Financial and Management Accounting: Calculation of Profit, Breakeven Analysis, Activity Based Costing, Variances, and Budgeting

VerifiedAdded on 2023/06/18

|8

|2219

|468

AI Summary

This article covers topics such as calculation of gross and net profit, breakeven analysis, advantages and disadvantages of activity based costing, variances, and budgeting for financial and management accounting. It also provides strategies for improving the financial position of the company.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL AND

MANAGEMENT

ACCOUNTING

MANAGEMENT

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

QUESTION- 1.................................................................................................................................3

1. Calculation of the gross and net profit..................................................................................3

2. Calculation of the gross and net profit to sales ratio and their significance for the business

3

3. Reasons for company’s declining profit and increasing cash flow problems between 2019

and 2020.......................................................................................................................................4

4. Recommended strategies for the improvement of the financial position of the company. . .4

Question: 2.......................................................................................................................................5

Calculating the Break Even Point of Production for this new product........................................5

Setting profitable sales revenue target by using breakeven analysis...........................................5

Advantages and disadvantages of switching off to Activity Based Costing................................5

QUESTION- 3.................................................................................................................................6

1. Calculation of three significant variances between budgeted and outrun figures....................6

2. Causes of variances..................................................................................................................7

3. Consequences for the business of each of these variances......................................................7

5. Advantages and disadvantages to switch from Incremental budgeting to Zero based

budgeting......................................................................................................................................7

QUESTION- 1.................................................................................................................................3

1. Calculation of the gross and net profit..................................................................................3

2. Calculation of the gross and net profit to sales ratio and their significance for the business

3

3. Reasons for company’s declining profit and increasing cash flow problems between 2019

and 2020.......................................................................................................................................4

4. Recommended strategies for the improvement of the financial position of the company. . .4

Question: 2.......................................................................................................................................5

Calculating the Break Even Point of Production for this new product........................................5

Setting profitable sales revenue target by using breakeven analysis...........................................5

Advantages and disadvantages of switching off to Activity Based Costing................................5

QUESTION- 3.................................................................................................................................6

1. Calculation of three significant variances between budgeted and outrun figures....................6

2. Causes of variances..................................................................................................................7

3. Consequences for the business of each of these variances......................................................7

5. Advantages and disadvantages to switch from Incremental budgeting to Zero based

budgeting......................................................................................................................................7

