Managing Financial Resources Report

VerifiedAdded on 2020/02/05

|14

|4368

|129

Report

AI Summary

This report analyzes the financial decisions of ABC Ltd., a company supplying and installing glazed windows. It explores various financing options (bank loans, retained earnings, share capital, overdrafts), their implications, and costs. The report emphasizes the importance of financial planning, assesses information needs of different stakeholders (investors, lenders, suppliers, employees, government), and demonstrates the impact of financing decisions on financial statements. Budget analysis (cash and marketing budgets) is included, along with unit cost calculations and pricing decisions using cost-plus pricing and return on capital employed methods. Investment appraisal techniques (payback period, accounting rate of return, net present value, internal rate of return) are applied to evaluate the viability of a new project in three different countries, recommending investment in Italy. Finally, the report compares and contrasts financial statement formats for different organizations (sole trader, partnership, company) and interprets ABC Ltd.'s financial performance using ratio analysis (current ratio, acid test ratio, return on capital employed, gross profit margin, net profit margin).

MANAGING FINANCIAL

RESOURCES

1

RESOURCES

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ...............................................................................................................................4

TASK 1.................................................................................................................................................4

AC 1.1 Types of finance sources.....................................................................................................4

AC 1.2 Implication of finance sources............................................................................................4

AC 1.3 Appropriate source of finance.............................................................................................5

TASK 2 ................................................................................................................................................5

AC 2.1 Cost of finance sources.......................................................................................................5

AC 2.2 Importance of financial planning........................................................................................6

AC 2.3 Assess the information need of users..................................................................................6

AC 2.4 Impact of finance on financial statements...........................................................................7

TASK 3 ................................................................................................................................................7

AC 3.1 Analysis of budget and appropriate decisions.....................................................................7

AC 3.2 Calculation of unit costs and pricing decisions...................................................................8

a) 35% mark-up...............................................................................................................................8

b) 25% return on capital employed..................................................................................................8

AC 3.3 Project viability test through investment appraisal techniques...........................................9

TASK 4...............................................................................................................................................11

AC 4.1 Purpose of income statement and balance sheet...............................................................11

AC 4.3 Calculation of ratios and interpretation.............................................................................11

CONCLUSION..................................................................................................................................12

REFERENCES...................................................................................................................................12

Index of Tables

Table 1: Cash budget of ABC Ltd.......................................................................................................6

Table 2: Marketing budget of ABC Ltd................................................................................................7

Table 3: Calculation of unit costs.........................................................................................................7

Table 4: Calculation of pay back period ..............................................................................................8

Table 5: Calculation of Accounting rate of return................................................................................9

Table 6: Calculation of Net present value and IRR..............................................................................9

Table 7: Calculation of ratios of ABC Ltd..........................................................................................11

2

INTRODUCTION ...............................................................................................................................4

TASK 1.................................................................................................................................................4

AC 1.1 Types of finance sources.....................................................................................................4

AC 1.2 Implication of finance sources............................................................................................4

AC 1.3 Appropriate source of finance.............................................................................................5

TASK 2 ................................................................................................................................................5

AC 2.1 Cost of finance sources.......................................................................................................5

AC 2.2 Importance of financial planning........................................................................................6

AC 2.3 Assess the information need of users..................................................................................6

AC 2.4 Impact of finance on financial statements...........................................................................7

TASK 3 ................................................................................................................................................7

AC 3.1 Analysis of budget and appropriate decisions.....................................................................7

AC 3.2 Calculation of unit costs and pricing decisions...................................................................8

a) 35% mark-up...............................................................................................................................8

b) 25% return on capital employed..................................................................................................8

AC 3.3 Project viability test through investment appraisal techniques...........................................9

TASK 4...............................................................................................................................................11

AC 4.1 Purpose of income statement and balance sheet...............................................................11

AC 4.3 Calculation of ratios and interpretation.............................................................................11

CONCLUSION..................................................................................................................................12

REFERENCES...................................................................................................................................12

Index of Tables

Table 1: Cash budget of ABC Ltd.......................................................................................................6

Table 2: Marketing budget of ABC Ltd................................................................................................7

Table 3: Calculation of unit costs.........................................................................................................7

Table 4: Calculation of pay back period ..............................................................................................8

Table 5: Calculation of Accounting rate of return................................................................................9

Table 6: Calculation of Net present value and IRR..............................................................................9

Table 7: Calculation of ratios of ABC Ltd..........................................................................................11

2

INTRODUCTION

Looking at the present competitive business environment, financial success plays a very

important role for the successful organization. For the present assignment, financial decisions will

be taken for the success of ABC Ltd who supply and installs glazed windows to individual houses

and businesses. In the current market, ABC Ltd wishes to take a project to supply and install glazed

windows to a new built compound in North West London. Present project report will helps to gather

appropriate funds from different sources. Moreover, financial planning will assist ABC management

to administrate funds effectively through optimum utilization. In addition, budgeting techniques

will helps to manage business functioning and avoid shortfall through excess availability of funds.

At the end, report will describe different type of financial statements and interpret financial

performance with the helps of ratio analysis method.

TASK 1

AC 1.1 Types of finance sources

ABC ltd, can acquire finance for its new project from the following sources:

Bank Loan: ABC Ltd, can acquire funds from bank loan. Bank provides funds for different

duration at an interest rate which is decided on the basis of loan amount and time period as well

(Hollander and Verriest, 2015.).

Retained earnings: Retained earnings is the balance of undistributed or reserved profits

which is retained mainly to mitigate future financial need. ABC Ltd, can use its retained earnings to

invest in new project.

Share capital: ABC Ltd, can issue both the equity and ordinary share capital in the market

and generate funds in the form of share capital.

Overdraft: Apart from loan, bank also allows businesses to withdraw some high amount

than their available bank balance, called overdraft. ABC ltd, is reputative company who is operating

from the last 50 years henceforth, it can use overdraft to mitigate their financial requirement.

AC 1.2 Implication of finance sources

Bank Loan: ABC Ltd, has to pay finance costs to obtain loan in the way of periodically

interest payments with the repayment of principle amount as well. Moreover, legal implications is

ABC Ltd, has to provide collateral security to secure their debts (Plumlee and et.al., 2015). On

contrary to it, loan does not diversify business control to the lenders. However, if ABC Ltd, goes for

bankruptcy, than it has to sell its business assets and repay to the lenders.

3

Looking at the present competitive business environment, financial success plays a very

important role for the successful organization. For the present assignment, financial decisions will

be taken for the success of ABC Ltd who supply and installs glazed windows to individual houses

and businesses. In the current market, ABC Ltd wishes to take a project to supply and install glazed

windows to a new built compound in North West London. Present project report will helps to gather

appropriate funds from different sources. Moreover, financial planning will assist ABC management

to administrate funds effectively through optimum utilization. In addition, budgeting techniques

will helps to manage business functioning and avoid shortfall through excess availability of funds.

At the end, report will describe different type of financial statements and interpret financial

performance with the helps of ratio analysis method.

TASK 1

AC 1.1 Types of finance sources

ABC ltd, can acquire finance for its new project from the following sources:

Bank Loan: ABC Ltd, can acquire funds from bank loan. Bank provides funds for different

duration at an interest rate which is decided on the basis of loan amount and time period as well

(Hollander and Verriest, 2015.).

Retained earnings: Retained earnings is the balance of undistributed or reserved profits

which is retained mainly to mitigate future financial need. ABC Ltd, can use its retained earnings to

invest in new project.

Share capital: ABC Ltd, can issue both the equity and ordinary share capital in the market

and generate funds in the form of share capital.

Overdraft: Apart from loan, bank also allows businesses to withdraw some high amount

than their available bank balance, called overdraft. ABC ltd, is reputative company who is operating

from the last 50 years henceforth, it can use overdraft to mitigate their financial requirement.

