Financial Analysis and Decision Making Report: Harvey Homes

VerifiedAdded on 2020/07/22

|27

|5456

|414

Report

AI Summary

This report presents a comprehensive financial analysis of Harvey Homes, examining its financial statements, including the statement of profit and loss, statement of financial position, and statement of cash flow. The analysis includes key financial ratios such as gross margin, net margin, return on capital employed, current ratio, quick ratio, and long-term debt to total assets. The report also covers market segment analysis, management forecasts, investment appraisal techniques, and sources of finance. Furthermore, it discusses non-financial factors, specifically highlighting the importance of hiring locals and making corporate connections. The executive summary highlights key findings, such as the current ratio's implications and the need to improve performance in certain regions. The report concludes with recommendations for improving financial performance and decision-making.

FINANCIAL DECISION

MAKING

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................1

PART 1............................................................................................................................................1

Analysis of statement of profit and loss.................................................................................1

Analysis of statement of financial position............................................................................4

Analysis of statement of cash flow.........................................................................................7

Market segment analysis........................................................................................................9

PART 2..........................................................................................................................................13

Management forecast............................................................................................................13

Investment appraisals techniques.........................................................................................13

Sources of finance................................................................................................................14

Non financial factors............................................................................................................15

Hiring Locals........................................................................................................................16

Making corporate connections.............................................................................................16

REFERENCES..............................................................................................................................17

APPENDIX....................................................................................................................................19

EXECUTIVE SUMMARY.............................................................................................................1

PART 1............................................................................................................................................1

Analysis of statement of profit and loss.................................................................................1

Analysis of statement of financial position............................................................................4

Analysis of statement of cash flow.........................................................................................7

Market segment analysis........................................................................................................9

PART 2..........................................................................................................................................13

Management forecast............................................................................................................13

Investment appraisals techniques.........................................................................................13

Sources of finance................................................................................................................14

Non financial factors............................................................................................................15

Hiring Locals........................................................................................................................16

Making corporate connections.............................................................................................16

REFERENCES..............................................................................................................................17

APPENDIX....................................................................................................................................19

Illustration Index

Illustration 1: Comparison of Gross margin ratio............................................................................1

Illustration 2: Comparison of Net margin ratio................................................................................2

Illustration 3: Comparison of return on capital employed...............................................................3

Illustration 4: Comparison of current ratio......................................................................................5

Illustration 5: Comparison of Quick ratio........................................................................................6

Illustration 6: Comparison of long term debt to total asset ratio.....................................................7

Illustration 7: Inflow and outflow of cash........................................................................................8

Illustration 8: Comparison of cash conversion cycle.......................................................................9

Illustration 9: Northern region.......................................................................................................10

Illustration 10: Midlands region.....................................................................................................11

Illustration 11: Southern region.....................................................................................................11

Index of Tables

Table 1: Calculation of Gross Margin Ratio..................................................................................19

Table 2: Calculation of Net Margin Ratio.....................................................................................19

Table 3: Calculation of ROCE.......................................................................................................19

Table 4: Calculation of Capital employed.....................................................................................20

Table 5: Calculation of current ratio..............................................................................................20

Table 6: Calculation of Quick ratio...............................................................................................20

Table 7: Calculation of quick assets..............................................................................................21

Table 8: Calculation of long term debt to total Assets ratio..........................................................21

Table 9: Cash flow statement.........................................................................................................21

Table 10: Calculation of DOI........................................................................................................22

Table 11: Calculation of DSO........................................................................................................22

Table 12: Calculation of DPO........................................................................................................22

Table 13: Cash conversion cycle...................................................................................................22

Table 14: Profits of different geographical region.........................................................................23

Illustration 1: Comparison of Gross margin ratio............................................................................1

Illustration 2: Comparison of Net margin ratio................................................................................2

Illustration 3: Comparison of return on capital employed...............................................................3

Illustration 4: Comparison of current ratio......................................................................................5

Illustration 5: Comparison of Quick ratio........................................................................................6

Illustration 6: Comparison of long term debt to total asset ratio.....................................................7

Illustration 7: Inflow and outflow of cash........................................................................................8

Illustration 8: Comparison of cash conversion cycle.......................................................................9

Illustration 9: Northern region.......................................................................................................10

Illustration 10: Midlands region.....................................................................................................11

Illustration 11: Southern region.....................................................................................................11

Index of Tables

Table 1: Calculation of Gross Margin Ratio..................................................................................19

Table 2: Calculation of Net Margin Ratio.....................................................................................19

Table 3: Calculation of ROCE.......................................................................................................19

Table 4: Calculation of Capital employed.....................................................................................20

Table 5: Calculation of current ratio..............................................................................................20

Table 6: Calculation of Quick ratio...............................................................................................20

Table 7: Calculation of quick assets..............................................................................................21

Table 8: Calculation of long term debt to total Assets ratio..........................................................21

Table 9: Cash flow statement.........................................................................................................21

Table 10: Calculation of DOI........................................................................................................22

Table 11: Calculation of DSO........................................................................................................22

Table 12: Calculation of DPO........................................................................................................22

Table 13: Cash conversion cycle...................................................................................................22

Table 14: Profits of different geographical region.........................................................................23

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EXECUTIVE SUMMARY

Analysing the financial statements helps in making comparative analysis of sales, profits,

investments etc. which further contributes to better decision making. Harvey homes is involved

in creating quality homes to people. The key findings of the report are that the current ratio of the

business is on higher side leading to productivity of the current assets. Further, the Harvey is not

earning mush revenues from Midland region hence, require improving product mix. The

company is low at its operating cash and therefore require working upon its operating income in

order to conduct its day to day business. The entity have been able to get loan for 150 million

through which it will be managing its cash requirements. There is an increase in revenue of the

entity also there is overall increase in the profits of the entity I comparison to the figures of

previous year.

