Analysis of Entrepreneurial Behavior and Performance

VerifiedAdded on 2020/07/22

|32

|4174

|61

AI Summary

The provided document is an extensive compilation of academic papers and research studies related to entrepreneurial behavior and performance. It includes 11 references from 2013 to 2017, covering topics such as management education, pricing strategies, and international financial statement analysis. The assignment aims to analyze the factors that influence business success and provide insights into strategies for improvement.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Analysis Project

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

1. INTRODUCTION ......................................................................................................................4

1.1 Purpose –................................................................................................................................4

1.2 Case analysis –.......................................................................................................................4

1.4 Key issues –...........................................................................................................................5

1.5 Rationale behind the selection of company -ok.....................................................................5

2.1 RATIO ANALYSIS ..................................................................................................................6

2.1.1 Profitability ratio analysis .................................................................................................6

2.1.2 Liquidity ratio analysis ......................................................................................................7

2.1.3 Financial health: leverage ratio ..........................................................................................8

2.1.4 Efficiency ratios..................................................................................................................9

Inventory turnover ratio (in days) ...............................................................................................9

3. STRATEGIC ANALYSIS ..........................................................................................................9

3.2.1 Porter Five Force Analysis ..............................................................................................11

3.2.2 New forces in construction industry................................................................................14

3.3 Operations and organisation analysis-.................................................................................14

3.4 Key success factors:.............................................................................................................14

Balance score card s...................................................................................................................15

5.2 Limitation of financial models in analysing the performance- ...........................................18

6.0 Conclusion ..........................................................................................................................19

7.0 Recommendation ...............................................................................................................19

8.0 Modelling.................................................................................................................................21

8.1 Scenarios Forecasting..........................................................................................................21

8.2 Scenario Description............................................................................................................22

1. INTRODUCTION ......................................................................................................................4

1.1 Purpose –................................................................................................................................4

1.2 Case analysis –.......................................................................................................................4

1.4 Key issues –...........................................................................................................................5

1.5 Rationale behind the selection of company -ok.....................................................................5

2.1 RATIO ANALYSIS ..................................................................................................................6

2.1.1 Profitability ratio analysis .................................................................................................6

2.1.2 Liquidity ratio analysis ......................................................................................................7

2.1.3 Financial health: leverage ratio ..........................................................................................8

2.1.4 Efficiency ratios..................................................................................................................9

Inventory turnover ratio (in days) ...............................................................................................9

3. STRATEGIC ANALYSIS ..........................................................................................................9

3.2.1 Porter Five Force Analysis ..............................................................................................11

3.2.2 New forces in construction industry................................................................................14

3.3 Operations and organisation analysis-.................................................................................14

3.4 Key success factors:.............................................................................................................14

Balance score card s...................................................................................................................15

5.2 Limitation of financial models in analysing the performance- ...........................................18

6.0 Conclusion ..........................................................................................................................19

7.0 Recommendation ...............................................................................................................19

8.0 Modelling.................................................................................................................................21

8.1 Scenarios Forecasting..........................................................................................................21

8.2 Scenario Description............................................................................................................22

8.3 Outcome...............................................................................................................................23

1. INTRODUCTION

1.1 Purpose –

The main purpose behind carry out such study is to shed light on the financial health and

performance of Eversendai in against to the competitors like Muhibbah & Sunway. Besides this,

it will also provide deeper insight about the key issues and condition of external market. Further,

report will also depict about the manner in which financial models and conventions helps in

doing suitable analysis of business. It will also include the details about recommendation through

which Eversendai can attain success in the competitive business environment.

1.2 Case analysis –

Eversendai is one of the leading organizations that is operated in the construction

industry of Malaysia. Portfolio of the company includes wide range of services such as long span

and roof structure, high rise building, plant & construction, oil & gas etc (Eversendai Malaysia,

2017). Further, Eversendai has expertise in including innovation aspect in construction project

through including composting infrastructure.

1.3 Background of the organization -

Eversendai is one of the leading business organizations of Malaysia which is known for

turnkey projects, oil & gas upstream & downstream as well as infrastructure and composite

structures. Company has employed 15000 people and having attractive portfolio of more than

300 accomplished projects over 14 different countries of the world. With the motive to maximize

the level of productivity and profitability Eversendai makes focus on safety, quality and client

satisfaction to a great extent (Eversendai Malaysia, 2017).

1.1 Purpose –

The main purpose behind carry out such study is to shed light on the financial health and

performance of Eversendai in against to the competitors like Muhibbah & Sunway. Besides this,

it will also provide deeper insight about the key issues and condition of external market. Further,

report will also depict about the manner in which financial models and conventions helps in

doing suitable analysis of business. It will also include the details about recommendation through

which Eversendai can attain success in the competitive business environment.

1.2 Case analysis –

Eversendai is one of the leading organizations that is operated in the construction

industry of Malaysia. Portfolio of the company includes wide range of services such as long span

and roof structure, high rise building, plant & construction, oil & gas etc (Eversendai Malaysia,

2017). Further, Eversendai has expertise in including innovation aspect in construction project

through including composting infrastructure.

1.3 Background of the organization -

Eversendai is one of the leading business organizations of Malaysia which is known for

turnkey projects, oil & gas upstream & downstream as well as infrastructure and composite

structures. Company has employed 15000 people and having attractive portfolio of more than

300 accomplished projects over 14 different countries of the world. With the motive to maximize

the level of productivity and profitability Eversendai makes focus on safety, quality and client

satisfaction to a great extent (Eversendai Malaysia, 2017).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

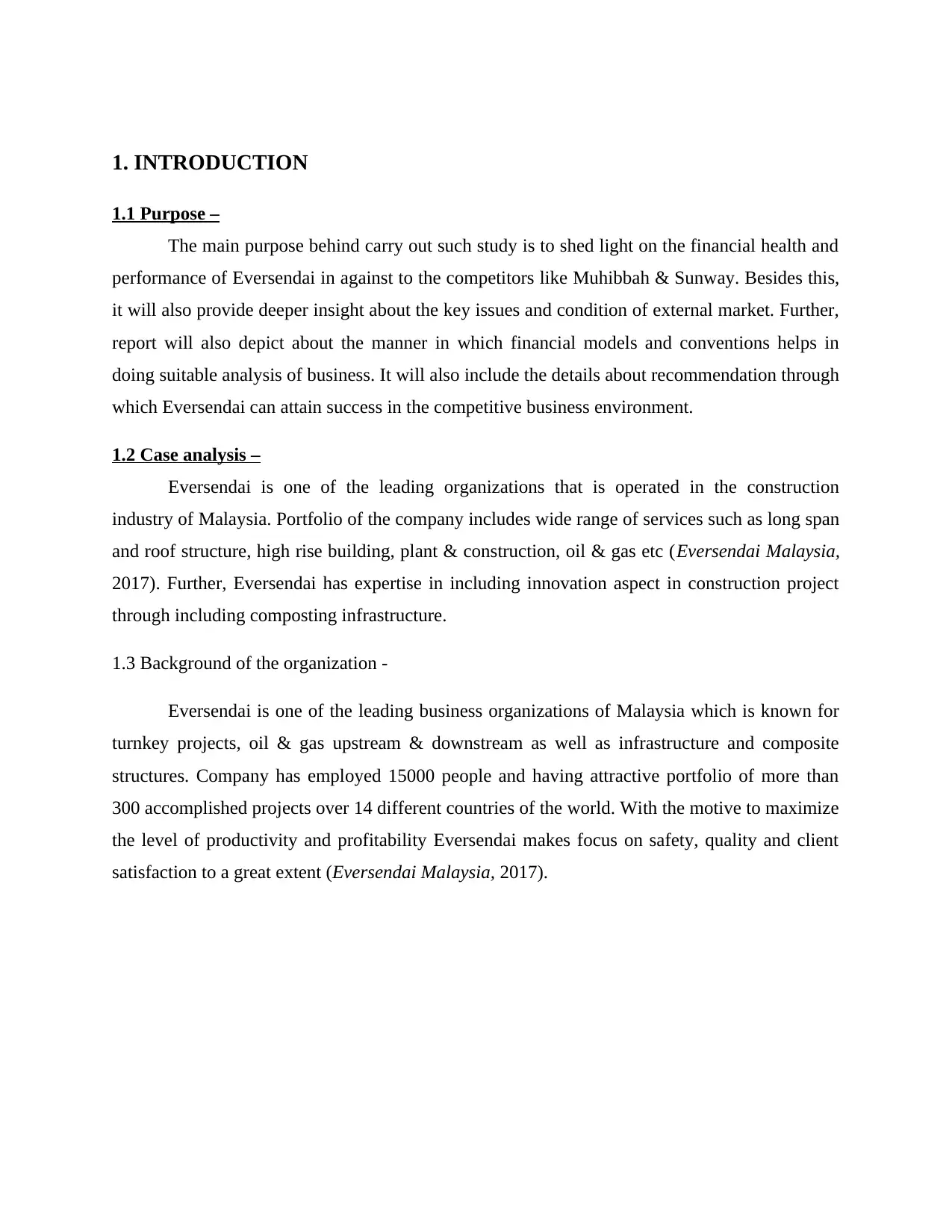

1.4 Key issues –

To assess the issues and measure the level of competition following analysis has been

done:

Basis of difference Eversendai ( main

company)

Muhibbah (rival

firm)

Sunway group

Compliance with

safety

High Follow to the

moderate level

Moderate

Adherence to quality High Moderate Moderate

Focus The main focus of the

organization is to

meet the client’s

requirement to a great

extent.

It lays emphasis on

the maximization of

profitability.

Sunway group makes

focus on increasing

the level of profit

margin rather than

client’s satisfaction.

Table 1: Comparative Value Proposition

1.5 Rationale behind the selection of company -

The main reasons behind the selection of Eversendai are that it was operated in the

construction industry of Malaysia from several years. Besides this, company is recognized for

the quality and safe projects offered by it to the customers. Hence, by analyzing the financials of

latest accounting years scholar would become able to present the fair solution of issue.

2.0 FINANCIAL ANALYSIS

Financial analysis is known as the assessment of the stability, profitability and viability of

a business and sub business. It is performed by those who are using ratio which provide

information which is gather from the financial statement. It helps us in determining the purchase

material and making decision regarding investing of capital.

To assess the issues and measure the level of competition following analysis has been

done:

Basis of difference Eversendai ( main

company)

Muhibbah (rival

firm)

Sunway group

Compliance with

safety

High Follow to the

moderate level

Moderate

Adherence to quality High Moderate Moderate

Focus The main focus of the

organization is to

meet the client’s

requirement to a great

extent.

It lays emphasis on

the maximization of

profitability.

Sunway group makes

focus on increasing

the level of profit

margin rather than

client’s satisfaction.

Table 1: Comparative Value Proposition

1.5 Rationale behind the selection of company -

The main reasons behind the selection of Eversendai are that it was operated in the

construction industry of Malaysia from several years. Besides this, company is recognized for

the quality and safe projects offered by it to the customers. Hence, by analyzing the financials of

latest accounting years scholar would become able to present the fair solution of issue.

2.0 FINANCIAL ANALYSIS

Financial analysis is known as the assessment of the stability, profitability and viability of

a business and sub business. It is performed by those who are using ratio which provide

information which is gather from the financial statement. It helps us in determining the purchase

material and making decision regarding investing of capital.

2.1 RATIO ANALYSIS

2.1.1 Profitability ratio analysis

Profitability ratios provide deeper insight about the returns that are generated by the firm

over the years and in against to competitors. Hence, by making assessment of such aspect firm

can develop suitable strategy for the near future.

Return on invested capital (in %)- Such ratio presents the return which is generated by

the firm by using funds invested by shareholders.

Particulars 2012 2013 2014 2015 2016

Return on Invested Capital

%

Eversendai 13.93 4.12 4.03 4.43 -13.26

Muhibbah -10.73 9.41 6.99 5.74 8.47

Sunway 6.06 20.14 8.85 7.41 5.25

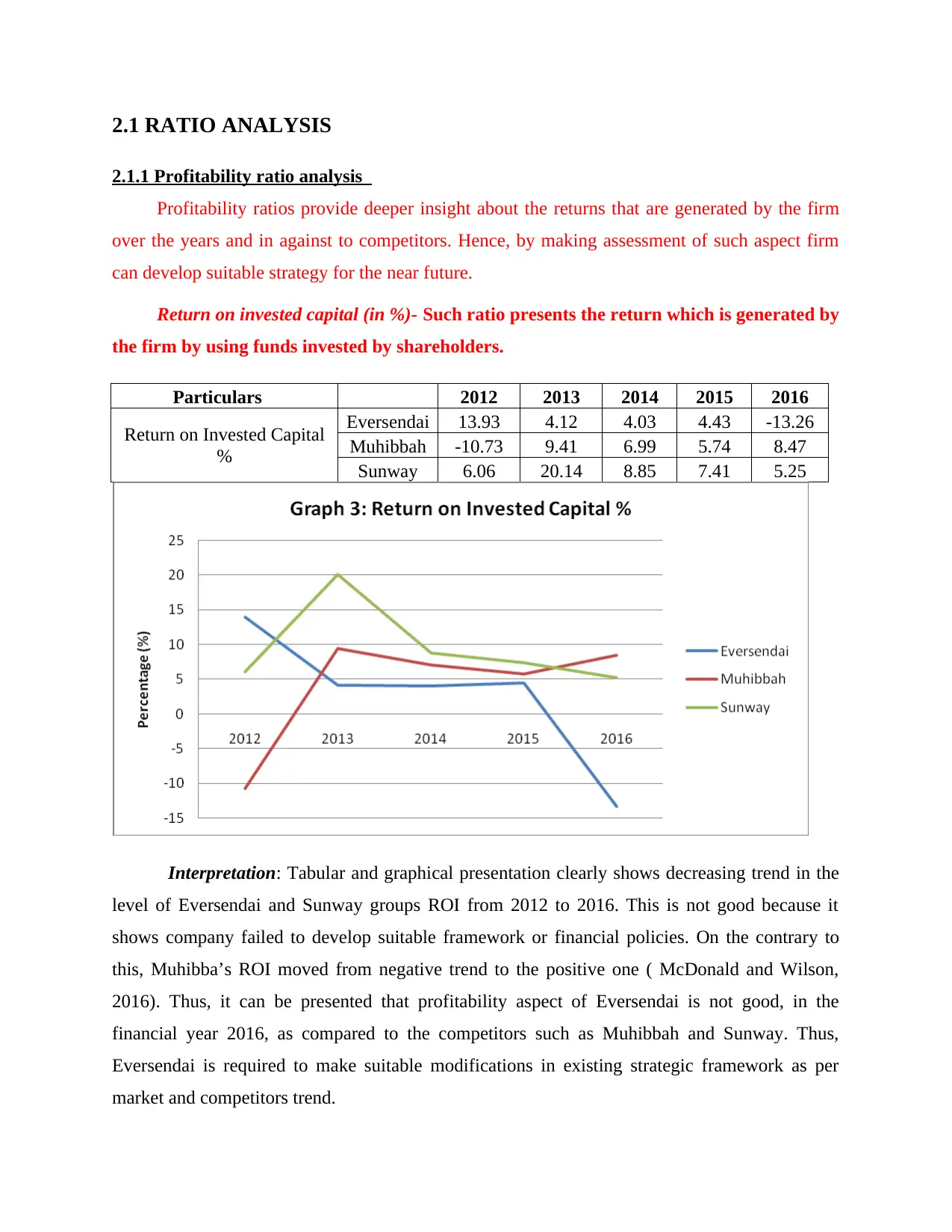

Interpretation: Tabular and graphical presentation clearly shows decreasing trend in the

level of Eversendai and Sunway groups ROI from 2012 to 2016. This is not good because it

shows company failed to develop suitable framework or financial policies. On the contrary to

this, Muhibba’s ROI moved from negative trend to the positive one ( McDonald and Wilson,

2016). Thus, it can be presented that profitability aspect of Eversendai is not good, in the

financial year 2016, as compared to the competitors such as Muhibbah and Sunway. Thus,

Eversendai is required to make suitable modifications in existing strategic framework as per

market and competitors trend.

2.1.1 Profitability ratio analysis

Profitability ratios provide deeper insight about the returns that are generated by the firm

over the years and in against to competitors. Hence, by making assessment of such aspect firm

can develop suitable strategy for the near future.

Return on invested capital (in %)- Such ratio presents the return which is generated by

the firm by using funds invested by shareholders.