AC 1.2 Implication of finance sources

Bank Loan: ABC Ltd, has to pay finance costs to obtain loan in the way of periodically

interest payments with the repayment of principle amount as well. Moreover, legal implications is

ABC Ltd, has to provide collateral security to secure their debts (Plumlee and et.al., 2015). On

contrary to it, loan does not diversify business control to the lenders. However, if ABC Ltd, goes for

bankruptcy, than it has to sell its business assets and repay to the lenders.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Retained earnings: There is no implication to use retained earnings. But still, ABC Ltd, can

not use its all of the net earnings because it has to maintain some reserve in the business as per legal

requirement. While, it dilute controlling rights to the equity investors. On contrary, in case of having

loss of all the invested funds than ABC ltd, does not need to pay to the shareholders.

Share capital: ABC Ltd, has to pay return to their investors either in the form of dividend

and capital appreciation. Moreover, dilution of control exists in this source. Legal implication is

ABC Ltd, has to fulfil all the legal and regulatory requirement such as prospectus issue and stock

exchange regulations (Rasoolpur, 2015). Capital will be repaid after the payment to the creditors

and lenders.

Overdraft: ABC Ltd has to pay interest which is comparatively high than loan interest rate.

Moreover, it is available to the limited extent and continuous overdraft create an negative image to

the business. It does not transfer controlling rights to the banks.

AC 1.3 Appropriate source of finance

On the basis of above evaluation, it can be said that bank loan will be the most appropriate

source due to the following reasons:

ABC Ltd, is a well-established company hence, it will has a good reputation and credit

position as well. So that, it can eliminate short-term, medium-term and long-term

requirement from this source.

ABC Ltd, can use its operational income to pay their interest obligations on loans.

Another benefit is interest payment is a deductible expenses for the tax determination. Thus,

it reduce ABC Ltd's tax obligation and enhance revenue as well.

It does not dilute controlling rights to the lenders so that management will be highly able to

exert their full control on the business operations.

In addition to it, ABC Ltd, can also use retained earnings because it is available without any

financial costs.

TASK 2

AC 2.1 Cost of finance sources

Type of finance sources Costs

Bank Loan 1. Periodical interest payment is the cost of bank loans which may

be fixed and fluctuate as well (Hollander and Verriest, 2015).

Retained earnings It does not involve any financial costs but still, opportunity cost is

included in this. It means that if ABC Ltd does not invest its retained

profits for the new project than it can use it in other profit gaining

function.

4

not use its all of the net earnings because it has to maintain some reserve in the business as per legal

requirement. While, it dilute controlling rights to the equity investors. On contrary, in case of having

loss of all the invested funds than ABC ltd, does not need to pay to the shareholders.

Share capital: ABC Ltd, has to pay return to their investors either in the form of dividend

and capital appreciation. Moreover, dilution of control exists in this source. Legal implication is

ABC Ltd, has to fulfil all the legal and regulatory requirement such as prospectus issue and stock

exchange regulations (Rasoolpur, 2015). Capital will be repaid after the payment to the creditors

and lenders.

Overdraft: ABC Ltd has to pay interest which is comparatively high than loan interest rate.

Moreover, it is available to the limited extent and continuous overdraft create an negative image to

the business. It does not transfer controlling rights to the banks.

AC 1.3 Appropriate source of finance

On the basis of above evaluation, it can be said that bank loan will be the most appropriate

source due to the following reasons:

ABC Ltd, is a well-established company hence, it will has a good reputation and credit

position as well. So that, it can eliminate short-term, medium-term and long-term

requirement from this source.

ABC Ltd, can use its operational income to pay their interest obligations on loans.

Another benefit is interest payment is a deductible expenses for the tax determination. Thus,

it reduce ABC Ltd's tax obligation and enhance revenue as well.

It does not dilute controlling rights to the lenders so that management will be highly able to

exert their full control on the business operations.

In addition to it, ABC Ltd, can also use retained earnings because it is available without any

financial costs.

TASK 2

AC 2.1 Cost of finance sources

Type of finance sources Costs

Bank Loan 1. Periodical interest payment is the cost of bank loans which may

be fixed and fluctuate as well (Hollander and Verriest, 2015).

Retained earnings It does not involve any financial costs but still, opportunity cost is

included in this. It means that if ABC Ltd does not invest its retained

profits for the new project than it can use it in other profit gaining

function.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Share capital Dividend payment on the invested capital is the costs of share capital.

Moreover, legal formalities and printing prospectus, shares and

photocopier charges are the costs of issuing share capital (Kozarevic and

Džafic, 2014).

Overdrafts Interets obligation is the costs of using bank overdraft.

AC 2.2 Importance of financial planning

Not only the collection of required funds is necessary but also its proper management is the

essential for the hazard-free operations. It is an evolving plan which changes according to the

environment changes and helps to achieve set financial goals.

It helps to utilize monetary sources such as income more effectively.

It assist ABC Ltd to enhance cash flow and monitor daily business expenses.

It helps to determine new investment opportunity and take benefits of it.

It ensure optimum utilization of funds and control spendings results in high profitability

(Importance of financial planning, n.d.).

It helps to identify shortage and excess of funds through preparing budgets. Henceforth,

shortfalls can be mitigate through effective financial decisions.

It build a strong capital base for ABC Ltd and provide financial security to the business so

that it can run successfully without any financial difficulties.

Financial planning will helps to measure ABC Ltd, financial growth over the period.

AC 2.3 Assess the information need of users

Investors: They invest their personal funds so that greater return can be earn in the form of

dividend. They will evaluate ABC Ltd's cash generating ability, capital structure, profitability,

investors return and financial position. So that, they can invest funds in the company which will

provide greater return to them.

Lenders: Lenders analyse credit position, debt burden capacity, profit margin, solvency

position and others (Carroll and Buchholtz, 2014). So that, they can secure their funds and earn

regular interest at fixed interval of time.

Suppliers: They provide short-term credit facility such as credit material supply. Therefore,

they analyse liquidity performance by measuring current assets and current liabilities and provide

funds in case, if ABC Ltd, is able to pay suppliers timely.

Employees: They desires to earn more and more salary from the organization. Hence, need

information about ABC Ltd, profit margin because high profit will lead to enhance worker's salary

with the other non-monetary benefits as well (Beringer, Jonas and Kock, 2013).

5

Moreover, legal formalities and printing prospectus, shares and

photocopier charges are the costs of issuing share capital (Kozarevic and

Džafic, 2014).

Overdrafts Interets obligation is the costs of using bank overdraft.

AC 2.2 Importance of financial planning

Not only the collection of required funds is necessary but also its proper management is the

essential for the hazard-free operations. It is an evolving plan which changes according to the

environment changes and helps to achieve set financial goals.

It helps to utilize monetary sources such as income more effectively.

It assist ABC Ltd to enhance cash flow and monitor daily business expenses.

It helps to determine new investment opportunity and take benefits of it.

It ensure optimum utilization of funds and control spendings results in high profitability

(Importance of financial planning, n.d.).

It helps to identify shortage and excess of funds through preparing budgets. Henceforth,

shortfalls can be mitigate through effective financial decisions.

It build a strong capital base for ABC Ltd and provide financial security to the business so

that it can run successfully without any financial difficulties.

Financial planning will helps to measure ABC Ltd, financial growth over the period.

AC 2.3 Assess the information need of users

Investors: They invest their personal funds so that greater return can be earn in the form of

dividend. They will evaluate ABC Ltd's cash generating ability, capital structure, profitability,

investors return and financial position. So that, they can invest funds in the company which will

provide greater return to them.

Lenders: Lenders analyse credit position, debt burden capacity, profit margin, solvency

position and others (Carroll and Buchholtz, 2014). So that, they can secure their funds and earn

regular interest at fixed interval of time.

Suppliers: They provide short-term credit facility such as credit material supply. Therefore,

they analyse liquidity performance by measuring current assets and current liabilities and provide

funds in case, if ABC Ltd, is able to pay suppliers timely.

Employees: They desires to earn more and more salary from the organization. Hence, need

information about ABC Ltd, profit margin because high profit will lead to enhance worker's salary

with the other non-monetary benefits as well (Beringer, Jonas and Kock, 2013).