PART 1

Analysis of statement of profit and loss

Gross Margin Ratio

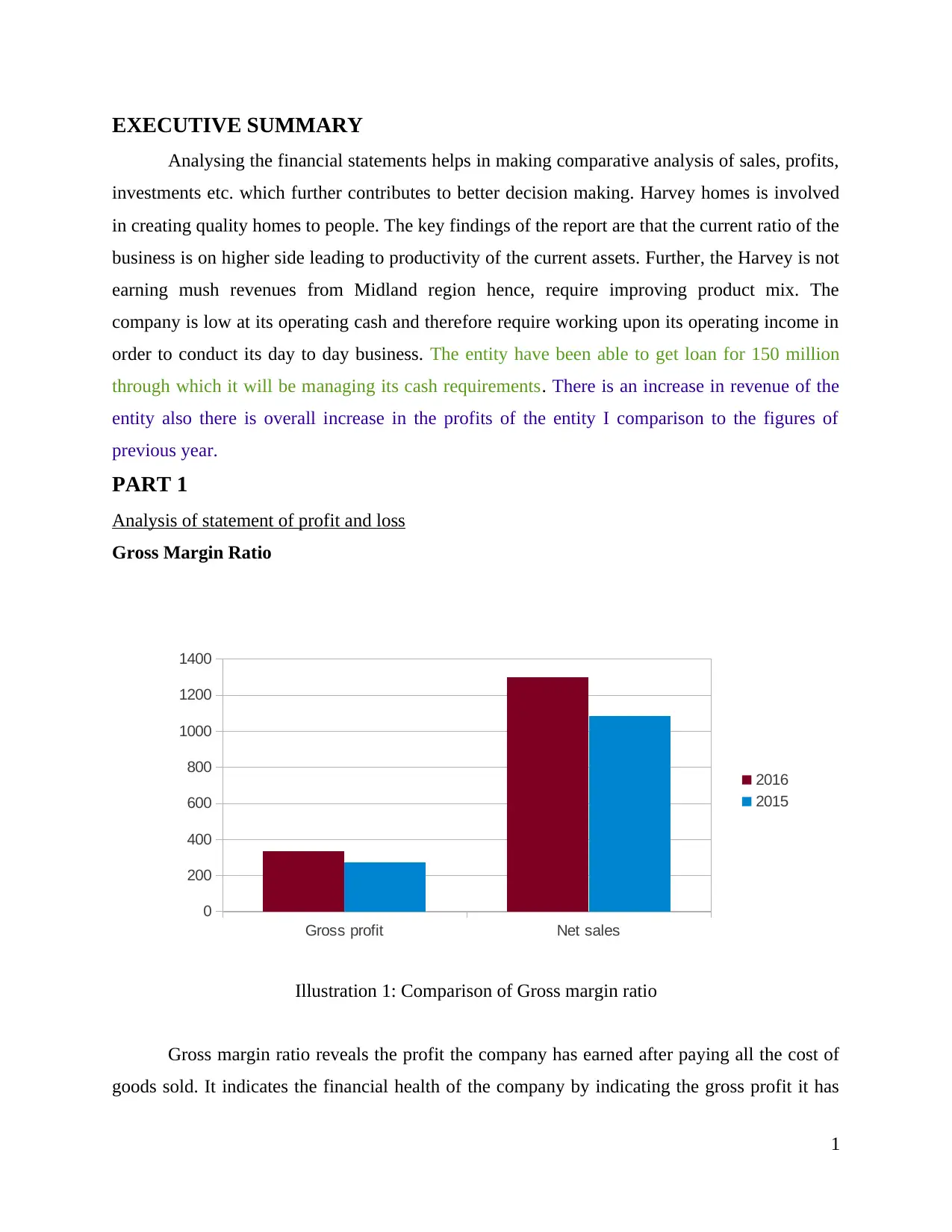

Gross margin ratio reveals the profit the company has earned after paying all the cost of

goods sold. It indicates the financial health of the company by indicating the gross profit it has

1

Gross profit Net sales

0

200

400

600

800

1000

1200

1400

2016

2015

Illustration 1: Comparison of Gross margin ratio

Analysing the financial statements helps in making comparative analysis of sales, profits,

investments etc. which further contributes to better decision making. Harvey homes is involved

in creating quality homes to people. The key findings of the report are that the current ratio of the

business is on higher side leading to productivity of the current assets. Further, the Harvey is not

earning mush revenues from Midland region hence, require improving product mix. The

company is low at its operating cash and therefore require working upon its operating income in

order to conduct its day to day business. The entity have been able to get loan for 150 million

through which it will be managing its cash requirements. There is an increase in revenue of the

entity also there is overall increase in the profits of the entity I comparison to the figures of

previous year.

PART 1

Analysis of statement of profit and loss

Gross Margin Ratio

Gross margin ratio reveals the profit the company has earned after paying all the cost of

goods sold. It indicates the financial health of the company by indicating the gross profit it has

1

Gross profit Net sales

0

200

400

600

800

1000

1200

1400

2016

2015

Illustration 1: Comparison of Gross margin ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

earned on every Pound of sales revenue (Huang and et.al., 2013). Based on table (Appendix 1), it

can be interpreted that gross margin ratio have grown in comparison to the results of 2015.

There is a rise in demand of customers for high quality housing. It shows that the

company is more efficient in comparison to last year. The reason of increase in gross profit

margin of the company is due to increase in its sales revenue in comparison to previous year. The

company have been able to do more sales due to increase in customer's demand.

The revenue have increased due to rise in the demands of housing which has initiated an

increase in the revenues from three segments of Harvey.

The cost of sales of the company have been increased from 811 million in 2015 to 965

million in 2016. The significant increase in cost of sales is because of increase in production

done by Harvey. It shows that the entity have been using more material, labour and overhead in

order to satisfy the arising demand. The percentage change in the amount of cost of sales in

comparison to the previous year is 18%

The cost of sales have increased more than the revenue which shows that it is required to

optimally utilize the resources and keep the cost of production to the minimum.

The ratio was 25.1% in 2015 and it has been increased to 25.6%. Statement of profit and

loss is prepared for Harvey Homes Plc for the year ended 31 December 2016 shows that the sales

revenues have grown from £1083 to £1297. It further reveals that overall profit of the entity

have also increased to a significant margin.

There is a loss in the ratio due to increased cost of sales of Harvey and revenue have not

been generated in comparison to its expenditure.