Particulars 2012 2013 2014 2015 2016

Return on Invested Capital

%

Eversendai 13.93 4.12 4.03 4.43 -13.26

Muhibbah -10.73 9.41 6.99 5.74 8.47

Sunway 6.06 20.14 8.85 7.41 5.25

Interpretation: Tabular and graphical presentation clearly shows decreasing trend in the

level of Eversendai and Sunway groups ROI from 2012 to 2016. This is not good because it

shows company failed to develop suitable framework or financial policies. On the contrary to

this, Muhibba’s ROI moved from negative trend to the positive one ( McDonald and Wilson,

2016). Thus, it can be presented that profitability aspect of Eversendai is not good, in the

financial year 2016, as compared to the competitors such as Muhibbah and Sunway. Thus,

Eversendai is required to make suitable modifications in existing strategic framework as per

market and competitors trend.

Net profit margin (in %): It entails the margin that is attained by the firm over the level

of indirect expenses.

Particulars 2012 2013 2014 2015 2016

Net Margin %

Eversendai 11.9 3.38 3.73 3.1 -17.62

Muhibbah -3.55 4.46 4.7 5.33 5.5

Sunway 17.34 7.21 15.47 14.07 16.34

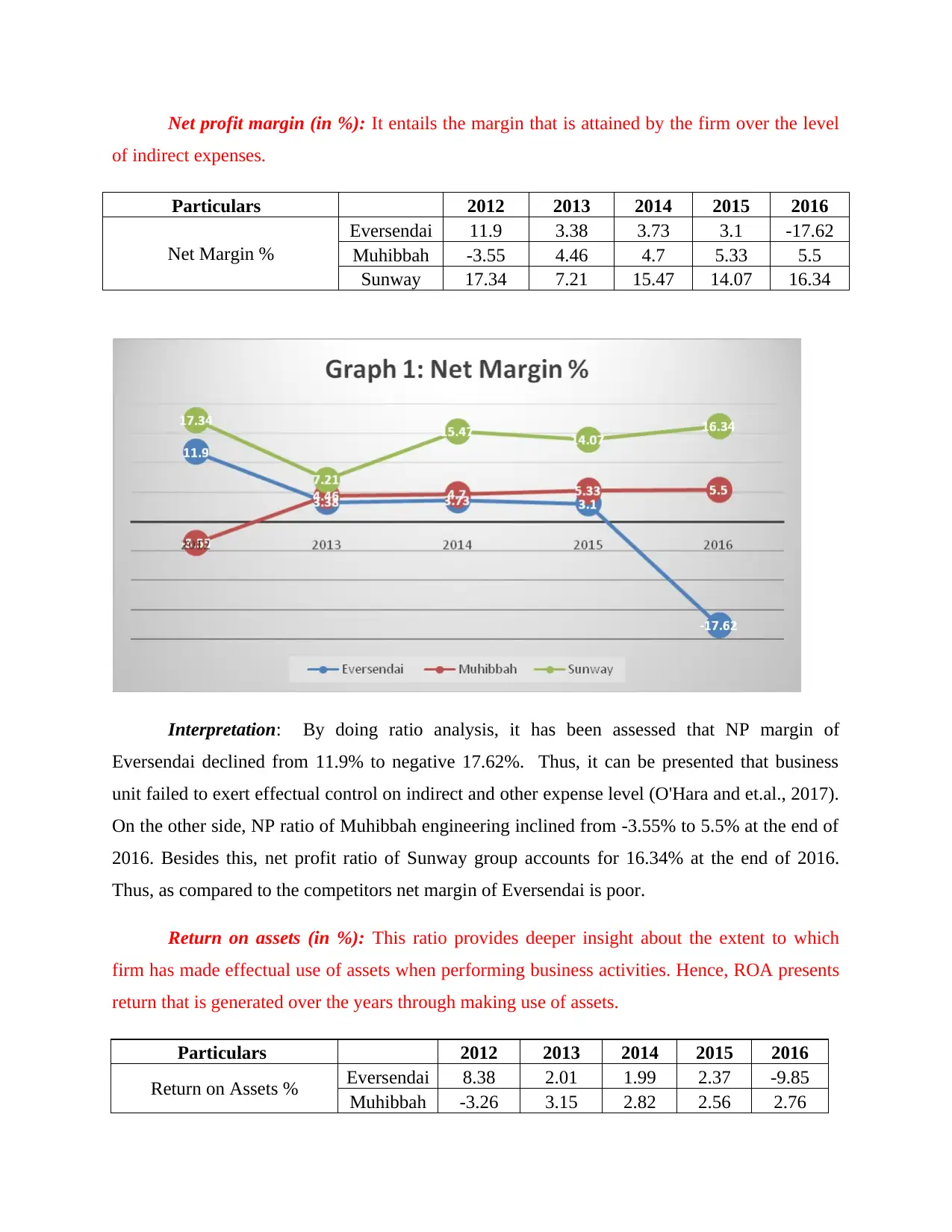

Interpretation: By doing ratio analysis, it has been assessed that NP margin of

Eversendai declined from 11.9% to negative 17.62%. Thus, it can be presented that business

unit failed to exert effectual control on indirect and other expense level (O'Hara and et.al., 2017).

On the other side, NP ratio of Muhibbah engineering inclined from -3.55% to 5.5% at the end of

2016. Besides this, net profit ratio of Sunway group accounts for 16.34% at the end of 2016.

Thus, as compared to the competitors net margin of Eversendai is poor.

Return on assets (in %): This ratio provides deeper insight about the extent to which

firm has made effectual use of assets when performing business activities. Hence, ROA presents

return that is generated over the years through making use of assets.

Particulars 2012 2013 2014 2015 2016

Return on Assets % Eversendai 8.38 2.01 1.99 2.37 -9.85

Muhibbah -3.26 3.15 2.82 2.56 2.76

of indirect expenses.

Particulars 2012 2013 2014 2015 2016

Net Margin %

Eversendai 11.9 3.38 3.73 3.1 -17.62

Muhibbah -3.55 4.46 4.7 5.33 5.5

Sunway 17.34 7.21 15.47 14.07 16.34

Interpretation: By doing ratio analysis, it has been assessed that NP margin of

Eversendai declined from 11.9% to negative 17.62%. Thus, it can be presented that business

unit failed to exert effectual control on indirect and other expense level (O'Hara and et.al., 2017).

On the other side, NP ratio of Muhibbah engineering inclined from -3.55% to 5.5% at the end of

2016. Besides this, net profit ratio of Sunway group accounts for 16.34% at the end of 2016.

Thus, as compared to the competitors net margin of Eversendai is poor.

Return on assets (in %): This ratio provides deeper insight about the extent to which

firm has made effectual use of assets when performing business activities. Hence, ROA presents

return that is generated over the years through making use of assets.

Particulars 2012 2013 2014 2015 2016

Return on Assets % Eversendai 8.38 2.01 1.99 2.37 -9.85

Muhibbah -3.26 3.15 2.82 2.56 2.76

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sunway 4.46 14.84 6.13 5.08 3.37

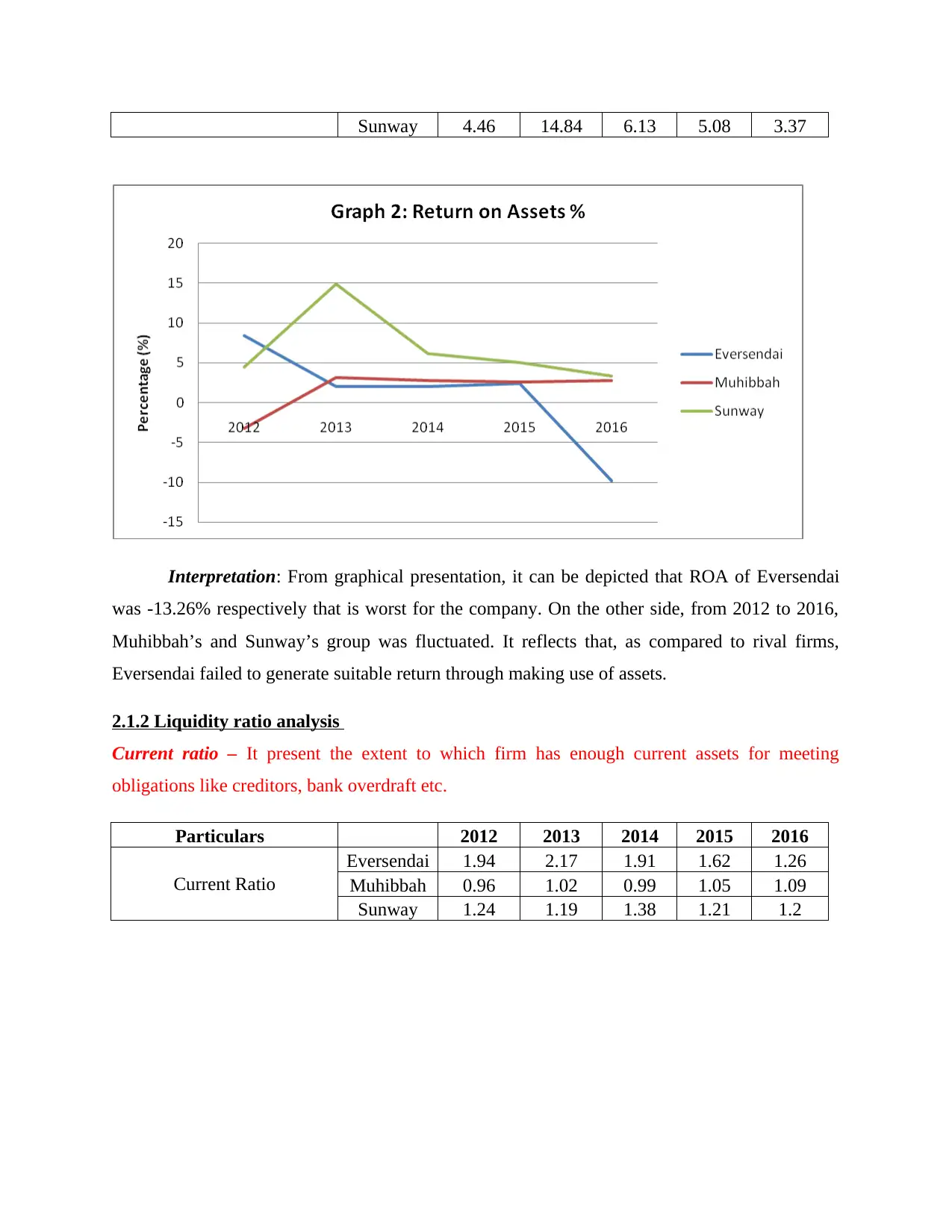

Interpretation: From graphical presentation, it can be depicted that ROA of Eversendai

was -13.26% respectively that is worst for the company. On the other side, from 2012 to 2016,

Muhibbah’s and Sunway’s group was fluctuated. It reflects that, as compared to rival firms,

Eversendai failed to generate suitable return through making use of assets.

2.1.2 Liquidity ratio analysis

Current ratio – It present the extent to which firm has enough current assets for meeting

obligations like creditors, bank overdraft etc.

Particulars 2012 2013 2014 2015 2016

Current Ratio

Eversendai 1.94 2.17 1.91 1.62 1.26

Muhibbah 0.96 1.02 0.99 1.05 1.09

Sunway 1.24 1.19 1.38 1.21 1.2

Interpretation: From graphical presentation, it can be depicted that ROA of Eversendai

was -13.26% respectively that is worst for the company. On the other side, from 2012 to 2016,

Muhibbah’s and Sunway’s group was fluctuated. It reflects that, as compared to rival firms,

Eversendai failed to generate suitable return through making use of assets.

2.1.2 Liquidity ratio analysis

Current ratio – It present the extent to which firm has enough current assets for meeting

obligations like creditors, bank overdraft etc.

Particulars 2012 2013 2014 2015 2016

Current Ratio

Eversendai 1.94 2.17 1.91 1.62 1.26

Muhibbah 0.96 1.02 0.99 1.05 1.09

Sunway 1.24 1.19 1.38 1.21 1.2

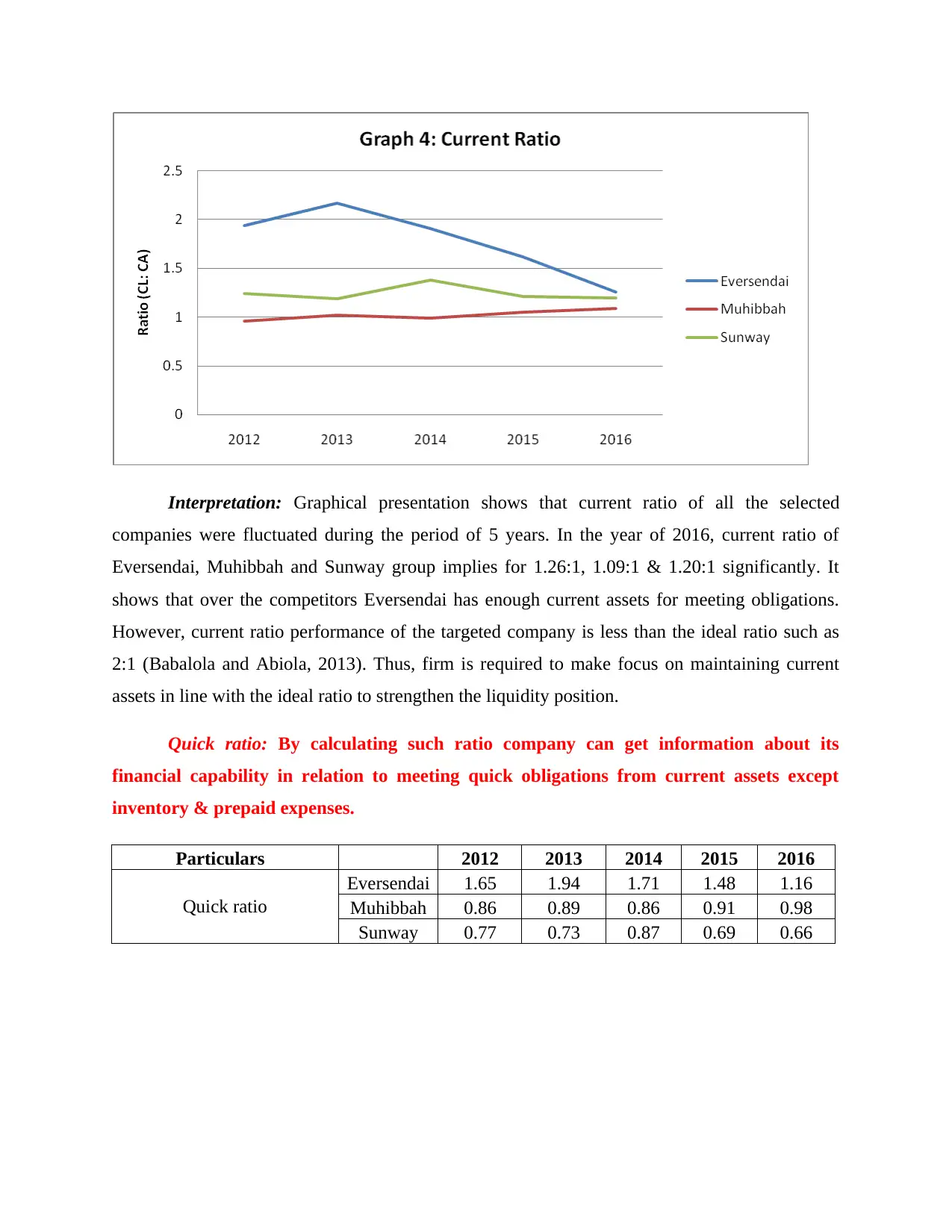

Interpretation: Graphical presentation shows that current ratio of all the selected

companies were fluctuated during the period of 5 years. In the year of 2016, current ratio of

Eversendai, Muhibbah and Sunway group implies for 1.26:1, 1.09:1 & 1.20:1 significantly. It

shows that over the competitors Eversendai has enough current assets for meeting obligations.

However, current ratio performance of the targeted company is less than the ideal ratio such as

2:1 (Babalola and Abiola, 2013). Thus, firm is required to make focus on maintaining current

assets in line with the ideal ratio to strengthen the liquidity position.

Quick ratio: By calculating such ratio company can get information about its

financial capability in relation to meeting quick obligations from current assets except

inventory & prepaid expenses.

