Financial Decision Making Analysis and Report for Panini Ltd

VerifiedAdded on 2023/06/10

|11

|3180

|267

Report

AI Summary

This report provides a comprehensive analysis of financial decision-making, focusing on the case of Panini Ltd. It begins by evaluating the importance of accounting and financing functions within a business, detailing the roles of financial accounting, management accounting, tax functions, and auditing. The report then explores various sources of finance available for business expansion, differentiating between debt and equity capital. A significant portion of the report is dedicated to the computation and interpretation of financial ratios, including gross profit margin, operating profit margin, and ROCE, providing insights into Panini Ltd.'s financial performance and operational efficiency. The analysis of these ratios offers a perspective on the company's profitability, productivity, and ability to generate returns from its capital investments. The report concludes with a summary of findings and recommendations based on the financial analysis conducted.

Financial Decision

making

making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Evaluate the importance of Accounting and financing functions................................................1

Sources of finance for expansion of business..............................................................................4

TASK 2............................................................................................................................................6

Compute the ratios.......................................................................................................................6

Interpret the above calculated ratios............................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Evaluate the importance of Accounting and financing functions................................................1

Sources of finance for expansion of business..............................................................................4

TASK 2............................................................................................................................................6

Compute the ratios.......................................................................................................................6

Interpret the above calculated ratios............................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Financial decision making assists an organisation to determine the fiscal, monetary and

profitable situation of the company. The analysis of the accounts and finances that the company

adapts are done and on the basis of those financial statements the decisions are made accordingly

(Baker and et.al,2018). In the respective report, the business organisation of Panini Ltd. is

mentioned. Panini Ltd. is a medium sized organisation that has implanted its operational business

in 2016. The business dealings of this company are in the field of supermarkets and

manufactures breads in UK supermarket industry. The report contains explanation of the part of

accounting and finance with respect to the duties and obligations of the company. It also explains

the different sources of finance that cater to the needs of the businesses. The critical evaluation

of financial statements of the business and its ratios with their respective analysis are also

provided.

TASK 1

Evaluate the importance of Accounting and financing functions.

Accounting departments: The accounts department of the company looks after the finance

related matters like recording financial transaction on daily basis, maintaining different types of

accounts and statement for analysis and calculation of profit/loss and comparison. Accounting

department is really important when it comes to any business organisation. There is various

function this department have to perform weather a huge or small enterprise all have to maintain

its accounts related books and maintain them on regular basis.

Financial accounting: This part includes recording, posting, summarizing and

interpreting the financial aspect of the business entity. The company have to record its

business related transactions like purchasing of raw material, sales, wages payment,

machinery purchasing etc. and there is various standard which are to be met while

journalizing these activities in the books of the account of company. After this this entry

are posted and transferred to trial balance in order to check any mistake occurred or not

(Barr and McClellan, 2018). The final step is to prepare the statements which are called

trading account, P&L account and balance sheet, to know about the closing inventory left

with the company, profit earned and the position of the company respectively by the

1

Financial decision making assists an organisation to determine the fiscal, monetary and

profitable situation of the company. The analysis of the accounts and finances that the company

adapts are done and on the basis of those financial statements the decisions are made accordingly

(Baker and et.al,2018). In the respective report, the business organisation of Panini Ltd. is

mentioned. Panini Ltd. is a medium sized organisation that has implanted its operational business

in 2016. The business dealings of this company are in the field of supermarkets and

manufactures breads in UK supermarket industry. The report contains explanation of the part of

accounting and finance with respect to the duties and obligations of the company. It also explains

the different sources of finance that cater to the needs of the businesses. The critical evaluation

of financial statements of the business and its ratios with their respective analysis are also

provided.

TASK 1

Evaluate the importance of Accounting and financing functions.

Accounting departments: The accounts department of the company looks after the finance

related matters like recording financial transaction on daily basis, maintaining different types of

accounts and statement for analysis and calculation of profit/loss and comparison. Accounting

department is really important when it comes to any business organisation. There is various

function this department have to perform weather a huge or small enterprise all have to maintain

its accounts related books and maintain them on regular basis.

