Financial Management Report: Techniques and Ethics at Tesco Plc

VerifiedAdded on 2023/01/06

|17

|4617

|36

Report

AI Summary

This report provides a comprehensive analysis of financial management principles, focusing on decision-making techniques, stakeholder management, and ethical considerations within the context of Tesco Plc. It explores various approaches to decision-making, including knowledge-based and formal/...

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Section A.....................................................................................................................................3

Section B......................................................................................................................................8

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Section A.....................................................................................................................................3

Section B......................................................................................................................................8

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Each company or business requires to spend funds in attempt to collect more cash and to

generate daily yields. As a result, the manger has to spend the assets of the company in secure

and sustainable investments. Financial management corresponds to the organizational

scheduling/planning, integration, handling and regulation of financial projects within an entity or

company. Which also involves the application of management concepts to the fiscal assets

of company, while playing essential role in fiscal governance (Shapiro, A.C. and Hanouna, P.,

2019). The Study covers multiple aspects of financial management like approaches and methods

of decision making, investment appraisal technique, ratio analysis and several other in context of

Tesco Plc which is UK’s leading supermarket and grocery chain.

MAIN BODY

Section A

Evaluation of techniques, approaches and factors for better decision making.

Approaches:

Knowledge based approach- Knowledge-based approach entails acknowledging

relevant information as a framework for accomplishing competitive position in market;

here term knowledge entails a tactic for organising and enhancing organisational results. It is

essential for a corporate firm to have knowledge-based approach so that key decisions taken

towards improved performance have some reasonable basis. this provides a major influence

on decision-making process of management within corporation (Al Breiki and Nobanee, 2019).

Formal and Informal approach- It establishes a straightforward roadmap towards

decision-making framework for the corporation. This approach replaces the analytical

approaches to decision-makings and offers an overview of the considerations regarding decision-

making. This aims to enhance the feasibility of picking alternatives which match the diverse

needs of the interested parties of the entity. The uncertainty of the roles is lowered by the

emergence of sensible options. The approach empowers for a relatively convenient revaluation

of the factors, parameters or amendments to the objectives of the interested parties/stakeholders.

This enables corporations to make better informed choices/decision in all dimensions.

Each company or business requires to spend funds in attempt to collect more cash and to

generate daily yields. As a result, the manger has to spend the assets of the company in secure

and sustainable investments. Financial management corresponds to the organizational

scheduling/planning, integration, handling and regulation of financial projects within an entity or

company. Which also involves the application of management concepts to the fiscal assets

of company, while playing essential role in fiscal governance (Shapiro, A.C. and Hanouna, P.,

2019). The Study covers multiple aspects of financial management like approaches and methods

of decision making, investment appraisal technique, ratio analysis and several other in context of

Tesco Plc which is UK’s leading supermarket and grocery chain.

MAIN BODY

Section A

Evaluation of techniques, approaches and factors for better decision making.

Approaches:

Knowledge based approach- Knowledge-based approach entails acknowledging

relevant information as a framework for accomplishing competitive position in market;

here term knowledge entails a tactic for organising and enhancing organisational results. It is

essential for a corporate firm to have knowledge-based approach so that key decisions taken

towards improved performance have some reasonable basis. this provides a major influence

on decision-making process of management within corporation (Al Breiki and Nobanee, 2019).

Formal and Informal approach- It establishes a straightforward roadmap towards

decision-making framework for the corporation. This approach replaces the analytical

approaches to decision-makings and offers an overview of the considerations regarding decision-

making. This aims to enhance the feasibility of picking alternatives which match the diverse

needs of the interested parties of the entity. The uncertainty of the roles is lowered by the

emergence of sensible options. The approach empowers for a relatively convenient revaluation

of the factors, parameters or amendments to the objectives of the interested parties/stakeholders.

This enables corporations to make better informed choices/decision in all dimensions.

You're viewing a preview

Unlock full access by subscribing today!

Techniques used in decision making:

Make or Buy Decision- This technique include deciding whether an corporation should

choose to produce 'in-house' products or services, or whether company should actually purchase

this from an external supplier. This enable company to concentrate on their key goods by

assigning non-critical activities to outside organizations; This is Profiting from a reduced cost

provided by outside manufacturers who are more competitive in the manufacture of those goods

or services (Chandra, 2020);

T –Chart- It is a schematic organiser that splits information across columns, typically

used for comparison. It gets its name from simple form of two columns: this appears like letter

"T" and flexible as well as widely utilized in all aspects. The matrix is structured to reflect the

positive and negative decisions. It means that both pro and con aspects are considered before

taking decisions.

Factors affecting decision making:

Environment Factor: The environment is especially significant factor when it applies to

the purchasing power of consumers and what goods they can usually afford. When considering

decisions, Respective company should consider that they must adhere with those requirements

or not, for example, place excessive costs on their products in situations of financial crisis.

Financial factor: Making a strategic decision relies on the organisation's capital and

funding structure of the company. As a consequence, leverage and effectiveness to make

decisions about raising funds in certain projects whose risks can effectively be met by the

business.

Stakeholder management and management of conflict objective of stakeholder groups.

A stakeholder is person or a community who has valid interest in corporation, association or

corporation; Stanford Research Institute describes stakeholders as all those individuals without

which sponsorship the entity will disappear. Stakeholders may be influenced or impacted by acts

of a company that may occur within or without a company (Yuniningsih, Pertiwi and Purwanto,

2019).

Make or Buy Decision- This technique include deciding whether an corporation should

choose to produce 'in-house' products or services, or whether company should actually purchase

this from an external supplier. This enable company to concentrate on their key goods by

assigning non-critical activities to outside organizations; This is Profiting from a reduced cost

provided by outside manufacturers who are more competitive in the manufacture of those goods

or services (Chandra, 2020);

T –Chart- It is a schematic organiser that splits information across columns, typically

used for comparison. It gets its name from simple form of two columns: this appears like letter

"T" and flexible as well as widely utilized in all aspects. The matrix is structured to reflect the

positive and negative decisions. It means that both pro and con aspects are considered before

taking decisions.

Factors affecting decision making:

Environment Factor: The environment is especially significant factor when it applies to

the purchasing power of consumers and what goods they can usually afford. When considering

decisions, Respective company should consider that they must adhere with those requirements

or not, for example, place excessive costs on their products in situations of financial crisis.

Financial factor: Making a strategic decision relies on the organisation's capital and

funding structure of the company. As a consequence, leverage and effectiveness to make

decisions about raising funds in certain projects whose risks can effectively be met by the

business.

Stakeholder management and management of conflict objective of stakeholder groups.

A stakeholder is person or a community who has valid interest in corporation, association or

corporation; Stanford Research Institute describes stakeholders as all those individuals without

which sponsorship the entity will disappear. Stakeholders may be influenced or impacted by acts

of a company that may occur within or without a company (Yuniningsih, Pertiwi and Purwanto,

2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Stakeholder management corresponds to crucial facet of the productive delivering of any plan,

strategy or activity. Stakeholder management concerns the stakeholder's interaction period and

the development of productive relationships with interested parties/stakeholders. This is method

of establishing, controlling and sustaining positive ties with stakeholders by ensuring an

acceptable impact on their perceptions of benefit arising from their investments. Stakeholder

management therefore allows a company move beyond its specified priorities by keeping current

stakeholders happy and, where possible, attracting potential investors in fair and ethical style.

There is a diverse range of participants in projects, ventures or proposals. Such

individuals have a substantial influence on the growth or failures of company. Stakeholder

management primarily connected with leveraging favorable forces and decreasing adverse

effects arise due to decisions of stakeholders. This emphasizes on distinguishing interested

parties, setting goals and impacts, designing a plan for maintaining partnerships and engaging

and influencing stakeholders. The entity would include an effective stakeholder engagement

framework for the management of the group 's interested parties. Classifying a stakeholder must

include all related parties whom presence has a specific and implicit effect on the business

(Boisjoly, Conine Jr and McDonald IV, 2020).

Managing conflicting objectives of different stakeholder groups

Conflicts among stakeholders and company managers involve more monies that

management make in salaries and pensions, while the fewer stockholders receive as bottom-line

net profits. Stockholders clearly need best executives to do their duty, they don't want to spend

more than have to. In certain companies, top-level administrators set their individual wage and

benefits arrangements with all intents and purposes.

It could be difficult to address the issue about who can govern the company — the

management who are recruited for their expertise and are deeply acquainted with the company or

the owners who could have no experiences related to operating the company but whose funds

make business tick.

