Financial Analysis and Decision Making Report: SKANSA Plc, UK

VerifiedAdded on 2023/01/05

|16

|4099

|77

Report

AI Summary

This report provides a comprehensive analysis of financial decision-making, using SKANSA Plc as a case study. It begins with an executive summary and an introduction to finance and accounting, defining their importance in business. The report delves into the roles, duties, and functions of the finance and accounting departments within an organization, highlighting their significance in investment, financing, dividend, and working capital management. It emphasizes the functions of cost control, investment appraisal, tax management, and financial statement preparation. The report then transitions to a financial analysis section, calculating and interpreting financial ratios from SKANSA Plc's financial statements to assess its financial health and performance from an investor's perspective. The report also includes a detailed overview of the roles and responsibilities of the accounting department, including financial accounting, management accounting, tax functions, and auditing, along with their importance in strategic and financial planning. The report offers insights into project funding and its associated risks, concluding with a summary of key findings and recommendations.

Financial Decision Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

This report summarizes that financial planning is a essential component for every

business as it enables organization to evaluate and analyse its financial position. Finance related

information plays a crucial role in identifying performance of business and its future

proficiencies. Effective financial analysis by proper understanding of financial statements and

appropriate linkage of identified information with business performance permits competence in

financial decision making process, it further enhances management efficiency of business.

This report summarizes that financial planning is a essential component for every

business as it enables organization to evaluate and analyse its financial position. Finance related

information plays a crucial role in identifying performance of business and its future

proficiencies. Effective financial analysis by proper understanding of financial statements and

appropriate linkage of identified information with business performance permits competence in

financial decision making process, it further enhances management efficiency of business.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Definition and importance of finance and accounting department in business along with there

roles, duties and functions:..........................................................................................................1

TASK 2............................................................................................................................................6

Calculation of ratios with the use of financial statement for the purpose of analysing financial

statement and commenting on it with perspective of investor:....................................................6

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Definition and importance of finance and accounting department in business along with there

roles, duties and functions:..........................................................................................................1

TASK 2............................................................................................................................................6

Calculation of ratios with the use of financial statement for the purpose of analysing financial

statement and commenting on it with perspective of investor:....................................................6

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Finance refers to the process of managing money in business. It includes borrowing of

money, investing, saving, borrowing as well as accounting. Accounting indicates a systematic

procedure of identifying, recording, summarizing and communicating financial transactions of

company (Bartel, 2018). This technique helps firm in tracking its income, expenditures,

investments, working capital etc. which ensures effective management of funds in business and

contributes in its smooth functioning. This report is based on financial and accounting

interpretation of SKANSA Plc. It is a UK based company and deals in construction and

development sector. This report consists description of functions, roles and duties of accounting

and finance along with its importance in organization. Further, financial statements of firm is

evaluated by calculating and interpreting ratios with the motive of analysing performance of

business.

TASK 1

Overview of organization: SKANSA Plc is a construction company and was founded in 1984.

it is headquartered in UK and is planning strategically for expanding its operations in counties of

Europe.

Definition and importance of finance and accounting department in business along with there

roles, duties and functions:

Finance department is an organizational part that focuses on managing funds of business

and plans their expenditure or investment (Blue, 2020). On the contrary, focus of Accounting

department is on recording and interpreting various financial transactions in business.

Roles of finance department: Following are the roles of department of finance in an

organization:

Investment function: Financial department of firm analyses profitability and suitability

of various projects by calculating net present values, future value, internal rate of return

etc. Financial decision makers are capable of evaluating risk factor associated with

investments and its expected yield. Hence, in depth analysis of projects enable SKANSA

Plc to deter threats of loss and provides overview of suitable investment options so that

organization can invest in appropriate alternative and earn high profitability (de Freitas

and et.al., 2020). It provides opportunity to firm for adequate use of its capital and

1

Finance refers to the process of managing money in business. It includes borrowing of

money, investing, saving, borrowing as well as accounting. Accounting indicates a systematic

procedure of identifying, recording, summarizing and communicating financial transactions of

company (Bartel, 2018). This technique helps firm in tracking its income, expenditures,

investments, working capital etc. which ensures effective management of funds in business and

contributes in its smooth functioning. This report is based on financial and accounting

interpretation of SKANSA Plc. It is a UK based company and deals in construction and

development sector. This report consists description of functions, roles and duties of accounting

and finance along with its importance in organization. Further, financial statements of firm is

evaluated by calculating and interpreting ratios with the motive of analysing performance of

business.

TASK 1

Overview of organization: SKANSA Plc is a construction company and was founded in 1984.

it is headquartered in UK and is planning strategically for expanding its operations in counties of

Europe.

Definition and importance of finance and accounting department in business along with there

roles, duties and functions:

Finance department is an organizational part that focuses on managing funds of business

and plans their expenditure or investment (Blue, 2020). On the contrary, focus of Accounting

department is on recording and interpreting various financial transactions in business.