Financial accounting: This part includes recording, posting, summarizing and

interpreting the financial aspect of the business entity. The company have to record its

business related transactions like purchasing of raw material, sales, wages payment,

machinery purchasing etc. and there is various standard which are to be met while

journalizing these activities in the books of the account of company. After this this entry

are posted and transferred to trial balance in order to check any mistake occurred or not

(Barr and McClellan, 2018). The final step is to prepare the statements which are called

trading account, P&L account and balance sheet, to know about the closing inventory left

with the company, profit earned and the position of the company respectively by the

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

following statements. From the point of the government the financial accounting is a

mandatory requirement for operating business. Hence, accounting is one of the statutory

requirements.

Management Accounting: Managerial accounting is another name for this function of

accounts department. The financial records of the company which is prepared is

interpreted, analysed and used for decision making. This is only meant for the decision

making committee, they use this accounts to review the performance, controlling,

detecting risk, stability, development and growth of the company, future projections,

surviving the dynamic environment etc. such accounts are not required by law or

mandatary reports that are to be maintained it is solely prepared by the organisation for

their internal matters and combines both financial and non-financial information. Not

required to be audited or investigation by any person or government (Brigham and

Houston, 2021).

There are various types of management accounting namely product costing, cash flow,

inventory analysis, constraints, financial leverage metrics, debtor’s management, budgeting,

trend identification, forecasting. All these reports are collaborated by the analyst in the internal

department of the cooperation to take the right decision and plan making.

Tax function: Tax is the amount which is charged on a person or an organisation on the

income by the government of the country. It is a compulsory amount which need to be

paid in particular period of time. The amount which is to be paid is calculated by a

described framework conveyed by the authorities. This accounting function is that field

only with tax related matters. Return filling, advance tax payments, payments and other

legal requirement. There are two type of taxes which needs to be accounted direct and

indirect tax one is on the income and other is on goods and services respectively. There

are various protocols which are to be followed and timely submission of these reports are

really important failing to which may lead to legal charges and suits against the entity or

any individual. There are various reliefs and grants which is provided to the tax payer. In

accordance to their income qualification deductions, exemptions, subsidies are given. So

in order to facilitate the process of tax payment such accounting is used (Cordero, Gil-

Izquierdo and Pedraja-Chaparro, 2022).

2

mandatory requirement for operating business. Hence, accounting is one of the statutory

requirements.

Management Accounting: Managerial accounting is another name for this function of

accounts department. The financial records of the company which is prepared is

interpreted, analysed and used for decision making. This is only meant for the decision

making committee, they use this accounts to review the performance, controlling,

detecting risk, stability, development and growth of the company, future projections,

surviving the dynamic environment etc. such accounts are not required by law or

mandatary reports that are to be maintained it is solely prepared by the organisation for

their internal matters and combines both financial and non-financial information. Not

required to be audited or investigation by any person or government (Brigham and

Houston, 2021).

There are various types of management accounting namely product costing, cash flow,

inventory analysis, constraints, financial leverage metrics, debtor’s management, budgeting,

trend identification, forecasting. All these reports are collaborated by the analyst in the internal

department of the cooperation to take the right decision and plan making.

Tax function: Tax is the amount which is charged on a person or an organisation on the

income by the government of the country. It is a compulsory amount which need to be

paid in particular period of time. The amount which is to be paid is calculated by a

described framework conveyed by the authorities. This accounting function is that field

only with tax related matters. Return filling, advance tax payments, payments and other

legal requirement. There are two type of taxes which needs to be accounted direct and

indirect tax one is on the income and other is on goods and services respectively. There

are various protocols which are to be followed and timely submission of these reports are

really important failing to which may lead to legal charges and suits against the entity or

any individual. There are various reliefs and grants which is provided to the tax payer. In

accordance to their income qualification deductions, exemptions, subsidies are given. So

in order to facilitate the process of tax payment such accounting is used (Cordero, Gil-

Izquierdo and Pedraja-Chaparro, 2022).

