Financial and Economic Literacy Report: Business Economics Concepts

VerifiedAdded on 2020/09/17

|18

|3695

|43

Report

AI Summary

This report delves into the critical role of economics and finance in business management. It examines various business economics concepts such as market structure (perfect competition, oligopoly, monopoly, monopolistic competition) and the impact of small and medium enterprises (SMEs) on GDP growth, referencing relevant theories like the Economic Change theory and Organisation Equilibrium Theory. The report further explores growth strategies, including Resource-Based and Market Development theories, and the influence of multinational corporations (MNCs) using the Product Life Cycle and Dunning's Eclectic Paradigm. It analyzes demand and supply dynamics, the Bank of England's monetary policy on the UK housing market, and macroeconomic indicators like GDP growth, inflation rates, and balance of payments. Additionally, the report covers financial ratios, present value, and net present value calculations. The analysis incorporates real-world examples like Conron shop and Tesco Plc, providing practical insights into financial and economic concepts. The report concludes by highlighting the importance of these concepts for effective economic growth.

Financial and Economic

Literacy for Managers

Literacy for Managers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Questions..........................................................................................................................................1

1. Business economics concepts of market structure, small and medium enterprises, growth

strategy and multinational corporations.................................................................................1

2. Concepts of demand and supply and monetary policy of Bank of England to UK housing

market.....................................................................................................................................3

3. Macroeconomics indicators and UK's past trend in five years...........................................4

4. Concepts of leverage and current account management....................................................6

5. A) Financial ratios..............................................................................................................7

B) Present value......................................................................................................................8

C) Net Present Value..............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

Questions..........................................................................................................................................1

1. Business economics concepts of market structure, small and medium enterprises, growth

strategy and multinational corporations.................................................................................1

2. Concepts of demand and supply and monetary policy of Bank of England to UK housing

market.....................................................................................................................................3

3. Macroeconomics indicators and UK's past trend in five years...........................................4

4. Concepts of leverage and current account management....................................................6

5. A) Financial ratios..............................................................................................................7

B) Present value......................................................................................................................8

C) Net Present Value..............................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Economics and finance plays crucial role in the company. Present report deals with

importance of business economics concepts and theories and Conron shop is taken which is

situated at Marylebone and is local high street store. Moreover, financial ratios of Tesco Plc is

calculated for two years. Thus, various theories and economic concepts are quite essential for

injecting overall economic growth in effective manner.

Questions

1. Business economics concepts of market structure, small and medium enterprises, growth

strategy and multinational corporations

The economic concepts are as follows-

Market structure

The market is the place where buyer and seller meet for exchanging particular

commodity often by paying price of the same. There are various market structure such as perfect

competition market, oligopoly, monopoly and monopolistic competition. In relation to this,

various theories can be explained such as neoclassical and modern theory. Neoclassical theory

states that customer attains satisfaction level when he gets commodity as per his choice. In

simple words, consumer demand and preferences are the main aspects by which demand and

supply of goods and services is affected. Customer needs affects supply and demand of products

quite effectually (Zietlow and et.al, 2018). Thus, neoclassical theory focuses on consumer buying

behaviour which affects demand and supply simultaneously.

On the other hand, modern theory is also relevant to market structure. The theory states

that macroeconomic elements affects firm quite effectively. Conron shop located in Marylebone

is directly affected by aspects such as income and buying pattern or behaviour of customers,

preferences of people and as such, this also influences economy of UK. When purchasing power

of customers are high, then nation and firms are benefited with much ease. Thus, it can be said

that demand and supply in the market is affected by customer needs.

Market structure means that it is nature of competition prevailing in the market and

pricing policy followed by different markets such as perfect competition market, oligopoly,

monopoly and monopolistic competition.

1

Economics and finance plays crucial role in the company. Present report deals with

importance of business economics concepts and theories and Conron shop is taken which is

situated at Marylebone and is local high street store. Moreover, financial ratios of Tesco Plc is

calculated for two years. Thus, various theories and economic concepts are quite essential for

injecting overall economic growth in effective manner.

Questions

1. Business economics concepts of market structure, small and medium enterprises, growth

strategy and multinational corporations

The economic concepts are as follows-

Market structure

The market is the place where buyer and seller meet for exchanging particular

commodity often by paying price of the same. There are various market structure such as perfect

competition market, oligopoly, monopoly and monopolistic competition. In relation to this,

various theories can be explained such as neoclassical and modern theory. Neoclassical theory

states that customer attains satisfaction level when he gets commodity as per his choice. In

simple words, consumer demand and preferences are the main aspects by which demand and

supply of goods and services is affected. Customer needs affects supply and demand of products

quite effectually (Zietlow and et.al, 2018). Thus, neoclassical theory focuses on consumer buying

behaviour which affects demand and supply simultaneously.

On the other hand, modern theory is also relevant to market structure. The theory states

that macroeconomic elements affects firm quite effectively. Conron shop located in Marylebone

is directly affected by aspects such as income and buying pattern or behaviour of customers,

preferences of people and as such, this also influences economy of UK. When purchasing power

of customers are high, then nation and firms are benefited with much ease. Thus, it can be said

that demand and supply in the market is affected by customer needs.

