure for purchasing property, plants and equipment (PPE) as the PPE cost of

the company was raised from £670000 to £996000 in 2017 to 2018, as shown in a review of

items listed in the Roast Ltd Statement of Financial position. Another noteworthy aspect is zero

cash and cash equivalents stated during 2018 by company while during year2017 it was £

134,000, which indicates that in 2018, the corporation utilized all cash resources/funds. The

current total assets figure was at £ 447000, that in year-2017 was £ 347000. In 2018, the

Company has granted no securities, because the equity capital of the corporation is £ 200,000 for

both years. Respective organization's overall-retained earnings are £ 660,000 in 2018, which

amounted to £ 579 000 in 2016, including income and general reserves or special reserves. So

cumulative equity figure rise to £ 860000 from £ 779000.

Long-term lending for firms is drastically increasing, with long-term debt for businesses

hitting £ 275,000 in 2018, which amounted to £ 100,000 in 2017. During 2018, the corporation

also obtained a overdraft account of £ 73,000. During the duration of 2017-2018, business

creditors are adjusted from £138000 to £235000. In 2017 to 2018, overall obligations/liabilities

have been increased by £ 345,000 (from GBP 238,000 to GBP 583,000).

In addition, a number of key metrics are described in the analysis for better assessing the

financial position of the respective organization when taking account of key balance sheet

elements. Ratio-analysis offer a better insight into the real-time fiscal or actual monetary

situation of the business (Hoffmann and Post, 2014). The following are important business ratio-

metrics in this respect:

Current Assets Ratio: This ratio related to short-term liquidity demonstrates whether a

corporation can pay off its current obligations and liabilities with all of its current assets. This

measure is relevant to find out organization is and isn't financially stable. The current ratio of 2

or beyond 2 is commonly accepted as a preferred standard which simply means that the current

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

assets of the organization will equate to double or more than double that of the current liabilities

of the organization (Nga and Ken Yien, 2013).

(GBP'000) Year - 2017 Year - 2018

Current assets 347 447

Current liabilities 138 308

Current ratio = Current

assets / Current liabilities

2.51 times 1.45 times

The above figures reveal that the corporation's current ratio in year-2017 was higher than

two times, that is 2.51, while it decreased to 1.45 times in year-2018. The fall in the current ratio

means that companies have lost flexibility in the servicing of current obligations by their current

assets.

