Analyzing Investments and Financial Ratios: A Report on Panini Ltd

VerifiedAdded on 2023/06/10

|11

|3303

|370

Report

AI Summary

This report provides a detailed financial analysis of Panini Ltd, a UK-based bread production company, focusing on its accounting department functions, financial factors for expansion, and financing methods. It assesses the company's financial health by calculating and analyzing key financial ratios for the years 2018 and 2019, including gross profit margin, operating profit margin, return on capital employed, current ratio, quick ratio, inventory turnover, receivables collection period, and payables payment period. The analysis offers insights into Panini Ltd's profitability, liquidity, and operational efficiency, along with recommendations for improving its financial performance. Desklib provides a platform for students to access this and other solved assignments.

Financial analysis

investing the company

Panini limited

investing the company

Panini limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

Task 1...............................................................................................................................................1

Part A: Accounting department and finance factors expansion...................................................1

Part B: Financing methods...........................................................................................................3

TASK 2............................................................................................................................................4

Part A: Using the right methods, calculate the eight ratios listed beneath..................................4

Part B: Personalized assessment of every ratio depending on section A's quantitative findings 6

CONCLUSION................................................................................................................................8

REFERENCES..............................................................................................................................10

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

Task 1...............................................................................................................................................1

Part A: Accounting department and finance factors expansion...................................................1

Part B: Financing methods...........................................................................................................3

TASK 2............................................................................................................................................4

Part A: Using the right methods, calculate the eight ratios listed beneath..................................4

Part B: Personalized assessment of every ratio depending on section A's quantitative findings 6

CONCLUSION................................................................................................................................8

REFERENCES..............................................................................................................................10

INTRODUCTION

A business is a governmental or commercial entity which works in advertising,

manufacturing, or technology (Ahmed, Manwani and Ahmed, 2018). Non-profit operations with

a philanthropic or community goal could be classified as a company. Some firms operate modest

enterprises within a specific company, while others are multi-industry behemoths. There are

many various kinds of businesses in modern environment. Small enterprises are those that are

run by a solitary entrepreneurial. They are frequently managed by a distinct independent

authority. Individuals with good financial understanding and decision-making abilities could

assess possibilities and make well-informed financial decisions, such as whether and how to save

and invest, evaluating expenses whilst completing a bigger purchase, and spending for the future

or other longer run goals. Panini ltd is a medium-sized firm based in the United Kingdom which

focuses in the production of bread for shops. The business began operations in 2016. The

company intends to extend its activities as a result of its existing success. Its gross worth is

presently £10723000.

Task 1

Part A: Accounting department and finance factors expansion

Accounting Department-

The observation, appraisal, and reporting of financial information by a corporation or

entity are referred to as financial accounting operations. In fundamental accounting or

first-level management, experts record, organize, and evaluate day-to-day corporate

operations. Financial accounting activities include systematic reporting, evaluating and

analysing, communicating results, and meeting legal standards. Panini ltd uses financial

accounting to assist its third-party suppliers. Financial statements are used by both

domestic and foreign entities to monitor Panini ltd's operations throughout period

(Ghesquiere, McAfee and Burnett, 2019).

Managerial accounting is the activity of identifying, monitoring, gathering, assessing,

arranging, and communicating data to help managers achieve corporate goals. It aids

executives in many aspects of their jobs, including budgeting, scheduling, recruiting,

directing, and monitoring. Accounting management tasks include maintaining data,

A business is a governmental or commercial entity which works in advertising,

manufacturing, or technology (Ahmed, Manwani and Ahmed, 2018). Non-profit operations with

a philanthropic or community goal could be classified as a company. Some firms operate modest

enterprises within a specific company, while others are multi-industry behemoths. There are

many various kinds of businesses in modern environment. Small enterprises are those that are

run by a solitary entrepreneurial. They are frequently managed by a distinct independent

authority. Individuals with good financial understanding and decision-making abilities could

assess possibilities and make well-informed financial decisions, such as whether and how to save

and invest, evaluating expenses whilst completing a bigger purchase, and spending for the future

or other longer run goals. Panini ltd is a medium-sized firm based in the United Kingdom which

focuses in the production of bread for shops. The business began operations in 2016. The

company intends to extend its activities as a result of its existing success. Its gross worth is

presently £10723000.

Task 1

Part A: Accounting department and finance factors expansion

Accounting Department-

The observation, appraisal, and reporting of financial information by a corporation or

entity are referred to as financial accounting operations. In fundamental accounting or

first-level management, experts record, organize, and evaluate day-to-day corporate

operations. Financial accounting activities include systematic reporting, evaluating and

analysing, communicating results, and meeting legal standards. Panini ltd uses financial

accounting to assist its third-party suppliers. Financial statements are used by both

domestic and foreign entities to monitor Panini ltd's operations throughout period

(Ghesquiere, McAfee and Burnett, 2019).

Managerial accounting is the activity of identifying, monitoring, gathering, assessing,

arranging, and communicating data to help managers achieve corporate goals. It aids

executives in many aspects of their jobs, including budgeting, scheduling, recruiting,

directing, and monitoring. Accounting management tasks include maintaining data,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

giving figures, appraising, and examining important data. Panini ltd uses management

accounting to plan, execute choices, collaborate, and control its business activities.

Taxes accounting is a field of accounting that works with the preparation and settlement

of taxes returns. Individuals, enterprises, companies, and other institutions all employ

taxes accounting. Taxes accounting covers profits, taxing expenses, charitable

contributions, and considerable appreciated gain on holdings. The accounting department

keeps track of all taxable financial resources owed to the business, throws away funds,

and ensures that refunds are made on time to prevent additional taxes. Panini Ltd.'s

accounting department keeps track of all taxable profits that must be given, prepares

aside cash, and ensures that refunds are done on time to prevent fiscal penalties (Guo and

Li, 2019).