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditing function: This is one of the controlling function. Auditing is basically checking

the records of the company with the physical evidence. For example: Cross checking the

inventory present in the organisation with the inventory shown in the books of account of

the company (Demina and Dombrovskaya, 2019).

The audit department of the organisation is in charge of the evaluation, control and risk

management of the operations taking place. The report generated by this examination is used for

finding out the real position of the organisation, any malfunction or misinterpretation of the

statements of the business entity and communicate the affairs to the internal committee or the

board of director. Sometimes auditing is required by law for certain company where public

interest is indulged.

Finance department: As the name suggests finance department of the business concern is the

one that deal with the assets and liabilities, cash inflows outflows related to the concern, trade

receivable and payables, salaries, stock, investments, trade and other occupation tasks. They plan

and manages the entities monetary responsibilities and looks after the profit and loss occurring

and effect on the concern.

Investing function: An investment is process that is done by an individual or an

organisation to channelize its surplus money into extra income. Main objective of

investments is wealth maximization. An organisation has its own short term and long

term goals in order to meet this objective investment plays a vital role. For a cooperation

a manger with the help of analyst and researchers put the surplus fund into the market for

buying different kind of assets, so as to earn extra profit which help in achieving

organisational motives. There is various option where investment can take place such as

stock market, real-estate, mutual funds, money market instrument, purchasing other

companies etc. there are various factors which should be kept in mind while investing

like, according to the financial need, time period for which it is to be done, risk bearing

capability, objective of investment.

Financing function: Every organisation in order to expand, grow and to diversify itself

have to take money from different options available in the market. This function helps in

decision making which resources among the different option available in the market is to

be used for funding (Gautam and Holani, 2019). Such finance makes users that needs are

fulfilled at a minimum cost, safety funds are acquired by the company, the decision is not

3

the records of the company with the physical evidence. For example: Cross checking the

inventory present in the organisation with the inventory shown in the books of account of

the company (Demina and Dombrovskaya, 2019).

The audit department of the organisation is in charge of the evaluation, control and risk

management of the operations taking place. The report generated by this examination is used for

finding out the real position of the organisation, any malfunction or misinterpretation of the

statements of the business entity and communicate the affairs to the internal committee or the

board of director. Sometimes auditing is required by law for certain company where public

interest is indulged.

Finance department: As the name suggests finance department of the business concern is the

one that deal with the assets and liabilities, cash inflows outflows related to the concern, trade

receivable and payables, salaries, stock, investments, trade and other occupation tasks. They plan

and manages the entities monetary responsibilities and looks after the profit and loss occurring

and effect on the concern.

Investing function: An investment is process that is done by an individual or an

organisation to channelize its surplus money into extra income. Main objective of

investments is wealth maximization. An organisation has its own short term and long

term goals in order to meet this objective investment plays a vital role. For a cooperation

a manger with the help of analyst and researchers put the surplus fund into the market for

buying different kind of assets, so as to earn extra profit which help in achieving

organisational motives. There is various option where investment can take place such as

stock market, real-estate, mutual funds, money market instrument, purchasing other

companies etc. there are various factors which should be kept in mind while investing

like, according to the financial need, time period for which it is to be done, risk bearing

capability, objective of investment.

Financing function: Every organisation in order to expand, grow and to diversify itself

have to take money from different options available in the market. This function helps in

decision making which resources among the different option available in the market is to

be used for funding (Gautam and Holani, 2019). Such finance makes users that needs are

fulfilled at a minimum cost, safety funds are acquired by the company, the decision is not

3

biased, the sourced fund is efficiently and effectively used. Importance of this process is

to identify the need, then source of fund, comparing different option available,

investment.