5

Government: ABC Ltd has to pay regular tax on their net earnings to the government. Thus,

government need information about profit from the profitability statement to determine tax

liabilities of ABC Ltd.

AC 2.4 Impact of finance on financial statements

Interest: Interest on bank loan and overdraft will be recorded as expenses in P&L a/c and

deducted from the cash balance in B/S.

Debt from bank: It will be recorded as long term liabilities under the head non-current

liabilities in B/S and increase cash position as well (Cerqueiro, Ongena and Roszbach, 2014).

Share capital: It will be disclose as owner's capital in the liabilities side of B/S and included

in cash balance.

Dividend: It will be disclose as payment in P&L a/c and deducted from the cash under the

head current assets.

Principal payment: Repayment of borrowed funds will be disclose as expenses in P&L a/c

and deducted from the loan amount. Moreover, it will be subtracted from the cash balance in

current assets.

TASK 3

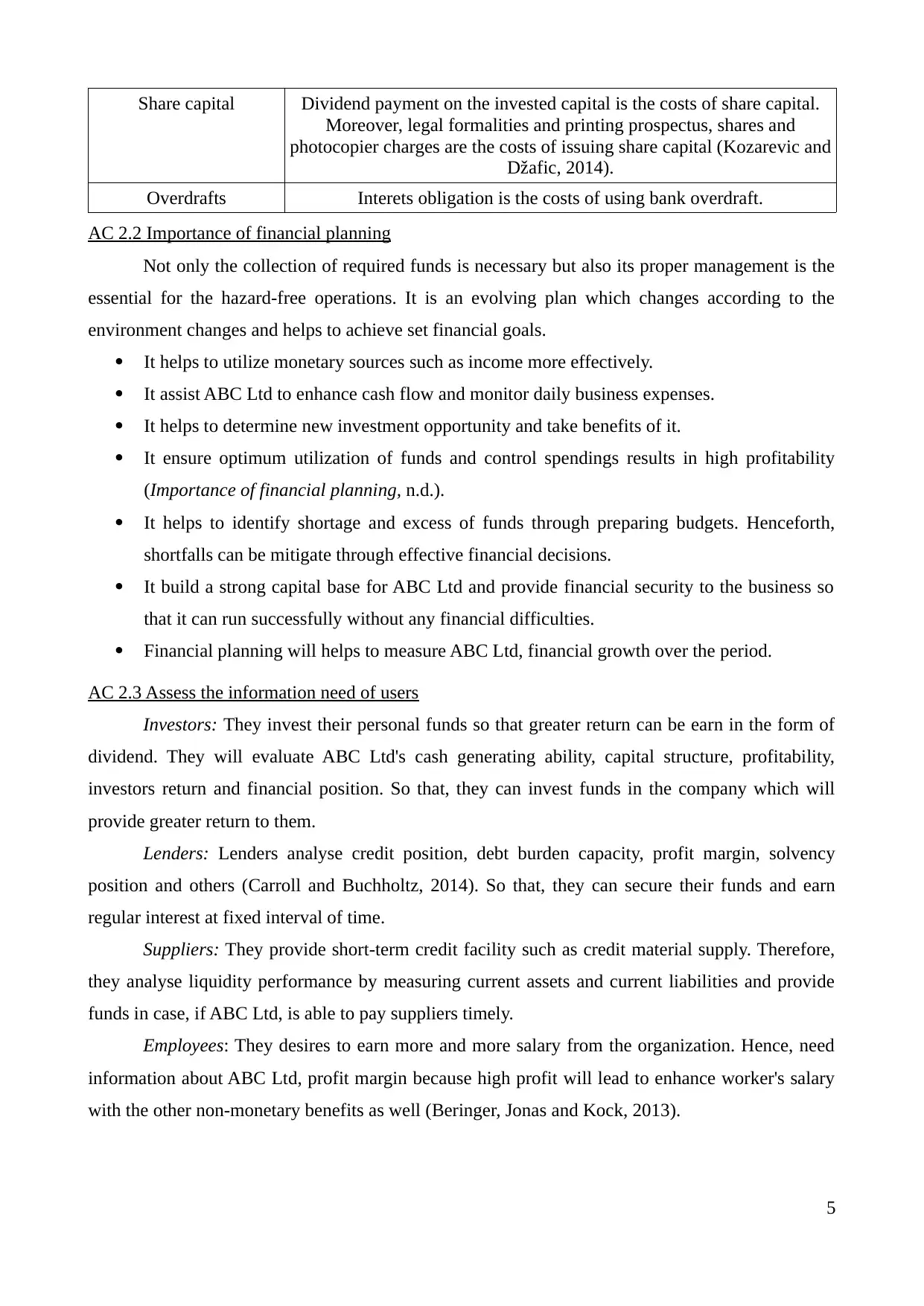

AC 3.1 Analysis of budget and appropriate decisions

Cash budget records all the estimated ABC Ltd's revenue and expenditures for the future

period (Cox, 2014).

Table 1: Cash budget of ABC Ltd

Particulars July August September

Customer instalments 25000 25000 25000

Credit sales 25000 25000

Total cash available for use 25000 50000 50000

Cash outflow

Payment to suppliers 15000

Overheads 5000 5000 5000

Total cash uses 5000 5000 20000

Net cash flow 20000 45000 30000

Initial cash available 100000 120000 165000

Ending cash balance 120000 165000 195000

Interpretation:

6

government need information about profit from the profitability statement to determine tax

liabilities of ABC Ltd.

AC 2.4 Impact of finance on financial statements

Interest: Interest on bank loan and overdraft will be recorded as expenses in P&L a/c and

deducted from the cash balance in B/S.

Debt from bank: It will be recorded as long term liabilities under the head non-current

liabilities in B/S and increase cash position as well (Cerqueiro, Ongena and Roszbach, 2014).

Share capital: It will be disclose as owner's capital in the liabilities side of B/S and included

in cash balance.

Dividend: It will be disclose as payment in P&L a/c and deducted from the cash under the

head current assets.

Principal payment: Repayment of borrowed funds will be disclose as expenses in P&L a/c

and deducted from the loan amount. Moreover, it will be subtracted from the cash balance in

current assets.

TASK 3

AC 3.1 Analysis of budget and appropriate decisions

Cash budget records all the estimated ABC Ltd's revenue and expenditures for the future

period (Cox, 2014).

Table 1: Cash budget of ABC Ltd

Particulars July August September

Customer instalments 25000 25000 25000

Credit sales 25000 25000

Total cash available for use 25000 50000 50000

Cash outflow

Payment to suppliers 15000

Overheads 5000 5000 5000

Total cash uses 5000 5000 20000

Net cash flow 20000 45000 30000

Initial cash available 100000 120000 165000

Ending cash balance 120000 165000 195000

Interpretation:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ABC Ltd, will generate high cash revenue of £25000, £50000 and £50000 over the period.

Firm will gather equal instalment of £25000 each month and receive £25000 in credit for 1 month.

On the other side, ABC Ltd, will incur cash expenses of £5000, £5000 and £20000. It will pay

supplier in 2 month lag period and overhead in the same year. This in turn, NCF will be £20000,

£45000 and £30000 and closing cash balance will be consistently increase from £120000 to

£165000 and £195000 respectively.