Particulars 2012 2013 2014 2015 2016

Quick ratio

Eversendai 1.65 1.94 1.71 1.48 1.16

Muhibbah 0.86 0.89 0.86 0.91 0.98

Sunway 0.77 0.73 0.87 0.69 0.66

companies were fluctuated during the period of 5 years. In the year of 2016, current ratio of

Eversendai, Muhibbah and Sunway group implies for 1.26:1, 1.09:1 & 1.20:1 significantly. It

shows that over the competitors Eversendai has enough current assets for meeting obligations.

However, current ratio performance of the targeted company is less than the ideal ratio such as

2:1 (Babalola and Abiola, 2013). Thus, firm is required to make focus on maintaining current

assets in line with the ideal ratio to strengthen the liquidity position.

Quick ratio: By calculating such ratio company can get information about its

financial capability in relation to meeting quick obligations from current assets except

inventory & prepaid expenses.

Particulars 2012 2013 2014 2015 2016

Quick ratio

Eversendai 1.65 1.94 1.71 1.48 1.16

Muhibbah 0.86 0.89 0.86 0.91 0.98

Sunway 0.77 0.73 0.87 0.69 0.66

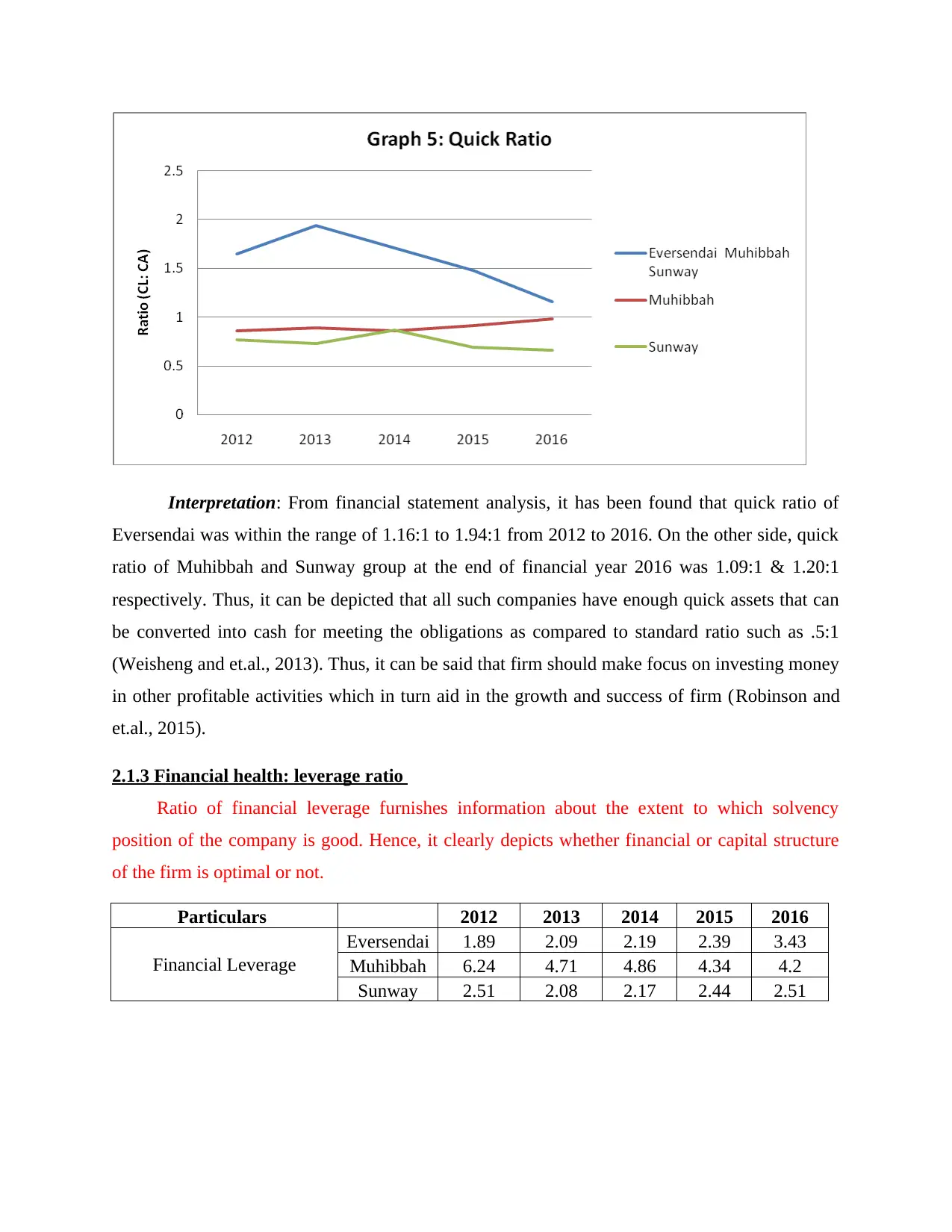

Interpretation: From financial statement analysis, it has been found that quick ratio of

Eversendai was within the range of 1.16:1 to 1.94:1 from 2012 to 2016. On the other side, quick

ratio of Muhibbah and Sunway group at the end of financial year 2016 was 1.09:1 & 1.20:1

respectively. Thus, it can be depicted that all such companies have enough quick assets that can

be converted into cash for meeting the obligations as compared to standard ratio such as .5:1

(Weisheng and et.al., 2013). Thus, it can be said that firm should make focus on investing money

in other profitable activities which in turn aid in the growth and success of firm (Robinson and

et.al., 2015).

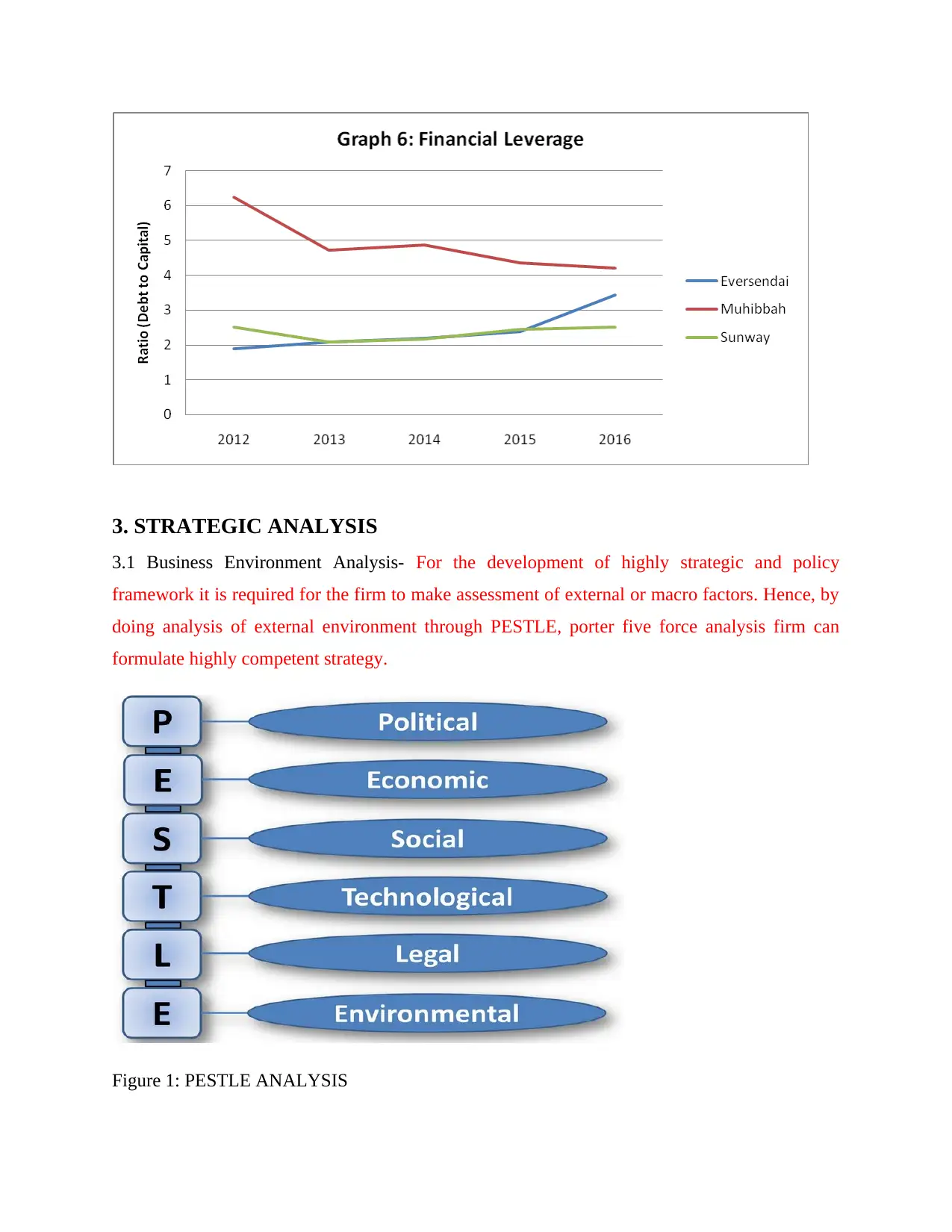

2.1.3 Financial health: leverage ratio

Ratio of financial leverage furnishes information about the extent to which solvency

position of the company is good. Hence, it clearly depicts whether financial or capital structure

of the firm is optimal or not.

Particulars 2012 2013 2014 2015 2016

Financial Leverage

Eversendai 1.89 2.09 2.19 2.39 3.43

Muhibbah 6.24 4.71 4.86 4.34 4.2

Sunway 2.51 2.08 2.17 2.44 2.51

Eversendai was within the range of 1.16:1 to 1.94:1 from 2012 to 2016. On the other side, quick

ratio of Muhibbah and Sunway group at the end of financial year 2016 was 1.09:1 & 1.20:1

respectively. Thus, it can be depicted that all such companies have enough quick assets that can

be converted into cash for meeting the obligations as compared to standard ratio such as .5:1

(Weisheng and et.al., 2013). Thus, it can be said that firm should make focus on investing money

in other profitable activities which in turn aid in the growth and success of firm (Robinson and

et.al., 2015).

2.1.3 Financial health: leverage ratio

Ratio of financial leverage furnishes information about the extent to which solvency

position of the company is good. Hence, it clearly depicts whether financial or capital structure

of the firm is optimal or not.

Particulars 2012 2013 2014 2015 2016

Financial Leverage

Eversendai 1.89 2.09 2.19 2.39 3.43

Muhibbah 6.24 4.71 4.86 4.34 4.2

Sunway 2.51 2.08 2.17 2.44 2.51

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

3. STRATEGIC ANALYSIS

3.1 Business Environment Analysis- For the development of highly strategic and policy

framework it is required for the firm to make assessment of external or macro factors. Hence, by

doing analysis of external environment through PESTLE, porter five force analysis firm can

formulate highly competent strategy.

Figure 1: PESTLE ANALYSIS

3.1 Business Environment Analysis- For the development of highly strategic and policy

framework it is required for the firm to make assessment of external or macro factors. Hence, by

doing analysis of external environment through PESTLE, porter five force analysis firm can

formulate highly competent strategy.

Figure 1: PESTLE ANALYSIS

(Source: Weisheng 2013 )

3.1.1 Political – Favourable

There is no political difficulty is deducted which can impact the cited organisation. The cost of

crude oil is expanded at the time when new goods and service tax is presented in Malaysia

(PESTLE analysis of Malaysia, 2017). Further in Malaysia's and Singapore the labour cost is the

lowest pay and it is permitted by Law control.

3.1.2 Economic– Unfavourable

There is some negative effect of economy on the firm. Singapore is stable monetarily and will

continue with the phenomenal monetary (McDonald and Wilson, 2016). Further the expansion of

business relied upon the hold that is 3%. On the other hand economies stay solid nevertheless

dropping and it is awaited that it will bounce back.

3.1.3 Social – Favourable

There are some social needs of country which is adjusted by the Eversendai, for instance it can

be stated that Malaysia's and Singapore who ties with business accomplice in Middle Eastern

nations which enable the firm to deal with different social difficulties (PESTLE analysis of

Malaysia, 2017).

3.1.4 Technological–Favourable

There is some capacity to adjust the vast majority of the innovation in their business. Further the

development in business is dynamic and specially in the oil and gas industry where the core

interest is in improvement (Chiang, Chen and Ho, 2016).

3.1.1 Political – Favourable

There is no political difficulty is deducted which can impact the cited organisation. The cost of

crude oil is expanded at the time when new goods and service tax is presented in Malaysia

(PESTLE analysis of Malaysia, 2017). Further in Malaysia's and Singapore the labour cost is the

lowest pay and it is permitted by Law control.

3.1.2 Economic– Unfavourable

There is some negative effect of economy on the firm. Singapore is stable monetarily and will

continue with the phenomenal monetary (McDonald and Wilson, 2016). Further the expansion of

business relied upon the hold that is 3%. On the other hand economies stay solid nevertheless

dropping and it is awaited that it will bounce back.

3.1.3 Social – Favourable

There are some social needs of country which is adjusted by the Eversendai, for instance it can

be stated that Malaysia's and Singapore who ties with business accomplice in Middle Eastern

nations which enable the firm to deal with different social difficulties (PESTLE analysis of

Malaysia, 2017).

3.1.4 Technological–Favourable

There is some capacity to adjust the vast majority of the innovation in their business. Further the

development in business is dynamic and specially in the oil and gas industry where the core

interest is in improvement (Chiang, Chen and Ho, 2016).

3.2 Competitive Forces Analysis

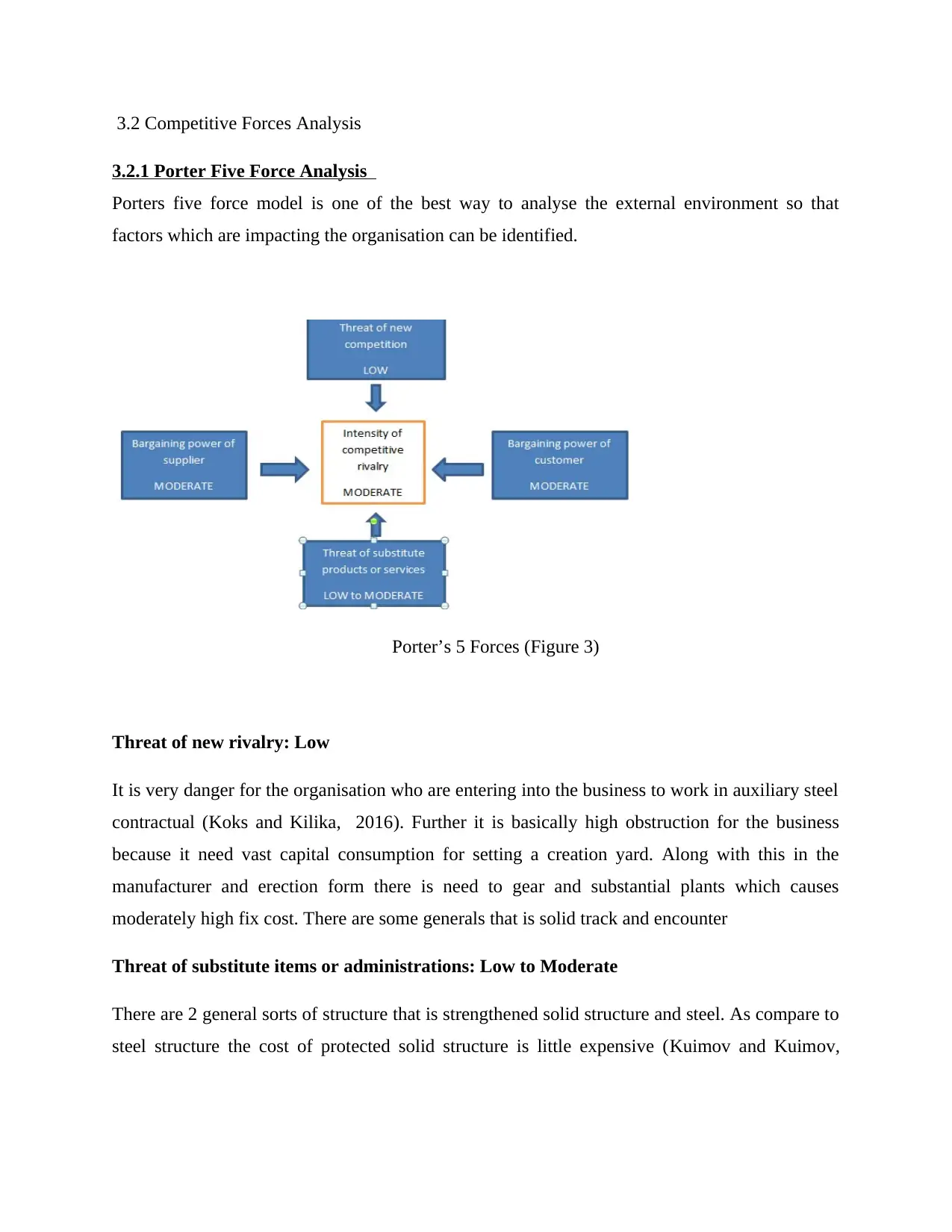

3.2.1 Porter Five Force Analysis

Porters five force model is one of the best way to analyse the external environment so that

factors which are impacting the organisation can be identified.