Dividend function: The distribution of surplus fund among the shareholder of the

company is known as dividend distribution. Such decisions are in the hand of board of

directors and internal committee. This extra income distribution is basically done by

listed company. Distribution is dependent upon the shareholding of the shareholder,

based on their number of holding dividend is provided (Kawugana and Faruna, 2019).

Dividend distribution builds trust in the company. A business entity might choose to not

to distribute this surplus rather invest it. Or can keep it as reserve for uncertainty that

might occur in future. Hence choosing what to do among the options available is the

function.

Working capital function: It is that sum of fund which is required by business entity to

meet its everyday operation requirements and current liabilities. For example, paying

salaries, payment to creditors, taxes and interest payments and other everyday liabilities

which working capital includes. This fund is really important for smooth flow of the

operation in the business entity. Total current assets deducted from current liability in

order to get this fund.

Sources of finance for expansion of business.

Sources of financial funding are needed for various purposes that include company growth,

expansions or financing business assets or production requirements. There exists a number of

reasons and requirements for which a company needs financing. The need is also categorised in

two ways, short term financial needs and long term financial needs. The requirements and

selection of the finances also depends upon the needs and future planning of the business entity.

The types of finances available are various depending upon what the business aims for.

The crucial sources for financial the funding requirements are:

Debt capital: It refers to the finance which is acquired by the company to b paid at a later

point of time including both the principal amount and the interest due. This is termed as

debt financing. It can be obtained either from banks or various private institutions that

lend these debts and provide their funding. Debt financing can also be done by issuing

4

to identify the need, then source of fund, comparing different option available,

investment.

Dividend function: The distribution of surplus fund among the shareholder of the

company is known as dividend distribution. Such decisions are in the hand of board of

directors and internal committee. This extra income distribution is basically done by

listed company. Distribution is dependent upon the shareholding of the shareholder,

based on their number of holding dividend is provided (Kawugana and Faruna, 2019).

Dividend distribution builds trust in the company. A business entity might choose to not

to distribute this surplus rather invest it. Or can keep it as reserve for uncertainty that

might occur in future. Hence choosing what to do among the options available is the

function.

Working capital function: It is that sum of fund which is required by business entity to

meet its everyday operation requirements and current liabilities. For example, paying

salaries, payment to creditors, taxes and interest payments and other everyday liabilities

which working capital includes. This fund is really important for smooth flow of the

operation in the business entity. Total current assets deducted from current liability in

order to get this fund.

Sources of finance for expansion of business.

Sources of financial funding are needed for various purposes that include company growth,

expansions or financing business assets or production requirements. There exists a number of

reasons and requirements for which a company needs financing. The need is also categorised in

two ways, short term financial needs and long term financial needs. The requirements and

selection of the finances also depends upon the needs and future planning of the business entity.

The types of finances available are various depending upon what the business aims for.

The crucial sources for financial the funding requirements are:

Debt capital: It refers to the finance which is acquired by the company to b paid at a later

point of time including both the principal amount and the interest due. This is termed as

debt financing. It can be obtained either from banks or various private institutions that

lend these debts and provide their funding. Debt financing can also be done by issuing

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

debt to public (Metawa and et.al 2018). The various sources in debt financing are

debentures, mortgages, corporate bonds. Companies take the debt issue and pay securities

against them to those taking up the securities. Debt financing is done in a restricted time

scenario as it requires the company to payback the amount to public from whom the

financing was done. The benefit of this method of financing is that it does not leads to

loss in the ownership of the company hence is a good source from the company point of

view.

Equity capital: Financing the company requirements with the help of equity capital is a

form of financing that invites the public to take ownership of company shares against the

amount that they pay. People investing in the company then become the shareholders of

the company and are obliged to the return payment for those shares. This approach leads

to dilution of ownership of company shares as for the amount it receives, the shares are

distributed. This source unlike debt financing does not requires the interest payments to

be made hence is better as compared to debts in this term (Modestino, Sederberg and

Tuller, 2019).