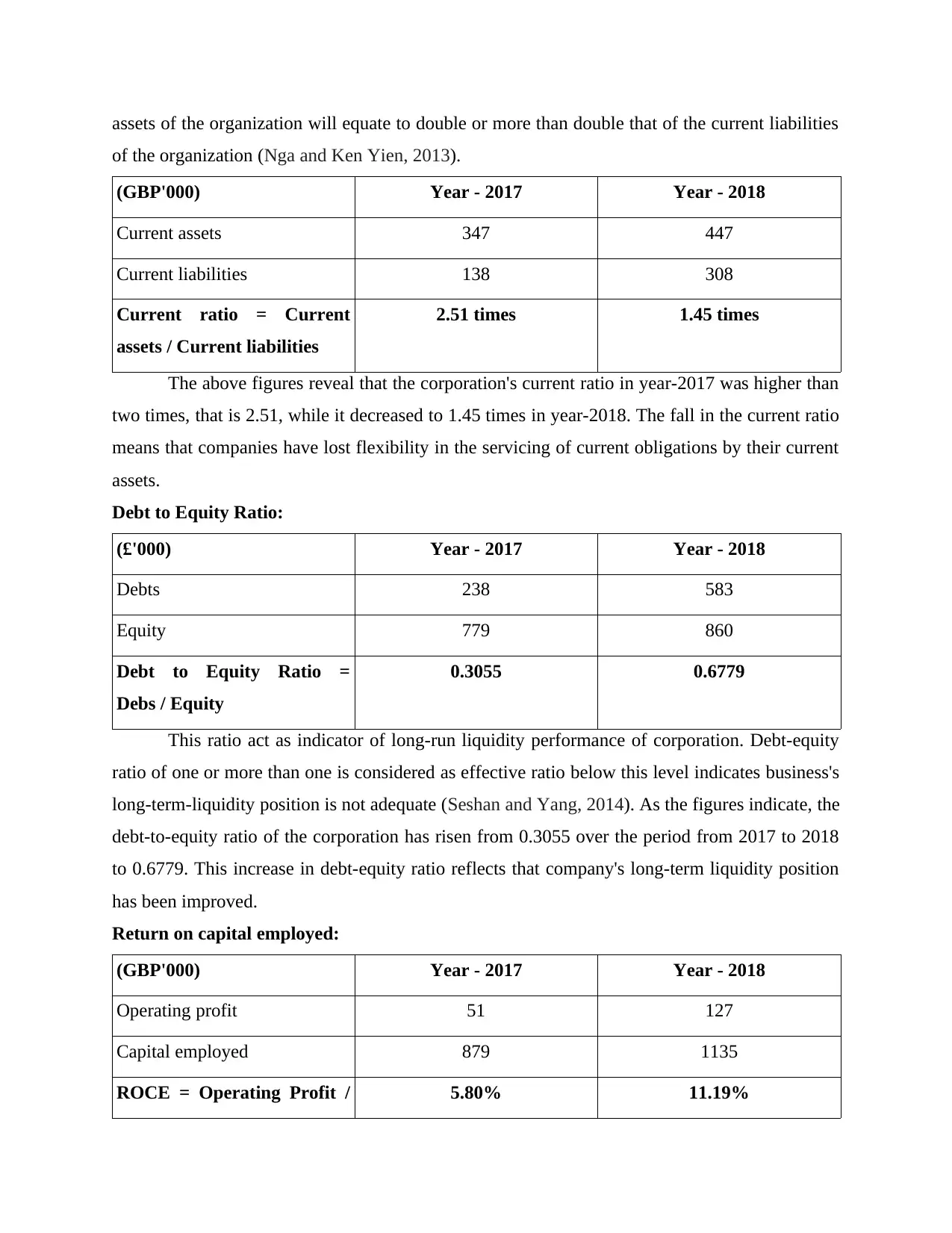

Debt to Equity Ratio:

(£'000) Year - 2017 Year - 2018

Debts 238 583

Equity 779 860

Debt to Equity Ratio =

Debs / Equity

0.3055 0.6779

This ratio act as indicator of long-run liquidity performance of corporation. Debt-equity

ratio of one or more than one is considered as effective ratio below this level indicates business's

long-term-liquidity position is not adequate (Seshan and Yang, 2014). As the figures indicate, the

debt-to-equity ratio of the corporation has risen from 0.3055 over the period from 2017 to 2018

to 0.6779. This increase in debt-equity ratio reflects that company's long-term liquidity position

has been improved.

Return on capital employed:

(GBP'000) Year - 2017 Year - 2018

Operating profit 51 127

Capital employed 879 1135

ROCE = Operating Profit / 5.80% 11.19%

of the organization (Nga and Ken Yien, 2013).

(GBP'000) Year - 2017 Year - 2018

Current assets 347 447

Current liabilities 138 308

Current ratio = Current

assets / Current liabilities

2.51 times 1.45 times

The above figures reveal that the corporation's current ratio in year-2017 was higher than

two times, that is 2.51, while it decreased to 1.45 times in year-2018. The fall in the current ratio

means that companies have lost flexibility in the servicing of current obligations by their current

assets.

Debt to Equity Ratio:

(£'000) Year - 2017 Year - 2018

Debts 238 583

Equity 779 860

Debt to Equity Ratio =

Debs / Equity

0.3055 0.6779

This ratio act as indicator of long-run liquidity performance of corporation. Debt-equity

ratio of one or more than one is considered as effective ratio below this level indicates business's

long-term-liquidity position is not adequate (Seshan and Yang, 2014). As the figures indicate, the

debt-to-equity ratio of the corporation has risen from 0.3055 over the period from 2017 to 2018

to 0.6779. This increase in debt-equity ratio reflects that company's long-term liquidity position

has been improved.

Return on capital employed:

(GBP'000) Year - 2017 Year - 2018

Operating profit 51 127

Capital employed 879 1135

ROCE = Operating Profit / 5.80% 11.19%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Capital Employed

This ratio is classified as efficiency ratio as it shows how efficient company is to utilise

its all funds employed in business activities. This ratio is crucial for investors because it indicates

how much return company will provide on investment or funding made by them in company

(Duclos, 2015). As shown in the table the ROCE rate of the enterprise was enhanced from 5.80%

to 11.19%. Which demonstrates that the capacity of Roast Ltd to produce returns on total capital

invested has been increased. It also implies that respective organisation is viable and

economically sound for investing purposes.

2.3 Statement of cash flows:

The objective of the cash flow statement is for a specified period of time (generally

quarterly and yearly) to indicate where money (cash flow) is created and where funds (cash

outflows) is expended. The liquidity and longer-term solvency of a corporation is critical for

analysis. Rather than accrual based accounting, the cash flow report utilizes cash-basis

accounting to be used by many businesses for balance and income statement (Carvalho, Meier

and Wang, 2016). This is critical since an organization can produce accounting sales but can not

obtain the money. It can produce taxes and revenues but don't provide the tools to remain

solvent. Analysis of a cash-basis flow statement assist in assessment of corporation's actual cash

position and liquidity position.

As in context of Roast Ltd, analysis of cash-flow statement for year 2018 shows that

during the year company's net cash generation from all operating activities is GBP 24000

(Negative figure). This cash outflow is due to amount spend towards purchase of stock and

delayed collection or increase in debtors. Amount of cash out flow towards inventing activities

during this year is GBP 358000 which solely due to purchase or capital expenditure towards

Property,Plant and Equipments. Lastly there is a cash inflow of GBP 1750000 in year 2018

though corporation's financing activities. Here this in flow is occurred as a consequence of

Proceeds from long-term borrowings. By accumulation of cash flows all the three activities

company's net increase / (decrease) in cash flows are (207000) while after considering Cash and

cash equivalents at the start of year, company's cash flow at year end is negative GBP 73000.