Porter’s 5 Forces (Figure 3)

Threat of new rivalry: Low

It is very danger for the organisation who are entering into the business to work in auxiliary steel

contractual (Koks and Kilika, 2016). Further it is basically high obstruction for the business

because it need vast capital consumption for setting a creation yard. Along with this in the

manufacturer and erection form there is need to gear and substantial plants which causes

moderately high fix cost. There are some generals that is solid track and encounter

Threat of substitute items or administrations: Low to Moderate

There are 2 general sorts of structure that is strengthened solid structure and steel. As compare to

steel structure the cost of protected solid structure is little expensive (Kuimov and Kuimov,

3.2.1 Porter Five Force Analysis

Porters five force model is one of the best way to analyse the external environment so that

factors which are impacting the organisation can be identified.

Porter’s 5 Forces (Figure 3)

Threat of new rivalry: Low

It is very danger for the organisation who are entering into the business to work in auxiliary steel

contractual (Koks and Kilika, 2016). Further it is basically high obstruction for the business

because it need vast capital consumption for setting a creation yard. Along with this in the

manufacturer and erection form there is need to gear and substantial plants which causes

moderately high fix cost. There are some generals that is solid track and encounter

Threat of substitute items or administrations: Low to Moderate

There are 2 general sorts of structure that is strengthened solid structure and steel. As compare to

steel structure the cost of protected solid structure is little expensive (Kuimov and Kuimov,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2017). There is high pressure of the qualities of steel material and it makes strain attribute make

it a basic construction element in development of tall structures.

Bargaining energy of clients: Moderate

As compare with the temporary worker the authority contractual worker has a better bartering

power. Further it can be stated that workers who are not permanent has much more grounded

dealing power which is giving a great track records of finishing (O'Hara and et.al., 2017). Further

Eversendai always welcome its customers so that they take interest or designated as named the

sub contractual worker in a portion of the undertaking

Bargaining energy of providers: Moderate

The primary crude material information is steel. As steel segments plates which are so forth item

and are accessible which is different from providers (O'Hara and et.al., 2017.). As a fabricator

with immense limit, buy of crude material in mass may give Eversendai slight edge.

Intensity of focused contention: Moderate

In the Middle East the Eversendaih as setup the coordinated auxiliary steel Tumkey temporary

Workers. The organisation has additional manufacture a reputation which it built up for

controlling plan establishment contractual (Koks and Kilika, 2016). Highest income of the

Eversendai at the time when it contrasted with the general temporary workers is that it could be

an signal of less especial competition among competitor.

Conclusion of porter five forces analysis: From the Porters five force model it is analysed that it

is very danger for the organisation who are entering into the business to work in auxiliary steel

contractual. Further it is basically high obstruction for the business because it needs vast capital

consumption for setting a creation yard.

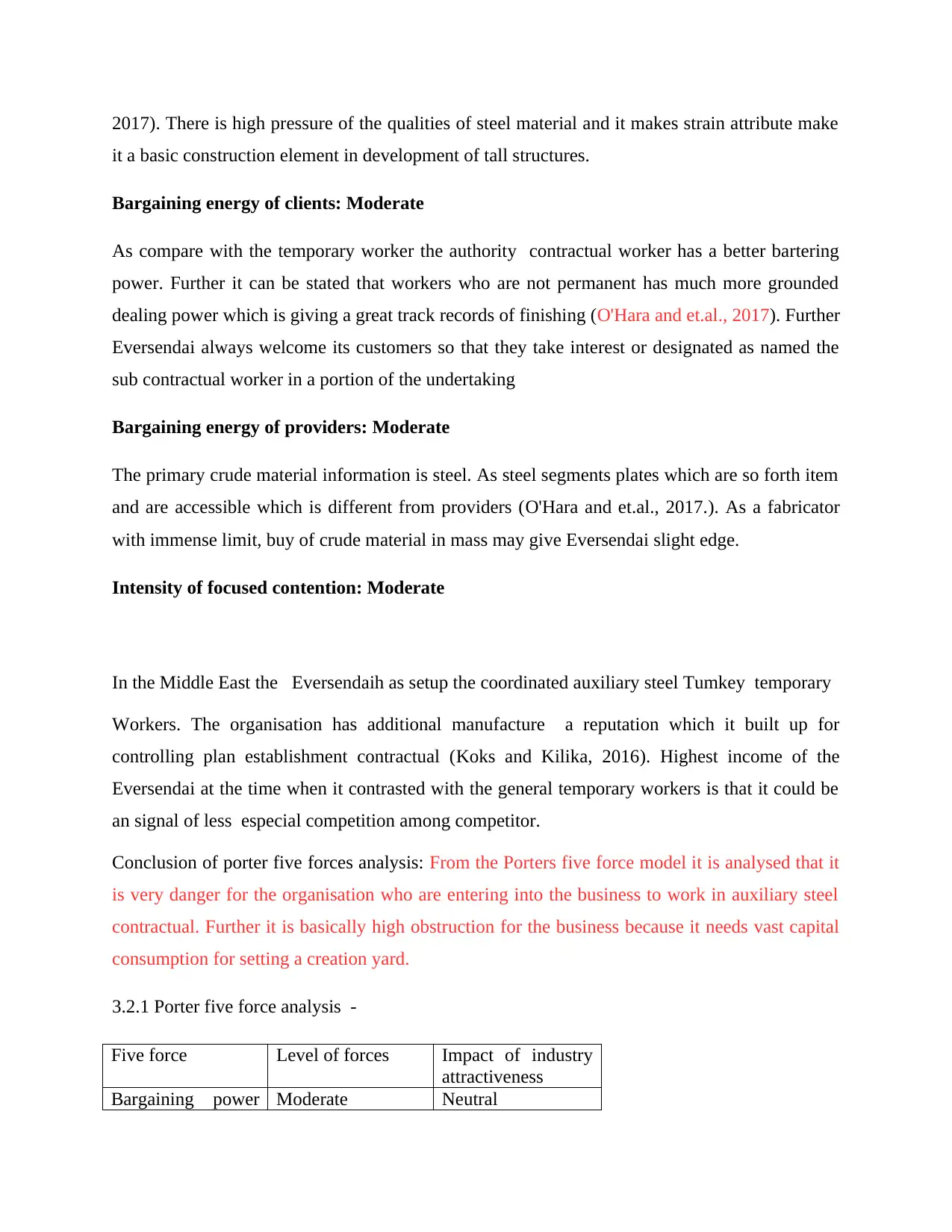

3.2.1 Porter five force analysis -

Five force Level of forces Impact of industry

attractiveness

Bargaining power Moderate Neutral

it a basic construction element in development of tall structures.

Bargaining energy of clients: Moderate

As compare with the temporary worker the authority contractual worker has a better bartering

power. Further it can be stated that workers who are not permanent has much more grounded

dealing power which is giving a great track records of finishing (O'Hara and et.al., 2017). Further

Eversendai always welcome its customers so that they take interest or designated as named the

sub contractual worker in a portion of the undertaking

Bargaining energy of providers: Moderate

The primary crude material information is steel. As steel segments plates which are so forth item

and are accessible which is different from providers (O'Hara and et.al., 2017.). As a fabricator

with immense limit, buy of crude material in mass may give Eversendai slight edge.

Intensity of focused contention: Moderate

In the Middle East the Eversendaih as setup the coordinated auxiliary steel Tumkey temporary

Workers. The organisation has additional manufacture a reputation which it built up for

controlling plan establishment contractual (Koks and Kilika, 2016). Highest income of the

Eversendai at the time when it contrasted with the general temporary workers is that it could be

an signal of less especial competition among competitor.

Conclusion of porter five forces analysis: From the Porters five force model it is analysed that it

is very danger for the organisation who are entering into the business to work in auxiliary steel

contractual. Further it is basically high obstruction for the business because it needs vast capital

consumption for setting a creation yard.

3.2.1 Porter five force analysis -

Five force Level of forces Impact of industry

attractiveness

Bargaining power Moderate Neutral

of buyer

Bargaining power

of supplier

Moderate favourable

Threat from new

entrants

Low Neutral

Threat from

substitute products

Low to Moderate favourable

Competitive rivalry Moderate Neutral

3.2.2 New forces in construction industry

Except Porters five forces there are many other forces which can affect the construction

industry that is digitalization. Here it can be state there is change in old economy due to which

lead to fundamentally increase in digitalization (Jardat, 2017.). There is internet facility

available on the client can easily get information related to different companies, price and

product. Due to increase in information technology it provides different options to the company

to make its product different from its competitor.

3.3 Operations and organisation analysis-

The Eversendai has taken many new methods so that it can easily deal with operational

and challenges which they face in industry. To create good position in market Eversendai can

take benefit from the project management culture (Kuimov and Kuimov, 2017). These

emphases on the meeting the deadline of the project which is effective for the firm. There are

most of the companies who have empowered of project manager to take the command of the

particular operations. Further strategic planning is a thrive on the organisation at the first stage

(Koks, and Kilika, 2014). To organise the scope of project which lead to spiralling out of

controls and limits the add which create delay. Along with this the Eversendai also need to stress

the need for dealing with risk management day to day. There are many risk which Eversendai

can face that is physical. Therefore, the management of construction company need to make sure

that it can easily deal with employees who are working on site must be safe and secure. Along

with this different types of risk such as economic downstairs, environmental damage and delay

in project can be focused on the management of the construction company.

Bargaining power

of supplier

Moderate favourable

Threat from new

entrants

Low Neutral

Threat from

substitute products

Low to Moderate favourable

Competitive rivalry Moderate Neutral

3.2.2 New forces in construction industry

Except Porters five forces there are many other forces which can affect the construction

industry that is digitalization. Here it can be state there is change in old economy due to which

lead to fundamentally increase in digitalization (Jardat, 2017.). There is internet facility

available on the client can easily get information related to different companies, price and

product. Due to increase in information technology it provides different options to the company

to make its product different from its competitor.

3.3 Operations and organisation analysis-

The Eversendai has taken many new methods so that it can easily deal with operational

and challenges which they face in industry. To create good position in market Eversendai can

take benefit from the project management culture (Kuimov and Kuimov, 2017). These

emphases on the meeting the deadline of the project which is effective for the firm. There are

most of the companies who have empowered of project manager to take the command of the

particular operations. Further strategic planning is a thrive on the organisation at the first stage

(Koks, and Kilika, 2014). To organise the scope of project which lead to spiralling out of

controls and limits the add which create delay. Along with this the Eversendai also need to stress

the need for dealing with risk management day to day. There are many risk which Eversendai

can face that is physical. Therefore, the management of construction company need to make sure

that it can easily deal with employees who are working on site must be safe and secure. Along

with this different types of risk such as economic downstairs, environmental damage and delay

in project can be focused on the management of the construction company.

3.4 Key success factors:

With the improvement in economy it leads to growth of construction company. There

many company who take advantage of economic environment and others try to come up from the

effect of the recession. There are some factors for the Eversendai to become successful.

Manage complexity: There are many construction project which are becoming complex. Here

Eversendai are using generic software for managing complex project. This help in managing

project effectively and efficiently (O'Hara and et.al., 2017.). This is one of the key success factor

of Eversendai company.

Embrace technology: Use of new technology is very effective for the firm in term of keeping all

the information safe and secure. Further, Eversendai is using advanced technology and it also

provide training and development facility to employees so that they can easily use new

technology. This is also one of the key factor for the Eversendai company.

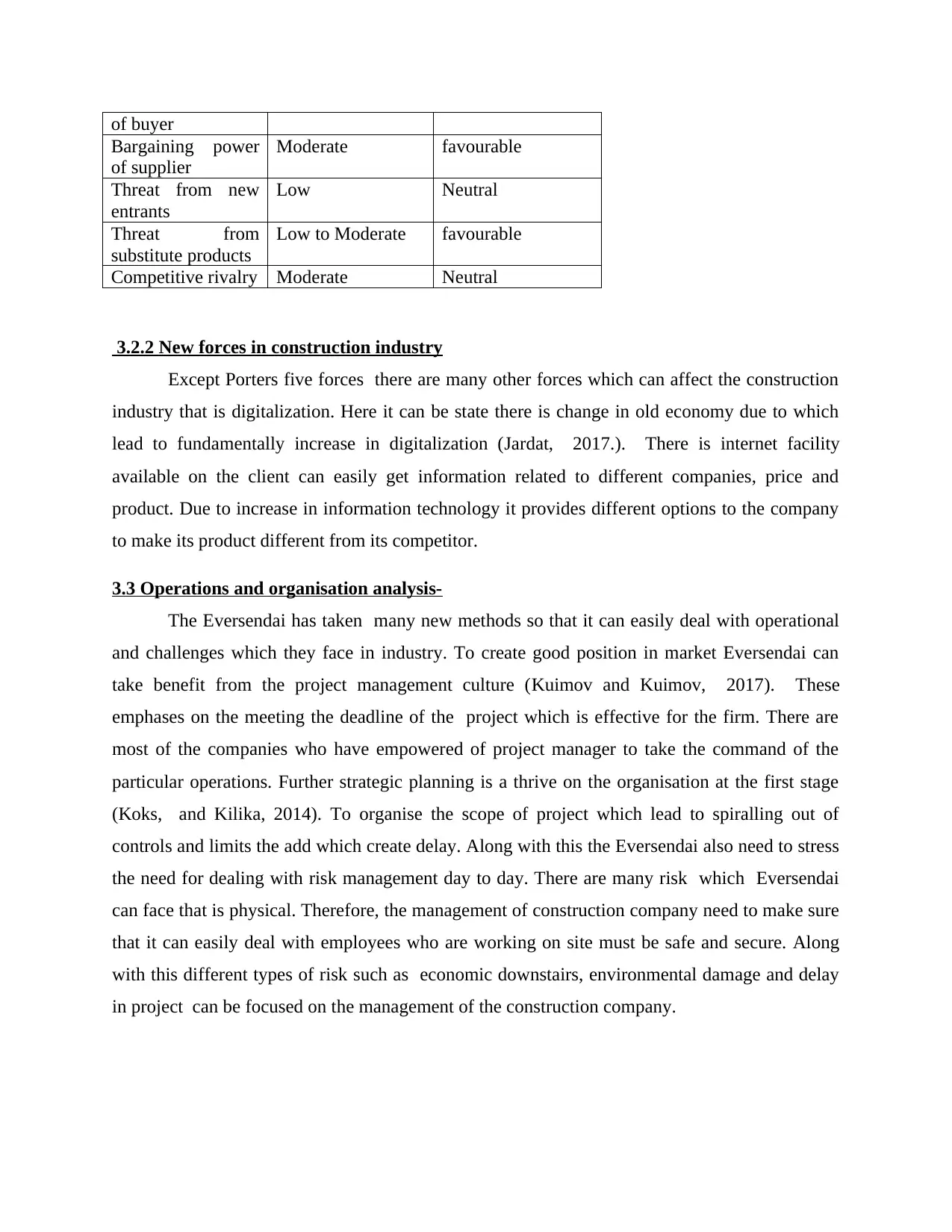

Balance score card s

Through the personal observation it is identified that there are different parts of employee

management and customer involvement which need to improved (Nguyen, 2017). Balance score

card is one of the effective tool which can be used by the firm for improving its various internal

functions. Further it can be used by the firm to measure and provide feedback to organisation.

Therefore, it can be stated that it is one of the effective way to measure the performance.

Personal interview can also conduct with the management of Eversendai company in respect to

prepared balance score card as below

Balance scored Industry specific

KPI

Eversendai Sunway Group Muhibbah

Engineering

Internal growth

and learning

Employee

satisfactio

n,

High Average Average

With the improvement in economy it leads to growth of construction company. There

many company who take advantage of economic environment and others try to come up from the

effect of the recession. There are some factors for the Eversendai to become successful.

Manage complexity: There are many construction project which are becoming complex. Here

Eversendai are using generic software for managing complex project. This help in managing

project effectively and efficiently (O'Hara and et.al., 2017.). This is one of the key success factor

of Eversendai company.