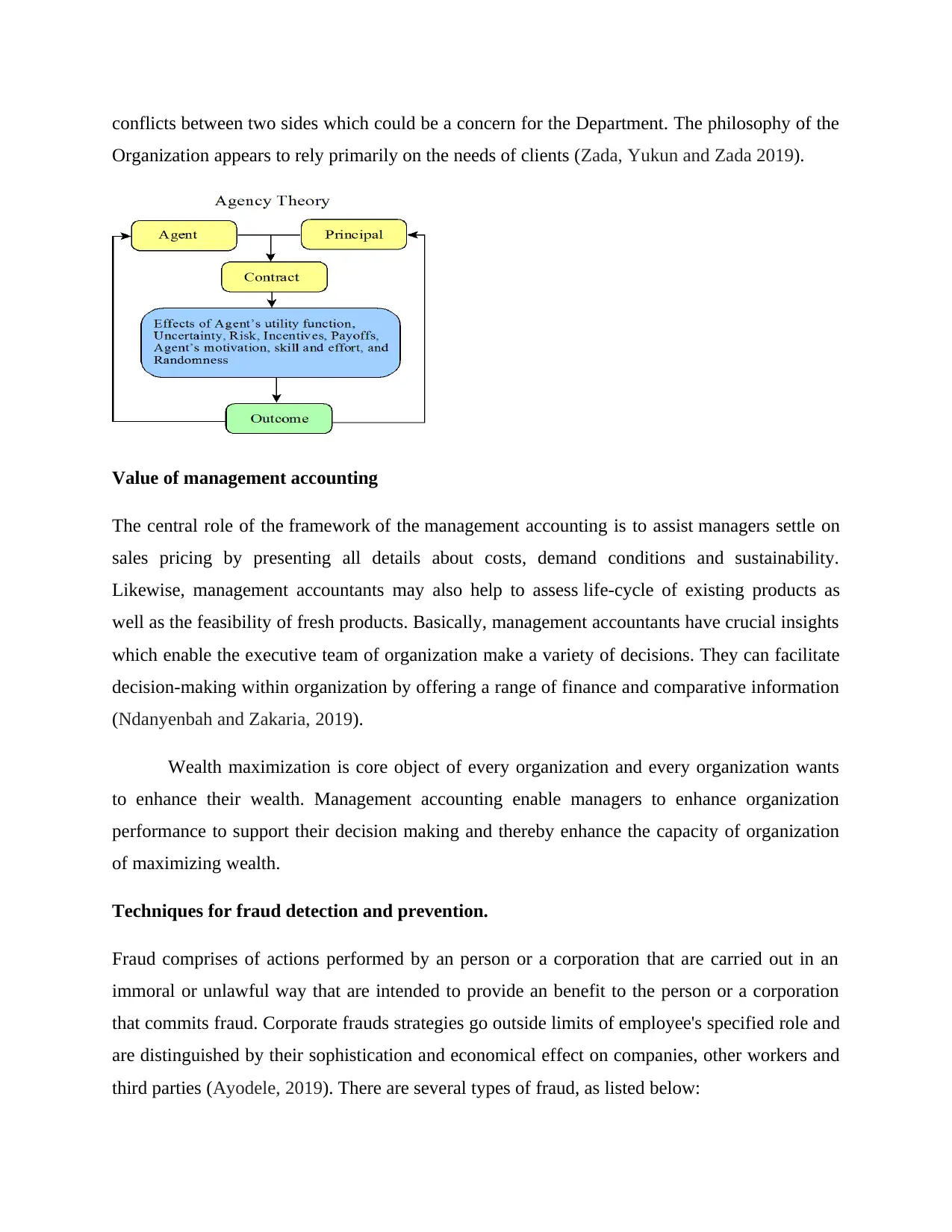

Agency Theory: Agency theory explains the complications that emerge whenever one party

represents other in industry but has differing viewpoints on key market issues or differing

preferences from the leader. An agent, working on account of other side, may object to right

course of actions and cause personal convictions to affect the results of the deal. An agent can

often prefer to behave in self-interest rather than in the desires of principal. This could lead to

strategy or activity. Stakeholder management concerns the stakeholder's interaction period and

the development of productive relationships with interested parties/stakeholders. This is method

of establishing, controlling and sustaining positive ties with stakeholders by ensuring an

acceptable impact on their perceptions of benefit arising from their investments. Stakeholder

management therefore allows a company move beyond its specified priorities by keeping current

stakeholders happy and, where possible, attracting potential investors in fair and ethical style.

There is a diverse range of participants in projects, ventures or proposals. Such

individuals have a substantial influence on the growth or failures of company. Stakeholder

management primarily connected with leveraging favorable forces and decreasing adverse

effects arise due to decisions of stakeholders. This emphasizes on distinguishing interested

parties, setting goals and impacts, designing a plan for maintaining partnerships and engaging

and influencing stakeholders. The entity would include an effective stakeholder engagement

framework for the management of the group 's interested parties. Classifying a stakeholder must

include all related parties whom presence has a specific and implicit effect on the business

(Boisjoly, Conine Jr and McDonald IV, 2020).

Managing conflicting objectives of different stakeholder groups

Conflicts among stakeholders and company managers involve more monies that

management make in salaries and pensions, while the fewer stockholders receive as bottom-line

net profits. Stockholders clearly need best executives to do their duty, they don't want to spend

more than have to. In certain companies, top-level administrators set their individual wage and

benefits arrangements with all intents and purposes.

It could be difficult to address the issue about who can govern the company — the

management who are recruited for their expertise and are deeply acquainted with the company or

the owners who could have no experiences related to operating the company but whose funds

make business tick.

Agency Theory: Agency theory explains the complications that emerge whenever one party

represents other in industry but has differing viewpoints on key market issues or differing

preferences from the leader. An agent, working on account of other side, may object to right

course of actions and cause personal convictions to affect the results of the deal. An agent can

often prefer to behave in self-interest rather than in the desires of principal. This could lead to

conflicts between two sides which could be a concern for the Department. The philosophy of the

Organization appears to rely primarily on the needs of clients (Zada, Yukun and Zada 2019).

Value of management accounting

The central role of the framework of the management accounting is to assist managers settle on

sales pricing by presenting all details about costs, demand conditions and sustainability.

Likewise, management accountants may also help to assess life-cycle of existing products as

well as the feasibility of fresh products. Basically, management accountants have crucial insights

which enable the executive team of organization make a variety of decisions. They can facilitate

decision-making within organization by offering a range of finance and comparative information

(Ndanyenbah and Zakaria, 2019).

Wealth maximization is core object of every organization and every organization wants

to enhance their wealth. Management accounting enable managers to enhance organization

performance to support their decision making and thereby enhance the capacity of organization

of maximizing wealth.

Techniques for fraud detection and prevention.

Fraud comprises of actions performed by an person or a corporation that are carried out in an

immoral or unlawful way that are intended to provide an benefit to the person or a corporation

that commits fraud. Corporate frauds strategies go outside limits of employee's specified role and

are distinguished by their sophistication and economical effect on companies, other workers and

third parties (Ayodele, 2019). There are several types of fraud, as listed below:

Organization appears to rely primarily on the needs of clients (Zada, Yukun and Zada 2019).

Value of management accounting

The central role of the framework of the management accounting is to assist managers settle on

sales pricing by presenting all details about costs, demand conditions and sustainability.

Likewise, management accountants may also help to assess life-cycle of existing products as

well as the feasibility of fresh products. Basically, management accountants have crucial insights

which enable the executive team of organization make a variety of decisions. They can facilitate

decision-making within organization by offering a range of finance and comparative information

(Ndanyenbah and Zakaria, 2019).

Wealth maximization is core object of every organization and every organization wants

to enhance their wealth. Management accounting enable managers to enhance organization

performance to support their decision making and thereby enhance the capacity of organization

of maximizing wealth.

Techniques for fraud detection and prevention.

Fraud comprises of actions performed by an person or a corporation that are carried out in an

immoral or unlawful way that are intended to provide an benefit to the person or a corporation

that commits fraud. Corporate frauds strategies go outside limits of employee's specified role and

are distinguished by their sophistication and economical effect on companies, other workers and

third parties (Ayodele, 2019). There are several types of fraud, as listed below:

You're viewing a preview

Unlock full access by subscribing today!

1. Thievery of money, tangible assets or sensitive information;

2. Misappropriation in financial statements

3. Frauds in procurement

4. Frauds in payroll

5. Misstatements in Financial Accounting

6. Unviable journal vouchers

7. Misleading cost statements

8. Fake employment certificate

9. Bribery, abuse.

One effective way to establish strategies and practices which are efficient in

stopping fraud is with help of experienced anti-fraud expert who has reviewed hundreds of

frauds cases to identify the most appropriate and efficient antifraud regulations, including

Develop simple and convenient-to-understand standards throughout top down. Develop an

employee guide which explicitly defines these requirements and prevents the guidelines from

being ambiguous. Always review the credentials and carry out background reviews that provide

employment, income, licenses and criminal records on all new employees. Safe physical

properties, access to documents and resources at all levels, including surveillance and the use of

pre-numbered cheque, hold the cheque secured, use a 'voided search' process and rarely sign

blank cheques. Please check all disbursements annually (Sinha and Datta, 2020).

Ethics: Ethics is the collection of policies or standards that the company can obey. While

corporate ethics relates to the code of conduct that companies are supposed to obey when doing

corporate. A norm is introduced by a company to control its actions by ethics. This allows them

to differentiate between the incorrect and the appropriate aspect of the market. They're based on

the development of a human experience. Which is why the ethics rely on the power of the

environment, the period and the circumstance. Company ethics encompasses many of these

ideals and beliefs and serves to direct the actions of companies. Businesses must maintain a

connection between the interests of customers and their ability to make profits. When keeping

these balances, companies also need to make tradeoffs. In order to counter certain situations, the

company has developed guidelines and standards. This means that corporations make profits

without impacting entities or society overall. The ethics of corporation reflect the ideology of the

enterprise.

2. Misappropriation in financial statements

3. Frauds in procurement

4. Frauds in payroll

5. Misstatements in Financial Accounting

6. Unviable journal vouchers

7. Misleading cost statements

8. Fake employment certificate

9. Bribery, abuse.

One effective way to establish strategies and practices which are efficient in

stopping fraud is with help of experienced anti-fraud expert who has reviewed hundreds of

frauds cases to identify the most appropriate and efficient antifraud regulations, including

Develop simple and convenient-to-understand standards throughout top down. Develop an

employee guide which explicitly defines these requirements and prevents the guidelines from

being ambiguous. Always review the credentials and carry out background reviews that provide

employment, income, licenses and criminal records on all new employees. Safe physical

properties, access to documents and resources at all levels, including surveillance and the use of

pre-numbered cheque, hold the cheque secured, use a 'voided search' process and rarely sign

blank cheques. Please check all disbursements annually (Sinha and Datta, 2020).