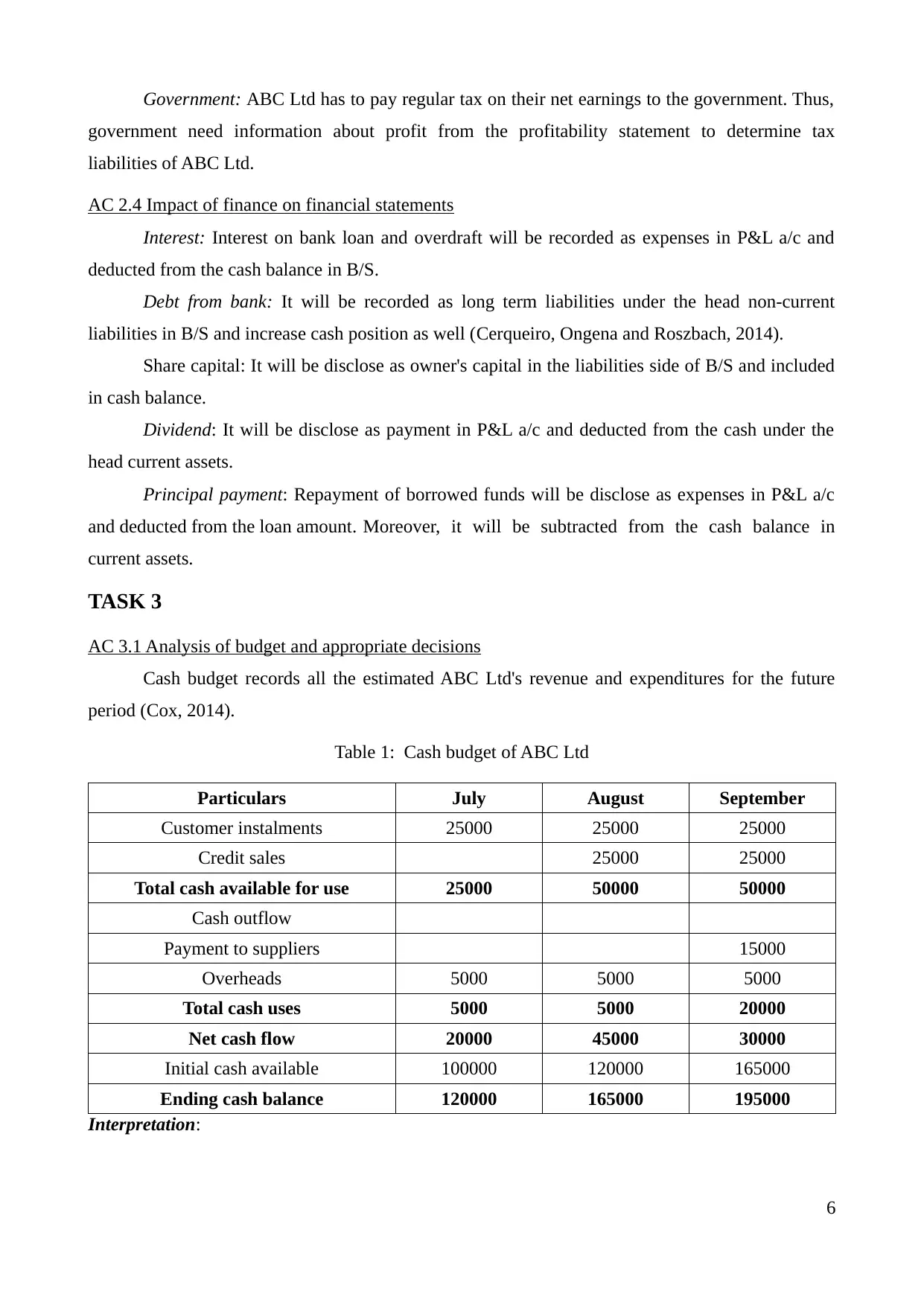

Table 2: Marketing budget of ABC Ltd

Particulars July August

Opening balance 5000 1500

Revenues from sponsors 8000 6000

Total cash 13000 7500

Expenses: Advertisement 5000 2000

Trade shows 2500 1000

Catalogs 1500 800

Sales Training 2500 1500

Total expense 11500 5300

Closing balance 1500 2200

As per the budget, it can be seen that marketing manager will expense funds for

advertisement, trade shows, catalogs and providing sales training to their staff so that effective

services can be given to the customers (Lawrence, 2008). Total expenses will be £11500 and £5300

and ending balance will be £1500 and £2200.

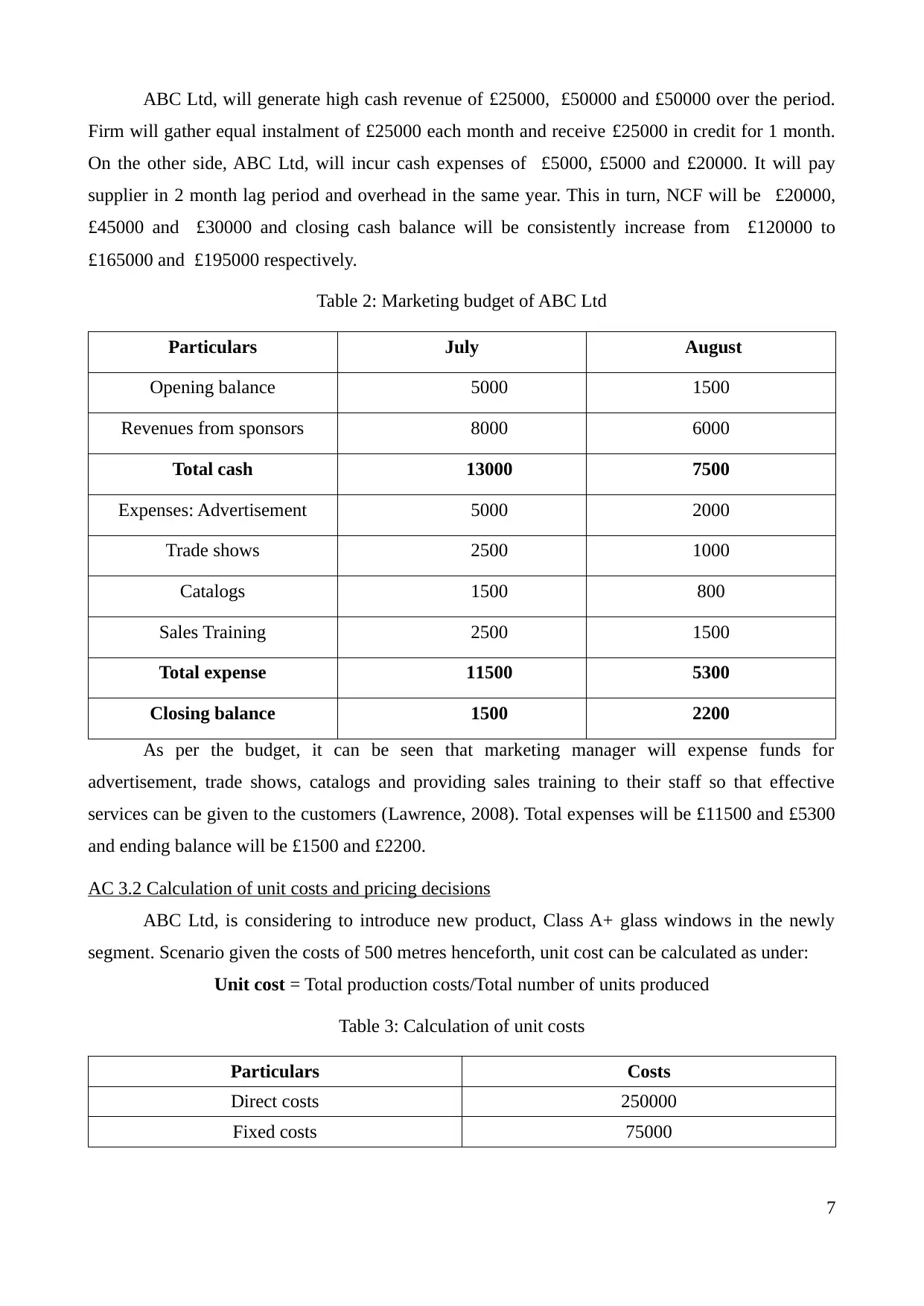

AC 3.2 Calculation of unit costs and pricing decisions

ABC Ltd, is considering to introduce new product, Class A+ glass windows in the newly

segment. Scenario given the costs of 500 metres henceforth, unit cost can be calculated as under:

Unit cost = Total production costs/Total number of units produced

Table 3: Calculation of unit costs

Particulars Costs

Direct costs 250000

Fixed costs 75000

7

Firm will gather equal instalment of £25000 each month and receive £25000 in credit for 1 month.