Embrace technology: Use of new technology is very effective for the firm in term of keeping all

the information safe and secure. Further, Eversendai is using advanced technology and it also

provide training and development facility to employees so that they can easily use new

technology. This is also one of the key factor for the Eversendai company.

Balance score card s

Through the personal observation it is identified that there are different parts of employee

management and customer involvement which need to improved (Nguyen, 2017). Balance score

card is one of the effective tool which can be used by the firm for improving its various internal

functions. Further it can be used by the firm to measure and provide feedback to organisation.

Therefore, it can be stated that it is one of the effective way to measure the performance.

Personal interview can also conduct with the management of Eversendai company in respect to

prepared balance score card as below

Balance scored Industry specific

KPI

Eversendai Sunway Group Muhibbah

Engineering

Internal growth

and learning

Employee

satisfactio

n,

High Average Average

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Training

program

for

employees

fixed in a month not fixed In six month

Process or

operation

Research and

development

quality control

Conduct within a

fixed period

Good

Conduct within a

fixed period

Medium

Conduct within a

fixed period

Poor

4.0 IDENTIFYING STRATEGIES

4.1 Ansoff matrix for Eversendai

This is on considering a vital drift challenged by the cited enterprise with a prompt

requirement of defending its business by together considering a profitable outlook of the

business. It is therefore by making a considerable use of Ansoff matrix, the current managerial

bodies of the quoted firm can analyse all possible growth strategies that can be opted by them to

further grow into the market (Takata, 2016). It is by making a definite use of these strategies, the

organisation can look upon the accessible alternatives to grow at a higher rate by either getting

into a newer set of market with the help of exopnaion or develop their existing number of

products and services. Also, on referring to the abilities of Eversendai and the doors open for the

growth of its business, they were found to choose the option of market advancement. This is for

instance on considering its entrance in the railroad development project where it hereby took the

advantage of a fresher industry.

program

for

employees

fixed in a month not fixed In six month

Process or

operation

Research and

development

quality control

Conduct within a

fixed period

Good

Conduct within a

fixed period

Medium

Conduct within a

fixed period

Poor

4.0 IDENTIFYING STRATEGIES

4.1 Ansoff matrix for Eversendai

This is on considering a vital drift challenged by the cited enterprise with a prompt

requirement of defending its business by together considering a profitable outlook of the

business. It is therefore by making a considerable use of Ansoff matrix, the current managerial

bodies of the quoted firm can analyse all possible growth strategies that can be opted by them to

further grow into the market (Takata, 2016). It is by making a definite use of these strategies, the

organisation can look upon the accessible alternatives to grow at a higher rate by either getting

into a newer set of market with the help of exopnaion or develop their existing number of

products and services. Also, on referring to the abilities of Eversendai and the doors open for the

growth of its business, they were found to choose the option of market advancement. This is for

instance on considering its entrance in the railroad development project where it hereby took the

advantage of a fresher industry.

Figure 5: Ansoff Matrix Analysis - Eversendai

Another possible practise was the substitute called market infiltration with a special context

of oil and gas industry. It is however required to be done within a period of 5 years on

considering the negative economic condition of this industry. Considering the same, it has been

found that the ability of the firms related to this industry are full of risks where its current assets

are available with a series of money related risks. It has in turn shown a high level of

disappointment with no choice of rolling out developments (Moreno-Izquierdo and et.al., 2016).

It is basically on overlooking the options of expansion and techniques of progression in articles

due to several cost related concerns. This in turn leads to a high state of disappointment with a

major chance of unverifiable fiscal circumstances.

Beside this, on considering the present labour situation of Eversendai, it is important for the

company to focus more upon the development of their present allotted tasks with an ability to

undertake new services as well (Kanakulya and Jinzhao, 2017). Likewise, upper hand will be

Another possible practise was the substitute called market infiltration with a special context

of oil and gas industry. It is however required to be done within a period of 5 years on

considering the negative economic condition of this industry. Considering the same, it has been

found that the ability of the firms related to this industry are full of risks where its current assets

are available with a series of money related risks. It has in turn shown a high level of

disappointment with no choice of rolling out developments (Moreno-Izquierdo and et.al., 2016).

It is basically on overlooking the options of expansion and techniques of progression in articles

due to several cost related concerns. This in turn leads to a high state of disappointment with a

major chance of unverifiable fiscal circumstances.

Beside this, on considering the present labour situation of Eversendai, it is important for the

company to focus more upon the development of their present allotted tasks with an ability to

undertake new services as well (Kanakulya and Jinzhao, 2017). Likewise, upper hand will be

achieved by focussing more upon getting into new divisional sector by together concentrating

upon newer set of activities with a marginal focus upon the existing divisions for driving profits.

Conclusion

It is concluded that with the use of Ansoff matrix current administrations and offering

inside existing markets are broke down. This strategy help Eversendai's in determining that

business need improvement or it can be improved by offering existing product in new market.

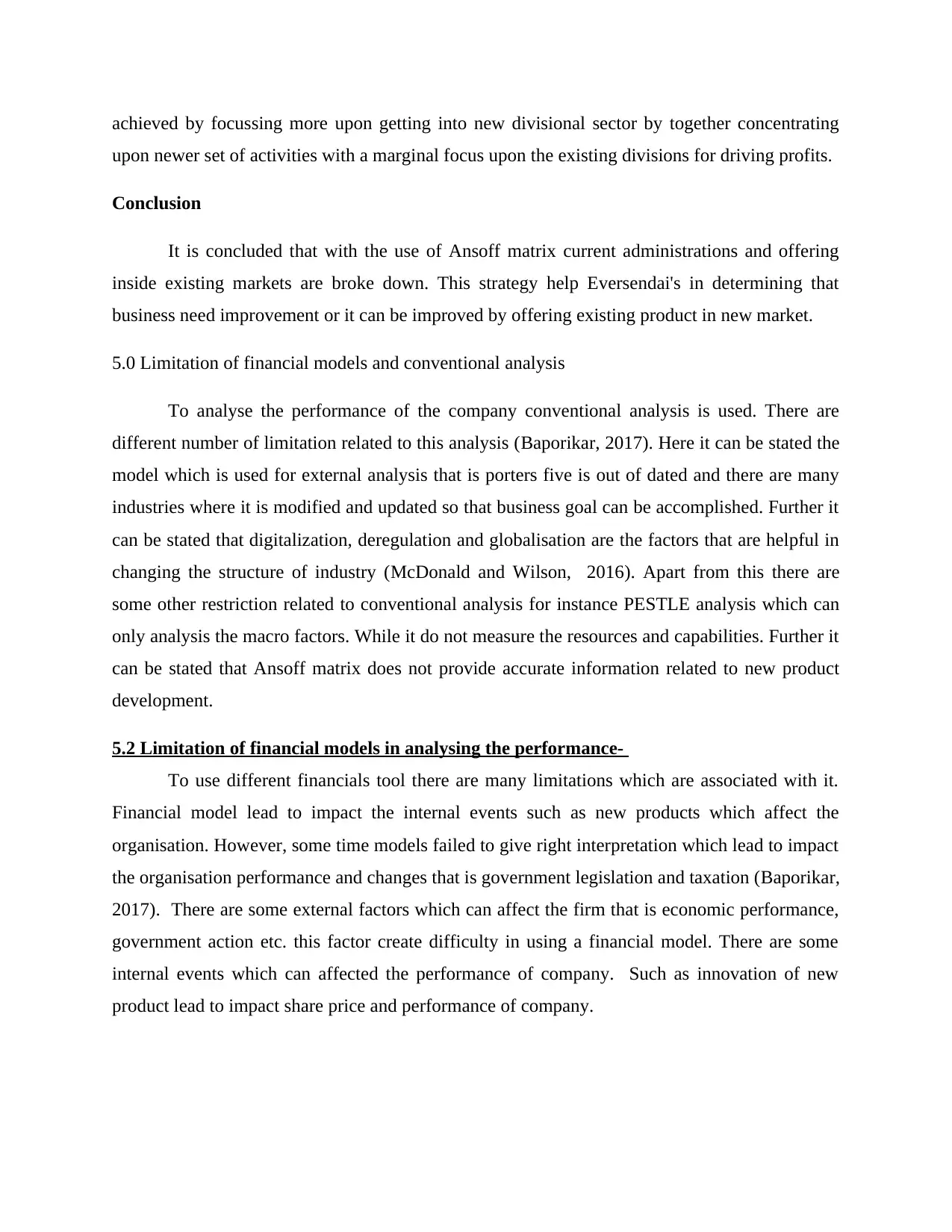

5.0 Limitation of financial models and conventional analysis

To analyse the performance of the company conventional analysis is used. There are

different number of limitation related to this analysis (Baporikar, 2017). Here it can be stated the

model which is used for external analysis that is porters five is out of dated and there are many

industries where it is modified and updated so that business goal can be accomplished. Further it

can be stated that digitalization, deregulation and globalisation are the factors that are helpful in

changing the structure of industry (McDonald and Wilson, 2016). Apart from this there are

some other restriction related to conventional analysis for instance PESTLE analysis which can

only analysis the macro factors. While it do not measure the resources and capabilities. Further it

can be stated that Ansoff matrix does not provide accurate information related to new product

development.

5.2 Limitation of financial models in analysing the performance-

To use different financials tool there are many limitations which are associated with it.

Financial model lead to impact the internal events such as new products which affect the

organisation. However, some time models failed to give right interpretation which lead to impact

the organisation performance and changes that is government legislation and taxation (Baporikar,

2017). There are some external factors which can affect the firm that is economic performance,

government action etc. this factor create difficulty in using a financial model. There are some

internal events which can affected the performance of company. Such as innovation of new

product lead to impact share price and performance of company.

upon newer set of activities with a marginal focus upon the existing divisions for driving profits.

Conclusion

It is concluded that with the use of Ansoff matrix current administrations and offering

inside existing markets are broke down. This strategy help Eversendai's in determining that

business need improvement or it can be improved by offering existing product in new market.

5.0 Limitation of financial models and conventional analysis

To analyse the performance of the company conventional analysis is used. There are

different number of limitation related to this analysis (Baporikar, 2017). Here it can be stated the

model which is used for external analysis that is porters five is out of dated and there are many

industries where it is modified and updated so that business goal can be accomplished. Further it

can be stated that digitalization, deregulation and globalisation are the factors that are helpful in

changing the structure of industry (McDonald and Wilson, 2016). Apart from this there are

some other restriction related to conventional analysis for instance PESTLE analysis which can

only analysis the macro factors. While it do not measure the resources and capabilities. Further it

can be stated that Ansoff matrix does not provide accurate information related to new product

development.

5.2 Limitation of financial models in analysing the performance-

To use different financials tool there are many limitations which are associated with it.

Financial model lead to impact the internal events such as new products which affect the

organisation. However, some time models failed to give right interpretation which lead to impact

the organisation performance and changes that is government legislation and taxation (Baporikar,

2017). There are some external factors which can affect the firm that is economic performance,

government action etc. this factor create difficulty in using a financial model. There are some

internal events which can affected the performance of company. Such as innovation of new

product lead to impact share price and performance of company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6.0 Conclusion

From the above report it can be concluded that return on investment of the firm is not

good. The net profit margin of the firm is declined which show that company is not earning

profit. Further,from the five porter model it is identified that company need to focus on

implementing new technology so that it can easily make good position in market. Further it can

be concluded company can make product different from its competitor in respect to gain good

position in market (Amirkhani, Nazeryani and Faraz, 2016). Further it is concluded that in the

market competitive rivalry in the industry reflects that firm need to focus on expansion. Political

factor have great impact on the firm as because of the changes in taxation rate.

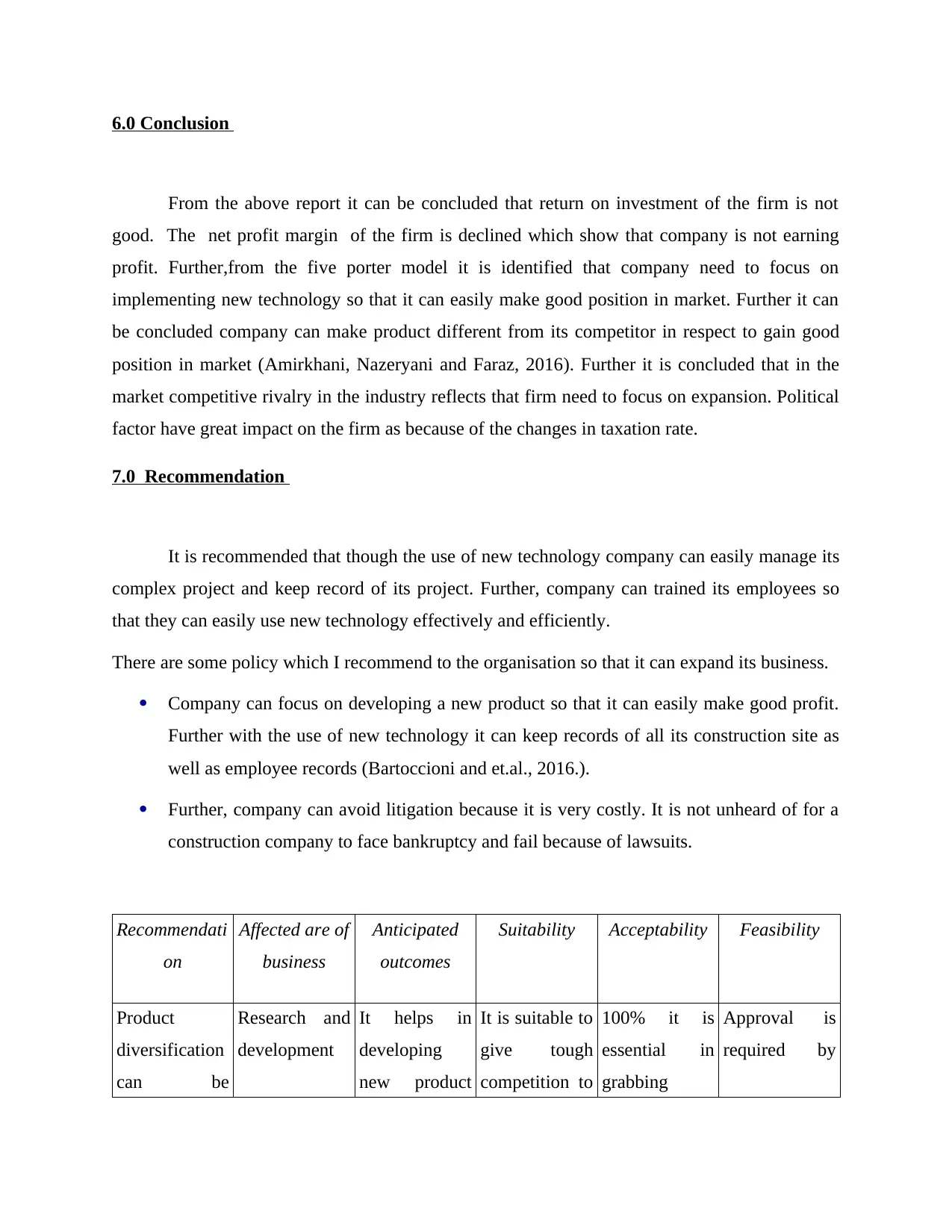

7.0 Recommendation

It is recommended that though the use of new technology company can easily manage its

complex project and keep record of its project. Further, company can trained its employees so

that they can easily use new technology effectively and efficiently.

There are some policy which I recommend to the organisation so that it can expand its business.

Company can focus on developing a new product so that it can easily make good profit.

Further with the use of new technology it can keep records of all its construction site as

well as employee records (Bartoccioni and et.al., 2016.).

Further, company can avoid litigation because it is very costly. It is not unheard of for a

construction company to face bankruptcy and fail because of lawsuits.

Recommendati

on

Affected are of

business

Anticipated

outcomes

Suitability Acceptability Feasibility

Product

diversification

can be

Research and

development

It helps in

developing

new product

It is suitable to

give tough

competition to

100% it is

essential in

grabbing

Approval is

required by

From the above report it can be concluded that return on investment of the firm is not

good. The net profit margin of the firm is declined which show that company is not earning

profit. Further,from the five porter model it is identified that company need to focus on

implementing new technology so that it can easily make good position in market. Further it can

be concluded company can make product different from its competitor in respect to gain good

position in market (Amirkhani, Nazeryani and Faraz, 2016). Further it is concluded that in the

market competitive rivalry in the industry reflects that firm need to focus on expansion. Political

factor have great impact on the firm as because of the changes in taxation rate.