Roles of finance department: Following are the roles of department of finance in an

organization:

Investment function: Financial department of firm analyses profitability and suitability

of various projects by calculating net present values, future value, internal rate of return

etc. Financial decision makers are capable of evaluating risk factor associated with

investments and its expected yield. Hence, in depth analysis of projects enable SKANSA

Plc to deter threats of loss and provides overview of suitable investment options so that

organization can invest in appropriate alternative and earn high profitability (de Freitas

and et.al., 2020). It provides opportunity to firm for adequate use of its capital and

1

implement a strong capital budgeting function for future growth and expansion plan of

SKANSA Plc.

Financing function: Analysing and comparing financial statement by finance

department of SKANSA Plc to evaluate its financial performance over the period and

avoid unnecessary expenditures and improvising profitability. It is a role of department of

finance in an organization to ensure adequate implementation of accounting principles

and proper design of financial processes (Falloon, 2020).

Dividend function: Manager of finance is responsible of implementing effective

dividend policy in an organization for the purpose of maximizing shareholder value

which further leads to improvisation in market value of business. Other dividend related

roles of SKANSA Plc's finance department are distributing profits adequately among

shareholders, having stable earning options so that the risk associated with equity share

owners reduce, balancing of dividend per share to maintain expectations of company as

well as share holders and ensuring that dividend announcement positively affect stock

market reputation of company.

Working capital function: Maintenance of working capital in business is essential for

fluent functioning of business operations. Working capital management plays a crucial

role in maintenance of adequate fund in business, so that SKANSA Plc can manage its

day to day operations and run business smoothly.

Importance of role of finance department:

It plays a vital role in meeting operational expenses of business, such as, interest

payments, purchase of raw materials etc. by effectively managing working capital

requirements.

Analyses of financial reports assess business in evaluating its profit or loss during period

which enables SKANSA in interpreting its performance and hence provides a financial

picture to management.

Finance department also ensures availability of business finance through various sources

and maintenance of retained earnings as an appealing source of investment capital

(Hrnjic, Reeb and Yeung, 2019).

Role of Accounts department: Major roles of accounts department in business along

with its critical evaluation are discussed below:

2

SKANSA Plc.

Financing function: Analysing and comparing financial statement by finance

department of SKANSA Plc to evaluate its financial performance over the period and

avoid unnecessary expenditures and improvising profitability. It is a role of department of

finance in an organization to ensure adequate implementation of accounting principles

and proper design of financial processes (Falloon, 2020).

Dividend function: Manager of finance is responsible of implementing effective

dividend policy in an organization for the purpose of maximizing shareholder value

which further leads to improvisation in market value of business. Other dividend related

roles of SKANSA Plc's finance department are distributing profits adequately among

shareholders, having stable earning options so that the risk associated with equity share

owners reduce, balancing of dividend per share to maintain expectations of company as

well as share holders and ensuring that dividend announcement positively affect stock

market reputation of company.

Working capital function: Maintenance of working capital in business is essential for

fluent functioning of business operations. Working capital management plays a crucial

role in maintenance of adequate fund in business, so that SKANSA Plc can manage its

day to day operations and run business smoothly.

Importance of role of finance department:

It plays a vital role in meeting operational expenses of business, such as, interest

payments, purchase of raw materials etc. by effectively managing working capital

requirements.

Analyses of financial reports assess business in evaluating its profit or loss during period

which enables SKANSA in interpreting its performance and hence provides a financial

picture to management.

Finance department also ensures availability of business finance through various sources

and maintenance of retained earnings as an appealing source of investment capital

(Hrnjic, Reeb and Yeung, 2019).

Role of Accounts department: Major roles of accounts department in business along

with its critical evaluation are discussed below:

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial accounting: This role of accounting department indicates recording of

transactions related to finance and its reporting through financial statements. Transactions

are recorded in journals, ledger and trial balance of business while it is further reported

and summarized in financial statements, such as, cash flow statement, income statement

and balance sheet of company. Hence, accounting department of SKANSA Plc enables it

to keep track of financial transactions with the use of specific guidelines.

Management accounting: it indicates preparation of reports about operations of business

that helps firm in long term as well as short term decision making process. Here, financial

information is provided to managers to SKANSA Plc that helps them in improvising

operation efficiency of business (Karmakar, Dutta and Biswas, 2018). This role is not

focused on external, rather, it focuses on improving internal decision making of company

by providing useful financial information with the motive of enhancing productivity and

strategic formulation of firm.

Tax function: This department contains specially trained team of accountants that

calculates taxable income of company. This ensures periodic estimation of tax payments

with systematic tax fillings in SKANSA Plc. It is a role of this department is to

investigate implications of taxes on financial plans and enhance proper planning of

budgets. Overall, it deals with tax affairs of business.

Auditing function: Accounting department plays another crucial role of conducting

internal audits in compliance with tax regulations. In relevance to SKANSA Plc., it

evaluates accounting systems of firm and analyse units of tax control for reducing taxes.

Proper training is provided to team members in accordance to audit regulations as well as

procedures.

Importance of roles of Accounting department:

This department is responsible for adequate recording of transactions related to funds.