On the other side, ABC Ltd, will incur cash expenses of £5000, £5000 and £20000. It will pay

supplier in 2 month lag period and overhead in the same year. This in turn, NCF will be £20000,

£45000 and £30000 and closing cash balance will be consistently increase from £120000 to

£165000 and £195000 respectively.

Table 2: Marketing budget of ABC Ltd

Particulars July August

Opening balance 5000 1500

Revenues from sponsors 8000 6000

Total cash 13000 7500

Expenses: Advertisement 5000 2000

Trade shows 2500 1000

Catalogs 1500 800

Sales Training 2500 1500

Total expense 11500 5300

Closing balance 1500 2200

As per the budget, it can be seen that marketing manager will expense funds for

advertisement, trade shows, catalogs and providing sales training to their staff so that effective

services can be given to the customers (Lawrence, 2008). Total expenses will be £11500 and £5300

and ending balance will be £1500 and £2200.

AC 3.2 Calculation of unit costs and pricing decisions

ABC Ltd, is considering to introduce new product, Class A+ glass windows in the newly

segment. Scenario given the costs of 500 metres henceforth, unit cost can be calculated as under:

Unit cost = Total production costs/Total number of units produced

Table 3: Calculation of unit costs

Particulars Costs

Direct costs 250000

Fixed costs 75000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total costs 325000

Total metre produced 500

Cost per metre 650

ABC Ltd, intends to decide selling price through using cost-plus-pricing method in which

prices can be set by adding an appropriate mark-up percentage in the cost.

a) 35% mark-up

Selling price = Unit cost + Mark-up percentage

S.P. = £650 per metre + (35%*£650 per metre)

= £650 + £227.5 per metre

= £877.5 per metre

= 878 (Approx)

b) 25% return on capital employed

S.P. = Unit costs + (25% of capital employed/500 metre)

= £650 + (25%*£100000)/500 metre

= £650 + £50

= £700

Interpretation: Thus, it becomes clear that ABC Ltd, should use cost-plus-pricing method

and add mark-up percentage of 35% on costs. So that, it can sale profit at £878 which is

comparatively higher than selling price as per 25% ROCE method. Thus, through sale the product

at £878 ABC Ltd, can earn greater turnover and profitability as well.

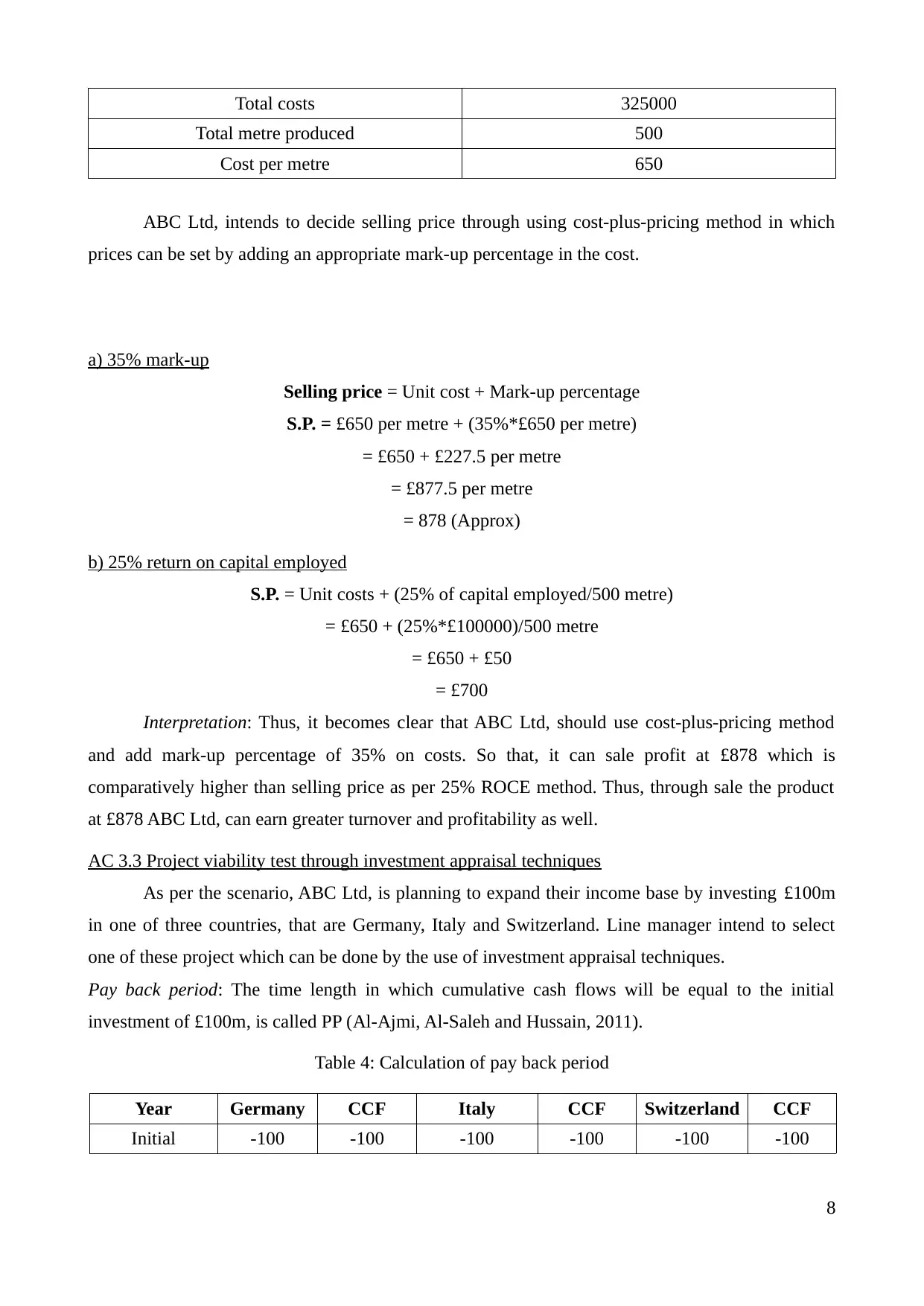

AC 3.3 Project viability test through investment appraisal techniques

As per the scenario, ABC Ltd, is planning to expand their income base by investing £100m

in one of three countries, that are Germany, Italy and Switzerland. Line manager intend to select

one of these project which can be done by the use of investment appraisal techniques.

Pay back period: The time length in which cumulative cash flows will be equal to the initial

investment of £100m, is called PP (Al-Ajmi, Al-Saleh and Hussain, 2011).