Auditors accounting is a type of accounting which concentrates on risk

administration and expense reducing solutions. Auditor specialists, on either side, are

unbiased professionals who examine a firm's financial statements from the outside. The

auditor position assists in determining the appropriateness of company controls,

promoting proper managerial procedures, and ensuring compliance with legislation and

standards, among several other factors. The auditor division at Panini Ltd. adds to the

general performance of the corporation.

Finance Sector-

Investment is a monetary item purchased with the purpose of producing additional

income or being transmitted at a profit at a higher intrinsic benefit. Because the economy

is uncertain, planning the rate of interest is challenging. There seems to be a threat

component to examine in addition to the ambiguity. While predicting whenever the

potential supply would come, this sensitivity component is critical. While contemplating

investment options, it's important to evaluate both the expected yield and the risks

involved. Panini Ltd will gain from the investment feature in the future (Khemakhem and

Boujelbene, 2018).

The choice of ownership and acquired capital for a corporation's financial stability is

referred to as financing concerns. This is critical for the business entity's earnings, asset

reserves, and shareholder earnings development. Corporate assistance is required

whenever the financial worth of the firm's stock boosts; this not only signals the

accounting to plan, execute choices, collaborate, and control its business activities.

Taxes accounting is a field of accounting that works with the preparation and settlement

of taxes returns. Individuals, enterprises, companies, and other institutions all employ

taxes accounting. Taxes accounting covers profits, taxing expenses, charitable

contributions, and considerable appreciated gain on holdings. The accounting department

keeps track of all taxable financial resources owed to the business, throws away funds,

and ensures that refunds are made on time to prevent additional taxes. Panini Ltd.'s

accounting department keeps track of all taxable profits that must be given, prepares

aside cash, and ensures that refunds are done on time to prevent fiscal penalties (Guo and

Li, 2019).

Auditors accounting is a type of accounting which concentrates on risk

administration and expense reducing solutions. Auditor specialists, on either side, are

unbiased professionals who examine a firm's financial statements from the outside. The

auditor position assists in determining the appropriateness of company controls,

promoting proper managerial procedures, and ensuring compliance with legislation and

standards, among several other factors. The auditor division at Panini Ltd. adds to the

general performance of the corporation.

Finance Sector-

Investment is a monetary item purchased with the purpose of producing additional

income or being transmitted at a profit at a higher intrinsic benefit. Because the economy

is uncertain, planning the rate of interest is challenging. There seems to be a threat

component to examine in addition to the ambiguity. While predicting whenever the

potential supply would come, this sensitivity component is critical. While contemplating

investment options, it's important to evaluate both the expected yield and the risks

involved. Panini Ltd will gain from the investment feature in the future (Khemakhem and

Boujelbene, 2018).

The choice of ownership and acquired capital for a corporation's financial stability is

referred to as financing concerns. This is critical for the business entity's earnings, asset

reserves, and shareholder earnings development. Corporate assistance is required

whenever the financial worth of the firm's stock boosts; this not only signals the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company's success, but also considerably enhances shareholder income. The financing

section at Panini Ltd. provides a strong financial basis for asset management.

Dividends are payments made by firms to shareholders who meet specific criteria. A

corporation's leadership board determines the dividend instalments and quantities.

Investors receive income from publicly traded corporations in exchange for their

contribution. The fiscal implementing job is to supervise the optimum payment strategy

for the firm's profitability. As a consequence, the corporation benefits from the highest

dividend payback ratio. It is normal to provide periodical rewards in the case of success.

Another approach is to offer existing stockholders additional shares. The payment

method allows Panini Ltd. to satisfy its shareholders' expectations (Koukal and Piel,

2017).

Working capital is used to finance activities and cover short-term obligations. A business

with sufficient working capital can reimburse its workers and suppliers, and also meeting

extra responsibilities like taxes and charges, even if it faced with monetary flow

difficulties. Working capital may be beneficial in balancing earnings swings. Some

enterprises endure seasonal revenue fluctuations, with some periods being more

profitable than some others. A corporation with sufficient cash flow could increase its

buying from suppliers before of busy seasons while yet paying its financial liabilities

during quiet periods. The working capital element aids Panini Ltd. in efficiently

managing its assets.

Part B: Financing methods

The sources of funds is utilised to fund company operations such as functioning and

administering them. In the accompanying scenario, Panini Ltd. manages its company activities

using several kinds of money accessible to the company. Ownership, borrowing, operating

capacity loans, period loans, and other types of financing are available. Such finances are utilised

to support commercial operations as well as the growth of company operations. It's likewise

important for the company's advertising and commercial initiatives. Such initiatives promote

creativity, ownership excellence, and monetary assistance. There are 2 kinds of funding available

which are described below:

Short-term financing: It is used to settle down financial commitments that are regarded

for the firm's short-term borrowing. It assists in the administration of surplus cash flow.

section at Panini Ltd. provides a strong financial basis for asset management.

Dividends are payments made by firms to shareholders who meet specific criteria. A

corporation's leadership board determines the dividend instalments and quantities.

Investors receive income from publicly traded corporations in exchange for their

contribution. The fiscal implementing job is to supervise the optimum payment strategy

for the firm's profitability. As a consequence, the corporation benefits from the highest

dividend payback ratio. It is normal to provide periodical rewards in the case of success.

Another approach is to offer existing stockholders additional shares. The payment

method allows Panini Ltd. to satisfy its shareholders' expectations (Koukal and Piel,

2017).

Working capital is used to finance activities and cover short-term obligations. A business

with sufficient working capital can reimburse its workers and suppliers, and also meeting

extra responsibilities like taxes and charges, even if it faced with monetary flow

difficulties. Working capital may be beneficial in balancing earnings swings. Some

enterprises endure seasonal revenue fluctuations, with some periods being more

profitable than some others. A corporation with sufficient cash flow could increase its

buying from suppliers before of busy seasons while yet paying its financial liabilities

during quiet periods. The working capital element aids Panini Ltd. in efficiently

managing its assets.