It provides effective financial information to business managers which can be further

utilised for strengthens strategic and financial planning of business (Kumar, Jindal and

Velaga, 2018).

Duties of finance and accounting department: While considering duties of accounting

and finance departments in an organization, following factors can be analysed:

3

transactions related to finance and its reporting through financial statements. Transactions

are recorded in journals, ledger and trial balance of business while it is further reported

and summarized in financial statements, such as, cash flow statement, income statement

and balance sheet of company. Hence, accounting department of SKANSA Plc enables it

to keep track of financial transactions with the use of specific guidelines.

Management accounting: it indicates preparation of reports about operations of business

that helps firm in long term as well as short term decision making process. Here, financial

information is provided to managers to SKANSA Plc that helps them in improvising

operation efficiency of business (Karmakar, Dutta and Biswas, 2018). This role is not

focused on external, rather, it focuses on improving internal decision making of company

by providing useful financial information with the motive of enhancing productivity and

strategic formulation of firm.

Tax function: This department contains specially trained team of accountants that

calculates taxable income of company. This ensures periodic estimation of tax payments

with systematic tax fillings in SKANSA Plc. It is a role of this department is to

investigate implications of taxes on financial plans and enhance proper planning of

budgets. Overall, it deals with tax affairs of business.

Auditing function: Accounting department plays another crucial role of conducting

internal audits in compliance with tax regulations. In relevance to SKANSA Plc., it

evaluates accounting systems of firm and analyse units of tax control for reducing taxes.

Proper training is provided to team members in accordance to audit regulations as well as

procedures.

Importance of roles of Accounting department:

This department is responsible for adequate recording of transactions related to funds.

It provides effective financial information to business managers which can be further

utilised for strengthens strategic and financial planning of business (Kumar, Jindal and

Velaga, 2018).

Duties of finance and accounting department: While considering duties of accounting

and finance departments in an organization, following factors can be analysed:

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Development of financial plan: It is a duty of this department of SKANSA Plc. to

forecast financial planning and prepare effective budgeting so that revenues and

expenditures of business can be tracked and effective strategy can be formulated for

managing funds of company in a proper manner ( Modestino, Sederberg and Tuller,

2019).

Activities of business development: As per assessment of financial conditions of

business, finance managers of SKANSA Plc. Is responsible for preparing development

activities as per the company's objective of expanding business in European countries.

Hence, department of accounting and finance is obliged to prepare a proper plan of

capital requirements and other expenses along with effective assessment of revenue

expected to earn. This assess business in analysing risk factor involved in expansion

strategy.

Reconciling financial transactions: It is a duty of finance department to reconcile

yearly, monthly as well as daily transactions related to finance to track performance of

firm. It indicates comparing set of two accounts for eliminating errors and increasing

accuracy. It also helps firm in identifying any fraud or discrepancies.

Advising on matter of project funding: Project funding indicates sum allotted in

projects. As in case of SKANSA Plc, firm is plan to invest in expansion projects hence, it

is a duty ODF finance and accounting department to evaluate risk associated with such

projects by identify initial investment required and its future returns (Niu, and et.al.,

2020).

Importance of duties related to finance and accounting department:

These departments have vital duty of interpreting financial information and avoiding any

errors or hindrances which improves effectiveness of business.

Further, its essential suggestions of finance related decisions and problems, secures

business from entering into non-profitable projects and directs focus of SKANSA Plc.

towards essential and profitable investment alternatives.

Function of Finance and account: While focusing on functions of these departments

some major points can be interpreted which are described below:

Cost Control – This function of finance and account department plays important for

every company to check the cost management in every department of organisation to

4

forecast financial planning and prepare effective budgeting so that revenues and

expenditures of business can be tracked and effective strategy can be formulated for

managing funds of company in a proper manner ( Modestino, Sederberg and Tuller,

2019).

Activities of business development: As per assessment of financial conditions of

business, finance managers of SKANSA Plc. Is responsible for preparing development

activities as per the company's objective of expanding business in European countries.

Hence, department of accounting and finance is obliged to prepare a proper plan of

capital requirements and other expenses along with effective assessment of revenue

expected to earn. This assess business in analysing risk factor involved in expansion

strategy.

Reconciling financial transactions: It is a duty of finance department to reconcile

yearly, monthly as well as daily transactions related to finance to track performance of

firm. It indicates comparing set of two accounts for eliminating errors and increasing

accuracy. It also helps firm in identifying any fraud or discrepancies.

Advising on matter of project funding: Project funding indicates sum allotted in

projects. As in case of SKANSA Plc, firm is plan to invest in expansion projects hence, it

is a duty ODF finance and accounting department to evaluate risk associated with such

projects by identify initial investment required and its future returns (Niu, and et.al.,

2020).

Importance of duties related to finance and accounting department:

These departments have vital duty of interpreting financial information and avoiding any

errors or hindrances which improves effectiveness of business.