7.0 Recommendation

It is recommended that though the use of new technology company can easily manage its

complex project and keep record of its project. Further, company can trained its employees so

that they can easily use new technology effectively and efficiently.

There are some policy which I recommend to the organisation so that it can expand its business.

Company can focus on developing a new product so that it can easily make good profit.

Further with the use of new technology it can keep records of all its construction site as

well as employee records (Bartoccioni and et.al., 2016.).

Further, company can avoid litigation because it is very costly. It is not unheard of for a

construction company to face bankruptcy and fail because of lawsuits.

Recommendati

on

Affected are of

business

Anticipated

outcomes

Suitability Acceptability Feasibility

Product

diversification

can be

Research and

development

It helps in

developing

new product

It is suitable to

give tough

competition to

100% it is

essential in

grabbing

Approval is

required by

accomplish

through

entering into a

new market or

by pricing

strategies.

for customers other

competitor

attention of

customers

management.

through

entering into a

new market or

by pricing

strategies.

for customers other

competitor

attention of

customers

management.

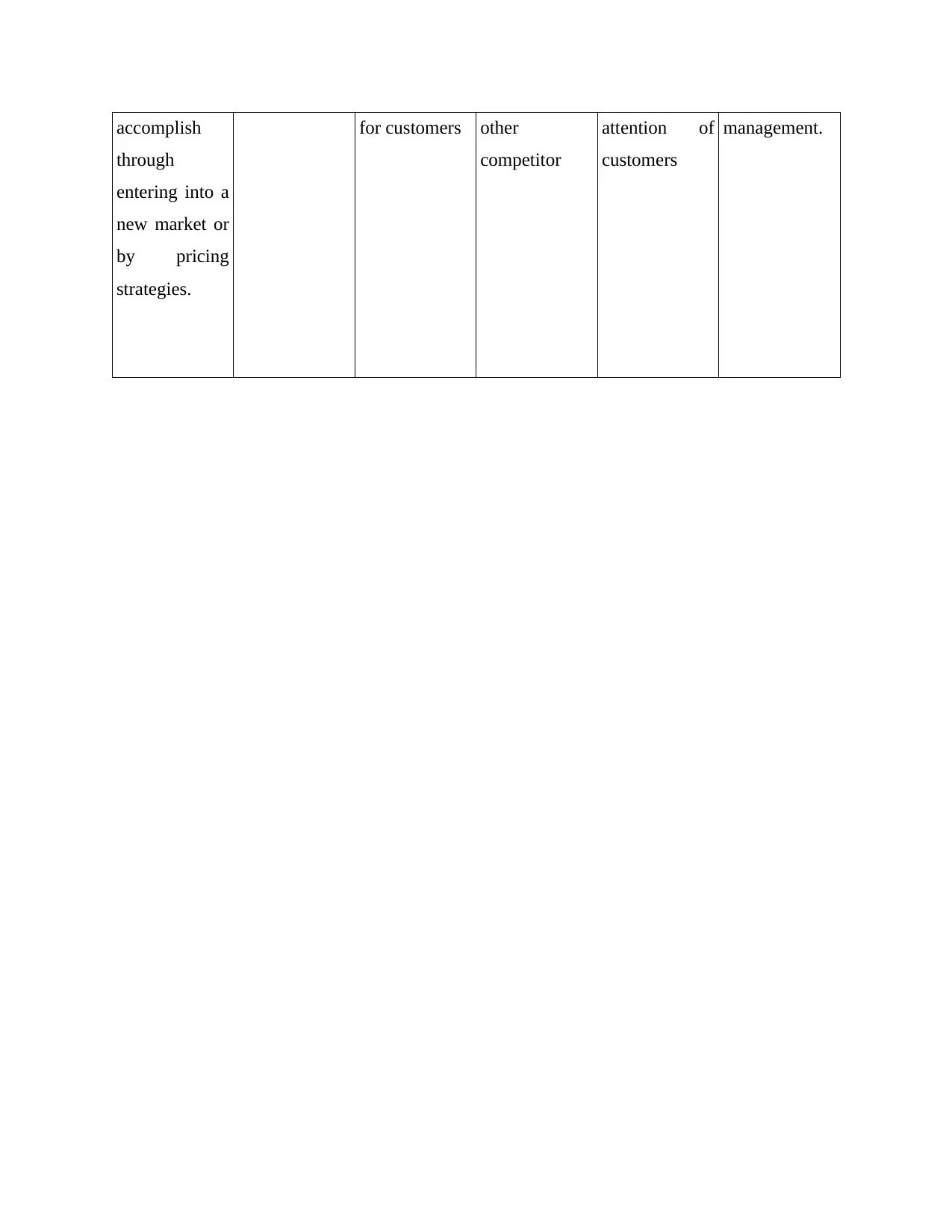

8.0 Modelling

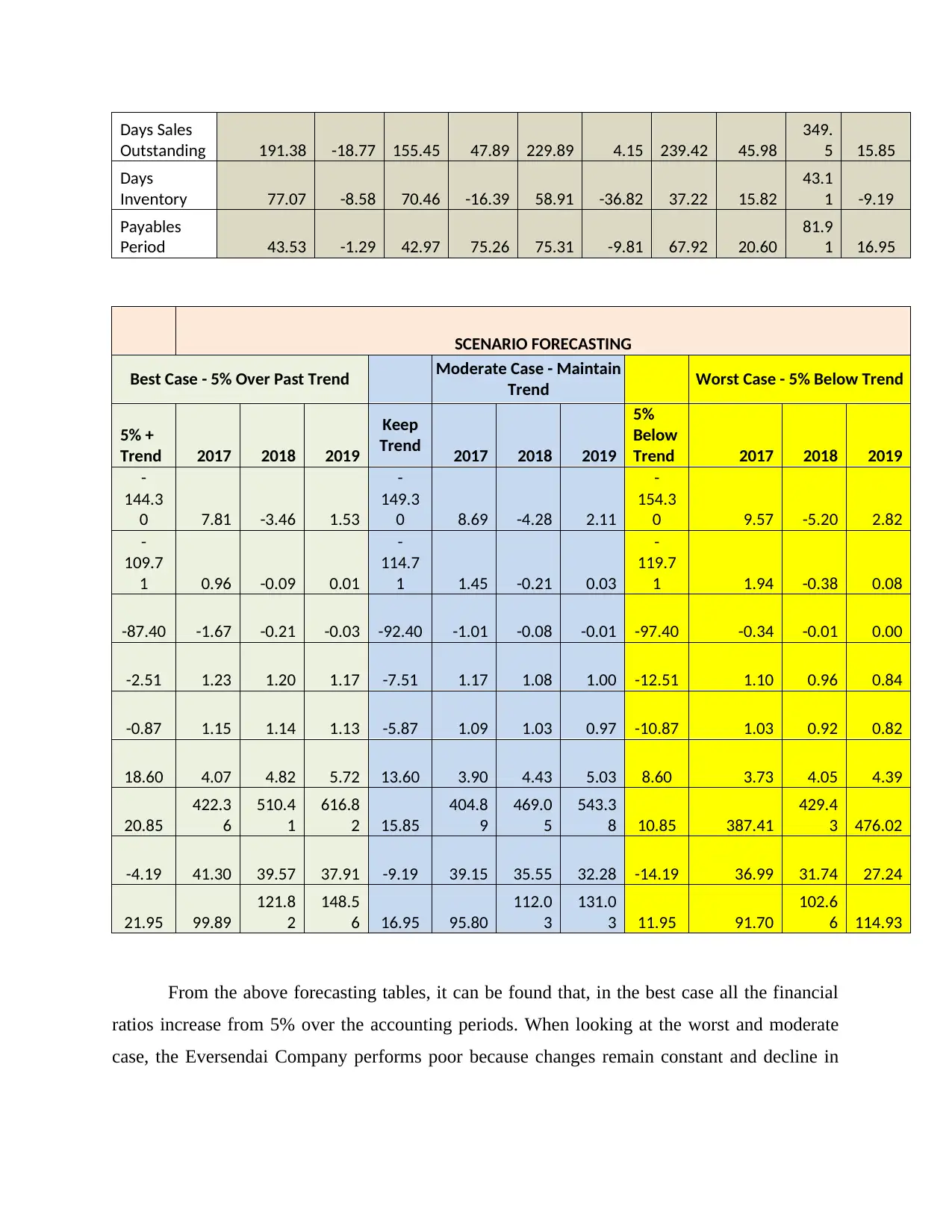

8.1 Scenarios Forecasting

The method in which future financial values are to be estimated for the company after taking base of the

past years is known as scenario modelling. In the present study, financial data of Eversendia forecasted on the basis

of three cases which are like best, moderate and worst. Moreover, on the basis of such cases scenario modelling for

cited firm is mentioned below:

Adjustments:

In order to do forecasting of the financial ratios of next three years of Eversendia

company there are some adjustments made. On the basis of various assumptions, scenario is

prepared for further fiscal periods. In this, three situations are assumed for estimation which is

like best, moderate and the worst case. Under the best and worst situation, ratios are adjusted

with the 5% rate in each year from 2017 to 2019. Apart from this, in the case of moderate also

adjustments made with the rate of 5%.

PAST TREND AREA

PAST 5 -YEAR

FINANCIAL

INDICATOR

S 2012

%

Chang

e 2013

%

Chang

e 2014

%

Chang

e 2015

%

Chang

e 2016

Av. %

Chang

e

Net Margin

% 11.9 -71.60 3.38 10.36 3.73 -16.89 3.1

-

668.39

-

17.6

2

-

149.30

Return on

Assets % 8.38 -76.01 2.01 -1.00 1.99 19.10 2.37

-

515.61 -9.85

-

114.71

Return on

Invested

Capital % 13.93 -70.42 4.12 -2.18 4.03 9.93 4.43

-

399.32

-

13.2

6 -92.40

Current

Ratio 1.94 11.86 2.17 -11.98 1.91 -15.18 1.62 -22.22 1.26 -7.51

Quick Ratio 1.65 17.58 1.94 -11.86 1.71 -13.45 1.48 -21.62 1.16 -5.87

Financial

Leverage 1.89 10.58 2.09 4.78 2.19 9.13 2.39 43.51 3.43 13.60

8.1 Scenarios Forecasting

The method in which future financial values are to be estimated for the company after taking base of the

past years is known as scenario modelling. In the present study, financial data of Eversendia forecasted on the basis

of three cases which are like best, moderate and worst. Moreover, on the basis of such cases scenario modelling for

cited firm is mentioned below:

Adjustments:

In order to do forecasting of the financial ratios of next three years of Eversendia

company there are some adjustments made. On the basis of various assumptions, scenario is

prepared for further fiscal periods. In this, three situations are assumed for estimation which is

like best, moderate and the worst case. Under the best and worst situation, ratios are adjusted

with the 5% rate in each year from 2017 to 2019. Apart from this, in the case of moderate also

adjustments made with the rate of 5%.

PAST TREND AREA

PAST 5 -YEAR

FINANCIAL

INDICATOR

S 2012

%

Chang

e 2013

%

Chang

e 2014

%

Chang

e 2015

%

Chang

e 2016

Av. %

Chang

e

Net Margin

% 11.9 -71.60 3.38 10.36 3.73 -16.89 3.1

-

668.39

-

17.6

2

-

149.30

Return on

Assets % 8.38 -76.01 2.01 -1.00 1.99 19.10 2.37

-

515.61 -9.85

-

114.71

Return on

Invested

Capital % 13.93 -70.42 4.12 -2.18 4.03 9.93 4.43

-

399.32

-

13.2

6 -92.40

Current

Ratio 1.94 11.86 2.17 -11.98 1.91 -15.18 1.62 -22.22 1.26 -7.51

Quick Ratio 1.65 17.58 1.94 -11.86 1.71 -13.45 1.48 -21.62 1.16 -5.87

Financial

Leverage 1.89 10.58 2.09 4.78 2.19 9.13 2.39 43.51 3.43 13.60

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Days Sales

Outstanding 191.38 -18.77 155.45 47.89 229.89 4.15 239.42 45.98

349.

5 15.85

Days

Inventory 77.07 -8.58 70.46 -16.39 58.91 -36.82 37.22 15.82

43.1

1 -9.19

Payables

Period 43.53 -1.29 42.97 75.26 75.31 -9.81 67.92 20.60

81.9

1 16.95

SCENARIO FORECASTING

Best Case - 5% Over Past Trend Moderate Case - Maintain

Trend Worst Case - 5% Below Trend

5% +

Trend 2017 2018 2019

Keep

Trend 2017 2018 2019

5%

Below

Trend 2017 2018 2019

-

144.3

0 7.81 -3.46 1.53

-

149.3

0 8.69 -4.28 2.11

-

154.3

0 9.57 -5.20 2.82

-

109.7

1 0.96 -0.09 0.01

-

114.7

1 1.45 -0.21 0.03

-

119.7

1 1.94 -0.38 0.08

-87.40 -1.67 -0.21 -0.03 -92.40 -1.01 -0.08 -0.01 -97.40 -0.34 -0.01 0.00

-2.51 1.23 1.20 1.17 -7.51 1.17 1.08 1.00 -12.51 1.10 0.96 0.84

-0.87 1.15 1.14 1.13 -5.87 1.09 1.03 0.97 -10.87 1.03 0.92 0.82

18.60 4.07 4.82 5.72 13.60 3.90 4.43 5.03 8.60 3.73 4.05 4.39

20.85

422.3

6

510.4

1

616.8

2 15.85

404.8

9

469.0

5

543.3

8 10.85 387.41

429.4

3 476.02

-4.19 41.30 39.57 37.91 -9.19 39.15 35.55 32.28 -14.19 36.99 31.74 27.24

21.95 99.89

121.8

2

148.5

6 16.95 95.80

112.0

3

131.0

3 11.95 91.70

102.6

6 114.93

From the above forecasting tables, it can be found that, in the best case all the financial

ratios increase from 5% over the accounting periods. When looking at the worst and moderate

case, the Eversendai Company performs poor because changes remain constant and decline in

Outstanding 191.38 -18.77 155.45 47.89 229.89 4.15 239.42 45.98

349.

5 15.85

Days

Inventory 77.07 -8.58 70.46 -16.39 58.91 -36.82 37.22 15.82

43.1

1 -9.19

Payables

Period 43.53 -1.29 42.97 75.26 75.31 -9.81 67.92 20.60

81.9

1 16.95

SCENARIO FORECASTING

Best Case - 5% Over Past Trend Moderate Case - Maintain

Trend Worst Case - 5% Below Trend

5% +

Trend 2017 2018 2019

Keep

Trend 2017 2018 2019

5%

Below

Trend 2017 2018 2019

-

144.3

0 7.81 -3.46 1.53

-

149.3

0 8.69 -4.28 2.11

-

154.3

0 9.57 -5.20 2.82

-

109.7

1 0.96 -0.09 0.01

-

114.7

1 1.45 -0.21 0.03

-

119.7

1 1.94 -0.38 0.08

-87.40 -1.67 -0.21 -0.03 -92.40 -1.01 -0.08 -0.01 -97.40 -0.34 -0.01 0.00

-2.51 1.23 1.20 1.17 -7.51 1.17 1.08 1.00 -12.51 1.10 0.96 0.84

-0.87 1.15 1.14 1.13 -5.87 1.09 1.03 0.97 -10.87 1.03 0.92 0.82

18.60 4.07 4.82 5.72 13.60 3.90 4.43 5.03 8.60 3.73 4.05 4.39

20.85

422.3

6

510.4

1

616.8

2 15.85

404.8

9

469.0

5

543.3

8 10.85 387.41

429.4

3 476.02

-4.19 41.30 39.57 37.91 -9.19 39.15 35.55 32.28 -14.19 36.99 31.74 27.24

21.95 99.89

121.8

2

148.5

6 16.95 95.80

112.0

3

131.0

3 11.95 91.70

102.6

6 114.93

From the above forecasting tables, it can be found that, in the best case all the financial

ratios increase from 5% over the accounting periods. When looking at the worst and moderate

case, the Eversendai Company performs poor because changes remain constant and decline in

upcoming three years. Henceforth, the company needs to consider case one which will give

better performance in the industry.