Net Margin Ratio

2

can be interpreted that gross margin ratio have grown in comparison to the results of 2015.

There is a rise in demand of customers for high quality housing. It shows that the

company is more efficient in comparison to last year. The reason of increase in gross profit

margin of the company is due to increase in its sales revenue in comparison to previous year. The

company have been able to do more sales due to increase in customer's demand.

The revenue have increased due to rise in the demands of housing which has initiated an

increase in the revenues from three segments of Harvey.

The cost of sales of the company have been increased from 811 million in 2015 to 965

million in 2016. The significant increase in cost of sales is because of increase in production

done by Harvey. It shows that the entity have been using more material, labour and overhead in

order to satisfy the arising demand. The percentage change in the amount of cost of sales in

comparison to the previous year is 18%

The cost of sales have increased more than the revenue which shows that it is required to

optimally utilize the resources and keep the cost of production to the minimum.

The ratio was 25.1% in 2015 and it has been increased to 25.6%. Statement of profit and

loss is prepared for Harvey Homes Plc for the year ended 31 December 2016 shows that the sales

revenues have grown from £1083 to £1297. It further reveals that overall profit of the entity

have also increased to a significant margin.

There is a loss in the ratio due to increased cost of sales of Harvey and revenue have not

been generated in comparison to its expenditure.

Net Margin Ratio

2

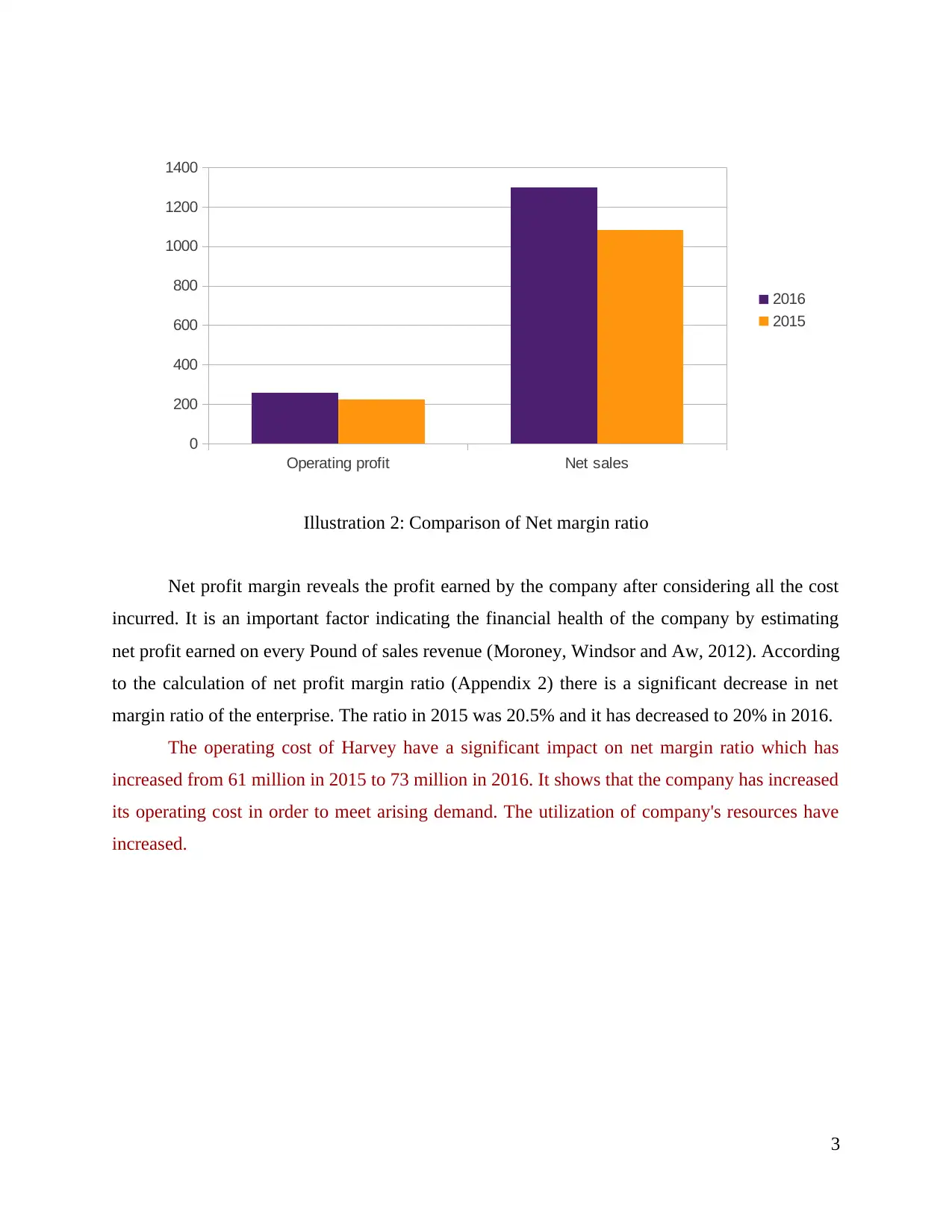

Net profit margin reveals the profit earned by the company after considering all the cost

incurred. It is an important factor indicating the financial health of the company by estimating

net profit earned on every Pound of sales revenue (Moroney, Windsor and Aw, 2012). According

to the calculation of net profit margin ratio (Appendix 2) there is a significant decrease in net

margin ratio of the enterprise. The ratio in 2015 was 20.5% and it has decreased to 20% in 2016.

The operating cost of Harvey have a significant impact on net margin ratio which has

increased from 61 million in 2015 to 73 million in 2016. It shows that the company has increased

its operating cost in order to meet arising demand. The utilization of company's resources have

increased.

3

Operating profit Net sales

0

200

400

600

800

1000

1200

1400

2016

2015

Illustration 2: Comparison of Net margin ratio

incurred. It is an important factor indicating the financial health of the company by estimating

net profit earned on every Pound of sales revenue (Moroney, Windsor and Aw, 2012). According

to the calculation of net profit margin ratio (Appendix 2) there is a significant decrease in net

margin ratio of the enterprise. The ratio in 2015 was 20.5% and it has decreased to 20% in 2016.

