Financial Decision Making

VerifiedAdded on 2023/01/12

|18

|4569

|34

AI Summary

This document provides an overview of financial decision-making in the context of the UK coffee house industry. It includes an industry review, business performance analysis, and investment appraisal techniques. The document also discusses the importance of financial decision-making in business.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Decision Making

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

EXECUTIVE SUMMARY.........................................................................................................................3

PART 1: Industry Review...........................................................................................................................3

Current UK coffee house industry...........................................................................................................3

PART 2: Business Performance Analysis....................................................................................................4

2.1 Statement of profit & loss..................................................................................................................4

2.2 Statement of financial position..........................................................................................................5

2.3 Statement of cash flow.......................................................................................................................7

PART 3 Investment Appraisal Techniques..................................................................................................9

3.1 (a) Management Appraisal.................................................................................................................9

3.2 (b) Investment Appraisal.................................................................................................................10

Source of finance...................................................................................................................................11

REFERENCES..........................................................................................................................................13

EXECUTIVE SUMMARY.........................................................................................................................3

PART 1: Industry Review...........................................................................................................................3

Current UK coffee house industry...........................................................................................................3

PART 2: Business Performance Analysis....................................................................................................4

2.1 Statement of profit & loss..................................................................................................................4

2.2 Statement of financial position..........................................................................................................5

2.3 Statement of cash flow.......................................................................................................................7

PART 3 Investment Appraisal Techniques..................................................................................................9

3.1 (a) Management Appraisal.................................................................................................................9

3.2 (b) Investment Appraisal.................................................................................................................10

Source of finance...................................................................................................................................11

REFERENCES..........................................................................................................................................13

EXECUTIVE SUMMARY

Financial decision-making refers to a systemic mechanism that leads to decisions related

to the obligations, securities and stock funds of companies. This section highlights the analysis of

Roast Ltd, the UK cafe chain's financial statements and other fiscal details to support Starbucks

in decision-making about the purchase of this coffee chain. The employee of fund department of

star bucks is asked by the Chief Financial Officer to reevaluate the budget and beauty of their

enterprise to obtain it later on. With this function all of the accounts are assessed which is why

ratios like net, gross and operating profit, debt fairness, current, quick ratios together side

operating cycle are all calculated. The organization decided to invest approximately 500 GPM

from the company also to ascertain the sustainability of the investment different methods are

used. The thing must arrange fund to invest in the projected job for that reason the direction is

suggested to have a financial loan by a bank in order that aims associated with job might

possibly be achieved successfully.

PART 1: Industry Review

Current UK coffee house industry

UK's coffee shop business is strong sufficiently encourage the growth of the nation as

whole. In addition to evaluate the industry analysis of it the following items may be regarded:

• As per a study, efficiency to the team of the coffee market in the GDP for the year 2017 was

approximately 3.7 billion pounds (Ahmed and Saravanaraj, 2016)

• It was projected that in the years ahead the company's sales would grow by 4.8 per cent as well

as the sum total of them would be about 6.6 billion pounds.

• There are also many organizations working in this field. Those are Raost Ltd., Espresso State.

Mcdonalds, Costa Coffee, Cafe 2U, Biscuit Break, Caffe Ritazza, Puccino's, Caffe Nero, etc.

• The real possibility available to organizations functioning in this business is to introduce these

espresso or other flavored coffee of it that are better suited to couch potatoes as they neglect milk

hot chocolate.

Financial decision-making refers to a systemic mechanism that leads to decisions related

to the obligations, securities and stock funds of companies. This section highlights the analysis of

Roast Ltd, the UK cafe chain's financial statements and other fiscal details to support Starbucks

in decision-making about the purchase of this coffee chain. The employee of fund department of

star bucks is asked by the Chief Financial Officer to reevaluate the budget and beauty of their

enterprise to obtain it later on. With this function all of the accounts are assessed which is why

ratios like net, gross and operating profit, debt fairness, current, quick ratios together side

operating cycle are all calculated. The organization decided to invest approximately 500 GPM

from the company also to ascertain the sustainability of the investment different methods are

used. The thing must arrange fund to invest in the projected job for that reason the direction is

suggested to have a financial loan by a bank in order that aims associated with job might

possibly be achieved successfully.

PART 1: Industry Review

Current UK coffee house industry

UK's coffee shop business is strong sufficiently encourage the growth of the nation as

whole. In addition to evaluate the industry analysis of it the following items may be regarded:

• As per a study, efficiency to the team of the coffee market in the GDP for the year 2017 was

approximately 3.7 billion pounds (Ahmed and Saravanaraj, 2016)

• It was projected that in the years ahead the company's sales would grow by 4.8 per cent as well

as the sum total of them would be about 6.6 billion pounds.

• There are also many organizations working in this field. Those are Raost Ltd., Espresso State.

Mcdonalds, Costa Coffee, Cafe 2U, Biscuit Break, Caffe Ritazza, Puccino's, Caffe Nero, etc.

• The real possibility available to organizations functioning in this business is to introduce these

espresso or other flavored coffee of it that are better suited to couch potatoes as they neglect milk

hot chocolate.

This sector faces various types of problems as well as challenges that create problem in

current time.

In present time this sector enhances their business activities at international level such as,

China, Australia and other markets.

Over the past some time the company has been increased rapidly because of enhance

demand of coffee culture which is most prominent.

Industry sales is projected to increase at a compounded annualized rate of 4.8 percent

over five years from 2019-20, plus 1.9 percent growth during current year, to around £6.6

billion.

PART 2: Business Performance Analysis

2.1 Statement of profit & loss

The analysis of P&L statements involves analysing the various line components in a

statement, as well as drives the development for particular items listed across several intervals.

This technique is used to recognize the price structure of a corporation, and its profit-making

ability. All the company factors create accounts on annual base for the role of recording most of

the direct, indirect, operating and non operating expenses together side incomes therefore that

adulthood might possibly be projected. As a way to pull many investors it's essential for the

organization to be certain its own income invoice is formed in orderly manner to ensure outside

parties may gauge the probable yields that might possibly be generated by these (Almenberg and

Dreber, 2015). In this framework, Roast Ltd 's revenue-statement analysis describes the company

's average has enhanced from £2022000 to £2534000 (25.32 percent growth) between 2017 and

2018, while the company's sales costs have altered from £1505000 to £1990000 between 2017

and 2018. Operating income for the Company in 2018 was 60,000. On the other side operating

costs increased from £ 466,000 in 2017 to £477,000 in 2018. During 2018 and 2017, Roast Ltd

reported operating profit of 127000 and 51000 signifying an upward pattern, in both. In 2018 and

2017 in both, the as a whole net profit of the company was 81000 and 36000, that also

demonstrates that the economic profit level of the corporation has been doubled. For the purpose

of assessing financial performance of the business subsequent ratios are computed:

current time.

In present time this sector enhances their business activities at international level such as,

China, Australia and other markets.

Over the past some time the company has been increased rapidly because of enhance

demand of coffee culture which is most prominent.

Industry sales is projected to increase at a compounded annualized rate of 4.8 percent

over five years from 2019-20, plus 1.9 percent growth during current year, to around £6.6

billion.

PART 2: Business Performance Analysis

2.1 Statement of profit & loss

The analysis of P&L statements involves analysing the various line components in a

statement, as well as drives the development for particular items listed across several intervals.