Further, its essential suggestions of finance related decisions and problems, secures

business from entering into non-profitable projects and directs focus of SKANSA Plc.

towards essential and profitable investment alternatives.

Function of Finance and account: While focusing on functions of these departments

some major points can be interpreted which are described below:

Cost Control – This function of finance and account department plays important for

every company to check the cost management in every department of organisation to

4

minimise the cost and ensure maximum utilisation of resources. SKANSA is

multinational construction company who focuses on activities of cost control department

and try to minimise the expenses of company through proper coordination and planning.

Investment appraisal – Finance and Account Department monitor the different

techniques involve in this like Capital Budgeting, investment appraisal techniques that

ensure all the project that comes in hand of company is profitable. SKANSA is

construction company which handles multiple projects from all over world. So, this is

essence of company to carefully examine this function to sustain in the market (Paley,

Tully and Sharma, 2019).

Handling Taxes issues – The core function of finance and account department is to

examine and control tax payment by company as this will indirectly effect the function

of company. SKANSA company is dealing in industry where they have to monitor their

tax payment regularly and ensure that tax payment is as per the guidelines and policies

because excess of tax payment will impact negatively and decrease in payment can put

them in danger.

Maintaining Financial statement – It is mandatory function to maintain and

preparation of financial statement of finance and accounts department. This shows how

company is performing and its final position and after this only further strategies were

formulated. SKANSA Plc company is also prepare and manage their financial statement

and on that basis they plan some strategies and tactics for future events.

Importance of function of accounts and finance function:

Cost control function is important to maintain a certain level of cost operation and if it

goes above that level than it will increase expense and effect the profitability of company.

For big company like SKANSA it is necessary to maintain their cost level at minimum

level and try to optimise at maximum level to maintain their profitability status (Roberts,

Armijo and Katada, 2018).

SKANSA is big construction company that deal with many suppliers and clients all over

the world and has to identify which project is beneficial for them in long term and short

term and accept these deals on the basis of capital budgeting techniques. In that

techniques various methods are there which used to calculate profitability of different

projects and investment appraisal.

5

multinational construction company who focuses on activities of cost control department

and try to minimise the expenses of company through proper coordination and planning.

Investment appraisal – Finance and Account Department monitor the different

techniques involve in this like Capital Budgeting, investment appraisal techniques that

ensure all the project that comes in hand of company is profitable. SKANSA is

construction company which handles multiple projects from all over world. So, this is

essence of company to carefully examine this function to sustain in the market (Paley,

Tully and Sharma, 2019).

Handling Taxes issues – The core function of finance and account department is to

examine and control tax payment by company as this will indirectly effect the function

of company. SKANSA company is dealing in industry where they have to monitor their

tax payment regularly and ensure that tax payment is as per the guidelines and policies

because excess of tax payment will impact negatively and decrease in payment can put

them in danger.

Maintaining Financial statement – It is mandatory function to maintain and

preparation of financial statement of finance and accounts department. This shows how

company is performing and its final position and after this only further strategies were

formulated. SKANSA Plc company is also prepare and manage their financial statement

and on that basis they plan some strategies and tactics for future events.

Importance of function of accounts and finance function:

Cost control function is important to maintain a certain level of cost operation and if it

goes above that level than it will increase expense and effect the profitability of company.

For big company like SKANSA it is necessary to maintain their cost level at minimum

level and try to optimise at maximum level to maintain their profitability status (Roberts,

Armijo and Katada, 2018).

SKANSA is big construction company that deal with many suppliers and clients all over

the world and has to identify which project is beneficial for them in long term and short

term and accept these deals on the basis of capital budgeting techniques. In that

techniques various methods are there which used to calculate profitability of different

projects and investment appraisal.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Laws and regulation are different and vary accordingly on their application and they

ensure the smooth functioning of business as it consist regulation of VAT, Sales tax,

Income Tax and funds which need to considered. SKANSA is large multinational

company in UK and it function and operate in different countries and has to follow rules

and regulation to addresses no causalities in terms of any situation.

Preparation and maintaining the financial statement is mandatory for company to check

their financial condition and SKANSA is maintaining proper financial statement and on

that basis they formulate their further operational strategies and balance income and

expense and try to find out the way to increase their profit margin.

TASK 2

Calculation of ratios with the use of financial statement for the purpose of analysing financial

statement and commenting on it with perspective of investor:

Financial analysis refers to assessment of finance related transactions for evaluating

performance of an organization on the basis of financial information. It permits firm to

identifying its strengths and weaknesses in relevance to financial data. Utilization of financial

analysis in SKANSA Plc. Authorizes firm in assessing managerial effectiveness as well as

operational efficiency. It also enables firm in determining its creditworthiness and current

position in terms of cash or financial position. It also serves as a measurement criteria for

stakeholder to evaluate reliability of company (Trinh and et.al., 2020). Financial ratio is an

effective tool for analysis of financial information. It serves as a relative magnitude among two

numerical values in financial statement. SKANSA Plc. Uses this technique to identify its

competencies in terms of finance. Company evaluates major five ratios that represents position

of entire business. These ratios are further interpreted below:

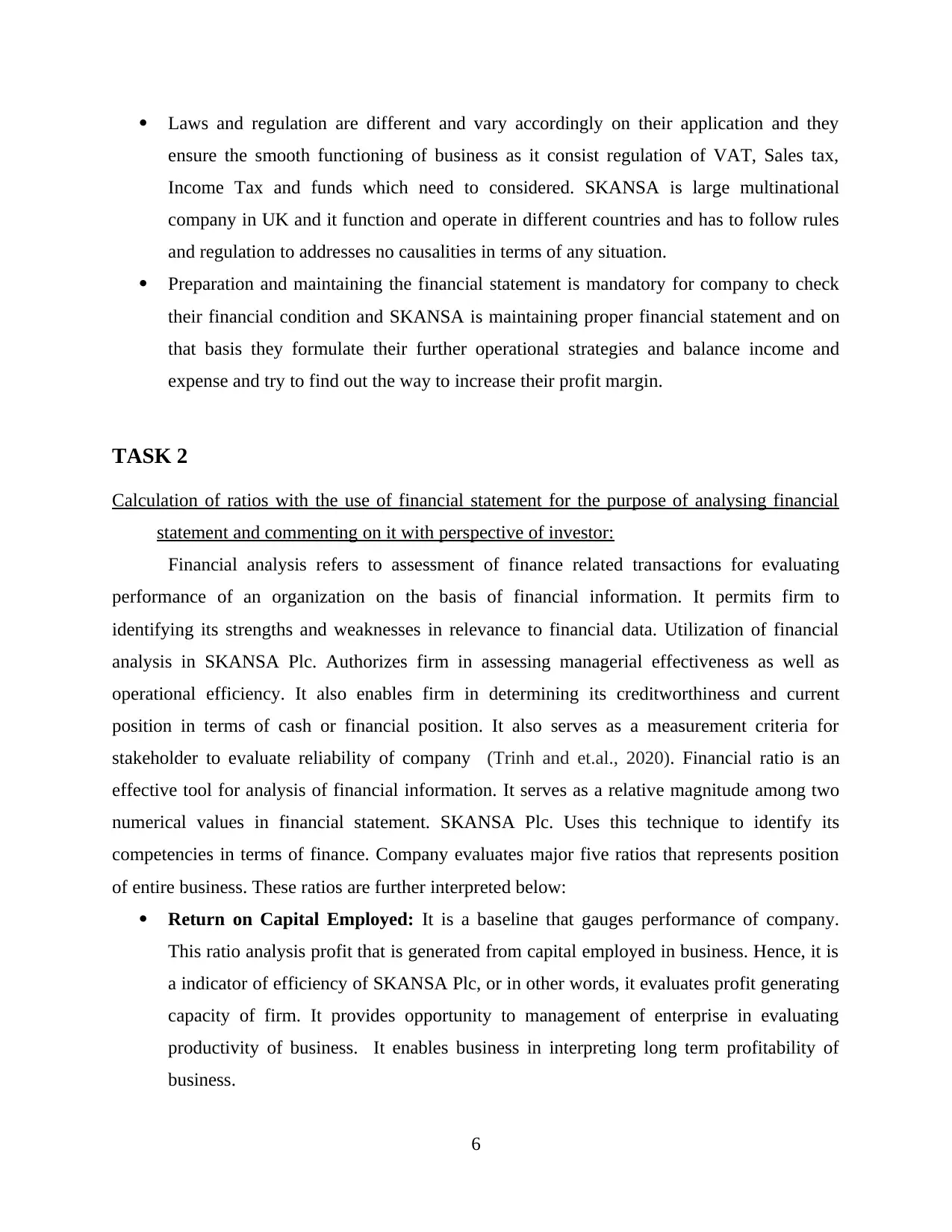

Return on Capital Employed: It is a baseline that gauges performance of company.

This ratio analysis profit that is generated from capital employed in business. Hence, it is

a indicator of efficiency of SKANSA Plc, or in other words, it evaluates profit generating

capacity of firm. It provides opportunity to management of enterprise in evaluating

productivity of business. It enables business in interpreting long term profitability of

business.

6

ensure the smooth functioning of business as it consist regulation of VAT, Sales tax,

Income Tax and funds which need to considered. SKANSA is large multinational

company in UK and it function and operate in different countries and has to follow rules

and regulation to addresses no causalities in terms of any situation.

Preparation and maintaining the financial statement is mandatory for company to check

their financial condition and SKANSA is maintaining proper financial statement and on

that basis they formulate their further operational strategies and balance income and

expense and try to find out the way to increase their profit margin.