The operating cost of Harvey have a significant impact on net margin ratio which has

increased from 61 million in 2015 to 73 million in 2016. It shows that the company has increased

its operating cost in order to meet arising demand. The utilization of company's resources have

increased.

3

Operating profit Net sales

0

200

400

600

800

1000

1200

1400

2016

2015

Illustration 2: Comparison of Net margin ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

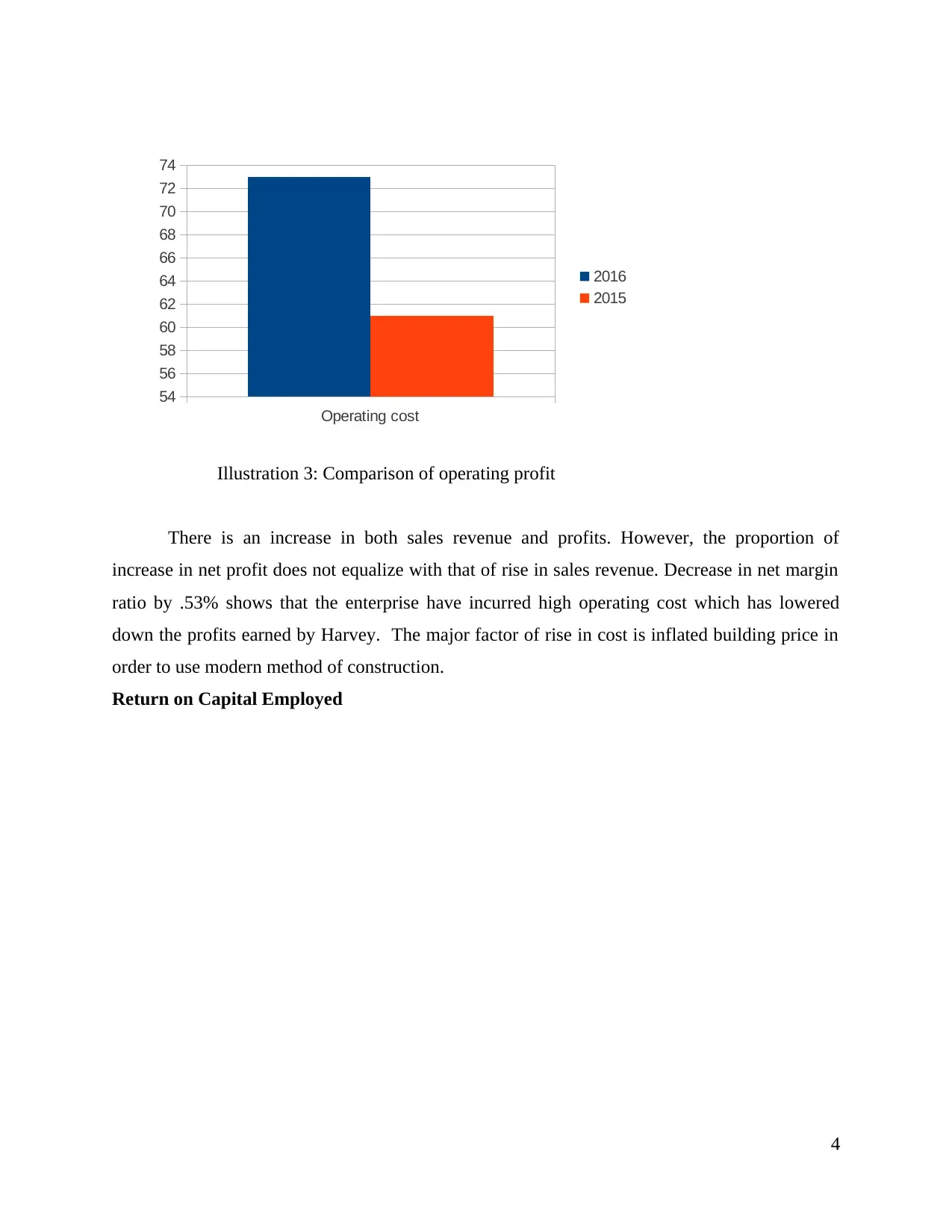

There is an increase in both sales revenue and profits. However, the proportion of

increase in net profit does not equalize with that of rise in sales revenue. Decrease in net margin

ratio by .53% shows that the enterprise have incurred high operating cost which has lowered

down the profits earned by Harvey. The major factor of rise in cost is inflated building price in

order to use modern method of construction.

Return on Capital Employed

4

Operating cost

54

56

58

60

62

64

66

68

70

72

74

2016

2015

Illustration 3: Comparison of operating profit

increase in net profit does not equalize with that of rise in sales revenue. Decrease in net margin

ratio by .53% shows that the enterprise have incurred high operating cost which has lowered

down the profits earned by Harvey. The major factor of rise in cost is inflated building price in

order to use modern method of construction.

Return on Capital Employed

4

Operating cost

54

56

58

60

62

64

66

68

70

72

74

2016

2015

Illustration 3: Comparison of operating profit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