QUESTION- 1

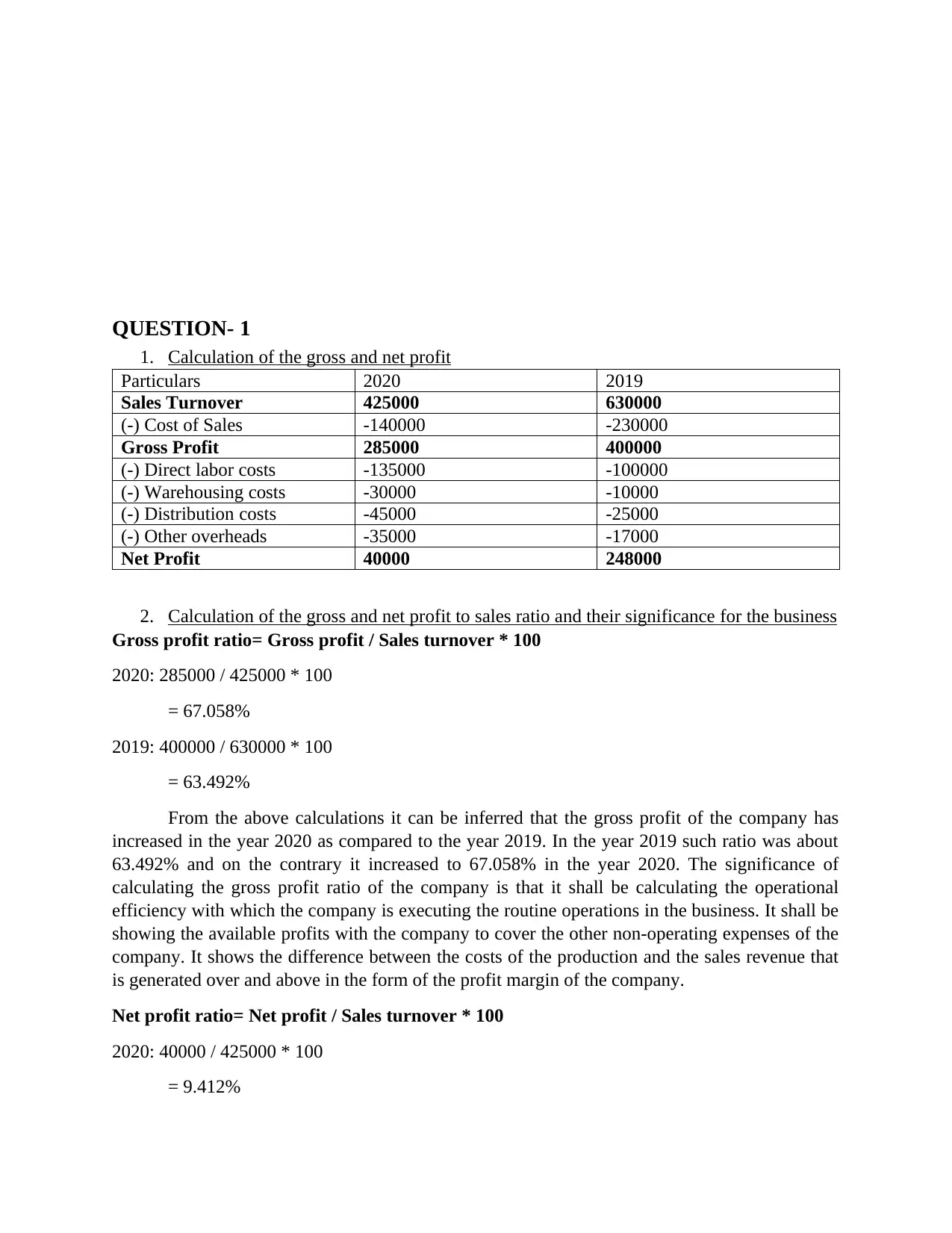

1. Calculation of the gross and net profit

Particulars 2020 2019

Sales Turnover 425000 630000

(-) Cost of Sales -140000 -230000

Gross Profit 285000 400000

(-) Direct labor costs -135000 -100000

(-) Warehousing costs -30000 -10000

(-) Distribution costs -45000 -25000

(-) Other overheads -35000 -17000

Net Profit 40000 248000

2. Calculation of the gross and net profit to sales ratio and their significance for the business

Gross profit ratio= Gross profit / Sales turnover * 100

2020: 285000 / 425000 * 100

= 67.058%

2019: 400000 / 630000 * 100

= 63.492%

From the above calculations it can be inferred that the gross profit of the company has

increased in the year 2020 as compared to the year 2019. In the year 2019 such ratio was about

63.492% and on the contrary it increased to 67.058% in the year 2020. The significance of

calculating the gross profit ratio of the company is that it shall be calculating the operational

efficiency with which the company is executing the routine operations in the business. It shall be

showing the available profits with the company to cover the other non-operating expenses of the

company. It shows the difference between the costs of the production and the sales revenue that

is generated over and above in the form of the profit margin of the company.