Market structure means that it is nature of competition prevailing in the market and

pricing policy followed by different markets such as perfect competition market, oligopoly,

monopoly and monopolistic competition.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

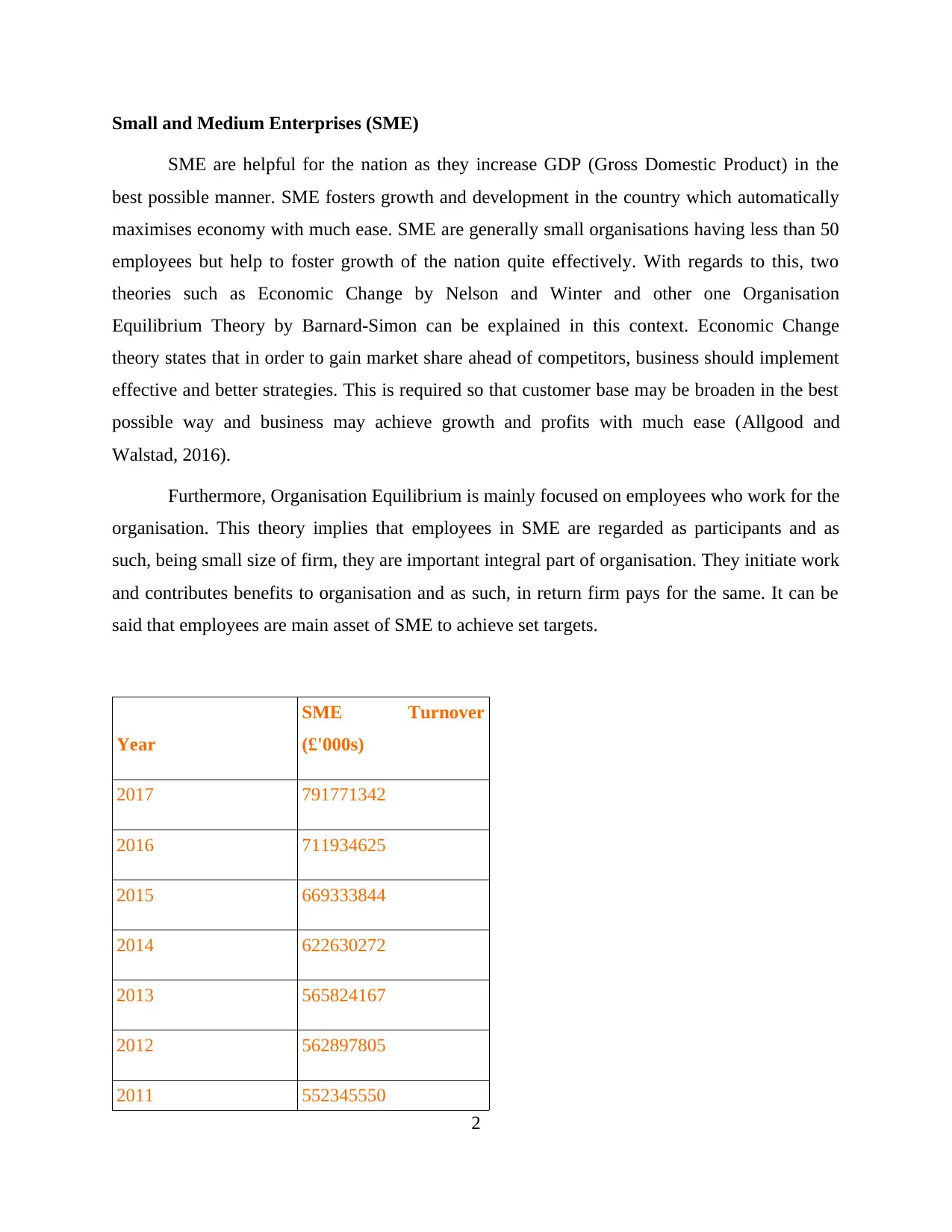

Small and Medium Enterprises (SME)

SME are helpful for the nation as they increase GDP (Gross Domestic Product) in the

best possible manner. SME fosters growth and development in the country which automatically

maximises economy with much ease. SME are generally small organisations having less than 50

employees but help to foster growth of the nation quite effectively. With regards to this, two

theories such as Economic Change by Nelson and Winter and other one Organisation

Equilibrium Theory by Barnard-Simon can be explained in this context. Economic Change

theory states that in order to gain market share ahead of competitors, business should implement

effective and better strategies. This is required so that customer base may be broaden in the best

possible way and business may achieve growth and profits with much ease (Allgood and

Walstad, 2016).

Furthermore, Organisation Equilibrium is mainly focused on employees who work for the

organisation. This theory implies that employees in SME are regarded as participants and as

such, being small size of firm, they are important integral part of organisation. They initiate work

and contributes benefits to organisation and as such, in return firm pays for the same. It can be

said that employees are main asset of SME to achieve set targets.

Year

SME Turnover

(£'000s)

2017 791771342

2016 711934625

2015 669333844

2014 622630272

2013 565824167

2012 562897805

2011 552345550

2

SME are helpful for the nation as they increase GDP (Gross Domestic Product) in the

best possible manner. SME fosters growth and development in the country which automatically

maximises economy with much ease. SME are generally small organisations having less than 50

employees but help to foster growth of the nation quite effectively. With regards to this, two

theories such as Economic Change by Nelson and Winter and other one Organisation

Equilibrium Theory by Barnard-Simon can be explained in this context. Economic Change

theory states that in order to gain market share ahead of competitors, business should implement

effective and better strategies. This is required so that customer base may be broaden in the best

possible way and business may achieve growth and profits with much ease (Allgood and

Walstad, 2016).