Part B: Financing methods

The sources of funds is utilised to fund company operations such as functioning and

administering them. In the accompanying scenario, Panini Ltd. manages its company activities

using several kinds of money accessible to the company. Ownership, borrowing, operating

capacity loans, period loans, and other types of financing are available. Such finances are utilised

to support commercial operations as well as the growth of company operations. It's likewise

important for the company's advertising and commercial initiatives. Such initiatives promote

creativity, ownership excellence, and monetary assistance. There are 2 kinds of funding available

which are described below:

Short-term financing: It is used to settle down financial commitments that are regarded

for the firm's short-term borrowing. It assists in the administration of surplus cash flow.

Working capital financing, account receivables, and financial institution borrowing are

examples of short-term financing (Montford and Goldsmith, 2016).

Long-term funding: This type of financing is being employed to fund company

functions and processes that are linked to the company's long-term performance. Long-

term funding is primarily utilised for projects that a company will pursue in terms of

enhancing its competitiveness.

TASK 2

Part A: Using the right methods, calculate the eight ratios listed beneath

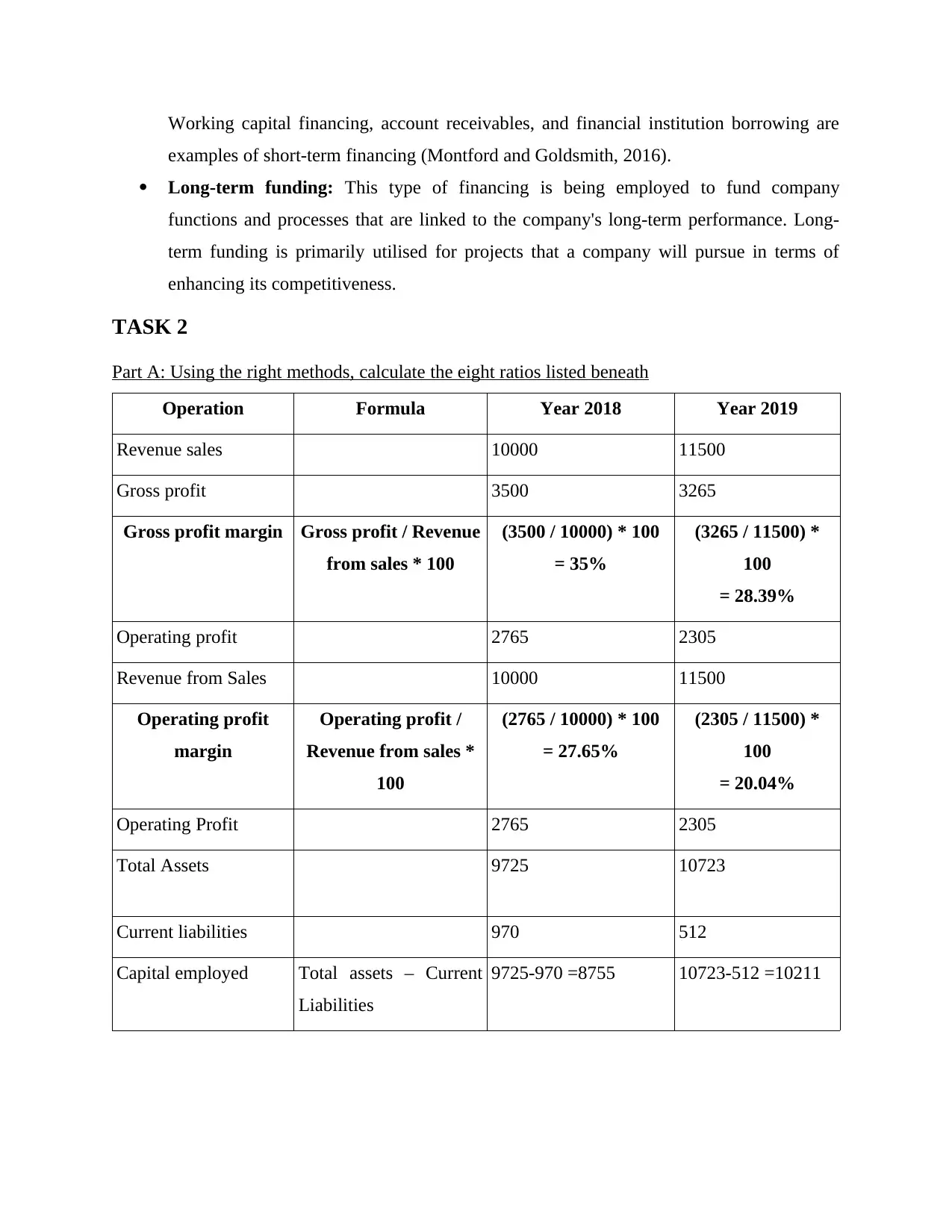

Operation Formula Year 2018 Year 2019

Revenue sales 10000 11500

Gross profit 3500 3265

Gross profit margin Gross profit / Revenue

from sales * 100

(3500 / 10000) * 100

= 35%

(3265 / 11500) *

100

= 28.39%

Operating profit 2765 2305

Revenue from Sales 10000 11500

Operating profit

margin

Operating profit /

Revenue from sales *

100

(2765 / 10000) * 100

= 27.65%

(2305 / 11500) *

100

= 20.04%

Operating Profit 2765 2305

Total Assets 9725 10723

Current liabilities 970 512

Capital employed Total assets – Current

Liabilities

9725-970 =8755 10723-512 =10211

examples of short-term financing (Montford and Goldsmith, 2016).

Long-term funding: This type of financing is being employed to fund company

functions and processes that are linked to the company's long-term performance. Long-

term funding is primarily utilised for projects that a company will pursue in terms of

enhancing its competitiveness.