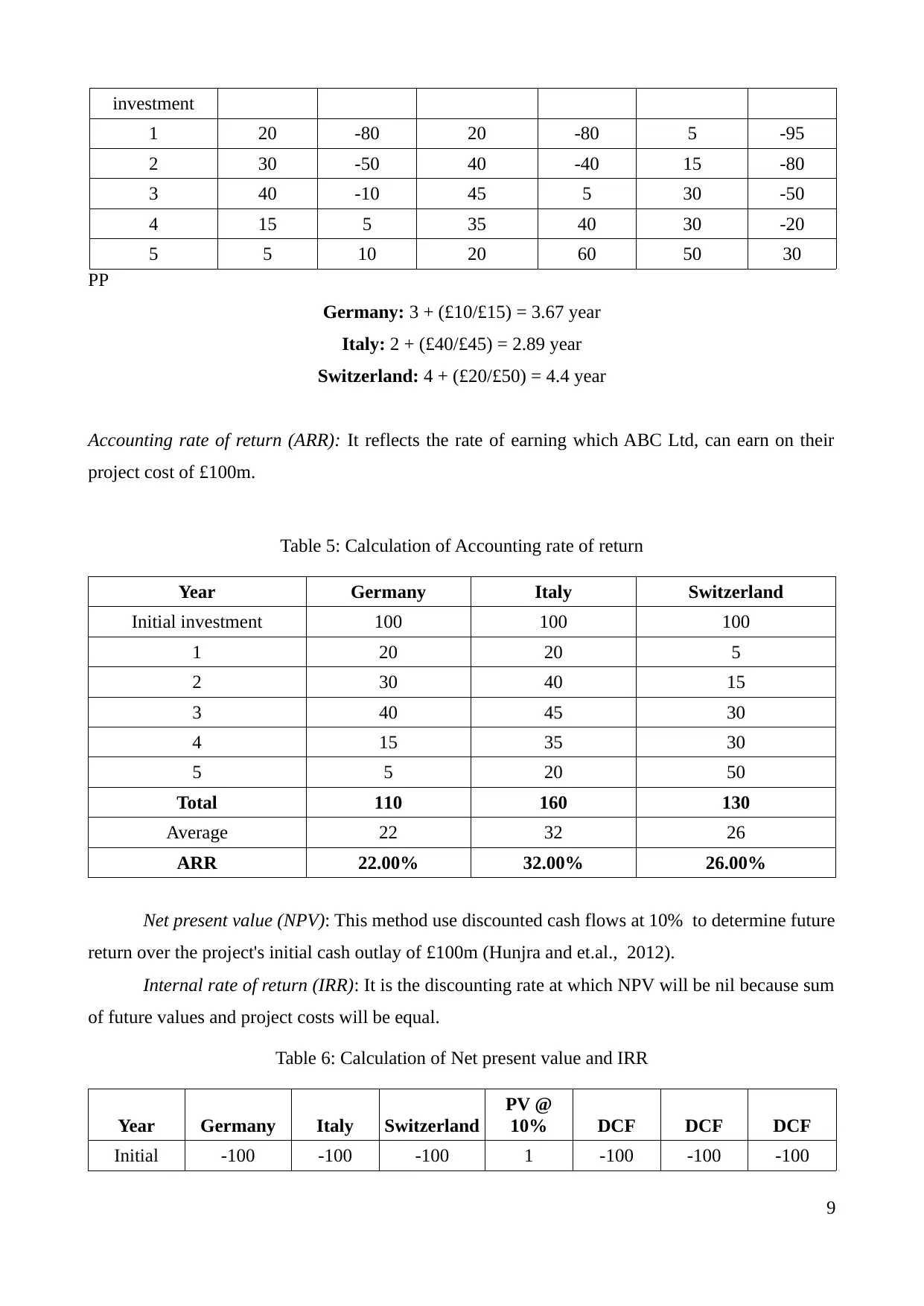

Table 4: Calculation of pay back period

Year Germany CCF Italy CCF Switzerland CCF

Initial -100 -100 -100 -100 -100 -100

8

Total metre produced 500

Cost per metre 650

ABC Ltd, intends to decide selling price through using cost-plus-pricing method in which

prices can be set by adding an appropriate mark-up percentage in the cost.

a) 35% mark-up

Selling price = Unit cost + Mark-up percentage

S.P. = £650 per metre + (35%*£650 per metre)

= £650 + £227.5 per metre

= £877.5 per metre

= 878 (Approx)

b) 25% return on capital employed

S.P. = Unit costs + (25% of capital employed/500 metre)

= £650 + (25%*£100000)/500 metre

= £650 + £50

= £700

Interpretation: Thus, it becomes clear that ABC Ltd, should use cost-plus-pricing method

and add mark-up percentage of 35% on costs. So that, it can sale profit at £878 which is

comparatively higher than selling price as per 25% ROCE method. Thus, through sale the product

at £878 ABC Ltd, can earn greater turnover and profitability as well.

AC 3.3 Project viability test through investment appraisal techniques

As per the scenario, ABC Ltd, is planning to expand their income base by investing £100m

in one of three countries, that are Germany, Italy and Switzerland. Line manager intend to select

one of these project which can be done by the use of investment appraisal techniques.

Pay back period: The time length in which cumulative cash flows will be equal to the initial

investment of £100m, is called PP (Al-Ajmi, Al-Saleh and Hussain, 2011).

Table 4: Calculation of pay back period

Year Germany CCF Italy CCF Switzerland CCF

Initial -100 -100 -100 -100 -100 -100

8

investment

1 20 -80 20 -80 5 -95

2 30 -50 40 -40 15 -80

3 40 -10 45 5 30 -50

4 15 5 35 40 30 -20

5 5 10 20 60 50 30

PP

Germany: 3 + (£10/£15) = 3.67 year

Italy: 2 + (£40/£45) = 2.89 year

Switzerland: 4 + (£20/£50) = 4.4 year

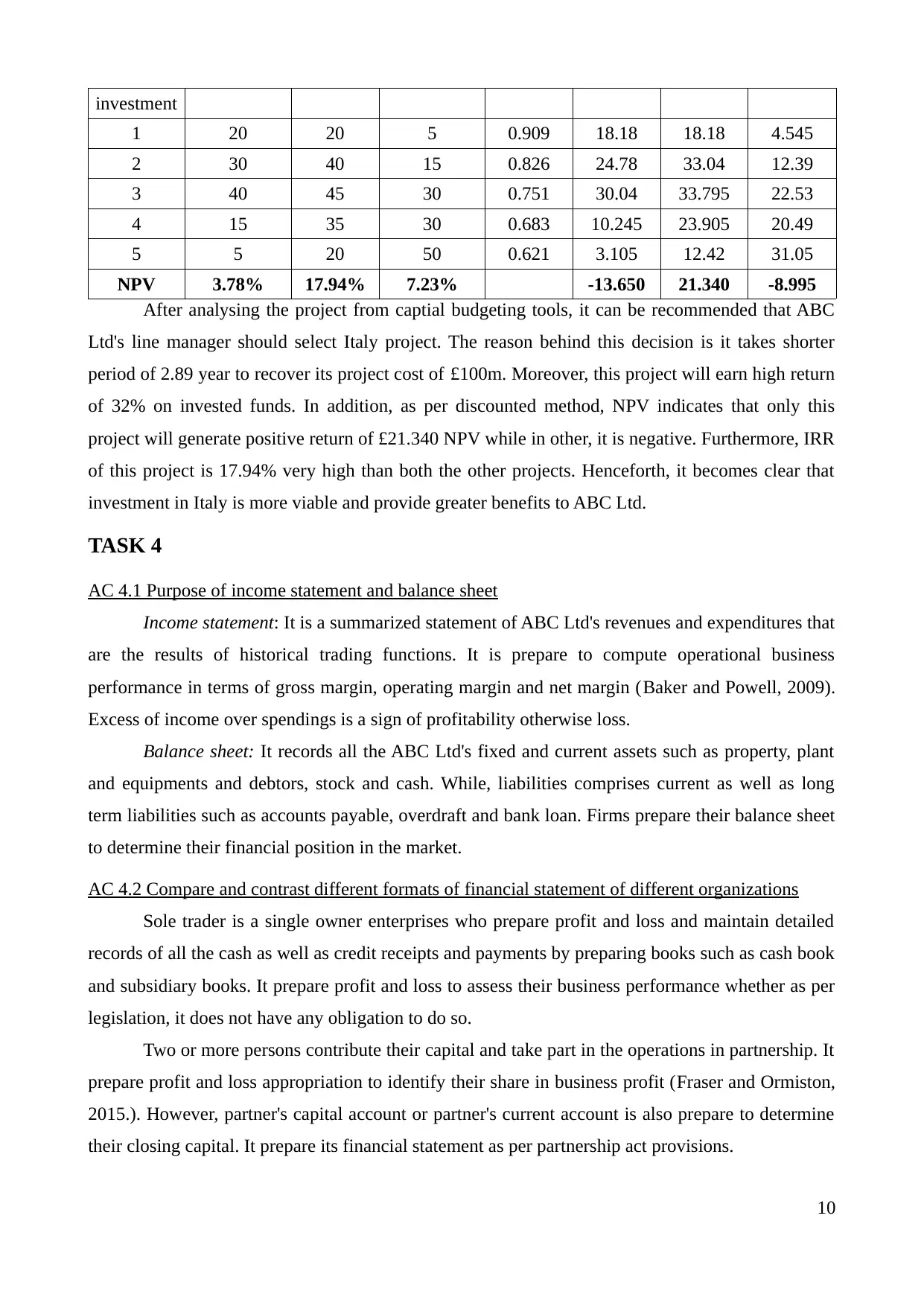

Accounting rate of return (ARR): It reflects the rate of earning which ABC Ltd, can earn on their

project cost of £100m.