Operating cash cycle: For effective analysis of cash-flows, this ratio is crucial as it shows the

true picture about how effectively company is generating cash from its operations. The OC

This ratio is classified as efficiency ratio as it shows how efficient company is to utilise

its all funds employed in business activities. This ratio is crucial for investors because it indicates

how much return company will provide on investment or funding made by them in company

(Duclos, 2015). As shown in the table the ROCE rate of the enterprise was enhanced from 5.80%

to 11.19%. Which demonstrates that the capacity of Roast Ltd to produce returns on total capital

invested has been increased. It also implies that respective organisation is viable and

economically sound for investing purposes.

2.3 Statement of cash flows:

The objective of the cash flow statement is for a specified period of time (generally

quarterly and yearly) to indicate where money (cash flow) is created and where funds (cash

outflows) is expended. The liquidity and longer-term solvency of a corporation is critical for

analysis. Rather than accrual based accounting, the cash flow report utilizes cash-basis

accounting to be used by many businesses for balance and income statement (Carvalho, Meier

and Wang, 2016). This is critical since an organization can produce accounting sales but can not

obtain the money. It can produce taxes and revenues but don't provide the tools to remain

solvent. Analysis of a cash-basis flow statement assist in assessment of corporation's actual cash

position and liquidity position.

As in context of Roast Ltd, analysis of cash-flow statement for year 2018 shows that

during the year company's net cash generation from all operating activities is GBP 24000

(Negative figure). This cash outflow is due to amount spend towards purchase of stock and

delayed collection or increase in debtors. Amount of cash out flow towards inventing activities

during this year is GBP 358000 which solely due to purchase or capital expenditure towards

Property,Plant and Equipments. Lastly there is a cash inflow of GBP 1750000 in year 2018

though corporation's financing activities. Here this in flow is occurred as a consequence of

Proceeds from long-term borrowings. By accumulation of cash flows all the three activities

company's net increase / (decrease) in cash flows are (207000) while after considering Cash and

cash equivalents at the start of year, company's cash flow at year end is negative GBP 73000.

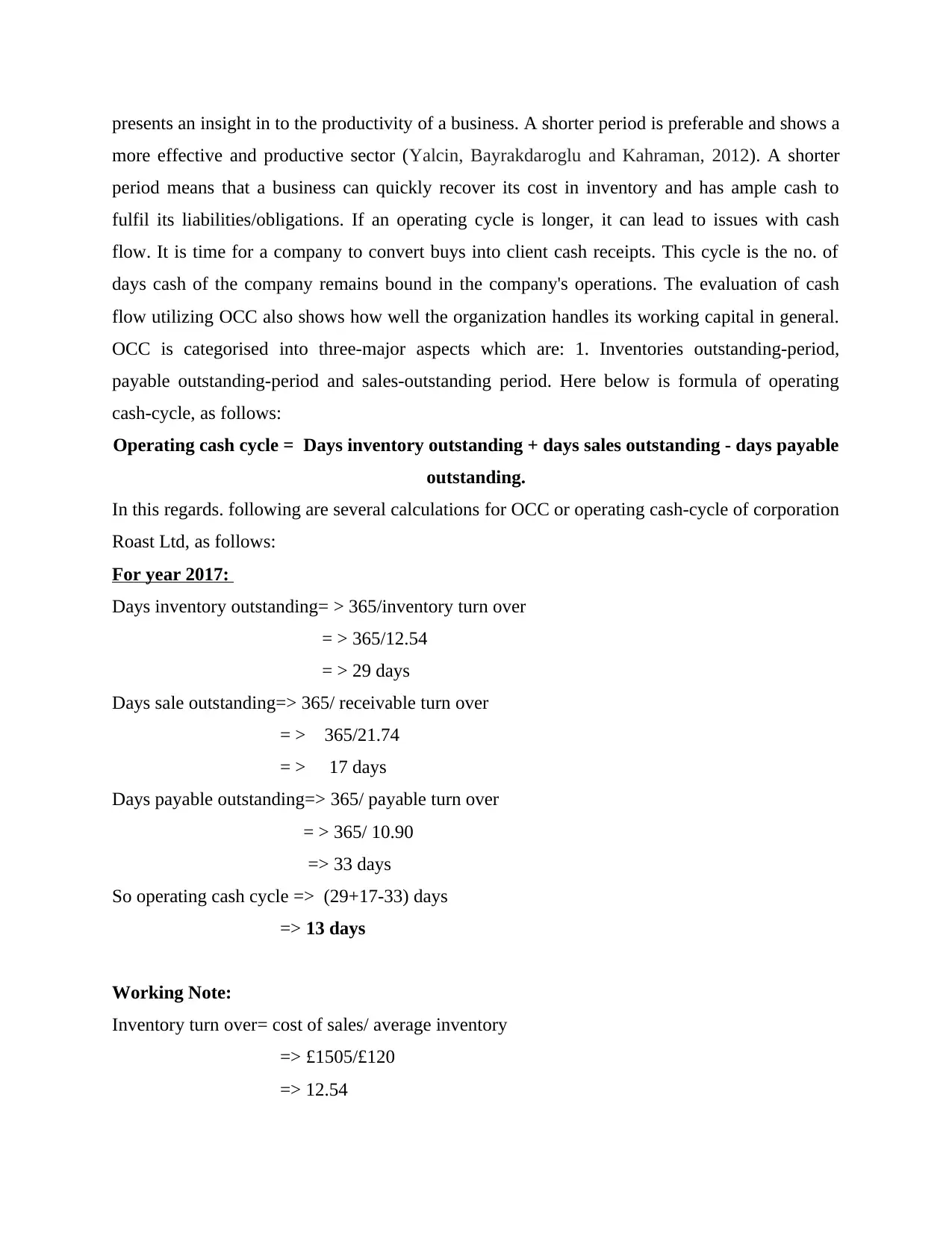

Operating cash cycle: For effective analysis of cash-flows, this ratio is crucial as it shows the