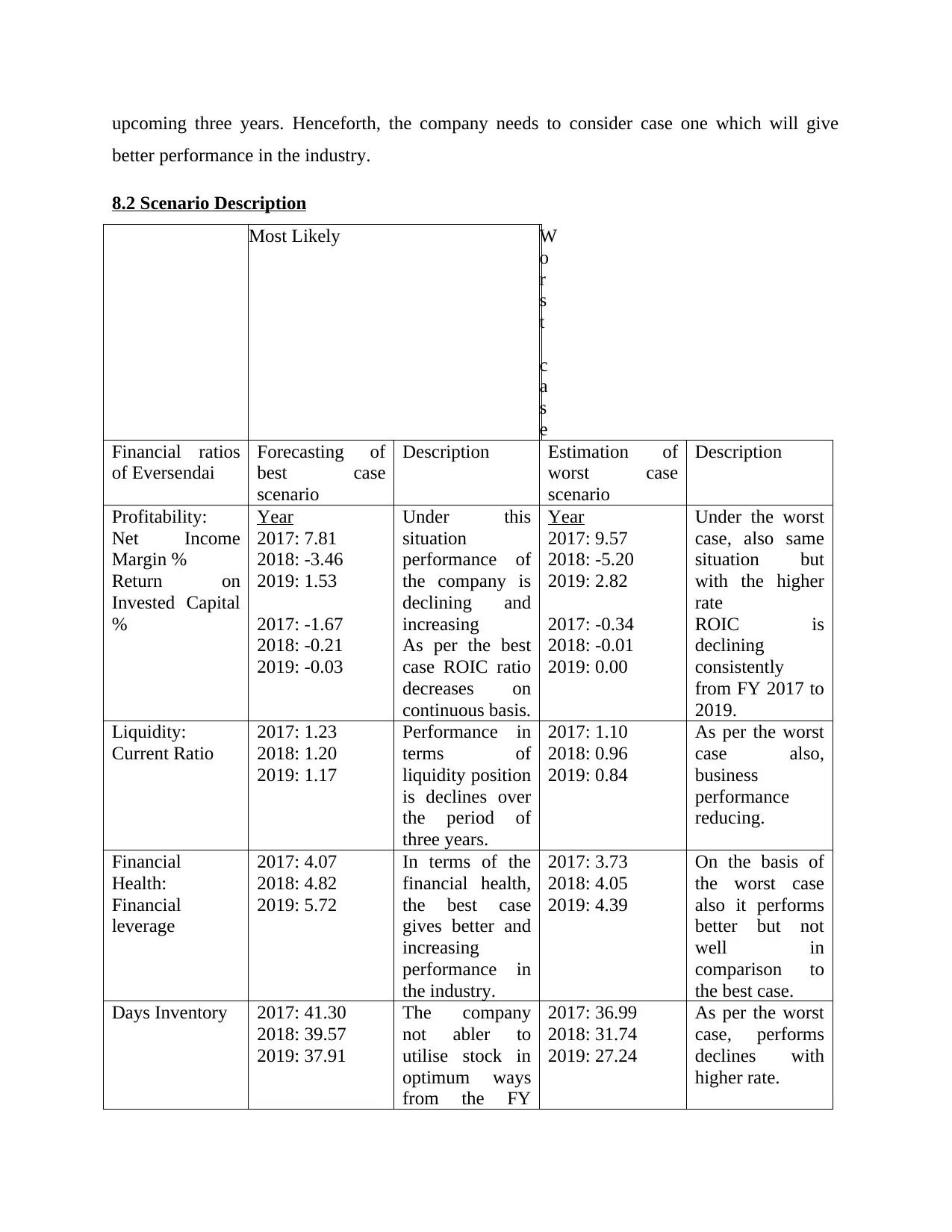

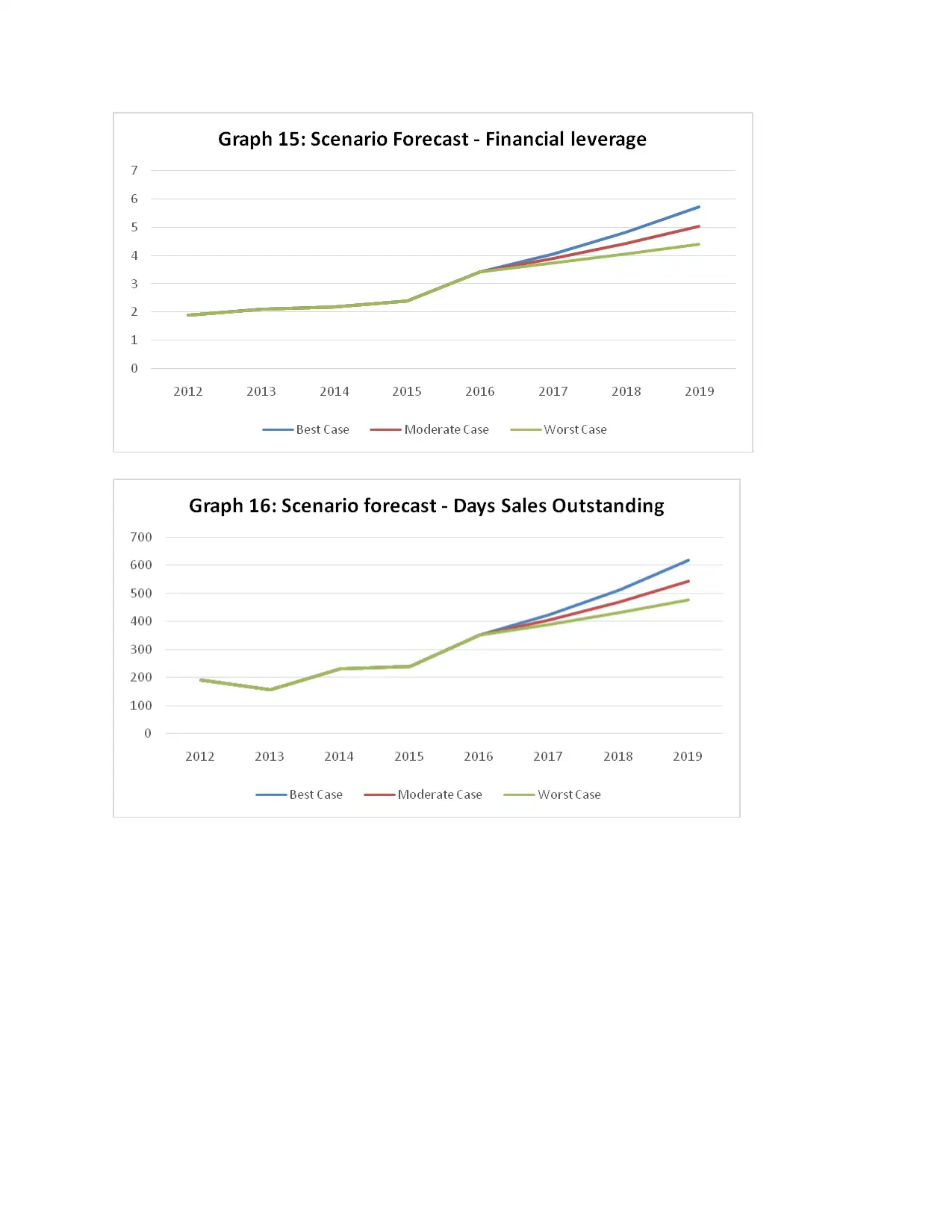

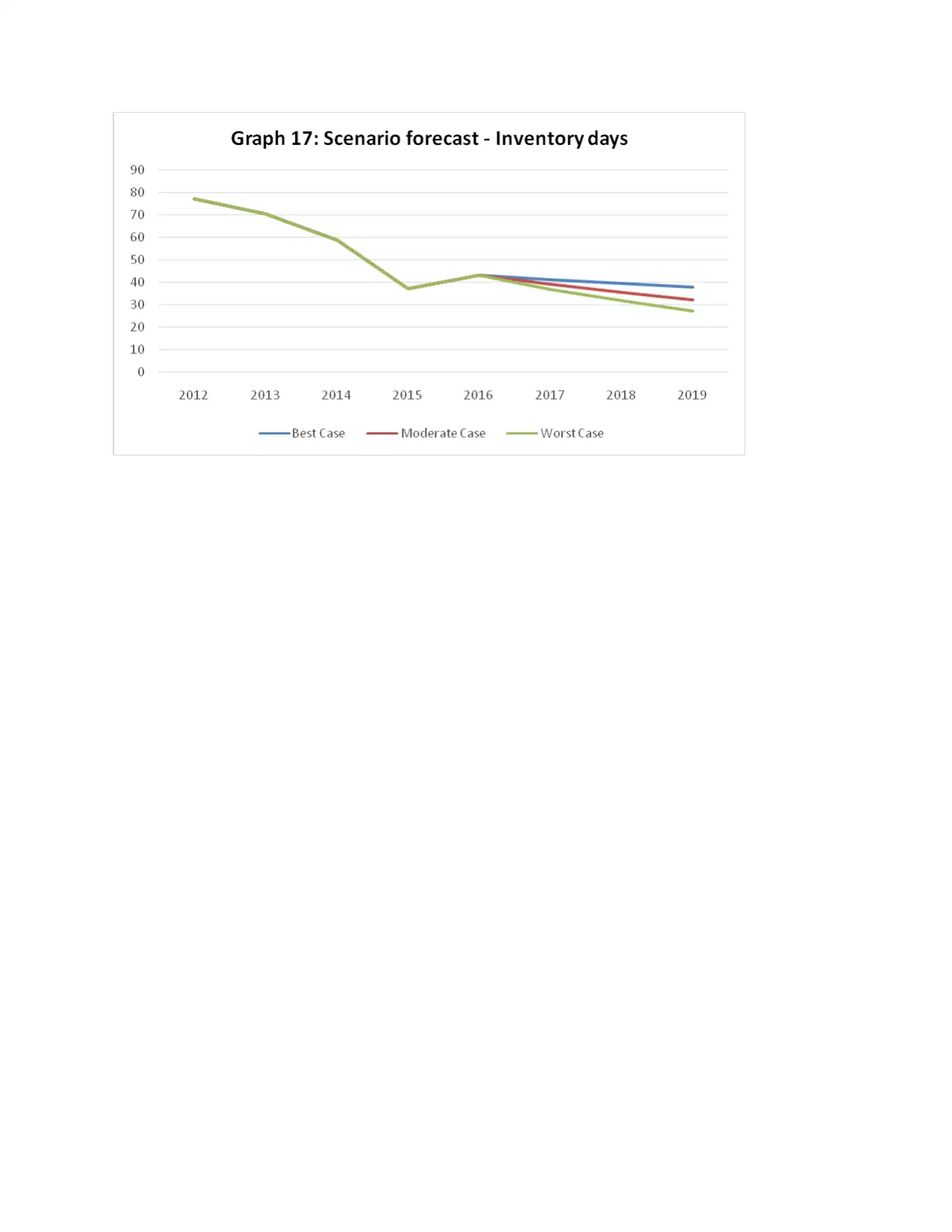

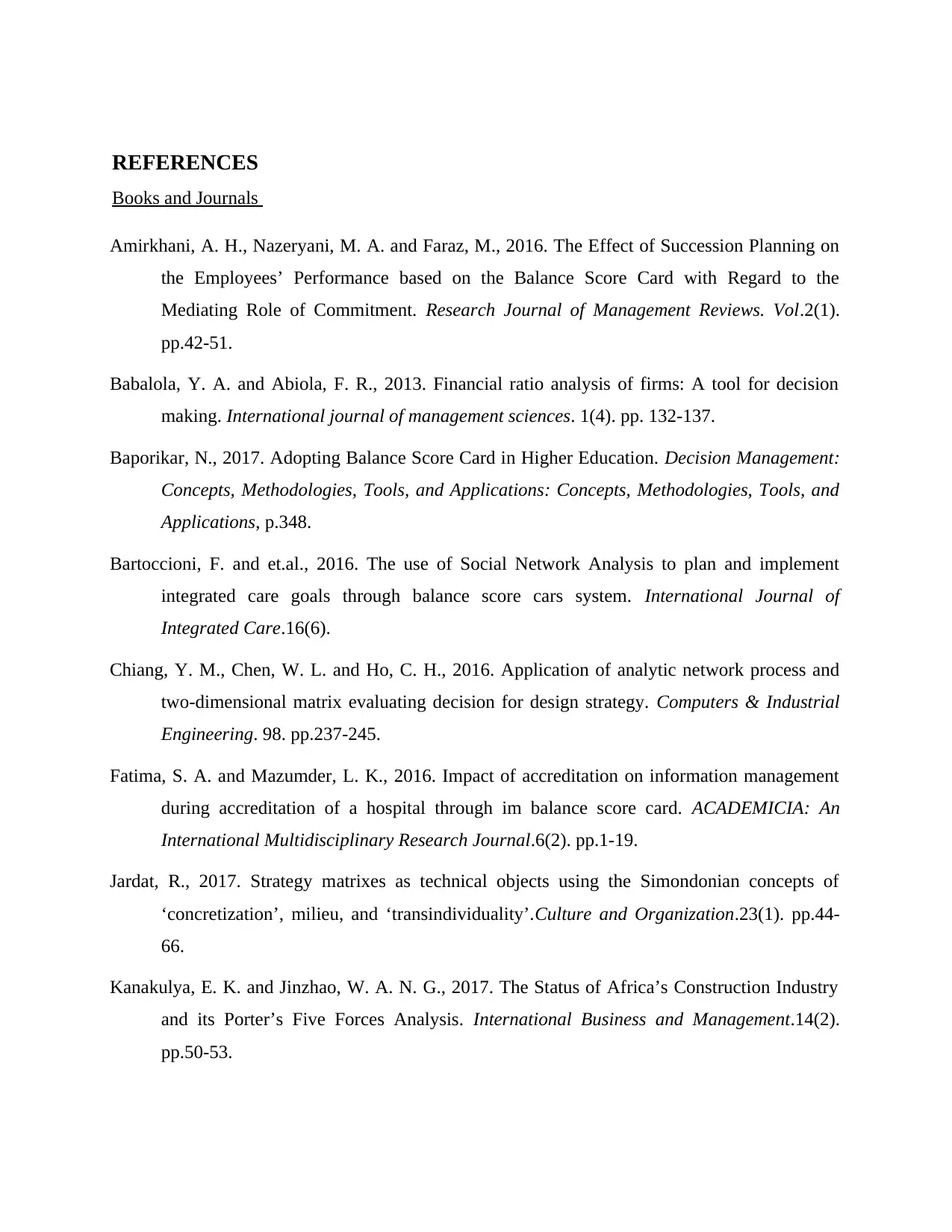

8.2 Scenario Description

Most Likely W

o

r

s

t

c

a

s

e

Financial ratios

of Eversendai

Forecasting of

best case

scenario

Description Estimation of

worst case

scenario

Description

Profitability:

Net Income

Margin %

Return on

Invested Capital

%

Year

2017: 7.81

2018: -3.46

2019: 1.53

2017: -1.67

2018: -0.21

2019: -0.03

Under this

situation

performance of

the company is

declining and

increasing

As per the best

case ROIC ratio

decreases on

continuous basis.

Year

2017: 9.57

2018: -5.20

2019: 2.82

2017: -0.34

2018: -0.01

2019: 0.00

Under the worst

case, also same

situation but

with the higher

rate

ROIC is

declining

consistently

from FY 2017 to

2019.

Liquidity:

Current Ratio

2017: 1.23

2018: 1.20

2019: 1.17

Performance in

terms of

liquidity position

is declines over

the period of

three years.

2017: 1.10

2018: 0.96

2019: 0.84

As per the worst

case also,

business

performance

reducing.

Financial

Health:

Financial

leverage

2017: 4.07

2018: 4.82

2019: 5.72

In terms of the

financial health,

the best case

gives better and

increasing

performance in

the industry.

2017: 3.73

2018: 4.05

2019: 4.39

On the basis of

the worst case

also it performs

better but not

well in

comparison to

the best case.

Days Inventory 2017: 41.30

2018: 39.57

2019: 37.91

The company

not abler to

utilise stock in

optimum ways

from the FY

2017: 36.99

2018: 31.74

2019: 27.24

As per the worst

case, performs

declines with

higher rate.

better performance in the industry.

8.2 Scenario Description

Most Likely W

o

r

s

t

c

a

s

e

Financial ratios

of Eversendai

Forecasting of

best case

scenario

Description Estimation of

worst case

scenario

Description

Profitability:

Net Income

Margin %

Return on

Invested Capital

%

Year

2017: 7.81

2018: -3.46

2019: 1.53

2017: -1.67

2018: -0.21

2019: -0.03

Under this

situation

performance of

the company is

declining and

increasing

As per the best

case ROIC ratio

decreases on

continuous basis.