5

debentures, mortgages, corporate bonds. Companies take the debt issue and pay securities

against them to those taking up the securities. Debt financing is done in a restricted time

scenario as it requires the company to payback the amount to public from whom the

financing was done. The benefit of this method of financing is that it does not leads to

loss in the ownership of the company hence is a good source from the company point of

view.

Equity capital: Financing the company requirements with the help of equity capital is a

form of financing that invites the public to take ownership of company shares against the

amount that they pay. People investing in the company then become the shareholders of

the company and are obliged to the return payment for those shares. This approach leads

to dilution of ownership of company shares as for the amount it receives, the shares are

distributed. This source unlike debt financing does not requires the interest payments to

be made hence is better as compared to debts in this term (Modestino, Sederberg and

Tuller, 2019).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

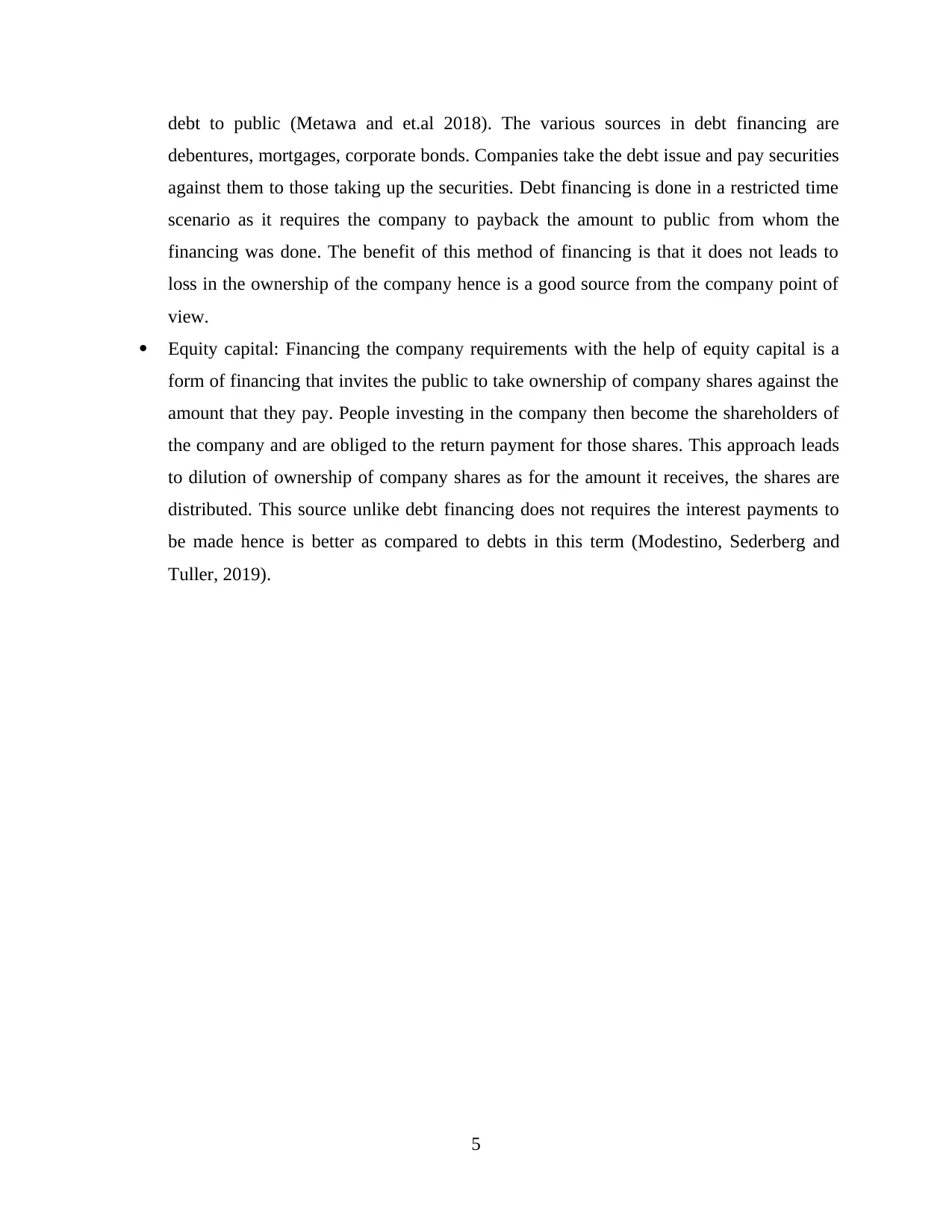

Compute the ratios.