true picture about how effectively company is generating cash from its operations. The OC

presents an insight in to the productivity of a business. A shorter period is preferable and shows a

more effective and productive sector (Yalcin, Bayrakdaroglu and Kahraman, 2012). A shorter

period means that a business can quickly recover its cost in inventory and has ample cash to

fulfil its liabilities/obligations. If an operating cycle is longer, it can lead to issues with cash

flow. It is time for a company to convert buys into client cash receipts. This cycle is the no. of

days cash of the company remains bound in the company's operations. The evaluation of cash

flow utilizing OCC also shows how well the organization handles its working capital in general.

OCC is categorised into three-major aspects which are: 1. Inventories outstanding-period,

payable outstanding-period and sales-outstanding period. Here below is formula of operating

cash-cycle, as follows:

Operating cash cycle = Days inventory outstanding + days sales outstanding - days payable

outstanding.

In this regards. following are several calculations for OCC or operating cash-cycle of corporation

Roast Ltd, as follows:

For year 2017:

Days inventory outstanding= > 365/inventory turn over

= > 365/12.54

= > 29 days

Days sale outstanding=> 365/ receivable turn over

= > 365/21.74

= > 17 days

Days payable outstanding=> 365/ payable turn over

= > 365/ 10.90

=> 33 days

So operating cash cycle => (29+17-33) days

=> 13 days

Working Note:

Inventory turn over= cost of sales/ average inventory

=> £1505/£120

=> 12.54

more effective and productive sector (Yalcin, Bayrakdaroglu and Kahraman, 2012). A shorter

period means that a business can quickly recover its cost in inventory and has ample cash to

fulfil its liabilities/obligations. If an operating cycle is longer, it can lead to issues with cash

flow. It is time for a company to convert buys into client cash receipts. This cycle is the no. of

days cash of the company remains bound in the company's operations. The evaluation of cash

flow utilizing OCC also shows how well the organization handles its working capital in general.

OCC is categorised into three-major aspects which are: 1. Inventories outstanding-period,

payable outstanding-period and sales-outstanding period. Here below is formula of operating

cash-cycle, as follows:

Operating cash cycle = Days inventory outstanding + days sales outstanding - days payable

outstanding.

In this regards. following are several calculations for OCC or operating cash-cycle of corporation

Roast Ltd, as follows:

For year 2017:

Days inventory outstanding= > 365/inventory turn over

= > 365/12.54

= > 29 days

Days sale outstanding=> 365/ receivable turn over

= > 365/21.74

= > 17 days

Days payable outstanding=> 365/ payable turn over

= > 365/ 10.90

=> 33 days

So operating cash cycle => (29+17-33) days

=> 13 days

Working Note:

Inventory turn over= cost of sales/ average inventory

=> £1505/£120

=> 12.54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

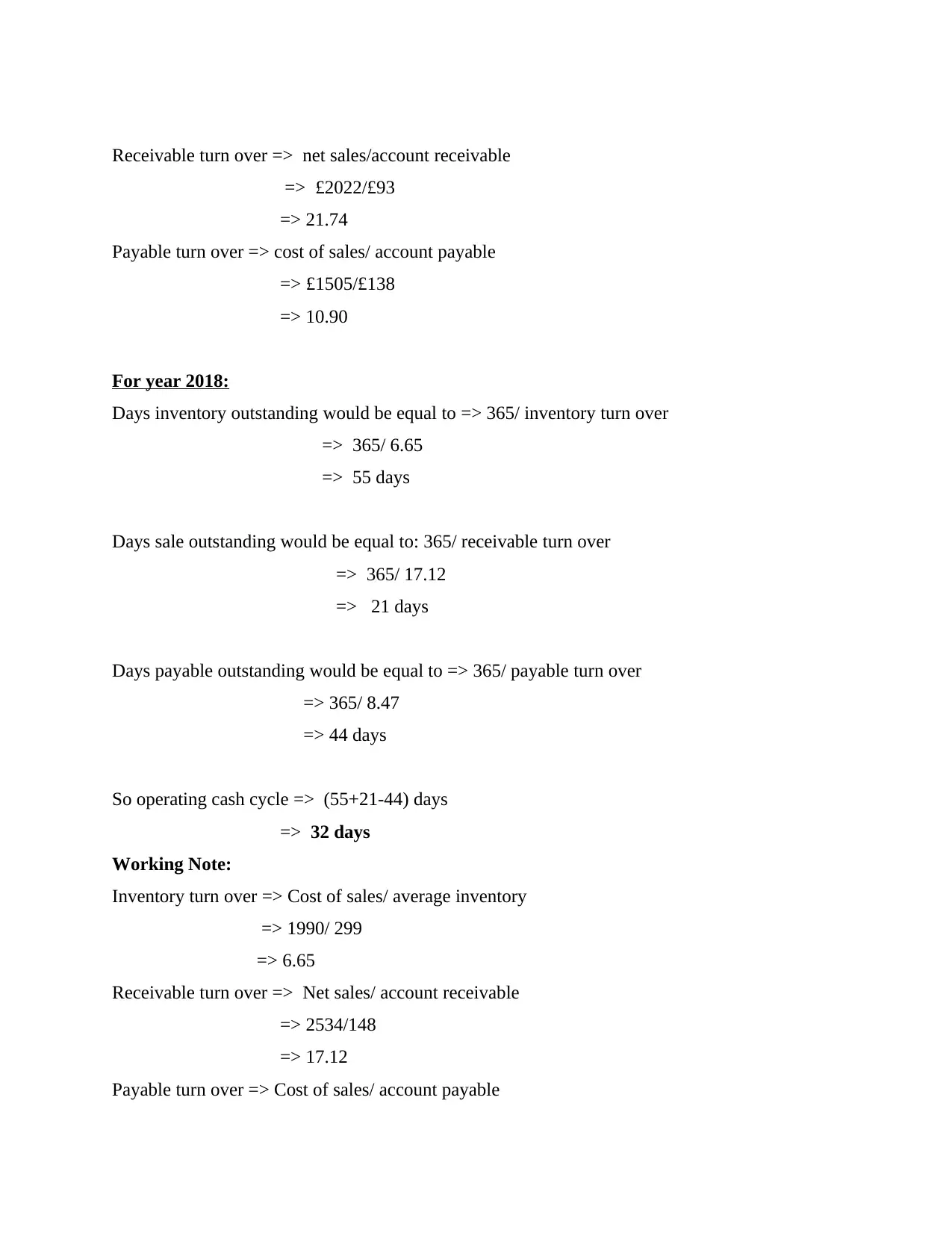

Receivable turn over => net sales/account receivable

=> £2022/£93

=> 21.74

Payable turn over => cost of sales/ account payable

=> £1505/£138

=> 10.90

For year 2018:

Days inventory outstanding would be equal to => 365/ inventory turn over

=> 365/ 6.65

=> 55 days

Days sale outstanding would be equal to: 365/ receivable turn over

=> 365/ 17.12

=> 21 days

Days payable outstanding would be equal to => 365/ payable turn over

=> 365/ 8.47

=> 44 days

So operating cash cycle => (55+21-44) days

=> 32 days

Working Note:

Inventory turn over => Cost of sales/ average inventory

=> 1990/ 299

=> 6.65

Receivable turn over => Net sales/ account receivable

=> 2534/148

=> 17.12

Payable turn over => Cost of sales/ account payable

=> £2022/£93

=> 21.74

Payable turn over => cost of sales/ account payable

=> £1505/£138

=> 10.90

For year 2018:

Days inventory outstanding would be equal to => 365/ inventory turn over

=> 365/ 6.65

=> 55 days

Days sale outstanding would be equal to: 365/ receivable turn over

=> 365/ 17.12

=> 21 days

Days payable outstanding would be equal to => 365/ payable turn over

=> 365/ 8.47

=> 44 days

So operating cash cycle => (55+21-44) days

=> 32 days

Working Note:

Inventory turn over => Cost of sales/ average inventory

=> 1990/ 299

=> 6.65

Receivable turn over => Net sales/ account receivable

=> 2534/148

=> 17.12

Payable turn over => Cost of sales/ account payable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=> 1990/235

=> 8.47

The operating-cash cycle calculations of the Roast Ltd have shown that the whole

operating cash cycle of the business is 13 days. Lower operating time shows that a business can

turn stocks into money more quickly. As assessed above corporation's OCC is around thirteen

days, this period is sufficient but as company is operating in cafe industry such period should be

lower (Forbes, Hudson, Skerratt and Soufian, 2015). However current period is also acceptable,

since corporation's inventories-days outstanding period is around twenty nine days and Days-sale

outstanding time-span is around thirteen days. Whereas payable-days outstanding period is

around 33-days. The whole calculation and analysis points out that Roast Ltd's operational

efficiency is quite good as operating-cash-cycle is optimum.

Dividend policy: It is a practice which the company implements to control its shareholder

dividend payment percentage. Several analysts suggest that dividend policy might be

theoretically irrelevant, given that stakeholders can sell their share or stocks if they need funds. It

was evaluated for company Roast Ltd that the corporation has not pursued a divided plan, since

the dividend payment of the company is null. Roast Ltd didn't pay its investors any dividend in

year 2018.

Part 3. Investment appraisals:

3.1 a Management forecast: Management forecast:

Roast Ltd's management unit is looking to raise about £ 500 million in capital. Across

five years from year 2017 to year 2021, a prediction produced of cash flows. According to the

business's estimate, their cash-flows or cash receipt will contribute to £ 60, £ 112, £ 148, £ 180

and £ 224 million. But this prediction gone wrong between 2017 and 2018. Further fall in gross-

margin as well as negative cash-flows indicates that such management predictions would not be

achieved. Therefore, the prediction should be readjusted according to current outputs of the

business.