TASK 2

Calculation of ratios with the use of financial statement for the purpose of analysing financial

statement and commenting on it with perspective of investor:

Financial analysis refers to assessment of finance related transactions for evaluating

performance of an organization on the basis of financial information. It permits firm to

identifying its strengths and weaknesses in relevance to financial data. Utilization of financial

analysis in SKANSA Plc. Authorizes firm in assessing managerial effectiveness as well as

operational efficiency. It also enables firm in determining its creditworthiness and current

position in terms of cash or financial position. It also serves as a measurement criteria for

stakeholder to evaluate reliability of company (Trinh and et.al., 2020). Financial ratio is an

effective tool for analysis of financial information. It serves as a relative magnitude among two

numerical values in financial statement. SKANSA Plc. Uses this technique to identify its

competencies in terms of finance. Company evaluates major five ratios that represents position

of entire business. These ratios are further interpreted below:

Return on Capital Employed: It is a baseline that gauges performance of company.

This ratio analysis profit that is generated from capital employed in business. Hence, it is

a indicator of efficiency of SKANSA Plc, or in other words, it evaluates profit generating

capacity of firm. It provides opportunity to management of enterprise in evaluating

productivity of business. It enables business in interpreting long term profitability of

business.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Formula:

Return on Capital Employed = Operating Profit / (Total Assets – Current Liability)*100

Particulars 2019 2018

Net profit 675 600

Capital employed 5850 3825

Result 11.54 15.69

Working note: Calculation of Capital Employed:

Particulars 2019 2018

Total assets 8070 4470

Less: Current liabilities 2220 645

Capital employed 5850 3825

From the above ratio it can be interpreted that return on capital employed of SKANSA

Plc. has decreased over a period of time. As it was 15.69 in 2018 but it reduced to 11.54 in 2019

which states that profit generating capacity of firms capital employed has decreased. Reason for

this can be employment of unnecessary equipments in business which are more probe to

increasing cost rather than providing profit (Vrbka and Rowland, 2019).

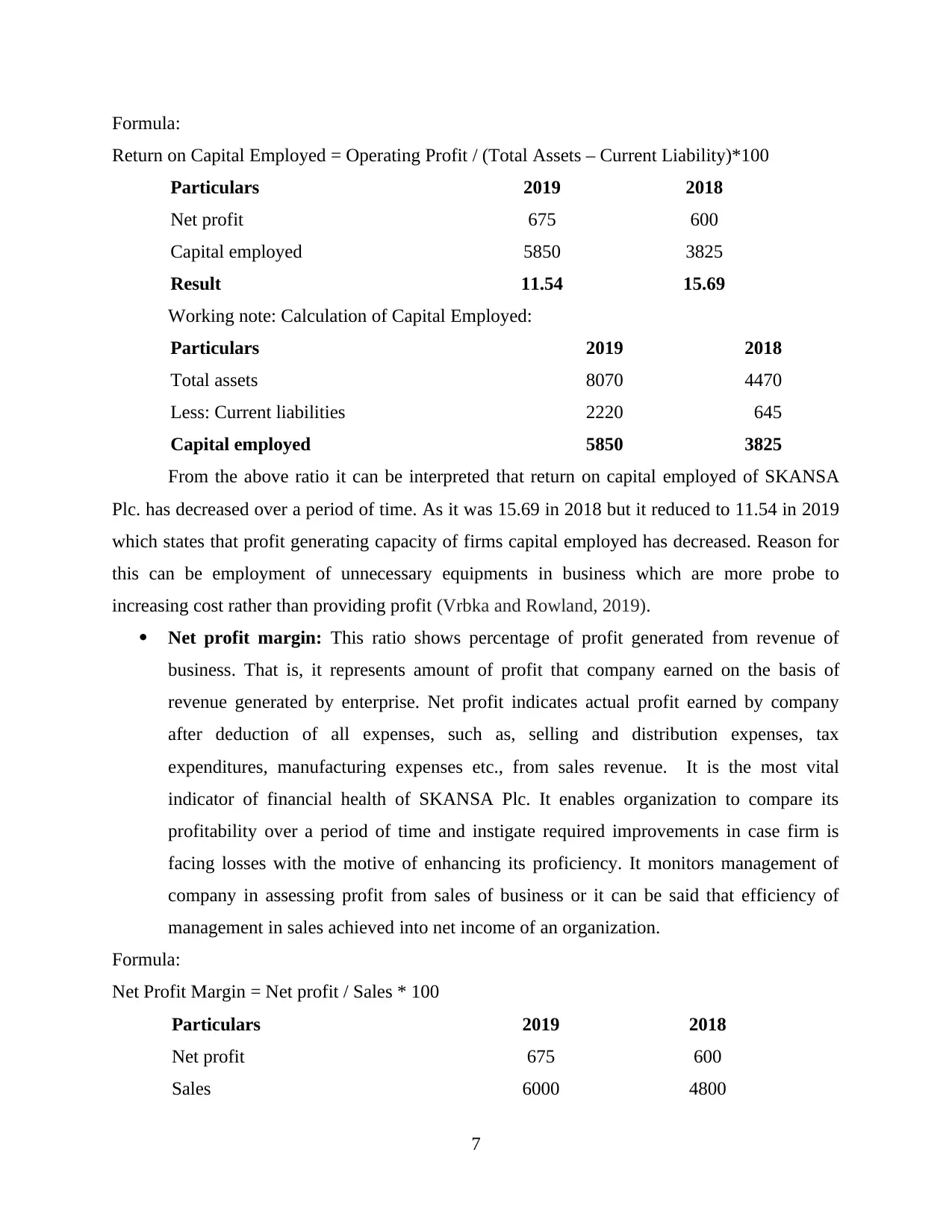

Net profit margin: This ratio shows percentage of profit generated from revenue of