Interpret the above calculated ratios.

Gross Profit Margin: This is a monetary ratio that shows how efficiently a company can

accomplish its mission with accessible assets in a desirable manner within a given time

frame. In 2018, Panini's net gross income was 35%, but in 2019 it was 28.39%, which is

not a huge difference from the previous year. This suggests that the company is less

productive in carrying out business activities. In this way, the company should actually

6

Compute the ratios.

Interpret the above calculated ratios.

Gross Profit Margin: This is a monetary ratio that shows how efficiently a company can

accomplish its mission with accessible assets in a desirable manner within a given time

frame. In 2018, Panini's net gross income was 35%, but in 2019 it was 28.39%, which is

not a huge difference from the previous year. This suggests that the company is less

productive in carrying out business activities. In this way, the company should actually

6

assess all of its previous records and communications and identify areas that lead to job

gaps and failures. In addition, it is necessary to control the consumption of the company

and try to use the restricted assets efficiently.

Operating Profit Margin: This monetary ratio helps to reflect the level of benefits created

through the organization's business activities, either the productivity or execution ratio.

This net income is also known as the EBIT (earnings before interest and tax) margin. In

2019, organizations should also cut job costs as they reduce the organization's profits.

Careful use of funds from restricted assets is also essential so that associations can take

advantage of accessible assets.

ROCE: It is a percentage showing a company's productive capacity actually using its

capital. ROCE is calculated by separating earnings before interest and assessments

(EBIT) from capital employed. The reduction in the ratio here indicates that Panini Ltd is

generating more unfortunate profits from its capital contributions and will therefore not

be able to meet the previous year's earnings figures in 2019.

Current ratio: The ongoing ratio also provides data on issues related to the general

obligations of the organization. The group's temporary commitments are down this year

compared to 2018, a sign that Panini has maintained enormous liquidity in the business

world.

Quick ratio: It looks at an organization's monetary balance and the value of its current

resources to determine its short-term liquidity. The quick ratio determines whether an

organization has enough money to deal with its nearby debt after exchanging its liquid

liquidity—the higher the ratio, the luckier the organization is in terms of liquidity. If the

ratio is low, organizations should approach vigilantly, and a subsequent stage may be to

assess how and how quickly new guesses can be obtained.

Inventory Turnover Days: It estimates an organization's ability to monitor access to

inventory from sellers and to keep merchandise from capacity to the rest of the inventory

organization. Inventory turnover is a ratio that shows how often an organization's

inventory is sold and replaced in a given time span. In 2019, stock turnover days

maintained a nice balance among their stocks, which is useful for companies to complete

swaps related to the previous year.

7

gaps and failures. In addition, it is necessary to control the consumption of the company

and try to use the restricted assets efficiently.

Operating Profit Margin: This monetary ratio helps to reflect the level of benefits created

through the organization's business activities, either the productivity or execution ratio.

This net income is also known as the EBIT (earnings before interest and tax) margin. In

2019, organizations should also cut job costs as they reduce the organization's profits.

Careful use of funds from restricted assets is also essential so that associations can take

advantage of accessible assets.

ROCE: It is a percentage showing a company's productive capacity actually using its

capital. ROCE is calculated by separating earnings before interest and assessments

(EBIT) from capital employed. The reduction in the ratio here indicates that Panini Ltd is

generating more unfortunate profits from its capital contributions and will therefore not

be able to meet the previous year's earnings figures in 2019.