Ethics: Ethics is the collection of policies or standards that the company can obey. While

corporate ethics relates to the code of conduct that companies are supposed to obey when doing

corporate. A norm is introduced by a company to control its actions by ethics. This allows them

to differentiate between the incorrect and the appropriate aspect of the market. They're based on

the development of a human experience. Which is why the ethics rely on the power of the

environment, the period and the circumstance. Company ethics encompasses many of these

ideals and beliefs and serves to direct the actions of companies. Businesses must maintain a

connection between the interests of customers and their ability to make profits. When keeping

these balances, companies also need to make tradeoffs. In order to counter certain situations, the

company has developed guidelines and standards. This means that corporations make profits

without impacting entities or society overall. The ethics of corporation reflect the ideology of the

enterprise.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ethical decision-making: This corresponds to the methods of considering and assessing options

in a way compatible with ethical standards. It is important to consider and avoid unethical

choices when taking ethical decisions as well as to choose the right ethical solution.The ethical

decision-making process includes:

Commitment: The urge to do right thing irrespective of costs;

Consciousness: Knowledge to behave consistently and bring moral values to everyday

actions

Competence: ability to gather and analyse information, create options and predict future

effects and threats.

Reflective analysis:

The study included the awareness of multiple methods and strategies in order to take

appropriate steps. During this study, I confronted a variety of problems as well as a well-

understood way to handle various objects.

Issues-The key challenge I encountered during this project was the study on unique topics and

activities. I used search-outcomes and results to figure out the necessary facts, but there are so

many alternatives that raised difficulty. This is since there was so little time to finish the job.

Along with the absence of sites linked to the providing of reliable data, it's also major issue for

me.

Stuff that I learn-In additament to the problems that have arisen throughout this journey, I

experience certain outstanding stuff that will aid me in long run. For eg, I discover how to

identify the relevant information through online sites. Alongside me, I acquire understanding of

the principle of stakeholder’s management, strategies for making strategic ethical decisions.

Section B

Company Overview:

Tesco plc is British international supermarket chain and consumer goods chain with

headquartered in Hertfordshire, England, UK. This is third leading supermarket-chain in the

world, calculated by gross sales and ninth most in world, based on revenues. It has supermarkets

in 7 nations throughout Europe as-well-as Asia, and is industry leader for grocery stores in the

in a way compatible with ethical standards. It is important to consider and avoid unethical

choices when taking ethical decisions as well as to choose the right ethical solution.The ethical

decision-making process includes:

Commitment: The urge to do right thing irrespective of costs;

Consciousness: Knowledge to behave consistently and bring moral values to everyday

actions

Competence: ability to gather and analyse information, create options and predict future

effects and threats.

Reflective analysis:

The study included the awareness of multiple methods and strategies in order to take

appropriate steps. During this study, I confronted a variety of problems as well as a well-

understood way to handle various objects.

Issues-The key challenge I encountered during this project was the study on unique topics and

activities. I used search-outcomes and results to figure out the necessary facts, but there are so

many alternatives that raised difficulty. This is since there was so little time to finish the job.

Along with the absence of sites linked to the providing of reliable data, it's also major issue for

me.

Stuff that I learn-In additament to the problems that have arisen throughout this journey, I

experience certain outstanding stuff that will aid me in long run. For eg, I discover how to

identify the relevant information through online sites. Alongside me, I acquire understanding of

the principle of stakeholder’s management, strategies for making strategic ethical decisions.

Section B

Company Overview:

Tesco plc is British international supermarket chain and consumer goods chain with

headquartered in Hertfordshire, England, UK. This is third leading supermarket-chain in the

world, calculated by gross sales and ninth most in world, based on revenues. It has supermarkets

in 7 nations throughout Europe as-well-as Asia, and is industry leader for grocery stores in the

United Kingdom (which has a industry sharing of about 28.4%) Hungary, Thailand and Ireland.

The corporation was established in 1919 by Cohen as collection of market booths in

the Hackney, London. The company's first title emerged in 1924, when Cohen bought shipment

of tea by T. E. Stockwell merged these letters with first two characters in surname and first one

formed in Barnet, during 1931. His company grew exponentially, and by year 1939 he more than

100 stores in the entire country. It has operated internationally since early 1990s, with activities

in Eleven other nations around the globe. The corporation withdrew from the US in 2013, but

appears to see success abroad as of year-2018. This has since 1960s differentiated into fields

including retailing of books, clothes, electronics, accessories, toys, fuel, software, finance

services, telecommunications and internet providers. In 1990s, company reconfigured itself as a

lower-cost, higher-volume supermarket aiming to target a variety of social classes with its lower-

cost "Tesco Good" variety and luxury Finest range. s

Ratio Analysis: Ratio analysis implies to method used by professionals to carrying out an

interpretative analysis of facts in corporation 's financial accounts. Such percentages are

measured from present year estimates and then applied to previous years, other firms, the sector

and even the organization to determine the corporation's results. In comparison, the measurement

of percentages is primarily used by the advocates of fiscal analysis (Alkaraan, 2020). In this

regard following is ratio analysis of Tesco Plc as follows through different criteria:

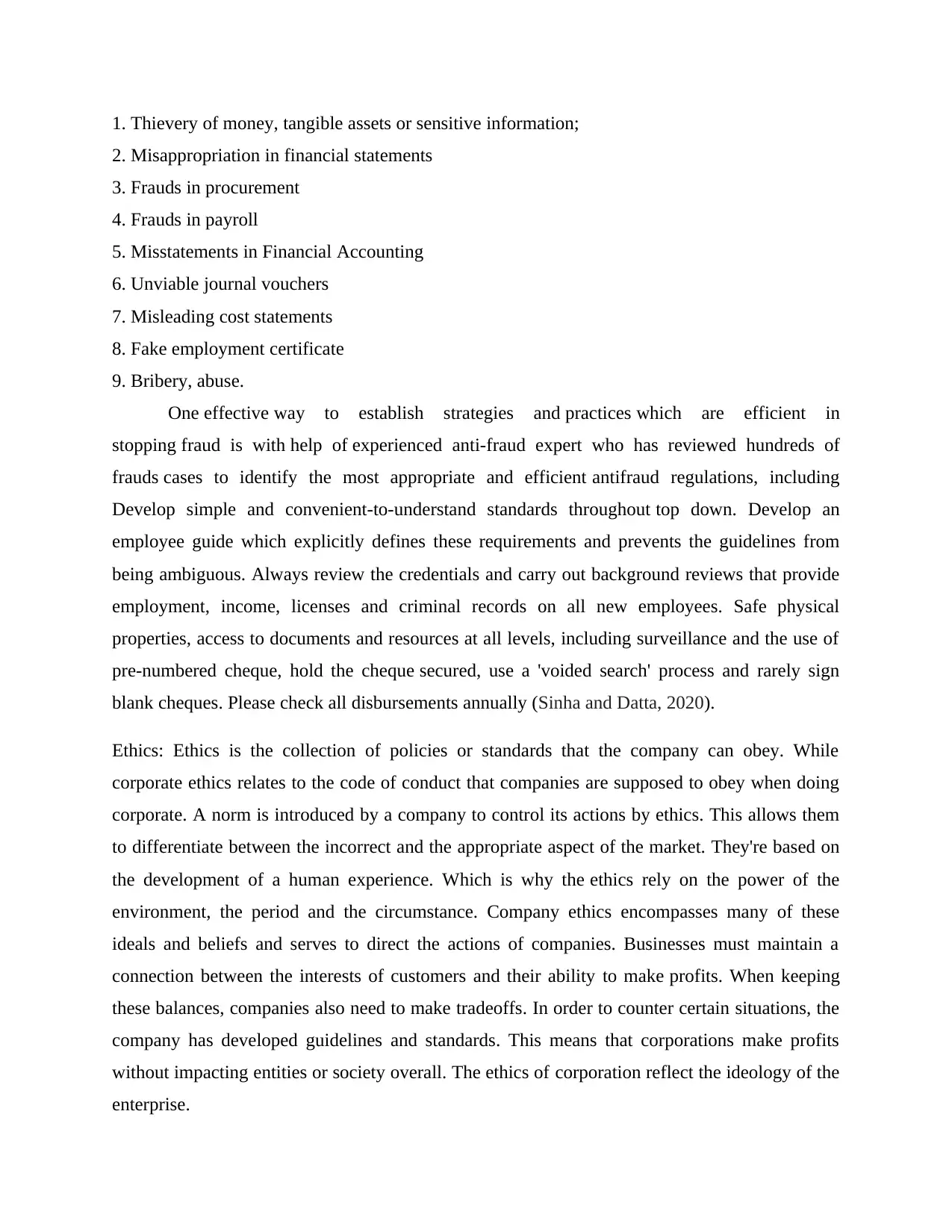

Profitability Ratio:

Ratio Formulae 2020 2019

Profitability ratios

ROCE

Operating Profit

*100/ (Total Equity

+Total Non-current

liabilities)

1315000 /

(13275000 +

21100000) =

3.82%

1674000 /

( 14858000

+ 13509000)

= 5.9%

Gross Profit Margin Gross Profit*100

/Revenue (sales)

4580000 /

64760000 =

7.07%

4144000 /

63911000 =

6.48%

Operating Profit Margin

Operating

Profit*100 /Revenue

(sales)