3.1 b Investment appraisal technique:

The methods often used to to assess the feasibility of financial decisions and capital

investments taken by the corporation are called different instruments and steps. Profitability-

index, NPV, internal return rate, payback period, and accounting-return rate are the core

=> 8.47

The operating-cash cycle calculations of the Roast Ltd have shown that the whole

operating cash cycle of the business is 13 days. Lower operating time shows that a business can

turn stocks into money more quickly. As assessed above corporation's OCC is around thirteen

days, this period is sufficient but as company is operating in cafe industry such period should be

lower (Forbes, Hudson, Skerratt and Soufian, 2015). However current period is also acceptable,

since corporation's inventories-days outstanding period is around twenty nine days and Days-sale

outstanding time-span is around thirteen days. Whereas payable-days outstanding period is

around 33-days. The whole calculation and analysis points out that Roast Ltd's operational

efficiency is quite good as operating-cash-cycle is optimum.

Dividend policy: It is a practice which the company implements to control its shareholder

dividend payment percentage. Several analysts suggest that dividend policy might be

theoretically irrelevant, given that stakeholders can sell their share or stocks if they need funds. It

was evaluated for company Roast Ltd that the corporation has not pursued a divided plan, since

the dividend payment of the company is null. Roast Ltd didn't pay its investors any dividend in

year 2018.

Part 3. Investment appraisals:

3.1 a Management forecast: Management forecast:

Roast Ltd's management unit is looking to raise about £ 500 million in capital. Across

five years from year 2017 to year 2021, a prediction produced of cash flows. According to the

business's estimate, their cash-flows or cash receipt will contribute to £ 60, £ 112, £ 148, £ 180

and £ 224 million. But this prediction gone wrong between 2017 and 2018. Further fall in gross-

margin as well as negative cash-flows indicates that such management predictions would not be

achieved. Therefore, the prediction should be readjusted according to current outputs of the

business.

3.1 b Investment appraisal technique:

The methods often used to to assess the feasibility of financial decisions and capital

investments taken by the corporation are called different instruments and steps. Profitability-

index, NPV, internal return rate, payback period, and accounting-return rate are the core

investment- appraisal techniques. The outcomes of every new venture, such as the acquisition or

takeover proposal, are primarily measured. In this context, various significant Investment

appraisal-techniques are addressed as follows:

Payback period: This clearly defines the time period expected to recover cumulative initial

investment or capital costs. It clearly lays no. years corporation can took to reimburse initial

proposal investment (Baker and Ricciardi, 2014). As shown, the payback period of 3 companies

is 4 years. It states specifically that the business will restore 500 million pounds cash outflow in

course of four years which is therefore feasible because the payback period is much less than the

whole of the venture, i.e. five years.

Benefits: This is the easiest and most convenient approach without any complex equations or

hypotheses.

Drawback: Some time outcomes of this method seems irrelevant due to avoidance of factors

like inflation, time-value of money etc.

Accounting rate of return: This is method under which a certain percentage is measured and

this percentage reflects how much return company would get form any project or investment

made. As can be seen in Figure: 3 project's ARR is around 18 percent. That percentage of project

is more than project's expected return so the ARR of 18 percent is effective, indicating that

investment or project is able to provide profits more than the expectations.

Benefits: This methodology is valuable to businesses because it explicitly defines every plan or

proposal's degree of profitability.

Drawback: This approach often lacks critical factors such as money's time-value, since cash

flows taken under it are not discounted (Chowdhuri, Yoon, Redmond, and Etudo, 2014).

Net-Preset Value or NPV: The findings of this approach demonstrate that any investment is net

viability. It is a popular and generally used way of assessing whether or not investment-proposal

would be profitable. The corporation's investment-proposal NPV is £ 110 million at cash flow

discounting rate of 5%, as illustrated in figures shown in exhibit:3. A positive value of NPV is a

determinant of any investment-proposal's financial viability.

Benefits: This techniques offers more precise and accurate outcomes about proposal's viability

as here cash-flows are effectively discounted.

Drawback: This method's main disadvantage is that no particular amount is used here to

measure cash-flows, so that the findings are sometimes unreliable.

takeover proposal, are primarily measured. In this context, various significant Investment

appraisal-techniques are addressed as follows:

Payback period: This clearly defines the time period expected to recover cumulative initial

investment or capital costs. It clearly lays no. years corporation can took to reimburse initial

proposal investment (Baker and Ricciardi, 2014). As shown, the payback period of 3 companies

is 4 years. It states specifically that the business will restore 500 million pounds cash outflow in

course of four years which is therefore feasible because the payback period is much less than the

whole of the venture, i.e. five years.

Benefits: This is the easiest and most convenient approach without any complex equations or

hypotheses.

Drawback: Some time outcomes of this method seems irrelevant due to avoidance of factors

like inflation, time-value of money etc.

Accounting rate of return: This is method under which a certain percentage is measured and

this percentage reflects how much return company would get form any project or investment

made. As can be seen in Figure: 3 project's ARR is around 18 percent. That percentage of project

is more than project's expected return so the ARR of 18 percent is effective, indicating that

investment or project is able to provide profits more than the expectations.

Benefits: This methodology is valuable to businesses because it explicitly defines every plan or

proposal's degree of profitability.

Drawback: This approach often lacks critical factors such as money's time-value, since cash

flows taken under it are not discounted (Chowdhuri, Yoon, Redmond, and Etudo, 2014).