Current ratio: The ongoing ratio also provides data on issues related to the general

obligations of the organization. The group's temporary commitments are down this year

compared to 2018, a sign that Panini has maintained enormous liquidity in the business

world.

Quick ratio: It looks at an organization's monetary balance and the value of its current

resources to determine its short-term liquidity. The quick ratio determines whether an

organization has enough money to deal with its nearby debt after exchanging its liquid

liquidity—the higher the ratio, the luckier the organization is in terms of liquidity. If the

ratio is low, organizations should approach vigilantly, and a subsequent stage may be to

assess how and how quickly new guesses can be obtained.

Inventory Turnover Days: It estimates an organization's ability to monitor access to

inventory from sellers and to keep merchandise from capacity to the rest of the inventory

organization. Inventory turnover is a ratio that shows how often an organization's

inventory is sold and replaced in a given time span. In 2019, stock turnover days

maintained a nice balance among their stocks, which is useful for companies to complete

swaps related to the previous year.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Debtor's Collection Period: Accounts receivable alludes to those days when the business

receives instalments from customers. A larger number of debt holders would indicate that

the organization should inject more support for its neglected receivables assets, while a

lower classification date would indicate that their business has less funds due, so it can be

done through different Ways to Get More Funding. In 2019, the Panini instalment period

was 42.54 days, significantly more than the previous year, suggesting that the

association's revenue set aside some profit in the organization's records.

Payable Payments Period: The standard time it takes for an organization to settle its

claims with an exchange-dealer is estimated by a creditor liability. In this way, it can

provide information on instalment propensity and whether a business uses open credit

institutions at all. In 2018, compared to 2019, organizations took 29.66 more days to meet

their obligations, a decent sign of the company's capabilities.

CONCLUSION

The reports involved were constructed, most likely because Panini Limited has a wide

variety of resources available for the assets to carry out its activities. The report discusses

bookkeeping and currency offices and their critical work in business activities to improve yields

and control currency exchange. Here, with the help of Panini's currency records, determine the

currency ratio to investigate the company's performance in 2018 and 2019. The report suggested

that the company was more proficient in 2018, but maintained good liquidity and inventory in

2019, with a correlation to the previous year. In this way, after distinguishing shortcomings and

circular areas, careful steps are proposed to improve the company's productive work and benefit

magnification.

8

receives instalments from customers. A larger number of debt holders would indicate that

the organization should inject more support for its neglected receivables assets, while a

lower classification date would indicate that their business has less funds due, so it can be

done through different Ways to Get More Funding. In 2019, the Panini instalment period

was 42.54 days, significantly more than the previous year, suggesting that the

association's revenue set aside some profit in the organization's records.

Payable Payments Period: The standard time it takes for an organization to settle its

claims with an exchange-dealer is estimated by a creditor liability. In this way, it can

provide information on instalment propensity and whether a business uses open credit

institutions at all. In 2018, compared to 2019, organizations took 29.66 more days to meet

their obligations, a decent sign of the company's capabilities.

CONCLUSION

The reports involved were constructed, most likely because Panini Limited has a wide

variety of resources available for the assets to carry out its activities. The report discusses

bookkeeping and currency offices and their critical work in business activities to improve yields

and control currency exchange. Here, with the help of Panini's currency records, determine the

currency ratio to investigate the company's performance in 2018 and 2019. The report suggested

that the company was more proficient in 2018, but maintained good liquidity and inventory in

2019, with a correlation to the previous year. In this way, after distinguishing shortcomings and

circular areas, careful steps are proposed to improve the company's productive work and benefit

magnification.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Baker, H.K. And et.al,2018. How financial literacy and demographic variables relate to

behavioral biases. Managerial Finance.

Barr, M.J. and McClellan, G.S., 2018. Budgets and financial management in higher education.

John Wiley & Sons.

Brigham, E.F. and Houston, J.F., 2021. Fundamentals of financial management: Concise.

Cengage Learning.