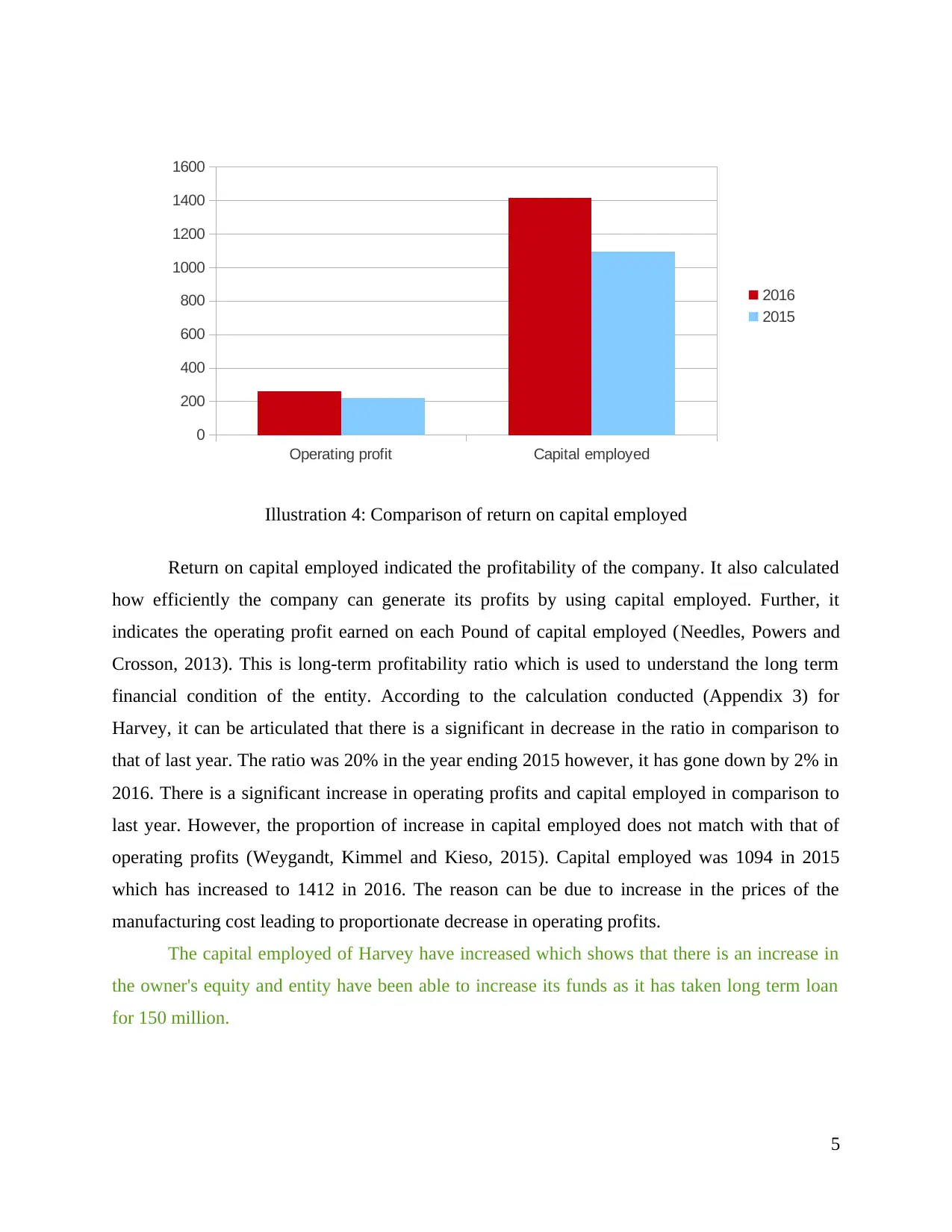

Return on capital employed indicated the profitability of the company. It also calculated

how efficiently the company can generate its profits by using capital employed. Further, it

indicates the operating profit earned on each Pound of capital employed (Needles, Powers and

Crosson, 2013). This is long-term profitability ratio which is used to understand the long term

financial condition of the entity. According to the calculation conducted (Appendix 3) for

Harvey, it can be articulated that there is a significant in decrease in the ratio in comparison to

that of last year. The ratio was 20% in the year ending 2015 however, it has gone down by 2% in

2016. There is a significant increase in operating profits and capital employed in comparison to

last year. However, the proportion of increase in capital employed does not match with that of

operating profits (Weygandt, Kimmel and Kieso, 2015). Capital employed was 1094 in 2015

which has increased to 1412 in 2016. The reason can be due to increase in the prices of the

manufacturing cost leading to proportionate decrease in operating profits.

The capital employed of Harvey have increased which shows that there is an increase in

the owner's equity and entity have been able to increase its funds as it has taken long term loan

for 150 million.

5

Operating profit Capital employed

0

200

400

600

800

1000

1200

1400

1600

2016

2015

Illustration 4: Comparison of return on capital employed

how efficiently the company can generate its profits by using capital employed. Further, it

indicates the operating profit earned on each Pound of capital employed (Needles, Powers and

Crosson, 2013). This is long-term profitability ratio which is used to understand the long term

financial condition of the entity. According to the calculation conducted (Appendix 3) for

Harvey, it can be articulated that there is a significant in decrease in the ratio in comparison to

that of last year. The ratio was 20% in the year ending 2015 however, it has gone down by 2% in

2016. There is a significant increase in operating profits and capital employed in comparison to

last year. However, the proportion of increase in capital employed does not match with that of

operating profits (Weygandt, Kimmel and Kieso, 2015). Capital employed was 1094 in 2015

which has increased to 1412 in 2016. The reason can be due to increase in the prices of the

manufacturing cost leading to proportionate decrease in operating profits.

The capital employed of Harvey have increased which shows that there is an increase in

the owner's equity and entity have been able to increase its funds as it has taken long term loan

for 150 million.

5

Operating profit Capital employed

0

200

400

600

800

1000

1200

1400

1600

2016

2015

Illustration 4: Comparison of return on capital employed

Analysis of statement of financial position

Financial statement gives a detailed analysis of company's assets and liabilities which is

disclosed to the investors so that they can decide whether they want to invest in the entity or not.

Also, it assists in making comparative analysis of assets and liabilities over the years. Following

are the ratios useful to interpret the results of the balance sheet and make the comparative

analysis easy:

Current Ratio:

Current ratio is used to calculate the liquidity of the organization where it finds that

whether the company will be able to pay its short term debts with its available current assets.

Higher current ratio indicates high potential to pay out its debts. The current ratio below 1

demonstrate the incapability and ratio more than 1 shows the potential of the entity. According to

calculation (Appendix 4) Harvey have managed to increase its current ratio in comparison to

2015. The current ratio was 2.9 in 2015 which has increased to 3.12 in 2016. It indicates that

Harvey is capable enough to pay out its short term liabilities through the available current assets.

The adequate availability of current assets shows that it will be able to pay back its

current liabilities through that money. There is an increase in the current assets and current

liabilities of Harvey in the current year. However, more current ratio of Harvey shows that it is

not using its current assets effectively. Further, it is advised to make investment in order to

6

Current assets Current liabilities

0

500

1000

1500

2000

2500

2016

2015

Illustration 5: Comparison of current ratio

Financial statement gives a detailed analysis of company's assets and liabilities which is

disclosed to the investors so that they can decide whether they want to invest in the entity or not.