1315000 /

64760000 =

2.03%

1674000 /

63911000

= 2.62 %

The corporation was established in 1919 by Cohen as collection of market booths in

the Hackney, London. The company's first title emerged in 1924, when Cohen bought shipment

of tea by T. E. Stockwell merged these letters with first two characters in surname and first one

formed in Barnet, during 1931. His company grew exponentially, and by year 1939 he more than

100 stores in the entire country. It has operated internationally since early 1990s, with activities

in Eleven other nations around the globe. The corporation withdrew from the US in 2013, but

appears to see success abroad as of year-2018. This has since 1960s differentiated into fields

including retailing of books, clothes, electronics, accessories, toys, fuel, software, finance

services, telecommunications and internet providers. In 1990s, company reconfigured itself as a

lower-cost, higher-volume supermarket aiming to target a variety of social classes with its lower-

cost "Tesco Good" variety and luxury Finest range. s

Ratio Analysis: Ratio analysis implies to method used by professionals to carrying out an

interpretative analysis of facts in corporation 's financial accounts. Such percentages are

measured from present year estimates and then applied to previous years, other firms, the sector

and even the organization to determine the corporation's results. In comparison, the measurement

of percentages is primarily used by the advocates of fiscal analysis (Alkaraan, 2020). In this

regard following is ratio analysis of Tesco Plc as follows through different criteria:

Profitability Ratio:

Ratio Formulae 2020 2019

Profitability ratios

ROCE

Operating Profit

*100/ (Total Equity

+Total Non-current

liabilities)

1315000 /

(13275000 +

21100000) =

3.82%

1674000 /

( 14858000

+ 13509000)

= 5.9%

Gross Profit Margin Gross Profit*100

/Revenue (sales)

4580000 /

64760000 =

7.07%

4144000 /

63911000 =

6.48%

Operating Profit Margin

Operating

Profit*100 /Revenue

(sales)

1315000 /

64760000 =

2.03%

1674000 /

63911000

= 2.62 %

You're viewing a preview

Unlock full access by subscribing today!

ROCE: The return on capital invested is profitability measure meant to demonstrate how

effectively a business uses its capital-funds to earn income/profits. Variance of return on capital

working considering NOPAT instead of EBIT. Tesco’s ROCE has been improved form 2019 to

2020 showing increasing trend. This shows company’s efficacy in terms to utilizing capital funds

to generate profits has been increased over the period.

GP Margin: This show how much profit figures company generates out of their core business

operations. Gross profit is simply difference of sales and cost of sales. Tesco’s GP margin has

been increased from 6.48% to 7.07% indicating upward trend. This is indication that company’s

effectiveness of generating gross-profits have been increased.

Operating Profit Margin: This encompasses operating activities (like overhead costs)

in computation. This number shall be measured without interests or taxes. The operating profit

ratio demonstrates how efficiently the organization allocates its capital. Tesco operating-profit

margin has been slightly declined from 2.62% to 2.03%. This decline shows that company’s

performance as to generating profits from business overall operations has been declined.

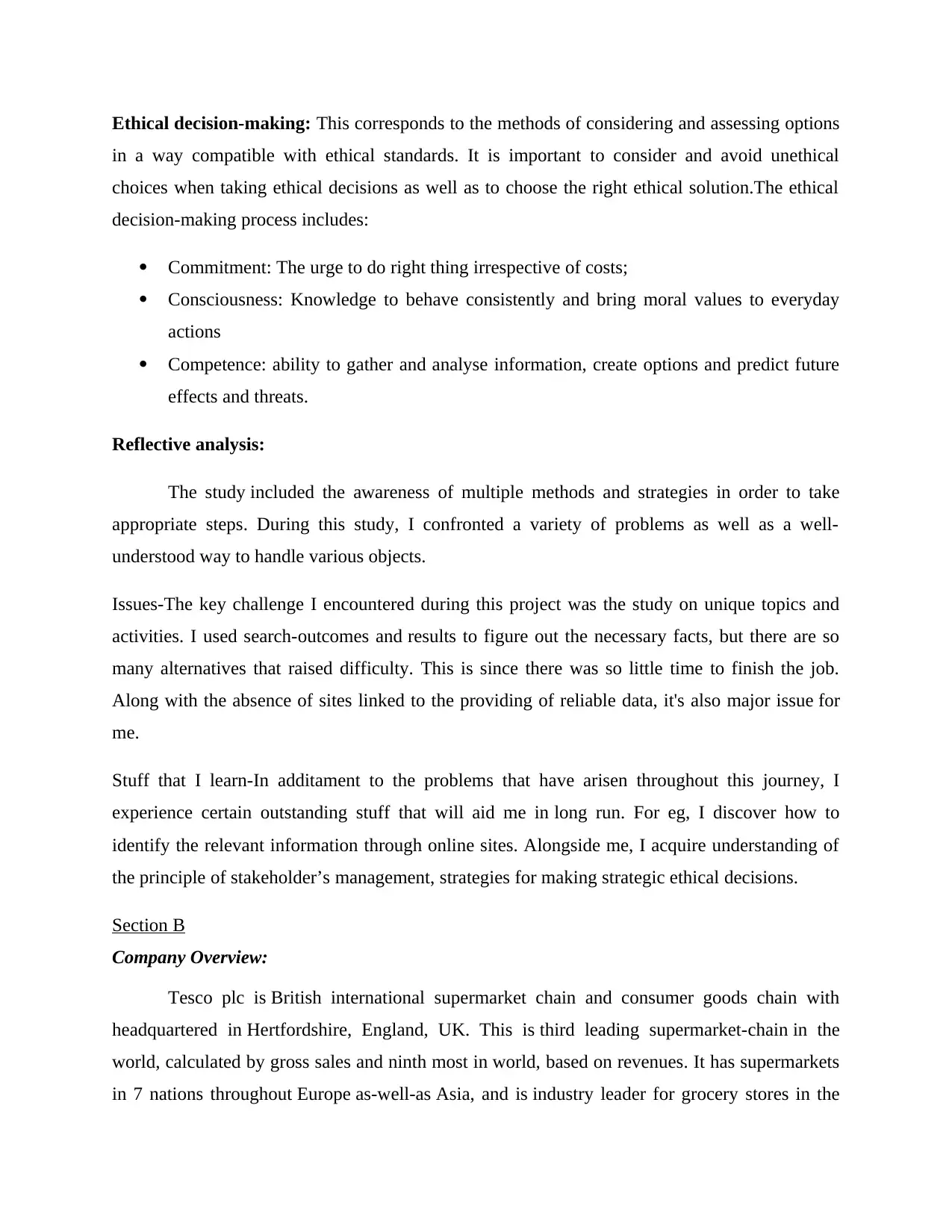

Liquidity ratios

Ratio Formulae 2020 2019

Working Capital

Ratio

Total Current Asset/

total current

Liabilities

13164000 /

17927000 =

0.73

12668000 /

20680000 =

0.61

Acid Test (quick)

Ratio

(Total Current Asset -

INV)/ total current

Liabilities

(13164000 –

2433000) /

17927000 =

0.60

(12668000

– 2617000) /

20680000 =

0.49

Working Capital Ratio: This also refers to current ratio which is proportion among entity’s

current assets and liabilities. Generally, ratio more-than 2 is regarded as appropriate. In both

years company’s current ratio is below 2although there is significant increment in ratio reflecting

incremental scenario in current ratio. This increase exhibits liquidity position of company has

been improved (Johnstone, 2020).

Acid Test Ratio: The acid test is good measure of whether a corporation has adequate shorter-

term assets to satisfy its current obligations. Often recognized as quick ratio, is liquidity ratio

effectively a business uses its capital-funds to earn income/profits. Variance of return on capital

working considering NOPAT instead of EBIT. Tesco’s ROCE has been improved form 2019 to

2020 showing increasing trend. This shows company’s efficacy in terms to utilizing capital funds

to generate profits has been increased over the period.

GP Margin: This show how much profit figures company generates out of their core business

operations. Gross profit is simply difference of sales and cost of sales. Tesco’s GP margin has

been increased from 6.48% to 7.07% indicating upward trend. This is indication that company’s

effectiveness of generating gross-profits have been increased.

Operating Profit Margin: This encompasses operating activities (like overhead costs)

in computation. This number shall be measured without interests or taxes. The operating profit

ratio demonstrates how efficiently the organization allocates its capital. Tesco operating-profit

margin has been slightly declined from 2.62% to 2.03%. This decline shows that company’s

performance as to generating profits from business overall operations has been declined.

Liquidity ratios

Ratio Formulae 2020 2019

Working Capital

Ratio

Total Current Asset/

total current

Liabilities

13164000 /

17927000 =

0.73

12668000 /

20680000 =

0.61

Acid Test (quick)

Ratio

(Total Current Asset -

INV)/ total current

Liabilities

(13164000 –

2433000) /

17927000 =

0.60

(12668000

– 2617000) /

20680000 =

0.49

Working Capital Ratio: This also refers to current ratio which is proportion among entity’s

current assets and liabilities. Generally, ratio more-than 2 is regarded as appropriate. In both

years company’s current ratio is below 2although there is significant increment in ratio reflecting

incremental scenario in current ratio. This increase exhibits liquidity position of company has

been improved (Johnstone, 2020).

Acid Test Ratio: The acid test is good measure of whether a corporation has adequate shorter-

term assets to satisfy its current obligations. Often recognized as quick ratio, is liquidity ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

which evaluates the capacity of a firm to repay their current liabilities with its fast or existing

assets. Tesco’s Acid Test ratio has been improved over the period and reached to 0.60 from 0.49.

this increment shows that Tesco’s net short term liquidity position has been strengthen.