This technique is used to recognize the price structure of a corporation, and its profit-making

ability. All the company factors create accounts on annual base for the role of recording most of

the direct, indirect, operating and non operating expenses together side incomes therefore that

adulthood might possibly be projected. As a way to pull many investors it's essential for the

organization to be certain its own income invoice is formed in orderly manner to ensure outside

parties may gauge the probable yields that might possibly be generated by these (Almenberg and

Dreber, 2015). In this framework, Roast Ltd 's revenue-statement analysis describes the company

's average has enhanced from £2022000 to £2534000 (25.32 percent growth) between 2017 and

2018, while the company's sales costs have altered from £1505000 to £1990000 between 2017

and 2018. Operating income for the Company in 2018 was 60,000. On the other side operating

costs increased from £ 466,000 in 2017 to £477,000 in 2018. During 2018 and 2017, Roast Ltd

reported operating profit of 127000 and 51000 signifying an upward pattern, in both. In 2018 and

2017 in both, the as a whole net profit of the company was 81000 and 36000, that also

demonstrates that the economic profit level of the corporation has been doubled. For the purpose

of assessing financial performance of the business subsequent ratios are computed:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

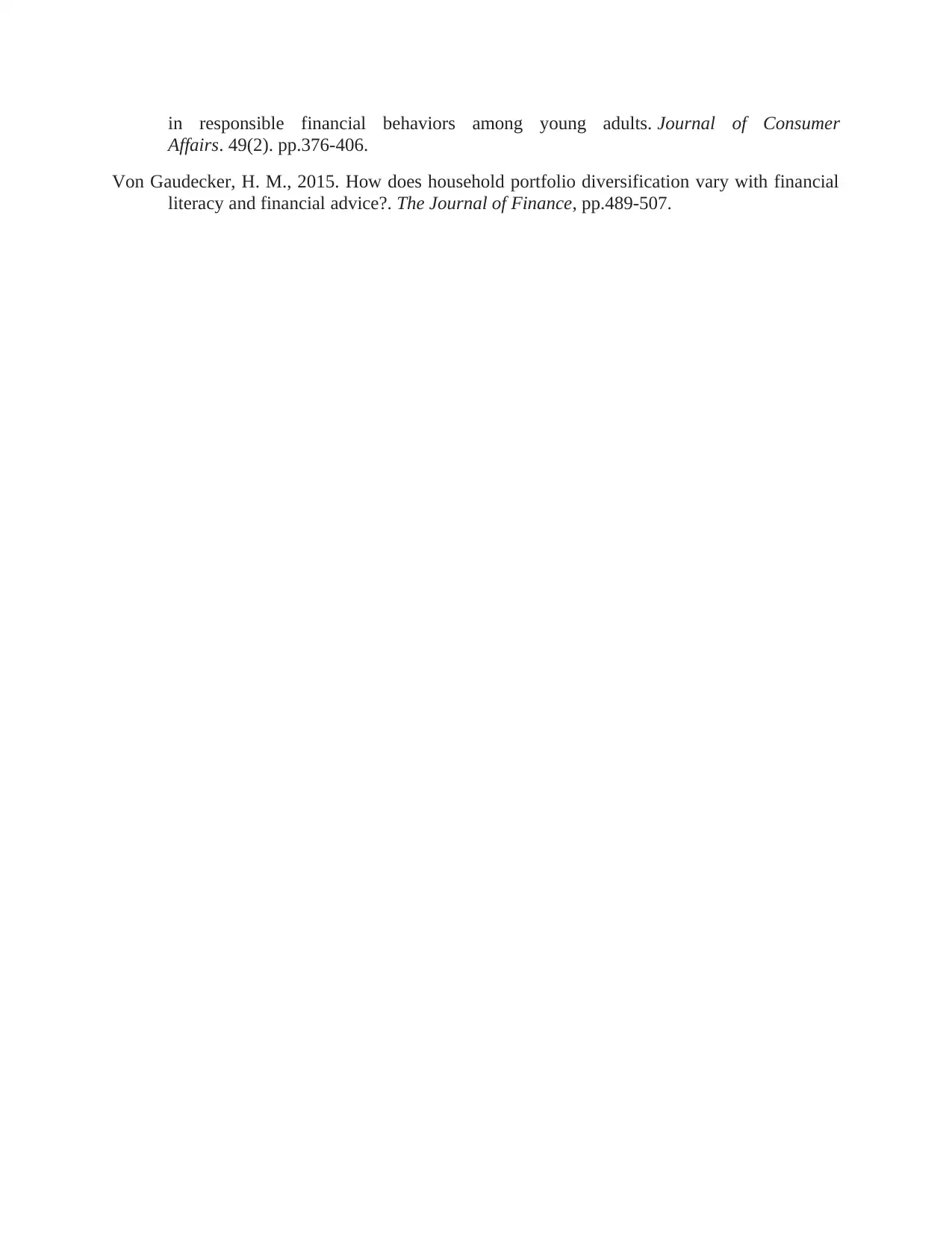

Gross Profit ratio: This ratio is determined for the purpose of evaluating the correlation among

gross margin and income. The key goal in using it is to assess a firm's operating efficiency. This

proportion may be measured in order to determine whether Roast Ltd is capable of producing

large profits or otherwise.

Operating profit ratio: This ratio is measured in order to measure an individual's personal

capacity to produce income while charging all of the capital values. The directors should also

evaluate the ability of Roast Ltd to produce income for the time ahead.

Net Profit Ratio: This ratio is determined as it is measured since charging all the costs, interest,

dividends and income in regard to determine the real percentage of revenue earned during the

year. This will be utilized to evaluate whether or not Roast Ltd would accomplish the aim of

earning income (Brown, Farrell and Weisbenner, 2016).

Calculations for all the above described ratios are as follows:

It has been calculated according to the above estimates that the entity's gross margin ratio was

greater in 2017 relative to 2018, that indicates that perhaps the corporation's operating efficiency

in this year was great compared with 2018. Operating and net profit figures indicate that as of

2018 Roast Ltd's performance is weaker in 2017. It reveals the business created increased

returns in 2018 than in the preceding period. Those figures demonstrate that the entity's success

is strong in the present time, and that it can draw the vast number of businesses.

2.2 Statement of financial position

Business entities announce of Financial situation for the objective of discovering that the

organisation can sustain on the sector or maybe not. For many the organizations it's crucial

generate it on annual basis in order that internal in addition to external stakeholders such as

creditors, employees, investors, clients, government etc. may track performance of business

enterprise. There is an assortment of traits that are required by these which can be value-added

and transparency, accuracy, compatibility etc. In this reference, when seen from the assessment

of budget items outlined in Roast Ltd's Statement of Financial Position, the business produced

capital spending on the acquisition of equipment, Plant and Equipment (PPE) as the PPE value of

gross margin and income. The key goal in using it is to assess a firm's operating efficiency. This

proportion may be measured in order to determine whether Roast Ltd is capable of producing

large profits or otherwise.

Operating profit ratio: This ratio is measured in order to measure an individual's personal

capacity to produce income while charging all of the capital values. The directors should also

evaluate the ability of Roast Ltd to produce income for the time ahead.

Net Profit Ratio: This ratio is determined as it is measured since charging all the costs, interest,

dividends and income in regard to determine the real percentage of revenue earned during the

year. This will be utilized to evaluate whether or not Roast Ltd would accomplish the aim of

earning income (Brown, Farrell and Weisbenner, 2016).

Calculations for all the above described ratios are as follows:

It has been calculated according to the above estimates that the entity's gross margin ratio was

greater in 2017 relative to 2018, that indicates that perhaps the corporation's operating efficiency

in this year was great compared with 2018. Operating and net profit figures indicate that as of

2018 Roast Ltd's performance is weaker in 2017. It reveals the business created increased

returns in 2018 than in the preceding period. Those figures demonstrate that the entity's success

is strong in the present time, and that it can draw the vast number of businesses.