Table 5: Calculation of Accounting rate of return

Year Germany Italy Switzerland

Initial investment 100 100 100

1 20 20 5

2 30 40 15

3 40 45 30

4 15 35 30

5 5 20 50

Total 110 160 130

Average 22 32 26

ARR 22.00% 32.00% 26.00%

Net present value (NPV): This method use discounted cash flows at 10% to determine future

return over the project's initial cash outlay of £100m (Hunjra and et.al., 2012).

Internal rate of return (IRR): It is the discounting rate at which NPV will be nil because sum

of future values and project costs will be equal.

Table 6: Calculation of Net present value and IRR

Year Germany Italy Switzerland

PV @

10% DCF DCF DCF

Initial -100 -100 -100 1 -100 -100 -100

9

1 20 -80 20 -80 5 -95

2 30 -50 40 -40 15 -80

3 40 -10 45 5 30 -50

4 15 5 35 40 30 -20

5 5 10 20 60 50 30

PP

Germany: 3 + (£10/£15) = 3.67 year

Italy: 2 + (£40/£45) = 2.89 year

Switzerland: 4 + (£20/£50) = 4.4 year

Accounting rate of return (ARR): It reflects the rate of earning which ABC Ltd, can earn on their

project cost of £100m.

Table 5: Calculation of Accounting rate of return

Year Germany Italy Switzerland

Initial investment 100 100 100

1 20 20 5

2 30 40 15

3 40 45 30

4 15 35 30

5 5 20 50

Total 110 160 130

Average 22 32 26

ARR 22.00% 32.00% 26.00%

Net present value (NPV): This method use discounted cash flows at 10% to determine future

return over the project's initial cash outlay of £100m (Hunjra and et.al., 2012).

Internal rate of return (IRR): It is the discounting rate at which NPV will be nil because sum

of future values and project costs will be equal.

Table 6: Calculation of Net present value and IRR

Year Germany Italy Switzerland

PV @

10% DCF DCF DCF

Initial -100 -100 -100 1 -100 -100 -100

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

investment

1 20 20 5 0.909 18.18 18.18 4.545

2 30 40 15 0.826 24.78 33.04 12.39

3 40 45 30 0.751 30.04 33.795 22.53

4 15 35 30 0.683 10.245 23.905 20.49

5 5 20 50 0.621 3.105 12.42 31.05

NPV 3.78% 17.94% 7.23% -13.650 21.340 -8.995

After analysing the project from captial budgeting tools, it can be recommended that ABC

Ltd's line manager should select Italy project. The reason behind this decision is it takes shorter

period of 2.89 year to recover its project cost of £100m. Moreover, this project will earn high return

of 32% on invested funds. In addition, as per discounted method, NPV indicates that only this

project will generate positive return of £21.340 NPV while in other, it is negative. Furthermore, IRR

of this project is 17.94% very high than both the other projects. Henceforth, it becomes clear that

investment in Italy is more viable and provide greater benefits to ABC Ltd.

TASK 4

AC 4.1 Purpose of income statement and balance sheet

Income statement: It is a summarized statement of ABC Ltd's revenues and expenditures that

are the results of historical trading functions. It is prepare to compute operational business

performance in terms of gross margin, operating margin and net margin (Baker and Powell, 2009).

Excess of income over spendings is a sign of profitability otherwise loss.

Balance sheet: It records all the ABC Ltd's fixed and current assets such as property, plant

and equipments and debtors, stock and cash. While, liabilities comprises current as well as long

term liabilities such as accounts payable, overdraft and bank loan. Firms prepare their balance sheet

to determine their financial position in the market.

AC 4.2 Compare and contrast different formats of financial statement of different organizations

Sole trader is a single owner enterprises who prepare profit and loss and maintain detailed

records of all the cash as well as credit receipts and payments by preparing books such as cash book

and subsidiary books. It prepare profit and loss to assess their business performance whether as per

legislation, it does not have any obligation to do so.

Two or more persons contribute their capital and take part in the operations in partnership. It

prepare profit and loss appropriation to identify their share in business profit (Fraser and Ormiston,

2015.). However, partner's capital account or partner's current account is also prepare to determine

their closing capital. It prepare its financial statement as per partnership act provisions.

10

1 20 20 5 0.909 18.18 18.18 4.545

2 30 40 15 0.826 24.78 33.04 12.39

3 40 45 30 0.751 30.04 33.795 22.53

4 15 35 30 0.683 10.245 23.905 20.49

5 5 20 50 0.621 3.105 12.42 31.05

NPV 3.78% 17.94% 7.23% -13.650 21.340 -8.995

After analysing the project from captial budgeting tools, it can be recommended that ABC

Ltd's line manager should select Italy project. The reason behind this decision is it takes shorter

period of 2.89 year to recover its project cost of £100m. Moreover, this project will earn high return

of 32% on invested funds. In addition, as per discounted method, NPV indicates that only this

project will generate positive return of £21.340 NPV while in other, it is negative. Furthermore, IRR

of this project is 17.94% very high than both the other projects. Henceforth, it becomes clear that

investment in Italy is more viable and provide greater benefits to ABC Ltd.

TASK 4

AC 4.1 Purpose of income statement and balance sheet

Income statement: It is a summarized statement of ABC Ltd's revenues and expenditures that

are the results of historical trading functions. It is prepare to compute operational business

performance in terms of gross margin, operating margin and net margin (Baker and Powell, 2009).

Excess of income over spendings is a sign of profitability otherwise loss.

Balance sheet: It records all the ABC Ltd's fixed and current assets such as property, plant

and equipments and debtors, stock and cash. While, liabilities comprises current as well as long

term liabilities such as accounts payable, overdraft and bank loan. Firms prepare their balance sheet

to determine their financial position in the market.

AC 4.2 Compare and contrast different formats of financial statement of different organizations

Sole trader is a single owner enterprises who prepare profit and loss and maintain detailed

records of all the cash as well as credit receipts and payments by preparing books such as cash book

and subsidiary books. It prepare profit and loss to assess their business performance whether as per

legislation, it does not have any obligation to do so.

Two or more persons contribute their capital and take part in the operations in partnership. It

prepare profit and loss appropriation to identify their share in business profit (Fraser and Ormiston,

2015.). However, partner's capital account or partner's current account is also prepare to determine

their closing capital. It prepare its financial statement as per partnership act provisions.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Company is a body which came into operation by fully complying with the legsilative

provisions. In UK, all the companies has to prepare required statement as per Company Act, 2006.

It is compulsory to prepare profitability statement and statement of financial position to assess

profit/loss and financial strength (Baker and Powell, 2009). However, other statement comprises

cash flow statement, fund flow statement and statement of changes in equity and retained earnings

as well. Moreover, auditors verify the statement from the historical records which will be publish in

the market. So that, accuracy, reliability and all the material information can be represented in

financial statements.