Furthermore, Organisation Equilibrium is mainly focused on employees who work for the

organisation. This theory implies that employees in SME are regarded as participants and as

such, being small size of firm, they are important integral part of organisation. They initiate work

and contributes benefits to organisation and as such, in return firm pays for the same. It can be

said that employees are main asset of SME to achieve set targets.

Year

SME Turnover

(£'000s)

2017 791771342

2016 711934625

2015 669333844

2014 622630272

2013 565824167

2012 562897805

2011 552345550

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2010 589871148

Growth strategy

Growth is required in every business and as such, strategies are needed to be

implemented. This means that organisation aims for gaining its market share which help to

maximise profits in the best possible way. Conron shop which is UK local High street store also

implements strategies to accelerate growth in effective manner. In relation to this, Resource-

Based and Market development theories are much relevant to growth strategy. Resource-Based

theory simply means that firm should have some resources which cannot be imitated by rivals in

the market. This implies that Conron shop is required to have valuable resources (Finke, Howe

and Huston, 2016).

The resources should be rare, valuable, non-substitutable and complex to imitate. These

elements make firm ahead of rivals and as such, growth can be achieved in the best possible

manner. On the other hand, Market development theory states that firm should explore more

markets so that it may sell products in effective manner. This means that new markets should be

identified and existing goods may be sold to them so that customer base may be broaden quite

3

Illustration 1: EU SME business

Growth strategy

Growth is required in every business and as such, strategies are needed to be

implemented. This means that organisation aims for gaining its market share which help to

maximise profits in the best possible way. Conron shop which is UK local High street store also

implements strategies to accelerate growth in effective manner. In relation to this, Resource-

Based and Market development theories are much relevant to growth strategy. Resource-Based

theory simply means that firm should have some resources which cannot be imitated by rivals in

the market. This implies that Conron shop is required to have valuable resources (Finke, Howe

and Huston, 2016).

The resources should be rare, valuable, non-substitutable and complex to imitate. These

elements make firm ahead of rivals and as such, growth can be achieved in the best possible

manner. On the other hand, Market development theory states that firm should explore more

markets so that it may sell products in effective manner. This means that new markets should be

identified and existing goods may be sold to them so that customer base may be broaden quite

3

Illustration 1: EU SME business

effectively. The market development theory is derived from Ansoff Matrix which is commonly

used theory in the business.

Internal growth means that business expand its operations without taking over mergers

and acquisitions. On the other hand, external growth implies organisation makes foreign

collaboration and take in joint venture for expansion.

Illustration 2: Growth strategy Source:

shutterstock.com

Multinational Corporations (MNC)

MNC are organisations having operations in domestic country and international as well.

These companies earn foreign currency which is quite essential for domestic nation to attain

economic growth in the best possible manner. This implies that nation and businesses both are

benefited with increased operations and as such, more profits are garnered quite effectually. In

addressing this, two theories such as Theory of Product Life Cycle by Vernon and Dunning's

Eclectic Paradigm both are relevant. First theory states that a particular product passes on several

stages before it is provided to consumers internationally. Various phases are introduction,

growth, maturity and decline (Lusardi and et.al, 2017). This means that product undergoes such

stages and is affected by forces of market. In this behalf, capital goods are provided to

international customers belonging to rich class.

On the other hand, Eclectic Paradigm Theory proposed by Dunning states that more

investments are required by MNC in order to accomplish tasks in the best possible manner. For

overcoming this, FDI (Foreign Direct Investment) is required to expand operations in

4

used theory in the business.

Internal growth means that business expand its operations without taking over mergers

and acquisitions. On the other hand, external growth implies organisation makes foreign

collaboration and take in joint venture for expansion.

Illustration 2: Growth strategy Source:

shutterstock.com

Multinational Corporations (MNC)

MNC are organisations having operations in domestic country and international as well.

These companies earn foreign currency which is quite essential for domestic nation to attain

economic growth in the best possible manner. This implies that nation and businesses both are

benefited with increased operations and as such, more profits are garnered quite effectually. In

addressing this, two theories such as Theory of Product Life Cycle by Vernon and Dunning's

Eclectic Paradigm both are relevant. First theory states that a particular product passes on several

stages before it is provided to consumers internationally. Various phases are introduction,

growth, maturity and decline (Lusardi and et.al, 2017). This means that product undergoes such

stages and is affected by forces of market. In this behalf, capital goods are provided to

international customers belonging to rich class.

On the other hand, Eclectic Paradigm Theory proposed by Dunning states that more

investments are required by MNC in order to accomplish tasks in the best possible manner. For

overcoming this, FDI (Foreign Direct Investment) is required to expand operations in

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

international destinations and produce profits quite effectively. Thus, by garnering investment,

operations can be increased which help country in achieving higher growth.

2. Concepts of demand and supply and monetary policy of Bank of England to UK housing

market

Demand and supply plays important role in the market. On the other hand, monetary

policy provided by Bank of England is also crucial to Housing market. This shows that when

interest changes, the same effect can be seen on demand and supply of customers who avail

loans for the housing purpose. This is evident from the fact that when interest rate is high on

mortgage, customers demand decreases and vice versa. Objective of Bank of England is to set

interest rate on housing loan which simultaneously affects mortgage lending prices. Furthermore,

mortgage lending facility is provided by the bank but its risky for the bank when customer

defaults on repaying principal amount along with interest accrued on the same (Davies, 2015).