2.2 Statement of financial position

Business entities announce of Financial situation for the objective of discovering that the

organisation can sustain on the sector or maybe not. For many the organizations it's crucial

generate it on annual basis in order that internal in addition to external stakeholders such as

creditors, employees, investors, clients, government etc. may track performance of business

enterprise. There is an assortment of traits that are required by these which can be value-added

and transparency, accuracy, compatibility etc. In this reference, when seen from the assessment

of budget items outlined in Roast Ltd's Statement of Financial Position, the business produced

capital spending on the acquisition of equipment, Plant and Equipment (PPE) as the PPE value of

the company expanded from £670,000 to £996,000 between 2017 and 2018. A further

noteworthy thing here is that the cash transactions of the corporation, which would in 2017 was

£134,000, were confirmed as nil in 2018, showing that the business used all of its financial

resources in 2018. Although the as a whole present rate of assets was managed to reach at

£447,000 in 2017 which was £347,000. Corporation did not issue any shareholdings during 2018

as the share capital of the company is £200,000 in both years. In 2018, the retained earnings of

the net profit and other resources corporation were reported at £660,000, but are £579,000 in

2017. Hence cumulative equity funds are increasing from £779000 to £860000.

Lengthy-term borrowings of the corporation are changing significantly, even though long-term

debts of the corporation were attained at £275,000 in 2018, which was £100,000 in 2017. In

2018, the firm also obtained a bank overdraft facility worth £ 73,000. Even when trade creditors

for the company were changed from 138000 to 235000 during the 2017-2018 period. Over the

year 2017 to 2018, overall average obligations are raised £ 345000 (from £238000 to

£583000).With the aim of investigation of operation after ratios will also be computed in

circumstance of Roast Ltd. Description of most them is the Following:

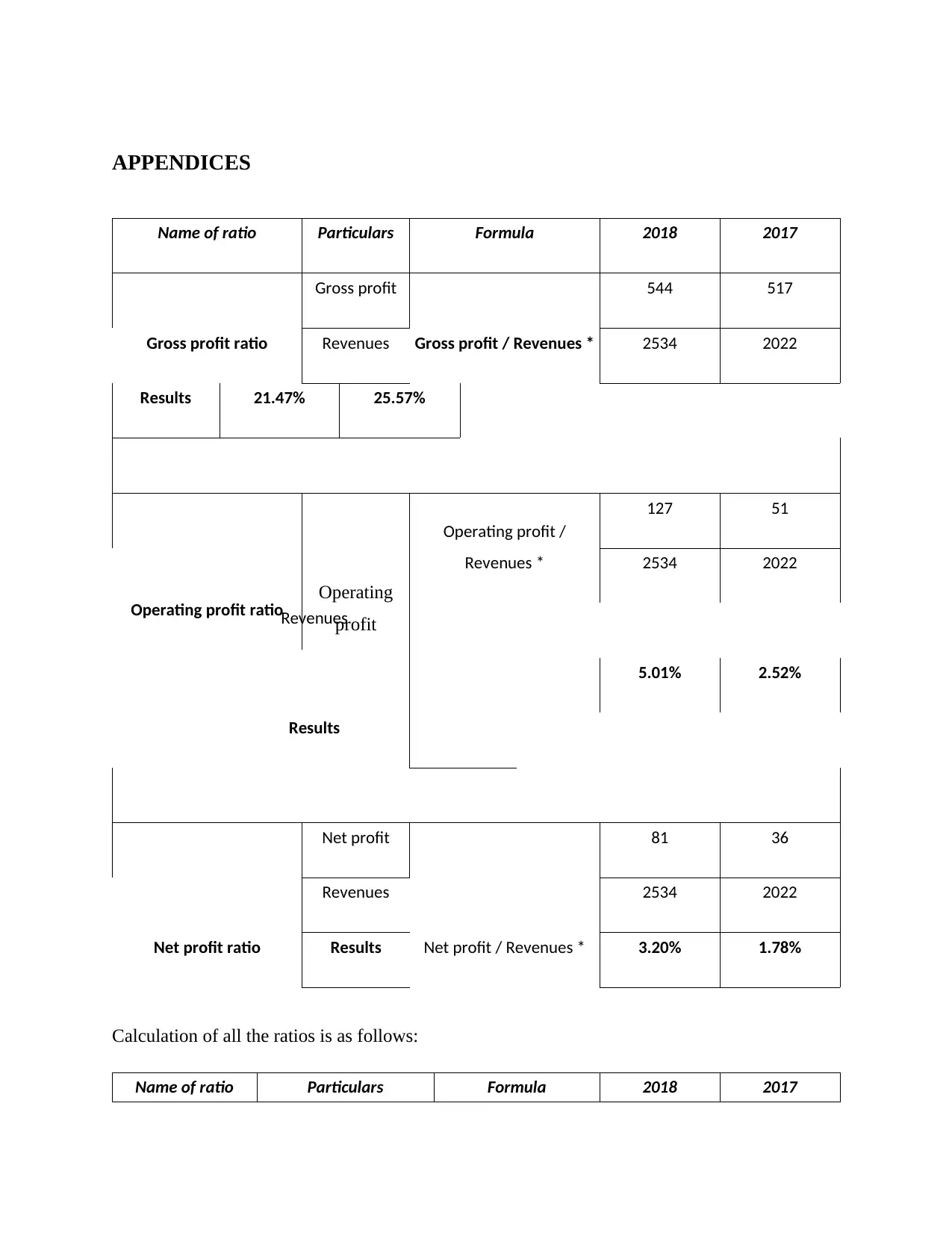

Debt equity ratio: It is one of the popular ratio that is used to measure the economic leverage. It

is important to be using outside obligations rather than existing assets for all companies in order

to boost the capacity to produce greater profits. To assess the same potential Roast Ltd must

measure this ratio.

Current ratio: It is a form of leverage ratio that is determined to decide if an individual will be

able to manage all of the quick-term obligations with existing assets throughout a year as well. It

could be supported to calculate the amount of liquidity of Roast Ltd.

Quick ratio: Current resources are calculated under this formula for measurement purposes to

evaluate the resources to meet quick-term obligations with the aid of marketable securities. This

ratio will be determined in order to examine whether Roast Ltd is able to cover the retained

earnings with swift capital (Dinçer, Yuksel and Bozaykut-Buk, 2018).

It has been calculated in the above equations that in 2018 Roast Ltd's capacity utilise liabilities

more so than equity markets is enhanced that demonstrates that the business's output is

increasing with period. Present ratio findings reveal that the individual's stability is weak in 2018

noteworthy thing here is that the cash transactions of the corporation, which would in 2017 was

£134,000, were confirmed as nil in 2018, showing that the business used all of its financial

resources in 2018. Although the as a whole present rate of assets was managed to reach at

£447,000 in 2017 which was £347,000. Corporation did not issue any shareholdings during 2018

as the share capital of the company is £200,000 in both years. In 2018, the retained earnings of

the net profit and other resources corporation were reported at £660,000, but are £579,000 in

2017. Hence cumulative equity funds are increasing from £779000 to £860000.

Lengthy-term borrowings of the corporation are changing significantly, even though long-term

debts of the corporation were attained at £275,000 in 2018, which was £100,000 in 2017. In

2018, the firm also obtained a bank overdraft facility worth £ 73,000. Even when trade creditors

for the company were changed from 138000 to 235000 during the 2017-2018 period. Over the

year 2017 to 2018, overall average obligations are raised £ 345000 (from £238000 to

£583000).With the aim of investigation of operation after ratios will also be computed in

circumstance of Roast Ltd. Description of most them is the Following:

Debt equity ratio: It is one of the popular ratio that is used to measure the economic leverage. It

is important to be using outside obligations rather than existing assets for all companies in order

to boost the capacity to produce greater profits. To assess the same potential Roast Ltd must

measure this ratio.

Current ratio: It is a form of leverage ratio that is determined to decide if an individual will be

able to manage all of the quick-term obligations with existing assets throughout a year as well. It

could be supported to calculate the amount of liquidity of Roast Ltd.

Quick ratio: Current resources are calculated under this formula for measurement purposes to

evaluate the resources to meet quick-term obligations with the aid of marketable securities. This

ratio will be determined in order to examine whether Roast Ltd is able to cover the retained

earnings with swift capital (Dinçer, Yuksel and Bozaykut-Buk, 2018).

It has been calculated in the above equations that in 2018 Roast Ltd's capacity utilise liabilities

more so than equity markets is enhanced that demonstrates that the business's output is

increasing with period. Present ratio findings reveal that the individual's stability is weak in 2018

relative to 2017. while, quick ratio , is also very small for 2018. Both suggest the individual's

flexibility is very small. Roast Ltd's output isn't good due to reduced profitability, as per the

financial state report. Zero cash is the key factor behind all this in 2018. Regardless of this

capacity the company is therefore decreased to compensate the sum of quick-term obligations.

2.3 Statement of cash flow

All the company factors invent an announcement to capture advice about cash inflows

and out flows therefore that liquidity of this organisation might possibly be ascertained that it is

called announcement of cash flows. Main reason for its formula will be to analyze which the

venture can meet most of the long-term targets or maybe not. With the assistance of this,

direction may determine they could spend less on prospective surgeries rather than. While

forming it different tasks are listed in it that are operating, financing and investing. By the end

full of the actions is generated to ensure it might be ascertained that enterprise've earned cash or

paid down it into the outside parties (Hastings and Mitchell, 2020). This can be discovered in

Roast Limited Corporation’s context that the cash flows from operating activities were negative

£24,000 in the year-2018. This implies more activities are becoming triggering cash flows.