Also, it assists in making comparative analysis of assets and liabilities over the years. Following

are the ratios useful to interpret the results of the balance sheet and make the comparative

analysis easy:

Current Ratio:

Current ratio is used to calculate the liquidity of the organization where it finds that

whether the company will be able to pay its short term debts with its available current assets.

Higher current ratio indicates high potential to pay out its debts. The current ratio below 1

demonstrate the incapability and ratio more than 1 shows the potential of the entity. According to

calculation (Appendix 4) Harvey have managed to increase its current ratio in comparison to

2015. The current ratio was 2.9 in 2015 which has increased to 3.12 in 2016. It indicates that

Harvey is capable enough to pay out its short term liabilities through the available current assets.

The adequate availability of current assets shows that it will be able to pay back its

current liabilities through that money. There is an increase in the current assets and current

liabilities of Harvey in the current year. However, more current ratio of Harvey shows that it is

not using its current assets effectively. Further, it is advised to make investment in order to

6

Current assets Current liabilities

0

500

1000

1500

2000

2500

2016

2015

Illustration 5: Comparison of current ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

generate extra income for the entity. The current assets of the entity have increased from 1595 in

2015 to 1979 to 2016 which has a greater impact on the rise of quick assets as well.

Quick Ratio:

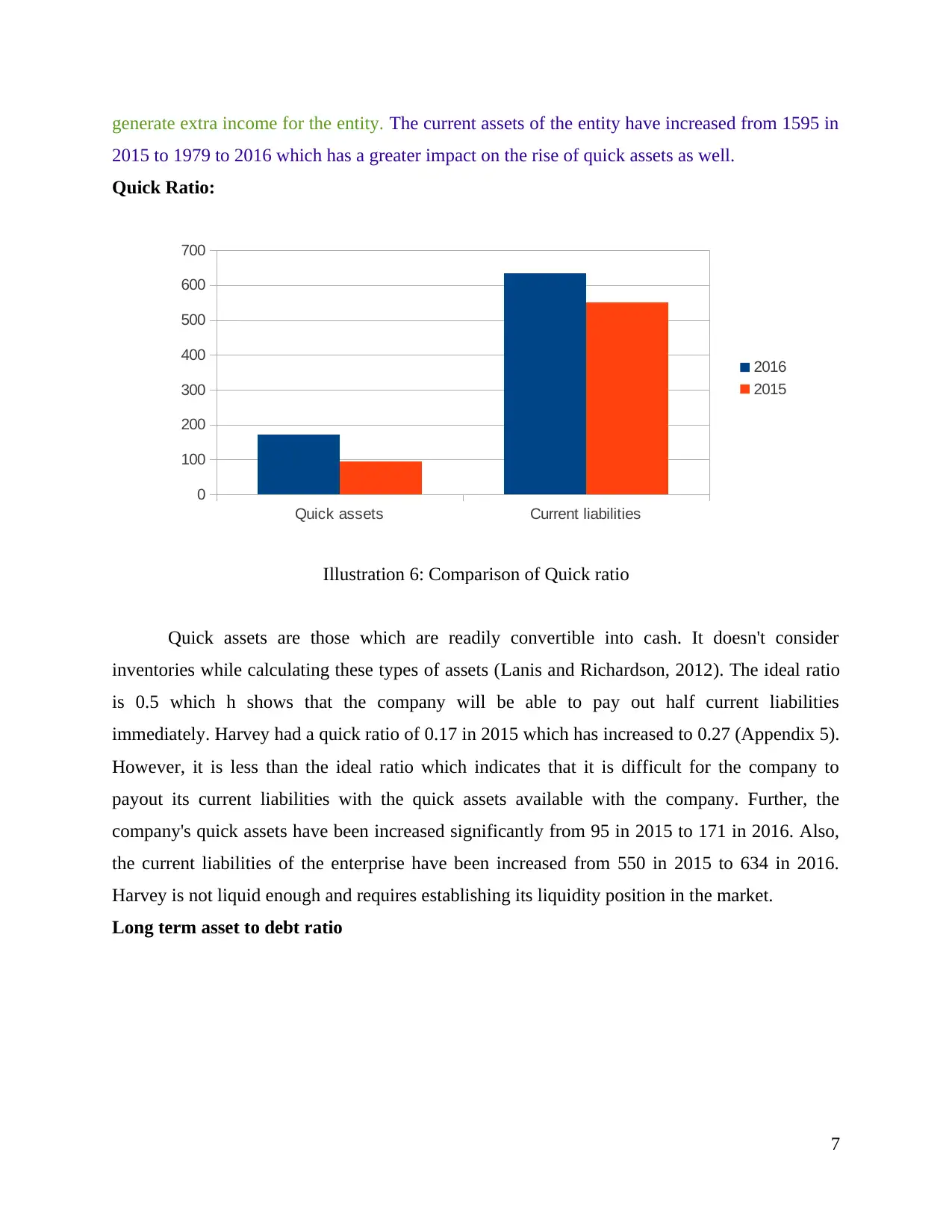

Quick assets are those which are readily convertible into cash. It doesn't consider

inventories while calculating these types of assets (Lanis and Richardson, 2012). The ideal ratio

is 0.5 which h shows that the company will be able to pay out half current liabilities

immediately. Harvey had a quick ratio of 0.17 in 2015 which has increased to 0.27 (Appendix 5).

However, it is less than the ideal ratio which indicates that it is difficult for the company to

payout its current liabilities with the quick assets available with the company. Further, the

company's quick assets have been increased significantly from 95 in 2015 to 171 in 2016. Also,

the current liabilities of the enterprise have been increased from 550 in 2015 to 634 in 2016.

Harvey is not liquid enough and requires establishing its liquidity position in the market.

Long term asset to debt ratio

7

Quick assets Current liabilities

0

100

200

300

400

500

600

700

2016

2015

Illustration 6: Comparison of Quick ratio

2015 to 1979 to 2016 which has a greater impact on the rise of quick assets as well.