The monetary policy has influence on housing market as interest rates are time-to-time

enacted by Bank of England. The main aim of monetary policy is to eradicate and reduce

inflation in the country. Another aim is to reduce unemployment rate up too maximum possible

extent. It can be referred to UK's government statistics data that retail sales are reduced by 0.4 %

which plays crucial role in the housing market due to the transformation of monetary policy.

Inflation is under control and lowered down in February 2018 as per the statistics data. In

5

Illustration 3: Demand Source: econport.org

operations can be increased which help country in achieving higher growth.

2. Concepts of demand and supply and monetary policy of Bank of England to UK housing

market

Demand and supply plays important role in the market. On the other hand, monetary

policy provided by Bank of England is also crucial to Housing market. This shows that when

interest changes, the same effect can be seen on demand and supply of customers who avail

loans for the housing purpose. This is evident from the fact that when interest rate is high on

mortgage, customers demand decreases and vice versa. Objective of Bank of England is to set

interest rate on housing loan which simultaneously affects mortgage lending prices. Furthermore,

mortgage lending facility is provided by the bank but its risky for the bank when customer

defaults on repaying principal amount along with interest accrued on the same (Davies, 2015).

The monetary policy has influence on housing market as interest rates are time-to-time

enacted by Bank of England. The main aim of monetary policy is to eradicate and reduce

inflation in the country. Another aim is to reduce unemployment rate up too maximum possible

extent. It can be referred to UK's government statistics data that retail sales are reduced by 0.4 %

which plays crucial role in the housing market due to the transformation of monetary policy.

Inflation is under control and lowered down in February 2018 as per the statistics data. In

5

Illustration 3: Demand Source: econport.org

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

relations to this, prices of house has also fallen down by 0.75 % and as such, consumption of

taking loans has increased because of change in monetary policy with regards to housing loan.

In relations to this, business economics of demand and supply can be explained. Law of

demand states that when quantity demand of particular commodity increases, when price of the

same falls. On the other hand, if price increases, quantity demand of the product decreases. This

means that customer like to purchase commodity which is available at low price and thus,

demand of the same increases in the market (Campenhout, 2015). Whereas, concept of supply

states that quantity of goods producer is willing to sell at a particular price. The law of supply

states that when quantity demand of product increases, due to the shortage, price increases and

when price reduces, producers are unwilling to sell as their profits reduces. Thus, supply and

demand moves in opposite direction.