Net profit ratio= Net profit / Sales turnover * 100

2020: 40000 / 425000 * 100

= 9.412%

1. Calculation of the gross and net profit

Particulars 2020 2019

Sales Turnover 425000 630000

(-) Cost of Sales -140000 -230000

Gross Profit 285000 400000

(-) Direct labor costs -135000 -100000

(-) Warehousing costs -30000 -10000

(-) Distribution costs -45000 -25000

(-) Other overheads -35000 -17000

Net Profit 40000 248000

2. Calculation of the gross and net profit to sales ratio and their significance for the business

Gross profit ratio= Gross profit / Sales turnover * 100

2020: 285000 / 425000 * 100

= 67.058%

2019: 400000 / 630000 * 100

= 63.492%

From the above calculations it can be inferred that the gross profit of the company has

increased in the year 2020 as compared to the year 2019. In the year 2019 such ratio was about

63.492% and on the contrary it increased to 67.058% in the year 2020. The significance of

calculating the gross profit ratio of the company is that it shall be calculating the operational

efficiency with which the company is executing the routine operations in the business. It shall be

showing the available profits with the company to cover the other non-operating expenses of the

company. It shows the difference between the costs of the production and the sales revenue that

is generated over and above in the form of the profit margin of the company.

Net profit ratio= Net profit / Sales turnover * 100

2020: 40000 / 425000 * 100

= 9.412%

2019: 248000 / 630000 * 100

= 39.365%

In the above calculations it can be evidently noticed that the net profit of the company has

significantly reduced as compared to the previous year. In the year 2019 the company has earned

net profit of 248000 but on the contrary in the year 2020 it significantly reduced to 40000. The

significance of the net profit ratio is that it shall be representing the net profits that have been

earned on per dollar of sales in the company. This shall be measuring the efficiency with which

the processes are being carried out in the business and apart from that such ratio is also of major

significance for the investors and the various stakeholders of the business. It will be representing

the net income that is generated on the percentage of sales. It shall be showing the profitability

position of the company.

3. Reasons for company’s declining profit and increasing cash flow problems between 2019

and 2020

There are certain reasons in the company because of which the profitability and the liquidity

position of the company are highly being affected and these are:-

The first and foremost reason is that the supply chain of the company is not strong

and reliable but is inefficient enough to not process the recent orders of the company.

This spoils the market share of the company.

The maintenance of the stock policy has also suffered as the closing stock has

significantly increased and this has blocked the funds to ruin the liquidity position.

Unnecessarily maintaining the excess inventory has also lead to the problem of

spoiling the stock to make it not resalable at the market value.

The other problem is that the payable and the receivable days of the company are not

equivalent and this is the reason it has lead to the inefficiencies.

The dividend policy of the company were not reasonable as they increased the

proportion of the dividends despite the significant reduction in the profits of the

company further spoiling the liquidity position of the company.

4. Recommended strategies for the improvement of the financial position of the company

These are the several recommendations for the company:-

The first and foremost strategy is that the company must appoint the efficient recovery

agent who can timely recover the dues and equivalently maintain the payable and the

receivable days for the smooth working capital cycle.

The efficient reordering quantity must be defined which shall be maximizing the

profitability in the company and reducing the costs simultaneously. The excess quantity

must not be maintained to block the funds.

The last strategy is to take efficient dividend decisions as per the profitability position of

the company. The right proportion of the dividends and the retained earnings must be

maintained in the company.

= 39.365%

In the above calculations it can be evidently noticed that the net profit of the company has

significantly reduced as compared to the previous year. In the year 2019 the company has earned

net profit of 248000 but on the contrary in the year 2020 it significantly reduced to 40000. The

significance of the net profit ratio is that it shall be representing the net profits that have been

earned on per dollar of sales in the company. This shall be measuring the efficiency with which

the processes are being carried out in the business and apart from that such ratio is also of major

significance for the investors and the various stakeholders of the business. It will be representing

the net income that is generated on the percentage of sales. It shall be showing the profitability

position of the company.

3. Reasons for company’s declining profit and increasing cash flow problems between 2019

and 2020

There are certain reasons in the company because of which the profitability and the liquidity

position of the company are highly being affected and these are:-

The first and foremost reason is that the supply chain of the company is not strong

and reliable but is inefficient enough to not process the recent orders of the company.

This spoils the market share of the company.