Net-Preset Value or NPV: The findings of this approach demonstrate that any investment is net

viability. It is a popular and generally used way of assessing whether or not investment-proposal

would be profitable. The corporation's investment-proposal NPV is £ 110 million at cash flow

discounting rate of 5%, as illustrated in figures shown in exhibit:3. A positive value of NPV is a

determinant of any investment-proposal's financial viability.

Benefits: This techniques offers more precise and accurate outcomes about proposal's viability

as here cash-flows are effectively discounted.

Drawback: This method's main disadvantage is that no particular amount is used here to

measure cash-flows, so that the findings are sometimes unreliable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3.2 Source of finance:

In business finances are critical because company could not function without funding for

a day. Therefore, it is important to search for efficacious finance sources. Source of finance is

based on the amount of cash, the complexity of the company, the time-frame of repayment, the

mixture of debts and equities, etc. The choice of sources often relies on the uses for which

funding are required. Funding necessary for the purchase of machinery, land & building, etc.

from these sources should be acquired, the tenure shall be five to ten years. The medium-term

funding is needed for more-than one year but lower than five years. Funds for covering daily

costs from quick-term sources must be obtained. As in given case Roast Ltd is require more

investment during 2019 in Italy which is around £400k. For such a huge amount company should

evaluate the benefits as well as drawbacks of multiple sources of funding, as follows:

Equity Financing: This is sources under which company's securities and stocks are sold in

market for raising funds. This is major source though which company can raise funds for short-

term as well as long-term objectives. This source of finance is most preferred as sometimes it

help to increase the overall wealth of company. Following are several benefits and limitations

associated with this finance source, as follows:

Benefit: The major benefit of equity finance is that the cash obtained from it is not obliged to be

repaid. Equity funding doesn't really drive cash out of organization, so overall liquidity position

remain in control after equity fiance.

Drawback: The biggest downside of equity financing that here is the loss of control and portion

of ownership. Controlled ownership might be lost as a result of forced public sale of securities.

Decentralized ownership also contributes to the loss of direct controlling over the organization.

Debt Finance: Debt Financing occurs whenever a corporation generates funds by issuing bonds,

bills or notes to individuals and/or retail investors for operating capital or capital spending. The

persons or entities are lenders in exchange for loaning money and obtain a guarantee to

reimburse the principal and debt interest. Here below are few advantages and drawbacks of this

source, as follows:

Benefit: A principal benefit of bond issuance and borrowings from lenders would be that a

owners have full ownership. While this not happen in case with equity source, as shareholders

have a corporation's proprietary rights.

In business finances are critical because company could not function without funding for

a day. Therefore, it is important to search for efficacious finance sources. Source of finance is

based on the amount of cash, the complexity of the company, the time-frame of repayment, the

mixture of debts and equities, etc. The choice of sources often relies on the uses for which

funding are required. Funding necessary for the purchase of machinery, land & building, etc.

from these sources should be acquired, the tenure shall be five to ten years. The medium-term

funding is needed for more-than one year but lower than five years. Funds for covering daily

costs from quick-term sources must be obtained. As in given case Roast Ltd is require more

investment during 2019 in Italy which is around £400k. For such a huge amount company should

evaluate the benefits as well as drawbacks of multiple sources of funding, as follows:

Equity Financing: This is sources under which company's securities and stocks are sold in

market for raising funds. This is major source though which company can raise funds for short-

term as well as long-term objectives. This source of finance is most preferred as sometimes it

help to increase the overall wealth of company. Following are several benefits and limitations

associated with this finance source, as follows:

Benefit: The major benefit of equity finance is that the cash obtained from it is not obliged to be

repaid. Equity funding doesn't really drive cash out of organization, so overall liquidity position

remain in control after equity fiance.

Drawback: The biggest downside of equity financing that here is the loss of control and portion

of ownership. Controlled ownership might be lost as a result of forced public sale of securities.

Decentralized ownership also contributes to the loss of direct controlling over the organization.

Debt Finance: Debt Financing occurs whenever a corporation generates funds by issuing bonds,

bills or notes to individuals and/or retail investors for operating capital or capital spending. The

persons or entities are lenders in exchange for loaning money and obtain a guarantee to

reimburse the principal and debt interest. Here below are few advantages and drawbacks of this

source, as follows:

Benefit: A principal benefit of bond issuance and borrowings from lenders would be that a

owners have full ownership. While this not happen in case with equity source, as shareholders

have a corporation's proprietary rights.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Drawback: A debt financings drawback is that corporations are obliged to repay the loan

principal together with interest-costs. Corporations with cash flow issues can find it challenging

to pay back the funds. Corporations that failed to repay their loans on time incur penalties.

principal together with interest-costs. Corporations with cash flow issues can find it challenging

to pay back the funds. Corporations that failed to repay their loans on time incur penalties.

REFERENCES

Books and journals:

Agarwal, S. and Mazumder, B., 2013. Cognitive abilities and household financial decision

making. American Economic Journal: Applied Economics. 5(1). pp. 193-207.

Kramer, L.A. and Weber, J.M., 2012. This is your portfolio on winter: Seasonal affective

disorder and risk aversion in financial decision making. Social Psychological and

Personality Science. 3(2). pp. 193-199.