Year

2017: 9.57

2018: -5.20

2019: 2.82

2017: -0.34

2018: -0.01

2019: 0.00

Under the worst

case, also same

situation but

with the higher

rate

ROIC is

declining

consistently

from FY 2017 to

2019.

Liquidity:

Current Ratio

2017: 1.23

2018: 1.20

2019: 1.17

Performance in

terms of

liquidity position

is declines over

the period of

three years.

2017: 1.10

2018: 0.96

2019: 0.84

As per the worst

case also,

business

performance

reducing.

Financial

Health:

Financial

leverage

2017: 4.07

2018: 4.82

2019: 5.72

In terms of the

financial health,

the best case

gives better and

increasing

performance in

the industry.

2017: 3.73

2018: 4.05

2019: 4.39

On the basis of

the worst case

also it performs

better but not

well in

comparison to

the best case.

Days Inventory 2017: 41.30

2018: 39.57

2019: 37.91

The company

not abler to

utilise stock in

optimum ways

from the FY

2017: 36.99

2018: 31.74

2019: 27.24

As per the worst

case, performs

declines with

higher rate.

2017 to 2019.

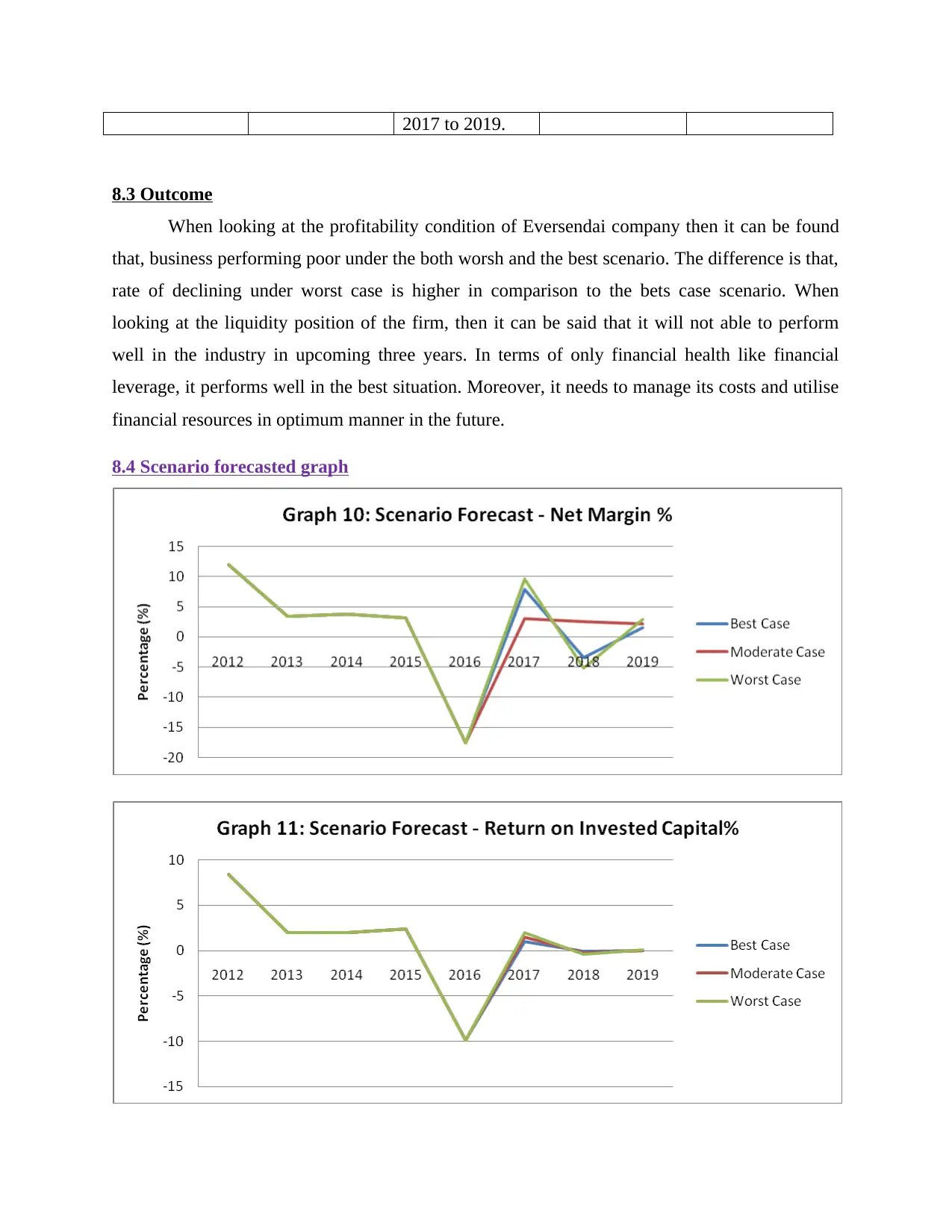

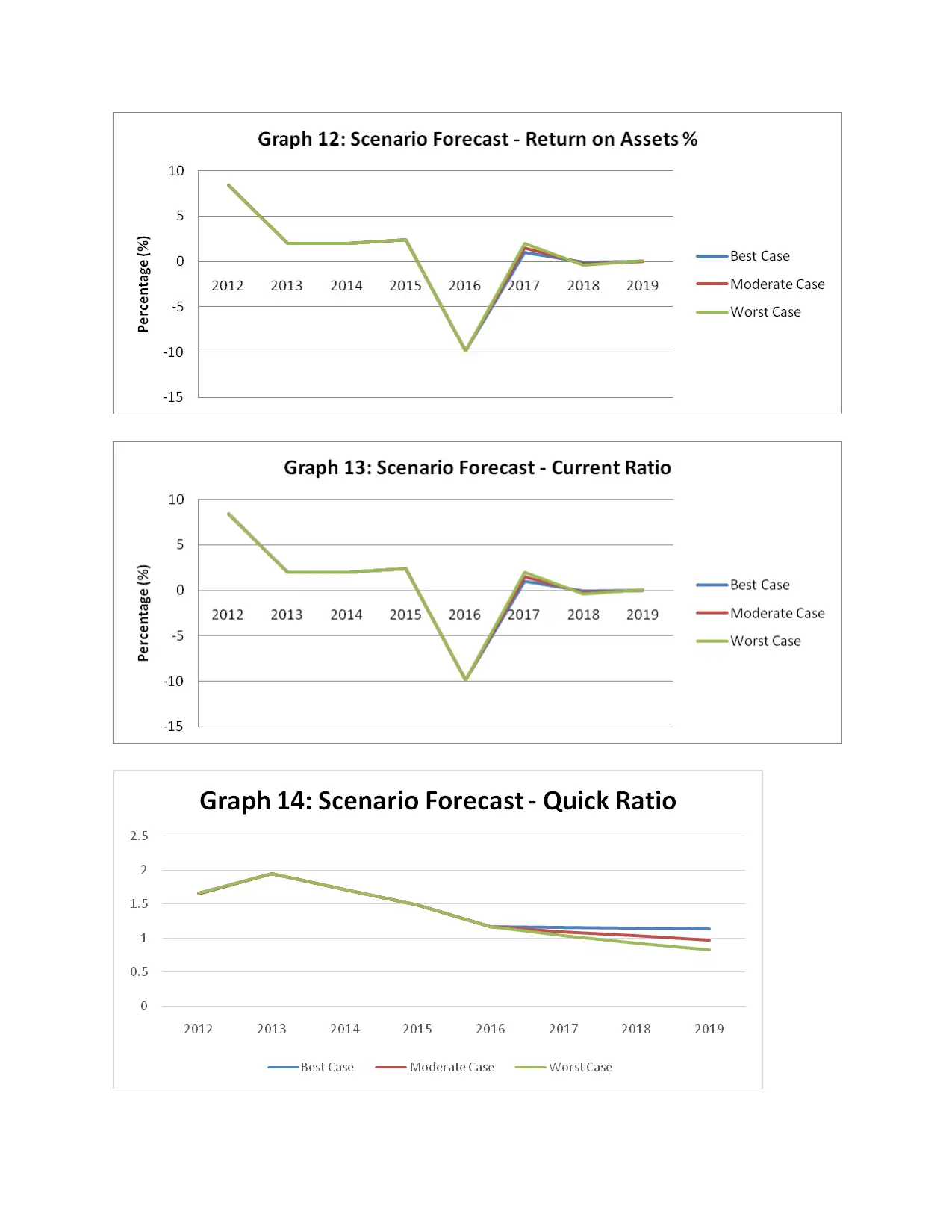

8.3 Outcome

When looking at the profitability condition of Eversendai company then it can be found

that, business performing poor under the both worsh and the best scenario. The difference is that,

rate of declining under worst case is higher in comparison to the bets case scenario. When

looking at the liquidity position of the firm, then it can be said that it will not able to perform

well in the industry in upcoming three years. In terms of only financial health like financial

leverage, it performs well in the best situation. Moreover, it needs to manage its costs and utilise

financial resources in optimum manner in the future.

8.4 Scenario forecasted graph

8.3 Outcome

When looking at the profitability condition of Eversendai company then it can be found

that, business performing poor under the both worsh and the best scenario. The difference is that,

rate of declining under worst case is higher in comparison to the bets case scenario. When

looking at the liquidity position of the firm, then it can be said that it will not able to perform

well in the industry in upcoming three years. In terms of only financial health like financial

leverage, it performs well in the best situation. Moreover, it needs to manage its costs and utilise

financial resources in optimum manner in the future.

8.4 Scenario forecasted graph

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Amirkhani, A. H., Nazeryani, M. A. and Faraz, M., 2016. The Effect of Succession Planning on

the Employees’ Performance based on the Balance Score Card with Regard to the

Mediating Role of Commitment. Research Journal of Management Reviews. Vol.2(1).

pp.42-51.

Babalola, Y. A. and Abiola, F. R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences. 1(4). pp. 132-137.

Baporikar, N., 2017. Adopting Balance Score Card in Higher Education. Decision Management:

Concepts, Methodologies, Tools, and Applications: Concepts, Methodologies, Tools, and

Applications, p.348.

Bartoccioni, F. and et.al., 2016. The use of Social Network Analysis to plan and implement

integrated care goals through balance score cars system. International Journal of

Integrated Care.16(6).

Chiang, Y. M., Chen, W. L. and Ho, C. H., 2016. Application of analytic network process and

two-dimensional matrix evaluating decision for design strategy. Computers & Industrial

Engineering. 98. pp.237-245.

Fatima, S. A. and Mazumder, L. K., 2016. Impact of accreditation on information management

during accreditation of a hospital through im balance score card. ACADEMICIA: An

International Multidisciplinary Research Journal.6(2). pp.1-19.

Jardat, R., 2017. Strategy matrixes as technical objects using the Simondonian concepts of

‘concretization’, milieu, and ‘transindividuality’.Culture and Organization.23(1). pp.44-

66.

Kanakulya, E. K. and Jinzhao, W. A. N. G., 2017. The Status of Africa’s Construction Industry

and its Porter’s Five Forces Analysis. International Business and Management.14(2).

pp.50-53.

Books and Journals

Amirkhani, A. H., Nazeryani, M. A. and Faraz, M., 2016. The Effect of Succession Planning on

the Employees’ Performance based on the Balance Score Card with Regard to the

Mediating Role of Commitment. Research Journal of Management Reviews. Vol.2(1).

pp.42-51.

Babalola, Y. A. and Abiola, F. R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences. 1(4). pp. 132-137.

Baporikar, N., 2017. Adopting Balance Score Card in Higher Education. Decision Management:

Concepts, Methodologies, Tools, and Applications: Concepts, Methodologies, Tools, and

Applications, p.348.

Bartoccioni, F. and et.al., 2016. The use of Social Network Analysis to plan and implement

integrated care goals through balance score cars system. International Journal of

Integrated Care.16(6).

Chiang, Y. M., Chen, W. L. and Ho, C. H., 2016. Application of analytic network process and

two-dimensional matrix evaluating decision for design strategy. Computers & Industrial

Engineering. 98. pp.237-245.

Fatima, S. A. and Mazumder, L. K., 2016. Impact of accreditation on information management

during accreditation of a hospital through im balance score card. ACADEMICIA: An

International Multidisciplinary Research Journal.6(2). pp.1-19.

Jardat, R., 2017. Strategy matrixes as technical objects using the Simondonian concepts of

‘concretization’, milieu, and ‘transindividuality’.Culture and Organization.23(1). pp.44-

66.

Kanakulya, E. K. and Jinzhao, W. A. N. G., 2017. The Status of Africa’s Construction Industry

and its Porter’s Five Forces Analysis. International Business and Management.14(2).

pp.50-53.

Koks, S. C. and Kilika, J. M., 2016. Towards a Theoretical Model Relating Product Development

Strategy, Market Adoption and Firm Performance: A Research Agenda. Journal of

Management and Strategy.7(1). p.90.

Kuimov, V. and Kuimov, V., 2017. A Contextual-Functional Analysis of the Enterprise

Performance. International Journal of Entrepreneurial Behavior & Research.23(2).

pp.356-362.

McDonald, M. and Wilson, H., 2016. Planning: Yes, it Really Works! Experiences from the Real

World. Marketing Plans 8e: How to Prepare Them, How to Profit from Them, pp.603-

614.

Moreno-Izquierdo, L. and et.al., 2016. Pricing Strategies of the European Low-Cost Carriers

Explained Using Porter's Five Forces Model. Tourism Economics.22(2). pp.293-310.

Nguyen, T. T., 2017. Management education as an industry and MBA as a product: revisiting

joint MBA programs using Porters five forces model.Global Business and Economics

Review.19(3). pp.356-377.

O'Hara, N. N. and et.al., 2017. Tuberculosis testing for healthcare workers in South Africa: A

health service analysis using Porter's Five Forces Framework. International Journal of

Healthcare Management.10(1). pp.49-56.

Petruzzo P. and et.al., 2015. Outcomes after bilateral hand allotransplantation: a risk/benefit ratio

analysis. Annals of surgery. 261(1). pp.213-220.

Robinson T. R. and et.al., 2015.International financial statement analysis. John Wiley & Sons.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial

ratios: A decision tree approach. Expert Systems with Applications. 40(10). pp. 3970-3983.

Takata, H., 2016. Effects of industry forces, market orientation, and marketing capabilities on

business performance: An empirical analysis of Japanese manufacturers from 2009 to

2011. Journal of Business Research.69(12). pp.5611-5619.

Weisheng, L. and et.al., 2013. Procurement innovation for public construction projects: A study

of agent-construction system and public-private partnership in China. Engineering,

Construction and Architectural Management. 20(6). pp.543-562.

ANDREI, V. and PRISECARU, I., 2014. The use of PESTEL analysis in development of

Strategy, Market Adoption and Firm Performance: A Research Agenda. Journal of

Management and Strategy.7(1). p.90.

Kuimov, V. and Kuimov, V., 2017. A Contextual-Functional Analysis of the Enterprise

Performance. International Journal of Entrepreneurial Behavior & Research.23(2).

pp.356-362.

McDonald, M. and Wilson, H., 2016. Planning: Yes, it Really Works! Experiences from the Real

World. Marketing Plans 8e: How to Prepare Them, How to Profit from Them, pp.603-

614.

Moreno-Izquierdo, L. and et.al., 2016. Pricing Strategies of the European Low-Cost Carriers

Explained Using Porter's Five Forces Model. Tourism Economics.22(2). pp.293-310.

Nguyen, T. T., 2017. Management education as an industry and MBA as a product: revisiting

joint MBA programs using Porters five forces model.Global Business and Economics

Review.19(3). pp.356-377.

O'Hara, N. N. and et.al., 2017. Tuberculosis testing for healthcare workers in South Africa: A

health service analysis using Porter's Five Forces Framework. International Journal of

Healthcare Management.10(1). pp.49-56.

Petruzzo P. and et.al., 2015. Outcomes after bilateral hand allotransplantation: a risk/benefit ratio

analysis. Annals of surgery. 261(1). pp.213-220.

Robinson T. R. and et.al., 2015.International financial statement analysis. John Wiley & Sons.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial

ratios: A decision tree approach. Expert Systems with Applications. 40(10). pp. 3970-3983.

Takata, H., 2016. Effects of industry forces, market orientation, and marketing capabilities on

business performance: An empirical analysis of Japanese manufacturers from 2009 to

2011. Journal of Business Research.69(12). pp.5611-5619.

Weisheng, L. and et.al., 2013. Procurement innovation for public construction projects: A study