The maintenance of the stock policy has also suffered as the closing stock has

significantly increased and this has blocked the funds to ruin the liquidity position.

Unnecessarily maintaining the excess inventory has also lead to the problem of

spoiling the stock to make it not resalable at the market value.

The other problem is that the payable and the receivable days of the company are not

equivalent and this is the reason it has lead to the inefficiencies.

The dividend policy of the company were not reasonable as they increased the

proportion of the dividends despite the significant reduction in the profits of the

company further spoiling the liquidity position of the company.

4. Recommended strategies for the improvement of the financial position of the company

These are the several recommendations for the company:-

The first and foremost strategy is that the company must appoint the efficient recovery

agent who can timely recover the dues and equivalently maintain the payable and the

receivable days for the smooth working capital cycle.

The efficient reordering quantity must be defined which shall be maximizing the

profitability in the company and reducing the costs simultaneously. The excess quantity

must not be maintained to block the funds.

The last strategy is to take efficient dividend decisions as per the profitability position of

the company. The right proportion of the dividends and the retained earnings must be

maintained in the company.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question: 2

1.

Fixed cost of producing new axel = 275000

Variable cost per axel = 20

Selling price per axel = 50

Calculating the Break Even Point of Production for this new product

Breakeven point = Fixed cost ÷ contribution per unit

= 275000 ÷ 30 (50 – 20)

= 9167 Units

[Contribution per unit = sales price unit - variable cost per unit]

2.

Setting profitable sales revenue target by using breakeven analysis

Performing sales at a breakeven point allows for recovering all the costs associated with the

production of a product. It is the sales at that point where there is no profit or no loss for the

company. So, if company resorts to selling products just at the level of breakeven point then the

company is able to recover all the cost associated with creating a ready to use products. So by

using breakeven or cost volume profit analysis technique, company can frame strategies to attain

breakeven sales and then further decide upon how much more sales they need to maximize their

profitability and achieve their set targets of profits which is possible only if the company is able

to sale product above breakeven point. Also, this techniques facilitates speedy recovery of all the

costs incurred in the process of production and other practices associated with the operations of

the business which is in some or the other way significant in making product available for sale in

the market. As this technique provide strategic direction to the management of the company, that

is why it is considered as the most effective techniques in setting profitable sales revenue targets

for the company.

3.

Advantages and disadvantages of switching off to Activity Based Costing

Activity based costing is that technique of costing used in the businesses where all of the

overhead cost incurred while carrying out the process of production are absorbed in the way they

are included in the final product’s cost. The technique is considered as the result oriented and

useful where there are more than one product that has been produced and sale by the company

and also it is possible to include the overhead costs in the costs of the product in an attempt to

absorb all these costs. Thus, this technique is considered and even proved to be ineffective for

those companies indulged in the production and sale of single product.

Advantages of using activity based costing are:

1.

Fixed cost of producing new axel = 275000

Variable cost per axel = 20

Selling price per axel = 50

Calculating the Break Even Point of Production for this new product

Breakeven point = Fixed cost ÷ contribution per unit

= 275000 ÷ 30 (50 – 20)

= 9167 Units

[Contribution per unit = sales price unit - variable cost per unit]

2.

Setting profitable sales revenue target by using breakeven analysis

Performing sales at a breakeven point allows for recovering all the costs associated with the

production of a product. It is the sales at that point where there is no profit or no loss for the

company. So, if company resorts to selling products just at the level of breakeven point then the

company is able to recover all the cost associated with creating a ready to use products. So by

using breakeven or cost volume profit analysis technique, company can frame strategies to attain

breakeven sales and then further decide upon how much more sales they need to maximize their

profitability and achieve their set targets of profits which is possible only if the company is able

to sale product above breakeven point. Also, this techniques facilitates speedy recovery of all the

costs incurred in the process of production and other practices associated with the operations of

the business which is in some or the other way significant in making product available for sale in

the market. As this technique provide strategic direction to the management of the company, that

is why it is considered as the most effective techniques in setting profitable sales revenue targets

for the company.