Quick Ratio:

Quick assets are those which are readily convertible into cash. It doesn't consider

inventories while calculating these types of assets (Lanis and Richardson, 2012). The ideal ratio

is 0.5 which h shows that the company will be able to pay out half current liabilities

immediately. Harvey had a quick ratio of 0.17 in 2015 which has increased to 0.27 (Appendix 5).

However, it is less than the ideal ratio which indicates that it is difficult for the company to

payout its current liabilities with the quick assets available with the company. Further, the

company's quick assets have been increased significantly from 95 in 2015 to 171 in 2016. Also,

the current liabilities of the enterprise have been increased from 550 in 2015 to 634 in 2016.

Harvey is not liquid enough and requires establishing its liquidity position in the market.

Long term asset to debt ratio

7

Quick assets Current liabilities

0

100

200

300

400

500

600

700

2016

2015

Illustration 6: Comparison of Quick ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

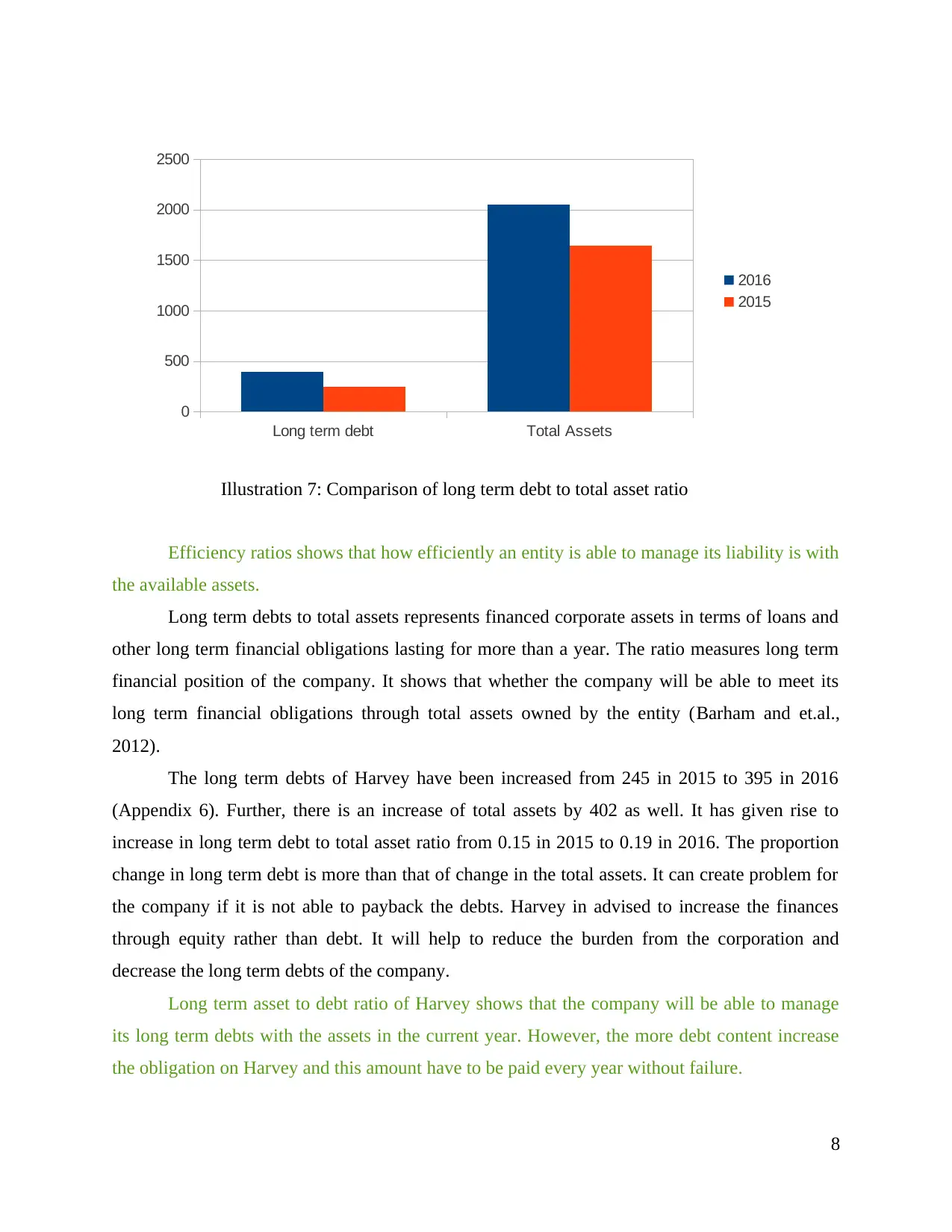

Efficiency ratios shows that how efficiently an entity is able to manage its liability is with

the available assets.

Long term debts to total assets represents financed corporate assets in terms of loans and

other long term financial obligations lasting for more than a year. The ratio measures long term

financial position of the company. It shows that whether the company will be able to meet its

long term financial obligations through total assets owned by the entity (Barham and et.al.,

2012).

The long term debts of Harvey have been increased from 245 in 2015 to 395 in 2016

(Appendix 6). Further, there is an increase of total assets by 402 as well. It has given rise to

increase in long term debt to total asset ratio from 0.15 in 2015 to 0.19 in 2016. The proportion

change in long term debt is more than that of change in the total assets. It can create problem for

the company if it is not able to payback the debts. Harvey in advised to increase the finances

through equity rather than debt. It will help to reduce the burden from the corporation and

decrease the long term debts of the company.

Long term asset to debt ratio of Harvey shows that the company will be able to manage

its long term debts with the assets in the current year. However, the more debt content increase

the obligation on Harvey and this amount have to be paid every year without failure.

8

Long term debt Total Assets

0

500

1000

1500

2000

2500

2016

2015

Illustration 7: Comparison of long term debt to total asset ratio

the available assets.

Long term debts to total assets represents financed corporate assets in terms of loans and

other long term financial obligations lasting for more than a year. The ratio measures long term

financial position of the company. It shows that whether the company will be able to meet its

long term financial obligations through total assets owned by the entity (Barham and et.al.,

2012).