business. That is, it represents amount of profit that company earned on the basis of

revenue generated by enterprise. Net profit indicates actual profit earned by company

after deduction of all expenses, such as, selling and distribution expenses, tax

expenditures, manufacturing expenses etc., from sales revenue. It is the most vital

indicator of financial health of SKANSA Plc. It enables organization to compare its

profitability over a period of time and instigate required improvements in case firm is

facing losses with the motive of enhancing its proficiency. It monitors management of

company in assessing profit from sales of business or it can be said that efficiency of

management in sales achieved into net income of an organization.

Formula:

Net Profit Margin = Net profit / Sales * 100

Particulars 2019 2018

Net profit 675 600

Sales 6000 4800

7

Return on Capital Employed = Operating Profit / (Total Assets – Current Liability)*100

Particulars 2019 2018

Net profit 675 600

Capital employed 5850 3825

Result 11.54 15.69

Working note: Calculation of Capital Employed:

Particulars 2019 2018

Total assets 8070 4470

Less: Current liabilities 2220 645

Capital employed 5850 3825

From the above ratio it can be interpreted that return on capital employed of SKANSA

Plc. has decreased over a period of time. As it was 15.69 in 2018 but it reduced to 11.54 in 2019

which states that profit generating capacity of firms capital employed has decreased. Reason for

this can be employment of unnecessary equipments in business which are more probe to

increasing cost rather than providing profit (Vrbka and Rowland, 2019).

Net profit margin: This ratio shows percentage of profit generated from revenue of

business. That is, it represents amount of profit that company earned on the basis of

revenue generated by enterprise. Net profit indicates actual profit earned by company

after deduction of all expenses, such as, selling and distribution expenses, tax

expenditures, manufacturing expenses etc., from sales revenue. It is the most vital

indicator of financial health of SKANSA Plc. It enables organization to compare its

profitability over a period of time and instigate required improvements in case firm is

facing losses with the motive of enhancing its proficiency. It monitors management of

company in assessing profit from sales of business or it can be said that efficiency of

management in sales achieved into net income of an organization.

Formula:

Net Profit Margin = Net profit / Sales * 100

Particulars 2019 2018

Net profit 675 600

Sales 6000 4800

7

Result 11.25 12.5

Interpretation of net profit ratio of SKANSA Plc. states that its percentage of profit from

revenue generated has reduced over time. While it was 12.5% in 2018 it came down to 11.25%

in 2019. As it can be analysed from income statement of company that its sales revenue has

increased in a year from 4800 to 6000 hence, it clearly indicates reason of declining profit is

increasing cost. Hence, firm should focus on reducing its expenditures for improvising

profitability.