3.

Advantages and disadvantages of switching off to Activity Based Costing

Activity based costing is that technique of costing used in the businesses where all of the

overhead cost incurred while carrying out the process of production are absorbed in the way they

are included in the final product’s cost. The technique is considered as the result oriented and

useful where there are more than one product that has been produced and sale by the company

and also it is possible to include the overhead costs in the costs of the product in an attempt to

absorb all these costs. Thus, this technique is considered and even proved to be ineffective for

those companies indulged in the production and sale of single product.

Advantages of using activity based costing are:

It provides with the accurate cost per product which then leads to appropriately pricing the

products.

Information pertaining to cost behaviour is better indicated under activity based costing.

Helps in reducing costs by identifying those activities involved in the process of production that

are not meant to be adding value to the product.

Better decision making regarding controlling of costs by allowing managers to control fixed

overhead costs by practicing higher control over those activities that are causing hike in these

fixed overhead costs.

Disadvantages of using activity based costing are:

Activity based costing renders less or very limited benefits if the overhead costs are basically

related to volume and overhead costs form very small proportion of the overall costs of the

production.

Activity based costing is considered to be more complex and expensive requiring high level of

expertise and experience of an individual involved in utilizing this technique.

Selecting and identifying cost drivers is considered as a biggest challenge associated with ABC

technique.

It is quite impossible to distribute all the overhead costs to specific activities.

Not appropriate and useful for small firms having less number of activities and cost drivers in the

process of production of the product.

In this way by allocating overhead costs to each of the activities performed for the production of

different product, the accurate cost of all the product lines can be determined and by adding

required profit margins to it, management can easily determine the price of all the product lines

of the business.

QUESTION- 3

1. Calculation of three significant variances between budgeted and outrun figures

Sales variance: actual sales – budgeted sales = £ 520000 - £ 870000 = £350000

unfavorable.

Direct material variance = budgeted direct cost of material – Actual cost of direct material =

£235000 – £200000 = £35000 favorable.

Direct labor variances = Budgeted labour cost - actual labour costs = £150000 – £220000 =

£70000 unfavorable.

products.

Information pertaining to cost behaviour is better indicated under activity based costing.

Helps in reducing costs by identifying those activities involved in the process of production that

are not meant to be adding value to the product.

Better decision making regarding controlling of costs by allowing managers to control fixed

overhead costs by practicing higher control over those activities that are causing hike in these

fixed overhead costs.

Disadvantages of using activity based costing are:

Activity based costing renders less or very limited benefits if the overhead costs are basically

related to volume and overhead costs form very small proportion of the overall costs of the

production.

Activity based costing is considered to be more complex and expensive requiring high level of

expertise and experience of an individual involved in utilizing this technique.

Selecting and identifying cost drivers is considered as a biggest challenge associated with ABC

technique.

It is quite impossible to distribute all the overhead costs to specific activities.

Not appropriate and useful for small firms having less number of activities and cost drivers in the

process of production of the product.

In this way by allocating overhead costs to each of the activities performed for the production of

different product, the accurate cost of all the product lines can be determined and by adding

required profit margins to it, management can easily determine the price of all the product lines

of the business.

QUESTION- 3

1. Calculation of three significant variances between budgeted and outrun figures

Sales variance: actual sales – budgeted sales = £ 520000 - £ 870000 = £350000

unfavorable.

Direct material variance = budgeted direct cost of material – Actual cost of direct material =

£235000 – £200000 = £35000 favorable.

Direct labor variances = Budgeted labour cost - actual labour costs = £150000 – £220000 =

£70000 unfavorable.

2. Causes of variances

The reason behind the occurrence of sales variance is due to the lower price set for the

products in an attempt to compete with other firms operating in the same industry. Also,

this company is not able to utilize attractive distribution channels to cope up with the

high demand for its products.