TASK 2

Part A: Using the right methods, calculate the eight ratios listed beneath

Operation Formula Year 2018 Year 2019

Revenue sales 10000 11500

Gross profit 3500 3265

Gross profit margin Gross profit / Revenue

from sales * 100

(3500 / 10000) * 100

= 35%

(3265 / 11500) *

100

= 28.39%

Operating profit 2765 2305

Revenue from Sales 10000 11500

Operating profit

margin

Operating profit /

Revenue from sales *

100

(2765 / 10000) * 100

= 27.65%

(2305 / 11500) *

100

= 20.04%

Operating Profit 2765 2305

Total Assets 9725 10723

Current liabilities 970 512

Capital employed Total assets – Current

Liabilities

9725-970 =8755 10723-512 =10211

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

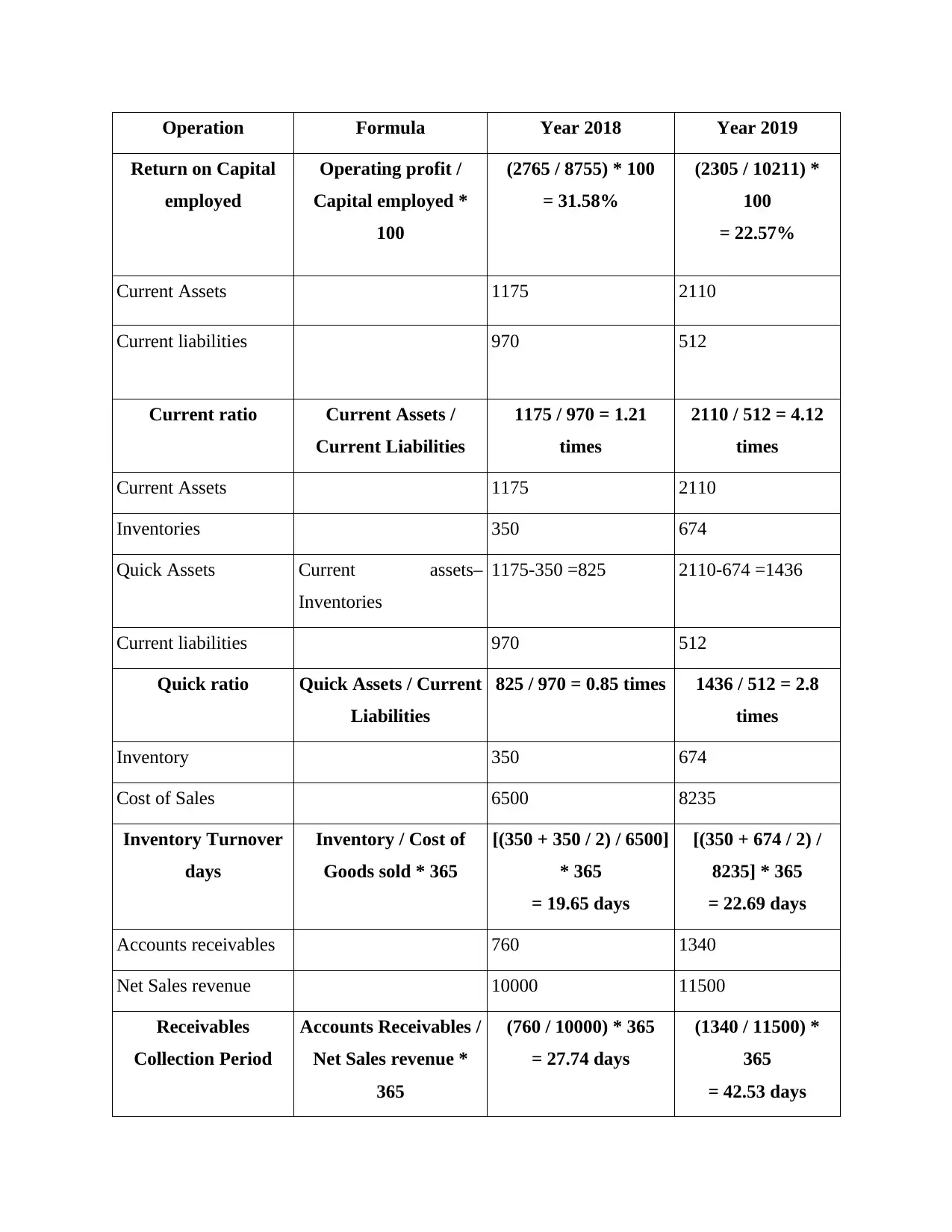

Operation Formula Year 2018 Year 2019

Return on Capital

employed

Operating profit /

Capital employed *

100

(2765 / 8755) * 100

= 31.58%

(2305 / 10211) *

100

= 22.57%

Current Assets 1175 2110

Current liabilities 970 512

Current ratio Current Assets /

Current Liabilities

1175 / 970 = 1.21

times

2110 / 512 = 4.12

times

Current Assets 1175 2110

Inventories 350 674

Quick Assets Current assets–

Inventories

1175-350 =825 2110-674 =1436

Current liabilities 970 512

Quick ratio Quick Assets / Current

Liabilities

825 / 970 = 0.85 times 1436 / 512 = 2.8

times

Inventory 350 674

Cost of Sales 6500 8235

Inventory Turnover

days

Inventory / Cost of

Goods sold * 365

[(350 + 350 / 2) / 6500]

* 365

= 19.65 days

[(350 + 674 / 2) /

8235] * 365

= 22.69 days

Accounts receivables 760 1340

Net Sales revenue 10000 11500

Receivables

Collection Period

Accounts Receivables /

Net Sales revenue *

365

(760 / 10000) * 365

= 27.74 days

(1340 / 11500) *

365

= 42.53 days

Return on Capital

employed

Operating profit /

Capital employed *

100

(2765 / 8755) * 100

= 31.58%

(2305 / 10211) *

100

= 22.57%

Current Assets 1175 2110

Current liabilities 970 512

Current ratio Current Assets /

Current Liabilities

1175 / 970 = 1.21

times

2110 / 512 = 4.12

times

Current Assets 1175 2110

Inventories 350 674

Quick Assets Current assets–

Inventories

1175-350 =825 2110-674 =1436

Current liabilities 970 512

Quick ratio Quick Assets / Current

Liabilities

825 / 970 = 0.85 times 1436 / 512 = 2.8

times

Inventory 350 674

Cost of Sales 6500 8235

Inventory Turnover

days

Inventory / Cost of

Goods sold * 365

[(350 + 350 / 2) / 6500]