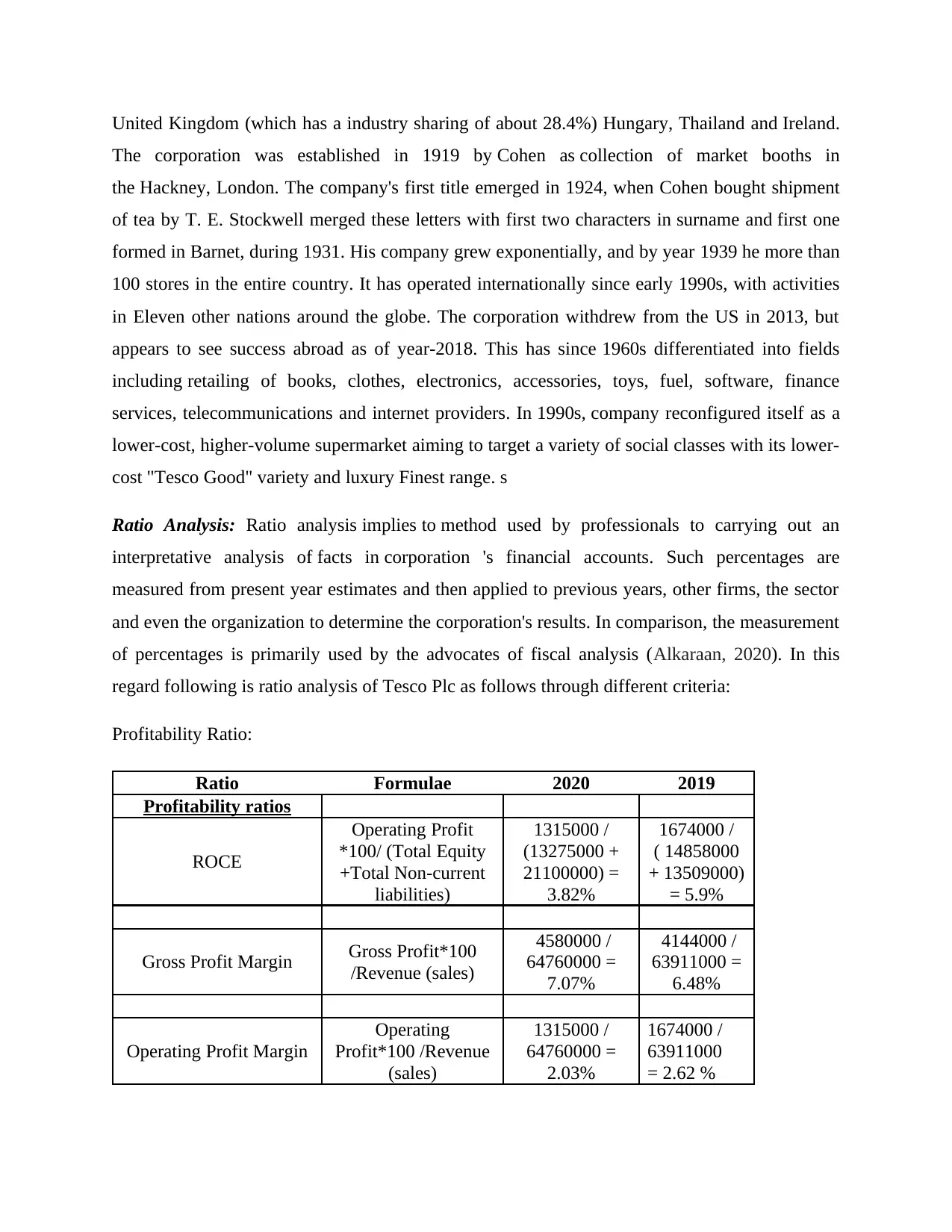

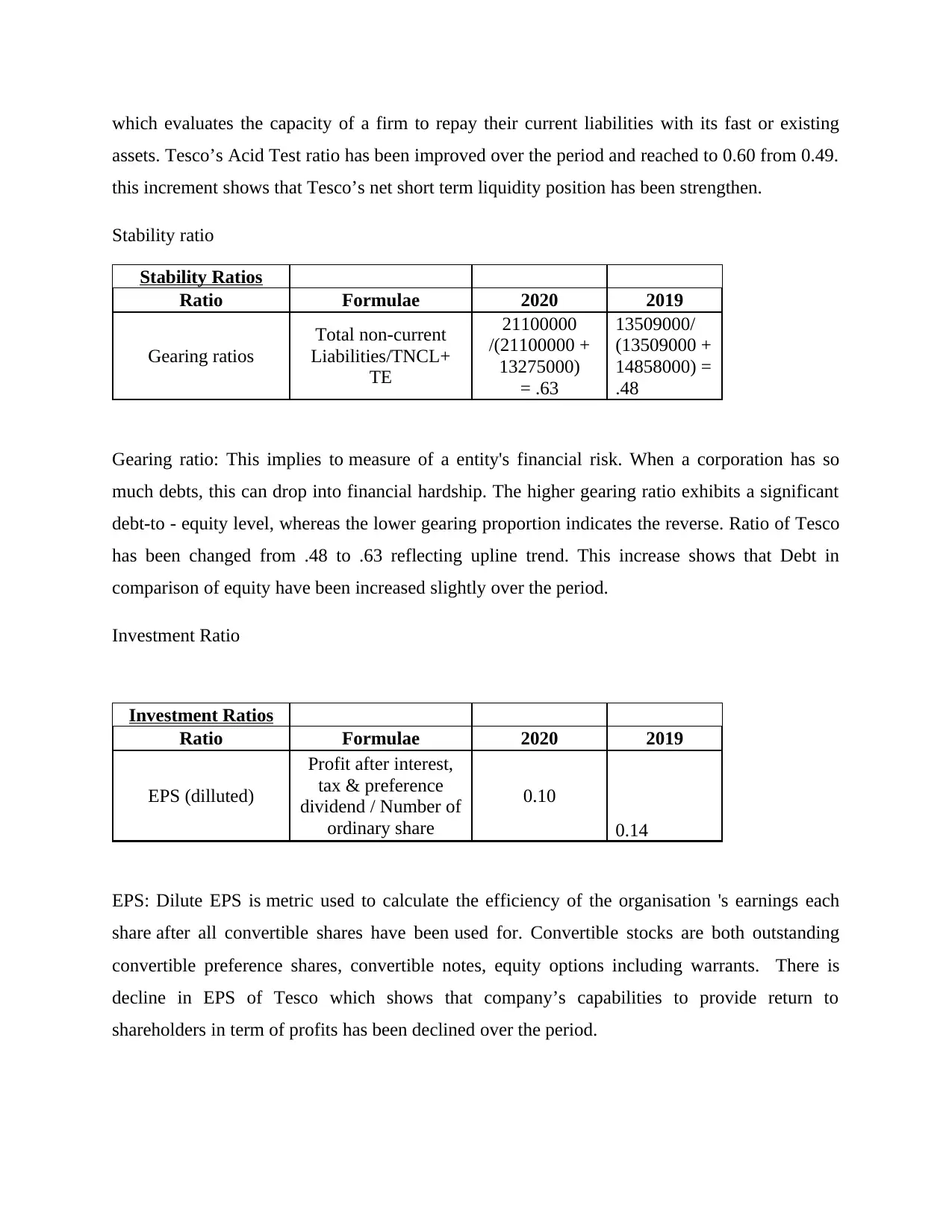

Stability ratio

Stability Ratios

Ratio Formulae 2020 2019

Gearing ratios

Total non-current

Liabilities/TNCL+

TE

21100000

/(21100000 +

13275000)

= .63

13509000/

(13509000 +

14858000) =

.48

Gearing ratio: This implies to measure of a entity's financial risk. When a corporation has so

much debts, this can drop into financial hardship. The higher gearing ratio exhibits a significant

debt-to - equity level, whereas the lower gearing proportion indicates the reverse. Ratio of Tesco

has been changed from .48 to .63 reflecting upline trend. This increase shows that Debt in

comparison of equity have been increased slightly over the period.

Investment Ratio

Investment Ratios

Ratio Formulae 2020 2019

EPS (dilluted)

Profit after interest,

tax & preference

dividend / Number of

ordinary share

0.10

0.14

EPS: Dilute EPS is metric used to calculate the efficiency of the organisation 's earnings each

share after all convertible shares have been used for. Convertible stocks are both outstanding

convertible preference shares, convertible notes, equity options including warrants. There is

decline in EPS of Tesco which shows that company’s capabilities to provide return to

shareholders in term of profits has been declined over the period.

assets. Tesco’s Acid Test ratio has been improved over the period and reached to 0.60 from 0.49.

this increment shows that Tesco’s net short term liquidity position has been strengthen.

Stability ratio

Stability Ratios

Ratio Formulae 2020 2019

Gearing ratios

Total non-current

Liabilities/TNCL+

TE

21100000

/(21100000 +

13275000)

= .63

13509000/

(13509000 +

14858000) =

.48

Gearing ratio: This implies to measure of a entity's financial risk. When a corporation has so

much debts, this can drop into financial hardship. The higher gearing ratio exhibits a significant

debt-to - equity level, whereas the lower gearing proportion indicates the reverse. Ratio of Tesco

has been changed from .48 to .63 reflecting upline trend. This increase shows that Debt in

comparison of equity have been increased slightly over the period.

Investment Ratio

Investment Ratios

Ratio Formulae 2020 2019

EPS (dilluted)

Profit after interest,

tax & preference

dividend / Number of

ordinary share

0.10

0.14

EPS: Dilute EPS is metric used to calculate the efficiency of the organisation 's earnings each

share after all convertible shares have been used for. Convertible stocks are both outstanding

convertible preference shares, convertible notes, equity options including warrants. There is

decline in EPS of Tesco which shows that company’s capabilities to provide return to

shareholders in term of profits has been declined over the period.