Cordero, J.M., Gil-Izquierdo, M. and Pedraja-Chaparro, F., 2022. Financial education and

student financial literacy: A cross-country analysis using PISA 2012 data. The Social

Science Journal. 59(1). pp.15-33.

Demina, I. and Dombrovskaya, E., 2019, October. Generating risk-based financial reporting.

In The 2018 International Conference on Digital Science (pp. 387-399). Springer,

Cham.

Gautam, R. and Holani, U., 2019. An exploratory study to identify the critical factors affecting

the individual investment decision-making. MUDRA: Journal of Finance and

Accounting. 6(2). pp.1-12.

Kawugana, A. and Faruna, F.S., 2019. Role of Financial Statement in Investment Decision

Making.

Metawa, N.,and et.al2018. Impact of behavioral factors on investors’ financial decisions: case of

the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance

and Management.

Modestino, A.S., Sederberg, R. and Tuller, L., 2019. Assessing the effectiveness of financial

coaching: Evidence from the Boston Youth Credit Building Initiative. Journal of

Consumer Affairs. 53(4). pp.1825-1873.

Narkabilova, G., 2021. ON THE IMPORTANCE OF DEVELOPING FINANCIAL LITERACY

AMONG PRIMARY SCHOOL PUPILS. Theoretical & Applied Science. (5). pp.219-

221.

Rai, H.B., and et.al., 2021. Sharing is caring: How non-financial incentives drive sustainable e-

commerce delivery. Transportation Research Part D: Transport and Environment. 93.

p.102794.

Smith, K.J. and Dhillon, G., 2019. Assessing blockchain potential for improving the

cybersecurity of financial transactions. Managerial Finance.

Udo, B.U.X. and PARENTI, R., 2021. The role of non-financial performance indicators and

integrated reporting in achieving sustainable value creation.

9

Books and Journals

Baker, H.K. And et.al,2018. How financial literacy and demographic variables relate to

behavioral biases. Managerial Finance.

Barr, M.J. and McClellan, G.S., 2018. Budgets and financial management in higher education.

John Wiley & Sons.

Brigham, E.F. and Houston, J.F., 2021. Fundamentals of financial management: Concise.

Cengage Learning.

Cordero, J.M., Gil-Izquierdo, M. and Pedraja-Chaparro, F., 2022. Financial education and

student financial literacy: A cross-country analysis using PISA 2012 data. The Social

Science Journal. 59(1). pp.15-33.

Demina, I. and Dombrovskaya, E., 2019, October. Generating risk-based financial reporting.

In The 2018 International Conference on Digital Science (pp. 387-399). Springer,

Cham.

Gautam, R. and Holani, U., 2019. An exploratory study to identify the critical factors affecting

the individual investment decision-making. MUDRA: Journal of Finance and

Accounting. 6(2). pp.1-12.

Kawugana, A. and Faruna, F.S., 2019. Role of Financial Statement in Investment Decision

Making.

Metawa, N.,and et.al2018. Impact of behavioral factors on investors’ financial decisions: case of

the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance

and Management.

Modestino, A.S., Sederberg, R. and Tuller, L., 2019. Assessing the effectiveness of financial

coaching: Evidence from the Boston Youth Credit Building Initiative. Journal of

Consumer Affairs. 53(4). pp.1825-1873.

Narkabilova, G., 2021. ON THE IMPORTANCE OF DEVELOPING FINANCIAL LITERACY

AMONG PRIMARY SCHOOL PUPILS. Theoretical & Applied Science. (5). pp.219-

221.

Rai, H.B., and et.al., 2021. Sharing is caring: How non-financial incentives drive sustainable e-

commerce delivery. Transportation Research Part D: Transport and Environment. 93.

p.102794.

Smith, K.J. and Dhillon, G., 2019. Assessing blockchain potential for improving the

cybersecurity of financial transactions. Managerial Finance.

Udo, B.U.X. and PARENTI, R., 2021. The role of non-financial performance indicators and

integrated reporting in achieving sustainable value creation.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.