* 365

= 19.65 days

[(350 + 674 / 2) /

8235] * 365

= 22.69 days

Accounts receivables 760 1340

Net Sales revenue 10000 11500

Receivables

Collection Period

Accounts Receivables /

Net Sales revenue *

365

(760 / 10000) * 365

= 27.74 days

(1340 / 11500) *

365

= 42.53 days

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

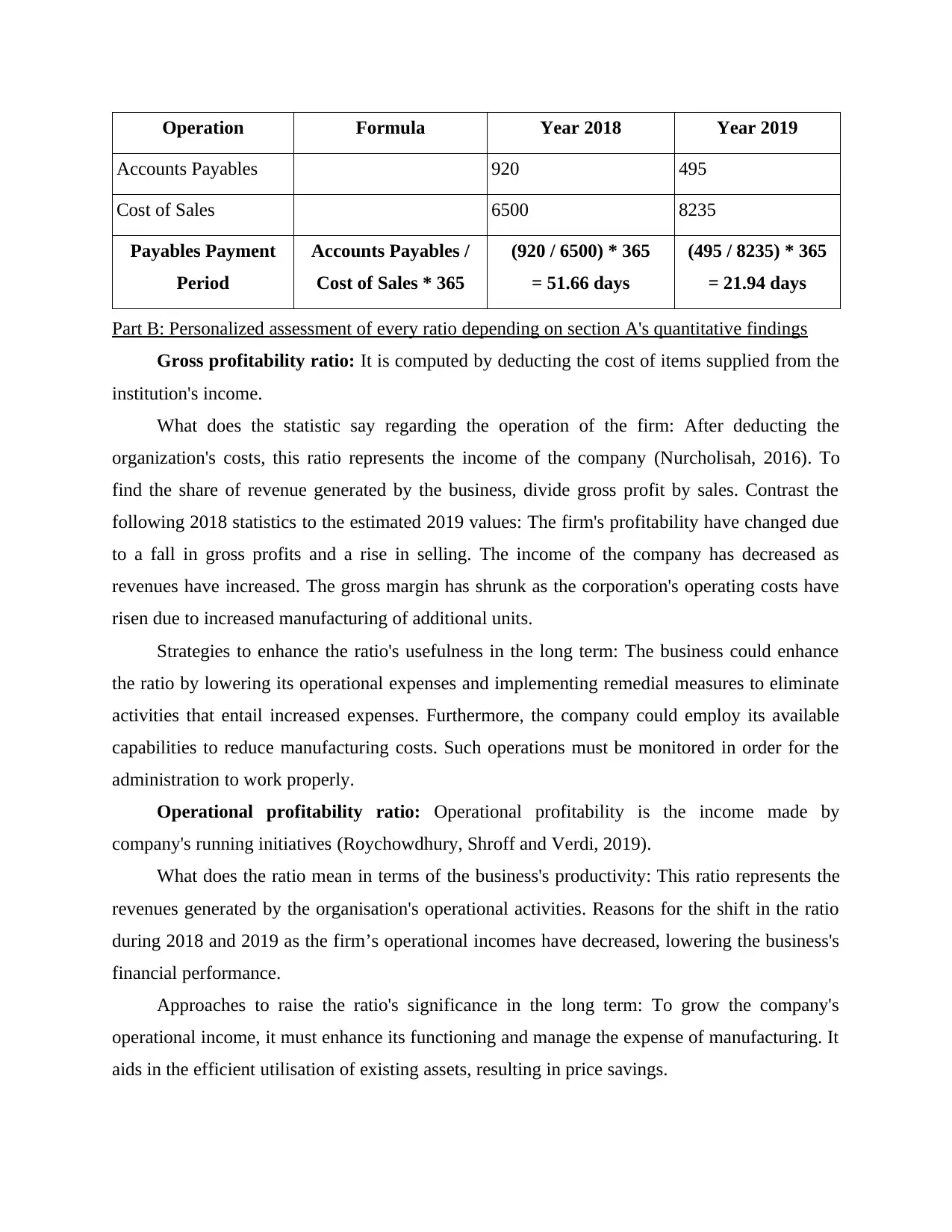

Operation Formula Year 2018 Year 2019

Accounts Payables 920 495

Cost of Sales 6500 8235

Payables Payment

Period

Accounts Payables /

Cost of Sales * 365

(920 / 6500) * 365

= 51.66 days

(495 / 8235) * 365

= 21.94 days

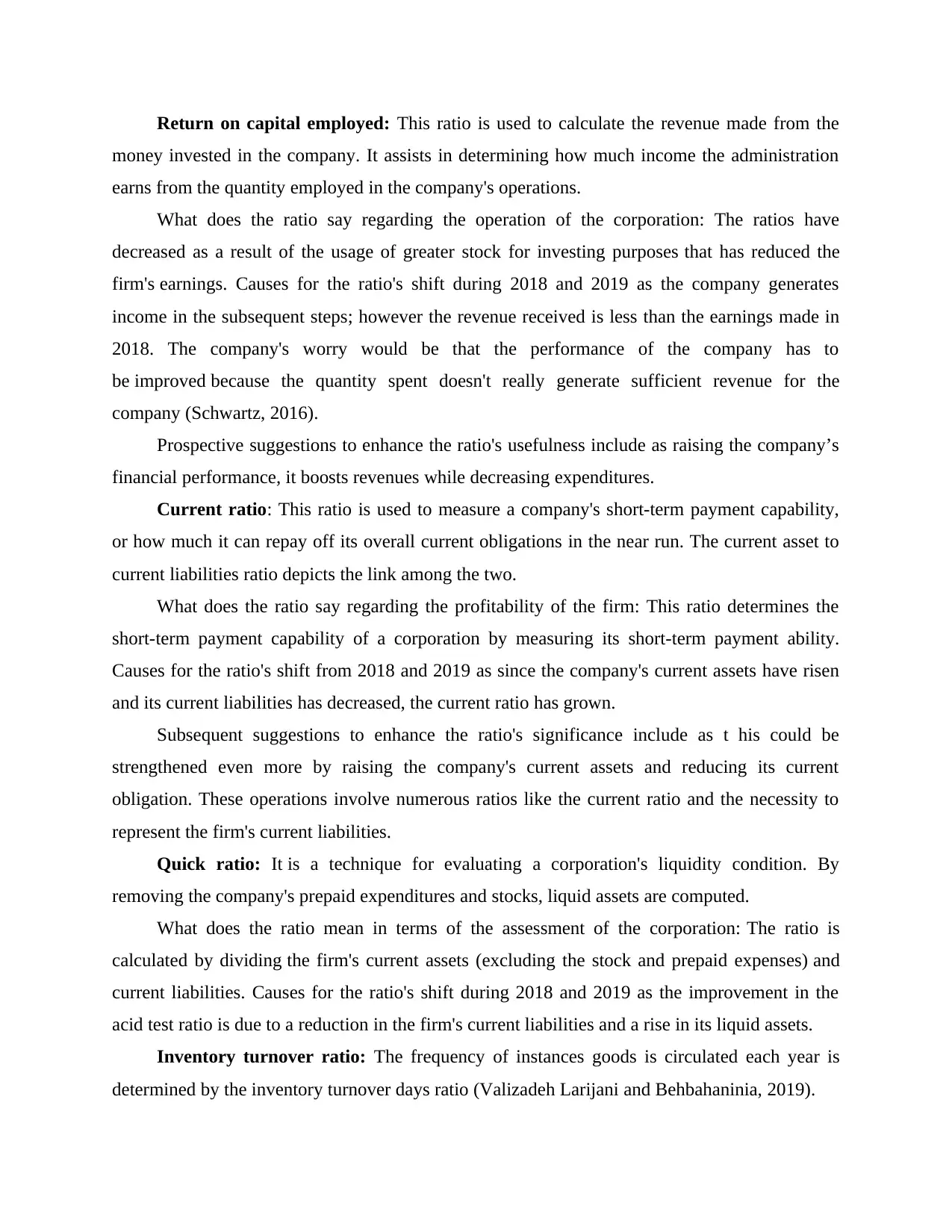

Part B: Personalized assessment of every ratio depending on section A's quantitative findings

Gross profitability ratio: It is computed by deducting the cost of items supplied from the

institution's income.

What does the statistic say regarding the operation of the firm: After deducting the

organization's costs, this ratio represents the income of the company (Nurcholisah, 2016). To

find the share of revenue generated by the business, divide gross profit by sales. Contrast the

following 2018 statistics to the estimated 2019 values: The firm's profitability have changed due

to a fall in gross profits and a rise in selling. The income of the company has decreased as

revenues have increased. The gross margin has shrunk as the corporation's operating costs have

risen due to increased manufacturing of additional units.

Strategies to enhance the ratio's usefulness in the long term: The business could enhance

the ratio by lowering its operational expenses and implementing remedial measures to eliminate

activities that entail increased expenses. Furthermore, the company could employ its available

capabilities to reduce manufacturing costs. Such operations must be monitored in order for the

administration to work properly.

Operational profitability ratio: Operational profitability is the income made by

company's running initiatives (Roychowdhury, Shroff and Verdi, 2019).

What does the ratio mean in terms of the business's productivity: This ratio represents the

revenues generated by the organisation's operational activities. Reasons for the shift in the ratio