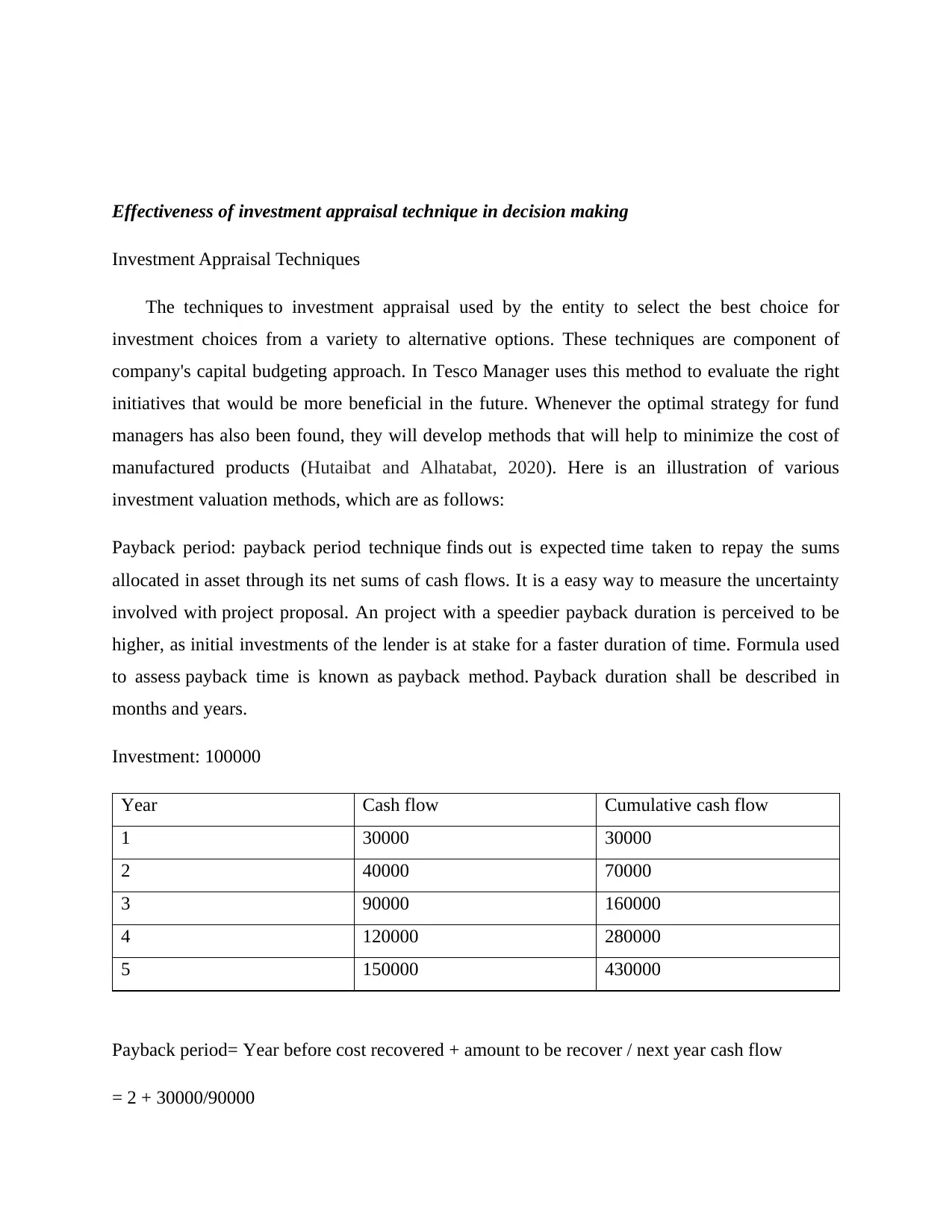

Effectiveness of investment appraisal technique in decision making

Investment Appraisal Techniques

The techniques to investment appraisal used by the entity to select the best choice for

investment choices from a variety to alternative options. These techniques are component of

company's capital budgeting approach. In Tesco Manager uses this method to evaluate the right

initiatives that would be more beneficial in the future. Whenever the optimal strategy for fund

managers has also been found, they will develop methods that will help to minimize the cost of

manufactured products (Hutaibat and Alhatabat, 2020). Here is an illustration of various

investment valuation methods, which are as follows:

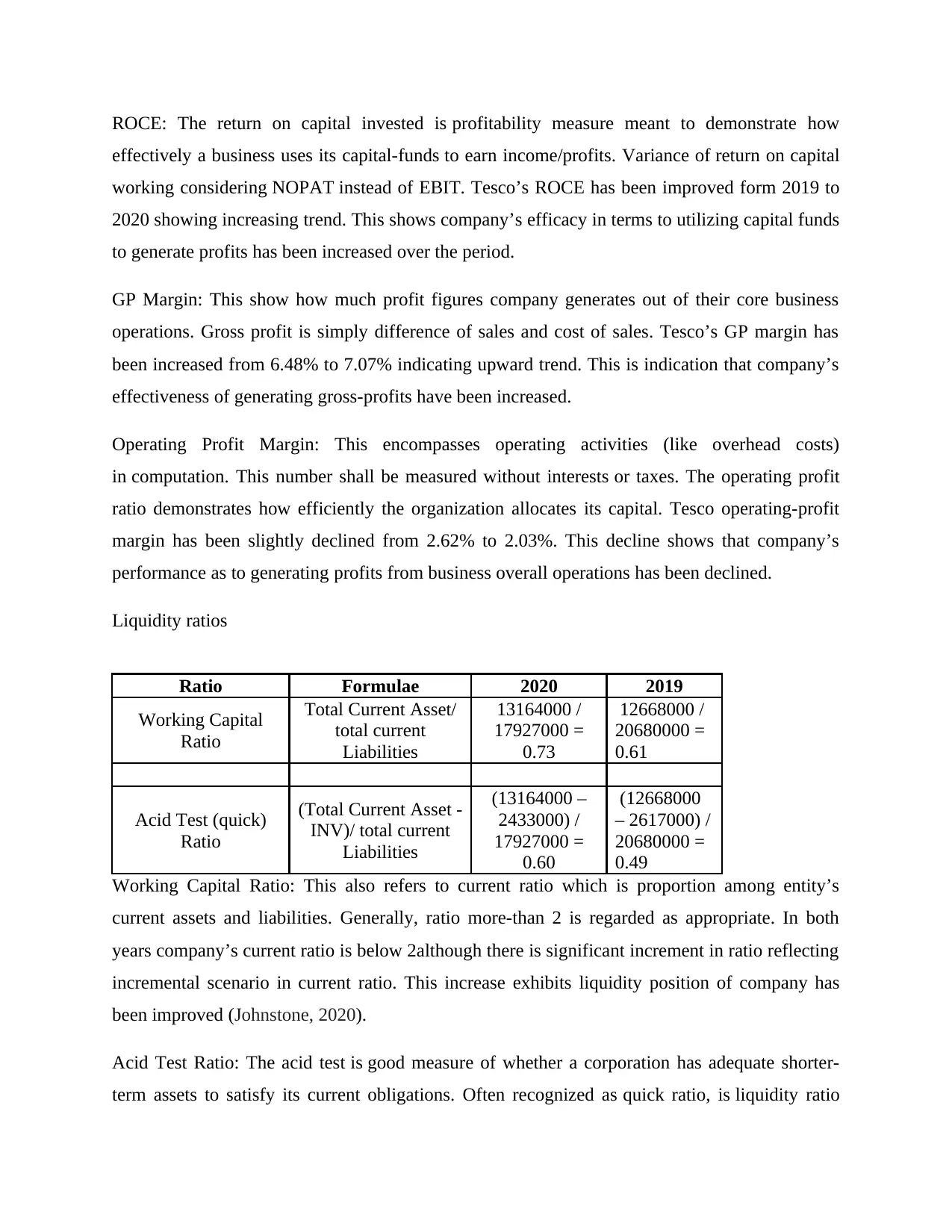

Payback period: payback period technique finds out is expected time taken to repay the sums

allocated in asset through its net sums of cash flows. It is a easy way to measure the uncertainty

involved with project proposal. An project with a speedier payback duration is perceived to be

higher, as initial investments of the lender is at stake for a faster duration of time. Formula used

to assess payback time is known as payback method. Payback duration shall be described in

months and years.

Investment: 100000

Year Cash flow Cumulative cash flow

1 30000 30000

2 40000 70000

3 90000 160000

4 120000 280000

5 150000 430000

Payback period= Year before cost recovered + amount to be recover / next year cash flow

= 2 + 30000/90000

Investment Appraisal Techniques

The techniques to investment appraisal used by the entity to select the best choice for

investment choices from a variety to alternative options. These techniques are component of

company's capital budgeting approach. In Tesco Manager uses this method to evaluate the right

initiatives that would be more beneficial in the future. Whenever the optimal strategy for fund

managers has also been found, they will develop methods that will help to minimize the cost of

manufactured products (Hutaibat and Alhatabat, 2020). Here is an illustration of various

investment valuation methods, which are as follows:

Payback period: payback period technique finds out is expected time taken to repay the sums

allocated in asset through its net sums of cash flows. It is a easy way to measure the uncertainty

involved with project proposal. An project with a speedier payback duration is perceived to be

higher, as initial investments of the lender is at stake for a faster duration of time. Formula used

to assess payback time is known as payback method. Payback duration shall be described in

months and years.