Operational exercises caused by the outflow of inventory levels approximately £ 179,000 but by

an increment of £55,000 in trade receivables. Although the capital structure from capital

expenditure are negative £358000 due to massive capital expenditure it toward the acquisition of

property , plant and equipment corporation. Rising lengthy-term debts led to an increase in cash

flows of £175,000 from funding activities.

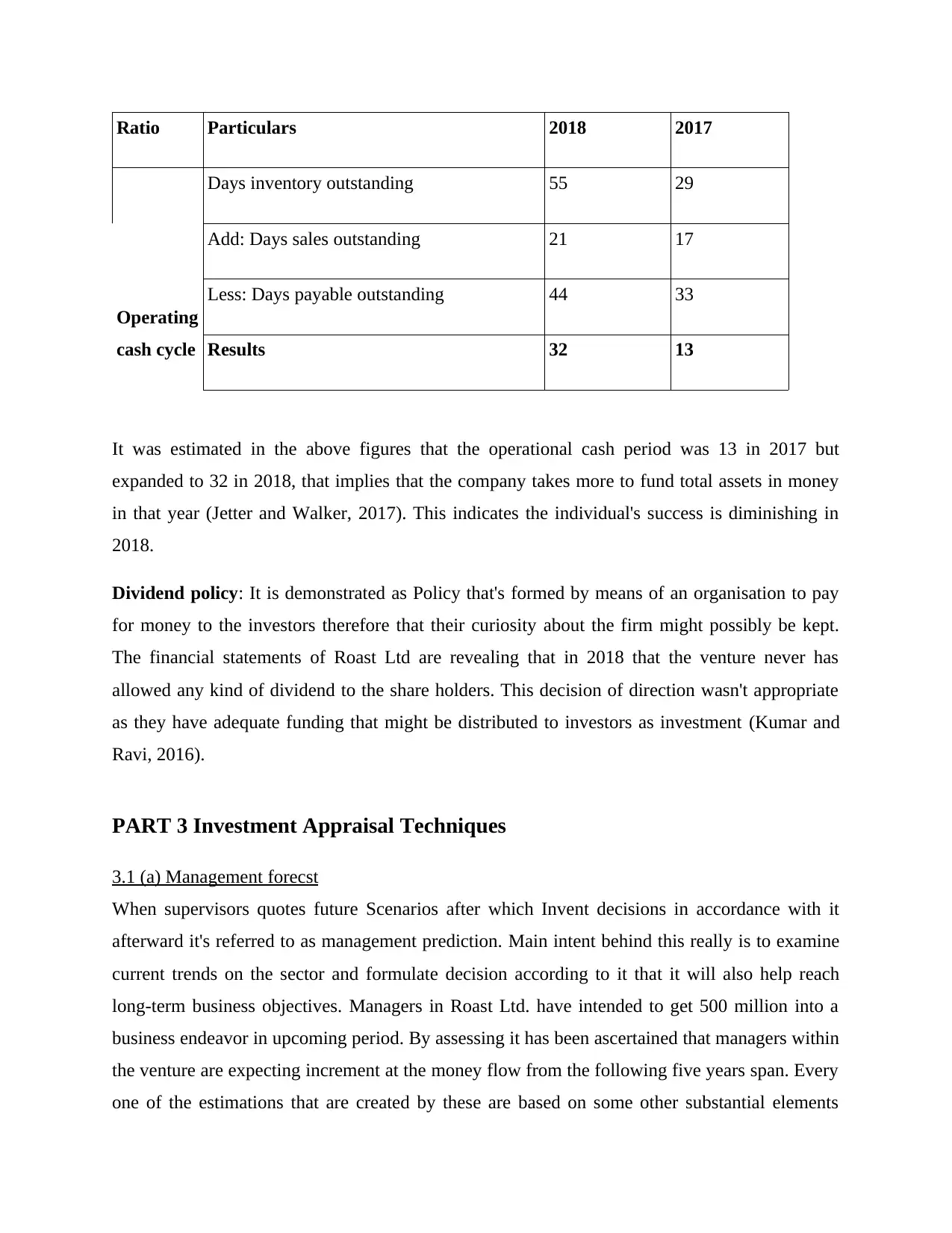

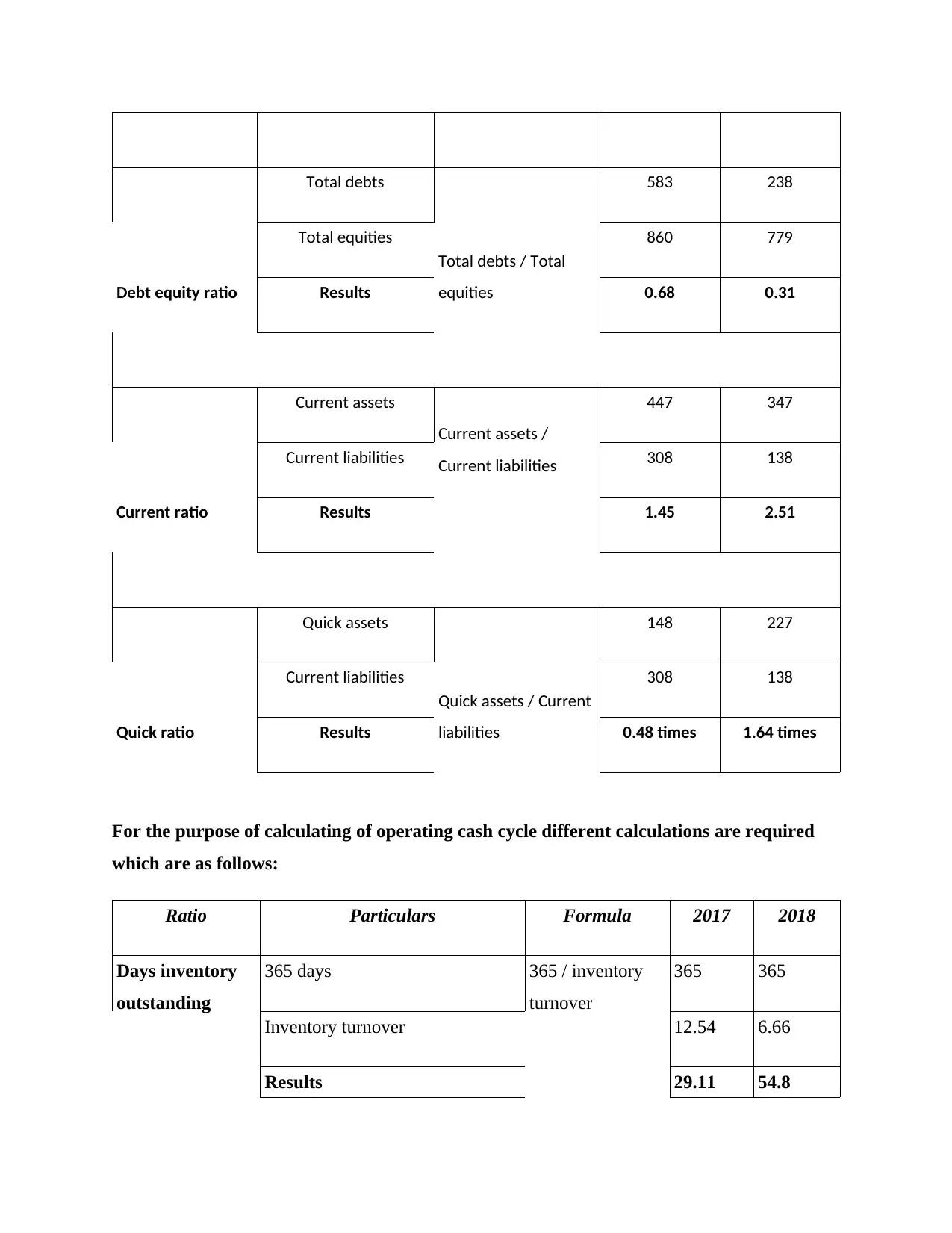

Operating Cash cycle: it's also called cash conversion cycle that's principally utilized by

organizations with the goal of assessing how long a organization will Have liquid resources in

the event the expenditure in inventory is going to be raised. With the Assistance of this threat of

bandwidth can be redeemed which may possibly happen because of plans of expansion. With the

Assistance of these supervisors will have the ability to ascertain the moment demanded by Roast

Ltd for own business enterprise to produce initial outlay of cash perform functional activities like

marketing, advertising etc. It's quite important for company factors as it can certainly help

determine the beneficial or Negative cash flow. If the interval is extremely long afterward it

reveals that present Resources weren't able to be turned directly into cash fast. Calculation of it's

the Following:

flexibility is very small. Roast Ltd's output isn't good due to reduced profitability, as per the

financial state report. Zero cash is the key factor behind all this in 2018. Regardless of this

capacity the company is therefore decreased to compensate the sum of quick-term obligations.

