FINC615 Unit 5 Project: Financial Analysis and Risk Assessment

VerifiedAdded on 2023/06/10

|8

|707

|176

Project

AI Summary

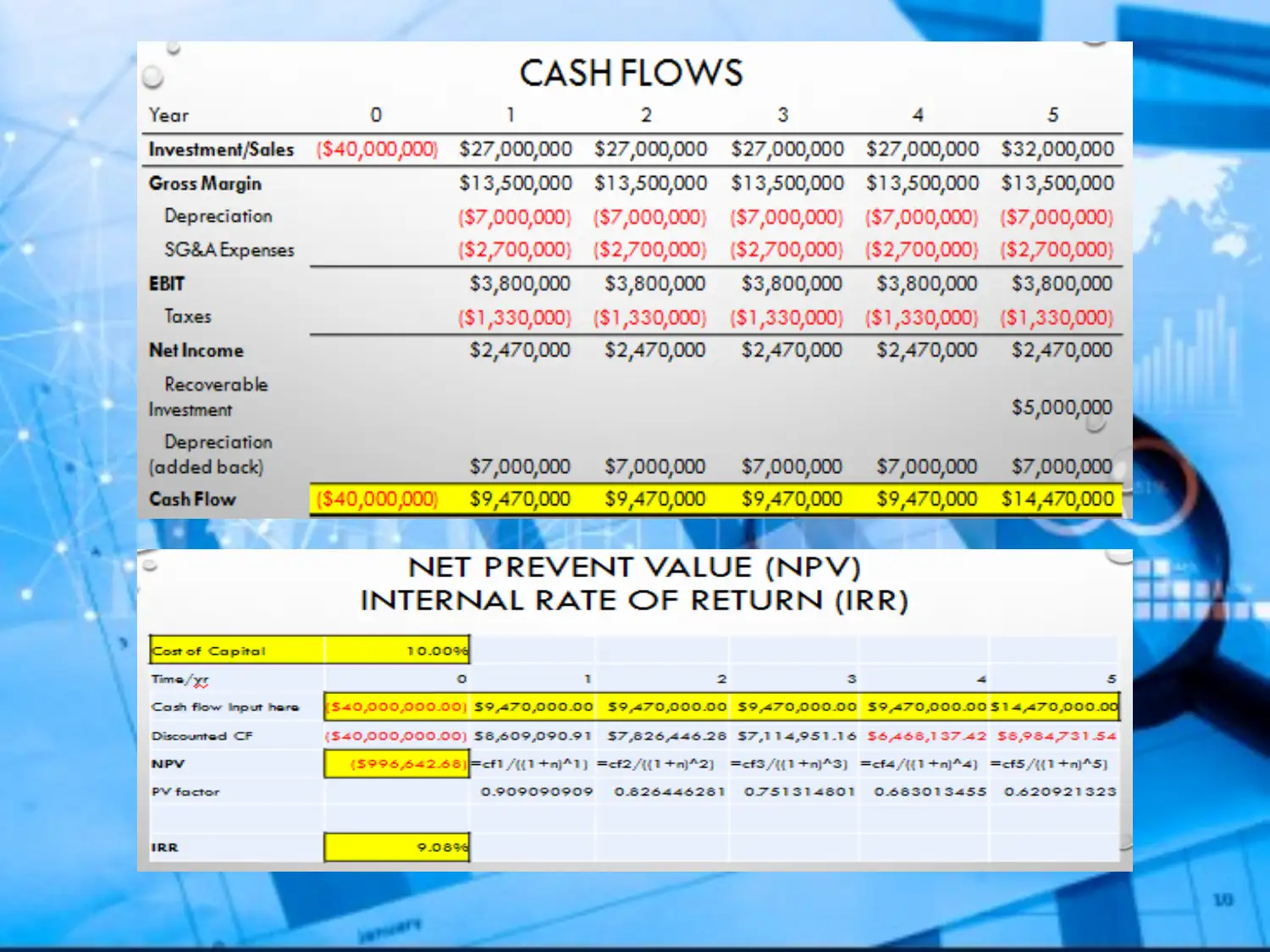

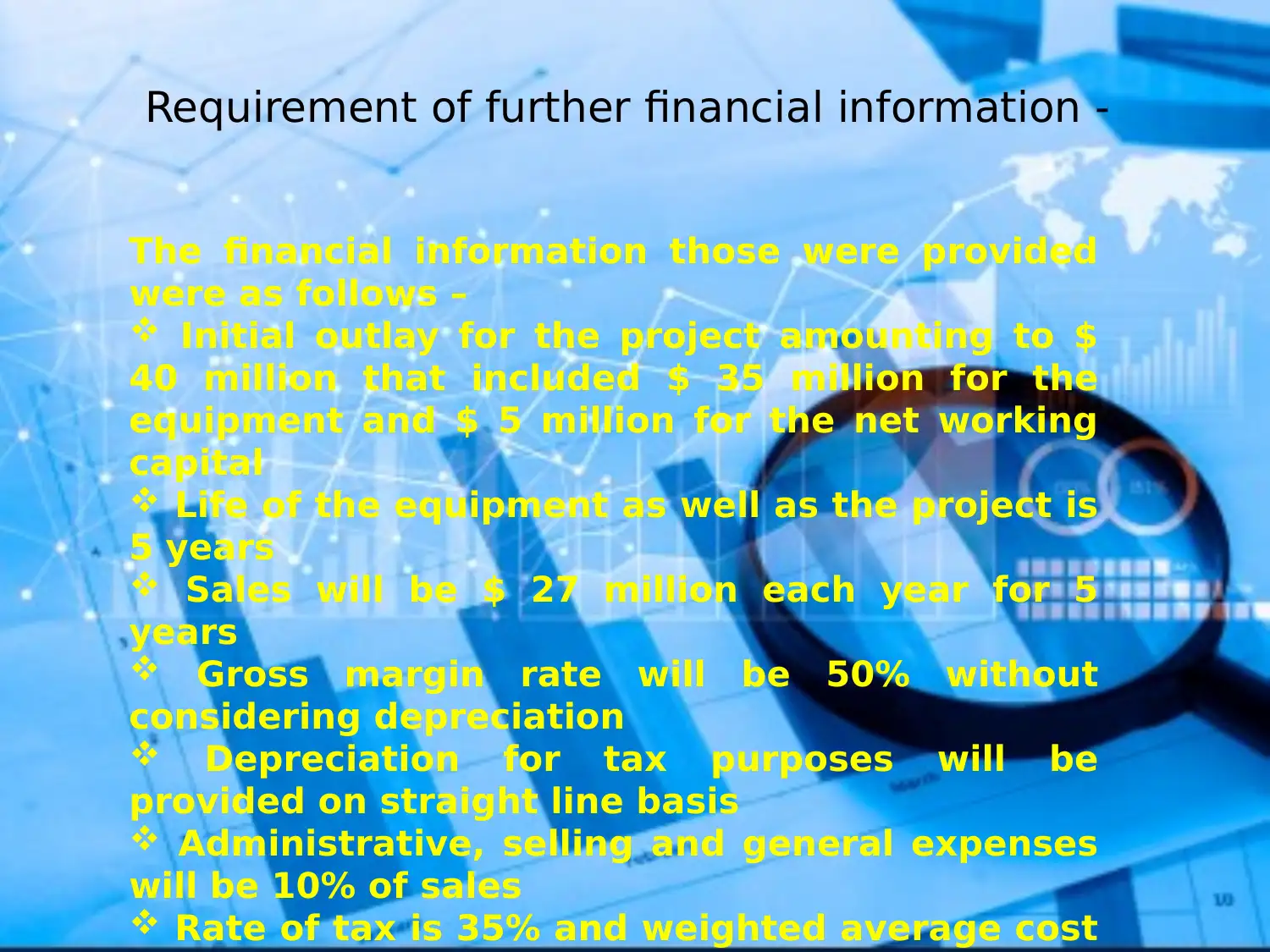

This project presents a financial analysis of the Apix Printing Coffee Packaging Project, focusing on the sufficiency of provided financial information for decision-making. The analysis utilizes Net Present Value (NPV) and Internal Rate of Return (IRR) to evaluate project feasibility, highlighting the importance of these metrics in capital budgeting. The project also explores how the provided financial data could be applied to other situations, such as computing the payback period. Furthermore, it delves into various risk methodologies crucial in capital budgeting, including corporate, industry-specific, stand-alone, market, international, and project-specific risks. The project uses the provided financial information to assess the project's viability and provides a comprehensive overview of financial analysis techniques.

1 out of 8

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)