Investment: 100000

Year Cash flow Cumulative cash flow

1 30000 30000

2 40000 70000

3 90000 160000

4 120000 280000

5 150000 430000

Payback period= Year before cost recovered + amount to be recover / next year cash flow

= 2 + 30000/90000

You're viewing a preview

Unlock full access by subscribing today!

= 2.33 years

This means that the initial cost of above project-venture would be recovered within 2.33 years

which is less than life cycle of project thus viable.

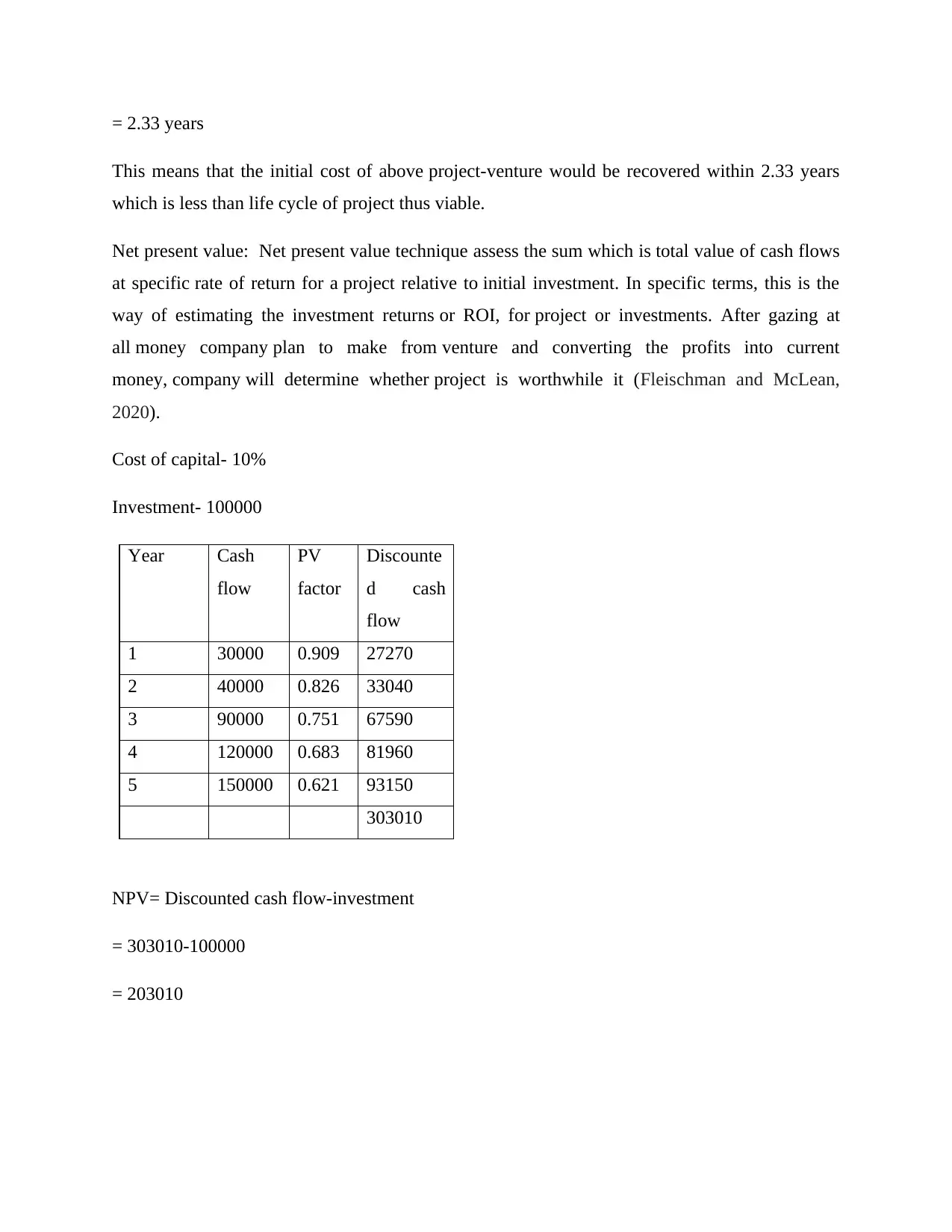

Net present value: Net present value technique assess the sum which is total value of cash flows

at specific rate of return for a project relative to initial investment. In specific terms, this is the

way of estimating the investment returns or ROI, for project or investments. After gazing at

all money company plan to make from venture and converting the profits into current

money, company will determine whether project is worthwhile it (Fleischman and McLean,

2020).

Cost of capital- 10%

Investment- 100000

Year Cash

flow

PV

factor

Discounte

d cash

flow

1 30000 0.909 27270

2 40000 0.826 33040

3 90000 0.751 67590

4 120000 0.683 81960

5 150000 0.621 93150

303010

NPV= Discounted cash flow-investment

= 303010-100000

= 203010

This means that the initial cost of above project-venture would be recovered within 2.33 years

which is less than life cycle of project thus viable.

Net present value: Net present value technique assess the sum which is total value of cash flows

at specific rate of return for a project relative to initial investment. In specific terms, this is the

way of estimating the investment returns or ROI, for project or investments. After gazing at

all money company plan to make from venture and converting the profits into current

money, company will determine whether project is worthwhile it (Fleischman and McLean,

2020).

Cost of capital- 10%

Investment- 100000

Year Cash

flow

PV

factor

Discounte

d cash

flow

1 30000 0.909 27270

2 40000 0.826 33040

3 90000 0.751 67590

4 120000 0.683 81960

5 150000 0.621 93150

303010

NPV= Discounted cash flow-investment

= 303010-100000

= 203010

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The net present value of project is positive that is of 203010 pounds and company should accept

this project.

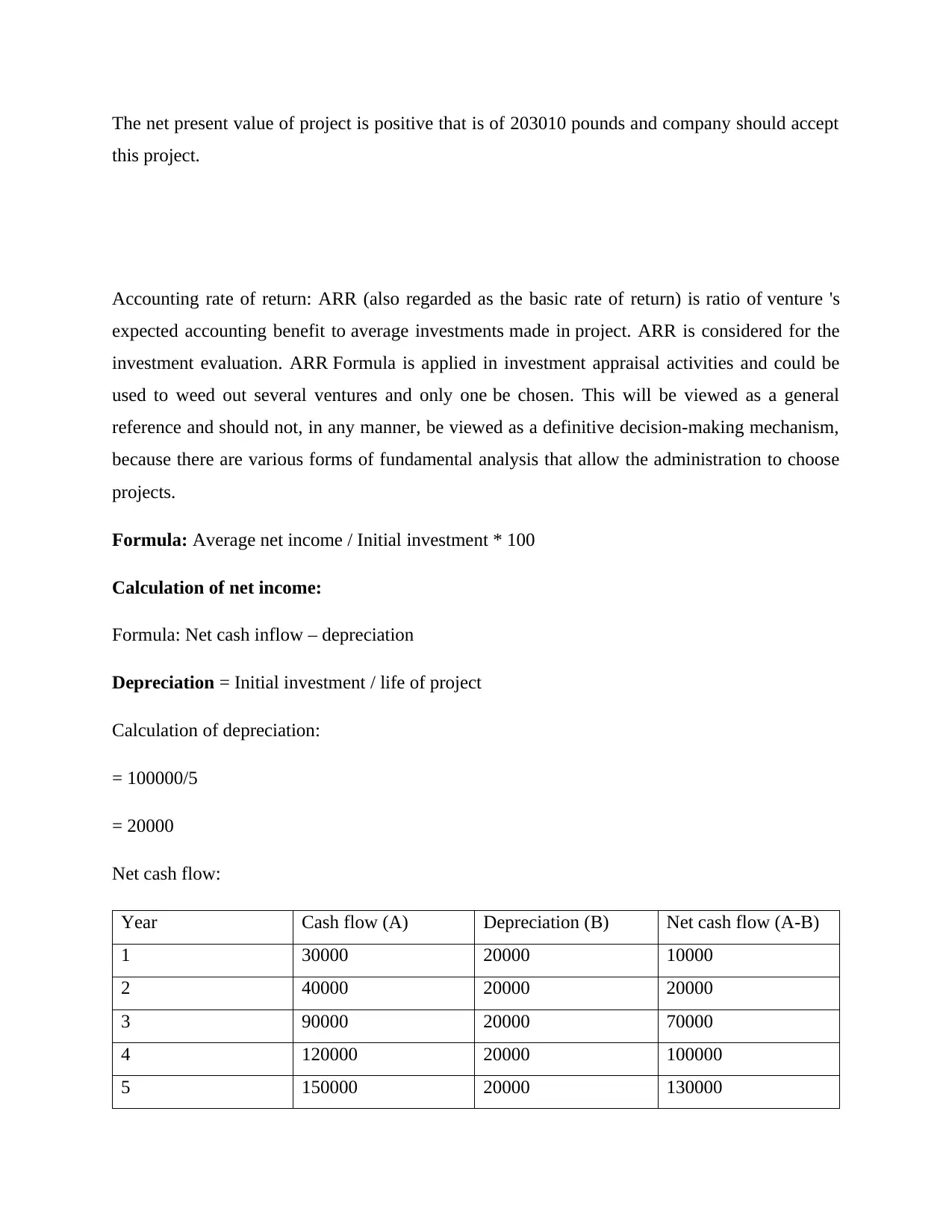

Accounting rate of return: ARR (also regarded as the basic rate of return) is ratio of venture 's

expected accounting benefit to average investments made in project. ARR is considered for the

investment evaluation. ARR Formula is applied in investment appraisal activities and could be

used to weed out several ventures and only one be chosen. This will be viewed as a general

reference and should not, in any manner, be viewed as a definitive decision-making mechanism,

because there are various forms of fundamental analysis that allow the administration to choose

projects.