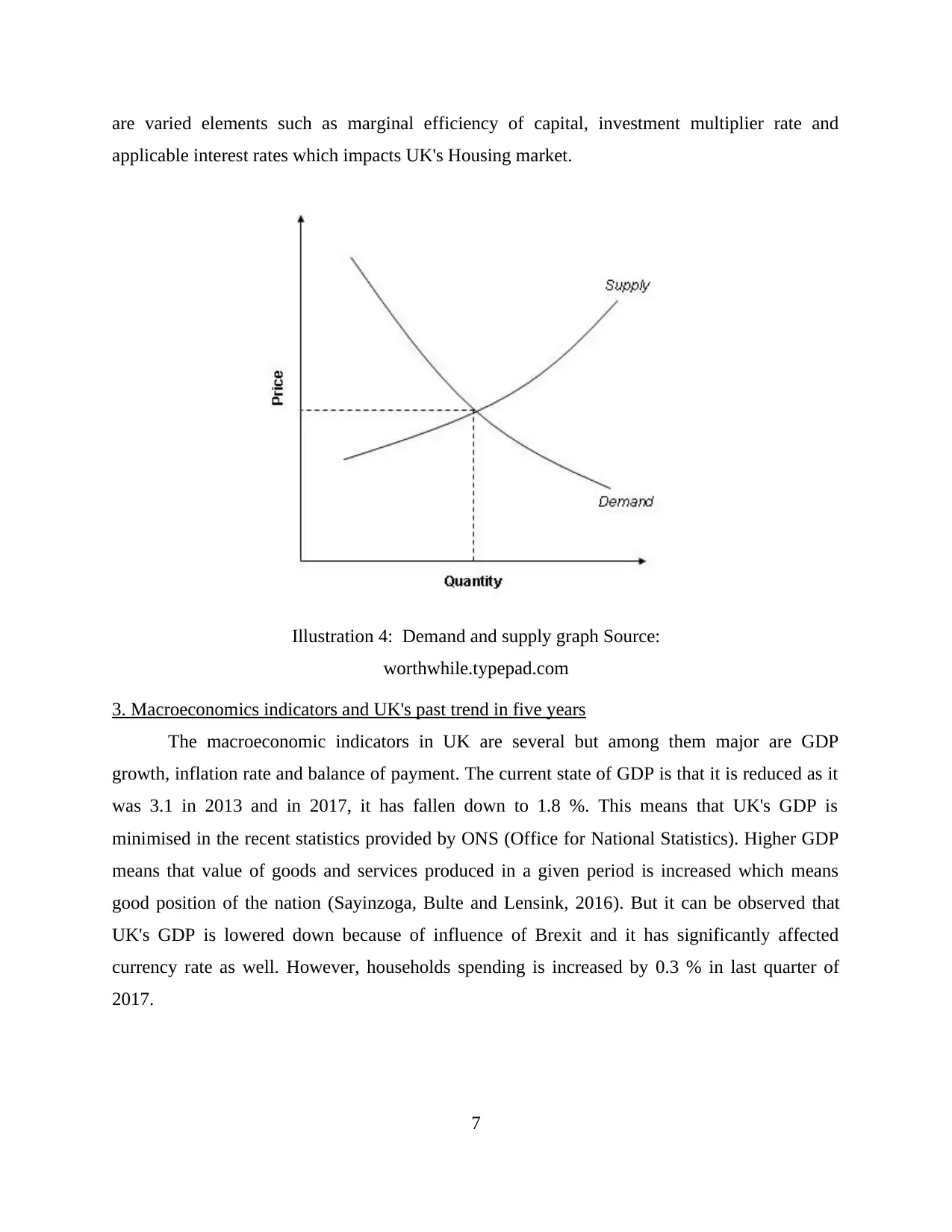

Demand, supply and monetary policy are interlinked to housing market. In this relation,

Consumer demand theory and Keynes Theory can be enumerated. Consumer demand theory

states that customer preferences affects demand and supply of goods. This means that needs of

people are required to be evaluated which is linked with housing market. Thus, demand of

customers is needed to set interest rate on loan. Keynes theory is related to money and states that

consumer purchase the commodity in order to attain utility out of the amount spent on particular

purchase. Customers have various motives such as speculative, precautionary and transactionary.

While, business economic concept of monetary policy is given by Keynes which states that there

6

taking loans has increased because of change in monetary policy with regards to housing loan.

In relations to this, business economics of demand and supply can be explained. Law of

demand states that when quantity demand of particular commodity increases, when price of the

same falls. On the other hand, if price increases, quantity demand of the product decreases. This

means that customer like to purchase commodity which is available at low price and thus,

demand of the same increases in the market (Campenhout, 2015). Whereas, concept of supply

states that quantity of goods producer is willing to sell at a particular price. The law of supply

states that when quantity demand of product increases, due to the shortage, price increases and

when price reduces, producers are unwilling to sell as their profits reduces. Thus, supply and

demand moves in opposite direction.

Demand, supply and monetary policy are interlinked to housing market. In this relation,

Consumer demand theory and Keynes Theory can be enumerated. Consumer demand theory

states that customer preferences affects demand and supply of goods. This means that needs of

people are required to be evaluated which is linked with housing market. Thus, demand of

customers is needed to set interest rate on loan. Keynes theory is related to money and states that

consumer purchase the commodity in order to attain utility out of the amount spent on particular

purchase. Customers have various motives such as speculative, precautionary and transactionary.

While, business economic concept of monetary policy is given by Keynes which states that there

6

are varied elements such as marginal efficiency of capital, investment multiplier rate and

applicable interest rates which impacts UK's Housing market.

Illustration 4: Demand and supply graph Source:

worthwhile.typepad.com

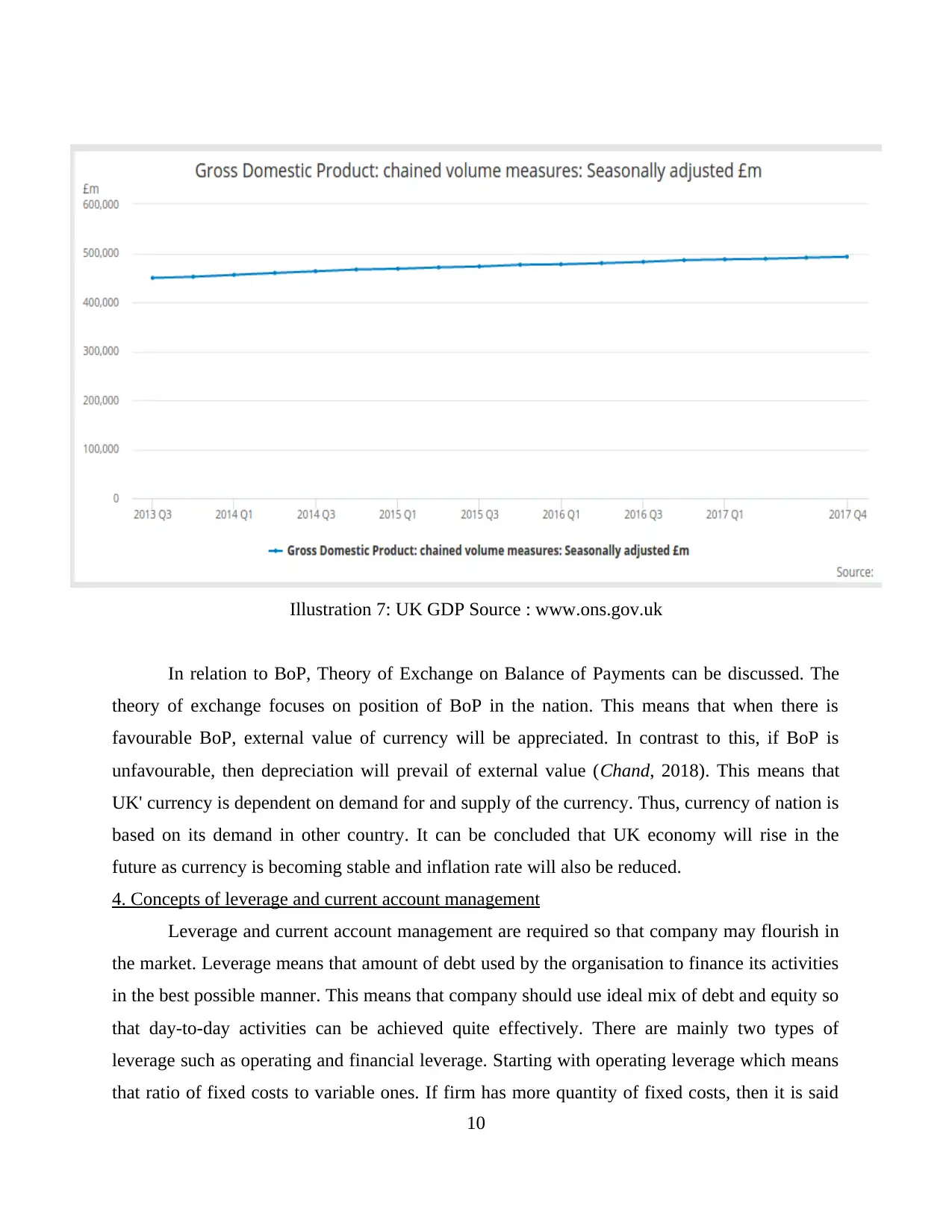

3. Macroeconomics indicators and UK's past trend in five years

The macroeconomic indicators in UK are several but among them major are GDP

growth, inflation rate and balance of payment. The current state of GDP is that it is reduced as it

was 3.1 in 2013 and in 2017, it has fallen down to 1.8 %. This means that UK's GDP is

minimised in the recent statistics provided by ONS (Office for National Statistics). Higher GDP

means that value of goods and services produced in a given period is increased which means

good position of the nation (Sayinzoga, Bulte and Lensink, 2016). But it can be observed that

UK's GDP is lowered down because of influence of Brexit and it has significantly affected

currency rate as well. However, households spending is increased by 0.3 % in last quarter of

2017.

7

applicable interest rates which impacts UK's Housing market.

Illustration 4: Demand and supply graph Source:

worthwhile.typepad.com

3. Macroeconomics indicators and UK's past trend in five years

The macroeconomic indicators in UK are several but among them major are GDP

growth, inflation rate and balance of payment. The current state of GDP is that it is reduced as it

was 3.1 in 2013 and in 2017, it has fallen down to 1.8 %. This means that UK's GDP is

minimised in the recent statistics provided by ONS (Office for National Statistics). Higher GDP

means that value of goods and services produced in a given period is increased which means

good position of the nation (Sayinzoga, Bulte and Lensink, 2016). But it can be observed that

UK's GDP is lowered down because of influence of Brexit and it has significantly affected

currency rate as well. However, households spending is increased by 0.3 % in last quarter of

2017.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Illustration 5: UK Inflation (CPI) Source: economichelp.org