2.3 Statement of cash flow

All the company factors invent an announcement to capture advice about cash inflows

and out flows therefore that liquidity of this organisation might possibly be ascertained that it is

called announcement of cash flows. Main reason for its formula will be to analyze which the

venture can meet most of the long-term targets or maybe not. With the assistance of this,

direction may determine they could spend less on prospective surgeries rather than. While

forming it different tasks are listed in it that are operating, financing and investing. By the end

full of the actions is generated to ensure it might be ascertained that enterprise've earned cash or

paid down it into the outside parties (Hastings and Mitchell, 2020). This can be discovered in

Roast Limited Corporation’s context that the cash flows from operating activities were negative

£24,000 in the year-2018. This implies more activities are becoming triggering cash flows.

Operational exercises caused by the outflow of inventory levels approximately £ 179,000 but by

an increment of £55,000 in trade receivables. Although the capital structure from capital

expenditure are negative £358000 due to massive capital expenditure it toward the acquisition of

property , plant and equipment corporation. Rising lengthy-term debts led to an increase in cash

flows of £175,000 from funding activities.

Operating Cash cycle: it's also called cash conversion cycle that's principally utilized by

organizations with the goal of assessing how long a organization will Have liquid resources in

the event the expenditure in inventory is going to be raised. With the Assistance of this threat of

bandwidth can be redeemed which may possibly happen because of plans of expansion. With the

Assistance of these supervisors will have the ability to ascertain the moment demanded by Roast

Ltd for own business enterprise to produce initial outlay of cash perform functional activities like

marketing, advertising etc. It's quite important for company factors as it can certainly help

determine the beneficial or Negative cash flow. If the interval is extremely long afterward it

reveals that present Resources weren't able to be turned directly into cash fast. Calculation of it's

the Following:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ratio Particulars 2018 2017

Operating

cash cycle

Days inventory outstanding 55 29

Add: Days sales outstanding 21 17

Less: Days payable outstanding 44 33

Results 32 13

It was estimated in the above figures that the operational cash period was 13 in 2017 but

expanded to 32 in 2018, that implies that the company takes more to fund total assets in money

in that year (Jetter and Walker, 2017). This indicates the individual's success is diminishing in

2018.

Dividend policy: It is demonstrated as Policy that's formed by means of an organisation to pay

for money to the investors therefore that their curiosity about the firm might possibly be kept.

The financial statements of Roast Ltd are revealing that in 2018 that the venture never has

allowed any kind of dividend to the share holders. This decision of direction wasn't appropriate

as they have adequate funding that might be distributed to investors as investment (Kumar and

Ravi, 2016).

PART 3 Investment Appraisal Techniques

3.1 (a) Management forecst

When supervisors quotes future Scenarios after which Invent decisions in accordance with it

afterward it's referred to as management prediction. Main intent behind this really is to examine

current trends on the sector and formulate decision according to it that it will also help reach

long-term business objectives. Managers in Roast Ltd. have intended to get 500 million into a

business endeavor in upcoming period. By assessing it has been ascertained that managers within

the venture are expecting increment at the money flow from the following five years span. Every

one of the estimations that are created by these are based on some other substantial elements

Operating

cash cycle

Days inventory outstanding 55 29

Add: Days sales outstanding 21 17

Less: Days payable outstanding 44 33

Results 32 13

It was estimated in the above figures that the operational cash period was 13 in 2017 but

expanded to 32 in 2018, that implies that the company takes more to fund total assets in money

in that year (Jetter and Walker, 2017). This indicates the individual's success is diminishing in

2018.

Dividend policy: It is demonstrated as Policy that's formed by means of an organisation to pay

for money to the investors therefore that their curiosity about the firm might possibly be kept.

The financial statements of Roast Ltd are revealing that in 2018 that the venture never has

allowed any kind of dividend to the share holders. This decision of direction wasn't appropriate

as they have adequate funding that might be distributed to investors as investment (Kumar and

Ravi, 2016).

PART 3 Investment Appraisal Techniques

3.1 (a) Management forecst

When supervisors quotes future Scenarios after which Invent decisions in accordance with it

afterward it's referred to as management prediction. Main intent behind this really is to examine

current trends on the sector and formulate decision according to it that it will also help reach

long-term business objectives. Managers in Roast Ltd. have intended to get 500 million into a

business endeavor in upcoming period. By assessing it has been ascertained that managers within

the venture are expecting increment at the money flow from the following five years span. Every

one of the estimations that are created by these are based on some other substantial elements

therefore it's going to be quite complex in order for them to build same cash inflow (Lee and

Lee, 2015).

3.2 (b) Investment Appraisal

To make strategic choices about investing in a venture in the strategic, all company companies

use various forms of strategies. Those are NPV, Pay Back Time, ARR etc. that could be used by

Roast Ltd's administrators in order to decide to invest 500 million pounds in a project. Definition

of them with their advantages and disadvantages is as obeys:

Pay Back Period: It can be described as a tool which can be utilised by organizations like Roast

Ltd. to calculate the period in which they can regain the value they are investing in a venture.

Sculpture 3 demonstrates that in 4 years the company will repay the expenditure which implies

that it is a reasonable idea to spend 500 million pounds. Expenditure may either have a brief or a

lengthy payback period. A quicker rate of return ensures that the money will be 'reimbursed'

relatively soon, that is, the value of the transaction will be easily compensated by the profitability

created by the transaction (Lichtenberg, 2016). Many of the advantages and disadvantages of this

approach include:

Pros: This is one of the easiest methods that can enable the administration decide

whether or not the savings vehicle will be productive. Through, multiple choices may be

measured easily.

Cons: With the help of it administrators cannot decide whether the decision would

contribute in the company's enhanced or reduced worth. Besides this time money supply

in this methodology is often neglected which can lead in conflicting outcomes.

Net Present Values: The system of calculating the discrepancy between reduced positive cash

flow and upfront investment could be described. A plan's net present value (NPV) reflects the

shift in the annual income / capital of a corporation that will benefit from the system's approval

during its lifespan. This represents the total cash inflows of the valuation of the venture less the

initial outlay expenditure. With the support of it, Roast Ltd's executives will also be capable of

assessing the feasibility of the company they expect to spend 500 million pounds into. Exhibit 3

indicates that the plan's current value is 110, which is a good number (Lusardi and Mitchell,

2017). Most of its advantages and drawbacks include:

Lee, 2015).

3.2 (b) Investment Appraisal

To make strategic choices about investing in a venture in the strategic, all company companies

use various forms of strategies. Those are NPV, Pay Back Time, ARR etc. that could be used by

Roast Ltd's administrators in order to decide to invest 500 million pounds in a project. Definition

of them with their advantages and disadvantages is as obeys:

Pay Back Period: It can be described as a tool which can be utilised by organizations like Roast

Ltd. to calculate the period in which they can regain the value they are investing in a venture.

Sculpture 3 demonstrates that in 4 years the company will repay the expenditure which implies

that it is a reasonable idea to spend 500 million pounds. Expenditure may either have a brief or a

lengthy payback period. A quicker rate of return ensures that the money will be 'reimbursed'

relatively soon, that is, the value of the transaction will be easily compensated by the profitability

created by the transaction (Lichtenberg, 2016). Many of the advantages and disadvantages of this

approach include:

Pros: This is one of the easiest methods that can enable the administration decide

whether or not the savings vehicle will be productive. Through, multiple choices may be

measured easily.