Positive or favorable variance associated with the cost of direct material is due to the

reduction in the price of the raw materials or maybe company’s efficiency has increased

in utilizing raw materials which leads to lower utilization of raw materials.

The reason behind an unfavorable variance associated with direct labor may be due to the

increase in the wage rate offered to the labor involved in the production of the products.

3. Consequences for the business of each of these variances

Sales variance depicts how the profitability of a company is fluctuating from the

budgeted figures. So that management can regularly track the rise and fall in the profits of

the company just by looking at its sales figures that whether it is above and below the

budgeted sales figures (Gabbi and Levich, 2019).

Unfavorable direct material variance allows for minimizing the wastage of raw materials

beforehand, so that management can save enough costs associated with direct materials.

Unfavorable direct labor variance indicates how much more the company has paid than

what it has expected to pay while preparing budgets.

4. Strategies for the correction of the variances

The company can reconsider the projected revenues and the prices in the company such

that the profit margin is affixed.

Increment in the marketing budget of the company so that the demand for the products

can be attracted with the help of the aggressive marketing tools of the company.

Proper training of the individual staff of the company and also using the advance

equipment in the business so that the labor efficiency is improved. This way the labor

rates will be efficiently identified in the company.

5. Advantages and disadvantages to switch from Incremental budgeting to Zero based

budgeting

Advantages:-

The reason behind the occurrence of sales variance is due to the lower price set for the

products in an attempt to compete with other firms operating in the same industry. Also,

this company is not able to utilize attractive distribution channels to cope up with the

high demand for its products.

Positive or favorable variance associated with the cost of direct material is due to the

reduction in the price of the raw materials or maybe company’s efficiency has increased

in utilizing raw materials which leads to lower utilization of raw materials.

The reason behind an unfavorable variance associated with direct labor may be due to the

increase in the wage rate offered to the labor involved in the production of the products.

3. Consequences for the business of each of these variances

Sales variance depicts how the profitability of a company is fluctuating from the

budgeted figures. So that management can regularly track the rise and fall in the profits of

the company just by looking at its sales figures that whether it is above and below the

budgeted sales figures (Gabbi and Levich, 2019).

Unfavorable direct material variance allows for minimizing the wastage of raw materials

beforehand, so that management can save enough costs associated with direct materials.

Unfavorable direct labor variance indicates how much more the company has paid than

what it has expected to pay while preparing budgets.

4. Strategies for the correction of the variances

The company can reconsider the projected revenues and the prices in the company such

that the profit margin is affixed.

Increment in the marketing budget of the company so that the demand for the products

can be attracted with the help of the aggressive marketing tools of the company.

Proper training of the individual staff of the company and also using the advance

equipment in the business so that the labor efficiency is improved. This way the labor

rates will be efficiently identified in the company.

5. Advantages and disadvantages to switch from Incremental budgeting to Zero based

budgeting

Advantages:-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It shall be leading to the justification of the expenses and shall reduce the unnecessary

costs of the company.

It shall be leading to the optimum allocation of the resources of the company avoiding the

wastages.

It shall be reducing the gaps in the budgeted and the actual performance of the company

and shall be making the rightful estimates in the company regarding the future.

Disadvantages:-

The conduct of the zero based budgeting is time consuming, cost inefficient and also

shall be requiring the experts in the process.

It is the complicated procedure to judge all the items from the zero level without the

support of the past estimates.

It shall also be hampering the routine operations of the business.

costs of the company.

It shall be leading to the optimum allocation of the resources of the company avoiding the

wastages.

It shall be reducing the gaps in the budgeted and the actual performance of the company

and shall be making the rightful estimates in the company regarding the future.

Disadvantages:-

The conduct of the zero based budgeting is time consuming, cost inefficient and also

shall be requiring the experts in the process.

It is the complicated procedure to judge all the items from the zero level without the

support of the past estimates.

It shall also be hampering the routine operations of the business.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.