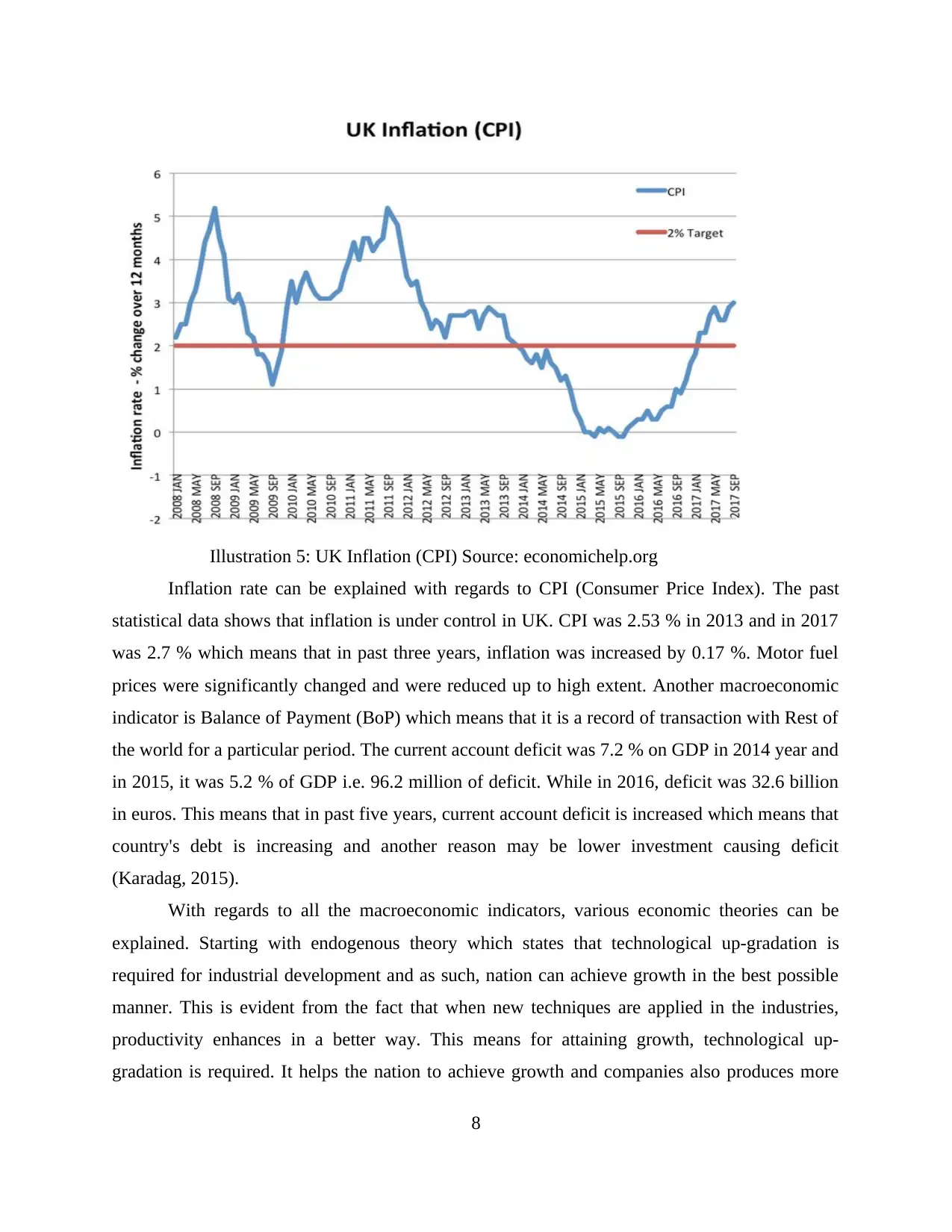

Inflation rate can be explained with regards to CPI (Consumer Price Index). The past

statistical data shows that inflation is under control in UK. CPI was 2.53 % in 2013 and in 2017

was 2.7 % which means that in past three years, inflation was increased by 0.17 %. Motor fuel

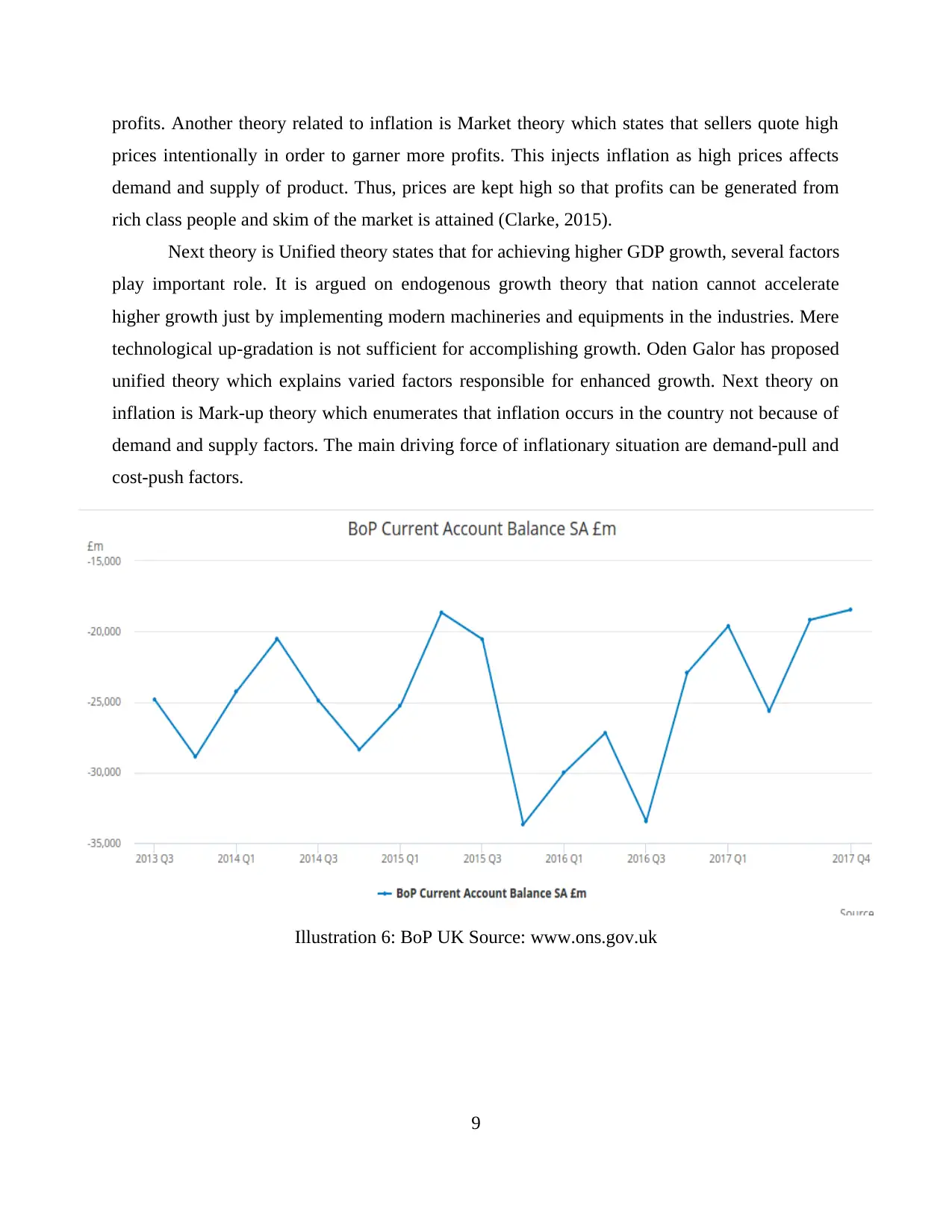

prices were significantly changed and were reduced up to high extent. Another macroeconomic

indicator is Balance of Payment (BoP) which means that it is a record of transaction with Rest of

the world for a particular period. The current account deficit was 7.2 % on GDP in 2014 year and

in 2015, it was 5.2 % of GDP i.e. 96.2 million of deficit. While in 2016, deficit was 32.6 billion

in euros. This means that in past five years, current account deficit is increased which means that

country's debt is increasing and another reason may be lower investment causing deficit

(Karadag, 2015).