Cons: With the help of it administrators cannot decide whether the decision would

contribute in the company's enhanced or reduced worth. Besides this time money supply

in this methodology is often neglected which can lead in conflicting outcomes.

Net Present Values: The system of calculating the discrepancy between reduced positive cash

flow and upfront investment could be described. A plan's net present value (NPV) reflects the

shift in the annual income / capital of a corporation that will benefit from the system's approval

during its lifespan. This represents the total cash inflows of the valuation of the venture less the

initial outlay expenditure. With the support of it, Roast Ltd's executives will also be capable of

assessing the feasibility of the company they expect to spend 500 million pounds into. Exhibit 3

indicates that the plan's current value is 110, which is a good number (Lusardi and Mitchell,

2017). Most of its advantages and drawbacks include:

Pros: With the aid of it, reliable and straightforward calculation of productivity could be

carried out but in this strategy time value of money is factored into the equation. It

contributes to making good choices, as it produces correct outcomes. The benefits of the

cost of capital provide the fact that it recognizes the value of time of resources and

enables the management team in making informed decisions.

Cons: The estimation process is very complex, so supervisors can need to spend extra

time on their estimates. The drawbacks of this method that includes the assumption that it

does not recognize the real costs which cannot be used by the business to compare the

varying sizes of works.

Accounting rate of return: It is used in investment planning to assess the return on investment

that could be achieved during a specified time period on a plan. Exhibit 3 indicates that ARR

would be 18 per cent for the expenditure of 500 million pound so it will be a competitive option

for Roast Ltd. Its advantages and disadvantages are:

Pros: By using ARR strategy the company executives will be capable to get a better

image of the feasibility of the company they intend to invest in. It is the only approach

focused on accounting rules which resulting in reliable which successful results.

Cons: When using this approach external forces are overlooked this can leave adverse

effect on the country’s competitiveness.

As per the above strategies indicates that the 500 million pound savings vehicle would be

advantageous to Roast Ltd since all of the strategies show good outcomes for it. Investments this

volume in company for the potential will achieve long-term targets including greater earnings

and revenue. The company is able to improve efficiency and competitiveness for years to come

by increasing this sum in industry (Rasheed and Siddiqui, 2019).

Source of finance

It is quite essential for a company to raise enough resources to carry out both the organizational

and executioner operations. Since Roast Ltd plans to spend 500 million pounds, it needs

administrators to obtain capital for the same. There are numerous reports that could produce

funds and resources from. And the organization will assess the hard-term and particular-term

impact of these channels before making some judgment about the supply of funding. Roast Ltd is

carried out but in this strategy time value of money is factored into the equation. It

contributes to making good choices, as it produces correct outcomes. The benefits of the

cost of capital provide the fact that it recognizes the value of time of resources and

enables the management team in making informed decisions.

Cons: The estimation process is very complex, so supervisors can need to spend extra

time on their estimates. The drawbacks of this method that includes the assumption that it

does not recognize the real costs which cannot be used by the business to compare the

varying sizes of works.

Accounting rate of return: It is used in investment planning to assess the return on investment

that could be achieved during a specified time period on a plan. Exhibit 3 indicates that ARR

would be 18 per cent for the expenditure of 500 million pound so it will be a competitive option

for Roast Ltd. Its advantages and disadvantages are:

Pros: By using ARR strategy the company executives will be capable to get a better

image of the feasibility of the company they intend to invest in. It is the only approach

focused on accounting rules which resulting in reliable which successful results.

Cons: When using this approach external forces are overlooked this can leave adverse

effect on the country’s competitiveness.

As per the above strategies indicates that the 500 million pound savings vehicle would be

advantageous to Roast Ltd since all of the strategies show good outcomes for it. Investments this

volume in company for the potential will achieve long-term targets including greater earnings

and revenue. The company is able to improve efficiency and competitiveness for years to come

by increasing this sum in industry (Rasheed and Siddiqui, 2019).

Source of finance

It is quite essential for a company to raise enough resources to carry out both the organizational

and executioner operations. Since Roast Ltd plans to spend 500 million pounds, it needs

administrators to obtain capital for the same. There are numerous reports that could produce

funds and resources from. And the organization will assess the hard-term and particular-term

impact of these channels before making some judgment about the supply of funding. Roast Ltd is

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

proposing another contribution of £400k in Italy from year-2019 in this sense. Therefore a report

on various sources of funding. Definition of all of them and their advantages and disadvantages

are as adopts:

Issuing shares in the market: This is one of the bank's lengthy-term origin that can assist a

company secure financing for commercial practices. Roast Ltd will use it to fund the 500-

million-pound incentive program (Benefits and Drawbacks of issuing shares, 2019). This has

numerous advantages and disadvantages that are as obeys:

Pros: It is a simple and lengthy-term finance origin that assists an organization in

correctly carrying out all organizational operations. The cost of paying dividends is

focused on the earnings that the company is not obliged to make available to investors on

an annualized basis.

Cons: When a company receives securities, the holder must divide the choice-making

power with the outside entities that purchase them.

Taking a bank loan: It is a source of funds that business companies use to take on additional

funding. If Roast Ltd takes it to finance its expenditure of 500 million pounds then earning

interest to the lender on an interest rate is quite necessary for it. Many of this source's advantages

and disadvantages are as pursues:

Pros: The amount owed to the creditor by the investor is taxable within revenue

legislation, so it can serve to minimize expenditures and raise profits

Cons: The rate of interest in bank loans is very strong due to which the borrower would

be expected to pay a certain sum of income (Tang, Baker and Peter, 2015).

From both of the origins of funds mentioned above, selecting lease option was suggested to

Roast Ltd's management and it is chosen by them then the holders would not have to

compromise any choice-making power with the lender. Roast Ltd does not take debt for the

funding because company pays out more than interest that impact on the liquidity position.

Besides this, it will also actually raise the proportion of debt funding as it would improve any use

of foreign funds in continuing operations. The main explanation for this decision was that after a

brief period and when the balance will be maintained as income, a bank loan would be written

on various sources of funding. Definition of all of them and their advantages and disadvantages

are as adopts:

Issuing shares in the market: This is one of the bank's lengthy-term origin that can assist a

company secure financing for commercial practices. Roast Ltd will use it to fund the 500-

million-pound incentive program (Benefits and Drawbacks of issuing shares, 2019). This has

numerous advantages and disadvantages that are as obeys:

Pros: It is a simple and lengthy-term finance origin that assists an organization in

correctly carrying out all organizational operations. The cost of paying dividends is

focused on the earnings that the company is not obliged to make available to investors on

an annualized basis.

Cons: When a company receives securities, the holder must divide the choice-making

power with the outside entities that purchase them.

Taking a bank loan: It is a source of funds that business companies use to take on additional

funding. If Roast Ltd takes it to finance its expenditure of 500 million pounds then earning

interest to the lender on an interest rate is quite necessary for it. Many of this source's advantages

and disadvantages are as pursues:

Pros: The amount owed to the creditor by the investor is taxable within revenue

legislation, so it can serve to minimize expenditures and raise profits

Cons: The rate of interest in bank loans is very strong due to which the borrower would

be expected to pay a certain sum of income (Tang, Baker and Peter, 2015).

From both of the origins of funds mentioned above, selecting lease option was suggested to

Roast Ltd's management and it is chosen by them then the holders would not have to

compromise any choice-making power with the lender. Roast Ltd does not take debt for the

funding because company pays out more than interest that impact on the liquidity position.

Besides this, it will also actually raise the proportion of debt funding as it would improve any use

of foreign funds in continuing operations. The main explanation for this decision was that after a

brief period and when the balance will be maintained as income, a bank loan would be written

off. At the end it is suggested that Starbucks must invest in this café because it provides

profitability in large manner.

profitability in large manner.

REFERENCES

Books and Journal

Ahmed, R. and Saravanaraj, M. G., 2016. Implications of heuristics in financial decision

making. Asian Journal of Research in Social Sciences and Humanities. 6(7). pp.1245-

1251.