during 2018 and 2019 as the firm’s operational incomes have decreased, lowering the business's

financial performance.

Approaches to raise the ratio's significance in the long term: To grow the company's

operational income, it must enhance its functioning and manage the expense of manufacturing. It

aids in the efficient utilisation of existing assets, resulting in price savings.

Accounts Payables 920 495

Cost of Sales 6500 8235

Payables Payment

Period

Accounts Payables /

Cost of Sales * 365

(920 / 6500) * 365

= 51.66 days

(495 / 8235) * 365

= 21.94 days

Part B: Personalized assessment of every ratio depending on section A's quantitative findings

Gross profitability ratio: It is computed by deducting the cost of items supplied from the

institution's income.

What does the statistic say regarding the operation of the firm: After deducting the

organization's costs, this ratio represents the income of the company (Nurcholisah, 2016). To

find the share of revenue generated by the business, divide gross profit by sales. Contrast the

following 2018 statistics to the estimated 2019 values: The firm's profitability have changed due

to a fall in gross profits and a rise in selling. The income of the company has decreased as

revenues have increased. The gross margin has shrunk as the corporation's operating costs have

risen due to increased manufacturing of additional units.

Strategies to enhance the ratio's usefulness in the long term: The business could enhance

the ratio by lowering its operational expenses and implementing remedial measures to eliminate

activities that entail increased expenses. Furthermore, the company could employ its available

capabilities to reduce manufacturing costs. Such operations must be monitored in order for the

administration to work properly.

Operational profitability ratio: Operational profitability is the income made by

company's running initiatives (Roychowdhury, Shroff and Verdi, 2019).

What does the ratio mean in terms of the business's productivity: This ratio represents the

revenues generated by the organisation's operational activities. Reasons for the shift in the ratio

during 2018 and 2019 as the firm’s operational incomes have decreased, lowering the business's

financial performance.