Formula: Average net income / Initial investment * 100

Calculation of net income:

Formula: Net cash inflow – depreciation

Depreciation = Initial investment / life of project

Calculation of depreciation:

= 100000/5

= 20000

Net cash flow:

Year Cash flow (A) Depreciation (B) Net cash flow (A-B)

1 30000 20000 10000

2 40000 20000 20000

3 90000 20000 70000

4 120000 20000 100000

5 150000 20000 130000

this project.

Accounting rate of return: ARR (also regarded as the basic rate of return) is ratio of venture 's

expected accounting benefit to average investments made in project. ARR is considered for the

investment evaluation. ARR Formula is applied in investment appraisal activities and could be

used to weed out several ventures and only one be chosen. This will be viewed as a general

reference and should not, in any manner, be viewed as a definitive decision-making mechanism,

because there are various forms of fundamental analysis that allow the administration to choose

projects.

Formula: Average net income / Initial investment * 100

Calculation of net income:

Formula: Net cash inflow – depreciation

Depreciation = Initial investment / life of project

Calculation of depreciation:

= 100000/5

= 20000

Net cash flow:

Year Cash flow (A) Depreciation (B) Net cash flow (A-B)

1 30000 20000 10000

2 40000 20000 20000

3 90000 20000 70000

4 120000 20000 100000

5 150000 20000 130000

330000

Average net income:

Year Net cash flow (A-B)

1 10000

2 20000

3 70000

4 100000

5 130000

Total 330000

= 330000/5

= 66000

So,

ARR= 66000/100000*100

= 66%

.

Importance of financial decision making to maintaining long term sustainability.

Financial decision-making relates to mechanism in which important financial decisions

are taken for the sustainable success of the company. The expertise of business managers rely on

the expertise of attempting to formulate an acquisition plan that can continue to boost the

potential performance of the business. The financial judgement was used to ensure the longer-

term economic growth of the company. Managers undertake decisions on resources, expenditure,

corporate policy, stock shareholder policy, inventory management measures, sustainability

management of organization. The predominant aim of running business is to preserve market

Average net income:

Year Net cash flow (A-B)

1 10000

2 20000

3 70000

4 100000

5 130000

Total 330000

= 330000/5

= 66000

So,

ARR= 66000/100000*100

= 66%

.

Importance of financial decision making to maintaining long term sustainability.

Financial decision-making relates to mechanism in which important financial decisions

are taken for the sustainable success of the company. The expertise of business managers rely on

the expertise of attempting to formulate an acquisition plan that can continue to boost the

potential performance of the business. The financial judgement was used to ensure the longer-

term economic growth of the company. Managers undertake decisions on resources, expenditure,

corporate policy, stock shareholder policy, inventory management measures, sustainability

management of organization. The predominant aim of running business is to preserve market

You're viewing a preview

Unlock full access by subscribing today!

sustainability for a prolonged span of period thus crucial economic and financial decisions

are required (Tan, 2019).

And if a corporation has an effective corporate framework and sound business

management, it will succeed in attractive markets for longer time to come. If businesses make

incorrect acquisitions or creative innovations, they cannot compete in the international market.

The performance of a organization lies on how well its management make financial decisions on

their corporate practices. This involves having a strong market share and defending competitors.

Organizations take strategic measures using efficient strategies that will monitor the workers of

the company. Upper management of Tesco adopts an appropriate corporate approach that

improves their productivity and provides them with comparative advantages in order to ensure

the viability of their business activities.

Recommendations for how management accounting can be used to improve financial

sustainability.

Most organizations already don't employ management accounting techniques at present to

support deliver sustainability outputs information for decision-making

process and recognize influential factors. It may have a negative effect on the output of

businesses. This is because, in order to increase the efficiency of corporate organizations, it is

necessary to obtain information in an appropriate way and it will become achievable by

the management accounting. Businesses should also use discussed accounting methods in order

to take corrective steps. Like in the case of the Tesco, their managers must implement this

managerial accounting structure to sustain their performance in market.

CONCLUSION

From above study this has been analyzed that management accountants are key personnel

which adopts different relevant techniques of management accounting as well as investment

appraisal techniques to increase the reliability of business decisions. This enable them to improve

organization’s sustainability performance and in long term this offers competitive advantages.

are required (Tan, 2019).

And if a corporation has an effective corporate framework and sound business

management, it will succeed in attractive markets for longer time to come. If businesses make

incorrect acquisitions or creative innovations, they cannot compete in the international market.

The performance of a organization lies on how well its management make financial decisions on

their corporate practices. This involves having a strong market share and defending competitors.

Organizations take strategic measures using efficient strategies that will monitor the workers of

the company. Upper management of Tesco adopts an appropriate corporate approach that

improves their productivity and provides them with comparative advantages in order to ensure

the viability of their business activities.

Recommendations for how management accounting can be used to improve financial

sustainability.

Most organizations already don't employ management accounting techniques at present to

support deliver sustainability outputs information for decision-making

process and recognize influential factors. It may have a negative effect on the output of

businesses. This is because, in order to increase the efficiency of corporate organizations, it is

necessary to obtain information in an appropriate way and it will become achievable by

the management accounting. Businesses should also use discussed accounting methods in order

to take corrective steps. Like in the case of the Tesco, their managers must implement this

managerial accounting structure to sustain their performance in market.

CONCLUSION

From above study this has been analyzed that management accountants are key personnel

which adopts different relevant techniques of management accounting as well as investment

appraisal techniques to increase the reliability of business decisions. This enable them to improve

organization’s sustainability performance and in long term this offers competitive advantages.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journal:

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. John Wiley & Sons.

Al Breiki, M. and Nobanee, H., 2019. The role of financial management in promoting

sustainable business practices and development. Available at SSRN 3472404.

Chandra, P., 2020. Fundamentals of Financial Management|. McGraw-Hill Education.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2),

pp.205-216.

Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., 2020. Working capital management:

Financial and valuation impacts

Zada, M., Yukun, C. and Zada, S., 2019. Effect of financial management practices on the

development of small-to-medium size forest enterprises: insight from

Pakistan. GeoJournal, pp.1-16.

Ndanyenbah, T.Y. and Zakaria, A., 2019. Application of Investment Appraisal Techniques by

Small and Medium Enterprises (SMEs) Operators in the Tamale Metropolis, Ghana.

Ayodele, T.O., 2019. Factors influencing the adoption of real option analysis in RED appraisal:

an emergent market perspective. International Journal of Construction Management,

pp.1-11.

Sinha, R. and Datta, M., 2020. Investment Appraisal of Sustainability Projects: An Assortment

of Financial Measures. In Social, Economic, and Environmental Impacts Between

Sustainable Financial Systems and Financial Markets (pp. 43-56). IGI Global.

Alkaraan, F., 2020. Strategic investment decision-making practices in large manufacturing

companies. Meditari Accountancy Research.

Johnstone, L., 2020. A systematic analysis of environmental management systems in SMEs:

Possible research directions from a management accounting and control stance. Journal

of Cleaner Production, 244, p.118802.

Fleischman, R. and McLean, T., 2020. Management accounting: theory and practice. Routledge.

Tan, H.C., 2019. Using a structured collaborative learning approach in a case-based management

accounting course. Journal of Accounting Education, 49, p.100638.

Hutaibat, K. and Alhatabat, Z., 2020. Management accounting practices’ adoption in UK

universities. Journal of Further and Higher Education, 44(8), pp.1024-1038.

Books and journal:

Shapiro, A.C. and Hanouna, P., 2019. Multinational financial management. John Wiley & Sons.

Al Breiki, M. and Nobanee, H., 2019. The role of financial management in promoting

sustainable business practices and development. Available at SSRN 3472404.

Chandra, P., 2020. Fundamentals of Financial Management|. McGraw-Hill Education.

Yuniningsih, Y., Pertiwi, T. and Purwanto, E., 2019. Fundamental factor of financial

management in determining company values. Management Science Letters, 9(2),

pp.205-216.

Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., 2020. Working capital management:

Financial and valuation impacts

Zada, M., Yukun, C. and Zada, S., 2019. Effect of financial management practices on the

development of small-to-medium size forest enterprises: insight from

Pakistan. GeoJournal, pp.1-16.

Ndanyenbah, T.Y. and Zakaria, A., 2019. Application of Investment Appraisal Techniques by

Small and Medium Enterprises (SMEs) Operators in the Tamale Metropolis, Ghana.

Ayodele, T.O., 2019. Factors influencing the adoption of real option analysis in RED appraisal:

an emergent market perspective. International Journal of Construction Management,

pp.1-11.

Sinha, R. and Datta, M., 2020. Investment Appraisal of Sustainability Projects: An Assortment

of Financial Measures. In Social, Economic, and Environmental Impacts Between

Sustainable Financial Systems and Financial Markets (pp. 43-56). IGI Global.

Alkaraan, F., 2020. Strategic investment decision-making practices in large manufacturing

companies. Meditari Accountancy Research.

Johnstone, L., 2020. A systematic analysis of environmental management systems in SMEs:

Possible research directions from a management accounting and control stance. Journal

of Cleaner Production, 244, p.118802.

Fleischman, R. and McLean, T., 2020. Management accounting: theory and practice. Routledge.

Tan, H.C., 2019. Using a structured collaborative learning approach in a case-based management

accounting course. Journal of Accounting Education, 49, p.100638.

Hutaibat, K. and Alhatabat, Z., 2020. Management accounting practices’ adoption in UK

universities. Journal of Further and Higher Education, 44(8), pp.1024-1038.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.