Almenberg, J. and Dreber, A., 2015. Gender, stock market participation and financial

literacy. Economics Letters, 137, pp.140-142.

Brown, J. R., Farrell, A. M. and Weisbenner, S. J., 2016. Decision-making approaches and the

propensity to default: Evidence and implications. Journal of Financial

Economics. 121(3). pp.477-495.

Chang, S. C., Tang, Y. C. and Liu, Y. J., 2016. Beyond objective knowledge: The moderating

role of field dependence–independence cognition in financial decision making. Social

Behavior and Personality: an international journal. 44(3). pp.519-527.

Dinçer, H., Yuksel, S. and Bozaykut-Buk, T., 2018. Evaluation of financial and economic effects

on green supply chain management with multi-criteria decision-making approach:

Evidence from companies listed in BIST. In Handbook of research on supply chain

management for sustainable development (pp. 144-175). IGI Global.

Hastings, J. and Mitchell, O. S., 2020. How financial literacy and impatience shape retirement

wealth and investment behaviors. Journal of Pension Economics & Finance. 19(1). pp.1-

20.

Kumar, B.S. and Ravi, V., 2016. A survey of the applications of text mining in financial

domain. Knowledge-Based Systems, 114, pp.128-147.

Lee, S.W. and Lee, K.H., 2015. Decision Making Model for Selecting Financial Company

Server Privilege Account Operations. Journal of the Korea Institute of Information

Security and Cryptology, 25(6), pp.1607-1620.

Lichtenberg, P. A., 2016. New approaches to preventing financial exploitation: a focus on the

banks. Public Policy & Aging Report. 26(1). pp.15-17.

Lusardi, A. and Mitchell, O. S., 2017. How ordinary consumers make complex economic

decisions: Financial literacy and retirement readiness. Quarterly Journal of

Finance. 7(03). p.1750008.

Rasheed, R. and Siddiqui, S. H., 2019. Attitude for inclusive finance: influence of owner-

managers’ and firms’ characteristics on SMEs financial decision making. Journal of

Economic and Administrative Sciences.

Tang, N., Baker, A. and Peter, P. C., 2015. Investigating the disconnect between financial

knowledge and behavior: The role of parental influence and psychological characteristics

Books and Journal

Ahmed, R. and Saravanaraj, M. G., 2016. Implications of heuristics in financial decision

making. Asian Journal of Research in Social Sciences and Humanities. 6(7). pp.1245-

1251.

Almenberg, J. and Dreber, A., 2015. Gender, stock market participation and financial

literacy. Economics Letters, 137, pp.140-142.

Brown, J. R., Farrell, A. M. and Weisbenner, S. J., 2016. Decision-making approaches and the

propensity to default: Evidence and implications. Journal of Financial

Economics. 121(3). pp.477-495.

Chang, S. C., Tang, Y. C. and Liu, Y. J., 2016. Beyond objective knowledge: The moderating

role of field dependence–independence cognition in financial decision making. Social

Behavior and Personality: an international journal. 44(3). pp.519-527.

Dinçer, H., Yuksel, S. and Bozaykut-Buk, T., 2018. Evaluation of financial and economic effects

on green supply chain management with multi-criteria decision-making approach:

Evidence from companies listed in BIST. In Handbook of research on supply chain

management for sustainable development (pp. 144-175). IGI Global.

Hastings, J. and Mitchell, O. S., 2020. How financial literacy and impatience shape retirement

wealth and investment behaviors. Journal of Pension Economics & Finance. 19(1). pp.1-

20.

Kumar, B.S. and Ravi, V., 2016. A survey of the applications of text mining in financial

domain. Knowledge-Based Systems, 114, pp.128-147.

Lee, S.W. and Lee, K.H., 2015. Decision Making Model for Selecting Financial Company

Server Privilege Account Operations. Journal of the Korea Institute of Information

Security and Cryptology, 25(6), pp.1607-1620.

Lichtenberg, P. A., 2016. New approaches to preventing financial exploitation: a focus on the

banks. Public Policy & Aging Report. 26(1). pp.15-17.

Lusardi, A. and Mitchell, O. S., 2017. How ordinary consumers make complex economic

decisions: Financial literacy and retirement readiness. Quarterly Journal of

Finance. 7(03). p.1750008.

Rasheed, R. and Siddiqui, S. H., 2019. Attitude for inclusive finance: influence of owner-

managers’ and firms’ characteristics on SMEs financial decision making. Journal of

Economic and Administrative Sciences.

Tang, N., Baker, A. and Peter, P. C., 2015. Investigating the disconnect between financial

knowledge and behavior: The role of parental influence and psychological characteristics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

in responsible financial behaviors among young adults. Journal of Consumer

Affairs. 49(2). pp.376-406.

Von Gaudecker, H. M., 2015. How does household portfolio diversification vary with financial

literacy and financial advice?. The Journal of Finance, pp.489-507.

Affairs. 49(2). pp.376-406.

Von Gaudecker, H. M., 2015. How does household portfolio diversification vary with financial

literacy and financial advice?. The Journal of Finance, pp.489-507.

APPENDICES

Name of ratio Particulars Formula 2018 2017

Gross profit ratio

Gross profit

Gross profit / Revenues *

544 517

Revenues 2534 2022

Results 21.47% 25.57%

Operating profit ratio

Operating

profit

Operating profit /

Revenues *

127 51

2534 2022

Revenues

5.01% 2.52%

Results

Net profit ratio

Net profit

Net profit / Revenues *

81 36

Revenues 2534 2022

Results 3.20% 1.78%

Calculation of all the ratios is as follows:

Name of ratio Particulars Formula 2018 2017

Name of ratio Particulars Formula 2018 2017

Gross profit ratio

Gross profit

Gross profit / Revenues *

544 517

Revenues 2534 2022

Results 21.47% 25.57%

Operating profit ratio

Operating

profit

Operating profit /

Revenues *

127 51

2534 2022

Revenues

5.01% 2.52%

Results

Net profit ratio

Net profit

Net profit / Revenues *

81 36

Revenues 2534 2022

Results 3.20% 1.78%

Calculation of all the ratios is as follows:

Name of ratio Particulars Formula 2018 2017

Debt equity ratio

Total debts

Total debts / Total

equities

583 238

Total equities 860 779

Results 0.68 0.31

Current ratio

Current assets

Current assets /

Current liabilities

447 347

Current liabilities 308 138

Results 1.45 2.51

Quick ratio

Quick assets

Quick assets / Current

liabilities

148 227

Current liabilities 308 138

Results 0.48 times 1.64 times

For the purpose of calculating of operating cash cycle different calculations are required

which are as follows:

Ratio Particulars Formula 2017 2018

Days inventory

outstanding

365 days 365 / inventory

turnover

365 365

Inventory turnover 12.54 6.66

Results 29.11 54.8

Total debts

Total debts / Total

equities

583 238

Total equities 860 779

Results 0.68 0.31

Current ratio

Current assets

Current assets /

Current liabilities

447 347

Current liabilities 308 138

Results 1.45 2.51

Quick ratio

Quick assets

Quick assets / Current

liabilities

148 227

Current liabilities 308 138

Results 0.48 times 1.64 times

For the purpose of calculating of operating cash cycle different calculations are required

which are as follows:

Ratio Particulars Formula 2017 2018

Days inventory

outstanding

365 days 365 / inventory

turnover

365 365

Inventory turnover 12.54 6.66

Results 29.11 54.8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Days sale

outstanding

365 days

365 / receivable

turnover

365 365

Receivable turnover 21.74 17.12

Results 16.79 21.32

Days payable

outstanding

365 days

365 / payable

turnover

365 365

Payable turnover 10.91 8.47

Results 33.46 43.09

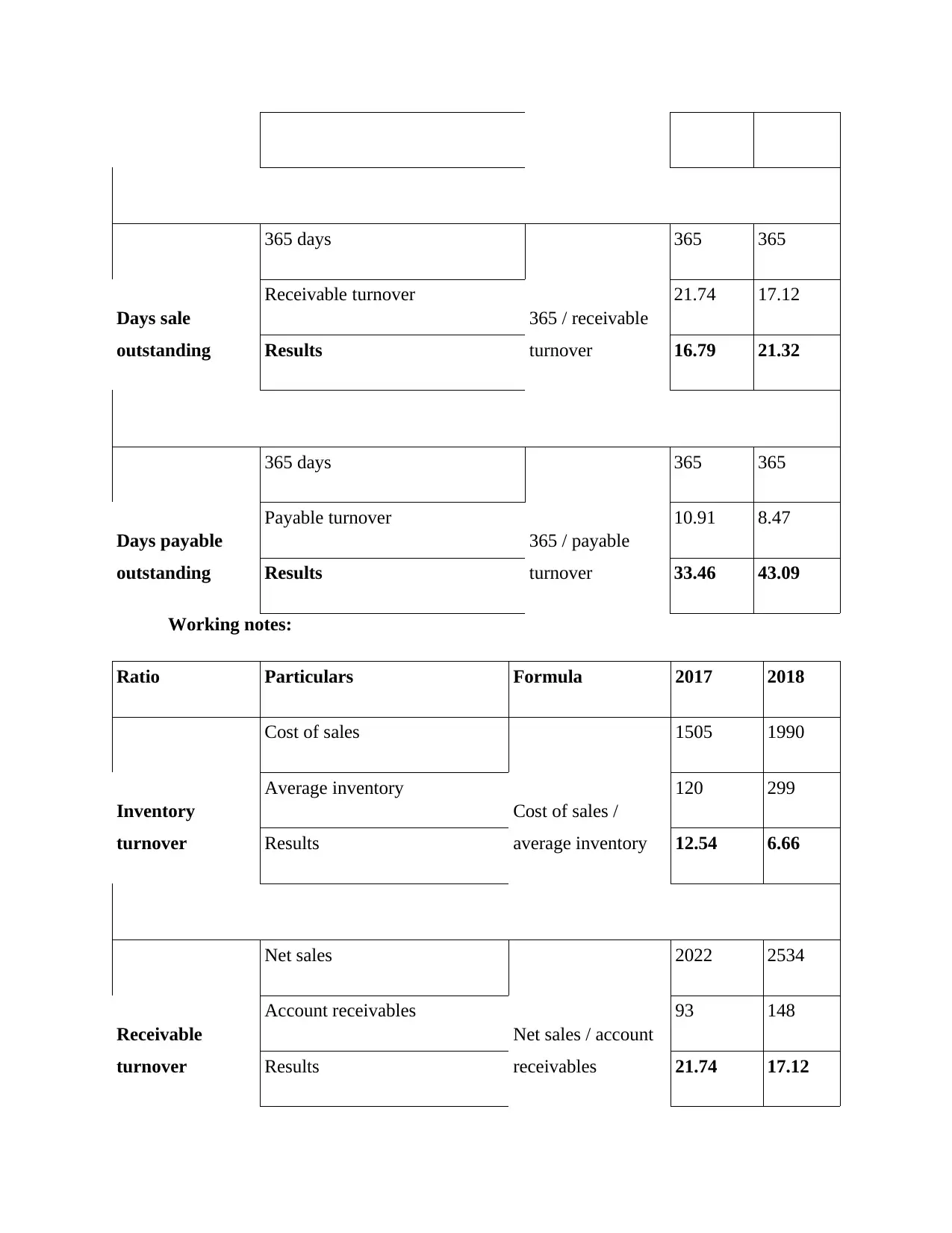

Working notes:

Ratio Particulars Formula 2017 2018

Inventory

turnover

Cost of sales

Cost of sales /

average inventory

1505 1990

Average inventory 120 299

Results 12.54 6.66

Receivable

turnover

Net sales

Net sales / account

receivables

2022 2534

Account receivables 93 148

Results 21.74 17.12

outstanding

365 days

365 / receivable

turnover

365 365

Receivable turnover 21.74 17.12

Results 16.79 21.32

Days payable

outstanding

365 days

365 / payable

turnover

365 365

Payable turnover 10.91 8.47

Results 33.46 43.09

Working notes:

Ratio Particulars Formula 2017 2018

Inventory

turnover

Cost of sales

Cost of sales /

average inventory

1505 1990

Average inventory 120 299

Results 12.54 6.66

Receivable

turnover

Net sales

Net sales / account

receivables

2022 2534

Account receivables 93 148

Results 21.74 17.12

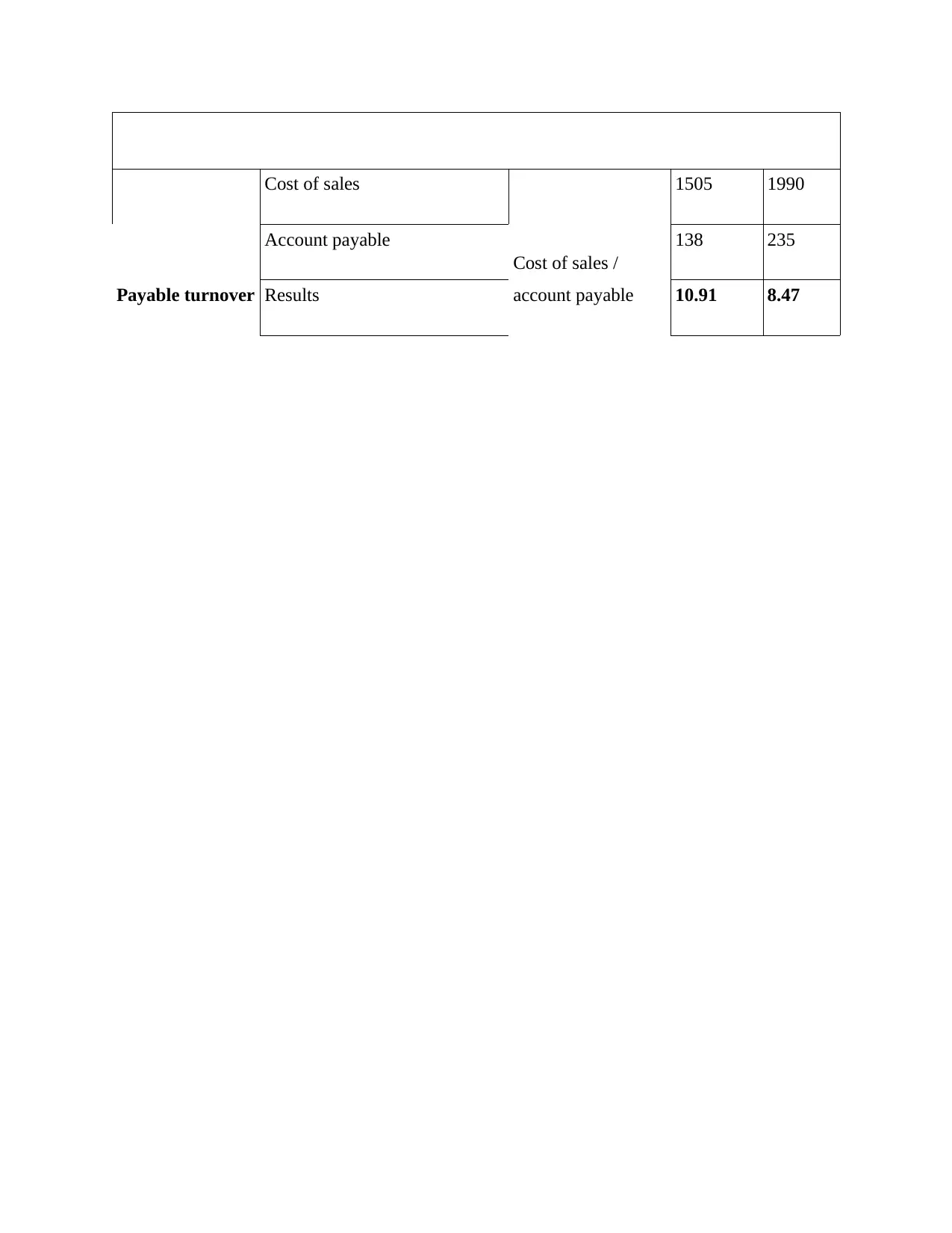

Payable turnover

Cost of sales

Cost of sales /

account payable

1505 1990

Account payable 138 235

Results 10.91 8.47

Cost of sales

Cost of sales /

account payable

1505 1990

Account payable 138 235

Results 10.91 8.47

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.