The long term debts of Harvey have been increased from 245 in 2015 to 395 in 2016

(Appendix 6). Further, there is an increase of total assets by 402 as well. It has given rise to

increase in long term debt to total asset ratio from 0.15 in 2015 to 0.19 in 2016. The proportion

change in long term debt is more than that of change in the total assets. It can create problem for

the company if it is not able to payback the debts. Harvey in advised to increase the finances

through equity rather than debt. It will help to reduce the burden from the corporation and

decrease the long term debts of the company.

Long term asset to debt ratio of Harvey shows that the company will be able to manage

its long term debts with the assets in the current year. However, the more debt content increase

the obligation on Harvey and this amount have to be paid every year without failure.

8

Long term debt Total Assets

0

500

1000

1500

2000

2500

2016

2015

Illustration 7: Comparison of long term debt to total asset ratio

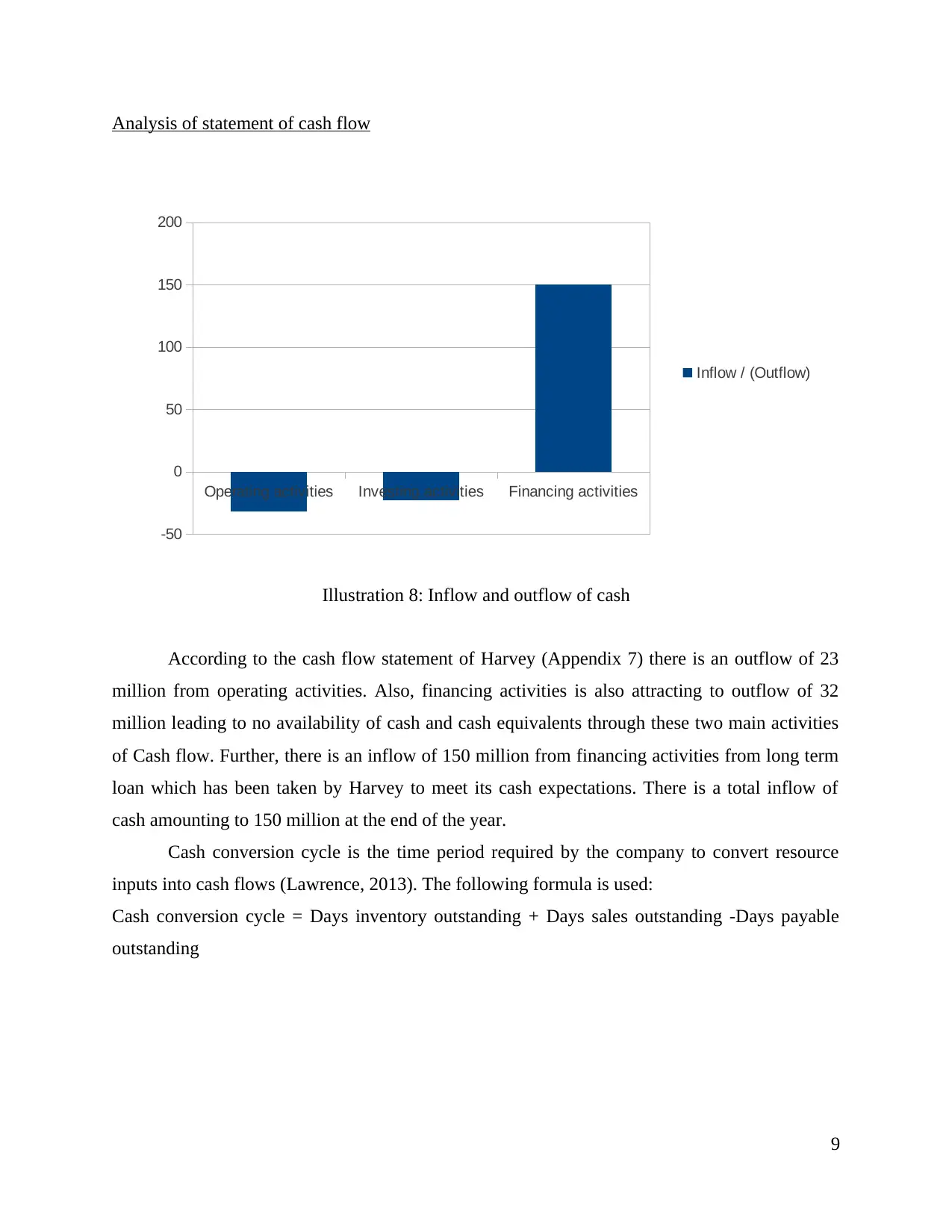

Analysis of statement of cash flow

According to the cash flow statement of Harvey (Appendix 7) there is an outflow of 23

million from operating activities. Also, financing activities is also attracting to outflow of 32

million leading to no availability of cash and cash equivalents through these two main activities

of Cash flow. Further, there is an inflow of 150 million from financing activities from long term

loan which has been taken by Harvey to meet its cash expectations. There is a total inflow of

cash amounting to 150 million at the end of the year.

Cash conversion cycle is the time period required by the company to convert resource

inputs into cash flows (Lawrence, 2013). The following formula is used:

Cash conversion cycle = Days inventory outstanding + Days sales outstanding -Days payable

outstanding

9

Operating activities Investing activities Financing activities

-50

0

50

100

150

200

Inflow / (Outflow)

Illustration 8: Inflow and outflow of cash

According to the cash flow statement of Harvey (Appendix 7) there is an outflow of 23

million from operating activities. Also, financing activities is also attracting to outflow of 32

million leading to no availability of cash and cash equivalents through these two main activities

of Cash flow. Further, there is an inflow of 150 million from financing activities from long term

loan which has been taken by Harvey to meet its cash expectations. There is a total inflow of

cash amounting to 150 million at the end of the year.

Cash conversion cycle is the time period required by the company to convert resource

inputs into cash flows (Lawrence, 2013). The following formula is used:

Cash conversion cycle = Days inventory outstanding + Days sales outstanding -Days payable

outstanding

9

Operating activities Investing activities Financing activities

-50

0

50

100

150

200

Inflow / (Outflow)

Illustration 8: Inflow and outflow of cash

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.