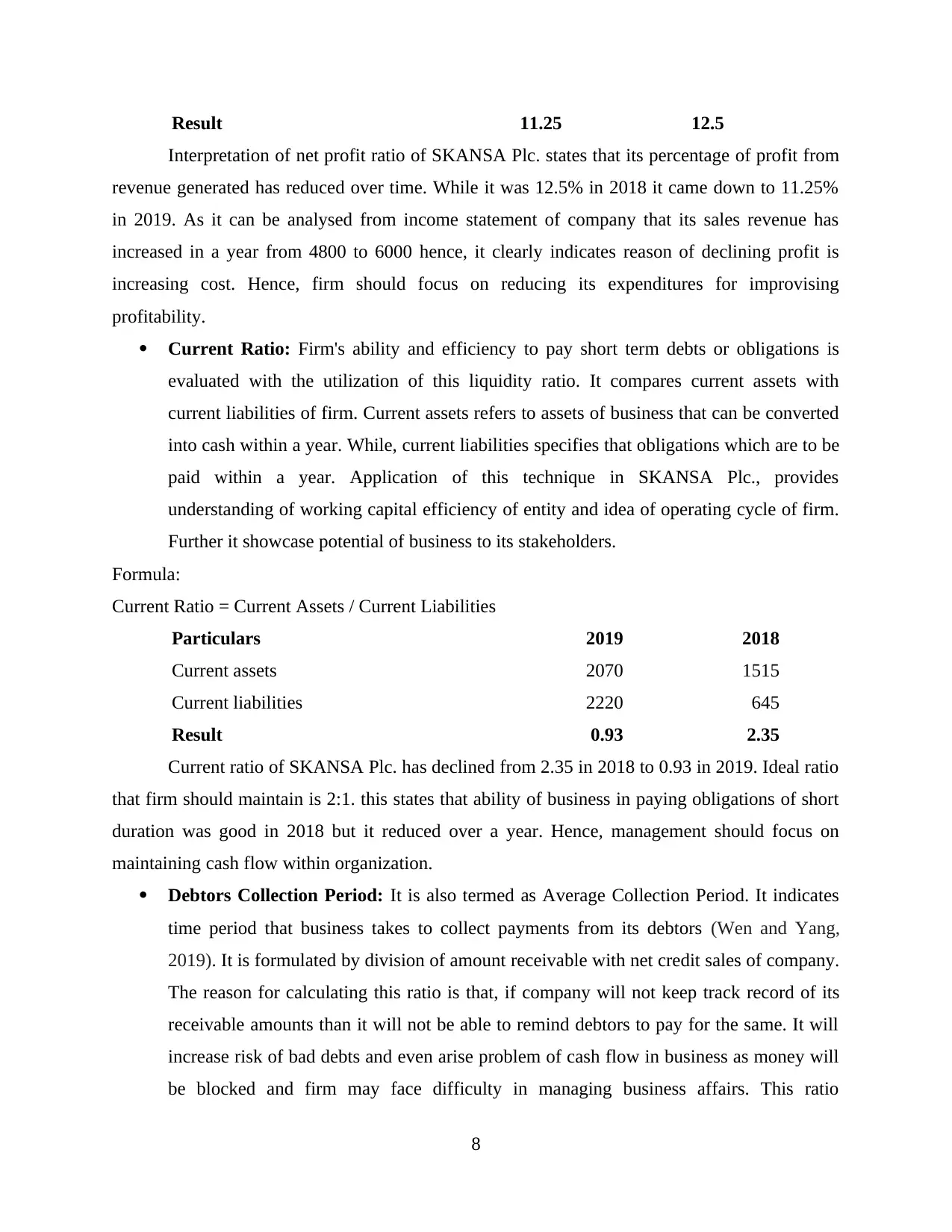

Current Ratio: Firm's ability and efficiency to pay short term debts or obligations is

evaluated with the utilization of this liquidity ratio. It compares current assets with

current liabilities of firm. Current assets refers to assets of business that can be converted

into cash within a year. While, current liabilities specifies that obligations which are to be

paid within a year. Application of this technique in SKANSA Plc., provides

understanding of working capital efficiency of entity and idea of operating cycle of firm.

Further it showcase potential of business to its stakeholders.

Formula:

Current Ratio = Current Assets / Current Liabilities

Particulars 2019 2018

Current assets 2070 1515

Current liabilities 2220 645

Result 0.93 2.35

Current ratio of SKANSA Plc. has declined from 2.35 in 2018 to 0.93 in 2019. Ideal ratio

that firm should maintain is 2:1. this states that ability of business in paying obligations of short

duration was good in 2018 but it reduced over a year. Hence, management should focus on

maintaining cash flow within organization.

Debtors Collection Period: It is also termed as Average Collection Period. It indicates

time period that business takes to collect payments from its debtors (Wen and Yang,

2019). It is formulated by division of amount receivable with net credit sales of company.

The reason for calculating this ratio is that, if company will not keep track record of its

receivable amounts than it will not be able to remind debtors to pay for the same. It will

increase risk of bad debts and even arise problem of cash flow in business as money will

be blocked and firm may face difficulty in managing business affairs. This ratio

8

Interpretation of net profit ratio of SKANSA Plc. states that its percentage of profit from

revenue generated has reduced over time. While it was 12.5% in 2018 it came down to 11.25%

in 2019. As it can be analysed from income statement of company that its sales revenue has

increased in a year from 4800 to 6000 hence, it clearly indicates reason of declining profit is

increasing cost. Hence, firm should focus on reducing its expenditures for improvising

profitability.

Current Ratio: Firm's ability and efficiency to pay short term debts or obligations is

evaluated with the utilization of this liquidity ratio. It compares current assets with

current liabilities of firm. Current assets refers to assets of business that can be converted

into cash within a year. While, current liabilities specifies that obligations which are to be

paid within a year. Application of this technique in SKANSA Plc., provides

understanding of working capital efficiency of entity and idea of operating cycle of firm.

Further it showcase potential of business to its stakeholders.

Formula:

Current Ratio = Current Assets / Current Liabilities

Particulars 2019 2018

Current assets 2070 1515

Current liabilities 2220 645

Result 0.93 2.35

Current ratio of SKANSA Plc. has declined from 2.35 in 2018 to 0.93 in 2019. Ideal ratio

that firm should maintain is 2:1. this states that ability of business in paying obligations of short

duration was good in 2018 but it reduced over a year. Hence, management should focus on

maintaining cash flow within organization.

Debtors Collection Period: It is also termed as Average Collection Period. It indicates

time period that business takes to collect payments from its debtors (Wen and Yang,

2019). It is formulated by division of amount receivable with net credit sales of company.

The reason for calculating this ratio is that, if company will not keep track record of its

receivable amounts than it will not be able to remind debtors to pay for the same. It will

increase risk of bad debts and even arise problem of cash flow in business as money will

be blocked and firm may face difficulty in managing business affairs. This ratio

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.