Approaches to raise the ratio's significance in the long term: To grow the company's

operational income, it must enhance its functioning and manage the expense of manufacturing. It

aids in the efficient utilisation of existing assets, resulting in price savings.

Return on capital employed: This ratio is used to calculate the revenue made from the

money invested in the company. It assists in determining how much income the administration

earns from the quantity employed in the company's operations.

What does the ratio say regarding the operation of the corporation: The ratios have

decreased as a result of the usage of greater stock for investing purposes that has reduced the

firm's earnings. Causes for the ratio's shift during 2018 and 2019 as the company generates

income in the subsequent steps; however the revenue received is less than the earnings made in

2018. The company's worry would be that the performance of the company has to

be improved because the quantity spent doesn't really generate sufficient revenue for the

company (Schwartz, 2016).

Prospective suggestions to enhance the ratio's usefulness include as raising the company’s

financial performance, it boosts revenues while decreasing expenditures.

Current ratio: This ratio is used to measure a company's short-term payment capability,

or how much it can repay off its overall current obligations in the near run. The current asset to

current liabilities ratio depicts the link among the two.

What does the ratio say regarding the profitability of the firm: This ratio determines the

short-term payment capability of a corporation by measuring its short-term payment ability.

Causes for the ratio's shift from 2018 and 2019 as since the company's current assets have risen

and its current liabilities has decreased, the current ratio has grown.

Subsequent suggestions to enhance the ratio's significance include as t his could be

strengthened even more by raising the company's current assets and reducing its current

obligation. These operations involve numerous ratios like the current ratio and the necessity to

represent the firm's current liabilities.

Quick ratio: It is a technique for evaluating a corporation's liquidity condition. By

removing the company's prepaid expenditures and stocks, liquid assets are computed.

What does the ratio mean in terms of the assessment of the corporation: The ratio is

calculated by dividing the firm's current assets (excluding the stock and prepaid expenses) and

current liabilities. Causes for the ratio's shift during 2018 and 2019 as the improvement in the

acid test ratio is due to a reduction in the firm's current liabilities and a rise in its liquid assets.

Inventory turnover ratio: The frequency of instances goods is circulated each year is

determined by the inventory turnover days ratio (Valizadeh Larijani and Behbahaninia, 2019).

money invested in the company. It assists in determining how much income the administration

earns from the quantity employed in the company's operations.

What does the ratio say regarding the operation of the corporation: The ratios have

decreased as a result of the usage of greater stock for investing purposes that has reduced the

firm's earnings. Causes for the ratio's shift during 2018 and 2019 as the company generates

income in the subsequent steps; however the revenue received is less than the earnings made in

2018. The company's worry would be that the performance of the company has to

be improved because the quantity spent doesn't really generate sufficient revenue for the

company (Schwartz, 2016).

Prospective suggestions to enhance the ratio's usefulness include as raising the company’s

financial performance, it boosts revenues while decreasing expenditures.

Current ratio: This ratio is used to measure a company's short-term payment capability,

or how much it can repay off its overall current obligations in the near run. The current asset to

current liabilities ratio depicts the link among the two.

What does the ratio say regarding the profitability of the firm: This ratio determines the

short-term payment capability of a corporation by measuring its short-term payment ability.

Causes for the ratio's shift from 2018 and 2019 as since the company's current assets have risen

and its current liabilities has decreased, the current ratio has grown.

Subsequent suggestions to enhance the ratio's significance include as t his could be

strengthened even more by raising the company's current assets and reducing its current

obligation. These operations involve numerous ratios like the current ratio and the necessity to

represent the firm's current liabilities.

Quick ratio: It is a technique for evaluating a corporation's liquidity condition. By

removing the company's prepaid expenditures and stocks, liquid assets are computed.

What does the ratio mean in terms of the assessment of the corporation: The ratio is

calculated by dividing the firm's current assets (excluding the stock and prepaid expenses) and

current liabilities. Causes for the ratio's shift during 2018 and 2019 as the improvement in the

acid test ratio is due to a reduction in the firm's current liabilities and a rise in its liquid assets.

Inventory turnover ratio: The frequency of instances goods is circulated each year is

determined by the inventory turnover days ratio (Valizadeh Larijani and Behbahaninia, 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

What does the ratio mean for the business's effectiveness: It aids in determining how much

revenue the business would be likely to make in a given amount of duration. Causes for the

ratio's shift during 2018 and 2019 as in the accompanying example, the determined ratio is used

to evaluate the rise in the company related expense of products supplied.

Subsequent approaches to enhance the ratio's significance: The company could opt to

minimise the stock accessible in the administration to maximise stock turnover.

Debtor collecting period- This ratio influences how long it takes the company to figure

out how much money it owes to its borrowers.

What does the ratio say regarding the profitability of the firm: The company related selling

have increased as the organization's selling has increased. Causes for the ratio's shift during 2018

and 2019 as the firm's trade receivables have grown.

Methods to raise the ratio's significance in the long term value: The ratios have grown as

the range of weeks in the company has climbed, and the length of days has also grown as sales

have grown.

Creditor's collecting period- This ratio defines how long it takes the administration to

pay the sum owed to its lenders. The amount of days it required to repay off its debtors is

likewise determined by this.

What does the ratio signify for the firm's earnings: It signifies that the duration it takes to

repay off its lenders has decreased, implying that the money would be given increasingly often.

Causes for the ratio's shift from 2018 and 2019 as the ratio has fallen as the firm's accounts

payable have fallen and its expense of goods sold has increased (Yuniningsih, Pertiwi and

Purwanto, 2019).

Prospective suggestions to enhance the ratio's usefulness include: This ratio aids in

measuring the efficacy of company's activity. The collecting of money must be done in a shorter

time frame, increasing the volume of contributions accessible.