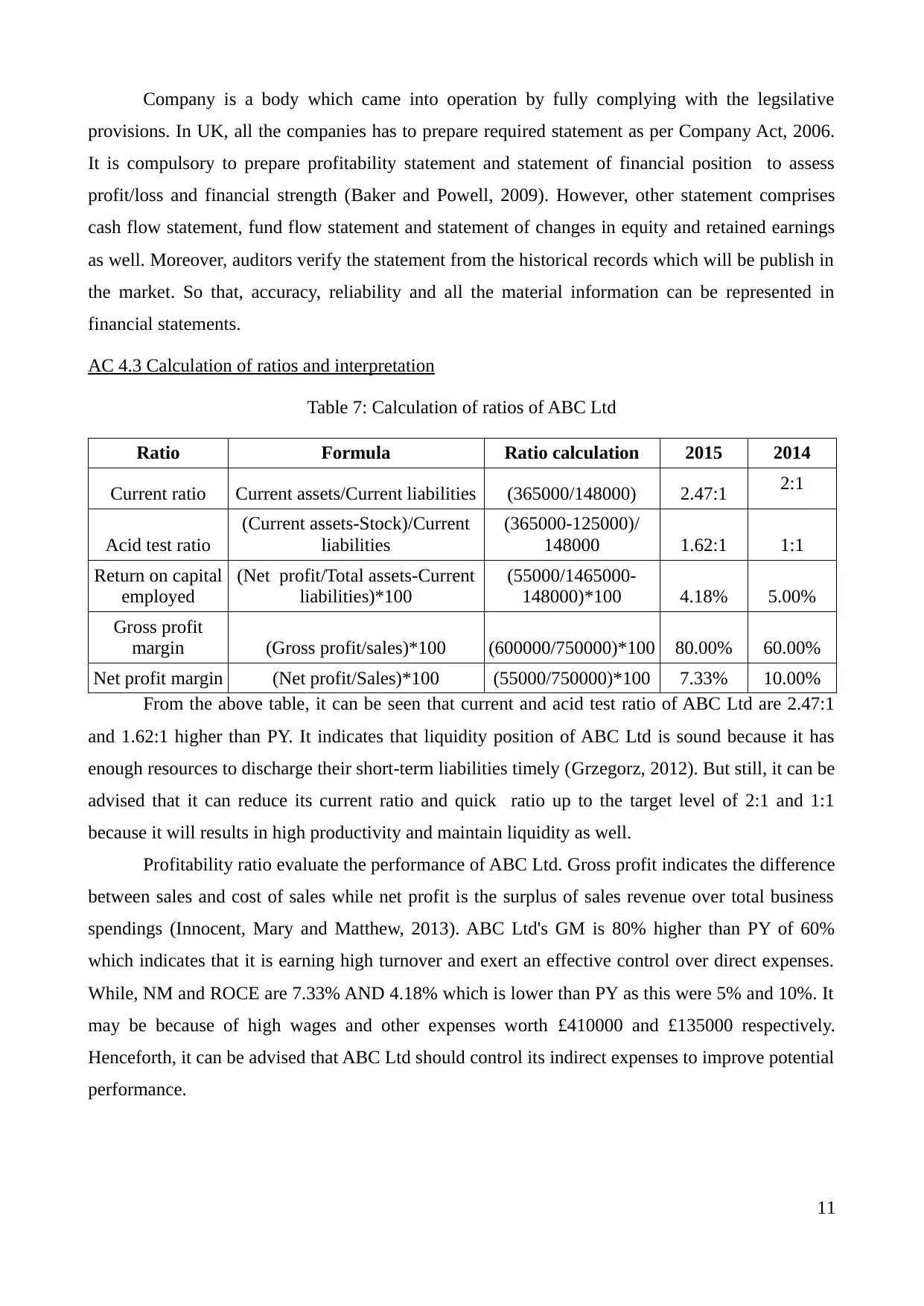

AC 4.3 Calculation of ratios and interpretation

Table 7: Calculation of ratios of ABC Ltd

Ratio Formula Ratio calculation 2015 2014

Current ratio Current assets/Current liabilities (365000/148000) 2.47:1 2:1

Acid test ratio

(Current assets-Stock)/Current

liabilities

(365000-125000)/

148000 1.62:1 1:1

Return on capital

employed

(Net profit/Total assets-Current

liabilities)*100

(55000/1465000-

148000)*100 4.18% 5.00%

Gross profit

margin (Gross profit/sales)*100 (600000/750000)*100 80.00% 60.00%

Net profit margin (Net profit/Sales)*100 (55000/750000)*100 7.33% 10.00%

From the above table, it can be seen that current and acid test ratio of ABC Ltd are 2.47:1

and 1.62:1 higher than PY. It indicates that liquidity position of ABC Ltd is sound because it has

enough resources to discharge their short-term liabilities timely (Grzegorz, 2012). But still, it can be

advised that it can reduce its current ratio and quick ratio up to the target level of 2:1 and 1:1

because it will results in high productivity and maintain liquidity as well.

Profitability ratio evaluate the performance of ABC Ltd. Gross profit indicates the difference

between sales and cost of sales while net profit is the surplus of sales revenue over total business

spendings (Innocent, Mary and Matthew, 2013). ABC Ltd's GM is 80% higher than PY of 60%

which indicates that it is earning high turnover and exert an effective control over direct expenses.

While, NM and ROCE are 7.33% AND 4.18% which is lower than PY as this were 5% and 10%. It

may be because of high wages and other expenses worth £410000 and £135000 respectively.

Henceforth, it can be advised that ABC Ltd should control its indirect expenses to improve potential

performance.

11

provisions. In UK, all the companies has to prepare required statement as per Company Act, 2006.

It is compulsory to prepare profitability statement and statement of financial position to assess

profit/loss and financial strength (Baker and Powell, 2009). However, other statement comprises

cash flow statement, fund flow statement and statement of changes in equity and retained earnings

as well. Moreover, auditors verify the statement from the historical records which will be publish in

the market. So that, accuracy, reliability and all the material information can be represented in

financial statements.

AC 4.3 Calculation of ratios and interpretation

Table 7: Calculation of ratios of ABC Ltd

Ratio Formula Ratio calculation 2015 2014

Current ratio Current assets/Current liabilities (365000/148000) 2.47:1 2:1

Acid test ratio

(Current assets-Stock)/Current

liabilities

(365000-125000)/

148000 1.62:1 1:1

Return on capital

employed

(Net profit/Total assets-Current

liabilities)*100

(55000/1465000-

148000)*100 4.18% 5.00%

Gross profit

margin (Gross profit/sales)*100 (600000/750000)*100 80.00% 60.00%

Net profit margin (Net profit/Sales)*100 (55000/750000)*100 7.33% 10.00%

From the above table, it can be seen that current and acid test ratio of ABC Ltd are 2.47:1

and 1.62:1 higher than PY. It indicates that liquidity position of ABC Ltd is sound because it has

enough resources to discharge their short-term liabilities timely (Grzegorz, 2012). But still, it can be

advised that it can reduce its current ratio and quick ratio up to the target level of 2:1 and 1:1

because it will results in high productivity and maintain liquidity as well.

Profitability ratio evaluate the performance of ABC Ltd. Gross profit indicates the difference

between sales and cost of sales while net profit is the surplus of sales revenue over total business

spendings (Innocent, Mary and Matthew, 2013). ABC Ltd's GM is 80% higher than PY of 60%

which indicates that it is earning high turnover and exert an effective control over direct expenses.

While, NM and ROCE are 7.33% AND 4.18% which is lower than PY as this were 5% and 10%. It

may be because of high wages and other expenses worth £410000 and £135000 respectively.

Henceforth, it can be advised that ABC Ltd should control its indirect expenses to improve potential

performance.

11

CONCLUSION

Report concluded that ABC Ltd, should collect funds through bank loan and retained

earnings. Moreover, it has to compute cost by adding 35% mark-up percentage in the cost and sell

the product at £878. Under the investment proposal, ABC Ltd, should select Italy because it will be

more viable and provide more benefits. At the end, report concluded that ABC Ltd, performed well

but still it can maximize its net earnings by maintain effective control over indirect business

expenses. By doing that, it can enhance its operational performance and enjoy greater success in

future period.

12

Report concluded that ABC Ltd, should collect funds through bank loan and retained

earnings. Moreover, it has to compute cost by adding 35% mark-up percentage in the cost and sell

the product at £878. Under the investment proposal, ABC Ltd, should select Italy because it will be

more viable and provide more benefits. At the end, report concluded that ABC Ltd, performed well

but still it can maximize its net earnings by maintain effective control over indirect business

expenses. By doing that, it can enhance its operational performance and enjoy greater success in

future period.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.