Lusardi, A., 2012. Financial literacy and financial decision-making in older

adults. Generations. 36(2). pp. 25-32.

Lu, Q., Won, J. and Cheng, J.C., 2016. A financial decision making framework for construction

projects based on 5D Building Information Modeling (BIM). International Journal of

Project Management. 34(1). pp.3-21.

Gamble, K.J., Boyle, P.A., Yu, L. and Bennett, D.A., 2014. Aging and financial decision

making. Management Science. 61(11). pp. 2603-2610.

Hoffmann, A.O. and Post, T., 2014. Self-attribution bias in consumer financial decision-making:

How investment returns affect individuals’ belief in skill. Journal of Behavioral and

Experimental Economics. 52. pp. 23-28.

Nga, J.K. and Ken Yien, L., 2013. The influence of personality trait and demographics on

financial decision making among Generation Y. Young Consumers. 14(3). pp. 230-243.

Seshan, G. and Yang, D., 2014. Motivating migrants: A field experiment on financial decision-

making in transnational households. Journal of Development Economics. 108. pp. 119-

127.

Duclos, R., 2015. The psychology of investment behavior:(De) biasing financial decision-

making one graph at a time. Journal of Consumer Psychology. 25(2). pp. 317-325.

Carvalho, L.S., Meier, S. and Wang, S.W., 2016. Poverty and economic decision-making:

Evidence from changes in financial resources at payday. American Economic

Review. 106(2). pp. 260-84.

Yalcin, N., Bayrakdaroglu, A. and Kahraman, C., 2012. Application of fuzzy multi-criteria

decision making methods for financial performance evaluation of Turkish

manufacturing industries. Expert Systems with Applications. 39(1). pp. 350-364.

Forbes, W., Hudson, R., Skerratt, L. and Soufian, M., 2015. Which heuristics can aid financial-

decision-making?. International review of Financial analysis. 42. pp. 199-210.

Baker, H.K. and Ricciardi, V., 2014. Investor behavior: The psychology of financial planning

and investing. John Wiley & Sons.

Chowdhuri, R., Yoon, V.Y., Redmond, R.T. and Etudo, U.O., 2014. Ontology based integration

of XBRL filings for financial decision making. Decision Support Systems. 68. pp. 64-

76.

Online:

Cafe Industry: UK, 2019. [Online]. Available through:

<https://www.worldcoffeeportal.com/Latest/News/2019/UK-coffee-shops-achieve-20-

years-of-sustained-grow>

Books and journals:

Agarwal, S. and Mazumder, B., 2013. Cognitive abilities and household financial decision

making. American Economic Journal: Applied Economics. 5(1). pp. 193-207.

Kramer, L.A. and Weber, J.M., 2012. This is your portfolio on winter: Seasonal affective

disorder and risk aversion in financial decision making. Social Psychological and

Personality Science. 3(2). pp. 193-199.

Lusardi, A., 2012. Financial literacy and financial decision-making in older

adults. Generations. 36(2). pp. 25-32.

Lu, Q., Won, J. and Cheng, J.C., 2016. A financial decision making framework for construction

projects based on 5D Building Information Modeling (BIM). International Journal of

Project Management. 34(1). pp.3-21.

Gamble, K.J., Boyle, P.A., Yu, L. and Bennett, D.A., 2014. Aging and financial decision

making. Management Science. 61(11). pp. 2603-2610.

Hoffmann, A.O. and Post, T., 2014. Self-attribution bias in consumer financial decision-making:

How investment returns affect individuals’ belief in skill. Journal of Behavioral and

Experimental Economics. 52. pp. 23-28.

Nga, J.K. and Ken Yien, L., 2013. The influence of personality trait and demographics on

financial decision making among Generation Y. Young Consumers. 14(3). pp. 230-243.

Seshan, G. and Yang, D., 2014. Motivating migrants: A field experiment on financial decision-

making in transnational households. Journal of Development Economics. 108. pp. 119-

127.

Duclos, R., 2015. The psychology of investment behavior:(De) biasing financial decision-

making one graph at a time. Journal of Consumer Psychology. 25(2). pp. 317-325.

Carvalho, L.S., Meier, S. and Wang, S.W., 2016. Poverty and economic decision-making:

Evidence from changes in financial resources at payday. American Economic

Review. 106(2). pp. 260-84.

Yalcin, N., Bayrakdaroglu, A. and Kahraman, C., 2012. Application of fuzzy multi-criteria

decision making methods for financial performance evaluation of Turkish

manufacturing industries. Expert Systems with Applications. 39(1). pp. 350-364.

Forbes, W., Hudson, R., Skerratt, L. and Soufian, M., 2015. Which heuristics can aid financial-

decision-making?. International review of Financial analysis. 42. pp. 199-210.

Baker, H.K. and Ricciardi, V., 2014. Investor behavior: The psychology of financial planning

and investing. John Wiley & Sons.

Chowdhuri, R., Yoon, V.Y., Redmond, R.T. and Etudo, U.O., 2014. Ontology based integration

of XBRL filings for financial decision making. Decision Support Systems. 68. pp. 64-

76.

Online:

Cafe Industry: UK, 2019. [Online]. Available through:

<https://www.worldcoffeeportal.com/Latest/News/2019/UK-coffee-shops-achieve-20-

years-of-sustained-grow>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.