CONCLUSION

According to the aforesaid assessment, Panini Ltd.'s efficiency and many roles require

further investigation. It additionally identifies places wherein the company has to improve. Such

activities contribute to the organization's long-term success. Different ratios are also computed to

estimate the fiscal condition of the company, with the goal of maintaining and increasing

revenue.

revenue the business would be likely to make in a given amount of duration. Causes for the

ratio's shift during 2018 and 2019 as in the accompanying example, the determined ratio is used

to evaluate the rise in the company related expense of products supplied.

Subsequent approaches to enhance the ratio's significance: The company could opt to

minimise the stock accessible in the administration to maximise stock turnover.

Debtor collecting period- This ratio influences how long it takes the company to figure

out how much money it owes to its borrowers.

What does the ratio say regarding the profitability of the firm: The company related selling

have increased as the organization's selling has increased. Causes for the ratio's shift during 2018

and 2019 as the firm's trade receivables have grown.

Methods to raise the ratio's significance in the long term value: The ratios have grown as

the range of weeks in the company has climbed, and the length of days has also grown as sales

have grown.

Creditor's collecting period- This ratio defines how long it takes the administration to

pay the sum owed to its lenders. The amount of days it required to repay off its debtors is

likewise determined by this.

What does the ratio signify for the firm's earnings: It signifies that the duration it takes to

repay off its lenders has decreased, implying that the money would be given increasingly often.

Causes for the ratio's shift from 2018 and 2019 as the ratio has fallen as the firm's accounts

payable have fallen and its expense of goods sold has increased (Yuniningsih, Pertiwi and

Purwanto, 2019).

Prospective suggestions to enhance the ratio's usefulness include: This ratio aids in

measuring the efficacy of company's activity. The collecting of money must be done in a shorter

time frame, increasing the volume of contributions accessible.

CONCLUSION

According to the aforesaid assessment, Panini Ltd.'s efficiency and many roles require

further investigation. It additionally identifies places wherein the company has to improve. Such

activities contribute to the organization's long-term success. Different ratios are also computed to

estimate the fiscal condition of the company, with the goal of maintaining and increasing

revenue.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Ahmed, F., Manwani, A. and Ahmed, S., 2018. Merger & acquisition strategy for growth,

improved performance and survival in the financial sector. Jurnal Perspektif

Pembiayaan Dan Pembangunan Daerah, 5(4), pp.196-214.

Ghesquiere, A.R., McAfee, C. and Burnett, J., 2019. Measures of financial capacity: A review.

The Gerontologist, 59(2), pp.e109-e129.

Guo, X. and Li, J., 2019, October. A novel twitter sentiment analysis model with baseline

correlation for financial market prediction with improved efficiency. In 2019 Sixth

International Conference on Social Networks Analysis, Management and Security

(SNAMS) (pp. 472-477). IEEE.

Khemakhem, S. and Boujelbene, Y., 2018. Predicting credit risk on the basis of financial and

non-financial variables and data mining. Review of Accounting and Finance.

Koukal, A. and Piel, J.H., 2017. HICSS-Financial Decision Support System for Wind Energy–

Analysis of Mexican Projects and a Support Scheme Concept. In Proceedings of the

50th Hawaii International Conference on System Sciences 2017 (pp. 972-981).

Honolulu: Hawaii International Conference on System Sciences.

Montford, W. and Goldsmith, R.E., 2016. How gender and financial self‐efficacy influence

investment risk taking. International Journal of Consumer Studies, 40(1), pp.101-106.

Nurcholisah, K., 2016. The effects of financial reporting quality on information asymmetry and

its impacts on investment efficiency.

Roychowdhury, S., Shroff, N. and Verdi, R. S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and Economics.

68(2-3). p.101246.

Schwartz, M.S., 2016. Ethical decision-making theory: An integrated approach. Journal of

Business Ethics, 139(4), pp.755-776.

Valizadeh Larijani, A. and Behbahaninia, P.S., 2019. Investigation of Effective Items on Stock

Return: Different Aspects effecting on Decision Making. Journal of Financial

Accounting Knowledge. 5(4). pp.69-102.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2),

pp.205-216.

Books and journals

Ahmed, F., Manwani, A. and Ahmed, S., 2018. Merger & acquisition strategy for growth,

improved performance and survival in the financial sector. Jurnal Perspektif

Pembiayaan Dan Pembangunan Daerah, 5(4), pp.196-214.

Ghesquiere, A.R., McAfee, C. and Burnett, J., 2019. Measures of financial capacity: A review.

The Gerontologist, 59(2), pp.e109-e129.

Guo, X. and Li, J., 2019, October. A novel twitter sentiment analysis model with baseline

correlation for financial market prediction with improved efficiency. In 2019 Sixth

International Conference on Social Networks Analysis, Management and Security

(SNAMS) (pp. 472-477). IEEE.

Khemakhem, S. and Boujelbene, Y., 2018. Predicting credit risk on the basis of financial and

non-financial variables and data mining. Review of Accounting and Finance.

Koukal, A. and Piel, J.H., 2017. HICSS-Financial Decision Support System for Wind Energy–

Analysis of Mexican Projects and a Support Scheme Concept. In Proceedings of the

50th Hawaii International Conference on System Sciences 2017 (pp. 972-981).

Honolulu: Hawaii International Conference on System Sciences.

Montford, W. and Goldsmith, R.E., 2016. How gender and financial self‐efficacy influence

investment risk taking. International Journal of Consumer Studies, 40(1), pp.101-106.

Nurcholisah, K., 2016. The effects of financial reporting quality on information asymmetry and

its impacts on investment efficiency.

Roychowdhury, S., Shroff, N. and Verdi, R. S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and Economics.

68(2-3). p.101246.

Schwartz, M.S., 2016. Ethical decision-making theory: An integrated approach. Journal of

Business Ethics, 139(4), pp.755-776.

Valizadeh Larijani, A. and Behbahaninia, P.S., 2019. Investigation of Effective Items on Stock

Return: Different Aspects effecting on Decision Making. Journal of Financial

Accounting Knowledge. 5(4). pp.69-102.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2),

pp.205-216.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.