With regards to all the macroeconomic indicators, various economic theories can be

explained. Starting with endogenous theory which states that technological up-gradation is

required for industrial development and as such, nation can achieve growth in the best possible

manner. This is evident from the fact that when new techniques are applied in the industries,

productivity enhances in a better way. This means for attaining growth, technological up-

gradation is required. It helps the nation to achieve growth and companies also produces more

8

Inflation rate can be explained with regards to CPI (Consumer Price Index). The past

statistical data shows that inflation is under control in UK. CPI was 2.53 % in 2013 and in 2017

was 2.7 % which means that in past three years, inflation was increased by 0.17 %. Motor fuel

prices were significantly changed and were reduced up to high extent. Another macroeconomic

indicator is Balance of Payment (BoP) which means that it is a record of transaction with Rest of

the world for a particular period. The current account deficit was 7.2 % on GDP in 2014 year and

in 2015, it was 5.2 % of GDP i.e. 96.2 million of deficit. While in 2016, deficit was 32.6 billion

in euros. This means that in past five years, current account deficit is increased which means that

country's debt is increasing and another reason may be lower investment causing deficit

(Karadag, 2015).

With regards to all the macroeconomic indicators, various economic theories can be

explained. Starting with endogenous theory which states that technological up-gradation is

required for industrial development and as such, nation can achieve growth in the best possible

manner. This is evident from the fact that when new techniques are applied in the industries,

productivity enhances in a better way. This means for attaining growth, technological up-

gradation is required. It helps the nation to achieve growth and companies also produces more

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profits. Another theory related to inflation is Market theory which states that sellers quote high

prices intentionally in order to garner more profits. This injects inflation as high prices affects

demand and supply of product. Thus, prices are kept high so that profits can be generated from

rich class people and skim of the market is attained (Clarke, 2015).

Next theory is Unified theory states that for achieving higher GDP growth, several factors

play important role. It is argued on endogenous growth theory that nation cannot accelerate

higher growth just by implementing modern machineries and equipments in the industries. Mere

technological up-gradation is not sufficient for accomplishing growth. Oden Galor has proposed

unified theory which explains varied factors responsible for enhanced growth. Next theory on

inflation is Mark-up theory which enumerates that inflation occurs in the country not because of

demand and supply factors. The main driving force of inflationary situation are demand-pull and

cost-push factors.

9

Illustration 6: BoP UK Source: www.ons.gov.uk

prices intentionally in order to garner more profits. This injects inflation as high prices affects

demand and supply of product. Thus, prices are kept high so that profits can be generated from

rich class people and skim of the market is attained (Clarke, 2015).

Next theory is Unified theory states that for achieving higher GDP growth, several factors

play important role. It is argued on endogenous growth theory that nation cannot accelerate

higher growth just by implementing modern machineries and equipments in the industries. Mere

technological up-gradation is not sufficient for accomplishing growth. Oden Galor has proposed

unified theory which explains varied factors responsible for enhanced growth. Next theory on

inflation is Mark-up theory which enumerates that inflation occurs in the country not because of

demand and supply factors. The main driving force of inflationary situation are demand-pull and

cost-push factors.

9

Illustration 6: BoP UK Source: www.ons.gov.uk

In relation to BoP, Theory of Exchange on Balance of Payments can be discussed. The

theory of exchange focuses on position of BoP in the nation. This means that when there is

favourable BoP, external value of currency will be appreciated. In contrast to this, if BoP is

unfavourable, then depreciation will prevail of external value (Chand, 2018). This means that

UK' currency is dependent on demand for and supply of the currency. Thus, currency of nation is

based on its demand in other country. It can be concluded that UK economy will rise in the

future as currency is becoming stable and inflation rate will also be reduced.

4. Concepts of leverage and current account management

Leverage and current account management are required so that company may flourish in

the market. Leverage means that amount of debt used by the organisation to finance its activities

in the best possible manner. This means that company should use ideal mix of debt and equity so

that day-to-day activities can be achieved quite effectively. There are mainly two types of

leverage such as operating and financial leverage. Starting with operating leverage which means

that ratio of fixed costs to variable ones. If firm has more quantity of fixed costs, then it is said

10

Illustration 7: UK GDP Source : www.ons.gov.uk

theory of exchange focuses on position of BoP in the nation. This means that when there is

favourable BoP, external value of currency will be appreciated. In contrast to this, if BoP is

unfavourable, then depreciation will prevail of external value (Chand, 2018). This means that

UK' currency is dependent on demand for and supply of the currency. Thus, currency of nation is

based on its demand in other country. It can be concluded that UK economy will rise in the

future as currency is becoming stable and inflation rate will also be reduced.

4. Concepts of leverage and current account management

Leverage and current account management are required so that company may flourish in

the market. Leverage means that amount of debt used by the organisation to finance its activities

in the best possible manner. This means that company should use ideal mix of debt and equity so

that day-to-day activities can be achieved quite effectively. There are mainly two types of

leverage such as operating and financial leverage. Starting with operating leverage which means

that ratio of fixed costs to variable ones. If firm has more quantity of fixed costs, then it is said

10

Illustration 7: UK GDP Source : www.ons.gov.uk

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18